Abstract

In an attempt to open the black box of high-growth firms within turbulent economic environments, this paper explores the role of corporate strategy, employee human capital and R&D capabilities in achieving exceptional growth performance in a crisis-hit economy. Relative and absolute growth measures based on both employment and sales are computed utilizing survey data on 1500 firms in the midst of the Greek crisis. Our findings indicate that adopting a geographical diversification strategy significantly increases the likelihood of becoming a fast-growing firm, irrespective of the growth metric used. Entering in diverse product markets and taking advantage of R&D capabilities appear to additionally contribute to relative employment change in HGFs of smaller size. Based on the absolute employment growth indicator, we provide some evidence that HGFs of larger size are able to grow fast through product diversification, acquiring other firms or by investing on training low-skilled employees. Nevertheless, hiring already highly educated persons seems to matter only for sales HGFs, while research collaborations are found to negatively affect the probability of growing fast in terms of sales.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The academic and policy interest for high-growth firms (HGFs) has been intensified during the last years, largely due to the contribution they are considered to have in terms of employment growth and economic development (Henrekson & Johansson, 2010; Acs, Parsons, & Tracy, 2008). Indeed, it has been demonstrated that firms’ growth rates are extremely skewed with a small number of HGFs being responsible for a disproportionately large amount of job creation (Coad, Daunfeldt, Hölzl, Johansson, & Nightingale, 2014a; Delmar, Davidsson, & Gartner, 2003). This stylized fact has motivated a considerable volume of research focusing on fast-growing, rapid-growth, high-impact or high-growth firms. Even though the label and the precise definition may differ, all these terms generally refer to a special type of firms which exhibit particularly high rates of growth and are commonly inspired from the pioneer work of Birch on the so-called ‘gazelles’ (Birch, 1979). Since then, a number of studies have consistently provided evidence that it is not new firms per se, but a relatively small number of HGFs that drive job creation (Storey, 1994; Henrekson & Johansson, 2010). Along these lines, entrepreneurship literature suggests that HGFs are the main engine of economic development and not just new ventures or small firms in general (Shane, 2009; Wong, Ho & Autio, 2005; Stam, Suddle, Hessels & Van Stel, 2009).

From a policy perspective, related research tends to question policies targeting the quantity of start-ups as a way to enhance economic growth and create jobs (e.g. Shane, 2009; Hölzl, 2014). Instead of subsidizing the formation of a typical start-up, Shane (2009) recommends that policy makers should focus on this subset of businesses with growth potential, arguing that it is better to have a small number of HGFs rather than a large number of typical start-ups. What is more, the recent financial crisis underlined the need for encouraging ventures of a rather ‘special’ form that can be sustainable in adverse times and support growth and employment (e.g. Brown & Lee, 2019; Giotopoulos, Kontolaimou & Tsakanikas, 2017a). Indeed, HGFs are likely to be more resilient to economic recessions (Todd & Taylor, 1993) constituting at the same time an important driver of economic development (Autio & Acs, 2010; Henrekson & Johansson, 2010). In this vein, policy priorities at a national as well as international level seem to change during the last years in favour of HGFs. European Commission sets supporting high-growth SMEs as a political objective in its Europe 2020 Strategy report (European Commission, 2010), while OECD examines ways in which governments can promote high-growth enterprises (OECD, 2010).

Given the rising academic and policy attention to HGFs, a considerable volume of recent studies attempt to (re)define, map and profile this special type of firms. Extant research explores firm-specific attributes of HGFs, such as size (Weinzimmer, Nystron & Freeman, 1998; Delmar et al., 2003; Shepherd & Wiklund, 2009) and age (Delmar et al., 2003; Haltiwanger, Jarmin & Miranda, 2013; Coad, Daunfeldt, Johansson, & Wennberg, 2014b). Other studies focus on sectoral dimensions (Smallbone, Leig & North, 1995; Delmar et al., 2003; Halabisky, Dreessen & Parsley, 2006; Acs & Mueller, 2008) or spatial characteristics of HGFs (Stam, 2005; Acs & Mueller, 2008), while the strategic intentions of this type of enterprises have been also investigated (Smallbone et al., 1995; Gundry and Welsch, 2001).

Nevertheless, there is a lack of knowledge on how these firms achieve high-growth rates as acknowledged in the growth literature, especially in turbulent economic environments (McKelvie & Wiklund, 2010). Limited relevant research using a crisis context, mostly, explores the role of firm size on firm growth (Peric & Vitezic, 2016, Varum & Rocha, 2013). The present paper attempts to enhance our knowledge on the growth modes of HGFs in times of crisis, focusing on a number of strategies, human resource practices and innovation capabilities that may be linked to firms’ exceptional performance even in adverse economic conditions.

Strategic management literature emphasizes mergers and acquisitions, product diversification and internationalization as the main forms of corporate strategy that allow firms to expand their horizontal boundaries (Besanko, Dranove, Shanley & Schaefer, 2009; Rothaermel, 2015). Moreover, the Penrose’s (1959) theory of growth provides strong argumentation according to which the generation, assimilation and transfer of knowledge at the firm level is of vital importance for the support of firm growth. From this perspective, firm growth largely depends on the processes through which knowledge is acquired and utilized (Macpherson & Holt, 2007). A firm’s knowledge residing in its founder and employee human capital facilitates the expansion of the firm’s resource base and creates new opportunities for firm growth and superior performance (Macpherson & Holt, 2007; Hitt, Bierman, Shimizu & Kochhar, 2001a). The role of R&D and innovation activities in the generation, absorption and exploitation of new knowledge has been also highlighted in the literature and being essentially linked to high firm growth (Stam & Wennberg, 2009; Hölzl, 2009).

In this context, the main purpose of this study is to open the black box of HGFs by exploring whether and in which way corporate strategy, employee human capital and R&D capabilities drive HGFs in a crisis-hit economy. To define HGFs the majority of relevant studies utilize relative growth metrics (i.e. percentage changes of firm size or logarithmic differences). Relative measurement of growth favours the participation of smaller firms in the set of HGFs, while absolute measurement of growth tends to favour larger firms. Since not all HGFs grow in the same way, it is important to measure different forms of growth with various growth measures (Delmar et al., 2003; Coad et al., 2014a). In this direction, we identify employment as well as sales HGFs based on both absolute and relative measures of firm growth and explore potential differentials between groups of HGFs dominated by large or small-sized firms.

The data used in the empirical analysis come from a two-wave survey of 1500 firms conducted in 2011 and 2013 in Greece, in the midst of economic crisis. Estimation results from probit models can cast light inside the black box of HGFs in adverse economic conditions, providing useful lessons for policy-makers, entrepreneurs and strategists. Particularly, the analysis can offer valuable insights into business mechanisms that enable the achievement of high growth, even during severe economic crises, and thus inform policy-making regarding entrepreneurship policies, as well as strategic decision-making within firms.

The paper is laid out as follows: “Background on the Greek economy” provides a brief overview of the Greek economy focusing on the crisis period; “Conceptual background” presents the conceptual background of our research based on extant literature; “Data and methodology” describes the survey data, the sample and the methodology used; “Results and discussion” presents and discusses the results of the empirical analysis; “Conclusions” concludes and provides some policy and managerial implications.

Background on the Greek economy

Greece represents a rather interesting case study for entrepreneurial policies and especially those aiming at firm growth. The economic crisis that burst in 2008 and lasted mainly up to 2015 has created a turbulent environment for the Greek economy being particularly harmful for the performance and the viability of a large number of Greek firms (Giotopoulos et al., 2017b; Williams & Vorley 2015; Kritikos & Dreger 2015). Over the period 2008–2013, Greece lost about 25% of its gross domestic product, unemployment increased to the level of 27%, private consumption declined by almost 30%, while the production potential of the economy was adversely affected (European Commission, 2013, 2017).

In the context of the economic adjustment programmes launched in 2010 as a way to deal with the sovereign debt crisis faced by Greece, strict austerity measures with an exclusive focus on “cost-competitiveness” and general labour market-based structural reforms were applied supporting fiscal consolidation (Meghir, Pissarides, Vayanos & Vettas, 2017). However, the cost for the economy and society appears to be very high in terms of loss of productive capacity, collapse of investment activity, unemployment, income reductions, inequality rise, tax burden on certain segments of society etc.

The economic crisis revealed long standing structural weaknesses of the productive system and the business model that firms had been pursuing. During the “good times”, that is the period 1994–2008, GDP growth was not driven by growth-oriented entrepreneurship and production. Instead of focusing on industrial and productive structural change, the vast majority of local firms preferred to focus mainly on internal markets, since prices were sticky, implying a higher markup for them while a promising turnover could be rather easily achieved (Gourinchas, Philippon & Vayanos, 2017). At the same time, Greece was (and still is) a country with high entrepreneurial rates, although most of it is self-employment (Cowling, 2000; Livanos, 2009). Hence, efforts for growth were weakened, despite rapid private sector leverage through bank credit.

Evidently, there is a current need for restructuring this productive and business system towards a growth trajectory closely associated with high firm growth prospects and industrial improvement. The adopted policy has not yet succeeded in transforming radically the pattern of entrepreneurial activity and production and still a lot remains to be done to be properly integrated in the industrial policy agenda. Hence, following related studies on HGFs in small economies (e.g. Srhoj et al., 2018; Coad & Scott, 2018) the Greek case may offer unique empirical insights that could be valuable when designing entrepreneurial policies on how firms can grow.

In the present work, the second wave of the survey undertaken in 2013 incorporates the peak of the Greek economic crisis, while the 2011 wave of the survey denotes the burst of the crisis. As a matter of fact the recessionary cycle of the Greek economy begun in 2008, along with the burst of the global economic crisis, where a negative growth rate in the GDP was recorded (−0.3%). By the end of 2011 the accumulative recession was −18% of the Greek GDP. At the end of 2013, Greece had lost 26.4% of its GDP, while in 2014 a slight positive rate was reported (+0.4%). That is why we consider the year 2013 as a crucial milestone representing the peak of the Greek economic crisis (European Commission, 2017).

Conceptual background

Corporate strategy

Ansoff (1957) in his seminal study identifies four main ways that firms may grow strategically, i.e. (a) by penetrating their existing markets with existing products, (b) by offering new products to their existing markets and (c) by entering into new markets, or (d) by penetrating new markets with new products. Among these growth strategies, product and geographical diversification have attracted considerable subsequent research interest (e.g. Hitt, Hoskisson & Ireland, 1994; Littunen & Tohmo, 2003; North & Smallbone, 2000; Pangarkar, 2008; Zahra, Ireland & Hitt, 2000) and have been related to value creation activities (Doukas & Lang, 2003; Zahra, Sapienza & Davidsson, 2006) that are based on the discovery, evaluation and exploitation of growth opportunities (Deligianni, Voudouris & Lioukas, 2015). In the same vein, Davies, Rondi and Sembenelli (2001) provide evidence on the interplay between product and international diversification strategies and the instances in which these two strategic choices can be alternative or complementary routes for overcoming growth constraints.

The role of utility-maximizing managers is central for pursuing growth in the influential managerial model of Marris (1963, 1964) which considers diversification as the only way by which firms can grow. In this model there is a certain ‘profit-maximizing’ growth rate, beyond which additional diversification has a lower expected profitability due to limitations in the managerial resources devoted to the operating efficiency of existing activities and the development of new activities (Coad, 2007). The significance of the management team for a firm’s expansion based on diversification has been also emphasized in the Penrose’s vision of firm growth. A firm’s resource base expands over time as existing managers gain more experience and new ones are trained and integrated into the firm. In this way, freed-up managerial resources can be directed to new activities. Importantly, these new activities should be related to the idiosyncrasies of the firm’s resource base in order for growth by diversification to effectively realize. Indeed, Penrose considers diversification almost a necessity for the firm in order to be able to compete successfully in the market.

Even though the relationship between product diversification and firm performance has been extensively explored, there are no unanimous results in the related literature regarding the nature of this relationship (e.g., Palich, Cardinal & Miller, 2000). Palich et al. (2000) provide evidence in favour of moderate levels of product diversification suggesting that firm performance increases as the firm shifts from single-business strategies to diversification related to the firm’s core activities. Focusing on firm growth as a performance indicator, Coad and Guenther (2014) report a significant negative effect of product diversification on subsequent employment growth arguing that existing employees normally get prepared for being active in a new sector well before the diversification event and that new hires may take place in the period before -not after- the event. What is more, contrary to authors’ expectations, their findings show a negative relationship between product diversification and subsequent sales growth, which may be explained on the grounds of significant lags between a product introduction and increases in sales and/or a possible decline in sales of established or withdrawn products after the introduction of the new one.

Importantly, small fast growing ventures may use diversification practices as a more proactive opportunity-driven response to increased uncertainty and turbulence (Jumpponen, Ikävalko & Pihkala, 2008; Laine & Galkina, 2017; Parnell, 2013). Diversified firms may limit their exposure to uncertainty related to the potential decline in the original business activity and spread the overall financial risk among various imperfectly correlated business1 activities (Palich et al., 2000; Coad & Guenther, 2013) offsetting in this way the harmful impact of unanticipated economic disruptions (Aivazian, Rahaman & Zhou, 2019).

Penetrating new international markets is also considered a major strategic move of the firm (Stam, Gibcus, Telussa & Garnsey, 2008) and an entrepreneurial strategy pursued, particularly, by smaller and medium-sized firms (Hitt, Ireland, Camp & Sexton, 2001b; Lu & Beamish 2001). Entrepreneurial firms can learn from their entries into international markets and the development and diffusion of this kind of knowledge throughout organization builds dynamic capabilities and competencies (Teece, Pisano & Shuen, 1997; Luo, 2000) and creates value for the firm’s owners (Hitt, Hoskisson & Kim, 1997; Geringer, Tallman & Olsen, 2000; Autio, Sapienza & Almeida, 2000). Indeed, international knowledge may help small firms in identifying growth opportunities in the foreign markets (Voudouris, Dimitratos & Salavou, 2011) as well as in taking appropriate action to enter and improve their competitive position in these markets (Zhou, 2007; Deligianni et al., 2015). Firms which pursue the geographical expansion of economic activities over national borders are mostly able to broaden their customer base and, thus, experience rapid growth (Dobbs and Hamilton 2007; Littunen & Tohmo, 2003).

Relevant research on high-growth patterns indicates that fast growing firms exhibit high levels of internationalization (Burgel, Fier, Licht & Murray, 2003), particularly export activity (O’Gorman, 2001; Zahra et al., 2000; Moschella, Tamagni & Yu, 2018) and pursue globally oriented strategies (Robson & Bennett, 2000). Despite the inherent risks embedded within a geographical diversification strategy (Parker, Storey & Van Witteloostuijn, 2010), many HGFs appear to be successful in generating growth by entering new geographical markets (Barringer & Greening, 1998; Mason & Brown, 2013). Focusing on the internationalization patterns and processes of HGFs in Scotland, Mason and Brown (2013) show that it is very likely for HGFs to have a physical presence in international markets and achieve high growth mainly by expanding their workforce overseas. In the same vein, there is evidence that HGFs adopt more aggressive forms of international expansion than less rapidly growing firms (Brown & Mawson, 2016).

Under turbulent economic conditions firms with export activity may exploit to a greater extent investment opportunities due to their advantage of larger scale and opportunities to hedge downturns across different markets (Burger et al., 2017). In our context, the small size of the Greek economy along with the turbulent economic environment that characterizes the country in the examined period may play a relevant role. More specifically, the sharp fall in domestic demand and the contraction of disposable incomes as a result of the recent crisis may have motivated firms of high-quality to pursue cross-border strategies as their main growth mode (Giotopoulos et al., 2017a).

Along with product diversification and cross-border geographical diversification, a number of scholars in the strategic management literature consider M&A, as a basic corporate strategy for the expansion of horizontal boundaries (Coad, 2007; Besanko et al., 2009; Parker et al., 2010; Rothaermel, 2015). McKelvie and Wiklund (2010) criticize the line of research that focuses on the growth outcomes of these strategies and not on the growth modes that firms follow, since the majority of these studies do not take into account the possible usage of other than organic growth processes, such as M&A. Thus, growth by acquisition constitutes a main process of corporate strategy by which firms actually grow (Coad, 2007; Dagnino, King & Tienari, 2017).

Penrose (1959) recognizes the acquisition of resources as a potentially attractive option for a firm to achieve growth. Nevertheless, acquisitions create new challenges for managers due to the adjustment costs and the high requirements in managerial resources that the acquisition process usually entails, potentially, impeding future organic growth. Indeed, the two modes of growth, i.e. acquisition vs. organic growth are distinguished in the Penrose’s theory, with organic growth being mostly related to smaller firms, younger firms, and emerging industries, while acquisition growth is more common in older and larger firms, and in mature industries. Penrose concludes that the two processes are fundamentally different in many respects and that pursuing either organic or acquisition growth is a firm’s strategic choice (McKelvie & Wiklund 2010).

In general, existing empirical evidence on the relationship between M&A and firm growth is rather mixed. Lockett, Wiklund, Davidsson and Girma (2011) find that acquisitions have positive effects on the subsequent growth of SMEs in Sweden, while Arvanitis and Stucki (2014) find that in the case of Swiss SMEs, there are multiple benefits for acquiring firms in terms of sales growth, growth of value-added per employee and sales of innovative products per employee. Other studies, though, report negative effects of M&A on firm growth measures based on employment and output (e.g. Conyon, Girma, Thompson & Wright, 2002). There are also empirical works which report mixed effects of M&A on firm growth for USA vs. European firms (Gugler & Yurtoglu 2004).

Focusing on HGFs, acquisition of new resources and capabilities is considered necessary when firms face the so-called ‘critical junctures’ in order to progress to the next phase of development (Vohora, Wright & Lockett, 2004). In the context of the resource-based theory of the firm, acquisition activity of HGFs can be explained on the basis of the heterodox resource needs of most rapidly growing firms which induce them to seek the required resources outside the boundaries of the organization (Mason & Brown, 2013; Brown, Mawson & Mason, 2017). Indeed, evidence from UK suggests that a significant proportion of HGFs engage in acquisition activity (Mawson, 2012). In addition, it is found that HGFs may achieve employment growth by acquiring other firms (Delmar et al., 2003), while HGFs which grow in sales are less likely to have been involved in a M&A prior to their growth period (Daunfeldt, Halvarsson & Mihaescu, 2015). Also, given the strategic resource gap that many firms face (Rothaermel, 2015), M&A may be a preferable strategic choice for firms in their attempt to adapt, survive and respond to economic turbulence (Martin-Rios & Pasamar, 2018). More particularly, firms with deep pockets or long purse (Besanko et al., 2009) are likely to take advantage of growth opportunities in crisis periods by acquiring vulnerable firms, in order to absorb and exploit new resources that are valuable, rare and difficult to imitate (Rothaermel, 2015).

Based on the above discussion, we explore the significance of three major strategies, i.e. product diversification, geographical diversification and M&A for a firm in order to exhibit high growth rates. Overall, we expect that these three corporate strategies are likely to positively affect a firm’s probability of achieving high growth rates in turbulent economic environments, as suggested by the following set of hypotheses.

-

H1a: Pursuing a product diversification strategy increases a firm’s probability of growing fast in a crisis-hit economy.

-

H1b: Pursuing a geographical diversification strategy increases a firm’s probability of growing fast in a crisis-hit economy.

-

H1c: Being involved in M&A increases a firm’s probability of growing fast in a crisis-hit economy.

Employee human capital

The selection, development, and use of human capital can be a main channel for firms to create value and improve their performance, since firm knowledge exists to a great extent within its human capital (Hitt et al., 2001). The resource-based theory of Penrose (1959) suggests that hiring individuals with “complementary skills” is, indeed, crucial for supporting the human capital base in the growing firm. Drawing on the Penrose’s theory many studies emphasize the role of human resources in building sustainable competitive advantage of firms (Wernerfelt, 1984; Dierickx & Cool, 1989; Barney, Wright & Ketchen, 2001).

Educational attainment and training constitute the main forms of employee human capital (Danvila-del-Valle, Estévez-Mendoza & Lara, 2019; Demir, Wennberg & McKelvie, 2017), which is considered to play a key role for the realization and maintenance of firms’ rapid growth (Dobbs & Hamilton, 2007; Almus, 2002). Acknowledging the importance of their workforce as a core competence, HGFs put particular emphasis on their human resources management (HRM) practices (Dobbs & Hamilton, 2007). According to Mason and Brown (2010) rapid-growth firms have distinctive HRM practices, involving employee training, employee development and a remuneration system that give employees financial incentives.

Even though some scholars highlight the benefits for HGFs from recruiting employees with an already high human capital base (Wennberg, 2009), a number of studies argue that HGFs seek to hire low-educated and, thus, low-cost employees and enhance their skills through in-house training (Rajan & Zingales, 2001; Lepak & Snell, 1999). Along these lines and given the often dynamic and rapidly changing organizational structure and work environment of HGFs Eisenhardt & Schoonhoven, 1990), Coad et al. (2014b) maintain that HGFs are likely to hire young, low experienced and low specialized labour if the costs of recruitment and training are lower than the costs of hiring highly skilled staff. Evidently, the resulting knowledge and experience from training employees with an initial low human capital base is likely to be idiosyncratic to the specific firm, improving the cost/benefit ratio of the firm’s human capital (Lepak & Snell, 1999). However, this may be particularly relevant for small HGFs, while the opposite may hold in the case of large HGFs which have already achieved a period of growth (Coad et al., 2014b).

In empirical terms, some studies provide evidence that the skill and educational level of employees is an important predictor of high growth (Lopez-Garcia & Puente, 2012). Nevertheless, this result does not seem to hold universally, especially in the case of rapid growing firms. Hölzl (2009) shows that a high-skilled personnel contributes to economic growth in technology leading countries rather than countries that lie away from the technological frontier. Also, this study reports a positive relationship between employee educational levels and growth for HGFs in southern and continental European Union member states, but a negative such relationship for HGFs in new member states of the European Union. Zhang, Yang and Ma (2008) provide evidence from China, suggesting that employees who hold a university degree are more common in rapid-growth firms compared to their lower-growth counterparts. On the other hand, Coad et al. (2014b) find that firms which grow fast in terms of employment tend to hire lower-educated workers in comparison to non-HGFs. Other studies focus on employee training and highlight the significant role that personnel training practices may have in HGFs’ exceptional performance providing empirical evidence from the United States (Barringer, Jones & Neubaum, 2005), as well as the United Kingdom (Sims & O’Regan, 2006). Similarly, Barbero, Casillas and Feldman (2011) based on a sample of Spanish HGFs find that employee training is particularly significant for HGFs with innovation-based growth orientation.

Thus, human capital appears to be particularly significant for HGFs, although in some instances, hiring low-skilled employees and, subsequently, investing in their training may be a preferable strategy. This may be the case when HGFs experience financial constraints (Martinsson, 2010), especially in turbulent times and, consequently, recruiting a critical mass of high-skilled employees entails a considerable payroll cost. On the other side, larger HGFs may exploit a form of scale economies in training, given the fact that the training programs they offer concern a large number of newcomers. So, as a part of a cost efficient strategy in crisis times, firms may prefer to employ low-educated individuals and invest in their training in order to maximize production at the lowest possible cost (Lepak & Snell 1999).

Based on the above, we formulate the following twofold hypothesis for the relationship between employee human capital and the likelihood of exhibiting high growth rates in turbulent economic times.

-

H2a: Educational attainment of employees does not increase a firm’s probability of growing fast in a crisis-hit economy.

-

H2b: Employee training increases a firm’s probability of growing fast in a crisis-hit economy.

R&D capabilities

In the context of strategic entrepreneurship, firms’ R&D efforts to innovate are considered as a high-risk process with a potential high-growth premium in case of success (Stam & Wennberg, 2009). Within the Schumpeterian process of creative destruction, fast growing firms act as the agents of dynamic reallocation of resources by combining existing input factors in novel ways to produce an innovation which, in turn, enables them to outperform the market (Hölzl, 2009). In-house R&D facilitates the emergence of knowledge creation routines within the firm which enable the generation of inventions (Rosenberg, 1990; Stam & Wennberg, 2009).

Empirical literature has largely confirmed the positive effects of R&D and innovation activities on firms’ sales growth (Geroski & Toker, 1996; Roper, 1997) and/or employment growth (Greenhalgh, Longland & Bosworth, 2001; Van Reenen, 1997). Increasing R&D investment as a part of an expansionary strategy is also found to be critical for leading EU service firms in responding to the financial crisis of 2008 (Martin-Rios & Pasamar, 2018). Along these lines, a number of studies provide evidence that R&D activities play a key role in shaping the growth patterns of HGFs (Coad & Rao, 2008; Hölzl, 2009). In particular, Freel (2000) demonstrates that innovation activities stimulate the growth rates for fast growing firms and not for the average firm. Similarly, Coad and Rao (2008), focusing on US manufacturing, find that even though the innovative activity may not be so important for sales growth of the average firm, innovativeness is of critical significance for the “superstar” HGFs. Hölzl (2009) examining the nexus between R&D behaviour of manufacturing SMEs and employment growth finds that R&D activity plays a critical role, especially for high-growth SMEs, in countries that are closer to the technological frontier. In general, the majority of empirical studies tend to support that the exceptional performance of HGFs is closely related to their systematic R&D activities (Audretsch, Coad & Segarra, 2014; Conte & Vivarelli, 2005).

On the other hand, some recent studies note that this conclusion may be sensitive when examining alternative proxies of innovation and R&D activities (Segarra & Teruel, 2014; Bianchini, Pellegrino & Tamagni, 2016) and that HGFs may depart from conventional R&D intensive firms (Colombelli, Krafft & Quatraro, 2014; Brown et al., 2017). Empirical studies provide evidence suggesting that fast growing firms are most likely to modify existing technologies rather than to introduce a radical innovation (Mason & Brown, 2013). Hinton and Hamilton (2013) find that HGFs in New Zealand were never the first to take a new idea to market. Consistently, Mason and Brown’s (2010) findings suggest that only few firms of Scottish HGFs are innovative while few of their innovations are an outcome of specific R&D activity.

Along similar lines, Stam and Wennberg (2009) indicate that R&D capabilities as a form of organizational-level dynamic capability are related to rapid growth only for a selected group of new high-tech firms and high-growth start-ups. Also, O’Regan, Ghobadian, and Gallear (2006) provide evidence from manufacturing SMEs which shows that sales HGFs neither invest as much in R&D, nor they introduce as many new products to the market as firms with static or declining sales. This discussion largely draws on the resource-based view, which represents an important theoretical paradigm when examining firm growth and is specifically relevant for SMEs which face resource scarcity in terms of knowledge (Grant, 1996), innovation resources and innovation capability (Sok & O’Cass, 2011). Due to this scarcity, many SMEs do not have the resources or capabilities to develop in house R&D or in-house ‘knowledge resources’ (Brunswicker & Van de Vrande, 2014), and thus look for external sources to access knowledge mechanisms (Mawson & Brown, 2017).

Caloghirou, Kastelli and Tsakanikas (2004) have debated on the mix between internal R&D capabilities and external knowledge sources as drivers for innovative performance, highlighting the role of the capability of a firm to recognize, assess and exploit information and knowledge outside its boundaries in the generation of innovation. External knowledge sources usually involve some sort of R&D alliances which improve the firm’s ability to understand and absorb knowledge from outside the firm such as the knowledge spillovers generated possibly by other organizations’ R&D (Cohen & Levinthal, 1989; Stam & Wennberg, 2009) or allow access to complementary resources (Stam et al., 2008). R&D inter-firm alliances constitute specific and identifiable routines of firms by which firms can achieve new resource combinations (Eisenhardt & Martin, 2000; Stam et al., 2008). In normal times, forms of collaboration such as joint ventures, research consortia and R&D alliances appear to be critical for HGFs, enabling them to access a broader base of resources (Dobbs & Hamilton, 2007).

However, procyclical arguments suggest that firms in times of crisis tend to consider innovation expenditures as more “luxurious” and thus reduce innovation activities due to limited resources, but also due to a perceived higher risk compared to more “baseline activities”. According to Block & Sandner (2009) the financial crisis can lead to a severe “funding gap” against technology-intensive and innovative start-ups. Recent studies focusing on the economic crisis of 2008 show that innovation expenditures of firms appear to be substantially diminished due to the adverse economic conditions (Archibugi, Filippetti & Frenz, 2013a, 2013b) and that these significant innovation project discontinuations are possibly related to increased financing constraints (Paunov, 2012). Thus, under particularly adverse economic conditions where internal markets are increasingly shrinking and the demand sharply drops, motives and efforts for innovation may be weak and inadequate failing to support the exceptional performance of firms.

Accordingly, in our context of analysis, we expect that in-house R&D and research collaborations may not help firms in realizing rapid growth. Thus, the last hypotheses to test can be written as follows:

-

H3a: In-house R&D does not increase a firm’s probability of growing fast in a crisis-hit economy.

-

H3b: Research collaborations do not increase a firm’s probability of growing fast in a crisis-hit economy.

Data and methodology

The data used in this paper stems from an extensive field survey that aimed at 2000 Greek firms, approached in two waves, once in 2011 and then again on 2013. A total of 1500 firms participated in both waves. Limiting the sample to those 1500 Greek firms that participated in both survey waves was a necessary condition for conducting our empirical analysis, since in this way we were able to measure the change in the firms’ size between the two waves and, accordingly, construct the relevant variables of growth metrics.

The empirical instrument of the survey, was a structured questionnaire that includes four major modules on firms’ characteristics: a) a “strategy section” with questions on the adopted strategies from the examined firms, b) a “performance section” where analytical information of the firms’ investment plans and economic performance was retrieved along with projections for the following years, c) an “innovation section” where questions about the innovation performance, R&D activity, patent activity and how such efforts were affected by the crisis were included, and d) a “human capital section” considering structural characteristics on firms’ employees. All interviews were undertaken through the CATI method and the contact person was in the vast majority of the cases the CEO of the firm. The response rate of the survey was estimated at 32.4%.

Regarding the variables used in the model specification, the dependent variable, that is HGFs is measured by a binary variable taking the value of 1 if the firm belongs to the upper 10% of the firm growth distribution in our sample over the 2011–2013 period, and 0 otherwise. This is in the same line with other studies which adopt an empirical rule in order to define HGFs based on the upper 1%, 5% or 10% of the growth distribution of firms in their sample over a specific time period (see for example Coad et al., 2014a, 2014b; Hölzl, 2009; Almus, 2002).Footnote 1

However, the composition of HGFs may be affected by the growth metric used (Coad et al., 2014a). In particular, relative change indicators are measured by percentage changes or log-differences, while absolute change indicators are measured by raw changes in size between two time points. Measures of absolute growth, by definition, are biased toward larger firms, while measures of relative growth are biased toward smaller firms (Coad, 2010). Another important issue in firm growth literature refers to the use of a proper growth indicator. Sales and number of employees are the most commonly used variables which growth indicators are based on. Since sales and employment growth are only modestly correlated (Shepherd & Wiklund, 2009; Coad, 2010), the use of the respective growth indicators could potentially lead to the identification of different sets of HGFs. In this study we use four alternative growth metrics which are constructed based on relative (ln-differences) and absolute (raw differences) changes in both employment and sales of firms between the examined periods.

Table 1 presents percentiles of the firm growth distribution across the four growth metrics adopted in our analysis. As already mentioned, to identify the HGFs in our sample, we focus on the upper 10% of the distribution. As shown in the last column of Table 1, the group of HGFs in our case consists of firms that have grown in the examined period by at least 37% based on the relative employment growth and by 20 employees according to the absolute employment growth measure. Accordingly, the group of sales HGFs includes firms that have increased their turnover by 27% in relative terms or by 2,825,589 euros in absolute terms. On the other hand, it is interesting to note that the lowest 10% of the distribution refers to firms which have been declined in size by at least 75% according to the relative employment growth or firms that have cut their staff by at least 40 employees in the examined period.

In addition, Table 2 reports the distribution of HGFs based on the aforementioned growth measures across four size categories, i.e. micro enterprises (fewer than 10 employees), small firms (10–49 employees), medium firms (50–249 employees) and large firms (250 or more employees) following the formal definition provided by European Union Commission (2003). Being consistent with theoretical predictions concerning the absolute and relative growth measures, Table 2 shows that the group of HGFs in our sample is dominated by firms of smaller size (micro and small) when growth is measured in relative terms, while the opposite holds when we use absolute changes in measuring firm growth.

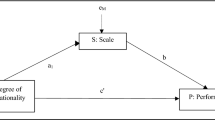

Focusing on the factors that may drive HGFs as discussed in “Conceptual background”, we classify the used explanatory variables in three categories, namely corporate strategies, R&D capabilities and employee human capital (see Fig. 1). Regarding corporate strategies, we use three variables which refer to product diversification, geographical diversification and M&A. R&D capabilities are captured by two variables, namely in-house R&D and research collaborations, while employees’ educational attainment and employee training are used to proxy the human capital embedded in firms’ workforce.

In constructing the independent variables of our models we used information derived from the first survey wave, taking into account that the potential impact of firms’ practices under examination (corporate strategies, human resource practices, R&D capabilities) on firm performance is expected to realize with a time lag. The main explanatory variables in our empirical analysis are described in more detail below:

-

Mergers and acquisitions: Firms were asked to estimate on a five-point Likert scale (‘not used’ to ‘high’) the extent to which mergers and acquisitions is a part of their strategy in the last 2 years.

-

Product diversification: Firms were asked to approximate on a five-point Likert scale (‘not used’ to ‘high’) the extent to which they have penetrated in different industries from their primary activity in the last 2 years.

-

Geographical diversification: Measured by the percentage share of firm exports in more than one international market to total sales.

-

Educational attainment of employees: Measured by the percentage share of employees with a PhD and/or a master degree.

-

Employee training: Measured by a binary variable that takes the value of 1 if the firm declares that it has trained its employees through internal or external training procedures, and the value of 0 otherwise.

-

In-house R&D: Measured by a binary variable that takes the value of 1 if the firm has an in-house R&D department and 0 otherwise.

-

Research collaborations: Measured by a binary variable that takes the value of 1 if the firm has participated in joint research projects with universities and research institutes in the last 2 years and 0 otherwise.

We also take into account firm- and environment-specific characteristics. In specific, we use the natural logarithm of firm sales as a measure of firm size. To control for potential credit constraints, firms were asked to estimate (on a 1–5 Likert scale), the level of credit crunch conditions they face due to banks’ inability to provide loans. We also include a set of industry dummies in our model.Footnote 2 Summary statistics and frequencies for the independent variables are reported in Tables 3, 4, and 5. On average, only a small fraction (4.4%) of a firm’s employees in our sample appears to hold a PhD or a Master degree (Table 3), while a large share (70%) of the surveyed firms report the implementation of employee training programmes (Table 4). With respect to R&D activities, less than 20% of the firms in our sample appear to have an R&D department and slightly more than 10% declare participation in research collaborations (Table 4). Looking at the corporate strategy variables, on average almost 22% of firm sales come from export activity in at least two foreign markets (Table 3), while product diversification seems to be a rather common strategy, with 25% of the examined firms reporting intense penetration in diverse product markets during the 2 years preceding the survey (Table 5). On the other hand, the majority of firms in our sample (63%) do not consider M&A as part of their corporate strategy in the last 2 years (Table 5) and a large share of firms (43%) declare that they face significant credit constraints.

In addition, the correlation matrix along with the VIF tests provided in Table 6 indicate the absence of high correlations among the independent variables, which in turn ensures that the econometric estimates are not biased due to possible multicollinearity problems.

The econometric analysis is based on the estimation of the following equation:

where HGFi indicates whether firm i belongs to the upper 10% of the firm growth distribution. The explanatory variables PrDivi, GeoDivi, M & Ai, InR & Di, ResColli, Educi, Traini, CredConstri and Sizei denote product diversification, geographical diversification, M&A, in-house R&D, research collaborations, educational attainment, employee training, bank-lending constraints and firm size of firm i, respectively. Finally, ui is the random error term and β denotes the vector of the coefficients to be estimated.

We estimate four models in the form of eq. (1) corresponding to the alternative growth metrics we employ to define the HGFs as described above. Since the dependent variable in either case is measured by a binary variable, we employ probit regressions, using the maximum likelihood estimation method to identify potential determinants of the probability that the firms exhibit high growth rates. In particular, we compute the marginal effects of the explanatory variables on the probability of a firm belonging to the group of HGFs for each of the four models. As a common practice, for the computation of the marginal effect of a specific variable we set all other variables at their mean value.

Results and discussion

Table 7 presents the estimation results of eq. (1) for the four growth indicators used to define HGFs in this study. Once again we note that the groups of HGFs are different among the estimated models since they are based on different growth metrics.

Focusing, first, on the corporate strategies adopted by the firms our results indicate that there is a large and highly significant positive impact of geographical diversification on the probability of being a HGF. Notably, this interesting result appears to be particularly strong in terms of both statistical significance and magnitude and holds for all models; i.e. it is independent from the growth metric used to determine HGFs. In other words, pursuing a geographical diversification strategy across borders seems to substantially increase a firm’s probability of exhibiting high-growth rates, irrespective of the growth measure used. A firm which successfully penetrates foreign markets enjoys multiple benefits in terms of acquiring new knowledge and building dynamic capabilities and competencies (Teece et al., 1997; Luo, 2000) which in turn are translated in high growth rates (Voudouris et al., 2011; Littunen & Tohmo, 2003). In our context, the small size of the Greek economy along with the turbulent economic environment that characterizes the country in the examined period may play a relevant role. More specifically, the sharp fall in domestic demand and the contraction of disposable incomes as a result of the recent crisis may have motivated firms of high-quality to pursue cross-border strategies as their main growth mode (Giotopoulos et al., 2017a). Thus, our results strongly support hypothesis H1b and also corroborate existing empirical evidence which recognizes geographical diversification as a major strategy that enables firms to achieve exceptional growth rates (Robson & Bennett, 2000; Beck, Demirgüç-Kunt & Maksimovic, 2005).

Regarding the rest of the examined corporate strategies, product diversification is found to strongly affect the probability of belonging to the group of HGFs in model 1, which is based on the relative employment growth metric. Given that this group is dominated by rather small-sized firms (see “Data and methodology”), this result may imply that expanding in different product markets may be a proactive opportunity-driven (entrepreneurial) response of small HGFs to increased uncertainty and turbulence (Jumpponen et al., 2008; Laine & Galkina, 2017; Parnell, 2013). Diversified firms may limit their exposure to uncertainty related to the potential decline in the original business activity and spread the overall financial risk among various imperfectly correlated business activities (Palich et al., 2000; Coad & Guenther, 2013), offsetting –at least to some extent- the harmful impact of unanticipated economic disruptions (Aivazian et al., 2019). To this end, being active in different product markets may require the multiplication of a number of input elements (Matusik & Fitza, 2012; Deligianni et al., 2017) and particularly staff expansion resulting, in effect, in high employment growth (in relative terms). The product diversification variable is also found to have an effect, though at 10% significance level, in model 2 referring to absolute employment HGF dominated by large firms. On the other hand, product diversification is not found significant for growing fast in terms of sales (models 4 and 5) probably due to significant lags between a product introduction and increases in sales and/or a possible decline in sales of established or withdrawn products after the introduction of the new one (Coad & Guenther, 2014). Hence, hypothesis H1a is validated in the cases of employment growth metrics but not in the cases of sales growth metrics.

In addition, mergers and acquisitions are found to have a significant (at the 10% significance level) but rather small effect on the probability of being a HGF based on the absolute employment growth measure (model 2). Since -as already mentioned- this employment growth metric tends to favour larger HGFs, this result may provide some support to Penrose’s (1959) view that acquisition growth is more likely in larger firms, contrary to organic growth which is more likely to be associated with smaller firms. The relevant finding is largely consistent with Delmar et al. (2003) who identify a cluster of HGFs which appear to grow fast in terms of employment mostly by acquiring other firms. Larger firms are likely to have difficulty in achieving further employment growth due to a strategic resource gap they face. Thus, they are expected to seek for new resources that are valuable, rare and difficult to imitate from other firms which resources are often embedded deep within (Rothaermel, 2015). This is particularly relevant to times of crisis where it may be easier for firms with deep pockets or long purse (Besanko et al., 2009) to identify and take advantage of opportunities to fill this resource gap by acquiring vulnerable firms. On the other hand, we find that mergers and acquisitions do not seem to play any relevant role for sales HGFs (models 3 and 4), yet, being in agreement with empirical evidence provided by Daunfeldt et al. (2015). Overall, our results seem to provide little support for hypothesis H1c referring to the significance of M&A for achieving exceptional growth rates under adverse economic conditions.

Focusing on employee human capital our results show that the likelihood of a firm to exhibit high growth in sales increases with the educational level of employees (models 3 and 4), although the corresponding marginal effects appear to be rather low. In case of employment HGFs (models 1 and 2) employee educational attainment does not seem to play any relevant role. Thus, hypothesis H2a is partially confirmed. However, this finding seems to be in accordance with empirical studies which find that employees’ high educational level is significant for firms which grow rapidly in terms of sales (e.g. Zhang et al., 2008). Given that sales can be considered an output and employees an input in a firm’s production function, HGFs that grow fast in sales might be expected to be more efficient than HGFs which grow rapidly in terms of employment; this probably implying that the personnel of sales HGFs is more skilled than the personnel of employment HGFs (Coad et al., 2014b). Moreover, our results provide little evidence in favour of hypothesis H2b, since employee training is found to increase the probability of growing fast only in the case of the absolute employment growth indicator (model 2). Even though the respective marginal effect appears to be rather high, it is statistically significant only at the 10% level. However, taking also into account that in this model the employees’ high educational level is not found statistically significant, this result may provide some support to the view that HGFs opt for hiring low skilled staff and invest in on-the-job training in order to enhance their knowledge and skills, given that the cost of training new staff may be lower than the cost of hiring staff with an already high human capital base (Coad et al., 2014b; Rajan & Zingales, 2001), in crisis periods.

With respect to firms’ R&D capabilities the picture from our results is not so clear, at least at first glance. Specifically, we find that firms undertaking in-house R&D activities are more likely to belong to the group of firms with the highest relative employment growth (at the 5% level of significance). In the same direction, the engagement of firms in research collaborations plays a positive and significant role (at the 10% level of significance) when we use the relative employment change as a growth metric (model 1). Within the Schumpeterian framework of innovation, fast growing firms are considered to play a more crucial role in the process of creative destruction and, under certain conditions, have a greater contribution to job creation than other firms (Henrekson & Johansson, 2010; Hölzl, 2009). In empirical terms, this finding is largely in agreement with studies highlighting the critical role of R&D and innovation activities in growing rapidly in terms of employment in advanced countries (Hölzl, 2009; Stam & Wennberg, 2009).

On the other hand, we find that internal R&D activities do not matter for sales HGFs, while participating in joint research projects has a negative effect on the likelihood of growing fast in terms of sales (models 3 and 4). A possible explanation of these results may relate to the firms’ behavior towards R&D and innovation activities under turbulent economic conditions. Specifically, R&D and innovation expenditures are usually considered as a luxury item in the expenses list and appear to be the first ones that firms tend to cut, when liquidity constraints emerge. Thus, firms are likely to reduce innovation activities due to limited resources, but also due to a perceived higher risk compared to more “baseline activities”. Indeed, there is evidence of substantial reductions in innovation expenditures of firms as a result of the economic crisis of 2008 (Archibugi et al., 2013a, 2013b). Thus, under particularly adverse economic conditions where internal markets are increasingly shrinking and the demand sharply drops, motives and efforts for innovation may be weak and inadequate failing to enhance the sales performance of HGFs. Overall, our results suggest that with the exception of employment HGFs based on the relative growth measure (model 1), R&D capabilities do not seem important for HGFs in times of crisis, thus, in general, providing support to hypotheses H3a and H3b.

Finally, firm size is found to positively affect the probability of growing fast in cases where absolute growth measures are used (models 2 and 4), while the corresponding effect appears to be negative in models 1 and 3 which use relative measures of firm growth. Evidently, these results corroborate our expectations on the dominance of larger firms in HGFs defined based on absolute growth metrics and on the overrepresentation of small-sized firms in the group of HGFs when relative growth indicators are used (Coad, 2010; Hölzl, 2009).

To check the robustness of our results we estimated a number of additional models. First, we tried alternative models using logit and OLS specifications. Furthermore, following Hölzl (2009) and Coad et al. (2014b)Footnote 3 we used an alternative definition of HGFs based on the upper 5% of firm growth distribution which resulted in a smaller HGF group exhibiting higher average growth rate. The main empirical results obtained in the above mentioned specificationsFootnote 4 are in the same direction with those reported in the paper. We also used the Birch index following Hölzl (2014) and Almus (2002) as an alternative growth metric which combines absolute and relative change into one number.Footnote 5 The results where exactly the same with those obtained using absolute employment growth (model 2). The correlation between the dependent variables of the two models (absolute employment growth and Birch indicator) was extremely high (0.93) indicating that the two measures identify similar groups of HGFs, being in agreement with existing evidence (Hölzl 2014).

Conclusions

The contribution of fast growing firms to job creation and economic development has been long acknowledged in the growth literature. High-growth firms have been lately received increasing attention from a both academic and policy perspective indicating a (re)focus on high-growth enterprises instead of small or new firms in general. However, our knowledge on the manners in which this special type of firms achieves high-growth rates, especially in turbulent economic environments, is still rather limited.

This paper explores how HGFs succeed to grow fast in Greece in times of crises, taking into account the heterogeneous nature of growth in this type of firms. To this end, a rich dataset is utilized based on a two-wave survey on 1500 Greek firms conducted in 2011 and 2013, i.e. during a particularly extraordinary period for the Greek economy. Given that the process of growth varies across heterogeneous firms, four alternative measures of growth are computed, namely relative employment growth, absolute employment growth, relative sales growth and absolute sales growth. Alternative growth strategies as well as firms’ human capital and R&D capabilities are explored and assessed as potential modes of exceptional growth performance of firms operating in a crisis-hit economy.

Results from probit models indicate that firms which adopt a geographical diversification strategy have significantly greater probability of growing fast irrespective of the growth metric employed. The turbulent economic environment may play a relevant role, as it is likely that high-quality firms intensively pursue cross-border strategies as a way to grow, especially during crisis times. This strong and highly significant finding may have interesting policy implications, pointing to the need to support and facilitate the export activity of entrepreneurial ventures, especially in small economies like Greece, through, for example, tax motives, lifting administrating barriers to exports (costs, time, paperwork), networking, participation in business trade fairs etc. In addition, entering in diverse product markets and taking advantage of R&D capabilities appear to be critical for HGFs of smaller size in realizing high relative employment growth. Small HGFs appear to intensify their R&D activities and resort to product diversification as a survivalist and employment expansion strategy, given the uncertainty and increased risks related to the original business activity in turbulent economic times.

On the other hand, based on the absolute employment growth indicator we find some evidence that HGFs of larger size are able to significantly expand their workforce not only through geographical and product diversification but also by acquiring other firms in which valuable and difficult to imitate resources reside, in an attempt to fill relevant resource gaps that they may face. Such strategic moves are probably easier for large financially strong firms to realize under adverse economic conditions where opportunities for acquiring vulnerable firms are most likely to arise. Our results also show that this type of HGFs may opt for hiring low-skilled staff and invest in on-the-job training in order to enhance their knowledge and skills. This does not seem to be the case for sales HGFs (defined using either absolute or relative growth measures) which appear to benefit, even to a small extent, from hiring highly-educated persons at the first place. Finally, R&D activities do not seem to contribute to the realization of high growth rates, probably due to the fact that research and innovation expenditures are considered a luxurious item and entail a higher risk for financially constrained firms in times of crisis.

If we could pinpoint some managerial implications that arise from these results, we could highlight a problem that is rather common in small sized economies and/or in crisis-hit economies. The effort to grow through international diversity is not a defensive strategy when internal markets cannot create higher demand or absorb more volume. It is rather the proper strategy that firms from such economies should follow, in order not just to survive but to also have a sustainable growth path. So, exploiting the economies of scale enabled by internationalization and investing in those resources that can support geographical diversification may represent a successful strategic mode of growth for firms in these economies.

A limitation of this paper that should be acknowledged is the short time window frame (2011–2013) used in our analysis to identify HGFs and their modes of growth. Indeed, it may be the case that high growth patterns of fast growing firms identified in a period tend not to persist in the next period (Daunfeldt & Halvarsson, 2015; Satterthwaite & Hamilton, 2017). Although it may be of high research and policy interest to examine the issue under extraordinary economic conditions such as those in Greece within a rather short time period, replicating the results in a broader time frame would be highly valued, enhancing the robustness of our results. In doing so, potential differences regarding the nature of hypothesised relationships between normal and turbulent periods could be also identified. Furthermore, interesting future research directions could involve exploring the left tail of the firm growth distribution, i.e. the low-growth firms which may play a critical role in the job destruction process in an economy.

Notes

Eurostat and OECD provide an alternative recommendation according to which firms with at least 10 employees in the start-year and annualized employment growth exceeding 20% during a 3-year period (Eurostat-OECD 2007) are considered as HGFs. However, this definition is not applicable in our case since it requires annual observations over a 3-year period.

More specifically, the examined firms are classified in nine industries defined based on 2-digit NACE codes: Food and Beverages, Textile, Paper and Publishing, Chemical Products, Plastic/ Elastic Industry, Non Metallic Industry, Basic Metals, Machine and Machinery Equipment, Furniture, and Rest of Manufacturing Industries.

Coad et al. (2014b) examined also HGFs by using the definition on the upper 1% of firm growth distribution. However, the specific definition is not applicable in our sample due to a very limited number of observations for HGFs.

These results are available upon request.

In our case the Birch indicator was computed using the formula: [((Employment2013) − (Employment2011))] ∗ (Employment2013/Employment2011)

References

Acs, Z. J., & Mueller, P. (2008). Employment effects of business dynamics: Mice, gazelles and elephants. Small Business Economics, 30(1), 85–100.

Acs, Z. J., Parsons, W., & Tracy, S. (2008). High-impact firms: Gazelles revisited. In Washington, DC: An office of advocacy working paper. U.S.: Small Business Administration (SBA).

Aivazian, V. A., Rahaman, M. M., & Zhou, S. (2019). Does corporate diversification provide insurance against economic disruptions? Journal of Business Research, 100, 218–233.

Almus, M. (2002). What characterizes a fast-growing firm? Applied Economics, 34(12), 1497–1508.

Ansoff, H. (1957). Strategies for diversification. Harvard Business Review, 35(5), 113–124.

Archibugi, D., Filippetti, A., & Frenz, M. (2013a). Economic crisis and innovation: Is destruction prevailing over accumulation? Research Policy, 42(2), 303–314.

Archibugi, D., Filippetti, A., & Frenz, M. (2013b). The impact of the economic crisis on innovation: Evidence from Europe. Technological Forecasting and Social Change, 80(7), 1247–1260.

Arvanitis, S., & Stucki, T. (2014). Do mergers and acquisitions among small and medium-sized enterprises affect the performance of acquiring firms? International Small Business Journal, 33(7), 752–773.

Audretsch, D. B., Coad, A., & Segarra, A. (2014). Firm growth and innovation. Small Business Economics, 43(4), 743–749.

Autio, E., & Acs, Z. (2010). Intellectual property protection and the formation of entrepreneurial growth aspirations. Strategic Entrepreneurship Journal, 4(3), 234–251.

Autio, E., Sapienza, H. J., & Almeida, J. G. (2000). Effects of age at entry, knowledge intensity, and imitability on international growth. Academy of Management Journal, 43(5), 909–924.

Barbero, J. L., Casillas, J. C., & Feldman, H. D. (2011). Managerial capabilities and paths to growth as determinants of high-growth small and medium-sized enterprises. International Small Business Journal, 29(6), 671–694.

Barney, J., Wright, M., & Ketchen, D. J. (2001). The resource-based view of the firm: Ten years after 1991. Journal of Management, 27(6), 625–641.

Barringer, B. R., & Greening, D. W. (1998). Small business growth through geographic expansion: A comparative case study. Journal of Business Venturing, 13(6), 467–492.

Barringer, B. R., Jones, F. F., & Neubaum, D. O. (2005). A quantitative content analysis of the characteristics of rapid-growth firms and their founders. Journal of Business Venturing, 20(5), 663–687.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2005). Financial and legal constraints to growth: Does firm size matter? Journal of Finance, 60(1), 137–177.

Besanko, D., Dranove, D., Shanley, M., & Schaefer, S. (2009). Economics of strategy. New York: Wiley & Sons.

Bianchini, S., Pellegrino, G., & Tamagni, F. (2016). Innovation strategies and firm growth. LEM working papers 2016/03, laboratory of economics and management (LEM). Pisa: Sant’Anna School of Advanced Studies.

Birch, D. (1979). The job generation process. Cambridge, MA: MIT Press.

Block, J., & Sandner, P. (2009). What is the effect of the financial crisis on venture capital financing? Empirical evidence from US Internet start-ups. Venture Capital, 11(4), 295–309.

Brown, R., & Lee, N. (2019). Strapped for cash? Funding for UK high growth SMEs since the global financial crisis. Journal of Business Research, 99, 37–45.

Brown, R., & Mawson, S. (2016). The geography of job creation in high growth firms: The implications of ‘growing abroad’. Environment and Planning C: Government and Policy, 34(2), 207–227.

Brown, R., Mawson, S., & Mason, C. (2017). Myth-busting and entrepreneurship policy: The case of high growth firms. Entrepreneurship Regional Development, 29(5–6), 414–443.

Brunswicker, S., & Van de Vrande, V. (2014). Exploring open innovation in small and medium-sized enterprises. In H. Chesbrough, W. Vanhaverbeke, & J. West (Eds.), New frontiers in open innovation (pp. 135–156). Oxford: Oxford University Press.

Burgel, O., Fier, A., Licht, G., & Murray, G. (2003). Internationalisation of high-tech start-ups and fast-growth: Evidence for UK and Germany. ZEW discussion paper 00–35. Mannheim: Centre for European Economic Research (ZEW).

Burger, A., Damijan, J. P., Kostevc, Č., & Rojec, M. (2017). Determinants of firm performance and growth during economic recession: The case of central and eastern European countries. Economic Systems, 41(4), 569–590.

Caloghirou, Y., Kastelli, I., & Tsakanikas, A. (2004). Internal capabilities and external knowledge sources: Complements or substitutes for innovative performance? Technovation, 24(1), 29–39.

Coad, A. (2007). Firm growth: A survey. Papers on economics and evolution 2007–03. Jena: Max Planck Institute of Economics, Evolutionary Economics Group.

Coad, A. (2010). Exploring the processes of firm growth: Evidence from a vector auto-regression. Industrial and Corporate Change, 19(6), 1677–1703.

Coad, A., Daunfeldt, S. O., Hölzl, W., Johansson, D., & Nightingale, P. (2014). High-growth firms: Introduction to the special section. Industrial and Corporate Change, 23(1), 91–112.

Coad, A., Daunfeldt, S. O., Johansson, D., & Wennberg, K. (2014). Whom do high-growth firms hire? Industrial and Corporate Change, 23(1), 293–327.

Coad, A., & Guenther, C. (2013). Diversification patterns and survival as firms mature. Small Business Economics, 41(3), 633–649.

Coad, A., & Guenther, C. (2014). Processes of firm growth and diversification: Theory and evidence. Small Business Economics, 43(4), 857–871.

Coad, A., & Rao, R. (2008). Innovation and firm growth in high-tech sectors: A quantile regression approach. Research Policy, 37(4), 633–648.

Coad, A., & Scott, G. (2018). High-growth firms in Peru. Cuadernos de Economía, 37(75), 674–696.

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: The two faces of R&D. The Economic Journal, 99, 569–596.

Colombelli, A., Krafft, J., & Quatraro, F. (2014). High-growth firms and technological knowledge: Do gazelles follow exploration or exploitation strategies? Industrial and Corporate Change, 23(1), 261–291.

Conte, A., & Vivarelli, M. (2005). One or many knowledge production functions? Mapping innovative activity using microdata. IZA discussion paper 1878. Bonn: Institute for the Study of Labor (IZA).

Conyon, M. J., Girma, S., Thompson, S., & Wright, P. W. (2002). The impact of mergers and acquisitions on company employment in the United Kingdom. European Economic Review, 46(1), 31–49.

Cowling, M. (2000). Are entrepreneurs different across countries? Applied Economics Letters, 7(12), 785–789.

Dagnino, G. B., King, D. R., & Tienari, J. (2017). Strategic management of dynamic growth. Long Range Planning, 50(4), 427–430.

Danvila-del-Valle, I., Estévez-Mendoza, C., & Lara, F. J. (2019). Human resources training: A bibliometric analysis. Journal of Business Research, 101, 627–636.

Daunfeldt, S. O., & Halvarsson, D. (2015). Are high-growth firms one-hit wonders? Evidence from Sweden. Small Business Economics, 44(2), 361–383.

Daunfeldt, S. O., Halvarsson, D., & Mihaescu, O. (2015). High-growth firms: Not so vital after all? RATIO Working paper 263. Stockholm: The Ratio Institute.

Davies, S. W., Rondi, L., & Sembenelli, A. (2001). Are multinationality and diversification complementary or substitute strategies? An empirical analysis on European leading firms. International Journal of Industrial Organization, 19(8), 1315–1346.

Deligianni, I., Voudouris, I., & Lioukas, S. (2015). Growth paths of small technology firms: The effects of different knowledge types over time. Journal of World Business, 50(3), 491–504.

Deligianni, I., Voudouris, I., & Lioukas, S. (2017). Do effectuation processes shape the relationship between product diversification and performance in new ventures? Entrepreneurship Theory and Practice, 41(3), 349–377.

Delmar, F., Davidsson, P., & Gartner, W. B. (2003). Arriving at the high-growth firm. Journal of Business Venturing, 18(2), 189–216.

Demir, R., Wennberg, K., & McKelvie, A. (2017). The strategic management of high-growth firms: A review and theoretical conceptualization. Long Range Planning, 50(4), 431–456.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35(12), 1504–1511.

Dobbs, M., & Hamilton, R. T. (2007). Small business growth: Recent evidence and new directions. International Journal of Entrepreneurial Behavior Research, 13(5), 296–322.

Doukas, J. A., & Lang, L. H. (2003). Foreign direct investment, diversification and firm performance. Journal of International Business Studies, 34(2), 153–172.

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21, 1105–1121.

Eisenhardt, K. M., & Schoonhoven, C. B. (1990). Organizational growth: Linking founding team, strategy, environment, and growth among US semiconductor ventures, 1978–1988. Administrative Science Quarterly, 35(3), 504–529.

European Commission. (2010). Europe 2020: A strategy for smart, sustainable and inclusive growth: Communication from the commission. Brussels: European Commission Publications Office.

European Commission. (2013). European economic forecast, winter 2013. Brussels: European Commission.

European Union Commission. (2003). Commission recommendation of 6 May 2003 concerning the definition of micro, small and medium-sized enterprises. Official Journal of the European Union, 46(L124), 36–41.

European Commission. (2017). European economic forecast, spring 2017. Brussels: European Commission.

Freel, M. S. (2000). Do small innovating firms outperform non-innovators? Small Business Economics, 14(3), 195–210.

Geringer, J. M., Tallman, S., & Olsen, D. M. (2000). Product and international diversification among Japanese multinational firms. Strategic Management Journal, 21(1), 51–80.

Geroski, P. A., & Toker, S. (1996). The turnover of market leaders in UK manufacturing industry, 1979–86. International Journal of Industrial Organization, 14(2), 141–158.

Giotopoulos, I., Kontolaimou, A., & Tsakanikas, A. (2017a). Drivers of high-quality entrepreneurship: What changes did the crisis bring about? Small Business Economics, 48(4), 913–930.

Giotopoulos, I., Kontolaimou, A., & Tsakanikas, A. (2017b). Antecedents of growth-oriented entrepreneurship before and during the Greek economic crisis. Journal of Small Business and Enterprise Development, 24, 528–544.

Gourinchas, P. O., Philippon, T., & Vayanos, D. (2017). The analytics of the Greek crisis. NBER Macroeconomics Annual, 31(1), 1–81.

Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17, 109–122.

Greenhalgh, C., Longland, M., & Bosworth, D. (2001). Technological activity and employment in a panel of UK firms. Scottish Journal of Political Economy, 48(3), 260–282.

Gugler, K., & Yurtoglu, B. B. (2004). The effects of mergers on company employment in the USA and Europe. International Journal of Industrial Organization, 22(4), 481–502.

Gundry, L. K., & Welsch, H. P. (2001). The ambitious entrepreneur: High growth strategies of women-owned enterprises. Journal of Business Venturing, 16(5), 453–470.

Halabisky, D., Dreessen, E., & Parsley, C. (2006). Growth in firms in Canada, 1985–1999. Journal of Small Business and Entrepreneurship, 19(3), 255–268.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who creates jobs? Small versus large versus young. Review of Economics and Statistics, 95(2), 347–361.

Henrekson, M., & Johansson, D. (2010). Gazelles as job creators: A survey and interpretation of the evidence. Small Business Economics, 35(2), 227–244.

Hinton, M., & Hamilton, R. T. (2013). Characterizing high-growth firms in New Zealand. The International Journal of Entrepreneurship and Innovation, 14(1), 39–48.

Hitt, M. A., Bierman, L., Shimizu, K., & Kochhar, R. (2001). Direct and moderating effects of human capital on strategy and performance in professional service firms: A resource-based perspective. Academy of Management Journal, 44(1), 13–28.

Hitt, M. A., Hoskisson, R. E., & Ireland, R. D. (1994). A mid-range theory of the interactive effects of international and product diversification on innovation and performance. Journal of Management, 20(2), 297–326.

Hitt, M. A., Hoskisson, R. E., & Kim, H. (1997). International diversification: Effects on innovation and firm performance in product-diversified firms. Academy of Management Journal, 40(4), 767–798.

Hitt, M. A., Ireland, R. D., Camp, S. M., & Sexton, D. L. (2001). Guest editor’s introduction to the special issue strategic entrepreneurship. Strategic Management Journal, 22(6/7), 479–492.

Hölzl, W. (2009). Is the R&D behaviour of fast-growing SMEs different? Evidence from CIS III data for 16 countries. Small Business Economics, 33(1), 59–75.

Hölzl, W. (2014). Persistence, survival, and growth: A closer look at 20 years of fast-growing firms in Austria. Industrial and Corporate Change, 23(1), 199–231.

Jumpponen, J., Ikävalko, M., & Pihkala, T. (2008). Management and change in turbulent times: How do Russian small business managers perceive the development of their business environment? Journal of Business Economics and Management, 9(2), 115–122.

Kritikos, A. S., & Dreger, C. (2015). The Greek crisis: A Greek tragedy? Vierteljahrshefte Zur Wirtschaftsforschung, 84, 5–8.

Laine, I., & Galkina, T. (2017). The interplay of effectuation and causation in decision making: Russian SMEs under institutional uncertainty. International Entrepreneurship and Management Journal, 13(3), 905–941.

Lepak, D. P., & Snell, S. A. (1999). The human resource architecture: Toward a theory of human capital allocation and development. Academy of Management Review, 24(1), 31–48.

Littunen, H., & Tohmo, T. (2003). The high growth in new metal-based manufacturing and business service firms in Finland. Small Business Economics, 21(2), 187–200.

Livanos, I. (2009). What determines self-employment? A comparative study. Applied Economics Letters, 16(3), 227–232.

Lockett, A., Wiklund, J., Davidsson, P., & Girma, S. (2011). Organic and acquisitive growth: Re-examining, testing and extending Penrose's growth theory. Journal of Management Studies, 48(1), 48–74.

Lopez-Garcia, P., & Puente, S. (2012). What makes a high-growth firm? A dynamic probit analysis using Spanish firm-level data. Small Business Economics, 39(4), 1029–1041.

Lu, J. W., & Beamish, P. W. (2001). The internationalization and performance of SMEs. Strategic Management Journal, 22(6–7), 565–586.

Luo, Y. (2000). Dynamic capabilities in international expansion. Journal of World Business, 35(4), 355–378.

Macpherson, A., & Holt, R. (2007). Knowledge, learning and small firm growth: A systematic review of the evidence. Research Policy, 36(2), 172–192.

Marris, R. (1963). A model of the ‘managerial enterprise’. Quarterly Journal of Economics, 77(2), 185–209.

Marris, R. (1964). The economic theory of managerial capitalism. London: Macmillan.

Martin-Rios, C., & Pasamar, S. (2018). Service innovation in times of economic crisis: The strategic adaptation activities of the top EU service firms. R&D Management, 48(2), 195–209.

Martinsson, G. (2010). Equity financing and innovation: Is Europe different from the United States? Journal of Banking & Finance, 34(6), 1215–1224.

Mason, C., & Brown, R. (2010). High growth firms in Scotland. Glasgow: Scottish Enterprise.