Abstract

Building on the literature on agglomeration economies, this study examines how urbanization, industry-diversification, district economics and incubating initiatives are associated to the creation of innovative start-ups in Italy. The empirical analysis is based on a sample of 6018 innovative start-ups distributed across 104 Italian NUTS 3 regions. Our findings show that incubating initiative and industrial districts play a major role for new venture creation and provide support to the positive role of urbanization economies and industry specialization over diversification. Finally, we discuss future research directions grounded on the empirical evidence provided by our study.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The link between new venture creation and agglomeration has been investigated at different levels of analysis (e.g. Davidsson et al. 1994; Guesnier 1994; Malecki 1984; Spilling 1996). Recent studies (e.g. Li et al. 2016; Fotopoulos 2013; Li and Geng 2012; Lasch et al. 2013; Bosma et al. 2008; Carree et al. 2008) show a renewed and growing interest in this topic. Leading political institutions and academic scholars widely acknowledged the key role of policy aimed at stimulating entrepreneurship and innovation as a key driver of economic and sustainable growth (Norrman and Klofsten 2009; Norrman and Bager-Sjögren 2010). The need to target policy towards entrepreneurship and innovation is perceived as even more crucial when considering idiosyncratic conditions of Southern Europe economies. Under this assumption, many initiatives were launched to stimulate entrepreneurship worldwide. In 2012, the Italian government introduced a new legislation in order to monitor innovative start-ups and provide specific and supportive measures. By the second half of 2016, the Italian register of Chamber of Commerce (Special section - Innovative start-ups) accounted for more than 6000 innovative start-ups, mainly belonging to the hi-tech sector (Calcagnini et al. 2016; Colombelli 2016).

The literature on agglomeration economies has identified two main mechanisms driving new venture creation: localization (or Mashallian or specialisation) externalities and urbanization (or Jacobs or diversification) externalities.

Previous works have investigated the role of both localisation and urbanisation externalities on entrepreneurial dynamics. Under the ‘Knowledge Spillover Theory of Entrepreneurship’ (KSTE) (Audretsch 1995; Audretsch and Lehmann 2005), urbanization economies rather than localization economies are considered the driving force for new venture creation (Jacobs 1969; Audretsch and Feldman 1996; Acs et al. 2008; Ghio et al. 2015). In urban area a variety of competences and different financial resources are more accessible, information flows are denser and market proximity is higher. Diversified urban areas thus result suitable locations for new ventures compared with industry-specialized and less urbanized areas (Jacobs 1969). Empirical and country-specific studies confirmed this finding (e.g. Bade and Nerlinger 2000; Van Oort and Atzema 2004). However, complete agreement among scholars on this issue is still missing (Fotopoulos 2013; Lasch et al. 2013; Colombelli 2016; Van der Panne 2004).

Another form of agglomeration economies that relate to the spatial concentration of firms within the same industry can be found in industrial districts (IDsFootnote 1) (Becattini 1987). Although similar, district economies are not the same as Mashallian externalities. First, firms within IDs belong to filieres (or vertical integrated branches) and not to the same industry. Moreover, within IDs the economic and the social systems are strongly linked and are based on a common system of social and cultural values. Another important feature of IDs is the balance between co-operation and competition, which is the base of a peculiar industrial climate that fosters innovation. All these socio-economic features characterising IDs generate positive externalities that, in turn, stimulate the creation of new firms. The empirical literature on industrial districts have confirmed that IDs areas presented the highest rate of new venture creation – typically in the form of Small-Medium-Enterprises (SMEs) – over the period 1980–1990 (Garofoli 1994; Garofoli 2006; Di Giacinto et al. 2013). Moreover, other studies reveal that localization of new ventures may show some form of ‘path dependency’ (Fotopoulos 2013; Belussi and Sedita 2009; Martin and Sunley 2006; Antonelli 1997; Patel and Pavitt 1997; Fagerberg et al. 2008; Moulaert and Sekia 2003). In this view, technological accumulation and learning dynamics within a geographical area lead to the persistence of innovation and new firm creation (Colombelli and Tunzelmann 2011). Thus, geographical areas with relatively high rates of new venture creation in the past are likely to show high rates of start-ups in the future (Fritsch and Mueller 2006; Hathaway 2013). The recent shift operated in several IDs from low-tech and mass production to a medium and hi-tech specialized and custom production (Belussi 2015; Belussi et al. 2012) further supports this hypothesis. Then, district economies may be conceived as a third mechanism that might explain the link between new ventures creation and agglomeration.

Finally, the cluster literature also reveals the key role of incubating initiatives, i.e. incubators and science parks, in explaining agglomeration of innovative new ventures (Colombo and Delmastro 2002; Ratinho and Henriques 2010), due also to their link with Universities and Research centres (Oakey 2007): this consideration reveals a forth mechanism to investigate.

This study will examine the relationship between urbanization, industry-diversification, district economies and incubating initiatives and new venture creation in Italy.

The analysis is based on 6018 innovative start-ups registered in the Italian Chamber of Commerce Firms Register (Special Section), classified according to two-digit ATECOFootnote 2 codes 2007. Since each firm may access several benefits through the enrolment in the Register, this is a valuable source of information for examining regional distribution of new ventures (Colombelli 2016). Other data were collected from ISTAT (the Italian institute of statistics), including the geographical distribution of 141 industrial districts, as well as from an empirical research (based on qualitative interviews combined with secondary sources) meant to locate and classify incubating initiatives.

The unit of analysis in this study is the NUTS3Footnote 3 geographical area. More precisely, all data were analysed considering 104 Italian NUTS3 regions – also known as ‘provinces’ – (representing our sample cases) using a multiple linear regression model.

Our findings show that incubating initiative and industrial districts play a major role for new venture creation and provide support to the positive role of urbanization economies and industry specialization over diversification.

The remainder of the study consists in five sections. Section 2 presents the theoretical background our six hypotheses stem from. Section 3 illustrates the Research Design and the methodology. Section 4 then illustrates econometric analysis regarding the relation between new venture creation and the explanatory factors. Finally, Section 5 and Section 6 respectively discuss the results and conclude the study, focusing explicitly on research value and relative policy implications.

Theoretical background and hypotheses development

During the historical period of mass production dominated by the Taylorism philosophy, localization and external economies (Marshall 1961) justified firm agglomeration or ‘clusterization process’ by industry. Localization economies are considered external to the firm (Romer 1986) but internally located in a specific geographic area. Marshall pioneered the concept of agglomeration economies and proposed four main forms of localization economies increasing the efficiency of each firm: economies of specialization generated by complementary activities and inter-firm division of labor; economies of labor force generated by the specialized pool of local labor supply; economies of information and communication, with particular reference to informal exchanges of information fostered by geographical proximity; and knowledge economies, i.e. spillovers (Marshall 1961; Zeitlin 1992; Rocha 2004). An important assumption of Marshallian externalities is that the concentration of a specific industry within a particular localized regional area facilitates knowledge spillovers across firms.

On the contrary, Jacobs (1969) considers knowledge spillovers across industry as the most important source of innovation and ultimately of economic growth. Similarly, Porter (2000, p.24) argues that ‘many, if not most, new businesses are formed in existing clusters rather than in isolated locations’. Nevertheless, he adds that new ventures, especially the innovative ones, might tend to isolate in their later stage of growth (see also Duranton and Puga 2001; Storper and Walker 1989) and also because new ideas need new spaces (Porter 2000). Since variety of industries and knowledge is higher in cities, Jacobs (Jacobs 1969), considers urbanization externalities as the main source of innovation and growth (Frenken et al. 2007). Under the ‘Knowledge Spillover Theory of Entrepreneurship’ (KSTE), urbanization economies rather than localization economies are considered the driving force for new venture creation (Jacobs 1969; Audretsch and Feldman 1996). In this paper we, thus, aim at verifying if Jacobs externalities are positively associated with innovative start-ups creation.

Different mechanisms leading to Jacobs externalities have been highlighted (Beaudry and Schiffauerova 2009; Bosma et al. 2008). First, a market size effect is supposed to be at play. In this view, urbanisation externalities are expected to be positively associated with new firm formation due to agglomeration benefits such as the access to a highly qualified labor pool, and closeness to customers and suppliers. In light of this argument, the first hypothesis can be advanced:

H1: Innovative new ventures birth rate is positively associated with level of urbanization.

Another important mechanism emerging from Jacobs’s work is the role of industry ‘diversity’ in fostering innovation (Jacobs 1969). Jacobs (1969) emphasizes the role of industry-diversified area promoting local competition rather than local monopoly (as presented by the Marshall’s framework), with particular reference to the competition for new ideas. Empirical evidence supports this theory (e.g. see for US, Bae and Koo 2008; see for Germany, Bade and Nerlinger 2000). In similar vein, Harrison et al. (1996) and Kelley and Helper (1999) provide detailed evidence witnessing the relative advantages of urban diversity rather than specialization. On the other hand, recent studies (Van der Panne 2004; Lasch et al. 2013) show contrasting results on this matter. Duranton and Puga (2001) introduce the life cycle concept to the debate on urban diversity vs local specialization. Thus, according to Duranton and Puga (2001), diversified cities are more suited to the early stages of a product’s life cycle while more specialized are better to conduct mass production of fully developed products. Since our investigation considers new ventures in their early stage, we advance the following hypothesis:

H2: Innovative new ventures birth rate is positively associated with level of industry-diversification.

Innovation economies and knowledge transmission alone cannot explain firm co-location (Saxenian 1994; Torre 2008) especially in the current dynamic and technologically advanced context. There is space for a socio-economic perspective (Rocha 2004). Indeed, innovation is not the result of a unique and isolated idea, while it arises within a socio-cultural context (Xavier Molina-Morales and Teresa Martínez-Fernández 2006). Informal and personal contact is necessary in order to transfer knowledge in its tacit dimension (Polanyi 1967; Audretsch 1998).

The Italian School (Pyke et al. 1990) already underlined the crucial role of informal interactions and exchange as well as the socio-cultural heritage of a specific location. This perspective values the recent history of Italian Industrial District (ID) and it finds also support from ‘path dependency theories’ (David 1985; Arthur 1994; Page 2006). Long debated by several authors, the heritage of ID in terms of entrepreneurial culture and pre-existing social-ties could play a significant role on new firm localization (Illeris 1992). Geographical areas with relatively high rates of new firm formation in the past are likely to show same high rate of start-ups in the future (Fritsch and Mueller 2006). This argument can be supported also by a very recent shift operated in several industrial districts from low-tech and mass production to a medium and hi-tech specialized and custom production (Belussi 2015; Belussi et al. 2012). Given the crucial role of the socio-cultural dimension and heritage of a territory in terms of technological accumulation, we advance a third hypothesis.

H3: Innovative new venture birth rate is positively associated with the number of industrial districts.

In the extant literature, Porter (1998) provides a comprehensive perspective on clusters which includes the aforementioned economies stemming from economic, innovative and the socio-economic literature (Rocha 2004; Rocha and Sternberg 2005). For instance, Porter (2000, p.15) expands the role of clusters as ‘striking feature of every national, regional, state and even metropolitan economy’ in terms of geographical scope. Indeed, in the innovative stream of the cluster literature (Jacobs 1969), clusters were limited on urban area. More importantly, Porter linked the cluster concept with the broader theory of competition in a global economy, inspiring several regional and national government policies. Among a variety of cluster policies, the establishment of incubating initiativesFootnote 4 (i.e. incubators and science parks) has been a major trend from 1990s to date (Oakey 2007), thus opening to a major debate on their contribution in fostering entrepreneurship and as tool for regional development (e.g. Amirahmadi and Saff 1993; McAdam and McAdam 2008; Sentana et al. 2017).

Typically, incubating initiatives provide dedicated infrastructure and resources for new ventures; tend to focus on hi-tech sectors; and are located inside or nearby universities (Grandi and Grimaldi 2003; Link and Scott 2007; Aernoudt 2004; Castells and Hall 1994; Koh et al. 2005; Link and Scott 2003; Studdard 2006). New ventures’ advantages of being located in or nearby incubating initiatives are rooted in three sets of economies: (i) specialized inputs from various industries, (ii) knowledge spillovers among diversified industries, (iii) a pool of skilled labor, and dedicated infrastructure and resources (Van Geenhuizen and Reyes-Gonzalez 2007). No evidence shows that incubating initiatives present all these advantages and economies at the same time, since each incubating initiative presents a unique characterization.

Although, the literature provides conflicting results on the incubating initiatives effectiveness as economic and regional development tool (Massey et al. 1992; Sherman 1999; Autio and Klofsten 1998), direct and immediate contribute on fostering entrepreneurship has been widely accepted (see for instance Mian 1994, 1997; Phillips 2002; Campbell and Allen 1987; Hackett and Dilts 2004). Thus, incubating initiatives reveal a further mechanism explaining the firm agglomeration process. Consistently with this argument, a fourth hypotheses can be advanced:

H4: Innovative new ventures birth rate is positively associate with the number of incubating initiatives (incubators and science parks).

Research design

This section presents details on research design concerning the chosen country, data sources, variables and methodology.

The empirical setting: Why Italy?

A link between historical heritage and recent entrepreneurial dynamics reveals the academic relevance of the ‘Italian case’. Building on past valuable contributions (e.g Becattini 1987; Colombelli 2016), an original analysis linking the past and successful roots of IDs with the present development of the Italian ‘entrepreneurship phenomenon’ is needed. The relevance of the recent history of the Italian Industrial District (ID) has been widely presented and discussed in the previous section; while the recent entrepreneurial dynamics deserve an accurate explanation.

In the time-span 2013–2015, in Italy more than 65 start-ups realized an exit strategy by means of IPO or Trade sale.Footnote 5 Also, this study presents and considers an increased number of incubating initiatives compared to previous studies (see Colombo and Delmastro 2002): since incubators and science parks are key actors of the start-up’s supportive system, the growth of such initiatives is an important factor to testify the Italian ecosystem’s development. Moreover, new investment funds supported by Fondo Italiano d’Investimenti (FOF – fund of funds), declared to be in their closing phase. A major attention from the media and Policy-makers is focused to innovative start-ups and their contributions to the economic growth. In 2012, the Italian government by the Decree Law 221/2012 so-called ‘Italian Start-up Act’, recognized the crucial role of entrepreneurship and innovation as drivers of sustainable economic growth. A special section of the firm’s Register was created to collect data about innovative new ventures (also known as ‘innovative start-ups’) plus a number of policies to support those initiatives. As a result, more than 6000 innovative start-ups had registered and claimed to be innovative, according to Registro Imprese (Italian Chamber of Commerce Firms Register – Special Section). The Law Decree considers as innovative start-ups ‘a firm, not listed and subject to Italian tax law, which has a turnover of less than 5 million euros, has been operational for more than 48 months, is owned directly for at least 51% by physical subjects, and, more importantly, has the social aim of developing innovative products or services, with a high technological contentFootnote 6’ (Colombelli 2016, p.386). For a more detailed description of the new Italian legislation on ‘innovative start-up’, see Colombelli (2016), and Calcagnini et al. (2016).

Data sources

We consider the Italian province (NUTS3 level) as unit of analysis. Data were collected from both primary and secondary data sources. In particular, data on the population of innovative start-ups (6018 firmsFootnote 7) established in Italy from 2012 to 2016, distributed across the 104Footnote 8 provinces (Fig. 1) and classified by industry through two-digit ATECO 2007 codes, were collected from the Italian Chamber of Commerce Firms Register - Special section. Those innovative start-ups due to their relative young age can be assumed in their early stage phase of the lifecycle. Table 1 shows the distribution of innovative start-ups by year, 2012–2016. The creation of a ‘special’ (i.e. specific) section for ‘Innovative start-ups’ followed the implementation of a new Italian regulation aforementioned Decree Law 221/2012 on “Further urgent measures for Italy’s economic growth”. Data covering population density, number of cities within a province, income pro-capita, house ownership, unemployment were collected from the Italian Institute of Statistics (ISTAT). As well, data on (141) industrial districts (Fig. 2) distributed across provinces were collected from ISTAT.

Primary data were instead collected to identify the incubating initiatives distributed by provinces.

The authors developed an original list of 203 incubating initiatives, identified by means of: (i) list of Certified IncubatorsFootnote 9 provided by the Italian Ministry of Economic Development (MISE); (ii) additional secondary sources (e.g. web search, press news, research reports) selected on the basis of the keywords ‘science parks’, ‘business innovation centre’, ‘incubator’, ‘accelerator’; and (iii) direct contacts and support provided by the association that mainly represent those initiatives in Italy (such as APSTI, Italia Start-up, PNI-Cube).

Then, the screening process has been conducted by means of 184Footnote 10 semi-structured qualitative interviews involving the director of the incubating initiatives, and enabling a mechanism of data triangulation (Yin 2013). The interviews had an average length of 35 min.

As a result, the authors built an original database of 140 incubating initiatives which conformed to the following criteria: (i) being active – meaning that at the time the research was conducted they ‘incubated’ and supported at least one start-up; (ii) offering services specifically addressed to start-ups; and (iii) among those services offered, mentoring and coachingFootnote 11 services were included. Fig. 3 summarize the research process and the main steps that led to identify the incubating initiatives. These initiatives accounted for either individual incubators with a single branch or each branch of multi-city/branch incubators. Fig. 4 shows the distribution of incubating initiatives by each NUTS3 region. It is noteworthy to mention that this investigation does not provide any implication about the quality of the Italian incubating initiatives and the services provided to start-ups (as such considerations lay outside of the study’s scope and aim).

Dependent variable (new venture birth rate)

In the current literature, there are two important and misleading views about new venture birth rate as an indicator of regional variation. It is widely recognized that the measurement of new venture creation in absolute number to explain regional variations can be misleading at times (Audretsch and Fritsch 1994; Armington and Acs 2002; Lasch et al. 2013).

However, there is less agreement among scholars when it comes to the relative indicators that should be used to measure new venture creation (Armington and Acs 2002; Garofoli 1994; Audretsch and Fritsch 1994; Guesnier 1994; Kangasharju 2000; Keeble and Walker 1994; Okamuro and Kobayashi 2006; Reynolds et al. 1995). Indeed, the new venture birth rate has been calculated by using as a denominator any of the following three indicators: 1) the number of existing firms or 2) number of employee or working population or 3) total population. The method chosen can vary according to the specific context and the availability of data (Audretsch and Fritsch 1994; Johnson and Conway 1997; Lasch et al. 2013). In accordance with Garofoli (1994), the use of the second or third method should prevail as both are based on the theory of entrepreneurial choice proposed by Evans and Jovanovic (1989): ‘each new business is started by someone’ (Audretsch and Fritsch 1994, p.361).

By considering the specific Italian context, this study considers the total population as denominator in the new venture birth rate. The reason for this decision is of a twofold nature. First, the effect of the low level of the employment may be predominant in influencing the rate over the contribution made by the real number of new firms (Garofoli 1994). Second, employment data is much less reliable for innovative industry (while several studies related to the manufacturing industry largely used employment data). Thus, we defined the innovative new venture birth rate in time period 2012–2016Footnote 12 in each NUTS3 region i (INRi), as the ratio of the local innovative start-ups to the total population in each NUTS3 (multiplied by 100.000 for presentation purposes):

Independent variables

To test our first hypothesis, the level of urbanization proxying for the market size effect has been measured through population density (POPD i) (Beaudry and Schiffauerova 2009) and distance (DISTANCE i) of each NUTS3 from the main administrative town in the NUTS2 region (Baptista and Mendonça 2010; Bonaccorsi et al. 2013; Colombelli 2016). These are the most widely used indicators in the literature. Turning to our second hypothesis, industry-diversification has been measured following Duranton and Puga (2000) and the relative measure has been preferred to an absolute indicator. Thus, we adopted the inverse of Hirshman-Herfindahl concentration index (Beaudry and Schiffauerova 2009). Here, the formula (1) related to the relative industry-diversification index used (RDIi):

where, sij is the share of industry j in a given i province (NUTS 3) and sj represent the share of industry j at national level. RDIi has been multiplied by 100.000 for scale reason.

To test the remaining hypotheses, the presence of industrial districts (IDi) and the presence of incubating initiatives (INCi) were operationalized by their numbers in each province. The IDs numbers were collected from ISTAT while the numbers of incubating initiatives are the result of an empirical effort that among others is part of the contribution the authors provide in this study. Table 2 summarize the hypothesis operationalization process by listing the key constructs and related independent variables used to measure their impact.

This study can be considered cross-sectional, since the independent variables are not available for all years. The latter consideration does not undermine the relevance of the tested hypotheses. Indeed, it is widely recognized that variables referring to socio-economic conditions are not subject to major changes from 1 year to another. Some issue on this matter could be related to the constructs: presence of IDs and presence of incubating initiatives. However, no major changes involved the numbers of IDs and incubating initiatives from the last census-period available and used in this study.

Methodology

The four hypotheses and relative indicator of new ventures birth rate were tested by using a multiple linear regression model (OLS). The test of such hypothesis requires the dependent variable INR i to be modelled as function of five independent variables (above explained). Furthermore, we added also a set of variables to control the impact of the economic feature of NUTS3 regions - which were 3 years lagged to avoid endogeneity concerns. Indeed, a wide range of studies argue that regional specific characteristics – such as high level of income and personal wealth (Ashcroft et al. 1991; Bosma and Schutjens 2007; Ashcroft et al. 1991) – explain a high proportion of regional variation in firm births in several European countries (Audretsch and Fritsch 1994; Keeble and Walker 1994; Armington and Acs 2002; Reynolds et al. 1995; Klapper et al. 2015). Hence, we introduced the following control variables: income pro-capita (INCOMEpC i), house ownership (HOUSEOWN i) and Gross Domestic Product pro-capita (GDPpC i). Moreover, since the creation of new firms can be the outcome of an ‘escape from unemployment’ strategy, the unemployment rate (UNEMPL i) was also considered (Carree et al. 2008). Below, Eq. (3) specifies the model tested in this study, which allows investigating empirical associations between the dependent and the independent variables:

As shown in Eq. (3) a log transformation has been applied to the dependent variable to correct for skewness. This is a common practice in entrepreneurship research in order to obtain both a higher fit and a better use of the data (Delmar 2006).

Table 3 provides the descriptive statistics related to the variables while Table 4 shows the correlation matrix. As evidence shows, correlations between some independent variables are relatively high. This is not surprising: for instance, population density (POPD i) is expected to be correlated with economic variables such as unemployment (UNEMPL i) or income (INCOMEpC i). In order to further cope with multicollinearity issues, we used engenvalues (characteristic roots) and condition numbers (or condition indices). The test returns a set of eigenvalues of relatively equal magnitudes (and higher than 0,1). This indicates that there is little multicollinearity (Freud and Littell 2000). While condition indices result greater than 42: since the threshold value is 30, no multicollinearity issues emerge from these tests (Lazaridis 2007). In addition, Value Inflation Factor (VIF) for each independent variable result less than 10 – the accepted cut-off value (Neter et al. 1990). This result further confirms that multicollinearity is not an issue for our data.

To confirm the robustness of these results, additional tests were conducted. Tests were made using the alternative measurements of the aforementioned dependent variable (see Section 3.3). For instance, by using the number of innovative start-ups (absolute measure) or dividing the number of innovative start-ups by the total working population. In similar vein, we made some further tests by acting on independent variables. We used Gini Index as alternative measure of the inverse of Hirshman-Herfindahl (Beaudry and Schiffauerova 2009). We also complemented level of urbanization with ‘number of cities’ within a province: a further indicator to capture context-specific elements linked to the level of urbanization and historical roots of Italian ‘comuni’ which constitute a province. These further checks provide similar results thus confirming the robustness of our analysis.

Empirical results

Results are presented in Table 5, including coefficients and p-values. The regression exhibits a moderate goodness of fit (R2 = 0,4062). Five independent variables were tested in four partial regression models (Model 1, 2, 3, 4), accordingly to the four hypotheses. Finally, a multiple linear regression (OLS) comprehensive of all the independent variables (Model 5) has been performed.

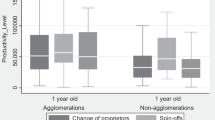

Model 1 confirms the positive association between urbanization economies and innovative start-ups birth rate. Both DISTANCE i and POPD i show a positive and significant coefficient. This confirms H1. Model 2 reveals a negative and significant association of the RDI i index with innovative start-ups birth rate. This result indicates that specialization rather than diversification might explain new venture birth rate. Hence, H2 is not verified. The number of industrial districts (ID i) is positively associated with new venture birth rate in a province, as revealed by the results from Model 3. This confirms H3. Also, the presence of incubating initiatives (INC i) is positively associated with the birth rate of innovative start-ups in a province. H4 is thus verified. Finally, results of Model 4 mainly confirm our results. However, when all the independent variables are included in the same model, POPD i looses its significance. Thus, H1 is only partially confirmed.

Discussion

In this section, we discuss how urbanization, industry-diversification, district economies and incubating initiatives are associated to the creation of innovative start-ups in Italy.

Although a wide range of literature (Jacobs 1969; Audretsch and Feldman 1996; Glaeser 1998) and several country-specific empirical studies (Van Oort and Atzema 2004; Bae and Koo 2008; Bade and Nerlinger 2000; Bishop 2012) support the urbanization hypotheses (H 1), our study offers mixed support. In line with Audretsch (1998), we found that when focusing on innovative start-ups, spatial agglomerations may be ‘vulnerable to technological lock-in’ (p. 24). Malecki (1984) recognizes two localization patterns: some new ventures agglomerate at city level, while others prefer to be more isolated. Bade and Nerlinger (2000), while confirming urbanization hypotheses, also suggest the presence of diseconomies by locating in high populated urban area (Lasch et al. 2013). In similar vein, Porter (2000) argues that new ideas need new space. Following these arguments, we suggest that it would be beneficial to further investigate the correlation between level of innovativeness of Italian start-ups and urbanization hypothesis.

The influence of industry-diversification on new venture creation has been tested with the second hypotheses. Industry-diversification has significant but negative effect on new venture creation (contrarily to our H2). Thus, findings suggest that specialization rather than diversification can be considered as driver of new venture creation. We interpret this result by building on previous works. For example, Frenken et al. (2007) propose the related variety concept, standing between diversification and specialization, i.e. regional differentiation within a set of technologically related industries. Recently, Colombelli (2016) for Italy, and Bishop (2012) for the UK, find empirical evidence that confirms the positive association between related variety and new firm creation. Our result is consistent with these works that show the role of diversification in related industries. Some scholars went even further, arguing that new ventures in a first instance locate in diversified urban areas, then move out-ward from such first location during their expansion phase (Duranton and Puga 2001; Porter 2000; Costa Campi et al. 2004; Leone and Struyk 1976). Porter (2000) also argues that new ideas need new spaces (Porter 2000). Although we focus on early stages start-ups, our sample may contain fast-growing firms as well slow growing ones: hence, we suspect that lifecycle maturity differences (within the early stage) might arise in our sample. This dynamic is a plausible interpretation of our results. However, this issue deserves further investigation in future works on Italian innovative start-ups. By conducting cross-country analyses, future studies could also consider the impact of country-specific and historical factors on entrepreneurship initiatives.

Findings show also that the presence of an ID in a given province results positively associated with new venture creation. Thus, this study offers further support to the district approach applied to new venture formation (Fotopoulos 2013; Belussi and Sedita 2009; Martin and Sunley 2006). Even though at different aggregate regional level (NUTS2) compared to our study, Fotopoulos (2013) finds empirical evidence in UK suggesting that past new venture creation rates determine future ones; in similar vein, Hájek et al. (2015) confirm this finding for Czech Republic. We add a further and empirical evidence to this debate, since the presence of a persistent and successful entrepreneurship culture is well expressed in the Italian case by the IDs. Moreover, we suggest that SMEs that typically populate an ID (ID’s SMEs) and innovative start-ups appear to be two connected worlds. This result may further support studies (such as Belussi 2015; Belussi et al. 2012) revealing the recent shift operated in several IDs from low-tech and mass production to a medium and hi-tech specialized and custom production. More importantly, we argue that a win-win relation can emerge and be exploited between ID’s SMEs and innovative start-ups which may represent a key driver for the future economic growth of Italy and other developed countries. Indeed, innovative products/services, processes and ways of doing business can be integrated with existing ones. This ‘collaborative’ view may represent a model alternative to the disruptive innovation (Christensen 2006), where start-ups discontinuously outplace incumbents, and the more consolidated Shumpeterian creative destruction, fostering competitiveness and ultimately economic growth and job creation. This is helped by the relative small size and similar entrepreneurial attitude shared by SMEs and innovative start-ups.

It is noteworthy to specify that this finding documents an important ‘signal’ of the connection between the innovative start-ups and the more consolidated ID’s SMEs. However, further investigation that may shed lights on this topic are needed especially in regard to the related policy implication.

The growing attention given by scholars, policy-makers and practitioners to the supportive start-up system, encouraged us also to investigate the correlation between incubating initiatives and innovative start-ups, expressed by the fourth hypotheses. In line with previous findings that claim a positive contribution of incubating initiatives on fostering entrepreneurship (Colombelli 2016; Colombo and Delmastro 2002; McAdam and McAdam 2008; Hackett and Dilts 2004; Mian 1994, 1997; Phillips 2002), our results provide support for this argument. More importantly, we observe that the new venture creation shows a strong correlation with the location of incubating initiatives. Thus, we add to the debate by shifting the locus of investigation from classic agglomeration economies (and urbanization economies) which are still receiving a wide attention by scholars (see Florida et al. 2017). Specifically, we highlight that drivers facilitating birth and growth of innovative start-ups (such as incubating initiatives) may deserve further academic attention. This study confers to the incubating initiatives a centrality in the debate on new venture creation. While focusing on a small portion (i.e. incubating initiatives) of the wider supportive start-up system commonly referred to as ‘entrepreneurship ecosystem’ (Isenberg 2010), this study contributes to putting forward future research directions.

Concluding with reference to the controls included in our model, results on unemployment rate suggest that our sample is made of opportunity entrepreneurs rather than necessity entrepreneurs (Williams and Williams 2014). In addition, Gross Domestic Product pro-capita (GDPpC i) correlates with new venture birth rate, thus, supporting the view of entrepreneurship as tool building upon and fostering existing economic and social regional and national disparities (Krugman 1991; Keeble and Wilkinson 2000; Esposto 1997; Fenoaltea 2003). However, no effect emerges considering the other proxies of regional wealth such as income pro-capita (INCOMEpC i) and house ownership (HOUSEOWN i). This evidence may reflect the conflicting result presented by previous studies on new venture creation and regional development (e.g. Reynolds 1997; Brock and Evans 1989; Reynolds 2001).

Conclusion

This study explores how urbanization, industry-diversification, district economies and incubating initiatives are associated to the creation of innovative start-ups in Italy. A cross-sample of Italian regional data informed our investigation. Our findings provide support to the market size argument of urbanization externalities. On the other hand, the results on industry diversification, industrial districts and incubators point to the positive role of specialization within vertical integrated branches that is supported by both the socio-cultural and the institutional contexts.

This study is not free of limitations. First of all, we investigated empirical associations, but causal effects cannot be ascertained in this framework. Moreover, we only refer to the Italian case. We are aware of the specificities related to what some scholar argues as a unique case of entrepreneurship: the Italian industrial districts. Although this country-specific standpoint is also a strength for this investigation, cross-country analysis might help us to extend the action-space of this research and its implications. Second, the representativeness of the sample. As condition to be registered in the Italian Chamber of Commerce Firms Register (Special Section) and have access to relative benefits, innovative start-ups have to be relatively young (up to 5 years). This might cut off some of the bio-tech companies that usually have a specific and longer early stage phase. A vertical investigation on the biotech industry might be useful to extend and improve the applicability of our results. Third, this study recognizes and focuses on the role of incubating initiatives. It would be interesting to investigate the influence of other actors of the supportive start-up system and compare their contribution on new venture creation. Valuable contributions already have investigated the influence of Universities (see Bonaccorsi et al. 2013; Cassia and Colombelli 2008), investors (see Fritsch and Schilder 2008) on new venture creation and agglomeration. There is still room for a comprehensive study including all the component of the ‘entrepreneurship ecosystem’ (Isenberg 2010). Moreover, although we recognize that incubating initiatives may affect new venture creation with a certain delay, we were unable to enclose time lag in our current data. Future studies - also by leveraging on our empirical effortFootnote 13 to identify the incubating initiatives operating in Italy - should be able to cope with such partial limitation.

As result, research value is connected to the incubating initiatives investigation. We advance Colombo and Delmastro’s (2002) valuable contribution on incubating initiatives. More importantly, our study recognizes the centrality of incubating initiatives on the extant debate on new venture creation studies. Indeed, the third finding and, above all, its magnitude support this view. Thus, the wider supportive start-up system (and its localization) will be a key driver when investigating new venture creation and agglomeration, and will be even more influential than traditional agglomeration theories, as partially suggested by our result. Given that incubating initiatives are only a small part of the wider supportive start-up system, there is clearly room for future research.

The positive correlation of IDs with new venture creation may also lead to another interesting argument and important policy implication. This finding appears as a ‘signal’ of the connection between two worlds often and erroneously considered as opposed to each other: ID’s SMEs and innovative start-ups. A win-win relation can be exploited between ID’s SMEs and innovative start-ups, and this may represent a key driver for the future economic growth of Italy and other developed countries. Policy-makers should design specific measures to facilitate a collaborative model between SMEs and innovative start-ups. Recent initiatives show that they are aware of this potential ‘marriage’. For instance, they have extended the legislation on innovative start-ups (see Calcagnini et al. 2016) also to SME that claim to be innovative. In addition to this, investors, incubating initiatives, serial entrepreneurs, evangelists, business angels and other actors, who are part of the wide start-up supportive system, should enhance and facilitate a dialogue between two different generation of entrepreneurs: those leading ID’s SMEs and those leading innovative start-ups. We are aware that further investigations that may shed light on this topic are needed, and our study points in that direction.

Notes

The industrial district is defined as a ‘socio-territorial entity which is characterized by the active presence of both a community of people and a population of firms in one naturally and historically bounded area. In the district, unlike in other environments, such as manufacturing towns, community and firms tend to merge’ (Pyke et al. 1990, p.38).

National version of the European nomenclature, NACE Rev. 2, published in the Official Journal of 20 December 2006 (Regulation (EC) no 1893/2006 of the European Parliament and of the Council of 20 December 2006).

NUTS stands for Nomenclature of Units for Territorial Statistics, geographical nomenclature subdividing the economic territory of the European Union (EU) into regions at three different levels: NUTS 1, 2 and 3 respectively, moving from larger to smaller territorial units. (Source EUROSTAT).

Although they present some differences, several scholars researched on incubators and science park together, considering them as business support and incubating initiatives (Colombo and Delmastro 2002; Sofouli and Vonortas 2007; Chan and Lau 2005; Ratinho and Henriques 2010; Phan et al. 2005). The literature recognizes a high degree of closeness in term of goals and basic characteristics (e.g. Phan et al. 2005).

Data were collected between 2013 and 2015 only by secondary source of data. As result, these numbers are probably underestimating the real numbers of exits as some values are not disclosed and publically available on press news.

According to Decree Law 221/2012, the core business of innovative start-ups consists of innovative goods or services of high technological value. A start-up fulfils the latter requirement if: either 20% of its costs are related to R&D; or at least one third of the team is made up of people who either hold a PhD or are PhD candidates at an Italian or foreign university or have conducted research for at least three years; or it is the owner or the licensee of a patent.

Updated to 18/07/2016.

The Italian province are 110. However, 5 provinces present some missing data. Thus, the analysis has been realized on 104 provinces

The list of Certified Incubators, provided by MISE, has not been considered exhaustive by nature as it is not mandatory for Incubators or Science Park to be enrolled in the predisposed special section of the Italian Chamber of Commerce Firms Register.

The high redemption rate (91% - 184 on 203) is due to the valuable collaboration with the aforementioned association: APSTI, Italia Start-up, PNI-Cube.

Updated to 18/07/2016.

Data will be available upon request, with the aim of fostering and enabling future research in the entrepreneurship filed.

References

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Bo, C. (2008). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Aernoudt, R. (2004). Incubators: Tool for entrepreneurship? Small Business Economics23, 2, 127–135.

Amirahmadi, H., & Saff, G. (1993). Science parks: A critical assessment. Journal of Planning Literature8, 2, 107–123.

Antonelli, C. (1997). The economics of path-dependence in industrial organization. International Journal of Industrial Organization, 15(6), 643–675.

Armington, C., & Acs, Z. J. (2002). The determinants of regional variation in new firm formation. Regional Studies, 36(1), 33–45.

Arthur, W. B. (1994). Increasing returns and path dependence in the economy. University of Michigan Press.

Ashcroft, B., Love, J. H., & Malloy, E. (1991). New firm formation in the British counties with special reference to Scotland. Regional Studies, 25(5), 395–409.

Audretsch, D. B. (1995). Innovation, growth and survival. International Journal of Industrial Organization, 13(4), 441–457.

Audretsch, B. (1998). Agglomeration and the location of innovative activity. Oxford Review of Economic Policy, 14(2), 18–29.

Audretsch, D. B., & Feldman, M. P. (1996). Innovative clusters and the industry life cycle. Review of Industrial Organization, 11(2), 253–273.

Audretsch, D. B., & Fritsch, M. (1994). The geography of firm births in Germany. Regional Studies, 28(4), 359–365.

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191–1202.

Autio, E., & Klofsten, M. (1998). A comparative study of two European business incubators. Journal of Small Business Management, 36(1), 30.

Bade, F. J., & Nerlinger, E. A. (2000). The spatial distribution of new technology-based firms: Empirical results for West-Germany. Papers in Regional Science, 79(2), 155–176.

Bae, J., & Koo, J. (2008). The nature of local knowledge and new firm formation. Industrial and Corporate Change, 18(3), 473–496.

Baptista, R., & Mendonça, J. (2010). Proximity to knowledge sources and the location of knowledge-based start-ups. The Annals of Regional Science, 45(1), 5–29.

Beaudry, C., & Schiffauerova, A. (2009). Who's right, Marshall or Jacobs? The localization versus urbanization debate. Research Policy, 38(2), 318–337.

Becattini, G. (Ed.). (1987). Mercato e forze locali: il distretto industriale. il Mulino.

Belussi, F. (2015). The international resilience of Italian industrial districts/clusters (ID/C) between knsowledge re-shoring and manufacturing off (near)-shoring. Investigaciones Regionales, 32, 89.

Belussi, F., & Sedita, S. R. (2009). Life cycle vs. multiple path dependency in industrial districts. European Planning Studies, 17(4), 505–528.

Belussi, F., Gottardi, G., & Rullani, E. (Eds.). (2012). The technological evolution of industrial districts (Vol. 29). Springer Science & Business Media.

Bishop, P. (2012). Knowledge, diversity and entrepreneurship: A spatial analysis of new firm formation in great Britain. Entrepreneurship & Regional Development, 24(7–8), 641–660.

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2013). University specialization and new firm creation across industries. Small Business Economics, 41(4), 837–863.

Bosma, N., & Schutjens, V. (2007). Patterns of promising entrepreneurial activity in European regions. Tijdschrift voor Economische en Sociale Geografie, 98(5), 675–686.

Bosma, N., Van Stel, A., & Suddle, K. (2008). The geography of new firm formation: Evidence from independent start-ups and new subsidiaries in the Netherlands. International Entrepreneurship and Management Journal, 4(2), 129–146.

Brock, W. A., & Evans, D. S. (1989). Small business economics. Small business economics., 1(1), 7–20.

Calcagnini, G., Favaretto, I., Giombini, G., Perugini, F., & Rombaldoni, R. (2016). The role of universities in the location of innovative start-ups. The Journal of Technology Transfer, 41(4), 670–693.

Campbell, C., & Allen, D. N. (1987). The small business incubator industry: Micro-level economic development. Economic Development Quarterly, 1(2), 178–191.

Carree, M., Santarelli, E., & Verheul, I. (2008). Firm entry and exit in Italian provinces and the relationship with unemployment. International Entrepreneurship and Management Journal, 4(2), 171–186.

Cassia, L., & Colombelli, A. (2008). Do universities knowledge spillovers impact on new firm’s growth? Empirical evidence from UK. International Entrepreneurship and Management Journal, 4(4), 453–465.

Castells, M., & Hall, P. (1994). In: Technopoles of the world: The making of twenty- first-century industrial complexes. London: Routledge.

Chan, K. F., & Lau, T. (2005). Assessing technology incubator programs in the science park: The good, the bad and the ugly. Technovation, 25(10), 1215–1228.

Christensen, C. M. (2006). The ongoing process of building a theory of disruption. Journal of Product Innovation Management, 23(1), 39–55.

Colombelli, A. (2016). The impact of local knowledge bases on the creation of innovative start-ups in Italy. Small Business Economics, 47(2), 383–396.

Colombelli, A., & von Tunzelmann, N. (2011). The persistence of innovation and path dependence. Handbook on the economic complexity of technological change, 105–119.

Colombo, M. G., & Delmastro, M. (2002). How effective are technology incubators?: Evidence from Italy. Research Policy, 31(7), 1103–1122.

Costa Campi, M. T., Blasco, A. S., & Marsal, E. V. (2004). The location of new firms and the life cycle of industries. Small Business Economics, 22(3), 265–281.

David, P. A. (1985). Clio and the economics of QWERTY. The American Economic Review, 75(2), 332–337.

Davidsson, P., Lindmark, L., & Olofsson, C. (1994). New firm formation and regional development in Sweden. Regional Studies, 28(4), 395–410.

Delmar, F. (2006). Measuring growth: Methodological considerations and empirical results. Entrepreneurship and the Growth of Firms, 1(1), 62–84.

Di Giacinto, V., Gomellini, M., Micucci, G., & Pagnini, M. (2013). Mapping local productivity advantages in Italy: Industrial districts, cities or both? Journal of Economic Geography, lbt021.

Duranton, G., & Puga, D. (2000). Diversity and specialisation in cities: Why, where and when does it matter? Urban Studies, 37(3), 533–555.

Duranton, G., & Puga, D. (2001). Nursery cities: Urban diversity, process innovation, and the life cycle of products. American Economic Review, 91, 1454–1477.

Esposto, A. G. (1997). Estimating regional per capita income: Italy, 1861-1914. Journal of European Economic History, 26(3), 585.

Evans, D. S., & Jovanovic, B. (1989). An estimated model of entrepreneurial choice under liquidity constraints. Journal of Political Economy, 97(4), 808–827.

Fagerberg, J., Verspagen, B., & Mowery, D. C. (2008). Innovation-systems, path-dependency and policy: The co-evolution of science, technology and innovation policy and industrial structure in a small, resource-based economy.

Fenoaltea, S. (2003). Notes on the rate of industrial growth in Italy, 1861–1913. The Journal of Economic History, 63(3), 695–735.

Florida, R., Adler, P., & Mellander, C. (2017). The city as innovation machine. Regional Studies, 51(1), 86–96.

Fotopoulos, G. (2013). On the spatial stickiness of UK new firm formation rates. Journal of Economic Geography, 14(3), 651–679.

Frenken, K., Van Oort, F., & Verburg, T. (2007). Related variety, unrelated variety and regional economic growth. Regional Studies, 41(5), 685–697.

Freud, R. J., & Littell, R. C. (2000). SAS system for regression. Sas Institute.

Fritsch, M., & Mueller, P. (2006). The evolution of regional entrepreneurship and growth regimes. In Entrepreneurship in the region (pp. 225–244). Springer US.

Fritsch, M., & Schilder, D. (2008). Does venture capital investment really require spatial proximity? An empirical investigation. Environment and Planning A, 40(9), 2114–2131.

Garofoli, G. (1994). New firm formation and regional development: The Italian case. Regional Studies, 28(4), 381–393.

Garofoli, G. (2006). per l'innovazione nei distretti industriali. I distretti industriali dal locale al globale, 77.

Ghio, N., Guerini, M., Lehmann, E. E., & Rossi-Lamastra, C. (2015). The emergence of the knowledge spillover theory of entrepreneurship. Small Business Economics, 44(1), 1–18.

Glaeser, E. L. (1998). Are cities dying? The Journal of Economic Perspectives, 12(2), 139–160.

Grandi, A., & Grimaldi, R. (2003). Exploring the networking characteristics of new venture founding teams: A stdy of italian academic spin-off. Small Business Economics, 21(4), 329–341.

Guesnier, B. (1994). Regional variations in new firm formation in France. Regional Studies, 28(4), 347–358.

Hackett, S. M., & Dilts, D. M. (2004). A systematic review of business incubation research. The Journal of Technology Transfer, 29(1), 55–82.

Hájek, O., Nekolová, J., & Novosák, J. (2015). Determinants of new business formation-some lessons from the Czech Republic. Economics & Sociology, 8(1), 147–156.

Harrison, B., Kelley, M. R., & Gant, J. (1996). Innovative firm behavior and local milieu: Exploring the intersection of agglomeration, firm effects, and technological change. Economic Geography, 72(3), 233–258.

Hathaway, I. (2013). Tech starts: High-technology business formation and job creation in the United States. Ewing Marion Kauffman Foundation Research Paper.

Illeris, S. (1992). The Herning-Ikast Textile Industry: An Industrial District in West Jutland. Entrepreneurship & Regional Development, 4(1), 73–84.

Isenberg, D. J. (2010). How to start an entrepreneurial revolution. Harvard Business Review, 88(6), 40–50.

Jacobs, J. (1969). The economy of cities. New York: Vintage.

Johnson, P., & Conway, C. (1997). How good are the UK VAT registration data at measuring firm births? Small Business Economics, 9(5), 403–409.

Kangasharju, A. (2000). Regional variations in firm formation: Panel and cross-section data evidence from Finland. Papers in Regional Science, 79(4), 355–373.

Keeble, D., & Walker, S. (1994). New firms, small firms and dead firms: Spatial patterns and determinants in the United Kingdom. Regional Studies, 28(4), 411–427.

Keeble, D., & Wilkinson, F. (2000). High-technology clusters. Networking and Collective Learning in Europe, Aldershot et al.

Kelley, M. R., & Helper, S. (1999). Firm size and capabilities, regional agglomeration, and the adoption of new technology. Economics of Innovation and New Technology, 8(1–2), 79–103.

Klapper, L., Love, I., & Randall, D. (2015). New firm registration and the businesscycle. International Entrepreneurship and Management Journal, 11(2), 287–306.

Koh, F. C., Koh, W. T., & Tschang, F. T. (2005). An analytical framework for science parks and technology districts with an application to Singapore. Journal of Business Venturing, 20(2), 217–239.

Krugman, P. (1991). Increasing returns and economic geography. Journal of Political Economy, 99(3), 483–499.

Lasch, F., Robert, F., & Le Roy, F. (2013). Regional determinants of ICT new firm formation. Small Business Economics, 1–16.

Lazaridis, A. (2007). A note regarding the condition number: The case of spurious and latent multicollinearity. Quality & Quantity, 41(1), 123–135.

Leone, R. A., & Struyk, R. (1976). The incubator hypothesis: Evidence from five SMSAs. Urban Studies, 13(3), 325–331.

Li, J., & Geng, S. (2012). Industrial Clusters, Shared Resources and Firm Performance. Entrepreneurship & Regional Development, 24(5–6), 357–381.

Li, M., Goetz, S. J., Partridge, M., & Fleming, D. A. (2016). Location determinants of high-growth firms. Entrepreneurship & Regional Development, 28(1–2), 97–125.

Link, A. N., & Scott, J. T. (2003). US science parks: The diffusion of an innovation and its effects on the academic missions of universities. International Journal of Industrial Organization, 21(9), 1323–1356.

Link, A. N., & Scott, J. T. (2007). The economics of university research parks. Oxford Review of Economic Policy, 23(4), 661–674.

Malecki, E. J. (1984). High technology and local economic development. Journal of the American Planning Association, 50(3), 262–269.

Marshall, A. (1961). Principles of economics: An introductory volume. London: Macmillan.

Martin, R., & Sunley, P. (2006). Path dependence and regional economic evolution. Journal of Economic Geography, 6(4), 395–437.

Massey, D., Quintas, P., & Wield, D. (1992). High tech fantasies. Science Parks in Society Science.

McAdam, M., & McAdam, R. (2008). High tech start-ups in university Science Park incubators: The relationship between the start-up's lifecycle progression and use of the incubator's resources. Technovation, 28(5), 277–290.

Mian, S. A. (1994). Are university technology incubators providing a milieu for technology-based entrepreneurship? Technology Management, 3(1), 86–93.

Mian, S. A. (1997). Assessing and managing the university technology business incubator: An integrative framework. Journal of Business Venturing, 12(4), 251–285.

Moulaert, F., & Sekia, F. (2003). Territorial innovation models: A critical survey. Regional Studies, 37(3), 289–302.

Neter, J., Wasserman, W., & Kunter, M. H. (1990). Applied linear statistical models: Regression, analysis of variance, and experimental design (3rd ed.). Irwin: Homewood, IL.

Norrman, C., & Bager-Sjögren, L. (2010). Entrepreneurship policy to support new innovative ventures: Is it effective? International Small Business Journal, 28(6), 602–619.

Norrman, C., & Klofsten, M. (2009). An entrepreneurship policy programme: Implications and expectations. The International Journal of Entrepreneurship and Innovation, 10(1), 33–42.

Oakey, R. (2007). Clustering and the R&D management of high-technology small firms: In theory and practice. R&D Management, 37(3), 237–248.

Okamuro, H., & Kobayashi, N. (2006). The impact of regional factors on the start-up ratio in Japan. Journal of Small Business Management, 44(2), 310–313.

Page, S. E. (2006). Path dependence. Quarterly Journal of Political Science, 1(1), 87–115.

Patel, P., & Pavitt, K. (1997). The technological competencies of the world's largest firms: Complex and path-dependent, but not much variety. Research Policy, 26(2), 141–156.

Phan, P. H., Siegel, D. S., & Wright, M. (2005). Science parks and incubators: Observations, synthesis and future research. Journal of Business Venturing, 20(2), 165–182.

Phillips, R. G. (2002). Technology business incubators: How effective as technology transfer mechanisms? Technology in Society, 24(3), 299–316.

Polanyi, M. (1967). The tacit dimension. Garden City, NY: Anchor.

Porter, M. E. (1998). Cluster and the new economics of competition.

Porter, M. E. (2000). Location, competition, and economic development: Local clusters in a global economy. Economic Development Quarterly, 14(1), 15–34.

Pyke, F., Becattini, G., & Sengenberger, W. (Eds.). (1990). Industrial districts and inter-firm co-operation in Italy. International Institute for Labour Studies.

Ratinho, T., & Henriques, E. (2010). The role of science parks and business incubators in converging countries: Evidence from Portugal. Technovation, 30(4), 278–290.

Reynolds, C. S. (1997). Vegetation processes in the pelagic: A model for ecosystem theory (Vol. 9). Oldendorf/Luhe: Ecology Institute.

Reynolds, P. D. (2001). National panel study of US business startups: Background and methodology. In Databases for the Study of Entrepreneurship (pp. 153–227). Emerald Group Publishing Limited.

Reynolds, P. D., Miller, B., & Maki, W. R. (1995). Explaining regional variation in business births and deaths: US 1976–88. Small Business Economics, 7(5), 389–407.

Rocha, H. O. (2004). Entrepreneurship and development: The role of clusters. Small Business Economics, 23(5), 363–400.

Rocha, H. O., & Sternberg, R. (2005). Entrepreneurship: The role of clusters theoretical perspectives and empirical evidence from Germany. Small Business Economics, 24(3), 267–292.

Romer, P. M. (1986). Increasing returns and long-run growth. The Journal of Political Economy, 94, 1002–1037.

Saxenian, A. (1994). Regional networks: industrial adaptation in Silicon Valley and route 128.

Sentana, E., González, R., Gascó, J., & LLopis, J (2017). The Social Profitability of Business Incubators: A Measurement Proposal. Entrepreneurship & Regional Development 29(1–2), 116–136.

Shepard, J. M. (2017). When incubators evolve: New models to assist innovative entrepreneurs. International Journal of Entrepreneurship and Innovation Management, 21(1–2), 86–104.

Sherman, H. D. (1999). Assessing the intervention effectiveness of business incubation programs on new business start-ups. Journal of Developmental Entrepreneurship, 4(2), 117.

Sofouli, E., & Vonortas, N. S. (2007). S&T Parks and business incubators in middle-sized countries: the case of Greece. The Journal of Technology Transfer, 32(5), 525–544.

Spilling, O. R. (1996). The entrepreneurial system: On entrepreneurship in the context of a mega-event. Journal of Business Research, 36(1), 91–103.

Storper, M., & Walker, R. (1989). The capitalist imperative: Territory, technology, and industrial growth. Blackwell.

Studdard, N. L. (2006). The effectiveness of entrepreneurial firm’s knowledge acquisition from a business incubator. International Entrepreneurship and Management Journal, 2(2), 211–225.

Torre, A. (2008). On the role played by temporary geographical proximity in knowledge transmission. Regional Studies, 42(6), 869–889.

Van der Panne, G. (2004). Agglomeration externalities: Marshall versus jacobs. Journal of Evolutionary Economics, 14(5), 593–604.

Van Geenhuizen, M., & Reyes-Gonzalez, L. (2007). Does a clustered location matter for high-technology companies' performance? The case of biotechnology in the Netherlands. Technological Forecasting and Social Change, 74(9), 1681–1696.

Van Oort, F. G., & Atzema, O. A. (2004). On the conceptualization of agglomeration economies: The case of new firm formation in the Dutch ICT sector. The Annals of Regional Science, 38(2), 263–290.

Williams, N., & Williams, C. C. (2014). Beyond necessity versus opportunity entrepreneurship: Some lessons from English deprived urban neighbourhoods. International Entrepreneurship and Management Journal, 10(1), 23–40.

Xavier Molina-Morales, F., & Teresa Martínez-Fernández, M. (2006). Industrial districts: Something more than a Neighbourhood. Entrepreneurship and Regional Development, 18(6), 503–524.

Yin, R. K. (2013). Case study research: Design and methods. Sage publications.

Zeitlin, J. (1992). Industrial districts and local economic regeneration: Overview and comment. Industrial Districts and Local Economic Regeneration, Frank Pyke ve Werner Sengenberger (Eds.), Geneva, International Institute for Labour Studies.

Acknowledgements

We would like to thank the Editors in Chief, the Guest Editors and the anonymous Reviewers, who helped significantly enhancing the study’s contributions as a result of the revision process. Any errors remain our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cavallo, A., Ghezzi, A., Colombelli, A. et al. Agglomeration dynamics of innovative start-ups in Italy beyond the industrial district era. Int Entrep Manag J 16, 239–262 (2020). https://doi.org/10.1007/s11365-018-0521-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-018-0521-8

Keywords

- New venture creation

- Agglomeration economies

- Innovative start-ups

- Industrial districts

- Incubators

- Industry-diversification