Abstract

The present study applies the lens of Institutional Theory to analyze the impact of a country’s entrepreneurial legitimacy on its entrepreneurial activity as well as on entrepreneurs’ access to financing. By creating a structural equation model of entrepreneurship in innovation-driven countries, the authors show that countries with greater entrepreneurial legitimacy have more entrepreneurial activity. The model was tested over a 5-year period, from 2009 to 2013. Results suggest that innovation-driven countries with more entrepreneurial legitimacy obtain greater rates of entrepreneurial activity. Further distinguishing among legitimacy types, cognitive legitimacy is shown to exert a stronger influence than regulative or normative legitimacy. The model also confirms a positive relationship between a country’s entrepreneurial legitimacy and access to financing. This occurs principally through regulative legitimacy. This study enlarges our knowledge of the existing differences in entrepreneurial activity among countries. It contributes to the literature on the country-level determinants of entrepreneurship, such as institutional conditions or financial access.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The importance of entrepreneurship for regional and national growth has been amply documented by academic research (Acs 2006; Carree et al. 2010). It has even been suggested that economic growth and increases in competitiveness are mostly driven by a few “high-impact entrepreneurs” (Acs 2008). Nevertheless, the reasons that explain the variance in rates of entrepreneurial activity still remain under study.

One such research avenue suggests that these variations could be caused by differences in institutional background or Entrepreneurial Framework Conditions (Levie and Autio 2008). Countries with different institutional backgrounds show different rates of entrepreneurship (Stenholm et al. 2013). More generally, a country’s institutional context influences its economic behavior (Peng et al. 2009). Among other reasons, this occurs because the institutional context alters the perception of uncertainty for entrepreneurial projects (Aidis 2005).

Institutional Theory has proven itself as an effective theoretical framework from which to interpret the effect of a country’s institutional context on entrepreneurial activity (Bruton et al. 2010; Jennings et al. 2013). This theory suggests that organizations must create an image of sustainability and legitimacy before being able to receive support (Starr and MacMillan 1990). Therefore, legitimacy is a key factor that helps mitigate the perception of risk (Desai 2008) and reduces uncertainty.

There is increasing empirical evidence of the link between legitimacy and business success (Baum and Oliver 1992; Díez-Martín et al. 2013a; Hannan and Carroll 1992; Ruef and Scott 1998). Numerous organizations develop initiatives to increase their legitimacy and thus gain competitive advantages, create new business opportunities, or improve access to the resources they need to survive and grow (Cruz-Suárez et al. 2014a; Deephouse and Suchman 2008; Simcic Brønn and Vidaver-Cohen 2008). A subset of this research highlights the importance of legitimacy in the survival of new ventures (see Bruton et al. 2010).

If individual legitimacy is critical for new venture survival, it would seem reasonable that a country’s overall legitimacy also influences success rates for entrepreneurial activity. Taking this into account, we set out to discover if countries as a whole can manage their legitimacy to achieve their entrepreneurship policy goals in the same way that organizations do. Under this paradigm, if countries are able to improve the perceptions of legitimacy, their rates of entrepreneurial activity would also increase.

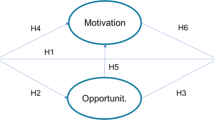

Thus, we define two distinct goals. The first is to better understand the effect of legitimacy on entrepreneurial activity in innovation-driven countries. The second is to analyze the effect of legitimacy on access to financing in these countries. Previous research has studied each of these relationships individually. Nevertheless, they should be considered as part of a whole. For this reason, we develop a model that measures the effect of legitimacy both on financing access as well as on entrepreneurial activity. The model divides legitimacy into three dimensions: regulative, normative, and cognitive (Scott 1995) (see Fig. 1).

The test of this model contributes to institutional theory because it analyzes the dimensions of the legitimacy interrelationships. Legitimacy is a multidimensional concept that cannot be understood without understanding the effect between their dimensions (Überbacher 2014). This research also contributes to entrepreneurship scholars by providing deeper insight about how the country legitimacy can develop the entrepreneurial activity and the resources acquisition. Moreover, it expands the understanding of the entrepreneurship which can be used by policymakers that seek to promote entrepreneurial activity.

To achieve these objectives, we begin by defining the concept of entrepreneurial legitimacy and its dimensions. This analysis will serve as the basis for establishing our research model and hypotheses. Following that, we describe the methodology utilized, including the data, variables, and methods employed in hypothesis testing. We then present the evaluation of the measurement model and results for the structural model. Finally, results and their implications are discussed.

Theoretical framework

Entrepreneurial legitimacy

The study of legitimacy in entrepreneurs has provided valuable insight into individual success for new ventures (Aldrich and Fiol 1994; Lounsbury and Glynn 2001; Shane and Foo 1999; Yu et al. 2013). Nevertheless, we know relatively little of the effect of a country’s legitimacy on entrepreneurial activity. The institutional prerequisites to create legitimacy have not yet been sufficiently researched (Bowen and De Clercq 2008).

In this paper, we present the idea that in an analogous manner to how an entity can perform actions that change its legitimacy and ultimately its chances for success (Díez-Martín et al. 2013b), a country—following its entrepreneurial policy—can modify its entrepreneurial legitimacy and therefore the chances of success of entrepreneurial activity.

Our focus here is on entrepreneurial legitimacy. To define entrepreneurial legitimacy we use the tools of Institutional Theory. Extending Suchman’s (1995) definition of legitimacy, we define a country’s entrepreneurial legitimacy as a generalized perception or assumption that the actions of a country to promote entrepreneurial activity are desirable, proper, or appropriate.

An entity’s legitimacy is determined by its internal or external constituents, who evaluate the desirability and social correctness of its actions (Ruef and Scott 1998). A country’s actions are evaluated by multiple stakeholders.

For the scope of this research, we examine entrepreneurs’ evaluations of their country’s initiatives to promote entrepreneurial activity. Specifically, we explore the factors in the entrepreneur’s mental model that are most conducive to stimulate entrepreneurship. These factors are related to the stimuli and restrictions in the business environment (Veciana and Urbano 2008). Among them, we find: culture, norms, values (North 1990), the judicial system (De Clercq et al. 2010), tradition, or economic incentives (Aldrich and Fiol 1994). All of these influence business development and success (Aldrich and Fiol 1994), thus favoring or limiting entrepreneurial activity (Bruton and Alhstrom 2003). We find that these elements can be classified according to the type of legitimacy they confer: regulative, normative, or cognitive (Scott 1995). Table 1 shows the definition of the three types of entrepreneurial legitimacy under study, as well as the distinctive perceptions that characterize them.

Regulative entrepreneurial legitimacy

Regulative legitimacy arises from the rules, policies, norms, and laws that affect individual behavior (Scott 1995). This type of legitimacy affects entrepreneurial activity by imposing a set of norms on entrepreneurs’ behavior that they must follow (Baumol and Strom 2007).

Different laws and regulation incentivize some behaviors and stunt others (Kostova and Roth 2002). A heavily regulated economic environment will have less new businesses, since excessive regulation has a negative effect on the intention to create a business (Djankov et al. 2002; Veciana and Urbano 2008). In a similar manner, generalized corruption and a weak rule of law can also generate uncertainty (Aidis 2005) and hinder entrepreneurial behaviors (Aidis et al. 2008). Entrepreneurs must have the assurance that their efforts can be rewarded, otherwise entrepreneurial activity and innovation will be undermined (Baumol 1996).

Business opportunities tend to be greater in countries with less regulation, free markets, and low entry barriers (El-Namaki 1988). This type of countries usually exhibit trustworthy taxation systems, coherent and predictable application of the law, less bureaucracy (Manolova et al. 2008), or tax incentives, which facilitates the starting of entrepreneurial projects. It has been proven that economies where it costs less to start a new business have a larger number of small businesses (Ayyagari et al. 2007).

When an entity meets its society’s values, norms, and expectations, it becomes legitimate (Suchman 1995). In consequence, when a country implements activities that are seen as desirable by entrepreneurs -such as the creation of norms that incentivize entrepreneurship or ensuring norm compliance- it will improve its entrepreneurial legitimacy.

-

Hypothesis 1

Countries with greater regulative entrepreneurial legitimacy have more entrepreneurial activity.

Normative entrepreneurial legitimacy

Normative legitimacy collects evaluations on an entity’s conformity with social norms, values, and beliefs (Busenitz et al. 2000; Scott 1995). This applies to the objectives and standards utilized as well as the means with which these are attained. The literature has shown that a society’s attitudes, beliefs, and expectations influence individual intentions to start a new venture (Krueger et al. 2000). In this line of thought, national culture—as a larger set of social references—also influences entrepreneurial intent (Stenholm et al. 2013).

A constant focal point for scientific research on entrepreneurship is the relationship between entrepreneurial activity and national cultural characteristics (Thornton et al. 2011). A substantial part of the differences in entrepreneurial activity among countries has been attributed to culture (Krueger et al. 2013; Hayton et al. 2002). This occurs because the cultural environment as perceived by the entrepreneurs impacts their level of persistence in initiating a new venture (Hopp and Stephan 2012). An extended review of empirical research to better understand the impact of national culture, alone and in interaction with other contextual factors, can be found in Hayton and Cacciotti (2013).

To understand the legitimacy of an organization one must examine how it is built. In this sense, culture is a determinant building block of legitimacy (Brown and Toyoki 2013; Ruebottom 2013; Treviño et al. 2014). To the point that cultural changes in a business influence their level of legitimacy (Drori and Honig 2013).

At a national level, promoting an entrepreneurial culture may facilitate a favorable institutional environment for entrepreneurship (Davidsson 1995) so that culture becomes a legitimating agent. In this sense, it has been observed that proactive and positive expectations or beliefs regarding entrepreneurial initiative (i.e.,: a culture of entrepreneurship) favor entrepreneurial intentions (Liñán et al. 2011a). Exposure to entrepreneurial cases and success stories may generate favorable beliefs and feelings about entrepreneurial activity (Gatewood et al. 1995). The same thing happens in countries where there are no negative perceptions of the uncertainty associated with an entrepreneurial venture (Bowen and De Clercq 2008). Similarly, it has been suggested that the difference between an individualist culture or a collective culture may also affect entrepreneurial activity (Dickson and Weaver 2008). Overall, a cultural environment that views entrepreneurial initiatives as something commonplace, familiar, understandable and acceptable is legitimizing entrepreneurship.

-

Hypothesis 2

Countries with greater normative entrepreneurial legitimacy have more entrepreneurial activity.

Normative entrepreneurial legitimacy directly influences entrepreneurial activity as well as cognitive entrepreneurial legitimacy. A study carried out by Liñán et al. (2011b) on entrepreneurial cognitions and start-up intentions shows that cognitive social capital (CSC), which is based on weak ties (social valuation), has a positive impact on perceived behavioural control. Research by Wennberg et al. (2013) supports these findings. Thus, the activity of a country that is built on its normative entrepreneurial legitimacy would exert a positive influence on cognitive entrepreneurial legitimacy.

The result of the relationship between normative and cognitive entrepreneurial legitimacy is explained by the development of entrepreneurial abilities. These abilities may be rooted in the value system of a specific group or society (Thomas and Mueller 2000). More specifically, social capital based on weak ties can generate a favourable social inclination toward entrepreneurial activity through the acquisition of information and experience (Jack and Anderson 2002; Hoang and Antoncic 2003).

Nevertheless, this study is focused on the direct relationship between normative entrepreneurial legitimacy and entrepreneurial activity. However, we believe that it could be an interesting future line of research.

Cognitive entrepreneurial legitimacy

Cognitive legitimacy represents conformity with the mental framework through which information is processed. This type of legitimacy is based on the existence of a common frame of reference used to evaluate a given situation (Scott 1995). Education and work experience are key factors in this area. They influence the degree to which individuals perceive that they are capable of starting new venture. Previous research on entrepreneurial intentions defines this perceived ability to execute intended behavior as self-efficacy (Krueger et al. 2000). In order to recognize the feasibility of a potential business, entrepreneurs must perceive that they possess sufficient skills to implement it (see Liñán et al. 2011a). This approach is similar to the concept of perceived behavioral control (Ajzen 1991) that originates from self-efficacy theory (Bandura 1977), which refers to people’s perceptions of their ability to perform a given behavior. Its importance lies in stating that intentions capture the motivational factors that influence behavior. Entrepreneurial cognition research work has been influenced by this conceptualization in explaining why entrepreneurs start a business (e.g., Fayolle et al. 2014; Liñán et al. 2013). Those that consider themselves able to successfully carry out a given task have more chances of doing so (Krueger and Carsrud 1993). Research has shown that this is not always the case. Gatewood et al. (1995) prove that there is not a clear relationship between the level of personal efficacy and persistence in carrying out an entrepreneurial project. Nevertheless, these authors conclude that entrepreneurs that can offer an explanation for their entrepreneurial plans are more persistent in carrying them out.

An entrepreneur must be prepared since this will be viewed positively by the organization’s stakeholders. It has been shown that there is a link between an entrepreneur’s preparation and funding for his or her new venture (Chen et al. 2009). Preparation in this context is interpreted as having the necessary skills to face any situation. In this link between preparation and funding, legitimacy is a moderator variable. In a study of entrepreneurs requesting funding, those with greater preparation were seen as more legitimate and obtained more resources (Pollack et al. 2012). When an entrepreneur is educated and prepared, those that evaluate him or her will more easily understand and trust the venture, which will increase its legitimacy (Delmar and Shane 2004; Tornikoski and Newbert 2007).

A country that wants to increase its entrepreneurial activity must consider the actions to promote desirables entrepreneurial capabilities. To this point, the type of education offered by a country and employment promoting measures play a key role. Education and working experience are key elements in the individual learning process. Both empower potential entrepreneurs to detect opportunities and execute projects. The self-image entrepreneurs have of their knowledge and skills influences how they recognize and exploit opportunities (Shane 2000). For example, not everybody is able to create a business plan but having one makes a difference (Magretta 2002). In it, the organizational style is defined and potential stakeholders can use it as an instrument to evaluate legitimacy.

-

Hypothesis 3

Countries with greater cognitive entrepreneurial legitimacy have more entrepreneurial activity

Access to financing

Obtaining legitimacy facilitates access to indispensable strategic resources that are necessary for growth and survival (Baum and Oliver 1992; Cruz-Suarez et al. 2014b). Brown (1998 page 35) suggests that “legitimate status is a sine qua non for easy access to resources, unrestricted access to markets, and long term survival.” Numerous studies support the existence of this relationship (Baum and Oliver 1991, 1992; Hannan and Carroll 1992; Kistruck et al. 2015; Singh et al. 1986). Analogously, a country’s entrepreneurial legitimacy would also be linked to the attraction of necessary resources.

One of the main problems facing entrepreneurs is the lack of access to capital (Blanchflower and Oswald 1998). Many entrepreneurs state that they need more financial assistance and identify this as one of the main causes for not starting a new venture. Multiple articles have referenced this situation (De Clercq et al. 2012; Hitt et al. 2011). It also occurs in different countries, independently of their level of development (Kwon and Arenius 2010).

Generally, entrepreneurs obtain financing from family, friends, and other acquaintances. Financing from other sources, like banks, is complicated (Blanchflower and Oswald 1998). Banks have difficulty evaluating the risk of these types of projects and, because of this, usually demand more guarantees. This situation could contribute to reduce entrepreneurial intent.

It has been proven that legitimacy makes it easier to attract financial resources (Deeds et al. 2004; Pollack et al. 2012; Pollock and Rindova 2003) and influences investors’ decision-making (Higgins and Gulati 2003). Having more available financial resources increases the possibilities of taking advantage of new business opportunities (Evans and Leighton 1989). Thus, it would be a reasonable supposition that a country with more entrepreneurial legitimacy has more financial resources available for its entrepreneurs.

-

Hypothesis 4

Countries with greater regulative entrepreneurial legitimacy obtain better access to financial resources

-

Hypothesis 5

Countries with greater normative entrepreneurial legitimacy obtain better access to financial resources

-

Hypothesis 6

Countries with greater cognitive entrepreneurial legitimacy obtain better access to financial resources

Entrepreneurial literature has shown that low capital requirements and better conditions for access to credit, increases the possibilities of establishing a business (Ho and Wong 2007; Shane and Venkataraman 2000; Shane 1996; Van Gelderen et al. 2006). This has been analyzed by researches in different populations. For instance, recent research supports the existence of a positive relationship between access to finance and entrepreneurship in the countries of the European Union (Morales Urrutia and Rodil Marzábal 2015). Similarly, the access to formal bank finance has been found as one determinant that influences regional start-up rates in South Africa (Naudé et al. 2008). It also occurs in Central and Eastern Europe countries (Pissarides 1999; Pissarides et al. 2003).

Access to finance is a condition in which entrepreneurship is likely to flourish (Acs et al. 2008). Researchers suggest that policymakers should emphasize access to financial capital because of the relationship with entrepreneurial activity (Cetindamar et al. 2012). Governments can encourage the access to finance in numerous ways (e.g., developing a fiscal policy that favors financial investment, encouraging capital risk agencies). These considerations lead to pose the following hypothesis:

-

Hypothesis 7

Countries with greater access to financial resources have more entrepreneurial activity

Methodology

Sample

The above-defined hypotheses were tested on a sample of high developed countries. This research examined these types of countries. To establish more developed countries the empirical research has based on the classification proposed by the World Economic Forum (WEF). The WEF considers that most developed countries are those where competition is obtained primarily by producing new and different goods using the most sophisticated production processes and by innovating new ones. Countries included in this group are referred by WEF as Innovation-driven countries. The difference with the less developed countries is that the latter base their competitiveness in areas such as: higher education and training, efficient goods markets, well-functioning labor markets, developed financial markets, or a large domestic or foreign market. Less developed countries lack sophisticated production processes and they are referred by WEF as Efficiency-driven countries.

Table 2 shows a list of all countries included in the group of Innovation-driven countries that have been analyzed in this research. This ranking was used for several motives. On the one hand, the countries’ populations have similar attributes. On the other hand, the effect of institutional conditions on businesses in developed economies has not been sufficiently studied. The existing literature has mostly researched these types of effects in emerging economies (e.g., De Clercq et al. 2010; Kibler and Kautonen 2014). The model was tested over a 5-year period, from 2009 to 2013.

Data

We used two data sources to construct the 15 variables employed in our analysis. The Global Competitiveness Index (GCI) and the Global Entrepreneurship Monitor (GEM). The GCI measures the microeconomic and macroeconomic foundations of national competitiveness. Data are collected from the World Economic Forum’s Executive Opinion Survey and other sources, such as the World Economic Outlook Database or the World Development Indicators (Schwab 2014). The data for the Global Entrepreneurship Monitor (GEM) survey items was collected with different survey techniques to avoid common method bias (see Bosma et al. 2012). From 37 countries in the sample (see GCI 2013–14), the GEM only included data on 33. The others were removed from the study: Bahrain, Cyprus, Malta and Qatar. Variables, descriptions and data sources for the variables used in the study are summarized in Table 2.

Variables

Entrepreneurial regulative legitimacy

Six different variables were used to measure entrepreneurial regulative legitimacy. Four of them were obtained from the GCI’s Institutions pillar. These variables aim to measure the levels of property rights (property rights and intellectual property protection) and ethics and corruption (diversion of public funds and public trust in politicians) in each country. Previous research has used these variables in a similar manner (e.g., Stenholm et al. 2013). All of these variables are measured on a 7-point Likert scale.

Additionally, two more variables were used (no. of procedures to start a business and no. of days to start a business) from the goods market efficiency pillar. This pillar aims to measure the ease with which a country can produce goods and services (Stenholm et al. 2013). Both these variables come from the World Bank’s Ease of Doing Business Index. The rankings obtained from these variables were rescaled and normalized.

Entrepreneurial normative legitimacy

Three variables from the GEM were utilized to measure national entrepreneurial legitimacy. Desirability of entrepreneurship as a career choice was measured through the percentage of 18–64 population who agree with the statement that in their country, most people consider starting a business as a desirable career choice (De Clercq et al. 2010; Liñán et al. 2011a). Media attention paid to entrepreneurship was measured through percentage of 18–64 population who agree with the statement that in their country, you will often see stories in the public media about successful new businesses (Liñán et al. 2011a; Stenholm et al. 2013). Media customarily report on the commentary and attacks to illegitimate corporations, which reflects the society’s values (Dowling and Pfeffer 1975). This approach to measuring legitimacy has been applied in previous studies (Bansal and Clelland 2004; Deephouse 1996). Finally, the status of entrepreneurs in each country was measured by using the percentage of 18–64 population who agree with the statement that in their country, successful entrepreneurs receive high status (Liñán et al. 2011a; Stenholm et al. 2013). Status is a variable that affects an organization’s legitimacy (Deephouse and Suchman 2008).

Entrepreneurial cognitive legitimacy

Entrepreneurial cognitive legitimacy was captured through the GEM variable perceived capabilities (e.g., Stenholm et al. 2013). This variable measures the percentage of 18–64 population who believe to have the required skills and knowledge to start a business.

Financial access

Four variables were used to measure each country’s access to financing. The GEM provided the informal investors rate (De Clercq et al. 2012) that measures the percentage of 18–64 population who have personally provided funds for a new business, started by someone else, in the past 3 years. The GCI included three relevant variables in the financial market development pillar: availability of financial services, ease of access to loans and venture capital availability (Kwon and Arenius 2010). These three variables are measured on a 7-point Likert scale

Entrepreneurial activity

Entrepreneurial activity was quantified with the GEM’s new business ownership rate. This variable measures the percentage of 18–64 population who are currently an owner-manager of a new business, i.e., owning and managing a running business that has paid salaries, wages, or any other payments to the owners for more than 3 months, but not more than 42 months.

Data analysis

In order to analyze the effect of a country’s entrepreneurial legitimacy on access to financing and entrepreneurial activity we used the Partial Least Squares (PLS) method, a variance-based structural equation modeling (Reinartz et al. 2009). This method allows assessment of the reliability and validity of the measures of theoretical constructs and the estimation of the relationships between these constructs (Barroso et al. 2010). PLS is an appropriate technique to use in a theory development situation such as in this study (Chin 2010) because: a) it is primarily intended for causal-predictive analysis, where the problems explored are complex and prior theoretical knowledge is scarce (Wold 1985) and b) studies where the use of secondary data makes the utilization of PLS advisable (Gefen et al. 2011).

Results

Measurement model

The individual item reliability, construct reliability, convergent validity, and discriminant validity of the measurement model were evaluated (Hair et al. 2012); with Table 3 showing the individual item reliability for 2013. Indicators with loadings below 0.707 (indicated by non-bold values in Table 3), were eliminated from the model (Carmines and Zeller 1979). This reliability analysis was applied to all study years with similar results.

Table 4 presents results for the model’s construct reliability, convergent validity and discriminant validity between 2009 and 2013. Construct reliability were assessed using composite reliability (rc) and Cronbach’s alpha (Roldán and Sánchez-Franco 2012). According to the Nunnally and Bernstein (1994) guidelines about construct reliability all of them were reliable. Convergent validity were assessed by examining the average variance extracted (AVE) (Hair et al. 2011). AVE measures for all latent variables were greater than 0.746, which is more than the 0.5 threshold suggested for research settings (Fornell and Larcker 1981). Regarding discriminant validity, the square root of the AVE of each latent variable (LV) was greater than its correlations with any other LV in the assessment, suggesting that the AVE was greater than the variance between the construct and other constructs in the model (Fornell and Larcker 1981). Besides, no item loads more highly on another construct than it does on the construct it intends to measure (Hair et al. 2011).

Structural model

Table 5 shows the variance explained (R Square) in the dependent constructs and the path coefficients (ß) for the model. Bootstrapping (5000 resamples) is used to generate standard errors and t-statistics (Hair et al. 2011). This allows us to assess the statistical significance of the path coefficients.

Financial access is the construct with the largest variance explained throughout all study years. Its values are between moderate and strong (see Chin 1998). In 2012, it reaches 0.707. The variance explained by entrepreneurial activity is moderate in all years, with a maximum value of 0.468 in 2010. In 2011, all the relationships in the model are significant since they surpass the minimum level indicated by a Student’s t-distribution with one tail and n - 1 (n = number of resamples) degrees of freedom. This does not happen every year.

The results show that a country’s entrepreneurial activity is significantly related to its entrepreneurial legitimacy. In three of the 5 years under study, regulative and normative entrepreneurial legitimacy exhibit a significant link with entrepreneurial activity (H1-H2). This happens in years 2010, 2011, and 2013. Therefore, we can state that the results partially support Hypotheses 1 and 2. Furthermore, cognitive legitimacy is significantly linked to entrepreneurial activity during the entire timespan. Therefore Hypothesis 3 is confirmed: countries with greater cognitive entrepreneurial legitimacy have more entrepreneurial activity.

Regulative legitimacy has a significant direct relation with financial access in all study years. These results support the hypothesis that more regulative legitimacy is linked with more access to financing (H4). Cognitive legitimacy is similarly linked, with a significant link to financial access in four out of 5 years. Even though it has low path coefficients (ß). This would confirm the hypothesis that more cognitive legitimacy is linked to greater financial access (H6). On the contrary, the results do not support a link between normative entrepreneurial legitimacy and financial access (H5). This link is highly significant in 2011 and more weakly so in 2009.

Finally, results confirm a significant direct relation between financial access and entrepreneurial activity (H7).

Table 6 summarizes the hypothesis results by showing the degree of support of each hypothesis as well as the support threshold considered.

Discussion

Overview and contributions

Previous research has paid special attention to the effect of a country’s institutional environment on its entrepreneurial activity (De Clercq et al. 2010; Stenholm et al. 2013). The link between institutional environment and financial access has also been amply investigated (De Clercq et al. 2012; Kwon and Arenius 2010). This study has developed a new approach to analyze these relationships. By applying the tenets of Institutional Theory (Meyer and Rowan 1977), we propose that entrepreneurial legitimacy has a long-lasting impact on financial access and entrepreneurial activity. To analyze this relationship, we developed a multidimensional measure of country-level entrepreneurial legitimacy that includes three legitimacy dimensions based on Scott’s (1995) typologies. This model enriches previous literature because it evaluates the full process of legitimacy. This unified model links entrepreneurial legitimacy with financial access and entrepreneurial activity as part of a whole. It is a more complex model that allows obtaining more comprehensive results. This model is useful for: institutional theory scholars, because it shows the relationships between the different dimensions of legitimacy and its connection to the access to resources; entrepreneurship scholars, because it provides a different view of the countries entrepreneurial activity by expanding the results of previous research; and policymakers, because it establishes where to allocate efforts and resources efficiently.

By examining innovation-driven countries (WEF classification), the results suggest the existence of a significant relationship between national entrepreneurial legitimacy and entrepreneurial activity. Innovation-driven countries with more entrepreneurial legitimacy obtain greater rates of entrepreneurial activity. This data is consistent with the postulates of Institutional Theory (DiMaggio and Powell 1983; Meyer and Rowan 1977) and previous studies linking legitimacy with business success (Baum and Oliver 1992; Díez-Martín et al. 2013a; Zimmerman and Zeitz 2002).

In innovation-driven countries, the link between legitimacy and entrepreneurial activity is preeminently sustained on cognitive legitimacy. When people have more knowledge and skills they have more possibilities of finding specific entrepreneurial opportunities (Shane 2000). These results agree with previous findings showing that self-efficacy positively influences entrepreneurial intentions (Liñán et al. 2011a; Lin and Si 2014; Mitchell et al. 2002). Cognitive legitimacy has proven itself to be the essential pillar on which to base long-lasting entrepreneurial activity at a national level. Nevertheless, normative and regulative legitimacy types are also important (Fernández-Serrano and Romero 2014). Some researchers have argued that regulative, rather than normative, legitimacy is the main driver of entrepreneurial activity (Stenholm et al. 2013). Our results indicate that both dimensions have a moderate effect on entrepreneurial activity. In this specific situation, regulative legitimacy has evidenced greater relevance than normative legitimacy. Normative legitimacy does not only have a weaker link but is also less significant. Dissatisfied individuals with the dominant cultural values will also become entrepreneurs (Hofstede et al. 2004). In sum, in agreement with Shane (2000) the results suggest that a country may have favorable rules, policies, norms, and laws promoting entrepreneurial activity as well as encouraging social norms, values, and beliefs for the same purpose; but without knowledge, skills, and capabilities entrepreneurial opportunities can hardly be discovered.

Legitimacy is important because it is positively linked to success (Ahlstrom and Bruton 2001; Díez-Martín et al. 2013a) and organizational survival (Ruef and Scott 1998; Tornikoski and Newbert 2007). Nevertheless, this link could not be adequately explained without the easier access to resources that having greater legitimacy makes possible (Zimmerman and Zeitz 2002). Our results support these hypotheses; particularly with regard to financial resources. Previous literature suggests that having legitimacy favors access to financial resources (Deeds et al. 2004). In our study of innovation-driven countries, a link has been observed between regulative entrepreneurial legitimacy and access to financial resources. This is a strong and long-lasting link that has also been observed by other scientists (De Clercq et al. 2012; Jeng and Wells 2000). Cognitive entrepreneurial legitimacy also demonstrated a significant, but weak, link to financial access. In a similar vein, businesses seeking financing obtain greater financial resources if they have cognitive legitimacy (Higgins and Gulati 2006; Pollack et al. 2012). These results show that a country must demonstrate the existence of favourable regulation to investors. Having achieved this aspect, a country needs to prove that it has sufficient knowledge, skills and capabilities to discover and manage entrepreneurial opportunities. Even if an individual demonstrates great entrepreneurial skills to a financial institution, if this institution considers that regulatory support for their investment is lacking they will not make a deal.

On the other hand, our results do not sustain the assertion that normative entrepreneurial legitimacy has a significant effect on access to financial resources. This could be explained by thinking of cognitive and regulative legitimacy as providing access to financing; and normative legitimacy as allowing one to obtain more financing but not to gain access to it (Lewellyn and Bao 2014).

Overall, the results of this study contribute to the growing literature on the country-level determinants of entrepreneurship, such as institutional conditions (Stenholm et al. 2013) or financial access (De Clercq et al. 2012). This research venue will enlarge our knowledge of the existing differences in entrepreneurial activity among countries (Wennekers et al. 2005). Furthermore, the measuring model offered here also supports the existence of a positive and long-lasting relationship between access to financing and entrepreneurial activity (Blanchflower and Oswald 1998; Evans and Leighton 1989). From a country framework, this research extends prior research on legitimacy, which has focused on company’s success (Hopp and Stephan 2012), survival (Ahlstrom et al. 2008), access to resources (Frydrych et al. 2014; Kannan-Narasimhan 2014; Kistruck et al. 2015), or the effects of legitimacy typologies (Díez-Martín et al. 2013a; Pollack et al. 2012).

Limitations and future research directions

Several limitations of this study provide directions for further research. The first is a consequence of the results of this investigation and its implications. The results are not applicable to all countries; just to the subset of innovation-driven countries. This study could be replicated for Factor and Efficiency-driven countries (WEF classification). Specific characteristics of a country may influence the nature of the link between entrepreneurial legitimacy and entrepreneurial activity.

Further expanding this line of research, the relative effect of the different dimensions of legitimacy on entrepreneurial activity could vary, as per Suchman (1995), not only among different economic sectors but also between countries. It would be constructive to know if there is a different relationship between legitimacy types and entrepreneurial activity in innovation-driven countries versus the other groups. In order to explore in deep the differences between countries, future research could include dummy variables by region.

This paper uses the GEM to measure entrepreneurial activity. Other researchers have questioned this instrument (Valliere 2010). The possibility of an instrument bias has been previously noted; with different results for measuring entrepreneurship according to the indicator used (Stenholm et al. 2013).

Future research may also analyze the effect of entrepreneurial legitimacy at a country level on its rate of entrepreneurial activity by using international indicators. On the other hand, the way we measure legitimacy also has room for improvement. More variables could be used to measure the constructs, especially for cognitive legitimacy.

This research analyses the direct relationship between entrepreneurial legitimacy, entrepreneurial activity, and financial access. Future research might study financial access as a mediating variable between entrepreneurial legitimacy and entrepreneurial activity.

Finally, the methods used in the model assume the linearity of relationships between the latent variables. The relationship between legitimacy and entrepreneurial activity does not seem to be linear.

Managerial implications

This study shines light on a number of managerial implications that could be applied to government policy. As stated above, these implications are applicable mostly to innovation-driven countries. Those responsible for designing policies in these areas must understand the importance of managing their national entrepreneurial legitimacy. This will impact not only entrepreneurial activity but also the development of financial markets. It would therefore be advisable to set entrepreneurial legitimacy as a strategic goal in economic policy. Governments must work to actively influence the perception that their environment has of them (Díez-Martín et al. 2013a) so they can obtain and maintain their entrepreneurial legitimacy. In this way, nations may contribute to economic growth (Bowen and De Clercq 2008).

On one hand, countries that want to increase their entrepreneurial activity should direct their efforts toward improving their cognitive entrepreneurial legitimacy. This means promote entrepreneurial capabilities, mainly by education and working experience. The governments should understand the forces and restraints, which contribute to the success or failure of entrepreneur activities in each country. Previous environmental model of entrepreneurship could be utilized for this end (e.g., Carayannis et al. 2003). For example, by applying the best entrepreneurial education programs detected among the most entrepreneurial countries. This research cannot ignore the successful educational programs that exist in most entrepreneurial countries. At the same time it cannot automatically assume that what works in some countries is going to work in another culture. For example, policymakers could stimulate entrepreneurship education beginning in the early stages of a child’s education, at the very latest during the junior high school years, because it is widely accepted and proven that entrepreneurship education has had an impact on student propensity and intentionality (Bae et al. 2014; Pittaway and Cope 2007).

However countries should not forget keeping a stable regulatory environment and nourishing an entrepreneurial culture. A country can increase its regulative entrepreneurial legitimacy primarily by reducing procedures officially required to start up and formally operate a business, as well as the time and cost to complete these procedures and the paid-in minimum capital requirement. Entrepreneurial literature suggests that heavier regulation of entry is generally associated with greater corruption but not with better quality of private or public goods. Within this circumstances, the principal beneficiaries appear to be the politicians and bureaucrats themselves (Djankov et al. 2002). At the same time, strengthen the entrepreneurial normative legitimacy would be possible by developing a culture that encourages entrepreneurship. The governments can develop measures to ensure that successful entrepreneurs receive high status. Through storytelling, countries can discursively create novel, yet legitimate, vision about entrepreneur’s status. Stories constitute critical cultural tools that actors can mobilize in the pursuit of legitimacy (Überbacher 2014).

On the other hand, if the main goal is to favor access to financial resources the recommended course of action would be to work toward initiatives that strengthen regulative legitimacy. Governmental policies affect the regulatory environments in which financial institutions operate, thereby affecting the lending infrastructure (Mitter and Kraus 2011). The development of financial and legal systems represent ones of the main approaches by which policymakers can alleviate entrepreneurs financing constraints (Beck and Demirguc-Kunt 2006; Mitter and Kraus 2011). In this line, it has been found that among the best actions for this purpose is allow the emergence of private initiative (e.g., crowdfunding, angel investors) through a generally permissive regulatory environment (Cull et al. 2006). In this context, it is the small firms that stand to gain most from a better-developed financial and legal systems (Beck et al. 2005). There are numerous government actions to encourage and entrepreneurial regulatory environment. For instance: measures to improve property rights and intellectual property protection; develop fluent judicial conflict resolution mechanisms; provide tax incentive schemes for investors; increase public trust in politicians; or reduce the diversion of public funds. These regulatory actions can increase the external financing (Beck et al. 2008).

References

Acs, Z. J. (2006). How is entrepreneurship good for economic growth? Innovations: Technology, Governance Globalization, 1(1), 97–107.

Acs, Z. J. (2008). Foundations of high impact entrepreneurship. Foundations and Trends in Entrepreneurship, 4(6), 535–620.

Acs, Z. J., Desai, S., & Hessels, J. (2008). Entrepreneurship, economic development and institutions. Small Business Economics, 31(3), 219–234.

Ahlstrom, D., & Bruton, G. D. (2001). Learning from successful local private firms in China: establishing legitimacy. Academy of Management Executive, 15(4), 72–83.

Ahlstrom, D., Bruton, G. D., & Yeh, K. S. (2008). Private firms in China: building legitimacy in an emerging economy. Journal of World Business, 43(4), 385–399.

Aidis, R. (2005). Institutional barriers to small- and medium-sized enterprise operations in transition countries. Small Business Economics, 25(4), 305–317.

Aidis, R., Estrin, S., & Mickiewicz, T. (2008). Institutions and entrepreneurship development in Russia: a comparative perspective. Journal of Business Venturing, 23(6), 656–672.

Ajzen, I. (1991). The theory of planned behavior P. A. M. Lange, A. W. Kruglanski, & E. T. Higgins, eds. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

Aldrich, H. E., & Fiol, C. M. (1994). Fools rush in? The institutional context of industry creation. Academy of Management Review, 19(4), 645–670.

Ayyagari, M., Beck, T., & Demirgüç-Kunt, A. (2007). Small and medium enterprises across the globe. Small Business Economics, 29(4), 415–434.

Bae, T. J., Qian, S., Miao, C., & Fiet, J. O. (2014). The relationship between entrepreneurship education and entrepreneurial intentions: a meta-analytic review. Entrepreneurship: Theory and Practice, 38(2), 217–254.

Bandura, A. (1977). Self-efficacy: toward a unifying theory of behavioral change. Psychological Review, 84(2), 191–215.

Bansal, P., & Clelland, I. (2004). Talking trash: legitimacy, impression management, and unsystematic risk in the context of the natural environment. Academy of Management Journal, 47(1), 93–103.

Barroso, C., Cepeda, G., & Roldan, J. L. (2010). Applying maximum likelihood and PLS on different sample sizes: Studies on SERVQUAL model and employee behaviour model. In V. E. Vinzi, W. W. Chin, J. Henseler, & H. Wang (Eds.), Handbook of partial least squares: Concepts, methods and applications (pp. 427–447). Berlin: Springer.

Baum, J. A. C. J., & Oliver, C. (1991). Institutional linkages and organizational mortality. Administrative Science Quarterly, 36(2), 187–218.

Baum, J., & Oliver, C. (1992). Institutional embeddedness and the dynamics of organizational populations. American Sociological Review, 57(4), 540–559.

Baumol, W. J. (1996). Entrepreneurship: productive, unproductive, and destructive. Journal of Business Venturing, 11(1), 3–22.

Baumol, W. J., & Strom, R. J. (2007). Entrepreneurship and economic growth. Strategic Entrepreneurship Journal, 1(3–4), 233–237.

Beck, T., & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: access to finance as a growth constraint. Journal of Banking & Finance, 30(11), 2931–2943.

Beck, T., Demirguc-Kunt, A., & Maksimovic, V. (2005). Financial and legal constraints to firm growth: does size matter? Journal of Finance, 60(1), 137–177.

Beck, T., Demirguc-Kunt, A., & Maksimovic, V. (2008). Financing patterns around the world: are small firms different? Journal of Financial Economics, 89(3), 467–487.

Blanchflower, D. G., & Oswald, A. J. (1998). What makes an entrepreneur? Journal of Labor Economics, 16(1), 26–60.

Bosma, N., Coduras, A., Litovsky, Y., & Seaman, J. (2012). GEM Manual. A report on the design, data and quality control of the Global Entrepreneurship Monitor. Retrieved from www.gemconsortium.org

Bowen, H. P., & De Clercq, D. (2008). Institutional context and the allocation of entrepreneurial effort. Journal of International Business Studies, 39(4), 747–767.

Brown, A. D. (1998). Narrative, politics and legitimacy in an IT implementation. Journal of Management Studies, 35(1), 35–58.

Brown, A. D., & Toyoki, S. (2013). Identity work and legitimacy. Organization Studies, 34(7), 875–896.

Bruton, G. D., & Alhstrom, D. (2003). An institutional view of China’s venture capital industry: explaining the differences between China and the West. Journal of Business Venturing, 18(2), 233–259.

Bruton, G. D., Ahlstrom, D., & Li, H.-L. (2010). Institutional theory and entrepreneurship: where are we now and where do we need to move in the future? Entrepreneurship: Theory and Practice, 34(3), 421–440.

Busenitz, L. W., Gomez, C., & Spencer, J. W. (2000). Country institutional profiles: unlocking entrepreneurial phenomena. Academy of Management Journal, 43(5), 994–1003.

Carayannis, E. G., Evans, D., & Hanson, M. (2003). A cross-cultural learning strategy for entrepreneurship education: outline of key concepts and lessons learned from a comparative study of entrepreneurship students in France and the US. Technovation, 23(9), 757–771.

Carmines, E. G., & Zeller, R. A. (1979). Reliability and validity assessment. Beverly Hills and London: Sage Publications.

Carree, M. A., Thurik, A. R., Acs, Z. J., & Audretsch, D. B. (2010). The Impact of Entrepreneurship on Economic Growth. In Z. J. Acs & D. B. Audretsch (Eds.), Handbook of Entrepreneurship Research (Vol. 5, pp. 557–594). Springer.

Cetindamar, D., Gupta, V. K., Karadeniz, E. E., & Egrican, N. (2012). What the numbers tell: the impact of human, family and financial capital on women and men’s entry into entrepreneurship in Turkey. Entrepreneurship and Regional Development, 24(1–2), 29–51.

Chen, X.-P., Yao, X., & Kotha, S. (2009). Entrepreneur passion and preparedness in business plan presentations: a persuasion analysis of venture capitalists’ funding decisions. Academy of Management Journal, 52(1), 199–214.

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. In G. A. Marcoulides (Ed.), Modern Methods for Business Research (Vol. 295, pp. 295–336). Lawrence Erlbaum Associates.

Chin, W. W. (2010). How to write up and report PLS analyses. In V. E. Vinzi, W. W. Chin, J. Henseler, & H. Wang (Eds.), Handbook of partial least squares: Concepts, methods and applications (pp. 655–690). Springer.

Cruz-Suárez, A., Prado-Román, C., & Díez-Martín, F. (2014). Por qué se institucionalizan las organizaciones. Revista Europea de Dirección y Economía de la Empresa, 23(1), 22–30.

Cruz-Suarez, A., Prado-Román, A., & Prado-Román, M. (2014). Cognitive legitimacy, resource access, and organizational outcomes. RAE-Revista de Administração de Empresas, 54(5), 575–584.

Cull, R., Davis, L. E., Lamoreaux, N. R., & Rosenthal, J.-L. (2006). Historical financing of small- and medium-size enterprises. Journal of Banking & Finance, 30(11), 3017–3042.

Davidsson, P. (1995). Culture, structure and regional levels of entrepreneurship. Entrepreneurship and Regional Development, 7(1), 41–62.

De Clercq, D., Danis, W. M., & Dakhli, M. (2010). The moderating effect of institutional context on the relationship between associational activity and new business activity in emerging economies. International Business Review, 19(1), 85–101.

De Clercq, D., Meuleman, M., & Wright, M. (2012). A cross-country investigation of micro-angel investment activity: the roles of new business opportunities and institutions. International Business Review, 21(2), 117–129.

Deeds, D. L., Mang, P. Y., & Frandsen, M. L. (2004). The influence of firms’ and industries’ legitimacy on the flow of capital into high-technology ventures. Strategic Organization, 2(1), 9–34.

Deephouse, D. L. (1996). Does isomorphism legitimate? Academy of Management Journal, 39(4), 1024–1039.

Deephouse, D., & Suchman, M. (2008). Legitimacy in organizational institutionalism. In K. R. Greenwood, C. Oliver, R. Suddaby, & Sahlin-Andersson (Eds.), The sage handbook of organizational institutionalism (pp. 49–77). London: Sage Publications.

Delmar, F., & Shane, S. (2004). Legitimating first: organizing activities and the survival of new ventures. Journal of Business Venturing, 19(3), 385–410.

Desai, V. M. (2008). Constrained Growth: How Experience, Legitimacy, and Age Influence Risk Taking in Organizations. Organization Science.

Dickson, P. H., & Weaver, K. M. (2008). The role of the institutional environment in determining firm orientations towards entrepreneurial behavior. International Entrepreneurship and Management Journal, 4(4), 467–483.

Díez-Martín, F., Prado-Roman, C., & Blanco-González, A. (2013a). Beyond legitimacy: legitimacy types and organizational success. Management Decision, 51(10), 1954–1969.

Díez-Martín, F., Prado-Román, C., & Blanco-González, A. (2013b). Efecto del plazo de ejecución estratégica sobre la obtención de legitimidad organizativa. Investigaciones Europeas de Dirección y Economía de la Empresa, 19(2), 120–125.

DiMaggio, P., & Powell, W. (1983). The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147–160.

Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2002). The regulation of entry. The Quarterly Journal of Economics, 117(1), 1–37.

Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: social values and organizational behavior. The Pacific Sociological Review, 18(1), 122–136.

Drori, I., & Honig, B. (2013). A process model of internal and external legitimacy. Organization Studies, 34(3), 345–376.

El-Namaki, M. S. S. (1988). Encouraging entrepreneurs in developing countries. Long Range Planning, 21(4), 98–106.

Evans, D. S., & Leighton, L. S. (1989). Some empirical aspects of entrepreneurship. American Economic Review, 79(3), 519.

Fayolle, A., Liñán, F., & Moriano, J. A. (2014). Beyond entrepreneurial intentions: values and motivations in entrepreneurship. International Entrepreneurship and Management Journal, 10(4), 679–689.

Fernández-Serrano, J., & Romero, I. (2014). About the interactive influence of culture and regulatory barriers on entrepreneurial activity. International Entrepreneurship and Management Journal, 10(4), 781–802.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50.

Frydrych, D., Bock, A. J., Kinder, T., & Koeck, B. (2014). Exploring entrepreneurial legitimacy in reward-based crowdfunding. Venture Capital: An International Journal of Entrepreneurial Finance, 16(3), 247–269.

Gatewood, E. J., Shaver, K. G., & Gartner, W. B. (1995). A longitudinal study of cognitive factors influencing start-up behaviors and success at venture creation. Journal of Business Venturing, 10(5), 371–391.

Gefen, D., Rigdon, E. E., & Straub, D. (2011). An update and extension to SEM guidelines for administrative and social science research. MIS Quarterly, 35(2), iii–A7.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: indeed a silver bullet. The Journal of Marketing Theory and Practice, 19(2), 139–152.

Hair, J., Sarstedt, M., Ringle, C., & Mena, J. (2012). An assessment of the use of partial least squares structural equation modeling in marketing research. Journal of the Academy of Marketing Science, 40(3), 414–433.

Hannan, M. T., & Carroll, G. (1992). Dynamics of organizational populations: density, legitimation, and competition. Oxford University Press.

Hayton, J. C., & Cacciotti, G. (2013). Is there an entrepreneurial culture? A review of empirical research. Entrepreneurship and Regional Development, 25(9–10), 708–731.

Hayton, J. C., George, G., & Zahra, S. A. (2002). National culture and entrepreneurship: a review of behavioral research. Entrepreneurship: Theory and Practice, 26(4), 33–52.

Higgins, M., & Gulati, R. (2003). Getting off to a good start: the effects of upper echelon affiliations on underwriter prestige. Organization Science, 14(3), 244–263.

Higgins, M., & Gulati, R. (2006). Stacking the deck: the effects of top management backgrounds on investor decisions. Strategic Management Journal, 27(1), 1–25.

Hitt, M. A., Ireland, R. D., Sirmon, D. G., & Trahms, C. (2011). Strategic entrepreneurship: creating value for individuals, organizations and society. Academy of Management Perspectives, 25(2), 57–75.

Ho, Y. P., & Wong, P. K. (2007). Financing, regulatory costs and entrepreneurial propensity. Small Business Economics, 28(2–3), 187–204.

Hoang, H., & Antoncic, B. (2003). Network-based research in entrepreneurship A critical review. Journal of Business Venturing, 18(2), 165–187.

Hofstede, G., et al. (2004). Culture’s role in entrepreneurship: Self-employment out of dissatisfaction. In T. E. Brown & J. M. Ulijn (Eds.), Innovation, entrepreneurship and culture (pp. 162–203). Cheltenham: Edward Elgar.

Hopp, C., & Stephan, U. (2012). The influence of socio-cultural environments on the performance of nascent entrepreneurs: community culture, motivation, self-efficacy and start-up success. Entrepreneurship and Regional Development, 24(9–10), 917–945.

Jack, S. L., & Anderson, A. R. (2002). The effects of embeddedness on the entrepreneurial process. Journal of Business Venturing, 17(5), 467–487.

Jeng, L. A., & Wells, P. C. (2000). The determinants of venture capital funding: evidence across countries. Journal of Corporate Finance, 6(3), 241–289.

Jennings, P. D., Greenwood, R., Lounsbury, M. D., & Suddaby, R. (2013). Institutions, entrepreneurs, and communities: a special issue on entrepreneurship. Journal of Business Venturing, 28(1), 1–9.

Kannan-Narasimhan, R. (2014). Organizational ingenuity in nascent innovations: gaining resources and legitimacy through unconventional actions. Organization Studies, 35(4), 483–509.

Kibler, E., & Kautonen, T. (2014). The moral legitimacy of entrepreneurs: an analysis of early-stage entrepreneurship across 26 countries. International Small Business Journal. doi:10.1177/0266242614541844.

Kistruck, G. M., Webb, J. W., Sutter, C. J., & Bailey, A. V. G. (2015). The double-edged sword of legitimacy in base-of-the-pyramid markets. Journal of Business Venturing, 30(3), 436–451.

Kostova, T., & Roth, K. (2002). Adoption of an organizational practice by subsidiaries of multinational corporations: institutional and relational effects. Academy of Management Journal, 45(1), 215–233.

Krueger, N., & Carsrud, A. (1993). Entrepreneurial intentions: applying the theory of planned behaviour. Entrepreneurship and Regional Development, 5(4), 315–330.

Krueger, N. F., Reilly, M. D., & Carsrud, A. (2000). Competing models of entrepreneurial intentions. Journal of Business Venturing, 15(5–6), 411–432.

Krueger, N., Liñán, F., & Nabi, G. (2013). Cultural values and entrepreneurship. Entrepreneurship and Regional Development, 25(9–10), 703–707.

Kwon, S.-W., & Arenius, P. (2010). Nations of entrepreneurs: a social capital perspective. Journal of Business Venturing, 25(3), 315–330.

Levie, J., & Autio, E. (2008). A theoretical grounding and test of the GEM model. Small Business Economics, 31(3), 235–263

Lewellyn, K. B., & Bao, S. R. (2014). A cross-national investigation of IPO activity: the role of formal institutions and national culture. International Business Review, 23(6), 1167–1178.

Lin, S., & Si, S. (2014). Factors affecting peasant entrepreneurs’ intention in the Chinese context. International Entrepreneurship and Management Journal, 10(4), 803–825.

Liñán, F., Santos, F. J., & Fernández, J. (2011a). The influence of perceptions on potential entrepreneurs. International Entrepreneurship and Management Journal, 7(3), 373–390.

Liñán, F., Urbano, D., & Guerrero, M. (2011b). Regional variations in entrepreneurial cognitions: start-up intentions of university students in Spain. Entrepreneurship and Regional Development, 23(3–4), 187–215.

Liñán, F., Nabi, G., & Krueger, N. (2013). British and Spanish entrepreneurial intentions: a comparative study. Revista de Economia Mundial, 33, 73–103.

Lounsbury, M., & Glynn, M. A. (2001). Cultural entrepreneurship: stories, legitimacy, and the acquisition of resources. Strategic Management Journal, 22(6–7), 545–564.

Magretta, J. (2002). Why business models matter. Harvard Business Review, 80(5), 86–92.

Manolova, T. S., Eunni, R. V., & Gyoshev, B. S. (2008). Institutional environments for entrepreneurship: evidence from emerging economies in Eastern Europe. Entrepreneurship: Theory and Practice, 32(1), 203–218.

Meyer, J., & Rowan, B. (1977). Institutionalized organizations: formal structure as myth and ceremony. American Journal of Sociology, 83(2), 340–363.

Mitchell, R. K., Smith, J. B., Morse, E. A., Seawright, K. W., Peredo, A. M., & McKenzie, B. (2002). Are entrepreneurial cognitions universal? Assessing entrepreneurial cognitions across cultures. Entrepreneurship Theory and Practice, 26(4), 9–32.

Mitter, C., & Kraus, S. (2011). Entrepreneurial finance – issues and evidence, revisited. International Journal of Entrepreneurship and Innovation Management, 14(2–3), 132–150.

Morales Urrutia, D., & Rodil Marzábal, Ó. (2015). Explanatory factors of business creation in ten European countries: a proposal from the institutional perspective. Revista de Economía Mundial, 40, 91–122.

Naudé, W., Gries, T., Wood, E., & Meintjies, A. (2008). Regional determinants of entrepreneurial start-ups in a developing country. Entrepreneurship and Regional Development, 20(2), 111–124.

North, D. (1990). Institutions, institutional change, and economic performance. Cambridge: Cambridge University Press.

Nunnally, J. C., & Bernstein, I. (1994). Psychometric Theory. McGraw Hill.

Peng, M. W., Sun, S. L., Pinkham, B., & Chen, H. (2009). The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives, 23(3), 63–81.

Pissarides, F. (1999). Is lack of funds the main obstacle to growth? EBRD’s experience with small- and medium-sized businesses in central and eastern Europe. Journal of Business Venturing, 14(5–6), 519–539.

Pissarides, F., Singer, M., & Svejnar, J. (2003). Objectives and constraints of entrepreneurs: evidence from small and medium size enterprises in Russia and Bulgaria. Journal of Comparative Economics, 31(3), 503–531.

Pittaway, L., & Cope, J. (2007). Entrepreneurship education: a systematic review of the evidence. International Small Business Journal, 25(5), 479–510.

Pollack, J. M., Rutherford, M. W., & Nagy, B. G. (2012). Preparedness and cognitive legitimacy as antecedents of new venture funding in televised business pitches. Entrepreneurship: Theory and Practice, 36(5), 915–939.

Pollock, T., & Rindova, V. (2003). Media legitimation effects in the market for initial public offerings. Academy of Management Journal, 46(5), 631–642.

Reinartz, W., Haenlein, M., & Henseler, J. (2009). An empirical comparison of the efficacy of covariance-based and variance-based SEM. International Journal of Research in Marketing, 26(4), 332–344.

Roldán, J. L., & Sánchez-Franco, M. J. (2012). Variance-based structural equation modeling: guidelines for using partial least squares in information systems research. In M. Mora, O. Gelman, A. Steenkamp, & M. Raisinghani (Eds.), Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems (pp. 193–221). IGI Global.

Ruebottom, T. (2013). The microstructures of rhetorical strategy in social entrepreneurship: building legitimacy through heroes and villains. Journal of Business Venturing, 28(1), 98–116.

Ruef, M., & Scott, W. (1998). A multidimensional model of organizational legitimacy: hospital survival in changing institutional environments. Administrative Science Quarterly, 43(4), 877–904.

Schwab, K. (2014). The Global Competitiveness Report 2013–14. World Economic Forum.

Scott, W. R. (1995). Institutions and organizations (p. 178). SAGE Publications.

Shane, S. (1996). Explaining variation in rates of entrepreneurship in the United States: 1899–1988. Journal of Management, 22(5), 747–781.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11(4), 448–469.

Shane, S., & Foo, M.-D. (1999). New firm survival: institutional explanations for new franchisor mortality. Management Science, 45(2), 142–159.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Simcic Brønn, P., & Vidaver-Cohen, D. (2008). Corporate motives for social initiative: legitimacy, sustainability, or the bottom line? Journal of Business Ethics, 87(S1), 91–109.

Singh, J., Tucker, D., & House, R. (1986). Organizational legitimacy and the liability of newness. Administrative Science Quarterly, 31(2), 171–193.

Starr, J. A., & MacMillan, I. C. (1990). Resource cooptation via social contracting: resource acquisition strategies for new ventures. Strategic Management Journal, 11(4), 79–92.

Stenholm, P., Acs, Z. J., & Wuebker, R. (2013). Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing, 28(1), 176–193.

Suchman, M. C. (1995). Managing legitimacy: strategic and institutional approaches. Academy of Management Review, 20(3), 571.

Thomas, A. S., & Mueller, S. L. (2000). A case for comparative entrepreneurship: assessing the relevance of culture. Journal of International Business Studies, 31(2), 287–301.

Thornton, P., Ribeiro-Soriano, D., & Urbano, D. (2011). Socio-cultural factors and entrepreneurial activity: an overview. International Small Business Journal, 29(2), 105–118.

Tornikoski, E. T., & Newbert, S. L. (2007). Exploring the determinants of organizational emergence: a legitimacy perspective. Journal of Business Venturing, 22(2), 311–335.

Treviño, L. K., den Nieuwenboer, N. A., Kreiner, G. E., & Bishop, D. G. (2014). Legitimating the legitimate: a grounded theory study of legitimacy work among ethics and compliance officers. Organizational Behavior and Human Decision Processes, 123(2), 186–205.

Überbacher, F. (2014). Legitimation of new ventures: a review and research programme. Journal of Management Studies, 51(4), 667–698.

Valliere, D. (2010). Reconceptualizing entrepreneurial framework conditions. International Entrepreneurship and Management Journal, 6(1), 97–112.

Van Gelderen, M., Thurik, R., & Bosma, N. (2006). Success and risk factors in the pre-startup phase. Small Business Economics, 26(4), 319–335.

Veciana, J., & Urbano, D. (2008). The institutional approach to entrepreneurship research. Introduction. International Entrepreneurship and Management Journal, 4(4), 365–379.

Wennberg, K., Pathak, S., & Autio, E. (2013). How culture moulds the effects of self-efficacy and fear of failure on entrepreneurship. Entrepreneurship and Regional Development, 25(9–10), 756–780.

Wennekers, S., van Wennekers, A., Thurik, R., & Reynolds, P. (2005). Nascent entrepreneurship and the level of economic development. Small Business Economics, 24(3), 293–309.

Wold, H. (1985). Systems analysis by partial least squares. In P. Nijkamp, H. Leitner, & N. Wrigley (Eds.), Measuring the unmeasurable (pp. 221–251). Dordrecht: Martinus Nijhoff Publishers.

Yu, J., Zhou, J. X., Wang, Y., & Xi, Y. (2013). Rural entrepreneurship in an emerging economy: reading institutional perspectives from entrepreneur stories. Journal of Small Business Management, 51(2), 183–195.

Zimmerman, M., & Zeitz, G. J. (2002). Beyond survival: achieving new venture growth by building legitimacy. Academy of Management Review, 27(3), 414.

Acknowledgments

The author would like to thank Professor Luis Tomás Díez de Castro for his valuable comments and suggestions to improve the paper and the participants of the research seminar at the Fundación Camilo Prado on 24th April 2014.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Díez-Martín, F., Blanco-González, A. & Prado-Román, C. Explaining nation-wide differences in entrepreneurial activity: a legitimacy perspective. Int Entrep Manag J 12, 1079–1102 (2016). https://doi.org/10.1007/s11365-015-0381-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-015-0381-4