Abstract

This study develops an entrepreneurial typology employing two dimensions, high versus low entrepreneurial alertness and internal versus external attributional styles that helps illustrate why entrepreneurs start new businesses. The resulting 2 × 2 typology of entrepreneurs identifies four entrepreneur types based on these two dimensions: the true believer, clueless, practical, and reluctant. Using a representative sample of 315 nascent entrepreneurs from the Panel Study of Entrepreneurial Dynamics, we found that some types differed across three key entrepreneurial characteristics, need for achievement, risk-taking propensity, and commitment, thereby providing some preliminary empirical support for the typology’s validity. We conclude by discussing future research avenues.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

“Why are individuals more or less likely to recognize entrepreneurial opportunities?” and, in turn, “why are individuals more or less likely to exploit these opportunities?” represent two fundamental questions in entrepreneurship research (Shane and Venkatraman 2000). To answer these questions, research has examined demographic (e.g. industry experience), behavioral (e.g., management style), personality (e.g., risk-taking propensity), and, more recently, cognitive (e.g., entrepreneurial alertness) characteristics that differentiate (1) entrepreneurs from non-entrepreneurs (e.g., Hornaday and Aboud 1971; Dunkelberg and Cooper 1982; Busenitz and Barney 1997) and (2) different types of entrepreneurs from each other (Smith 1967; Miner 2000; Erikson 2001; Gaglio and Katz 2001).

In examining the latter, several researchers have developed typologies to classify entrepreneurs. Such typologies can be useful, in general, for studying complex issues because they allow researchers to categorize individual subjects (e.g., items, people, or organizations) into discrete groups, which, in turn, permits detailed analysis and intergroup comparison (Rich 1992). Thus, entrepreneur typologies recognize the diversity that exists among entrepreneurs and permit grouping them according to their common characteristics, which may be critical to advancing our understanding of the different reasons why different entrepreneurs found new ventures.

Currently, however, most extant typologies classify entrepreneurs based on either demographic or personality characteristics. Given that cognitive studies focus on how entrepreneurs acquire, process, store, and use information (Baron 2004), developing a cognitive-based typology appears to be an important next step. One promising research avenue for examining cognitive issues has been to gauge how entrepreneurs differ in their alertness to new opportunities (Kirzner 1973). Research suggests that entrepreneurs, especially successful ones, may possess a schema that assists them in recognizing opportunities (Ardichvili et al. 2003). For example, Gaglio and Katz (2001) proposed four entrepreneurial types according to their positions on the “entrepreneurial alertness” continuum. Although a typology based on entrepreneurial alertness (EA) appears useful for differentiating among types of entrepreneurs, to date, limited empirical testing exists validating this typology. Furthermore, although EA may suffice to explain why some individuals are better able to discover opportunities than others are, it may be insufficient, given its primary focus on opportunity recognition, to explain why some individuals are more likely to exploit these opportunities by creating new ventures. Thus, other important factors in tandem with EA may impact the exploitation decision (Minniti 2004).

We posit that one such factor may be whether entrepreneurs attribute internal or external explanations to their success and failure as a general rule. Studies, however, have only recently employed these concepts from attribution theory (Kelley 1967) to investigate how attributional biases contribute to or impede entrepreneurial success (Zacharakis et al. 1999; Shaver et al. 2001; Rogoff et al. 2004).

Accordingly, by merging previous attribution and EA research, we develop an entrepreneurial typology that helps illustrate different reasons why entrepreneurs start new businesses. To this end, we briefly review previous research on entrepreneurial typologies as well as both attribution theory and EA. Next, we draw upon this literature to develop a 2 × 2 typology of entrepreneurs, which identifies four types of entrepreneurs based on these two dimensions: the true believer, clueless, practical, and reluctant. We then develop our hypotheses related to characteristics (e.g., risk taking) that may differ across entrepreneurs and test them employing a representative sample of 315 nascent entrepreneurs from the Panel Study of Entrepreneurial Dynamics to provide some preliminary empirical support for the typology’s value. We conclude by discussing future research avenues.

Literature review and research framework

Extant entrepreneurial typologies

Because we cannot assume that all those who form new businesses possess the same attributes such as background variables, personalities, management or cognitive styles, it seems both possible and reasonable to group them into different types. This information can facilitate research by reducing the enormous range of potential variables to a manageable size (Hambrick 1983). Table 1 summarizes selected classification frameworks from previous entrepreneurship research. These entrepreneurial typologies have played a central role in the developing literature on venture start-up, management, and subsequent performance.

Examining previous studies shows they have employed a wide array of factors to classify entrepreneurs, and, consequently, they have developed a variety of entrepreneurial typologies. As noted in the table, however, most have focused on either demographic or experience rather than cognitive characteristics. Thus, developing a typology based on the latter seems to be a useful next step for two reasons. First, the cognitive approach, in general, has proven useful for investigating both opportunity recognition and evaluation processes in entrepreneurship (e.g., Keh et al. 2002; Krueger 2000). Second, recent research suggests that both demographic and experience characteristics may serve as antecedents to cognitive attributes, which, in turn, may affect entrepreneurial decisions (Ardichvili et al. 2003).

Entrepreneurial alertness

Recently, the cognitive approach has sparked a “comeback” of the people side of entrepreneurship (Mitchell et al. 2002; Korunka et al. 2003; Baron 2004). This approach explains how entrepreneurs reason, form judgments, and reach decisions by examining the considerable heterogeneity that exists in entrepreneurial cognitions (e.g., Schneider and Angelmar 1993; Busenitz and Barney 1997; Forbes 1999).

One promising view about why entrepreneurs start businesses has emerged from the cognitive approach-the concept of EA. Kirzner (1973, 1979, 1985) defined alertness as an individual’s “ability to notice without search opportunities that have hitherto been overlooked” (1979: 48). Employing this definition, researchers have attempted to demonstrate the existence of alertness schema, defined as mental models created by individuals that represent the cumulative experience, learning, feelings, and meanings about how the physical and social worlds work (Gaglio 1997). Psychologists (Higgins and King 1981; Fiske and Taylor 1991) observed that some people habitually activate a particular schema, regardless of its appropriateness to the moment (i.e., “chronic schema”). Building on this concept, Gaglio (1997) conceptualized EA as “chronic schema activation,” and Gaglio and Katz (2001) hypothesized that persons who possess such schema show a tendency to search for and notice change and market disequilibria as well as respond to information that does not match their current schemas. Similarly, Baron (2004) proposed that because of their complex and adaptive mental frameworks, individuals with high EA will be more able to “think outside the box” than people with low EA.

Accordingly, EA involves whether an entrepreneur’s mental schema enhances or reduces the probability of recognizing new venture opportunities. From this perspective, the entrepreneur is an “opportunity-identifier” (Busenitz 1996), who has the ability to spot viable opportunities for new products or services by “serendipity” rather than by deliberate search. This conceptualization coincides with Kirzner (1979), who posited information-seeking behavior as EA’s central tenet.

Thus, it seems clear that EA poses a useful dimension for understanding why some persons are better able to identify opportunities than others. No guarantee exists, however, that highly alert individuals who identify market opportunities will then exploit these opportunities by forming new ventures. In that sense, EA may be a necessary but not sufficient tool in our attempt to develop an entrepreneurial typology. For example, in Kirzner’s (1979) framework, alertness to market opportunities depends, in part, on whether an entrepreneur grasps the opportunity once it has been perceived. Kirzner (1979, 1985) maintains that although an individual cannot consciously trigger alertness, it will not be activated unless the individual has a reason to do so. Employing an economist’s perspective, Kirzner (1979, 1985) interprets this motivational issue in terms of market environments and market incentives, whereas we approach it from a cognitive perspective that examines how individuals’ attributional styles may contribute to alertness activation. Similarly, Gaglio and Katz (2001) noted that even highly alert individuals may discount opportunities for several reasons including a motivation to maintain the status quo.

In summary, previous research suggests that EA provides one important dimension for differentiating entrepreneurs. Though useful, research also suggests it may not suffice in isolation to inform us why some entrepreneurs exploit opportunities they have recognized. We propose that individuals will be more likely to start a new business based on such opportunities if they firmly believe that their internal attributes, such as ability and efforts to locate and attain the necessary resources for the new venture, will lead to successfully establishing the venture. For example, those who are highly alert to opportunities may not actually exploit the opportunities if they attribute external causes to their successes whereas those who are low alert to opportunities may be more likely to exploit opportunities than highly alert people if they make internal attributions to their success. Thus, we next review literature on attribution theory and attributional styles.

Attribution theory and attributional styles

Attribution theory research in the field of psychology spans more than 50 years and has become incorporated into the study of virtually all aspects of psychology (Abramson et al. 1978; Weiner 1985; Graham and Folkes 1990; Seligman 1990). According to Kelley (1967), attribution refers to the process through which individuals infer or perceive the causes of events, others’ behavior, or the dispositional properties of any entity in the environment. Baron (1998) further suggests that virtually everyone engages in an orderly and rational attribution process when attempting to determine the causes for an event. In our study, attribution theory plays an important role in explaining the cognitive process that entrepreneurs go through when they make decisions about whether or not to exploit discovered opportunities.

Previous research has identified numerous attributional dimensions. For example, Weiner (1985) discusses five underlying causal dimensions, and of these, his first dimension, internal/external or locus of causality, appears to be the most widely accepted. Locus of causality refers to whether individuals believe the cause of a particular outcome resides within or outside them, although it has been used interchangeably with locus of control by many researchers. Martinko (1995) suggests that the majority of these perspectives can be classified as self- or other attribution theories. Attributional style, as a self-attribution theory, refers to the systematic ways in which people explain their own successes and failures (Kent and Martinko 1995).

Heider (1958) was the first to propose that task performance would depend on the balance between personal force and environmental force. Key elements of personal force include ability and effort, whereas key elements of environmental force include task difficulty and luck. Combining Heider’s (1958) proposition with Weiner’s (1985) locus of causality dimension generates two attributional styles of entrepreneurs: (1) an internal attributional styles where entrepreneurs would attribute their success to internal causes such as ability and effort and (2) an external attributional styles where entrepreneurs would attribute their success to external causes such as task difficulty and luck. We approach attributional style as a trait that is consistent across situations and heavily influences attributions for specific situations (Russell 1991). In addition, we classify entrepreneurs according to how they interpret their overall self-assessments rather than of any particular event.

Research framework

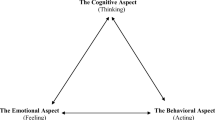

The previous discussion suggests that in order to answer the key question: “Why are some individuals more likely to identify and, in turn, exploit opportunities than others?” both dimensions of EA and attributional style must be employed to account for the two equally essential steps in the entrepreneurial process of new venture creation. First, individuals identify an opportunity for future development, and the dimension of EA addresses this issue. Second, the individuals who discover the opportunity must decide whether they are going to act upon it. EA, however, may be insufficient to explain why some individuals who have identified opportunities are more likely to exploit the opportunity by forming a new business than others. Attributional style offers an explanation to this phenomenon by suggesting that persons with internal attributional styles are more likely to exploit the opportunity because they believe their internal causes of ability and effort will lead to their successful creation of new ventures. In contrast, those with external attributional styles may be less likely to exploit opportunities because they may not believe their ability and efforts will help them successfully create a new venture unless external causes (e.g., luck) exist.

Therefore, in our attempt to develop an entrepreneurial typology that can help explain the new venture creation process, we need both dimensions of EA and attributional style. Table 2 highlights how these two building blocks are used to derive the typology. Four types of entrepreneurs emerge as shown in the table. Next, we discuss each type based on their EA and attributional characteristics.

The true believer

The true believer is characterized as having high EA and an internal attributional style. This is the typical entrepreneur that entrepreneurship research has studied, although all four types have the capacity to found and grow ventures. True believers are willing to make changes in the schema, frame, or evaluation process to accurately accommodate, predict, and profit from the new information because they believe they have the ability to reallocate available resources to meet situational demands. They may also have greater potential for pursuing an entrepreneurial career because they constantly, habitually, and proactively search for market disequilibria. They desire to obtain information and are likely to be strongly committed to their venture given their high internal attributions.

The clueless

The clueless type refers to entrepreneurs who have low EA but an internal attributional style. This type of individuals may be less alert to new information, or even not aware of market situations or events that may be a valuable opportunity. They may still become entrepreneurs, however, because they believe their hard work and strong capability will lead to their success regardless of task difficulty. Clueless entrepreneurs may also act on opportunities provided by other people.

The practical

The practical entrepreneur is characterized as having high EA and an external attributional style. These individuals are able to detect signals from market disequilibria, but they tend to discount potential opportunities, because their external attributional styles make them skeptical of their ability to exploit it. Thus, they do not have a proactive attitude toward the opportunity they discover. They might not act on an opportunity unless they are strongly encouraged, or they may exploit a favorable situation but lack confidence in their success.

The reluctant

The reluctant entrepreneurs are those with low EA and an external attributional style. They are most probably involved in entrepreneurship for reactive reasons such as unemployment or serendipity. They are not motivated to search for new information and its implications because their low EA and external attributional styles do not encourage them to proactively look for change.

Hypothesis development

Having developed this 2 × 2 typology based on the dimensions of attributional styles and EA, we can now employ it to predict the characteristics of different types of entrepreneurs as an initial empirical test of the typology. Several studies have centered on personal characteristics of entrepreneurs (e.g., Hornaday and Aboud 1971; Dunkelberg and Cooper 1982), including distinguishing between successful and unsuccessful entrepreneurs (Utsch and Rauch 2000). Thus, if different entrepreneur types in our 2 × 2 typology exhibit significant differences across these characteristics, it will provide preliminary empirical support for the typology’s validity. We examine three such characteristics prevalent in extant research: need for achievement, commitment, and risk-taking propensity.

Need for achievement

According to Venkataraman (1997), our understanding of entrepreneurship will not be complete unless we understand the motivation of the individuals involved. Recent research suggests that motivational traits are an important factor in entrepreneurial activity and success (Baum et al. 2000; Stewart and Roth 2001). Specifically, some studies suggest that the innate need for achievement (nAch), a desire to do well in order to attain an inner feeling of personal accomplishment, is essential (McClelland 1961, 1987). For example, Langan-Fox (1995) identified three different types of female entrepreneurs based on nAch level. Research has also shown that nAch has significant impact on expansion intention (Lau and Busenitz 2001) and venture growth (Lee and Tsang 2001).

In our typology, true believers attribute internal causes to their success and possess high alertness to market disequilibria. Because they are better able to discover opportunities and act on them, we expect they should also have a strong desire to set challenging goals and standards for themselves and constantly strive to improve their current situation. Thus, we would anticipate their nAch to be particularly high. We predict slightly lower nAch for the clueless type, because although they also offer internal causes to their success overall, they exhibit low EA. Next, practical entrepreneurs have external attributional styles and high EA, so, we would expect they would not have as high a nAch because their external attributional style impedes them from proactively participating into the entrepreneurial activity. Finally, reluctants, with external attributional style and low EA, would likely have the lowest nAch because they do not have a strong desire to achieve, and indeed may be pushed into the entrepreneurial process. Thus,

Hypothesis 1: Need for achievement will be the highest for the true believer, followed by clueless, practical, and reluctant entrepreneurs.

Commitment

Starting a new business is high-pressure and requires serious dedication and commitment. “Being my own boss” becomes more like a lifestyle where work is the dominant factor, and research has investigated the impact of commitment on business growth. For example, Granger et al.’s (1995) study found a high variety of commitment among self-employed publishers and Lau and Busenitz’s (2001) study found that owner’s commitment was positively related to intention to grow a firm.

We posit that the four entrepreneurs in our typology will differ in their commitment to their new ventures. The true believer entrepreneurs should have a genuine passion for their new business and a strong drive to start up a venture. Therefore, we would expect that they would have the highest level of commitment to their business. The opposite group is represented by reluctant entrepreneurs, who may have elected to become involved in the entrepreneurial process due to reactive causes such as unemployment or serendipity. Their decision to undertake entrepreneurship may be involuntary, and, thus, we would anticipate them to have the lowest degree of commitment. In general, it seems reasonable to expect that clueless and practical entrepreneurs will demonstrate moderate level of commitment given the former’s internal attribution and the latter’s high EA. Thus:

Hypothesis 2: True believers and the reluctant will demonstrate the highest and lowest commitment to their new business, respectively, whereas the clueless and practical will demonstrate moderate commitment.

Risk-taking propensity

Entrepreneurs seek and realize productive opportunities and consequently function in an uncertain environment; thus, they must not be overwhelmed by risky situations. Research, however, has lacked agreement on the nature of entrepreneurial risk taking. Historically, much of the literature has characterized entrepreneurs as high risk-takers (Brockhaus 1980; Brockhaus and Horwitz 1986), but other authors have argued that entrepreneurs assess and calculate risks carefully and are more likely to be moderate than high risk takers (Caird 1991; Cunningham and Lischeron 1991). Employing a cognitive perspective, several researchers have proposed studying the risk assessment process rather than simply treating it as a personological characteristic (Shaver and Scott 1991; Gatewood et al. 1995; Palich and Bagby 1995).

Based on two cognitive dimensions, our entrepreneurial framework suggests that the true believer will be more likely to take high risks regardless of what difficulties they encounter because their internal attributional styles should allow them to discount the difficulties. Although clueless entrepreneurs also offer employ internal attributions, their lower EA may make them less ready to accept new information that appears risky to them. Similarly, it is reasonable to predict that the practical entrepreneurs will have even lower risk taking propensity because their external attributional styles tend to emphasize the difficulties and risks they encounter. Finally the reluctant entrepreneurs’ risk taking should be especially low due to both their external attributional styles and low alertness to opportunities. Thus,

Hypothesis 3: Risk-taking propensity will be the highest for the true believer, followed by clueless, practical, and reluctant entrepreneurs.

Methodology

Sampling procedures

In this study we use data from the Panel Study of Entrepreneurial Dynamics (PSED) to test our hypotheses. The PSED, administered by the Institute for Social Research at the University of Michigan, is a research program that was initiated to provide systematic, reliable and generalizable data on the underlying processes and factors that lead individuals to pursue the creation of a new business firm. The entire database became public in July 2002.

To collect PSED data, researchers contacted 64,622 individuals in the United States by telephone using a random-digit dialing process between July 1998 and January 2000 to identify nascent entrepreneurs. Data were collected two phases. First, researchers telephoned households nationwide contacting 1,000 adults (500 females and 500 males) 18 years of age or older each week. Quota sampling was used to ensure that half sample were men and the other half were women. In the second phase of the research, researchers forwarded respondents who met the three criteria for nascent entrepreneurs detailed below to the University of Wisconsin Survey Research Laboratory, where researchers conducted 60-minute phone interviews and provided 12-page self-administered questionnaires with a promise of cash payment (Shaver et al. 2001).

Because PSED’s purpose was to identify important features of the business start-up process of nascent entrepreneurs, two questions in the telephone screening were designed to identify people who might be starting businesses either as autonomous start-ups or as something being done in cooperation with a current employer. The respondent had to answer “yes” to either of the following questions to be considered candidates for the nascent entrepreneur interview: (1) Are you, alone or with others, now trying to start a new business? (2) Are you, alone or with others, now starting a new business or new venture for your employer? An effort that is part of your job assignment?

Those who were identified as candidates for nascent entrepreneurs had to meet three additional criteria to be located as eligible nascent entrepreneurs. (1) They are currently active in the startup effort; (2) they anticipate full or part ownership of the new business; and (3) the effort is still in the start-up phase and is NOT an infant firm, defined as a business in which the startup effort has a positive monthly cash flow that covers expenses and salaries for the owner/manager for more than 3 months. One question asked whether the business had achieved sufficient cash flow for 3 months to pay expenses and the owner-manager’s salary. If the answer was affirmative, then the activity was considered an infant business (i.e., no longer in the organizing stage), and the respondent was dropped from the sample.

Sample and weights

The final sample of PSED respondents totaled 1,261, with 830 nascent entrepreneurs and 431 in the comparison group. Because we employed both attributional style and EA to develop our typology, subjects who failed to provide answers to either dimension were deleted from our analysis, resulting in 536 cases. In addition, the PSED oversampled females, so they comprised nearly one-half of all nascent entrepreneurs with complete data. Reynolds (2000) suggested that any analysis be completed with a weighted sample because appropriate tests of statistical significance require using weighted samples. Thus, following Reynolds (2000), we employed post-stratification weights based on estimates of gender, age, education, and race/ethnicity from the U.S. Census Bureau’s Current Population Survey. After the missing cases on gender and race were removed, a total of 514 cases were left, and the ratio of males to females was 252:262. We randomly selected 129 female entrepreneurs so that the final ratio of males to females was 252:129 with female entrepreneurs approximating about half of male entrepreneurs. This weighting procedure reduced the sample size to a total of 381 cases. Because the age, education, and race/ethnicity distributions were similar between male and female nascent entrepreneurs, these variables were not greatly affected by using weights. The non-response bias test between usable responses and non-usable responses, however, shows that the responses were biased toward Caucasian entrepreneurs, and results, thus, should be interpreted accordingly. Table 3 presents demographic characteristics of the final sample.

Typology measures

Attributional styles

Psychologists have developed several attributional styles measures, although Peterson et al’s (1982) Attributional Style Questionnaire (ASQ) appears to be the most widely accepted. The ASQ asks general-purpose questions intended to examine the respondent’s interpretations based on several causal dimensions discussed above. We created an eight-item measure for attributional styles from the PSED that simulated the purpose and structure of Peterson et al’s ASQ to test the entrepreneurs’ general attributions of their success. All these eight items ask respondents to assess the extent to which they attribute internal or external causes to their success. The Cronbach alpha for the eight items was 0.71 (See Appendix).

Next, we performed a mean split on the data. We defined respondents scoring higher and lower than the mean as having internal and external attributional styles, respectively.

Entrepreneurial alertness

To capture Kirzner’s (1979) notion of alertness, that is, “serendipity” rather than “deliberate search,” we created our measure of alertness by employing the following PSED question: “Which of the following led to your business idea?” There are eight possible answers to this question. Four of them represent high alertness because they reflect that the entrepreneur’s readiness or chronic schema actually led to a business idea rather than some deliberate search for it: (1) it developed from another idea I was considering; (2) my experience in a particular industry or market; (3) thinking about solving a particular problem; and (4) knowledge or expertise with technology. Four items indicate low alertness because they reflect that the entrepreneur’s business idea came from deliberate search by discussing about the possibility of future opportunities with other people: discussions with (1) my friends and family; (2) potential or existing customers; (3) existing suppliers or distributors; and (4) potential or existing investors/lenders. The respondents were asked to check all the answers that apply. We coded checked and unchecked answers as “1” and “2,” respectively.

To measure EA, we first created a variable called “High Alertness” by multiplying the four items designed to represent high alertness. Following the same procedure, we created “Low Alertness” by multiplying the four items designed to represent low alertness. We then subtracted Low from High Alertness. We categorize each subject based on the following criteria: (1) If the result of subtraction is a negative value, which means the subject checked more High Alertness items than Low Alertness items, we regard the subject as representing high alertness, and labeled it “1.” (2) If the result of subtraction is a positive value, which means the subject checked more Low Alertness items than High Alertness items, we regard the subject as representing low alertness, and labeled it “2.” (3) If the result of subtraction is zero, which means the subject checked equal number of high alertness items and low alertness items, we regard the subject as “undecided.”

There are 66 cases labeled as “undecided,” so we eliminated them from our final weighted sample, leaving 315 cases. Combining the two groups of alertness (high versus low) with the two groups of attributional styles (internal versus external) discussed above, we classified each subject as one of the four types of entrepreneurs: true believer (n=104), clueless (n=58), practical (n=103), and reluctant (n=50).

Entrepreneurial characteristics

Need for achievement

We measured each entrepreneur’s need for achievement based on six items (see Appendix). The Cronbach alpha for these items is 0.76.

Commitment

We measured entrepreneurs’ commitment to their new businesses based on their response to the question “Owning my own business is more important than spending time with my family.” (1 = completely untrue and 5 = completely true):

Risk-taking propensity

We measured risk-taking propensity based on subjects’ responses to the question, “I enjoy the challenge of situations that many consider risky.” (1 = completely untrue and 5 = completely true):

Control variables

We also included four control variables in the model to reduce confounding effects due to the entrepreneurs’ difference in demographic characteristics: gender, age, education, and ethnicity.

Data analysis

Before testing our three hypotheses, we conducted a preliminary analysis to determine the overall relationship between our set of characteristics (i.e., need for achievement, commitment, and risk taking) and typology (i.e., EA and attributional style) dimensions to ensure that we were not discarding information by collapsing our variables into discrete high/low categories. (We thank an anonymous reviewer for this insight). Specifically, if each characteristic correlates highly with both typology dimensions, then creating a typology could actually result in losing information by splitting continuous variables into discrete categories. If, however, the correlation differs between each characteristic and dimension, then the typology may help categorize entrepreneurs into internally homogenous groups, which, in turn, would permit more detailed analysis and intergroup comparison (cf. Rich 1992). To test these relationships, we employed hierarchical logistic and least squares regression employing EA and attributional style as dependent variables, respectively, given that the former is binary and the latter is continuous. For each equation, we first entered our control variables followed by the characteristics.

We then tested our three hypothesized relationships in an exploratory manner using MANOVA for two reasons. First, in our study, we are trying to create a typology to explain entrepreneurs’ characteristics in their business startup process. Therefore, our research questions are more concerned with the existence of effects than with the relative strength and causality of relationships. MANOVA, rather than linear regression, is an analytic tool that is appropriate for this purpose (Pedhazur and Schmelkin 1991). Second, we have three characteristics and, hence, three hypotheses in our analysis. We found that the three characteristics were moderately correlated with correlation coefficients ranging from 0.12 to 0.33. Given this, MANOVA is superior to a series of ANOVA tests because the latter only tests differences in means, whereas MANOVA is sensitive not only to mean differences but also to the direction and size of correlations among the dependent variables (Bray and Maxwell 1985).

Results

Table 4 summarizes descriptive statistics for our variables. As noted in the table, the correlation between our typology dimensions is non-significant. In addition, Tables 5 and 6 provide the regression results for our preliminary analysis. As noted in the tables, all three characteristics were positively and significantly related to attributional style, but none was significantly related to EA. In tandem, these results reduce the concern that information might be lost by employing a typology both because the dimensions are independent and the characteristics have different relationships with each dimension.

Table 7 summarizes the results of MANOVA procedures, which tested the main effect of entrepreneurial types after the effects of the four control variables were removed. The Wilk’s Lambda for our independent variable “Type” is 0.75 and the corresponding p-value for overall effect is 0.00, which means that four types of entrepreneurs differ in terms of their nAch, commitment, and risk-taking propensity. The univariate test was significant for all three dependent variables. The p-value for nAch was 0.00, and the four mean values show that the true believers have the highest nAch, followed by the clueless, practical, and reluctant. The adjusted R-squared was 0.18.

The univariate test for commitment showed the p-value equaled 0.00, and the four mean values show that the true believers have the highest level of commitment to their new businesses, followed by the clueless, practical, and reluctant. The adjusted R-squared was 0.06.

Similarly, the univariate test for risk-taking propensity showed a p-value of 0.02, and the four mean values also indicate a clear pattern that the true believers have the highest level of risk-taking propensity, followed by the clueless, practical, and reluctant. The adjusted R-squared was 0.22. Overall, these results generally supported our hypotheses.

Next, we performed pairwise comparisons to further test our hypotheses (see Table 8). Hypothesis 1 posited that the four entrepreneur types would demonstrate different nAch levels. However, the true believers and clueless show no significant differences, nor do the practical and reluctant. This suggests that internal versus external attributional styles rather than EA impact results.

The pairwise comparisons for commitment illustrate something very different from nAch. As shown in Table 8, the only significant difference occurs between the true believers and the reluctant. True believers, however, have similar level of commitment as the practical entrepreneurs, suggesting that commitment does not vary based on attributional styles. In contrast, the significant difference in commitment between true believers and reluctants suggest that EA interacts with attributional styles in its relationship with commitment.

For risk-taking propensity, the pairwise comparisons show a similar pattern as those for nAch. True believers and clueless show no significant differences; nor do the practical and reluctant. This again suggests that attributional style rather than EA primarily impacts results .

Discussion

The overall pattern of our results provides general support for our hypotheses positing differences in entrepreneurs’ characteristics for different entrepreneur types in our typology based on EA and attributional style. The four types demonstrated different degrees of nAch, commitment, and risk taking propensity. Although many entrepreneurship researchers have employed the concept of EA to describe entrepreneurs in terms of their opportunity identification, our results show that it may be insufficient, in isolation, to help us understand such “why” questions as “why some individuals are more likely to start building a new business than others, given that they have all identified the opportunities?”

Pairwise comparisons for all the three dependent variables showed a clear picture that the internal versus external attributional styles pose a stronger position in explaining the differences among the four entrepreneur types. We found that for two dependent variables, nAch and risk-taking propensity, true believers and clueless emerged as a group as did the practical and reluctant. It is noteworthy that the dimension that accounts for the difference between these two “broad” groups is attributional style rather than EA.

We realize the controversial issue regarding nAch and risk-taking propensity as distinguishing characteristics of entrepreneurs. A recent review of national culture and entrepreneurship, however, treats nAch as part of cultural values and risk-taking from a cognitive perspective (Hayton et al. 2002). Further, this review reveals substantial work that has included these characteristics as moderators in entrepreneurial process. Therefore, we believe that these characteristics still render themselves important in entrepreneurship research if we investigate them from a different perspective such as cognitive or cultural perspective rather than simply from psychological point of view.

The pairwise comparisons for commitment represent a totally different story with the only significant difference occurring between the true believer and the reluctant entrepreneurs. This illustrates an interaction effect between EA and attributional styles. Combined with the result for the other two dependent variables, it is clear entrepreneurial characteristics did not vary across different EA levels. However, EA still plays an important role to predict commitment when another critical dimension, attributional style, is present. As discussed above, highly alert individuals tend to spend more time subconsciously “searching” for new information by reading business-related magazines or by thinking about business ideas. Highly committed individuals tend to spend more time working on the business by sacrificing their leisure time or time with family members. Therefore, high EA entrepreneurs also show high commitment to their business whereas low EA ones do not.

The overall pattern of the results illustrates that entrepreneurs with internal attributional styles demonstrate a distinctively higher nAch commitment and risk-taking propensity. It also presents a contrasting profile between the true believer and the reluctant. The true believer is the typical entrepreneur that both practitioners and researchers are interested in. They strive to achieve more, are more committed to the new business development and are high risk takers. In contrast, the reluctant type of entrepreneurs is most likely to get engaged in entrepreneurial process by serendipity, by assignment from their boss, or by unemployment. Therefore, they may have a desire to discontinue the entrepreneurial activity once such a chance is available for them.

Limitations

Although the PSED has provided us with this set of systematic and reliable data regarding the key features of nascent entrepreneurs in their startup process, these data were not specifically collected to test our hypotheses. Consequently, we employed some proxy measures to estimate the phenomena of interest to us. Results should, thus, be interpreted with this limitation in mind. Future research should also examine these results employing longitudinal data for more in-depth examination of related issues. Another issue stemming from this sample is that this data set treats both nascent independent and corporate entrepreneurs similarly. Future research may want to test whether the effect of this entrepreneurial typology varies across these different types.

In addition, the reason that EA is not sufficient alone in our typology to predict entrepreneurs’ characteristics may stem from the fact that there are other dynamics in the new business startup process that influence the interaction between alertness and attributional styles. For example, several studies have shown that attributional styles lead to cognitive biases or heuristics in entrepreneurial decision-making, which may, in turn, impact the start-up process (Zacharakis et al. 1999; Mitchell et al. 2002; Baron 2004). Factors such as cultural or ethnic values (Waldinger et al. 1990; McGrath and MacMillan 1992) are proposed to have a significant impact on entrepreneurial cognitions. Future research will need to investigate if these dynamics moderate the relationship between this entrepreneurial typology and our characteristics variables.

Conclusion

It has become evident that entrepreneurs are diverse and many different types of entrepreneurs exist (Gartner et al. 1994). Researchers have sought to categorize entrepreneurs and their businesses along a variety of dimensions to better comprehend and analyze the entrepreneurial growth process. Extant entrepreneurial typologies have provided a useful way of thinking about entrepreneurs.

To build on this research, we developed an entrepreneurial typology with two dimensions: EA and attributional style. Results from our preliminary empirical analysis generally supported our hypotheses that four types of entrepreneurs reflect different degrees of nAch, commitment, and risk-taking propensity. A clear pattern of our data analysis emerged that attributional styles play a pivotal role in predicting entrepreneurs’ characteristics, whereas EA has significant impact on our hypothesized relationships only when it interacts with attributional styles. The current study, however, only tested our typology with three entrepreneurial characteristics. The nomological validity of this typology will be further strengthened by future research investigating performance measures such as success rate across the different types.

References

Abramson, L., Seligman, M., & Teasdale, J. (1978). Learned helplessness in humans: Critique and reformulation. Journal of Abnormal Psychology, 87, 49–74.

Ardichvili, A., Cardozo, R., & Ray, S. (2003). A theory of entrepreneurial opportunity identification and development. Journal of Business Venturing, 18, 105–123.

Baron, R. (1998). Cognitive mechanisms in entrepreneurship: Why and when entrepreneurs think differently than other people. Journal of Business Venturing, 13, 275–294.

Baron, R. (2004). The cognitive perspective: A valuable tool for answering entrepreneurship’s basic why questions. Journal of Business Venturing, 19, 221–239.

Baum, R., Locke, E. A., & Smith, K. G. (2000). A longitudinal model of a multi-dimensional model of venture growth. Academy of Management Journal, 44, 292–303

Bray, J. H., & Maxwell, S. E. (1985). Multivariate analysis of variance: Quantitative applications in the social sciences. Thousand Oaks, CA: Sage.

Brockhaus, R. H. Sr. (1980). Risk taking propensity of entrepreneurs. Academy of Management Journal, 23, 509–520.

Brockhaus, R. H. Sr., & Horwitz, P. S. (1986). The psychology of the entrepreneur. In D. L. Sexton & R. W. Smilor (Eds). The art and science of entrepreneurship (pp. 25–48). Cambridge, MA: Ballinger.

Busenitz, L. W. (1996). Research on entrepreneurial alertness: Sampling, measurement, an theoretical issues. Journal of Small Business Management, October, 35–44.

Busenitz, L. W., & Barney, J. (1997). Differences between entrepreneurs and managers in large organizations: Biases and heuristics in strategic decision making. Journal of Business Venturing, 12, 9–30.

Caird, S. (1991). The enterprising tendency of occupational groups. International Small Business Journal, 9, 75–81.

Cunningham, J. B., & Lischeron, J. (1991). Defining entrepreneurship. Journal of Small Business Management, 29, 45–61.

Dunkelberg, W. C., & Cooper, A. C. (1982). Entrepreneurial typologies. In K. H. Vesper (Ed.), Frontiers of Entrepreneurship Research (pp. 1–15). Wellesley, MA: Babson College.

Erikson, T. (2001). Revisiting Shapero: A taxonomy of entrepreneurial typologies. New England Journal of Entrepreneurship, 4, 9–15.

Filley, A. C., & Aldag, R. J. (1978). Characteristics and measurement of organizational typology. Academy of Management Journal, 21, 578–591.

Fiske, S. T., & Taylor, S. E. (1991). Social cognition (2nd edn.). New York: McGraw Hill.

Forbes, D. (1999). Cognitive approaches to new venture creation. International Journal of Management Reviews, 1, 415–439.

Gaglio, C. M. (1997). Opportunity identification: Review, critique and suggested research directions. Advances in Entrepreneurship, Firm Emergence and Growth, 3, 139–202.

Gaglio, C., & Katz, J. (2001). The psychological basis of opportunity identification: Entrepreneurial alertness. Small Business Economics, 16, 95–111.

Gartner, W., Shaver, K., Gatewood, E., & Katz, J. (1994). Finding the entrepreneur in entrepreneurship. Entrepreneurship Theory and Practice, 18, 5–9.

Gatewood, E. J., Shaver, K. G., & Gartner, W. B. (1995). A longitudinal study of cognitive factors influencing start-up behaviors and success at venture creation. Journal of Business Venturing, 10, 371–391.

Graham, S., & Folkes, V. S. (1990). Attribution theory: Applications to achievement, mental health, and interpersonal conflict. Hillsdale, NJ: Erlbaum.

Granger, B., Stanworth, J., & Stanworth, C. (1995). Self-employment career dynamics: The case of ‘unemployment push’ in UK book publishing. Work, Employment & Society, 9, 499–516.

Hambrick, D. (1983). An empirical typology of mature industrial-product environments. Academy of Management Journal, 26, 213–230.

Hayton, J. C., George, G., & Zahra, S. A. (2002). National culture and entrepreneurship: A review of behavioral research. Entrepreneurship Theory and Practice, Summer, 33–52.

Heider, F. (1958). The psychology of interpersonal relations. New York: Wiley.

Higgins, E. T., & King, G. (1981). Accessibility of social constructs: Information processing consequences of individual and contextual variability. In N. Cantor & J. F. Kihlstrom (Eds.), Personality, Cognition, and Social Interaction (pp. 69–121). Hillsdale, NJ: Erlbaum.

Hornaday, J. A., & Aboud, J. (1971). Characteristics of successful entrepreneurs. Personnel Psychology, 24, 141–153.

Keh, H. T., Foo, M. D., & Lim, B. C. (2002). Opportunity evaluation under risky conditions: The cognitive processes of entrepreneurs. Entrepreneurship Theory and Practice, 27(2), 125–148.

Kelley, H. H. (1967). Attribution theory in social psychology. Nebraska symposium on motivation (pp. 192–238). University of Nebraska Press.

Kent, R. L., & Martinko, M. J. (1995). The measurement of attributions in organizational research. In M. J. Martinko (Ed.), Attribution theory: An organizational perspective. Delray Beach, FL: St. Lucie.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago: University of Chicago Press.

Kirzner, I. M. (1979). Perception, opportunity, and profit. Chicago: University of Chicago Press.

Kirzner, I. M. (1985). Discovery and capitalist process. Chicago: University of Chicago Press.

Korunka, C., Frank, H., Lueger, M., & Mugler, J. (2003). The entrepreneurial personality in the context of resources, environment, and the startup process—A configurational approach. Entrepreneurship Theory and Practice, Fall, 23–42.

Krueger, N. (2000). The cognitive infrastructure of opportunity emergence. Entrepreneurship Theory and Practice, 25(3), 5–23.

Kubferberg, F. (1998). Humanistic entrepreneurship and entrepreneurial career commitment. Entrepreneurship & Regional Development, 10, 171–188.

Langan-Fox, J. (1995). Achievement motivation and female entrepreneurs. Journal of Occupational & Organizational Psychology, 68, 209–219.

Lau, C. M., & Busenitz, L. W. (2001). Growth intentions of entrepreneurs in a transitional economy: The People’s Republic of China. Entrepreneurship Theory and Practice, 26, 5–20.

Lee, D. Y., & Tsang, E. W. K. (2001). The effects of entrepreneurial personality, background and network activities on venture growth. Journal of Management Studies, 38, 583–602.

Martinko, M. (1995). The nature and function of attribution theory within the organizational sciences. In M. J. Martinko (Ed.), Attribution theory: An organizational perspective. Delray Beach, FL: St. Lucie.

McClelland, D. C. (1961). The achieving society. Princeton: Van Nostrand.

McClelland, D. C. (1987). Characteristics of successful entrepreneurs. Journal of Creative Behavior, 21, 219–233.

McGrath, R. G., & MacMillan, I. C. (1992). More like each other than anyone else? A cross-cultural study of entrepreneurial perceptions. Journal of Business Venturing, 7, 419–429.

Miner, J. B. (2000). Testing a psychological typology of entrepreneurship using business founders. The Journal of Applied Behavioral Science, 36, 43–69.

Minniti, M. (2004). Entrepreneurial alertness and asymmetric information in a spin-glass model. Journal of Business Venturing, 19, 637–658.

Mitchell, R. K., Busenitz, L., Lant, T., McDougall, P. P., Morse, E. A., & Smith, J. B. (2002). Toward a theory of entrepreneurial cognition: Rethinking the people side of entrepreneurship research. Entrepreneurship Theory and Practice. Winter: 93-1-4.

Palich, L. E., & Bagby, D. R (1995). Using cognitive theory to explain entrepreneurial risk taking: Challenging conventional wisdom. Journal of Business Venturing, 10, 425–438.

Pedhazur, E. J., & Schmelkin, L. P. (1991). Measurement, design, and analysis: An integrated approach. Hillsdale, NJ: Erlbaum.

Peterson, C., Semmel, A., von Bayer, C., Abramson, L., Metalsky, G., & Seligman, M. (1982). The Attributional Style Questionnaire. Cognitive Therapy and Research, 6, 287–300.

Reynolds, P. D. (2000). National panel study of U. S. business start-ups: Background and methodology. In J. Katz (Ed). Advances in Entrepreneurship, Firm Emergence, and Growth, 4 (pp. 153–227). Stanford, CT: JAI.

Rich, P. (1992). The organizational taxonomy: Definition and design. Academy of Management Review, 17, 758–782.

Rogoff, E. G., Lee, M. S., & Sub, D. C. (2004). “Who done it” Attributions by entrepreneurs and experts of the factors that cause and impede small business success. Journal of Small Business Management, 42, 364–376.

Russell, D. (1991). The measurement of attribution process: Trait and situational approaches. In S. L. Zelen (Ed). New models, new extensions of attrabution theory (pp. 55–83). New York: Springer-Verlag.

Schneider, S. C., & Angelmar, R. (1993). Cognition in organizational analysis: Who is minding the store? Organization Studies, 14, 347–374.

Seligman, M. E. P. (1990). Learned optimism. New York: Pocket books.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25, 217–226.

Shaver, K., & Scott, L. (1991). Person, process, and choice: The psychology of new venture creation. Entrepreneurship Theory and Practice, 16(2), 23–45.

Shaver, K., Gartner, W., Crosby, E., Bakalarova, K., & Gatewood, E. (2001). Attributions about entrepreneurship: A framework and process for analyzing reasons for starting a business. Entrepreneurship Theory and Practice, 26(2), 5–32.

Smith, N. (1967). The entrepreneurship and his firm: The relationship between type of man and type of company. Lansing, MI: Michigan State University.

Smith, N. R., & Miner, J. B. (1983). Type of entrepreneur, type of firm, and managerial motivation: Implications for organizational life cycle theory. Strategic Management Journal, 4, 325–340.

Stewart, W. H., & Roth, P. L. (2001). Risk propensity differences between entrepreneurs and managers. Journal of Business Venturing, 14, 189–214.

Ucbasaran, D., Daniels, K., Westhead, P., & Wright, M. (2004). A cognitive typology of entrepreneurs. Paper presented at the Babson–Kauffman Entrepreneurship Research Conference, Glasgow, Scotland.

Utsch, A., & Rauch, A. (2000). Innovativeness and initiative as mediators between achievement orientation and venture performance. European Journal of Work and Organizational Psychology, 9, 45–62.

Venkataraman, S. (1997). The distinctive domain of entrepreneurship research: An editor’s perspective. In J. Katz & R. Brockhaus (Eds.), Advances in Entrepreneurship, Firm Emergence and Growth, 3, 119–138. Greenwich, CT: JAI.

Waldinger, R., Aldrich, H., & Ward, R. (1990). Opportunities, group characteristics, and strategies. In R. Waldinger, H. Aldrich, R. Ward, et al. (Eds.), Ethnic Entrepreneurs (pp. 13–48). Newbury Park, CA: Sage.

Weiner, B. (1985). An attribution theory of achievement motivation and innovation. Psychological Review, 92, 548–573.

Zacharakis, A., Meyer, G., & DeCastro, J. (1999). Differing perceptions of new venture failure: A matched exploratory study of venture capitalists and entrepreneurs. Journal of Small Business Management, 37(3), 1–14.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Items used to measure Attributional Styles

Question: Your reactions to this specific business startup would be very useful. How would you respond to the following descriptions of the firm and its situation?

1 = completely disagree | 2 = generally disagree | 3 = neutral |

4 = generally agree | 5 = completely agree |

-

If I work hard, I can successfully start a business.

-

Overall, my skills and abilities will help me start a business.

-

I am confident I can put in the effort needed to start a business.

Question: The following statements can be used to describe most people. How accurately would they describe you?

1 = completely untrue | 2 = mostly untrue | 3 = it depends |

4 = mostly true | 5 = completely true |

-

I can do anything I set my mind on doing.

-

There is no limit as to how long I would give maximum effort to establish my business.

-

My personal philosophy is to “do whatever it takes” to establish my own business.

-

When I make plans I am almost certain to make them work.

-

When I get what I want, it is usually because I worked hard for it.

Items used to measure Need for Achievement

Question: To what extent are the following reasons important to you in establishing this new business?

1 = to no extent | 2 = to a little extent | 3 = to some extent |

4 = to a great extent | 5 = to a very great extent |

-

To achieve a higher position for myself in society.

-

To continue to grow and learn as a person.

-

To achieve something and get recognition for it.

-

To fulfill a personal vision.

-

To lead and motivate others

-

To challenge myself.

Rights and permissions

About this article

Cite this article

Tang, J., Tang, Z. & Lohrke, F.T. Developing an entrepreneurial typology: the roles of entrepreneurial alertness and attributional style. Int Entrep Manage J 4, 273–294 (2008). https://doi.org/10.1007/s11365-007-0041-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-007-0041-4