Abstract

Pollution and energy crisis are actual issues in Europe, including the EU Central and Eastern European states. In this context, the objective of this paper is to assess the impact of economic growth and electricity prices for non-household consumers on pollution. The empirical findings reveal the U pattern for energy industry and inverted U pattern for manufacturing in the period 2007–2021 in the EU countries from Central and Eastern Europe. Renewable energy consumption reduces the CO2 and GHG emissions in energy industry. FDI and electricity prices determine the reduction in GHG and CO2 emissions in both sectors. These results are the basis for policy recommendations.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Today, environmental degradation, the depletion of natural resources, and global warming are some of the infinite problems facing the planet (Wang et al. 2023a; Lorente et al. 2023; Sharma et al. 2023). With the aim of putting an end to this problem, in 2015, the United Nations enacted the 2030 Agenda, where 17 Sustainable Development Goals (SDGs) were decreed, which seek, among other things, to achieve affordable and clean energy (SDG7), achieve sustainable cities and communities (SDG11), establish climate action (SDG 13), or protect the life of terrestrial ecosystems (SDG15) (Huang et al. 2022; Alvarado et al. 2023; Simionescu et al. 2023a). These goals and policies put in place should help to improve the environment over the years and make the planet more sustainable, although much remains to be done (Sinha et al. 2020; Cifuentes-Faura 2022a).

The production, consumption, and transport energy have significant impact on environment. Energy production, circulation, and use present environmental effects like climate change, waste generation, waterways, and acidification (Diaz et al. 2012). Economic activities in energy industry have effects on global warming because of the pollution and deforestation. The fuels combustion generates GHG emissions, but electricity has no harmful effect on the environment (Sørensen 2011). However, renewable energy use and green technologies in energy industry might improve the quality of environment due to less pollution and methods related to industrial ecology.

In developing countries, the benefits brought by manufacturing and especially export in this sector might be cancelled by the environmental degradation and health issues because of the pollution. In this context, clean production technologies are required. The transfer of green technologies and necessary technical skills enhance the efficiency of production in manufacturing by reducing the quantity of water, pollutant substances, and energy. Green investment portfolios, regulations to support friendly environmental investment, and improvement in environmental regulations are other important solutions to mitigate the environmental impact of manufacturing in developing countries (Jiang et al. 2014).

Air pollution remains one of the major challenges for most of the EU countries, including those located in Central and Eastern Europe (CEE). In this region, the main source of pollution is the burning of solid fuels for industrial and domestic heating purposes. The most important consequences of pollution are related to serious health issues (asthma, lung cancer, breathing problems, cardiovascular disease, etc.) (Chung et al. 2022). Considering these negative effects, European policy-makers struggle to reduce pollution that is a major cause also for climate changes. Therefore, more targeted initiatives are necessary to identify the source of pollution and the most relevant factors to control it. There are industries that bring particular important contribution to pollution in CEE countries. The environmental taxes seem not to be the most successful solution to reduce environmental degradation. Therefore, a deeper analysis should be made to investigate the connection between economic development and pollution, since, in most cases, the orientation to profit is more important for companies than environmental protection.

The economic growth-pollution nexus is based on environmental Kuznets curve (EKC) that is also employed here in a specification that includes renewable energy consumption. The EKC has been extended to include other relevant variables, especially economic indicators like index of economic freedom and foreign direct investment. However, current challenges should be taken into consideration when the EKC is extended. The energy crisis has a significant impact on pollution and we included electricity price in non-household consumers to check if this indicator reduces pollution or not. The actual energy crisis requires measures to ensure energy supply and optimal prices for energy consumers. The EU established more targets to manage the energy crisis: reduce the high electricity and gas prices for companies and households, mitigate energy dependency, enhance green energy transition, and more security of gas supplies (Belaïd et al. 2023). High energy prices could be reduced by less electricity consumption, fixing a limit for the revenues of energy producers, and cooperation from fossil fuels business (McWilliams et al. 2022).

Given the importance of this topic for the CEE countries, the aim of this paper is to evaluate the impact of economic growth and electricity prices on pollution. Two proxies for pollution are considered: greenhouse gases (GHG) emissions and carbon dioxide (CO2) emissions. The paper employs dynamic panel data models for the period 2007–2021 in the case of the 11 CEE states in the EU for energy industry and manufacturing. The results indicate different patterns in the pollution-growth nexus, but the electricity price for non-household consumers reduces pollution.

After this introduction, the paper reviews literature in the “Literature review” section, describes data and methods in the “Methodology and data” section, and reports results in the “Results and discussion” section. These findings are subject to discussion and conclusions in the “Results and discussion” and “Conclusions” sections.

Literature review

The determinants that can influence pollution are diverse, as shown by the extensive literature. It is important to know how these determinants affect the environment in order to combat problems such as climate change, environmental degradation, or global warming, and thus contribute to a more sustainable planet and in line with the Sustainable Development Goals and the Agenda 2030 (Usman et al. 2021; Cifuentes-Faura 2021; Usman and Radulescu 2022; Qadeer et al. 2022; Cifuentes-Faura 2022b). The conclusions drawn from previous work in the literature tend to vary depending on the location, the period analyzed, and the methodology used.

The environmental Kuznets curve (EKC) hypothesis, which states that pollutant emissions increase with income during the initial phase of economic growth and decrease once a certain income threshold is reached, has generally been used to study the relationship between economic growth and pollution (Makhdum et al. 2022; Simionescu and Cifuentes-Faura 2023). It proves that there is an inverse U-shaped relationship between economic expansion and environmental quality.

Kais and Sami (2016) analyzed 58 countries for the period 1990–2012 applying generalized method of moments (GMM), and confirmed the existence of an inverted U-shaped relationship. Shahbaz et al. (2017) studied the situation in China between 1970 and 2012, applying Bayer and Hanck combined cointegration test and ARDL, and also confirmed the environmental Kuznets curve hypothesis. Rafindadi and Usman (2019), employing canonical cointegration regression and fully modified ordinary least squares (FMOLS) with South Africa data from 1971 to 2014, determined the existence of inverted U in the country. Adebayo (2020) also confirms the ECK hypothesis in Mexico between 1971 and 2016, using ARDL, FMOLS and DOLS, and wavelet coherence approaches. Ibrahim and Ajide (2021) for G-7 countries, applying ARDL model and dynamic fixed effect (DF), mean group (MG), and pooled mean group (PMG); Massagony and Budiono. (2022) using ADRL in Indonesia; and Farooq et al. (2022) for 180 countries using a global panel data analysis validated the EKC hypothesis. Saqib et al. (2022), in their analysis for several European countries between 1990 and 2020, using the augmented mean group and Dumitrescu and Hurlin panel causality tests, conclude that GDP and its square form an inverted U-shaped curve, thus confirming the EKC hypothesis.

However, there are also papers that do not support the EKC hypothesis. Katircioglu and Katircioglu (2018) expose that the EKC curve is not inverted U-shaped in Turkey for the period 1960 to 2013. Sarkodie and Strezov (2018) conclude that EKC hypothesis is not verified in Ghana and the USA for the period 1971–2013, but it is verified in China and Australia. Dong et al. (2020), Dogan and Inglesi-Lotz (2020), or Pata and Aydin (2020) reject the EKC hypothesis in their works.

The impact of foreign direct investment (FDI) on pollution is also mixed (Uche et al. 2023). Jain (2017) analyzed using OLS-GMM data from 13 countries for the period 1991–2011 and concluded that FDI is associated with lower CO2 emissions. Rafindadi et al. (2018), using PMG, also deduced that FDI decreases CO2 emissions in Gulf Cooperation Council countries between 1990 and 2014. Rafique et al. (2020), using augmented mean group (AMG), analyzed BRICS countries from 1990 to 2017 and determined that FDI has a negative impact on carbon emissions. Wang et al. (2022) analyzed several territories in China between 2000 and 2018 using quantile regression and also concluded that dependence is negative. Similar results are offered by Shahbaz et al. (2018) for the analysis of France between 1955 and 2016, Nasir et al. (2019) for ASEAN-5 countries between 1982 and 2014, or Do and Dinh (2020) for Vietnam in 1980–2014.

The study of Sarkodie and Strezov (2018) found that foreign direct investment increases the level of CO2 emissions in Indonesia from 1982 to 2016. Haug and Ucal (2019), applying ADRL, found that FDI did not increase pollution and CO2 emissions in Turkey between 1974 and 2014. Sajeev and Kaur (2020), in their analysis for India from 1980 to 2012, concluded that FDI had a negative effect on the environment and pollution in the long term, but a positive effect in the short term. Usman et al. (2022) analyzed the G-7 economies and conclude that FDI also degrades environmental eminence in the long term. Zhang et al. (2023) find that foreign direct investment decreases regional emissions of air pollutants in their analysis of environmental efficiency in China between 2008 and 2020.

Acevedo-Ramos et al. (2023) in a study for Colombia with ARDL estimation and dynamic stochastic simulations concluded that FDI contributes negatively to carbon dioxide emissions and its effect is not significant for the ecological footprint and is negative for methane emissions.

In recent years, research on the connection between pollution and renewable energy has garnered a lot of interest. Numerous studies demonstrate how renewable energy helps to reduce carbon dioxide emissions (Hu et al. 2018; Adams and Acheampong 2019). Kahia et al. (2019) concluded that renewable energy consumption decreases emissions of polluting gases such as CO2 in MENA countries (2019), as did Naz et al. (2019) in Pakistan.

Chen et al. (2019) found that renewable energy consumption causes a decrease in CO2 emissions for the period 1995–2012 in China. Naseem and Guang Ji (2021), using fixed effects estimators and GMM, showed that renewable energy is negatively correlated with CO2 emissions in South Asia for the period 2000–2017. Usman and Radulescu (2022) employ panel data models such as AMG and CCEMG estimators to study the environmental impact of top nuclear energy-producing countries and conclude that the use of non-renewable energy degrades the environment. Usman et al. (2021) analyze the 15 most polluting countries between 1990 and 2017 and conclude that the use of non-renewable energies is the main cause of environmental damage and that renewable energies contribute significantly to reducing environmental degradation. Wang et al. (2023b) conclude, using the augmented mean group (AMG) technique, that the consumption of renewable energies favors the restoration of environmental integrity among the main emitting countries between 1990 and 2020. Other works in the same line are those of Dogan and Seker (2016), Acheampong et al. (2019), Leitão and Lorente (2020), and Itoo and Ali (2023).

Jahanger et al. (2023) analyze BRICS countries between 1990 and 2018 using panel quantile, FMOLS, and DOLS estimators and determine which renewable energies reduce emissions and restore environmental sustainability. Usman et al. (2023) in their study for Mercosur economies between 1990 and 2018 determine that renewable energies together with technological innovations reduce the level of pollution. Wang et al. (2023c) analyze 1990–2020 data from Japan and highlight the positive impacts of renewable energy in protecting the environment.

Dong et al. (2020) also analyzed, using CCEMG (common correlated effects mean group) and AMG, the nexus between CO2 emissions and renewable energy in 120 countries and distinguishing various groups according to income level. They conclude that renewable energy consumption is negatively related to emissions at the global level and also in selected income clusters, but in this case the effect is not significant. In contrast, Nathaniel and Iheonu (2019) analyzed 19 African countries using AGM from 1990 to 2014 and showed that renewables hardly inhibit CO2 emissions.

On the other hand, there are few studies on the relationship between electricity prices and pollutant emissions. Milin et al. (2022) argue that increased electricity use can lead to environmental problems and increased pollutant emissions. Kim (2015) argues that rising energy electricity prices, together with government energy regulations and new developments, may lead to a decrease in energy intensity and result in improved environmental sustainability. In addition, prices are a response of political bodies to combat environmental problems (Liddle 2018; Sadiq et al. 2022). Tan-Soo et al. (2019) show that electricity price affects pollution and that its effect on industrial emissions from industrial plants in China is not uniform across different pollutants. Talbi et al. (2022) argue that electricity prices positively influence the demand for renewable energy by indirectly affecting pollution. Wu et al. (2022) conclude that increasing the price of energy reduces CO2 emissions. Simionescu et al. (2023b), in their analysis for CEE countries, state that higher electricity prices reduce pollution.

Value added in industry and construction has also been considered as another determinant of pollution. Naudé (2011) argues that industrialization is positively related to pollutant emissions through its contribution to GDP growth, increased energy use, and carbon sources. Degand (2011) and Zhang et al. (2013) conclude that industrialization is one of the main determinants of pollutant emissions.

Zhang et al. (2009) show that during the early stages of industrialization there are higher energy emissions, but that after this stage emissions will be reduced. Stefanski (2013) concludes that industrialization drives the inverted U-shaped pattern between income and emissions intensity. Zhou et al. (2013) in their analysis for China in the period 1995–2009 argue that through upgrading and optimizing the industrial structure, emissions can be reduced. Xiuhui and Raza (2022) concluded that the most important factor in the decrease of CO2 emissions in Pakistan in the period 1990–2019 was the value added of industry. Similar results are offered by Jiang and Liu (2023) who conclude that the value added of industry (including construction) as a share of GDP is the second most important factor contributing to the growth of CO2 emissions in BRICS countries. Acevedo-Ramos et al. (2023) estimate that there is statistical evidence to conclude that industry value added does not influence the ecological footprint and that in the short run it increases CO2 emissions and decreases them in the long run.

Another factor affecting environmental pollution is the index of economic freedom (EF). Economic freedom is the ability of individuals to engage in economic activities without restrictions by the state (Kim 2023). The impact of this variable on pollution and emissions is also unclear. Greater economic freedom can worsen the quality of the environment as more energy and natural resources are used (Chen 2022).

Cheon et al. (2017) find that EF negatively influences emissions of pollutant gases such as CO2 in 111 countries between 2005 and 2013. Bjørnskov (2020) analyzed 155 countries for the period 1975–2015 and found that economic freedom reduces global CO2 emissions. Adesina and Mwamba (2019), using GMM, show that EF negatively affects CO2 emissions in several African countries between 1995 and 2013. Jain and Kaur (2022) for several Asian countries between 1981 and 2016 conclude that greater economic freedom leads to less pollution.

In contrast, Joshi and Beck (2018), applying GMM, find that EF increases pollutant emissions in OECD countries, and conversely in non-OECD countries. Shahnazi and Shabani (2021) find that economic freedom reduces pollutant emissions beforehand, but they subsequently increase in European Union (EU) countries in the period 2000–2017. Chen (2022), using the ARDL approach, analyzes the effect of government size on pollutant emissions between 1990 and 2018 and concludes that there is a positive effect in all BRICS countries except Russia. Amin et al. (2023), applying AMG and CCEMG, find that EF increases CO2 emissions in the Asian countries analyzed.

Methodology and data

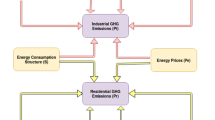

The employs panel data associated to the EU member states located in Central and Eastern Europe: Czechia, Romania, Estonia, Croatia, Latvia, Slovak Republic, Bulgaria, Poland, Hungary, Lithuania, and Slovenia. The dependent variable in the models is represented by a proxy for pollution in two specific sectors with significant contribution to this phenomenon: manufacturing and energy industry. The dataset covers the period 2007–2021. The specification of the equation based on EKC is based on a polynomial function of order 2 that links the level of pollution measured by greenhouse gases (GHG) emissions and carbon dioxide (CO2) emissions with a proxy for economic growth at the national level (GDP) and at the sectoral level (value added in industry and construction sector). A description of the variables used in the panel data models is made in Table 1.

The research starts with two baseline models that link pollution (GHG emissions, CO2 emissions) in each sector (pollutione and pollutionm) with GDP or VAI and with REC. Robustness check is ensured by adding more control variables: index of economic freedom, electricity prices for non-household consumers, foreign direct investment.

pollutione—level of pollution in energy industry

pollutionm—level of pollution in manufacturing

VAI—value added in industry

GDP—gross domestic product

REC—renewable energy consumption

Xj—vector of explanatory variables (economic freedom index—EF, human development index—HDI, foreign direct investment—FDI, price—electricity prices for non-household consumers)

ak,bk,ck, dk, a5j, b5j, c5j, d5j—parameters for k=0,1,2,3,4 and j=1,2,3, where j—index for additional explanatory variables

u 1it, u2it, u3it, u4it—error terms

i—index for state, t—index for year

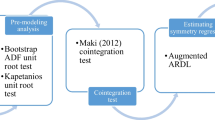

The endogeneity and the short period under consideration under the lack of cointegration recommend the use of dynamic panel GMM estimator. The Windmeijer (2005) finite-sample correction approach is used to construct the two-step system GMM due to its capacity to manage heteroskedasticity and autocorrelation. The Hansen (1982) over-identification test is employed to check the validity of the instruments under the null hypothesis that establishes instruments’ exogeneity. Serial correlation is checked using Arellano and Bond (1991) test.

The data series are considered in the natural logarithm to reduce multicollinearity between explanatory variables. Preliminary tests are used before the construction of the dynamic panel data models.

Pesaran’s CD test is used to check for cross-sectional dependence, since this test is not affected by the sample dimension (Pesaran, 2015). The null hypothesis of this test indicates independence between cross-sections:

ρ ij—pair-wise correlation coefficient associated to errors

Since we are in the case of unbalanced panels, the CD statistic of Pesaran’s test is computed as:

T ij—number of common observations between two cross-sections (i and j)

The slope heterogeneity is checked using Pesaran and Yamagata (2008) test:

I t—unit matrix

\({\overset{\sim }{\sigma}}_i^2\)—variance estimate

\({\hat{\beta}}_i\)—OLS estimator for country i

\({\overset{\sim }{\beta}}_{WFE}\)—weighted fixed effect pooled estimator

We computed standardized dispersion (\(\hat{\Delta }\)) and biased-adjusted dispersion (\({\overline{\Delta }}_{adj}\)):

If cross-sectional dependence is checked, then Pesaran’s CADF test is employed to establish the stationary character of the series. If the data series are non-stationary with the same order to integration, the Westerlund test is used to check for cointegration.

Table 2 reports the descriptive statistics and shows a large range of CO2 and GHG in energy industry compared to the level of pollution in manufacturing sector. The maximum increase in GHG emissions and in CO2 emissions in the energy industry is reported in Estonia in 2013, while the lowest values were reached by Latvia in 2020. The highest growth of GHG emissions in manufacturing was observed in the Czech Republic in 2007 and the minimum growth in Hungary in 2012.

Slovakia presented the maximum growth in 2011 in the case of CO2 emissions in manufacturing. The minimum increase in CO2 in this sector was reached in Latvia in 2016. Latvia reduced its pollution because of decline in industry after restoration of independence in 1991 and due to environmental legislation, which promoted also specific environmental taxes (Laplante and Smits, 1998).

Results and discussion

For the data series in natural logarithm the matrix of correlation is computed, but no strong correlations were observed between the explanatory variables. Table 3 suggests cross-sectional dependence only for GDP at 1% significance level. The homogeneity hypothesis is checked for VAI, CO2 in energy industry, GHG in energy industry, and CO2 in manufacturing at 10% significance level, while heterogeneity is fulfilled for the rest of the series.

The results of Pesaran’s CADF test depend on the number of lags. Therefore, the augmentation is made by adding one and two lags. Table 4 indicates that the data series in level are stationary only for GDP and CO2 in manufacturing, while the data in level are integrated of order 1 at 5% significance for the rest of the variables excepting.

The Westerlund test is employed to check for cointegration, but the results in Table 5 show the lack of cointegration in all the cases at 5% significance level.

Given the absence of cointegration between data series, the dynamic panel GMM estimations are considered. The results based on panel data models in Table 6 reveal important insights. First, there is a tendency of increase in the GHG emissions in energy industry, while GHG emissions in manufacturing tend to decrease in time. These results show that the environment policies in energy sector do not have the expected impact or the environmental initiatives were not sufficient to manage the negative impact associated to the development of the energy sector. Hence, more efforts should be made to reduce GHG emissions in energy sector. Second, opposite patterns are observed in explaining the variation of GHG emissions in energy industry and manufacturing. The U pattern is observed in energy industry which is in line with the previous observation that states the overall tendency of increase in the variation of GHG emissions. On the other hand, inverted U pattern is observed in manufacturing sector.

In energy industry, renewable energy consumption significantly reduced the variation in GHG emissions, while the impact was not significant in the case of manufacturing sector. Economic freedom has no impact on pollution in both industries, while variation in FDI and electricity price has a significant and negative influence on GHG emissions in both cases. We have run models including HDI variation in the models based on GHG emissions, but a significant impact of this variable on GHG emissions was not revealed.

As we can notice from estimations, in the model with GDP, FDI significantly and negatively contribute on reducing GHG emissions in energy industry and manufacturing industry. This impact is much stronger than the effect of the renewable energy consumption in reducing GHG emissions, which means that pollution haven hypothesis is validated for these new 11 EU member states. Energy prices for non-households are significantly and negatively related to GHG emissions, contributing to the reduction of GHG emissions both in energy industry and in the manufacturing industry. In the model with value added in industry, FDI also confirm the pollution haven hypothesis, but the most negative impact of FDI on reducing GHG emissions can be seen in the energy industry against manufacturing industry. Based on achieved results, it is also worth mentioning that renewable energy consumption plays an important role in reducing GHG emissions only in energy industry, not in the manufacturing one. This means that manufacturing industry still relies on traditional energy sources, as fossil fuels, and this is why the impact of renewable energy is not significant here, while in the energy sector, the share of renewable energy of total energy mix is higher, so the impact is significant and negative. Also, the impact of FDI is much stronger in the energy sector on decreasing GHG emissions, comparing to the manufacturing industry, meaning that CEE countries attracted large shares of FDI into the energy industry and into the renewable energy area. To summarize, for reducing GHG emissions, governments should create a favorable legal framework to attract more FDI into these countries. Also, an increased price for non-household consumers is also responsible for reducing GHG emissions. The impact of GDP is much larger in energy sector on gas emissions than in manufacturing sector, while for the added value in industry, the impact is larger in manufacturing than in energy sector. However, the impact of GDP is different against the impact of VAI in the short run and long run in those two investigated sectors. Economic growth determines the decrease of GHG emissions in the short run, but in the long run its impact is significant and positive which means that economic activity increases GHG emissions in the long run and deters environment in the energy sector, just like VAI, only that the impact of VAI is weaker than the effect of GDP growth on GHG emissions. On the contrary, VAI determines an increase of GHG emissions in the short run in both sectors and a decrease of GHG emissions in the long run, but the impact is very weak in the energy sector and very strong in the manufacturing industry (see Table 6).

When CO2 emissions in each industry are considered, an overall tendency of increase in the level of pollution is observed (Table 7). The U pattern for energy industry and inverted U pattern for manufacturing are kept also for this proxy of pollution. Same shapes were achieved both in the models with GHG emissions and in the models with CO2 emissions. The inverted U-shaped EKC we have achieved between GDP, GDP square, and emissions for the manufacturing industry was demonstrated by many previous studies for many countries or large groups of developed or developing countries (Makhdum et al. 2022; Simionescu and Cifuentes-Faura 2023; Kais and Sami 2016; Shahbaz et al. 2017; Rafindadi and Usman 2019; Ibrahim and Ajide 2021; Farooq et al. 2022). However, there are also papers that do not support the EKC hypothesis and proved a U-shaped EKC (Ozcan 2013; Katircioglu and Katircioglu 2018; Bader and Ganguli 2019; Ansari et al. 2020) as we have found for the energy sector. There are also many studies investigating the relation between value added in industry and pollutant emissions that found an inverted U-shaped EKC and validated EKC theory (Zhang et al. 2009; Stefanski 2013; Zhou et al. 2013; Xiuhui and Raza 2022; Jiang and Liu 2023; Acevedo-Ramos et al. 2023).

Renewable energy consumption reduces the CO2 emissions in energy industry. In manufacturing, the renewable energy use has the capacity to reduce the CO2 only when we control for value added in industry. FDI and electricity prices determine the reduction in CO2 emissions in both sectors. In case of CO2 emissions, human development index is significant only in the manufacturing industry for reducing carbon emissions, while renewable energy consumption is significant in both industries, but with a stronger negative impact on emissions into the energy industry sector. The impact of GDP on carbon emissions is larger in manufacturing sector than in the energy industry. On contrary, the impact of added value on carbon emissions is larger in the energy sector than in the manufacturing one. These results are opposite to the findings above where we determined the factors impacting on GHG emissions. So, the overall activity is more polluting in energy industry and less polluting in manufacturing sector, while the industrial activity is more carbon polluting in the manufacturing sector and less carbon polluting in the energy one. Another important finding is the fact that renewable energy consumption decreases both GHG emissions and carbon emissions, and its impact is stronger in the energy sector than in the manufacturing industry if we include overall activity, namely GDP. This expected negative association between renewable energy consumption and emissions was confirmed by many previous studies for different countries (Hu et al. 2018; Adams and Acheampong 2019; Kahia et al. 2019; Naz et al. 2019; Chen et al. 2019; Naseem and Guang Ji 2021; Jamil et al. 2022; Dogan and Seker 2016; Acheampong et al. 2019; Leitão and Lorente 2020; Itoo and Ali 2023; Dong et al., 2020). Economic freedom was not found as being significant for GHG emissions nor for carbon emissions. Summarizing results, the most important factors impacting on GHG or carbon emissions are economic growth and industrial output, followed by human development index which supports the decrease of carbon emissions but only in manufacturing industry. Other factors with a significant negative impact on emissions in both sectors are FDI and energy prices for non-household consumers, the last one having an inhibiting effect on overall activity or on industrial output. The negative impact of the electricity prices for non-household consumers on GHG emission is stronger than that on carbon emissions for both investigated industries. This negative impact of electricity prices on emissions which is not always uniform on all types of emissions was validated by other authors (Kim 2015; Sadiq et al. 2022; Tan-Soo et al. 2019; Wu et al. 2022). We have achieved same results for the impact of FDI which is much stronger on GHG emissions than on carbon emissions and it is stronger in the energy sector in the presence of GDP growth than when we have considered industrial output. This negative impact of FDI on pollutant emissions was confirmed by numerous studies, with many methods and for different countries or group of countries (Jain 2017; Rafindadi et al. 2018; Rafique et al. 2020; Wang et al. 2022; Shahbaz et al. 2018; Nasir et al. 2019). Some interesting results are related to the non-significant impact of economic freedom on GHG and carbon emissions, although these countries made great progresses on the way of removing economic barriers of entering on the market, and on liberalization of the prices in the electricity sector. However, economic freedom does not seem to have a stimulating impact on economic growth or on industrial output and, thus, on GHG emissions or on carbon emissions. Some previous studies have also found no significant relation between economic freedom and pollution. Wood and Herzog (2014) investigated a wide international panel of countries during 2000–2010 and found no significant association between those variables. The effect of HDI is also surprising because this variable is significant only for carbon emissions into the manufacturing sector. However, as other previous studies have demonstrated for CEE region, HDI determines the impact of economic growth on carbon emissions (Lazăr et al. 2019). Lawson (2020) also analyzed Sub-Saharan countries and found no association between HDI and carbon emissions. However, there are studies confirming our negative association. Alotaibi and Alajlan (2021) found a negative association between HDI and pollution. Van Tran et al. (2019) proved a negative relation for developing countries, but no significant association for the developed economies. Expanding those findings and correlating with our results, we can conclude that manufacturing sector is still developing, while the energy sector of the CEE countries is a more mature one.

All in all, different patterns are observed in energy sector and manufacturing (U-shape and inverted U-shape, respectively). Renewable energy consumption proved to reduce pollution in energy industry, while FDI and electricity prices determine lower level of pollution in both industries. These results are subject to policy recommendations. Based on the achieved results, it seems that continuous liberalization of the electricity prices and cutting all granted exemptions and subsidies will support the decrease of pollution, just like FDI inflows can support the same aim. FDI bring green technologies and support green innovations into the host countries and that can reduce pollution in the long run. Based on the new clean technologies, it can be achieved the target of reaching a sustainable economic growth and sustainable industrial output with a reduced emissions level. Also, human development is an important explanatory factor for the manufacturing industry on its path of reducing carbon emissions. Manufacturing sector needs larger improvements in the labor work force area. Improving education, health conditions, and the general standard for living expresses the level of overall development of an economy. This way people can better acknowledge the importance of preserving the environment for them and for future generations. Attracting FDI and improving human development index request financing support from the governments that should grant fiscal and non-fiscal facilities for foreign investors but also allocate large public funds for education and health sectors, but also from the private sector which should support research and development and innovations for cleaner technologies.

Conclusions

In this study, we have aimed to investigate the validity of EKC curve in energy industry and manufacturing industry, during 2007–2021 in 11 new EU member states, using GDP growth and GDP growth square in one model and added value in industry (as share of GDP) and added value in industry square in another model. As dependent variable, we have also used two different variables as proxy for pollution, GHG emissions and CO2 emissions. For each industry and for each of those two models built with GDP growth or added value in industry, we have estimated 2 different sub-models, one including only renewable energy consumption and another one including renewable energy consumption, but also other exogenous variables such as economic freedom index, FDI, human development index, and energy price for non-household consumers. We have checked the existance of cross-sectional dependence among the panel and heterogenity and cross-sectional dependence was validated for almost all variables of the models; then, we have applied Pesaran’s CADF unit root test and Westerlund co-integration test. The results have showed that variables are no co-integrated in the long run. For estimations, we have used a dynamic panel GMM to deal with short dataset in the presence of no co-integration and cross-sectional dependence among the panel.

Results demonstrate a U-shaped curve expressing the relation between GDP growth and emissions (GHG and CO2 emissions) in the energy sector, and an inverted U-shaped curve expressing the relation between added value in industry and emissions in the manufacturing sector. In all estimated models, GDP growth and added value in industry, respectively, display the largest impact on GHG and CO2 emissions. Renewable energy consumption exerts a negative impact on GHG and CO2 emissions in all the estimated models, but this effect is not as large as the impact of other exogenous factors included in the models (FDI, HDI, electricity prices for non-household consumers). Economic freedom was not found to be significant in any of these models. Human development index displays the strongest impact after GDP growth in the models that include GDP, but it was not found to be significant for carbon emission in the energy industry. Its impact is negative on emissions, which means it mitigates pollution. On the other hand, other important factors reducing emissions are FDI inflows and energy prices for non-household consumers in both investigated industries.

Based on the achieved results, we can elaborate some policy recommendations designed to mitigate environmental pollution burden in those 11 new EU member states. The national authorities of those new EU member states should implement economic policies and adapt the regulatory framework for stimulating the human development, and that means investing in education and training, in research and development, and in the health sector. Financing all these areas requires large financial funds allocated by the government, and for achieving these goals, a public-private partenership is needed for training the labor force according to the market demands. Also, for attracting FDI, these states can not rely on fiscal stimulus or incentives, because they need large financial funds for the above-mentioned sectors in order to improve also human development index needed for a developing sector such as manufacturing one. In this sector, where the labor force is low qualified, human development index increase is essential for industrial output and also for achieving environmental targets. That is why it is necessary to adapt the regulatory framework for easining the access on the markets for foreign investors, and for reducing bureaucratic burden on the investors. Some other facilities granted to foreign investors are necessary besides fiscal stimulus. The process of gradually liberalization of the energy prices should continue, because a higher price of energy for the economic agents does not support the boom of overall economic activity and industrial output which can badly detter environment. Moreover, the level of the energy prices should be harmonized among EU countries. New EU member states benefited for an extended period to align, but with many extemptions and delays. That is why this process should continue. The governments should also support and promote renewable energy sources in production and consumption. That implies a large information process about the advantages of using these types of energy sources, the financial support available for promoting renewable energy sources into consumption (by granting banking credits with subsidized interest rate or by accessing financial funds allocated by European banks or organizations for this specific purpose), and the benefits in the long run for the environment, and thus, in the end, for people’s health. Governments should also allocate larger funds for research and development, which can be used for a green innovations, economy, and energy transition. This can be also achieved in a public-private partnership frame.

This study has few limitations. First, the period can be extended further because for now we had limited yearly observations for the analyzed variables in these 11 CEE member states. Second, a comparison between old EU member states and new EU member states can be performed in order to achieve interesting results and to design different policy recommendations for those 2 sub-groups of EU countries, or the analysis can present results for each country included into the panel to see the specific differences among EU countries. Another direction of further research can be represented by building new models for analyzing these two important industries, by including other independent variables and control variables as well as such as economic complexity index, instead of economic growth and urbanization, political stability or energy prices for household consumers as control variables.

Data availability

All data are publicly available and authors provided their source into the manuscript.

References

Acevedo-Ramos JA, Valencia CF, Valencia CD (2023) The Environmental Kuznets Curve hypothesis for Colombia: impact of economic development on greenhouse gas emissions and ecological footprint. Sustain 15(4):3738

Acheampong AO, Adams S, Boateng E (2019) Do globalization and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? Sci Total Environ 677:436–446

Adams S, Acheampong AO (2019) Reducing carbon emissions: the role of renewable energy and democracy. J Clean Prod 240:118245

Adebayo TS (2020) Revisiting the EKC hypothesis in an emerging market: an application of ARDL-based bounds and wavelet coherence approaches. SN Applied Sciences 2(12):1–15

Adesina KS, Mwamba JWM (2019) Does economic freedom matter for CO2 emissions? Lessons from Africa. J Dev Areas 53(3):1–14. https://doi.org/10.1353/jda.2019.0044

Alotaibi A, Alajlan N (2021) Using quantile regression to analyze the relationship between socioeconomic indicators and carbon dioxide emissions in G20 countries. Sustainability 13(13):7011. https://doi.org/10.3390/su13137011

Alvarado R, Murshed M, Cifuentes-Faura J, Işık C, Hossain MR, Tillaguango B (2023) Nexuses between rent of natural resources, economic complexity, and technological innovation: the roles of GDP, human capital and civil liberties. Resources Policy 85:103637

Amin N, Shabbir MS, Song H, Farrukh MU, Iqbal S, Abbass K (2023) A step towards environmental mitigation: do green technological innovation and institutional quality make a difference? Technol Forecast Soc Change 190:122413

Ansari, M.A., Haider, S. and Khan, N.A. (2020) Does trade openness affects global carbon dioxide emissions: evidence from the top CO2 emitters, Manag Environ Qual, Vol. 31 No. 1, pp. 32-53. https://doi.org/https://doi.org/10.1108/MEQ-12-2018-0205

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Bader Y, Ganguli S (2019) Analysis of the association between economic growth, environmental quality and health standards in the Gulf Cooperation Council during 1980-2012. Manag Environ Qual 30(5):1050–1071. https://doi.org/10.1108/MEQ-03-2018-0061

Belaïd F, Al-Sarihi A, Al-Mestneer R (2023) Balancing climate mitigation and energy security goals amid converging global energy crises: the role of green investments. Renew Energ 205:534–542

Bjørnskov C (2020) Economic freedom and the CO2 Kuznets Curve. Available at SSRN 3508271. https://doi.org/10.2139/ssrn.3508271

Chen L (2022) How CO2 emissions respond to changes in government size and level of digitalization? Evidence from the BRICS countries. Environ Sci Pollut Res 29:457–467

Chen Y, Zhao J, Lai Z, Wang Z, Xia H (2019) Exploring the effects of economic growth, and renewable and non-renewable energy consumption on China’s CO2 emissions: evidence from a regional panel analysis. Renew Energ 140:341–353

Cheon S, Kim J, Kim J (2017) An analysis on the influence of economic freedom index, renewable energy generation ratio, energy consumption and GDP on CO2 emission. J Korean Soc Miner Energy Resour Eng 54(3):242–252

Chung CY, Yang J, Yang X, He J (2022) Long-term effects of ambient air pollution on lung cancer and COPD mortalities in China: a systematic review and meta-analysis of cohort studies. Environ Impact Assess Rev 97:106865

Cifuentes-Faura J (2021) Environmental policies to combat climate change in europe and possible solutions: European green deal and circular economy. Int J Sustain Policy Pract 17(2):27–36

Cifuentes-Faura J (2022a) European Union policies and their role in combating climate change over the years. Air Qual Atmos Health 15(8):1333–1340

Cifuentes-Faura J (2022b) Circular economy and sustainability as a basis for economic recovery post-COVID-19. Circ Econ Sustain 2(1):1–7

Degand E (2011) China and India: economic development and environmental issues. In: EIAS newsletter (March/April). European Institute for Asian Studies, Brussels

Diaz N, Ninomiya K, Noble J, Dornfeld D (2012) Environmental impact characterization of milling and implications for potential energy savings in industry. Procedia CIRP 1:518–523

Do T, Dinh H (2020) Short-and long-term effects of GDP, energy consumption, FDI, and trade openness on CO2 emissions. Accounting 6(3):365–372

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 27:12717–12724

Dogan E, Seker F (2016) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energ 94:429–439

Dong K, Dong X, Jiang Q (2020) How renewable energy consumption lower global CO2 emissions? Evidence from countries with different income levels. World Econ 43(6):1665–1698

Farooq S, Ozturk I, Majeed MT, Akram R (2022) Globalization and CO2 emissions in the presence of EKC: a global panel data analysis. Gondw Res 106:367–378

Haug AA, Ucal M (2019) The role of trade and FDI for CO2 emissions in Turkey: non-linear relationships. Energy Econ 81:297–307

Hu H, Xie N, Fang D, Zhang X (2018) The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: evidence from 25 developing countries. Appl Energy 211:1229–1244

Huang Y, Haseeb M, Usman M, Ozturk I (2022) Dynamic association between ICT, renewable energy, economic complexity and ecological footprint: is there any difference between E-7 (developing) and G-7 (developed) countries? Technol Soc 68:101853

Ibrahim RL, Ajide KB (2021) Nonrenewable and renewable energy consumption, trade openness, and environmental quality in G-7 countries: the conditional role of technological progress. Environ Sci Pollut Res 28(33):45212–45229

Itoo HH, Ali N (2023) Analyzing the causal nexus between CO2 emissions and its determinants in India: evidences from ARDL and EKC approach. Manag Environ Qual 34(1):192–213

Jahanger A, Hossain MR, Usman M, Onwe JC (2023) Recent scenario and nexus between natural resource dependence, energy use and pollution cycles in BRICS region: does the mediating role of human capital exist? Resour Policy 81:103382

Jain M (2017) Does sustainable “economic development path” pair with “climatic mortification”: testimony from bric and other developing nations. Amity Glob Bus Rev 12(1):91–99

Jain M, Kaur S (2022) Carbon emissions, inequalities and economic freedom: an empirical investigation in selected South Asian economies. Int J Soc Econ 49(6):882–913

Jamil K, Liu D, Gul RF, Hussain Z, Mohsin M, Qin G, Khan FU (2022) Do remittance and renewable energy affect CO2 emissions? An empirical evidence from selected G-20 countries. Energy & Environment 33(5):916–932

Jiang L, Lin C, Lin P (2014) The determinants of pollution levels: firm-level evidence from Chinese manufacturing. J Comp Econ 42(1):118–142

Jiang R, Liu B (2023) How to achieve carbon neutrality while maintaining economic vitality: An exploration from the perspective of technological innovation and trade openness. Sci Total Environ 868:161490.https://doi.org/10.1016/j.scitotenv.2023.161490

Joshi P, Beck K (2018) Democracy and carbon dioxide emissions: assessing the interactions of political and economic freedom and the environmental Kuznets curve. Energy Res Soc Sci 39:46–54

Kahia M, Ben Jebli M, Belloumi M (2019) Analysis of the impact of renewable energy consumption and economic growth on carbon dioxide emissions in 12 MENA countries. Clean Technol Environ Policy 21:871–885

Kais S, Sami H (2016) An econometric study of the impact of economic growth and energy use on carbon emissions: panel data evidence from fifty-eight countries. Renew Sustain Energy Rev 59:1101–1110

Katircioglu S, Katircioglu S (2018) Testing the role of fiscal policy in the environmental degradation: the case of Turkey. Environ Sci Pollut Res 25:5616–5630

Kim AB (2023) 2023 Index of economic freedom. The Heritage Foundation. Available at: https://www.heritage.org/index/about

Kim YS (2015) Electricity consumption and economic development: are countries converging to a common trend? Energy Econ 49:192–202

Laplante B, Smits K (1998) Estimating industrial pollution in Latvia. ECSSD Rural Development and Environment Sector, Working Paper, 4

Lawson LA (2020) GHG emissions and fossil energy use as consequences of efforts of improving human well-being in Africa. J Environ Manage 273:111136

Lazăr D, Minea A, Purcel AA (2019) Pollution and economic growth: evidence from Central and Eastern European countries. Energy Econ 81:1121–1131

Leitão NC, Lorente DB (2020) The linkage between economic growth, renewable energy, tourism, CO2 emissions, and international trade: the evidence for the European Union. Energies 13(18):4838

Liddle B (2018) Consumption-based accounting and the trade-carbon emissions nexus. Energy Econ 69:71–78

Lorente DB, Mohammed KS, Cifuentes-Faura J, Shahzad U (2023) Dynamic connectedness among climate change index, green financial assets and renewable energy markets: novel evidence from sustainable development perspective. Renew Energ 204:94–105

Makhdum MSA, Usman M, Kousar R, Cifuentes-Faura J, Radulescu M, Balsalobre-Lorente D (2022) How do institutional quality, natural resources, renewable energy, and financial development reduce ecological footprint without hindering economic growth trajectory? Evidence from China. Sustain 14(21):13910

Massagony A, Budiono (2022) Is the environmental Kuznets curve (EKC) hypothesis valid on CO2 emissions in Indonesia? Int J Environ Stud 80(1):20–31

McWilliams B, Sgaravatti G, Tagliapietra S and Zachmann G (2022) A grand bargain to steer through the European Union’s energy crisis (Vol. 22, No. 14, pp. 2022-2009). Bruegel.

Milin IA, Mungiu Pupazan MC, Rehman A, Chirtoc IE, Ecobici N (2022) Examining the relationship between rural and urban populations’ access to electricity and economic growth: a new evidence. Sustain 14(13):8125

Naseem S, Guang Ji T (2021) A system-GMM approach to examine the renewable energy consumption, agriculture and economic growth’s impact on CO2 emission in the SAARC region. GeoJournal 86(5):2021–2033

Nasir MA, Huynh TLD, Tram HTX (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manage 242:131–141

Nathaniel SP, Iheonu CO (2019) Carbon dioxide abatement in Africa: the role of renewable and non-renewable energy consumption. Sci Total Environ 679:337–345

Naudé W (2011) Climate change and industrial policy. Sustain 3(7):1003–1021

Naz S, Sultan R, Zaman K, Aldakhil AM, Nassani AA, Abro MMQ (2019) Moderating and mediating role of renewable energy consumption, FDI inflows, and economic growth on carbon dioxide emissions: evidence from robust least square estimator. Environ Sci Pollut Res 26(3):2806–2819

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138–1147. https://doi.org/10.1016/j.enpol.2013.07.016

Pata UK, Aydin M (2020) Testing the EKC hypothesis for the top six hydropower energy-consuming countries: Evidence from Fourier Bootstrap ARDL procedure. J Clean Prod 264:121699

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econom Rev 34(6–10):1089–1117

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142(1):50–93

Qadeer A, Anis M, Ajmal Z, Kirsten KL, Usman M, Khosa RR et al (2022) Sustainable development goals under threat? Multidimensional impact of COVID-19 on our planet and society outweigh short term global pollution reduction. Sustain Cities Soc 83:103962

Rafindadi AA, Usman O (2019) Globalization, energy use, and environmental degradation in South Africa: startling empirical evidence from the Maki-cointegration test. J Environ Manage 244:265–275

Rafindadi AA, Muye IM, Kaita RA (2018) The effects of FDI and energy consumption on environmental pollution in predominantly resource-based economies of the GCC. Sustain Energy Technol Assess 25:126–137

Rafique MZ, Li Y, Larik AR, Monaheng MP (2020) The effects of FDI, technological innovation, and financial development on CO2 emissions: evidence from the BRICS countries. Environ Sci Pollut Res 27(19):23899–23913

Sadiq M, Wen F, Bashir MF, Amin A (2022) Does nuclear energy consumption contribute to human development? Modeling the effects of public debt and trade globalization in an OECD heterogeneous panel. J Clean Prod 375:133965

Sajeev A, Kaur S (2020) Environmental sustainability, trade and economic growth in India: implications for public policy. Int Trade, Politics and Development 4(2):141–160

Saqib N, Ozturk I, Usman M, Sharif A, Razzaq A (2022) Pollution haven or halo? How European countries leverage FDI, energy, and human capital to alleviate their ecological footprint. Gondw Res 116:136–148

Sarkodie SA, Strezov V (2018) Empirical study of the environmental Kuznets curve and environmental sustainability curve hypothesis for Australia, China, Ghana and USA. J Clean Prod 201:98–110

Shahbaz M, Khan S, Ali A, Bhattacharya M (2017) The impact of globalization on CO2 emissions in China. Singap Econ Rev 62(04):929–957

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857

Shahnazi R, Shabani ZD (2021) The effects of renewable energy, spatial spillover of CO2 emissions and economic freedom on CO2 emissions in the EU. Renew Energ 169:293–307

Sharma GD, Shahbaz M, Singh S, Chopra R, Cifuentes-Faura J (2023) Investigating the nexus between green economy, sustainability, bitcoin and oil prices: contextual evidence from the United States. Resour Policy 80:103168

Simionescu M, Cifuentes-Faura J (2023) Sustainability policies to reduce pollution in energy supply and waste sectors in the V4 countries. Util Policy 82:101551

Simionescu M, Rădulescu M, Cifuentes-Faura J (2023b) Renewable energy consumption-growth nexus in European countries: a sectoral approach. Eval Rev 47(2):287–319

Simionescu M, Radulescu M, Balsalobre-Lorente D, Cifuentes-Faura J (2023a) Pollution, political instabilities and electricity price in the CEE countries during the war time. J Environ Manage 343:118206

Sinha A, Sengupta T, Alvarado R (2020) Interplay between technological innovation and environmental quality: formulating the SDG policies for next 11 economies. J Clean Prod 242:118549

Sørensen B (2011) Life-cycle analysis of energy systems: from methodology to applications. Royal Society of Chemistry

Stefanski R (2013) Structural transformation and pollution. In: Paper presented at the University of Surrey Economics Seminar. March 8

Talbi B, Jebli MB, Bashir MF, Shahzad U (2022) Does economic progress and electricity price induce electricity demand: a new appraisal in context of Tunisia. J Public Aff 22(1):e2379

Tan-Soo JS, Zhang XB, Qin P, Xie L (2019) Using electricity prices to curb industrial pollution. J Environ Manage 248:109252

Uche E, Das N, Bera P, Cifuentes-Faura J (2023) Understanding the imperativeness of environmental-related technological innovations in the FDI–environmental performance nexus. Renew Energ 206:285–294

Usman M, Radulescu M (2022) Examining the role of nuclear and renewable energy in reducing carbon footprint: does the role of technological innovation really create some difference? Sci Total Environ 841:156662

Usman M, Balsalobre-Lorente D, Jahanger A, Ahmad P (2023) Are Mercosur economies going green or going away? An empirical investigation of the association between technological innovations, energy use, natural resources and GHG emissions. Gondw Res 113:53–70

Usman M, Jahanger A, Makhdum MSA, Radulescu M, Balsalobre-Lorente D, Jianu E (2022) An empirical investigation of ecological footprint using nuclear energy, industrialization, fossil fuels and foreign direct investment. Energies 15(17):6442

Usman M, Makhdum MSA, Kousar R (2021) Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustain Cities Soc 65:102590

Van Tran N, Van Tran Q, Do LTT, Dinh LH, Do HTT (2019) Trade off between environment, energy consumption and human development: do levels of economic development matter? Energy 173:483–493

Wang J, Usman M, Saqib N, Shahbaz M, Hossain MR (2023c) Asymmetric environmental performance under economic complexity, globalization and energy consumption: Evidence from the World’s largest economically complex economy. Energy 279:128050. https://doi.org/10.1016/j.energy.2023.128050

Wang M, Hossain MR, Mohammed KS, Cifuentes-Faura J, Cai X (2023b) Heterogenous effects of circular economy, green energy and globalization on CO2 emissions: policy based analysis for sustainable development. Renew Energ 211:789–801

Wang R, Usman M, Radulescu M, Cifuentes-Faura J, Balsalobre-Lorente D (2023a) Achieving ecological sustainability through technological innovations, financial development, foreign direct investment, and energy consumption in developing European countries. Gondw Res 119:138–152

Wang Z, Gao L, Wei Z, Majeed A, Alam I (2022) How FDI and technology innovation mitigate CO2 emissions in high-tech industries: evidence from province-level data of China. Environ Sci Pollut Res 29(3):4641–4653

Wood J, Herzog I (2014) Economic freedom and air quality. Fraser Institute, Vancouver, Canada, April

Wu J, Abban OJ, Boadi AD, Charles O (2022) The effects of energy price, spatial spillover of CO2 emissions, and economic freedom on CO2 emissions in Europe: a spatial econometrics approach. Environ Sci Pollut Res 29(42):63782–63798

Xiuhui J, Raza MY (2022) Delving into Pakistan’s industrial economy and carbon mitigation: an effort toward sustainable development goals. Energ Strat Rev 41:100839

Zhang R, Yang L, Yao Y, Zheng C (2013) Gray relational analysis of industrial structure and carbon emission intensity: based on Guangzhou data. In: Proceedings of the 2013 international conference on business computing and global information, pp 1186–9

Zhang M, Mu H, Ning Y, Song Y (2009) Decomposition of energy-related CO2 emission over 1991–2006 in China. Ecol Econ 68(7):2122–2128

Zhang Z, Fu H, Xie S, Cifuentes-Faura J, Nasilloyevich UB (2023) Role of green finance and regional environmental efficiency in China. Renew Energ 214:407–415. https://doi.org/10.1016/j.renene.2023.05.076

Zhou X, Zhang J, Li J (2013) Industrial structural transformation and carbon dioxide emissions in China. Energy Policy 57:43–51

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Mihaela Simionescu: data collection; formal analysis; material preparation; Magdalena Radulescu: investigation, discussion of results, conclusions; Javier Cifuentes-Faura: investigation; writing the original draft. All authors approved the manuscript to be submitted for publication.

Corresponding author

Ethics declarations

Ethical approval

Not applicable

Consent to participate

Not applicable

Consent for publication

All authors approved the manuscript to be submitted for publication.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Simionescu, M., Radulescu, M. & Cifuentes-Faura, J. Pollution and electricity price in the EU Central and Eastern European countries: a sectoral approach. Environ Sci Pollut Res 30, 95917–95930 (2023). https://doi.org/10.1007/s11356-023-29109-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-29109-0