Abstract

This paper evaluates the importance of combining digital finance with conventional finance and information technology (IT) to bring new opportunities for green technology innovation and transformation within polluting industries. This study builds a theoretical framework “digital finance → financing constraints → R&D investment → green technology innovation” to demonstrate the causal mechanism between digital finance and firms’ green innovation by using the serial two-mediator model. The study shows that digital finance could reduce financial constraints and increase R&D investments, thereby improving enterprises’ green technology innovation in the long run. Moreover, based on the moderating effect model, we find that digital transformation in a polluting firm tends to strengthen the linkage between digital finance and green technology innovation through supervising the use of loans, reviewing green technology innovation projects, and reducing managers’ short-sighted behaviors to avoid agency problems. Furthermore, the heterogeneity analysis shows that the effects of digital finance on green innovation are more apparent in state-owned enterprises and the regions with lower financial development and with higher financial supervision.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Green technology innovation refers to the innovation that minimizes environmental damage and ensures that natural resources are used in the most effective way possible. The traditional manufacturing firms in metal smelting and heavy chemical industries are likely to negatively affect the environment in the process of resource utilization. Under the background of climate change and sustainable development goals, Chinese firms try to promote transformation and upgrading in the course of carrying out green innovation. However, these firms have difficulty obtaining loans and other financing channels to conduct an eco-effective upgrade of their existing infrastructure and equipment due to the inefficient financing market in China. In addition, local financial departments strictly restrict state-own firms’ capital and investments by adhering to profitability criteria and risk control requirements, which reduces the green technology innovation ability of traditional manufacturing industries (Feng et al. 2022a, b).

With the rapid development of big data, artificial intelligence, 5G, and other digital technologies, financial institutions are willing to offer digital finance to improve the efficiency of financial services and reduce service costs (Lin and Ma 2022). In recent years, the development of digital technology has given rise to a digital finance model, which has created a new platform for polluting firms to improve the efficient allocation of capital factors, broaden lending channels, and obtain financial support for green investments (Ding et al. 2023). Digital finance can promote technological innovation and industrial upgrading, solve the problems of corporate financing dilemmas and industrial lag, and enrich green financial services (Gomber et al. 2018). Under the policy support for sustainable development, financial institutions are likely to provide bank lending, equity financing, and green credit rating services to polluting firms that support their green and sustainable development, thereby alleviating the financing constraint of green technology innovation (Feng et al. 2022a, b).

The literature has documented that green technology innovation is affected by digital finance through macro and micro levels. From the macro perspective, existing studies mainly discuss the impact of digital finance on carbon emission and the transformation of polluting industries (Cheng et al. 2023; Li et al. 2023; Tao et al. 2022), green technology and renewable technology innovation (Borah et al. 2023; Yousaf 2021), and environmental sustainability (Hou et al. 2022; Udeagha and Muchapondwa 2023). From the micro perspective, previous studies discuss the role of digital finance in optimizing financial performance, alleviating external financial constraints, stimulating internal capital flows, and making green investments (Ding et al. 2022; Ding et al. 2023; Lin and Ma 2022).

Conventional finance has many deficiencies in promoting green innovation, but emerging digital finance is filling the gaps left by conventional finance with the support of information technology (Cao et al. 2021). The previous studies mainly focus on the short-term effect of digital finance on enterprises’ green technology innovation, but they lack in-depth discussions on its long-term effect. Moreover, previous studies only focus on the single path of digital finance to promote enterprises’ green technology innovation by easing financing constraints. To fill the research gap, this study applies the serial two-mediator model to detect the mechanism of digital finance affecting enterprises’ green technology innovation with considering changes in the internal financial decision-making and external financial environment.

The contribution of this paper to the developing literature includes three points. First, this paper further explores whether digital finance has a long-term incentive effect on enterprises’ green technology innovation. Second, this paper explores the complex mechanism of digital finance affecting green technology innovation that is different from the single mechanism test of digital finance. We construct a serial two-mediator model to test the theoretical hypotheses with the data of Chinese firms in heavy pollution industries. The multi-chain mechanism is as follows: digital finance → financing constraints → R&D investment → green technology innovation. Third, few studies concern the effect of financial supervision on the linkage between digital finance and green technology innovation. This paper empirically examines the heterogeneity between digital finance and green technology innovation under different financial supervision intensities. These scenarios are helpful to understand the new problems raised by intervention in digital finance and green technology innovation, thereby proposing possible policy solutions.

The remainder of the paper is organized as follows. The “Literature review and theoretical and hypothesis development” section provides the literature review and hypotheses. The “Data” section introduces data and variables. The “Methodologies” section shows methodologies. The “Results” section interprets empirical results and robustness tests. The “Heterogeneity analysis” section provides the heterogeneity analysis. The “Endogeneity tests” section shows the endogeneity tests. The “Moderating effect test” section shows the moderating effect test. The “Conclusions and implications” section provides a synthesized discussion of our findings, limitations, and conclusions.

Literature review and theoretical and hypothesis development

Literature review

This study focuses on the effect of financing activities on green technology innovation since financial support and services are the “fuel” of green technology innovation. Schumpeter (1912) applies the endogenous model to demonstrate the influence of financial development on technological innovation (Schumpeter and Backhaus 2003). Subsequently, the research on the relationship between financial development and technological innovation has attracted extensive attention. Some studies show that technological innovation could be impacted by the scale of financial development, the efficiency of financial development, the scale of bank loans, and the size of the stock market (Cao et al. 2022; Lee and Wang 2022; Wang and Wang 2021). However, other studies show that an effective financial system can also play a role in promoting technological innovation through information screening and project selection, risk management, incentive and supervision, and other approaches (Thakor 1996). On the other hand, weak financial development also exposes problems such as the limited coverage of traditional financial services, the imperfect development of the financial system, and the misallocation of financial resources (Liu et al. 2022; Meng and Zhang 2022). In addition, firms often encounter financing constraints when carrying out green innovation because they often face some problems, such as disclosing information and asset valuation distortion, they hardly obtain loans due to a lack of collateral (Kong et al. 2022).

Theoretical development and hypothesis development

The influence of digital finance on green technology innovation

The development of green technology innovation activities relies on financial support. However, bank credit is not always the most appropriate form of financing for new, innovative, and high-growth small and medium-scaled enterprises (SMEs). Additionally, due to the inefficient financial market in China, alternative financing tools, such as equity finance and corporate bonds, are generally underutilized by SMEs. The development of digital finance improves the quality of the traditional financial system and brings new opportunities for companies that have difficulty obtaining financial support. From the perspective of production, digital finance improves green credit capacity and strengthens green investments to fill the financing gap on green technology innovation and low-carbon transition, which results in production efficiency (Feng et al. 2022a, b; Yu and Yan 2022).

From the perspective of consumption, digital finance promotes the expansion of the consumption scale and upgrades the consumption structure (Zhang et al. 2023). With the increasing awareness of green innovation or sustainability by consumers, the demand for green products is growing fast (Flores and Jansson 2022). Based on Big Data and open bank technologies, digital finance could quickly access and analyze market information and trends. These technologies can provide immediate feedback to producers, thereby stimulating technological, product, and service upgrades and forcing green technology innovation.

From the financial institutions’ perspective, digital finance expands the depth and breadth of traditional finance to support green technology innovation of enterprises. The breadth of digital finance is reflected in the use of the Internet to open electronic accounts, eliminate space and time constraints, and provide affordable financial services (Li et al. 2022). The depth of digital finance indicates that financial institutions offer diverse types of financial services, such as microfinance, credit, bonds, and other services, to meet firms’ diversified needs (Ding et al. 2023).

From the perspective of sustainability, strict environmental regulation forces conventional firms to make green upgrades and transformations (Hou et al. 2022). On the other hand, enterprises carry out proactive green innovation to improve environmental responsibility performance and competitive advantage (Ding et al. 2023). Green digital finance is geared to finance initiatives with a sustainable development goal. The aim is to speed up the reassignment of capital to carbon–neutral assets and release new sources of climate and socially just finance.

-

Hypothesis 1: Digital finance could promote green technology innovation.

Digital finance, financial constraints, and green technology innovation

With the deep integration of traditional financial services and digital technology, digital finance can effectively alleviate information asymmetry between enterprises and financial institutions and then promote enterprise innovation and development. Kong et al. (2022) show that digital finance indirectly promotes green innovation by improving the quality of firms’ environmental information disclosure and reducing financial constraints. Specifically, digital financial institution usually works with loan-sourcing channels (or third-party data providers) to assess the creditworthiness of enterprises. Also, it will engage the channel to develop a pre-screening model to accurately evaluate and supervise the loan applications for green technology innovation projects, thus complementing the traditional credit scores and soft information used by traditional banks (Gomber et al. 2018). This pattern of digital finance not only reduces credit risk but also increases the approval rate, thus enhancing the enterprise experience by offering loan promotions and options only to whitelisted merchants from the channel. Thus, we propose hypothesis 2.

-

Hypothesis 2: Digital finance could promote green technology innovation by alleviating financing constraints.

Digital finance, R&D investment, and green technology innovation

Green innovation requires a long period of knowledge reserve and technology accumulation, but it is estimated to have low-profit margins and slow return on investments. Green R&D investment differs from other forms of investment since it carries much higher uncertainty and risks. Moreover, firms must ensure continuous investments in green innovation to prevent R&D failure, which leads to high adjustment costs of investments (Xiang et al. 2022). In the absence of sufficient financial support and incentives, knowledge spillovers and environmental protection might deprive the motivation of R&D activities and reduce the development of green technologies (Sánchez-Sellero and Bataineh 2022).

Digital finance promotes lending to enterprises and stimulates R&D investments because Internet credit intensifies bank loan competition (Ding et al. 2022). Because the competition between online and offline financial institutions has promoted banks to promote loans to firms at lower interest rates, many firms choose external finance to increase R&D investments (Yu and Yan 2022). Sufficient R&D investments could enhance employees’ awareness of green innovation and stimulate enthusiasm for green technology innovation, thereby improving their production efficiency and benefitting environmental protections. Thus, we propose hypothesis 3.

-

Hypothesis 3: Digital finance could promote corporate green technology innovation through increasing R&D investments.

Serial two-mediator model of financing constraints and R&D investment

Because R&D investments suffer from a high level of uncertainty, adverse selection, moral hazard, and agency problems, financial constraints are positively associated with R&D investments (Xiang et al. 2022). The higher level of agency problem and information asymmetry in the case of R&D investments raises the cost of external financing and makes the firm more reliant on internal financing (Hall et al. 2016). The pecking order theory shows that firms tend to increase R&D investments with internal funds primarily (Myers 1984). However, some empirical evidence shows that digital finance helps to reduce the cost of capital by mitigating financial constraints and encouraging firms to use more funds from external sources to finance R&D investments, which is a benefit for green technology innovation (Liu et al. 2022; Meng and Zhang 2022). Thus, we propose hypothesis 4.

-

Hypothesis 4: Digital finance can promote corporate green technology innovation through the channel “digital finance → financing constraint → R&D investment → green technology innovation.”

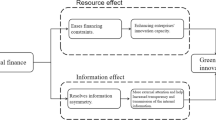

Based on the above hypothesis, this paper constructs a multiple serial two-mediator model to study the mechanism of digital finance influencing corporate green technology innovation, which is shown in Fig. 1.

Data

This paper selects the A-share listed companies from among the heavy pollution industries in China from 2012 to 2020 as the research sample. The green transformation of polluting companies and industries has an important implication for sustainable development. The data processing steps are as follows. First, the Special Treatment (ST and ST*) and Particular Transfer (PT) companies are excluded from the sample; second, we remove the samples of listed firms with missing data. Third, we remove the companies with a debt-to-asset ratio greater than 100%. All financial data and the data of green patents are obtained from the Chinese Research Data Services (CNRDS) database. The data of digital finance are obtained from the Peking University Digital Inclusive Finance Index (2012–2020) compiled by the Digital Finance Research Center of Peking University. The other macro data such as the GDP of each region are obtained from the China City Statistical Yearbook.

The dependent variable is green technology innovation, which is measured by the number of patents. The green technology innovation is equal to the number of patents plus one. Then, we take the natural logarithm. The independent variable is the digital finance index, which includes three dimensions, such as the overall digital finance index, depth of digital finance, and breadth of digital finance. We also take natural logarithms for all indexes. Moreover, to avoid endogeneity bias due to omitted variables, this study controls for several variables, such as firm age (AGE), equity concentration (EQUITY), audit opinion (OPIN), wearing two hats (MERGE), leverage ratio (LEV), total asset turnover (TURN), return on assets (ROA), and earnings per share (EPS).

Mediators are financing constraints and R&D investments. First, based on Hadlock and Pierce (2010)’s method, the financing constraint (SA) is calculated by the formula: \(\mathrm{SA}=0.043\times {\mathrm{Size}}^{2}-0.737\times \mathrm{Size}+0.04\times \mathrm{Age}\). Size is the natural logarithm of firm assets, and age is the number of operating years of firms. Second, R&D investments (RD) take a natural logarithm. The specific descriptions and descriptive statistics of the above variables are listed in Table 1.

Methodologies

Fixed effects regression models

To test the overall impact of digital finance on green technology innovation, this paper sets up the following empirical model.

where model (1) is the base model, in which the subscripts i and t denote firms and years, respectively. The core explanatory variable is the digital finance index, and the coefficient k describes the effect of digital finance on firms’ green technology innovation. Controlit represents a series of control variables, such as AGE, EQUITY, OPIN, LEV, MERGE, TURN, ROA, and EPS. \({\mathrm{FE}}_{j}\) denotes industry fixed effects, \({\mathrm{FE}}_{t}\) denotes the year fixed effect, and \({\epsilon }_{it}\) denotes the random error term.

Mediation model of financing constraints and R&D investment

To further explore the mechanism of digital finance on green technology innovation, we introduce two key mediators into the models. In the first stage, this study applies a two-step approach to examine the mediating effect. Based on the basic regression model, models (2) and (3) are constructed to test the mediating role of financing constraints on green technology innovation. Models (4) and (5) are constructed to test the mediating role of R&D investment in green technology innovation.

In the second stage, this study hypothesizes that the model including digital finance has both direct and indirect effects on green technology innovation. Additionally, there are two or more mediators, with the mediator of financial constraints being a cause of the other mediator of R&D investment. The serial two-mediator model is used to further investigate the chain mediating effect of “financing constraints → R&D investment.”

where SA denotes financing constraint and RD represents R&D investment; the mediation effect of financial constraint is equal to θ1 times β2; the mediation effect of R&D investment is equal to δ1 times φ2; the chain mediation effect of serial two-mediator (financing constraint and R&D investment) is equal to the product of θ1 times μ2 and times γ3.

Results

Baseline regression results

Table 2 reports the results of the basic model. The results in column (1) show that the coefficient of digital finance (Index) is 0.828, and it is significantly positive at the level of 1%, which means that digital finance can effectively impact firms’ green technology innovation. Moreover, this paper subdivides the digital finance index into two dimensions: coverage breadth (Breadth) and depth of use (Depth). Columns (2) and (3) show that coefficients of the Breadth and Depth are significantly positive at 0.485 and 0.696, respectively. The results show that both the coverage breadth and use depth of digital finance can stimulate green technology innovation, which confirms hypothesis 1. In order to solve the endogenous problems caused by reverse causality, we take the one-period lag of independent variables (i.e., L.Index, L.Breadth, and L.Depth) to run the robustness check. The results in columns (4)–(6) show that the coefficients (L.Index, L.Breadth, and L.Depth) are significantly positive, which is consistent with the results in columns (1)–(3). Thus, all the above results support hypothesis 1 that digital finance promotes Chinese firms’ green innovation.

Previous studies show that digital finance positively affects green technology innovation in the short term (Feng et al. 2022a, b), but few studies discuss the long-term effect of digital finance. By taking the second-order to the fifth-order lag of the digital finance index (L2.Index–L5.Index), this paper examines whether the lag period of digital finance has long-run effects on green innovation. Table 3 shows that the coefficients of digital finance (L2.Index–L5.Index) are all significantly positive, which indicates that digital finance can drive green technology innovation in the long term. This analysis increases the objectivity and reliability of the argument that digital finance promotes enterprise green technology innovation.

Mechanism analysis

Mediation of financing constraints

Based on the mediation models (2) and (3), column (2) in Table 4 shows that the coefficient of digital finance on the financial constraint (θ1) is − 0.177***, which indicates that digital finance could effectively alleviate the financing constraints. Column (3) shows that the coefficient of financial constraint on green innovation (β2) is − 0.917***, suggesting financial constraints would hinder green innovation. The mediation effect of financial constraint between digital finance and green innovation is equal to 0.162 (− 0.177 times − 0.917). Thus, digital finance can effectively drive green technology innovation through the path of easing financing constraints, which supports hypothesis 2.

Mediation of R&D investment

Column (4) shows that the coefficient of digital finance on green innovation (δ1) is 1.837***, indicating that digital finance could stimulate firms to increase their R&D investments. Column (5) shows that the coefficient of R&D (φ2) is 0.259, indicating that the increase in R&D investment could improve green innovation for high-polluting firms. The mediating effect of R&D investment between digital finance and green innovation is equal to 0.476 (1.837 times 0.259). Therefore, digital finance can stimulate green technology innovation through increasing R&D investment, which demonstrates hypothesis 3.

The multiple mediations of financial constraint and R&D investment

Column (2) in Table 4 shows that the impact of digital finance on financial constraint is − 0.177***. Column (6) shows that the coefficient of financial constraint on R&D investment is − 0.836***. Column (7) shows that the coefficient of R&D investment in green innovation is 0.249***. Thus, the multiple mediating effects of financial constraint and R&D investment are 0.037 (− 0.177 times − 0.836 times 0.249). These results support the positive multiple mediation effect of “financing constraint → R&D investment” between digital finance and green technology innovation.

Robustness tests

Tobit model

The dependent variable (the number of green patent applications) is partly continuous but with a positive mass at one or more points. Therefore, we use the Tobit model to run the robustness check. The Tobit model is usually used in a large number of applications where the dependent variable is observed to be zero in the sample. Column (1) in Table 5 shows that the coefficient of digital finance on green innovation is 1.420***. The result based on the Tobit model coincides with the above analysis.

Removing firms in municipalities

In China, there are four municipalities (i.e., Beijing, Shanghai, Chongqing, and Tianjin) directly under the central government. They have better policy support, better development space, and more resources. Firms in municipalities have relatively active green innovation activities, and the speed of digital finance development is also relatively faster. In order to eliminate the influence of municipalities on the robustness of empirical results, the firms in four municipalities are deleted. Column (2) in Table 5 shows that the coefficient of digital finance is 0.610***, which passes the 1% significance level test. The robustness result also supports hypothesis 1 after deleting the sample of municipalities directly under the central government.

Alternative-dependent variable

In order to further ensure the reliability of the regression, we apply an alternative dependent variable of green innovation by replacing the measure “the number of green patent applications” with “the number of green patents granted.” Column (3) in Table 5 shows that the coefficient of digital finance is 0.656***. The robust results support hypothesis 1 as well.

Removing the samples of firms with zero green patents in 10 years

The robustness test removes the sample with zero green patent applications during 2012–2020. The result in column (4) shows that the coefficient of digital finance is 0.730 and significantly positive at the 1% level. Thus, the green innovation driven by digital finance is still robust after deleting the samples of firms with zero green patents in the experimental period.

Heterogeneity analysis

Heterogeneity analysis based on ownership

This paper divides the sample into two subsamples to distinguish the effect of digital finance on green innovation between state-owned firms and private firms. As columns (1) and (2) in Table 6, the coefficient of digital finance on green innovation is 1.612*** in the stated-owned firms, but it is 0.505*** in private firms. From this result, we find that green innovation among state-owned firms is more affected by digital finance than that in private firms. One possible reason is that state-owned firms in China that operate in heavily polluting industries have long been subject to more government intervention and take on more social responsibility for environmental protection. At the same time, they also have better access to traditional and digital financial resources (Ding et al. 2023).

Heterogeneity analysis based on financial development

According to Jauch and Watzka (2016)’s study, financial development is measured by bank credit/GDP. Based on the median of financial development, we then divide the whole sample into two parts: firms in regions with a higher level of financial development and firms in regions with a lower level of financial development. As columns (3) and (4), the coefficient of digital finance on green innovation is 1.012*** in regions with a lower level of financial development, and it is 0.452*** in regions with a higher level of financial development. The results suggest that digital finance is more influential on green technology innovation in regions with a lower level of financial development. Because traditional financial institutions cannot meet firms’ demand for financial resources under the lower financial development, many firms face the barriers of financing constraints. However, the development of digital finance provides fair, fast, and transparent access to financial services to many small businesses as possible. Therefore, digital finance plays a greater role in areas with a low level of traditional financial services and ultimately promotes green technology innovation of enterprises.

Heterogeneity analysis based on financial supervision

The intensity of financial regulation is the ratio of regional financial supervision expenditure to the financial industry’s added value (Cao et al. 2021). Based on the median value of this ratio, this study divides the whole sample into two parts: weak financial supervision and strong financial supervision. Columns (5) in Table 6 shows that the coefficient of digital finance on green innovation is 0.528*** under weak financial supervision. Column (6) shows that the coefficient of digital finance on green innovation is 1.031*** under high financial supervision. Thus, better financial supervision not only could strengthen the function of digital finance to serve the real economy but also enhance information transparency, regulate corporate financial and investment behaviors, improve resource utilization efficiency, and promote green technology innovation.

Endogeneity tests

The most common causes of endogeneity include omitted variables, simultaneity, and selection bias in the estimated equation. On the one hand, the development of digital finance can promote green technology innovation, and green technology innovation requires more digital financial support. Therefore, there is a mutual influence between the two. On the other hand, many other factors affect green technology innovation. Although we add important control variables in model (1) to minimize the endogenous problems caused by omitted variables, there is a possibility of omitted variables, which may affect the accuracy of the regression results.

For these reasons, we employ two techniques to address endogeneity. First, put the first-order lag of digital finance into the model as the core explanatory variable. This approach may solve the endogenous problem caused by bidirectional causality. Second, we employ instrumental variables to address possible endogeneity issues. The instrumental variable needs to meet two conditions: it must be related to digital finance, and it must not be related to the random disturbance term. In order to weaken the endogeneity problem caused by omitted variables, the 2SLS instrumental variable method is used for verification. We draw on Jie et al. (2023) and apply the geographical distance from each city to Hangzhou, the origin of digital finance, as an instrumental variable. The reason is that the distance from the place of enterprise registration to Hangzhou is directly related to the city’s digital financial development level and will not affect the green technology innovation of enterprises. Therefore, the distance from the company’s registered place to Hangzhou can be used as an instrumental variable for digital finance. The results of the IV estimation still confirm the hypotheses of this paper. Please see the detailed statistical estimations in Table 7.

Moderating effect test

This study further explores the moderating effect of digitalization transformation of heavy-polluting enterprises on the relationship between digital finance and green technology innovation. Based on the agency cost theory, digital transformation reduces both external transaction costs and internal control costs while also reducing information asymmetries between managers and shareholders (Nambisan et al. 2019; Wen et al. 2021). In firms with a higher degree of digitalization, digital finance promotes green technology innovation through supervising the use of loans, reviewing green technology innovation projects, and reducing managers’ short-sighted behaviors that avoid agency problems (Su et al. 2023).

First, we design an index to show the degree of digitalization transformation for each polluting enterprise in a city. Specifically, we apply the Python crawler to obtain keywords related to digital transformation in the annual report of heavy-polluting enterprises and conduct word frequency statistics. Second, we design a moderating effect model as model (8).

Based on model (1), model (8) further introduces digital transformation (DTit) and the interaction item (Index × DT). The results are shown in columns (2) and (4) of Table (8). The coefficients of the interaction term are 0.103** and 0.030*, which pass the significance test of 5% and 10%, respectively. Hence, polluting enterprises with a higher degree of digitalization are likely to use digital finance to promote green technology innovation and transformation. Please see the detailed statistical estimations in Table 8.

Conclusions and implications

Digital finance is an important driving force for the green transformation of polluting enterprises. This study constructs a theoretical research framework of “digital finance → financing constraints → R&D investment → green technology innovation.” Also, we apply the fixed-effects model, mediation model, and serial two-mediator model to examine the mechanism of digital finance to promote green innovation or transformation for China’s heavy polluters.

We find that digital finance is conducive to alleviating financing constraints and increasing R&D investments, thereby resulting in green transformation and innovation in the long run. Moreover, through heterogeneity analysis, we find that state-owned enterprises make better use of digital finance to drive green transformation than private enterprises. Additionally, in regions with weak financial development and high financial supervision, digital finance could expand the scope and capacity of financial services to more polluting enterprises and help them realize green technology innovation.

Based on the above conclusions, this study puts forward the following policy recommendations. From the national perspective, governments should increase investments in IT infrastructure, such as the Internet, blockchain, and other digital technologies. These investments will optimize the digital financial service mechanism and effectively solve problems of information asymmetry and the difficult evaluation of green projects. Additionally, governments should promote inclusive and sustainable policies for the support of green innovation and the transformation of pollution. Moreover, regulatory agencies should design regulatory sandboxes to help green technology enterprises resist potential legal and policy risks and to shorten the time and cost of entering the market for innovative business models and products.

From the perspective of financial institutions, they should conduct in-depth research on the development characteristics of polluters and design appropriate digital products, such as digital inclusion loans and green bonds, to help them carry out green innovation activities. Green Credit Guidelines were promulgated by the China Banking Regulatory Commission (CBRC) in 2012 that encourage banks to support green, low-carbon, and recycling economies and to manage environmental and social risks in lending services. The implementation of the guidelines will make Chinese banks gain a strategic position to restructure their lending portfolios, improve service quality, and catalyze development transformation (Cheng et al. 2023). The outcome of the study might be helpful to regulators and managers of Chinese banks in embedding sustainability into their bank strategy.

From the perspective of polluting enterprises, firms should take advantage of digital banking and non-banking services, such as microfinance, venture capital, and crowdfunding, to provide adequate R&D funds for innovation. In addition, they should improve the transparent management information available and provide clear audited financial statements to alleviate the information asymmetry between the supply and demand of funds. Also, they should connect their financial credits and the information of green innovation projects with digital platforms to effectively identify the quality of green innovation and achievements of pollution transformation, so as to obtain recognition from capital market.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author upon reasonable request.

References

Borah PS, Dogbe CSK, Pomegbe WWK, Bamfo BA, Hornuvo LK (2023) Green market orientation, green innovation capability, green knowledge acquisition and green brand positioning as determinants of new product success. Eur J Innov Manag 26(2):364–385

Cao, Law SH, Samad ARBA, Mohamad WNBW, Wang J, Yang X (2022) Effect of financial development and technological innovation on green growth—analysis based on spatial Durbin model. J Clean Prod 365:132865

Cao, Nie L, Sun H, Sun W, Taghizadeh-Hesary F (2021) Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327:129458

Cheng X, Yao D, Qian Y, Wang B, Zhang D (2023) How does fintech influence carbon emissions: evidence from China’s prefecture-level cities. Int Rev Financ Anal 102655

Ding, Gu L, Peng Y (2022) Fintech, financial constraints and innovation: evidence from China. J Corp Financ 73:102194

Ding, Huang J, Chen J (2023) Does digital finance matter for corporate green investment? Evidence from heavily polluting industries in China. Energy Econ 117:106476

Feng S, Chong Y, Yu H, Ye X, Li G (2022a) Digital financial development and ecological footprint: evidence from green-biased technology innovation and environmental inclusion. J Clean Prod 380:135069

Feng S, Zhang R, Li G (2022b) Environmental decentralization, digital finance and green technology innovation. Struct Chang Econ Dyn 61:70–83

Flores PJ, Jansson J (2022) SPICe—Determinants of consumer green innovation adoption across domains: a systematic review of marketing journals and suggestions for a research agenda. Int J Consum Stud 46(5):1761–1784

Gomber P, Kauffman RJ, Parker C, Weber BW (2018) On the fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J Manag Inf Syst 35(1):220–265

Hadlock CJ, Pierce JR (2010) New evidence on measuring financial constraints: moving beyond the KZ index. Rev Financ Stud 23(5):1909–1940

Hall BH, Moncada-Paternò-Castello P, Montresor S, Vezzani A (2016) Financing constraints, R&D investments and innovative performances: new empirical evidence at the firm level for Europe. Econ Innov New Technol 25(3):183–196

Hou H, Zhu Y, Wang J, Zhang M (2022) Will green financial policy help improve China’s environmental quality? the role of digital finance and green technology innovation. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-22887-z

Jauch S, Watzka S (2016) Financial development and income inequality: a panel data approach. Empir Econ 51(1):291–314

Jie O, Liu S, Li H (2023) How does the development of digital finance affect small business tax compliance? Empirical evidence from China. China Econ Rev 101971

Kong T, Sun R, Sun G, Song Y (2022) Effects of digital finance on green innovation considering information asymmetry: an empirical study based on Chinese listed firms. Emerg Mark Financ Trade 58(15):4399–4411

Lee C-C, Wang C-S (2022) Financial development, technological innovation and energy security: evidence from Chinese provincial experience. Energy Econs 112:106161

Li, Feng S-X, Xie X (2022) Spatial effect of digital financial inclusion on the urban–rural income gap in China—analysis based on path dependence. Economic Research-Ekonomska Istraživanja 1–22

Li, Wu H, Jiang J, Zong Q (2023) Digital finance and the low-carbon energy transition (LCET) from the perspective of capital-biased technical progress. Energy Econ 120:106623

Lin B, Ma R (2022) How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J Environ Manage 320:115833

Liu J, Jiang Y, Gan S, He L, Zhang Q (2022) Can digital finance promote corporate green innovation? Environ Sci Pollut Res 29(24):35828–35840

Meng F, Zhang W (2022) Digital finance and regional green innovation: evidence from Chinese cities. Environ Sci Pollut Res 29(59):89498–89521

Myers SC (1984) Capital structure puzzle. In: National Bureau of economic research Cambridge, Mass., USA

Nambisan S, Wright M, Feldman M (2019) The digital transformation of innovation and entrepreneurship: progress, challenges and key themes. Res Policy 48(8):103773

Sánchez-Sellero P, Bataineh MJ (2022) How R&D cooperation, R&D expenditures, public funds and R&D intensity affect green innovation? Technol Anal Strategic Manag 34(9):1095–1108

Schumpeter J, Backhaus U (2003) The theory of economic development. Springer US, pp 61–116

Su J, Wei Y, Wang S, Liu Q (2023) The impact of digital transformation on the total factor productivity of heavily polluting enterprises. Sci Rep 13(1):6386

Tao R, Su C-W, Naqvi B, Rizvi SKA (2022) Can Fintech development pave the way for a transition towards low-carbon economy: a global perspective. Technol Forecast Soc Chang 174:121278

Thakor AV (1996) The design of financial systems: an overview. J Bank Finance 20(5):917–948

Udeagha MC, Muchapondwa E (2023) Green finance, fintech, and environmental sustainability: fresh policy insights from the BRICS nations. Int J Sust Dev World 1–17

Wang X, Wang Q (2021) Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour Policy 74:102436

Wen H, Lee C-C, Song Z (2021) Digitalization and environment: how does ICT affect enterprise environmental performance? Environ Sci Pollut Res 28(39):54826–54841

Xiang X, Liu C, Yang M (2022) Who is financing corporate green innovation? Int Rev Econ Financ 78:321–337

Yousaf Z (2021) Go for green: green innovation through green dynamic capabilities: accessing the mediating role of green practices and green value co-creation. Environ Sci Pollut Res 28(39):54863–54875

Yu M, Yan A (2022) Can digital finance accelerate the digital transformation of companies? From the perspective of M&A. Sustainability 14(21):14281

Zhang R, Wu K, Cao Y, Sun H (2023) Digital inclusive finance and consumption-based embodied carbon emissions: a dual perspective of consumption and industry upgrading. J Environ Manage 325:116632

Funding

This study was supported by National Natural Science Foundation of China (no. 71804096) and Natural Science Foundation of Shandong Province, China (nos. ZR2021MG028 and ZR2022QG077).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Data collection and funding acquisition were performed by Jianwei Li. The hypothesis development, methodology, and results were completed by Guoxin Zhang. The rest of the abstract, introduction, literature review, and conclusions were completed by John Ned and Lu Sui. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, J., Zhang, G., Ned, J.P. et al. How does digital finance affect green technology innovation in the polluting industry? Based on the serial two-mediator model of financing constraints and research and development (R&D) investments. Environ Sci Pollut Res 30, 74141–74152 (2023). https://doi.org/10.1007/s11356-023-27593-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27593-y