Abstract

This paper examines the asymmetric impacts of both renewable energy consumption and economic complexity on Saudi Arabia’s economic growth in nonlinear autoregressive distributed lag (NARDL) frameworks. We firstly adopt the methodology of both standard NARDL and multiple threshold NARDL (MT-NARDL) models using quarterly data over the period 2000Q1–2015Q4. Then, we test the direction of the causal relationships between the underlying variables using both symmetric and asymmetric Granger causality tests. Our results from the standard NARDL model indicate that the long-term impact of a negative shock in renewable energy consumption on economic growth is significantly negative, while the short-term impact of either positive or negative shocks has a significant positive effect. Moreover, both positive and negative shocks in economic complexity have significant negative effects on economic growth in the long term, while economic growth is only affected by the negative change in economic complexity in the short term. Our estimates based on the best MT-NARDL model indicate that, in the long run, the effect of extremely large changes in renewable energy consumption is significantly different from the effect of small changes in renewable energy consumption on Saudi Arabia’s economic growth. However, the effect of extremely large changes in economic complexity does not significantly differ from the effect of small changes in economic complexity on economic growth in the long run. Alternatively, in the short run, the effects of extremely large changes in both renewable energy consumption and economic complexity are not significantly different from the effects of small changes in those variables on economic growth. Finally, the symmetric/asymmetric causality nexus between positive/negative shocks to either renewable energy consumption or economic complexity and positive/negative shocks to economic growth is found to be neutral. The findings of this study provide deeper insights into the relationship between renewable energy consumption, economic complexity, and economic growth in Saudi Arabia and can be used for recommending different policies in the long run and short run.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The use of renewable energy is increasing all over the world due to the availability of its resources, unstable energy prices, and reduced negative effects of climate change. An increase in its use has multiple benefits for society such as mitigating climate change, reducing the emission of air pollutants, and improving energy security. Renewable energy consumption (REC) contributed to about 22% of the world’s final energy consumption by 2015 (e.g., Inglesi-Lotz and Dogan 2018; Namahoro et al. 2021; among others). Furthermore, the global demand for renewable energy is expected to rise to 31% by 2035 because of the full benefits of using renewable energy (Conti et al. 2016). Meanwhile, developed and developing countries are working in advance to increase renewable energy (Zhang et al. 2017; Khoie et al. 2019; Namahoro et al. 2021; among others).

With the increasing use of renewable energy, there has been a great deal of literature that has examined the causal nexus between REC and economic growth (EG). The analysis of the direction of causality between REC and EG has been a central theme in the energy economics literature. It provided pertinent policy implications for both energy and environmental sustainability. This causality nexus has been categorized in the light of four different hypotheses: growth, conservation, feedback, and neutrality (e.g., Kraft and Kraft 1978). The first hypothesis postulates that EG depends on REC. If this hypothesis is valid, then the energy conservation policies can adversely affect the actual path of EG because REC is an important factor of EG. The second hypothesis assumes a one-way causal impact running from EG to REC. If this hypothesis is satisfied, then the energy conservation policies will not adversely affect EG since the dependence of EG on REC is low. The third hypothesis highlights a bidirectional causality between EG and REC. Within the framework of this hypothesis, the energy conservation policies can undermine EG. Moreover, developments in EG may also affect REC. Lastly, the fourth hypothesis suggests no causality between EG and REC. The validity of this hypothesis suggests that a decrease in REC will not affect EG. Otherwise, the debate on this research problem is still alive and burning since the empirical evidence remains controversial and ambiguous (e.g., Ewing et al. 2007; Fang 2011; Yildirim et al. 2012; Pao and Fu 2013; Ocal and Aslan 2013; Tiwari 2014; Azlina et al. 2014; among others).

In this paper, we focus on Saudi Arabia’s economy with different motivations, reasons, and characteristics. Saudi Arabia has the physical capacity to control and make use of huge renewable energy sector opportunities. Under vision 2030, the National Renewable Energy Program (NREP) has initiated a strategy aimed at maximizing the renewable energy sources in the total energy budget of the country. REC has increased and has become observed. Besides, there is an acceleration of EG in most countries of the world, which needs an increase in electricity generation. For this reason, Saudi Arabia has made a strategy aimed at increasing REC by at least twofold by 2030 to keep pace with economic development and meet the increasing demand for electricity (e.g., Toumi and Toumi 2019). In light of the specific goals of Vision 2030, the NREP has set an organized and specific roadmap aimed at diversifying local energy sources, stimulating sustainable economic development, creating a new renewable energy industry, and fulfilling the Kingdom’s commitments to reduce CO2 emissions and global warming.

Otherwise, some other studies consider economic complexity as a potential channel of EG (e.g., Hidalgo and Hausmann 2009; Hausmann and Hidalgo 2011; among others). These studies provide evidence of economic complexity that led to growth. Economic complexity is related to product diversification and the country’s ability to take advantage of accumulated knowledge and endowments to diversify the country’s exports. It is a powerful indicator that captures the capabilities (human development, knowledge, innovation, trade, etc.) of the whole economy. As argued by Hidalgo and Hausmann (2009) and Hausmann and Hidalgo (2011), EG is determined by the stock of productive knowledge and skills to diversify productivity in an economy. This indicates that product diversification enhances diversified exports which in turn stimulate economic growth. In this thought base, Hidalgo and Hausmann (2009) jointly developed the Economic Complexity Index (ECI) which measures the complexity of an economy’s productive capacity. According to these authors, a lower ECI reflects an economy that is less complex and diversified in terms of productive capabilities and therefore has less impact on economic development. However, a higher ECI indicates a more complex and diversified economy which also diversifies exports and thus stimulates economic progress.

Following the Harvard Growth Lab’s annual ranking of country and product complexity, Japan, Switzerland, Germany, South Korea, and Singapore are the first ranked countries in the table with their ECI scores being higher than level 2. Interestingly, Saudi Arabia is ranked 39 in the table with a moderate ECI score of 0.62 due to the middle complex nature of the economy. Given that the ECI score is higher for the most developed countries, it is a matter of concern to raise questions since they are less endowed with natural resources. According to Gylfason and Zoega (2006), developed Asian countries like Japan, Singapore, and Hong Kong do not have their wealth from exporting primary products that have no value in the international market. Moreover, the authors argued that these economies are more complex in terms of productivity, and what constitutes their exports are manufactured products and services such as machinery and technology. Despite the moderate ECI score for Saudi Arabia, export diversification policy options for this country have not been explored in depth. Therefore, this lack of literature raises the impetus for this current study to examine whether renewable energy consumption and economic complexity have significant effects on economic growth in Saudi Arabia.

The contribution of the current study is threefold. First, we extend the frontiers of knowledge by considering the role of economic complexity in the nexus between REC and EG in Saudi Arabia. Owing to this, we contribute to the REC-EG nexus assumption by using an augmented growth model. To the best of our knowledge, this is the first study that addresses this matter and considers economic complexity as a channel of EG, while focusing on Saudi Arabia’s economy. Note that Saudi Vision 2030 provides a roadmap developed by the Kingdom to diversify investments away from oil, which recognizes that Saudi Arabia still lacks a competitive renewable energy sector at present. Indeed, the government of Saudi Arabia has promoted some energy regulations to reduce its dependence on oil exports. These measures may be affected by the sophistication of the social, economic, technical, or environmental characteristics of energy systems, and their complex social and technological dynamics. The empirical literature has emphasized that the technological process is the main basis of EG (e.g., Hidalgo et al. 2007; Hidalgo and Hausmann 2009). Second, from a methodological perspective, this study firstly uses both the NARDL (Shin et al. 2014) and MT-NARDL (e.g., Verheyen 2013; Pal and Mitra 2015, 2016, 2019; among others) models. Although the NARDL framework has been widely adopted in the empirical energy literature, its application while considering the nexus between REC and EG in Saudi Arabia is limited. Besides, to the best of our knowledge, no study has investigated such a relationship using the MT-NARDL approach. It should be stressed that both NARDL and MT-NARDL models have three main advantages: (i) They are applicable regardless of whether the underlying variables are purely integrated of order one or purely integrated of order zero or in mixed order, with the condition of not being integrated beyond order one. (ii) They allow us to estimate the transmission between the independent and dependent variables both in the short run and long run simultaneously. (iii) The MT-NARDL model takes into account the effects of the dependent variable on extreme positive and negative values of the independent variable and identifies the response to moderate changes in the independent variable. Third, policy officials and other stakeholders can gain knowledge on how to promote economic growth through the function of economic complexity and the use of renewable energies. Our empirical analysis supports policy officials’ direct policy proposals regarding maximizing the benefits of renewable energies by focusing on economic complexity.

The remainder of the paper is structured as follows; the “Literature review” section summarizes the related empirical literature. The “Data description and empirical model” section describes the data and specifies the empirical model. The “Econometric methodology” section presents the methodology. The “Empirical results” section discusses the empirical findings. The “Conclusions and policy implications” section concludes the paper with some policy recommendations.

Literature review

Renewable energy consumption-economic growth nexus

Renewable energy has become a major factor influencing EG for all international countries. Interestingly, the development and use of renewable energy turn out to be an inevitable choice in a global context characterized by energy shortage and environmental pollution. Therefore, Saudi Arabia is making more and more efforts to integrate renewable energy into the energy mix. However, these efforts give to raise the following research question: Does more REC support EG in Saudi Arabia? To answer this last question, several empirical studies have examined the causal nexus between REC and EG.

The empirical single-country studies listed in Table 1 have globally supported one of the four above-mentioned hypotheses on the causal relationship between REC and EG. However, the findings from these studies are, at best, mixed, divergent, and conflict across different countries. This divergence in empirical results is mainly due to the utilization of different data and periods, as well as to the difference in the adopted mathematical, statistical, and econometric methodologies.

Economic complexity-economic growth nexus

Economic complexity and its connection with EG represent an important and increasingly researched topic during the last decades. It has been seen as a superior reflector of the level of technological advancement or innovation in a country as well as a better determinant of its long-run EG (e.g., Abdon and Felipe 2011; Caldarelli et al. 2012; Hausmann et al. 2014; Kemeny and Storper 2014; Cristelli et al. 2015; Hartmann et al. 2017, among others).

Economic complexity was implicitly elaborated by the seminal works of Hidalgo et al. (2007) and Hausmann et al. (2007) who created a model for the network connection between products. By examining the network similarities between the exported products, they showed that products that are exported mainly by high-income countries are located in the center network, while those exported by low-income countries are located in the periphery. Given that international trade data can be interpreted as a bipartite network between countries and products, Hidalgo and Hausmann (2009) proposed the “method of reflections” to capture the level of ECI. Using this method, the ECI is measured through the reflection of economic outcomes (e.g., Hidalgo and Hausmann 2009; Hausmann et al. 2011, 2014; Mariani et al. 2015). Particularly, the level of ECI is reflected by the revealed comparative advantage or the extent to which a country effectively exports a given product. In this regard, the ECI does not stand for the quantitative aspects of economic development or the total contribution of economic sectors to the GDP (Hartmann et al. 2017). Instead, it is a more “qualitative” aspect of economic outcome (Mariani et al. 2015). According to Hidalgo and Hausmann (2009), Hausmann and Hidalgo (2010), and Hausmann et al. (2011), ECI stands for the stock of knowledge accumulated in a population (also known as product knowledge, or production complexity). Therefore, it indicates the development of productive capabilities (i.e., technological advancement) at different levels, such as individuals, organizations, and organizational networks.

Moreover, ECI offers an advantage over other indicators since it measures the competitiveness of an economy through two concepts: “diversity” and “ubiquity” of exported products (e.g., Hidalgo and Hausmann 2009; Bustos et al. 2012; Lapatinas 2019). According to these authors, the concept of “diversity’’ reflects the number of products produced and exported by a country with revealed comparative advantage, while the “ubiquity” concept stands for the number of countries that have an advantage in exporting a given product. Therefore, a country is said to be more sophisticated (complex) if it can export a wider range of products, which have relatively high ubiquity (i.e., exported by a few other countries).

The literature regarding the connection between ECI and EG started with the seminal works of Hausmann et al. (2007) and Hidalgo and Hausmann (2009). Hausmann et al. (2007) found a positive association between a country’s set of capabilities and its rate of EG and suggested that some goods have higher spillover effects than others. Expanding on this result, Hidalgo and Hausmann (2009) pointed out that the ECI reflects a country’s good level of capabilities and is a better indicator of long-term EG. This result suggests that the complexity of an economy sets an equilibrium level of income. In addition, this result has been replicated by several empirical studies using national, subnational, and international data.

At the subnational level, Poncet and de Waldemar (2013) examined the link between ECI and EG using a panel of 221 Chinese cities and various control variables. Their findings indicate that one additional standard deviation in ECI contributes to approximately 0.7% of yearly per capita EG. Balsalobre et al. (2017) found a positive connection between ECI and EG using interregional trade data from Spain. Similarly, Coniglio et al. (2016) utilized provincial data from Italy and found that one standard deviation in ECI is associated with 7–10% growth in per capita EG in a 3-year interval. Likewise, Chávez et al. (2017) showed that ECI is significant in explaining the variation of wealth among regional economies in Mexico. They also found that ECI is robust in explaining the EG in some Mexican states. Using regional data for 31 Chinese provinces between 1990 and 2015, Gao and Zhou (2018) found that ECI is linearly and positively correlated with GDP per capita, supporting that ECI is a driving force of EG. Furthermore, Lo Turco and Maggioni (2020) explored the US occupation data and found a positive association between future EG and occupational complexity. Using a panel data quantile regression methodology, Dogan et al. (2020) showed that the EG of European countries was enhanced due to ECI. Lastly, Buccellato and Corò (2020) conducted a study on European regions and drew the conclusion stipulating that economic complexity helps the convergence of lagging Eastern European regions. They also argued that economic complexity contributes to the increasing gaps between the more and the less advanced European regions.

At the national level, very few studies have looked at the connection between ECI and EG. To the best of our knowledge, only the study of Gozgor (2018) has investigated this relationship. Interestingly, a significant positive correlation has been found between ECI and EG in the US economy.

At the international level, Hidalgo and Hausmann (2009) and Simoes and Hidalgo (2011) showed that ECI has a significant and sustainable positive effect on EG. Their results also prove that ECI can explain the cross-country income differences and predict their future growth rates. Using the method of reflection suggested by Hidalgo and Hausmann (2009), Felipe et al. (2012) computed the measures of product and country complexity and ranked 5107 products and 124 countries. They argued that if the productive structure of an economy is more complex, then its production capabilities will be stronger. Besides, Felipe et al. (2012) claimed that ECI allows for predicting the future short- and long-run EG. However, Ourens (2013) pointed out that ECI can only predict the long-run EG. Furthermore, Ourens (2013) indicated that the connection between ECI and long-run EG is reproduced using six-digit trade data. Besides, Hausmann et al. (2014) proved that the causal nexus between ECI and EG is robust in controlling for competitiveness, institutions, education, export concentration, and natural resource exports. In addition, Ferrarini and Scaramozzino (2016) found that the complexity of production and its adaptability has a positive effect on the per capita income of 89 countries between 1990 and 2009. Otherwise, Stojkoski et al. (2016) reconstructed the ECI using merchandise and service exports data. Their findings reveal the existence of a positive correlation between ECI and per capita EG. In addition, Zhu and Li (2017) employed cross-country panel data for 210 countries and showed that ECI is a predictor of EG. They also found that ECI and human development depict a positive linkage with EG. Moreover, Domini (2022) calculated historical ECIs for dozens of countries using data from world fairs held in Paris from 1855 to 1900. His results indicate that one standard deviation increases in ECI contribute approximately 3–4% to future EG.

Using aggregate data from 31 OECD countries and the GMM panel VAR model, Udeogu et al. (2021) showed that ECI has a significant positive impact on EG. In addition, they suggested that a one standard deviation shock to the ECI at time 0 contributes around 2.34% to the average rate of EG within the first period, while the aggregate impact on EG is about 4.4% in the long run. According to these authors, the positive connection between ECI and EG could be explained by the fact that countries exporting complex and diverse products tend to be high-income (rich, developed) countries, while those exporting noncomplex and ubiquitous products unsurprisingly tend to be low-income (poor, developing) countries. Using cross-country data, Du and O’Connor (2021) showed that economic complexity acts as a channel through which entrepreneurship stimulates growth, and thus, they found that increasing economic complexity has a direct impact on economic progress. Lybbert and Xu (2022) proposed an innovation-adjusted ECI (i-ECI), which reflects the firms’ decisions about where to seek patent protection on industry-specific inventions and captures the firms’ perceived innovation potential in the recipient countries. They found a strong positive correlation between the i-ECI and future EG. In conclusion, the authors indicated that the i-ECI is a stronger and more statistically precise predictor of EG than the unadjusted ECI.

Lastly, Tabash et al. (2022) examined the link between natural resources, economic complexity, and economic growth in a sample of 24 African economies for the years 1995–2017. Using the system generalized method of moments (GMM) estimation method, the authors documented a positive impact of ECI on EG. Such a positive link was observed when ECI interacts with natural resources and conjunctionally affects EG.

Data description and empirical model

Data description

In the current study, we use five-time series data in annual frequency, including real Gross Domestic Product (RGDP), capital (K), the total labor force (L), REC, and ECI. Because of data availability issues, we limit our analysis to the period 2000–2015. RGDP is a proxy for EG and is measured in constant 2010 US dollars. Saudi Arabia is a high-income country, ranking as the 32nd richest economy per capita. Its 34.3 million inhabitants have a GDP per capita of $23,139 ($48,948 PPP; 2019). The growth rate of GDP per capita has averaged − 0.5% over the past five years, below regional averages. REC is defined as the sum of hydroelectric power, geothermal energy, solar energy, wind energy, and biomass energy and is measured in quadrillion BTUs. Saudi Vision 2030 currently provides a roadmap for the kingdom to diversify away from traditional energy sources, recognizing that it still lacks a competitive renewable energy sector. One of the short-term goals is to produce as much solar and wind energy by generating 9.5 gigawatts of renewable energy.

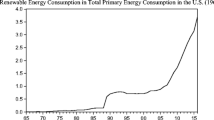

Figure 1 shows the share of REC in the total final energy consumption (TFEC) in Saudi Arabia over the period 1990 to 2015. As indicated in Fig. 1, the share of REC in TFEC has decreased over the study period. In addition, REC is almost flat from 1996 to 2015. Given that Saudi Arabia is currently making great efforts to benefit from renewable energy sources, we can expect a positive impact of REC on its EG in the long term.

K is defined as the real gross capital formation (RGCF) and is calculated in millions of constant US dollars. L is defined by the World Bank Development Indicators (WDI) as the active population including all individuals that have supplied labor and contributed to the production for a given period. It is measured by millions of people. The RGDP, RGCF, and L variables are obtained from the WDI online database. Otherwise, the REC Series is collected from the ‘Sustainable Energy for All’ online database.

Lastly, ECI measures the capabilities, productivity, and knowledge of an economy that is determined by the diversity, ubiquity, and complexity of the products it exports (e.g., Hidalgo and Hausmann 2009; Hausmann et al. 2011; Gozgor 2018; among others). Data on ECI is sourced from the Atlas of Economic Complexity database (https://atlas.cid.harvard.edu/). Saudi Arabia ranks 39th most complex country in the ECI ranking. Compared to the previous decade, the economy of Saudi Arabia has become more complex, improving 47 places in the ECI ranking (see Fig. 2). This improvement in complexity was driven by the diversification of Saudi Arabia’s exports. Going forward, Saudi Arabia is in a position to take advantage of a moderate number of opportunities to diversify its production using its existing expertise. Otherwise, Saudi Arabia is somewhat less complex than would be expected for its income level. Hence, its economy is expected to grow slowly.

Empirical model

To investigate the relationship between REC and EG, we utilize the following growth modelFootnote 1:

where \(Y\) denotes RGDP, \(K\) is proxied by RGCF, and \(L\) is the total labor force.

By dividing Eq. (1) with \(L\), we get the following expression:

where \(Y/L\) denotes the RGDP per worker, and \(K/L\) refers to the RGCF per worker.

By adding both the REC and ECI variables into Eq. (2), we get:

Equation (3) can also be parameterized as follows:

where \(\alpha\), \(\beta ,\) and \(\gamma\) stand for the elasticities of RGDP compared to RGCF, REC, and ECI, respectively.

The empirical model in Eq. (4) can be transformed into its natural logarithmic form as follows:

where \({\varepsilon }_{t}\) is a random error term.

Econometric methodology

NARDL model

Unlike the traditional ARDL cointegration model (Pesaran and Shin 1998; Pesaran et al. 2001), the NARDL approach (Shin et al. 2014) has two advantages. First, its estimation technique emphasizes asymmetric effects of potential determinants of the dependent variable from the short-term and long-term perspectives. Second, the estimation of the NARDL model is more efficient and reliable when the sample size is small. The NARDL model allows the decomposition of the positive and negative partial cumulative sum of the explanatory variables. Formally, Shin et al. (2014) introduced the following regression:

where \({y}_{t}\) is the dependent variable; \({\beta }^{+}\) and \({\beta }^{-}\) are the asymmetric long-run parameters which capture asymmetric changes; \({u}_{t}\) is a random error term; and \({x}_{t}\) denotes a \(k\times 1\) vector of several regressors such that

where \({x}_{t}^{+}\) and \({x}_{t}^{-}\) denote the partial cumulative sum of positive and negative changes in \({x}_{t}\):

Shin et al. (2014) extended the ARDL model by developing a flexible dynamic parametric framework aimed at modeling the relations exhibiting combined long-term and short-term asymmetries. Formally, they proposed the following NARDL(p,q) framework:

where \(p\) and \(q\) denote the lag orders for \({y}_{t}\) and \({x}_{t}\), respectively; \({\phi }_{j}\) is the autoregressive parameter, \({\theta }_{j}^{+}\) and \({\theta }_{j}^{-}\) stand for the asymmetrically distributed lag parameters, and \({\varepsilon }_{t}\sim iid\left(0,{\sigma }_{\varepsilon }^{2}\right)\).

The NARDL model in Eq. (11) can be rewritten in its error correction form as follows:

where \(\rho =\sum_{j=1}^{p}{\phi }_{j}-1\); \({\gamma }_{j}=-\sum_{i=j+1}^{p}{\phi }_{i}\) for \(j=1,\dots ,p-1\); \({\theta }^{+}=\sum_{j=0}^{q}{\theta }_{j}^{+}\); \({\theta }^{-}=\sum_{j=0}^{q}{\theta }_{j}^{-}\); \({\varphi }_{0}^{+}={\theta }_{0}^{+}\); \({\varphi }_{0}^{-}={\theta }_{0}^{-}\); \({\varphi }_{j}^{+}=-\sum_{i=j+1}^{q}{\theta }_{j}^{+}\) for \(j=1,\dots ,q-1\); \({\varphi }_{j}^{-}=-\sum_{i=j+1}^{q}{\theta }_{j}^{-}\) for \(j=1,\dots ,q-1\); and \({\xi }_{t}={y}_{t}-\left({\beta }^{+\mathrm{^{\prime}}}{x}_{t}^{+}+{\beta }^{-}\mathrm{^{\prime}}{x}_{t}^{-}\right)\) represents the nonlinear error correction term (ECT) such that \({\beta }^{+}=-{\theta }^{+}/\rho\) and \({\beta }^{-}=-{\theta }^{-}/\rho\).

Equation (12) can be estimated using the standard OLS since the regressors can be decomposed in their positive and negative partial sums. However, in Eq. (12), the correlation between residuals and regressors may be different from zero. To deal with this issue, Shin et al. (2014) considered the following process for \({\Delta x}_{t}\):

where \({v}_{t}\sim iid\left(0,{\Sigma }_{v}\right)\), with \({\Sigma }_{v}\) denoting a \(k\times k\) positive definite variance–covariance matrix.

Then, Shin et al. (2014) expressed the error term \({\varepsilon }_{t}\) in terms of \({v}_{t}\) as follows:

where \({v}_{t}\) is assumed to be uncorrelated with \({e}_{t}\); \({x}_{t}\) is a \(k\times 1\) vector of I(1) regressors given by Eq. (13) and \({e}_{t}\sim iid\left(0,{\sigma }_{e}^{2}\right)\).

By substituting Eq. (14) into Eq. (12), the resulting conditional NARDL-based ECM model is given by

where \({\pi }_{0}^{+}={\theta }_{0}^{+}+\omega\); \({\pi }_{0}^{-}={\theta }_{0}^{-}+\omega\); \({\pi }_{j}^{+}={\varphi }_{j}^{+}-{\omega }^{\mathrm{^{\prime}}}{{\varvec{\Lambda}}}_{j}\) for \(j=1,\dots ,q-1\); \({\pi }_{j}^{-}={\varphi }_{j}^{-}-{\omega }^{\mathrm{^{\prime}}}{{\varvec{\Lambda}}}_{j}\) for \(j=1,\dots ,q-1\); and \(\rho <0\) guarantees the dynamic stability of the NARDL-based ECM model.

To test the evidence of long- and short-term asymmetries among the series, Shin et al. (2014) used a standard Wald test for both the null hypothesis of symmetric long-run dynamics \(\left({H}_{LR}^{S}:{\beta }^{+}={\beta }^{-}=\beta \right)\) and the null hypothesis of symmetric short-run dynamics \(\left({\left(i\right)H}_{SR}^{S}:{\pi }_{j}^{+}={\pi }_{j}^{-}={\pi }_{j} \mathrm{for} j=0,\dots ,q-1 \mathrm{or }{\left(ii\right)H}_{SR}^{S}: \sum_{j=0}^{q-1}{\pi }_{j}^{+}=\sum_{j=0}^{q-1}{\pi }_{j}^{-}\right)\).

Based on the NARDL-ECM framework in Eq. (15), Shin et al. (2014) developed two bounds-testing procedures to validate the potential presence of an asymmetric long-run (cointegration) relationship. First, they followed Banerjee et al. (1998) and proposed a t-statistic, denoted as \({t}_{BDM}\), to test \({H}_{0}:\rho =0\) against \({H}_{1}:\rho <0\). If \({H}_{0}:\rho =0\) fails to be rejected, then there is no long-run relationship between \({y}_{t}\), \({x}_{t}^{+}\) and \({x}_{t}^{-}\). Second, they proposed an F-test, called the PSS bounds test, denoted as \({F}_{PSS}\), \(\left({H}_{PSS}:\rho ={\beta }^{+}={\beta }^{-}=0\right)\). If \({H}_{PSS}\) fails to be rejected, then there is no asymmetric cointegration.

Shin et al. (2014) further derived the asymmetric dynamic multipliers, which are associated with unit shocks in \({x}_{t}^{+}\) and \({x}_{t}^{-}\), respectively, on \({y}_{t}\). To do so, they considered the following ARDL-in-levels:

where \(\phi \left(L\right)=1-\sum_{i=1}^{p-1}{\phi }_{i}{L}^{i}\); \({\theta }^{+}\left(L\right)=\sum_{i=0}^{q}{\theta }_{i}^{+}{L}^{i}\) and \({\theta }^{-}\left(L\right)=\sum\nolimits_{i=0}^{q}{\theta }_{i}^{-}{L}^{i}\).

Pre-multiplying Eq. (16) by \({\phi \left(L\right)}^{-1}\), we find

where \({\lambda }^{+}\left(L\right)=\sum\nolimits_{j=0}^{\infty }{\lambda }_{j}^{+}={\phi \left(L\right)}^{-1}{\theta }^{+}\left(L\right)\) and \({\lambda }^{-}\left(L\right)=\sum_{j=0}^{\infty }{\lambda }_{j}^{-}={\phi \left(L\right)}^{-1}{\theta }^{-}\left(L\right)\).

Note that the cumulative dynamic multiplier effects of \({x}_{t}^{+}\) and \({x}_{t}^{-}\) allow describing the asymmetric adjustment paths and/or duration of the disequilibrium. They are given by

where \({m}_{h}^{+}\to {\beta }^{+}=-{\theta }^{+}/\rho\) as \(h\to \infty\) and \({m}_{h}^{-}\to {\beta }^{-}=-{\theta }^{-}/\rho\) as \(h\to \infty\).

Lastly, if the short-term symmetry is accepted, then Eq. (15) reduces to the NARDL model with long-term asymmetry:

Otherwise, if long-term symmetry is accepted, then Eq. (15) reduces to the NARDL model with short-term asymmetry:

where \(\theta =-\rho \beta\)

MT-NARDL model

The NARDL model of Shin et al. (2014) is a single threshold ARDL, which just disintegrates the independent variable \({x}_{t}\) into positive and negative partial sums. It has focused on the median value of the regressor as the threshold point. However, it does not precisely detect the spillover effect of all changes in regressors from small to large. Rather than focusing on one threshold point (whether around the median or at the median value), the two-threshold NARDL model of Verheyen (2013) has focused on two threshold points. Then, Pal and Mitra (2015, 2016) proposed the MT-NARDL model, which has focused on more than two threshold points. This model splits the regressor into different quantiles to explore the asymmetric transmission of the regressor with minor to major fluctuations.

One limitation of the MT-NARDL model is the sample size which decreases as the threshold increases. For example, a single threshold divides the estimated sample into two halves. With four thresholds, the estimated number of samples becomes one-fifth of the original, and thus, fewer samples reduce the accuracy of the estimates. Since we have 64 observations, we decompose the series into four partial sums at most. We firstly split the \({x}_{t}\) series into three partial sum series:

In Eq. (21), \({x}_{t}\left({\omega }_{1}\right)\), \({x}_{t}\left({\omega }_{2}\right)\), and \({x}_{t}\left({\omega }_{3}\right)\) are three partial sums where the 30th and 70th quantiles of the \({x}_{t}\) fluctuations are set as two thresholds given by \({\tau }_{30}\) and \({\tau }_{70}\), respectively, and derived as follows:

where \(I\left(.\right)\) is an indicator function that takes the value 1 when the conditions are expressed within the parentheses in Eqs. (22a–22c) are satisfied; otherwise, it is zero.

The splitting of \({x}_{t}\) fluctuation in two quantiles is expressed in a NARDL framework as follows:

where \(k=j+1\).

Equation (23) refers to the two thresholds NARDl model. The cointegration among the long-run variables of Eq. (23) can be tested using the following the null hypothesis \({H}_{0}:{\theta }_{1}={\theta }_{2}={\theta }_{3}={\theta }_{4}=0\). To perform the bound tests for cointegration, we use the critical values provided by Pesaran et al. (2001) and Shin et al. (2014). Furthermore, we use the Wald test to assess the short-run asymmetry using the null hypothesis \({H}_{0}:{\varphi }_{2i}={\varphi }_{3i}={\varphi }_{4i}\). We also employ the Wald test to evaluate the long-run asymmetry by testing the null hypothesis \({H}_{0}:{\theta }_{2}={\theta }_{3}={\theta }_{4}\).

To determine whether the impact of large changes in \({x}_{t}\) differs significantly from the effect of smaller changes in \({x}_{t}\) on \({y}_{t}\), we further decompose the exogenous variable (changes in \({x}_{t}\)) in quartiles by setting three thresholds. The splitting of the \({x}_{t}\) series into four partial sum series is given as follows:

In Eq. (24), \({x}_{t}\left({\omega }_{1}\right)\), \({x}_{t}\left({\omega }_{2}\right)\), \({x}_{t}\left({\omega }_{3}\right)\), and \({x}_{t}\left({\omega }_{4}\right)\) are four partial sums where the 25th, 50th, and 75th quartiles of the changes in \({x}_{t}\) are set as three thresholds given by \({\tau }_{25}\), \({\tau }_{50}\), and \({\tau }_{75}\), respectively, and derived as follows:

where \(I\left(.\right)\) is an indicator function that takes the value 1 when the conditions within the parentheses in Eqs. (25a–25d) are satisfied; otherwise, it is zero.

The splitting of \({x}_{t}\) fluctuation in quartiles is expressed in an NARDL framework as follows:

where \(k=j+1\).

Equation (26) refers to the three thresholds NARDL model. To validate the cointegration relationship among variables in Eq. (26), we test the null hypothesis \({H}_{0}:{\theta }_{1}={\theta }_{2}={\theta }_{3}={\theta }_{4}={\theta }_{5}=0\). We perform the bound tests for cointegration using the critical values suggested by Pesaran et al. (2001) and Shin et al. (2014). Next, we assess the short-run asymmetry using the Wald test under the null hypothesis \({H}_{0}:{\varphi }_{2i}={\varphi }_{3i}={\varphi }_{4i}={\varphi }_{5i}\). Finally, we evaluate the long-run asymmetry using the Wald test under the null hypothesis \({H}_{0}:{\theta }_{2}={\theta }_{3}={\theta }_{4}={\theta }_{5}\).

For the MT-NARDL model implementation, we follow the same steps as described for the NARDL approach. First, we estimate Eq. (23) and Eq. (26) using the OLS technique. Second, we estimate the cointegration relationship using the standard Wald test. Therefore, we obtain the F-statistic and compare it with the asymptotic upper bound critical value. Lastly, we apply the Wald test to examine whether the effect of change in \({x}_{t}\) is symmetric or asymmetric on \({y}_{t}\) both in the long run and the short run.

Asymmetric causality test

Granger and Yoon (2002) developed the idea of transforming data into both cumulative positive and negative shocks to test for (hidden) cointegration. This approach has been extended to causality analysis by Hatemi-J (2012). In this vein, causality is considered asymmetric insofar as positive and negative changes may have different causal effects. Let assume \({y}_{1t}\) and \({y}_{2t}\) be two integrated variables. To inspect the causality between these series, Hatemi-J (2012) assumed that \({y}_{1t}\) and \({y}_{2t}\) are expected to follow the following random walk processes:

where \(t=1,\dots ,T\) refers to the period; \({y}_{\mathrm{1,0}}\) and \({y}_{\mathrm{2,0}}\) are the constants; and \({\varepsilon }_{1,i}\) and \({\varepsilon }_{2,i}\) denote the white noise disturbance terms.

Hatemi-J (2012) defined positive and negative shocks as follows:

Therefore, \({\varepsilon }_{1,i}\) and \({\varepsilon }_{2,i}\) can be expressed as follows:

Substituting Eq. (30) into Eq. (27) and Eq. (31) into Eq. (28), we get the following processes:

Lastly, the positive and negative shocks of each series can be defined as follows:

It should be stressed that positive and negative shocks have permanent impacts on the underlying variables. The next step is to test the causality between positive cumulative shocks as well as between negative cumulative shocks. Let us assume \({y}_{t}^{+}=\left({y}_{1,i}^{+},{y}_{2,i}^{+}\right)\). Testing for asymmetric causality can be done using a VAR(p) model:

where \({y}_{t}^{+}\) denotes the \(2\times 1\) vector of variables, \(\upsilon\) is the \(2\times 1\) vector of intercepts, \({A}_{r}\) is a \(2\times 2\) matrix of parameters for lag order \(r=1,\dots ,p\), and \({u}_{t}^{+}\) is a \(2\times 1\) vector of error terms.

To select the optimal lag order \(p\), Hatemi-J (2003, 2008, 2012) proposed the following Hatemi-J criterion (HJC):

where \({\widehat{\Omega }}_{j}\) represents the estimated covariance matrix of the error terms in the VAR(p) model based on lag order \(j\); \(n\) denotes the number of equations in the VAR(p) model; and \(T\) is the number of observations.

To test the null hypothesis that the \(k\) th element of \({y}_{t}^{+}\) does not Granger cause the \(\omega\) th element of \({y}_{t}^{+}\), Hatemi-J (2012) used a VAR(p) approach, which is given by

where \(Y:=\left({y}_{1}^{+},\dots ,{y}_{T}^{+}\right)\) is a \(\left(n\times T\right)\) matrix; \(D:=\left(\upsilon ,{A}_{1},\dots ,{A}_{p}\right)\) is a \(\left(n\times \left(1+np\right)\right)\) matrix; \(Z:=\left({Z}_{0},\dots ,{Z}_{t-1}\right)\) is a \(\left(\left(1+np\right)\times T\right)\) matrix with \({Z}_{t}:={\left(\begin{array}{ccc}1& {y}_{t}^{+}& {y}_{t-1}^{+}\end{array}\begin{array}{cc}\cdots & {y}_{t-p+1}^{+}\end{array}\right)}^{^{\prime}}\) is a \(\left(\left(1+np\right)\times 1\right)\) matrix for \(t=1,\dots ,T\); and \(\delta :=\left({u}_{1}^{+},\dots ,{u}_{T}^{+}\right)\) is a \(\left(n\times T\right)\) matrix.

The null hypothesis of non-Granger causality is given as \({H}_{0}:C\beta =0\) and is tested using the following Wald test statistic:

where \(\otimes\) is the Kronecker product, \(\beta =vec\left(D\right)\), \(C\) is a \(\left(p\times n\left(1+np\right)\right)\) indicator matrix, and \({S}_{U}=\frac{{\widehat{\delta }}_{U}^{'}{\widehat{\delta }}_{U}}{T-q}\) denotes the estimated covariance matrix of the unrestricted VAR(p) model, with \(q\) representing the number of parameters in each equation of the VAR model.

According to Hatemi-J (2012), if the normality assumption is satisfied, then \(Wald{\sim \chi }^{2}\left(p\right)\). However, if the variables are not normally distributed, then the bootstrapping simulation technique is the solution to remedy this issue. On the other hand, \({H}_{0}:C\beta =0\) is rejected if the calculated Wald test statistic is higher than their corresponding critical values.

Empirical results

Summary statistics

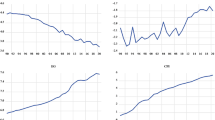

In the current study, we first convert the yearly time series into quarterly data using a quadratic match-sum approach, which is particularly appropriate to avoid both the small sample and seasonality problems (Shahbaz et al. 2017). This method is also preferred to other interpolation alternatives due to its convenient operating procedure. Then, we convert all quarterly variables to their natural logarithm to ensure better distributional properties. Figure 3 illustrates the time trend of the quarterly series from 2000Q1 to 2015Q4. Both RGCF and REC show positive upward trends, while RGDP and ECI indicate an alternation of negative downward and upward trends over the sample period. Furthermore, from 2010, REC began to play a significant role in the energy mix of Saudi Arabia.

Table 1 reports the descriptive statistics of the series. The mean and median values of RGDP, RGCF, and REC are positive and quite similar, while ECI is found to be negative to the same degree. RGDP reveals the highest average, followed by RGCF, REC, and ECI. It is also found that ECI is the most volatile series when compared to the other variables. RGDP is found to be the less volatile series, indicating that RGDP has been stable from 2000Q1 to 2015Q4 in Saudi Arabia. For each variable, the 10-Trim value is close to the mean, while the IQR shows the nonexistence of both severe and mild outliers in the data series. Moreover, all variables have asymmetric distribution. They also exhibit a negative skewness, indicating that their distribution is skewed toward the left. The Excess kurtosis values show that all variables follow a platykurtic distribution. Moreover, the outcomes of the JB, SW, SW’, and S/K normality tests generally lean toward the conclusion that the normality assumption can be rejected. Based on the characteristics of the series, it seems necessary to rely on asymmetric methods.

The outcomes of the correlation analysis are also depicted in Table 1. They show that all variables have a significant correlation with each other. A moderate negative and significant correlation was found between RGCF and RGDP. Furthermore, a strong negative correlation is observed between REC and RGDP as well as between ECI and RGDP. In addition, the positive and significant correlations between RGCF and REC and between ECI and REC are regarded as very strong. Lastly, a significant moderate positive correlation was shown between REC and ECI (Table 2).

Next, we check the unit root properties of the series before testing for cointegration. Note that the ARDL/NARDL approaches can be applied for time series that are purely stationary, i.e., I(0), or purely integrated of order 1, i.e., I(1), or that have a mixture of I(0) and I(1).Footnote 2 Nevertheless, they cannot be applied for series that are integrated of order 2, i.e., I(2) because the bounds testing cointegration approach becomes invalid in this case (Ibrahim 2015; Rasheed et al. 2019, among others). To ensure that none of the underlying variables is I(2), we first perform the ADF, PP, and KPSS unit root tests (Dickey and Fuller 1979; Phillips and Perron 1988; Kwiatkowski et al. 1992). As illustrated in Table 3, the outcomes of the ADF test show that the non-stationary property of all variables, i.e., I(1), is checked in the level, with intercept, as well as with trend and intercept, respectively. In addition, the results confirm that none of the underlying variables is I(2). For the PP test, the outcomes indicate that all series are in a mixed order when considering intercept, and trend and intercept assumptions, respectively. The same conclusion holds for the results of the KPSS test when considering intercept and trend assumptions.

Otherwise, the results of the ADF, PP, and KPSS unit root tests may be misleading, biased, and inconsistent due to the existence of possible structural breaks in the data series (Perron, 1989; Rappoport and Reichlin 1989; Narayan and Popp 2010, among others). To remedy this problem, we use the augmented ADF-type unit root test of Narayan and Popp (2010) which considers innovational outliers and assumes unknown structural break dates. The main advantage of this test is that its associated critical values (CVs) converge with increasing sample size to the CVs when structural break dates are known. Meanwhile, Narayan and Popp (2013) showed that Narayan and Popp’s (2010) unit root test is superior to other conventional and structural break unit root tests (e.g., Perron 1989, 1997; Zivot and Andrews 1992; Schmidt and Phillips 1992; Lumsdaine and Papell 1997; Lee and Strazicich 2001, 2003, 2013; Popp 2008) since it has better size properties and high power in accurately identifying the structural break dates.

The findings outlined in Table 4 show that the variables are I(0), assuming two unknown structural breaks in both the level and slope of the trending series, respectively. As the underlying variables examined in this study are integrated in mixed order, the nexus between RGCF, REC, ECI, and RGDP can be analyzed using the ARDL-type model. Therefore, the ARDL/NARDL bounds tests (Pesaran et al. 2001; Shin et al. 2014) can be applied reliably.

The key structural break dates are 2006Q2 and 2010Q3 for EG, 2004Q4 and 2007Q3 for RGCF, 2005Q3 and 2010Q3 for REC, and 2008Q3 and 2013Q1 for ECI. The structural break date 2006Q2 may be linked with Saudi Arabia’s capital market crash of 2006, also known as the “Black February,” which was an important event in the economic and political life of the Kingdom. Similarly, the structural break date 2010Q3 refers to the period of the 2007–2010 global financial crisis, which has been considered the worst crisis since the Great Depression of the 1930s.

Finally, we check for linearity or nonlinearity of the data series before performing the regression models. We confirm the nonlinearity pattern of the considered variables using the BDS test for independence suggested by Brock et al. (1996). The outcomes reported in Table 5 indicate that all the underlying variables are found to be nonlinearly dependent on all embedding dimensions.

NARDL results

After performing unit root analysis, we proceed to the asymmetric cointegration analysis based on the NARDL specification. We use a general-to-specific modeling strategy in selecting the suitable NARDL model, starting from a maximum length of \(p=q=4\). We examine the potential asymmetric long-run (cointegration) relationship between the series using the \({t}_{BDM}\) test of Banerjee et al. (1998) and the \({F}_{PSS}\) test of Pesaran et al. (2001), suggested by Shin et al. (2014). The results, outlined in Table 6, show that the values of both the \({F}_{PSS}\) and \({t}_{BDM}\) test statistics exceed the upper CVs of the bounds calculated by Pesaran et al. (2001) at the 1% significance level. Therefore, we conclude to the existence of a valid asymmetric long-run relationship between RGCF, REC, ECI, and RGDP in Saudi Arabia.

Additionally, we use a Wald-type test to capture both long- and short-run asymmetries between the series. The findings shown in Table 7 indicate that both the null hypotheses of no asymmetry in both the long- and short-run coefficients (\({H}_{LR}^{S}:{\beta }_{X}^{+}={\beta }_{X}^{-}\) and \({H}_{SR}^{S}: \sum_{j=0}^{q}{\pi }_{j,X}^{+}=\sum_{j=0}^{q}{\pi }_{j,X}^{-}\), respectively) are rejected for all variables. This finding indicates that EG responds to all variables in an asymmetric and nonlinear manner in both the long run and short run. Accordingly, our empirical findings confirm the relevance of the asymmetric NARDL model. Then, we analyze both the long- and short-run estimates of the selected NARDL(3,2,1,2,4,0,4) model with structural breaks, along with diagnostic tests. The two break dummies (\({D}_{2006,Q2}\) and \({D}_{2010,Q3}\)) are incorporated in the NARDL model as fixed regressors to account for break dates.

The findings reported in Table 8 show that the long-term effect of a positive change in REC on RGDP is positive, inelastic, but not significant. The estimated long-run coefficient of \(\mathrm{ln}{REC}_{t-1}^{+}\) is found to be 0.0122, suggesting that a 1% rise in REC will increase Saudi Arabia’s long-run EG by 1.22%. This finding is consistent with the results of Luqman et al. (2019) and Abbasi et al. (2020) on the Pakistani economy. However, it contradicts those of Baz et al. (2021) who found a negative effect of positive shocks in REC on Pakistani’s long-run EG. Therefore, any positive shock to REC would stimulate growth and development in the economy of Saudi Arabia. In the long run, we also find that a negative change in REC has a significant negative impact on Saudi Arabia’s EG. The estimated long-run coefficient of \(\mathrm{ln}{REC}_{t-1}^{-}\) is found to be − 2.4879, revealing that any fall in REC will reduce Saudi Arabia’s long-run EG. This negative coefficient shows that any decrease in REC will hamper Saudi Arabia’s long-run EG. Our results contradict those of Luqman et al. (2019), Abbasi et al. (2020), and Baz et al. (2021) who indicated that negative shocks in REC would promote Pakistani’s long-run EG.

The sign of both positive and negative coefficients of \(\mathrm{ln}{REC}_{t-1}\) is not the same and different in magnitude (in terms of absolute values), suggesting that REC has a significant asymmetric impact on RGDP. In this regard, the government authorities and policymakers should make big efforts to shift to renewable energy sources to improve the growth of the economy and to prevail over environmental degradation. In this vein, they should start generating electricity from renewable resources and focus on installing the latest technologies for energy efficiency. In addition, they should enable investors in terms of licensing fees, creating companies, landing acquisitions, and supplying connections to the grid.

Otherwise, positive shocks to RGCF have significant negative effects on the long-run RGDP. This result suggests that an increase in RGCF would hamper Saudi Arabia’s EG in the long term. This result corroborates the findings of Baz et al. (2021) who found a negative relationship between positive shocks in RGCF and Pakistani’s long-term EG. Alternatively, our results contradict those of Sahoo and Dash (2009) and Shahbaz et al. (2017) for India, and Luqman et al. (2019) for Pakistan, who noted the existence of a positive association between positive shocks in RGCF and EG in the long run. In this regard, both government and policymakers should monitor the capital investments and promote policies designed to achieve the highest sustainable EG in the long term. Alternatively, a negative shock to RGCF has a significant positive effect on Saudi Arabia’s long-run RGDP. Therefore, a decrease in RGCF would boost the long-run EG in Saudi Arabia. This finding is consistent with those of Shahbaz et al. (2017) on the Indian economy. It also corroborates with the results of Luqman et al. (2019) and Baz et al. (2021) on the Pakistani economy. It should be stressed that a negative shock in RGCF (i.e., a capital shortage) combined with excess labor in some sectors of the economy may harm the long-run EG. It is possible to avoid this situation via good connectivity between the different sectors of the economy by absorbing the labor abundance from one sector to another sector for its production purposes. Such a solution implies that a negative shock to RGCF may still generate a positive effect on long-run EG in Saudi Arabia. Lastly, the association between a positive/negative shock to the ECI and RGDP is found to be negative, inelastic, and significant at the 1% significance level. This finding suggests that any rise in ECI will hamper Saudi Arabia’s long-run EG. Therefore, any policy in Saudi Arabia aiming at increasing the level of ECI will not contribute to EG. Our findings contradict the recent results of Zhu and Li (2017), Gozgor (2018), Dogan et al. (2020), and Udeogu et al. (2021) who found that ECI has a significant positive impact on long-term EG. As such, policymakers and government authorities in Saudi Arabia should consider ECI as an important factor in EG in the long term. To do so, they should elaborate long-term strategies to enhance innovation in goods and services through diversifying exports and exporting high-tech products.

Turning now to the short-run analysis, the findings show that a positive shock in REC is statistically significant, inelastic, and positively linked to RGDP (a coefficient of 0.1462). This result indicates that a 1% increase in REC at lag 0 will rise Saudi Arabia’s short-run EG by 14.62%. A similar finding was obtained for Pakistan (Baz et al. 2021). By contrast, the short-run effect of a positive shock in REC on RGDP at lag 1 is negative, inelastic, and significant at the 1% level. This finding suggests that a 1% increase in REC at lag 1 lowers EG by 33.93% in the short term. Similar results were obtained for Pakistan (Luqman et al. 2019). As such, any ignorance of REC may harm the EG of Saudi Arabia. Based on this result, policymakers in Saudi Arabia should introduce renewable energy technologies as a possible way to control energy deficiency. On the other hand, we find that negative shocks to REC in the previous periods (lags 0, 1, 2, and 3) are positively related to RGDP in the short term. This outcome implies that any effort to decrease renewable energy use in productive activities will stimulate and boost Saudi Arabia’s EG in the short term. These findings contradict those of Luqman et al. (2019) and Baz et al. (2021) who found a negative correlation between negative changes in REC and EG in Pakistan. Based on these results, we recommend that renewable energy has a motivating role in the development of economic activities. As such, policymakers and government should be vigilant in utilizing REC efficiently in different production sectors through the appropriate and effective channels.

Regarding the RGCF, positive shocks have a significant negative effect on RGDP in the very short term (a coefficient of − 0.1340 at lag 0). This finding corroborates with the results of Baz et al. (2021), but it contradicts the findings of Shahbaz et al. (2017) and Luqman et al. (2019). However, a positive shock in RGCF in the previous period (lag 1) is positively associated with EG (a coefficient of 0.1015). A reverse conclusion was drawn by Shahbaz et al. (2017), Luqman et al. (2019), and Baz et al. (2021). Our empirical results highlight the important role of capital use and its contribution to the short-run EG since any positive shock to RGCF in the previous period will hurt EG in the next period. Otherwise, the relationship between a negative shock to the RGCF and RGDP in the same period is found to be positive, inelastic, and statistically significant at the 1% level (a coefficient of 0.2230). This result is also consistent with the findings for Pakistan (Shahbaz et al. 2017; Luqman et al. 2019; Baz et al. 2021). In this regard, policymakers and government should be cautious when planning a short-term policy about capital investment.

Alternatively, negative changes in ECI increase RGDP in the same period (coefficient of 0.051 at lag 0) as well as in previous periods (coefficients of 0.116, 0.1179, and 0.1165 at lags 1, 2, and 3, respectively). Our results confirm that ECI improves the short-run EG in Saudi Arabia. The positive impacts of ECI on RGDP have been confirmed by the results of prior studies such as Hausmann et al. (2007), Agosin (2009), Hidalgo and Hausmann (2009), Hartmann (2014), and Hartmann et al. (2016, 2017). Our findings are also consistent with the recent results of Gozgor (2018) who found that ECI is positively linked to EG for the USA in the short term. Furthermore, our results are close to those of Zhu and Li (2017) for 210 countries, where they have found that an increase in ECI contributes to greater short-term EG. On policy grounds, we suggest that government and policymakers in Saudi Arabia should promote the ECI since it can prompt EG in the short term. Lastly, the results indicate that the two-dummy variables (\({D}_{2006,Q2}\) and \({D}_{2010,Q3}\)) have significant positive impacts on EG (coefficients of 0.045 and 0.0069). This outcome indicates that the measures taken by the government in the 2006s and 2010s have improved domestic production and, in turn, EG.

Otherwise, the ECT is important in adjustments to the equilibrium since it helps us to know how speedily variables converge to equilibrium. The results show that the estimated coefficient of \({ECT}_{t-1}\) is negative, inelastic, and statistically significant at the 1% level. This coefficient also indicates that the RGDP per worker in Saudi Arabia converges to its long-run equilibrium by a speed of adjustment through the channels of RGCF, REC, and ECI. The coefficient of − 0.4260 shows that 42.6% of the short-run deviations from the long-run equilibrium are corrected in a quarter. On the other hand, the adjustment speed is computed as the inverse of the absolute value of the ECT. It represents, in quarters, how long it takes for deviations from disequilibrium to return to equilibrium (Pao and Tsai 2010). In our study, when there is a deviation from long-run equilibrium, it can take approximately 2.35 quarters (i.e., 1/0.426) to return to equilibrium.

From the empirical findings in Table 8, we also conclude that the NARDL model is well satisfactory since approximately 82% \(({\overline{R} }^{2}=0.8194)\) of RGDP dynamics is explained by RGCF, REC, and ECI. Additionally, we take a look at residual diagnostics to approve the adequacy of the selected NARDL model, such as residual normality, serial correlation, heteroscedasticity, model specification, and model stability. The results outlined in Table 6 provide evidence that the retained NARDL model appears to be suitable since it does not suffer from any of the above issues. The outcomes of the Breusch-Godfrey test as well as the Durbin-Watson statistic indicate that the NARDL model is free from serial correlation problems. Also, the results of the ARCH and Breusch-Pagan-Godfrey tests reveal the absence of conditional heteroskedasticity in the residuals of the NARDL model. Moreover, the findings of the Jarque–Bera test confirm the residual normality. Besides, the Ramsey RESET test statistic is not statistically significant, suggesting that the NARDL model is correctly specified. Furthermore, the F-statistic further confirms the appropriateness of the NARDL model specification.

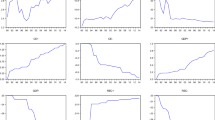

We further use both the cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) tests to examine the stability of the regression. The results, displayed in Fig. 4, show that the blue line lies within the 5% critical boundaries, suggesting the stability of the estimated NARDL model. Moreover, the estimated coefficient of \(\mathrm{ln}{RGDP}_{t-1}\) is negative and statistically significant at the 1% level, which also confirms the stability of the NARDL model.

Finally, we plot in Fig. 5 the asymmetric cumulative dynamic multipliers which show the patterns of the dynamic adjustment of RGDP to changes in RGCF, REC, and ECI shocks from the initial equilibrium to the new long-run equilibrium. Both positive and negative dynamic multipliers are estimated based on the best-fitted NARDL model giving the smallest AIC. They are represented by the thick and dotted black lines. The positive and negative curves capture the dynamic adjustment of RGDP to positive and negative shocks of the underlying variables at a given forecast horizon, respectively. In our paper, the cumulative multipliers are carried out using 15 horizons that correspond to 15 quarters. Note that the difference between the dynamic multipliers related to positive and negative shocks, i.e., \({m}_{h}^{+}-{m}_{h}^{-}\), represents the asymmetric curve (strong dotted red line), which is shown with its critical (lower and upper) bounds (thin red lines) at a 95% bootstrap confidence interval.

As shown in Fig. 5, all the graphs validate the significant asymmetric response of RGDP to shocks in RGCF, REC, and ECI. The empirical findings disclose that the cumulative effects of easing REC or a negative change in REC dominate the cumulative effects of tightening REC or a positive change in REC. In particular, the positive REC shocks have marginal positive effects on RGDP. However, the negative REC shocks have greater positive effects on RGDP. These findings reveal the existence of a negative nexus between REC and RGDP in Saudi Arabia. Moreover, an overall positive association is observed between RGCF and RGDP. The impact of a positive change in RGCF dominates that of a negative change. Furthermore, an overall negative relationship exists between ECI and RGDP in Saudi Arabia since negative shocks in ECI dominate the positive shocks in RGDP.

MT-NARDL results

Starting from the idea that the effects of the regressors may differ from extremely low to extremely large changes, we also employ the MT-NARDL model in our estimations. With this model, we provide fresh evidence and a more robust analysis of the preceding results. We firstly introduce two thresholds, namely the 30th and 70th quantiles, to decompose both REC and ECI variables into three partial sums. Then, we decompose these variables into four partial sums. The application of the MT-NARDL model is well justified since the selected variables are found to achieve stationarity in order, not beyond the first difference.

The estimation and diagnostic results of the two thresholds NARDL model are reported in Table 9 based on Eq. (23). Our empirical findings indicate that, in the long run, changes in REC contribute significantly to EG in Saudi Arabia. At the upper threshold, a 1% change in REC decreases the RGDP by 1.0043%. However, at the middle and lower thresholds, a proportionate change in REC results in respectively 2.8432% and 0.1944% increases in RGDP. Remarkably, the effects of REC on RGDP are greater in the upper quantile than in the lower quantile. This finding suggests that EG potentials through the REC vanish at the lower threshold. Findings from the two thresholds NARDL model also indicate that changes in ECI contribute significantly to EG in Saudi Arabia by reducing its RGDP at all threshold levels in the long run. Interestingly, the impacts are found to be greater in the lower quantile than in the upper quantile. This implies that economic growth potentials of economic complexity fizzle out at the upper threshold. Regarding the control variables, the long-run coefficient of RGCF has a significant negative impact on EG in Saudi Arabia. A 1% change in RGCF leads to a 0.1917% decrease in EG.

In the short run, the upper quantile of REC leads to decreasing RGDP; however, such effect fizzles out at the lower quantile. Furthermore, the results indicate that changes in ECI at different periods significantly increase Saudi Arabia’s EG at only the lower quantile in the short run. Lastly, changes in RGCF result in significant negative changes in RGDP at the current period, while their short-run impacts at lagged periods are found to be positive and statistically significant.

The Wald tests for asymmetry (\({W}_{LR}\) and \({W}_{SR}\)) at panel D from Table 9 provides strong evidence to reject the null hypothesis of symmetry in both the long run and short run for both REC and ECI variables. This implies that the effects of REC and ECI on RGDP in Saudi Arabia are asymmetric in both the long run and short run. The diagnostic tests in the lower panel (panel E) from Table 9, including the normality, heteroscedasticity, serial correlation, and stability tests, conform with the required standards, implying that the estimates are robust. Otherwise, the adjusted coefficient of determination recorded in the MT-NARDL model with two thresholds (\({\overline{R} }^{2}=72.3\%\)) as against 81.94% recorded in the standard NARDL model indicates that the latter model still gives a better account of the relationship between the variables.

We further decompose both REC and ECI variables into quartile series (four partial sums) to probe for more robust estimations. The empirical findings from two-quantile decompositions are almost similar to that of quartile decompositions (see Table 9). Notably, at the third (upper) quantile, a change in REC contributes significantly to EG in the long run. Specifically, a 1% change in REC at the 3rd quartile leads to a 1.1077% increase in RGDP. The results also indicate that in the long run, changes in ECI contribute significantly to EG in Saudi Arabia by reducing its RGDP. At both the lower and upper thresholds, a 1% change in ECI leads to decreases in RGDP by − 0.2752% and − 0.2499%, respectively. In particular, the impacts are greater in the upper quartile than in the lower quartile. Moreover, the EG potentials of ECI fizzle out at the lower threshold. Lastly, the impact of RGCF on RGDP is found to be significantly negative in the long run.

In the short run, the effects of REC on RGDP vary considerably between positive and negative with the passage of time and threshold. Notably, the most non-desirable impact is recorded in the second quartile. A similar result is observed for the short-run impacts of ECI on RGDP. In particular, the most desirable effect is recorded in the first quartile. Finally, the effects of RGCF on RGDP are varying in the short run.

The results of the Wald tests (\({W}_{LR}\) and \({W}_{SR}\)) indicate that the null hypothesis of symmetry fails to be accepted in both the long run and short run for the ECI variable. Such findings imply that the impact of ECI on RGDP in Saudi Arabia is asymmetric in both time dimensions. However, the null hypothesis fails to be rejected in the short run for the REC variable. Therefore, the effects of REC on RGDP are found to be symmetric in the short run, while they are asymmetric in the long run. Besides, all post-estimation tests point to a very robust analysis and prove the superiority of the MT-NARDL model with three thresholds to the standard NARDL model. This dominance is confirmed by comparing the values of \({\overline{R} }^{2}\) recorded in both models. Comparatively, the goodness of fits recorded in the MT-NARDL model with three thresholds is found to be stronger than those recorded in the first two models. This further proves the superiority of the quartile decomposed series to the two quantile-decomposed series and the single threshold ARDL models.

To sum up, we collect the results for the standard NARDL and MT-NARDL models with both two and three thresholds in Tables 10 and 11. Regarding Tables 8 and 9, all \({F}_{PSS}\), \({t}_{BDM}\), and F-statistics, used for testing the cointegrated relationships, are tabulated in Table 10. The cointegration relationship between the underlying variables is confirmed to be held for Saudi Arabia.

In Table 11, we also capture all \({W}_{LR}\) and \({W}_{SR}\) values from Tables 7 and 9 to compare the strength of asymmetry both in the long run and short run. The nulls of symmetry are rejected for both REC and ECI variables in the long run, implying strong asymmetric transmission between REC, ECI, and RGDP changes. In the short run, the nulls of no asymmetry are rejected at the 1% level for the ECI variable, implying strong asymmetric transmission between EG and ECI changes. Nevertheless, the asymmetric effect between REC and EG is found to be weak.

Causality analysis

In this sub-section, we apply both the symmetric and asymmetric bootstrap Granger causality tests suggested by Hacker and Hatemi-J (2006, 2012) and Hatemi-J (2012), respectively. The findings displayed in Table 12 show evidence of a neutral effect in symmetric analysis between REC and RGDP. This finding indicates that REC does not hamper Saudi Arabia’s economy since fossil fuel energy sources have a greater share in Saudi Arabia’s energy mix. It corroborates with the results of Bulut and Muratoglu (2018) and Baz et al. (2021) for Turkish and Pakistani economies, respectively. A similar neutral effect is observed for ECI and EG in symmetric causality analysis, revealing that ECI has no role in Saudi Arabia’s economy. Table 12 also reports that RGCF does not Granger cause RGDP in Saudi Arabia. This result is consistent with the findings of Bulut and Muratoglu (2018) on the Turkish economy. However, our findings contradict the results of Shahbaz et al. (2017) and Baz et al. (2021) who found respectively bidirectional and unidirectional causal relationships between EG and capital use in Pakistan.

To examine the potential asymmetric causal nexus between EG and the remaining series, we utilize Hatemi-J’s (2012) test. The findings summarized in Table 12 indicate that the asymmetric causality between positive shocks in REC and RGDP is not significant. Therefore, the underlying relationship seems to be neutral since increasing RGDP does not depend on positive shocks to REC, and vice versa. Similarly, a negative shock in REC does not Granger cause a negative shock in RGDP. Accordingly, the asymmetric causal linkage between RGDP and REC in Saudi Arabia is neutral. Our findings support the results of Bulut and Muratoglu (2018) who showed that neither positive shocks nor negative shocks in REC Granger cause the corresponding positive and negative shocks in Turkish EG. However, our results contradict the findings of Baz et al. (2021) who found a feedback effect between REC and Pakistani EG for positive shocks.

Regarding the causal relationship between RGDP and capital use, we find a neutral causal effect between positive/negative shocks in RGDP and RGCF. Such a finding has also been drawn by Shahbaz et al. (2017) and Bulut and Muratoglu (2018). Finally, the asymmetric causal hypothesis reveals no significant relationship between positive shocks to ECI and RGDP. Similarly, no causality is found between negative shocks to ECI and RGDP. These results suggest a neutral causal effect of ECI on RGDP in Saudi Arabia.

Conclusions and policy implications

To the best of our knowledge, this is the first empirical study that examined the asymmetric effects of ECI on the relationship between REC and EG in Saudi Arabia. For this purpose, we firstly used the conventional NARDL approach which captures the potential asymmetric effects of the considered variables on EG in Saudi Arabia. Preliminary results indicate that EG reacts to all considered independent variables in an asymmetric and nonlinear manner in both the short run and long run, thus validating the appropriateness of the asymmetric NARDL model. Besides, our empirical findings show that the short- and long-run effects of a positive chock in REC on EG significantly differ from both the short- and long-run effects of a negative chock. This outcome is not consistent with the impact of ECI. In the long run, both positive and negative shocks in ECI have significant negative effects on EG. However, EG is only influenced by the negative shock in ECI in the short run. Furthermore, the size of the impact of a positive change in both REC and ECI is found to be higher than the effect of a negative shock in the long term.

In a second step, we used an advanced technique like the MT-NARDL model (Pal and Mitra 2015, 2016). Compared to traditional NARDL, which decomposes the regressor to a positive and negative partial sum, the MT-NARDL takes into account the short-run and long-run effects of extremely large-to-moderate changes in regressors on the dependent variable. We split both REC and ECI changes into three and four partial sums to yield exact evaluations and more detailed outcomes. The empirical findings from the best MT-NARDL model support a very strong cointegration relationship between the underlying variables. In the long run, the asymmetric effect between ECI, REC, and EG is found to be strong. Changes in ECI contribute significantly to EG, with the effects being particularly bigger in the upper quartile than in the lower quartile. However, in the short run, the asymmetric effect is very strong while considering the ECI variable, while it is found weaker with REC. The effects of both REC and ECI on EG vary considerably between positive and negative over time and threshold. The most undesirable effect of REC is recorded in the second quartile, while the most desirable impact of ECI is recorded in the first quartile.

Lastly, we extended the analysis to the symmetric/asymmetric causality nexus of REC, ECI, and EG by exploring these relationships in Saudi Arabia. The results derived from the symmetric Bootstrap Granger causality test (Hacker and Hatemi-J 2006, 2012) approve the existence of a neutrality hypothesis between EG and REC as well as between EG and ECI. These results reveal no role of both REC and ECI in Saudi Arabia’s economy. The same conclusion was drawn when using the asymmetric Bootstrap Granger causality test (Hatemi-J 2012).

The empirical findings of this study reveal some important policy implications. For Saudi Arabia, investing in renewable energy is a long-term strategic initiative supporting the Kingdom’s vision of 2030. Such a strategy will make it possible to produce affordable, safe, and sustainable energy, which will contribute to promoting sustainable development in the long term. However, Saudi Arabia is still highly dependent on oil resources, which reveals the need to change the direction of financing to renewable energy producers to increase the share of renewable energy in the global energy mix. Saudi Arabia plans to invest approximately 380 billion riyals ($101 billion) in renewable energy projects and another 142 billion riyals in energy distribution until 2030. Also, Saudi Arabia aims for 50% renewable energy by 2030 and backs a huge tree-planting initiative. Policymakers should promote the diversification of Saudi Arabia’s energy mix since it will reduce the Kingdom’s dependence on oil and its greenhouse gas emissions. Moreover, such an action will allow job creation and catalyze economic development, supporting the Kingdom’s long-term prosperity in line with Vision 2030’s goals. Policymakers should also promote the creation of a new renewable energy technology industry and support the build-up of this promising sector through harnessing private sector investment and encouraging public–private partnerships. Finally, investment in renewable energy sources should also be encouraged to address the challenges of environmental degradation and the depletion of traditional sources of energy.

The results presented in this study indicate that ECI enhances EG in Saudi Arabia. Otherwise, they offer a new dimension for Saudi Arabia to promote its economic development. Particularly, given that ECI hurts the long-run income changes, policymakers should have a long-term vision by making long-run strategies aimed at inventing (or producing) new goods and services. Nevertheless, this does not mean that the government should change its current industrial (production) policy. Instead, policymakers should construct their strategies based on the current available productive capabilities in the economy. When building these long-term strategies, the country must maintain and improve the positive short-term impact of ECI so that its long-term impact can be felt. Moreover, the country must realize that it may take a lot of time for the system to return to its equilibrium, especially when there is a shock in the long-term relationship. Therefore, there exists a slight trade-off when choosing between the short term and the long term. However, as our findings suggest, the best way to achieve prosperity and development is to take advantage of ECI in the short run and try to enhance it in the long run.

Our empirical study has some limitations that should be recognized but also identifies promising avenues for future research. First, because some reference variables were unavailable before 2000 and after 2015, the period used in this study was limited to only 16 years. Future research should employ a larger data set with a longer period and re-test the validity of our results. Second, future research should consider the effects of disaggregated measures of renewable energy on EG. Third, future studies may incorporate the environmental degradation caused by EG. The main research question needing more investigation is how the EG resulting from REC and ECI may impact the environment and Saudi Arabia’s commitment to the Paris Agreement (COP21). Finally, in the current work, we investigated only one dimension of ECI. Future works should examine other dimensions of ECI such as ECI + (Nguyen et al. 2021) and i-ECI (Lybbert and Xu, 2022).

Data availability

The data is available on request from the corresponding author.

Notes

References

Abbasi K, Jiao Z, Shahbaz M, Khan A (2020) Asymmetric impact of renewable and non-renewable energy on economic growth in Pakistan: new evidence from a nonlinear analysis. Energy Explor Exploit 38(5):1946–1967

Abdon A, Felipe J (2011) The product space: what does it say about the opportunities for growth and structural transformation of Sub-saharan Africa? (Levy Economics Institute Working Paper Archive No, wp_670. https://ideas.repec.org/p/lev/wrkpap/wp_670.html.

Agosin MR (2009) Export diversification and growth in emerging economies. CEPAL Rev 97:115–131

Apergis N, Payne JE (2010a) Renewable energy consumption and growth in Eurasia. Energy Econ 32(6):1392–1397

Apergis N, Payne JE (2010b) Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Energy Pol 38(1):656–660

Apergis N, Payne JE (2011b) The renewable energy consumption–growth nexus in Central America. Appl Energy 88:343–347

Apergis N, Payne JE (2012b) Renewable and non-renewable energy consumption-growth nexus: evidence from a panel error correction model. Energy Econ 34(3):733–738