Abstract

Green merger and acquisition (GMA) is becoming a growing tendency for heavily polluting enterprises in recent years; however, the realization path of green transformation through GMA is still unexplored. Taking 48 Chinese heavily polluting enterprises that had GMA in 2018 as the research object, this paper constructs the “M&A attributes, Organizational characteristics, and External environment” (M-O-E) framework, by using the method of fuzzy-set qualitative comparative analysis (fsQCA) to reveal the configurations of conditions that lead to high levels of green innovation performance. The results show that the high green technology innovation performance after GMA of heavily polluting enterprises is the outcome of multiple antecedents, and no singular antecedent is sufficient for achieving it. Besides, there are three equivalent configurations of conditions to achieve green transformation: professional buyer, internal leading, and internal-external linkage. Among them, the professional buyer configuration highlights that the combination of M&A experience and M&A scale is of great importance, the internal leading configuration emphasizes that the existence of environmental awareness and organizational resources is the core conditions, and the internal-external linkage configuration requires simultaneous efforts of M&A experience and government environmental regulations. Our research contributes to the understanding of green transformation in heavily polluting enterprises from a configurational perspective, and provides a practice-oriented guide to achieve green transformation for the government and heavily polluting enterprises.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

With severe climate warming and environmental pollution (Yu and Khan 2021a; Yu et al. 2021b), green transformation has become a widely discussed topic around the world (Lu 2021; Yu and Khan 2021b; Schipper and Silvius 2021). In order to achieve green transformation, the government has developed stringent environmental regulations to constrain corporate behavior. In this context, an increasing number of heavily polluting enterprises tend to obtain cleaner production equipment, green technology, and management experience through green merger and acquisition (GMA), thereby addressing the demand for green transformation (Li et al. 2020; Zhao and Jia 2022). As a consequence, exploring the realization path of green transformation through GMA is of practical significance.

Green transformation is considered an effective approach to reducing severe environmental risks, such as pollution problems, and excessive resource exploitation (Vargas-Hernández et al. 2021). Scholars predominately examine the driving factors of green transformation from external and internal environments. Previous studies have pointed out that government subsidies have a positive influence on green sustainable development (Xie et al. 2019), and this effect is more prominent for green product innovation (Hu et al. 2021). Through strict environmental regulations, the government can stimulate enterprises to conduct green innovation (Ren et al. 2018), especially for enterprises with small-scale, poor governance structure or weak profitability (Fang et al. 2021). In addition, green finance is also beneficial to environmental innovation (D’Orazio and Valente 2019). In terms of internal factors, several scholars propose that green innovation requires a major expenditure of resources (Glaser et al. 2013; Cainelli et al. 2015; McGahan 2021), and internal corporate governance acts as a mediator to reduce environmental damage (Forcadell et al. 2020; Jacoby et al. 2019). Despite existing research focused extensively on the driver of green transformation, there were few studies that examined this topic from the perspective of GMA.

GMA, as a form of M&A, is a green investment model that combines traditional technological M&A with the concept of environmental protection (Salvi et al. 2018). Compared with other forms of green management activities, GMA has an obvious advantage in speed (Li et al. 2020). Through GMA, heavily polluting enterprises can quickly absorb advanced green production equipment and technology from merged enterprises and realize greener production in a short time, improving their green innovation ability and green image (Chen 2008) and guaranteeing the pursuit of economic benefits (Hao et al. 2021). Contrarily, other scholars are skeptical about this viewpoint. Pan et al. (2019a) argue that GMA is just a strategic response of heavily polluting enterprises to media pressure, rather than substantive green transformation and upgrading. In particular, some enterprises implement GMA out of policy arbitrage, which leads to the environmental performance afterwards not improving significantly (Huang and Yuan 2021). It is apparent that the impact of GMA on green transformation is controversial. This ambiguous conclusion leads us to wonder whether existing studies have ignored the motivations and specific scenarios of GMA.

Moreover, prior studies on GMA and enterprise green transformation primarily used the regression analysis method (Pan et al. 2019a; Li et al. 2020; Zhao and Jia 2022), focusing on the “net effect” of one or several factors on the dependent variable, which ignores the interactions and complementarities among multiple factors and is inconsistent with reality (Khedhaouria and Thurik 2017). As a result, enterprises are confused about how to adopt GMA to realize green transformation.

Against this backdrop, we aim to address the following questions: firstly, what are the key factors of an enterprise’s transformation through GMA, and can a single condition in isolation be sufficient for successful transformation? Secondly, for enterprises conducting GMA, what are the effective paths to achieve a successful green transformation? Thirdly, for heterogeneous enterprises with different motivations and specific scenarios, are these paths equivalent? To solve these problems, we construct the “M-O-E” integration analysis framework based on the sample of China’s heavily polluting enterprises that conducted GMA in 2018. Using fuzzy-set qualitative comparative analysis (fsQCA), this paper explores the “joint effect” of six antecedents on the green innovation performance through GMA, as well as the complementary and substitutive relationships among these conditions, thus revealing the pragmatic equivalent paths for heavily polluting enterprises to achieve green transformation through GMA.

We consider China’s heavily polluting enterprises as the research sample for three reasons. Firstly, China, a high-carbon emitting country in the world (Khan et al. 2021a; Wu and Lin 2022), has incorporated environmental responsibility into official performance evaluation and announced the goal of “carbon neutrality” by 2060 at the 75th UN General Assembly. It is urgent for China’s heavily polluting enterprises to achieve green transformation. Secondly, as the largest developing country in the world, China shares the same characteristics as other developing countries in energy consumption and economic development. Its practice of green transformation has been an important inspiration for other developing countries in the world. Thirdly, the practice of heavily polluting enterprises’ GMA in China has developed rapidly in recent years, which provides a perfect situation for research. According to the statistics of the China Stock Market & Accounting Research Database (https://www.gtarsc.com/)Footnote 1, from 2006 to 2018, there were 1926 M&A in China’s heavily polluting industries, of which 404 were GMA, accounting for 20.98%. The annual distribution of GMA of heavily polluting enterprises in China from 2006 to 2018 is depicted in Fig. 1. We can see that the number of GMAs of heavily polluting enterprises continues to fluctuate, and the overall trend is upward. Consequently, with the rise of GMA in practice, GMA for Chinese samples is also of great value.

Our study provides significant contributions in two ways. Firstly, from a theoretical perspective, we propose a comprehensive framework based on the “M-O-E” dimension and a holistic approach based on fsQCA to determine the configurations of conditions that lead to high levels of green innovation. We enriched the research literature in the fields of GMA and enterprise green transformation. Secondly, from a practical perspective, this study provides valuable insights for heavily polluting enterprises’ green transformation through GMA. Existing studies generally conclude which factors are beneficial to green transformation, making enterprises very confused about which factors could jointly achieve this goal, so they still do not know what to do next. By examining multiple antecedents from a configurational perspective, this study appropriately overcomes this deficiency and shares pragmatic equivalent paths for heterogeneous enterprises to achieve green transformation.

The structure of the remainder is as follows: the “Literature review” section reviews the existing literature. The “Research design” section presents the data source, research methods, and research variables. The “Data analysis and results” section presents the paths to high green innovation performance. The configurations of conditions for achieving high levels of green innovation performance are discussed in the “Discussion” section. The “Conclusions, policy implications, and future research” section concludes.

Literature review

GMA and green innovation

Green transformation is also called green innovation or ecological innovation. Scholars have primarily studied the factors that influence green innovation (Jones et al. 2021; Khan et al. 2021b): first, external factors, such as government subsidies (Bellucci et al. 2019; Greco et al. 2017; Howell 2017; Kveton and Horak 2018; Wang et al. 2017), environmental regulations (Fang et al. 2021; Ren et al. 2018; Shao et al. 2020; Xie et al. 2017), low-carbon initiatives (Khan et al. 2022), and bank loans (D’Orazio and Valente 2019; Zhang et al. 2019). Second, in terms of internal factors, corporate governance structure (Forcadell et al. 2020; Jacoby et al. 2019), organizational resources (Bradley et al. 2011; Cainelli et al. 2015; Glaser et al. 2013; McGahan 2021), and environmental awareness (Sarkis et al. 2010; Tseng et al. 2013; Yang and Liu 2021; Zameer et al. 2021) have been analyzed by scholars. Unfortunately, there are only a few studies concerning GMA’s influence on green innovation.

In the context of increasingly stringent environmental regulations, heavily polluting enterprises are increasingly inclined to GMA, which facilitates rapid green transformation and enhances competitive advantage compared to other green management activities (Li et al. 2020). Instead of spending on new technology development, new product development, improving production lines, and hiring skilled workers, it not only saves the cost of green management activities, but increases the efficiency of green transformation (Li et al. 2020; Zhao and Jia 2022). Therefore, the enterprise, as an acquirer, can acquire the clean production equipment and advanced technology of the target and contribute to its own green transformation and upgrading (Lu 2021). In addition, GMA effectively enhances the organizational legitimacy of an enterprise (Li et al. 2020), making it more acceptable for governments and the public to access resources and further promoting green innovation.

MOE framework

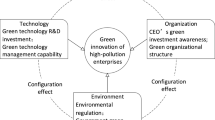

Tornatizky and Fleischer (1990) put forward a TOE integration analysis framework and pointed out that the factors influencing technological innovation mainly include three types: technological conditions, organizational conditions, and environmental conditions. Since they did not restrict the specific variables for each type of factor in the framework, researchers were able to adjust them according to their research, with greater flexibility and operability. Consequently, the framework has been widely used in the areas of business performance, supply chain system selection, and business model innovation (Awa and Ojiabo 2016; Wang et al. 2016; Yeo and Grant 2019). Therefore, we intend to adjust the explanatory variables from M&A characteristics (M), organizational characteristics (O), and external environment (E), combined with China’s green innovation development practice, and to construct a GMA innovation performance analysis framework (MOE) for heavily polluting enterprises. We explain each element in turn.

(M) M&A attributes

Previous research on M&A characteristics emphasized the importance of M&A experience and transaction scale. M&A experience is the business operation mode formed during the M&A process, as well as the M&A ability demonstrated during the M&A process (Basuil and Datta 2015), which focuses on how to acquire knowledge and skills related to M&A. The relationship between M&A experience and acquisition performance is ambiguous. According to organizational learning theory, prior acquisition experience benefits enterprises not only in various aspects of the acquisition process in subsequent transactions, but also in absorbing new information and technology related to targets (Barkema and Schijven 2008; Basuil and Datta 2019), thereby promoting post-M&A performance. Especially for cross-border and cross-industry M&A, acquisition experience can effectively overcome the “outsider disadvantage” of the acquired enterprises (Collins et al. 2009; Kang and Padmanabhan 2005). On the other hand, learning transfer theory denotes that positive outcomes only result from similar experiences (Ellis et al. 2011). When acquisition experience is misapplied to a new situation, it may incur “far transfers” and value destruction (Basuil and Datta 2015), which is bad for green innovation. Therefore, Bettinazzi and Zollo (2021) propose that the features of experience, such as experience homogeneity and the proximity to the knowledge domain, act as boundary conditions on the relationship between M&A experience and acquisition performance.

With respect to transaction scale, it has been confirmed that it is one of the important factors that affect decision complexity, technology absorption difficulty, and post-M&A risk integration (Ellis et al. 2011), which in turn fosters green innovation. Some scholars argue that relatively large acquisitions could provide important benefits for the acquirer (Bae et al. 2013; Basuil and Datta 2019; Colombage et al. 2014; Dutta et al. 2013). However, other scholars have found either negative or no significant evidence between transaction scale and acquisition performance (Danbolt and Maciver 2012; Tanja et al. 2011). Meanwhile, there is convincing evidence that large acquisitions undermine the value of the acquirer and that the increased complexity of consolidating large enterprises may make the expected synergies of mergers more uncertain (Alexandridis et al. 2013), which is disadvantageous to the development of green innovation in enterprises.

(O) Organizational characteristics

In terms of organizational characteristics, organizational resources and executives’ environmental awareness play dominant roles in green innovation. An enterprise is a combination of resources, and the heterogeneous resources are a source of competitive advantage (Glaser et al. 2013). The existing research on the impact of organizational resources on green innovation mainly focuses on two aspects: on the one hand, based on resource-based theory, slack resources provide an informal way to offer support for green innovation activities, which is an important factor influencing the green innovation of enterprises (McGahan 2021). Besides, as a potential “buffer,” organizational slack resources ensure that green innovation does not lead to direct financial distress even if it does not succeed (Bradley et al. 2011; Cainelli et al. 2015). Principal-agent theory, in contrast, assumes that when organizational slack resources are greater than expected, enterprises tend to search for and seize external opportunities to consume these resources (Wu and Hu 2020). This leads to “opportunity-seeking” behavior, which often leads to the phenomenon of “reduced” green innovation efforts (Salge and Vera 2013).

Top executives’ environmental awareness is a tangible representation of senior management’s awareness of the impact of climate change. According to the upper echelon theory, executives are important predictors of organizational strategic choices and performance levels, and the environmental awareness of top executives is the concrete manifestation of senior management’s awareness. Managers with high environmental awareness have an open and supportive attitude towards green innovation (Sarkis et al. 2010; Zameer et al. 2021), are good at encoding and integrating information with corporate resources (Kocabasoglu et al. 2007), absorbing knowledge from within and outside the organization and applying it to green innovation, and giving a proactive response to environmental issues (Tseng et al. 2013; Yang and Liu 2021).

(E) External environment

As a key external factor influencing green innovation, the government usually adopts environmental regulation policies in combination with government support policies to maximize incentives for enterprises to conduct green innovation and improve their green innovation efficiency, of which the most important policies are environmental regulations and government innovation subsidies (Liao 2018). Currently, there are three main conclusions about the relationship between environmental regulations and green innovation: Firstly, environmental regulations can promote green innovation in enterprises (Fang et al. 2021; Ren et al. 2018; Xie et al. 2017) through increasing their R&D investment in green innovation (Borsatto and Amui 2019; Chakraborty and Chatterjee 2017) and improving energy efficiency (Pan et al. 2019b). Secondly, environmental regulations can discourage technological innovation (Borghesi et al. 2015; Cainelli and Mazzanti 2013; Lanoie et al. 2011), because they increase normal operating costs and reduce profits, thereby cutting down on innovation enthusiasm. Thirdly, the impact of environmental regulations on green innovation is non-linear, namely there is a non-monotonic or non-significant correlation between them (Amores-Salvado et al. 2015; Blind 2012; Shang et al. 2021). Consequently, evolutionary economics argues that not all environmental regulations lead to green innovation because enterprises have different characteristics and therefore generate different rules of conduct (Shao et al. 2020), and in the short and long term, the impact of environmental regulations on green innovation is different.

Despite numerous studies have addressed the relationship between government subsidies and innovation, the conclusions are inconsistent (Wu and Hu 2020). Compared with general innovation, green innovation requires higher costs. Under increasingly stringent environmental regulations, government green innovation subsidies can help finance green innovation and reduce the cost of green innovation (Bellucci et al. 2019), which stimulates the enthusiasm of enterprises to implement green innovation activities (Greco et al. 2017; Kveton and Horak 2018). Contrarily, there is convincing evidence that government subsidies are “crowded out” as a result of weak supervision, thus leading to high rent-seeking costs (Howell 2017; Wang et al. 2017), which is bad for innovation, especially for green innovation. In addition, there is a non-linear dynamic relationship between government innovation subsidies and green innovation, which mainly depends on enterprise heterogeneity (Howell 2017).

Through reviewing the previous studies, we can find the following research gaps that need to be addressed: (1) the existing literature mainly explores the factors influencing green transformation from the perspective of regression analysis, but ignores the interaction and complementarity effects of the antecedents. (2) The existing research generally demonstrates which factors are conducive to green transformation while others are not, which fails to reveal the path to achieving green transformation for heterogeneous enterprises. Therefore, this paper uses the fsQCA method to explore how multiple antecedents interact with each other to shape heavily polluting enterprises’ engagement in green innovation, thus guiding heavily polluting enterprises on how to select an appropriate path to achieve green transformation. Figure 2 is the research framework of this paper.

Research design

Data source and sample selection

This paper covers China’s GMA samples of heavily polluting enterprises in 2018. The reasons are as follows: firstly, heavily polluting enterprises are critical targets of China’s Ministry of Environmental Protection, and their GMAs are typical for others. Secondly, on January 1, 2018, the Environmental Protection Tax Law of the People’s Republic of China came into effect, which is the strictest environmental protection law in history. Under the increased pressure of environmental regulations, heavily polluting enterprises are more inclined to adopt GMA. Third, up to now, some GMAs for 2019 and beyond are still in progress.

According to the announcements from the Ministry of Environmental Protection in its Circular on Environmental Protection Verification of Listed Companies and Listed Companies Applying for Refinancing, heavily polluting industries are defined as thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, building materials, mining, chemicals, petrochemicals, pharmaceuticals, paper, fermentation, sugar, vegetable oil processing, brewing, textile, and leather industries. Firstly, we select the M&A data of heavily polluting enterprises from the CSMAR database, and then filter them as follows: (1) removing samples where the acquirer enterprises are ST and *ST; (2) removing samples where the trading status of listed companies is the buyer; (3) removing samples of failed M&A transactions; (4) excluding M&A samples of asset divestiture, debt restructuring, asset replacement, and share repurchase; and (5) merging the same samples of the same enterprise in the same year. Secondly, by manually consulting the M&A announcements of heavily polluting enterprises, using the content analysis method to comprehensively analyze the purpose of each M&A, the business scope of the target enterprise, and the possible impact of the M&A on the acquirer enterprise, we can determine whether the M&A event is a GMA. Finally, we obtained 48 samples of GMA in 2018.

The data in this paper comes from several databases: green innovation data comes from the official website of China’s State Intellectual Property Office (https://www.cnipa.gov.cn/); environmental awareness and M&A data come from the China Stock Market & Accounting Research Database (CSMAR); environmental regulations data comes from the official website of the Shenzhen Stock Exchange (http://www.szse.cn/). Part of the missing data is collected manually through the official websites of listed companies, Eastmoney (http://www.eastmoney.com) and Hexun Finance (http://www.hexun.com).

Table 1 shows the industry’s distribution of samples for this study. The samples of 48 heavily polluting enterprises with GMA are mainly concentrated in the industries of non-metallic mineral products and electric power (C30), heat production, and supply (D44), 19 of which accounted for 39.58%. Meanwhile, the total transaction amount of the electricity and heat production and supply industry is the largest, amounting to RMB 2730,240,500, with an average transaction amount of RMB 248,203,680. With only one enterprise and just a transaction amount of RMB 40,379,600, the textile industry (C17) possesses the lowest transaction amount.

Research methods

In view of the difficulty of traditional regression analysis in answering the question of “Under which conditions will GMA produce high green innovation performance?”, this paper attempts to employ the fuzzy-set QCA method in qualitative comparative analysis (QCA) to overcome this deficiency. The reasons for choosing this method are as follows: (1) QCA is a method of analyzing problems from the perspective of configuration. The existing research on green innovation performance generally adopts the regression analysis approach, focusing on the “net effect” of one or several factors on the outcome variables, which ignores the mutual interactions and complementarities among multiple factors (Khedhaouria and Thurik 2017). The QCA approach takes a holistic perspective and a combinatorial mindset (Mendel and Korjani 2013), focusing on what happens when multiple factors interact with each other and what can happen when different factors are jointed together to lead to the same result, namely the heterogeneous paths equivalence problem with the same goal but different paths (Douglas et al. 2020; Rihoux and Ragin 2009). (2) QCA is a mathematical set analysis method. Compared with the traditional regression method, the QCA method combines the advantages of quantitative and qualitative research (Ragin 1987). The necessity and sufficiency between the outcome variables and the antecedent variables are analyzed by using the idea of a mathematical set, the perfect combination of theory and practice. Different from the traditional correlation between the outcome variables and the antecedent variables, it emphasizes the asymmetrical causal relations (Misangyi et al. 2017). (3) There are three types of QCA methods: crisp-set QCA (csQCA), multi-value QCA (mvQCA), and fuzzy-set QCA (fsQCA). Given that the subject of this paper contains continuous variables, the use of the fuzzy-set QCA better reflects the effect of changes in the degree of different antecedent variables on the outcomes (Schneider and Wagemann 2012).

Research variables

Outcome

Green innovation performance (GP)

Since patents are the main form of representing enterprises’ innovation achievements and since the data sources of patents are more objective and accurate than other indicators, we measure green innovation performance by the number of green patent applications throughout the year (Hirshleifer et al. 2012). According to the patent announcement of the State Intellectual Property Office, the number of patent applications in the year before the GMA, the year in which the GMA was conducted, the year after the GMA, and the 2 years after the GMA were searched one by one according to the stock codes and names of the selected heavily polluting enterprises. Based on the contents of the patent applications, we determine whether they belong to the fields of clean production, ecological agriculture, pollution control, environmental monitoring, and other green patents (including green utility model patents and green invention patents). Assuming t is the year of GMA, the green innovation performance after GMA is the difference between the average number of green patent applications in the year t, 1 year after GMA (t+1), and the number of green patent applications in the year before GMA (t-1).

Conditions

(1) GMA experience (EX)

Considering the changing external market environment and regulatory environment, the experience accumulated through GMA in the earlier years is of little significance to the reference of GMA in the sample period of this study. Therefore, this paper defines the experience of GMA of heavily polluting enterprises in 2006 as the cut-off point. Firstly, by using the M&A data in the CSMAR database to screen out all the M&A transactions of the selected heavily polluting enterprises since 2006, and then carefully reading their M&A announcements, based on the description of M&A transactions from the websites of listed companies, Eastmoney and Hexun Finance, we can judge whether GMA transactions have taken place before 2018. If there has been GMA, the EX value is 1, otherwise 0. In fact, except for Zhejiang KAN Special Materials Co., Ltd. (stock code: 002012) in 2009, other enterprises’ GMA experience is in 2013 and later, indicating that the accumulated GMA experience for this study period is valuable.

(2) Size of M&A (BY)

It reflects the amount paid by the acquirer enterprise to acquire the assets or technology of the acquired enterprise during the process of GMA. We use the natural logarithm after the value of the buyer’s expenditure plus 1 to measure the scale of M&A.

(3) Environmental awareness (BE)

Environmental awareness reflects enterprises’ attention to environmental issues. So far, scholars have not reached an agreement on the measurement. Some scholars adopted the interviews and questionnaires with executives (Peng and Liu 2016; Zameer et al. 2021), but their accuracy largely depends on the rationality of the questionnaire design and the interviewees’ cooperation. Hence, we check whether the selected enterprises have disclosed their environmental protection awareness, environmental policy, environmental management organizational structure, circular economy development pattern, green development, etc. in their environmental information disclosure reports.

(4) Organizational resources (RE)

Innovation activities require significant resources, and the availability of resources is an important factor in innovation success (Yalcinkaya et al. 2007), especially for green innovation. Compared with the current ratio, the quick ratio excludes the less liquid assets such as inventory, which reflects the resources that the enterprises can really use flexibly. Therefore, with reference to Marlin and Geiger (2015) and Wu and Hu (2020), we use a quick ratio of financial metrics to measure organizational resources.

(5) Government environmental regulations (PR)

This paper uses the environmental protection tax to measure the environmental regulations faced by enterprises (Yu et al. 2021a). Specifically, we check the annual financial report through the Shenzhen stock exchange and obtain the amount of “environmental protection tax” from “tax and extra charges.” If it is not disclosed in the taxes and attachments, then we refer to the sewage charges, sanitation charges, landscaping charges, and other alternatives as noted in the management expenses details in the notes to the financial statements. Finally, we take the natural logarithm after the amount of environmental protection tax plus 1 as the alternative metric.

(6) Green subsidies (GS)

The annual reports usually disclosed the amount of general government subsidies, rather than green innovation subsidies. Following (Hu et al. 2021; Xie et al. 2019), we use keywords to identify which government subsidies belong to green innovation, such as government R&D support, credit discounts, and other items that incentivize enterprises to implement green activities. In addition, the amount of green subsidies is adjusted by dividing it by total assets to eliminate the effect of different sizes.

Data analysis and results

Calibration

In fsQCA, each variable is treated as a fuzzy set with different membership degrees. Therefore, the first step of fsQCA is to calibrate the data based on three critical thresholds. Following the calibration method of Fiss (2011), the 95%, 50%, and 5% quantiles of the variables are used as the thresholds for full membership (1.0), crossover point (0.5), and full non-membership (0), respectively (Fiss 2011). Although the combination of antecedent conditions, rather than the effect of a single antecedent condition on the outcome, is investigated in qualitative comparative analysis, the correlation between the antecedent conditions and the outcome is analyzed in this paper. Table 2 shows the descriptive statistics and correlation analysis of the calibrated data. There is no correlation between GP and the antecedent conditions, which indicates that none of the antecedent conditions in isolation can lead to high green innovation performance.

Analysis of necessary conditions

In QCA analysis, the first step is to test whether any condition is necessary for the outcome (Ragin 1987). When the consistency level of an antecedent condition is higher than 0.9, that is, when Consistency (Xi ≤ Yi) = ∑ (min(Xi ≤ Yi))/ ∑ (Yi)> 0.9, the antecedent condition is a necessary condition, which means that the condition must exist when the outcome occurs (Douglas et al. 2020; Rihoux and Ragin 2009; Tang et al. 2020). As shown in Table 3, the highest consistency score is ~BY, which is equal to 0.8263 and less than the critical value of 0.9. As a result, none of the six antecedent conditions needs to be removed from the subsequent truth table (Khedhaouria and Thurik 2017).

Construction of a truth table

It is necessary to set the frequency threshold and consistency threshold of fuzzy-set evaluation when constructing a truth table. Since this paper involves 48 cases, if the frequency threshold is set to 2, the number of included cases is only 10% of the total cases, which is lower than the selection criteria of 75% of the frequency threshold. Consequently, in this paper, the frequency threshold is set to 1. Considering the actual distribution of the cases in this paper, we set the consistency threshold at 0.8, which is greater than the recommended minimum of 0.75 (Fiss 2011). There are 48 cases and 6 antecedents in this paper. After constructing the truth table, there are 64 (26 rows in this study) configurations, that is, 64 combinations of conditions related to the established result of high GMA performance.

Results and analysis

It is difficult to make a clear counterfactual analysis (Schneider and Wagemann 2012) because the existing literature cannot draw consistent conclusions between the six antecedent conditions and the outcome. Therefore, in the process of using fsQCA3.0 software to solve the intermediate solution, for the question of under which circumstances will six antecedent conditions produce high green innovation performance, we choose all the options of the antecedent condition “existence or absence.” Through logically reducing the number of rows in the truth table based upon Boolean algebra to simplify the combination, there are three kinds of solutions in the result part of the fsQCA method: the parsimonious solution, the intermediate solution, and the complex solution. Among them, the intermediate solution takes the logical remainder into account, which accords with the theoretical expectation, and it is usually reported in the results report (Fiss 2011; Khedhaouria and Thurik 2017), while the parsimonious solution is used to judge the existence or absence of a core condition. Table 4 shows the results of the configuration analysis.

As we can see in Table 4, there are 5 groups of configurations with high green innovation performance through GMA. In QCA, the coverage of the solution is roughly akin to the R2 in regression analysis. Here, the coverage of the total solution is 0.3485, which meets the criterion of QCA in management science. The consistency of the overall solution is 0.9161, above the given benchmark value of 0.8, indicating that these 5 groups of configurations can be regarded as a combination of sufficient conditions for enterprises conducting GMA to produce high green innovation performance. In addition, the consistency minimum of the single solution is 0.9289, higher than 0.85, indicating that each configuration in this paper has passed the QCA test.

In order to reveal the effective paths of GMA, we classify the configurations with the same core conditions as C1a and C1b, C3a, and C3b, thus resulting in three configurations being associated with high green innovation performance through GMA: the professional buyer configuration, the internal leading configuration, and the internal-external linkage configuration. Besides, it is noteworthy that no antecedent condition in isolation is sufficient to allow the high level of green transformation, providing further evidence that high green innovation performance is the result of a combination of antecedent conditions.

The professional buyer configuration includes C1a (EX*BY*~BE*~RE*~PR) and C2a (EX*BY*~BE*RE*GS*PR), the raw coverage is 0.1021 and 0.0841, respectively. Professional buyer configuration demonstrates that the presence of M&A experience and M&A scale work as core conditions, with the absence of environmental awareness work as a supplementary condition. The biggest advantage of QCA is the ability to accurately identify real cases that fit a specific pathway. There are 4 cases that rely on this path to achieve high green innovation, including Jidian Co., Ltd (stock code: 000875), Zanyu Technology Group Co., Ltd (stock code: 002637), Guangdong Dow Technology Co., Ltd (stock code: 300409), and Huzhou Yongxing Special Stainless Steel Co., Ltd (stock code: 002756).

The internal leading configuration includes C2 (~EX*~BY*BE*RE*~PR*GS), which has the highest unique coverage of 0.1326. In this configuration, the absence of M&A experience and M&A scale, the existence of environmental awareness and organizational resources are the core conditions, while the absence of environmental regulation and the existence of government green innovation subsidies are peripheral conditions. The typical cases are Zhejiang Jinying Co., Ltd (stock code: 000875), Sanxiang New Material Co., Ltd (stock code: 603663), Industrial Co., Ltd (stock code: 603928) and Ningxia Qinglong Pipe Industry Co., Ltd (stock code: 024574).

The internal-external linkage configuration includes C3a (EX*~BY*~RE*~GS*PR) and C3b (EX*~BY*~Be*~RE*PR), and the raw coverage is 0.1374 and 0.1063, respectively. The experience of M&A, the presence of government environmental regulations, and the lack of M&A scale are all sufficient for achieving high green innovation performance. Comparing the configurations of C3a and C3b, it can be found that the absence of environmental awareness and green innovation subsidies can replace each other, pointing to the result of “equifinality” (Khedhaouria and Thurik 2017). This path to green transformation applies to Beijing Jingneng Electric Power Co., Ltd (stock code: 600578), Henan Yuneng Holding Co., Ltd (stock code: 001896), Shaanxi Black Cat Coking Co., Ltd (stock code: 601015), and Guangdong Shaoneng Group Co., Ltd (stock code: 000601).

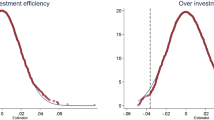

Robustness test

We adopt three methods to test the robustness: (1) improving PRI consistency. According to (Khedhaouria and Thurik 2017, Schneider and Wagemann 2012), we improved PRI consistency to 0.77 (> 0.75). As shown in Table 5, the consistency of the solution is 0.9213, the coverage of the solution is 0.3736, and there is just a little bit of change. (2) Replacing the measurement of green innovation performance. Using the mean value of green patent applications in the year t, 1 year (t+1), and 2 years (t+2) after GMA minus the number of green patent applications in the year before M&A (t−1) to remeasure the green innovation performance, Table 6 shows that the consistency of the solution changed from 0.9161 to 0.9131, and the coverage of the solution changed from 0.3485 to 0.3189, both of which changed little. (3) Adjusting the crossover point by 5%. Following Meuer (2017), Tang et al. (2020), Zhang and Li (2021), we change the crossover point by reducing 5% and re-calibrate all variables. The consistency of the solution and the coverage of the solution are 0.9453 and 0.3300, respectively (shown in Table 7). In terms of configurations, the core conditions stay the same in Table 5, Table 6, and Table 7, and no substantial changes have taken place in the number and combination of configurations, indicating that the findings are relatively robust (Greckhamer et al. 2018).

Discussion

To precisely clarify the realization paths to green transformation, we illustrate Fig. 3 to reshow the configurations of conditions. Of which,√ represents the existence of a certain condition, and × represents the absence of a certain condition. In the following we will analyze each configuration in turn.

Professional buyer configuration

Professional buyer configuration indicates that the large-scale GMA activities initiated by enterprises with rich GMA experience will effectively promote green technology innovation. On the one hand, large-scale M&A has scale effects (Lera and Sornette 2017) and thus contributes to improving enterprise value. However, on the other hand, it increases the complexity of transactions (Alexandridis et al. 2013), which increases the uncertainty of expected synergies (Basuil and Datta 2019) and may diminish marginal returns. GMA, similar to other M&A, needs to deal with the high levels of uncertainty during the M&A process and subsequent resource integration. A wealth of experience, particularly in decision making, can be effective in reducing uncertainty during the merger process and in actively integrating (Basuil and Datta 2015; Kang and Padmanabhan 2005). GMA deals target enterprises with clean production facilities or advanced low-carbon technologies, and the size of the M&A is at least as important to the subsequent green innovation of the enterprise as the R&D investment (Medda 2020). As a result, relying on the experience accumulated in the early stages, heavily polluting enterprises implement a new round of large-scale GMA, and leverage the advantages of M&A scale, thus effectively boosting their green transformation and upgrading.

Guangdong Dowstone Technology Co., Ltd. (stock code: 300409), which is mainly engaged in the production and sale of glazing materials for architectural ceramics, and the raw materials used are mainly various mineral powders and metal oxides, is a typical example in 2016. It acquired a 35% equity interest in Qingdao Haoxin New Energy Technology Co., Ltd. for RMB 118 million in cash, accumulating valuable GMA experience. In 2018, it again acquired the entire equity of Guangdong Jaina Energy Technology Co. In January 2019, Jaina Energy was recognized as a national high-tech enterprise, and the quantity and quality of Dow Technologies’ green patent applications have been significantly improved through GMA. This indicates that Dow Technologies has successfully acquired Guangdong Jaina Energy Technology Co., Ltd. and achieved green transformation through the accumulation of GMA experience in the early stages.

Internal leading configuration

Internal leading configuration highlights that the combination of organizational resources and environmental awareness is sufficient for a heavily polluting enterprise to achieve green transformation, particularly in the context of the first GMA. A strand of literature (e.g., Yang and Liu, 2021; Zameer et al., 2021; Zhang et al., 2015) contended the importance of environmental awareness for enterprise green technology innovation, the higher the environmental awareness of executives, the stronger the motivation of enterprises to engage in green technology innovation (Wu and Lin 2022). But green innovation also requires an abundance of resources (McGahan 2021, Vanacker et al. 2017), which enhances environmental resilience and risk-taking and thus facilitates green innovation (Wei et al. 2020). Thus, enterprises with more internal resources and a strong sense of environmental awareness are inclined to make a green transition as quickly as possible through M&A. However, due to a lack of successful experience in acquiring other “green” enterprises, these enterprises choose to acquire on a smaller scale.

For instance, Sanxiang New Material Co., Ltd (stock code: 603663), belonging to the non-metallic mineral products industry, is a typical example in 2018. With the corporate culture of “continuous innovation for the development of new materials,” it makes a strong emphasis on green innovation. Despite its lack of experience in GMA, it acquired a 20% share in Liaoning Huazirconium New Materials Co. in September 2018, fully absorbing the advanced R&D technology and production processes in the field of zirconium sponge materials and gradually improving its own green innovation.

Internal-external linkage configuration

Internal-external linkage configuration stresses the role of environmental regulations and the experience in GMA. Although environmental regulations are controversial instruments for sustainable economic development (Shao et al. 2020), they are important external drivers of green innovation (Chakraborty and Chatterjee 2017; Fang et al. 2021; Lv et al. 2021; Shang et al. 2021; Sun et al. 2019; Zameer et al. 2021; Zhou and Du 2021), especially in the context of carbon neutrality (Wu and Lin 2022).

Similar to other M&A, GMA has a signaling effect (Zhang et al., 2020a, b) through sending positive signals to the public about its environmental protection behavior, which is conducive to enhancing its organizational legitimacy (Li et al. 2020), building a reputation (Lu 2021), and gaining easier access to credit resources (Li et al. 2020). Therefore, heavily polluting enterprises tend to conduct small-scale GMAs to cater to public and media scrutiny (Huang and Yuan 2021), but without substantially transforming (Pan et al. 2019a). Government environmental regulations increased the probability of penalties (Yu et al. 2021a), making enterprises strengthen environmental technology research to respond to stringent regulations. Therefore, environmental regulations are important when heavy polluters are engaged in small-scale GMA.

The Beijing Jingneng Electric Power Co., Ltd. (stock code: 600578) is a typical example of the internal-external linkage configuration, which has been the focus of monitoring by the Environmental Protection Department. It acquired Inner Mongolia Jinglong Power Generation Co., Ltd. in 2017, accumulating some GMA experience. In 2018, it acquired Inner Mongolia Jingning Thermal Power Co., Ltd. again, further expanded its installed scale, and effectively overcame its deficiency in unit output, low ratio of heat and power, and other industry gaps.

Conclusions, policy implications, and future research

Research conclusions

Although it is widely acknowledged that heavily polluting enterprises should be involved in green transformation, how to improve green innovation is still unexplored. By using the fuzzy-set qualitative comparative analysis approach (fsQCA), this paper constructs the M&A attributes—organizational characteristics—external environment (M-O-E) integration framework from a configurational perspective.

Specifically, we analyze the impact of the combination of M&A attributes (GMA experience, GMA transaction scale), enterprise characteristics (organizational resources, environmental awareness), and the external environment (environmental regulations, government green innovation subsidies), focusing on how the six antecedents interact with each other to determine configurational conditions leading to high green innovation through GMA. Taking 48 heavily polluting enterprises that conducted GMA in China in 2018 as research observations, we find that (1) high green innovation performance through GMA is the outcome of multiple antecedents, and a single antecedent in isolation is not sufficient for achieving it; (2) instead, there are three equivalent configurations that result in high green innovation, namely professional buyer configuration, internal leading configuration, and internal-external linkage configuration; (3) therein, the professional buyer configuration emphasizes the importance of M&A experience and M&A scale; the internal leading configuration highlights the combination of environmental awareness and organizational resources in the absence of effective experience; and the internal-external linkage configuration requires simultaneous efforts of M&A experience and environmental regulations.

Research implications

This paper contributes to the understanding of green innovation in heavily polluting enterprises by focusing on the multidimensions of green transformation from a configurational perspective. Existing studies usually adopt quantitative methods, mainly regression models, to address the “net effect” of a single factor on green innovation, typically assuming that other factors remain constant, but these factors interact with each other in reality. Obviously, it is an approach to changing reality to adapt to the methods, making research on green innovation suffer from a mismatch between reality and methods. Whether their conclusions can be applied in practice is unclear.

Therefore, building upon related green innovation research that has already advocated a configurational perspective (Borsatto and Bazani 2021), which considers the asymmetry of cause and effect (Douglas et al. 2020; Rihoux and Ragin 2009), we expand the GMA-GI (green innovation) relationship by focusing on the heavily polluting enterprises from a novel perspective. The configurations we reveal and the explanations we provide can serve as references for future theory development. Lastly, by conducting an analysis combining enterprise heterogeneity (including M&A characteristics and enterprise characteristics) and government behavior heterogeneity (including government green innovation subsidies and environmental regulations), we advance the frontiers of GMA-GI research and provide theoretical support for the claim that the effectiveness of government innovation subsidies and environmental regulations varies in different contexts (Shao et al. 2020).

This paper also provides practical guidance on how to achieve green transformation. Firstly, for heavily polluting enterprises, their decision makers should be aware that a mere certain antecedent may not be able to achieve green transformation through GMA, while the key lies in multiple antecedents joint together. Secondly, it is only when heavily polluting enterprises lack GMA experience but have strong environmental awareness and organizational resources that small-scale GMA can truly improve their green innovation, and blind over-expansion may hinder green and sustainable development. Thus, it is necessary to reduce the scale of GMA when there is a lack of experience. Thirdly, when formulating rules and regulations, the government should comprehensively consider the heterogeneity of enterprises and enhance the regulations’ applicability. The study demonstrates that different regulation intensities are effective in increasing green innovation performance, whereas they are contingent on the scale of GMA. Experienced heavily polluting enterprises employ small-scale GMA as a strategy to deal with public and media scrutiny, which is somehow similar to greenwashing behavior and requires stricter environmental regulation. With large-scale GMAs, experienced heavily polluting enterprises sincerely hope to accelerate industrial upgrading through GMA, with environmental regulations playing a secondary role. Finally, it is noteworthy that government subsidies are peripheral conditions in the three configurations that lead to high green innovation. Therefore, the government should find the root of crowding out innovation subsidies and improve their efficiency to achieve the optimal governance effect.

Limitations and future research

The limitations of this study are as follows: firstly, due to the unavailability of GMA data, the M&A-Organization-Environment (M-O-E) framework only considers the characteristics of the acquirer. We do not have access to the information of unlisted companies and fail to take the acquired characteristics into account in the M-O-E framework (Chari and Chang 2009). Secondly, we take the number of green patent applications as a proxy for enterprise green transformation, but green transformation encompasses both reducing pollutant emissions and improving production efficiency (Barbier 2020), and how to more accurately measure green transformation needs to be explored in the future.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

The CSMAR database is an important and widely used database for studying China issues. At present, the CSMAR database has covered 18 series, including Factor Research, Characteristics, Green Economy, Stock, Company, Overseas, Information, Fund, Bond, Industry, Economy, and Commodity Futures. It contains 160+ databases, more than 4000 tables, and 50,000 fields.

References

Alexandridis G, Fuller KP, Terhaar L, Traylos NG (2013) Deal size, acquisition premia and shareholder gains. J Corp Financ 20:1–13. https://doi.org/10.1016/j.jcorpfin.2012.10.006

Amores-Salvado J, Martin-de Castro G, Navas-Lopez JE (2015) The importance of the complementarity between environmental management systems and environmental innovation capabilities: a firm level approach to environmental and business performance benefits. Technol Forecast Soc 96:288–297. https://doi.org/10.1016/j.techfore.2015.04.004

Awa HO, Ojiabo OU (2016) A model of adoption determinants of ERP within T-O-E framework. Inform Technol Peopl 29:901–930. https://doi.org/10.1108/itp-03-2015-0068

Bae SC, Chang KY, Kim D (2013) Determinants of target selection and acquirer returns: evidence from cross-border acquisitions. Int Rev Econ Financ 27:552–565. https://doi.org/10.1016/j.iref.2013.01.009

Barbier EB (2020) Is green rural transformation possible in developing countries? World Dev 131:104955. https://doi.org/10.1016/j.worlddev.2020.104955

Barkema HG, Schijven M (2008) How do firms learn to make acquisitions? A review of past research and an agenda for the future. J Manage 34:594–634. https://doi.org/10.1177/0149206308316968

Basuil DA, Datta DK (2015) Effects of industry- and region-specific acquisition experience on value creation in cross-border acquisitions: the moderating role of cultural similarity. J Manage Stud 52:766–795. https://doi.org/10.1111/joms.12128

Basuil DA, Datta DK (2019) Effects of firm-specific and country-specific advantages on relative acquisition size in service sector cross-border acquisitions: an empirical examination. J Int Manag 25:66–80. https://doi.org/10.1016/j.intman.2018.07.001

Bellucci A, Pennacchio L, Zazzaro A (2019) Public R&D subsidies: collaborative versus individual place-based programs for SMEs. Small Bus Econ 52:213–240. https://doi.org/10.1007/s11187-018-0017-5

Bettinazzi ELM, Zollo M (2021) Stakeholder orientation and experiential learning: evidence from corporate acquisitions. J Manage Stud. https://doi.org/10.1111/joms.12782

Blind K (2012) The influence of regulations on innovation: a quantitative assessment for OECD countries. Res Policy 41:391–400. https://doi.org/10.1016/j.respol.2011.08.008

Borghesi S, Cainelli G, Mazzanti M (2015) Linking emission trading to environmental innovation: evidence from the Italian manufacturing industry. Res Policy 44:669–683. https://doi.org/10.1016/j.respol.2014.10.014

Borsatto J, Amui LBL (2019) Green innovation: unfolding the relation with environmental regulations and competitiveness. Resour Conserv Recy 149:445–454. https://doi.org/10.1016/j.resconrec.2019.06.005

Borsatto J, Bazani CL (2021) Green innovation and environmental regulations: a systemati-c review of international academic works. Environ Sci Pollut Res 28:63751–63768. https://doi.org/10.1007/s11356-020-11379-7

Bradley SW, Shepherd DA, Wiklund J (2011) The importance of slack for new organizations facing ‘tough’ environments. J Manage Stud 48:1071–1097. https://doi.org/10.1111/j.1467-6486.2009.00906.x

Cainelli G, Mazzanti M (2013) Environmental innovations in services: manufacturing-servi-ces integration and policy transmissions. Res Policy 42:1595–1604. https://doi.org/10.1016/j.respol.2013.05.010

Cainelli G, De Marchi V, Grandinetti R (2015) Does the development of environmental innovation require different resources? Evidence from Spanish manufacturing firms. J Clean Prod 94:211–220. https://doi.org/10.1016/j.jclepro.2015.02.008

Chakraborty P, Chatterjee C (2017) Does environmental regulation indirectly induce upstre-am innovation? New evidence from India. Res Policy 46:939–955. https://doi.org/10.1016/j.respol.2017.03.004

Chari MDR, Chang KY (2009) Determinants of the share of equity sought in cross-border acquisitions. J Int Bus Stud 40:1277–1297. https://doi.org/10.1057/jibs.2008.103

Chen YS (2008) The driver of green innovation and green image - green core competence. J Bus Ethics 81:531–543. https://doi.org/10.1007/s10551-007-9522-1

Collins JD, Holcomb TR, Certo ST, Hitt MA, Lester RH (2009) Learning by doing: cross-border mergers and acquisitions. J Bus Res 62:1329–1334. https://doi.org/10.1016/j.jbusres.2008.11.005

Colombage SRN, Gunasekarage A, Shams SMM (2014) Target’s organisational form and returns to Australian bidders in cross-border acquisitions. Account Financ 54:1063–1091. https://doi.org/10.1111/acfi.12031

D’Orazio P, Valente M (2019) The role of finance in environmental innovation diffusion: an evolutionary modeling approach. J Econ Behav Organ 162:417–439. https://doi.org/10.1016/j.jebo.2018.12.015

Danbolt J, Maciver G (2012) Cross-border versus domestic acquisitions and the impact on shareholder wealth. J Bus Finan Account 39:1028–1067. https://doi.org/10.1111/j.1468-5957.2012.02294.x

Douglas EJ, Shepherd DA, Prentice C (2020) Using fuzzy-set qualitative comparative analysis for a finer-grained understanding of entrepreneurship. J Bus Venturing 35:105970. https://doi.org/10.1016/j.jbusvent.2019.105970

Dutta S, Saadi S, Zhu PC (2013) Does payment method matter in cross-border acquisitions? Int Rev Econ Financ 25:91–107. https://doi.org/10.1016/j.iref.2012.06.005

Ellis KM, Reus TH, Lamont BT, Ranft AL (2011) Transfer effects in large acquisitions:how size-specific experience matters. Acad Manage J 54:1261–1276. https://doi.org/10.5465/amj.2009.0122

Fang ZM, Kong XR, Sensoy A, Cui X, Cheng FY (2021) Government’s awareness of E-nvironmental protection and corporate green innovation: a natural experiment from the New Environmental Protection Law in China. Econ Anal Policy 70:294–312. https://doi.org/10.1016/j.eap.2021.03.003

Fiss PC (2011) Building better causal theories: a fuzzy set approach to typologies in organization research. Acad Manage J 54:393–420. https://doi.org/10.5465/amj.2011.60263120

Forcadell FJ, Sanchez-Riofrio A, Guerras-Martin LA, Romero-Jordan D (2020) Is the restructuring-performance relationship moderated by the economic cycle and the institutional environment for corporate governance? J Bus Res 110:397–407. https://doi.org/10.1016/j.jbusres.2020.01.055

Glaser M, Lopez-de-Silanes F, Sautner Z (2013) Opening the Black Box: internal capital markets and managerial power. J Financ 68:1577–1631. https://doi.org/10.1111/jofi.12046

Greckhamer T, Furnari S, Fiss PC, Aguilera RV (2018) Studying configurations with qualitative comparative analysis: best practices in strategy and organization research. Strateg Organ 16:482–495. https://doi.org/10.1177/1476127018786487

Greco M, Grimaldi M, Cricelli L (2017) Hitting the nail on the head: Exploring the relationship between public subsidies and open innovation efficiency. Technol Forecast Soc 118:213–225. https://doi.org/10.1016/j.techfore.2017.02.022

Hao XY, Chen FL, Chen ZF (2021) Does green innovation increase enterprise value? Bus Strateg Environ. https://doi.org/10.1002/bse.2952

Hirshleifer D, Low A, Teoh SH (2012) Are overconfident CEOs better innovators? J Financ 67:1457–1498. https://doi.org/10.1111/j.1540-6261.2012.01753.x

Howell A (2017) Picking ‘winners’ in China: do subsidies matter for indigenous innovation and firm productivity? China Econ Rev 44:154–165. https://doi.org/10.1016/j.chieco.2017.04.005

Hu D, Qiu L, She MY, Wang Y (2021) Sustaining the sustainable development: how do firms turn government green subsidies into financial performance through green innovation? Bus Strateg Environ 30:2271–2292. https://doi.org/10.1002/bse.2746

Huang W, Yuan T (2021) Substantive transformation and upgrading or strategic policy arbitrage -- the impact of green industry policy on green M&A of industrial enterprises. Journal of Shanxi University of Finance and economics 43:56–67. https://doi.org/10.13781/j.cnki.1007-9556.2021.03.005

Jacoby G, Liu MZ, Wang YF, Wu ZY, Zhang Y (2019) Corporate governance, external control, and environmental information transparency: evidence from emerging markets. J Int Financ Mark I 58:269–283. https://doi.org/10.1016/j.intfin.2018.11.015

Jones P, Wynn MG (2021) The circular economy, resilience, and digital technology deployment in the mining and mineral industry. International Journal of Circular Economy and Waste Management (IJCEWM) 1(1):16–32. https://doi.org/10.4018/IJCEWM.2021010102

Kang RC, Padmanabhan P (2005) Revisiting the role of cultural distance in MNC’s foreign ownership mode choice: the moderating effect of experience attributes. Int Bus Rev 14:307–324. https://doi.org/10.1016/j.ibusrev.2005.01.001

Khan SAR, Godil DI, Jabbour CJC, Shujaat S, Razzaq A, Yu Z (2021a) Green data analytics, blockchain technology for sustainable development, and sustainable supply chain practices: evidence from small and medium enterprises. Ann Oper Res. https://doi.org/10.1007/s10479-021-04275-x

Khan S, Godil DI, Zhang Y et al (2022) Adoption of renewable energy sources, low-carbon initiatives, and advanced logistical infrastructure-a step toward integrated global progress. Sustain Dev 30(1):275–288. https://doi.org/10.1002/sd.2243

Khan S, Ponce P, Thomas G et al (2021b) Digital technologies, circular economy practices and environmental policies in the era of COVID-19. Sustainability 13(22):12790. https://doi.org/10.3390/su132212790

Khedhaouria A, Thurik R (2017) Configurational conditions of national innovation capabili-ty: a fuzzy set analysis approach. Technol Forecast Soc 120:48–58. https://doi.org/10.1016/j.techfore.2017.04.005

Kocabasoglu C, Prahinski C, Klassen RD (2007) Linking forward and reverse supply chai-n investments: The role of business uncertainty. J Oper Manag 25:1141–1160. https://doi.org/10.1016/j.jom.2007.01.015

Kveton V, Horak P (2018) The effect of public R&D subsidies on firms’ competitiveness: regional and sectoral specifics in emerging innovation systems. Appl Geogr 94:119–129. https://doi.org/10.1016/j.apgeog.2018.03.015

Lanoie P, Laurent-Lucchetti J, Johnstone N, Ambec S (2011) Environmental policy, innov-ation and performance: new insights on the porter hypothesis. J Econ Manage Strat 20:803–842. https://doi.org/10.1111/j.1530-9134.2011.00301.x

Lera SC, Sornette D (2017) Quantification of the evolution of firm size distributions due to mergers and acquisitions. PLoS One 12:e0183627. https://doi.org/10.1371/journal.pone.0183627

Li B, Xu L, McIver R, Wu Q, Pan AL (2020) Green M&A, legitimacy and risk-taking: evidence from China’s heavy polluters. Account Financ 60:97–127. https://doi.org/10.1111/acfi.12597

Liao ZJ (2018) Environmental policy instruments, environmental innovation and the reputation of enterprises. J Clean Prod 171:1111–1117. https://doi.org/10.1016/j.jclepro.2017.10.126

Lou ZK, Chen SY, Yin WW, Zhang C, Yu XY (2022) Economic policy uncertainty and firm innovation: evidence from a risk-taking perspective. Int Rev Econ Financ 77:78–96. https://doi.org/10.1016/j.iref.2021.09.014

Lu J (2021) Can the green merger and acquisition strategy improve the environmental pro-tection investment of listed company? Environ Impact Asses 86:106470. https://doi.org/10.1016/j.eiar.2020.106470

Lv CC, Shao CH, Lee CC (2021) Green technology innovation and financial development:do environmental regulation and innovation output matter? Energ Econ 98:105237. https://doi.org/10.1016/j.eneco.2021.105237

Marlin D, Geiger SW (2015) A reexamination of the organizational slack and innovation relationship. J Bus Res 68:2683–2690. https://doi.org/10.1016/j.jbusres.2015.03.047

McGahan AM (2021) Integrating insights from the resource-based view of the firm into the new stakeholder theory. J Manage 47:1734–1756. https://doi.org/10.1177/0149206320987282

Medda G (2020) External R&D, product and process innovation in European manufacturing companies. J Technol Transfer 45:339–369. https://doi.org/10.1007/s10961-018-9682-4

Mendel JM, Korjani MM (2013) Theoretical aspects of fuzzy set qualitative comparative analysis (fsQCA). Inform Sci 237:137–161. https://doi.org/10.1016/j.ins.2013.02.048

Meuer J (2017) Exploring the complementarities within high-performance work systems: a set-theoretic analysis of UK firms. Hum Resour Manage-US 56:651–672. https://doi.org/10.1002/hrm.21793

Misangyi VF, Greckhamer T, Furnari S, Fiss PC, Crilly D, Aguilera R (2017) Embracing causal complexity: the emergence of a neo-configurational perspective. J Manage 43:255–282. https://doi.org/10.1177/0149206316679252

Schipper R, Silvius G (2021) Transition to the circular economy: implications to program management. International Journal of Circular Economy and Waste Management (IJCEWM) 1(1):33–53. https://doi.org/10.4018/IJCEWM.2021010103

Vargas-Hernández JG, López-Lemus JA (2021) Resources and capabilities of SMEs through a circular green economy. International Journal of Circular Economy and Waste Management (IJCEWM) 1(1):1–15. https://doi.org/10.4018/IJCEWM.2021010101

Pan A-l, Liu X, Qiu J-L, Shen Y (2019a) Can green M&A of heavy polluting enterprises achieve substantial transformation under the pressure of media. China Industrial Economics 174-192 (In Chinese). https://doi.org/10.19581/j.cnki.ciejournal.20190131.005

Pan A, Wu Q (2020) Official turnover and green M&A of heavily polluting enterprises -- an empirical study based on the government’s environmental performance appraisal system. Journal of Shandong University 146-160 (In Chinese). https://doi.org/10.19836/j.cnki.37-1100/c.2020.04.016

Pan A, Wang H, Qiu J (2021) Confucian culture and green M&A of heavily polluting enterprises. Accounting Research 133-147 (In Chinese). https://doi.org/10.3969/j.issn.1003-2886.2021.05.011

Pan XF, Ai BW, Li CY, Pan XY, Yan YB (2019b) Dynamic relationship among environmental regulation, technological innovation and energy efficiency based on large scale provincial panel data in China. Technol Forecast Soc 144:428–435. https://doi.org/10.1016/j.techfore.2017.12.012

Peng XR, Liu Y (2016) Behind eco-innovation: Managerial environmental awareness and external resource acquisition. J Clean Prod 139:347–360. https://doi.org/10.1016/j.jclepro.2016.08.051

Ragin CC (1987) The comparative method: moving beyond qualitative and quantitative strategies. University of California Press, Berkeley

Ren SG, Li XL, Yuan BL, Li DY, Chen XH (2018) The effects of three types of environmental regulation on eco-efficiency: a cross-region analysis in China. J Clean Prod 173:245–255. https://doi.org/10.1016/j.jclepro.2016.08.113

Rihoux B, Ragin C (2009) Configurational comparative methods: qualitative comparative analysis (QCA) and related techniques. Sage, Thousand Oaks

Salge TO, Vera A (2013) Small steps that matter: incremental learning, slack resources and organizational performance. Brit J Manage 24:156–173. https://doi.org/10.1111/j.1467-8551.2011.00793.x

Salvi A, Petruzzella F, Giakoumelou A (2018) Green M&A deals and bidders’ value Cr-eation: the role of sustainability in post-acquisition performance. Int Bus Res 11:96–105. https://doi.org/10.5539/ibr.v11n7p96

Sarkis J, Gonzalez-Torre P, Adenso-Diaz B (2010) Stakeholder pressure and the adoption of environmental practices: the mediating effect of training. J Oper Manag 28:163–176. https://doi.org/10.1016/j.jom.2009.10.001

Schneider CQ, Wagemann C (2012) Set-theoretic methods for the social sciences: a guide to qualitative comparative analysis. Cambridge University Press, Cambridge

Shang LN, Tan DQ, Feng SL, Zhou WT (2021) Environmental regulation, import trade, and green technology innovation. Environ Sci Pollut Res 1–11. https://doi.org/10.1007/s11356-021-13490-9

Shao S, Hu ZG, Cao JH, Yang LL, Guan DB (2020) Environmental regulation and ente-rprise innovation: a review. Bus Strateg Environ 29:1465–1478. https://doi.org/10.1002/bse.2446

Sun C, Ding D, Fang X, Zhang H, Li J (2019) How do fossil energy prices affect the stock prices of new energy companies? Evidence from Divisia energy price index in China’s market. Energy 169:637–645. https://doi.org/10.1016/j.energy.2018.12.032

Tang PC, Yang SX, Yang SW (2020) How to design corporate governance structures to enhance corporate social responsibility in China’s mining state-owned enterprises? Resour Policy 66:101619. https://doi.org/10.1016/j.resourpol.2020.101619

Tanja S, Ninon K, Sutton (2011) How does national culture impact internalizati-on benefits in cross-border mergers and acquisitions? Financial Review 46:103–125. https://doi.org/10.1111/j.1540-6288.2010.00292.x

Tseng ML, Wang R, Chiu ASF, Geng Y, Lin YH (2013) Improving performance of greeninnovation practices under uncertainty. J Clean Prod 40:71–82. https://doi.org/10.1016/j.jclepro.2011.10.009

Vanacker T, Collewaert V, Zahra SA (2017) Slack resources, firm performance, and the institutional context: evidence from privately held European firms. Strategic Manage J 38:1305–1326. https://doi.org/10.1002/smj.2583

Wang YB, Li JZ, Furman JL (2017) Firm performance and state innovation funding: evidence from China’s innofund program. Res Policy 46:1142–1161. https://doi.org/10.1016/j.respol.2017.05.001

Wang YS, Li HT, Li CR, Zhang DZ (2016) Factors affecting hotels’ adoption of mobile reservation systems: a technology-organization-environment framework. Tourism Manage 53:163–172. https://doi.org/10.1016/j.tourman.2015.09.021

Wei Y, Nan HX, Wei GW (2020) The impact of employee welfare on innovation perfor-mance: evidence from China’s manufacturing corporations. Int J Prod Econ 228:107753. https://doi.org/10.1016/j.ijpe.2020.107753

Wu HQ, Hu SM (2020) The impact of synergy effect between government subsidies and slack resources on green technology innovation. J Clean Prod 274:122682. https://doi.org/10.1016/j.jclepro.2020.122682

Wu RX, Lin BQ (2022) Environmental regulation and its influence on energy-environmental performance: evidence on the porter hypothesis from China’s iron and steel industry. Resour Conserv Recy 176. https://doi.org/10.1016/j.resconrec.2021.105954. Accessed 29 Otc 2021

Xie RH, Yuan YJ, Huang JJ (2017) Different types of environmental regulations and heterogeneous influence on “green” productivity: evidence from china. Ecol Econ 132:104–112. https://doi.org/10.1016/j.ecolecon.2016.10.019

Xie XM, Zhu QW, Wang RY (2019) Turning green subsidies into sustainability: how gr-een process innovation improves firms’ green image. Bus Strateg Environ 28:1416–1433. https://doi.org/10.1002/bse.2323

Yang GH, Liu BL (2021) Research on the impact of managers’ green environmental awareness and strategic intelligence on corporate green product innovation strategic performance. Ann Oper Res. https://doi.org/10.1007/s10479-021-04243-5

Yeo B, Grant D (2019) Exploring the factors affecting global manufacturing performance. Inform Technol Dev 25:92–121. https://doi.org/10.1080/02681102.2017.1315354

Yu HW, Liao LQ, Qu SY, Fang DB, Luo LF, Xiong GQ (2021a) Environmental regulati-on and corporate tax avoidance:a quasi-natural experiments study based on China’s new environmental protection law. J Environ Manage 296:113160. https://doi.org/10.1016/j.jenvman.2021.113160

Yu Z, Khan SAR (2021) Green supply chain network optimization under random and fuzzy environment. Int J Fuzzy Syst. https://doi.org/10.1007/s40815-020-00979-7

Yu Z, Khan SAR (2021) Evolutionary game analysis of green agricultural product supply chain financing system: COVID-19 pandemic. Int J Logist-Res App. https://doi.org/10.1080/13675567.2021.1879752

Yu Z, Khan SAR, Umar M (2021b) Circular economy practices and industry 4.0 technologies: a strategic move of automobile industry. Bus Strateg Environ. https://doi.org/10.1002/bse.2918

Zameer H, Wang Y, Saeed MR (2021) Net-zero emission targets and the role of managerial environmental awareness, customer pressure, and regulatory control toward environmental performance. Bus Strateg Environ 30:4223–4236. https://doi.org/10.1002/bse.2866

Zhang B, Wang ZH, Lai KH (2015) Mediating effect of managers’ environmental concern: bridge between external pressures and firms’ practices of energy conservation in China. J Environ Psychol 43:203–215. https://doi.org/10.1016/j.jenvp.2015.07.002

Zhang DY, Du WC, Zhuge LQ, Tong ZM, Freeman RB (2019) Do financial constraints curb firms’ efforts to control pollution? Evidence from Chinese manufacturing firms. J Clean Prod 215:1052–1058. https://doi.org/10.1016/j.jclepro.2019.01.112

Zhang M, Li B (2021) How to design regional characteristics to improve green economic efficiency: a fuzzy-set qualitative comparative analysis approach. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-15963-3

Zhang T, Zhang Z, Yang J (2020a) When does corporate social responsibility backfire in acquisitions? Signal incongruence and acquirer returns. J Bus Ethics 175(01):45–58. https://doi.org/10.1007/s10551-020-04583-5

Zhao XY, Jia M (2022) Sincerity or hypocrisy: can green M&A achieve corporate environmental governance? Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-17464-9

Zhou XX, Du JT (2021) Does environmental regulation induce improved financial develo-pment for green technological innovation in China? J Environ Manage 300:113685. https://doi.org/10.1016/j.jenvman.2021.113685

Zhang T, Zhang Z, Yang J (2020b) When does corporate social responsibility backfire in acquisitions? Signal Incongruence and Acquirer Returns. J Bus Ethics 175(01):45–58. https://doi.org/10.1007/s10551-020-04583-5

Funding

This work was supported by the Project of Postgraduate Research & Practice Innovation Program of Jiangsu Province (Grant No. KYCX21_2089). 2089); National Social Science Fund Later Funding Project of China [No. 21FGLB017].

Author information

Authors and Affiliations

Contributions

Yan Zhang: conceptualization, methodology, writing—original draft, writing—review and editing, software and validation. Ziyuan Sun: supervision, project administration, writing—review and editing. Mengxin Sun: data curation, writing—original draft, writing—review and editing. Yiqiang Zhou: software, formal analysis and investigation.

Corresponding author

Ethics declarations

Ethic approval

This study follows all ethical practices during writing.

Consent to participate

The authors have read and approved the final manuscript.

Consent for publication

The authors agree to the publication of the journal.

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, Y., Sun, Z., Sun, M. et al. The effective path of green transformation of heavily polluting enterprises promoted by green merger and acquisition—qualitative comparative analysis based on fuzzy sets. Environ Sci Pollut Res 29, 63277–63293 (2022). https://doi.org/10.1007/s11356-022-20123-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-20123-2