Abstract

Over the last few decades, environmental deterioration has accelerated significantly. Environmental degradation has been a subject of research across the world because of its impact on billions of people. However, there has been no international agreement on lowering the utilization of energy and CO2 emissions (CO2), while demand for fossil fuels grows in emerging economies. On the other hand, the recent COP26 summit brought all parties together to accelerate action toward reaching the goals of the Paris Agreement and the UN Framework Convention on Climate Change. Although previous research shows that international trade promotes positive socioeconomic outcomes, other experts argue that it contributes to natural resource shortages and ecological deterioration. Thus, the current research considers the effect of international trade, renewable energy use and technological innovation on consumption-based carbon emissions (CCO2), coupled with the role of financial development and economic growth in the BRICS economies between 1990 and 2018. Moreover, this research utilizes the common correlated effects mean group (CCEMG), augmented mean group (AMG) and Dumitrescu and Hurlin (2012) causality methods to assess these interrelationships. The study findings reveal that renewable energy use, exports and technological innovation mitigate CCO2, whereas economic growth and imports trigger CCO2 in the BRICS economies. The panel causality outcomes also reveal that all the variables except financial development can predict CCO2 emissions. Based on the study findings, we recommend the adoption of policies, regulations and the development of legislative frameworks that promote technological innovation and the shift toward sustainable energy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Environmental deterioration is one of the most pressing issues facing the world today, thus causing academics and researchers to be keenly interested in the subject (Adebayo and Acheampong 2021; Onifade et al. 2022; Alola et al. 2021). Air pollution is the most important driver of global warming, despite the fact that there are numerous forms of pollution. Greenhouse gas emissions (GHGs) are at the heart of air pollution, which are largely propelled by carbon emissions (CO2). Because CO2 is seen as the greatest threat to the environment, governments have established commitments through the recent COP26 to further accelerate their efforts toward achieving the objective of the Paris Agreement and the UN Framework Convention on Climate Change, which is to minimize the emission level. CO2 emissions have become the subject of numerous studies aimed at comprehending the factors that drive it. The bulk of this research used the STIRPAT or Environmental Kuznets Curve (EKC) frameworks to examine population and income, concluding that these economic indicators are the primary cause of CO2 emissions. However, these studies are not completely helpful, considering that the ultimate objective of any study is to advise policymakers on the implementation of relevant policies. This is mainly because it would not be a good strategy suggestion to propose that population and/or GDP trigger CO2 emissions and should thus be decreased to curb emissions.

In this context, one of the major problems related to the implementation of policies and measures based on these investigations revolves on how to implement them and decrease CO2 without mitigating the quality of life across different countries. In addition to population and GDP, numerous studies in the environmental literature have explored additional demographic, energy and social-economic indicators (Adedoyin et al. 2021; Awosusi et al. 2022a; Alola et al. 2021; Oladipupo et al. 2021; Adebayo et al. 2022a). Nevertheless, it is hard to claim that all of these studies take into account other factors in order to be relevant for CO2 emission reduction policymaking. Furthermore, several studies have examined a collection of indicators without offering a theoretical basis for doing so. For sustainable growth, it is imperative that renewable energy is mostly employed for production activities, and the efficiency of this energy is achieved through advancement of innovation from the transfer of technology (trade). These factors are among the considerations that motivated us to undertake this study.

In the present research, we incorporate technological innovation and renewable energy usage into our model. They have three primary benefits: theoretically, they are anticipated to lessen CO2 emissions, and they can also promote nations’ well-being. Hydropower, solar energy and solar are the most common renewable energy sources. Furthermore, expanding consumption of renewable energy, also known as energy transition (ET) toward renewables, is a significant aspect of the plans of several countries. Energy transition (ET) is defined by IRENAFootnote 1 as a roadmap toward transforming the international energy industry from fossil-fueled to carbon-free energy by the middle of this century. The main distinctive characteristic of ET that renders it more significant for countries is its capability to provide three primary benefits: mitigation of pollution, green economic expansion and energy security. The mitigation of pollution has garnered particular interest because of the global importance of the issue.

Furthermore, recognized energy organizations including IRENA and IEA view technological innovation as one of the primary drivers for reducing emissions (Adedapo et al. 2022; Acheampong et al. 2019; Akadırı et al. 2021; Adeshola et al. 2021). Finally, recognized institutions such as the UN environmental programs, IRENA, UN Industrial Development Organization and IRENA confirm that technological innovation can help achieve other SDGs such as energy security, health, economic expansion, water, food and poverty reduction in addition to the sustainability of the environment (Ali et al. 2020). Furthermore, it is generally acknowledged that technological innovation are critical for the growth of countries’ energy and social-economic systems, as well as for reducing emissions (Ozturk and Acaravci 2016; Adebayo et al. 2022b; Shahbaz et al. 2018; Solarin et al. 2017; Oladipupo et al. 2021). The United Nations considers innovation, which is at the heart of technology advancement, to be a crucial indicator in the Sustainable Development Goals (SDG).

The research objective is to use a theoretically grounded framework to assess the influence of international trade, financial development, technological innovation , income and renewable energy on CCO2 emissions as well as to make policy suggestions that would be beneficial for reducing carbon emissions.

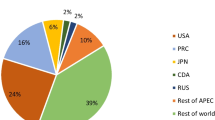

The BRICS countries are used as a case study in this research. There are several reasons for utilizing these countries. Firstly, the BRICS nations account for 42% of the world populace with over 3 billion people (World Bank, 2021). With such a massive population, international trade and economic expansion have enormous potential. From 2008 to 2018, the BRICS nations’ economies grew at a rapid pace, contributing 51.3% to the world economy (Adedoyin et al. 2020; Dingru et al. 2021). Aside from economic development, their share of overall international trade increased from 11.8 to 16.4% between 2008 and 2018 (Fu et al. 2021). Secondly, in 2018, the BRICS nations accounted for 40% of world primary energy consumption. Furthermore, the BRICS nations utilized 66.8% of coal, 30.8% of wind, 25.2% of oil, 24.4% of hydro and 19.5% of global natural gas. Moreover, the BRICS nations also make a significant contribution to energy production. In 2016, the BRICS accounted for 38.3% of overall world electricity generation, 63.7 of coal output, 21.7% of natural gas production and 21.2% of oil production. In 2016, GHGs accounted for 41.3% of global emissions (Rahman, 2020). Renewable energy, which is seen as a crucial element in reducing CO2 emissions, is growing rapidly across the BRICS nations. Regarding renewable energy, the BRICS countries account for 36% of the world’s total renewable energy, contributing to a reduction in CO2 emissions with a steady increase in renewable energy projects (Ding et al. 2021; Hasanov et al. 2021). Furthermore, the BRICS nations have spent a total of US$130 billion on renewable energy development (IEEFA, 2016). The BRICS nations reduce a significant amount of CO2 emissions as their investments in renewable energy grow (IRENA 2016).

The following studies also focused their investigations on the BRICS economies: Chien et al. (2021) employed carbon emissions as the indicator for environmental degradation without adjusting for international trade, although the effect of financial development and economic growth was examined. Also, Sun et al. (2022) failed to adjust for international trade even though the impact of renewable energy was examined. The study of Awosusi et al. (2022b) also employed a different indicator for environmental degradation, while Razzaq et al. (2021a) employed CCO2 as the indicator for environmental degradation but only examined the impact of technological innovation on CCO2 emissions, failing to examine the effect of other indicators used in this study such as renewable energy use, international trade and financial development, different from the current research.

This research adds to the ongoing studies in numerous ways. Firstly, by providing the first analysis on the influence of technological innovation, renewable energy use and financial development on CCO2 emissions in the BRICS nations, this research adds to the energy and environment literature. Secondly, this research adds to previous research (Adebayo and Rjoub 2021; S. Ali et al. 2020; Ding et al. 2021) by incorporating financial development as a significant driver of CCO2 emissions for the BRICS countries from 1990 to 2018. Thirdly, as international trade expands, particularly among the BRICS nations, it is critical that the impact of international trade on CCO2 emissions is assessed. Previous research, as well as studies in the BRICS economies, have taken into account the effect of trade openness in their investigations. However, as a composite measure, trade openness does not enable the distinct effects of imports and exports on CO2 emissions to be isolated. As a result, we include imports and exports as distinct indicators in the research (Ding et al. 2021; Mikayilov, et al. 2018a, b). Moreover, as one of the primary channels of globalization, international trade expansion makes it necessary to account for the degradation of the environment. As a result, CCO2 emissions, which is the international trade-adjusted emission metric, must be considered. The literature, on the other hand, has mostly concentrated on CO2 emissions according to the region. According to recent research, it is preferable to examine CCO2 emissions rather than territorial-based CO2 (Adebayo and Kirikkaleli 2021; Ding et al. 2021; Khattak et al. 2020). Fourthly, unlike several other studies, this research considers cointegration, integration, and heterogeneity and cross-country interdependence in panel data. Furthermore, recent econometric approaches are used, including the cross-sectional test (Westerlund, 2007), cointegration test, slope heterogeneity test, augmented mean group (AMG) methods and common correlated effects mean group (CCEMG).

The subsequent sections of this paper are as follows: Section 2 presents a synopsis of relevant studies, which is accompanied by theoretical framework, data and methods in Section 3. Section 4 discloses the findings and discussion, while Section 5 concludes the research.

Summary of studies

A large body of research has examined the factors that influence CO2 emissions in particular groups of countries, regions and countries. Previous studies have highlighted several determinants of CO2 emissions such as international trade, inequality income, urbanization, globalization, stock market, agriculture, renewable energy, technological innovation (TEC), consumption of energy, natural resource rent and financial development (Su et al. 2021; Acheampong et al. 2019; Kirikkaleli et al. 2022; Agboola et al. 2021; Alola, 2019; Bekun et al. 2019; Gyamfi et al. 2021; Kirikkaleli and Adebayo 2021; Orhan et al. 2021; Pata 2021a; Sarkodie and Adams, 2018; Wang et al. 2021). The literature review has been broken down into five segments to give a more reasonable insight into the determinants of CO2 emissions. The following presents a summary of the selected literature:

Economic growth effect on CO 2 emission

Regarding the connection between economic expansion (GDP) and CO2 emissions, a plethora of studies have been conducted to inform both policymakers and the public about this interconnection (Alola et al. 2021; Fatima et al. 2021; Li et al. 2021; Pata 2021b; Solarin et al. 2018). For instance, using a dataset between 1965 and 2019, Awosusi et al. (2021) scrutinized the growth-emissions connection utilizing wavelet tools in South Korea. Their findings indicated the existence of a positive coherence between CO2 and GDP, which illustrates that South Korea’s GDP is not green. Similarly, the study of Akinsola et al. (2021) on the GDP-CO2 emissions connection in Indonesia between 1965 and 2018 using ARDL approach disclosed that an increase in GDP causes an increase in CO2 emissions. Likewise, the research of Zhang et al. (2021) on the CO2 and GDP nexus using a dataset from 1971 and 2018 unveiled a positive GDP-CO2 association. Likewise, the research of Alola et al. (2019) and Bekun et al. (2019) reported a positive emissions-growth interconnection. Furthermore, Odugbesan et al. (2021) scrutinized the emissions-growth linkage in Brazil from 1965 to 2019. Their study outcomes affirmed that an increase in GDP causes an increase in CO2. Similarly, using Italy as a case study, Ali and Kirikkaleli (2021) investigated the influence of GDP on CO2 emissions using nonlinear ARDL between 1990 and 2018. Their empirical outcomes unveiled that a positive (negative) shock in GDP increases (decreases) emissions of CO2. Moreover, the research of Lin et al. (2021) on the CO2-growth interrelationship reported that economic expansion triggers CO2 emissions.

-

Hypothesis 1: Economic growth will increase CCO2 emissions.

International trade effect on CO2 emission

International trade is commonly acknowledged as a significant factor in CO2 emissions (Ali and Kirikkaleli, 2021; S. Ali et al. 2020). According to previous research, boosting global trade stimulates the flow of products between nations, therefore enhancing international production. Both the environmental footprint and energy usage have risen as a result of growing tendencies in worldwide trade and production. Global trade entails the movement of polluting businesses to nations that have less strict ecological legislation (Ding et al. 2021). To measure the influence of the international trade on CO2, current research on the interrelationship between CO2 and foreign trade has split trade into imports and exports. The majority of previous studies have examined the connection between CO2 emissions and trade, while there are just a few investigations on CCO2 emissions (Ali and Kirikkaleli, 2021; Hasanov et al. 2021; Liddle, 2018; Mikayilov, et al. 2018a, b; Razzaq et al. 2021a, b).

Likewise, Knight and Schor (2014) conducted research on the effect of international trade on CCO2 emissions in 29 high-income countries from 1991 to 2008, and their findings disclosed that imports trigger CCO2, while exports mitigate CCO2 emissions. Likewise, the study of Fernández-Amador et al. (2017) reported similar findings by confirming a positive connection between imports and CCO2. In addition, exports influence CCO2 emissions negatively. Moreover, the research of Hasanov et al. (2018) on the determinants of CCO2 in oil-exporting countries established that the effect of CCO2 is negative, while the effect of imports on CCO2 is positive. The study of Ding et al. (2021) utilizing the G-7 nations as a case study established that imports affect CCO2 emissions, while exports’ impact on CCO2 is negative. Using a quarterly dataset from 1990 to 2018 and long-run estimators (FMOLS, and DOLS), the study of Khan et al. (2020a) established that exports curb CCO2, while imports increase CCO2 emissions. Based on the above discussions, the following hypotheses can be proposed:

-

Hypothesis 2: Exports will mitigate CCO2 emissions; therefore, there will be carbon neutrality.

-

Hypothesis 3: Imports will increase CCO2 emissions.

Effect of financial development on CO2 emissions

A thriving financial sector is critical for an economy’s economic and human and growth, but also it is also critical to assess the influence of FD on the environment. Although research assessing the interrelationship between FD and ecological deterioration is available, the conclusions are mixed (Ahmad et al. 2021; Kihombo, et al. 2021; Razzaq et al. 2021a; Shahbaz et al. 2013). According to the first line of evidence, FD greatly improves the quality of the environment by minimizing environmental degradation. For example, using the BRICS, Tamazian et al. (2009) assessed the FD-CO2 interrelationship and found that FD aids in curbing CO2 emissions. Similarly, using the global economy, Kirikkaleli and Adebayo, 2021) scrutinized the influence of FD on CO2 from 1990Q1 to 2018Q1. The investigators applied both FMOLS and DOLS, and their findings revealed a negative CO2-FD association. Moreover, the study of He et al. (2021b) in Mexico between 1990 and 2018 on the CO2-FD nexus disclosed that FD helps in abating CCO2 emissions. Similarly, using 23 economies and long-run estimators (DOLS and FMOLS), Dogan and Seker (2016) scrutinized the CO2-FD interconnection, and their findings uncovered that FD plays a pivotal role in mitigating CO2.

The second segment of the study unveils a positive CO2-FD interconnection. For example, the study of Boutabba (2014) on the CO2-FD nexus found a positive CO2-FD interconnectedness, which shows that FD mitigates the quality of the environment in India. Moreover, the research of Odugbesan and Adebayo (2021) between FD and CO2 from 1971 to 2016 disclosed a positive CO2-FD interrelationship. Similarly, using a dataset between 1990 and 2018, the research of Kihombo et al. (2021) for the WEMA nations reported that an upsurge in FD in WEMA nations mitigates the quality of the environment. Likewise, the study of Odugbesan et al. (2021) in Thailand established that FD contributes to the degradation of the environment in Thailand. Moreover, using Malaysia as a case study, the research of Charfeddine and Kahia (2019) for 25 African countries over the period 1985–2015 reported a positive interrelationship between CO2 emissions and FD, suggesting that FD contributes to CO2 in the 25 African countries.

In contrast, the third body of evidence shows that CO2 emissions are unaffected by FD. For example, Zhang et al. (2021) evaluated the influence of FD on CO2 in Malaysia spanning the period between 1971 and 2017. Their finding disclosed an insignificant CO2-FD interrelationship. Likewise, the study of Destek and Sarkodie (2019) on the CO2-FD interrelation established an insignificant CO2-FD association.

-

Hypothesis 4: Financial development will mitigate/increase CCO2 emissions

Effect of technological innovation on CO2 emissions

For several years, research on the effect of technological innovation on CO2 emissions has been dormant. However, recent research has empirically established the eco-innovation role in abating CO2 emissions ( Cheng et al. 2021; Chen and Lee, 2020; Hasanov et al. 2021). For instance, Adebayo and Kirikkaleli (2021) assessed the CO2-TEC interrelationship in the global economy, and their study established a negative CO2-TEC association. Utilizing a dataset from 1990 and 2018 for a panel of G7 economies, Ali et al. (2020) scrutinized the CO2-TEC relationship. Their findings using the CS-ARDL approach disclosed that TEC mitigates CCO2 emissions in the short and long run. Using OECD countries, the study of Mensah et al. (2018) reported that TEC aids in curbing CO2. Similarly, utilizing France as the study’s focus, Solarin et al. (2018) reported that a decrease in CO2 emissions is caused by TEC. Moreover, Cheng et al. (2021) reported a negative interconnection between TEC and CO2 emissions, which implies that TEC helps in abating the emissions of CO2. Likewise, the study of Khan et al. 2020b) for China utilizing a dataset from 1990Q1 to 2018Q4 established that TEC helps in abating the emissions of CO2. Similarly, Yii and Geetha (2017) investigated the interconnectedness between CO2 and TEC in Malaysia between 1971 and 2013. Their findings using the VECM approach disclosed that eco-innovation mitigates CO2. Likewise, the study of Fan and Hossain (2018), utilizing data from China and India between 1974 and 2016, disclosed that TEC helps in abating the emissions of CO2. Furthermore, the research of Lin and Zhu (2019) in China reported that TEC helps in abating the emissions of CO2.

-

Hypothesis 5: Technological innovation will mitigate CCO2 emissions; therefore, there will be carbon neutrality.

Effect of renewable energy on CO2 emissions

Renewable energy can help nations diversify their fuel suppliers, reduce costs and generate a more stable energy supply. Furthermore, governments can enhance energy security, minimize reliance on imported oil and prevent fuel spills by diversifying and ensuring dependable energy supply. Over the years, significant works have been conducted to inform the public and policymakers on the role of renewable energy use in curbing CO2 emissions. For instance, using a panel of G20 economies, Paramati et al. (2017) assessed the CO2-REC nexus. Their empirical outcomes disclosed a negative CO2-REC interrelationship, which implies that utilizing green energy mitigates the emissions of CO2 in the G20 economies. Similarly, Aliprandi et al. (2016) conducted research on the effect of REC on CO2 in selected OECD nations from 1980 to 2018 and reported a negative CO2-REC interrelationship. Moreover, the study of Khattak et al. (2020) on the BRICS economies between 1980 and 2016 using the CCEMG approach reported a negative effect of REC on CO2. This implies that renewable energy can enhance the quality of the environment in the selected OECD economies. Similarly, the investigation of Sulaiman et al. (2020) using 27 European Union (EU) and a dataset between 1990 and 2017 reported a CO2-REC negative association. Moreover, using a dataset from 1990 to 2014, the research of Anwar et al. (2021) unveiled a negative CO2-REC connection in 15 Asian economies. Likewise, Pata (2021a) reported a negative connection between CO2 and REC in the BRIC nations from 1971 to 2016. Similarly, Adebayo and Kirikkaleli’s (2021) study on Japan between 1990Q1 and 2015Q4 disclosed that REC helps in curbing CO2 emissions. In summary, these researchers discovered that REC helps in curbing the emissions of CO2.

-

Hypothesis 6: Renewable energy use will mitigate CCO2 emissions; therefore, there will be carbon neutrality.

Theoretical underpinning, data and methods

Theoretical underpinning

This section presents the theoretical underpinning of the research. This research is built on the theoretical perspective of trade-adjusted carbon emissions and ecological modernization theory (EMT). The theory of trade-adjusted carbon emissions proposes that trade-adjusted carbon emissions must be investigated, primarily in emissions exporting nations, because export-oriented economies are embedded with greater technology levels. The EMT concludes that environmental issues raised by economic expansion could be mitigated by enhancing resource efficiency (renewable energy) through technological innovation. We make connections between technological innovation and consumption-based emissions considering the aforementioned assumptions.

Consumption-based carbon emissions (CCO2) is a trade-adjusted metric that accounts for the international trade effect. This metric is modified to account for emissions from imports and exports. This metric is computed by adding import emissions to domestic use demand from the governments and households and removing exports (Khan et al. 2020a; Ding et al. 2021; Razzaq et al. 2021a, b). Likewise, it also accounts for inventory changes, overseas procurements by local consumers and gross fixed capital formation. Moreover, this metric also includes emissions consumed in one nation and produced in another. As a result, this research assesses the component-based impacts of international trade using exports and imports individually, in accordance with prior findings of Hasanov et al. (2018) and Udemba et al. (2021).

Different components of the economy, such as net exports, government expenditures, investment and investment, are included in the gross domestic product (GDP). Domestic consumption accounts for a sizable percentage of GDP. As a result, increasing domestic consumption can result in a significant upsurge in CO2 emissions. Therefore, as the BRICS economies’ incomes increase, it is reasonable to presume that the economies have imported emissions via consumption and trade (Ahmad et al. 2020; Liddle, 2018; Sarkodie and Adams, 2018). Therefore, GDP is anticipated to trigger CCO2, i.e. \(\left({\beta }_{1}=\frac{{\alpha CCO}_{2}}{\alpha GDP}>0\right)\).

Imports, according to these scholars, increase CO2 emissions, especially when a commodity is manufactured overseas and imported. Thus, it is anticipated that imports will increase CCO2, i.e. \(\left({\beta }_{2}=\frac{{\alpha CCO}_{2}}{\alpha IMP}>0\right)\). Domestic output, on the other hand, is exported abroad and utilized by customers in the receiving nation. As a result of this scenario, domestic CO2 emissions fall while CCO2 emissions rise in the receiver nation ((Ding et al. 2021; Hasanov et al. 2018)). Based on this, the effect of export on CCO2 is expected to be negative, i.e. \(\left({\beta }_{3}=\frac{{\alpha CCO}_{2}}{\alpha EXP}<0\right)\).

Likewise, it is anticipated that the adoption of environmentally friendly technology advancements and the use of renewable energy can assist in abating CCO2 emissions via a variety of routes. Firstly, renewable energy can help nations diversify their fuel suppliers, reduce costs and generate a more stable energy supply. Secondly, governments can enhance energy security, minimize reliance on imported oil and prevent fuel spills by diversifying and ensuring dependable energy supply. As a result, because renewable energy generates no or minimal greenhouse gases, it is projected to curb CCO2 emissions. Therefore, REC is anticipated to abate CCO2, i.e. \(\left({\beta }_{4}=\frac{{\alpha CCO}_{2}}{\alpha REC}<0\right)\). Thirdly, technological innovations that are eco-friendly substitute traditional energy-intensive manufacturing equipment with greener and more efficient technology, thus lowering economic and environmental burdens. Hence, the technological innovations effect on CCO2 emissions is anticipated to be negative, i.e. \(\left({\beta }_{5}=\frac{{\alpha CCO}_{2}}{\alpha TEC}<0\right)\).

From a theoretical standpoint, there are two opposing viewpoints on the role of financial development in ecological deterioration. First, by devoting more funding to renewable energy and mobilizing the resources needed to invest in ecologically friendly infrastructure and ensuring its long-term profitability, FD can help in abating the degradation of the environment (Acheampong et al. 2020; Boutabba, 2014; Tamazian et al. 2009). Financial development also allows nations to employ modern technology for ecologically friendly and green production, thus enhancing global and regional environmental sustainability (Ahmad et al. 2021; Bekhet et al. 2017; Charfeddine and Kahia, 2019). A larger degree of FD, on the other hand, may result in ecological damage. Financial development, according to Ahmad et al. (2021), makes it easier for enterprises and people to obtain low-cost financing, allowing them to establish a new firm or expand an existing one. This increases the consumption of energy, which has a negative influence on the quality of the environment. Thus, FD is anticipated to mitigate CCO2 if it is eco-friendly, i.e. \(\left({\beta }_{6}=\frac{{\alpha CCO}_{2}}{\alpha FD}<0\right)\); otherwise, \(\left({\beta }_{6}=\frac{{\alpha CCO}_{2}}{\alpha FD}>0\right)\) is not ecofriendly.

Data

This research assessed the effects of renewable energy use (REC), financial development (FD), technological innovation (TEC), imports (IMP), economic growth (GDP) and exports (EXP) on CCO2 emissions for the BRICS economies utilizing a dataset from 1990 to 2018. Consumption-based carbon emissions (CCO2) is the dependent variable, which is calculated in metric tons. The independent variables are renewable energy consumption, which is estimated as the percentage of total final energy consumed, financial development (FD), which is measured as the financial development index, technological innovation (TEC), which is measured as patent resident and nonresident, and economic growth, which is calculated as GDP per capita constant US$. Moreover, CCO2, FD and TEC data are gathered from the Global Carbon Atlas (GCA, 2019), International Monetary Fund (IMF) and World Bank database, respectively. Figure 1 shows the analysis flowchart, while Figs. 2 and 3 show the trends of consumption-based carbon emissions and GDP per capita for BRICS economies from 1990 to 2018, respectively.

Model construction

International trade is divided into imports and exports to investigate the influence of international trade on CCO2 for the baseline model, a method that is similar to that used in previous studies (Ali & Kirikkaleli, 2021; S. Ali et al. 2020; Ding et al. 2021). The fact that the BRICS countries import high-energy-intensive commodities, which may add considerably to CCO2, might potentially be a reason for this approach. The base framework utilized in this investigation is shown in Model 1 below. The basic model was then expanded with the consumption of renewable energy, financial development and technological innovation to provide four distinct models. Five models were developed based on the reasons presented in this research’s theoretical underpinnings. The baseline model is constructed as follows.

Model 1: The base model.

Mode1 2: We incorporate renewable energy consumption (REC) into Model 1.

Model 3: We incorporate technological innovation (TEC) into Model 1.

Model 4: We incorporate financial development (FD) into Model 1.

Model 5: We incorporate both renewable energy use (REC) and technological innovation (TEC) into Model 1.

Heterogeneity, endogeneity and cross-sectional dependence are connected to the cross-country regression estimation. To overcome these econometric problems, various different tests were used. The first step in the research was to conduct the cross-sectional dependence and slope homogeneity tests. Secondly, the CADF and CIPS tests were employed in this investigation. With respect to cross-sectional dependence and heterogeneity concerns, this test outperforms conventional tests. Thirdly, the error-correction mechanism (ECM) technique proposed by Westerlund (2007) was used. This technique is unaffected by slope heterogeneity and cross-sectional dependence. For long-run coefficient estimation, the AMG and CCEMG methods were adopted. These techniques are robust to heterogeneous slope and cross-sectional dependence, respectively. Therefore, when estimating the models, the problems of endogeneity, heterogeneity and cross-section dependency are eradicated. The subsequent section presents a detailed explanation of the methods applied.

Econometrics methodology

Cross-sectional dependence and homogeneity of slope tests

The probability of cross-sectional dependence (CSD) in the data set has grown as a result of globalization and the expansion of trade. Globalization’s spillover effects are triggered by a variety of disturbances, including oil price shocks, global financial crises and other conventional shocks. This research used (Pesaran 2006) the CSD test to solve this issue. Another essential method involved determining whether the slopes in panel data were homogeneous or heterogeneous. This research used the Hashem Pesaran and Yamagata (2008) heterogeneity/homogeneity of slope (HS) test to achieve this goal. Assuming homogeneity for each cross-section results in misleading and incorrect findings. The following is the HS test equation:

where the adjusted SH and coefficient of the delta slope homogeneity are illustrated by \({\stackrel{\sim }{\Delta }}_{ASCH}\) and \({\stackrel{\sim }{\Delta }}_{SCH}\), respectively.

Stationarity tests

The second-generation Pesaran and Shin (CIPS) and Pesaran cross-sectional augmented Im unit root tests were utilized as a further phase in this research. With respect to CSD and heterogeneity issues, this test outperforms the conventional tests (Pesaran 2007). The CIPS test is depicted in Eq. (8):

In Eq. 8, \({\overline{Y} }_{t-1}\) and \(\Delta \overline{{Y }_{t-l}}\) represent the cross-section average. The value of CIPS is derived as follows:

The cross-sectional augmented Dickey-Fuller test derived from Eq. (8) is denoted by the term CADF in Eq. (9).

Co-integration test

After identifying the stationarity characteristics for each variable, this research used the Westerlund (2007) cointegration technique to evaluate the co-integrating interaction between the series in the long term. This technique is resilient to CSD and slope heterogeneity, and is based on four statistics: two for group mean statistics and two for panel. The general form of the Westerlund cointegration is as follows:

The null and alternative hypotheses are “no cointegration for BRICS economies” and “there is cointegration for the BRICS economies”, respectively.

Panel long-run estimates

Conventional long-run estimators, such as the fully-modified OLS (FMOLS) and dynamic OLS (DOLS), are unable to address slope heterogeneity and cross-sectional dependence problems, resulting in erroneous and biased results, according to (Pesaran and Smith, 1995). We used a panel of augmented mean group (AMG) and common correlated effects mean group (CCEMG) estimators to significantly address these conditions, which give efficient and consistent findings in the face of heterogeneity and cross-sectional dependence. Moreover, Pesaran (2006) introduced the panel CCEMG estimator, which was further expanded by Kapetanios et al. (2011). Following Wang et al. (2021)’s work, we used the panel augmented mean group (AMG) estimator to evaluate the robustness of the panel dynamic CCEMG estimator (He et al. 2021a; Shan et al. 2021). The CCEMG estimator is illustrated as follows:

In Eq. (14), target variables are illustrated by \({Y}_{it}\) and \({\overline{x} }_{it}\). The country-specific estimate of elasticity is illustrated by \({\delta }_{i}\), and common factor with unconnected characteristics unnoticed is illustrated by \({f}_{t}\). The stochastic term and constant are illustrated by \({\varepsilon }_{it}\) and \({\tau }_{li}\) respectively. The approximation approach of the unobserved common factors \({f}_{t}\) in Eq. (14) above is the major distinction between the AMG and CCEMG estimators. The CCEMG estimator combines the cross-sectional mean of the precise effect identified and the explanatory and dependent variables into a linear combination. The OLS method is then used to estimate each coefficient. The AMG estimator uses a two-step technique to estimate the unseen common dynamic effect and includes the common dynamic effect indicator to accommodate for cross-sectional dependence.

Panel causality test

The Dumitrescu and Hurlin (2012) Granger non-causality estimator is used in this work to explore the long-run causal connections among cointegrated macro-economic variables. Policymakers can create more accurate policies by examining the causality direction. When there is cross-sectional dependence, this technique works perfectly. This test employs a set of Wald statistics derived from the causality averages of Granger and Engle (1983) across the different heterogeneous panels. This method is also useful for collecting balanced and diverse panel data. This method may also be applied to cross-sectional dependence. Equation (15) depicts the Dumitrescu and Hurlin causality test as follows:

The null and alternative hypotheses are “no causality” and “there is causality”, respectively.

Findings and discussion

It is critical to evaluate cross-sectional dependence and slope heterogeneity before assessing the variables responsible for CCO2 emissions. Table 1 shows the outcomes of slope heterogeneity in all the models. We reject the null hypothesis of the test in all five models based on the estimated values of the adjusted tilde \(({V}_{adj})\) and delta tilde \(\left(\widehat{\Delta }\right)\) and their corresponding P values. This indicates that the variables are heterogeneous across the different cross sections in all the models. Based on this finding, we applied heterogeneous panel estimators in this empirical analysis.

The CSD results are depicted in Table 2, and the outcomes show that at a significance level of 1%, the null hypothesis of cross-sectional independence is rejected. This suggests that there is a significant cross-sectional dependence between the variables of investigation in all the models. In panel estimation, taking into account slope homogeneity and cross-sectional dependence helps policymakers legitimize the different environmental externalities linked with the variables and, as a result, helps them formulate well-organized policies.

The use of second-generation panel unit root testing is required to control cross-sectional dependence and heterogeneity. Table 3 shows the CADF and CIPS unit root tests outcomes. In the presence of cross-sectional dependence and heterogeneity, both tests are robust. The CADF and CIPS unit root test outcomes disclosed that all the variables (CCO2, GDP, IMP, EXP, TEC, FD and REC) are I(1), signifying the rejection of the null hypothesis (non-stationarity) at first difference. This finding aids in the selection of suitable panel estimators for investigating the long-run influence of the regressors (CCO2, GDP, IMP, EXP, TEC, FD and REC) on CCO2 emissions in the BRICS nations.

Before assessing the long-run effect of GDP, IMP, EXP, TEC, FD and REC on CCO2, it is essential to capture the long-run cointegration in the models. Based on this knowledge, we applied the Westerlund cointegration test. Table 4 summarizes the results of the Westerlund (2007) panel cointegration test for the five models. The Westerlund cointegration test outcomes revealed a long-run cointegration between CCO2 and the regressors in the five models. Thus, the null hypothesis of “no cointegration for the BRICS nations” is rejected in the five models. As a result, in each of the five models, there is confirmation of cointegration between CCO2 and the regressors. Thus, we conclude that the parameters under investigation are interconnected in the long run in each of the five models.

We proceed by assessing the influence of technological innovation, financial development, economic growth, imports and exports on CCO2 emissions in the BRICS nations. Table 5 reveals the AMG and CCEMG long-run estimators’ outcomes. Firstly, the effect of imports (IMP) on CCO2 emissions is positive in all the models in the BRICS economies. This implies that keeping other factors constant, upsurges in CCO2 of 0.081% (Model 1), 0.0149% (Model 2), 0.1863% (Model 3), 0.027% (Model 4) and 0.0153% (Model 5) are caused by a 1% upsurge in imports (IMP) in the BRICS economies. The BRICS nations import a considerable amount of final and intermediate goods and services as emerging economies. Increased imports imply increased domestic consumption and, as a result, increased CCO2 emissions. Imports provide a significant contribution to national consumption. For instance, in 2019, Russia imported US$238 billion, India imported US$474 billion, China imported US$1.58 trillion and South Africa imported US$88 billion from the rest of the world (OEC 2021). The studies of Khan et al. (2020a) for nine oil-exporting nations, Hasanov et al. (2021) for the BRICS nations, and Hussain and Khan, (2021) for the top five emitters reported similar findings.

Moreover, the effect of exports (EXP) on CCO2 is negative in all the five models in the BRICS nations. This shows that holding other indicators unchanged, decreases in CCO2 of − 0.2808% (Model 1), −0.2604% (Model 2), −0.2821% (Model 3), −0.2858% (Model 4) and −0.2536% (Model 5) are caused by a 1% upsurge in exports (EXP) in the BRICS economies. In theory, as we mentioned in Sect. 3, the more a nation exports, the fewer services and goods it consumes domestically. These nations export a significant amount of services and goods to other nations. As a result of this scenario, domestic CO2 emissions fall while CCO2 emissions rise in the receiver nation. These nations export substantial goods and services. For instance, in 2019, Russia exported US$407 billion, India exported US$330 billion, China exported US$2.57 trillion and South Africa exported US$109 billion from the rest of the world (OEC, 2021). The study of Hussain and Khan (2021) for the top emitters between 1990 and 2018 supports this finding. Furthermore, the work of Khan et al. (2020a) for G-7 nations, Adebayo et al. (2021) for MINT economies and Ali et al. (2020) for oil-exporting economies reported similar findings.

Furthermore, we observed a positive CCO2-GDP interrelationship in all the models, as disclosed in Table 5. This shows that upsurges in CCO2 of 0.5279% (Model 1), 0.7844% (Model 2), 1.0777% (Model 3), 1.4045% (Model 4) and 0.4659% (Model 5) are caused by a 1% surge in economic growth (GDP) by holding other indicators unchanged in the BRICS economies. Therefore, economic expansion in the BRICS economies triggers CCO2 emissions. This outcome is consistent with the theoretical framework presented in Sect. 3. Furthermore, ecological theories such as the EKC and STIRPAT anticipate that an increase in GDP will lead to higher emissions of CO2. In addition, an upsurge in the level of income or economic activities is connected with increased consumption of final and intermediate goods and services, resulting in increased emissions of CO2 (Razzaq et al. 2021b; Awosusi et al. 2022b). This outcome is consistent with the works of Hasanov et al. (2018) for oil-exporting countries, Khan et al. (2020a) for nine oil-exporting nations, Knight and Schor (2014) for 29 high-income countries, Adebayo et al. (2022a) for the MINT economies and Khan et al. (2020b) for China, who reported a positive CCO2-GDP interrelationship.

Moreover, in Models 2 and 5, we found a negative CCO2-REC interrelationship in the BRICS nations, which suggests that renewable energy aids in curbing CCO2 emissions. This demonstrates that a 1% upsurge in renewable energy mitigates CCO2 emissions by −0.6155% (Model 2) and —0.6387% (Model 5) holding other indicators unchanged in the BRICS economies. As we stated in Sect. 3, taking into account that total energy consumption is calculated as the sum of renewable energy sources and fossil fuels consumptions, a rise in consumption of renewable mitigates the share of fossil fuel, which in turn decreases the emissions of CO2. Therefore, renewable energy can help nations diversify their fuel suppliers, reduce costs and generate a more stable energy supply. The BRICS nations are averting a significant amount of CO2 emissions as their investment in renewable energy grows (IRENA 2017). The finding of the negative renewable energy and CO2 emissions interrelationship concurs with the studies of Yuping et al. (2021) for Argentina and Gyamfi et al. (2021) for Mediterranean nations. Also, the studies of Miao et al. (2022), He et al. (2021a) and Xu et al. (2022) found an adverse interconnection between renewable energy and environmental degradation in newly industrialized countries (NICs), the top 10 energy transition economies and Brazil, respectively.

Additionally, we observed a negative CCO2-TEC interrelationship in the BRICS nations. This illustrates that holding other indicators unchanged, decreases in CCO2 emissions of −0.2365% (Model 3) and −0.0117% (Model 5) are caused by a 1% upsurge in TEC in the BRICS economies. This implies that technological innovation aids in curbing the emissions of CO2. This outcome shows that the BRICS countries profited from technological innovation by either minimizing pollutant emissions or lessening the strain on their natural resources. Similarly, the growth of the industry for eco-goods and eco-services connected to the environment (e.g. IT) over the last several decades illustrates why the BRICS countries see technological innovation as a crucial driver and determinant of energy efficiency, climate change and environmental conservation. This finding complies with prior scholars such as Hussain and Khan, (2021) and Udemba et al. (2021), who reported a negative connection between TEC and CCO2 emissions. Also, the study of Zhuang et al. (2021) and An et al. (2021) found that TEC mitigates CO2 in the provinces of China and Belt and Road Initiative nations, respectively.

Lastly, the effect of financial development (FD) on CCO2 is positive and insignificant, which implies that FD does not impact CCO2 emissions in the BRICS economies. This finding is unexpected given the fact that the financial sectors of emerging nations such as the BRICS are still in their early phase and financial development might not aid in abating the degradation of the environment. This outcome is conformity with the works of Bekhet et al. (2017) for GCC nations, Ramzan et al. (2021) for Latin American nations and Sekali and Bouzahzah (2019) for Morocco.

As a check for robustness, we applied the AMG approach suggested by Eberhardt (2012) to validate the CCEMG outcomes. Table 5 summarizes the results of the AMG, and the results show that economic growth and imports mitigate environmental sustainability, while exports, technological innovation and renewable energy consumption enhance the quality of the environment. Furthermore, financial development does not affect environmental degradation in the BRICS nations. Figure 4 shows the graphical outcomes of the CCEMG and AMG.

The present research proceeds by examining the causal effect of the regressors (financial development, renewable energy use, imports, technological innovation and exports) on CCO2 emissions in the BRICS economies using a panel causality test. The outcomes of the causality test are presented in Table 6. The outcomes disclosed the following: (i) there is a feedback causal interrelationship between CCO2 emissions and exports, which implies that exports can predict the level of CCO2 emission in the BRICS nations and vice-versa; (ii) a two-way causal interconnection exists between CCO2 emissions and GDP, which implies that CCO2 emissions and GDP can predict each other. Therefore, any policy suggestion channeled toward GDP will have a substantial effect on CCO2 emissions and vice-versa; (iii) there is a unidirectional causal connection from REC and TEC to CCO2. This suggests that renewable energy and technological innovation consumption can predict CCO2 emissions in the BRICS nations. Thus, policies directed toward TEC and REC will have a significant effect on CCO2 emissions; and (iv) a two-way causal association exists between CCO2 emissions and imports, which shows that both CCO2 emissions and imports can predict each other.

Conclusion and policy direction

Conclusion

This research explores the long-run and causal effect of international trade and technological innovation on consumption-based carbon emissions as well as the role of financial development, renewable energy use and economic growth in the BRICS economies utilizing a dataset spanning between 1990 and 2018. To assess the cointegrating interrelationship between CCO2 emissions and the regressors, we used a series of second-generation panel techniques such as cross-sectional dependence (CSD), CIPS, CADF, slope homogeneity (SH), Westerlund cointegration, common correlated effects mean group (CCEMG) and augmented mean group (AMG). The following are some of the important outcomes. Firstly, all the models exhibited slope homogeneity (SH) and cross-sectional dependence (CSD), as disclosed by the HS and CSD tests. Secondly, the CADF and CIPS tests confirmed the robustness of CSD and HS by revealing an identical I(1) order of integration for all variables. Thirdly, there is long-run interconnection between CCO2 and the regressors in all the models, as revealed by Westerlund panel co-integration. Fourth, the long-run estimate outcomes of the second-generation CCEMG technique showed that technological innovation, renewable energy usage and exports mitigate CCO2 emissions, while economic growth and imports contribute to CCO2 emissions in the BRICS economies. The robustness outcomes of the CCEMG results were further validated by the AMG model. Fifth, the outcomes of the causality test unveiled a unidirectional causality running from technological innovation and renewable energy consumption to CCO2 emissions.

Policy path

With regard to policy ramifications, this research makes the following key suggestions. Firstly, the government should develop measures to promote renewable energy usage and technological innovation. Secondly, the present findings suggest that the BRICS countries should use cost-effective environmentally-friendly technology to facilitate the transition to sustainable energy sources. The BRICS countries can reduce the negative environmental effect (CO2 emissions) of economic growth and trade by embracing and engaging in cleaner production technologies. The BRICS countries should place a greater emphasis on technological innovation and shift their manufacturing sectors away from non-renewable energy usage toward renewable energy use. This will not only assist the economy, but also the environment by lowering CO2. This will require a concerted effort to boost the collective development of sustainable energy initiatives. Fourth, the current study has demonstrated that imports have a negative impact on the environment (CCO2 emissions). As a result, policymakers should not rush to impose import taxes to deter excessive spending, as this might harm economic expansion and trade openness. Instead, a viable strategy would be to raise public awareness of the ecological consequences of imported goods, provide subsidies for green imports and facilitate the transfer of green technologies. Finally, financial development may not enhance the quality of the environment in developing economies such as the BRICS nations and other developing economies where the structural shift of the financial sector is still in its early stages. As a result, the BRICS governments must adopt strong mitigating measures.

Limitations of the study

The main drawback of this research is that it only investigates the BRICS countries. Future studies can reproduce these outcomes in various regions, such as the MINT, OECD, G-7, RECEP, and EU countries, as well as African and Asian regions. Secondly, another limitation that, technological innovation, financial development, renewable energy use and economic growth were utilized as control variables to test the interrelationship between CCO2 emissions and international trade. Future research should examine other factors that influence CCO2 levels, such as interest rates, nonrenewable energy, fiscal policy and government spending.

Data availability

Data is readily available on request from the corresponding author.

Notes

International Renewable Energy Agency.

Abbreviations

- AMG:

-

Augmented mean group

- BRICS:

-

Brazil, Russia, India, China and South Africa

- CO2 :

-

Carbon emissions

- CCO2 :

-

Consumption-based carbon emission

- CCEMG:

-

Common correlated effects mean group

- CSD:

-

Cross-sectional dependence

- GDP:

-

Economic growth

- GHGs:

-

Greenhouse gas emissions

- EXP:

-

Exports

- EMT:

-

Ecological modernization theory

- FD:

-

Financial development

- IMP:

-

Import

- REC:

-

Renewable energy use

- TEC:

-

Technological innovation

References

Acheampong AO, Adams S, Boateng E (2019) Do globalization and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? Sci Total Environ 677:436–446. https://doi.org/10.1016/j.scitotenv.2019.04.353

Acheampong AO, Amponsah M, Boateng E (2020) Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ 88:104768. https://doi.org/10.1016/j.eneco.2020.104768

Adebayo TS, Acheampong AO (2021) Modelling the globalization-CO2 emission nexus in Australia: evidence from quantile-on-quantile approach. Environ Sci Pollut Res 29(7):9867–9882

Adebayo TS, Kirikkaleli D (2021) Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environ Dev Sustain 23(11):16057–16082. https://doi.org/10.1007/s10668-021-01322-2

Adebayo TS, Rjoub H (2021) Assessment of the role of trade and renewable energy consumption on consumption-based carbon emissions: evidence from the MINT economies. Environ Sci Pollut Res 28(41):58271–58283. https://doi.org/10.1007/s11356-021-14754-0

Adebayo TS, Awosusi AA, Rjoub H, Panait M, Popescu C (2021) Asymmetric impact of international trade on consumption-based carbon emissions in MINT Nations. Energies 14(20):6581

Adebayo TS, Agyekum EB, Kamel S, Zawbaa HM, Altuntaş M (2022a) Drivers of environmental degradation in Turkey: designing an SDG framework through advanced quantile approaches. Energy Rep 8:2008–2021

Adebayo TS, Awosusi AA, Rjoub H, Agyekum EB, Kirikkaleli D (2022b) The Yuping influence of renewable energy usage on consumption-based carbon emissions in MINT economies. Heliyon 8(2):e08941. https://doi.org/10.1016/j.heliyon.2022.e08941

Adedapo AT, Adebayo TS, Akadiri SS, Usman N (2022) Does interaction between technological innovation and natural resource rent impact environmental degradation in newly industrialized countries? New evidence from method of moments quantile regression. Environ Sci Pollut Res 29(2):3162–3169

Adedoyin FF, Gumede MI, Bekun FV, Etokakpan MU, Balsalobre-lorente D (2020) Modelling coal rent, economic growth and CO2 emissions: does regulatory quality matter in BRICS economies? Sci Total Environ 710:136284. https://doi.org/10.1016/j.scitotenv.2019.136284

Adedoyin FF, Ozturk I, Agboola MO, Agboola PO, Bekun FV (2021) The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: the role of economic policy uncertainties. Energy Pol 150:112115. https://doi.org/10.1016/j.enpol.2020.112115

Adeshola I, Adebayo TS, Oladipupo SD, Rjoub H (2021) Wavelet analysis of impact of renewable energy consumption and technological innovation on CO2 emissions: evidence from Portugal. Environ Sci Pollut Res 43(3):1–18

Adewale Alola A, Ozturk I, Bekun FV (2021) Is clean energy prosperity and technological innovation rapidly mitigating sustainable energy-development deficit in selected sub-Saharan Africa? A Myth or Reality Energy Policy 158:112520. https://doi.org/10.1016/j.enpol.2021.112520

Agboola MO, Adebayo TS, R5joub H, Adeshola I, Agyekum EB, Kumar NM (2021) Linking economic growth, urbanization, and environmental degradation in China: what is the role of hydroelectricity consumption? Int J Environ Res Public Health 18(13):6975–6990

Ahmad F, Draz MU, Ozturk I, Su L, Rauf A (2020) Looking for asymmetries and nonlinearities: the nexus between renewable energy and environmental degradation in the Northwestern provinces of China. J Clean Prod 266:121714. https://doi.org/10.1016/j.jclepro.2020.121714

Ahmad M, Ahmed Z, Yang X, Hussain N, Sinha A (2021) Financial development and environmental degradation: do human capital and institutional quality make a difference? Gondwana Res 23(3):112–127. https://doi.org/10.1016/j.gr.2021.09.012

Akadırı SS, Alola AA, Usman O (2021) Energy mix outlook and the EKC hypothesis in BRICS countries: a perspective of economic freedom vs. economic growth. Environ Sci Pollut Res 28(7):8922–8926

Akadiri SS, Adebayo TS, Rjoub H (2022) On the relationship between economic policy uncertainty, geopolitical risk and stock market returns in South Korea: a quantile causality analysis. Ann Financ Econ 7(2):22–34

Akinsola GD, Adebayo TS, Odugbesan JA, Olanrewaju VO (2021) Determinants of environmental degradation in Thailand: empirical evidence from ARDL and wavelet coherence approaches. Pollution 7(1):181–196

Akinsola GD, Awosusi AA, Kirikkaleli D, Umarbeyli S, Adeshola I, Adebayo TS (2022) Ecological footprint, public-private partnership investment in energy, and financial development in Brazil: a gradual shift causality approach. Environ Sci Pollut Res 29(7):10077–10090

Ali M, Kirikkaleli D (2021) The asymmetric effect of renewable energy and trade on consumption-based CO2 emissions: the case of Italy. Integr Environ Assess Manag 2(11):12–36. https://doi.org/10.1002/ieam.4516

Ali S, Khan Z, Umar M, Kirikkaleli D, Jiao Z (2020) Consumption-based carbon emissions and International trade in G7 countries: the role of environmental innovation and renewable energy. Sci Total Environ 730:138945. https://doi.org/10.1016/j.scitotenv.2020.138945

Aliprandi F, Stoppato A, Mirandola A (2016) Estimating CO2 emissions reduction from renewable energy use in Italy. Renew Energy 96:220–232. https://doi.org/10.1016/j.renene.2016.04.022

Alola AA (2019) The trilemma of trade, monetary and immigration policies in the United States: accounting for environmental sustainability. Sci Total Environ 658:260–267. https://doi.org/10.1016/j.scitotenv.2018.12.212

Alola AA, Bekun FV, Sarkodie SA (2019) Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci Total Environ 685:702–709. https://doi.org/10.1016/j.scitotenv.2019.05.139

Alola AA, Adebayo TS, Onifade ST (2021) Examining the dynamics of ecological footprint in China with spectral granger causality and quantile-on-quantile approaches. Int J Sustain Dev World Ecol 29(3):263–276. https://doi.org/10.1080/13504509.2021.1990158

An H, Razzaq A, Haseeb M, Mihardjo LW (2021) The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: new evidence from Method of Moments Quantile Regression. Environ Sci Pollut Res 28(5):5254–5270

Anwar A, Sinha A, Sharif A, Siddique M, Irshad S, Anwar W, Malik S (2021) The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: evidence from selected Asian countries. Environ Dev Sustain 10(3):23–30. https://doi.org/10.1007/s10668-021-01716-2

Awosusi AA, Kirikkaleli D, Akinsola GD, Adebayo TS, Mwamba MN (2021) Can CO2 emissions and energy consumption determine the economic performance of South Korea? A time series analysis. Environ Sci Pollut Res 28(29):38969–38984. https://doi.org/10.1007/s11356-021-13498-1

Awosusi AA, Mata MN, Ahmed Z, Coelho MF, Altuntaş M, Martins JM, Martins JN, Onifade ST (2022) How do renewable energy, economic growth and natural resources rent affect environmental sustainability in a globalized economy? Evidence from Colombia based on the gradual shift causality approach. Front Energy Res 9:1–3

Awosusi AA, Adebayo TS, Altuntaş M, Agyekum EB, Zawbaa HM, Kamel S (2022) The dynamic impact of biomass and natural resources on ecological footprint in BRICS economies: a quantile regression evidence. Energy Rep 8:1979–1994

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sustain Energy Rev 70:117–132. https://doi.org/10.1016/j.rser.2016.11.089

Bekun FV, Alola AA, Sarkodie SA (2019) Toward a sustainable environment: nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029. https://doi.org/10.1016/j.scitotenv.2018.12.104

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41. https://doi.org/10.1016/j.econmod.2014.03.005

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213. https://doi.org/10.1016/j.renene.2019.01.010

Chen Y, Lee C-C (2020) Does technological innovation reduce CO2 emissions? Cross-Country Evidence. J Clean Prod 263:121550. https://doi.org/10.1016/j.jclepro.2020.121550

Cheng C, Ren X, Dong K, Dong X, Wang Z (2021) How does technological innovation mitigate CO2 emissions in OECD countries? Heterogeneous analysis using panel quantile regression. J Environ Manage 280:111818. https://doi.org/10.1016/j.jenvman.2020.111818

Chien F, Anwar A, Hsu CC, Sharif A, Razzaq A, Sinha A (2021) The role of information and communication technology in encountering environmental degradation: proposing an SDG framework for the BRICS countries. Technol Soc 65:101587

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Ding Q, Khattak SI, Ahmad M (2021) Towards sustainable production and consumption: assessing the impact of energy productivity and eco-innovation on consumption-based carbon dioxide emissions (CCO2) in G-7 nations. Sustain Prod Consum 27:254–268. https://doi.org/10.1016/j.spc.2020.11.004

Dingru L, Ramzan M, Irfan M, Gülmez Ö, Isik H, Adebayo TS, Husam R (2021) The role of renewable energy consumption towards carbon neutrality in BRICS nations: does globalization matter? Front Environ Sci 9(4):7–15. https://doi.org/10.3389/fenvs.2021.796083

Dogan E, Seker F (2016) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energy 94:429–439. https://doi.org/10.1016/j.renene.2016.03.078

Dumitrescu E-I, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Eberhardt M (2012) Estimating panel time-series models with heterogeneous slopes. Stand Genomic Sci 12(1):61–71. https://doi.org/10.1177/1536867X1201200105

Fan H, Hossain MI (2018) Technological innovation, trade openness, CO2 emission and economic growth: comparative analysis between China and India. Int J Energy Econ Pol 8(6):240–257

Fatima T, Shahzad U, Cui L (2021) Renewable and nonrenewable energy consumption, trade and CO2 emissions in high emitter countries: does the income level matter? J Environ Planning Manage 64(7):1227–1251. https://doi.org/10.1080/09640568.2020.1816532

Fernández-Amador O, Francois JF, Oberdabernig DA, Tomberger P (2017) Carbon dioxide emissions and economic growth: an assessment based on production and consumption emission inventories. Ecol Econ 135:269–279. https://doi.org/10.1016/j.ecolecon.2017.01.004

Fu Q, Álvarez-Otero S, Sial MS, Comite U, Zheng P, Samad S, Oláh J (2021) Impact of renewable energy on economic growth and CO2 emissions—evidence from BRICS countries. Processes 9(8):1281. https://doi.org/10.3390/pr9081281

GCA (2019) Global carbon atlas, Retrieved from http://www.globalcarbonatlas.org/en/CO2-emissions. Accessed 12 Feb 2022

Granger CW, Engle R (1983) Applications of spectral analysis in econometrics. Handb Stat 3:93–109

Gyamfi BA, Adebayo TS, Bekun FV, Agyekum EB, Kumar NM, Alhelou HH, Al-Hinai A (2021) Beyond environmental Kuznets curve and policy implications to promote sustainable development in Mediterranean. Energy Rep 7:6119–6129. https://doi.org/10.1016/j.egyr.2021.09.056

Hasanov FJ, Liddle B, Mikayilov JI (2018) The impact of international trade on CO2 emissions in oil exporting countries: territory vs consumption emissions accounting. Energy Econ 74:343–350. https://doi.org/10.1016/j.eneco.2018.06.004

Hasanov FJ, Khan Z, Hussain M, Tufail M (2021) Theoretical framework for the carbon emissions effects of technological progress and renewable energy consumption. Sustain Dev 29(5):810–822. https://doi.org/10.1002/sd.2175

Hashem Pesaran M, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142(1):50–93. https://doi.org/10.1016/j.jeconom.2007.05.010

He X, Adebayo TS, Kirikkaleli D, Umar M (2021b) Consumption-based carbon emissions in Mexico: an analysis using the dual adjustment approach. Sustain Prod Consum 27:947–957. https://doi.org/10.1016/j.spc.2021.02.020

He K, Ramzan M, Awosusi AA, Ahmed Z, Ahmad M, Altuntaş M (2021a) Does globalization moderate the effect of economic complexity on CO2 emissions? Evidence from the top 10 energy transition economies. Front Environ Sci 34(5):45–55. https://doi.org/10.3389/fenvs.2021.778088

Hussain M. & Khan J. A. (2021). The nexus of environment-related technologies and consumption-based carbon emissions in top five emitters: empirical analysis through dynamic common correlated effects estimator. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-15333-z

IEEFA (2016) Institute for energy economics and financial analysis. Retrieved from https://ieefa.org/. Accessed 12 Feb 2022

IRENA (2016) Renewable energy target setting. International Renewable Energy Agency. Retrieved from https://www.irena.org. Accessed 23 Dec 2021

IRENA (2017) Renewable energy target setting. Abu Dhabi, UAE: International Renewable Energy Agency. Retrieved from: https://www.irena.org/publications/2015/Jun/Renewable-Energy-Target-Setting. Accessed 8 Feb 2022

Kapetanios G, Pesaran MH, Yamagata T (2011) Panels with non-stationary multifactor error structures. J Econom 160(2):326–348. https://doi.org/10.1016/j.jeconom.2010.10.001

Khan Z, Ali M, Jinyu L, Shahbaz M, Siqun Y (2020a) Consumption-based carbon emissions and trade nexus: evidence from nine oil exporting countries. Energy Economics 89:104806. https://doi.org/10.1016/j.eneco.2020.104806

Khan Z, Ali M, Kirikkaleli D, Wahab S, Jiao Z (2020b) The impact of technological innovation and public-private partnership investment on sustainable environment in China: consumption‐based carbon emissions analysis. Sustain Dev 28(5):1317–1330. https://doi.org/10.1002/sd.2086

Khattak SI, Ahmad M, Khan ZU, Khan A (2020) Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: new evidence from the BRICS economies. Environ Sci Pollut Res 27(12):13866–13881. https://doi.org/10.1007/s11356-020-07876-4

Kihombo S, Ahmed Z, Chen S, Adebayo TS, Kirikkaleli D (2021) Linking financial development, economic growth, and ecological footprint: what is the role of technological innovation? Environ Sci Pollut Res 28(43):61235–61245. https://doi.org/10.1007/s11356-021-14993-1

Kirikkaleli D, Adebayo TS (2021) Do renewable energy consumption and financial development matter for environmental sustainability? New Global Evidence. Sustain Dev 29(4):583–594

Kirikkaleli D, Güngör H, Adebayo TS (2022) Consumption‐based carbon emissions, renewable energy consumption, financial development and economic growth in Chile. Bus Strategy Environ 31(3):1123–1137. https://doi.org/10.1002/bse.2945

Knight KW, Schor JB (2014) Economic growth and climate change: a cross-national analysis of territorial and consumption-based carbon emissions in high-income countries. Sustainability 6(6):3722–3731. https://doi.org/10.3390/su6063722

Li M, Ahmad M, Fareed Z, Hassan T, Kirikkaleli D (2021) Role of trade openness, export diversification, and renewable electricity output in realizing carbon neutrality dream of China. J Environ Manage 297:113419. https://doi.org/10.1016/j.jenvman.2021.113419

Liddle B (2018) Consumption-based accounting and the trade-carbon emissions nexus. Energy Econ 69:71–78. https://doi.org/10.1016/j.eneco.2017.11.004

Lin B, Zhu J (2019) The role of renewable energy technological innovation on climate change: empirical evidence from China. Sci Total Environ 659:1505–1512. https://doi.org/10.1016/j.scitotenv.2018.12.449

Lin X, Zhao Y, Ahmad M, Ahmed Z, Rjoub H, Adebayo TS (2021) Linking innovative human capital, economic growth, and CO2 emissions: an empirical study based on Chinese provincial panel data. Int J Environ Res Public Health 18(16):8503. https://doi.org/10.3390/ijerph18168503

Mensah CN, Long X, Boamah KB, Bediako IA, Dauda L, Salman M (2018) The effect of innovation on CO2 emissions of OCED countries from 1990 to 2014. Environ Sci Pollut Res 25(29):29678–29698

Miao Y, Razzaq A, Adebayo TS, Awosusi AA (2022) Do renewable energy consumption and financial globalisation contribute to ecological sustainability in newly industrialized countries? Renew Energy 185(12):688–697. https://doi.org/10.1016/j.renene.2022.01.073

Mikayilov JI, Galeotti M, Hasanov FJ (2018) The impact of economic growth on CO2 emissions in Azerbaijan. J Clean Prod 197:1558–1572. https://doi.org/10.1016/j.jclepro.2018.06.269

Mikayilov JI, Hasanov FJ, Liddle B (2018) The impact of international trade on CO2 emissions in oil exporting countries: territory vs consumption emissions accounting. Energy Econ 74:343–350. https://doi.org/10.1016/j.eneco.2018.06.004

Odugbesan JA, Adebayo TS (2021) Modeling CO2 emissions in South Africa: empirical evidence from ARDL based bounds and wavelet coherence techniques. Environ Sci Pollut Res 28(8):9377–9389

Odugbesan JA, Adebayo TS, Awosusi AA, Akinsola GD, Wong WK, Rjoub H (2021) Sustainability of energy-induced growth nexus in Brazil: do carbon emissions and urbanization matter? Sustainability 13(8):4371

OEC (2021) Observatory of economic complexity. Retrieved from: https://atlas.cid.harvard.edu/. Accessed 10 Feb 2022

Oladipupo SD, Adebayo TS, Awosusi AA, Agyekum EB, Jayakumar A, Kumar NM (2021) Dominance of fossil fuels in Japan’s national energy mix and implications for environmental sustainability. Int J Environ Res Public Health 18(14):7347–7356

Onifade ST, Alola AA, Adebayo TS, Obumneke M (2022) Does it take international integration of natural resources to ascend the ladder of environmental quality in the newly industrialized countries? Resour Pol 4(2):23–33

Orhan A, Adebayo TS, Genç SY, Kirikkaleli D (2021) Investigating the linkage between economic growth and environmental sustainability in India: do agriculture and trade openness matter? Sustainability 13(9):4753. https://doi.org/10.3390/su13094753

Ozturk I, Acaravci A (2016) Energy consumption, CO2 emissions, economic growth, and foreign trade relationship in Cyprus and Malta. Energy Sources B: Econ Plan Policy 11(4):321–327

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371. https://doi.org/10.1016/j.eneco.2017.06.025

Pata UK (2021a) Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: testing the EKC hypothesis with a structural break. Environ Sci Pollut Res 28(1):846–861. https://doi.org/10.1007/s11356-020-10446-3

Pata UK (2021b) Linking renewable energy, globalization, agriculture, CO2 emissions and ecological footprint in BRIC countries: a sustainability perspective. Renew Energy 173(23):197–208

Pesaran MH (2006) Estimation and Inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012. https://doi.org/10.1111/j.1468-0262.2006.00692.x

Pesaran MH (2007) A simple panel unit root test in the presence of cross‐section dependence. J Appl Econom 22(2):265–312

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econ 68(1):79–113. https://doi.org/10.1016/0304-4076(94)01644-F

Rahman MM (2020) Environmental degradation: the role of electricity consumption, economic growth and globalisation. J Environ Manage 253:109742. https://doi.org/10.1016/j.jenvman.2019.109742

Ramzan M, Adebayo TS, Iqbal HA, Awosusi AA, Akinsola GD (2021) The environmental sustainability effects of financial development and urbanization in Latin American countries. Environ Sci Pollut Res 28(41):57983–57996

Razzaq A, Wang Y, Chupradit S, Suksatan W, Shahzad F (2021) Asymmetric inter-linkages between green technology innovation and consumption-based carbon emissions in BRICS countries using quantile-on-quantile framework. Technol Soc 66:101656. https://doi.org/10.1016/j.techsoc.2021.101656

Razzaq A, Sharif A, Najmi A, Tseng ML, Lim MK (2021) Dynamic and causality interrelationships from municipal solid waste recycling to economic growth, carbon emissions and energy efficiency using a novel bootstrapping autoregressive distributed lag. Resour Conserv Recycl 166:105372

Sarkodie SA, Adams S (2018) Renewable energy, nuclear energy, and environmental pollution: accounting for political institutional quality in South Africa. Sci Total Environ 643:1590–1601. https://doi.org/10.1016/j.scitotenv.2018.06.320

Sekali J, Bouzahzah M (2019) Financial development and environmental quality: empirical evidence for Morocco. Int J Energy Econ Pol 9(2):67–74

Shahbaz M, Kumar Tiwari A, Nasir M (2013) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Pol 61:1452–1459. https://doi.org/10.1016/j.enpol.2013.07.006

Shahbaz M, Shahzad SJH, Mahalik MK, Hammoudeh S (2018) Does globalisation worsen environmental quality in developed economies? Environ Model Assess 23(2):141–156. https://doi.org/10.1007/s10666-017-9574-2

Shan S, Ahmad M, Tan Z, Adebayo TS, Man Li RY, Kirikkaleli D (2021) The role of energy prices and non-linear fiscal decentralization in limiting carbon emissions: tracking environmental sustainability. Energy 234:121243. https://doi.org/10.1016/j.energy.2021.121243

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719. https://doi.org/10.1016/j.energy.2017.02.089

Solarin SA, Al-Mulali U, Gan GGG, Shahbaz M (2018) The impact of biomass energy consumption on pollution: evidence from 80 developed and developing countries. Environ Sci Pollut Res 25(23):22641–22657. https://doi.org/10.1007/s11356-018-2392-5

Su ZW, Umar M, Kirikkaleli D, Adebayo TS (2021) Role of political risk to achieve carbon neutrality: evidence from Brazil. J Environ Manag 298:113463

Sulaiman C, Abdul-Rahim AS, Ofozor CA (2020) Does wood biomass energy use reduce CO2 emissions in European Union member countries? Evidence from 27 members. J Clean Prod 253:119996. https://doi.org/10.1016/j.jclepro.2020.119996

Sun Y, Bao Q, Siao-Yun W, Islam MU, Razzaq A (2022) Renewable energy transition and environmental sustainability through economic complexity in BRICS countries: fresh insights from novel Method of Moments Quantile regression. Renew Energy 184:1165–1176

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Pol 37(1):246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Udemba EN, Adebayo TS, Ahmed Z, Kirikkaleli D (2021) Determinants of consumption-based carbon emissions in Chile: an application of non-linear ARDL. Environ Sci Pollut Res 28(32):43908–43922. https://doi.org/10.1007/s11356-021-13830-9

Umar M, Ji X, Kirikkaleli D, Xu Q (2020) COP21 roadmap: do innovation, financial development, and transportation infrastructure matter for environmental sustainability in China? J Environ Manage 271:111026. https://doi.org/10.1016/j.jenvman.2020.111026

Wang KH, Liu L, Adebayo TS, Lobonț OR, Claudia MN (2021) Fiscal decentralization, political stability and resources curse hypothesis: a case of fiscal decentralized economies. Resour Pol 72:102071

Westerlund J (2007) Testing for Error correction in panel data*. Oxford Bull Econ Stat 69(6):709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

World Bank (2021) World development indicators. Retrieved from http://data.worldbank.org/country. Accessed 5 Dec 2021

Xu D, Salem S, Awosusi AA, Abdurakhmanova G, Altuntaş M, Oluwajana D, Kirikkaleli D, Ojekemi O (2022) Load capacity factor and financial globalization in Brazil: the role of renewable energy and urbanization. Front Environ Sc 6(9):4–20. https://doi.org/10.3389/fenvs.2021.823185

Yii K-J, Geetha C (2017) The Nexus between technology innovation and CO2 emissions in Malaysia: evidence from granger causality test. Energy Procedia 105:3118–3124. https://doi.org/10.1016/j.egypro.2017.03.654

Yuping L, Ramzan M, Xincheng L, Murshed M, Awosusi AA, BAH SI, Adebayo TS (2021) Determinants of carbon emissions in Argentina: the roles of renewable energy consumption and globalization. Energy Rep 7:4747–4760

Zhang L, Li Z, Kirikkaleli D, Adebayo TS, Adeshola I, Akinsola GD (2021) Modeling CO2 emissions in Malaysia: an application of Maki cointegration and wavelet coherence tests. Environ Sci Pollut Res 28(20):26030–26044. https://doi.org/10.1007/s11356-021-12430-x

Zhuang Y, Yang S, Razzaq A, Khan Z (2021) Environmental impact of infrastructure-led Chinese outward FDI, tourism development and technology innovation: a regional country analysis. J Environ Plan Manag 1–33

Author information

Authors and Affiliations

Contributions

OO designed the experiment and collected the dataset. The introduction and literature review sections were written by HR, and OO constructed the methodology section and empirical outcomes in the study. HR, AAA and EBA contributed to the validation and review of the study. All the authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval