Abstract

This article seeks to examine the impacts of renewable and non-renewable energy on carbon dioxide emissions for 14 Middle East and North Africa economies using fully modified least-squares and vector error correction model techniques. Different sectoral outputs (agricultural, industry, and services) are considered in the analysis to find the influence of each sector on carbon emissions and to validate the environmental Kuznets curve model at both aggregate and disaggregate levels. The fully modified least-squares estimates show that renewable energy enhances environmental quality, whereas non-renewable energy deteriorates it. We also find that the industry sector has the highest contribution to environmental degradation. The results of the vector error correction model technique show a two-way linkage between CO2 emissions and renewable energy and between CO2 emissions and non-renewable energy in both short and long runs. At the sectoral level, we also find a two-way linkage between agricultural value added and CO2 emissions, a unidirectional relationship running from emissions to industry value added, and a unidirectional linkage running from services value added to CO2 emissions in both short and long runs. Therefore, governments must focus their actions on environmental policies of a green and inclusive economy that combine tools of environmental economics with those of the ecological economy. This can be considered a call for policymakers to take relevant and quick policies and actions towards low-carbon energy to reach these dual objectives.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Concerns about the planet’s sustainability have become a growingly influential topic in policy and academic circles, and more recently with the publication of the United Nations’ report “The Future We Want” in 2012 (Dhahri and Omri, 2018). To deal with these concerns, Zhai and Chang (2019) argue that a set of decisions must be made fairly, considering an interesting aspect of sustainability, such as mitigating climate change and environmental damage. For that reason, the Paris Climate Change Agreement was signed in 2015 by 196 countries who have agreed to change their growth model by moving towards a more “ecologically sustainable” growth model (Bouyghrissi et al. 2021; Dhahri et al., 2021; Hamid et al. 2021; Murshed et al. 2021a,b). The representatives of these countries have committed to curbing their respective greenhouse gas and other types of emissions for limiting global temperature rise to less than 2 °C over the pre-industrial temperature level (Omri et al. 2021). Reducing CO2 emissions is, therefore, relevant for these countries to meet the commitments. Therefore, they should follow a transition from the use of non-renewable to renewable energies, keeping in mind CO2 emission reductions. The conventional dependence on the use of non-renewable energy resources to meet the world’s energy demand has ultimately generated consensus among the worldwide economies for achieving both socio-economic and environmental sustainability, particularly through the efficient use of cleaner renewable energies (Murshed 2020).

Recently, with the growing interest in achieving sustainable development goals (SDGs), scholars, policymakers, and international organizations have been interested more and more on the role of renewable energy as a pathway to low-carbon economies. For instance, the new SDGs’ agenda considers renewable energy resources as a way to achieve some SDGs, such as ensuring healthy lives through reducing air pollution, enhancing energy-use efficiency levels, equitable quality education, and sustainable growth for all (Murshed et al. 2021a, 2021b; Omri et al. 2022). SDGs 7 and 13 of this agenda highlight the significance of renewable energy in mitigating climate change and environmental impacts. They call for substantially increasing the share of renewable energy in the total energy mix by the end of 2030 (Murshed and Tanha 2021), which potentially support economic development without increasing CO2 emissions and related risks, and therefore any effort to achieve the SDGs will augment the demand for renewable energy resources (Omri and Belaïd 2021). In this context, Murshed et al. (2020) argue that the transition from non-renewable energy to cleaner and environmentally friendly renewable energy use helps reverse worsening trends in greenhouse gas emissions. Some other scholars, such as Luderer et al. (2012) and Rockström et al. (2017), also argue that increasing the share of renewables in the global energy mix must be aligned with policies aimed at decarbonizing the global atmosphere.

In light of the above discussion, the main objective of this study is to examine the role of renewable and non-renewable energy use in reducing CO2 emissions for 14 Middle East and African countries (2014). To our knowledge, none of the existing studies on the determinants of CO2 emissions in the MENA region has been interested in investigating the short- and long-run impacts of both types of energy on CO2 emissions. We choose the MENA region because its characteristics are very well adapted to the case of this study. In addition, two main reasons allow us to focus on this region: (i) despite progress and development over the past decade, the MENA countries face a series of challenges for their long-term security and prosperity in the twenty-first century. Although many of the economic challenges in the region have been widely analyzed, environmental challenges are little taken into account in the process of formulating economic policies in these countries (Sakmar et al., 2011). However, it has the highest CO2 emissions per dollar of production in the world and is ranked as the second greatest polluted region in the world, after South Asia (Omri, 2013); (ii) the region has developed rapidly in recent years the market for renewable energy with increased investment and an expanding pipeline of projects to take advantages of the abundance of energy resources renewable sources. Despite the short- and long-run impacts of renewable and non-renewable energy, this study also extends previous studies on determinants of CO2 emissions by integrating different sectoral GDP (agriculture, industry, and services) to the environmental function to show the contribution of each sector on increasing emissions in the MENA region and to validate the presence of the EKC hypothesis at aggregate and disaggregated levels.

The rest of the article is as such: the “Determinants of CO2 emissions” section reviews the existing literature on the determinants of CO2 emissions. The “Data and model specification” section describes the used data and empirical model. The “Empirical results” section discusses the results, and finally the fifth concludes and provides recommendations for the policymakers in the MENA region.

Determinants of CO2 emissions

Economic growth and CO 2 emissions

Most of the empirical debates on the environment-growth nexus have focused on validating the EKC model. As mentioned above, the existing studies on the EKC are however inconclusive and contradictory. For instance, by using two non-linear parametric functional forms (Gamma and Weibull functions) as alternatives to the standard specification (polynomial function), Galeotti and Lanza (2005) examine the impact of economic growth on CO2 emissions for three groups of countries (OECD, non-OECD, and the two groups together) over the period 1960–1995. They show an inverted U-shaped relationship for the three groups with turning points around 15,000 US$ for the first group, 17,000 US$ for the second, and 13,000 US$ for the third group. In the same spirit, Richmond and Kaufmann (2006) examine the same relationship for 36 countries (20 OECD countries and 16 developing countries) over the period 1973–1997 using three different models, namely fixed-effects model, random-effect model, and random coefficient model; the latter model was favored. The authors validate the EKC hypothesis only for the OECD panel of countries and for the global panel. Using data for six Central American countries over the period 1971–2004, Apergis and Payne (2009) examine the links among CO2 emissions, energy usage, and output using a VECM technique. Their findings show that there exists an inverted U-shaped running from income growth to CO2 emissions, validating, therefore, the EKC hypothesis. Using data for 43 developing economies, Narayan and Narayan (2010) also validate the EKC hypothesis in the case of Middle Eastern and South Asian countries by using a panel cointegration approach. In Saudi Arabia, examine the factors influencing environmental sustainability using panel FMOLS and DOLS estimators and they confirm the presence of the EKC hypothesis. Using data for six South Asian countries, Murshed (2020) also examines the validity of the EKC by taking into account liquefied petroleum gas (LPG) consumption for the period 1980–2016 by employing an autoregressive distributed lag (ARDL) regression, which confirms the validity of this hypothesis only for Bangladesh, India, Sri Lanka, and Bhutan. In the same spirit, Murshed and Dao (2020) examine the validity of the EKC hypothesis controlling for the role of export quality on the relationship between growth and CO2 emissions for five South Asian countries. Their findings validate this hypothesis for the group of countries, whereas the country-specific results show heterogeneity of these findings in this regard.

However, some other studies find no evidence of EKC. Among them, by applying the ordinary least squares (OLS) model, Roca et al. (2001) find no evidence of this hypothesis in Spain. In the case of Turkey and 19 European economies, Acaravci and Ozturk (2010) also find no evidence of the EKC. Jaunky (2010) tests the presence of the EKC for 36 high-income countries and their empirical findings show that the EKC hypothesis does not hold in these economies, but shows that carbon emissions decline in high-income economies over time. A similar result was found by Esteve and Tamarit (2012) in the case of Spain. Using a panel of OECD and emerging economies, Özokcu and Ozdemir (2017) also find no evidence of EKC. Isik et al. (2019) also investigate the EKC for 51 countries using the common correlated effects and the augmented mean group estimation procedures. Their findings reveal that only in 14 out of 51 countries the EKC hypothesis is validated. Some other studies, such as Friedl and Getzner (2003) and Martinez-Zarzoso and Bengochea-Maranco (2004), find N-shaped link between economic growth and environmental degradation. Recently, Badeeb et al. (2020) analyze the GDP-CO2 emissions nexus in resource-based economies. Their empirical results suggest that the EKC mechanism does not explain the economic growth-environment nexus in these countries. In addition, Khan et al. (2020) study the linkage among energy, economic growth, and emissions for 51 countries of the “Belt & Road Initiative (BRI).” The results show that the EKC hypothesis validated between growth and the environment for BRI countries.

CO 2 emissions, and renewable and non-renewable energy

The impact of renewable and non-renewable energy on CO2 emissions is a key subject in the environmental economics literature. For instance, Le et al. (2020) examine the energy consumption-economic growth-CO2 emissions nexus for 102 countries. They show that both types of energy increase economic growth across countries, supporting the growth hypothesis. They also find that non-renewable energy sources increase emissions. In the same spirit, in Saudi Arabia, Alkhathlan and Javid (2013) find that economic development and energy use cause emissions in the short and long runs. Energy use increases economic development only in the long run. In the same context, Alshehry and Belloumi (2015) find a long-term linkage among growth, CO2 emissions, and energy use and price. In Turkey, Bulut (2017) tests the impacts of renewable and non-renewable energies on CO2 emissions and he shows that emissions are positively related to both types of energy. In the case of the USA, Twumasi (2017) also studies the linkage between CO2 emissions and renewable energy, and their results indicate that rising the production of renewable energy does not necessarily lead to lessen emissions. Using data for 25 Euro Mediterranean economies, investigate the contributions of GDP per capita, and renewable and non-renewable energy on CO2 emissions and show a positive impact of economic growth and non-renewable energy on CO2 emissions; however, renewable energy negatively influences CO2 emission. For Sub-Sahara Africa, show that both types of energy increase CO2 emissions. In the case of Malaysia, Saudi (2019) analyzes the impacts of technological innovation, and renewable and non-renewable energies on the validity of the EKC model using the ARDL bound testing approach. They find that renewable energy significantly reduces emissions; however, non-renewable energy increases CO2 emissions. Using data for Argentina, Brazil, Paraguay, Uruguay, and Venezuela, examine the causality among CO2 emissions, economic growth, urbanization, and renewable and non-renewable energy. Their findings show bi-directional relationships among variables, except urbanization. Similarly, investigates the effects of economic complexity, renewable and non-renewable energy on CO2 emissions, and ecological footprint in the USA. He finds that non-renewable energy increases both types of environmental degradation, while renewable energy reduces them. For BRICS countries, Wang and Zhang (2020) investigate the role of research and development on the relationship between economic growth and CO2 emissions by employing the fully modified ordinary least squares (FMOLS) method for the period 1996–2014 and they find that industrialization, urbanization, and economic activity have negative impacts on the decoupling of economic growth from emissions, whereas renewable energy use helps the decoupling. Using data for 147 countries, Li et al. (2021) examine the impacts of economic, energy, social, and trade structural changes on per capita CO2 emissions and they find that increasing the use of renewable energy helped to decrease CO2 emissions. In the same direction, Wang and Zhang (2020) investigate the effect of trade openness on decoupling economic growth from CO2 emissions using data for 182 countries and they find that high oil prices and renewable energy contribute to decoupling economic growth from CO2 emissions.

Data and model specification

Data

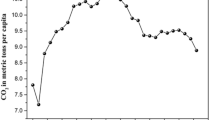

The study uses data for 14 selected MENA countriesFootnote 1 over document that covers the period 1990–2014. The variables included in the analysis are CO2 emissions per capita (in metric tons per capita), GDP per capita (constant 2010 US dollars), non-renewable energy consumption (in kg of oil equivalent per capita), renewable energy consumption (REC) defined as combustible renewable and waste % of total energy, foreign trade measured as the total of exports and imports as % of GDP, financial development measured as the ratio of money supply to GDP, per capita agricultural value added (YA) in constant 2010 US dollars, per capita industry value added (YI) in constant 2010 US dollars, and per capita services value added (YS) in constant 2010 US dollars. The dataset are sourced from the World Bank databases (WDI).

Tables 1 and 2 report the descriptive statistics and the pairwise correlations among the different variables, respectively. From the information reported in Table 1, we can see that, over the sample time, the logarithm of CO2 emissions ranges from around − 0.84 to around 1.5 metric tons, logarithm of per capita GDP ranges from around 6.9 to around 11.2, logarithm of non-renewable energy consumption ranges from around 5.3 to around 10 kg of oil equivalent per capita, and logarithm of renewable energy consumption ranges from around − 4.8% to around 3.9%. Furthermore, the pairwise correlations reported in Table 2 show that non-renewable energy consumption has the highest correlation with per capita CO2 emissions, while the lowest is for financial development. The renewable energy consumption variable is negatively correlated with per capita CO2 emissions; however, non-renewable energy consumption is positively correlated with emissions, indicating that promoting renewables is able to mitigate the impact of non-renewable energy on CO2 emissions in MENA countries. The assessed coefficients of the correlation matrix provide evidence that all estimations will not be seriously affected by the multicollinearity problem.

Model specifications

This study employs the FMOLS and VECM techniques to extract the effect of renewable energy and non-renewable energy, and aggregated and disaggregated sectoral outputs (agriculture, industry, services). In this study, financial sector development and foreign trade are included in the model as control variables. Previous studies, such as Omri et al. (2015), Murshed (2020), Ben Youssef et al. (2020), Omri et al. (2021), among others, show that financial development and trade increase CO2 emissions. The general specification of the model is as follows:

The model in Eq. (1) can be written in the following logarithmic form:

To validate the EKC hypothesis at aggregate and disaggregate levels of output, Eq. (1) could be specified in the following multiple regression models:

where \(i=1,\dots \dots , 14\) designates countries and \(t=1990,\dots \dots ., 2016\) designates the time period; \({\varepsilon }_{i,t}\) designates the estimated residuals; \({\alpha }_{1}\),……,\({\alpha }_{7}\) denote the elasticity of environmental pollution using CO2 emissions with respect to economic growth (GDP), squared GDP (GDP2), renewable energy, non-renewable energy (NRE), sectoral outputs (YA, YI, and YS), financial development (FD), and trade openness, respectively.

The foundation of the EKC is that the level of pollution should increase at the same time as per capita income increases, up to a certain point, during which pollution should decrease as GDP per capita enters a different level. The link between emissions, economic growth, real agriculture, real service, and the real industry is explained as follows:

-

If α1 = α2 = 0, the hypothesis of EKC can be rejected;

-

If α2 = 0 and α1 > 0, there is a linear relationship;

-

If α1 > 0 and α2 < 0, there exists an inverted U-shaped.

Empirical results

Tests of cross-sectional dependency and panel unit root

We begin our empirical research by examining the stationarity of the used variables. Before running the stationarity tests, we should check the existence of cross-sectional dependency in the panel to choose between the first- and second-generation panel unit root tests. Using the Pesaran et al., (2004) CD test, Table 3 shows that the null hypothesis of cross-sectional independence is accepted in the panel, implying that we cannot run the second-generation tests. Therefore, we will use three first-generation tests, namely the IPS test of Im et al. (2003), the LLC test of Levin et al. (2002), and the Fisher-PP test of Phillips and Perron (1988). Table 3 summarizes the findings of this testing and it indicates that all the variables are stationary first differences (I (1)). We can then suspect cointegration relationships between the different variables.

Panel cointegration tests

Pedroni (1999, 2004) presents seven (7) tests based on the estimate of the residual of the long-term model in the scenario when the cointegration connections involve more than two variables. Pedroni tests accommodate for heterogeneity by using factors that might differ across individuals. According to the alternative hypothesis, each individual has a cointegration connection, but the parameters of this cointegration relationship are not definitely the same for each individual in the panel (Hurlin and Mignon 2007). In addition, Kao (1999) also proposed tests for the null hypothesis of absence of cointegration: Dickey-Fuller type test and Dickey-Fuller type augmented test. Unlike Pedroni tests, Kao considers the specific scenario when the cointegration vectors are assumed to be homogenous among individuals. Unlike Pedroni tests, Kao considers the specific scenario when the cointegration vectors are assumed to be homogenous among individuals. Table 4 summarizes the findings of the panel cointegration tests.

From the results of the cointegration tests of Pedroni, we can observe that the majority of the statistics allows us to accept the hypothesis of a cointegration relationship between renewable and non-renewable energy consumption, CO2 emissions, real industry value added per capita, real agriculture value added per capita, economic growth, and real services value added per capita, trade openness, and financial development at 1% and 5%. According to the Pedroni cointegration test findings, the majority of these statistics demonstrate the existence of a long-term connection and therefore a cointegration relationship between CO2 emissions and control variables. Thus, the results show that the probability associated with T-statistic is 0.00; as a result, the null hypothesis of no cointegration may be ruled out. We can therefore say that there is a cointegration linkage among CO2 emissions, renewable and non-renewable energy, agriculture, trade openness, financial development, and economic growth.

FMOLS estimates

The results from the estimation of the FMOLS for EKC are given in Table 5. The FMOLS estimates confirm that CO2 emissions tend to decrease with the increase of renewable energy consumption, ranging from − 0.0187 to − 0.0859%; however, non-renewable energy consumption increases CO2 emissions in all the estimated models, ranging from 0.763 to 0.84%. This result is in line with Shafiei and Salim (2014) who investigate the impact of disaggregated energy consumption on CO2 emissions for OECD countries and they show that renewable energy decreases CO2 emissions whereas non-renewable energy increases emissions. They suggest that policymakers in OECD countries should focus on clean energy deployment to make a substantial contribution to both curbing CO2 emissions and decreasing the use of non-renewable energy. Moreover, the FMOLS estimates indicate that the long-term influence of GDP on CO2 emissions is significant. The findings show that a 1% rise in economic growth corresponds to a 1.3079% increase in CO2 emissions. This result confirms the findings of who investigate the determinant of CO2 emissions in Saudi Arabia and they show that economic growth is a key factor that influences CO2 emissions, suggesting that CO2 emissions may be decreased at the costs of economic growth or encouraging the use of environmentally friendly technologies. This result is also confirmed by for 12 Western European countries, calling policymakers to make quick and relevant solutions to decrease CO2 emissions without reducing economic growth. However, at the 1% threshold, squared GDP has a negative and statistically significant effect, implying that an increase in square GDP results in a reduction of 0.0770 in CO2 emissions. Since the GDP coefficient is positive and significant, while the GDP2 coefficient is negative and significant, the presence of an EKC is definitely confirmed by the results of model 1, indicating that CO2 emissions increase with economic development at the initial stages of development, but decrease after the economy surpasses a certain threshold. This result is also confirmed by Choi et al (2010) for China and Korea, Torrini et al (2016) for Brazil and Japan, Fujii et al (2018) for 26 countries, Saucedo et al. (2017) for OECD countries, and Kong and Khan (2019) for developed and developing economies. The coefficients of financial development and trade openness are positive, while these two variables positively and significantly affect CO2 emissions at the 5% and 1% levels. The impact of international commerce on emissions is captured by the degree of trade openness. Strong environmental laws in industrialized nations generally result in polluting offshoring companies to countries with less environmental controls (this is the “pollution haven” assumption). As a result, the coefficient sign of trade openness fluctuates depending on the nations’ degree of development (Grossman and Krueger, 1996). In developed countries, trade openness reduces environmental degradation, while the opposite effect is observed in developing countries. In addition, according to the results in Table 5, we see that the coefficient of agriculture and square agriculture are positive and statistically significant at the 1% threshold, this means that an increase of 1% in these two variables increases CO2 emissions by 0.2200 and 0.0273, respectively. Finally, a one-point increase in real industry value added per capita (YI) leads to a 0.7160-point increase in CO2 emissions. However, an increase in the point of the real added value of services per inhabitant (YS) leads to a reduction of 0.0175 points in CO2 emissions.

Results of VECM technique

We use VECM technique to examine if the short- and long-term connections between variables are causative. The causation relationship is established in two phases: the first stage is to estimate the residuals of Eq. (2) whereas the second step is to estimate the short-term adjustment coefficients. The VECM in the panel is as follows:

where ∆ is the first difference operator; m is the lag length, CO2 is the natural log of CO2 emissions, NRE is the natural log of non-renewable energy, RE is the natural log of renewable energy, YA is the natural log of agriculture, GDP is the natural log of economic growth, FD is the natural log of financial development, TR is the natural log of trade openness, YI is the natural log of real industry, and YS is the log of real services, respectively. μ is the random error term, and ECT is the error correction term. The parameter α reflects the movements in the equilibrium relationship between CO2 emissions and other variables.

The results of the Granger causality tests are presented in Table 6. In model 1, we find that there is a two-way relationship between CO2 emissions and GDP per capita and between CO2 emissions and renewable energy in the short and long runs. This outcome differs from that of Menyah and Wolde-Rufael (2010) for the USA and Apergis et al. (2010a, b) for 19 developed and developing economies; however, it is similar to Lu (2017) for 24 Asian countries, Saidi and Mbarek (2016) for nine developed countries, and Khobai and Le Roux (2017) for South Africa. Likewise, there is a two-way association between non-renewable energy and CO2 emissions in the short and long runs. The outcome is consistent with the findings of Saidi and Mbarek (2016). Furthermore, a unidirectional causal relationship ranging from trade openness and financial development to CO2 emissions in both the short and long runs is found. In addition, renewable energy usage and economic growth have a bidirectional link and this finding strongly confirms the studies of in the case of G7 countries, in the case of six Latin American developing countries, Hung-Pin (2014) for nine OECD countries, and Khawlah (2016) for Jordan.

Regarding model 2, there is a two-way causal relationship between agricultural value added and CO2 emissions and between renewable energy and CO2 emissions. In addition, our results show a two-way relationship between non-renewable energy and CO2 emissions in the short and long runs. We have short- and long-term unidirectional causality running from financial development and trade openness to CO2 emissions. This outcome is in line with the findings of Omri et al. (2015). In addition, renewable energy and agriculture value added have a two-way causal connection in the short and long terms, but no causal link between agriculture and non-renewable energy. So, the production of agricultural goods in the MENA region depends on the use of renewable energy. Farmers and/or the government can get the required capital for the production and use of renewable energy by increasing agricultural value added. This finding contradicts that of Ben Youssef et al., (2016), who showed that increasing agricultural value added lowers renewable energy use in Brazil. As a result, there is a one-way link between agricultural and renewable energy usage.

Regarding model 3, in the short and long runs, we report that CO2 emissions and industry value added have a unidirectional connection. In addition, a two-way relationship is found between non-renewable energy and CO2 emissions in both the short and long runs. But in both the short and long terms, there is a one-way link between renewable energy and CO2 emissions.

Finally, for model 4, in both the short and long runs, we reveal a one-way link between renewable energy use and CO2 emissions. This result contradicts the results of Menyah and Wolde-Rufael (2010) for the USA and Shafiei and Salim (2014) for OECD countries. The findings also show that non-renewable energy and CO2 emissions have a bidirectional causal connection. Our results also show that there is a one-way causal link from services value added to CO2 emissions. In addition, they also reveal a one-way causality that runs from financial development and trade openness to CO2 emissions.

Conclusion and policy implications

This inquiry examines the effects of renewable and non-renewable energy consumption, among other control variables, on CO2 emissions for 14 MENA countries. We apply panel techniques of cointegration and Granger causality tests (VECM) to verify the existence of long-run associations and to examine the causality between the variables. The panel FMOLS technique is also used to estimate long-term relationships among variables. Empirical results show that renewable energy decreases CO2 emissions, whereas non-renewable energy increases emissions. They also confirm the presence of a robust long-term relationship between per capita CO2 emissions and per capita income. In addition, the positive and negative signs of the coefficients of GDP and its squared seem to validate the existence of the EKC. However, at the sectoral level, this hypothesis has not been validated and the industry sector has the highest contribution to environmental degradation. In addition, renewable energy contributes to improving environmental quality, whereas non-renewable energy deteriorates it. Granger’s causality results show a two-way linkage between renewable energy and CO2 emissions and between non-renewable energy and CO2 emissions in both short and long runs. At the sectoral level, we also find a two-way causal relationship between agricultural value added and CO2 emissions, a unidirectional causality running from CO2 emissions to industry value added, and a unidirectional causality running from services value added to CO2 emissions in both in short and long-terms.

To reduce the aggregate and disaggregate effects of outputs on environmental degradation, policymakers in MENA countries must focus their actions on environmental policies of a green and inclusive economy that combine tools of environmental economics with those of the ecological economy. This can be done by supporting the use of renewable energies that can significantly reduce carbon dioxide emissions, supporting the view that renewable energies offer many advantages, from mitigating emissions and cleaning the air, to lowering fossil fuel prices and creating more jobs than non-renewable energies. Private investors should participate more actively in the broad field of renewable energy by recognizing the barriers to increased investment in renewable energy and supporting more public–private partnerships (PPPs). Multilateral negotiations between public and private sectors, university, and non-governmental organizations are also essential to the transition towards low-carbon economies.

Data availability

The data are available upon demand by request to the corresponding author.

Notes

Namely Algeria, Egypt, Iran, Iraq, Jordan, Kuwait, Lebanon, Mauritania, Morocco, Qatar, Saudi Arabia, Tunisia, UAE, and Yemen.

References

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35(12):5412–5420

Alshehry AS, Belloumi, M. (2015). Energy consumption, carbon dioxide emissions and economic growth: The case of Saudi Arabia. Renew Sust Energy Rev 41:237–247

Alkhathlan K, Javid M (2013) Energy consumption, carbon emissions and economic growth in Saudi Arabia: An aggregate and disaggregate analysis. Energy Policy 62:1525–1532

Apergis N, Payne JE (2009) CO2 emissions, energy usage, and output in Central America. Energy Policy 37(8):3282–3286

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010a) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69(11):2255–2260

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69:2255–2260

Badeeb RA, Lean HH, Shahbaz M (2020) Are too many natural resources to blame for the shape of the environmental Kuznets curve in resource-based economies? Resour Policy 68:101694

Ben Youssef A, Hammoudeh S, Omri A (2016) Simultaneity modeling analysis of the environmental Kuznets curve hypothesis. Energy Econ 60:266–274

Ben Youssef A, Boubaker S, Omri A (2020) Financial development and macroeconomic sustainability: modeling based on a modified environmental Kuznets curve. Clim Change 163(2):767–785

Bouyghrissi, S., Murshed, M., Jindal, A., Berjaoui, A., Mahmood, H., & Khanniba, M. (2021). The importance of facilitating renewable energy transition for abating CO2 emissions in Morocco. Environmental Science and Pollution Research, 1–16.

Bulut, U. (2017). The impacts of non-renewable and renewable energy on CO2 emissions in Turkey.Environmental Science and Pollution Research, 1–11.

Choi, E., Heshmati, A., & Cho, Y. (2010). An empirical study of the relationships between CO2 emissions, economic growth and openness.

Grossman GM, Krueger AB (1996) The inverted-U: what does it mean?. Environ Dev Econ 1(1):119–122

Dhahri S, Omri A (2018) Entrepreneurship contribution to the three pillars of sustainable development: What does the evidence really say?. World Dev 106:64–77

Dhahri S, Slimani S, Omri A (2021) Behavioral entrepreneurship for achieving the sustainable development goals. Technol Forecast Soc Chang 165:120561

Esteve V, Tamarit C (2012) Threshold cointegration and nonlinear adjustment between CO2 and income: the environmental Kuznets curve in Spain, 1857–2007. Energy Econ 34(6):2148–2156

Fujii H, Iwata K, Chapman A, Kagawa S, Managi S (2018) An analysis of urban environmental Kuznets curve of CO2 emissions: empirical analysis of 276 global metropolitan areas. Appl Energy 228:1561–1568

Friedl B, Getzner M (2003) Determinants of CO2 emissions in a small open economy. Ecol Econ 45(1):133–148

Galeotti M, Lanza A (2005) Desperately seeking environmental Kuznets. Environ Modell Soft 20(11):1379–1388

Hamid I, Alam MS, Murshed M, Jena PK, Sha N, Alam MN (2021) The roles of foreign direct investments, economic growth, and capital investments in decarbonizing the economy of Oman. Environ Sci Pollut Res, 1–17.

Hung-Pin L (2014) Renewable energy consumption and economic growth in nine OECD countries: bounds test approach and causality analysis. The Scientific World Journal, 2014.

Hurlin C, Mignon V (2007) Une Synthèse des Tests de Cointégration sur Données de Panel. Économie&prévision. 4/2007 (n°180–181), 241–265. Accessed on 21 March 2016 from www.cairn.info/revue-economie-et-prevision-2007-4-page-241.htm

Im KS, Pesaran, MH, Shin Y (2003) ‘Testing for unit roots in heterogeneous panels’, J Econom, 115:53-74.

Isik, C., Ongan, S., & Özdemir, D. (2019). The economic growth/development and environmental degradation: evidence from the US state-level EKC hypothesis. Environ Sci Pollut Res 26(30):30772–30781

Jaunky VC (2010) Divergence of electric power consumption: evidence from the SAPP. J Dev Areas 123–147

Kao C (1999) Spurious regression and residual-based test for cointegration in panel data. Journal of Econom 90:1–44

Khan A, Chenggang Y, Hussain J, Banob S, Nawaz A (2020) Natural resources, tourism development, and energy-growth-CO2 emission nexus: a simultaneity modeling analysis of BRI countries. Resources Policy 68:101751

Khawlah AAAS (2016) Renewable energy consumption, CO2 emissions and economic growth: a case of Jordan. Int J Bus Economics Res 5(6):217–226

Khobai HB, Le Roux P (2017) The relationship between energy consumption, economic growth and carbon dioxide emission: the case of South Africa. Int J Energy Econ Policy 7(3):102–109

Kong Y, Khan R (2019) To examine environmental pollution by economic growth and their impact in an environmental Kuznets curve (EKC) among developed and developing countries. PloS one 14(3):e0209532

Le TH, Chang Y, Park D (2020) Renewable and nonrenewable energy consumption, economic growth, and emissions: International evidence. Energy J 41(2)

Levin A, Lin CF, Chu J (2002) Unit root test in panel data: asymptotic and finite-sample properties. J Econom 108:1–24

Li R, Wang Q, Liu Y, Jiang R (2021) Per-capita carbon emissions in 147 countries: the effect of economic, energy, social, and trade structural changes. Sustain Prod Consum 27:1149–1164

Lu WC (2017) Renewable energy, carbon emissions, and economic growth in 24 Asian countries: evidence from panel cointegration analysis. Environ Sci Pollut Res 24(33):26006–26015

Luderer G, Bosetti V, Jakob M, Leimbach M, Steckel JC, Waisman H, Edenhofer O (2012) The economics of decarbonizing the energy system—results and insights from the RECIPE model intercomparison. Clim Chang 114(1):9–37

Martinez-Zarzoso I, Bengochea-Marancho A (2004) Pooled Mean Group Estimation for an environmental Kuznets Curve for Co2. Econ Lett 82:121–126

Menyah K, Wolde-Rufael Y (2010) CO2 emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 38(6):2911–2915

Murshed M (2020) An empirical analysis of the non-linear impacts of ICT-trade openness on renewable energy transition, energy efficiency, clean cooking fuel access and environmental sustainability in South Asia. Environ Sci Pollut Res Int 27(29):36254–36281

Murshed M, Tanha MM (2021) Oil price shocks and renewable energy transition: empirical evidence from net oil-importing South Asian economies. Energy Ecol Environ 6:183–203

Murshed M, Chadni MH, Ferdaus J (2020) Does ICT trade facilitate renewable energy transition and environmental sustainability? Evidence from Bangladesh, India, Pakistan, Sri Lanka, Nepal and Maldives. Energy, Ecol Environ 5(6):470–495

Murshed M, Alam R, Ansarin A (2021b) The environmental Kuznets curve hypothesis for Bangladesh: the importance of natural gas, liquefied petroleum gas, and hydropower consumption. Environ Sci Pollut Res 28(14):17208–17227

Murshed M, Dao NTT (2020) Revisiting the CO2 emission-induced EKC hypothesis in South Asia: the role of Export Quality Improvement. GeoJournal, 1–29.

Murshed, M., Rahman, M. A., Alam, M. S., Ahmad, P., & Dagar, V. (2021b). The nexus between environmental regulations, economic growth, and environmental sustainability: linking environmental patents to ecological footprint reduction in South Asia. Environmental Science and Pollution Research, 1–22.

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth: Panel data evidence from developing countries. Energy Policy 38(1):661–666

Omri A (2013) CO2 emissions, energy consumption and economic growth nexus in MENA countries: Evidence from simultaneous equations models. Energ Econ 40:657–664

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Economics 48:242–252

Omri A, Belaïd F (2021) Does renewable energy modulate the negative effect of environmental issues on the socio-economic welfare?. J Environ Manag 278:111483

Omri A, Omri H, Slimani S, Belaid F (2022) Environmental degradation and life satisfaction: Do governance and renewable energy matter?. Technol Forecast Soc Chang 175:121375

Özokcu S, Özdemir Ö (2017) Economic growth, energy, and environmental Kuznets curve. Renew Sust Energ Rev 72:639–647

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet Theor 20:597–625

Pedroni P (1999) ‘Critical values for cointegration tests in heterogeneous panels with multiple regressors’, Oxford Bulletin of Economics and Statistics (Special Issue), pp.653–669.

Pesaran MH, Schuermann T, Weiner SM (2004) Modeling regional interdependencies using a global error-correcting macroeconometric model. J Buss Econ Stat 22(2):129–162

Phillips P, Perron P (1988) Testing for a unit root in time series regression. Biometrica 75:333–346

Richmond AK, Kaufmann RK (2006) Energy prices and turning points: the relationship between income and energy use/carbon emissions. Energ J 27(4)

Roca J, Padilla E, Farré M, Galletto V (2001) Economic growth and atmospheric pollution in Spain: discussing the environmental Kuznets curve hypothesis. Ecol Econ 39(1):85–99

Rockström J, Gaffney O, Rogelj J, Meinshausen M, Nakicenovic N, Schellnhuber HJ (2017) A roadmap for rapid decarbonization. Science 355(6331):1269–1271

Saidi K, Mbarek MB (2016) Nuclear energy, renewable energy, CO2 emissions, and economic growth for nine developed countries: evidence from panel Granger causality tests. Prog Nucl Energy 88:364–374

Sakmar SL, Wackernagel M, Galli A, Moore D (2011) Sustainable development and Environmental Challenges in the MENA Region: Accounting for the Environment in the 21st century. In Economic Research Forum

Saucedo A, Edgar J, Díaz P, del Pilar Parra OM (2017). Estimating environmental Kuznets curve: the impact of environmental taxes and energy consumption in CO2 emissions of OECD countries. In DIEM: Dubrovnik International Economic Meeting (Vol. 3, No. 1, pp. 901–912).

Shafiei S, Salim RA (2014) Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: a comparative analysis. Energy Policy 66:547–556

Torrini FC, Souza RC, Oliveira FLC, Pessanha JFM (2016) Long term electricity consumption forecast in Brazil: a fuzzy logic approach. Socioecon Plann Sci 54:18–27

Twumasi YA (2017) Relationship between CO2 emissions and renewable energy production in the United States of America. Arch Curr Res Int 7(1):1–12

Wang Q, Zhang F (2020) Does increasing investment in research and development promote economic growth decoupling from carbon emission growth? An empirical analysis of BRICS countries. J Clean Prod 252:119853

Zhai T, Chang YC (2019) The contribution of China’s civil law to sustainable development: Progress and prospects. Sustainability 11(1):294

Author information

Authors and Affiliations

Contributions

Anis Omri: conceptualization, formal analysis, validation. Kais Saidi: data curation, software, writing–original draft.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

Not applicable.

Additional information

Communicated by Roula Inglesi-Lotz

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Omri, A., Saidi, K. Factors influencing CO2 emissions in the MENA countries: the roles of renewable and non-renewable energy. Environ Sci Pollut Res 29, 55890–55901 (2022). https://doi.org/10.1007/s11356-022-19727-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19727-5