Abstract

This study aims to analyze the impact of ICT, renewable energy consumption, and financial development on CO2 emissions in selected developing countries of East and South Asia. Using panel data spanning 1985–2020, Pooled Mean Group (PMG) estimator is used to analyze the short-run and long-run effects. Results suggest that ICT and financial development positively contribute to the degradation of the environment in the long run, while their impact on CO2 emissions is insignificant in the short run. On the other hand, renewable energy consumption affects environmental quality positively in both the long run and short run. It is also examined that economic growth affects CO2 emissions positively but the squared economic growth reduces CO2 emissions which validates inverted U-shaped EKC hypothesis. The empirical findings of the Granger Causality test suggest unidirectional causality from ICT and financial development to CO2 emissions, while a bi-directional relationship is found among renewable energy and CO2 emissions. Results imply that governments in these countries need to invest in renewable energy to control environmental degradation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

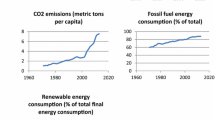

The worldwide increasing population, globalization, and industrial pace have put all the countries around the globe to expand economic activities. Economic growth can never threaten a country, but unorganized and unsustainable growth puts unbearable pressure on natural resources and energy that ultimately hurts the environmental quality. The need to accomplish sustainable development and environmental protection has provoked policymakers and researchers to focus on the ways to reduce environmental degradation. Environmental degradation is a constant threat permeating the world and creating global warming. Since the turn of the century, global carbon dioxide (CO2) emissions have rapidly risen. In 2014, global carbon emissions surpassed 36 billion tonnes, up from 1.6 billion tonnes in 1990. In recent decades, it has resulted in a significant upsurge in global average temperature (Karl et al. 2015), posing a danger to human health and well-being. Global warming worsens the physical health of creatures through extreme weather conditions such as heatwaves, floods and droughts, and disruptions in the water system (He et al. 2021).

The severe effects of global warming induced by carbon emissions are becoming more widely recognized. The impact of energy use and carbon emissions on climate change has been the attention of researchers and policymakers. The excessive use of non-renewable energy and deforestation increases the carbon concentration level in the atmosphere, contributing to an increase in the earth’s temperature (Radhi 2009). The significant contribution to CO2 emissions comes from burning fossil fuels for energy and transportation (Adebayo and Kirikkaleli 2021). In developing countries, due to lack of resources and R&D, traditional methods are used to satisfy the energy demand; however, reliance on renewable energy sources such as wind, solar, and hydropower can effectively meet the energy needs without affecting environmental quality. In 2014, the global total primary energy supply was 13.7 billion tonnes of oil equivalent, with fossil fuel energy accounting for more than 80% of the overall energy supply. The renewable energy consumption rate, on the other hand, accounts for less than 20% of total energy consumption. Renewable energy has minimal carbon emissions compared to fossil fuels, sometimes even nil. Renewable energy may be used to replace fossil fuels and decrease carbon emissions (Bolük and Mert 2014).

Another option to reduce CO2 emissions is to use information and communication (ICT hereafter) to avoid commuting, eventually decreasing pollution. According to European Commissions report, the internet can raise energy efficiency, and the decrease in energy demand positively affects environmental quality. Information and communication technology has advanced at a breakneck pace during the last two decades. Various countries are interested in learning how to use information technology to decrease energy use and prevent environmental damage. In previous empirical research, using information technology to promote economic growth was seen as one potential method to increase efficiency while reducing energy use. ICT can improve production efficiency and reduce the usage of material goods, which ultimately reduces energy demand and thus reduces the environmental burden. ICT also helps cut the amount of paperwork and, therefore, positively affects the environmental quality. The ICT-oriented approaches such as videoconferencing or integrated point-of-sale systems in businesses can lessen the environmental load. However, the increasing trend of e-learning has reduced traveling, affecting CO2 emissions negatively.

Despite the encouraging effects of ICT on the environment, ICT is also found to affect the environment adversely (Coroama and Hilty 2014; Park et al. 2018). The intensive use and dependency of businesses, academic, and research institutions on the internet have taken the growth and development to the next level at the cost of increased electricity consumption. In order to use the internet without any interruption due to load shedding, many businesses and institutions have installed large units of diesel generators that emit gases that pollute the air. Financial development can also affect environmental quality by financing R&D and innovations. A developed financial sector can monitor the channelization of funds to projects that promote energy efficiency and environment-friendly production techniques. However, an unstructured financial sector lacks transparency and management skills that, in turn, finance activities without considering the social and environmental consequences.

Though, the problem is that the developing economies such as East and South Asian emerging economies have tried to be more progressive without considering environmental quality, which is also essential to get a developed status. However, the intensified internet use and energy and unstructured financial sectors triggered environmental deterioration. Whereas moving to renewable energy was too early to decide its assistance to environmental sustainability. On the other hand, developing economies are now considering research and development innovations in financial sectors. Moving towards renewables and ICT efficiency towards reducing energy demand still has left the question of whether these factors are considered helpful in reducing the environmental hazards in these developing economies. Since the influence of renewable energy, ICT, and developed financial structure on the environment is ambiguous, the basic purpose of this study is to highlight the impact of relying on renewable energy sources, ICT, and the developed financial sector on the environment in the developing regions of East and South Asia. However, this research investigates the short-run and long-run impacts of renewable energy, information and communication technology, and financial development on the quality of the environment.

The following is the rest of the research: The “Literature review” section reviews the past literature. The “Methodology” section delves into the data and methodology, while the “Results and discussion” section delves into the results and discussion of the empirical study. The “Conclusion and policy implication” section concludes the current study’s findings and suggests policy recommendations based on results.

Literature review

Many studies in the literature analyze the impact of different financial and economic activities on the emission of CO2. The literature review is divided into three sections, namely, (i) ICT and the emission of CO2, (ii) Consumption of renewable energy and the emissions of CO2, and (iii) Financial development and the emission of CO2.

ICT and the emission of CO2

There exist many studies that emphasize the role of ICT in ensuring environmental sustainability. One of the channels through which ICT affects the environment is economic growth. Appropriate conduct and utilization of ICT bring a positive structural change that leads to different environment-friendly technological advances (Shahiduzzaman and Alam 2014; Zhang and Liu 2015; Goundar and Appana 2018). Bapna et al. (2010) examined that ICT increases production efficiency and promotes online transactions that eventually affect the environment positively due to a reduction in commuting. Nguyen et al. (2020) argue that ICT introduces production processes that are cleaner and ecologically sustainable. The provision of fast and effective network avenues lessens the cost/traffic per minute linked with economic activities (Gillwald and Stork 2008; Asongu 2017, Kouton 2019). The association among ICT and carbon emissions is not always linear. Higón et al. (2017) confirm that there exists an inverted U-shaped association between ICT and CO2. ICT is also thought to trim down the consumption of energy which in turn reduces CO2 emissions and improves environmental quality (Ishida 2015; Gelenbe and Caseau 2015; Lu 2018).

On the other hand, the use of ICT is also observed to directly hurt environmental quality by massively increasing the emission of CO2. The increased usage and disposal of ICT raises energy consumption, which positively impacts carbon dioxide emissions (Lee and Brahmasrene 2014; Salahuddin et al. 2016; Park et al. 2018; Belkhir and Elmeligi 2018; Shabani and Shahnazi 2019; Barış-Tüzemen et al. 2020). Zhang and Liu (2015) predicted the ICT-related energy demand to go up to 430 GW by 2020. Many studies have concluded that ICT raises the consumption rate of electricity due to the rebound effect. ICT-induced energy rebound effects lead to an upsurge in energy intensity and bring about environmental degradation (Bomhof et al. 2009; Sadorsky 2012; Van Heddeghem et al. 2014; Lv et al. 2019; Arshad et al. 2020). Contrary to significant findings, many studies in the literature have concluded a trivial effect of ICT on the quality of the environment. Amri (2018) finds that ICT has an insignificant impact on CO2 emissions in Tunisia. Asongu et al. (2018) conclude that in Sub-Saharan Africa, ICT alone does not significantly impact carbon emissions.

Consumption of renewable energy and the emission of CO2

One of the drawbacks of ICT is that it stimulates energy consumption, and increasing demand for energy consumption has forced renewable energy and non-renewable energy usage. The increasing pressure on the use of non-renewable energy sources is causing CO2 emissions to increase dramatically. That draws the attention of policymakers to switch from conventional sources of energy to renewable energy sources (Amri 2018; Shaheen et al. 2020; Assi et al. 2021). Zafar et al. (2019) argues that energy consumption negatively affects environmental quality in countries with outdated production technologies. Researches across different countries have shown that fossil fuel consumption positively contributes to CO2 emissions (Mensah et al. 2019; Churchill et al. 2018; Wang and Zhu 2020). According to Bölük and Mert (2014), in order to shield the economy from the risk of oil price volatility and environmental pollution, many countries have adopted different sources of renewable energy. Several researchers have shown a significant negative relationship between environmental degradation and renewable energy consumption (Jaforullah and King 2015; Al-Mulali et al. 2016; Assi et al. 2021). Boutabba (2014) and Jebli and Youssef (2015) find a long-run and negative association between renewable energy use and CO2. Similarly, Ibrahim and Waziri (2020) found that renewable energy consumption in SSA countries significantly reduces CO2 emissions.

Lu (2018) argues that renewable energy consumption has natural resource constraints, e.g., launching PV modules for solar energy requires land and an abundance of sunlight. Working on the same line, Park et al. (2018) highlights that many EU countries are using renewable energy due to the availability of waves, wind, and geothermal energy sources in the area and suggests using energy mix to mitigate the consumption of non-renewables for the production of electricity. On the other hand, many studies have found the bi-directional relationship between consumption of green energy and emission of CO2 (Dogan and Seker 2016; Dong et al. 2017). Contrary to the one way and two way link between renewable energy consumption and the emission of carbon dioxide, some studies evident the insignificant effect of consumption of green energy on environmental degradation (Menyah and Wolde-rufael 2010; Bento and Moutinho 2016; Jebli and Youssef 2017; Boontome et al. 2017; Liu et al. 2017).

Financial development and the emission of CO2

It is believed that a developed financial sector contributes to the economic growth of the country by stimulating economic activities (Guru and Yadav 2019; Yang 2019; Raheem et al. 2020). These financial-led economic activities have resulted in a surge in energy demand (Sadorsky 2011; Ozatac et al. 2017; Shahbaz et al. 2018; Samour et al. 2019). According to Saud and Chen (2018), an increase in financial activities triggers economic activities and affects environmental quality negatively. Salahuddin et al. (2016) argue that easy access of firms to financial instruments decreases financial costs and thus causes an increase in production activities that require energy which consequently affects the emission of CO2 positively in both the short run and long run. Farhani and Ozturk (2015) and Amri (2018) confirm that financial development causes environmental degradation. However, according to Tsaurai and Chimbo (2019), financial development plays an intermediating role through ICT adding to CO2 emissions. At the same time, Sadorsky (2011) believes that access to finance encourages consumers to purchase costly items such as air conditioners and cars, which increases CO2 emissions.

On the other hand, many authors consider that financial development contributes to environment quality positively. According to Tamazian et al. (2009), the availability of financial resources encourages using advanced technology at low cost and motivates investments in environmentally friendly projects. Atsu et al. (2021) point out that increasing financial service promotes innovation and increases energy efficiency. Financial development encourages firms to invest in environmentally friendly production techniques by removing credit constraints. Park et al. (2018) confirms in his study that financial development reduces CO2 emission in developed countries because leading financial institutions provide loans to research and development (R&D) and renewable energy projects at low-interest rates that increase energy efficiency and decrease the emission of CO2. Based on their findings, Xu et al. (2018) suggest the financial sectors to provide financial services that promote environmentally friendly production technology and reduce environmental degradation. Conversely, Lu (2018) found a negative but insignificant effect of financial development on the emission of carbon dioxide.

Research gap

The above-mentioned brief literature has addressed a direct relationship between ICT, renewable energy consumption, financial development, and emissions of carbon dioxide. Thus, the present study addressed the research gap related to the important cross-sections. The present research has focused on the important cross-sections of developing East and South Asia to investigate the association between ICT, renewable energy usage, financial development, and carbon dioxide emissions which have been seldom inspected in the literature. Meanwhile, this research has a sole combination of ICT, renewable energy, financial development, trade, and economic growth to spotlight the influence on carbon dioxide (CO2) emissions, not sufficiently inspected in the literature.

Methodology

To empirically analyze the impact of ICT, renewable energy, and financial development on carbon dioxide emissions, panel data covering the period from 1985–2020 is employed. However, we have considered ten developing countries from East Asia and South Asia. These countries include Bangladesh, China, Pakistan, the Philippines, India, Vietnam, Sri Lanka, Nepal, Mongolia, and Malaysia. In this study, carbon emissions measured in metric tons per capita are used for carbon emissions. For renewable energy, the use of renewable energy as a ratio of aggregate energy is used. This study takes the GDP growth rate to measure the impact of GDP growth on CO2. Trade as a percentage of GDP is used to calculate the effect of trade on CO2 emissions. To gauge the level of financial development, this study considers domestic credit to the private sector as the ratio of GDP; however, internet consumers as a percentage of the populace are used for ICT. World Development Indicators provide data on dependent and independent variables (WDI).

To analyze the impact of independent variables on a dependent variable, this study uses a linear econometric model, and the model specification is as follows:

where i denotes country and t represents time, whereas CO2 is per capita CO2 emissions, GDP is GDP growth rate, RE is renewable energy, FD is financial development, ICT is information and communication technology, and trade is trade openness; however, to check the hypothesis of Environmental Kuznets Curve, the square of GDP growth rate is also included in the equation.

Before applying the panel unit root test, we used the cross-sectional dependence (from now on CD) test suggested by Pesaran (2004) to assess cross-sectional relations across sample countries. According to Pesaran (2007), disregarding the existence of cross-sectional dependence while checking the unit root test results in substantial distortions and false conclusions. CD test under the null hypothesis of no cross-sectional dependence has the following test statistic:

In Eq. (2), \(\widehat{{\uprho }_{\mathrm{ij}}}\) are the coefficients of cross-sectional correlation. To address the issue of cross-sectional dependence, CADF and CIPS unit root test is used. The statistic of CADF is obtained using the following regression:

whereas, CIPS statistic is calculated using the estimates of CADF regression:

In order to examine the long-run association between variables, this study applied Westerlund (2007) cointegration test. In contrast to the Westerlund cointegration test, other tests such as Pedroni and Kao cointegration test suppose cross-sectional independence. However, the Westerlund test provides robust results even when the cross-sectional dependency is present. Based on two panel and two group statistics, using the following equation, the Westerlund approach tests the null hypothesis that there is no cointegration:

In Eq. (5), d is used for deterministic components, whereas qi and pi denote the lead orders and lag lengths across individual cross-sections, respectively. To estimate the long-run and short-run impact of independent variables on CO2 emissions, the panel ARDL models are employed, and the equation is as follows:

Akaike information criterion is employed to decide the optimal lag to use. The error correction form of the above model is written as follows:

where

While \({\varphi }_{i}\) is the speed of adjustment coefficient, and a significant and negative value of the speed of adjustment coefficient confirms integration between dependent and independent variables, whereas, \({\uppi }_{1\mathrm{i}}\), \({\uppi }_{2\mathrm{i}}, {\uppi }_{3\mathrm{i}}, {\uppi }_{4\mathrm{i}}\), \({\uppi }_{5\mathrm{i}}\), and \({\uppi }_{6\mathrm{i}}\) are the long-run coefficients. We have applied both MG (mean group) and PMG (pooled mean group) estimates. In panel ARDL models, the PMG approach by Pesaran et al. (1999) is based on the assumption that long-run coefficients πi are common across cross-sections and heterogeneity in the short-run coefficients. On the other hand, the MG approach by Pesaran and Smith (1995) is the least restrictive and assumes heterogeneity of all parameters; however, for selecting the appropriate method, the Hausman test is used.

This paper also examined the causal relationship between variables using the Dumitrescu and Hurlin (2012) causality test, which resolves the issue of heterogeneity. This test assumes the following linear heterogeneous model:

The null hypothesis of this model assumes no causality (Bi = 0) between panels, and the alternate hypothesis is founded on the presence of Granger causality.

Results and discussion

Before using the unit root test to check the stationarity of variables, this study uses a cross-sectional dependence test. There are several reasons, such as common border, same ethnicity or culture, and trade agreements, that may cause cross-sectional dependence in panel data. Therefore, it is essential to control these cross-sectional effects, or else results will be biased and inconsistent. The result of the cross-sectional dependence test is reported in Table 1. Results indicate that the p-values for all variables are less than 0.05, so we reject the null hypothesis and conclude that cross-sectional dependence exists.

Since the CD-test confirms the cross-sections are not independent, CIPS and CADF unit root tests by Pesaran (2007) are applied to test the stationarity of variables. CIPS and CADF tests control the cross-sectional dependence between panels (Danish et al. 2018). The outcomes of both tests are shown in Table 2.

Results of the CIPS test shows that financial development (FD), renewable energy (RE), GDP growth, and square of GDP are stationary at a level. In contrast, other variables are found to be stationary at the first difference. However, the CADF test shows that only renewable energy (RE) and GDP growth are stationary at a level, and others are stationary at first difference.

In order to test the existence of a potential long-run equilibrium relationship between variables, the cointegration test introduced by Westerlund (2007) has been used because it gives efficient results in even small samples. Another reason for using the Westerlund cointegration test is that it controls a large degree of heterogeneity among panels in both the long run and short run and allows for cross-sectional dependency. The result of the Westerlund cointegration test is given in Table 3. The group statistic value is significant at a 1% significance level; thus, we reject the null hypothesis of no cointegration.

To estimate the long-run and short-run effects of renewable energy consumption, financial development, and ICT on the emissions of CO2, the Panel ARDL approach has been used. For the selection of optimal lag length, Akaike information criteria (AIC) is used. The result of Panel ARDL estimation is given in Table 4. Both MG and PMG estimators are employed. However, the Hausman test is used to choose between these two estimators. The value of the Hausman statistic is 3.41, with a probability value of 0.530. Since the probability value is greater than 0.05, thus, we do not reject the null hypothesis of homogeneity restriction and conclude that the PMG estimator is efficient and consistent. A significant long-run relationship among variables requires the value of the error-correction term (ECT) to be significant and negative. Results indicate that the value of ECT is negative and significant at a 1% level of significance in both MG and PMG models. In the PMG model, the value of ECT is around 19% indicating that 19% disequilibrium is being corrected annually. However, the value of ECT is − 0.39 in the MG model, which suggests that about 39% of the imbalance is being corrected annually.

The results of the PMG model show that in the long run, financial development affects environmental degradation positively and significantly. However, its impact is insignificant in the short run. In the long run, a 1% increase in financial development increases CO2 emissions by 0.1207%, and this result is in line with the studies of Nasir et al. (2019) and Zakaria and Bibi (2019). Our result indicates that in developing regions of Asia, the financial sector creates scale effects by providing loans to increase economic activities. Financial sectors in the developing regions are not targeting energy-efficient and environment-friendly projects, and hence due to unrestricted and unplanned capitalization, financial development is affecting the environment negatively. Many studies have shown that institutional quality enhances financial development (Huang 2010; Khan et al. 2020). Institutional quality helps in restructuring the financial system so that it can operate its functions efficiently. Thus, low institutional quality is one reason why financial development negatively affects the environment in Asia’s developing countries.

The impact of renewable energy on environmental degradation is negative and significant in both the long and short run. In the short run, a 1% increase in renewable energy reduces CO2 emissions by 0.655%. In the long run, a 1% increase in renewable energy consumption decreases CO2 emissions by 0.489%. This result is in accordance with the findings of Jebli and Youssef (2015), Waheed et al. (2018), Chen et al. (2019), and Faisal et al. (2020). Increasing renewable energy consumption, such as solar and wind energy sources, does not emit CO2, affecting environmental quality. Increasing reliance on renewable energy sources reduces the proportionate use of non-renewable energy and thus causes CO2 to reduce.

The short-run results of the PMG model show that the coefficient of GDP growth is statistically insignificant. At the same time, the long-run effects of the PMG model illustrate that GDP growth influences CO2 emissions positively and significantly at a 1% level of significance. Results indicate that a 1% increase in GDP growth leads to a 0.2981% increase in CO2 emissions in the long run. This result is consistent with the findings of Linh and Lin (2014) and Lu (2018). Our findings confirm that an increase in economic activities in developing countries leads to excessive use of non-renewable energy sources and depletion of natural resources, including deforestation, which eventually negatively affects environmental quality. However, the squared of GDP carries a negative sign in the long run, confirming the validity of the inverted U-shaped environmental Kuznets curve hypothesis.

On the other hand, trade is also having an insignificant impact on the emission of CO2, while its effects on CO2 emissions are positive and significant in the long run. Table 4 indicates that a 1% increase in trade causes CO2 emissions to increase by 0.0788% in the developing regions of Asia. Our findings are in accordance with the study of Mrabet and Alsamara (2017). An increase in trade spurs economic activities, which thereby causes an increase in the demand for natural resources and energy. Thus, in developing countries, trade through its scale effects causes an increase in the CO2 emissions. However, these developing countries are unable to capture technological effects through trade.

ICT is found to affect CO2 emissions positively and significantly in the long run, while its effect on environmental degradation is insignificant in the short run. One percent increase in ICT increases CO2 emissions by 0.5314% in the long run. Our findings are consistent with Park et al. (2018) and Danish et al. (2018). The results demonstrate that the use of ICT-related equipment in developing countries of Asia is not energy efficient, which results in high energy consumption. The increasing use of the internet requires electronic equipment that needs electricity consumption that puts pressure on the economy to use non-renewable sources of energy such as fossil fuel energy which ultimately affects the environmental quality adversely.

In order to identify the direction of the causal relationship between variables, Dumitrescu-Hurlin (DH) causality test developed by Dumitrescu and Hurlin (2012) is used in this study. The DH test considers the heterogeneity in panel data. The result of the DH causality test is given in Table 5, which confirms that the results of the causality test are compatible with the results of the PMG model. Based on the value of W-stat and Z bar-stat, we conclude that unidirectional causality runs from financial development to CO2 emissions, which is consistent with the result of Park et al. (2018). A bi-directional causality is found between renewable energy and CO2 emissions. Renewable energy consumption causes a decrease in pollution, which is supported by Chen et al. (2019) and Assi et al. (2021) while increasing CO2 emissions emphasize the importance of using renewable energy, which is consistent with the study of Salim and Rafiq (2012).

A unidirectional causality is observed from GDP, trade, and ICT to CO2 emissions, confirming our PMG result. A unidirectional causality from financial development to renewable energy suggests that a developed financial sector helps finance energy efficiency projects (Eren et al. 2019). Bidirectional causality is found between GDP and financial development, which is consistent with the study of Isik et al. (2017) and Park et al. (2018). A unidirectional causality is observed to be running from financial development to trade because financial services support the investors to increase their production and encourage them to export their products. Results show that ICT causes GDP, and Faisal et al. (2020) support the unidirectional causality from ICT to GDP. Unidirectional causality is examined from financial development to ICT, and this outcome is consistent with the study of Pradhan et al. (2015). Bidirectional causality between GDP and RE is also observed because the increased level of GDP increases the need for energy, increasing the demand for both renewable and non-renewable energy. In contrast, an increase in the consumption of renewable energy increases GDP. Results also show a unidirectional causality running from trade to GDP, which is supported by Meijers (2014). It is also observed that there is bidirectional causality between ICT and trade, which is compatible with the study of Arvin et al. (2021).

Conclusion and policy implication

This study applies the panel ARDL model to estimate the impact of ICT, financial development, and renewable energy on environmental degradation. To assess the long-run effects, this study employs the PMG approach. In addition to PMG, Dumitrescu-Hurlin (DH) causality test is also used to examine the causal relationship between variables. The long-run estimates show that increasing ICT usage causes CO2 emissions to increase in developing countries of Asia. Similarly, financial development, economic growth, and trade also contribute to CO2 emissions positively. In contrast, economic growth squared helps mitigate CO2 emissions and confirmed the validity of the inverted U-shaped environmental Kuznets curve in the developing regions of Asia.

Furthermore, renewable energy consumption affects CO2 emissions negatively. The unidirectional causal relationship is found running from financial development, ICT, trade, and GDP to CO2 emissions, while a bi-directional relationship is observed between renewable energy and CO2 emissions. Results of this study imply that developing countries need to improve the use of ICT to control environmental degradation. Better utilization of ICT can lead to improved environmental quality through ICT-based solutions to energy intensity, commutation, and utilization of natural resources. Since financial development is found to affect CO2 emissions positively, that drew the attention of policymakers of developing countries towards having a planned financial structure that should approve finance to environment-friendly projects only. In comparison, the negative effect of renewable energy on CO2 emissions emphasizes the need to reduce the dependency on fossil fuel energy consumption.

Availability of data and materials

The datasets generated and analyzed are not publicly available but are available from the corresponding author on reasonable request.

References

Adebayo TS, Kirikkaleli D (2021) Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environ Dev Sustain 1–26. https://doi.org/10.1007/s10668-021-01322-2

Al-Mulali U, Ozturk I, Solarin SA (2016) Investigating the environmental Kuznets curve hypothesis in seven regions: the role of renewable energy. Ecol Ind 67:267–282. https://doi.org/10.1016/j.ecolind.2016.02.059

Amri F (2018) Carbon dioxide emissions, total factor productivity, ICT, trade, financial development, and energy consumption: testing environmental Kuznets curve hypothesis for Tunisia. Environ Sci Pollut Res 25(33):33691–33701. https://doi.org/10.1007/s11356-018-3331-1

Arshad Z, Robaina M, Botelho A (2020) The role of ICT in energy consumption and environment: an empirical investigation of Asian economies with cluster analysis. Environ Sci Pollut Res 27(26):32913–32932. https://doi.org/10.1007/s11356-020-09229-7

Arvin MB, Pradhan RP, Nair M (2021) Uncovering interlinks among ICT connectivity and penetration, trade openness, foreign direct investment, and economic growth: the case of the G-20 countries. Telematics Inform 60:101567. https://doi.org/10.1016/j.tele.2021.101567

Asongu SA (2017) Knowledge economy gaps, policy syndromes, and catch-up strategies: fresh South Korean lessons to Africa. J Knowl Econ 8(1):211–253. https://doi.org/10.1007/s13132-015-0321-0

Asongu SA, Le Roux S, Biekpe N (2018) Enhancing ICT for environmental sustainability in sub-Saharan Africa. Technol Forecast Soc Chang 127:209–216. https://doi.org/10.1016/j.techfore.2017.09.022

Assi AF, Isiksal AZ, Tursoy T (2021) Renewable energy consumption, financial development, environmental pollution, and innovations in the ASEAN+ 3 group: evidence from (P-ARDL) model. Renew Energy 165:689–700. https://doi.org/10.1016/j.renene.2020.11.052

Atsu F, Adams S, Adjei J (2021) ICT, energy consumption, financial development, and environmental degradation in South Africa. Heliyon e07328. https://doi.org/10.1016/j.heliyon.2021.e07328

Bapna R, Barua A, Mani D, Mehra A (2010) Research commentary—cooperation, coordination, and governance in multisourcing: an agenda for analytical and empirical research. Inf Syst Res 21(4):785–795. https://doi.org/10.1287/isre.1100.0328

Barış-Tüzemen Ö, Tüzemen S, Çelik AK (2020) Does an N-shaped association exist between pollution and ICT in Turkey? ARDL and quantile regression approaches. Environ Sci Pollut Res 27(17):20786–20799. https://doi.org/10.1007/s11356-020-08513-w

Belkhir L, Elmeligi A (2018) Assessing ICT global emissions footprint: trends to 2040 & recommendations. J Clean Prod 177:448–463. https://doi.org/10.1016/j.jclepro.2017.12.239

Bento JPC, Moutinho V (2016) CO2 emissions, non-renewable and renewable electricity production, economic growth, and international trade in Italy. Renew Sustain Energy Rev 55:142–155. https://doi.org/10.1016/j.rser.2015.10.151

Bölük G, Mert M (2014) Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: evidence from a panel of EU (European Union) countries. Energy 74:439–446. https://doi.org/10.1016/j.energy.2014.07.008

Bomhof F, Van Hoorik P, Donkers M (2009) Systematic analysis of rebound effects for’greening by ict’initiatives. Commun Strateg 76:77

Boontome P, Therdyothin A, Chontanawat J (2017) Investigating the causal relationship between non-renewable and renewable energy consumption, CO2 emissions and economic growth in Thailand. Energy Procedia 138:925–930. https://doi.org/10.1016/j.egypro.2017.10.141

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41. https://doi.org/10.1016/j.econmod.2014.03.005

Chen Y, Wang Z, Zhong Z (2019) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216. https://doi.org/10.1016/j.renene.2018.07.047

Churchill SA, Inekwe J, Ivanovski K, Smyth R (2018) The environmental Kuznets curve in the OECD: 1870–2014. Energy Econ 75:389–399. https://doi.org/10.1016/j.eneco.2018.09.004

Coroama VC, Hilty LM (2014) Assessing internet energy intensity: a review of methods and results. Environ Impact Assess Rev 45:63–68. https://doi.org/10.1016/j.eiar.2013.12.004

Danish MSS, Senjyu T, Yaqobi MA, Nazari Z, Matayoshi H, Zaheb H (2018) The role of ICT in corruption elimination: a holistic approach. In 2018 IEEE 9th Annual Information Technology, Electronics and Mobile Communication Conference (IEMCON) (pp. 859-864). IEEE.

Dogan E, Seker F (2016) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energy 94:429–439. https://doi.org/10.1016/j.renene.2016.03.078

Dong K, Sun R, Hochman G (2017) Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy 141:1466–1478. https://doi.org/10.1016/j.energy.2017.11.092

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Eren BM, Taspinar N, Gokmenoglu KK (2019) The impact of financial development and economic growth on renewable energy consumption: empirical analysis of India. Sci Total Environ 663:189–197. https://doi.org/10.1016/j.scitotenv.2019.01.323

Faisal F, Tursoy T, Pervaiz R (2020) Does ICT lessen CO 2 emissions for fast-emerging economies? An application of the heterogeneous panel estimations. Environ Sci Pollut Res 1–12. https://doi.org/10.1007/s11356-019-07582-w

Farhani S, Ozturk I (2015) Causal relationship between CO 2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676. https://doi.org/10.1007/s11356-015-4767-1

Gelenbe E, Caseau Y (2015) The impact of information technology on energy consumption and carbon emissions. Ubiquity 2015(June):1–15

Gillwald A, Stork C (2008) ICT access and usage in Africa. Towards Evidence-based ICT Policy and Regulation policy paper series; 2008, v. 1, no. 2

Goundar S, Appana S (2018) Mainstreaming development policies for climate change in Fiji: a policy gap analysis and the role of ICTs. In: Sustainable Development: Concepts, Methodologies, Tools, and Applications (pp. 402–432). IGI Global. https://doi.org/10.4018/978-1-5225-3817-2.ch020

Guru BK, Yadav IS (2019) Financial development and economic growth: panel evidence from BRICS. J Econ Financ Admin Sci. https://doi.org/10.1108/JEFAS-12-2017-0125

He X, Adebayo TS, Kirikkaleli D, Umar M (2021) Analysis of dual adjustment approach: consumption-based carbon emissions in Mexico. Sustain Prod Consump 2(4):12–26. https://doi.org/10.1016/j.spc.2021.02.020

Higón DA, Gholami R, Shirazi F (2017) ICT and environmental sustainability: a global perspective. Telematics Inform 34(4):85–95. https://doi.org/10.1016/j.tele.2017.01.001

Huang Y (2010) Determinants of financial development. Springer, Basingstoke

Ibrahim KM, Waziri SI (2020) Improving ICT and renewable energy for environmental sustainability in sub-Saharan Africa. J Res Emerg Mark 2(3):82

Ishida H (2015) The effect of ICT development on economic growth and energy consumption in Japan. Telematics Inform 32(1):79–88. https://doi.org/10.1016/j.tele.2014.04.003

Işik C, Kasımatı E, Ongan S (2017) Analyzing the causalities between economic growth, financial development, international trade, tourism expenditure and/on the CO2 emissions in Greece. Energy Sources B 12(7):665–673. https://doi.org/10.1080/15567249.2016.1263251

Jaforullah M, King A (2015) Does the use of renewable energy sources mitigate CO2 emissions? A reassessment of the US evidence. Energy Econ 49:711–717. https://doi.org/10.1016/j.eneco.2015.04.006

Jebli MB, Youssef SB (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sustain Energy Rev 47:173–185. https://doi.org/10.1016/j.rser.2015.02.049

Jebli MB, Youssef SB (2017) The role of renewable energy and agriculture in reducing CO2 emissions: evidence for North Africa countries. Ecol Indic 74:295–301. https://doi.org/10.1016/j.ecolind.2016.11.032

Karl TR, BoyinArquez A, Huang B, Lawrimore JH, McMahon JR, Menne MJ, Peterson TC, Vose RS, Zhang H-M (2015) Possible artifacts of data biases in the recent global surface warming hiatus. Science 348(6242):1469–1472. https://doi.org/10.1126/science.aaa5632

Khan H, Khan S, Zuojun F (2020) Institutional quality and financial development: evidence from developing and emerging economies. Glob Bus Rev 0972150919892366

Kouton J (2019) Information communication technology development and energy demand in African countries. Energy 189:116192. https://doi.org/10.1016/j.energy.2019.116192

Lee JW, Brahmasrene T (2014) ICT, CO2 emissions and economic growth: evidence from a panel of ASEAN. Glob Econ Rev 43(2):93–109. https://doi.org/10.1080/1226508X.2014.917803

Linh DH, Lin SM (2014) CO2 Emissions, energy consumption, economic growth and FDI in Vietnam. Manag Glob Trans Int Res J 12(3)

Liu X, Zhang S, Bae J (2017) The impact of renewable energy and agriculture on carbon dioxide emissions: investigating the environmental Kuznets curve in four selected ASEAN countries. J Clean Prod 164:1239–1247. https://doi.org/10.1016/j.jclepro.2017.07.086

Lu WC (2018) The impacts of information and communication technology, energy consumption, financial development, and economic growth on carbon dioxide emissions in 12 Asian countries. Mitig Adapt Strat Glob Chang 23(8):1351–1365. https://doi.org/10.1007/s11027-018-9787-y

Lv Q, Liu H, Yang D, Liu H (2019) Effects of urbanization on freight transport carbon emissions in China: common characteristics and regional disparity. J Clean Prod 211:481–489. https://doi.org/10.1016/j.jclepro.2018.11.182

Meijers H (2014) Does the internet generate economic growth, international trade, or both? IEEP 11(1):137–163. https://doi.org/10.1007/s10368-013-0251-x

Mensah IA, Sun M, Gao C, Omari-Sasu AY, Zhu D, Ampimah BC, Quarcoo A (2019) Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J Clean Prod 228:161–174. https://doi.org/10.1016/j.jclepro.2019.04.281

Menyah K, Wolde-Rufael Y (2010) CO2 emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 38(6):2911–2915. https://doi.org/10.1016/j.enpol.2010.01.024

Mrabet Z, Alsamara M (2017) Testing the Kuznets Curve hypothesis for Qatar: a comparison between carbon dioxide and ecological footprint. Renew Sustain Energy Rev 70:1366–1375. https://doi.org/10.1016/j.rser.2016.12.039

Nasir MA, Huynh TLD, Tram HTX (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manag 242:131–141. https://doi.org/10.1016/j.jenvman.2019.03.112

Nguyen TT, Pham TAT, Tram HTX (2020) Role of information and communication technologies and innovation in driving carbon emissions and economic growth in selected G-20 countries. J Environ Manag 261:110162. https://doi.org/10.1016/j.jenvman.2020.110162

Ozatac N, Gokmenoglu KK, Taspinar N (2017) Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: the case of Turkey. Environ Sci Pollut Res 24(20):16690–16701. https://doi.org/10.1007/s11356-017-9317-6

Park Y, Meng F, Baloch MA (2018) The effect of ICT, financial development, growth, and trade openness on CO 2 emissions: an empirical analysis. Environ Sci Pollut Res 25(30):30708–30719. https://doi.org/10.1007/s11356-018-3108-6

Pesaran M (2004) General diagnostics tests for cross sectional dependence in panel models (No. 1240). Discussion Paper

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312. https://doi.org/10.1002/jae.951

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econ 68(1):79–113. https://doi.org/10.1016/0304-4076(94)01644-F

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94(446):621–634

Pradhan RP, Arvin MB, Norman NR (2015) The dynamics of information and communications technologies infrastructure, economic growth, and financial development: evidence from Asian countries. Technol Soc 42:135–149. https://doi.org/10.1016/j.techsoc.2015.04.002

Radhi H (2009) Evaluating the potential impact of global warming on the UAE residential buildings–a contribution to reduce the CO2 emissions. Build Environ 44(12):2451–2462. https://doi.org/10.1016/j.buildenv.2009.04.006

Raheem ID, Tiwari AK, Balsalobre-Lorente D (2020) The role of ICT and financial development in CO2 emissions and economic growth. Environ Sci Pollut Res 27(2):1912–1922. https://doi.org/10.1007/s11356-019-06590-0

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39(2):999–1006. https://doi.org/10.1016/j.enpol.2010.11.034

Sadorsky P (2012) Information communication technology and electricity consumption in emerging economies. Energy Policy 48:130–136. https://doi.org/10.1016/j.enpol.2012.04.064

Salahuddin M, Alam K, Ozturk I (2016) Is rapid growth in internet usage environmentally sustainable for Australia? An empirical investigation. Environ Sci Pollut Res 23(5):4700–4713. https://doi.org/10.1007/s11356-015-5689-7

Salim RA, Rafiq S (2012) Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ 34(4):1051–1057. https://doi.org/10.1016/j.eneco.2011.08.015

Samour A, Isiksal AZ, Resatoglu NG (2019) Testing the impact of banking sector development on Turkey’s CO2 emissions. Appl Ecol Environ Re 17(3): 6497–6513. https://doi.org/10.15666/aeer/1703_64976513

Saud S, Chen S (2018) An empirical analysis of financial development and energy demand: establishing the role of globalization. Environ Sci Pollut Res 25(24):24326–24337. https://doi.org/10.1007/s11356-018-2488-y

Shabani ZD, Shahnazi R (2019) Energy consumption, carbon dioxide emissions, information and communications technology, and gross domestic product in Iranian economic sectors: a panel causality analysis. Energy 169:1064–1078. https://doi.org/10.1016/j.energy.2018.11.062

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857. https://doi.org/10.1016/j.eneco.2018.07.020

Shaheen MA, Hasanien HM, Mekhamer SF, Talaat HE (2020) Optimal power flow of power networks with penetration of renewable energy sources by harris hawks optimization method. In 2020 2nd International Conference on Smart Power & Internet Energy Systems (SPIES) (pp. 537–542). IEEE. https://doi.org/10.1109/SPIES48661.2020.9242932

Shahiduzzaman M, Alam K (2014) Information technology and its changing roles to economic growth and productivity in Australia. TelecommunPolicy 38(2):125–135. https://doi.org/10.1016/j.telpol.2013.07.003

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Tsaurai K, Chimbo B (2019) The impact of information and communication technology on carbon emissions in emerging markets. Int J Energy Econ Policy 9(4):320–326

Van Heddeghem W, Lambert S, Lannoo B, Colle D, Pickavet M, Demeester P (2014) Trends in worldwide ICT electricity consumption from 2007 to 2012. Comput Commun 50:64–76. https://doi.org/10.1016/j.comcom.2014.02.008

Waheed R, Chang D, Sarwar S, Chen W (2018) Forest, agriculture, renewable energy, and CO2 emission. J Clean Prod 172:4231–4238. https://doi.org/10.1016/j.jclepro.2017.10.287

Wang Z, Zhu Y (2020) Do energy technology innovations contribute to CO2 emissions abatement? A spatial perspective. Sci Total Environ 726:138574. https://doi.org/10.1016/j.scitotenv.2020.138574

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

Xu Z, Baloch MA, Meng F, Zhang J, Mahmood Z (2018) Nexus between financial development and CO2 emissions in Saudi Arabia: analyzing the role of globalization. Environ Sci Pollut Res 25(28):28378–28390. https://doi.org/10.1007/s11356-018-2876-3

Yang F (2019) The impact of financial development on economic growth in middle-income countries. J Int Financ Mark Inst Money 59:74–89. https://doi.org/10.1016/j.intfin.2018.11.008

Zafar MW, Saud S, Hou F (2019) The impact of globalization and financial development on environmental quality: evidence from selected countries in the Organization for Economic Co-operation and Development (OECD). Environ Sci Pollut Res 26(13):13246–13262. https://doi.org/10.1007/s11356-019-04761-7

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26(8):7926–7937. https://doi.org/10.1007/s11356-019-04284-1

Zhang C, Liu C (2015) The impact of ICT industry on CO2 emissions: a regional analysis in China. Renew Sustain Energy Rev 44:12–19. https://doi.org/10.1016/j.rser.2014.12.011

Author information

Authors and Affiliations

Contributions

Zakia Batool: initial draft preparation; Syed Muhammad Faraz Raza: methodological framework, econometric results estimation, and hypothesis testing; Sajjad Ali: review of literature, data collection, and tabulation; Syed Zain Ul Abidin (corresponding author email: thesyedzain@gmail.com): results interpretation, causality testing, and technical advice. All authors have contributed to the submitted paper.

Corresponding author

Ethics declarations

Ethics approval

This original work has not been submitted anywhere else for publication.

Consent for publication

The paper submitted with the mutual consent of authors for publication in Environmental Science and Pollution Research.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Batool, Z., Raza, S.M.F., Ali, S. et al. ICT, renewable energy, financial development, and CO2 emissions in developing countries of East and South Asia. Environ Sci Pollut Res 29, 35025–35035 (2022). https://doi.org/10.1007/s11356-022-18664-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-18664-7