Abstract

The present study investigates the causality between energy consumption, natural resources, and carbon emissions volatility. For empirical results, the study analyzed panel data of a Group of Twenty (G-20) countries from 1995 to 2018. The results of Pooled Mean Group (PMG) showed that the consumption of conventional energy sources increases the carbon emissions in the region under consideration. The results also showed that economic growth and carbon emissions are associated with each other according to the Environmental Kuznets Curve hypothesis. The findings showed that rent on mineral resources, oil resources, and forest rent have a positive and significant impact on carbon emissions in G-20 countries. The findings of this study show the complex nature of the relationship between natural resources consumption and carbon dioxide emissions. The study suggests a three-dimensional policy framework for the group of twenty countries of economic cooperation to address the environmental issues with a special focus on natural resources preservation and green economic growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Environmental changes and global warming are the major challenges of the current century. There is a strong relationship between world development patterns and the natural environment. Human activities, productivity, and relations are sharply tuned by natural resources endowment, geography, weather conditions, and plenty of other characteristics of the environment. Renewable and non-renewable natural resources depletion is causing environmental degradation Hanif (2018a). Several types of anomalies are originating in form of air, water, and soil pollution. A tension is found in perceptions of preservation or utilization of natural resources, one perception tells that we should preserve the environment while the other says that we should utilize natural resources efficiently and sustainably. Even natural environment is badly affected as a result of deforestation or clearing land for buildings, countries still prefer to have more infrastructure development.

Changing patterns of economic growth and economic integration are impacting the ways of natural resources utilization (Mensah et al. 2019; Hanif and Gago-de-Santos 2017; Marsiglio et al. 2016). Sustainable use of natural resources is not only important for the conservation of the environment but also the survival of life. The relationship of humans with society and the environment is acknowledging the significance of sustainable development. The perception attributed to development now is not only confined to social and economic development but also is leading toward sustainable development. The statement that positive social development must impact the environment positively seems vague.

Natural resources play a vital role in economic development, according to the World Bank (2020) in the achievement of Millennium Development Goals (MDGs) and surety of sustainability; this is necessary to use natural resources wisely. Since the concern is that natural resources depletion can be the cost of economic growth, countries are relying on resources extraction for economic growth that is continually increasing their rents (mineral rents, oil rents, natural gas rents, forest rents). Without wisely use of natural resources a sustainable growth is not possible, and more harm like environmental degradation is additional (Alharthi and Hanif 2020; Shi et al. 2019; Sinha and Shahbaz 2018; Perman et al. 2003) .

With economic development, humans are now seriously considering changes in the environment. Because a healthy and clean environment is essential for human health that ultimately has an impact on productivity. The G20 founded in 1999, consists of 19 countries along with European Union. This group has a huge impact worldwide and to pursue the purpose of this study is to use G20 for analysis. The first reason for choosing G20 is its competency and ability to show trends worldwide, alone, the G20 group has accounted for 85% of the global economy, 80% of global trade, and 60% of the global population (Hanif et al. 2020, 2019a; Cui et al. 2018). The second reason is G20 group is an amalgam of developed and developing economies that provides a perfect combination for analysis. Thirds reason is G20 is influential on the environment and advised to consider environmental issues seriously in the United Nations’ (UN) climate change meeting (Ongan et al. 2020; Nazir et al. 2018; Liu and Xiao 2018) .

There is essential to obtain sustainable energy to limit carbon dioxide emissions. Renewable energy is recognized as a clean form of energy. It is enthralling to review past studies related to renewable energy and natural resource rents to mitigate carbon dioxide emissions. In Brazil, Russia, India, China, and South Africa (BRICS), a relationship has been established between natural resource rents, renewable energy, economic growth, and carbon dioxide emissions. The abundance of natural resources has reduced the carbon dioxide emission in Russia, opposed to South Africa. As well as, the environmental Kuznets curve (EKC) hypothesis developed in China, Russia, Brazil, and South Africa (Bekun et al. 2019; Churchill et al. 2019; Bokpin et al. 2015). In another evidence of BRICS countries, the negative impact of natural resource rents and renewable energy on ecological footprint is evident. This indicates that natural resource rents and renewable energy positively contribute to environmental quality. The positives of economic growth and negatives of doubled economic growth on ecological footprint have evidenced the early stage and inverted U-shaped EKC hypothesis in BRICS. However, the country-wise EKC hypothesis is confirmed in all BRICS countries (Cansino et al. 2019; Costantini and Martini 2010; Downey et al. 2010). At the provincial level in China, the natural resources are associated with carbon dioxide emissions in four Chinese provinces. Environmental degradation in Xinjiang and Shaanxi is much significant than that in Ningxia and Gansu. On the other hand, there are fewer carbon dioxide emissions in Qinghai province. Therefore, the EKC hypothesis is applied only in Qinghai and Xinjiang provinces. However, renewable energy supports carbon dioxide emissions mitigation and promoting environmental sustainability in northwest China (Acheampong 2018; Aşici 2013; Breitung 2005).

The first objective of this study is to examine the relationship between economic growth and carbon emissions for G-20 countries. To achieve this objective, the study adopts the Environmental Kuznets Curve (EKC) hypothesis and examines the relationship between economic growth and depletion of the environment. According to EKC, when economies are at an early stage of economic growth, usually their production activities or economic growth increase environmental degradation and after achieving a particular level of economic growth, the positive relationship between economic growth and carbon emissions turns negative. In short, the relationship between economic growth and environmental degradation develops a U-shape curve (Luo et al. 2017). The second objective of this study is to highlight the impact of natural resources consumption on environmental degradation. High reliance on natural resources, on one hand, exerts pressure on natural resources and on the other hand increases environmental degradation. To achieve this objective study employs mineral rent, forest rent, oil rent, and natural gas rent to examine their role in environmental degradation. The study is using panel data for G20 from 1995–2018. To estimate robust results, we have performed the null hypothesis of homogeneity through Hausman type test. Thus, it can be concluded that Pooled Mean Group (PMG) is the most efficient estimator for the proposed model. Therefore, the study reports the long-run and short-run estimates based on PMG. The composition of the rest of the study is as follows.

The literature review is presented in the “Literature review” section; data and methodological framework are presented in the “Data and methodology” section. The estimation and results are presented in the “Results and discussion” section and the conclusion is given in the “Conclusion and recommendations” section.

Literature review

Many studies are conducted on resource use and environmental degradation that shown its significance. Munasinghe (1999) studied the affiliation among the economic growth and degradation of the environment and tunneled it through using EKC. This paper argued that if we made reforms to achieve socioeconomic gains, these come with the cost of omission in some other policies like institutional imperfections. This paper argued that the EKC approach seemed to relate from stages of the environment to stages of development. But environmentally amended measures could change the shape of the environment to development relationship. This study concludes that “win–win” policies can lead to gains on both the environmental and economic sides.

Scherr (2000) studied the relationship between poverty with the environment by “downward spiral” that by population growth and economic deprivation is the reason for environmental degeneration. Rural poor are blamed for environmental degeneration in literature, but the reason is lack of local endowment leads to a lack of resource conservation policies that ultimately cause environmental degradation. Local institutions also do not support the poor for the adoption of environment-friendly techniques.

Hanif (2017) provided an alternate description of the association between income and degradation of the environment, i.e., a U-shaped curve. In developing nations, patterns of consumption and production of the rural population play a vital role in the depletion of the environment. The occurrence of EKC may have been achieved when assumptions like perfect competition market in which there seems a relaxation for factors and products. This EKC depends on the type of indicators that are representing environmental pressure; however, they showed a reverse pattern may exist.

Jorgenson (2003) studied the relationship between environmental degradation and consumption that is a hot issue for the globe. This study argued that this relationship is deeply embedded in hierarchical inter-state relationships. By using cross-national relationship for 208 countries and recursive indirect model is made for the estimation of direct and indirect impacts of domestic inequality, urbanization, rate of literacy on environmental footprints like per capita consumption of natural resources. Results found that per capita consumption of natural resources is positively related to urbanization, while negatively related to domestic inequality. This study also demonstrated a cross-national variation of consumption with two outliers like periphery and relatively high semi-periphery.

At the regional level of China, Cui et al. (2018) explored that renewable energy and squared economic growth negatively influenced carbon dioxide emissions in China’s Western and Eastern regions, evident EKC inverted U-shaped hypothesis. On the other hand, statistically insignificant in the country’s Central region does not hold the U-shaped EKC. In the Organization of Economic Cooperation and Development (OECD) countries, renewable energy consumption has reduced per capita carbon dioxide emissions. The increased economic growth upsurges the per capita carbon dioxide emissions significantly and directs to U-shaped EKC valid for OECD countries (Cansino et al. 2019). Another evidence of Hanif (2018b) for African countries revealed that renewable energy consumption negatively influences carbon dioxide emissions. However, gross domestic product (GDP) growth intensifies carbon dioxide emissions in BRICS economies. Lee and Min (2015) explained that an upsurge in energy has reduced environmental degradation and finds the EKC hypothesis in 74 countries of the world. Yang et al. (2020) said that the high consumption of renewable energy has reduced carbon dioxide emissions by about 40% in California, Virginia, and Dublin. Hanif (2018c) found that renewable energy consumption negatively affects the ecological footprint in East Asia and the Pacific countries. According to findings, this study does not hold the U-shaped environmental Kuznets curve hypothesis in OECD countries.

Some past studies have shown the insignificant effect of renewable energy on environmental degradation. Li et al. (2016) employed the data of seven selected countries, and results suggest that renewable energy consumption has an insignificant effect on pollution in the sub-Saharan and the Middle East and North African (MENA) region. So EKC hypothesis exists where renewable energy consumption has a significant impact on environmental pollution. Hanif et al. (2019b) tested the validity of the hypothesis between economic growth and carbon dioxide emissions in Turkey, and their results provide evidence to support the U-shaped hypothesis as well as renewable energy consumption does not affect carbon dioxide emission. Zambrano-Monserrate et al. (2018) found no evidence for the validity of the EKC hypothesis in Peru and found a unidirectional causality relationship between carbon dioxide emissions and their determinants. An empirical finding from the Augmented Mean Group (AMG) reveals that renewable energy has insignificant relation with carbon dioxide emissions in nineteen countries of Africa (Nathaniel and Iheonu 2019). Adams and Nsiah (2019) reported that renewable energy and economic growth have an insignificant effect on carbon dioxide emissions in 28 countries of Africa in the long run.

Costantini and Martini (2010) studied the association between economic growth and depletion of the environment by making use of EKC. Many pieces of research focus on the study of EKC but this study aimed to fill incompleteness by purposing modified EKC. This modified MEKC including aspects of sustainability and well-being. Panel data technique is used, and technological capability as additional variable and comparisons is drawn in between EKC and MEKC.

Nadkarni (2010) studied the environmental degradation and poverty pattern in India and third world countries. There is a trade-off that exists between poverty and environmental degradation; when there is a decrease in environmental degradation, poverty increases and vice versa. This phenomenon hurts the poor, so developing nations have to grow in an environment-friendly way to achieve development because by economic prosperity, countries can deal with poverty alleviation.

Downey et al. (2010) studied the relationship between the eradication of natural resources, armed ferocity, and depletion of the environment, it also demonstrated that without this relationship the linkage between humans and the environment cannot be fully described. This study contended that armed violence is the cause of many coinciding mechanisms like the fight for natural resources because resources are crucial for the industry so for state power. Ten types of minerals are indicated that these are extracted and used in the United States (US) economy and their extraction is one cause of armed violence. This study also examines that there is an association between armed violence and big mining companies like African mines that are receiving funds from World Bank, also with petroleum and rainforest resource extraction. This armed violence is the cause of environmental degradation.

Aşici (2013) studied the relationship of economic growth with pressure on a sustainable environment. There seems to be stress on nature which is being measured through the usage of data for disinvestment side of adjustment in the net savings that is the sum of energy, minerals, net forest depletion, and CO2 emissions from the World Bank. Panel instrumental variable technique is used on data of 213 countries from 1970 to 2008. Regression analysis found that there exists a positive relationship between income and pressure on nature which seems to be intense in the countries with low, middle income. An increase in income led to decrease pressure on forests but increase CO2 and mineral extraction. Trade is also found to be related to an increase in pressure on nature so this study supports the race-to-the-bottom hypothesis.

Farhani et al. (2014) is an addition to the existing literature of Environmental Kuznets curve by using two different specifications EKC and human development (HD) based EKC for 10 Middle East and North African (MENA) countries from 1990 to 2010 by applying panel data techniques. One specification EKC shows U-shape between income and environmental degradation, HD based EKC shows U-shape between HD and sustainability. This relation is shaped by many factors like trade, energy, the role of law, and manufacture-added value, concluding that HD and sustainability are critical for adequate environmental policies.

Zakarya et al. (2015) studied that the consequences of change in the climate are significant in all regions and expected to intensify in years to come. Climate change is causing significant dangers to the health of human beings which also includes the development and food security of individuals. So, there is a need to reduce greenhouse gas emissions to save the changes in the climate. This research examines the relationship that occurs between foreign direct investment (FDI), consumption of energy, CO2 emissions, and economic growth for BRICS countries by the usage of panel co-integration and causality techniques. Results found a significant association between carbon dioxide and economic variables and a unidirectional causality indirection of CO2 to independent variables.

Bokpin et al. (2015) studied the influence of natural resources on FDI (i.e., foreign direct investment). This study has used data for natural resources rents like oil rents, mineral rents, and forest rents with FDI for 49 African countries from 1980 to 2011. By using the generalized method of moment (GMM) technique, this study found that natural resources help attract FDI but it depends on their marginal contribution.

Bekun et al. (2019) studied the long-run relationship and causality between sustainable and non-sustainable consumption of energy, economic performance in function of carbon while natural resource rent is taken as an additional variable to model. Panel-pooled mean auto-regressive distributed lag (ARDL) is applied on balanced pool data of 1996 to 2014 for sixteen European Union countries. Results shown consumption of nonrenewable energy in economic performance elevates CO2 and contrarily consumption of renewable energy deteriorates CO2 emissions. Feedback causality is also observed between natural resources rent and economic growth.

From reviewing the literature, it is found that these studies are lacking focus on G-20 nations while relating resource consumption with environmental degradation. Most of the literature is focusing on CO2 emissions with other variables like trade openness, economic growth, and military expenditure in the literature mostly resource consumption is focused on natural resources are least addressed. Therefore, by looking at the literature gap, the current research focuses to examine the association between resource consumption and environmental degradation for G2-0 countries.

Data and methodology

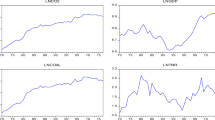

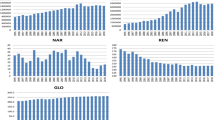

The study used data series of World Development Indicators (WDI) which is published by the World Bank (2020). Data were extracted for G20 countries from 1995 to 2018. The data on CO2 emissions metric tons per capita as a proxy for the depletion of the environment. Data on rents of different variables such as oil, mineral, coal, natural gas, and forest are taken from WDI to show the effects of natural resource consumption on environmental degradation.

Model specification

The functional form of the proposed model based on different researches of Hanif et al. (2019a, b) and Hanif (2018a, b, c) can be written as follows.

In Eq. (1), GDP per capita and GDP per capita square are used to test the EKC hypothesis which expressed the U-shaped relationship between economic growth and CO2 emissions. Environmental Kuznets curve hypothesis is used in this research particularly for achieving the objective of the current research. The descriptions of dependent and independent variables used in Eq. (1) are given below.

Carbon dioxide emissions (CO2). In this study, annual rate of CO2 emissions in metric tons was used to measure the environmental degradation.

Gross domestic product (GDP). The study used the annual rate of real per capita gross domestic product, based on purchasing power parity (PPPs) 2011, is utilized to examine the impact of economic growth on environmental degradation.

Square of gross domestic product (GDP2). The study used the square term of an annual rate of real per capita gross domestic product to test the EKC hypothesis.

Rent on mineral resources (RMR). Annual growth rate of rent earned from mineral resources US$ (based on PPPs 2011) is measured to examine the impact of mineral rent on environmental degradation.

Rent on forest resources (RFR). Annual growth rate of rent earned from forest resources US$ (based on PPPs 2011) is measured to examine the impact of forest rent on environmental degradation.

Rent from oil resources (ROR). Annual growth rate of rent earned from oil resources US$ (based on PPPs 2011) is measured to examine the impact of oil rent on environmental degradation.

Rent from gas resources (RGR). Annual growth rate of rent earned from gas resources US$ (based on PPPs 2011) is measured to examine the impact of gas rent on environmental degradation.

This research is using the EKC model to check long-run co-integration between variables. The main focus of this research is to find out the relationship between natural resources consumption and CO2 emissions. After taking the natural log, the econometric model based on the functional form expressed in Eq. (1) can be written as follows.

In Eq. (2), the subscript ‘i’ and ‘t’ show the cross-section and time-period respectively. On all variables, unit root tests (Im et al. 2003; Levin et al. 2002) are applied to see stationarity. To check the dependency of cross-sectional data, Pesaran et al. (1999) scaled LM test, and CD test is applied in which null hypothesis is written as “there exists no cross-sectional dependence.” To check slope heterogeneity, Pesaran and Yamagata (2008) test is applied with the null hypothesis that slopes are homogeneous. After applying all tests when there is stationarity along with cross-sectional dependence and slopes are heterogeneous, pooled mean group is suitable for analysis. This study aimed to investigate the long-run relationship between main variables of concern by using PMG, uniqueness of PMG is that it is a combination of MG (Pesaran et al. 1999) and DFE. PMG provides unique estimates of both a long run and a short run along with the speed of adjustment and is given in Eqs. 2 and 3.

In Eq. (3), ‘y’ denotes a dependent variable, ‘X’ represents the independent variable, and ‘\(\boldsymbol{\varnothing }\)’ shows the coefficient of adjustment. In Eq. (4), ‘\(\theta\)’ shows the long-run coefficient.

Results and discussion

Table 1 shows the descriptive statistics of dependent and independent variables analyzed in the present study.

After reporting the descriptive summary of dependent and independent variables, the study applies augmented Dickey-Fuller (ADF) and Phillips Peron (PP) tests to examine the stationarity in the data series. To examine stationarity, ADF and PP tests are performed at the level and first difference, the results are given in Table 2.

Table 2 shows the results of the unit root test based on augmented Dickey-Fuller (ADF) and Phillips Peron (PP) tests. According to the results, the data series for carbon emissions is stationary at a level while all other independent variables are stationary at first difference. This means that all data series are stationary and our model has a mixed level of integration, i.e., I(0) and I(1). Now the cointegration test can be applied to check the long-run and short-run estimates. To select an appropriate test for cointegration, first, we need to apply the cross-sectional dependence (CD) test on the variables. In this study, three versions of the CD test are applied and results are given in Table 3.

Table 3 shows the results of the cross-sectional dependence test; here, the p values are less than 0.05 for all three tests. Therefore, the results of Breusch-Pagan LM, Pesaran-scaled LM, and CD tests are rejecting the null hypothesis. So, it is concluded that there exists cross-sectional dependence in the data series. Due to the presence of cross-sectional dependence, the Westerlund (2008) test for cointegration was applied in the study to examine the cointegration between dependent and a set of independent variables. The results of the Westerlund cointegration test are given in Table 4.

Table 4 shows the rejection of the null hypothesis of no co-integration. According to the results there exists cointegration between dependent and independent variables. However, slope heterogeneity is also an important factor, and to estimate the robust results the slope heterogeneity test a standard delta test proposed by Pesaran and Yamagata (2008) is applied and results are given in Table 5.

Table 5 shows the rejection of the null hypothesis that slope coefficients are homogeneous. Thus, the present study estimates long-run and short-run estimates based on pooled mean group (PMG) which reports robust results when the slope coefficients are heterogeneous.

Table 6 shows the long-run estimates based on pooled mean group estimation. The results show the positive coefficient for economic growth, which highlights the contribution of economic growth to carbon emissions in the selected countries. This means that the current economic growth pattern in G-20 countries contributing the environmental degradation. The findings show that a 1% increase in economic growth may cause a 0.35% increase in carbon emissions if all other factors are considered constant. The study also regressed the square of economic growth on CO2 emissions and establishes a negative relationship between the square term of economic growth and carbon emissions. According to the results, 1% increase in the square of economic growth reduces the carbon emission by about 0.05%. This negative relationship confirms the presence of EKC and highlights that after some turning point the increase in economic growth will reduce the carbon emissions in the observed group of economies and endorse the finding of Hanif (2018a), Hanif and Gago-de-Santos (2017), and Li et al. (2016).

The results also highlight the positive and statistically significant relationship between rent from mineral resources and CO2 emissions. More precisely, a 1% increase in RMR may lead to carbon emission of about 0.09%, if all other factors are considered constant. Thus, the findings show that the high consumption rate of mineral resources may help to increase the government revenue but it stimulates carbon emissions in the selected countries. The results also show that a 1% increase in rent from oil resources increases carbon emissions by about 0.07%, if all other factors are considered constant. Similarly, the results highlight that a 1% increase in rent from forest resources and rent from gas may increase the CO2 emissions by about 0.08% and 0.024% respectively in the sample countries. In short, the results indicate that the rent from natural resources is a significant contributing factor to environmental degradation in G-20 countries. The findings of this study are in line with Downey et al. (2010), Hanif and Chaudhry (2015), Luo et al. (2017), Hanif et al. (2019a), Hanif et al. (2020), Huang et al. (2020).

The empirical results show that the current pattern to improve economic growth and reliance on natural resources are both stimulating factors of carbon emissions in G-20 economies. Therefore, joint efforts to control carbon emissions are necessary at the regional level. From the empirical findings of the present study, it can be suggested that there is a need to highlight the channels which may improve economic growth and lessen the burden on natural resources in the long run. Finally, to examine the stability of the model, an error correction mechanism is developed and the results of the error correction model are given in Table 7.

Table 7 shows the results of the error correction model and shows the speed of adjustment. According to the results error term, the coefficient of \({EC}_{t-1}\) which is negative, less than 1, and statistically significant at a 1% level of significance. Here, the negative sign shows that the model is converging from short run to long run for the attainment of equilibrium. The coefficient value shows the speed of adjustment and according to the results, about 8.2% error will be corrected each year to attain the equilibrium. Hence, PMG estimates have predicted both the short-run and long-run influence of natural resources consumption on carbon emissions. A similar analysis was done by Huang et al. (2020) for developing Asian countries, and the findings of the present study are consistent with their work. Estimation analysis found a log of GDP positively related to carbon dioxide emissions, which shows increasing growth is increasing the emissions and damaging the environment in the short-run period as well. While the negative sign of GDP2 shows that the increase in economic growth reduces carbon emissions and the findings of the present study confirm the environmental Kuznets curve for both short-run and long-run periods. In the short-run period, the impact of natural resources on CO2 emissions is almost negligible. The results show that rent from mineral resources (RMR), rent from forest resources (RFR), and rent from gas resources (RGR) have an insignificant relationship with environmental degradation. However, the rent from oil resources (ROR) shows a statistically significant and positive association with carbon emissions. The short-run estimates highlight that oil extraction is playing a major role in CO2 emissions and increasing environmental issues in G-20 countries.

Conclusion and recommendations

The study spotlights that the increase in economic growth increasing environmental degradation and extensive use of natural resources also stimulating environmental challenges in G-20 countries. The findings highlight that natural resources have a huge impact on CO2 emissions, and there is a need to understand that the massive extraction of oil, gas, minerals, and forest resources not only enhancing the scarcity of such natural resources for future generations but also increasing carbon emission and depleting the natural environment. The governments need to put limits on the extraction of natural resources and the imposition of high taxes on natural resources extraction could be used as an effective tool to control the high extraction of such resources. The oil resources among the other natural resources are playing a key role to increase carbon emissions in the short-run and long-run periods. Therefore, there is a dire need to promote the use of sustainable and environmentally friendly fuels like biofuels should be encouraged to lower the reliance on oil resources. Micro-level studies should be done on issues like this so the problem can be solved in depth. Based on policy insight from research, the study suggests preventing excessive usage of resources and maximizing the clean role of renewable energy to mitigate carbon emissions and sustainable growth. Effective resource utilization and good governance should rule over the inappropriate usage of natural resources. The regulatory authorities should maintain transparency and accountability for the efficient use of natural resources since the objective of the institutions for better governance is essential. In addition, the high reliance on coal and wood-burning to meet the energy requirement at the domestic level promotes ecological deterioration. Therefore, there is a need to use alternative energy sources such as solar panels and electric heating systems to meet the energy requirements at the household level. Finally, cooperation among the economic blocks in terms of environmental protection is also necessary to improve green economic growth and preserve the natural environment at the regional as well as global level.

Data availability

Not applicable.

References

Acheampong AO (2018) Economic growth, CO2 emissions and energy consumption: what causes what and where? Energy Econ 74:677–692

Adams S, Nsiah C (2019) Reducing carbon dioxide emissions; does renewable energy matter? Sci Total Environ 693:133288

Aşici AA (2013) Economic growth and its impact on environment: a panel data analysis. Ecol Ind 24:324–333

Bekun FV, Emir F, Sarkodie SA (2019) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765

Bokpin GA, Mensah L, Asamoah ME (2015) Foreign direct investment and natural resources in Africa. J Econ Stud

Breitung J (2005) A parametric approach to the estimation of cointegration vectors in panel data. Economet Rev 24(2):151–173

Cansino JM, Román-Collado R, Molina JC (2019) Quality of institutions, technological progress, and pollution havens in Latin America. An analysis of the environmental Kuznets curve hypothesis. Sustainability 11(13):3708

Churchill SA, Inekwe J, Smyth R, Zhang X (2019) R&D intensity and carbon emissions in the G7: 1870–2014. Energy Econ 80:30–37

Costantini V, Martini C (2010) A modified environmental Kuznets curve for sustainable development assessment using panel data. Int J Global Environ Issues 10(1–2):84–122

Cui H, Zhao T, Shi H (2018) STIRPAT-based driving factor decomposition analysis of agricultural carbon emissions in Hebei, China. Pol J Environ Stud 27(4)

Downey L, Bonds E, Clark K (2010) Natural resource extraction, armed violence, and environmental degradation. Organ Environ 23(4):417–445

Farhani S, Mrizak S, Chaibi A, Rault C (2014) The environmental Kuznets curve and sustainability: a panel data analysis. Energy Policy 71:189–198

Hanif I (2017) Economics-energy-environment nexus in Latin America and the Caribbean. Energy 141:170–178

Hanif I (2018a) Energy consumption habits and human health nexus in Sub-Saharan Africa. Environ Sci Pollut Res 25(22):21701–21712

Hanif I (2018b) Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on carbon emissions in Sub-Saharan Africa. Environ Sci Pollut Res 25(15):15057–15067

Hanif I (2018c) Impact of fossil fuels energy consumption, energy policies, and urban sprawl on carbon emissions in East Asia and the Pacific: a panel investigation. Energ Strat Rev 21:16–24

Hanif I, Gago-de-Santos P (2017) The importance of population control and macroeconomic stability to reducing environmental degradation: an empirical test of the environmental Kuznets curve for developing countries. Environ Dev 23:1–9

Hanif I, Chaudhry IS (2015) Interlinks of fiscal decentralization and public investment in Pakistan. Pak J Commer Soc Sci (PJCSS) 9(3):850–864

Hanif I, Aziz B, Chaudhry IS (2019a) Carbon emissions across the spectrum of renewable and nonrenewable energy use in developing economies of Asia. Renew Energy 143:586–595

Hanif I, Raza SMF, Gago-de-Santos P, Abbas Q (2019b) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171:493–501

Hanif I, Wallace S, Gago-de-Santos P (2020) Economic growth by means of fiscal decentralization: an empirical study for federal developing countries. SAGE Open 10(4):2158244020968088

Huang Y, Raza SMF, Hanif I, Alharthi M, Abbas Q, Zain-ul-Abidin S (2020) The role of forest resources, mineral resources, and oil extraction in economic progress of developing Asian economies. Resour Policy 69:101878

Alharthi M, Hanif I (2020) Impact of blue economy factors on economic growth in the SAARC countries. Marit Bus Rev 5(3):253–269

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115(1):53–74

Jorgenson AK (2003) Consumption and environmental degradation: a cross-national analysis of the ecological footprint. Soc Probl 50(3):374–394

Lee KH, Min B (2015) Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J Clean Prod 108:534–542

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econom 108(1):1–24

Li T, Wang Y, Zhao D (2016) Environmental Kuznets curve in China: new evidence from dynamic panel analysis. Energy Policy 91:138–147

Liu D, Xiao B (2018) Can China achieve its carbon emission peaking? A scenario analysis based on STIRPAT and system dynamics model. Ecol Ind 93:647–657

Luo G, Weng JH, Zhang Q, Hao Y (2017) A reexamination of the existence of environmental Kuznets curve for CO 2 emissions: evidence from G20 countries. Nat Hazards 85(2):1023–1042

Marsiglio S, Ansuategi A, Gallastegui MC (2016) The environmental Kuznets curve and the structural change hypothesis. Environ Resource Econ 63(2):265–288

Mensah CN, Long X, Dauda L, Boamah KB, Salman M (2019) Innovation and CO 2 emissions: the complementary role of eco-patent and trademark in the OECD economies. Environ Sci Pollut Res 26(22):22878–22891

Zambrano-Monserrate MA, Silva-Zambrano CA, Davalos-Penafiel JL, Zambrano-Monserrate A, Ruano MA (2018) Testing environmental Kuznets curve hypothesis in Peru: the role of renewable electricity, petroleum and dry natural gas. Renew Sustain Energy Rev 82:4170–4178

Munasinghe M (1999) Is environmental degradation an inevitable consequence of economic growth: tunneling through the environmental Kuznets curve. Ecol Econ 29(1):89–109

Nathaniel SP, Iheonu CO (2019) Carbon dioxide abatement in Africa: the role of renewable and non-renewable energy consumption. Sci Total Environ 679:337–345

Nadkarni MV (2010) Poverty, environment, development: a many-patterned nexus. Econ Polit Wkly 1184–1190

Nazir MI, Nazir MR, Hashmi SH, Ali Z (2018) Environmental Kuznets curve hypothesis for Pakistan: empirical evidence from ARDL bound testing and causality approach. Int J Green Energy 15(14–15):947–957

Ongan S, Isik C, Ozdemir D (2020) Economic growth and environmental degradation: evidence from the US case environmental Kuznets curve hypothesis with application of decomposition. J Environ Econ Policy 1–8

Perman R, Ma Y, McGilvray J, Common M (2003). Natural resource and environmental economics. Pearson Education

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142(1):50–93

Pesaran MH, Shin Y, Smith RP (1999) Pooled group estimation of dynamic heterogeneous panels. J.Am. Stat Assoc 94:621–634

Scherr SJ (2000) A downward spiral? Research evidence on the relationship between poverty and natural resource degradation. Food Policy 25(4):479–498

Shi X, Liu H, Riti JS (2019) The role of energy mix and financial development in greenhouse gas (GHG) emissions reduction: evidence from ten leading CO 2 emitting countries. Econ Politica 36(3):695–729

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711

Westerlund J (2008) Panel cointegration tests of the Fisher effect. J Appl Economet 23(2):193–233

World Bank (2020) World development indicators 2016. World Bank Publications, cop, Washington, DC, p 2020

Yang Z, Abbas Q, Hanif I, Alharthi M, Taghizadeh-Hesary F, Aziz B, Mohsin M (2020) Short-and long-run influence of energy utilization and economic growth on carbon discharge in emerging SREB economies. Renew Energy 165:43–51

Zakarya GY, Mostefa B, Abbes SM, Seghir GM (2015) Factors affecting CO2 emissions in the BRICS countries: a panel data analysis. Procedia Econ Financ 26:114–125

Funding

Supported by Humanities Special Foundation Southwest Petroleum University (Grant Number: 2019RW010).

Author information

Authors and Affiliations

Contributions

Chen Yu-Ke: Initial draft preparation; Rehmat Ullah Awan: Review of literature, data collection, and tabulation; Babar Aziz: Methodological framework and technical advice. Ishtiaq Ahmad: Econometric results estimation, hypothesis testing; Sarah Waseem (corresponding author email: sarah.wasimfccu@gmail.edu.pk): Results interpretation and diagnostic testing.

Corresponding author

Ethics declarations

Ethics approval

This is an original work that has not been submitted anywhere else for publication.

Consent to participate

All authors have contributed to the submitted paper.

Consent for publication

The paper submitted with the mutual consent of authors for publication in Environmental Science and Pollution Research.

Competing interests

Not applicable.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yu-Ke, C., Awan, R.U., Aziz, B. et al. The relationship between energy consumption, natural resources, and carbon dioxide emission volatility: empirics from G-20 economies. Environ Sci Pollut Res 29, 25408–25416 (2022). https://doi.org/10.1007/s11356-021-17251-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17251-6