Abstract

Despite consistent investments, grants, and other concessions in the power sector, nationwide power outages still remain an issue, even in 2020, disrupting business operations, contributing to huge recurrent expenses on generators and alternative sources of electricity in homes, businesses, and institutions. In this paper, we examine the role of electricity consumption on economic growth, while controlling for labor, capital, and carbon emissions, using the autoregressive distributed lag (ARDL) and the novel dynamic ARDL (DYNARDL) simulation analysis over the periods 1981–2019. Empirical results show that electricity consumption, capital, and labor exert positive inelastic impacts, while carbon emissions exert negative inelastic significant impact on economic growth within the period under investigation. From policy standpoint, we are of the opinion that stable supply and consumption of electricity can possibly boost economic growth and engender social stability in Nigeria. Thus, there is a need to strengthen the effectiveness of power sector and its energy generating agencies by ensuring periodic replacement of worn-out equipment in terms of adequately financed and efficient labor in order to enhance the contribution of the sector on economic growth, while in terms of environmental degradation, policy makers should work towards promotion of green economy for a sustainable economic growth and environment in Nigeria.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Nigeria as an entity has faced enormous challenge of unstable and limited access to electricity for many decades, as the demand for electricity far outweighs the supply. This development has no doubt been a major hindrance to her economic progress, which has affected and stifled the performance of some of the revenue-generating agencies and institutions in all the sectors of the economy. According to Ferguson et al. (2000), the growing incidence of power supply shortages has largely been identified as the main factor accounting for the declining growth of many less developed countries (LCD). This development is clearly linked to their failure to improve generating capacity as a result of mono source of power generation (hydropower).

However, electricity is essential to modern civilization and as such, it is vital to homes and critical for the survival of businesses. The electrification figure in sub-Sahara Africa is very low and needs urgent attention (Oyedepo 2014). As at 2007, 40% of Nigerians had access to electricity, with the majority of electricity supply being provided to the urban areas but there has been little improvement over the years as the current access stood at about 45%, with 36% rural and 55% urban (Fakehinde et al. 2019). As at April 2020, there are currently 20 million households without power, and the universal access is targeted at 2030, with the major issues attributed to this being macroeconomic forces, lack of credit-worthy utilities, and absence of a strong transparent regulator United States Agency for International Development (USAID, 2020). This access is both epileptic and unreliable (Abdulkareem 2016; Babatunde et al. 2019; Nnaji 2011; Nweke et al. 2016) with incessant grid collapse. To enjoy electricity when needed, most Nigerian homes and businesses have resulted to the use of captive gasoline and diesel generators due to poor electricity supply from the grid. This, however, comes at a price to both the environment and economics of the nation. In 2017, it was reported that about 70 million generators of different sizes and capacity were imported into Nigeria based on research by a solar energy company (Ajibade 2017). The proliferation of on-site generators in Nigeria is due largely to the challenges of poor and unavailable grid electricity. With the seemingly electricity infrastructure deficit with an available generation capacity of 6,056 MW, transmission capacity of 7,500 MW, and largely dilapidated and inadequate distribution capacity for an estimated population of almost 200 million, Nigeria is grossly deficient in electricity infrastructure and unable to meet her electricity demand (Ole 2020).

Despite consistent investments by the federal government, local and international investors, grants, and other concessions in the electricity sector, nationwide power outages still remain an issue, even in 2020, disrupting business operations, contributing to huge recurrent expenses on generators and alternative sources of electricity in homes, businesses, institutions, and federal government agencies (Okorie and Sylvester 2016). Rai (2004) showed that the standard of living in a country can be measured by per-capita energy consumption, and the per-capita energy consumption is a measure of the per-capita income and a measure of a nation’s prosperity. Ogundipe and Apata (2013) documented that the economic growth in the South Asia Association for Regional Cooperation (SAARC) countries such as India, Bangladesh, and Pakistan could be largely linked to its energy consumption. Energy therefore not only is a significant contributor to the economy for the promotion of productive activities in the economy across the agriculture, manufacturing, mining, construction, transportation, and other sectors, but also serves as a key driver of socioeconomic development, spanning across productivity, education, health, and growth in income levels across different strata in nations (Nnaji et al. 2010).

Meanwhile, the information available to us shows that there are few literatures on the debate of electricity consumption and economic growth in Nigeria. However, these studies mostly suffer from two main limitations including omission of variable bias, when testing for causality within a bivariate VAR (see Yoo 2005) and over-reliance on cross-sectional data to explain country-specific issues (see Yoo 2005; Wolde-Rafael 2006). With the adoption of autoregressive distributed lag (ARDL) approach to examine the relationship between electricity consumption and economic growth in Nigeria, this study evaluates the relationship between electricity consumption and economic growth using Nigeria as a case study both in the short and in the long run.

To the best of the authors’ knowledge, this current study is among the few studies that have investigated the subject matter while incorporating the control variables most especially impacts of environmental sustainability targets for Nigeria using dynamic autoregressive distributed lag simulations (DYNARDL). In addition, to control for omitted variable bias, we incorporate capital and labor participation, thus a Cobb-Douglas production function to analyze how output elasticity measures the reaction of output to a change in labor and capital employed in the process of production, and carbon emissions to capture impact of environmental degradation. Results show strong evidence for short- and long-run relationships between the sampled variables. This indicates that a stable supply of electricity consumption has the capacity to boost economic growth and social stability in Nigeria. Findings from this study is relevant to policy makers and stakeholders in the power sector to come up with sound and workable policies that would revive the power sector and put it on the pedestal of growth, alongside labor, efficient capital, and conducive environment in oiling the wheel of the economy progress.

The rest of the paper is structured as follows: the “Literature review” section provides literature review; the “Data and methodology” section covers the data and methodology; the “Results and discussion of findings” section accounts for the results and discussion of findings and the “Concluding remarks and policy recommendations” section offers concluding remarks.

Literature review

The interest in the energy consumption growth debate was triggered by the pioneering effort of Kraft and Kraft (1978). Ever since, the electricity growth thesis in the literature has taken different twists and turns without a common conclusion. Previous research on this debate was widely conducted for countries in Latin America, the Caribbean’s, and Asia, while few concentrated on the countries in sub-Saharan Africa with less research in the case of Nigeria (Odhiambo 2009). The argument has always been the relationship between electricity consumption and economic growth. This work is centered around the fact that electricity consumption has formed higher percentage in the energy consumed in most countries especially the LDCs and has clearly redirected our focus on what our paper examines. Meanwhile, the debate has triggered four different strands of conclusions on the electricity consumption growth hypothesis as established in the literature.

The electricity-led growth hypothesis is the first strand of conclusion that electricity consumption is linked with economic growth, while the growth-driven thesis of electricity consumption forms the second strand. The third strand, however, is the feedback debate, which established that there is bidirectional causality between electricity consumption and economic growth. Finally, the neutrality debate, which is the fourth strand, argues that there is no causal link between electricity consumption and economic growth.

In the literature, studies (Shiu and Lam 2004; Narayan and Singh 2007; Bekun and Agboola 2019; Balcilar et al. 2019; Samu et al. 2019; Asongu et al. 2020; Ali et al. 2020; Saint Akadiri et al. 2020a, b) have confirmed the electricity consumption-led economic growth hypothesis. Narayan and Singh (2007) investigate the nexus between electricity consumption and economic growth for Fiji within a multivariate framework with the bounds testing approach to cointegration. The study found that electricity consumption, GDP, and labor force are only cointegrated when GDP is the endogenous variable. They also adopted Granger causality F-test and found that in the long run, causality runs from electricity consumption and labor force to GDP, implying that Fiji is an energy-dependent country. Lee (2005) re-investigates the co-movement and the causality relationship between energy consumption and GDP in 18 developing countries, using data for the period 1975 to 2001. Lee employed panel unit root, heterogeneous panel cointegration, and panel-based error correction models. The paper found a clear support of a long-run cointegration relationship after allowing for the heterogeneous country effect using a full-modified OLS. The evidence shows that long-run and short-run causalities run from energy consumption to GDP, but not vice versa. Others with similar findings include Masih and Masih (1996) for India, Asafu-Adjaye (2000) for India and Indonesia, Wolde-Rafael (2004) for Shanghai, and Ho and Siu (2007) for Hong Kong.

Moreover, studies that have validated the growth-driven electricity consumption hypothesis are well discussed in the literature. Some of them comprise the pioneer study of Kraft and Kraft (1978) that examined the relationship between electricity consumption and gross national product (GNP) for USA from 1947 to 1974 using “Sims” technique. The study uncovered a unidirectional causality running only from GNP to gross energy input (GEI) with an implication that energy conservation is a feasible policy without creating damaging effect on the economic activities. Wolde-Rafael (2006) tested the long-run and causal relationship between electricity consumption per capita and real gross domestic product (GDP) per capita for 17 African countries for the period 1971–2001. The paper adopted the newly developed cointegration test proposed by Pesaran et al. (2001) and using a modified version of the Granger causality as advanced by Toda and Yamamoto (1995). The empirical evidence shows a long-run relationship between electricity consumption per capita and real GDP per capita for only 9 countries and Granger causality for only 12 countries. For 6 countries, there was a positive unidirectional causality running from real GDP per capita to electricity consumption per capita: an opposite causality for 3 countries and bi-directional causality for the remaining 3 countries. Others with similar findings include Yu and Choi (1985) for the Philippines, and more recently, by Al-Iriani (2006) for the Gulf Cooperation Countries.

Meanwhile, some studies have also identified and established the feedback thesis, which argues that there is bidirectional causality between electricity consumption and economic growth. Masih and Masih (1996) investigate the cointegration relationship between total energy consumption and real income of six Asian economies: India, Pakistan, Malaysia, Singapore, Indonesia, and the Philippines. The study adopted a dynamic vector error-correction model and variance decomposition technique. Results reveal that while all pairwise relationships shared common univariate integrational properties, only relationships for three countries (India, Pakistan, and Indonesia) were cointegrated. For these countries, temporal causality results were mixed with unidirectional causality from energy to income for India, exactly the reverse for Indonesia, and mutual causality for Pakistan. The variance decompositions were not inconsistent with these results and provided us with an additional insight as to the relatively more dominant direction of causation in Pakistan. Simple bivariate vector-autoregressive models for the three non-cointegrated systems did not indicate any direction of causality, significantly in either direction. Odhiambo (2009) examined the causal relationship between electricity consumption and economic growth in South Africa. The paper incorporates the employment rate as an intermittent variable in the bivariate model between electricity consumption and economic growth, thereby creating a simple trivariate causality framework. The empirical results indicate an evidence of distinct bidirectional causality between electricity consumption and economic growth in South Africa. In addition, the results show that employment in South Africa Granger-causes economic growth. Asafu-Adjaye (2000) estimates the causal relationships between energy consumption and income for India, Indonesia, the Philippines, and Thailand, using cointegration and error-correction modeling techniques. The results indicate that, in the short run, unidirectional Granger causality runs from energy to income for India and Indonesia, while bidirectional Granger causality runs from energy to income for Thailand and the Philippines. In the case of Thailand and the Philippines, energy, income, and prices are mutually causal. The study results do not support the view that energy and income are neutral with respect to each other, with the exception of Indonesia and India where neutrality is observed in the short run. Fatai et al. (2004) investigated the possible impact of energy conservation policies on the New Zealand economy which is examined and compared with Australia and several Asian economies. Causality between energy consumption and GDP in New Zealand is investigated as the causal relationship between GDP and various disaggregate energy data (coal, natural gas, electricity, and oil). Based on the energy data used, it appears that energy conservation policies may not have significant impacts on real GDP growth in industrialized countries such as New Zealand and Australia compared to some Asian economies. Meanwhile, the following studies have also found similar results with different econometric approach: Glasure and Lee (1998) for South Korea, Singapore, Thailand, and the Philippines; Soytas and Sari (2003) for Argentina; and Oh and Lee (2004) for South Korea.

Interestingly, neutrality school of thought has found no relationship between electricity consumption and economic growth as established in the literature. Those studies include Akinlo (2008) who examines the causal relationship between energy consumption and economic growth for eleven countries in sub-Saharan Africa with the adoption of autoregressive distributed lag (ARDL) bounds test. The study finds that energy consumption is cointegrated with economic growth in Cameroon, Cote d’Ivoire, Gambia, Ghana, Senegal, Sudan, and Zimbabwe. Moreover, this test suggests that energy consumption has a significant positive long-run impact on economic growth in Ghana, Kenya, Senegal, and Sudan. Granger causality test based on vector error correction model (VECM) shows bi-directional relationship between energy consumption and economic growth for Gambia, Ghana, and Senegal. However, Granger causality test shows that economic growth Granger causes energy consumption in Sudan and Zimbabwe. The neutrality hypothesis is confirmed in respect of Cameroon and Cote d’Ivoire. The same result of no causality was found for Nigeria, Kenya, and Togo. Soytas and Satri (2003) evaluate the time series properties of energy consumption and GDP and reexamine the causality relationship between the two series in the top 10 emerging markets and G-7 countries. The results provide evidence of bi-directional causality in Argentina, causality running from GDP to energy consumption in Italy and Korea, and from energy consumption to GDP in Turkey, France, Germany, and Japan. Hence, energy conservation may harm economic growth in the last four countries. The study Erol and Yu (1987) also validated the neutrality debate, and Yu and Jin (1992) for the case of the USA and Murray and Nan (1996) for France, Germany, Luxemburg, Norway, India, Israel, Portugal, the UK, the USA, and Zambia.

Data and methodology

Data

To analyze the short- and long-run relationship between the GDP proxy for economic growth and electricity consumption, the study employs annual time-series data between the periods 1981–2019 for Nigeria. The data were sourced from World Bank Development Indicators (World Bank 2019) as shown in Table 1.

Empirical model

The relationship between electricity consumption and economic growth has been well debated in the growth literature. What added momentum to the debate in the recent time has been the prevalent issue of climate change, energy crises, prices of crude oil, and the ever-growing emission of carbon into the atmosphere. The ability to establish the exact relationship between electricity consumption and economic growth is of immense relevance to policy formulation, especially for countries such as Nigeria, which rely heavily on electricity as her sole source of energy. Meanwhile, the empirical support for electricity-led growth would imply that conservation policies could be disastrous for economic growth, which inherently enhances poverty, and reduces both job creation and societal welfare (Ghosh 2002; Odhiambo 2009). Further, if economic growth is related to electricity consumption, then there might be little to worry about when implementing electricity-related conservation policies (Asafu-Adjaye 2000, Narayan and Smyth 2005).

This study adopts a Cobb-Douglas production function with constant returns to scale like the work of Ogundipe and Apata (2013) where they specified thus:

In the model above, Y is the total production (output), L is the labor input, K is capital input, and A is the total factor productivity. α and β are the output elasticities of labor and capital respectively. This can further be re-specified in the following format:

The explicit form of the model stated in a log-linearized form can be presented as contained in Jelil et al. (2014) as follows:

GDPt represents gross domestic product, ELECt is the electricity consumption (kilowatt per capita), LPt is the total labor force, Kt is the capital, CO2t is for carbon emissions, and εt is the white noise term. The a priori expectation is such that β1, β2, β3, and β4 > 0.

Econometric method

This study adopts the autoregressive distributed lag bounds testing (ARDL) model developed by Pesaran and Shin (1998). The model is used because of its suitability in modeling a time series particularly in a small sample sizes, it produces both short-run and long-run estimates, and it imposes no restriction on coefficient and suitable for mixed integrated series among others (see Pesaran 1997; Laurenceson and Chai 2003; Banerjee et al. 1993; Ender and Lee 2004).

Following Pesaran and Shin (1998), the error correction version of the ARDL model is stated as follows:

Equation (2) captures the error correction in the ARDL model in which ϖ is the constant vector parameter, Λ and Π are the short-run parameters, yt captures the endogenous vector variable, xt is a vector of the other explanatory variables as outlined above, and Ω1 and Ω2 are the parameters of the long-run relationship. εt is the error term, assumed to be serially uncorrelated and homoscedastic.

As noted, while introducing the ARDL model, all the variables have to be stationary, either in level or at first difference, to check this property before proceeding to the full ARDL model. This paper engages Phillips and Perron (1988), and Elliot et al. (1996). Dickey-Fuller generalized least squares (DF-GLS) test examines the unit root property of the coefficients. This is to ensure that none of the variables is I(2).

For confirmatory analysis purposes, this study conducts the dynamic ARDL simulations. The dynamic ARDL simulations’ algorithms are crucial for examining co-movement and short- and long-run equilibrium nexus both in levels and in first differences. Meritoriously, the novel DYNARDL simulations is embedded with visualization interface to test for possible counterfactual variations in the observed variables, based on the principle of “all things being equal.” Therefore, the novel DYNARDL simulation method is an improved and crucial time series method for policy making (Sarkodie and Owusu 2020).

ARDL bounds testing procedure

The Pesaran, Shin, and Smith (1998) cointegration technique involves a 2-stage procedure in the estimation of the long-run relationship. In the first stage, the existence of cointegration among the variables (bounds testing) is tested using the standard Wald or Fisher F-test. The null hypothesis is that the coefficients of the lagged regressors in the error correction version of the ARDL model (Eq. (2)) are zero, i.e., H0 : Ω1 = Ω2 = 0. This null is tested against the alternative hypothesis of H1 : Ω1 ≠ Ω2 ≠ 0.Footnote 1 We can only proceed to the second stage of estimation once cointegration has been established among the variables. At this stage, the short-run and long run parameters are estimatedFootnote 2 using the following two equations:

Long-run equation:

This is obtained from Eq. (2) where appropriate lags have been selected for both the dependent and independent variables via information criterion after confirming the existence of long-run relationship.

The short-run dynamic error correction equation is given below:

where \( {\mathrm{ecm}}_{t-1}={y}_{t-1}-\frac{{\hat{\Omega}}_2}{{\hat{\Omega}}_1}{x}_{t-1} \) obtained from (5) above; yt and xt are as previously defined; γ1j are the short-run parameters; ϕ measures the speed of adjustment to a new equilibrium whenever there is a shock. It also provides means of validating the existence of cointegration or long-run relationship among the variables. It is usually expected to be negative (to infer convergence) and significant and less than one in absolute value for the model to be stable.

Stability checks

Using Brown et al. (1975), a stability check is carried out on the model for stability verification. The cumulative sum (CUSUM) and cumulative sum of square (CUSUMSQ) are conducted on recursive regression residual. The CUSUM test is based on the cumulative sum of recursive residuals based on the first set of n observations. A similar procedure is used to carry out the CUSUMSQ that is based on the square of recursive residuals. For our model to be stable, the plots of the CUSUM and CUSUMSQ must fall within 5% critical bounds.

Results and discussion of findings

This section discusses the empirical results comprising of the unit root tests, the bounds testing for cointegration, the long-run and short-run estimates of the model, error correction, and finally, the stability and diagnostics test results.

Table 2 presents the mean, median, maximum, minimum, standard deviation, and skewness, Kurtosis, and Jarque-Bera for the individual time series data. In relative terms, results suggest a one-to-one relationship between the series as the electricity consumption recorded the highest figure on the average as compared to other parameters. The series also indicate relative deviation from their mean value as revealed by the command of standard deviation. Meanwhile, most of the series are positively skewed and seem to have followed normal distribution based on the Jarque-Bera statistic.

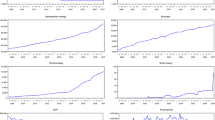

Graphical analysis

Data analysis comes as the first step, after collecting data and possibly some data cleaning, then explore the data using graphs. The graphical picture depicts the visual preview of the series under evaluation. The visual plot is an informal test that gives a glimpse of the behavior of the variables.

The graphical representations in Fig. 1 show that the variables contain trend, thus a further test to ascertain the stationarity status of the variables.

Unit root test

Preliminary analysis such as the unit-root test is necessary to establish the stationarity status of the data series to avoid spurious results during estimation. The unit root results for ADF-GLS and PP are reported in Table 3.

Since the variables are non-stationary at levels, we reported results for first difference (see Table 3) where all series are statistically significant at 0.01 and 0.05% levels. Thus, we conclude that all series are integrated at order 1(1). This automatically paves the way for the use of the ARDL bounds testing procedure to ascertain the existence of long-run and short-run relationships between the variables under observation in line with the study objective.

Pesaran, Shin, and Smith bounds test

After the order of integration has been established, we test for the long-run relationship between variables using the Pesaran, Shin, and Smith (PSS) bounds testing approach with novel Kripfganz and Schmeider (KS) critical values and approximate values as reported in Table 4. The estimated F-statistic of 8.39 and t-statistics of −5.152 is higher when compared with the upper bounds (critical values) of 4.982 and −4.038 at 0.01% significance level. The long-run cointegration relationship is further confirmed by novel KS critical values and approximate values at 0.01% significance level, hence, the rejection of null hypothesis of no level relationship. Therefore, both the PSS bounds testing with the novel KS critical values and approximate values provide an evidence of a cointegration relationships among the series. The implication is that electricity consumption, effective labor force, capital, carbon emissions, and economic growth have a stable long-run relationship.

In the short run, all the reported coefficients are statistically different from zero and complied with expected signs except electricity consumption and capital. Results show that, a 1% increase in labor, capital, and CO2 emissions increases economic growth by 0.991 and 0.257%, while a 1% increase in electricity consumption and capital decreases economic growth by 0.208 and 0.213% (at 0.01 and 0.05 significance level) in the short run (see Table 5).

Also, we present the long-run estimates in the upper part of Table 5. All the parameters are statistically significant and positive, except CO2 emissions. Electricity consumption, labor, and capital are positive and statistically significant at 0.01 and 0.05% levels respectively. The results suggest that a 1% increase in electricity consumption and capital increases economic growth by 0.635, 0.886, and 0.191% in the long run. This indicates that electricity consumption, labor, and capital have inelastic impact on the level of economic growth in Nigeria. In addition, result shows that the economic growth will decrease by 0.726% with a 1% rise in environmental degradation. This findings shows that economic activities in Nigeria mostly depends on larger consumption of non-renewable energy that is fossil fuels, thus, an energy-dependent economy. Thus, the more the non-renewable energy sources is consumed and used for production/economic activities, the more the economy grows. Over all, in the long run, the indicator of electricity consumption has a positive impact on economic growth in Nigeria. From this result, one can infer that a stable supply of electricity alongside efficient labor and adequate capital to fund the sector has the capacity to boost economic growth and thus social stability in Nigeria. However, for a sustainable economic growth and conductive environment, policy makers should move the economy from being non-renewable dependent economy to a more energy-saving and efficient technology economy for the benefits of both the immediate and future generations.

Table 5 above also contains the estimated error correction term (adjustment coefficient). The result indicates that the degree of error correction term (ECT) is not only negative (convergence) but also statistically significant with an absolute value that lies between zero and one in compliance with error correction principle. It establishes a long-run convergence among the series, which implies that if any external shock were introduced into the model, it would still converge with time. However, the coefficient of error correction term (ECT) is estimated to be 0.642 (approximately 64%). This implies that the speed of error adjustment of the variables under observation from the initial shock would be corrected and converged to the tune of about 64% in the long run per annum. As a confirmatory test, we conduct the dynamic ARDL simulations (see Table 6). The dynamic ARDL simulation results as reported in Table 6 mimic the ARDL results reported in Table 5. Thus, we are of the opinion that electricity consumption, labor, and capital plays significant roles in economic growth, while environmental degradation decreases growth of the sampled nation both in the short and in the long run respectively. These findings corroborate the study of Ghosh (2020) for India, Wolde-Rafael (2006) for 17 African countries, Odhiambo (2009) for South Africa, Akinlo (2009) and Akomolafe and Danladi (2014) for Nigeria, and Yoo and Kwak (2010) for South America.

The diagnostics tests were also carried out on the growth model (Table 7). The rejection of the null hypothesis at all significance levels confirm that this current study growth model is free of serial correlation and is homoscedastic and normally distributed. This indicates that the growth model is a well-specified model and is reliable, robust, and sound for policy decision-making. The results of the stability test also confirm that the relationship between the economic growth and electricity consumption model is a good fit and is robust, stable, and sufficient for policy making.

Concluding remarks and policy recommendations

The main objective of this study is to evaluate the existence of a long-run relationship between the GDP proxy for economic growth and electricity consumption in Nigeria with the adoption of ARDL bounds testing approach of cointegration analysis and the novel dynamic ARDL (DYNARDL) simulations analysis. The estimation is done based on Cobb-Douglas growth model for the period covering 1981–2019. The motivation for the paper emanated from the debate of the dearth in empirical studies on the growth electricity nexus in Nigeria. We established strong evidence that electricity consumption exerts significant impact for economic growth within the period under investigation. The coefficient of error correction term (ECT), which is within the error correction principle, indicates that given any initial shock in the GDP growth, the speed of adjustment to its long-run equilibrium path would be about 64% approximately per annum.

The implication of the overall results suggests that the stable supply and consumption of electricity can possibly boost economic growth and engender social stability in Nigeria. It is based on this background that we recommend that policies that could enhance electricity generation should be pursued and implemented. Going by the inelastic impact of electricity consumption on economic growth, as obtained in the analysis; we therefore call for the need to strengthen the effectiveness of energy-generating agencies by ensuring periodic replacement of worn-out equipment and necessary tools in order to drastically reduce power losses in Nigeria. Having constant electricity supply in a period of prepaid meter would increase consumption, revenue for the sector, and overall sustainable economic growth.

Lastly, the government should put in place workable and effective regulations that would help in modifying our unaggressive electricity market to a more competitive one. To achieve this, workable and effective electricity models from emerging and developed countries should adopted to regulate power sector and make more abundant its citizenry. It is paramount to emphasize that competitive power sector would ensure adequate, efficient, affordable, and reliable electricity for Nigerians, having in mind that privatization of the power sector is just a change of ownership and does not necessarily create or guarantee neither efficiency nor competition. We are of the opinion that, specifically, efficient manpower, adequate financing, and lessons from jurisdictional experiences that have adopted sound electricity models, via effective regulation in the power sector, would stimulate the gains and enhance competitiveness of the sector. Failure recorded in the power sector privatization had make it difficult to justify the improvement in power sector due to the poor quality of service.

The negative impact of carbon emissions calls for a serious attention by the government and policy makers in charge of environmental sustainability targets for the sampled country. It appears that increases in CO2 emissions as a byproduct of the amount of non-renewable energy consumed and utilized for productive and economic activities have a detrimental impact on the level of growth. The more the metric tons of CO2 emissions consumed, the less the level of economic growth. This indicates that much of the resources would have to be sacrificed in cleaning the environment for habitual purposes both in the short and in the long run. For a sustainable economic growth and in other to promote a conducive environment, government, policy makers, and private firms and individuals have a role to play. These economic agents should work together in order to move the economy forward from being a non-renewable dependent economy to a more energy-saving for both consumption, production, and thus overall economic growth of the nation. Replacement of non-renewable energy sources (fossil fuels) for automobiles, households’ appliances, and industrial machines with energy-saving and efficient technologies is advocated for the benefits of both the immediate and future generations. Generally, policy makers should work towards promotion of green economy for a sustainable economic growth and environment.

Availability of data and materials

We sourced all data from World Bank Development Database.

Notes

Pesaran, Shin, and Smith (1998) provide critical values to test the hypothesis, with and without time trend. The critical values are grouped into “upper” and “lower” bounds, where the upper bound assumes that all the variables are jointly first-difference stationary, i.e., I(1) and the lower bound assumes that all the variables are level stationary or I(0). To reject the null hypothesis, the calculated F-statistic must be above the upper bound critical value. If the calculated F-statistic is found to be below the lower bound, a decision to fail to reject the null hypothesis is required for the model. As a final point, if the calculated F-statistic lies in between the upper and the lower bound, the test result is inconclusive. At this stage, knowledge of the order of integration (or time series properties of the variables) is required to proceed.

The lag length and lag criterion are chosen; the criterion could be any of Schwartz, Hannan Quinn, or the Akaike. Stability and diagnostic checks are carried out for heteroscedasticity, serial correlation, functional form misspecification, and normality of the data.

References

Akinlo AE (2009) Electricity consumption and economic growth in Nigeria: evidence from cointegration and co-feature analysis. J Policy Model 31(5):681–693

Akomolafe AK, Danladi J (2014) Electricity consumption and economic growth in Nigeria: A multivariate investigation. Int J Econ Finance Manag 4:177–182

Asongu SA, Agboola MO, Alola AA, Bekun FV (2020) The criticality of growth, urbanization, electricity and fossil fuel consumption to environment sustainability in Africa. Sci Total Environ 712:136376

Ali HS, Nathaniel SP, Uzuner G, Bekun FV, Sarkodie SA (2020) Trivariate modelling of the nexus between electricity consumption, urbanization and economic growth in Nigeria: fresh insights from Maki Cointegration and causality tests. Heliyon 6(2)

Abdulkareem A (2016) Evaluation and mitigation of technical losses on power lines: a case study of Nigeria 330-kv network (Doctoral dissertation). Covenant University, Nigeria

Ajibade I (2017) Can a future city enhance urban resilience and sustainability? A political ecology analysis of Eko Atlantic city, Nigeria. International Journal of Disaster Risk Reduction 26:85–92

Akinlo AE (2008) Energy consumption and economic growth: evidence from 11 African countries: Energy Econ 30, 2391–2400

Al-Iriani MA (2006) Energy–GDP relationship revisited: an example from GCC countries using panel causality. Energy Policy 34(17):3342–3350

Asafu-Adjaye J (2000) The relationship between energy consumption, energy prices and economic growth: time series evidence from Asian developing countries. Energy Econ 22(6):615–625

Balcilar M, Bekun FV, Uzuner G (2019) Revisiting the economic growth and electricity consumption nexus in Pakistan. Environ Sci Pollut Res 26(12):12158–12170

Bekun FV, Agboola MO (2019) Electricity consumption and economic growth nexus: evidence from Maki cointegration. Eng Econ 30(1):14–23

Babatunde OM, Munda JL, Hamam Y (2019) A comprehensive state-of-the-art survey on power generation expansion planning with intermittent renewable energy source and energy storage. Int J Energy Res 43(12):6078–6107

Banerjee A, Dolado Lobregad JJ, Mestre Zamarreño R (1993) On some simple tests for cointegration: the cost of simplicity Banco de España, Servicio de Estudios

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. Journal of the Royal Statistical Society. Series B (Methodological) 37:149–192

Elliot BE, Rothenberg TJ, Stock JH (1996) Efficient tests of the unit root hypothesis. Econometrica 64(8):13–36

Enders W, Lee J (2004) Testing for a unit root with a nonlinear Fourier function. In Econometric Society 2004 Far Eastern Meetings (Vol. 457)

Erol U, Yu ESH (1987) Causal relationship between energy and income for industrialised countries. J Energy Dev 9:75–89

Fakehinde OB, Fayomi OS, Efemwenkieki UK, Babaremu KO, Kolawole DO, Oyedepo SO (2019) Viability of hydroelectricity in Nigeria and the future prospect. Energy Procedia 157:871–878

Fatai K, Oxley L, Scrimgeour FG (2004) Modelling the causal relationship between energy consumption and GDP in New Zealand, Australia, India, Indonesia, the Philippines and Thailand. Math Comput Simul 64(3–4):431–445

Ferguson R, Wilkinson W, Hill R (2000) Electricity use and economic development. Energy Policy 28(13):923–934

Ghosh S (2002) Electricity consumption and economic growth in India. Energy Policy 30(2):125–129

Glasure YU, Lee AR (1998) Cointegration, error-correction, and the relationship between GDP and energy: the case of South Korea and Singapore. Resource and Energy Econ 20(1):17–25

Ho CY, Siu KW (2007) A dynamic equilibrium of electricity consumption and GDP in Hong Kong: an empirical investigation. Energy Policy 35(4):2507–2513

Jelil AA, Olotu AE, Omojola SO (2014) Optimizing the effectiveness of financial reporting through human resources accounting. Int J Account Res 42(1836):1–13

Kraft J, Kraft A (1978) On the relationship between energy and GNP. The Journal of Energy and Development:401–403

Laurenceson J, Chai JC (2003) Financial reform and economic development in China Edward Elgar Publishing

Lee CC (2005) Energy consumption and GDP in developing countries: a cointegrated panel analysis. Energy Econ 27(3):415–427

Masih AM, Masih R (1996) Energy consumption, real income and temporal causality: results from a multi-country study based on cointegration and error-correction modelling techniques. Energy Econ 18(3):165–183

Murray DA, Nan GD (1996) A definition of the gross domestic product–electrification interrelationship. Journal Energy Development 19:275–283

Narayan PK, Singh B (2007) The electricity consumption and GDP nexus for the Fiji Islands. Energy Econ 29(6):1141–1150

Narayan PK, Smyth R (2005) Electricity consumption, employment and real income in Australia evidence from multivariate Granger causality tests. Energy Policy 33(9):1109–1116

Nnaji BART (2011) Power sector outlook in Nigeria: government renewed priorities. presentation at Securities and Exchange Commission, Abuja, June

Nnaji CE, Uzoma CC, Chukwu JO (2010) The role of renewable energy resources in poverty alleviation and sustainable development in Nigeria. Cont J Soc Sci 3(31):31–37

Nweke JN, Ekwue AO, Ejiogu EC (2016) Optimal location of distributed generation on the Nigerian power system. Niger J Technol 35(2):398–403

Odhiambo NM (2009) Finance-growth-poverty nexus in South Africa: a dynamic causality linkage. J Socio-Econ 38(2):320–325

Ogundipe AA, Apata A (2013) Electricity consumption and economic growth in Nigeria. J Bus Manag Appl Econ 11(4)

Oh W, Lee K (2004) Energy consumption and economic growth in Korea: testing the causality relation. J Policy Model 26(8–9):973–981

Okorie D, Sylvester MA (2016) Electricity consumption and economic growth: the Nigerian case. Int J Curr Res 8:12

Ole NC (2020) The Nigerian electricity regulatory framework: hotspots and challenges for off-grid renewable electricity development. J Energy & Natural Resources Law 1-24

Oyedepo SO (2014) Towards achieving energy for sustainable development in Nigeria. Renew Sustain Energy Rev 34:255–272

Odhiambo NM (2009) Electricity consumption and economic growth in South Africa: a trivariate causality test. Energy Econ 31(5):635–640

Pesaran MH (1997) The role of economic theory in modelling the long run. Econ J 107(440):178–191

Pesaran MH, Shin Y (1998) An autoregressive distributed-lag modelling approach to cointegration analysis. Econom Soc Monogr 31:371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Rai GD (2004) Non-conventional energy resources. Khpu Khanna, India 369:331–337

Samu R, Bekun FV, Fahrioglu M (2019) Electricity consumption and economic growth nexus in Zimbabwe revisited: fresh evidence from Maki cointegration. Int J Green Energy 16(7):540–550

Saint Akadiri S, Alola AA, Olasehinde-Williams G, Etokakpan MU (2020) The role of electricity consumption, globalization and economic growth in carbon dioxide emissions and its implications for environmental sustainability targets. Sci Total Environ 708:134653

Saint Akadiri S, Alola AA, Bekun FV, Etokakpan MU (2020) Does electricity consumption and globalization increase pollutant emissions? Implications for environmental sustainability target for China. Environ Sci Pollut Res 27(20):25450–25460

Shiu A, Lam PL (2004) Electricity consumption and economic growth in China. Energy Policy 32(1):47–54

Sarkodie SA, Owusu PA (2020) How to apply the novel dynamic ARDL simulations (dynardl) and Kernel-based regularized least squares (krls). MethodsX 7:101160

Soytas U, Sari R (2003) Energy consumption and GDP: causality relationship in G-7 countries and emerging markets. Energy Econ 25(1):33–37

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1-2):225–250

Wolde-Rafael Y (2004) Disaggregated industrial energy consumption and GDP: the case of Shanghai, 1952–1999. Energy Econ 26(1):69–75

Wolde-Rafael Y (2006) Electricity consumption and economic growth: a time series experience for 17 African countries. Energy Policy 34(10):1106–1114

World Bank (2019) Global Financial development report 2019/2020: Bank regulation and supervision a decade after the global financial crisis. The World Bank

Yoo SH (2005) Electricity consumption and economic growth: evidence from Korea. Energy policy 33(12):1627–1632

Yoo SH, Kwak SY (2010) Electricity consumption and economic growth in seven South American countries. Energy Policy 38(1):181–188

Yu ES, Choi JY (1985) The causal relationship between energy and GNP: an international comparison. J Energ Dev 249–272

Yu ESH, Jin JC (1992) Cointegration tests of energy consumption, income, and employment. Resour Energy 14:259–266

Author information

Authors and Affiliations

Contributions

Martins O. Apinran is responsible for the study development.

Nurudden Usman sourced for data, methodology, and estimations.

Seyi Saint Akadiri is responsible for the empirical discussion.

Chinwendu Ifunanya, Onuzo is responsible for manuscript development and proofreading.

Corresponding author

Ethics declarations

Ethical approval

The authors mentioned in the manuscript have agreed for authorship, read and approved the manuscript, and given consent for submission and subsequent publication of the manuscript.

Consent to participate

Not applicable

Consent to publish

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Apinran, M.O., Usman, N., Akadiri, S.S. et al. The role of electricity consumption, capital, labor force, carbon emissions on economic growth: implication for environmental sustainability targets in Nigeria. Environ Sci Pollut Res 29, 15955–15965 (2022). https://doi.org/10.1007/s11356-021-16584-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16584-6