Abstract

Over the past four decades, the Egyptian economy has suffered from both income inequality and environmental degradation. This dual problem raises the question about the nature of the relationship between inequality and the environment in a developing country like Egypt. In this regard, the study aims to examine the impact of income inequality on carbon emissions during the period 1975–2017. The analysis considers the ability of the political economy approach compared to the Keynesian trade-off approach to explain the inequality-environment relationship in Egypt. To do this, the novel dynamic autoregressive distributed lags approach is employed to capture the short-run and long-run relationships and to overcome the complications associated with the structure of the widely used autoregressive distributive lags model. The findings show that the relationship between inequality and CO2 emissions is not a trade-off. Rather, inequality leads to environmental deterioration in the long run, but there is no significant effect in the short run. In the long run, a 1% rise in the Gini coefficient increases CO2 emissions by 2.28%. These results support the political economy approach in explaining the inequality-environment nexus. Hence, the economic development policies adopted in Egypt during the past four decades have led to a negative impact on the environment. The study advises economic policy makers in Egypt to adopt income redistribution policies to reduce the severity of income inequality. Improving income distribution has a positive effect on the environment in Egypt.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Debates on the relationship between income inequality and environmental degradation have increased in recent years, especially in light of the increasing trends in both carbon dioxide emissions and income inequality in many countries. According to the United Nation Development Program (UNDP, 2019), income inequality has increased in both developed and developing countries during the last four decades. The unprecedented economic growth and widespread gains in well-being seen over the previous several decades have in many countries failed to bridge the vast income gaps that exist both within and between countries. Income and wealth are increasingly concentrated at the top in many countries. With data from 1990 to 2015, the share of global income flowing to the richest 1% of the population increased in 46 of 57 countries, and in all 92 countries providing data, the bottom 40% earned less than 25% of the total income (United Nations 2020). The obvious failure to distribute fruits of economic growth equally among all members of society does not affect only economic, political, and social aspects, but also extends to affect environmental indicators. The situation is not better in environmental indicators globally. Global carbon emissions have increased with an annual average of 2.28% during the period 1990–2018 (World Bank 2021).

Increasing trends of both income inequality and environmental degradation globally call for the need to analyze the relationship between them. As noted in many recent studies concerning environmental degradation (Cheng et al. 2021; Hundie 2021; Kusumawardani and Dewi 2020; Zhao et al. 2021; Zhou and Hu 2021), it has become popular to consider income inequality in the estimation models to capture causes of environmental degradation. Adding income inequality is also observed as a major variable in recent studies when testing the hypothesis of the environmental Kuznets curve (Chen et al. 2020; Uddin et al. 2020). This interest may be due to the potential effect of income inequality on the individual’s ability to choose between consuming harmful or environmentally quality goods.

Despite a large number of recent studies examining the relationship between environmental degradation and income inequality based on different panel data techniques (e.g., Baloch et al. 2020; Chen et al., 2020; Liu et al. 2019; Uddin et al. 2020), the studies related to analyzing the effect of inequality on environmental degradation on individual countries are not as numerous as required. Although the results of panel data studies are important in understanding the relationship between these two variables, they failed in reaching a specific global view on the nature of the effect of income inequality on environmental degradation (Hailemariam et al. 2020). The reason for this failure is the great discrepancy in the different panel data results about whether the effect of inequality on environmental degradation is negative or positive. This contradiction in panel data results makes it appropriate in this paper to study the environmental effects of income inequality using the new methods available in the time series econometrics, instead of analyzing a large scale of countries using panel data techniques, so that the results and policy implications drawn from the study will be more specific and clearer. Although environmental degradation and income inequality are considered to be globally prevalent features, the current study focuses on the impact of income inequality produced by economic development policies over more than four decades on environmental degradation in Egypt as a specific country. To our knowledge, no previous study was conducted dedicated to the Egyptian economy on the impact of inequality on environmental deterioration.

In this context, there are two main approaches to study the environmental effects of income inequality. As shown in Fig. 1, the first is called the political economy approach (Boyce 1994, 2007; Magnani 2000; Torras and Boyce 1998), which considers that income inequality deteriorates environmental indicators, so more inequality will be reflected in more environmental degradation. Accordingly, income inequality leads to the existence of corruption that passes and accommodates foreign and local investments in many projects that are harmful to the environment. High inequality supports the economic power of this class that opposes any policies to improve environment indicators; this is because inequality reduces the ability for collective action to reduce environmental degradation. This wealthy class with political influence will not allow laws that limit environmental pollution. Therefore, environmental considerations will not be taken into account in light of the prevalence of an unfair distribution of income and wealth.

As for the second approach, it is based on the interpretation of determining the environmental effects of inequality on the Keynesian approach (Heerink et al. 2001; Ravallion et al. 2000), which is concerned with the critical role that aggregate demand exerts on economic activity. This approach believes that inequality in income distribution leads to a transfer of income from the poor to the rich, and thus the demand for environmentally friendly goods and services will increase by the rich, and thus more inequality leads to an improvement in environmental indicators. In explaining this trade-off between inequality and the environment, this approach relies on the high level of the marginal propensity to emit among the poor. If the degree of inequality in income distribution decreases and some income is transferred from the rich to the poor, then an increase in the total consumption of the poor will occur, and this increase will be directed to the consumption of more cheap goods that do not take into account environmental considerations, which puts pressure on resources and ultimately leads to an increase in carbon dioxide emissions. Hence, inequality supports the environment according to this approach. Consequently, this study aims to determine which of these two approaches is more capable of explaining the environmental impacts of income inequality in Egypt during the period 1975–2017.

The Egyptian economy is a suitable case to study the environmental impacts of income inequality for many reasons. First, Egypt is a developing economy seeking to achieve economic development which affects both environment and the structure of income distribution, and if there is a trade-off between these two variables, then the Egyptian economy will face a difficult choice in its development path. Available statistics on the pattern of income distribution in Egypt indicate that the Gini coefficient of the income distribution has increased during the previous decades from an average of 0.37 in the 1970s to 0.39 during the 1980s, then to 0.41 during the 1990s, and finally increased to 0.42 during the period 2000–2017 (Solt 2019). This means that the pattern of economic development that Egypt followed during the previous decades was biased towards the rich. Therefore, this noticeable increase in income inequality calls for studying its impact on environmental deterioration in Egypt, especially since many recent studies have confirmed a significant effect of inequality on the environment (Cheng et al. 2021; Kusumawardani and Dewi 2020; Zhao et al. 2021).

This study seeks to achieve several objectives. First, it aims to identify the appropriate approach to understand the impact of income inequality on environmental degradation in Egypt as a developing country. Second, the study covers an important period in the path of economic development in Egypt that has begun in 1975, which is the year after the Egyptian government announced a fundamental structural change in its economic orientations from an economy depending on government intervention to an economy facilitated by supply and demand mechanisms and integrated with the world economy (Farzanegan et al. 2020). This new economic orientation has resulted in a change in the pattern of income distribution during the four decades following this year. In this context, it is necessary to determine the effect of the new pattern of income distribution on environmental degradation in Egypt during this relatively long period. Third, in Egypt, not only a deterioration in income distribution has occurred, but an environmental deterioration has also occurred during the past four decades. Carbon dioxide emissions have increased at an annual average of 2.13% during the period 1975–2017 (British Petroleum 2020). Many of the explanations tried to find the main drivers of carbon dioxide emissions in many developed and developing countries, but there is a severe dearth of empirical works on the environmental effects of inequality that have been conducted for the Egyptian economy.

The study employs the dynamic autoregressive distributed lags (DARDL) recently developed by Jordan and Philips (2018) to capture both the short and long-run relationships between income inequality and environmental degradation in Egypt and avoid the difficulty in explaining the results of the widely known ARDL of Pesaran et al. (2001) which suffers from a complex structure in the estimation equation that usually includes lags, differences, and difference lags in both short and long terms.

The remainder of the study is structured as follows. The second section reviews the literature related to the impact of inequality on the environment, while the third section describes the data and exposes the methodology of the dynamic ARDL model versus the ARDL model, whereas the fourth section discusses the estimation results. Section 5 concludes.

Literature review

Over the past decades, academic attention began to study the determinants of environmental degradation. Empirical works are devoted, in the early stage of research, to estimate the effects of economic growth on the environment, and many studies conducted on developed and developing countries provided evidence on the existence of the inverted U-curve hypothesis in describing the relationship between economic growth and environmental degradation (Grossman and Krueger 1995). Indeed, the Environmental Kuznets Curve (EKC) implies a nonlinear relationship between the two variables in which the environment begins to deteriorate in the early stages of economic growth and then improves after reaching a specific real income threshold.

Despite the importance to investigate the effects of income growth to understand environmental degradation, researchers realized the necessity to monitor the impact of the structure of income distribution by considering the environmental effect of income inequality indicators. In this respect, several approaches have been used to determine the effect of income inequality on environmental degradation. One of them is to capture its effects indirectly by estimating the effects that inequality will have on factors that positively or negatively affect environmental degradation. Uzar (2020) presented his analysis of the impact of inequality on one of the main factors that reduce environmental deterioration, renewable energy consumption, in 43 developed and developing countries during the period 2000–2015. He concluded that reducing income inequality will increase the consumption of renewable energy. This result can give us evidence that inequality harms the environment because of its negative effect on renewable energy consumption.

Researchers tried to estimate the environmental impacts of income inequality directly by adding one of its indicators into the estimation model. As usual, there are many contradictory results about this effect. Some believe that inequality improves the environment, others believe that inequality deepens environmental degradation. In this context, one can distinguish between two main trends that explain the impact of income inequality on the environment. The first trend is called the Keynesian approach (Ravallion et al. 2000), and the second is called the political economy approach (Boyce 1994, 2007; Torras and Boyce 1998). According to the Keynesian approach, more inequality enhances the environment. Differences in marginal propensity to consume between poor and rich lead the rich to consume more in friendly environmental goods and services if their incomes increase at the expense of the poor, so inequality improves the environment. On the other hand, if redistribution policies transfer incomes from the rich to the poor to reduce income inequality, the poor will increase their demand by consuming more unfriendly environmental goods and services and thus inducing environmental degradation. This trade-off relationship between income inequality and the environment has been supported by many empirical studies in developed and developing countries. Hailemariam et al. (2020) supported this hypothesis by estimating the effects of income inequality on carbon dioxide emissions in OECD countries using the common correlated effects mean group CCEMG to consider the problem of cross-section dependency; they found that an increase in income inequality measured by the Gini coefficient reduced the CO2 emissions. Other methodologies are employed to support the Keynesian or trade-off hypothesis, for example, Hübler (2017) employed the quantile regression technique instead of the mean regression techniques to estimate the effects of income inequality on different quantiles of carbon emissions. He found that increasing inequality could reduce CO2 emissions.

The second main trend in studying the effects of income inequality on the environment is what is called the political economy approach. According to Boyce (2007), high wealth inequalities harm the environment. This view explains the effect of inequality on the environment through the political dimension of inequality which results in the concentration of wealth. More income inequality creates a small class that can deepen its political positions based on its economic power and becomes effective in the decision-making process. Therefore, the concerns of this group will not concern with projects that support the environment as much as it will focus on influencing investment towards environmentally unfriendly investments. According to Boyce (2007), if the parties benefiting from environmental pollution have the economic power backed by political influence, then the parties affected by the negative environmental impacts will not be able to bring about legislative changes that protect the environment. Then, the effect of inequality harms the environment as long as this wealthy class exists and influences investment decisions. So, as noted in recent research, more equality in income distribution could reduce CO2 emissions (Zhang and Zhao 2014). The political economy explanation of inequality-emissions nexus has been supported also by Knight et al. (2017); they found that increasing the wealth share of the top 10% had a positive effect on the per capita CO2 emissions. According to this study, the concentration of wealth leads to political influence and economic power preventing any positive actions to protect the environment. The same results are driven by Uzar and Eyuboglu (2019) through employing the ARDL methodology to investigate the environmental effects of income inequality in Turkey during 1984–2014. Their results show that inequality harms the environment which makes it one of the main factors affecting the environment policy design that aims to reduce emissions.

Based on the previous analysis, the current study contributes to the recent debate on the impact of inequality on environmental degradation by studying the relationship between these two variables in the Egyptian economy as one of the developing economies. Conducting this study, which covers more than four decades, is important due to the lack of similar studies on the impact of inequality on environmental degradation in Egypt, and this contributes to bridging part of the empirical research gap and contributes to addressing the appropriate approach in explaining the impact of inequality on environmental degradation in the short and long terms using the DARDL methodology developed by Jordan and Philips (2018).

Data and methodology

This part starts by presenting the data used in the study and its sources, with an analysis of the most important statistical characteristics, then it moves to define the model specification and presents the variables used in the study and the reasons for choosing these variables. The final section in this part explains the DARDL model versus the ADRL model.

Data

The present study examines the effect of income inequality on environmental degradation using carbon dioxide emissions (CO2) as a proxy for the state of the environment in Egypt during the period (1975–2017). Despite the availability of data for many independent variables in this study after 2017, the time range of the study stopped in 2017 due to the absence of published data on both CO2 emissions and Gini coefficient after that year.

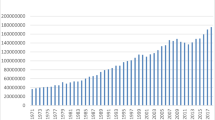

The independent variables include the Gini index (gini) to measure income inequality as used by many studies, real gross domestic product per capita (gdppc) to measure economic growth, people living in urban areas as a share of total population (urb) to capture the urbanization effect, the sum of exports and imports of goods and services measured as a share of gross domestic product to express trade openness, and primary energy consumption per capita (gigajoule per capita) to track energy consumption effect on CO2. All variables will be used in logarithms to overcome the heteroscedasticity problem (Khan et al. 2019a). Tables 1 and 2, and Figure 2 describe the variables used in the study and trace the time path evolution for the series during the period (1975–2017).

There are many statistical properties of the data presented in Table 2. Perhaps, the most noticeable is the coefficient of variance, which measures the ratio of the standard deviation to the mean. Real GDP per capita has achieved the highest percentage of variation compared to the rest of the variables, reaching (32.5%), which means that there is a large variation or dispersion in incomes among individuals, and this is supported by the rise in the mean of Gini coefficient (0.4). On the other hand, the dependent variable in this study, CO2, also showed a great variation that reached 24.8% during the study period. This variation in carbon dioxide emissions and the rest of the variables may justify the need to study the relationship between these variables in the short run and long run.

Table 3 indicates that there is a strong correlation between all the independent variables and the dependent variable except for trade openness, where these coefficients are more than 90% in all variables, and more than 74% for urbanization. So, it is necessary to place these independent variables in the estimation model of the study. It is noted from Figure 2 that there is an upward trend in carbon dioxide emissions, economic growth, and energy consumption, while the openness index is characterized by volatility and the urbanization index took a downward trend with a relative fluctuation in Egypt during the period from 1975 until 2017.

Model specification: dynamic ARDL versus ARDL

The main objective of the study is to find out the effect of income inequality on the environmental pollution in Egypt proxied by CO2 emission, and then the Gini coefficient represents the main independent variable in the study. To avoid model specification bias, the study adds control variables depending on the results of many studies in the relevant literature concerning CO2 drivers. Several studies have used GDP per capita to capture the effect of economic growth on carbon dioxide emissions. Several studies have demonstrated the significant effect of economic growth on carbon dioxide emissions (e.g., Hdom and Fuinhas 2020; Radmehr et al. 2021; Rahman et al. 2021), and therefore it would be inappropriate to ignore this variable when formulating the estimated model. Its effect is usually studied within the environmental Kuznets curve hypothesis, which indicates that economic growth deteriorates the environment in the early stages of development and then turns into enhancing the environment in the advanced levels of economic development.

The study also includes urbanization proxied by the percentage of the population living in urban areas as a control variable. Several new studies like Hashmi et al. (2021) and Yao et al. (2021) have begun to be concerned with the impact of urbanization on the environment as one of the main sources affecting carbon dioxide emissions. It is not appropriate to ignore urbanization in the estimable model. Ignoring urbanization leads to miss of important information about the impact of one of the structural change variables associated with the process of economic development. Increasing population moving from rural to urban to meet the requirements of industrial expansion accompanying economic development leads to an increase in energy consumption (Hashmi et al. 2021) which affects carbon emissions. This concern of the environmental effect of urbanization in the empirical literature prompted us to include it as an independent variable in the study, especially since many of the results captured a significant effect of urbanization on carbon emissions (Ali et al. 2019). On the other hand, urbanization is an important indicator to know the development that is taking place at the level of structural change, especially in a developing country seeking to achieve economic development like Egypt. Despite the concentration of the population in Egypt in the Nile Valley, the urbanization rate increased at an annual average of 2.17% during the period 1975–2017 (World Bank 2021). This growth in urbanization rates in Egypt necessitates studying its impact on the environment.

As the Egyptian economy applied many economic policies during the study period (1975–2017), which are consistent with the nature of economic policy programs of both the International Monetary Fund and the World Bank, and which were aimed largely at liberalizing foreign trade, it was appropriate to study the impact of these policies on carbon dioxide emissions by adding an index of trade openness, which measures the ratio of total exports and imports to GDP, to analyze the environmental effect of trade openness in Egypt. Tracking the impact of trade openness on the environment is a common practice in much empirical research such as Leal and Marques (2020).

Previous and current studies confirmed the significant effect of energy consumption on carbon emissions (e.g., Ang 2007; Salari et al. 2021). They used data for both renewable and nonrenewable energy consumption, but due to the lack of data covering the period (1975–2017), this study uses only the primary energy consumption data in the empirical model, and we could not include the consumption of renewable energy.

Accordingly, the econometric model can be formulated in a logarithmic form as follows:

in which β1, β2, β3, β4, and β5 account for the elasticity of carbon dioxide emissions lCO2t in response to a 1% change in income inequality (lgini), GDP per capita (lgdppc),urbanization (lurb), trade openness (ltrade), and energy consumption per capita (lecpc) respectively. β0 and et denote constant and the error term respectively, t refers to the year, and l means logarithm. All variables are defined in Table 1.

The main feature of the ARDL methodology according to Pesaran et al. (2001) is the possibility of testing cointegration among time series that differ in the degree of integration so that it does not exceed I(1) and provided that the dependent variable is integrated after taking the first difference I(1). Thus, as long as there is no time series integrated in the second-order I(2), it is possible to test the relationship between the variables not only in the long run but rather to monitor the behavior of these variables in the short run and to capture the adjustment process by estimating the error correction term.

The ARDL model can be formulated as follows:

where ∆ refers to the first difference, p and qi denote the lag length determined by Akaike information criterion (AIC), and ∈t represents the error term. The long-run relationships will be captured by b, whereas the short-run relationships will be explored by a. Long-run equilibrium relationship among variables is tested using F-statistic based on the null hypothesis of no cointegration H0 : a1 = a2 = a3 = a4 = a5 = a6 = 0 and against the alternative hypothesis of the existence of cointegration of H1 : a1 ≠ a2 ≠ a3 ≠ a4 ≠ a5 ≠ a6 ≠ 0. According to Pesaran et al. (2001), if the value of the F-statistic is greater than the upper bound of the critical values, then there is a long-run equilibrium relationship among the variables, and if the calculated value of the F-statistic is less than the lower bound then there is a long-run equilibrium relationship among the variables. This study depends on the critical bounds values provided by Kripfganz and Schneider (2019).

The error correction model can be estimated according to Eq. (3) whereas ECTt − 1 represents a one lagged error correction term and δ is the adjustment coefficient that must be statistically significant and negative to guarantee the convergence towards the equilibrium path in the long run.

Despite the simple implementation and the wide use of ARDL models in studying the relationship between variables in the short and long runs, there are many complications in understanding and interpreting the results of these models as they usually contain multiple lags or differences lags. The complex structure of ARDL models leads to difficulty in quantifying the short and long-run effects of the independent variables on the dependent variable which may lead to a lack of clarity for the decision-maker to apply the appropriate economic policy. In addition to the importance of knowing the extent of a relationship between the variables, as well as the direction of this relationship, the policy maker also needs a clear answer to the following question: What is the effect of an increase or decrease in one of the independent variables in the ARDL model on the response variable while the other variables remain constant? To overcome these difficulties, Jordan and Philips (2018) presented a Dynamic Autoregressive Distributed Lags model using simulation to predict the effect of a positive or negative change in one of the regressors on the dependent variable while keeping the rest of the variables constant (Khan et al. 2019b).

According to Danish and Ulucak (2020) and Jordan and Philips (2018) the error correction term estimated by dynamic ARDL can be calculated according to Eq. (4):

By generating 5000 simulations, the dynamic ARDL not only can estimate coefficients in the short and long runs but also predict, using graphs, the response of carbon dioxide emissions to positive and negative shocks in every independent variable while other regressors are constant (Khan et al. 2020).

Results and discussion

This part presents the results of the empirical study. It begins by testing the stationarity of time series using the Clemente–Montañés–Reyes unit root test, which takes into account structural breaks. This is appropriate for the current study as it covers a relatively long period from 1975 to 2017, whereas the Egyptian economy has implemented many structural policies that may constitute potential sources of structural breaks that must be taken into account when conducting stationarity tests. The second subsection presents results of the Bounds cointegration test using F-statistic and T-statistic values compared with critical values of Kripfganz and Schneider (2019), while the third subsection presents the results of applying the DARDL model and also shows the results of the ARDL model as a robustness check.

Unit root tests

During the study period 1975–2017, fundamental changes have been occurred in macroeconomic policies based on different IMF programs implemented in the Egyptian economy. These programs included many structural adjustment policies like privatization and exchange rate liberalization. So, it is necessary to test the stationarity of time series considering the presence of structural breaks (Perron 1989).

The study applies Clemente–Montañés–Reyes unit root test with two endogenous structural breaks (Clemente et al. 1998) to capture the sudden changes in means of the series called the additive outliers model (AO), along with exploring the gradual changes called innovative outliers (IO). According to the results of the Clemente–Montañés–Reyes unit root test listed in Table 4, all series are integrated in order one I(1), meaning that the dynamic ARDL cointegration test could be performed.

Bounds cointegration test

According to the results of unit root tests tabulated in Table 4, the bounds test for cointegration is performed to explore the eventual existence of long-run relationships among variables. Table 5 includes F-statistic and T-statistic values compared with critical values of Kripfganz and Schneider (2019) and approximate p values. The results indicate that the null hypothesis of no cointegration can be rejected as both F and T calculated values are greater than the critical values of the upper bounds I(1) at 10% and 5% levels of significance respectively. This result confirms the existence of a long-run equilibrium relationship between CO2, income inequality, economic growth, urbanization, trade openness, and primary energy consumption in Egypt during the period (1975–2017).

Estimation results and discussion

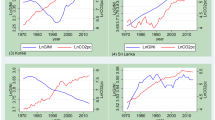

Table 6 displays estimation results of both the dynamic simulated ARDL model and the ARDL model used as a robustness check model, whereas Figures 3–7 depict the effects of 1% decrease and 1% increase in predicted income inequality, economic growth, urbanization, trade openness, and energy consumption on CO2 emissions in Egypt respectively over the next 30 years. Results indicate that the value of the error correction term ECTt − 1 is negative and statistically significant. This means that, in the short run, the model corrects its deviation (error) and converges to the long-run equilibrium path at a speed of 75% annually.

Results of several diagnostic tests provided in Table 6 are confirming the power and reliability of the dynamic ARDL and ARDL assessment results. According to the Jarque-Bera test, residuals are normally distributed, and the models do not suffer from the serial correlation according to the Breusch-Godfrey LM test for autocorrelation, and also there is no problem of heteroskedasticity as indicated by the results of the Breusch-Pagan/Cook-Weisberg test for heteroskedasticity. On the other hand, the diagnostic tests indicate that models are stable and do not suffer from specification bias according to the cumulative sum test for parameter stability and Ramsey RESET tests respectively. Results indicate that in the short run, there is a positive but not significant relationship between income inequality and carbon dioxide emissions, whereas, there is a statistically significant and positive relationship between them in the long term, as a 1% rise in income inequality increases carbon dioxide emissions in the long run by 2.285%. This effect of income inequality in Egypt in long run is consistent with other results in recent works like Baloch et al. (2020) and Wolde-Rufael and Idowu (2017) and contradicts with others (Grunewald et al. 2017). This finding is inconsistent with the inequality-environment trade-off approach which depends on the high marginal propensity to emit for the poor. Despite the high ratio of private consumption to GDP in Egypt that reached 88% in 2017, which means that the marginal propensity to consume in Egypt is very high and accordingly the expected effect of income inequality will harm the environment if inequality is reduced in favor of the poor, the results suggest that more inequality does not reduce CO2 emission in Egypt. This finding is very important for economic policy makers in Egypt. There is no need to worry about environmental degradation if income redistribution policies are implemented in favor of the poor. According to the DARDL results, it is possible to reduce inequality and improve the environment at the same time in the long run.

The harmful effect of income inequality on the environment in the long term means that the political economy approach to understanding the effect of inequality on environmental pollution is valid in the Egyptian economy, and deepening inequality through transferring incomes to the rich at the expense of the poor in Egypt will not lead to an increase in the rich’s demand for environmentally friendly goods, but it will lead to an increase in the demand of the poor to purchase less environmentally friendly and cheaper goods, which harms the environment. On the other hand, the continued concentration of income and wealth in the hands of the few people or rich class has led to creating political centers based on its economic power that enabled them to block any laws taking environmental considerations into account, whether at the level of domestic production or imports from abroad.

Although economic growth does not affect environmental pollution in the short term, its effect, in the long run, is positive and significant. Results show that an increase in the real per capita GDP by 1% will lead to an increase in carbon dioxide emission rates in Egypt by 1.04% in the long run. This can be explained relying on the fact that the real GDP per capita in Egypt is still low ranging from 802.7 to 2817.3 according to Table 2, so any increase in real income will be directed to more consumption at the expense of environmental degradation.

Results refer to a very harmful environmental effect of urbanization in the short and long terms in Egypt. A 1% increase in the ratio of the population living in urban areas raises CO2 emissions by 11.6% and 3.99% in the short and long runs respectively. This bad impact of urbanization on the environment in Egypt is observed in the results in recent works on urbanization-emissions nexus (Das Neves Lopes et al. 2020; Ullah et al. 2020).

As for the impact of trade openness on the environment in Egypt, results show a harmful effect on the environment, which contradicts with Shahbaz et al. (2013) and recently Zubair et al. (2020) but is consistent with other works (Asongu 2018; Sannassee and Seetanah 2016). A 1% increase in trade openness results in an increase in carbon dioxide emissions by 0.14% and 0.19% in the short and long terms respectively. This result supports the political economy approach in explaining the harmful effect of inequality on the environment. In many developing economies, trade openness and capital account liberalization led to an increase in imports of goods and encouraged foreign direct investments that work in anti-environment and many dirty industries which faced many environmental restrictions in developed countries since the early 1970s (Al-Ayouty et al. 2017). Results also indicate significant and negative effects of energy consumption on CO2 emission in both short and long terms. This result contrasts with the positive effect captured in many recent empirical works in developing countries and needs further investigation.

Conclusion and policy implications

The previous analysis is an extension of the empirical studies assessing the relationship between income inequality and environmental degradation in developing economies. The study aimed to examine the extent to which economic policy makers in Egypt could rely on the political economy approach in determining the effect of income inequality on environmental degradation during the period (1975–2017). To this end, the study employed the dynamic ARDL methodology initiated by Jordan and Philips (2018) to estimate the environmental impacts of evolutions in the Gini coefficient during the short run and long run. The main finding of the study is that income inequality harms the environment in Egypt in the long run despite the absence of a significant relationship between them in the short run. A rise in the Gini coefficient by 1% increases carbon emissions in Egypt by 2.28% in the long run. This is consistent with the political economy approach which believes that income inequality harms the environment. The study also employed the ARDL model for robustness check, and its results are compatible with the Dynamic ARDL results.

There are several implications for both economic policy and environmental policy. Firstly, the pattern of economic development in Egypt was not only biased towards the rich at the expense of the poor, but rather led to a negative impact on the environment reflected by an increase in carbon emissions over the period (1975–2017). This is a complex problem the Egyptian economy suffers, and it can be mitigated by adopting economic policies that redistribute income in favor of the poor and improve the environmental indicators in Egypt. The results indicate that more income inequality may lead to more environmental degradation in Egypt. Economic policy makers can affect the environment positively by adopting fiscal policies that reduce the number of the poor and redistribute income for the benefit of the majority. Accordingly, the study recommends that the Egyptian government expand its social protection programs included in its reform program, supported by the Extended Fund Facility arrangement with the International Monetary Fund In late 2016. Fiscal policy can play an important role in reducing income inequality by increasing public spending on human development indicators.

Secondly, when studying the factors affecting environmental pollution, it is necessary not to be satisfied with the real income growth index as a measure of economic activity, but it is also important to consider the effect of the income distribution structure accompanying the growth process in the estimation model, especially in developing economies that seek to achieve economic development and the requirements of sustainable development. According to the results of the DARDL model, both economic growth, as well as income inequality, did not have a significant effect on environmental degradation in the short term. However, both have a significant effect in the long term, as a 1% rise in income inequality leads to an increase in carbon emissions by 2.28%, while a 1% increase in real GDP per capita leads to an increase in emissions by close to 1.04%. This confirms that the impact of income inequality is important for understanding environmental degradation in Egypt.

Thirdly, it is noticeable according to the previous analysis that it is wrong to continue pursuing the biased economic growth policies for the rich at the expense of the poor in Egypt claiming that inequality improves the environment. The analysis showed that more inequality deteriorated the environment despite the rise in private consumption in Egypt to rates that reached more than 80% of the GDP, which means that the increase in incomes of the poor will go to more consumption and then more pressures on the environment. This result means that the Keynesian approach in explaining the relationship between inequality and the environment is not valid in the Egyptian economy.

Fourthly, the previous analysis illustrated that there is no trade-off relationship between income inequality and environmental degradation, and therefore economic policy in Egypt will not be subject to choosing one of them and sacrificing the other. Rather, an improvement in income distribution in Egypt will lead to an improvement in the environment and the achievement of some sustainable development goals.

Finally, the findings extracted from the DARDL model remain constrained by the income inequality index used to express the major independent variable of the study. The study used the Gini coefficient, and despite its importance, the lack of published data by local or international institutions, on other measures of income inequality and the concentration of wealth in Egypt, such as the share of the richest 10%, 5%, or 1% of the population, or the evolution of the poor over a long time series did not enable the study to fully capture the effect of changing the pattern of income distribution on the environmental degradation in Egypt. On the other hand, we open the way for further research to support or critique the findings of this study through the use of other indicators of environmental degradation in Egypt in addition to carbon emissions. Moreover, instead of using data on the Gini coefficient and carbon emissions for the Egyptian economy as a whole, it is recommended also to use more detailed data on these variables to cover different regions of Egypt to capture different environmental effects of income inequality across different regions.

References

Al-Ayouty I, Hassaballa H, Rizk R (2017) Clean manufacturing industries and environmental quality: the case of Egypt. Environmental Development 21:19–25. https://doi.org/10.1016/j.envdev.2016.11.005

Ali R, Bakhsh K, Yasin MA (2019) Impact of urbanization on CO2 emissions in emerging economy: evidence from Pakistan. Sustain Cities Soc 48:101553. https://doi.org/10.1016/j.scs.2019.101553

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35(10):4772–4778

Asongu SA (2018) CO 2 emission thresholds for inclusive human development in sub-Saharan Africa. Environ Sci Pollut Res 25(26):26005–26019

Baloch MA, Danish K, S U-D, Ulucak ZŞ, Ahmad A (2020) Analyzing the relationship between poverty, income inequality, and CO2 emission in Sub-Saharan African countries. Sci Total Environ 740:139867. https://doi.org/10.1016/j.scitotenv.2020.139867

Boyce JK (1994) Inequality as a cause of environmental degradation. Ecol Econ 11(3):169–178

Boyce JK (2007) Is inequality bad for the environment. Res Soc Probl Public Policy 15:267–288

British Petroleum(2020).Statistical Review of World Energy. Available at https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Chen J, Xian Q, Zhou J, Li D (2020) Impact of income inequality on CO2 emissions in G20 countries. J Environ Manag 271:110987. https://doi.org/10.1016/j.jenvman.2020.110987

Cheng Y, Wang Y, Chen W, Wang Q, Zhao G (2021) Does income inequality affect direct and indirect household CO2 emissions? A quantile regression approach. Clean Techn Environ Policy 23(4):1199–1213

Clemente J, Montañés A, Reyes M (1998) Testing for a unit root in variables with a double change in the mean. Econ Lett 59(2):175–182

Danish, Ulucak R (2020) Linking biomass energy and CO2 emissions in China using dynamic Autoregressive-Distributed Lag simulations. J Clean Prod 250:119533. https://doi.org/10.1016/j.jclepro.2019.119533

Das Neves Lopes M, Decarli CJ, Pinheiro-Silva L, Lima TC, Leite NK, Petrucio MM (2020) Urbanization increases carbon concentration and pCO2 in subtropical streams. Environ Sci Pollut Res 27(15):18371–18381. https://doi.org/10.1007/s11356-020-08175-8

Farzanegan MR, Hassan M, Badreldin AM (2020) Economic liberalization in Egypt: a way to reduce the shadow economy? J Policy Model 42(2):307–327. https://doi.org/10.1016/j.jpolmod.2019.09.008

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Grunewald N, Klasen S, Martínez-Zarzoso I, Muris C (2017) The trade-off between income inequality and carbon dioxide emissions. Ecol Econ 142:249–256. https://doi.org/10.1016/j.ecolecon.2017.06.034

Hailemariam A, Dzhumashev R, Shahbaz M (2020) Carbon emissions, income inequality and economic development. Empir Econ 59(3):1139–1159. https://doi.org/10.1007/s00181-019-01664-x

Hashmi SH, Fan H, Habib Y, Riaz A (2021) Non-linear relationship between urbanization paths and CO2 emissions: a case of South, South-East and East Asian economies. Urban Clim 37:100814. https://doi.org/10.1016/j.uclim.2021.100814

Hdom HAD, Fuinhas JA (2020) Energy production and trade openness: assessing economic growth, CO2 emissions and the applicability of the cointegration analysis. Energy Strategy Reviews 30:100488. https://doi.org/10.1016/j.esr.2020.100488

Heerink N, Mulatu A, Bulte E (2001) Income inequality and the environment: aggregation bias in environmental Kuznets curves. Ecol Econ 38(3):359–367

Hübler M (2017) The inequality-emissions nexus in the context of trade and development: a quantile regression approach. Ecol Econ 134:174–185. https://doi.org/10.1016/j.ecolecon.2016.12.015

Hundie SK (2021) Income inequality, economic growth and carbon dioxide emissions nexus: empirical evidence from Ethiopia. Environ Sci Pollut Res 28:43579–43598. https://doi.org/10.1007/s11356-021-13341-7

Jordan S, Philips AQ (2018) Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stata J 18(4):902–923

Khan MK, Teng JZ, Khan MI (2019a) Effect of energy consumption and economic growth on carbon dioxide emissions in Pakistan with dynamic ARDL simulations approach. Environ Sci Pollut Res 26(23):23480–23490. https://doi.org/10.1007/s11356-019-05640-x

Khan MK, Teng JZ, Khan MI, Khan MO (2019b) Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci Total Environ 688:424–436. https://doi.org/10.1016/j.scitotenv.2019.06.065

Khan MI, Teng JZ, Khan MK (2020) The impact of macroeconomic and financial development on carbon dioxide emissions in Pakistan: evidence with a novel dynamic simulated ARDL approach. Environ Sci Pollut Res 27:39560–39571. https://doi.org/10.1007/s11356-020-09304-z

Knight KW, Schor JB, Jorgenson AK (2017) Wealth inequality and carbon emissions in high-income countries. Social Currents 4(5):403–412

Kripfganz S, & Schneider DC (2019). Response surface regressions for critical value bounds and approximate p-values in equilibrium correction models

Kusumawardani D, Dewi AK (2020) The effect of income inequality on carbon dioxide emissions: a case study of Indonesia. Heliyon 6(8):e04772. https://doi.org/10.1016/j.heliyon.2020.e04772

Leal PH, Marques AC (2020) Rediscovering the EKC hypothesis for the 20 highest CO2 emitters among OECD countries by level of globalization. Int Econ 164:36–47. https://doi.org/10.1016/j.inteco.2020.07.001

Liu Q, Wang S, Zhang W, Li J, Kong Y (2019) Examining the effects of income inequality on CO2 emissions: Evidence from non-spatial and spatial perspectives. Appl Energy 236:163–171. https://doi.org/10.1016/j.apenergy.2018.11.082

Magnani E (2000) The Environmental Kuznets Curve, environmental protection policy and income distribution. Ecol Econ 32(3):431–443

Perron P (1989) Are per capita carbon dioxide emissions converging among industrialized countries? New time series evidence with structural breaks’. Econometrica 57:1361–1401

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Radmehr R, Henneberry SR, Shayanmehr S (2021) Renewable energy consumption, CO2 emissions, and economic growth nexus: a simultaneity spatial modeling analysis of EU countries. Struct Chang Econ Dyn 57:13–27. https://doi.org/10.1016/j.strueco.2021.01.006

Rahman MM, Nepal R, Alam K (2021) Impacts of human capital, exports, economic growth and energy consumption on CO2 emissions of a cross-sectionally dependent panel: evidence from the newly industrialized countries (NICs). Environ Sci Pol 121:24–36. https://doi.org/10.1016/j.envsci.2021.03.017

Ravallion M, Heil M, Jalan J (2000) Carbon emissions and income inequality. Oxf Econ Pap 52(4):651–669

Salari M, Javid RJ, Noghanibehambari H (2021) The nexus between CO2 emissions, energy consumption, and economic growth in the US. Economic Analysis and Policy 69:182–194

Sannassee RV, & Seetanah B (2016). Trade openness and CO2 emission: evidence from a SIDS. In Handbook of environmental and sustainable finance (pp. 165–177). Elsevier

Shahbaz M, Kumar Tiwari A, Nasir M (2013) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459. https://doi.org/10.1016/j.enpol.2013.07.006

Solt F (2020) The standardized world income inequality database. Version 8 (V3 ed.). Harvard Dataverse. https://doi.org/10.7910/DVN/LM4OWF

Torras M, Boyce JK (1998) Income, inequality, and pollution: a reassessment of the environmental Kuznets curve. Ecol Econ 25(2):147–160

Uddin MM, Mishra V, Smyth R (2020) Income inequality and CO2 emissions in the G7, 1870–2014: evidence from non-parametric modelling. Energy Econ 88:104780. https://doi.org/10.1016/j.eneco.2020.104780

Ullah S, Ozturk I, Usman A, Majeed MT, Akhtar P (2020) On the asymmetric effects of premature deindustrialization on CO2 emissions: evidence from Pakistan. Environ Sci Pollut Res 27(12):13692–13702. https://doi.org/10.1007/s11356-020-07931-0

United Nations. (2020). World Social Report 2020: inequality in a rapidly changing world. In World social report 2020 (p. 216). New York, UN

Uzar U (2020) Is income inequality a driver for renewable energy consumption? J Clean Prod 255:120287. https://doi.org/10.1016/j.jclepro.2020.120287

Uzar U, Eyuboglu K (2019) The nexus between income inequality and CO2 emissions in Turkey. J Clean Prod 227:149–157

Wolde-Rufael Y, Idowu S (2017) Income distribution and CO2 emission: a comparative analysis for China and India. Renew Sust Energ Rev 74:1336–1345. https://doi.org/10.1016/j.rser.2016.11.149

World Bank (2021) World Development Indicators. https://databank.worldbank.org/source/world-development-indicators

Yao F, Zhu H, Wang M (2021) The impact of multiple dimensions of urbanization on CO2 emissions: a spatial and threshold analysis of panel data on China’s prefecture-level cities. Sustain Cities Soc 103113:103113. https://doi.org/10.1016/j.scs.2021.103113

Zhang C, Zhao W (2014) Panel estimation for income inequality and CO2 emissions: a regional analysis in China. Appl Energy 136:382–392

Zhao W, Hafeez M, Maqbool A, Ullah S, Sohail S (2021) Analysis of income inequality and environmental pollution in BRICS using fresh asymmetric approach. Environ Sci Pollut Res 1–11

Zhou S, Hu A (2021) Will China fall into the “Middle Income Trap”? BT—China: surpassing the “Middle Income Trap” (S. Zhou A. Hu (eds.); pp. 71–131). Springer Singapore. https://doi.org/10.1007/978-981-15-6540-3_3

Zubair AO, Abdul Samad A-R, Dankumo AM (2020) Does gross domestic income, trade integration, FDI inflows, GDP, and capital reduces CO2 emissions? An empirical evidence from Nigeria. Curr Res Environ Sustain 2:100009. https://doi.org/10.1016/j.crsust.2020.100009

Availability of data and materials

The datasets are available in the World Development Indicators data of the World Bank, British Petroleum Statistics (2020), and Solt (2020).

Author information

Authors and Affiliations

Contributions

The author contributed to all parts of this article.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

“Not applicable” for this paper.

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ali, I.M.A. Income inequality and environmental degradation in Egypt: evidence from dynamic ARDL approach. Environ Sci Pollut Res 29, 8408–8422 (2022). https://doi.org/10.1007/s11356-021-16275-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16275-2