Abstract

We study the pricing strategies of supply chains of green products under behaviour-based pricing. Considering consumer preferences for green product functional attributes and environmental attributes, we construct a two-stage supply chain. The optimal behaviour pricing of green products is solved, and the effects of green sensitivity and the cost coefficient on the optimal price are analysed. We find that when consumers are less sensitive to the greenness, with the increase in the market share of green products, green product retailers will increase the loyalty price. An increase in greenness sensitivity and a decrease in the greenness cost coefficient will increase the wholesale prices and retail prices of green products. Consumer attention to the greenness and a decrease in the initial market share of green products will be conducive to promoting the greenness and improving the environment. Consumers’ emphasis on the greenness of their products will lead to higher profits for the manufacturers and retailers of green products.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Green products are generally regarded as environmentally friendly, resource-saving, healthy and harmless. In both developed and developing countries, the concept of green product consumption has become increasingly popular, the supply of green products has been expanding and the scale of green consumption has continued to grow (Giri et al. 2019). According to the 2019 Tmall double 11 green consumption reports, the number of green consumers in Tmall in 2018–2019 exceeded 380 million, 5.8 times the year-on-year growth in 2015. However, there is still a large gap compared with the monthly active users (more than 600 million) on the platform. Therefore, we can foresee that in the future, green and nongreen products will coexist in the market with increasingly strong competition between them.

Therefore, it is particularly important to explore the pricing strategy of green products and the impact of the pricing strategy on the supply chain of green products. Currently, the most widely used pricing method in the green product supply chain (GPSC) is unified pricing. In the big data era, enterprises can have both online and offline sales channels such as mobile devices, mobile applications, cookies, information systems and a series of information technologies to obtain and record a substantial amount of customer information and use it to implement differential pricing for loyal and new customers (Rhee and Thomadsen 2017). For example, when consumers log on to the shopping website or app of Amazon or JD, they may be surprised to find that such Internet sellers show them commodities preferred by consumers according to their purchase information and web-browsing records and that these sellers can identify whether consumers have ever purchased such commodities before (Wang and Ng 2018). Currently, behaviour-based pricing (BBP) and customer identification are used in many fields, such as commodity sales, telecommunications services, and travel and housekeeping services. Additionally, past evidence has proven that BBP can dynamically price consumers’ characteristics and purchase history based on big data. Thus, BBP can achieve the purpose of increasing profits (Shiller 2014).

Therefore, when green and nongreen products compete in the market, especially when selling products through the Internet, an increasing number of enterprises adopt BBP for new and old customers. Table 1 presents some actual cases of BBP with respect to green products on the Alibaba platform in 2020. As presented in Table 1, the Alibaba platform implemented BBP for formaldehyde-resistant cleaning of 5-in-1 interior wall paint by Nippon (green building materials through the GREENGUARD Gold air quality certification) and Zeqiu brand natural straws (green household products without the addition of harmful calcium carbonate, talcum powder). Among them, the price of formaldehyde-resistant cleaning of 5-in-1 interior wall paint by Nippon sold to old customers was 46.4 CNY/L, and that charged to new customers was 45.4 CNY/L. Zeqiu brand natural straws were sold to old customers at 17.9 CNY/100 straws and new customers at 15.4 CNY/100 straws. These cases led us to think about the application of BBP in green product pricing. In this article, we answer the following questions:

-

(1)

Given the different initial market shares of green products, how does sensitivity to greenness affect the choice of BBP for GPSCs?

-

(2)

What are the effects of the initial market shares of green products, sensitivity coefficients of greenness and cost coefficients of greenness on wholesale and retail pricing, greenness, the environment and profits of enterprises in the GPSCs?

Differing from previous studies, most of the previous literature concerning GPSC pricing seldom applied behavioural pricing (Jamali and Rasti-Barzoki 2018; Sana 2020), and the advantages of BBP and its successful practices in other fields provide new ideas for the study in this paper. Some previous research focused on the combination of BBP and organic product pricing strategies (Liu et al. 2019, 2020), but the model is designed to include only the retailers of the products without considering the decision of the supply chain. Therefore, this paper analyses the influence of the green product initial market share and green degree sensitivity coefficient on green product manufacturers’ wholesale pricing, green degree decision and profit after the implementation of BBP in the retail segment and provides scientific support for decision-making research concerning the GPSC.

The rest of the paper proceeds as follows. After the introduction, we give a literature review. In the ‘Problem definition and hypothesis’ section, we discuss the assumptions and the problem description of this paper. In the ‘Model and equilibrium results’ section, solutions to the problem are shown, and the applicable conditions for using BBP are analysed. The ‘Equalisation results analysis’, section conducts parametric sensitivity analysis. The ‘Numerical analysis’ section is the numerical simulation analysis. In the ‘Conclusions’ section, conclusions and future research suggestions are offered.

Literature review

This report discusses the pricing strategy of green products in the context of behavioural pricing using game theory. Therefore, we briefly introduce the latest literature concerning the pricing of green products based on game theory and product behaviour pricing.

Considering environmental protection, an increasing number of green products are being produced and marketed. Scholars have researched how these green products compete with nongreen products (Agi et al. 2020). The discussion mainly covers the optimal pricing of green products (Agi and Yan 2020), decision making at the level of greenness of green products (Karaer et al. 2017), optimal production and inventory decisions regarding green products (Chung et al. 2013; Yang et al. 2017), the green product sales effort level and advertising decisions (Shen et al. 2019), the optimal government tax rate or optimal subsidy strategy (Huang et al. 2020), channel selection and other related topics (Jian et al. 2019). Scholars have also studied fairness (Chen et al. 2020), vehicle loading (Kellner and Schneiderbauer 2019), the location of retailers (Dilek et al. 2018), consumer sensitivity and social responsibility (Ghosh et al. 2020; Lin et al. 2021; Liu and Xiao 2019) and the optimal pricing of green products. For example, Agi and Yan (2020) discussed the positioning of and optimal pricing strategy for green products and brown products when the manufacturer and retailer are supply chain leaders in a market segment in which consumers are willing to pay a premium for green products. Li et al. (2021) focused on different pricing strategies from the perspective of profit improvement. These authors found that the pricing strategies affect the profit level of green supply chain members but do not affect decisions at the level of greenness. Different market potentials lead to different wholesale pricing strategies. Huang et al. (2020) performed a comparative analysis of three subsidy modes for green manufacturers under capital constraints and attempted to find a win-win subsidy mode. Ghosh et al. (2020) simultaneously considered the impact of the cost of greenness and government intervention on the pricing, profit and level of greenness of green products. Assuming that both manufacturers and consumers are environmentally aware and responsible, Liu and Xiao (2019) discussed the optimal price, the reverse channel structure strategy and collection rate decision making in a closed-loop supply chain. Chen et al. (2020) extended the discussion of green product pricing strategies to the context of cross-border supply chains and considered the coordination mechanism of green supply chains based on the concept of fairness under different regulatory policies of trans-regional governments.

However, the above research focused on the pricing of green products without BBP implementation, ignoring the fact that when an increasing number of enterprises can identify their loyal customers, they may use and are willing to use information about consumers’ purchase history to provide consumers with different prices or products (Li and Jain 2016). In recent years, scholars have conducted a considerable amount of research on BBP (references to Fudenberg and Villas-Boas 2006, 2012). These studies have involved questions such as whether the model is dynamic or static (Fudenberg and Tirole 2000; Shaffer and Zhang 1995), whether competition is the third degree of price discrimination or personalised pricing (Jing 2017; Rhee and Thomadsen 2017; Zhang 2011),and whether BBP harms or improves company profitability (Jing 2017; Li and Jain 2016). For example, Li and Jain (2016) analyse the influence of consumer concerns on the enterprise behaviour pricing strategy, finding that the profit obtained by enterprises from BBP increased with consumer concerns for fairness but reduced consumer surplus and improved social welfare. Rhee and Thomadsen (2017) studied BBP in a vertical differentiation model. Choe et al. (2017) proposed a dynamic competition model between two companies to study the impact of differentiated prices on prices and profits throughout the sales cycle. Jing (2017) studied how behaviour-based price discrimination (BBPD) affects the endogenous quality differences and profits of enterprises in a two-stage vertical duopoly. The BBP model constructed by Colombo (2018) considers the personality characteristics of consumers. Liu et al. (2019) discussed the impact of government subsidies on the production cost of organic agricultural products on the behavioural pricing and profits of enterprises when conducting BBP on organic and ordinary agricultural product producers. Furthermore, Xu et al. (2020) added consumptive habits data based on BBP to distinguish old and new consumers and high-cost and low-cost consumers, and they studied how BBP and consumer cost-based pricing (CCP) affect the price, market share and profit of channel members.

In contrast to the above studies, this study considers a two-stage supply chain consisting of two manufacturers (a local nongreen product manufacturer and a nonlocal green product manufacturer) and a green product retailer selling the two products of different greenness. This paper combines BBP with the pricing strategy of GPSC. It analyses the applicable conditions to realise BBP equilibrium of GPSC as well as the influence of market share and various parameters on the pricing, greenness, environment and profit of green products after using BBP. Therefore, the main contributions of this paper are as follows.

-

Extending the single attribute utility function in the previous BBP model. The utility function of green products bought by consumers is considered based on two aspects—product functional and environmental quality attributes.

-

We discuss the pricing and green degree decisions of green product manufacturers in the implementation of BBP and explore the change in BBP of green product retail with related parameters by adding green product manufacturers into the BBP model.

-

The influence of market share, the sensitivity coefficient of product greenness and the cost coefficient of greenness on BBP, as well as greenness, the impact of the environment and the profits of the GPSC, are analysed.

Problem definition and hypothesis

Parameters and variables

In this section, we will first define the symbols used in the paper, as shown in Table 2.

Problem definition and assumptions

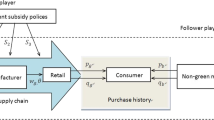

In recent years, the increase in the categories and quantity of green products and the change in consumers’ preference for green products have intensified the competition between green and nongreen products. To win the competition, enterprises evaluate customers’ affect, preferences, locations, historical purchase records and other characteristics through big data and other information means to determine the optimal behavioural pricing strategy and maximise their profits and market. This paper considers behavioural pricing in supply chain competition for green and nongreen products. To simplify the study, it is assumed that the supply chain for nongreen products consists of only a manufacturer of nongreen products that is locally located that produces and sells. The GPSC consists of green product manufacturers and retailers, and the green product retailers order from the green product manufacturers. To make the model more realistic, we consider the effects of transportation costs, consumers’ sensitivity to greenness and customers’ purchasing history. The main framework of the supply chain is shown in Fig. 1.

Considering that there are multiple periods throughout the sales cycle, consumers’ preferences and purchasing behaviours will change in different periods due to price, environmental preferences (Dhir et al. 2021), consumer trust (Leggett 2020), age, geographical location, education level, diversified needs (Sun et al. 2019) and novelty seeking. For convenience of analysis, the whole sales cycle is standardised into two periods (t = 0, 1). As green manufacturers dominate the supply chain, before period t (t = 0, 1), green product manufacturers first determine green products’ wholesale price and greenness. Since the manufacturers themselves produce and sell nongreen products, there is no wholesale price. We assume that consumers in each period will not choose either green or nongreen products of the same category.

The order of the two-period game is as follows: In period t = 0, the two types of products are in competition to obtain the corresponding market share, and the green product market share is x0. Purchase histories are public information. Let h(x) : [0, 1] → {g, b} describe the purchase history of each consumer 푥, x ∈ (0, 1); h(x) = g imply that consumer x purchased green products in period t = 0, while h(x)=b denotes that consumer x purchased nongreen products in period t = 0. In period t = 1, consumers seek a diversification of purchases, and green product retailers and nongreen product manufacturers price the two products differently according to purchase histories. Meanwhile, green product retailers purchase products from their manufacturers according to market demand qg and wholesale price wg.

Assumption 1. Product attributes

Following Wang and Hazen (2016) and Bansal and Gangopadhyay (2003), we assume that green products and nongreen products have two attributes. The first is the functional attribute of the product, denoted by U. The second is the environmental quality attribute of the product. It is assumed that the initial environmental impact of the product is D. Green product manufacturers will take certain measures to make their green products environmentally friendly. The greenness of green products is represented by θ, where θ ∈ [0, D], and the environmental pollution caused by the production and consumption of green products is reduced to D − θ.

Assumption 2. Consumer utility

Considering that there are multiple periods in the sales cycle and that the purchase behaviour of consumers in period t = 1 will be affected by the price, the environment and other factors, following Rhee and Thomadsen (2017), Jamali and Rasti-Barzoki (2018) and their research on consumer utilities, it is assumed that in period t = 1, the utility of green product consumers will be influenced by retail price, greenness and transportation cost. Therefore, in period t = 1, the utility function for consumers who purchase green products is U(x) = U − gi − τx + γθ, while the utility function for consumers who purchase nongreen products is U(x) = U − bi − τ(1 − x).

Assumption 3. \( {C}_g\left(\theta \right)=\mu \frac{\theta^2}{2} \)

Compared with the production of nongreen products, green product manufacturers will invest more in the greenness of their products. For convenience of research, this paper mainly considers the cost of green product manufacturers in terms of greenness. Therefore, suppose that the cost of green products is \( {C}_g\left(\theta \right)=\mu \frac{\theta^2}{2} \) and that the production cost of nongreen products is 0 (Jamali and Rasti-Barzoki 2018; Li and Jain 2016).

Assumption 4. g i > w g, w g q g > C g b i > 0

In period t = 1, green retailers must price (loyalty price and poaching price) higher than the wholesale price of green products because the profit of green product retailers must be positive. Meanwhile, the revenue of wholesale sales of green products should be greater than the production cost of green products to ensure that the profit of wholesalers of green products is positive. In addition, to ensure that nongreen product manufacturers do not lose money, the retail price of nongreen products (loyalty price and poaching price) must be greater than 0 (Jamali and Rasti-Barzoki 2018; Li and Jain 2016).

The demand functions

Based on the above hypotheses, the utility of consumer x in period t = 1 can be defined as follows:

For consumers who purchase green productg in period t = 0, in period t = 1, due to the influence of price and other factors, they may turn to buying nongreen products. Let \( {x}_1^g \) be given. Consumers indexed by \( x\le {x}_1^g \) still consume green products in period t = 1 and enjoy loyalty prices. Consumers indexed by \( x>{x}_1^g \), who have bought green products before, switch to product b in period t = 1. Therefore, \( {x}_1^g \) must satisfy U − go − τx + γθ = U − bn − τ(1 − x), as shown in Fig. 2. Similarly, \( {x}_1^b \) must satisfy U − bo − τ(1 − x) = U − gn − τx + γθ.

Model and equilibrium results

The decision variables of nongreen product manufacturers are the loyalty price and poaching price of nongreen products; the decision variables of green product manufacturers are the greenness and wholesale price of green products; and the decision variables of green product retailers are the loyalty price and poaching price of green products. According to the supply chain structure in Fig. 1, the following is the profit function of each member in the supply chain:

The profit of the nongreen product manufacturer (Mb) is as follows:

The profit of the green product manufacturer (Mg) is as follows:

The profit of the green product retailer (Rg) is as follows:

Green product manufacturers are dominant, and each member of the supply chain makes decisions to maximise its profit. The decision order is as follows. First, the green product manufacturer determines the wholesale price and greenness of the green product; then, the green product retailer determines the retail price of the green product (loyalty price and poaching price), while the nongreen product manufacturer determines the loyalty price and poaching price of the nongreen product. Based on the above decision-making process, by using the reverse solution method to solve the problem, the equilibrium results under enterprise profit maximisation are obtained and are presented in Table 3. The relevant solution process is shown in the Appendix.

The total environmental impact of two types of products:

Lemma 1

Only when the sensitivity coefficient of greenness meets the following conditions can the GPSC implement BBP:

-

1)

When \( {x}_0\in \left(0,\right.\left.\frac{4}{7}\right] \),\( 0<\gamma <\sqrt{\frac{44\mu \tau {x}_0}{\left(5{x}_0+1\right)}} \);

-

2)

When \( {x}_0\in \left(\frac{4}{7},\right.\left.\frac{3}{5}\right) \),\( \sqrt{\frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)}}<\gamma <\sqrt{\frac{44\mu \tau {x}_0}{\left(5{x}_0+1\right)}} \);

-

3)

When \( {x}_0\in \left.\left[\frac{3}{5}\right.,1\right) \),\( \sqrt{\frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)}}<\gamma <\sqrt{\frac{12\mu \tau \left(4-3{x}_0\right)}{\left(7-5{x}_0\right)}} \)

Proof

See Appendix.

The relevant conditions in Lemma 1 are obtained based on the condition that enterprises in the green and nongreen supply chains will not lose money and that the retail price is higher than the wholesale price after the implementation of BBP. Lemma 1 indicates that for different initial market shares of green products, the consumers’ greenness sensitivity will have an impact on whether enterprises in the GPSC choose BBP. The balance of BBP in GPSC exists only when the consumer’s green sensitivity is in a reasonable range.

Equalisation results analysis

In this section, the influence of some parameters on the price, profit, environment and greenness of green products in the supply chain in the case of BBP is investigated.

The effect of the initial market share of green products on pricing, greenness and environment

Theorem 1

As the initial market share of green products increases, when consumers’ green sensitivity is relatively low (\( \gamma <2\sqrt{\mu \tau} \)), green product retailers will increase the loyalty price of green products. When consumers’ green sensitivity is relatively high (\( 2\sqrt{\mu \tau}<\gamma <\sqrt{8\mu \tau} \)), green retailers will lower the loyalty price of green products.

Proof

Take the first derivative of the green product with respect to parameter x0:

\( \frac{d{g}_o^{\ast }}{d{x}_0}=\frac{\tau \left(-3{\gamma}^2+12\mu \tau \right)}{-2{\gamma}^2+16\mu \tau} \), such that 8μτ > γ2; thus, when 4μτ > γ2, \( \frac{d{g}_o^{\ast }}{d{x}_0}>0 \); additionally, when 4μτ < γ2 < 8μτ, \( \frac{d{g}_o^{\ast }}{d{x}_0}<0 \). Theorem 1 is proved.

Theorem 1 shows that when the green sensitivity of consumers in the market is relatively low, with the increase in the proportion of consumers who buy green products in the previous stage, green product retailers will have stronger confidence in the future market. However, when consumers are more concerned about the greenness of products, retailers of green products will reduce the loyalty pricing of green products with the strengthening of the dominant position of green products in the initial market.

In previous practical studies on BBP (Wang et al. 2020), companies in different industries also offered repurchasing customer discounts or increased loyalty prices but did not discuss the behavioural pricing of green products in the context of different green sensitivities. However, consumers differ in their green sensitivity to different products (Jamali and Rasti-Barzoki 2018). According to the different consumers’ green degrees of sensitivity, Theorem 1 corresponds to different initial market share changes and green product retailers’ pricing strategies for loyal customers.

Theorem 2

Increasing the initial market share of green products will reduce the greenness of green products and have a negative impact on environmental improvement.

Proof

The first derivative of the greenness of green products and the total impact of the two types of products on the environment with respect to parameter x0 is derived.

We find that the initial market share of green products is not only negatively correlated with the greenness of green products but also has a negative impact on environmental improvement. As the initial market share of green products increases, the market share and wholesale price of green products in the second period decrease (\( \frac{d{q}_g}{d{x}_0}=\frac{-\mu \tau}{-{\gamma}^2+8\mu \tau}<0 \),\( \frac{d{w}_g^{\ast }}{d{x}_0}=\frac{-4\mu {\tau}^2}{-{\gamma}^2+8\mu \tau}<0 \)). Thus, green product manufacturers generate less revenue. To reduce the impact of the decreased revenue from green products on their profits, green product manufacturers will reduce the greenness of their products to reduce their costs. This decision will mitigate the negative impact of the increase in the initial market share of green products on the profits of green product manufacturers.

On the other hand, the market share of green products in the second period \( {q}_g^{\ast } \) will decrease with the increase in x0; when the greenness of green products and the market share in the second period are reduced, because \( {E}^{\ast }=D-{\theta}^{\ast }{q}_g^{\ast } \), the total impact of the two types of products on the environment increases. Hence, theorem 2 is proven. Theorem 2 shows that the implementation of BBP is not conducive to improvement in the product quality and overall environment in the green supply chain in the market with continuously enriched green products.

The effect of the sensitivity coefficient of greenness on pricing, greenness, environment and profit

Theorem 3

The prices of green products (wholesale price, loyalty price and poaching price) are positively correlated with the sensitivity coefficient of greenness.

Proof

The first derivative of the prices of green and nongreen products (loyalty price and poaching price) with respect to parameter γ is derived.

This result means that with the increase in consumer sensitivity to product greenness, green product manufacturers and retailers increase both their wholesale price and their sales price (loyalty price and poaching price). At this point, nongreen product manufacturers will reduce their sale price to reduce the loss caused by the increase in the consumer green sensitivity coefficient.

Theorem 4

In the context of BBP, consumer attention to the greenness of products not only promotes the greenness of green products but also improves the environmental effects on society.

Proof

The first derivative of greenness and the environment with respect to parameter γ is derived and is as follows:

\( \frac{d{\theta}^{\ast }}{d\gamma}=\frac{\tau \left({\gamma}^2+8\mu \tau \right)\left(2-{x}_0\right)}{{\left(-{\gamma}^2+8\mu \tau \right)}^2}>0,\frac{d{E}^{\ast }}{d\gamma}=-\frac{\mu {\tau}^2\left(3{\gamma}^2+8\mu \tau \right){\left(2-{x}_0\right)}^2}{{\left(-{\gamma}^2+8\mu \tau \right)}^3}<0 \).

Thus, theorem 4 is proven. It is noted that the sensitivity of consumers to greenness under the BBP model will influence the decision-making of green product manufacturers. The more sensitive consumers are to greenness, the more motivated manufacturers of green products are to improve the greenness of their products, thus promoting the overall green level of society.

Theorem 5

In the context of BBP, consumers’ attention to the greenness of products will help to improve the profits of enterprises in the GPSC.

Proof

The first derivative of the profits of green product manufacturers and retailers with respect to parameter γ is derived and is as follows:

Therefore, when consumer sensitivity to product greenness increases, the profits of manufacturers and retailers of green products also increase. As consumer preference for greenness increases, manufacturers and retailers of green products increase the wholesale price and retail price, respectively, of green products. Hence, the market share of green products in the second period does decrease due to the increase in price, but rather, they occupy a larger market (\( \frac{d{q}_g^{\ast }}{r}=\frac{2\mu \gamma \tau \left(2-{x}_0\right)}{{\left(-{\gamma}^2+8\mu \tau \right)}^2}>0 \)). Therefore, although the increase in the degree of greenness increases the cost for green product manufacturers, the sales revenue of green products increases even more, meaning that the profits of green product manufacturers will also ultimately increase.

The growth rate of the green product retail price with the green sensitivity coefficient γ is faster than that of the wholesale price with the green sensitivity coefficient γ. From theorem 3, we know \( \frac{d{g}_o^{\ast }}{d\gamma}=\frac{d{g}_n^{\ast }}{d\gamma}>\frac{d{w}_g^{\ast }}{d\gamma}>0 \)). Thus, the profits of green product retailers also increase with the increase in the green sensitivity coefficient γ.

Theorems 3–5 show that under the behavioural pricing strategy, improvement in consumers’ green sensitivity will be conducive to improvement in enterprises’ profits, the greenness of green products and the overall environment in the supply chain of green products. Meanwhile, the wholesale and retail pricing of green products will also increase. Therefore, enterprises in the GPSC should increase publicity and advertising efforts to improve consumers’ green sensitivity.

The effect of the green degree cost coefficient on pricing

Theorem 6

In the context of BBP, the prices of green products (wholesale price, loyalty price and poaching price) are negatively correlated with the green degree cost coefficient.

Proof

The first derivative of the prices of green and nongreen products (wholesale price, loyalty price and poaching price) with respect to parameter μ is derived.

This means that the higher the unit cost is to improve the greenness of green products, the lower the optimal greenness will be (\( \frac{d{\theta}^{\ast }}{d\mu}=\frac{-8\gamma {\tau}^2\left(2-{x}_0\right)}{{\left(-{\gamma}^2+8\mu \tau \right)}^2}<0 \)). Accordingly, manufacturers and retailers of green products will reduce the wholesale price and the sale price (loyalty price, poaching price) to increase their sales volume and maximise profits. As nongreen products narrow the gap between green and nongreen products, their manufacturers have the confidence to raise their selling prices to obtain more unit product profits.

Numerical analysis

We use a numerical example to analyse the influence of the initial market share of green products on the profits of enterprises in the supply chain of green and nongreen products. All parameter values are set according to the problem hypothesis and satisfy the conditions in lemma 1. Suppose τ = 0.3, μ = 1.2. Then, when \( 0<{x}_0<\frac{4}{7} \), γ = 0.38, and when \( \frac{4}{7}\le {x}_0< \)1, γ = 1.47. Figures 3 and 4 describe the changes in the profits of enterprises in the supply chain of green and nongreen products, respectively, corresponding to different initial market shares of green products.

As evidenced from Figs. 3 and 4, the increase in the initial market share of green products results in a decrease in profits for green product manufacturers in the second period (\( \frac{d{\pi}_{Mg}^{\ast }}{d{x}_0}=\frac{\mu {\tau}^2\left({x}_0-2\right)}{-{\gamma}^2+8\mu \tau}<0 \)). This indicates that when the initial market share of green products is higher, the wholesale price of green products will be lower and the market share will be reduced even though the production cost of green products is lower as the production cost is affected by greenness. Thus, the profits of green product manufacturers will be lower (\( \frac{d{w}_g^{\ast }}{d{x}_0}=\frac{-4\mu {\tau}^2}{-{\gamma}^2+8\mu \tau}<0,\frac{d{q}_g^{\ast }}{d{x}_0}=\frac{-\mu \tau}{-{\gamma}^2+8\mu \tau}<0\Big) \). Therefore, for manufacturers of green products, a lower initial share of green products can actually be more beneficial.

With the increase in the initial market share of green products, the profits of manufacturers of nongreen products in the second period exhibit a trend of first declining and then increasing. In other words, the more intense the market competition is in the first period, the lower the profits of nongreen product manufacturers will be in the second period. This is because the profits of the manufacturers of nongreen products in the second period depend on the sum of the profits under the sales prices (loyalty price and poaching price) of nongreen products. Accordingly, the larger the initial market share of green products is, the lower the loyalty price and the corresponding market capacity of nongreen products will be in the second period (\( \frac{d{b}_{bo}^{\ast }}{d{x}_0}=\frac{-\tau \left(-5{\gamma}^2+36\mu \tau \right)}{-4{\gamma}^2+32\mu \tau}<0 \), \( \frac{d\left(1-{x}_1^b\right)}{d{x}_0}=\frac{-\left(-5{\gamma}^2+36\mu \tau \right)}{8\left(-{\gamma}^2+8\mu \tau \right)}<0 \)). Similarly, the higher the poaching price of nongreen products is in the second period, the higher its corresponding market share will be (\( \frac{d{b}_n^{\ast }}{d{x}_0}=\frac{\tau \left(-5{\gamma}^2+44\mu \tau \right)}{-4{\gamma}^2+32\mu \tau}>0 \), \( \frac{d\left({x}_0-{x}_1^g\right)}{d{x}_0}=\frac{\left(-5{\gamma}^2+44\mu \tau \right)}{8\left(-{\gamma}^2+8\mu \tau \right)}>0 \)). Therefore, the increased revenue from a nongreen product’s poaching price is less than the decreased revenue from its loyalty price. Hence, the profits of nongreen product manufacturers also decrease.

In the second period, the profits of green retailers in the two intervals where 0\( <{x}_0<\frac{4}{7} \) and \( \frac{4}{7}<{x}_0<1 \) exhibit a trend of first decreasing and then increasing. This is because several factors affecting green product retailers’ profits reveal the following trends: as the initial market share of green products increases, the wholesale price and poaching price of green products decrease (\( \frac{d{g}_n^{\ast }}{d{x}_0}=\frac{-\tau \left(-3{\gamma}^2+36\mu \tau \right)}{-2{\gamma}^2+16\mu \tau}<0 \)), and the market share corresponding to the poaching price decreases first and then increases (\( \frac{d\left({x}_1^b-{x}_0\right)}{d{x}_0}=\frac{-\left(-7{\gamma}^2+28\mu \tau \right)}{8\left(-{\gamma}^2+8\mu \tau \right)} \). When \( \gamma <2\sqrt{\mu \tau} \), the market share corresponding to the poaching price decreases; when \( 2\sqrt{\mu \tau}<\gamma \), the market share corresponding to the poaching price increases and the loyalty price increases and then decreases (\( \frac{d{g}_o^{\ast }}{d{x}_0}=\frac{\tau \left(-3{\gamma}^2+12\mu \tau \right)}{-2{\gamma}^2+16\mu \tau} \). Furthermore, when \( \gamma <2\sqrt{\mu \tau} \), loyalty prices increase, and when \( 2\sqrt{\mu \tau}<\gamma \), loyalty prices decrease, while the market share corresponding to the loyalty price increases (\( \frac{d{x}_1^g}{d{x}_0}=\frac{\left({\gamma}^2+20\mu \tau \right)}{8\left(-{\gamma}^2+8\mu \tau \right)}>0 \)). As a result, the profits of green retailers fluctuate within different ranges.

Conclusions

Considering that an increasing number of enterprises have been trying to increase profits by implementing BBP in recent years, this paper studies the pricing strategy of the GPSC when applying BBP. The main differences between our paper and the existing studies are as follows. First, when discussing the pricing strategy of the GPSC, the existing literature mostly adopts the unified pricing model. Additionally, the literature concerning the behavioural pricing of green products fails to consider the supply chain processes involved in moving products from raw materials to customers. However, this paper constructs a two-stage behavioural pricing model of the GPSC based on the dual preferences of consumers for product functional attributes and environmental attributes and analyses the conditions for the existence of a BBP balance in the GPSC. One contribution of this paper is combining GPSC with behavioural pricing. Second, after the implementation of BBP, this paper clarifies the impact of various factors related to the GPSC (initial market share of green products, sensitivity coefficient of greenness, cost coefficient of green degree) on the pricing strategy, green degree strategy, profit and environment of each enterprise in the GPSC. Therefore, another contribution of this paper is comprehensively considering the impact of green product related factors on the economic and environmental benefits of the supply chain under BBP.

The main conclusions of the study are as follows. (1) Under the BBP, as the initial market share of green products increases, when consumers’ green sensitivity is relatively low (\( \gamma <2\sqrt{\mu \tau} \)), green product retailers will increase the loyalty price of green products. When consumers' green sensitivity is relatively high (\( 2\sqrt{\mu \tau}<\gamma <\sqrt{8\mu \tau} \)), green retailers will lower the loyalty price of green products. (2) The wholesale price and sales price of green products (loyalty price and poaching price) are positively correlated with the sensitivity coefficient of greenness and negatively correlated with the cost coefficient of the green degree. (3) Consumers’ increasing attention to the greenness of products is conducive to improving the greenness of products, improving the environment, and bringing higher profits to green product manufacturers and retailers. (4) With the continuous expansion of the initial market of green products, the implementation of BBP will have a negative impact on the improvement in the product quality and the overall environment in the GPSC.

Through numerical experiments, we find that with the increase in the initial market shares of green products, the profits of nongreen product manufacturers’ first decrease and then increase, while the profits of green product manufacturers decrease and the profits of green product retailers present a trend of first decreasing, then increasing, then decreasing and then increasing again.

There are some limitations in our work. Our model considers only a supply chain composed of two manufacturers and one retailer. In the real world, however, supply chains may contain multiple enterprises. Therefore, one future research direction involves a supply chain of green or nongreen products that is composed of multiple enterprises. On the other hand, we can also consider a situation in which green and nongreen products are sold in multiple channels at the same time. In addition, given the increased government support for environmental protection, it would be interesting to discuss the pricing of green and nongreen products under government intervention. Additional factors include environmental barriers, green barriers, tariff barriers, etc., and the pricing and related decisions of supply chains of green and nongreen products, all of which can be considered in our future research.

Data availability

Not applicable.

References

Agi MAN, Yan X (2020) Greening products in a supply chain under market segmentation and different channel power structures. Int J Prod Econ 223:107523. https://doi.org/10.1016/j.ijpe.2019.107523

Agi MAN, Faramarzi-Oghani S, Hazır Ö (2020) Game theory-based models in green supply chain management: a review of the literature. Int J Prod Res 1–20:4736–4755. https://doi.org/10.1080/00207543.2020.1770893

Bansal S, Gangopadhyay S (2003) Tax/subsidy policies in the presence of environmentally aware consumers. J Environ Econ Manag 45:333–355. https://doi.org/10.1016/S0095-0696(02)00061-X

Chen D, Ignatius J, Sun D, Goh M, Zhan S (2020) Pricing and equity in cross-regional green supply chains. Eur J Oper Res 280:970–987. https://doi.org/10.1016/j.ejor.2019.07.059

Choe C, King S, Matsushima N (2017) Pricing with cookies: behavior-based price discrimination and spatial competition. Manag Sci 64:5669–5687. https://doi.org/10.1287/mnsc.2017.2873

Chung SH, Weaver RD, Friesz TL (2013) Strategic response to pollution taxes in supply chain networks: dynamic, spatial, and organizational dimensions. Eur J Oper Res 231:314–327. https://doi.org/10.1016/j.ejor.2013.05.036

Colombo S (2018) Behavior- and characteristic-based price discrimination. J Econ Manag Strateg 27:237–250. https://doi.org/10.1111/jems.12244

Dhir A, Sadiq M, Talwar S, Sakashita M, Kaur P (2021) Why do retail consumers buy green apparel? A knowledge-attitude-behaviour-context perspective. J Retail Consum Serv 59:102398. https://doi.org/10.1016/j.jretconser.2020.102398

Dilek H, Karaer Ö, Nadar E (2018) Retail location competition under carbon penalty. Eur J Oper Res 269:146–158. https://doi.org/10.1016/j.ejor.2017.10.060

Fudenberg D, Tirole J (2000) Customer poaching and brand switching. RAND J Econ 31:634–657. https://doi.org/10.2307/2696352

Fudenberg D, Villas-Boas JM (2006) Behavior-based price discrimination and customer recognition. In: Hendershott TJ (ed) Handbokon Economics and Information Systems. Elsevier, Oxford, pp 377–436

Fudenberg D, Villas-Boas JM (2012) Price discrimination in thedigital economy. In: Peitz M, Waldfogel J (eds) Oxford Handbookof the Digital Economy. Oxford University Press, Oxford, pp 1–30

Ghosh D, Shah J, Swami S (2020) Product greening and pricing strategies of firms under green sensitive consumer demand and environmental regulations. Ann Oper Res 290:491–520. https://doi.org/10.1007/s10479-018-2903-2

Giri RN, Mondal SK, Maiti M (2019) Government intervention on a competing supply chain with two green manufacturers and a retailer. Comput Ind Eng 128:104–121. https://doi.org/10.1016/j.cie.2018.12.030

Huang S, Fan ZP, Wang N (2020) Green subsidy modes and pricing strategy in a capital-constrained supply chain. Transport Res E-Log 136:101885. https://doi.org/10.1016/j.tre.2020.101885

Jamali MB, Rasti-Barzoki M (2018) A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J Clean Prod 170:1029–1043. https://doi.org/10.1016/j.jclepro.2017.09.181

Jian M, He H, Ma C, Wu Y, Yang H (2019) Reducing greenhouse gas emissions: a duopoly market pricing competition and cooperation under the carbon emissions cap. Environ Sci Pollut Res Int 26:16847–16854. https://doi.org/10.1007/s11356-017-8767-1

Jing B (2017) Behavior-based pricing, production efficiency, and quality differentiation. Manag Sci 63:2365–2376. https://doi.org/10.1287/mnsc.2016.2463

Karaer Ö, Kraft T, Khawam J (2017) Buyer and nonprofit levers to improve supplier environmental performance. Prod Oper Manag 26:1163–1190. https://doi.org/10.1111/poms.12612

Kellner F, Schneiderbauer M (2019) Further insights into the allocation of greenhouse gas emissions to shipments in road freight transportation: the pollution routing game. Eur J Oper Res 278:296–313. https://doi.org/10.1016/j.ejor.2019.04.007

Leggett A (2020) Bringing green food to the Chinese table: how civil society actors are changing consumer culture in China. J Consum Cult 20:83–101. https://doi.org/10.1177/1469540517729009

Li KJ, Jain S (2016) Behavior-based pricing: an analysis of the impact of peer-induced fairness. Manag Sci 62:2705–2721. https://doi.org/10.1287/mnsc.2015.2265

Li P, Rao C, Goh M, Yang Z (2021) Pricing strategies and profit coordination under a double echelon green supply chain. J Clean Prod 278:123694

Lin J, Fan R, Tan X, Zhu K (2021) Dynamic decision and coordination in a low-carbon supply chain considering the retailer's social preference. Socio Econ Plan Sci 101010. https://doi.org/10.1016/j.seps.2021.101010

Liu Y, Xiao T (2019) Pricing and collection rate decisions and reverse channel choice in a socially responsible supply chain with green consumers. IEEE Trans Eng Manag 67:483–495. https://doi.org/10.1109/TEM.2018.2887118

Liu K, Lan Y, Li W, Cao E (2019) Behavior-based pricing of organic and conventional agricultural products based on green subsidies. Sustainability 11:1151–1166. https://doi.org/10.3390/su11041151

Liu K, Lan Y, Li W (2020) Behavior-based pricing between organic and general food enterprises. Br Food J 122:107–121. https://doi.org/10.1108/BFJ-08-2018-0500

Rhee KE, Thomadsen R (2017) Behavior-based pricing in vertically differentiated industries. Manag Sci 63:2729–2740. https://doi.org/10.1287/mnsc.2016.2467

Sana SS (2020) Price competition between green and non green products under corporate social responsible firm. J Retail Consum Serv 55:102118. https://doi.org/10.1016/j.jretconser.2020.102118

Shaffer G, Zhang ZJ (1995) Competitive coupon targeting. Mark Sci 14:395–416. https://doi.org/10.1287/mksc.14.4.395

Shen B, Liu S, Zhang T, Choi TM (2019) Optimal advertising and pricing for new green products in the circular economy. J Clean Prod 233:314–327. https://doi.org/10.1016/j.jclepro.2019.06.022

Shiller BR (2014) First Degree Price Discrimination Using Big Data. Working Paper. Department of Economics, Brandeis University, Waltham

Sun Y, Liu N, Zhao M (2019) Factors and mechanisms affecting green consumption in China: a multilevel analysis. J Clean Prod 209:481–493. https://doi.org/10.1016/j.jclepro.2018.10.241

Wang Y, Hazen BT (2016) Consumer product knowledge and intention to purchase remanufactured products. Int J Prod Econ 181:460–469. https://doi.org/10.1016/j.ijpe.2015.08.031

Wang X, Ng CT (2018) New retail versus traditional retail in e-commerce: channel establishment, price competition, and consumer recognition. Ann Oper Res 291:921–937. https://doi.org/10.1007/s10479-018-2994-9

Wang J, Fan X, Zhang T (2020) Behaviour-based pricing and wholesaling contracting under supply chain competition. J Oper Res Soc:1–17. https://doi.org/10.1080/01605682.2020.1750310

Xu M, Tang W, Zhou C (2020) Price discrimination based on purchase behavior and service cost in competitive channels. Soft Comput 24:2567–2588. https://doi.org/10.1007/s00500-019-03760-7

Yang H, Luo J, Wang H (2017) The role of revenue sharing and first-mover advantage in emission abatement with carbon tax and consumer environmental awareness. Int J Prod Econ 193:691–702. https://doi.org/10.1016/j.ijpe.2017.08.032

Zhang J (2011) The perils of behavior-based personalization. Mark Sci 30:170–186. https://doi.org/10.1287/mksc.1100.0607

Acknowledgements

The authors thank the editor and anonymous reviewers for their constructive comments.

Funding

This study was partially supported by the National Natural Science Foundation of China (71971078; 71601074) and Natural Science Foundation of Hunan Province (2019JJ40042).

Author information

Authors and Affiliations

Contributions

Conceptualisation and methodology: Kanying Liu and Wei Li; software: Kanying Liu; validation: Kanying Liu and Yong Lan; writing: Kanying Liu, Wei Li, Erbao Cao and Yong Lan

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of equilibrium results in Table 3: First, Eqs. (1) and (2) are substituted into the profit function of nongreen product manufacturer πMb, the poaching price and loyalty price at maximum πMb are solved, and simultaneous equations are established \( \left\{\begin{array}{c}\frac{d{\pi}_{Mb}}{d{b}_n}=0\\ {}\frac{d{\pi}_{Mb}}{d{b}_o}=0\end{array}\right. \). Solving the equations, you get \( \left\{\begin{array}{c}{b}_n=\frac{g_o}{2}-\frac{\tau }{2}-\frac{\gamma \theta}{2}+\tau {x}_0\kern0.5em \\ {}{b}_o=\frac{g_n}{2}+\frac{\tau }{2}-\frac{\gamma \theta}{2}\end{array}\right. \). The expressions of bn and bo regarding go and gn are substituted into the profit functions of Eqs. (1) and (2) and green product retailer πRg, and the poaching price and loyalty price when πRg is maximum are solved to obtain \( \left\{\begin{array}{c}{g}_n=\frac{3\tau }{2}+\frac{w_g}{2}+\frac{\gamma \theta}{2}-2\tau {x}_0\\ {}{g}_o=\frac{\tau }{2}+\frac{w_g}{2}+\frac{\gamma \theta}{2}+\tau {x}_0\end{array}\right. \). Then, go and gn are substituted into bn and bo and Eqs. (1) and (2). Then, the wholesale price and greenness of green product manufacturer πMg at the maximum can be obtained to obtain \( \left\{\begin{array}{c}{w}_g^{\ast }=\frac{8\mu {\tau}^2-4\mu {\tau}^2{x}_0}{-{\gamma}^2+8\mu \tau}\\ {}{\theta}^{\ast }=\frac{2\gamma \tau -\gamma \tau {x}_0}{-{\gamma}^2+8\mu \tau}\end{array}\right. \). Further, other equilibrium results in Table 3 can be obtained.

Proof of Lemma 1

According to assumption 4, to ensure the validity of the solution, that is, \( {g}_i^{\ast }>{w}_g^{\ast }>0,{b}_i^{\ast }>0,{w}_g^{\ast }{q}_g^{\ast }>{C}_g \),

If Eq. (A.5) is true, then −γ2 + 8μτ > 0 must be satisfied. Eq. (A.1) can be simplified to \( \frac{\tau \left(-3{\gamma}^2{x}_0+{\gamma}^2+20\mu \tau {x}_0\right)}{-2{\gamma}^2+16\mu \tau}>0 \), and this formula is always true when x0 ∈ (0, 1).

According to Eq. (A.2), (1 − 3x0)γ2 < 4μτ(4 − 7x0). At this time, if \( {x}_0<\frac{1}{3} \), then \( {\gamma}^2<\frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)} \); if \( {x}_0>\frac{1}{3} \), then \( {\gamma}^2>\frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)} \). Otherwise, the wholesale price of green products will be higher than the retail price (poaching price), and green retailers will lose money.

According to Eq. (A.3), \( {\gamma}^2<\frac{44\mu \tau}{\left(5{x}_0+1\right)} \). According to Eq. (A.4), \( {\gamma}^2<\frac{12\mu \tau \left(4-3{x}_0\right)}{\left(7-5{x}_0\right)} \), and when x0 ∈ (0, 1), \( \frac{44\mu \tau}{\left(5{x}_0+1\right)}>0 \), \( \frac{12\mu \tau \left(4-3{x}_0\right)}{\left(7-5{x}_0\right)}>0 \) are always true.

So when \( {x}_0<\frac{1}{3} \), \( {\gamma}^2<\mathit{\min}\left(\frac{44\mu \tau {x}_0}{\left(5{x}_0+1\right)},\frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)},\frac{12\mu \tau \left(4-3{x}_0\right)}{\left(7-5{x}_0\right)}\right) \). By comparison, it can be seen that when \( \frac{44\mu \tau {x}_0}{\left(5{x}_0+1\right)} \) is the least in the interval, then \( \gamma <\sqrt{\frac{44\mu \tau {x}_0}{\left(5{x}_0+1\right)}} \); when \( {x}_0>\frac{1}{3} \), \( {\gamma}^2>\frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)} \), but \( \frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)} \) is less than 0 in \( {x}_0\in \left(\frac{1}{3},\right.\left.\frac{4}{7}\right) \), and by comparison, we know that when \( {x}_0\in \left(\left.\frac{1}{3},\frac{3}{5}\right)\right. \), \( \frac{44\mu \tau}{\left(5{x}_0+1\right)}<\frac{12\mu \tau \left(4-3{x}_0\right)}{\left(7-5{x}_0\right)} \). Thus, when \( {x}_0\in \left(0,\right.\left.\frac{4}{7}\right] \), \( 0<\gamma <\sqrt{\frac{44\mu \tau {x}_0}{\left(5{x}_0+1\right)}} \). When \( {x}_0>\frac{4}{7} \), \( \frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)}>0 \), and when \( {x}_0\in \left(\left.\frac{4}{7},\frac{3}{5}\right)\right. \), \( \frac{44\mu \tau}{\left(5{x}_0+1\right)}<\frac{12\mu \tau \left(4-3{x}_0\right)}{\left(7-5{x}_0\right)} \), then \( {x}_0\in \left[\frac{3}{5}\right.,\left.1\right) \), \( \frac{12\mu \tau \left(4-3{x}_0\right)}{\left(7-5{x}_0\right)}<\frac{44\mu \tau}{\left(5{x}_0+1\right)} \). Thus, when \( \frac{4}{7}<{x}_0<\frac{3}{5} \), \( \frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)}<{\gamma}^2<\frac{44\mu \tau}{\left(5{x}_0+1\right)} \); when \( \frac{3}{5}<{x}_0<1 \), \( \frac{4\mu \tau \left(4-7{x}_0\right)}{\left(1-3{x}_0\right)}<{\gamma}^2<\frac{12\mu \tau \left(4-3{x}_0\right)}{\left(7-5{x}_0\right)} \), lemma 1 is proven.

Rights and permissions

About this article

Cite this article

Liu, ., Li, W., Cao, E. et al. A behaviour-based pricing model of the green product supply chain. Environ Sci Pollut Res 28, 65923–65934 (2021). https://doi.org/10.1007/s11356-021-15659-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15659-8