Abstract

This study analyzes the effects of credit constraints on technical efficiency of Boro rice growers in the district of Pabna in Bangladesh. Using a simple random sampling technique, the data was collected from 570 Boro rice growers from the Pabna district of Bangladesh. Before conducting a field survey, a theoretical model was designed to identify credit-constrained and non-constrained rice growers. We have analyzed the collected data in two phases: first, we investigated the technical efficiency of Boro rice growers using the stochastic frontier model (SFA); and second, we used an inefficiency effect model to estimate the influence of credit constraints on technical efficiency. Findings indicate that credit-constrained rice growers (CCRG) are 6.7% less technically efficient than credit non-constrained rice growers (CNRG). Findings further indicate that the education level of the household head, family size, certified seed, sowing time, access to extension services, off-farm income, and household savings have significant effects on the technical efficiency of both groups of rice growers. Furthermore, credit size has a significantly positive impact, whereas the interest rate imposed on the principal amount has a significantly negative impact.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Adequate access to credit is considered as a comprehensive tool for agricultural growth and rural development (Li et al. 2016; Lin et al. 2019; Amanullah et al. 2020). In recent years, the capital requirements of the farming communities, on the one hand, have increased tremendously. On the other hand, formal financial institutions are reluctant to allocate funds for agriculture, considering the nature of uncertainties in this sector (Arshad et al. 2017a, b). Farmers in developing countries heavily depend on formal and informal credit sectors due to insufficient savings. The production and financial structure theory note that if financially constrained farm households have opportunities to get credit, overall productivity performance can be enhanced (Elahi et al. 2018).

Existing literature (von Cramon-Taubadel and Saldias 2014; Chandio et al. 2019; Attipoe et al. 2020; Ekinci and Omay 2020; Long et al. 2020; Kattel et al. 2020) has posited that farmers’ credit constraints along with environmental factors influence farmers’ performance in different ways and may decrease farm productivity. In developing countries, the financial market is fragmented. Its failure arises from asymmetric information, the influence of informal lenders, strict terms and conditions of loan disbursement, controlled monitoring, etc. (Bhattacharya et al. 2020). Although globally, financial experts are working on sustainable rural development programs by offering different financial services on subsidized rates; real farming communities in most of the developing countries are deprived of adequate access to formal credit (Dong et al. 2012; Li et al. 2018; Jin et al. 2019; Ma et al. 2019; Cao and Leung 2020; Okoruwa et al. 2020).

The present rural financial market in Bangladesh is highly imperfect, mainly impacted by knowledge scarcity, information complexity, restricting credit volumes, monitoring, non-performing portfolio ratios (NPPs), and most importantly, stimulating private money lenders. In addition, loan applicants have to provide several kinds of legal and supporting documents depending on the amount of the loan and the cash facility the borrowers are requested to avail (Ma et al. 2019). These hurdles create a rigorous credit environment which may result in low agricultural productivity (Bashir and Mehmood 2010; Mehmood et al. 2018).

Bangladesh is the fourth largest rice producer (Roy et al. 2014) and the third-largest rice consumer in the world (Shew et al. 2019). Rice farming employs 48% of the total labor force and contributes 70% to the national agricultural gross domestic product (GDP). According to an estimate, around 13 million farmers in Bangladesh grow the rice crop that covers around 10 million hectares of land (Hossain et al. 2012). Farmers usually grow three varieties of rice, i.e., Aus, Amon, and Boro, and among these three varieties, 42% of the rice growers grow the Boro variety (Hasnain et al. 2016). Boro rice is widely known as an irrigated rice crop planted during December and early February and harvested during the dry season between April and June. Compared to other rice varieties, Boro rice contributes the highest production, at 4.03 t/ha (BER 2019), but this is much lower than other Asian countries, like Japan, Indonesia, Vietnam, China, and South Korea. In Vietnam, the average rice production is 5.63 t/ha, Thailand 3.0 t/ha, India 3.59 t/ha, and Bangladesh 2.93 t/ha (FAO 2012). This lower production compared to other Asian players indicates a massive economic loss. To enhance productivity and ensure food security, it is significantly important to understand how to allocate the resources and increase farm efficiency technically and develop a new production technique to reduce costs and maximize resource utilization (Charnes et al. 1978; Fatemi and Atefatdoost 2020; Kumar et al. 2020; Li et al. 2020). This is the reason why a study on technical efficiency of rice growers will be of great significance toward increasing overall farm efficiency.

Despite the significant contribution of rice crops to national GDP, Bangladesh’s farming community is facing several challenges, like lack of advanced production technologies, shortage of water, poor soil salinity, and insect or pest attack (Ahmed et al. 2021; Rana and Moniruzzaman 2021; Sarkar et al. 2021). The annual rice production statistics in Bangladesh show that the industry is still in its embryonic stage. Nonetheless, there is a significant gap between rice demand and supply in Bangladesh and this gap is widening at an alarming rate (Timsina et al. 2018; Shew et al. 2019). This existing disequilibrium in the rice market can be reduced if the government focuses on the financial issues, controls the farm input prices, and implements effective policies and regulations. Mehmood et al. (2018) and Zhao and Barry (2014) evinced that credit constraints restrict farmers from purchasing key inputs that indirectly can affect farm productivity.

Credit constraints could have both direct and indirect impacts: directly, they can influence farmers’ purchasing ability; and indirectly, they can affect farmers’ risk averting behavior that restricts them from taking risks, such as investment in advanced technologies (Boucher et al. 2008; Diana et al. 2010; Shew et al. 2019; Duong and Thanh 2019; Carrer et al. 2020; Kattel et al. 2020). Thus, farmers with insufficient funds or who are financially constrained have not been able to achieve the maximum production level. Like in other developing countries, in Bangladesh, farmers are trapped in a vicious cycle of poverty and debt. From one aspect, they need finance to help them purchase basic farm inputs (Bidisha et al. 2018; Long et al. 2020), while on the other, financial institutions are reluctant to disburse the loan to them, considering the risks involved in the agriculture sector (Arshad et al. 2017b; Mehmood et al. 2017).

In most cases, financial institutions reject loan applications or disburse lesser amounts than requested. Financial institutions in rural Bangladesh evaluate farmers’ net worth, years of experience, property they offer as mortgage, their loan history, etc. If farmers fulfill all these requirements, banks approve loans at different interest rates by applying an equity ratio.

To the best of the authors’ knowledge, very few studies are available on credit constraints and the technical efficiency of rice growers in Bangladesh, while the available studies have ignored several key variables in the empirical analysis. So far, extant studies have addressed several issues and analyzed both demand-side credit constraints and supply-side credit constraints. Moreover, these studies have ignored the impact of diversified income sources on the technical efficiency of rice growers. Thus, we identified all these gaps and evaluated the farm households’ technical efficiency by considering demand and supply-side credit constraints. Following the method of several researchers (Komicha and Öhlmer 2008; Cabrera et al. 2010; Koirala et al. 2013; Haryanto et al. 2016), we used the stochastic frontier model (SFA) and inefficiency effects model to analyze rice growers’ technical efficiency. Considering the importance of technical efficiency and farmers’ credit constraints, we mainly addressed two questions:

-

a)

Do credit constraints affect the technical sefficiency of Boro rice growers?

-

b)

Does access to credit affect the technical efficiency of Boro rice farmers?

A theoretical framework to identify credit-constrained households

Prior to the field survey, the authors designed a theoretical framework and identified credit constrained and credit non-constrained rice growers (see Fig. 1). The issues of credit constraints appear from both supply and demand-sides as noted by scholars (Boucher et al. 2008; Diana et al. 2010; Chiu et al. 2014; Mehmood et al. 2017; Beyhaghi et al. 2020). The demand-side credit constraints arise from inadequate household income, past bad credit records, absence of collateral and guarantee, etc. In contrast, supply-side credit constraints arise when lenders offer insufficient loans to household farmers (Mehmood et al. 2017). If the loan provider recognizes that the farmers will be incapable of repaying the principal or the interest, there is a huge chance that the loan application will be rejected. These fundamental factors take preference when financial markets are imperfect or interest rates are exceptionally high (Jana 2015). Particularly, we identified credit constraints by focusing on the non-price restricting mechanism, which could arise in two situations. Firstly, the farm households which applied for a loan at current interest rates but were rejected by the financial institutions; and secondly, farm households do not want to borrow due to various risks and demand crises (Beyhaghi et al. 2020).

Based on the theoretical model, if the rice growers received the total amount as requested from the financial institutions, they were classified as credit non-constrained rice growers (CNRG), and if they received a partial amount or their loan applications were rejected by the financial institutions, they were classified as credit-constrained rice growers (CCRG). It was also hypothesized that if farmers received the total amount from the financial institutions as requested, they would have been in a position to purchase farm inputs and invest in advanced technologies that result in higher efficiency. On the contrary, farmers who did not receive a sufficient fund would not have been able to access the maximum inputs for production, thus resulting in lower efficiency. Fig. 1 also shows that farmers who rely on credit are split into two groups: (1) farmers who have not applied for credit; and (2) farmers who have applied for credit. Farmers who have not applied for credit could have been due to several reasons, including risk rationing and cost operation rationing as a result of risk aversion or some other reasons (Diana et al. 2010; Zhao and Barry 2014; Bond et al. 2015; Kjenstad et al. 2015; Beyhaghi et al. 2020; Galema 2020; Long et al. 2020). Boro rice growers who applied for credit are divided into three subcategories: (i) Farmers who applied for credit and were granted the full amount (as they had submitted all the requirements and in-demand and supply-sides show there is no presence of quantity rationing) are known as CNRG; (ii) farmers whose applications were not accepted for a reasonable sum of credit (i.e., less than 100%), and some of them were rejected directly; and (iii) some farmers applied for the credit by contacting private lenders directly, and most of them managed to get the loan, although some farmers have not received the loan. The situation of quantity rationing usually arises from asymmetric information (Zhao and Barry 2014). Finally, the authors identified three categories of farmers: (i) credit-constrained farmers; (ii) credit non-constrained farmers; and (iii) farmers who have not applied for credit because of sufficient funds. Notably, the last category was excluded from the dataset.

Materials and methods

Study population and place

The study was conducted in the District of Pabna in Bangladesh. The Pabna District is located in the southeast boundary of the Rajshahi Division. Its temperature ranges from 9.6 to 36.8 °C, with an annual rainfall of 1872 mm. The soil of the district is highly fertile and divided into four categories: the flood plains of the Baring Tracts, Karatoya, Ganges, and Jamuna. This district was selected as the scope of the study, considering its share in the national agricultural GDP, i.e., around 15%. Moreover, the selection of rice crops was based on two primary reasons: firstly, rice is the leading food crop in Bangladesh; and secondly, in the agriculture industry, rice contributes around 70% of the added value.

Survey design and data collection

A simple random sampling technique was adopted and 570 rice growers from 10 Union Councils of Pabna District were selected (Fig. 2). A pilot survey was conducted and information from 50 farm households was collected using a pre-tested and well-structured questionnaire. Necessary amendments were made to the questionnaire before conducting the final field survey. The farm households were identified as credit constrained and credit non-constrained using a direct elicitation approach.

Notably, farm households who had neither applied for a loan nor faced credit issues in both categories were removed from the database because their loan demand from financial institutions was zero. A list of rice growers was obtained from the Agricultural Department of Bangladesh, and a total of 597 rice growers were interviewed. The total response rate was 96%, while 4% of respondents were unavailable or refused to provide the information. Thus, the total sample size is 570, including 200 CNRG and 370 CCRG.

Econometric estimation

Stochastic frontier analysis

The SFA, developed by Aigner et al. (1977), was used to analyze the technical efficiency of rice growers. This model has been widely used in earlier studies (Tipi et al. 2009; Cabrera et al. 2010; Heriqbaldi et al. 2015; Bhattacharyya and Mandal 2016; Hasnain et al. 2016). The basic equation is given below:

In Eq. (1), Yi represents the expected output of ith rice growers, Xi denotes an observed function of inputs or descriptive variables, while (Xi; β) specifies the framework’s production frontier. The random deviation of output is known as vi, which is an asymmetric random error and measured empirically as N \( \left(0,{\upsigma}_{\mathrm{v}}^2\ \right) \), while (ui) denotes a set of non-negative random variables allied with the inefficiency model for rice growers in production with a mean (u) variance (\( {\upsigma}_{\upmu}^2 \)) (which is \( \mid \mathrm{N}\ \Big(\mathrm{u},{\upsigma}_{\mathrm{u}}^2\mid \)), as well as treated as a half-normal distribution (Kumbhakar and Lovell 2000). The variance constraints of the framework are σ2= \( {\upsigma}_{\mathrm{v}}^2 \)+\( {\upsigma}_{\upmu}^2; \) λ= \( \raisebox{1ex}{${\upsigma}_{\upmu}^2$}\!\left/ \!\raisebox{-1ex}{${\upsigma}^2$}\right. \) and 0 ≤ λ ≤ 1. Considering the distribution assumption of variance (vi) and (ui), we generated an assessment of (ui), from its restrictive probability by generating the standard integral:

In Eq. (2),\( {\mathrm{u}}_{\mathrm{i}}^{\ast }=\left(\mathrm{u}{\upsigma}_{\mathrm{v}}^2+{\upvarepsilon}_{\mathrm{i}}{\upsigma}_{\upmu}^2\right)/{\upsigma}_{\mathrm{v}}^2+{\upsigma}_{\upmu}^2\Big) \),

\( {\sigma}_v^{\ast 2} \)≡\( {\sigma}_v^2{\sigma}_u^2 \)/ (\( {\sigma}_v^2+{\sigma}_u^2\Big) \) and ɸ (.) and ɸ(.) denote accumulative distribution and likelihood density functions. We obtained the value of variance from Eq. (1), (vi) and (ui) by swapping the estimation of εiσi and l, which is associated with output-related (TEi) of ith Boro rice growers. The output level is explained as the proportion of perceived output to uppermost attainable production, symbolized by exp − vi and expressed as follows:

The distribution of (ui) from Eq. (3) confined the estimated TE of Boro rice growers between 0 and 1. Therefore, we obtained the efficiency score from diverse groups of rice growers for our study. We defined it as1 − exp {(−ui| εi)}. Besides, we treated it as a dependent variable whereas assessing inefficiency models (CNRG, CCRG and total sample). Finally, to assess the TE of rice growers, the overall form of the SFA framework is mentioned below:

where the aggregate output for the rice growers is Yi, measured in kilograms, and Xij is the selected input variables explained as farmland area, cost of seedling, farm labor cost, the cost of fertilizer application, cost of pesticides, irrigation cost (as stated earlier); the β0 are the coefficients of descriptive variables that need to be projected and (vi) and (ui) have already been explained in Eq. 1.

In the second stage of the unified analysis, the authors applied the inefficiency effects model to determine the technical efficiency of rice growers. Battese and Coelli (1995) extended the work of Aigner et al. (1977) and introduced the inefficiency effects model with the SFA. We used the inefficiency effects model by applying the maximum likelihood estimation method.

In Eq. (5), IEi represents the inefficiency scores, in which Zi is a vector of designated variables that impacts inefficiency within different classified groups of Boro rice growers, and ƞi is a random error term in the database set, which is distributed with a zero mean and variance normally and independently.

Data description

The dependent variable Yi was measured as a total yield for ith rice growers in a cropping session on a per-acre basis (measured in kilograms). Six independent variables were included in the model to measure technical efficiency (TE). These include farmland area X1 indicating the total area used to cultivate the rice crop (measured in acres); cost of seedling X2 indicates the cost of seed-applied on acre basis (analyzed in per 100 bundles); farm labor cost X3 reflects the required typical number (No.) of labor (equal to the adult male) during the cropping session; the cost of fertilizer used X4 is the cost of fertilizer used on an acre (as analyzed in kilograms), that is, urea and potash; cost of pesticides X5 used for plant protection procedures indicates the aggregate application of pesticides, weedicides, etc., in a cropping season (analyzed in kilograms); irrigation cost X6 symbolizes the cost of irrigation in a cropping season analyzed in number on an acre basis. Descriptive statistics related to outputs and input variables were chosen for technical efficiency analysis are portrayed in Annexure 4 in the Appendix.

In the second stage, the inefficiency effects model was used to estimate the determinants of farmers’ technical efficiency. The variable age of the household head Z1 represents the total age of the household head (estimated in years); Z2 represents the schooling level of the head of household (measured in years); household size Z3 represents the household family size (estimated as total number of family members in a household); seed quality Z4 is the dummy variable which stands for certified seed (if certified seed is used, then 1, otherwise, 0); Z5 represents the dummy variable for the time of seed sowing (if the rice seed is sown in time, then 1, otherwise, 0); as a dummy variable, Z6 is for own tube-well (if tube-well is owned, then 1, otherwise, 0); access to extension services, Z7 is represented as a dummy variable (if taken extension services facility, then 1, otherwise, 0); for livestock, Z8 is represented as a dummy variable (if own livestock, then 1, otherwise, 0); for off-farm income, Z9 is represented as a dummy variable (if there is opportunity for off-farm earning option, then 1, otherwise, 0); Z10 is chosen as a dummy variable for the household head’s annual savings (projected in 1000 BDT); Z11 is represented as a dummy for credit size (calculated in 1000 BDT); Z12 is chosen as a dummy variable for the interest rate imposed on the loan amount (calculated in percentage); Z13 reflects credit availability as a dummy variable (if yes=1; otherwise=0). Descriptive statistics of all explanatory variables used in the inefficiency effects model are presented in Annexure 5 in the Appendix.

Results and discussion

Maximum likelihood estimates of the production frontier

The results show that for both CNRG and CCRG, the coefficients of farmland area variables are 0.028 and 0.093, respectively (see Table 1). This coefficient value explains that 1% increase in the unit of farmland area results in an estimated increase in the Boro rice yield by 0.02% for the CNRG and 0.09% for CCRG. For cost of seedling, we find the highest input consequence on Boro rice production, and the calculated elasticities are 0.60 for CNRG and 0.454 for CCRG. One reason for this is that most farmers in the study area used better quality seed for the Boro rice cultivation, which significantly and positively patronage Boro rice yield. The CCRG farm labor cost coefficient value is 0.042 and significant at the 5% level of probability. The coefficient values of the cost of fertilizer for CNRG and CCRG are 0.119 and 0.141, respectively. CNRG and CCRG, respectively, have 0.090 and 0.058 coefficients for the cost of pesticides values. For CNRG, the coefficient value of the irrigation cost is 0.060 and significant at the 5% level of probability, while for CCRG, the same coefficient value is insignificant.

Scale effect

The scale elasticity shows declining returns to scale (DRS) in all our models. The calculated figure of the scale effect is lesser than one. It indicates no significant connection between the farm inputs and the amount of products produced for the sample of Boro rice growers. This study indicates that farmers in the surveyed areas might not be managing their land effectively or introducing appropriate innovation. We successfully proved that farm households, at least by statute, have obtained enough income to afford their most basic needs or requirements. This study indicates that farm households’ productivity can be improved by capacity building rather than by expanding their size.

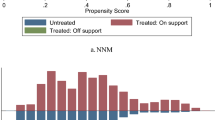

Range of technical efficiency

The results show that the mean technical efficiency of CNRG is 88.76% and 82.06% for CCRG (Table 2). The difference in the mean technical efficiency is 6.70%, which indicates technical efficiency gaps between CNRG and CCRG. Therefore, in both cases, the rice growers can increase the efficiency level by 11.24% for CNRG and 17.94% for CCRG, by employing their existing level of resources. Findings further show that around 75% of CNRG and 46% of CCRG attained more than 80% of technical efficiency scores. Findings are in line with the studies by Min et al. (2020) and Wang et al. (2020), who obtained technical efficiency scores of 88.76% for CNRG and 82.06% for CCRG in China. Findings also support the earlier studies of Balcombe et al. (2007) and Jalilov et al. (2019) conducted in Bangladesh. Furthermore, in South Asia, technical efficiency ranged from 0.82 to 0.97% (Bibi et al. 2020).

Technical inefficiency effects estimate

Table 3 presents the factors affecting the technical inefficiency of rice growers. Following the methods of Cabrera et al. (2010) and Mehmood et al. (2017), the authors explained the findings of the inefficiency effects model concerning technical efficiency. This indicates that a negative impact on technical inefficiency has a positive impact on technical efficiency.

The calculated parameters suggest that household’s head age (considered as agricultural farming experience) has a significant but negative effect on CNRG. The negative sign signifies that old farmers in the area surveyed are less productive than their younger counterparts. The coefficients of the education level in both groups of growers are positive and significant, but the impact seems stronger on CNRG. Komicha and Öhlmer (2008) noted that education, as a source of human capital, improves management efficiency and increases farmers’ understanding on handling complex issues, like loan acquisition. The coefficient of household size is significant and positive for both groups of growers. This indicates that the technical efficiency of growers increases with increases in household size. This may be due to the fact that more family members are involved in farming practices and help farmers to manage farm activities.

The coefficients of certified seed for both CNRG and CCRG are positive and significant. Findings evince that the seed can generate higher output if it is sowed on time. These results concur with Musaba and Bwacha’s (2014) analytical work. The coefficient of own irrigation system for CCRG is significant at 10% probability level, with a positive impact on rice producers’ technical efficiency, while for CNRG, it is vice versa and insignificant. The presence of severe electricity issues in rural areas of Bangladesh is always a challenge, and diesel and petrol prices are extremely costly. As a result, most farmers in rural areas rely on external irrigation sources. Therefore, logically, we should not conclude that the CNRG community of rice growers with their irrigation system are less efficient than those who did not.

Awareness of the role of production and proper distribution is vital to accelerate the current level of productivity at the farm level, as well as to impact the growth of the agricultural sector (Das et al. 2017). The value of the extension services coefficient for both CNRG and CCRG is positive and significant, which indicates the success of Bangladesh’s agricultural development corporation (Afrad et al. 2019). Similarly, the wing of traction facilities and the availability of compost for livestock agriculture in rural Bangladesh have greatly improved farmers’ productivity and helped minimize overall production costs. The coefficient value of livestock is significant and positive for CNRG, pointing out that those who have livestock facilities are typically more efficient than other farmers.

Diversified sources of income play a role as a benchmark for pull or push factors (Escobal 2001; Mariyono 2018) among farm households. Diversified income sources in rural Bangladesh are not substantially seen or very limited due to many factors, such as demographic characteristics, lack of sufficient credit facilities, and lack of technical personnel (Reardon et al. 2000; Kabir et al. 2019; Kabir et al. 2020). According to our results, the value of off-farm income coefficients is significant and positive for both the CNRG and CCRG categories. These results are somewhat similar to Tipi et al.’s (2009) work. Furthermore, the household saving coefficients for both the CNRG and CCRG classes are positive and significant at 5% probability level, suggesting a greater efficiency for households with comparatively higher savings potential.

The credit size indicator has a significant and positive effect on both the CNRG and CCRG categories. The influence of the volume of credit can be easily seen in two separate ways. Initially, increasing the volume of credit would positively affect farm households to implement advanced technologies and help to distribute their resources rationally. Furthermore, it is possible to condense the size of the loan per unit cost of service. At the same time, certain expenses are systemic at the time of loan disbursement (e.g., hiring counsel, third party assessment, mortgage payments), irrespective of the amount of credit. In comparison, the principal interest charges have a major detrimental impact on the technical efficiency of both the CNRG and CCRG classes. (Drehmann et al. 2010; Mallick 2012), showing that higher interest rates are levied by financial institutions in rural Bangladesh, mostly due to credit delinquency.

In a nutshell, the full sample parameter evaluation is close to that of CNRG and CCRG to some degree (see Table 3). The primary objective of the study is to assess the effect of credit constraints on growers’ technical efficiency. After reviewing several studies (Komicha and Öhlmer 2008; Afrin et al. 2017; Bidisha et al. 2018), we examined credit availability as a dummy variable (as mentioned earlier). The availability of credit (as a dummy) determines its effect on technical efficiency, but credit constraints were assessed using the direct elicitation process. Generally speaking, the finding shows that the availability of credit has a substantially positive impact on the technical efficiency of Boro rice farmers. In comparison to the hypothesis of economic experts, who believed that the monetary market in rural Bangladesh does not make a major contribution to improving the livelihood of the rural poor, the results of our study are in tandem with the work carried out by Ayaz et al. (2010) and Kabir et al. (2020). However, risk reluctance mechanisms at the household level must be dramatically reduced by offering subsidy insurance premiums, as indicated by Arshad et al. (2016) and Tuihedur Rahman et al. (2018).

Conclusions and policy implications

The effect of credit constraints on the technical efficiency of rice growers was analyzed using cross-sectional data collected from the district of Pabna in Bangladesh. The authors used the technique of direct elicitation and identified rice growers into two categories: CCRG and CNRG. A simple random sampling was adopted and 570 farm households were recruited to get the necessary information. The technical efficiency of rice growers was estimated using the SFA. The mean technical efficiency of CNRG is 88.76% and CCRG is 82.06%. This indicates that in the area surveyed, CNRG and CCRG, in principle, could increase their technical efficiency by 11.24% and 17.94%, respectively. The difference between the technical efficiency scores of CNRG and CCRG is 6.70%.

Moreover, findings of the inefficiency effects model show that the technical efficiency of both groups of rice growers is affected by the years of schooling, the size of household, sowing time, extension facilities, off-farm income, and savings of the household head. The variable of credit size is positive, and the interest rates on the principal amount have significantly negative effects on the technical efficiency of rice growers. Access to credit on the technical efficiency of farm households is significant and positive. However, while our research reveals a very strong effect of the availability of credit on the technical efficiency of Boro rice farmers, one issue is quite mysterious as to why perfection does not exist in the rural financial market as well as poverty has not been substantially reduced in rural agricultural communities in Bangladesh and elsewhere in low-income nations.

Our findings signify that access to formal credit help can minimize the households’ financial constraints and allow them to purchase farm inputs. Therefore, the government and private financial organizations should simplify the loan procedure and reduce the interest rate for agriculture businesses. Moreover, the government must increase the per acre credit limit, considering the financial requirements and input costs. Financial institutions should also open their branches in remote areas of Pabna District to facilitate farmers that would in turn increase their loan portfolio.

Data availability

All data and materials will be available based on reviewer request.

References

Afrad SI, Wadud F, Babu SC (2019) Reforms in agricultural extension service system in Bangladesh. In: Agricultural Extension Reforms in South Asia, pp 13–40. https://doi.org/10.1016/b978-0-12-818752-4.00002-3

Afrin S, Haider MZ, Islam MS (2017) Impact of financial inclusion on technical efficiency of paddy farmers in Bangladesh. Agric Financ Rev 77:484–505. https://doi.org/10.1108/AFR-06-2016-0058

Ahmed Z, Guha GS, Shew AM, Alam GMM (2021) Climate change risk perceptions and agricultural adaptation strategies in vulnerable riverine char islands of Bangladesh. Land Use Policy 103:1–10. https://doi.org/10.1016/j.landusepol.2021.105295

Aigner D, Lovell CAK, Schmidt P (1977) Formulation and estimation of stochastic frontier production function models. J Econ 6:21–37. https://doi.org/10.1016/0304-4076(77)90052-5

Amanullah, Lakhan GR, Channa SA et al (2020) Credit constraints and rural farmers’ welfare in an agrarian economy. Heliyon 6:e05252. https://doi.org/10.1016/j.heliyon.2020.e05252

Arshad M, Amjath-Babu TS, Kächele H, Müller K (2016) What drives the willingness to pay for crop insurance against extreme weather events (flood and drought) in Pakistan? A hypothetical market approach. Clim Dev 8:234–244. https://doi.org/10.1080/17565529.2015.1034232

Arshad M, Amjath-Babu TS, Krupnik TJ, Aravindakshan S, Abbas A, Kächele H, Müller K (2017a) Climate variability and yield risk in South Asia’s rice–wheat systems: emerging evidence from Pakistan. Paddy Water Environ 15:249–261. https://doi.org/10.1007/s10333-016-0544-0

Arshad M, Kächele H, Krupnik TJ, Amjath-Babu TS, Aravindakshan S, Abbas A, Mehmood Y, Müller K (2017b) Climate variability, farmland value, and farmers’ perceptions of climate change: implications for adaptation in rural Pakistan. Int J Sustain Dev World Ecol 24:532–544. https://doi.org/10.1080/13504509.2016.1254689

Attipoe SG, Jianmin C, Opoku-Kwanowaa Y, Ohene-Sefa F (2020) The determinants of technical efficiency of cocoa production in Ghana: an analysis of the role of rural and community banks. Sustain Prod Consum 23:11–20. https://doi.org/10.1016/j.spc.2020.04.001

Ayaz S, Hussain Z, Sial MH (2010) Role of credit on production efficiency of farming sector in Pakistan (A Data Envelopment Analysis). World Acad Sci Eng Technol 42:1028–1033

Balcombe K, Fraser I, Rahman M, Smith L (2007) Examining the technical efficiency of rice producers in Bangladesh. J Int Dev 19:1–16. https://doi.org/10.1002/jid.1284

Bashir MK, Mehmood Y (2010) Institutional credit and rice productivity: A case study of District Lahore, Pakistan. China Agric Econ Rev 2:412–419. https://doi.org/10.1108/17561371011097722

Battese GE, Coelli TJ (1995) A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empir Econ 20:325–332. https://doi.org/10.1007/BF01205442

BER (2019) Bangladesh economic review. Ministry of Finance. Government of the People’s Republic of Bangladesh, Dhaka 1–358

Beyhaghi M, Firoozi F, Jalilvand A, Samarbakhsh L (2020) Components of credit rationing. J Financ Stab 50:1–14. https://doi.org/10.1016/j.jfs.2020.100762

Bhattacharya M, Inekwe JN, Valenzuela MR (2020) Credit risk and financial integration: an application of network analysis. Int Rev Financ Anal 72:1–14. https://doi.org/10.1016/j.irfa.2020.101588

Bhattacharyya A, Mandal R (2016) A generalized stochastic production frontier analysis of technical efficiency of rice farming: a case study from Assam, India. Indian Growth Dev Rev 9:114–128. https://doi.org/10.1108/IGDR-10-2015-0041

Bibi Z, Khan D, Haq I u (2020) Technical and environmental efficiency of agriculture sector in South Asia: a stochastic frontier analysis approach. Environ Dev Sustain 23:9260–9279. https://doi.org/10.1007/s10668-020-01023-2

Bidisha SH, Hossain MA, Alam R, Hasan MM (2018) Credit, tenancy choice and agricultural efficiency: evidences from the northern region of Bangladesh. Econ Anal Policy 57:22–32. https://doi.org/10.1016/j.eap.2017.10.001

Bond EW, Tybout J, Utar H (2015) Credit rationing, risk aversion, and industrial evolution in developing countries. Int Econ Rev (Philadelphia) 56:695–722. https://doi.org/10.1111/iere.12119

Boucher SR, Carter MR, Guirkinger C (2008) Risk rationing and wealth effects in credit markets: theory and implications for agricultural development. Am J Agric Econ 90:409–423. https://doi.org/10.1111/j.1467-8276.2007.01116.x

Cabrera VE, Solís D, del Corral J (2010) Determinants of technical efficiency among dairy farms in Wisconsin. J Dairy Sci 93:387–393. https://doi.org/10.3168/jds.2009-2307

Cao S, Leung D (2020) Credit constraints and productivity of SMEs: evidence from Canada. Econ Model 88:163–180. https://doi.org/10.1016/j.econmod.2019.09.018

Carrer MJ, Maia AG, de Mello Brandão Vinholis M, de Souza Filho HM (2020) Assessing the effectiveness of rural credit policy on the adoption of integrated crop-livestock systems in Brazil. Land Use Policy 92:1–10. https://doi.org/10.1016/j.landusepol.2020.104468

Chandio AA, Jiang Y, Gessesse AT, Dunya R (2019) The nexus of agricultural credit, farm size and technical efficiency in Sindh, Pakistan: a stochastic production frontier approach. J Saudi Soc Agric Sci 18:348–354. https://doi.org/10.1016/j.jssas.2017.11.001

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2:429–444. https://doi.org/10.1016/0377-2217(78)90138-8

Chiu LJV, Khantachavana SV, Turvey CG (2014) Risk rationing and the demand for agricultural credit: a comparative investigation of Mexico and China. Agric Financ Rev 74:248–270. https://doi.org/10.1108/AFR-05-2014-0011

Das S, Munshi M, Kabir W, Biswas J (2017) Intervention of ICTs in rice production in Bangladesh: an impact study. Bangladesh Rice J 20:67–72. https://doi.org/10.3329/brj.v20i2.34130

Diana F, Guirkinger C, Boucher S (2010) Risk, credit constraints and financial efficiency in Peruvian agriculture. J Dev Stud 46:981–1002. https://doi.org/10.1080/00220380903104974

Dong F, Lu J, Featherstone AM (2012) Effects of credit constraints on household productivity in rural China. Agric Financ Rev 72:402–415. https://doi.org/10.1108/00021461211277259

Drehmann M, Sorensen S, Stringa M (2010) The integrated impact of credit and interest rate risk on banks: a dynamic framework and stress testing application. J Bank Financ 34:713–729. https://doi.org/10.1016/j.jbankfin.2009.06.009

Duong PB, Thanh PT (2019) Adoption and effects of modern rice varieties in Vietnam: micro-econometric analysis of household surveys. Econ Anal Policy 64:282–292. https://doi.org/10.1016/j.eap.2019.09.006

Ekinci MF, Omay T (2020) Current account and credit growth: the role of household credit and financial depth. North Am J Econ Financ 54:101244. https://doi.org/10.1016/j.najef.2020.101244

Elahi E, Abid M, Zhang L, ul Haq S, Sahito JGM (2018) Agricultural advisory and financial services; farm level access, outreach and impact in a mixed cropping district of Punjab, Pakistan. Land Use Policy 71:249–260. https://doi.org/10.1016/j.landusepol.2017.12.006

Escobal J (2001) The determinants of nonfarm income diversification in rural Peru. World Dev 29:497–508. https://doi.org/10.1016/S0305-750X(00)00104-2

FAO (2012) Food and agricultural commodities production from http://www.fao.org/faostat/en/#data/QC.

Fatemi M, Atefatdoost A (2020) The alternative model to predict adoption behavior of agricultural technologies. J Saudi Soc Agric Sci 19:383–390. https://doi.org/10.1016/j.jssas.2020.04.003

Galema R (2020) Credit rationing in P2P lending to SMEs: do lender-borrower relationships matter? J Corp Finan 65:101742. https://doi.org/10.1016/j.jcorpfin.2020.101742

Haryanto T, Talib BA, Salleh NHM (2016) Technical efficiency and technology gap in Indonesian rice farming. Agris On-line Pap Econ Inform 08:29–38. https://doi.org/10.7160/aol.2016.080303

Hasnain MN, Hossain ME, Islam MK et al (2016) Determinants of technical efficiency of rice farms in northcentral and north-western regions in Bangladesh. J Dev Areas 45:73–94. https://doi.org/10.1016/j.wdp.2017.12.001

Heriqbaldi U, Purwono R, Haryanto T, Primanthi MR (2015) An analysis of technical efficiency of rice production in Indonesia. Asian Soc Sci 11:91–102. https://doi.org/10.5539/ass.v11n3p91

Hossain MK, Kamil AA, Baten MA, Mustafa A (2012) Stochastic frontier approach and data envelopment analysis to total factor productivity and efficiency measurement of Bangladeshi rice. PLoS One 7:1–9. https://doi.org/10.1371/journal.pone.0046081

Jalilov S, Mainuddin M (2019) Efficiency in the rice farming: evidence from Northwest Bangladesh. Agriculture 9:1–14. https://doi.org/10.3390/agriculture9110245

Jana J (2015) Prague economic papers / online first money market equilibrium. Prague Econ Pap 25:321–334. https://doi.org/10.18267/j.pep.564

Jin M, Zhao S, Kumbhakar SC (2019) Financial constraints and firm productivity: evidence from Chinese manufacturing. Eur J Oper Res 275:1139–1156. https://doi.org/10.1016/j.ejor.2018.12.010

Kabir MJ, Cramb R, Alauddin M, Gaydon DS (2019) Farmers’ perceptions and management of risk in rice-based farming systems of south-west coastal Bangladesh. Land Use Policy 86:177–188. https://doi.org/10.1016/j.landusepol.2019.04.040

Kabir J, Cramb R, Alauddin M, Gaydon DS, Roth CH (2020) Farmers’ perceptions and management of risk in rice/shrimp farming systems in South-West Coastal Bangladesh. Land Use Policy 95:104577. https://doi.org/10.1016/j.landusepol.2020.104577

Kattel RR, Regmi PP, Sharma MD, Thapa YB (2020) Factors affecting adoption of improved method in large cardamom curing and drying and its impact on household income in the Eastern Himalayan road-corridor of Nepal. Technol Soc 63:1–13. https://doi.org/10.1016/j.techsoc.2020.101384

Kjenstad EC, Su X, Zhang L (2015) Credit rationing by loan size: a synthesized model. Q Rev Econ Financ 55:20–27. https://doi.org/10.1016/j.qref.2014.08.001

Koirala KH, Mishra AK, Mohanty S (2013) Determinants of rice productivity and technical efficiency in the Philippines. South Agric Econ Assoc Annu Meet 1:1–15. https://doi.org/10.13140/2.1.3275.1360

Komicha H, Öhlmer B (2008) Effect Of credit constraint on production efficiency of farm households in Southeastern Ethiopia. Ethiop J Econ 15:2–32. https://doi.org/10.4314/eje.v15i1.39816

Kumar A, Takeshima H, Thapa G, Adhikari N, Saroj S, Karkee M, Joshi PK (2020) Adoption and diffusion of improved technologies and production practices in agriculture: Insights from a donor-led intervention in Nepal. Land Use Policy 95:104621. https://doi.org/10.1016/j.landusepol.2020.104621

Kumbhakar SC, Lovell CAK (2000) Stochastic frontier analysis. Cambridge University Press. https://doi.org/10.1017/cbo9781139174411

Li C, Lin L, Gan CEC (2016) China credit constraints and rural households’ consumption expenditure. Financ Res Lett 19:158–164. https://doi.org/10.1016/j.frl.2016.07.007

Li YA, Liao W, Zhao CC (2018) Credit constraints and firm productivity: microeconomic evidence from China. Res Int Bus Financ 45:134–149. https://doi.org/10.1016/j.ribaf.2017.07.142

Li W, Clark B, Taylor JA, Kendall H, Jones G, Li Z, Jin S, Zhao C, Yang G, Shuai C, Cheng X, Chen J, Yang H, Frewer LJ (2020) A hybrid modelling approach to understanding adoption of precision agriculture technologies in Chinese cropping systems. Comput Electron Agric 172:105305. https://doi.org/10.1016/j.compag.2020.105305

Lin L, Wang W, Gan C, Nguyen QTT (2019) Credit constraints on farm household welfare in rural China: evidence from Fujian Province. Sustain 11:1–19. https://doi.org/10.3390/su11113221

Long LK, Van Thap L, Hoai NT (2020) An application of data envelopment analysis with the double bootstrapping technique to analyze cost and technical efficiency in aquaculture: do credit constraints matter? Aquaculture 525:735290. https://doi.org/10.1016/j.aquaculture.2020.735290

Ma S, Wu X, Gan L (2019) Credit accessibility, institutional deficiency and entrepreneurship in China. China Econ Rev 54:160–175. https://doi.org/10.1016/j.chieco.2018.10.015

Mallick D (2012) Microfinance and moneylender interest rate: evidence from Bangladesh. World Dev 40:1181–1189. https://doi.org/10.1016/j.worlddev.2011.12.011

Mariyono J (2018) Productivity growth of Indonesian rice production: sources and efforts to improve performance. Int J Product Perform Manag 67:1792–1815. https://doi.org/10.1108/IJPPM-10-2017-0265

Mehmood Y, Rong K, Arshad M, Bashir MK (2017) Doliquidity constraints influence the technical efficiency of wheat growers? Evidence from Punjab, Pakistan. J Anim Plant Sci 27:667–679

Mehmood Y, Rong K, Bashir MK, Arshad M (2018) Does partial quantity rationing of credit affect the technical efficiency of dairy farmers in Punjab, Pakistan?: An application of stochastic frontier analysis. Br Food J 120:441–451. https://doi.org/10.1108/BFJ-03-2017-0162

Min SHI, Paudel KP, Feng-bo C (2020) Mechanization and efficiency in rice production in China. J Integr Agric 19:2–15. https://doi.org/10.1016/S2095-3119(20)63439-6

Musaba E, Bwacha I (2014) Technical efficiency of small scale maize production in Masaiti District, Zambia: A Stochastic Frontier Approach. J Econ Sustain Dev 5:104–111

Okoruwa VO, Abass AB, Akin-Olagunju OA, Akinola NA (2020) Does institution type affect access to finance for cassava actors in Nigeria? J Agric Food Res 2:1–8. https://doi.org/10.1016/j.jafr.2020.100023

Rana MMP, Moniruzzaman M (2021) Transformative adaptation in agriculture: a case of agroforestation in Bangladesh. Environ Challenges 2:1–11. https://doi.org/10.1016/j.envc.2021.100026

Reardon T, Taylor JE, Stamoulis K, Lanjouw P, Balisacan A (2000) Effects of non-farm employment on rural income inequality in developing countries: an investment perspective. J Agric Econ 51:266–288. https://doi.org/10.1111/j.1477-9552.2000.tb01228.x

Roy R, Chan NW, Rainis R (2014) Rice farming sustainability assessment in Bangladesh. Sustain Sci 9:31–44. https://doi.org/10.1007/s11625-013-0234-4

Sarkar A, Abdul J, Al A et al (2021) Structural equation modeling for indicators of sustainable agriculture : prospective of a developing country’s agriculture. Land Use Policy 109:1–12. https://doi.org/10.1016/j.landusepol.2021.105638

Shew AM, Durand-Morat A, Putman B, Nalley LL, Ghosh A (2019) Rice intensification in Bangladesh improves economic and environmental welfare. Environ Sci Policy 95:46–57. https://doi.org/10.1016/j.envsci.2019.02.004

Tipi T, Yildiz N, Nargeleçekenler M, Çetin B (2009) Measuring the technical efficiency and determinants of efficiency of rice (Oryza sativa) farms in marmara region, Turkey. New Zeal J Crop Hortic Sci 37:121–129. https://doi.org/10.1080/01140670909510257

Tuihedur Rahman HM, Robinson BE, Ford JD, Hickey GM (2018) How do capital asset interactions affect livelihood sensitivity to climatic stresses? Insights from the northeastern floodplains of Bangladesh. Ecol Econ 150:165–176. https://doi.org/10.1016/j.ecolecon.2018.04.006

von Cramon-Taubadel S, Saldias R (2014) Access to credit and determinants of technical inefficiency of specialized smallholder farmers in chile. Chil J Agric Res 74:413–420. https://doi.org/10.4067/S0718-58392014000400006

Wang J, Etienne X, Ma Y (2020) Deregulation, technical efficiency and production risk in rice farming: evidence from Zhejiang Province, China. China Agric Econ Rev 12:605–622. https://doi.org/10.1108/CAER-11-2019-0197

Zhao J, Barry JP (2014) Effects of credit constraints on rural household technical efficiency. China Agric Econ Rev 6:654–668. https://doi.org/10.1108/caer-10-2012-0115

Acknowledgements

The authors are extremely thankful to the Professor Dr. Jianchao Luo, College of Economics and Management, Northwest A& F University, Yangling, Shaanxi, 712100, P. R. China, for providing necessary facilities during research work.

Funding

The study is supported by “Research on the Effectiveness Evaluation Risk Control and System Construction of the Agricultural Credit Guarantee Policy,” the National Natural Science Foundation of China (NSFC), January 2019–2022, No. 71873100. Sponsor and host: Jianchao Luo. This research is also supported by “Research on the Effect Evaluation, Operational Pattern, Supporting Policy of the contracted Management of Farmland Mortgage Finance,” The National Natural science Foundation of China (NSFC), Jan 2016–Dec 2019, No. 71573210. Sponsor and host Jianchao Luo.

Author information

Authors and Affiliations

Contributions

MGR and LJC conceived and designed the research work; acquisition of data performed by FH and MGR; MGR, RR, MSH, KZH, and TS analyzed the data; MGR, YM, and AAK interpret the data; drafting the article by MGR, YM; MGR, MSH, RR, YM, and FH wrote and revised the manuscript; critical revision of the article conducted by LJC, FH, and YM. All authors have read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval

This is an observational study. We confirmed that no ethical approval is required.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Rabbany, M.G., Mehmood, Y., Hoque, F. et al. Do credit constraints affect the technical efficiency of Boro rice growers? Evidence from the District Pabna in Bangladesh. Environ Sci Pollut Res 29, 444–456 (2022). https://doi.org/10.1007/s11356-021-15458-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15458-1