Abstract

Incorporating vertical environmental protection pressure, fiscal pressure, and government environmental regulatory behavior into a unified research framework, this paper empirically tests local governments’ regulatory behavior on sulfur dioxide under incompatible dual pressures using data of 30 regions in China from 2003 to 2017. The results show that as the vertical environmental protection pressure increases, local governments will improve the regulation intensity on sulfur dioxide. However, as local governments’ fiscal pressure increases, the effect of vertical environmental protection pressure on local governments’ environmental regulations will be weakened. Based on the “neighborhood imitation effect,” the impact of neighboring regions is considered when measuring fiscal pressure. The results still show that fiscal pressure will weaken the improving effect of vertical environmental protection pressure on the local government’s environmental regulation. After controlling the endogenous problem and a series of robustness tests, the above conclusions are still valid. The results indicate that improving the status of environmental protection in the performance evaluation is an effective means to promote the implementation of environmental regulations by local governments. However, China’s environmental governance cannot depend solely on improving the proportion of environmental protection in performance evaluations of local officials. A reasonable promotion incentive mechanism should be designed to avoid the incompatibility pressure caused by conflicting tasks to distort the local government’s compliance with the central government’s pollution control intention.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

As a typical air pollutant, sulfur dioxide (SO2) is harmful to human health. It can cause decreased lung function, airway inflammation, asthma, and respiratory diseases and even shorten the human lifespan. Therefore, reducing SO2 emissions is of great significance to the sustainable development of human society. Figure 1 shows the 25 countries with the largest SO2 emissions in 2018. It can be seen from Fig. 1 that most of these countries are developing countries. Greenstone and Hanna (2014) pointed out that weak institutions are the main obstacles to environmental improvement in developing countries. Therefore, it is becoming more and more important to study the dilemma of environmental governance from the perspective of institutions and design effective environmental regulations in developing countries.

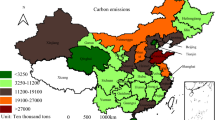

As the largest developing country, China was the biggest emitter for SO2 until about a decade ago. However, with the efforts of the Chinese government, SO2 emissions have dropped significantly. Figure 2 shows the changing trend of SO2 in China from 2003 to 2017. It can be seen from Fig. 2 that SO2 mainly comes from enterprise production, and the changes in total SO2 and industrial SO2 basically maintain a parallel relationship. Nevertheless, China still remains the third largest emitter in the world (see Fig. 1). Therefore, taking China as an example and studying the achievements and difficulties of SO2 emission reduction in China from the perspective of the institution, it has important reference significance for promoting SO2 governance in other developing countries to achieve global environmental improvement.

Fiscal decentralization under political centralization is the basic institutional background for understanding China’s development, which has become a consensus (Huang 1996; Zhang 2006). Under political centralization, the central government appoints local governments based on relative performance (Caldeira 2012; Xu 2011). Therefore, to gain advantages of promotion, local governments may sacrifice the environment (Yang et al. 2020; Zhao et al. 2020). Researches show that the reason for China’s repeated environmental pollution problems is the incomplete implementation of environmental policies by local governments. Cai et al. (2016) argue that local governments in China are too eager to achieve economic growth goals and choose to ignore environmental protection laws and regulations and even turn a blind eye to environmental violations in order to create a “good business environment.” Zhang and Fu (2008) believe that although China’s current environmental regulatory framework seems to be comprehensive, the supervision is weak, which provides opportunities for the transfer of pollution-intensive multinational companies. Zhang (2016) and Hong et al. (2019) also support this view, arguing that local governments have great incentives to relax environmental regulations. Therefore, the key to China’s environmental pollution control lies in correcting the behavior of local governments. Jia and Chen (2019) believe that the central government with invincible vertical political power should pay more attention to the environment and change the incentive structure, promoting local governments to focus on the environment.

However, under fiscal decentralization, the central government’s fiscal resources are relatively concentrated, while the local governments’ power to handle affairs is relatively concentrated (Zhu and Gao 2010). It leads local governments to face fiscal expenditure pressure. Local governments have an incentive to reduce the environmental regulation intensity to attract liquidity resources to alleviate fiscal pressure (Zhang 2016). In fact, both theoretical research and empirical research support this conclusion. For example, the second-generation fiscal decentralization theory assumes that local governments are rational people (Guo et al. 2020), and they may sacrifice public welfare to pursue benefits (Weingast 2009). In terms of empirical research, Zang and Liu (2020) study the relationship between fiscal decentralization and government environmental governance behavior. They point out that fiscal decentralization is not conducive to improving the efficiency and performance of government environmental governance. Guo et al. (2020) find that fiscal revenue decentralization exacerbates local environmental pollution more seriously than expenditure decentralization. From this perspective, even if the central government attaches importance to environmental protection and even improves its status in performance evaluation, local governments still have the incentive to relax the intensity of environmental regulation (Ran 2013).

So under the vertical environmental protection pressureFootnote 1 and fiscal pressure, will local governments actively fulfill their responsibilities to increase environmental regulations’ intensity? Regrettably, most of the existing literature discusses the environmental regulation behavior of local governments from the perspective of fiscal decentralization (Chen and Chang 2020; Kuai et al. 2019; Guo et al. 2020), and there are relatively few studies on the impact of fiscal pressure on the environmental regulation of local governments (Xi 2017; Bai et al. 2018). Bai et al. (2018) believe that China’s fiscal system is a system with a high degree of expenditure responsibility and a relatively low proportion of local income, especially the proportion of budgetary revenues. Local governments have no or only little formal tax powers. Therefore, the behavior of local governments should be explained from the perspective of fiscal pressure. In addition, the studies above ignore the impact of environmental protection pressure from the central government, which makes it difficult to explain the above problems. Based on this, this paper applies the STIRPAT model, taking industrial SO2 treatment as an example, and incorporates both vertical environmental protection pressure and fiscal pressure into this paper to study whether local governments will enhance the intensity of regulation on SO2 under the dual pressure. Compared with existing researches, the contributions of this article are as follows.

Firstly, to the best of our knowledge, this is the first empirical study to integrate the vertical environmental protection pressure, fiscal pressure, and environmental regulation behavior of local governments into a unified framework. This paper makes up for the neglect of vertical environmental protection pressure in the existing researches and investigates the environmental regulation behavior of local government under the dual pressure of incompatibility.

Secondly, the impact of fiscal pressure from surrounding areas is considered when measuring local fiscal pressure. There is a promotion tournament among local governments in China (Chen et al. 2005; Ghanem and Zhang 2014), which shows that the government’s environmental regulation behavior may not be affected by its own absolute fiscal pressure but by relative fiscal pressure. Meanwhile, a large number of studies have shown that neighboring regions have a “neighborhood imitation effect,” which means that relative fiscal pressure is more likely to come from neighboring areas (Bai et al. 2018; Zhang 2016; Zhang et al. 2020). However, existing studies have neglected the impact of fiscal pressure from surrounding areas when measuring fiscal pressures.

Thirdly, this paper incorporates vertical environmental protection pressure and fiscal pressure into a unified analysis framework, enriching the research on incompatible multi-task principal-agent issues between vertical governments.

The rest of this article is organized as follows. We first outline our theoretical framework and propose our hypotheses in the “Theory and hypotheses” section. The “Research design” section introduces our data and empirical methodology, followed by the presentation of empirical findings in “Results and analysis” section. The “Endogeneity problem and robustness test” section is the robustness test. The paper concludes with research findings and policy implications in the “Conclusion and policy implications” section.

Theory and hypotheses

SO2 emissions mainly come from enterprise production. As the emitter of pollution, enterprises should bear the responsibility of reducing pollution. However, environmental resources have the characteristics of public goods, and enterprises lack the enthusiasm for pollution control. So the government should take responsibility for regulating the pollution behavior of enterprises (Wang et al. 2018; Wan et al. 2020). To effectively regulate the enterprises to control pollution, China actively explores the balance between economic development and environmental protection according to national conditions. The importance of ecological civilization construction has gradually become prominent in the institutional arrangements. In terms of environmental protection practice, the party and the government actively explore practical and effective environmental regulation tools (Guo and Lu 2019). Jia and Chen (2019) and Xiang and van Gevelt (2020) use the difference-in-difference (DID) and case-study approach to evaluate the effects of environmental protection inspection policy and affirm the effectiveness of the environmental policy. Nie et al. (2020) study the effect of the administrative inquiry for environmental protection. The results show that this policy is conducive to pollution reduction. In addition, Cao et al. (2020) analyze the effectiveness of China’s environmental regulations in terms of the impact of environmental regulations on the green economy.

However, a profound paradox lies in China’s environmental governance. On the one hand, the central government has formulated many laws and regulations, established a top-down environmental administration management system, and actively participated in international cooperation in environmental affairs. On the other hand, the implementation effects of many environmental policies are unsatisfactory, and the environmental quality continues to deteriorate. The reason for the deviation between the theory and reality in the effects of environmental policies is that there are problems in the implementation of environmental policies. Kostka and Mol (2013) believe that the lack of implementation by local governments may cause the environmental improvement effects to fail to the expected goals. Ghanem and Zhang (2014) find that local governments may have “whitewashing behaviors” in the process of implementing environmental regulations. In China’s environmental management system, the central and local governments have different responsibilities. The central government’s primary responsibility lies in formulating environmental policies and monitoring their implementation. Local governments are responsible for implementing environmental policies (Deng et al. 2012; Zhang et al. 2020). And the incomplete implementation of environmental regulations by local governments is the core problem hindering China’s environmental governance (Zhang 2016).

Many researchers discuss why local governments have an incomplete implementation of environmental regulations from the perspective of the local officials’ promotion. For local governments, the maximization of political power is their core goal. According to the public choice theory, government officials are not public man but rational economic people with their interests. Local governments, as economic man, instinctively pursue their interests. When developing the regional economy and providing public services, local governments are not entirely based on maximizing social welfare. They may selectively perform tasks conducive to their interests. Promotion is the most important pursuit of officials, so local governments’ behaviors are ultimately to serve this goal. However, due to the different ways of getting a promotion, the forms of political incentives are also different. In western democracies, officials are elected mainly by the public. To get more votes is the most prominent political incentive. In contrast, China’s officials are appointed by the central government. The form of political power acquisition leads local governments to be accountable to the central government (Chien 2010). To gain promotion advantages, local government officials will selectively perform assessment tasks based on the proportion of assessment tasks. When the proportion of environmental performance in the official assessment system is relatively low, local governments may sacrifice the local environment for their interests (Ghanem and Zhang 2014). On the contrary, as the central government pays more attention to the environment, it can correct the local government’s negligence on the environment. Jiang et al. (2019) find that local governments will speed up the full implementation of environmental regulations under the regulatory pressure of the central government. Chong and Sun (2020) study the evolutionary path of the tripartite behavior of the central government, local governments, and polluting companies and believe that the central government’s attention to the environment can encourage local governments to perform environmental protection responsibilities. Although Jiang et al. (2019) and Chong and Sun (2020) support that local governments actively perform environmental protection responsibilities under the environmental pressure of the central government, they both conduct theoretical analyses and lack the necessary empirical research support. Based on this, this paper proposes hypothesis 1 and tests it from an empirical level.

Hypothesis 1

With the improvement of the vertical environmental protection pressures, local governments will actively fulfill their environmental protection responsibilities to increase the intensity of regulation on industrial SO2.

Under the performance appraisal system, the central government also evaluates local government capabilities from the completion of other tasks besides environmental protection. These tasks include economic growth, infrastructure construction, employment rate, and social stability. Therefore, local governments perform their environmental protection duties not under one single assessment task but under multiple, even conflicting tasks. Meanwhile, the completion of these tasks requires the support of matching fiscal resources. Since the tax distribution reform in 1994, the share of local government’s revenue has fallen rapidly. However, under the framework of fiscal decentralization, the administrative power of local governments has not been reduced much, resulting in the asymmetry of fiscal power and administrative power of local governments. Therefore, some scholars have studied local environmental pollution from the perspective of fiscal decentralization. Kuai et al. (2019) find that fiscal decentralization is conducive to the PM2.5 concentration reduction. However, Guo et al. (2020) believe that fiscal decentralization is not conducive to environmental improvement. Chen and Chang (2020) also believe that fiscal decentralization has adverse effects on government environmental performance and governance efficiency. It can be seen that current researches on the relationship between fiscal decentralization and pollution reduction are controversial. Bai et al. (2018) believe that under the fiscal decentralization system, the fiscal pressure caused by the mismatch of fiscal revenue and fiscal expenditure is the main reason that affects local government behavior. Therefore, the environmental regulation behavior of local governments should be studied from the perspective of fiscal pressure. In fact, as China’s fiscal expenditures continue to grow in recent years, local governments have faced greater fiscal pressures. As shown in Fig. 3, although the fiscal revenue has been growing year by year since 2003, the increase rate is far less than the increased rate of local governments’ fiscal expenditure. So it leads to a growing fiscal gap.

The mismatch between fiscal revenue and fiscal expenditure causes local governments to be in “fiscal hunger” for a long time. To alleviate the fiscal pressure, local governments attempt to increase fiscal revenue by expanding the tax base. Simultaneously, compared with the service industry, the industrial industry has lower requirements for economic development. The cost for local governments to promote industrial development is also relatively low. Therefore, local governments have sufficient incentives and conditions to promote industrial growth (Xi et al. 2017). Otherwise, industrial enterprises tend to choose sites with looser environmental regulations (Dean et al. 2009). To attract these enterprises, local governments relax environmental regulation standards, leading to their behavior deviating from the willingness of the central government to control pollution. Based on this, this paper proposes the following hypothesis.

Hypothesis 2

Constrained by fiscal pressures, the positive effect of vertical environmental protection pressure on the environmental regulation of local governments will be reduced.

Figure 4 shows the relationship among vertical environmental protection pressure from the central government to control pollution, fiscal pressure, and local governments’ environmental regulation.

Based on the above analysis, the existing studies have conducted in-depth research on the environmental regulation behavior of local governments from different perspectives, and these have been an important reference for this study. Unfortunately, there are still some shortcomings in the existing studies. Firstly, although the existing literature believes that the central government’s attention to the environment can correct local governments’ behaviors, the conclusions are mostly obtained through theoretical analysis. Few studies have verified these conclusions from an empirical level, resulting in the lack of necessary empirical support for these studies. This study can provide direct empirical support for these theoretical studies. Secondly, although scholars have conducted various studies on the influencing factors of local government’s environmental regulation behavior, few scholars have investigated local government’s environmental regulation behavior under incompatible dual pressures. This article incorporates vertical environmental pressures and fiscal pressures into the research framework at the same time, which is helpful to explore the changes in local government environmental regulations when facing incompatible dual pressures. It can provide experience support for the central government to formulate reasonable assessment tasks. Finally, existing studies have focused on absolute fiscal pressure when measuring fiscal pressure. In fact, the relative performance evaluation under political centralization will lead to the fiscal pressure faced by local governments, which may partly come from surrounding areas. Existing studies ignore the consideration of relative financial pressure. In addition to examining the impact of absolute fiscal pressure, this study also examines the impact of relative fiscal pressure.

Research design

Methodology

The IPAT model examines the basic laws of natural and social science (Ehrlich and Holdren 1971). So the IPAT model is widely used to study the qualitative or quantitative relationships among environment, population, economy, and technology. However, this model has limitations in studying the non-proportional effects between explanatory variables and environmental consequences. Rosa and Dietz (1998) went on developing the STIRPAT model. Although many researchers have made minor changes, the predominant researchers in this field have employed STIRPAT to examine the nexus of sustainability and socioeconomic variables (Nasrollahi et al. 2018).

STIRPAT allows the model to be extended to improve its analytical interpretation by adding, subtracting, or decomposing factors. In this study, the improved nonlinear random regression STIRPAT model proposed by Rosa and Dietz (1998) is selected. Combined with the research purpose of this paper and the research of existing scholars, this paper extends it as follows:

where Iit is environmental regulations of local government at period t in regioni. WCGPit is vertical environmental protection pressure from central government. FGPit is fiscal pressure of local governments. OPLit is the degree of openness. INS2it is the proportion of the secondary industry. INS3it is the proportion of the tertiary industry. POPDit reflects the number of people. PGDPit reflects the degree of affluence. TECit reflects the level of technology. eit is the error term.βj (j = 1, 2, 3......9) is the parameter to be estimated.

In order to further examine the mechanism of incompatible dual pressure on local government environmental regulation, we introduce the interactive term of vertical environmental pressure and fiscal pressure, and then Formula (1) can be rewritten as:

Variables and data

Explained variable I it (SO2)

The existing research on the measurement of the intensity of environmental regulations can be divided into two types: one is a measurement method based on pollution control input (Morgenstern et al. 2002; Becker 2005; Cole and Elliott 2007), and the other is a measurement method based on pollutant emission (Xing and Kolstad 2002; Javorcik and Wei 2003). Due to the lack of necessary statistics on the input of industrial sulfur dioxide treatment, this paper uses the industrial sulfur dioxide emission intensity to measure the regulatory behavior of local governments on sulfur dioxide. This paper chooses industrial SO2 as the research object, mainly based on the following reasons:

-

(1)

As a major environmental pollutant, SO2 has been closely monitored by various countries since the 1970s. Compared with other pollutants, SO2 is not only closely related to the economic development process but also has statistical continuity.

-

(2)

As pointed out by Antweiler et al. (2001), SO2 emissions have strong local effects, and there are many advanced pollution reduction technologies available, which means that there are no technical constraints on the reduction of SO2. If governments want to govern SO2, they can certainly achieve SO2 emission reductions. Therefore, changes in SO2 can better reflect the regulatory behavior of local governments.

-

(3)

SO2 is mainly emitted during industrial production, and the emissions from residents’ lives are relatively small. In addition, it can be seen from Fig. 1 that the changing trend of industrial SO2 and the changing trend of the total SO2 are almost parallel, which indicates that the treatment effect of SO2 mainly comes from the reduction of industrial SO2. This means that the regulation of SO2 is bound to affect the development of the regional economy. Therefore, through the change of SO2, it is possible to effectively identify the environmental regulation behaviors of local governments when they face environmental protection pressure and fiscal pressure.

The reasons above are also the reasons why current scholars prefer to use SO2 as the research object (Antweiler et al. 2001; Bernauer and Koubi 2012; Nan et al. 2019; Lou et al. 2020).

The vertical environmental pressure WCGP it

The vertical environmental protection pressure is abstract and difficult to be measured. However, the willingness of the author is often loaded on the text. Meanwhile, the conceptional mode and linguistic expression features of the text reflect the effective information of the author (Ghose et al. 2012). So the vertical environmental protection pressure from the central government can be measured through the relevant documents issued by the central government.

This paper uses the frequency of environment-related words in the central government work report to measure the vertical environmental protection pressure from the central government. Some scholars have used the frequency and proportion of environment-related words to measure government environmental regulation. For example, Chen et al. (2018) use the proportion of the five words (huanjing, nengyuan, wuran, jianpai, huanbao) in the total words as the proxy variable of government environmental governance. Chen and Chen (2018) used the frequency of richer environmental words (huanjingbaohu, huanbao, wuran, nenghao, jianpai, paiwu, shengtai, lvse, ditan, kongqi, eryanghualiu, eryanghuatan, huaxuexuyangliang, PM10, PM2.5) in the government work report to measure the government’s environmental regulation intensity.

These two studies provide a good foundation for this paper. We find that Chen and Chen (2018) take richer environmental words. However, huanjingbaohu cannot express the meaning of huanjingzhiliang, huanjingziyuan. Therefore, this paper replaces huanjingbaohu with huanjing according to the research of Chen et al. (2018)Footnote 2.

Fiscal pressure FGP it

Bai et al. (2018) use FGP = (fiscal expenditure − fiscal revenue)/fiscal revenue to measure fiscal pressure. However, they ignore the fiscal pressure from surrounding provinces. A large number of studies have shown that there are promotion tournaments among local governments in China (Chen et al. 2005; Ghanem and Zhang 2014), which shows that the government’s environmental regulation behavior may not be affected by its own absolute fiscal pressure but by relative fiscal pressure. At the same time, the “neighborhood imitation effect” indicates that relative fiscal pressure is more likely to come from neighboring regions (Bai et al. 2018; Zhang 2016; Zhang et al. 2020). This paper remolds this index:

Firstly, the method of Bai et al. (2018) is adopted to calculate the fiscal pressure:

Secondly, calculate the mean of the fiscal gap of neighboring regions:

where \( {V}_{ij}=\left\{\begin{array}{l}1\kern0.75em i\ and\ j\ are\ adjacent\\ {}0\kern0.75em i\ and\ j\ are\ not\ adjacent\end{array}\right. \), and n is the total number of sample areas.

The fiscal pressure of the region i can be reflected as lnFGPit1 = ln FGPit − ln FGNit. The greater the value, the greater the fiscal pressure of the region i. And it is worth noting that we take the logarithm first and then take the difference. If we take the difference first, we will have a negative number, and then we cannot take the logarithm.

Figure 5 shows the variation trend of fiscal pressure in each region.

Control variables

According to the existing researches, other influencing factors are also controlled in this paper.

-

(1)

Industrial structure (INS2it and INS3it). We measure the industrial structure by the ratio of the added value of the secondary and tertiary industries to the GDP.

-

(2)

Economic development levels (PGDPit). We measure economic development levels by real GDP per capita. Currently, most scholars believe that the economic development level and enterprise pollution have an inverted U-shaped relationship. When the economic development level is low, people will sacrifice the environment for economic growth. On the contrary, when the economy is high, people have enough money for pollution control and environmental technology development. So we introduce the square of the level of economic development to verify whether this kind of relationship is established.

-

(3)

Trade openness (OPLit). We use the ratio of total import and export to GDP to measure trade openness.

-

(4)

Population size (POPDit). Considering that there are great differences among provinces in the administrative area and population size, it is not comparable to directly use the total population. This paper uses population density to measure population size.

-

(5)

Technology level (TECit). The technology of energy conservation and emission reduction is the main way of environmental governance, which directly determines the pollution level. The existing researches measure the technical level from two aspects of technical input and technical output. Technical input is mainly measured by the proportion of R&D employees in the total employees. Although this kind of index is reasonable to some extent, there are still some problems that cannot be ignored in the study of this paper. This index can only reflect the intensity of investment but cannot reflect the degree of actual transformation into results. Otherwise, the index is too general. For example, since R&D activities include energy-saving and emission-reduction technologies and product updating and other activities, it is impossible to identify the intensity of investment in R&D of energy-saving and emission-reduction technologies. Based on this, this paper uses the output of energy consumption per unit, namely energy efficiency, as a proxy variable to measure the technological level of energy conservation and emission reduction.

Data source

To deal with the increasingly serious ecological and environmental problems, the central government put forward the “Scientific Outlook on Development” in 2003. Meanwhile, the central government changes the development path of pursuing GDP at the expense of the environment and links environmental performance with cadres’ promotion. At the same time, the data of SO2 after 2017 is seriously missing. So the period of this paper is 2003–2017. Due to the serious lack of data in Tibet, Hong Kong, Macao, and Taiwan, these areas are not included in this study.

The data of industrial SO2 from 2003 to 2015 are from China Environmental Yearbook, and the data from 2016 to 2017 are from Statistical Yearbooks of various regions. Nominal GDP, industrial added value, the output value of the second industry and the tertiary industry, fiscal expenditure, fiscal revenue, total import and export, GDP index, and the index of industrial value added are from China Statistical Yearbook, the New China 60 Years of Statistical Data Collection, Database of China’s Economic and Social Development Statistics, and Statistical Yearbook of provinces and cities. Total energy consumption comes from China Energy Statistics Yearbook. The central government work reports come from the China Government Net. The central government’s budgetary expenditures and environmental protection budgetary expenditures are from the Yearbook of Chinese Finance. Table 1 is a statistical description of the related variables.

Results and analysis

Before estimating the parameters, it is necessary to perform a unit root test on each panel data series. This is because if the data is non-stationary and the regression is performed directly, the regression result obtained is most likely to be a pseudo-regression. So this paper uses LLC and ADF to test the stationarity of panel data series. From the results of the unit root test of panel data, it can be seen that the regression variables in the model are stable regardless of whether it is for the test of common unit root or individual unit root (see Table 2). Therefore, this article incorporates all variables into the regression model together. In addition, in order to avoid the problem of multicollinearity, when introducing interaction terms, this paper subtracts their average values from fiscal pressure and vertical environmental pressure, respectively.

The Hausman test can select the correct model setting. The test results show that the concomitant probabilities of the Hausman test are all less than 0.1. Therefore, this paper selects fixed effects to estimate Formulas (1) and (2). The time effect is also controlled to exclude the influence of time-varying factors on regression results. In addition, in order to address the panel heteroscedasticity and autocorrelation problems, the standard error is corrected. The regression results are shown in Table 3. In model (1) and model (2), the fiscal pressure does not include adjacent regions’ influence. In model (3) and model (4), the fiscal pressure includes adjacent regions’ influence.

First of all, the relationship between the vertical environmental protection pressure (lnWCGP) and lnSO2 is analyzed. In model (1), the regression coefficient of the lnWCGP is −3.7107, while in model (2), the regression coefficient of the lnWCGP is −3.2163. The coefficients all pass the test of 10% significance. Obviously, if we do not control the interaction between the vertical environmental protection pressure and fiscal pressure, we will overestimate the effect of the vertical environmental protection pressure. After considering the impact of neighboring regions on local fiscal pressures, the results still show that we will overestimate the effectiveness of the vertical environmental protection pressure if we ignore the interaction item.

Without considering the impact of fiscal pressure, it can be seen from the results of model (1) and model (3) that the regression coefficients of the vertical environmental protection pressure (lnWCGP) are both significantly negative. It means that when fiscal pressure is ignored, as vertical pressure on environmental protection rises, local governments will increase the intensity of environmental regulation. This conclusion is consistent with the theoretical analysis of Jiang et al. (2019) and Chong and Sun (2020). In fact, the result is not difficult to understand. Under the appointment promotion system, the promotion of local officials is determined by the higher-level government. In order to obtain promotion opportunities, local governments will inevitably intervene in the affairs of their jurisdictions in accordance with the intentions of the central government. When the central government pays attention to environmental protection, local governments will naturally perform environmental protection responsibilities and increase the intensity of environmental regulations in their jurisdictions. Hypothesis 1 is proved.

In addition, the regression results of model (2) and model (4) show that the interaction between vertical environmental pressure and fiscal pressure is significantly positive at 5%. Therefore, considering the impact of fiscal pressure, according to the regression results of model (2) and model (4), the impact of the vertical environmental protection pressure on local environmental regulation behavior can be expressed as: ‐3.2163 + 0.1717 ∗ lnFGP (‐3.7696 + 0.1406 ∗ lnFGP1). The coefficient of lnFGP (lnFGP1) is positive, which means that when fiscal pressure increases, the positive impact of vertical environmental pressure on local environmental regulatory behavior will be weakened. Hypothesis 2 is proved. There are mainly two reasons accounting for the result. On the one hand, under great financial pressure, local governments do not have sufficient financial guarantees in environmental governance, which makes it difficult for local governments to fully comply with the central government’s environmental protection wishes (Bao and Guan 2019). On the other hand, under great financial pressure, local governments will pay more attention to the construction and stability of financial resources and tend to introduce overcapacity enterprises by relaxing environmental regulations to expand the tax base (Xi et al. 2017).

As the fiscal pressure in model (4) considering the influence of the surrounding areas, the results are more in line with the actual situation. Therefore, this paper analyzes the influence of other control variables on government’s environmental regulation according to the model (4). The regression results show that the proportion of secondary production (lnINS2) has adverse effects on local government environmental regulation behavior. However, the coefficients are not significant at the 10% level. The coefficient of lnPGDP is positive but not significant. The coefficient of lnPGDP*lnPGDP is negative and statistically significant at the 10% level. Besides, in order to verify the possible linear relationship between lnPGDP and lnSO2, the lnPGDP*lnPGDP is removed in this paper. But the result shows that the coefficient of lnPGDP is still not statistically significant at the 10% level. It shows that there is an inverted U relationship between China’s economic development and environmental pollution. The proportion of the tertiary industry (lnINS3) is not conducive to the improvement of environmental quality. The coefficient is statistically significant at the 10% level. This result is consistent with the researches of Xi et al. (2017). It is because China is in the stage of transition from the secondary industry to the tertiary industry, and the tertiary industry provides more services for the secondary industry. The degree of openness (lnOPL) significantly reduces industrial SO2. This conclusion shows that “pollution halo” is valid for industrial SO2. Energy-saving technology measured by energy efficiency has significantly reduced industrial SO2. The coefficient of lnTEC is negative, and the coefficient passes the test of 5% significance. It indicates that the improvement of energy efficiency reduces pollution emissions

Endogeneity problem and robustness test

Endogeneity problem

There are two core explanatory variables in this paper: vertical environmental protection pressure and fiscal pressure. There is no endogenous problem in vertical environmental protection pressure. This is because the measurement of vertical environmental protection pressure is mainly based on the work report of the central government. The central government reports are reported at the beginning of the year, so neither economic activity nor any other activity can affect the work report that year. Moreover, the central government is the upper government, and the local government has limited influence on the central government. The explained variables in this paper are provincial-level data, while the WCGP belongs to the upper level, so the endogeneity problem caused by reverse causality is avoided. However, there may be a reverse causal relationship between fiscal pressure and government environmental regulations. The improvement of environmental regulations may impact the production behavior of local enterprises, resulting in a decrease in the fiscal revenue of the local government, which will increase the pressure of the fiscal gap.

To ensure the robustness and accuracy of empirical results, we take some methods to deal with endogeneity. Instrumental variables are often regarded as effective means to solve endogenous problems. Instrumental variables are highly correlated with endogenous explanatory variables but not highly correlated with residual variables. It is usually difficult to find strict exogenous instrumental variables, so scholars often use the lag term of explanatory variables as instrumental variables (Hu and Liu 2019). This paper uses the lag term of fiscal pressure as an instrumental variable according to the existing research. That is, the sample interval of fiscal pressure is 2002–2016. Table 4 reports the regression results with fiscal pressure lagging one period as the explanatory variable. From the results, it can be seen that the environmental regulation behavior of local governments under environmental pressure has increased and the regression coefficient of fiscal pressure is still insignificant. However, the interaction term between environmental pressure and fiscal pressure is significantly positive. The results show the robustness of the above conclusions of this paper.

In addition, this paper uses the lag value of fiscal pressure as an instrumental variable and applies the two-stage least squares method (2SLS) to deal with endogeneity problem depending on the existing research. The regression results are shown in Table 5. In the process of regression, we conduct underidentification test, weak identification test, and overidentification test. The test results all show that the above-mentioned instrumental variables are effective. Moreover, the regression results still show that the environmental protection pressure from the central government is conducive to promoting the environmental regulation of local governments, but the fiscal pressure will weaken the effect of this promotion, indicating that the results are stable.

After controlling the endogenous problem, the significance of the core variables in this article has been significantly improved.

Robustness test

To ensure the robustness of the research conclusions, this paper further adopts the method of replacing the estimation method and core explanatory variables to re-estimate Formulas (1) and (2). It can be seen from the foregoing that after controlling the endogenous problem, the significance of the core variables in this paper has been significantly improved. Therefore, we use the lag term of fiscal pressure in this part.

Firstly, we take the feasible generalized least squares (FGLS) method to estimate the relationship between environmental pressure, fiscal pressure, and local environmental regulations, which can test the sensitivity of the regression results to the estimation method. Table 6 shows the regression results. It can be seen from the regression results that after changing the estimation method, the regression coefficient of environmental pressure is still significantly negative, and the regression coefficient of environmental pressure and fiscal pressure is significantly positive. This shows the robustness of the above conclusions of this paper.

Secondly, this paper uses the proportion of the central government’s environmental protection expenditure in fiscal expenditure to measure the vertical environmental pressure. The implementation of any policy must be matched with appropriate fiscal resources. The higher the fiscal budget, the higher the status of the project on the agenda. Therefore, the higher the proportion of the environmental protection budget in the central government’s fiscal budget, the higher the central government’s willingness to combat pollution. This means that the status of environmental protection in the governance of the country will increase, so the environmental protection pressure faced by local governments will increase accordingly. Since China began to make statistics on fiscal expenditure on environmental protection in 2007, the sample interval of this paper started in 2007 for the robustness test using this indicator. The results are shown in Table 7. It can be seen from the results that the conclusions of this paper are robust.

Conclusion and policy implications

Conclusion

Based on the STIRPAT model and using data of 30 provinces from 2003 to 2017, this research investigates local governments’ environmental regulation behaviors under incompatible dual pressures. The results show that ignoring fiscal pressure constraints will overestimate the positive impact of the vertical environmental protection pressure on local environmental regulation. With the improvement of the vertical environmental protection pressure, local governments will actively fulfill their environmental protection responsibilities to improve their jurisdictions’ environmental regulation. However, such efforts have been weakened by fiscal pressure, which explains why China’s environmental quality has achieved little improvement with the increase of environmental pressure in recent years. This research confirms that the central government’s attitude towards the environment determines local government efforts’ direction. Simultaneously, the study also confirms that if the central government ignores the coordination of other tasks and environmental protection, it will cause the local government to deviate from the central government’s intentions.

Policy implications

Based on the research conclusions, the policy implications are as follows.

The central government should improve the top-level design of environmental protection policies and regulate governments’ functions in environmental governance. Meanwhile, when setting environmental goals, the central government should clarify environmental goals and reduce the space for local governments to independently interpret environmental goals. It can avoid deviations between the original intention of the policy and its implementation results. Besides, the central government should actively participate in local governments’ environmental protection practices to supervise the efficiency of local governments’ environmental policy implementation.

A reasonable incentive mechanism for local governments should be designed to avoid conflicting tasks that distort local governments’ compliance with the central government’s willingness to control pollution. There is a contradiction between the tasks of economic development, fiscal revenue, unemployment rate, and environmental protection for the current development level of China. This contradiction is mainly reflected in the following aspects: on the one hand, local governments introduce industrial enterprises to promote economic development in their districts to increase fiscal revenue and alleviate the unemployment rate, which is bound to go against environmental improvement. On the other hand, strict environmental regulations will increase industrial enterprises’ entry costs, which is not conducive to completing the above assessment tasks. Under the dual pressure of this incompatibility, it is bound to distort local governments’ compliance with the willingness of the central government to control pollution. Therefore, when improving environmental protection status in the performance appraisal, the central government should appropriately relax the appraisal standards for other tasks.

The upper-level government divides local governments’ expenditure responsibilities rationally and allocates appropriate fiscal resources to reduce the fiscal pressure caused by institutional reasons. The fiscal pressure comes from the fact that local governments cannot make ends meet, caused by the imperfect construction of the local government revenue system and the downward shift of expenditure responsibility. Therefore, under the background of the fiscal system reform, China can accelerate governance through the method of system optimization. On the one hand, China should properly divide the fiscal powers and expenditure responsibilities of local governments. If the expenditure responsibility needs to be shifted down, it should be supplemented with matching fiscal resources. On the other hand, China should establish a stable fiscal security system for local governments to reduce systemic fiscal pressure, thereby mitigating its adverse effects on local government behavior.

Future research directions

This study has some limitations. First of all, according to the stage of pollution control, there are two pollution control methods: source pollution control (before pollutants are generated) and end pollution control (after pollutants are generated). There are differences between the two pollution control methods in terms of cost input and pollution control effect. Under the pressure of vertical environmental protection and fiscal pressure, which pollution control method will local governments adopt? Secondly, local governments usually use command and control instruments and market-based instruments to implement environmental regulations. The implementation costs of the two regulatory instruments are different. Under the pressure of vertical environmental protection and fiscal pressure, which regulatory instruments will local governments focus on? These questions will provide a challenge for the upcoming research. The research on the above issues is helpful for a deeper analysis of local government behavior choices under incompatible dual pressures.

Notes

Vertical environmental pressure refers to environmental protection pressure from the upper-level government. In this paper, it mainly refers to environmental pressure from the central government. Unless otherwise specified, all environmental protection pressures mentioned in this article refer to vertical environmental protection pressures.

After checking the government work report, the number of occurrences of the following words is subtracted. This is because although these words contain the word huanjing, they have nothing to do with the ecological environment. These words are as follows: zhengzhihuanjing, jingjihuanjing, wenhuahuanjing, touzihuanjing, xiaofeihuanjing, zhianhuanjing, guojihuanjing, hepinghuanjing, zhoubianhuanjing, jiuyehuanjing, neiwaihuanjing, fazhanhuanjing, tizhihuanjing, jinronghuanjing, yulunhuanjing, fazhihuanjing, chuangxinhuanjing, chuangyehuanjing, maoyihuanjing, xinyonghuanjing, jingmaohuanjing, lvyouhuanjing, zhengcehuanjing, waibuhuanjing, zhiduhuanjing, wangluohuanjing, wendinghuanjing, yingshanghuanjing, jingzhenghuanjing, yinghuanjing, ruanhuanjing.

References

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91(4):877–908

Bai J, Lu J, Li S (2018) Fiscal pressure, tax competition and environmental pollution. Environ Resour Econ 73(2):431–447

Bao G, Guan B (2019) Does fiscal pressure reduce the environmental governance efficiency of local governments. China Popul, Resour Environ 29(4):38–48 (in Chinese)

Becker RA (2005) Air pollution abatement costs under the Clean Air Act: evidence from the PACE survey. J Environ Econ Manag 50(1):144–169

Bernauer T, Koubi V (2012) Are bigger governments better providers of public goods? Evidence from air pollution. Public Choice 156(3-4):593–609

Cai H, Chen Y, Gong Q (2016) Polluting thy neighbor: unintended consequences of China’s pollution reduction mandates. J Environ Econ Manag 76:86–104

Caldeira E (2012) Yardstick competition in a federation: theory and evidence from China. China Econ Rev 23(4):878–897

Cao Y, Liu J, Yu Y, Wei G (2020) Impact of environmental regulation on green growth in China’s manufacturing industry-based on the Malmquist-Luenberger index and the system GMM model. Environ Sci Pollut Res 27(33):41928–41945

Chen X, Chang CP (2020) Fiscal decentralization, environmental regulation, and pollution: a spatial investigation. Environ Sci Pollut Res 27(25):31946–31968

Chen S, Chen D (2018) Air pollution, government regulations and high-quality economic development. Econ Res J 53:20–33 (in Chinese)

Chen Y, Li H, Zhou LA (2005) Relative performance evaluation and the turnover of provincial leaders in China. Econ Lett 88(3):421–425

Chen Z, Kahn ME, Liu Y, Wang Z (2018) The consequences of spatially differentiated water pollution regulation in China. J Environ Econ Manag 88:468–485

Chien SS (2010) Economic freedom and political control in Post-Mao China: a perspective of upward accountability and asymmetric decentralization. Asian J Polit Sci 18(1):69–89

Chong D, Sun N (2020) Explore emission reduction strategy and evolutionary mechanism under central environmental protection inspection system for multi-agent based on evolutionary game theory. Comput Commun 156:77–90

Cole MA, Elliott RJ (2007) Do environmental regulations cost jobs? An industry-level analysis of the UK. BE J Econ Anal Pol 7(1):28–48

Dean JM, Lovely ME, Wang H (2009) Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. J Dev Econ 90(1):1–13

Deng H, Zheng X, Huang N, Li F (2012) Strategic interaction in spending on environmental protection: spatial evidence from Chinese cities. China World Econ 20(5):103–120

Ehrlich PR, Holdren JP (1971) Impact of population growth. Science 171(3977):1212–1217

Ghanem D, Zhang J (2014) ‘Effortless perfection:’ do Chinese cities manipulate air pollution data? J Environ Econ Manag 68(2):203–225

Ghose A, Ipeirotis PG, Li B (2012) Designing ranking systems for hotels on travel search engines by mining user-generated and crowdsourced content. Mark Sci 31(3):493–520

Greenstone M, Hanna R (2014) Environmental regulations, air and water pollution, and infant mortality in India. Am Econ Rev 104(10):3038–3072

Guo S, Lu J (2019) Jurisdictional air pollution regulation in China: a tragedy of the regulatory anti-commons. J Clean Prod 212:1054–1061

Guo S, Wen L, Wu Y, Yue X, Fan G (2020) Fiscal decentralization and local environmental pollution in China. Int J Environ Res Public Health 17(22):8661

Hong T, Yu N, Mao Z (2019) Does environment centralization prevent local governments from racing to the bottom? –evidence from China. J Clean Prod 231:649–659

Hu S, Liu S (2019) Do the coupling effects of environmental regulation and R&D subsidies work in the development of green innovation? Empirical evidence from China. Clean Technol Environ 21(9):1739–1749

Huang Y (1996) Central-local relations in China during the reform era: the economic and institutional dimensions. World Dev 24(4):655–672

Javorcik BS, Wei SJ (2003) Pollution havens and foreign direct investment: dirty secret or popular myth? BE J Econ Anal Pol 3(2):1–34

Jia K, Chen S (2019) Could campaign-style enforcement improve environmental performance? Evidence from China’s central environmental protection inspection. J Environ Manag 245:282–290

Jiang K, You D, Merrill R, Li Z (2019) Implementation of a multi-agent environmental regulation strategy under Chinese fiscal decentralization: an evolutionary game theoretical approach. J Clean Prod 214:902–915

Kostka G, Mol APJ (2013) Implementation and participation in China’s local environmental politics: challenges and innovations. J Environ Pol Plan 15(1):3–16

Kuai P, Yang S, Tao A, Sa Z, Khan ZD (2019) Environmental effects of Chinese-style fiscal decentralization and the sustainability implications. J Clean Prod 239:118089

Lou L, Li J, Zhong S (2020) Sulfur dioxide (SO2) emission reduction and its spatial spillover effect in high-tech industries: based on panel data from 30 provinces in China. Environ Sci Pollut Res 6. https://doi.org/10.1007/s11356-021-12755-7

Morgenstern RD, Pizer WA, Shih J-S (2002) Jobs versus the environment: an industry-level perspective. J Environ Econ Manag 43(3):412–436

Nan Y, Li Q, Yu J, Cai H, Zhou Q (2019) Has the emissions intensity of industrial sulphur dioxide converged? New evidence from China’s prefectural cities with dynamic spatial panel models. Environ Dev Sustain 22(6):5337–5369

Nasrollahi Z, Hashemi M-S, Bameri S, Mohamad Taghvaee V (2018) Environmental pollution, economic growth, population, industrialization, and technology in weak and strong sustainability: using STIRPAT model. Environ Dev Sustain 22(2):1105–1122

Nie Y, Cheng D, Liu K (2020) The effectiveness of environmental authoritarianism: evidence from China’s administrative inquiry for environmental protection. Energy Econ 88:104777

Ran R (2013) Perverse incentive structure and policy implementation gap in China’s local environmental politics. J Environ Pol Plan 15(1):17–39

Rosa EA, Dietz T (1998) Climate change and society: speculation, construction and scientific investigation. Int Sociol 13(4):421–455

Wan K, Shackley S, Doherty RM, Shi Z, Zhang P, Golding N (2020) Science-policy interplay on air pollution governance in China. Environ Sci Pol 107:150–157

Wang Y, Zuo Y, Li W, Kang Y, Chen W, Zhao M, Chen H (2018) Does environmental regulation affect CO2 emissions? Analysis based on threshold effect model. Clean Technol Environ 21(3):565–577

Weingast BR (2009) Second generation fiscal federalism: the implications of fiscal incentives. J Urban Econ 65(3):279–293

Xi P, Liang R, Xie Z (2017) Tax sharing adjustments, fiscal pressure and industrial pollution. J World Econ 10:170–191 (in Chinese)

Xiang C, van Gevelt T (2020) Central inspection teams and the enforcement of environmental regulations in China. Environ Sci Pol 112:431–439

Xing Y, Kolstad CD (2002) Do lax environmental regulations attract foreign investment. Environ Resour Econ 21(1):1–22

Xu C (2011) The fundamental institutions of China’s reforms and development. J Econ Lit 49(4):1076–1151

Yang T, Liao H, Wei YM (2020) Local government competition on setting emission reduction goals. Sci Total Environ 745:141002

Zang J, Liu L (2020) Fiscal decentralization, government environmental preference, and regional environmental governance efficiency: evidence from China. Ann Reg Sci 65:439–457

Zhang X (2006) Fiscal decentralization and political centralization in China: implications for growth and inequality. J Comp Econ 34(4):713–726

Zhang H (2016) Strategic interaction of regional environmental regulation: an explanation on the universality of incomplete enforcement of environmental regulation. China Industr Econ 7:74–90 (in Chinese)

Zhang J, Fu X (2008) FDI and environmental regulations in China. J Asia Pac Econ 13(3):332–353

Zhang Z, Jin T, Meng X (2020) From race-to-the-bottom to strategic imitation: how does political competition impact the environmental enforcement of local governments in China? Environ Sci Pollut Res 27(20):25675–25688

Zhao Y, Liang C, Zhang X (2020) Positive or negative externalities? Exploring the spatial spillover and industrial agglomeration threshold effects of environmental regulation on haze pollution in China. Environ Dev Sustain. https://doi.org/10.1007/s10668-020-01114-0

Zhu Z, Gao Y (2010) The involvement of financial pressure and official performance: research on the local government investment and financing platform. Macroeconomy 202(12):30–35 (in Chinese)

Availability of data and material

The data and material used or analyzed during the current study are available from the corresponding author on reasonable request.

Funding

This work was supported by the National Ministry of Education Humanities and Social Science Research Planning Fund Project [18YJA790031].

Author information

Authors and Affiliations

Contributions

Conceptualization, Po Kou; writing (original draft), Po Kou; methodology, Po Kou and Ying Han; formal analysis and investigation, Po Kou and Ying Han; funding acquisition, Ying Han.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kou, P., Han, Y. Vertical environmental protection pressure, fiscal pressure, and local environmental regulations: evidence from China’s industrial sulfur dioxide treatment. Environ Sci Pollut Res 28, 60095–60110 (2021). https://doi.org/10.1007/s11356-021-14947-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-14947-7