Abstract

The fiscal decentralization system under China’s political centralization affects local economic and environmental policies, and thus has an important impact on environmental quality. This paper uses the panel data of 285 cities in China from 2003 to 2018 and the spatial Durbin model to empirically analyze the impact of fiscal decentralization on haze pollution and its mechanism. The results show that the increase in fiscal decentralization will significantly aggravate the haze pollution in and around the region, and this conclusion is still valid after a series of robustness tests. Moreover, the impact of fiscal decentralization on haze pollution has significant heterogeneity in the size and region of the city, and the sample period. In addition, mechanism analyses show that fiscal decentralization has aggravated haze pollution by increasing infrastructure construction, reducing environmental regulations, and intensifying market segmentation. Further analyses reveal that, on the one hand, local governments have the ability to control haze pollution in their own regions according to their own wishes and interests, but on the other hand, adjustments to environmental policies in surrounding areas will significantly inhibit the control of environmental policies in the region, thereby making local governments haze pollution has not been effectively controlled. This is essentially a “Race to bottom” phenomenon among local governments in environmental policies.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Due to the long-term industrialization and the development model of “Treatment after Pollution,” the existing pollution problems of haze in developed countries are not obvious. However, with the rapid advancement of China’s industrialization and urbanization, the problem of haze pollution has gradually become prominent, and it has shown the obvious characteristics of high frequency, wide range, high pollution levels, and severe damage. According to the “2019 Bulletin of the State of the Ecological Environment in China,” in 2019, 53.4% of the 337 prefecture-level and above cities in China had air pollution exceeding the limit. In addition, there were 1666 days of severe pollution and 452 days of extremely severe pollution, and the days with PM2.5 as the primary pollutant accounted for 78.8% of the days with severe pollution and above. For this reason, the Chinese government attaches great importance to haze governance. In July 2018, the State Council released the “Three-Year Action Plan to Win the Battle of Blue Sky,” which clearly stressed that by 2020, the concentration of PM2.5 in cities at or above the prefectural level that did not meet the standards would be reduced by more than 18% compared with 2015, and the number of days with severe pollution or above would be reduced by more than 25% compared with 2015.

To reduce environmental pollution and improve environmental quality has become a common understanding of the public, and a lot of scholars have conducted extensive and in-depth research on it. These studies mainly focus on the following two aspects: First, the factor decomposition method is used to decompose the influencing factors of environmental pollution, including economic development factors, industrial structure factors, and technical factors, and then they have analyzed the relative degree of impact of these factors on environmental pollution (Li et al. 2017; Su et al. 2017; Yu et al. 2018). Second, empirical analysis is used to verify the environmental Kuznets curve (Gill et al. 2018), or to analyze the impact of structure (Cheng et al. 2018a), technology (Kang et al., 2018), energy (Hu et al. 2018), international trade (Liddle 2018), foreign direct investment (Zhu et al. 2017), and urbanization (Zhang et al. 2017b) on the environment.

The abovementioned research carried out extensive and in-depth analysis of the influencing factors of environmental pollution from an economic point of view. However, the impact of the economy on environmental quality cannot be independent of the system. In China, fiscal decentralization reform under political centralization is considered to be a very important institutional factor (Zhang et al. 2018). Under the Chinese-style fiscal decentralization system, local governments need to develop the local economy on the one hand, while improving people’s livelihood and protecting the environment on the other. They need to coordinate economic development and environmental protection (Zhang et al. 2017a, b). The traditional theory of fiscal decentralization believes that compared with the central government, local governments can provide public goods more efficiently according to residents’ preferences and regional conditions, thus helping to improve environmental quality (Oates and Portney 2003). However, competition among local governments under decentralization system may also lead to biased fiscal expenditure preference and “race to the bottom” behavior, which will further deteriorate environmental quality (Dijkstra and Fredriksson 2010). However, the basis of these traditional fiscal decentralization theories is not completely in line with China’s national conditions. The assumption that local governments aim at optimizing public services no longer exists in China due to the loss of political foundation, and the incentive mechanism foundation is completely different. Therefore, it is quite necessary and critical to investigate the impact of fiscal decentralization on environmental pollution and its mechanism from the practical level for pollution control in China.

Compared with the existing literature, the main contributions of this paper are as follows: First, in terms of research content, this paper uses the standard deviation of haze pollution at the county level to measure the fluctuation degree of haze pollution in each city, and conducts an empirical analysis on the impact of fiscal decentralization on haze pollution fluctuation and its spatial spillover effect, so as to further verify whether fiscal decentralization has caused the environmental “Race to the bottom” behavior of local governments; second, in terms of research methods, this paper adopts the spatial Durbin model to include the spatial effects of independent variables and dependent variables at the same time for analysis, so as to make the estimation results more accurate and reliable; thirdly, in terms of sample selection, statistical data of 285 cities and 2383 counties and districts in China from 2003 to 2018 are adopted for analysis. Such large sample data with fine scale can be used for more accurate econometric analysis.

Literature review

There is no doubt that fiscal decentralization can significantly affect the behavior of local government which then has an important impact on environmental quality. Early theoretical studies mostly supported the idea that a higher degree of fiscal decentralization was conducive to improving local environmental quality. Tiebout (1956) analyzed the incentive effects of fiscal decentralization on local government through the “voting with feet” theory. The research found that, in order to attract both residents and resources into the jurisdiction, a higher degree of fiscal decentralization could encourage local government to adopt specific financial revenue and expenditure policies; these would meet both the demands of residents and the services of public products, where providing higher levels of environmental quality was an important content. Oates and Schwab (1988) and Wilson (1996) also pointed out that, if there was no imperfect market or redistributive public policy, local government would aim at maximizing welfare and provide an optimal level of environmental quality for its residents, that is, increasing the degree of fiscal decentralization could help improve environmental quality. Wellisch (1995) even noted that, in the case of high openness, because local residents only obtained part of an enterprise’s profits while shouldering all the costs of pollution, the competition between regions might lead to excessive environmental protection. Oates, 2001) further pointed out that because environmental quality was a local public good and because local government had a better understanding of local information than the federal government, the environmental standards made by local government were more conducive to environmental protection. Levinson (2003) argued that fiscal decentralization would bring the effects of both “race to top competition” and “nimbyism.” Local government would then raise its environmental standards and transfer its pollutants to other regions by adopting stricter environmental policies, thus resulting in an even higher environmental quality in the local area.

With the development of further theories of fiscal decentralization more and more scholars have questioned the earlier theories. They hold that local governments would have their own considerations and interests and might make some decisions inconsistent with the rights and interests of local residents. Holmstrom and Milgrom (1991) pointed out that since local government could provide a wide variety of services for local residents in its jurisdiction, the GDP-oriented evaluation mechanism would encourage local government officials to strive towards economic growth resulting in a distortion of how resources are allocated. Qian and Roland (1998) further stated that under a system of multiple targets and multiple tasks only a properly designed mechanism could ensure that the policy decisions made by local governments with the goal of profit maximization in mind could be consistent with the interests of residents. If an incentive-compatible system were lacking local governments would provide only a minimal level of environmental quality for residents; local government would maximize its own interests. Kunce and Shogren (2005) believed, in reality, it was difficult to meet the conditions of perfect market or perfect non-redistribution public policies on just the theoretical premises of Oates and Schwab (1988). As a result, destructive competition related to economic growth was inevitable and this would undoubtedly lead to environmental degradation. Dijkstra and Fredriksson (2010) made further efforts to relax the preconditions of the Oates and Schwab (1988) model hypothesis, and found that decentralized environmental policies would result in poorer environmental standards and trigger a “Race to the Bottom” effect. Mintz and Tulkens (1986), Wildasin (1988), Ulph (2000), Fredriksson et al. (2003), Kunce and Shogren (2007) also found that local governments could compete with each other by relaxing their local environmental standards so as to reach such goals as the attraction of investment, increases in employment and taxes.

Many scholars have also analyzed the impact of fiscal decentralization on environmental pollution from the practical level, but the research conclusions are quite different. First, some empirical studies support the conclusion that fiscal decentralization is beneficial to environmental improvement. This is mainly because inter-regional competition may lead to “race up” effect. Higher fiscal decentralization will bring stricter environmental regulations, making fiscal decentralization conducive to environmental improvement (Levinson 2003). According to Chupp (2011), based on the data of the USA, local governments tend to set higher environmental standards when the state government can gain more benefits from environmental management. Based on the data of provinces in China, Wei et al. (2018) found that fiscal decentralization was conducive to environmental improvement, and this effect was more significant under the effect of market segmentation. Second, some scholars have found that fiscal decentralization has no significant effect on environmental pollution. Based on the data of 47 countries from 1979 to 1999, Sigman (2014) found that fiscal decentralization did not lead to environmental quality deterioration, that is, there was no environmental “Race to the bottom” among local governments. He (2015) found that fiscal decentralization had no significant impact on waste water, waste gas, and solid waste per capita based on the panel data of China’s provincial level from 1995 to 2010. Sjoberg and Xu and Lin 2018), based on the data of the US RCRA from 1998 to 2011, found that decentralization of RCRA did not bring about environmental “race to the bottom” behavior. Third, some studies have found that fiscal decentralization aggravates local environmental pollution. Kamp et al. (2017) empirically analyzed the impact of fiscal decentralization on China’s governance policies and found that local governments, in pursuit of their own interests, tend to slow down or prevent the implementation of centrally mandated governance reforms. Based on China’s provincial panel data from 1995 to 2012, Zhang et al. 2017a, b) found that environmental policies were conducive to controlling the growth of carbon emissions, while China’s unique fiscal decentralization system greatly inhibited the emission reduction effect of environmental policies, increasing the total carbon emissions and leading to the green environmental paradox. Based on the panel data of 30 provinces in China from 2005 to 2016, Ran et al. (2020) concluded that fiscal decentralization would lead to the increase of carbon emissions, and this policy was unfavorable to the control of carbon emissions.

Compared with the existing literature, the main contributions of this paper are as follows: (1) in terms of research content, as to the deep-seated reasons that fiscal decentralization affects environmental pollution, that is, whether fiscal decentralization has caused the environmental “race to bottom” behavior of local governments, most of the existing literature remains qualitative (Kamp et al. al. 2017), did not give a clear answer, and lack of rigorous quantitative evidence, which awaits further empirical testing. In order to verify whether fiscal decentralization has caused the environmental “race to the bottom” behavior of local governments, this paper uses the standard deviation of haze pollution at the county level to measure the fluctuation degree of haze pollution in each city, and empirically analyzes the impact of fiscal decentralization on haze pollution fluctuation and its spatial spillover effect.

(2) In terms of research methods, the existing literature mainly considers the high dispersion and strong externality of environmental pollutants (Sigman 2005; Lipscomb and Mobarak 2017), while independent variables may also have spillover effects in space. In fact, the change of independent variables in the local area will not only affect the dependent variables in the local area but also influence the dependent variables in the surrounding area through the spatial spillover effect (Meliciani and Savona 2015; Cheng et al. 2018b). From the perspective of spatial econometrics, neglecting these spatial effects may lead to errors in estimation and analysis. In this paper, the spatial Durbin model is used to analyze the spatial effects of independent variables and dependent variables, so that the estimation results are more accurate and reliable.

(3) In terms of sample selection, most existing studies on fiscal decentralization in China are analyzed based on provincial data (Hao et al. 2019), and lack of data analysis at the city level. In fact, the sub-provincial tax sharing system is not as thorough and “uniform” as that implemented between the central government and the provinces. Each province often implements different tax sharing policies for cities with different economic conditions within the province. Although the central government suggests sharing taxes according to tax categories or proportions, there are still different degrees of tax division between provinces and cities according to industries and enterprise affiliation (Zhou and Wu 2015). Therefore, the indicators of fiscal decentralization measured from the provincial level have big defects, which may lead to errors in estimation and analysis. In this paper, the data of 285 Chinese cities from 2003 to 2018 were used for analysis.

Model establishment, variable description, and data sources

Model establishment

Ehrlich and Holdren (1971) put forward the IPAT analytical framework for the determinants of environmental impacts, a framework that divides environmental impacts into three parts. The IPAT equation is I = P × A × T where I represents the environmental impact, measured in this paper by the concentration of PM2.5 pollution; P, A, and T represent population, affluence and technology respectively. Dietz and Rosa (1994) then put forward the STIRPAT model which not only retains those three factors in the IPAT model that influence environment impacts but also introduces stochastic terms for empirical analyses. The basic form of STIRPAT is:

where i represents the city, t represents the time, and ε represents the random error term. The existing literature has shown that fiscal decentralization can significantly affect the behavior of local governments and thus has an important impact on environmental pollution. Therefore, this paper incorporates the variable of fiscal decentralization into the STIRPAT model so as to analyze its effect on environmental impact. The specific formula is as follows:

where D represents the variable of fiscal decentralization and ϑ represents the effect elasticity of fiscal decentralization on PM2.5 pollution. Combined with the existing studies, we can establish the following ordinary static panel model on the basis of Eq. (2):

where X represents other control variables affecting haze pollution. Considering that haze pollution and their respective variables may have spatial spillover effects on spatial dimensions, this paper incorporated the spatial lag items of haze pollution and each independent variable on the basis of Eq. (3), and constructed the following spatial Durbin model:

Among them, ηi, νt, εit represent the regional effect, time effect, and random disturbance term respectively, reflecting the random disturbance of different dimensions affecting haze pollution. W represents the spatial weight matrix, reflecting the spatial correlation between regions. Since the spatial effect of haze pollution is not only directly related to the urban economic aggregate but also inseparable from the geographical distance between cities (Ma et al. 2016), this paper adopts the economic distance to construct the spatial weight matrix. First, we construct the traditional spatial weight matrix of geographical distance \( {W}_{ij}^d=\left\{{w}_{ij}^d\right\} \), where \( {w}_{ij}^d=1/{d}_{ij} \), where dij represents the linear distance between city i and city j. Then, we construct the economic distance space weight matrix Wij according to the following formula:

where \( {\overline{Y}}_i \) represents the average real GDP of city i during the inspection period, \( \overline{Y} \) bar represents the average real GDP of all sample cities during the inspection period, and N represents the total number of city samples.

Variable description

Dependent variable

PM2.5 pollution (I)

Due to measurement of PM2.5 really being a recent phenomenon in China, the paper uses satellite data for analysis. According to the measurement method of Van Donkelaar et al. (2016), the international geophysical information network center of Columbia University in the USA used satellites to measure aerosol optical depth and obtained the global annual average of PM2.5 from 2001 to 2018 through a mathematical model. This method for estimating is relatively scientific and has high validity and reliability (Cheng et al. 2017; 2020). This paper uses this set of radar data and ArcGIS software in combination with the vector map of Chinese city level administrative regions to parse it into numerical values of the annual PM2.5 concentration from 2003 to 2018.

Core explanatory variable

Fiscal decentralization (D)

The existing literature mostly uses expenditure and income indexes to measure the degree of fiscal decentralization (Sun et al. 2017; Que et al. 2018). We first adopt the expenditure index to measure the degree of fiscal decentralization and then use the income index to test for robustness. For fiscal expenditure (income) decentralization, considering the differences in urban fiscal management systems, the formula is D = fdc/(fdc + fdp + fdf), where fdc, fdp, and fdf represent per capita fiscal expenditure (income) at the urban level, the provincial level, and the central level respectively. This index effectively excludes both the influences of population scale and transfer payments from central to local governments, thus measuring urban fiscal decentralization scientifically and reasonably.

Control variables

Population density (P)

Considering the great differences in both administrative areas and population sizes among cities, it is more scientific to use population density to measure the effects of demographic factors on PM2.5 pollution. Generally, the bigger the population density is, the bigger the demands for energy of the city will be, and thus the higher the pollutant emissions will be (Mohammad and Khosrul 2021). We use the population per unit area to measure population density and expect population density to have a significant positive effect on urban PM2.5 pollution.

Economic development level (A)

Economic development level is an important factor affecting environmental pollution. Classic EKC theory points out that environmental pollution will show an inverted “U” curve with improvements in economic development levels. According to Atasoy (2017) and Gill et al., (2018), we incorporate both the linear term and the quadratic term of economic development into the regression equation and empirically investigate the effect of economic growth on PM2.5 pollution.

Technological level (T)

Both improvements in technological levels and the application of clean technologies are crucial for energy conservation and emissions reduction. Because technological progress is essential for improvements in energy efficiency and energy efficiency is the external reflection of technological levels (Sheng and Guo 2016), this paper uses energy efficiency to measure the technological level. Considering China’s coal-dominated energy consumption structure and the high correlation between coal and electricity, this paper uses the ratio of adjusted GDP to electricity consumption to measure energy efficiency (technological level). We expect that technological level has significant negative effect on urban PM2.5 pollution.

Industrial structure (S)

Because secondary industry plays a major role in energy consumption and pollution emissions, the structure of industrialization is not beneficial for energy saving and emission reduction. This paper adopts the ratio of third industry GDP to that of secondary industry GDP to measure industrial structure. This index not only directly measures the upgrading of industrial structure but also indirectly measures the trend in services in the industrial structure; it is thus scientific and reasonable to use this index to measure industrial structure (Cheng et al. 2018a, b). We expect industrial structure to have a significant negative effect on urban PM2.5 pollution.

Traffic intensity (R)

The literature has shown that motor vehicle exhaust can affect PM2.5 pollution to a large extent. Some studies have shown that both more and more motor vehicles and increasing serious traffic congestion have aggravated PM2.5 pollution in China (Li et al. 2017; Cheng et al. 2017). We thus use the traffic intensity to measure the traffic pressure. Considering the availability and validity of data, the traffic intensity can be measured by the ratio of the number of motor vehicles to the total length of roads. We expect traffic intensity to have a significant positive effect on urban PM2.5 pollution.

Meteorological factors, including temperature (M), precipitation (E), and wind speed (W)

Existing literature shows that atmospheric pollution is closely related to meteorological conditions. When the distribution of pollution sources and their emissions are relatively stable, the concentration of atmospheric particulate matter also depends on the transport and diffusion of particulate matter under various meteorological conditions. First of all, China is a big country in heating, and its heating mainly relies on burning coal. If the average temperature (M) in this year is relatively low, the duration of central heating and carbon emissions in this year will be increased, which will increase the concentration of PM2.5 in the air (Liang et al. 2015). Therefore, annual average temperature (M) is added as a control variable in this paper, and it is expected that annual average temperature will have a significant negative impact on urban haze pollution. Secondly, precipitation has a certain cleaning effect on air pollutants and is conducive to the precipitation of air pollution particles (Li et al. 2014). Therefore, this paper adds the average annual precipitation (E) as the control variable, and it is expected that average annual precipitation has a significant negative impact on urban haze pollution. Finally, strong winds can disperse airborne air pollutants (Wen et al. 2020). Therefore, this paper selects the annual average wind speed of the nearest station as the control variable, and it is expected that wind speed has a significant negative impact on urban haze pollution.

Data sources

Since China’s national economy industry classification system underwent a major adjustment in 2002, the starting year we choose is 2003. According to the principle of data availability and validity, this paper selected the statistical data of 285 cities in mainland China from 2003 to 2018 for analysisFootnote 1. Data were collected from the “Statistical Yearbook of China Cities” (2004–2019), the “Statistical Yearbook of China” (2004–2019) and the Center for Socio-Economic Data and Applications, Columbia University. The variables reflecting the climate characteristics of each city were calculated based on the meteorological observation data of 743 conventional stations provided by the China Climate Center. The specific calculation process is as follows: if a weather station happens to be located in a city, we directly take the data of the station as the climate information of the city; if the city has more than one weather station, we take the average value. For cities without a weather station, the nearest weather station is used as the climate data for the city. Variable description and its calculation method are shown in Table 1, and descriptive statistical results of related variables are shown in Table 2.

Empirical results and analysis

Empirical analysis on the impact of fiscal decentralization on urban haze pollution in China

The selection criteria of spatial econometric models are as follows: Comparing Wald statistics and LR statistics to test whether the spatial Durbin model can be simplified into a spatial lag model or a spatial error model. If the null hypothesis H0 : θ = 0 and H0 : θ + δβ = 0Footnote 2 are rejected, then the spatial Durbin model is more suitable; if the null hypothesis H0 : θ = 0 cannot be rejected, and the robust LM test supports the spatial lag model more, then the spatial lag model is more suitable; if the null hypothesis H0 : θ + δβ = 0 cannot be rejected, and the robust LM test supports the spatial error model more, then the spatial error model is more suitable. In addition, the Hausman test is still used to determine whether the spatial panel model should adopt the form of fixed effect or random effect; For the selection of the fixed effect form, we also need to use the Joint significance test to judge. For the estimation of the spatial Durbin model, we use the improved maximum likelihood estimation method (Lesage and Fischer 2008; Elhorst 2010). Compared with spatial two-stage least square method (S2SLS) and generalized moment estimation method (GMM), this improved maximum likelihood estimation method is more effective in terms of effectiveness, consistency and operability.

The results show that Wald _ spatial _ lag test and LR _ spatial _ lag test reject the null hypothesis of H0 : θ = 0 at the significance level of 1%, respectively; meanwhile, Wald _ spatial _ error test and LR _ spatial _ error test reject the null hypothesis of H0 : θ + δβ = 0 at the significance level of 1%, respectively, which indicates that the spatial Durbin model is more suitable. Hausman test is significant at the level of 1%, which indicates that the fixed effect model is more appropriate. From the results of the joint significance test of space fixed effect and time fixed effect, it can be found that both the null hypothesis of no space fixed effect and no time fixed effect are rejected, which indicates that the spatiotemporal fixed effect model is more suitable.

Without considering the spatial lag term of independent variables, the regression coefficient can reflect the influence of independent variables on dependent variables. However, when the spatial lag term of independent variable is taken into account, the regression coefficient no longer reflects the influence of independent variable on dependent variable. This is mainly because the change of independent variable will not only affect the haze pollution of the city itself but also affect the haze pollution of the surrounding city through the spatial spillover effect. In this case, the spatial spillover effect cannot be accurately measured based on the spatial lag term coefficient in the spatial Durbin model, which leads to the wrong interpretation of the model estimation results (Elhorst 2014). Lesage and Pace (2009) proposed the direct effect, indirect effect, and total effect under the spatial Durbin model through the partial differential matrix analysis method to accurately reflect the influence of independent variables on dependent variables. The direct effect represents the average influence of the independent variable on the dependent variable of the region, the indirect effect represents the average influence of the independent variable on the dependent variable of the surrounding region, and the total effect represents the average influence of the independent variable on the dependent variable of all regions. This paper adopts this partial differential matrix method to calculate the impact of fiscal decentralization on haze pollution. The decomposition results are shown in Table 3 below.

As can be seen from Table 3, the direct effect coefficient of fiscal decentralization on haze pollution is significantly positive, which indicates that fiscal decentralization significantly aggravates local haze pollution, mainly due to the following two aspects: on the one hand, under the Chinese-style fiscal decentralization system with a political centralization background, the central government controls the promotion and punishment of local officials. To better evaluate and promote local officials, the central government often uses economic growth as an important metric. Local officials, seeking political advancement, tend to invest existing resources in their region’s economic growth rather than focusing on environmental improvements. The higher the degree of fiscal decentralization, the greater the fiscal autonomy of local governments, and the more obvious this tendency. On the other hand, with the improvement of fiscal decentralization, local governments are likely to further relax environmental regulatory standards in order to develop the economy, in order to compete for liquid resources and market. Under the environmental constraints of low standards, the pollution behavior of enterprises cannot be effectively controlled, which leads to the deterioration of local environmental quality.

The indirect effect coefficient of fiscal decentralization on haze pollution is significantly positive, which indicates that the improvement of fiscal decentralization in the region will not only worsen the haze pollution in the region but also aggravate the haze pollution in the surrounding areas. The possible reasons are as follows: on the one hand, with the improvement of fiscal decentralization in the region, haze pollution in the region will become more and more serious. The high diffusion and strong externality of such haze pollution will significantly aggravate the haze pollution in the surrounding areas, which has been verified in the previous section. On the other hand, with the increase of fiscal decentralization in the region, local governments may lower their environmental supervision standards in order to promote economic growth. In order to compete, the surrounding regions will lower their environmental regulatory standards accordingly, leading to a “race to the bottom” behavior of environmental policies among regions. We will examine this further in the next section.

From the perspective of control variables, the greater the population density, the more likely it is to aggravate haze pollution in the region. This is mainly because the higher population density increases residents’ demand for energy and electricity. The coefficient of the first term of economic development level is significantly positive, and the coefficient of the second term is significantly negative, indicating that there is an inverted “U” curve between haze pollution and economic development level. In other words, with the improvement of the level of economic development, China’s haze pollution shows a trend of increasing first and then decreasing. This conclusion is consistent with the environmental Kuznets curve. This is mainly because in the early stages of economic development, the economic structure shifted from agriculture to energy-intensive heavy industry, which increased pollution emissions, and then the economy shifted to low-pollution services and knowledge-intensive industries. As a result, the input structure changed, the emission level per unit of output fell, and the environmental quality improved. The service-oriented industrial structure is conducive to the improvement of haze pollution, mainly because the service industry has less demand for energy compared with the industry. Traffic intensity has a significant positive impact on haze pollution, which is mainly because higher traffic intensity increases the demand for energy and is not conducive to the diffusion and dilution of vehicle exhaust. Among meteorological factors, temperature, precipitation, and wind speed all have significant negative effects on haze pollution. This is mainly because rising annual average temperature will lead to a decline in the intensity of central heating, alleviating haze pollution in northern China. The increase of precipitation is beneficial to the particulate pollutants in settling air, while the higher wind speed is beneficial to the diffusion of atmospheric pollutants, and the air quality will be improved under the combined action of the two. What is not expected is that technological progress has not improved haze pollution, which may be due to the following two aspects: On the one hand, China’s technological progress is mainly elementary-oriented, while there are few green technologies and their applications centered on energy conservation and emission reduction. On the other hand, technological progress may lead to the rebound effect of energy, so that the energy saving effect and pollutant emission reduction effect generated by the improvement of energy efficiency at the technical level are nibbled by the new round of energy consumption and pollutant emission brought about by the deepening of capital and output growth.

Robustness test

Endogenous treatment

The above spatial Durbin model may have endogeneity problem, so this paper adopts the dynamic spatial Durbin model to deal with endogeneity. For the dynamic spatial Durbin model, we use the quasi-maximum likelihood estimation method with corrected errors to estimate (Yu et al. 2008; Lee and Yu 2010a; Lee and Yu 2010b). Compared with the maximum likelihood estimation method, this modified quasi-maximum likelihood estimation method has a good small-sample property and can better solve the endogeneity problem and estimation bias problem (Elhorst 2014). The decomposition results are shown in column (1) of Table 4. It can be seen from the decomposition results that, compared with the empirical results above, except for the coefficient of spatial spillover effect and its significance level changed to a certain extent, the coefficient and significance level of fiscal decentralization are basically consistent with the above research conclusions, which indicates that the impact of fiscal decentralization on haze pollution is reliable and robust.

Replace fiscal decentralization metrics

Existing studies often use expenditure index or revenue index to measure fiscal decentralization. The expenditure index of fiscal decentralization has been used for relevant analysis above, and then we use revenue index of fiscal decentralization to conduct robustness test. The decomposition results are shown in column (2) of Table 4. It can be seen from the decomposition results that the coefficient and significance level of fiscal decentralization are basically consistent with the above research conclusion, which indicates that the research conclusion is robust.

Replace environmental pollution metrics

Since sulfur dioxide is a major component of PM2.5 (Shen et al. 2020; Yan et al. 2020), and both sulfur dioxide and PM2.5 are gaseous pollutants, so urban sulfur dioxide is used in this paper for robustness test. The decomposition results are shown in column (3) of Table 4 below. It can be seen from the decomposition results that the impact coefficient and significance level of fiscal decentralization on SO2 are basically consistent with the above research conclusions.

Heterogeneity analysis

Heterogeneity of city size

There are two effects of city size on haze: agglomeration effect and crowding effect. With the continuous expansion of the city scale, on the one hand, the external economic effect, namely the agglomeration effect, gradually appears, mainly reflected in the sharing, matching and learning mechanism. On the other hand, when a city reaches a certain size, crowding in traffic, commuting cost, marginal land rent, etc., may start to make an appearance. All these may lead to different effects of fiscal decentralization policies. Therefore, according to the standards for setting city size released by the State Council in 2014, this paper conducts heterogeneity analysis and defines cities with a population between 1 million and 5 million as large cities, while cities with a population below 1 million are defined as small and medium-sized cities. Col. (1) and (2) of Table 5 are the test results of the heterogeneity of city size. According to the results, the direct effect coefficients and indirect effect coefficients of cities of different sizes are still significantly positive, which is consistent with the above conclusion, that is, fiscal decentralization can significantly increase the degree of haze pollution. Moreover, compared with small and medium-sized cities, fiscal decentralization has a greater impact on haze pollution in big cities. This indicates that with the expansion of city size, the agglomeration effect is gradually weakened, while the crowding effect is gradually dominant.

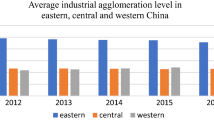

Heterogeneity of region

Due to the large differences in the level of economic and social development in different regions, the impact of fiscal decentralization on haze pollution may be regionally heterogeneous. For this reason, this paper divides China into eastern, central and western regions for regression analysis, and the specific decomposition results are shown in columns (3) to (5) in Table 5. According to the results, the regression results of the subsamples in the eastern, central and western regions of China are in good agreement with the regression results of the whole samples. In addition, the significance of the direct effect of fiscal decentralization on haze pollution and the absolute value of the coefficient gradually decreased from east to west, while the significance of the indirect effect and the absolute value of the coefficient also presented the same rule. For the western region, the indirect effect coefficient is even not significant. This may be because the eastern region of China has a relatively developed economic development level compared with the central and western regions. Heavy industry and polluting emission enterprises are mostly concentrated in the eastern region, and the pollution sources are relatively concentrated.

Heterogeneity of sample period

Since China began to implement the “12th Five-Year Plan” in 2011, which clearly stipulates that the total emission of major pollutants should be included in the binding index, this paper decomposes the sample period into two periods from 2003 to 2010 and 2011 to 2018 for regression analysis. The specific decomposition results are shown in columns (6) and (7) of Table 5. According to the results, the direct effect coefficient and indirect effect coefficient of the two samples are both positive, which is consistent with the above conclusion. In addition, the impact of fiscal decentralization on haze pollution from 2003 to 2010 was greater than that from 2011 to 2018. This is mainly because after 2011, China incorporated the total amount of major pollutants into the constraint index, and local governments began to gradually strengthen pollution control and supervision, thus weakening the influence of fiscal decentralization on haze.

Mechanism analysis

In fact, the impact of fiscal decentralization on haze pollution can be realized through a variety of mechanisms. Combined with the actual situation of China and existing literature (Que et al. 2018; Kuai et al. 2019), this paper mainly considers the following possible mechanisms: First, research and development investment (R&D). Fiscal decentralization may enable local governments to make more flexible use of fiscal funds and increase R&D investment through government subsidies and tax incentives. This paper uses the proportion of the expenditure of science and technology to the total expenditure of local finance to measure the R&D. Second, infrastructure (INFRA). Fiscal decentralization could make it easier for local governments to build more infrastructure, leading to more vehicle emissions, which are also important sources of PM2.5. In this paper, highway network density is used to measure infrastructure. Third, environmental regulation (ENRE). Fiscal decentralization may lead to regional regulatory competition, with local governments competing to offer preferential tax rates and lower environmental regulatory standards. This paper uses SO2 removal rate as environmental regulation measure. Fourth, market segmentation (MS). Fiscal decentralization may aggravate market segmentation, lead to repeated construction and efficiency loss, and is not conducive to cross-regional optimal allocation of innovation resources. Referred to Poncet (2003), this paper uses price method to measure market segmentation. The spatial Durbin model is still used for regression analysis, and the estimated decomposition results are shown in Table 6.

As can be seen from Table 6, fiscal decentralization has a significantly positive impact on R&D and infrastructure. This shows that with the improvement of fiscal decentralization, local governments have greater economic freedom and can use financial funds more flexibly. In addition, government subsidies, tax incentives, and other measures may be adopted to increase investment in R&D and infrastructure construction, thus increasing the emissions of traffic pollutants and increasing the concentration of haze pollution. The impact of fiscal decentralization on environmental regulation is significantly negative, which indicates that the improvement of fiscal decentralization significantly reduces the degree of environmental regulation, which means that regulation competition exists among local governments. When the degree of fiscal decentralization of local governments increases, local governments are more likely to lower environmental standards to attract the inflow of factors, so as to compete for liquid resources and the market. Under the environmental constraints of low standards, enterprises’ emission behavior cannot be effectively controlled, which leads to the deterioration of local environmental quality. In addition, the coefficient of influence of fiscal decentralization on market segmentation is significantly positive, which indicates that the improvement of fiscal decentralization intensifies the local market segmentation, indicating that there is still trade protectionism among local governments.

Through the above analysis, this paper finds that the influence of fiscal decentralization on haze pollution in China has the following completely different transmission mechanisms: First, fiscal decentralization enables local governments to have more discretionary funds to invest in scientific and technological research and development, but this part of research and development investment may not be used for environmental pollution control, so the increase of R&D has no significant impact on the improvement of haze pollution. Second, fiscal decentralization enables local governments to have more economic freedom, use fiscal funds more flexibly, increase infrastructure construction, and increase traffic pollutant emissions, which intensifies China’s haze pollution. Third, fiscal decentralization can lead to regional regulatory competition, which makes local governments compete to reduce tax rates and environmental supervision standards to attract factor inflows. This not only is detrimental to the improvement of technical efficiency but also increases environmental pollutant emissions. Fourth, fiscal decentralization will also aggravate market segmentation and trade protectionism, which will not only bring about repeated construction and efficiency loss but also inhibit the optimal allocation effect of resources across regions, widen the technological gap between regions, reduce energy efficiency, and thus improve the haze pollution level.

Analysis of the deep causes of the impact of fiscal decentralization on haze pollution

As indicated above, the improvement of fiscal decentralization in this region will significantly aggravate the haze pollution in this region and its surrounding areas, and the possible explanation is given according to the specific characteristics of fiscal decentralization in China. So does this explanation make sense? Will China’s fiscal decentralization lead to a vicious environmental competition of “race to the bottom”? Is this the result of local governments being powerless and unable to control environmental problems, or is it a deliberate act of self-interest? Sigman (2014) and Huang (2017) believe that fiscal decentralization will not only affect pollution levels but also affect pollution fluctuations. In addition, the fluctuation of pollution can reflect the government’s ability to control environmental policies to a certain extent. If local governments have a strong ability to control environmental policies, they will make environmental policies according to the local actual situation and costs, thus making the pollution fluctuation greater (Sigman 2014). Based on this logic, we will empirically analyze the impact of fiscal decentralization on haze pollution fluctuations, so as to further elaborate the environmental behaviors of local governments.

In order to measure the haze pollution fluctuation of each city more scientifically and accurately, we further subdivide the urban geographical unit and use the standard deviation of the haze pollution at the county level subordinate to each city to measure the haze pollution fluctuation degree of each city. The specific calculation formula is as follows:

where Stdi, t represents the haze pollution fluctuation degree of the city i in the year t, Ii, j, t represents the haze pollution degree of the county j under the city i in the year t, and ni represents the number of counties under the city i. We used ArcGIS software combined with vector maps of China’s county-level administrative regions to analyze raster data into specific values of the average annual PM2.5 concentration in 2383 counties and districts in China from 2003 to 2018. Then, formula (8) is used to calculate the fluctuation degree of haze pollution in 285 cities in China from 2003 to 2018. We still used the spatial Durbin model for regression analysis, and the decomposition results are shown in Table 7.

As can be seen from the decomposition results in Table 7, the direct effect coefficient of fiscal decentralization is significantly positive, which indicates that the improvement of fiscal decentralization in this region will significantly increase the volatility of haze pollution in this region. This is mainly because fiscal decentralization enables local governments to adjust their environmental policies according to local conditions in order to meet their heterogeneous preferences. With the improvement of fiscal decentralization, the fiscal autonomy of local governments will be greater and the space for such policy adjustment will be greater. In this sense, China’s local government has the ability to control haze pollution in its own region. It can significantly influence the fluctuation of local haze pollution by adjusting its environmental policies, that is, it can choose the environmental quality level that reflects its own preferences and interests.

The indirect effect coefficient of fiscal decentralization is significantly negative, which indicates that the improvement of fiscal decentralization in this region will significantly weaken the volatility of haze pollution in surrounding areas. This is mainly because with the increase of fiscal decentralization, local governments will have more space to adjust their environmental policies. However, in order to compete with each other, the surrounding areas must make corresponding adjustments according to the adjustment of local environmental policies, which further verifies the existence of environmental policy competition among local governments. Therefore, we can find that, on the one hand, local governments have the ability to control haze pollution in their own region according to their own will and interests, but on the other hand, the adjustment of environmental policies in surrounding areas has significantly inhibited the control of environmental policies in their own region, so that the haze pollution in their own region has not been effectively controlled. This is essentially a “race to the bottom” competition among local governments in environmental policies.

Conclusions and enlightenment

This paper empirically analyzes the impact of Chinese-style fiscal decentralization on haze pollution and its fluctuation. The results show that the improvement of fiscal decentralization will not only significantly increase the haze pollution emissions in the region but also significantly aggravate the haze pollution in the surrounding areas. In addition, the effect is greater for large cities, eastern regions, and samples from the pre-2011 period. Mechanism analysis suggests that fiscal decentralization aggravates haze pollution by strengthening infrastructure construction, reducing environmental regulations and intensifying market segmentation. Further analysis of the deep causes shows that the improvement of fiscal decentralization can increase the volatility of haze pollution in the region, which indicates that the local government has the ability to control the local haze pollution according to its own will and ability. However, the improvement of fiscal decentralization will also weaken the fluctuation of haze pollution in surrounding areas, which indicates that the adjustment of environmental policies in surrounding areas will significantly inhibit the control of environmental policies in the region, thus causing the haze pollution in the region to be not effectively controlled. This means that local governments will implement the destructive environmental competition of “Race to the bottom” in order to compete with each other. According to the research in this paper, we can get the following enlightenment:

First, we need to accelerate the establishment and improvement of a modern fiscal system and reasonably divide the fiscal powers and expenditure responsibilities between the central government and local governments. On the one hand, the central government should decentralize fiscal power on the existing basis, and increase the incline to environmental quality improvement expenditure in addition to ensuring the financial expenditure required by regional economic development. On the other hand, on the existing basis, the administrative authority should be upgraded to expand the scope of responsibility and expenditure of the central government in environmental management, and gradually reduce the interference of local governments in environmental management. At the same time, we will further improve the financial payment transfer system to transfer the environmental protection will of higher governments to lower governments.

Second, we should improve the evaluation mechanism of officials and establish a scientific and reasonable incentive mechanism of officials’ performance evaluation. On the one hand, we should improve the evaluation system of local leaders’ performance, emphasize the importance of green GDP in the promotion evaluation system, and include environmental evaluation projects. On the other hand, environmental auditing should be carried out to strengthen the accountability mechanism for the environmental responsibility of local officials and enhance the willingness of local officials to improve environmental quality.

Third, we should improve the legal conditions and market rules to prevent the destructive environmental competition of “Race to the bottom” among local governments. The central government should establish a competitive environment of market economy that is conducive to the efficient flow of factors, and prevent the emergence of “race to bottom” behaviors such as excessive investment, regardless of environmental costs and supply of cheap land, which may distort resource allocation, so as to reverse the vicious competitive strategy of local governments seeking rapid economic development at the expense of the environment.

In this paper, the spatial Durbin model was used to study the impact of fiscal decentralization on haze pollution and its fluctuation in China, and on this basis, heterogeneity analysis and mechanism test were carried out. However, there are still some deficiencies in this paper. The study of this paper believes that fiscal decentralization will aggravate the degree of haze pollution, but in reality, there are many other factors that have not been completely eliminated, which will also have an impact on haze pollution. In future studies, methods such as IV, DID, and RD can be considered to further exclude the influence of other factors on haze pollution.

Data Availability

Not applicable.

Notes

Bijie, Tongren, Chaohu, Sansha, and Haidong were not included in the analysis due to administrative division adjustment, and Lhasa was not included in the analysis due to incomplete data.

Both the null hypothesis H0 : θ = 0 and H0 : θ + δβ = 0 are expressed relative to the basic form of the spatial Durbin model. The specific model is as follows:

$$ \kern2.5em Y=\rho WY+\alpha {l}_N+ X\beta + WX\theta +\varepsilon $$$$ \kern2.5em \upvarepsilon \sim \mathrm{N}\left(0,{\sigma}^2{I}_n\right) $$When θ = 0, the spatial Durbin model is simplified to the spatial lag model.

When θ + δβ = 0, the spatial Durbin model is simplified to a spatial error model.

References

Atasoy BS (2017) Testing the environmental Kuznets curve hypothesis across the U.S.: Evidence from panel mean group estimators. Renew Sust Energ Rev 77:731–747

Cheng ZH, Li LS, Liu J (2017) Identifying the spatial effects and driving factors of urban PM2.5 pollution in China. Ecol Indic 82:61–75

Cheng ZH, Li LS, Liu J (2018a) Industrial structure, technical progress and carbon intensity in China’s provinces. Renew Sust Energ Rev 81:2935–2946

Cheng ZH, Li LS, Liu J (2018b) The spatial correlation and interaction between environmental regulation and foreign direct investment. J Regul Econ 54(2):124–146

Chupp BA (2011) Environmental constituent interest, green electricity polices, and legislative voting. J Environ Econ Manag 62:254–266

Dietz T, Rosa E A (1994) Rethinking the environmental impacts of population, affluence and technology. Human Ecology Review 2:277–300

Dijkstra BR, Fredriksson PG (2010) Regulatory environmental federalism. Ann Rev Resour Econ 2(1):319–339

Ehrlich P R, Holdren J P (1971) Impacts of population growth. Science 7:1212–1217

Elhorst JP (2010) Spatial panel data models. In Handbook of applied spatial analysis. M M Fischer, A Getis. 377-407. Berlin: Springer.

Elhorst JP (2014) Matlab software for spatial panels. Int Reg Sci Rev 37(3):389–405

Fredriksson PG, List JA, Millimet DL, (2003) Bureaucratic corruption, environmental policy and inbound US FDI: theory and evidence. Journal of Public Economics,87(7-8).

Gill AR, Viswanathan KK, Hassan S (2018) The Environmental Kuznets Curve (EKC) and the environmental problem of the day. Renew Sust Energ Rev 81:1636–1642

Hao Y, Chen YF, Liao H, Wei YM (2019) China’s fiscal decentralization and environmental quality: theory and an empirical study. Environ Dev Econ:1–23

He QC (2015) Fiscal decentralization and environmental pollution: evidence from Chinese panel data. China Econ Rev 36:86–100

Holmstrom B, Milgrom P (1991) Multi-task principal-agent analyses: incentive contracts, asset ownership and job design. Journal of Law, Economics and. Organization 7:24–52

Hu H, Xie N, Fang DB, Zhang XL (2018) The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: Evidence from 25 developing countries. Appl Energy 211:1229–1244

Huang SF (2017) A study of impacts of fiscal decentralization on smog pollution. World Econ 2:127–152

Kamp DVD, Lorentzen P, Mattingly D (2017) Racing to the bottom or to the top? Decentralization, Revenue pressures, and governance reform in China. World Dev 95:164–176

Kang ZY, Li K, Qu JY (2018) The path of technological progress for China’s low-carbon development: evidence from three urban agglomerations. J Clean Prod 178:644–654

Kuai P, Yang S, Tao A, Zhang S', Khan ZD (2019) Environmental effects of Chinese-style fiscal decentralization and the sustainability implications. J Clean Prod 239:118089

Kunce M, Shogren J (2005) On interjurisdictional competition and environmental federalism. J Environ Econ Manag 50:212–224

Kunce M, Shogren J (2007) Destructive interjurisdictional competition: Firm, capital and labor mobility in a model of direct emission control. Ecol Econ 60(3):543–549

Lee LF, Yu JH (2010a) A spatial dynamic panel data model with both time and individual fixed effects. Econometric Theory 26(2):564–597

Lee LF, Yu JH (2010b) Some recent developments in spatial panel data models. Reg Sci Urban Econ 40(5):255–271

Lesage JP, Fischer MM (2008) Spatial growth regressions. Model specification, estimation and interpretation. Spat Econ Anal 3(3):1742–1870

LeSage JP, Pace RK (2009) Introduction to spatial econometrics. Boca Raton, US: CRC Press Taylor & Francis Group. 54-73.

Levinson A (2003) Environmental regulatory competition: a status report and some new evidence. Natl Tax J 56:91–106

Li L, Qian J, Ou CQ, Zhou YX, Guo C, Guo YM (2014) Spatial and temporal analysis of Air Pollution Index and its timescale-dependent relationship with meteorological factors in Guangzhou, China, 2001-2011. Environ Pollut 190:75–81

Li AJ, Zhang AZ, Zhou YZ, Yao X (2017) Decomposition analysis of factors affecting carbon dioxide emissions across provinces in China. J Clean Prod 141:1428–1444

Liang X, Zou T, Guo B (2015) Assessing Beijing’s PM2.5 pollution: severity, weather impact, APEC and winter heating. Proceedings of the Royal Society A: Mathematical, Physical and Engineering Science 471:20150257

Liddle B (2018) Consumption-based accounting and the trade-carbon emissions nexus. Energy Econ 69:71–78

Lipscomb M, Mobarak AM (2017) Decentralization and pollution spillovers: evidence from the re-drawing of country borders in Brazil. Rev Econ Stud 84:464–502

Ma YR, Q J, Fan Y (2016) Spatial linkage analysis of the impact of regional economic activities on PM2.5 pollution in China. J Clean Prod 139:1157–1167

Meliciani V, Savona M (2015) The determinants of regional specialization in business services: agglomeration economics, vertical linkages and innovation. J Econ Geogr 15:387–416

Mintz J, Tulkens H (1986) Commodity tax competition between member states of a federation: equilibrium and efficiency. J Public Econ 29(2):133–172

Mohammad MR, Khosrul A (2021) Clean energy, population density, urbanization and environmental pollution nexus: evidence from Bangladesh. Renew Energy 03:103

Oates WE (2001) A reconsideration of environmental federalism. Resources For the Future, Discussion Papers dp-01-54.

Oates WE, Portney PR (2003) The political economy of environmental policy. Handbook of environmental economics. Elsevier,325-354.

Oates WE, Schwab R (1988) Economic competition among jurisdictions: efficiency enhancing or distortion inducing? J Public Econ 35(3):333–354

Poncet S (2003) Measuring Chinese domestic and international integration. China Econ Rev 14(1):1–21

Qian YY, Roland G (1998) Federalism and the soft budget constrain. Am Econ Rev 88(5):1143–1162

Que W, Zhang YB, Liu SB, Yang CP (2018) The spatial effect of fiscal decentration and factor market segmentation on environmental pollution. J Clean Prod 184:402–413

Ran QY, Zhang JN, Hao Y (2020) Does environmental decentralization exacerbate China’s carbon emissions? Evidence based on dynamic threshold effect analysis. Sci Total Environ 721:137656

Shen JY, Zhao QB, Cheng Z et al (2020) Insights into source origins and formation mechanisms of nitrate during winter haze episodes in the Yangtze River Delta. Sci Total Environ 741:140187

Sheng PF, Guo XH (2016) The long-run and short-run impacts of urbanization on carbon dioxide emissions. Econ Model 53:208–215

Sigman H (2005) Transboundary spillovers and decentralization of environmental policies. J Environ Econ Manag 50(1):82–101

Sigman H (2014) Decentralization and environmental quality: an international analysis of water pollution levels and variation. Land Econ 90(1):114–130

Su B, Ang BW, Li YZ (2017) Input-output and structural decomposition analysis of Singapore’s carbon emissions. Energy Policy 105:484–492

Sun Z, Chang CP, Hao Y (2017) Fiscal decentration and China’s provincial economic growth: a panel data analysis for China’s tax sharing system. Qual Quant 51:2267–2289

Tiebout C (1956) A pure theory of local expenditures. J Polit Econ 64(5):416–424

Ulph A (2000) Harmonization and optimal environmental policy in a federal system with asymmetric information. Journal of Environmental Economics and Mangement 29(2):224–241

van Donkelaar A, Martin RV, Brauer M, Hsu NC, Kahn RA, Levy RC, Lyapustin A, Sayer AM, Winker DM (2016) Global estimates of fine particulate matter using a combined geophysical-statistical method with information from satellites. Environ Sci Technol 50(7):3762–3772

Wei Q, Zhang YB, Liu SB, Yang CP (2018) The spatial effect of fiscal decentralization and factor market segmentation on environmental pollution. J Clean Prod 184:402–413

Wellisch D (1995) Locational choices of firms and decentralized environmental policy with various instruments. J Urban Econ 37(3):290–310

Wen W, Ma X, Tang YX, Wei P, Wang JK, Guo CW (2020) The impacts of meteorology on source contributions of air pollution in winter in Beijing, 2015–2017 changes. Atmospheric Pollution Research 11:1953–1962

Wildasin D (1988) Nash equilibrium in models of fiscal competition. J Public Econ 35(2):229–240

Wilson LS (1996) Capital mobility and environmental standards: is there a race to the bottom? In: Harmonization and Fair Trade. MIT Press, Cambridge, MA, pp 395–427

Xu B, Lin BQ (2018) What cause large regional differences in PM2.5 pollutions in China? Evidence from quantile regression model. J Clean Prod 174:447–461

Yan FH, Cheng WH, Jia SG et al (2020) Stabilization for the secondary species contribution to PM2.5 in the Pearl River Delta (PRD) over the past decade, China: a meta-analysis. Atmos Environ 242:117817

Yu JF, Jong RD, Lee LF (2008) Quasi-maximum likelihood estimators for spatial dynamic panel data with fixed effects when both N and T are large. J Econ 146(1):118–134

Yu S W, Zheng S H, Li X, Li L X. China can peak its energy-related carbon emissions before 2025: Evidence from industry restructuring. Energy Econ, 2018 73 :91-107.

Zhang K, Zhang ZY, Liang QM (2017a) An empirical analysis of the green paradox in China: from the perspective of fiscal decentralization. Energy Policy 103:203–211

Zhang N, Yu KR, Chen ZF (2017b) How does urbanization affect carbon dioxide emissions? A cross-country panel data analysis. Energy Policy 107:678–687

Zhang B, Chen XL, Guo HX (2018) Does central supervision enhance local environmental enforcement? Quasi-experimental evidence from China. J Public Econ 164:70–90

Zhou LA, Wu M (2015) Tax sharing rates among sub-provincial governments in China: facts and explanation. Financial Research 10:64–80

Zhu L, Gan QM, Liu Y, Yan ZJ (2017) The impact of foreign direct investment on SO2 emissions in the Beijing-Tianjin-Hebei region: a spatial econometric analysis. J Clean Prod 166:189–196

Funding

This paper was supported by the National Natural Foundation of China (71803087).

Author information

Authors and Affiliations

Contributions

Zhonghua Cheng: conceptualization; formal analysis; methodology; writing-original draft.

Yeman Zhu: formal analysis; writing-review and editing; software.

Corresponding author

Ethics declarations

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Cheng, Z., Zhu, Y. The spatial effect of fiscal decentralization on haze pollution in China. Environ Sci Pollut Res 28, 49774–49787 (2021). https://doi.org/10.1007/s11356-021-14176-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-14176-y