Abstract

Innovation technologies have been recognized as an efficient solution to alleviate carbon emissions stem from the transport sector. The aim of this study is to investigate the impact of innovation on carbon emissions stemming from the transportation sector in Mediterranean countries. Based on the available data, Albania, Algeria, Bosnia and Herzegovina, Croatia, Egypt, Morocco, Tunisia, and Turkey are selected as the 8 developing countries; and Cyprus, France, Greece, Israel, Italy, and Spain are selected as the 6 developed countries and included in the analysis. Due to data constraints, the analysis period has been determined as 1997–2017 for the developing Mediterranean countries and 2003–2017 for the developed Mediterranean countries. After determining the long-term relationship with the panel co-integration method, we obtained the long-term coefficients with PMG and DFE methods. The empirical test results indicated that the increments in the level of innovation in developing countries have a positive impact on carbon emissions due to transportation if the innovation results from an increase in patents. An increase in the level of innovation in developed countries has a positive impact on carbon emissions due to transportation if the innovation results from an increase in trademark. As a result, innovation level has a positive effect on carbon emissions due to transportation, and this effect is stronger for developed countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since the Rio Declaration on Environment and Development and the Statement of principles for the Sustainable Management of Forests were accepted by more than 178 Governments at the United Nations Conference on Environment and Development (UNCED 1992) in June 1992, innovation processes toward sustainable development (eco-innovations) have received increasing attention in different sectors. This raises the question “how to promote innovation technologies to reach sustainable environment targets without sacrificing growth and performance in different sectors?”

As a fundamental approach, there are two alternative ways to increase output. One should either increase the inputs for the production process, or “new ways” in which to get more output with the same amount of input (Rosenberg 2004:1). “New ways” can be categorized under three forms (Broughel and Thierer 2019:5): (1) cost reduction, (2) quality improvement, and (3) new production methods as well as alternative goods and services. Schumpeter (2000) defined innovation as “the introduction of new technical methods, products, sources of supply, and forms of industrial organization.” Roger (1983) described innovation as an idea, object, or practice that can be accepted as new by the people.

In the literature, there are many studies pointing to the spillover effect of innovation and technology on economic growth. Ulku (2004) investigated the relationship between innovation and economic growth in 20 OECD and 10 non-OECD countries over the period 1981–1997. The empirical results provided evidence of a positive relationship between innovation and per capita GDP in both OECD and non-OECD countries. The author also pointed out that the effect of R&D stock on innovation was significant only in the large markets of OECD countries. Pece et al. (2015) analyzed the effects of innovation on the economic growth in Poland, the Czech Republic, and Hungary. The empirical results showed that there is a positive relationship between economic growth and innovation. Innovation and R&D provide competitiveness, progress, and finally economic growth. Maradana et al. (2017) also found bidirectional causality between innovation and economic growth for 19 European countries spanning the period 1989–2014. Hence, according to the findings of many studies in the related literature, there is a close and bidirectional relationship between innovation and economic growth.

Since innovation technologies are improved for sustainable economic growth and sustainable environment, they can also be used in transport and energy sector. Actually, innovation is one of the key factors to control the spurring of the rise in CO2 emissions, and there has been an outcry for innovative technologies. To combat environmental pollution due to CO2 emissions stemming from transport, new innovative technologies have been developed and patented in the last decade (Mensah et al. 2018). Efficiency, intensity, and technology of vehicles are highly effective on the level of pollution and environment quality (Goulias 2007: 66). Indeed, innovative technologies in the energy sector may bring less consumption, lower energy cost, more efficiency, higher quality of the environment, and economic growth. Due to the improvements in energy efficiency technologies, electrification, and applying more environment-friendly energy resources, global transport emissions rose by less than 0.5%. Comparing with the annual increase of 1.9% since 2000, this rate of increase is promising (Teter et al. 2020). A remarkable reduction in fuel per kilometer around the world in the upcoming years can be possible by innovative technologies and hybridization. However, strong policies are needed to ensure maximum efficiency in automotive technology to transfer their benefit into fuel economy improvement. It is a fact that changing traditional pollutive transport technologies will require the adoption of environment-friendly innovative technologies. The development of innovative and high-performance technologies in the transportation sector will provide fine tuning of the design of transportation equipment (IEA 2009a: 35).

Transportation is one of the most important determinants of economic activities and our daily life. Nevertheless, the transport sector has been facing economic, technological, and environmental challenges. Parallel to the increasing population and economic needs, there has been an exponential increase in conventional fuel use in the transport sector. Hence, the negative impacts of oil are increasing faster than ever. The transportation sector which includes the movement of people and goods by cars, trains, airplanes, and other vehicles is now one of the major sources of global warming and air pollution. The greatest proportion of greenhouse gas emissions belongs to CO2 emissions resulting from the combustion of fossil-fuel-based products in the transport sector. There are certain reasons for increasing CO2 emissions in the transport sector: The most important reason is that in all cities, particularly in the metropolis, there is growing congestion. Congestion increases especially in rush hours due to staying in the traffic and exhausting more gas and carbon emissions. And since the transport is highly dependent on oil which is a nonrenewable energy source, there is an increasing rate of air pollution. Moreover, cities are getting larger, and the landscapes of cities are changing. In many countries, the instruction sector is one of the locomotive sectors. Urban transformation, constructing new buildings, and high-rises lead to the dramatic degradation of urban landscapes. Constructing new towns increases the need for new roads and transport facilities which cause the demolition of historical buildings and reductions in open space and green areas. And also, constructing new places and decentralizing cities caused longer trips with more vehicles. This also leads to higher dependence on cars rather than short trips with public transportation. Finally, globalization affected many sectors such as tourism, aviation, and international trade. Through multinational corporations, there are great industrial investments all over the world. These corporations initiated new patterns of distribution of goods/products which causes dramatic increases in global, regional, and local transportation activities (Banister 2005: 16-17). Similarly, globalization motivated the tourism and aviation sectors which resulted in more transportation and more carbon emissions.

Starting from the beginning of the 1900s, conventional fossil fuel has been used extensively in the transport industry. Excessive use of fossil fuels in the transport sector causes pollution and environmental degradation. The largest sources of transportation-based greenhouse emissions are passenger cars and light-duty trucks which represent more than half of the emissions from this sector. The other half of greenhouse gas emissions from the transportation sector comes from commercial aircraft, ships, boats, trains, and pipelines (EPA 2019). Numerically, transport accounts for almost 16.2% of global energy use and CO2 emissions. Therefore, transport is responsible for both direct emissions from fossil fuels to power transport vehicles and indirect emissions through electricity. Road transport has a share of 11.9 % in total transport. Road trucks include cars, buses, and motorcycles (this group represents 60% of total road trucks) and trucks and lorries. Aviation is also responsible for the carbon emissions from domestic (40%) and international aviation (60%) (Ritchie and Roser 2020). Besides, parallel to the increasing demand for modern highways, infrastructure constructions affect the land surface dramatically and cause great losses on habitat and biodiversity. The transportation sector is also one of the basic causes of air pollution-related death and disease such as cancer, asthma, and bronchitis (Rowland et al. 1998: 10). Figure 1 illustrates the global transport sector’s carbon emission trends over the period 2000–2019. World total CO2 emissions steadily increase from 5.8 Gt in 2000 to 8.2 Gt in 2019. Comparing with the shipping and aviation sectors, passenger road vehicles and road freight vehicles contributed more to total CO2 emissions.

IEA (2009a) reported that transport is responsible for one quarter of global energy-related CO2 emissions. However, in 2019, the global transport sector energy intensity that is calculated by total energy consumption per unit of GDP fell by 2.3% (Teter et al. 2020). Besides, the Covid-19 pandemic adversely affected the transportation sector. Until the Covid-19 pandemic started in the early days of 2020, CO2 emissions were rising around 1% every year in the last 10 years (Le Quéré et al. 2020:647). Due to global lockdown precautions, 57% of global oil demand declined. Sharp declines in energy demand in 2020:Q1 led to a 5% fall compared with 2019:Q1 in global carbon emissions. Road transport declined between 50 and 75%. At the end of March 2020, the global transport activity fell by 50% of the 2019 level. Indeed, CO2 emissions dropped more than energy demand since the greatest carbon-incentive fuels had the largest drops in demand during this period. The regions which experienced the earliest impacts of the Covid-19 had the largest CO2 emissions falls. It is also expected that the global lockdown will cause sharp declines in the global CO2 emissions and will be recorded as 30.6 Gt by the end of this year. This amount is approximately 8% lower than the previous year (IEA 2020a, 2020b). However, once the pandemic is over, there may be even more CO2 emissions in all sectors starting from the transport. Road vehicles such as cars, trucks, buses, and other motor vehicles are responsible for ¾ of transport CO2 emissions. Moreover, carbon emissions from aviation and shipping are rising which points out the necessity to have international cooperation and initiating global policies (Teter et al. 2020). IEA (2009b) predicted that unless there are international cooperation and global measures, worldwide car ownership will be triple to more than 2 billion; the trucking sector will be expected to be double, and aviation will increase by fourfold by 2050. These increases in all subsectors of transportation will double the transport energy use that will bring higher rates of CO2 emissions. Indeed, transport energy use and CO2 emissions are estimated to increase by 50% by 2030 and more than 80% by 2050 (IEA 2009a: 29, 35).

Figure 2 represents the carbon emissions of Mediterranean countries. We included Israel, Italy, France, Spain, Greece, and Cyprus as developed Mediterranean countries and Turkey, Albania, Bosnia and Herzegovina, Croatia, Algeria, Tunisia, and Morocco as developing Mediterranean countries in our study. During the 2000–2016 period, carbon emissions of developed countries were always higher. However, starting from 2010, while developing Mediterranean countries’ carbon emissions were rising, carbon emissions of developed Mediterranean countries started to decline. The decrease in carbon emissions in developed Mediterranean countries can be due to increasing energy efficiency and innovative technologies in the energy sector.

Developed and developing Mediterranean countries carbon emissions from the transportation sector (million tones, 2000–2016). Source: Authors’ own calculations from Ritchie and Roser (2020). Developing Mediterranean countries: Turkey, Albania, Bosnia and Herzegovina, Croatia, Algeria, Tunisia, and Morocco. Developed Mediterranean countries: Israel, Italy, France, Spain, Greece, and Cyprus

Figure 3 illustrates the carbon emissions of the transport subsectors in developed and developing Mediterranean countries in 2017. According to Fig. 3, transport combustion by road is much higher than transport combustion by shipping and aviation both in developed and developing Mediterranean countries.

Developed and developing Mediterranean countries carbon emissions from transport (Road and shipping–aviation) (2017, million tones). Source: IEA (2019a)

Although historically, there has been a close relationship between economic growth and transportation, there is a trade-off between economic growth, transport increase, and environmental degradation. The question is whether we can initiate sustainable economic growth with less CO2 emissions. Moreover, to avoid the disastrous effect of climate change, global CO2 emissions must be decreased at least by 50%. To reach this target, transport will have a crucial position. Even though there are huge cuts in CO2 in all other sectors, unless transport does not reduce CO2 emissions by 2050, it will be impossible to meet the target (IEA 2009a: 29).

It is a fact that the transport sector is one of the leading sectors contributing to carbon emissions on a global scale (Chaudhry et al. 2020). Despite the fact that the transport sector causes environmental pollution, it is also one of the pioneer sectors which have the greatest technological developments and innovation that bring energy efficiency and less fuel consumption. Many studies have pointed out that innovation in the transport sector not only provides energy efficiency but also increases the service life of vehicles. Besides, the gains in efficiency of energy consumption lead reduction in the per-unit price of energy services. This causes increases in energy consumption and carbon emissions (the rebound effect). In their studies, Greening et al. (2000); Herring and Roy (2007); Jin et al. (2018); Erdoğan et al. (2019a); Erdoğan et al. (2020); Erdoğan et al. (2019b); and Lemoine (2019) pointed out the interrelation between economic growth, technological innovation, and increasing energy consumption which leads rebound effect.

Moreover, the level of development of the countries may be also crucial in analyzing the contribution of the transport sector to carbon emissions. The findings of the researches considering the development level of the countries in order to find solutions to combat the increase in carbon emissions on a global scale may be helpful. In this context, the questions to be answered in order to determine the relationship between the level of development of countries and the magnitude of carbon emissions are listed below:

-

The lower the economic growth, the less allocation of sources to be transferred to innovation. Does using low technologies in the transport sector result in high carbon emissions?

-

Does higher income per capita in developed countries aggravate carbon emissions due to the increasing demand for energy-saving vehicles? Yet drivers may be more comfortable driving more if they believe that their vehicles consume less fuel and produce fewer pollutants.

-

How do the demand to own a car and the desire to drive affect carbon emissions?

-

Indeed, the level of development difference among the countries in the Mediterranean region is significant. Does it make a difference in carbon emissions?

In this vein, the aim of this study is to investigate whether there is a difference between developed Mediterranean countries and developing Mediterranean countries regarding the impact of innovation on the transport sector and carbon emissions. The Mediterranean basin has been an important and strategic region, and all countries located in this region have a critical role both in economic and political relations. However, the macroeconomic performances of developed and developing Mediterranean countries demonstrate great differences. The macroeconomic performances of Euro-Mediterranean countries are better than most of the Eastern and Southern Mediterranean countries. Thus, their R&D expenditures, economic growth rates, GDP per capita, and the level of innovation investments are far better than their developing counterparts. Furthermore, energy efficiency technologies, means of the transport sector, and environmental policies and level of environmental awareness are not homogenous in sample countries. Therefore, while developing Mediterranean countries’ carbon emissions were rising in recent years, carbon emissions of developed Mediterranean countries started to decline. This is probably related to increasing energy efficiency and innovative technologies in the energy sector.

To provide a precise analysis, we divided the Mediterranean countries into two groups as developed Mediterranean countries and developing Mediterranean countries. Based on the available reliable data, Albania, Algeria, Bosnia and Herzegovina, Croatia, Egypt, Morocco, Tunisia, and Turkey are selected as the 8 developing countries; and Cyprus, France, Greece, Israel, Italy, and Spain are selected as the 6 developed countries. We kindly explain the reasons why we distinguished the sample countries as developed and developing Mediterranean countries. Since the income per capita in developed countries is higher than in developing countries, it is possible for these countries to transfer more resources to the area of innovation. Transferring more resources to innovation investments can be helpful to control and reduce environmental degradation. Therefore, innovation in developed countries is expected to be more effective in reducing carbon emissions comparing to developing countries. In order to analyze whether this expectation is correct or not, the countries within the scope of the study have been classified as developed and developing countries. Due to data constraints, the analysis period has been determined as 1997–2017 for the developing Mediterranean countries and 2003–2017 for the developed Mediterranean countries. After determining the long-term relationship with the panel co-integration method, we obtained the long-term coefficients with FMOLS and DOLS methods. We applied Pedroni co-integration test. It allows for panel-specific co-integrating vectors and based on the stationarity test of error terms with panel and group tests statistics (v, rho, ADF, and PP).

To the best of our knowledge, there is no other study that investigates the effects of innovation on the transport sector carbon emissions in the Mediterranean countries. Hence, the contribution of our paper to the related literature is analyzing the relationship between innovation and transport sector carbon emissions in the developed and developing Mediterranean countries.

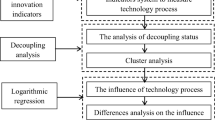

The remainder of the paper is organized as follows: The second part is the literature review. The third part introduces the model; the fourth part explains the data and methodology, the statistical properties of data, and stylized facts; and the last part presents the empirical results and policy implications.

Literature review

The literature review of our study will be analyzed under two headlines: The first headline is the relationship between the transportation sector and CO2 emissions. And the second one is the relationship between innovation and CO2 emissions. The summary table for the literature review can be seen in Appendix 4.

Innovation and CO2 emissions

Johnstone et al. (2010) examined the effects of environmental policies on technological innovation in the case of renewable energy on the 25 OECD countries using the panel data during the period 1978–2003. The researchers concluded that public policy had a crucial role in determining patent applications and the development of new renewable energy technologies. The authors pointed the public expenditures on R&D and the Kyoto Protocol that encouraged the patent activities on wind and solar power as the significant effects on increasing innovation activities.

Fei et al. (2014) investigated the energy–growth nexus by taking the effects of clean energy, CO2 emissions, and technological innovation into account in Norway and New Zealand during the period 1971–2010. The authors indicated that there was a long-term equilibrium between clean energy, economic growth, and CO2 emissions. They also showed that while clean energy alleviates the CO2 emissions, it also brings extra cost on the economic growth of both countries. While technological innovation implies advancements in energy efficiency, New Zealand does not intend to apply technological innovation in clean energy production. Irandoust (2016) analyzed the relationship between renewable energy consumption, technological innovation, CO2 emissions, and economic growth in the Nordic countries (Denmark, Finland, Norway, and Sweden). The empirical results indicated that there was a unidirectional causality running from technological innovation to renewable energy and from renewable energy to economic growth for all sample countries. The authors pointed out the importance of technological innovation on renewable energy and economic growth. In another study for China, Zhang et al. (2017) investigated the effect of environmental innovations during 2000–2013 using SGMM technique. They indicated that resource innovation, knowledge innovation, and environmental innovation measures reduce CO2 emissions effectively in China. Samargandi (2017) reached similar findings for the case of Saudi Arabia. Mensah et al. (2018) investigated the effects of innovation on CO2 emission in 28 OECD countries over the period 1990–2014 using the STIRPAT model. The researchers concluded that innovation has a crucial role in the mitigation of CO2 emissions. They also pointed out that the higher the GDP per capita, the greater the rise in CO2 emissions. Kahouli (2018) examined the causality relationship between energy electricity consumption, R&D stocks, CO2 emissions, and economic growth in Mediterranean countries over the period 1990–2016. The empirical results indicated the existence of strong feedback effects between electricity, R&D stocks, CO2 emissions, and economic growth. It was also found that there was a one-way causality between R&D stocks and economic growth, and a unidirectional causality between R&D and CO2 emissions.

Danish (2019) also found that the ICT mitigates the CO2 emissions in the 59 countries along Belt and Road spanning the period 1990–2016. Petrovic and Lobanov (2020) analyzed the impact of R&D expenditures on CO2 emissions in 16 OECD countries for the period between 1981 and 2014. Shahbaz et al. (2020) revealed parallel results in their study on the role of technological innovations in China. The authors found that technological innovations have a negative impact on CO2 emissions. Nguyen et al. (2020) confirm this finding. The authors investigated 13 selected G-20 countries over the period 2000–2014 and concluded that together with energy price, foreign direct investment, and trade openness, technology and spending on innovation have a mitigating effect over CO2 emissions. The authors found statistically significant relationships between CO2 emissions, innovation, and ICT. The authors found that R&D investment has negative effects on CO2 emissions in the long term. They showed that a 1% growth of R&D investments mitigates CO2 emissions by 0.09–0.15% on average. Wen et al. (2020) analyzed the spillover effects of technological innovation on CO2 emissions in 30 provinces of China spanning the period 2000–2015 in the construction sector. The authors indicated the key role of technological innovation in CO2 emission reduction in the construction industry.

Although most of the studies in the literature indicated the moderating effects of innovation on CO2 emissions, there are some studies that reached different results:

Álvarez-Herránza et al. (2017) employed a panel dataset of 28 OECD countries to analyze the effects of improvements in energy research development on greenhouse gas emissions spanning the period 1990––2014. The empirical results indicated that energy innovation measures could not reach its whole impacts at once, instead, it needs more time to reach the targets and their full effect.

Amri et al. (2018) investigated the moderating role of technological innovation on the devastating effects of trade and energy consumption on environmental sustainability in Tunisia spanning the period 1971–2014. They found that there was no causality between technological innovation and CO2 emissions and there was a unidirectional impact of technological innovation on energy consumption both in short and long terms. Besides, technological innovation had indirect significance by decreasing the impact of energy consumption on CO2 emissions.

Khattak et al. (2020) analyzed the effects of innovation, renewable energy, and GDP per capita on CO2 emissions in BRICS countries over the period 1980–2016. The test results showed that technological innovation could not mitigate the CO2 emissions in China, India, Russia, and South Africa. It was found that there was bidirectional causality between innovation and CO2 emissions; innovation and GDP per capita; innovation and renewable energy consumption; and CO2 emissions and GDP per capita.

Although most of the literature focuses on how innovation contributes to alleviating climate impact on the environment by examining the mitigating innovative technologies, Su and Moaniba (2017) tried to analyze the causality via a reverse approach. The authors analyzed the effects of climate changes on innovation technologies on a dataset of 70 countries. The authors concluded that increasing levels of CO2 emissions cause more innovations related to climate change. Therefore, the author suggested diverting public funds to innovative activities that contribute to combating climate change.

Du et al. (2019b) investigated the effects of green technology innovations on CO2 emissions in 71 countries for the period 1996–2012. Based on the empirical findings, it was indicated that green technology innovations do not have a significant impact on mitigating CO2 emissions in economies whose income level is below the threshold. On the contrary, the economies whose income level is above the threshold reduction effects became significant. The authors also found that CO2 emission per capita and per capita GDP is inverted U-shaped and urbanization level and industrial structure.

Koçak and Şentürk Ulucak (2019) examined the effects of R&D expenditures on CO2 emissions using the STIRPAT model for OECD countries during the period 2003–2015. The empirical results showed that, contrary to the expectations, there was a significant positive relationship between the R&D expenditures and CO2 emissions due to R&D improvements in energy efficiency and fossil fuel. The authors also found that the power and storage R&D expenditures have a mitigating effect on CO2 emissions.

Transportation and CO2 emissions

Zhou et al. (2013) examined the CO2 emissions performance of China’s transport sector over the period 2003–2009. The empirical results indicated that the number of environmentally efficient regions decreased in the given period. The authors also found that the Eastern region of the country had the best results in adjusting CO2 emissions as transport infrastructure facilities are better in this region. Hence, they underlined the importance of the development of transport infrastructure technologies in the abatement of CO2 emissions.

Li et al. (2013) explored the effects of factors such as vehicle fuel intensity, working vehicle stock per freight transport operator, industrialization level, and economic growth on the CO2 emissions from road freight transportation in China over the period 1985–2007. The test results showed that while economic growth is the most important factor in increasing CO2 emissions, the ton-kilometer per value added of industry and the market concentration level significantly decrease CO2 emissions.

Guo et al. (2014) analyzed the contributions of population, energy intensity, energy structure, and economic activities to CO2 emission increments in the transport sector spanning the period 2005–2012 in different provinces and regions of China. The authors concluded that the Eastern region of China had the highest CO2 emissions and per capita CO2 emissions but the lowest CO2 emissions intensity in its transport sector, whereas the Western side had the highest CO2 emission intensity and the fastest emission increasing trend in its transport sector. They also pointed out that there has been a great increase in CO2 emissions in the transport sector in parallel to economic activities.

Fan and Lei (2016) explored the impact of transportation intensity, energy structure, energy intensity, the output value of per unit traffic turnover, population, and economic growth on CO2 emissions in the transportation sector over the period 1995–2012 in Beijing, China. The authors found that economic growth, energy intensity, and size of the population are the primary reasons for transportation carbon emissions. They also found that transportation intensity and energy structure are the negative drivers of CO2 emissions in the transportation sector.

Wang and He (2017) investigated the CO2 marginal mitigation costs of the regional transportation sector, CO2 emissions efficiency, economic efficiency, and productivity in China from 2007 to 2012. The authors found that CO2 emissions efficiency and marginal mitigation cost of CO2 emissions are negatively correlated. Hence, improving CO2 emissions efficiency leads to a reduction in CO2 marginal mitigation costs.

Zhu and Du (2019) analyzed the driving factors of CO2 emissions of road transportation in Australia, Canada, China, India, Russia, and the USA for the period of 1990–2016. The empirical results indicated that carbon emissions of road transportation had a dramatic increase since 1990. Besides, both the economic output and the increasing population had positive effects on CO2 emissions of the road transportation sector.

Du et al. (2019a) analyzed the relationship between the transportation sector and the Chinese economy from 2002 to 2012. The authors searched the effects of all means of transportation, i.e., the rail, road, water, and air on the generation of CO2 emissions. The empirical findings indicated that the road subsector increased CO2 emissions whereas the rail subsector resulted in mitigation in CO2 emissions due to technological advances.

Khan et al. (2020) investigated the sectorial effects on CO2 emission in Pakistan over the period 1991–2017. The researcher revealed that while the agriculture and services sectors have a negative effect on CO2 emissions, the construction, manufacturing, and transportation sectors contribute to the CO2 emissions. They also pointed out the importance of technological innovations for the CO2 emissions reduction strategies.

Georgatzi et al. (2020) examined the determinants of CO2 emissions due to the transport sector for 12 European countries during the period 1994–2014. Based on the test results, it was concluded that infrastructure investments by the transport sector do not have a significant effect on CO2 emissions; and also, there was a bidirectional relationship between environmental policy stringency and CO2 emissions.

Although in most of the studies researchers found similar results that point to the positive relationship between the transport sector and CO2 emissions, some papers indicated that the results may vary. In their study on the impact of public transportation on CO2 emissions for Chinese provinces, Jiang et al. (2018) concluded that although the results were heterogeneous, the findings support inverted U-shaped nexus between public transportation and CO2 emissions for provinces whose CO2 emission levels are different. Hence, if the public transportation level exceeds a threshold value, the relationship between the two variables may turn from positive to negative.

Data

There are many factors affecting CO2 emissions such as the size of population, urbanization, economic growth, FDI, financial development, trade, and energy intensity (Pham et al. 2020; Nasir et al. 2019). Innovation is also very effective on CO2 emissions. Thus, analyzing the effects of innovation on a sectorial basis may be useful for developing specific policies.

This study examines the relationship between innovation and transportation sector carbon emissions in developed and developing Mediterranean countries. The development levels of countries are considered as one of the main antecedents of innovation capability and transportation habits. In this context, in this study, Mediterranean countries are divided into two groups as developed and developing Mediterranean countries. On the basis of real GDP, IMF (2019) classified eight countries (Cyprus, France, Greece, Israel, Italy, Malta, Slovenia, and Spain) as developed and ten countries (Albania, Algeria, Bosnia and Herzegovina, Croatia, Egypt, Lebanon, Libya, Morocco, Tunisia, and Turkey) as emerging or developing Mediterranean countries. According to this classification of IMF and depending on the availability of data, the relationship between innovation and carbon emissions from the transport sector in eight developing countries (Albania, Algeria, Bosnia and Herzegovina, Croatia, Egypt, Morocco, Tunisia, and Turkey) will be analyzed with annual data between 1997 and 2017. Because of the data constraints, for six developed countries (Cyprus, France, Greece, Israel, Italy, and Spain) innovation-carbon emission nexus through the transport sector will be investigated over the period 2003–2017.

The estimation equations are as follows.

The abbreviations in the equations define the following concepts:

- tco2it:

-

CO2 emissions from the transport sector

- patentit:

-

Number of patent applications

- tmit:

-

Number of trademark applications

- lngdppcit:

-

Per capita income

- lngdppcit2:

-

The square of per capita income

- Xit:

-

Control variables

In the equations, the number of patents and the number of trademarks are considered as indicators of innovation capability, while trade (trade openness), FD (financial development), urban (the number of people living in urban areas), and energy (energy consumption) are the control variables.

In order to test the validity of the Kuznets hypothesis, Eqs. (2) and (4) are created as quadratic equations.

CO2 emissions from transport (Mt CO2/year) include sources from fossil fuel use (combustion and flaring), industrial processes (cement, steel, chemicals, and urea), and product use (Muntean et al. 2018). Patent applications are worldwide patent applications filed through the Patent Cooperation Treaty procedure or with a national patent office for exclusive rights for an invention. A patent provides protection for the invention (a product or process that provides a new way of doing something or offers a new technical solution to a problem) to the owner of the patent. TM (trademark applications) is the number of applications to register a trademark with a national or regional (registered to Intellectual Property (IP) office). GDP per capita is gross domestic product divided by midyear population. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies. Data are in current US dollars. Trade (trade openness) is the value of exports of goods and services + the value of imports of goods and services/GDP (%). FD, financial development (domestic credit to the private sector by banks (% of GDP)), refers to financial resources provided to the private sector by financial corporations. Urban (the World Bank population estimates) refers to the number of people living in urban areas. Energy (quad Btu) refers to the use of primary energy consumption. Energy use data were obtained from the US Energy Information Administration, carbon emission from transport data were obtained from the Muntean et al. (2018) (European Union Report—Fossil CO2 emissions of all world countries) reports, and other data were obtained from the World Bank. In the study, all data except energy were taken as the natural logarithm. Descriptive statistics of the data are shown in Table 1.

According to descriptive statistics in Table 1, the yearly average of CO2 emissions from the transport sector in developed countries is 62.1 (Mt CO2), whereas it is 18.4 (Mt CO2) in developing countries. This shows that CO2 emissions from the transport sector in developed countries are 3.5 times greater than those in developing countries. While the average GDP per capita in the developed countries is $30,500, it is $4800 in the developing countries. The energy consumption of developed countries is approximately three times that of developing countries. Although there is not a significant difference between the international trade performances of developed and developing countries, the developed Mediterranean countries showed a remarkable performance in financial development and innovation. Finally, the average urban population is 23.9 million for developed countries, whereas it is 17.2 million for developing countries.

Methodology and empirical results

The purpose of this study is to investigate the effect of innovation on carbon emission from the transport sector in Mediterranean region countries. The stationarity of the series is important in choosing the preferred estimation method. Therefore, the first step of the analysis is to investigate the stationarity of the series. Another important factor affecting the estimation results in panel data analysis is cross-sectional dependency. O’Connell (1998) showed that cross-sectional dependency increases the possibility of rejecting the null hypothesis. Panel unit root tests can be divided into two: (1) first-generation unit root tests assuming cross-sectional independence of series and (2) second-generation unit root tests assuming cross-sectional dependence of series. In order to choose the appropriate estimation method, it is necessary to investigate the cross-sectional dependency of the series.

The Pesaran (2004) CD test and Pesaran and Yamagata (2008) LMadj (bias-adjusted cross-sectional dependence Lagrange multiplier) test were used to test the presence of cross-sectional dependence.

CD test statistics are calculated as follows:

LMadj test statistics are calculated as follows:

Hypotheses of CD test:

H0: No cross-sectional dependence

H1: Has the cross-sectional dependence

Table 2 shows the results of the cross-sectional dependency of the series.

As shown in Table 2, according to the CD test results, the null hypothesis is rejected at the 10% significance level. The basic hypothesis suggests that there is no cross-sectional dependency for all variables except the GDPPC series. Hence, it is decided that the cross-sectional dependency problem exists. For the GDPPC series, it is seen that the basic hypothesis cannot be strongly rejected. On the other hand, according to the LMajd test result for the GDPPC series, the basic hypothesis suggesting that there is no cross-sectional dependency is rejected, and it is decided that the cross-sectional dependency problem exists. According to the results of the LMajd test, it is decided that the cross-sectional dependency problem exists for all series except for TM, TRADE, and FD series.

According to CD test results at a 10% significance level for developed countries, it is decided that the cross-sectional dependency problem exists for all variables except GDPPC, URBAN, and FD series. For these three variables, LMajd test statistics show that the cross-sectional dependency problem exists. According to the LMajd test result, it is decided that the cross-sectional dependency problem exists for all series except TCO2, PAT, and TM series. However, the basic hypothesis cannot be strongly rejected within these series; the test statistics almost exceed the 10% level. As a result, it was decided that the cross-sectional dependency problem exists for all series in the analysis.

PANIC test

In our study, the PANIC (panel analysis of non-stationarity in idiosyncratic and common component) test proposed by Bai and Ng (2004) will be used. In this method, if the mean values added as explanatory variables are not stationary, regression analysis may be spurious regression. In this case, normal distribution will not be used. Also, in the CA method, the common factors and idiosyncratic term are assumed to be equally stationary (Erdoğan et al. 2020). However, since the first difference of the variable is used in the PCA method, the problem of spurious regression disappears. Besides, since stationarity for the common factors and idiosyncratic term is considered separately, it is not necessary for them to be stationary at the same level.

The cross-sectional dependency problem can cause the estimation results to be biased for unit root analysis. While first-generation panel unit root tests assume cross-sectional independence, second-generation panel unit root tests take cross-sectional dependency into account (see Bai and Ng 2004; Moon and Perron 2004; Pesaran 2007; Chang 2002). Second-generation unit root tests handle common factors with CA (cross-average) or PCA (principal component analysis) methods. In the CA method, average values of cross-section units are added to the unit root estimation equation. However, if the mean values added as explanatory variables are not stationary in this method, regression analysis may be spurious regression. In this case, the normal distribution cannot be used. Another issue is that in the CA method, it is assumed that the common factors and idiosyncratic term are equally stationary (Erdoğan et al. 2020). However, since the first difference of the variable is used in the PCA method, the problem of spurious regression has been resolved. In addition, since stationarity for the common factors and the idiosyncratic term is considered separately, it is not necessary to be stationary at the same level.

The PANIC (panel analysis of non-stationarity in idiosyncratic and common component) test proposed by Bai and Ng (2004) allows the analysis of not only the observed variables but also the common factors. In the PANIC method, unobserved dynamic common factors are investigated by the principal component method. In this methodology, it is proposed to decompose Yit into three components: deterministic component (Dit,), common factors (Ft), and idiosyncratic component (eit). In other words, it is assumed that Yit consists of these three components. The Yit can be seen in Eq. (7).

In Eq. 7, Dit represents polynomial trend function, Ft: Ft = [F1t ,F2t ,… ,Frt]′ is an r × 1 vector of common factors, and λi = [λ1 ,λ2 ,… ,λr ]′ is a vector of factor loadings.

By predicting Eq. (7), not only the stationarity of common factors but also the stationarity of the idiosyncratic components can be investigated. If at least one of the common factors or idiosyncratic component is nonstationary, it is decided that the variable is nonstationary. On the other hand, if both components are stationary, the variable is considered stationary. In the PANIC test, the null hypothesis represents the unit root.

In other unit root test methods, tests may tend to reject the null hypothesis, especially when one of the components is strongly I (0) and the other is I (1). This problem is eliminated since the components are handled separately in the PANIC test. In addition, since the components are separated in the PANIC test, the degree of cross-sectional dependency of idiosyncratic components decreases. Finally, since more cross-sectional information can be used in the PANIC test, the estimation results are more reliable.

PANIC test statistics are shown in Eqs. (8), (9), (10), and (11).

For p = 0 (intercept model)

For p = 1 (intercept and trend model)

PANIC test statistics (Pa and Pb) are included in Eqs. (8) and (10). PMSB (panel modified Sargan–Bhargava) shows the corrected Sargan–Bhargava test statistics in the case of autocorrelation in Eqs. (9) and (11).

Unit root results are shown in Appendix 1. Developing country results are included in the first part of the table. According to the intercept model results, the null hypothesis cannot be rejected at the 5% significance level for TCO2, TM, TRADE, and URBAN series, and it is decided that these series are stationary. The other series are not stationary. According to the results of intercept and trend models, the null hypothesis cannot be rejected for all series except EC series, and it is decided that the series are nonstationary. For the EC series, the null hypothesis for Pa statistics is rejected. However, Pb and PMSB statistics show that the series is nonstationary. As a result, considering that there is a trend effect in series in general, it is decided that all series are nonstationary at the 5% significance level based on the results of the intercept and trend model.

The second part of the table includes the results of developed countries. The null hypothesis cannot be rejected according to the Pb statistics for the GDPPC, TRADE, and URBAN series for the intercept model. However, the null hypothesis is rejected for Pa and PMSB test statistics. According to Pa and Pb statistics for the TCO2 series, the null hypothesis cannot be rejected, but the null hypothesis is rejected for the PMSB test statistics. The results of the intercept and trend model indicated that the null hypothesis cannot be rejected for all series except the PAT series, and it is decided that the series are nonstationary. For the PAT series, the null hypothesis cannot be strongly rejected. In addition, Pb and PMSB statistics show that the series is nonstationary. As a result, since we consider that there is a trend effect in series as a general similar to the developing countries, it is decided that all series are nonstationary at the 5% significance level based on the results of fixed and trended model.

After investigating the degree of integration of the series, it is necessary to determine whether the estimation equations provide the assumption of cross-sectional independence and homogeneity in order to select the appropriate co-integration method and estimators. As explained before, for cross-sectional dependence, the Pesaran (2004) CD test and Pesaran et.al. (2008) LMadj (bias-adjusted cross-sectional dependence Lagrange multiplier) test are used. In order to investigate the homogeneity assumption, Pesaran and Yamagata (2008) tests that are widely used in the literature are preferred.

Pesaran and Yamagata (2008: 54-55) proposed the delta (Δ) test by developing the Swamy (1970) test to investigate homogeneity. Test statistics and hypotheses of the Delta test are as follows:

H0: βi = β slope coefficients are homogeneous

H1: β ≠ βj, slope coefficients are not homogeneous

Table 3 shows the test results of the equations considered within the scope of the analysis for homogeneity and cross-sectional dependency.

According to the results in Table 3, the null hypothesis that the slope coefficient for the homogeneity test results is homogeneous is rejected, and it is decided that all estimation equations are heterogeneous. On the other hand, according to both CD test (Pesaran 2004) and LMadj test (Pesaran et al., 2008), the basic hypothesis that suggests that there is no cross-sectional dependency cannot be rejected for all equations, and it is decided that the problem of cross-sectional dependency does not exist in the equations. Therefore, it is necessary to use heterogeneous models in data analysis. Also, taking the cross-sectional dependency into consideration is important. Nevertheless, since there is no cross-sectional-dependency for estimated equations in our samples, Pedroni and Durbin–Hausman panel co-integration tests are preferred to investigate the co-integration relations between the series.

Pedroni panel co-integration test

The Pedroni co-integration test which allows for panel-specific co-integrating vectors is based on the stationarity test of error terms with panel and group tests statistics (v, rho, ADF, and PP). The Pedroni test also allows individual slope coefficients and trend coefficients between cross sections. It developed seven test statistics consisting of within groups and between groups tests (within groups tests assume that the AR parameter is the same and the between groups tests assume that AR parameter varies). These test statistics consist of 4 within dimension (panel co-integration statistics) and 3 between dimension (group-mean statistics) tests. In the Pedroni co-integration test, the basic hypothesis suggests that there is no co-integration relationship is tested. The alternative hypothesis states that at least one unit is cointegrated. Group-mean statistics also provides additional information on heterogeneity between units. The seven predicted test statistics for co-integration analysis are shown as follows:

In Pedroni (2004), panel t- and group t-statistics are obtained from the regressions shown as follows:

Panel ρ- and panel t-statistics are estimated by the long-term variance of ηit by the following regression:

Pedroni panel co-integration test results are shown in Table 4.

According to Table 4, the first part illustrates the test results for developing countries for both Eqs. (2) and (4) with trademark variables and Eqs. (1)–(3) with the patent variable. In the first part, according to all test statistics, the null hypothesis suggesting that there is no co-integration relationship between the series is rejected, and it is decided that a co-integration relationship exists. On the other hand, according to the results regarding the developed countries in the second part, the null hypothesis is rejected according to the other test statistics except for the ADF test statistics for Eqs. (1), (2), and (3), and it is decided that a co-integration relationship exists. As an alternative to the Pedroni test, the Durbin–Hausman test was preferred since it presents panel and group statistics separately.

Durbin–Hausman panel co-integration test

The Durbin–Hausman test, developed by Westerlund (2008), takes the cross-sectional dependency into account and presents both panel and group statistics. This test is effective if the dependent variable is I (1), and it is also effective when some of the independent variables are I (0) (Westerlund 2008). Group statistics are based on the assumption of the heterogeneous panel (the autoregressive parameter is different for each section in the panel), and the panel statistics is based on the assumption of the homogeneous panel (the autoregressive parameter is the same for each section in the panel).

Test statistics and hypotheses are as follows:

H0: There is no co-integration for all units.

H1: There is co-integration for some units.

Table 5 shows the Durbin–Hausman panel co-integration test results.

The test results presented in Table 4 indicate that group statistics and panel statistics are given separately. For group statistics, the null hypothesis is rejected at the 10% significance level for the equations involving both the trademark variable and patent variable, and it is decided that there is a long-term relationship between the series. On the other hand, the results of the panel statistics are more complex. Except for Eq. (4) for developing countries, the test statistics cannot reject the null hypothesis, and it is decided that there is no relationship between the series. That is, there is a relationship at the 10% significance level for developed countries.

Based on the findings, group statistics are taken into consideration since there is heterogeneity in estimation equations. As a result, supporting the Pedroni test results, it has been concluded that there is a co-integration relationship for both developed and developing country groups.

Long-run coefficients

Pesaran et al. (1999) suggested the PMG (the pooled mean group/panel ARDL) methodology obtain long-run coefficients. This methodology allows for the estimation of both short-term and long-term slope coefficients within the scope of the panel co-integration analysis. Panel ARDL model allows heterogeneity, the change of error correction terms between groups in the short-term period, and the change of constant variable, short-term coefficients. The dynamic fixed effect (DFE) estimator proposed by Pesaran and Smith (1995) is based on the PMG (panel ARDL methodology). The heterogeneous dynamic fixed-effect method can be used to estimate long- and short-term parameters for samples with large N and large T. This model allows the intercepts, slope coefficients, and error variances to change between cross sections (Yıldırım et al. 2020).

Table 6 shows the PMG and DFE test results for developing countries. PMG test results are seen in the first part of the table. According to PMG test results, energy consumption for all equations positively and statistically significantly affects carbon emission. GDP for linear equations (Eqs. 1 and 3) positively affects carbon emission. For quadratic equations, the effect of GDP on carbon emission is negative, and the effect of GDP square is positive. This result does not support the EKC hypothesis. Similarly, the DFE test does not support the EKC hypothesis. The effect of the TRADE variable is negative and statistically significant. The effect of TRADE on carbon emissions is generally negative. The effect of FD and URBAN variables is generally positive.

When the innovation variables, which are the focus of our study, are examined, the effect of the patent variable is positive for both PMG and DFE tests and statistically significant at 1% level. On the other hand, the effect of the trademark variable is statistically insignificant. Table 7 shows PMG and DFE results for developed countries.

In Table 7, it is seen that energy consumption has a generally positive effect on carbon emission for both PMG and DFE tests. The PMG test does not support the EKC hypothesis, on the other hand, the DFE model supports the EKC hypothesis. TRADE generally reduces carbon emissions for the PMG model. URBAN and FD have statistically significant and positive effects according to the PMG model results. For the DFE model, TRADE and URBAN do not have a statistically significant effect. For the DFE model, FD reduces carbon emissions.

When the innovation variables are examined, the effect of the patent variable is positive for the PMG test and statistically significant at 1% level. It is statistically insignificant for the DFE test. On the other hand, the effect of the trademark variable is statistically significant and positive for both PMG and DFE tests.

Robustness

In this study, firstly, cross-sectional dependency is checked for unit root test, and PANIC method is used as the most updated and appropriate method. In this method, 3 different statistics are used for robustness check. Panel modified Sargan–Bhargava test results are also presented for the autocorrelation problem, especially as an important deficiency of PANIC test statistics.

On the other hand, the cross-sectional dependency and heterogeneity of the estimated equations are investigated in order to determine the appropriate method for investigating the co-integration relationship. According to the findings, Pedroni methodology, which presents both group and panel statistics, and Durbin–Hausman methodologies that consider cross-sectional dependency and heterogeneity are used. Both unit root tests and co-integration test results provide consistent results.

In order to obtain long-term coefficients, we prefer PMG and DFE tests, which are methods suitable for the estimation equations. Autocorrelation and heteroscedasticity can cause results to be biased and inconsistent for these methodologies. We analyzed estimation equations for autocorrelation and heteroscedasticity problems, and test results can be seen in Appendix 2. Modified Bhargava et al. Durbin–Watson and Baltagi–Wu (LBI) tests are preferred for autocorrelation. According to Baltagi (2008) if the modified Bhargava et al. Durbin–Watson and Baltagi–Wu (LBI) tests statistics are less than 2, there is a serious autocorrelation problem. According to the results in Appendix 2, it is seen that the test statistics are close to or above 2. On the other side, according to heteroscedasticity test results, the basic hypothesis stated that the variance is equal between the units for all equations is rejected, and it is decided that there is a heteroscedasticity problem. For prediction equations to tackle the problem of heteroscedasticity, we use the estimators developed by Arellano (1987), Froot (1989), and Rogers (1993), which provide robust parameter estimates.

PMG and DFE test results generally support each other. On the other hand, different test statistics are also available. Therefore, we use Hausman test to investigate which of the PMG or DFE estimators are more effective. In this way, the effective estimator has been determined. Hausman test results are seen in Appendix 3. According to the test results, it is concluded that the DFE estimators are effective.

As a result, evidence has been reached in our study that for developing countries, Kuznets hypothesis is not valid, and for developed countries, Kuznets hypothesis is valid. For developing countries, if the increase in innovation level is caused by the increase in patents, it has a negative effect on carbon emissions from transportation. Trademark increase does not have a statistically significant effect on carbon emissions. The test results for developed countries indicated that the patent increase does not have a statistically significant effect on carbon emissions and the trademark increase have a positive effect on the carbon emission.

Conclusion

In this study, the impact of innovation on carbon emissions originating from the transportation sector is analyzed in the Mediterranean countries. Considering the IMF (2019) report, Mediterranean countries are divided into two groups as developed and developing countries: 8 developing countries whose data can be accessed (Albania, Algeria, Bosnia and Herzegovina, Croatia, Egypt, Morocco, Tunisia, and Turkey) and 6 developed countries (Cyprus, France, Greece, Israel, Italy, and Spain). The analysis period has been determined as 1997–2017 for developing countries and 2003–2017 for developed countries, depending on the availability of data.

In our study, patent applications and trademark applications, which are frequently used in the literature, were used as innovation indicators. The estimation equations for each innovation indicator were created both linearly and quadratic linearly to test the Kuznets hypothesis. Hence, 4 equations were used in total. We concluded that while the Kuznets hypothesis is not valid for developing countries, it is valid for developed countries. For developing countries, the increase in the level of innovation has a positive impact on carbon emissions due to transport if the innovation results from the increase in patents. However, the trademark increase does not have a statistically significant effect on carbon emissions. The empirical results of the developed countries indicated that the patent increase does not have a statistically significant effect and the trademark increase has a positive effect on carbon emission. As the development level of the countries increases, the demand for personal vehicles also increases. In the developed countries, the income per capita is high enough to have own car. Therefore, as Erdoğan et al. (2020) pointed, although a relative decrease in CO2 emissions from vehicles is observed through energy-saving innovation technologies and energy efficiency in the transportation sector, parallel to the increasing national income, having more personal vehicles, and driving more bring more energy consumption in the developed Mediterranean countries. Hence, to decrease the CO2 emissions in the Mediterranean countries, environment-friendly innovation technologies should be improved. However, parallel to Rennings’ (2000) findings, it should be noted that the new model of environment-friendly vehicles needs infrastructure investments for adaptation and diffusion. Therefore, convenient infrastructure investments should be initiated such as having widespread charging stations and technological improvement to compete with their conventional counterparts. Besides, conventional car owners should be encouraged to consume less pollutive fuels, and the government should initiate regulations and measures to control low-quality polluting fuels. Furthermore, environment-friendly vehicles such as electric vehicles should be widespread through tax incentives and other supports.

In the future, the effects of innovation on CO2 emissions on a sectorial basis can be an important subject for researches. Not only the sectors that contribute to the global CO2 emissions but also less pollutive sectors can be included in the studies. Besides, different sectors and different country groups can be included in the forthcoming studies. It may be wise to apply more sophisticated econometric models in order to reach alternative results that have never been reached before. This may provide possibility to make comparisons and estimations of econometric models. The findings of the researches on a sectoral basis may also provide a positive contribution to policy makers.

Data availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

References

Álvarez-Herránza A, Balsalobreb D, Cantos JM, Shahbaz M (2017) Energy innovations-GHG emissions nexus: fresh empirical evidence from OECD countries. Energy Policy 101:90–100

Amri F, Bélaïd F, Roubaud R (2018) Does technological innovation improve environmental sustainability in developing countries? Some evidence from Tunisia. The Journal of Energy and Development, 44, No. 1/2 (Autumn 2018 and Spring 2019), 41–60

Arellano M (1987) Computing robust standart errors for within group estimators. Oxf Bull Econ Stat 49(4):431–434

Bai J, Ng S (2004) A PANIC attack on unit roots and co-integration. Econometrica 74(4):1127–1177

Baltagi BH (2008) Econometric analysis of panel data, vol 4. Wiley, New York

Banister D (2005) Unsustainable transport, city transport in the new century. Routledge, Abingdon

Broughel J, Thierer A (2019) Technological innovation and economic growth: a brief report on the evidence. Mercatus Research, Mercatus Center at George Mason University, Arlington

Chang Y (2002) Nonlinear IV unit root tests in panels with cross-section dependency. J Econ 110:261–292

Chaudhry SM, Ahmed R, Shafiullah M, Huynh TLD (2020) The impact of carbon emissions on country risk: evidence from the G7 economies. J Environ Manag 265:110533

Danish (2019) Effects of information and communication technology and real income on CO2 emissions: the experience of countries along Belt and Road. Telematics Inform 45:101300

Du H, Chen Z, Peng B, Southworth F, Ma S (2019a) What drives CO2 emissions from the transport sector? A linkage analysis. Energy 175:195–204

Du K, Li P, Yan Z (2019b) Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol Forecast Soc Chang 146:297–303

Erdoğan S, Gedikli A, Yılmaz AD, Haider A (2019a) Investigation of energy consumption–economic growth nexus: a note on MENA sample. Energy Rep 5:1281–1292

Erdoğan S, Yıldırım DÇ, Gedikli A (2019b) Investigation of causality analysis between economic growth and CO2 emissions: the case of BRICS - T countries. Int J Energy Econ Policy 9(6):430–438

Erdoğan S, Yıldırım S, Yıldırım DÇ, Gedikli A (2020) The effects of innovation on sectoral carbon emissions: evidence from G20 countries. J Environ Manag 267:110637

Fan F, Lei Y (2016) Decomposition analysis of energy-related carbon emissions from the transportation sector in Beijing. Transp Res Part D: Transp Environ 42:135–145

Fei Q, Rasiah R, Shen LJ (2014) The clean energy-growth nexus with CO2 emissions and technological innovation in Norway and New Zealand. Energy Environ 25(8):1323–1344

Froot KA (1989) Consistent covariance matrix estimation with cross-sectional dependence and heteroskedasticity in financial data. J Financ Quant Anal 24(3):333–355

Georgatzi VV, Stamboulis Y, Vetsikas A (2020) Examining the determinants of CO2 emissions caused by the transport sector: empirical evidence from 12 European countries. Econ Anal Policy 65:11–20

Goulias D (2007) Development of high performance and innovative infrastructure materials. In: Goulias KG (ed) Transport Science and Technology. Elsevier, Oxford, pp 55–67

Greening LA, Greene DL, Difiglio C (2000) Energy efficiency and consumption-the rebound effect—a survey. Energy Policy 28:389–401

Guo B, Geng Y, Franke B, Hao H, Liu Y, Chiu A (2014) Uncovering China’s transport CO2 emission patterns at the regional level. Energy Policy 74:134–146

Herring H, Roy R (2007) Technological innovation, energy efficient design and the rebound effect. Technovation 27(4):194–203

IEA (2009a) Transport, energy, and CO2, moving towards sustainability. France

IEA (2009b) Transport, Energy and CO2. Report, October 2009

IEA (2019a) CO2 emissions from fuel combustion by sector 2017. https://www.iea.org/data-and-statistics/charts/transport-sector-co2-emissions-by-mode-in-the-sustainable-development-scenario-2000-2030. Accessed 10 Jan 2021

IEA (2019b) Transport sector CO2 emissions by mode in the sustainable development scenario, 2000-2030, 22 November 2019. https://www.iea.org/data-and-statistics/charts/transport-sector-co2-emissions-by-mode-in-the-sustainable-development-scenario-2000-2030. Accessed 10 Jan 2021

IEA (2020a) Transport-improving the sustainability of passenger and freight transport. https://www.iea.org/topics/transport. Accessed 10 Jan 2021

IEA (2020b) Global energy review 2020. April 2020. https://www.iea.org/reports/global-energy-review-2020/global-energy-and-co2-emissions-in-2020. Accessed 10 Jan 2021

IMF (2019) World economic outlook, October 2019: Global manufacturing downturn, rising trade barriers. International Monetary Fund. Research Dept., Washington DC:USA

Irandoust M (2016) The renewable energy-growth nexus with carbon emissions and technological innovation: evidence from the Nordic countries. Ecol Indic 69:118–125

Jiang Y, Zhou Z, Liu C (2018) The impact of public transportation on carbon emissions: a panel quantile analysis based on Chinese provincial data. Environ Sci Pollut Res 26:4000–4012

Jin L, Duan K, Tang X (2018) What is the relationship between technological innovation and energy consumption? Empirical analysis based on provincial panel data from China. Sustainability 10(145):1–13

Johnstone N, Haščič I, Popp D (2010) Renewable energy policies and technological innovation: evidence based on patent counts. Environ Resour Econ 45:133–155

Kahouli B (2018) The causality link between energy electricity consumption, CO2 emissions, R&D stocks and economic growth in Mediterranean countries (MCs). Energy 145:388–399

Khan AN, En X, Raza MY, Khan NA, Ali A (2020) Sectorial study of technological progress and CO2 emission: insights from a developing economy. Technol Forecast Soc Chang 151:119862

Khattak SI, Ahmad M, Khan Z, Khan A (2020) Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: new evidence from the BRICS economies. Environ Sci Pollut Res 27(12):13866–13881

Koçak E, Şentürk Ulucak Z (2019) The effect of energy R&D expenditures on CO2 emission reduction: estimation of the STIRPAT model for OECD countries. Environ Sci Pollut Res 26:14328–14338

Le Quéré C, Jackson RB, Jones MW, Smith AJP, Abernethy S, Andrew RM et al (2020) Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement. Nat Clim Chang 10:647–653

Lemoine D (2019) General equilibrium rebound from energy efficiency innovation. NBER Working Paper, No. 25172, September 2019

Li H, Lu Y, Zhang J, Wang T (2013) Trends in road freight transportation carbon dioxide emissions and policies in China. Energy Policy 57:99–106

Maradana RP, Pradhan RP, Dash S, Gaurav K, Jayakumar M, Chatterjee D (2017) Does innovation promote economic growth? Evidence from European countries. J Innov Entrep 6(1):1–23

Mensah CN, Long X, Boamah KB, Bediako IA, Dauda L, Salman M (2018) The effect of innovation on CO2 emissions of OECD countries from 1990 to 2014. Environ Sci Pollut Res 25:29678–29698

Moon R, Perron B (2004) Testing for a unit root in panels with dynamic factors. J Econ 122:81–126

Muntean M, Guizzardi D, Schaaf E, Crippa M, Solazzo E, Olivier JGJ, Vignati E (2018) Fossil CO2 emissions of all world countries - 2018 Report. EUR 29433 EN, Publications Office of the European Union, Luxembourg

Nasir MA, Huynh TLD, Tram HTX (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manag 242:131–141

Newey WK, West KD (1994) Automatic lag selection in covariance matrix estimation. Rev Econ Stud 61(4):631–653. https://doi.org/10.2307/2297912

Nguyen TT, Pham TAT, Tram HTX (2020) Role of information and communication technologies and innovation in driving carbon emissions and economic growth in selected G-20 countries. J Environ Manag 261:110162

O’Connell PGJ (1998) The overvaluation of purchasing power parity. J Int Econ 44(1):1–19

Pece AM, Simona OEO, Salisteanu F (2015) Innovation and economic growth: an empirical analysis for CEE countries. Procedia Econ Finance 26:461–467

Pedroni P (2004) Panel cointegration: asymtotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory 20:597–625

Pesaran MH (2004) General diagnostic tests for cross-section dependence in panels. Cambridge Working Papers in Economics, 435

Pesaran MH (2007) A simple unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econ 142(1):50–93

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94(446):621–634

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econ 68:79–113

Petrovic P, Lobanov MM (2020) The impact of R&D expenditures on CO2 emissions: evidence from sixteen OECD countries. J Clean Prod 248:119187

Pham NM, Huynh TLD, Nasir MA (2020) Environmental consequences of population, affluence and technological progress for European countries: a Malthusian view. J Environ Manag 260:110143

Rennings K (2000) Redefining innovation-eco-innovation research and the contribution from ecological economics. Ecol Econ 32:319–332

Ritchie H. Roser M (2020) Emissions by sectors. Our World in Data. https://ourworldindata.org/emissions-by-sector#annual-greenhouse-gas-emissions-by-sector. Accessed 10 Jan 2021

Roger EM (1983) Diffusion of innovation, 3rd edn. The Free Press, New York

Rogers WH (1993) Regression standard errors in clustered samples. Stata Tech Bull 13:19–23

Rosenberg N (2004) Innovation and economic growth. OECD. https://www.oecd.org/cfe/tourism/34267902.pdf. Accessed 10 Jan 2021

Rowland, F. S.; Bruce, J. P; Graedel, T. E.; Reck, R. A.; Sperling, D.; and Waltn, C. M. (1998). Atmospheric change and the North American transportation sector: summary of a trilateral workshop. Incidental Report No. IR98-1, The Royal Society of Canada, 1–24

Samargandi N (2017) Sector value addition, technology and CO2 emissions in Saudi Arabia. Renew Sust Energ Rev 78:868–877

Schumpeter JA (2000) Entrepreneurship as innovation. The University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship, Available at SSRN: https://ssrn.com/abstract=1512266. Accessed 10 Jan 2021

Shahbaz M, Raghutla C, Song M, Zameer H, Jiao Z (2020) Public-private partnership investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Energy Econ 86:104664

Su H-N, Moaniba IM (2017) Does innovation respond to climate change? Empirical evidence from patents and greenhouse gas emissions. Technol Forecast Soc Chang 122:49–62

Swamy PAVB (1970) Efficient inference in a random coefficient regression model. Econometrica 38:311–323

Teter J, Tattini J, Petropoulos A (2020) Tracking transport 2020- more efforts needed. Tracking Report, IEA, May 2020. https://www.iea.org/reports/tracking-transport-2020#. Accessed 10 Jan 2021

The United States Environmental Protection Agency (EPA) (2019) Source of greenhouse emissions, transportation sector emissions. https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions#carbon-dioxide. Accessed 10 Jan 2021

Ulku H (2004) R&D, Innovation, and economic growth: an empirical analysis. IMF Working Paper, WP/04/185, September 2004

UNCED (1992) Sustainabel development goals platform, Agenda 21. https://sustainabledevelopment.un.org/outcomedocuments/agenda21. Accessed 10 Jan 2021

Wang Z, He W (2017) CO2 emissions efficiency and marginal abatement costs of the regional transportation sectors in China. Transp Res Part D: Transp Environ 50:83–97

Wen Q, Chen Y, Hong J, Chen Y, Ni D, Shen Q (2020) Spillover effect of technological innovation on CO2 emissions in China’s construction industry. Build Environ 171:106653

Westerlund J (2008) Panel co-integration tests of the Fisher effect. J Appl Econ 23(2):193–223

Yıldırım S, Gedikli A, Erdoğan S, Yıldırım DÇ (2020) Natural resources rents-financial development nexus: evidence from sixteen developing countries. Res Policy 68:101705

Zhang Y-J, Peng Y-L, Ma C-Q, Shen B (2017) Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 100:18–28

Zhou G, Chung W, Zhang X (2013) A study of carbon dioxide emissions performance of China’s transport sector. Energy 50:302–314

Zhu C, Du W (2019) A research on driving factors of carbon emissions of road transportation industry in six Asia-Pacific countries based on the LMDI decomposition method. Energies 12(4152):1–19

Author information

Authors and Affiliations

Contributions

NDÇ: writing—original draft preparation and data collection; AG: investigation, conceptualization, and methodology; SE: supervision; KA: investigation, writing—review and editing; DÇY: conceptualization, methodology, and formal analysis.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Appendix 2

Appendix 3

Appendix 4

Rights and permissions

About this article

Cite this article

Demircan Çakar, N., Gedikli, A., Erdoğan, S. et al. A comparative analysis of the relationship between innovation and transport sector carbon emissions in developed and developing Mediterranean countries. Environ Sci Pollut Res 28, 45693–45713 (2021). https://doi.org/10.1007/s11356-021-13390-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-13390-y