Abstract

This paper investigates the role of economic complexity on energy demand using the panel dataset of 25 Organization for Economic Co-operation and Development (OECD) countries from 1978 to 2016. Both real per capita income level and economy-wide real energy price index are critical determinants in energy demand modeling. The battery of the cross-sectional dependency test proposed by Pesaran (2004 and 2007) is used, signaling the presence of cross-sectional dependency in the dataset. Thus, the Westerlund (2007) cointegration test is also used, revealing the long-run relationship between the series. Moreover, the results from using the Augmented Mean Group (AMG) estimations illustrate that real per capita income level positively affects energy demand while real energy price and economic complexity negatively influence on it. From a policy perspective, we suggest increasing technological innovation (i.e., higher economic complexity) will reduce the energy demand. The reduction of massive energy usage may be beneficial for the natural environment’s health in the OECD countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

What drives the energy demand? This question is an interesting research task in the empirical energy literature since energy consumption is an essential input for production after the industrial revolution in 1837. The industrial revolution has also resulted in social and economic changes of the twenty-first century. As a result, the world economy’s energy demand has risen approximately 2.5% per year since the 1850s (Sorrell 2015). There are several determinants of demand for energy in the literature, and economic growth and energy prices are leading them (Carfora et al. 2019; Fotis et al. 2017). With the transformation of the production process, the empirical literature has included new energy demand drivers. For example, a higher level of human capital can play an essential role in energy demand since it may provide consumers’ energy efficiency (Li et al. 2019; Shahbaz et al. 2019).

This paper uses a new potential determinant of energy demand: The Economic Complexity Index (henceforth ECI). We explore the impact of ECI on energy demand. The ECI can significantly affect the demand for energy since it is a substantial measure of the structural transformation indicator, and it represents industrial production to technological innovation (Hidalgo et al. 2007). Economic complexity also shows the interdependence of industries in the economic system (Neagu and Teodoru 2019). ECI is also related to technological innovation as a process, which reduces production costs and leads to the emergence of new products (Farhani and Solarin 2017). It is important to note that technological innovation is associated with an economy’s “capabilities,” captured by the institutions and knowledge accumulation (Hidalgo 2009). The advanced economies’ capabilities are generally high since they use the educated (skilled) workers and high-technology in the production process (Hartmann et al. 2017).

Overall, this paper’s primary variable of interest is the ECI, and it is used in the energy demand function. The ECI can capture the effects of education, infrastructure, quality of institutions, and the research and development (R&D) expenditures (Hidalgo 2011; Hidalgo and Hausmann 2009) in the production process. Hidalgo and Hausmann (2009) firstly calculate the ECI, and they use the trade data from the COMTRADE database. Therefore, the calculation of the ECI is based on the data of the exports rather than all domestic goods (Gozgor 2017). Thus, a higher value of ECI represents the exporting “high value-added” (complex) products (Gozgor et al. 2018). Reaching a higher level of ECI demonstrates upgrading production capabilities due to more skilled labor and education (Hausmann et al. 2011).

There are also previous papers, which have used the ECI as a determinant of different variables. For instance, Can and Gozgor (2017) use both energy demand and ECI as potential determinants of the CO2 emissions in France, covering from 1964 to 2011. The authors find the harmful effect of energy consumption on environmental quality as it increases CO2 emissions, whereas the ECI improves it by reducing CO2 emissions. Dogan et al. (2019) explore the impact of ECI on CO2 emissions in the panel dataset of 55 countries for the period from 1971 to 2014. The authors also divide the nations according to their income levels and find that the ECI raises CO2 emissions in the low-income and middle-income economies.

In this paper, we focus on OECD countries since the ECI dataset of Hausmann et al. (2011) demonstrates that these countries are the highest level of ECI. Therefore, this paper tests a hypothesis that the ECI is the primary determinant of energy consumption in OECD countries. To put it differently, we test a suggestion that a higher level of capabilities (measured by ECI) yields to a more upper or lower energy demand level. Following Liddle and Huntington (2020), the control variables (i.e., real per capita income and economy-wide real energy price index) are included in the empirical model since they can change the impact of ECI on the energy demand. For this purpose, we utilize various panel data estimations and focus on the balanced panel dataset in 25 OECD countries from 1978 to 2016. To the best of the authors’ knowledge, this paper is the first research that motivates us to investigate the impact of ECI on energy demand in OECD countries. This issue is the main contribution of the paper to the existing literature. The empirical results indicate that economic complexity negatively affects energy demand. In contrast, real per capita income level and economy-wide real energy price index are detrimental to energy demand in the balanced panel dataset of 25 OECD countries.

The rest of the paper is as follows—the “Determinants of energy demand: theoretical background and previous studies” section reviews the literature. The “Model, data, and methodology” section explores the data and estimation procedure, while the “Discussion of the findings and policy implications” section provides the findings and policy discussion. The “Conclusion” section concludes.

Determinants of energy demand: theoretical background and previous studies

Theoretical background

In the traditional energy economics literature, it was argued that the primary driver of the energy demand is economic growth (Bhattacharya et al. 2016). There are four views on the relationship between energy demand and economic growth.Footnote 1 The “growth hypothesis” is the first view, which shows the positive effect of economic activity on energy demand. This hypothesis is possible when energy is used as one of the inputs in the economic activities. The “conservation hypothesis” comes under the second view, which shows that the energy demand affects economic performance. This hypothesis is valid when industrial activities are linked to energy consumption. The usage of energy in economic activities will result in economic growth. The “feedback hypothesis” that comes under the third view shows a mutual and positive relationship between energy demand and economic growth. This view shows that both economic growth and energy demand are complementary to each other. In other words, energy demand is not possible without economic growth, whereas economic growth is also not possible without energy demand. The “neutrality hypothesis” comes under the fourth view, demonstrating the absence of a relationship between economic growth and energy demand. In other words, one can suggest that any change in energy demand will not impact economic growth and vice-versa (Ozturk 2010).

Previous studies

Various studies have found the validity of different hypotheses based on the data from multiple countries and different periods. These papers have utilized different estimation techniques, and therefore, the findings are heterogeneous (Tiba and Omri 2017). Nevertheless, the relationship between energy demand and economic performance is well-investigated (Apergis et al. 2018; Shahbaz et al. 2016; Gozgor and Can 2017; Farhani and Solarin 2017; Mahalik et al. 2017; Paramati et al. 2016; Sbia et al. 2017; Faisal et al. 2018; Rafindadi and Mika’Ilu 2019; Gozgor et al. 2020). These studies arrive at the mixed findings while studying the impact of economic growth on energy demand using country-specific data or cross-country data. For instance, economic growth is the driving factor of energy demand, evidenced from the studies of Shahbaz et al. (2016) in India, Faisal et al. (2018) in Iceland, and Gozgor et al. (2020) in OECD countries. In contrast, economic growth adversely affects energy demand, which is also evidenced from the studies of Mahalik et al. (2017) in India, Rafindadi and Mika’Ilu (2019) in the UK, and Farhani and Solarin (2017) in the USA. Sbia et al. (2017) also indicate the non-linear relationship between economic growth and electricity demand in the United Arab Emirates. Subsequently, Gozgor et al. (2020) also noted the positive effect of real oil prices on OECD countries’ energy demand. Nonetheless, we should use economic growth and energy price index as a potential determinant of the energy consumption in our empirical analysis for OECD economies.

One can argue that ECI should be considered a significant factor in energy demand. However, to the best of our knowledge, existing literature shows no study that examines the effects of the ECI on energy consumption in developed or developing countries. However, various studies analyze new determinants of energy demand, such as education and human capital. When we look at some of these previous studies. Using the time-series analysis, Salim et al. (2017) also analyze the impact of education on China’s energy demand. The authors find the beneficial effect of education on energy demand as it reduces energy consumption by promoting energy efficiency. Similar evidence that human capital decreases the energy demand is obtained by Akram et al. (2019) in India from 1980 to 2014. Using the bootstrapping autoregressive-distributed lag (ARDL) method for the USA, Shahbaz et al. (2019) find a long-run impact of education on the short-run demand for energy. Besides, their findings validate the feedback effect between education and energy demand in the long-run.

Consequently, the previous studies on the determinants of the energy demand have provided mixed findings. The different conclusions can be related to countries’ choices (China, India, or the USA) or the econometric methodology (time-series analysis or panel data estimations). At this stage, we consider the ECI as a potential new determinant of the energy demand. For this purpose, we focus on 25 OECD countries within a balanced panel data framework for the period from 1978 to 2016.

Model, data, and methodology

Empirical model and data

This study examines the determinants of energy demand in the panel dataset of 25 OECDFootnote 2 countries from 1978 to 2016. According to the previous literature, energy demand is mainly determined by per capita GDP and energy price (e.g., Adeyemi and Hunt 2014; Ajmi et al. 2015; Mahalik et al. 2017; Shahbaz et al. 2016, 2017; Gozgor et al. 2020). The primary target of this paper is to analyze the role of the ECI on energy demand. Therefore, we can write the following model:Footnote 3

Given that logarithmic function for the demand of energy is a traditional approach in the empirical literature, function in Eq. (1) is written in the following way:

Where TFC is total final energy consumption per capita (toe) in the country i at time t, GDPC is the GDP per capita (constant 2010 US$), ENPR is economy-wide energy price real index, and finally, ECI denotes economic complexity.Footnote 4 Moreover, υit and εit denote the fixed effects (both country and period) and the error term, respectively. Since we are using panel data of heterogeneous OECD countries, it is further essential to assume fixed of all countries’ social and economic fluctuations.

We expect that α1 > 0 as the per capita GDP increases and the energy consumption increases, too (Shahbaz et al. 2017). Besides, α2 < 0 because the higher price of energy leads to lower energy consumption. This hypothesis implies that rising energy prices will demotivate people to buy more energy from the open market because they feel that buying energy is expensive. Looking at the theoretical mechanism of economic complexity effects on energy demand, the impact of the ECI on energy demand should be negative (α3 < 0) since reaching a higher level of technological innovation resulting from economic complexity will reduce the energy demand. This issue may be possible because exporters using energy-saving technology will require less energy in the production.

The paper uses the balanced panel data over the period 1978–2016 in 25 OECD countries. The frequency of the data is annual. The total final energy consumption per capita (toe), GDPC is the GDP per capita (constant 2010 US$), economy-wide energy price real index, and finally, ECI denote economic complexity. The real GDP per capita is collected from the World Development Indicators of the World Bank. In contrast, the data on financial energy consumption per capita and economic-wide energy price real index is also sourced from Liddle and Huntington (2020). The data for the ECI comes from the Atlas of Economic Complexity provided by Hausmann et al. (2011).Footnote 5 According to the dataset, a higher level of ECI indicates further economic complexity. The ECI is an indicator based on the scale for the “complexity” of goods in the export basket and covers a higher number of products.Footnote 6 In here, the ECI is introduced relatively considering a unit variance at the annual frequency. In other words, the value for the ECI of zero in a country indicates that the country’s economic complexity level equals the world average in a year (Dogan et al. 2019). Furthermore, the value for the ECI of one means that a country is one standard deviation higher than the average of the world’s value.Footnote 7 In other words, economic complexity is used since it is a measure of knowledge when a country engages in producing a diversified range of products.

Preliminary analysis of the data

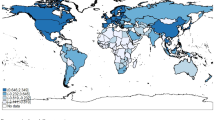

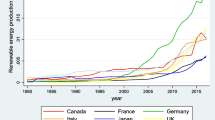

The trend of the variables is reported in the Appendix Figures from 1, 2, 3, and 4. Table 1 presents the average mean highest for GDP per capita, followed by economy-wide energy real price, total final energy consumption per capita, and economic complexity. Except for real GDP per capita, the standard deviation for all other variables is small.

The correlation matrix in Table 2 also shows that real GDP per capita is positively correlated with total final energy consumption per capita. In contrast, economy-wide energy real price index and economic complexity are negatively correlated with it. The minimal magnitude of the correlation between the independent variables is concerned; it does not produce a threat of multicollinearity problem for modeling the energy demand function. In such a situation, the estimated coefficients are expected to be unbiased.

However, we may end up facing the problem of cross-sectional dependency as we are using the cross-country dataset for 25 OECD economies within a balanced panel framework. To overcome this problem, we use the battery of panel unit root tests proposed by Pesaran (2004, 2007), an extension of Im et al.’s (2003) unit-root analysis. Pesaran (2007) takes the cross-sectionally augmented Dicky-Fuller (ADF) regression and estimates the cross-sectional units in the panel by the ordinary least squares (OLS). For this purpose, we first run the cross-sectional dependence (CD) test of Pesaran (2004) and then the second generation PUR test of Pesaran (2007).

Table 3 reveals that the null hypothesis of cross-section independence is rejected based on the significance level of the CD test, which indicates that cross-sectional dependence in the dataset is present. Indeed, Table 4 describes the second-generation cointegration test that also captures the cross-sectional dependence in the data series. Our results show that all the independent variables are non-stationary and stationary at their first difference while our dependent variable is stationary. The cointegration test proposed by Westerlund (2007) accommodates the cross-sectional dependence and does not impose any common factor restrictions. Hence, we analyze whether variables have a long-run relationship or not. The results in Table 5 findings indicate that the variables in the estimation are cointegrated. This evidence implies that there exists a long-run relationship between the variables.

Given the mixed order of the integration among the variables, i.e., I(0) and I(1), we use the Augmented Mean Group (AMG) developed by Eberhardt (2012). The AMG estimates capture time-variant unobservable heterogeneous effect, cross-sectional dependence, and, finally, identification problems. Table 6 shows that both economy-wide energy total price and economic complexity negatively impact total final energy consumption per capita. Moreover, GDP per capita has a positive impact on the total final energy consumption per capita significantly. These results provide important implications that are discussed in the “Discussion of the findings and policy implications” section.

Discussion of the findings and policy implications

Using the AMG estimation techniques indicates that the primary driver of the energy demand is the per capita income. This finding is consistent with the studies of Shahbaz et al. (2016) in India, Faisal et al. (2018) in Iceland, and Gozgor et al. (2020) in the OECD countries. The positive impact of income level on energy demand is possible because the OECD countries are developed. The people in developed countries with their higher income level demand more energy for mitigating their luxurious lifestyle. This evidence further shows that people in OECD countries prioritize sustaining their life status rather than protecting the natural environment where they live. This issue again brings environmental consequences, which can reduce the life expectancy of the people. This finding warrants an important energy-saving policy if environmental education can be provided to the rich people in OECD countries.

The economy-wide real energy price negatively and significantly influences energy demand in the OECD countries. This finding is not consistent with the recent study of Gozgor et al. (2020), where they find the positive impact of oil prices on energy prices. This differential finding may be possible that we take the overall energy price, but they consider crude oil price in modeling energy demand function. In terms of our findings, it may be argued that people buy less energy from the open market when energy prices are higher. This evidence is because they feel expensive to buy different energy types from the market and calculate their financial savings. In the presence of rising energy prices, buying energy will reduce the capacity for financial savings. The economic complexity is used as a proxy for measuring technological innovation which also reduces energy demand in OECD countries. This finding is not consistent with the recent study of Paramati et al. (2020). They find the promoting role of R&D investments proxy for technological innovation on renewable energy demand in European Union member countries. In the case of our finding, it may be argued that when producers use energy-saving technology in the production process, their energy demand is low. This evidence also brings dual implications for reducing energy demand and improving the natural environment. In line with these implications, it can be further argued that non-renewable energy usage can be reduced in OECD countries in particular and other advanced economies to bring green growth (Bhattacharya et al. 2016).

These findings bear some policy implications for OECD countries. In terms of empirical findings, we find that both economic complexity and economy-wide real energy prices are detrimental to final energy consumption in OECD countries. From a policy perspective, we suggest increasing energy prices and stimulating economic complexity will bring a “win-win” position to increase commodity tax revenue and reduce the energy demand in OECD countries. In such a situation, two immediate implications are apparent. The government in OECD countries can be benefitted from rising energy prices in terms of higher tax revenue and protection of the natural environment. Since income level enhances the demand for energy, ecologists and behavioral economists should focus on changing people’s lifestyle habits in developed countries like the OECD. Once too many energy-consuming lifestyle habits are controlled, lower energy demand is automatically expected even if they have a higher income level at their disposal. In such a line, we also suggest that environmental education should be enhanced and mediated in people’s minds to think about the environmental consequences of massive energy demand on their present and future generations’ health and life expectancy in OECD countries.

Conclusion

In this paper, we reanalyzed the determinants of energy demand in the OECD countries. We included a new variable, so-called the ECI, as a possible determinant of energy demand for this purpose. The AMG estimation procedure findings indicate that both the ECI and the index of economy-wide real energy prices are detrimental to energy demand. In contrast, real income level increases it in the panel dataset of 25 OECD economies from 1978 to 2016.

A future study can investigate the impact of economic complexity on energy demand in each OECD country (in terms of oil-importing vs. oil-exporting economy) using the time-series estimation technique. Examining the effects of economic complexity on different aspects of energy (e.g., fossils, renewables, and nuclear) can also be an important research question for scholars working in energy strategy review. In line with the few recent studies (e.g., Ahmed et al. 2019a, b, 2020; Bhattacharya et al. 2016, 2017; Rahman et al. 2020; Li et al. 2019; Mahalik et al. 2020; Paramati et al. 2020), another avenue for future research is to include technological innovation (e.g., economic complexity as a proxy for technological innovation), energy demand, economic growth, foreign energy aid, tourism development, and stock market development in OECD countries while modeling the carbon emissions function.

Data availability

The datasets of the current study are publicly available, and they are also available from the corresponding author on reasonable request.

Notes

Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Korea Republic, Mexico, the Netherlands, New Zealand, Norway, Poland, Portugal, Spain, Sweden, Switzerland, the UK, and the USA.

Note that we consider a dynamic model following Liddle and Huntington (2020).

In the literature review, we have observed that the price of oil is one of the leading determinants of OECD countries. It is important to note that coal prices can also be determinant of the energy demand in developing countries, such as China.

For details, visit https://atlas.media.mit.edu/en/resources/data/

Accurately, the ECI based on the “diversity” (number of products) of the export basket and the “ubiquity” (number of countries to produce the related products) of the products. To put it differently, the ECI is measured both by “diversity” and the “ubiquity” of the exporting products, and each measured by taking into account the other (Can and Gozgor 2017).

Refer also to Gozgor (2018) for the interpretation of the ECI.

References

Adeyemi OI, Hunt LC (2014) Accounting for asymmetric price responses and underlying energy demand trends in OECD industrial energy demand. Energy Economics 45:435–444

Ahmad M, Khan Z, Rahman ZU, Khattak SI, Khan ZU (2019a) Can innovation shocks determine CO2 emissions (CO2e) in the OECD economies? A new perspective. Economics of Innovation and New Technology 1–21

Ahmad M, Haq Z, Khan Z, Khattak SI, Rahman ZU, Khan S (2019b) Does the inflow of remittances cause environmental degradation? Empirical evidence from China. Economic Research–Ekonomska Istraživanja 32(1):2099–2121

Ahmad M, Khattak SI, Khan S, Rahman ZU (2020) Do aggregate domestic consumption spending & technological innovation affect industrialization in South Africa? An application of linear & nonlinear ARDL models. J Appl Econ 23(1):44–65

Ajmi AN, Hammoudeh S, Nguyen DK, Sato JR (2015) On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Economics 49:629–638

Akram V, Jangam BP, Rath BN (2019) Does human capital matter for reduction in energy consumption in India? International Journal of Energy Sector Management 13(2):359–376

Apergis N, Can M, Gozgor G, Lau CKM (2018) Effects of export concentration on CO 2 emissions in developed countries: an empirical analysis. Environmental Science and Pollution Research 25(14):14106–14116

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Applied Energy 162:733–741

Bhattacharya M, Churchill SA, Paramati SR (2017) The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renewable Energy 111:157–167

Can M, Gozgor G (2017) The impact of economic complexity on carbon emissions: evidence from France. Environmental Science and Pollution Research 24(19):16364–16370

Carfora A, Pansini R, Scandurra G (2019) The causal relationship between energy consumption, energy prices, and economic growth in Asian developing countries: a replication. Energy Strategy Reviews 23:81–85

Dogan B, Saboori B, Can M (2019) Does economic complexity matter for environmental degradation? An empirical analysis for different stages of development. Environmental Science and Pollution Research 26:31900–31912

Eberhardt M (2012) Estimating panel time-series models with heterogeneous slopes. The Stata Journal 12(1):61–71

Farhani S, Solarin SA (2017) Financial development and energy demand in the United States: new evidence from combined cointegration and asymmetric causality tests. Energy 134:1029–1037

Faisal F, Tursoy T, Gunsel Resatoglu N, Berk N (2018) Electricity consumption, economic growth, urbanisation and trade nexus: empirical evidence from Iceland. Economic Research-Ekonomska Istraživanja 31(1):664–680

Fotis P, Karkalakos S, Asteriou D (2017) The relationship between energy demand and real GDP growth rate: the role of price asymmetries and spatial externalities within 34 countries across the globe. Energy Economics 66:69–84

Gozgor G (2017) Does trade matter for carbon emissions in OECD countries? Evidence from a new trade openness measure. Environmental Science and Pollution Research 24(36):27813–27821

Gozgor G (2018) A new approach to the renewable energy-growth nexus: evidence from the USA. Environmental Science and Pollution Research 25(17):16590–16600

Gozgor G, Can M (2017) Does export product quality matter for CO2 emissions? Evidence from China. Environmental Science and Pollution Research 24(3):2866–2875

Gozgor G, Lau CKM, Lu Z (2018) Energy consumption and economic growth: new evidence from the OECD countries. Energy 153:27–34

Gozgor G, Mahalik MK, Demir E, Padhan H (2020) The impact of economic globalization on renewable energy in the OECD countries. Energy Policy 139:111365

Hartmann D, Guevara MR, Jara-Figueroa C, Aristarán M, Hidalgo CA (2017) Linking economic complexity, institutions, and income inequality. World Development 93:75–93

Hausmann R, Hidalgo CA, Bustos S, Coscia M, Chung S, Jimenez J, Simoes A, Yildirim M (2011) The Atlas of Economic Complexity. Puritan Press, Cambridge, MA

Hidalgo, C.A. (2009). The dynamics of economic complexity and the product space over a 42 year period. Harvard University Center for International Development Working Paper, No.189.

Hidalgo CA (2011) Discovering Southern and East Africa's Industrial Opportunities. The German Marshall Fund of the United States. Economic Paper Series, Washington, D.C.

Hidalgo CA, Hausmann R (2009) The building of economic complexity. Proceedings of the National Academy of Sciences of the United States of America (PNAS) 106(26):10570–10575

Hidalgo CA, Klinger B, Barabasi AL, Hausmann R (2007) The product space conditions the development of nations. Science 317(5837):482–487

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. Journal of Econometrics 115(1):53–74

Inglesi-Lotz R (2016) The impact of renewable energy consumption to economic growth: a panel data application. Energy Economics 53:58–63

Li H, Gozgor G, Lau CKM, Paramati SR (2019) Does tourism investment improve the energy efficiency in transportation and residential sectors? Evidence from the OECD economies. Environmental Science and Pollution Research 26(18):18834–18845

Liddle B, Huntington H (2020) Revisiting the income elasticity of energy consumption: a heterogeneous, common factor, dynamic OECD & non-OECD country panel analysis. The Energy Journal 41(3):207–229

Mahalik MK, Babu MS, Loganathan N, Shahbaz M (2017) Does financial development intensify energy consumption in Saudi Arabia? Renewable and Sustainable Energy Reviews 75:1022–1034

Mahalik MK, Villanthenkodath MA, Mallick H, Gupta M (2020) Assessing the effectiveness of total foreign aid and foreign energy aid inflows on environmental quality in India. Energy Policy 112015

Neagu, O., & Teodoru, M.C. (2019). The relationship between economic complexity, energy consumption structure and greenhouse gas emission: heterogeneous panel evidence from the E.U. countries. Sustainability, 11 (2), 497.

Ozturk I (2010) A literature survey on energy–growth nexus. Energy Policy 38(1):340–349

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Economics 56:29–41

Paramati SR, Alam MS, Hammoudeh S, Hafeez K (2020) Long-run relationship between R&D investment and environmental sustainability: evidence from the European Union member countries. International Journal of Finance & Economics, forthcoming. https://doi.org/10.1002/ijfe.2093

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels, No. 1240, Institute for the Study of Labor (IZA): Bonn

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics 22(2):265–312

Rafindadi AA, Mika’Ilu AS (2019) Sustainable energy consumption and capital formation: Empirical evidence from the developed financial market of the United Kingdom. Sustainable Energy Technologies and Assessments, 35, 265–277

Rahman ZU, Cai H, Ahmad M (2020) A new look at the remittances-FDI-energy-environment nexus in the case of selected Asian nations. Singapore Economic Review, 1–19, forthcoming, doi. https://doi.org/10.1142/S0217590819500176

Salim R, Yao Y, Chen GS (2017) Does human capital matter for energy consumption in China? Energy Economics 67:49–59

Shahbaz M, Gozgor G, Hammoudeh S (2019) Human capital and export diversification as new determinants of energy demand in the United States. Energy Economics 78:335–349

Shahbaz M, Mallick H, Mahalik MK, Sadorsky P (2016) The role of globalization on the recent evolution of energy demand in India: implications for sustainable development. Energy Economics 55:52–68

Shahbaz M, Van Hoang TH, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Economics 63:199–212

Sbia, R., Shahbaz, M., & Ozturk, I. (2017). Economic growth, financial development, urbanisation and electricity consumption nexus in UAE. Economic Research–Ekonomska Istraživanja, 30(1), 527–549.

Sorrell, S. (2015). Reducing energy demand: A review of issues, challenges and approaches. Renewable and Sustainable Energy Reviews, 47, 74–82.

Tiba S, Omri A (2017) Literature survey on the relationships between energy, environment and economic growth. Renewable and Sustainable Energy Reviews 69:1129–1146

Westerlund J (2007) Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics 69(6):709–748

Acknowledgments

We would like to thank anonymous reviewers and the editor for their useful comments to enhance the research’s merit.

Funding

We would like to acknowledge grants from the National Social Science Fund of China (16BJY052) and the Fundamental Research Funds for the Provincial Universities of Zhejiang (GB201902002) and “Uncertainty, Institutional Investor Risk Transfer and Financial Risk”.

Author information

Authors and Affiliations

Contributions

Jianchun Fang: conceptualization, supervision, funding acquisition

Giray Gozgor: conceptualization, writing—original draft preparation, visualization

Mantu Kumar Mahalik: methodology, software, investigation

Hemachandra Padhan: data curation, software, investigation

Ruihui Xu: writing, reviewing and editing, funding acquisition

Corresponding author

Ethics declarations

Ethical approval

Not applicable

Consent to participate

Not applicable

Consent to publish

Not applicable

Competing interests

The authors declare that they have no conflict of interest.

Additional information

Responsible Editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Fang, J., Gozgor, G., Mahalik, M.K. et al. The impact of economic complexity on energy demand in OECD countries. Environ Sci Pollut Res 28, 33771–33780 (2021). https://doi.org/10.1007/s11356-020-12089-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-12089-w