Abstract

This study is conducted to address the research question of whether hydroelectricity and fossil fuels contribute to sustainable economic development in an emerging economy in this era of globalization? Further, this study applies the novel approach of Harvey unit root test which is a linearity test to predict the possible existence of non-linearity. The results confirmed that the majority of the series in this study are linear. Furthermore, the two break test is applied to investigate the integration sequence of the series. The bounds test approach confirms the existence of a long-run association among the variables. Additionally, the long-run relationship is analysed within the framework of the ARDL approach. Financial development, fossil fuel, and capital positively contribute to economic development, while the effect of hydroelectricity is insignificant. Moreover, globalization effects GDP negatively. The symmetric causality suggests a uni-directional causal movement from hydroelectricity consumption and globalization towards GDP. The outcome of the study emphasizes the importance of renewable sources such as hydropower energy for ensuring sustainable development in the presence of globalization.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The demand for energy has been on the rise around the globe. This demand for energy, on the one hand, upsurges the use (domestic and commercial) of energy to fill the growing need. At the same time, the significant emissions into the atmosphere are causing damage to the environment. This situation has motivated researchers to investigate alternative sources of energy that offer less emissions and more productivity. This further encourages the use of hydroelectric power and other renewable sources of energy that have a significant effect in decreasing the dangerous emissions, thus ensuring sustainable development. The means of hydroelectric power were first developed in 1935, with consistent improvement in hydro technology observed until 1974.Footnote 1 Approximately 20% of the world’s electricity produced by hydropower is characterized as clean energy, while its demand is rising around the globe.Footnote 2

The generation of renewable energy through the use of wind, water, and other sources lessens the global destruction caused by the CO2 emissions produced by other sources of energies, such as the consumption of fossil fuel energy, which includes oil, gas, petroleum, and coal (Solarin et al., 2019). The use of hydroelectricity not only safeguards the environment from pollution but at the same time, efficient production can bring prosperity by facilitating a clean atmosphere and ultimately contributing to economic growth. Also, generating electricity from water is a renewable and cheap source of clean energy. This source of energy production is never-ending and provides a continuous supply of power that also helps to control the overflow of water in the form of floods. Previous research studies have mostly focused on the size of the hydropower, viewing its advantages to fulfil the growing and clean energy requirement for different countries that is the need to combat the CO2 emissions (Xingang et al. 2012; Bildirici and Gökmenoğlu 2017).

This study investigates the role of the hydroelectricity effect in ensuring sustainable economic growth with low carbon emissions while accounting for financial development, fossil fuel, capital, and globalization for Turkey over the period 1970–2015. Turkey was chosen for this study based on the following reason. This country has the 13th largest economy in the world and is moving towards better prospects in terms of socio-economic development. This has been witnessed in the past 15 years as a result of the significant rise in the real GDP growth rate of 5.7% annually on an average basis. Ultimately, this upsurges the demand for energy in Turkey, which is expected to rise over 90% in the next 10 years. The principal means of energy for Turkey is coal which contributes 34% and oil (28%). Similarly, the contributions of hydroelectricity and other sources of energy are 5% and 9% respectively. Turkey can produce 433 TWh per year in total hydro energy, but it only produces 166 TWh per year. Instead of using its abundant resources of renewables and hydropower, the country still uses fossil fuels (gas, oil, coal, and petroleum) imported from other countries. Turkey depends on fossil fuels for the generation of electricity. The generation of electricity from fossil fuel is 167 billion kWh as compared with 67 billion kWh from hydroelectricity (Energy Information Agency, 2020). This generation of electricity from fossil fuels is at the cost of environmental degradation, thus declaring Turkey one of the 20th largest emitters of carbon dioxide in the world.Footnote 3 Since hydroelectricity consumption is more environmentally friendly as compared with fossil fuels. Moreover, the generation of electricity using the hydropower is cheaper than other renewable energy as wind and solar (Solarin and Ozturk 2015; Solarin et al. 2019). To the best of the authors’ knowledge, this empirical study is the first of its kind to investigate such a relationship for Turkey. Thus far, the Turkish government has stimulated the use of renewable resources in the coming decades, especially hydroelectricity because of the abundance of water reservoirs. Likewise, Turkey is an emerging economy that has possessed suitable natural resources and encouraging policy framework that will allow it to take its place among the top users of renewable energy sources. Moreover, this study will further be accompanied by a causal relationship to determine the appropriate policy. For instance, the absence of any causal relationship between hydroelectricity and GDP infers that both the energy and economic sector are not related to each. This assumption is in line with the classical economist who identified the labour and capital stock as the determinant of economic growth and not the energy sector. Likewise, the unidirectional causality from GDP to hydroelectricity confirms that production does not depend on the energy sector. Moreover, the energy conservation policies in this regard shall have no harmful effects on the economy. However, if a unidirectional causal relationship moves from hydroelectricity to GDP, this suggests that energy plays a crucial role in the economic development of an economy. Decreasing the volume of energy consumption may adversely affect economic development and vice-versa (Sebri 2015).

Currently, Turkey operates 478 hydropower plants in 69 different places of the country. The Government of Turkey intends to construct 534 more hydropower plants in the future. One of the rich reservoirs of water is the Black Sea, and this can be used for developing hydropower plants in Turkey. Also, Turkey possesses 555 large dam reservoirs, 664 small dams, 5 different watersheds, 25 hydrological basins, and 120 lakes.Footnote 4

Additionally, the financial sector of Turkey has been influenced by its strong banking sector that reveals a significant growth as it provides more than 70% of the financial services. The Turkish banking sector emerged strongly after 2001 (Ozatac 2017). Currently, there are 53 banks that are operating in Turkey, including 13 development and investment banks, 34 deposit banks, and 6 participation banks. Moreover, the BDDK (Bankacılık Düzenleme ve Denetleme Kurumu) has also approved the establishment of a new bank (Golden Global Yatirim Bankasi).Footnote 5 The banking sector of Turkey’s total assets reached 864 billion dollars with a significant increase in the net profit, which reached 13 billion dollars for the first time. Around 27% of total assets are contributed by foreign investors. Hence, the Turkish banking sector can easily facilitate the private sector to finance hydroelectric power development to move the country towards future prosperity. Until now, the Turkish banks have completed 47 projects by providing funds for enhancing the capacity of renewable energy. Additionally, since 2009, the European Bank for Reconstruction and Development (EBRD) completed more than 75 projects for sustainable energy in Turkey including the Bares and Rotor (two largest wind farms of Turkey) and the second-largest geothermal power plant in Europe (largest in Turkey) by investing more than 3 billion euros via Akbank.Footnote 6 Therefore, based on the above discussion, the role of hydropower will be analysed for the case of Turkey in the presence of financial developement, which will provide interesting insights.

The contribution of this paper to the existing literature is that it investigates the effect of hydroelectric, fossil fuel, domestic credit to the private sector (DCP) (financial development), and gross fixed capital formation in the presence of globalization on economic growth. Previous studies focus on considering the association between energy consumption and economic growth. This study is undertaken to address the research question of whether hydroelectricity and fossil fuels contribute to sustainable economic development for the case of an emerging economy in this era of globalization? Therefore, this study contributes to the existing literature by modelling the hydroelectricity consumption and fossil fuel in addition to economic growth, and CO2 emission in a multivariate framework to avoid any omitted variable bias. To the best of authors’ knowledge, this nexus has so far received inadequate attention for the case of Turkey. Since the role of sustainable development is an important issue that needs to address keeping low carbon emission at the other end. Also, this study uses several proxies for globalization, such as financialglobalization (FG) and economic globalization (EG), to investigate this nexus in identifying the economic and financial impact to ensure sustainable development. Furthermore, the study uses the novel method of Harvey et al. (2008) to determine the linearity of the series before applying the linear methods. This test can identify and facilitate us in applying methods based on linearity. The two structural break test is further adopted to clarify the issue of stationarity in the presence of two endogenous structural breaks in a series. The long-run and short-run elasticities are determined under the ARDL framework along with the diagnostic tests. Moreover, the causality among the variables is determined using the recent approach of Hacker and Hatemi-J (2012) to predict the causal directions among the variables.

The remainder of the study has been ordered as follows. “Literature review” identifies the related literature. “Model construction and data collection” highlights the data and model construction to be incorporated. “Methodology of the study” clarifies the methodology to be adopted. “Results and discussion” sheds lights on the results and provides a discussion, while “Conclusion and policy implications” supports the empirical results of the study with policy implications.

Literature review

Hydro energy consumption and economic growth nexus

Previous literature regarding energy consumption, including renewable and hydropower for the advancement of a country, have produced different findings. These findings are different based on the data sample and/or for different countries with various econometric techniques. For instance, Solarin et al. (2019) identified a long-term association between hydro energy consumption and economic growth for China for the period 1970 to 2014. The findings confirmed that hydropower has a favourable effect on the country’s GDP. Aydın (2010) identified that building hydropower plants in Turkey has a long-term favourable influence on carbon emissions. The study of Apergis et al. (2016) explored the long-term association between hydroelectricity consumption and economic development for Turkey from 1965 to 2012. The findings highlighted that both hydro energy consumption and real gross domestic product are cointegrated. They proposed that hydroelectricity consumption has had significant importance for reinforcing economic growth in recent years. Uyar and Gökçe (2017) conducted a study for Turkey and explored the association between energy consumption and GDP. They used the panel quantile regression technique with data from 1985 to 2013. The findings highlighted the influence of hydro energy consumption on economic growth at various quantiles.

Renewable energy consumption, environmental pollution, and economic growth nexus

The role of renewable energy consumption and environmental pollution in recent literature has been of paramount importance. In this regard, Halkos and Tzeremes (2014) examined the nexus between renewable energy consumption and GDP for 36 countries from 1990 to 2011. They employed a nonparametric method for their study. The findings identified a nexus between economic growth and renewable energy consumption. Gozgor et al. (2018) examined the influence of renewable energy and non-renewable energy consumption on various countries’ economic development. They chose panel data for 29 OECD (Organization for Economic Cooperation and Development) countries for the period 1990 to 2013. They applied the ARDL bounds test to investigate this relationship. The results revealed that together, renewable energy and non-renewable energy consumption significantly assist the country’s economic growth. Shakouri and Khoshnevis Yazdi (2017) performed a study for South Africa using a sample period from 1971 to 2015. The findings of the study identified the link between renewable energy consumption and economic expansion using the ARDL bounds testing approach. They concluded that both renewable energy consumption and GDP are important and interdependent.

Energy consumption and GDP nexus

The study of Lise and Van Montfort (2007) explored the association between energy consumption and gross domestic product for Turkey by applying the cointegration method using data from 1970 to 2003. The results confirmed evidence of a long-run relationship. Furthermore, evidence of a bidirectional causal relationship was also found. Similarly, Acaravci (2010) examined the nexus related to energy consumption and GDP and examined the causal association between them. Furthermore, the ARDL and Granger causality approaches were applied to annual data spanning the period from 1977 to 2006. The ARDL cointegration analysis indicated that there is a long-term association among energy consumption per capita and real gross domestic product per capita. Similarly, the outcome of the Granger causality approach suggested a unidirectional causal link between energy consumption and GDP. The findings highlighted that electricity upsurges economic growth in the case of Turkey. Cakmak (2015) identified the causal link between energy consumption per capita and gross domestic product per capita by employing the Johansen cointegration technique using data from 1971 to 2012 for Turkey. The Granger causality under the framework of VECM was applied. The outcome of their study revealed a nexus between energy consumption and GDP. However, the findings of their study showed the impact of energy consumption on gross domestic product. Yalta (2011) conducted a study for Turkey and identified the relationship between energy consumption and real gross domestic product for the period 1950–2006. The study findings highlighted no evidence of a causal relation in the case of the exchange rate and oil price. Akkemik and Göksal, 2012 evaluated the relationship between energy consumption and gross domestic product considering the heterogeneity for 79 countries with a sample period of 1980 to 2007. Their empirical evidence indicated the variability in the causal relationship for different countries. Likewise, Wang et al. (2011) examined the association between energy consumption and economic development for Heilongjiang province covering the period from 1980 to 2009. The conventional techniques were applied in evaluating the relationship. Moreover, the findings highlighted that economic growth causes energy consumption. However, the study did not find any significant effect of energy consumption on GDP.

FD and EC nexus

The nexus between financial development (FD) and energy consumption (EC) has been investigated in the previous studies. For instance, Çetin et al. (2015) performed a study for Turkey using data from 1960 to 2011 by applying the ARDL and Johansen–Juselius methods along with the vector error correction model for a causal association. The findings derived a favourable long-term connection between FD and EC. Furthermore, their study recommended that FD is crucial for EC for Turkey. Another study by Altay and Topcu (2015) investigated the association between FD and EC using data from 1980 to 2011 for Turkey. The study applied cointegration and causality approaches. The study did not find any indication of a long-run connection. Moreover, the causal findings supported the neutrality hypothesis for the energy-finance nexus in the short-run. Saud et al. (2018) applied panel data for the period 1990 to 2014 to the Next Eleven countries. Using second-panel generation techniques, the study identified that globalization upsurges the demand for energy consumption. Additionally, the feed-back hypothesis was validated in FD and EC. Rashid (2015) explored the nexus between FD, GDP and EC in Pakistan. The study applied the VECM approach to identify the causal association in addition to the cointegration. The findings highlighted a one-way causal association from electricity consumption to FD. Similarly, Roubaud and Shahbaz (2017) conducted a study for Pakistan to evaluate the nexus between EC and gross domestic product at the total and sectoral level employing data from 1972 to 2014. The long-run elasticities were computed using the ARDL approach. The VECM Granger causality analysis was employed to observe causal inferences. The findings of the study highlighted that the FD sector stimulates the use of electricity use and upsurges GDP. Evidence of a bidirectional causal relationship was established between EC and FD in both the agricultural and service sectors. Their empirical findings illustrated that financial development and EC effect economic development. Gungor and Simon (2017) identified the linkage between FD, EC, industrialisation, and urbanization for the case of South Africa. The study employed data spanning the period from 1970 to 2014 by employing the Johansen cointegration and Granger causality analysis under the VECM framework. The study findings highlighted the long-run association between EC and FD. Furthermore, a bidirectional causal relationship has been obtained between FD and EC. Topcu and Çoban (2017) considered the Turkish manufacturing industry to analyse the nexus between FD and firm development over the period 1989 to 2010. The supply-leading hypothesis was validated using the second generation panel techniques that take heterogeneity into account. The study further showed that Turkish firm growth across the sub-sectors is not uniform.

In summary, based on the comprehensive literature reviewed above, this study applies novel techniques in the form of Harvey et al. (2008) to confirm the linearity of the series before applying linear methods. Unlike, this test has been missing in the above studies. Moreover, the role of structural breaks is investigated by identifying the integration order in the presence of breaks. The long-run and short-run elasticities are investigated under the ARDL framework in a multivariate regression using globalization, fossil fuel, and hydroelectricity to avoid specification bias. Furthermore, financial and economic globalization is used to capture the effect. Moreover, a novel approach of symmetric causality is applied, as suggested by Hacker and Hatemi-J (2012).

Model construction and data collection

Model construction

This study investigates the role of hydroelectricity consumption and GDP including fossil fuels, EC, DCP, capital, and the globalization index as regressors. Thus far, in the literature, the role of hydroelectricity consumption and fossil fuels has been ignored. Moreover, the use of financial globalization (FG) and economic globalization (EG) has also been ignored in previous studies. However, both the FG and EG cannot be ignored while investigating this kind of energy-growth nexus. Moreover, these variables are chosen based on the consideration that hydro and fossil fuel energy consumption, DCP, capital, and globalization index directly affect the economic growth.

In this regard, following the seminal study of Solarin et al. (2019), by including financial globalization and economic globalization as two proxies in addition to the globalization index, the proposed model can be written as

After transforming the model into its logarithmic form, the model can be written as

The population series from the World Bank is used to convert all the variables into per capita. In Eq. 2 above, the GDPE represents the real gross domestic product per capita (constant 2010 US$), FEP is fossil fuel energy consumption per capita (which is a combination of natural gas, consumption of oil and coal in tons of oil equivalent), DCPE is domestic credit to the private sector per capita (% of gross domestic product) which is recognized by FD, HEP is hydroelectricity consumption per capita from hydroelectric sources (% of total), and GFCFP is gross fixed capital formation per capita (% of gross domestic product). Moreover, the above model will be proxied first with the globalization index, followed by financial and economic globalization. Globalization is the process through which all world economies are integrated and with international systems in terms of foreign direct investments, capital movements, international trade, the global technology, and the economic activity of multinational firms (SGD17). The data for EGI, EG, and FG have been collected from Dreher (2006).Footnote 7 It is expected that the sign of fossil fuel energy consumption, domestic credit to the private sector, and gross fixed capital formation will be positive. More consumption of fossil fuels will upsurge economic growth. FE includes natural gas, oil, coal, and petroleum and for energy generation and other valuable objectives such as for transportation, houses, and industrial and commercial purposes. Therefore, the sign of fossil fuel is expected to be positive. Domestic credit to the private sector provides loans to the public thereby improving the living standards of the people. This consequently encourages investors who set up new businesses, which has a positive effect on economic growth. The expected sign of financial development is positive. Capital plays a vital role in improving the infrastructure, such as road construction, private residential housing, railway facilities, and of the purchase of equipment such as plant and machinery to install more fixed assets for industrial and commercial structures, thus adding value to the economic growth. Therefore, the sign of capital is expected to be positive. Globalization is expected to affect economic growth positively with more urbanization and industrialisation. With the use of new technology, free trade in a country will have a positive impact on globalization Solarin et al. (2019).

Data collection

The details of the variables along with units of measurement and data collection sources have been shown in the below Table 1.

Methodology of the study

Linearity test

It is important to investigate the linearity of the series before applying the linear unit root tests and linear cointegration methods. The linear approach is adopted to investigate the appropriateness of the variables under the linear frame. However, the outcomes will be biased if the linear sequence is investigated under the non-linear framework (Solarin and Bello 2018), (Kilian and Vigfusson, 2011). Specifically, this study applies Harvey et al.’s (2008) linearity test to explore the linearity of the series.

Unit root test

The unit root test is used to determine the integration order of the series. Without identifying the integration order, various cointegration methods cannot be applied. This identifies the importance of the stationarity measure of the series taken into the account. Moreover, abrupt changes in the series cause breaks that need to be highlighted before identifying the integration order. The conventional unit root tests are unable to measure these breaks. Ignoring these structural breaks might lead to incorrect determination of the integration order. Hence, it is necessary to apply the structural breaks unit root test. In this regard, Perron and Vogelsang (1992) measured one endogenous structural break. Additionally, it was clarified that one endogenous structural break is not sufficient to determine the integration order. Therefore, the study is further extended to identify the integration order in the presence of two endogenous breaks by applying the modified Clemente et al. (1998) to the extent of two structural breaks.

ARDL bounds testing approach

The ARDL bounds test can be applied to any series irrespective of the order of integration; however, it must be ensured that none of the variables in the sequence is I(2). This study is used to predict the long-run nexus among the variables by applying the autoregressive distributive lag (ARDL) as proposed by Pesaran et al. (2001). The reasons for adopting this approach rather than other methods of cointegration are as follows:

Firstly, this approach performs better when dealing with small sample data. Secondly, this approach does not require a unique order of the series. Thirdly, the long-run and short-run associations of the variables are determined under the ARDL framework using Eq. 3 to Eq. 8 respectively.

Apart from this, the ARDL bounds analysis computes the unrestricted error correction model (ECM), which further identifies the evidence of a long-run relationship and system stability. The ARDL bounds test takes the lag of the dependent variables, which is helpful in countering the residual serial correlation problem. The short-run coefficient for this study can be represented as below

where ECTt − 1 represents the error correction term. The CUSUM (cumulative sum) and CUSUMsq (cumulative sum of squares) are applied to identify the stability of the long-run coefficients over the selected sample period. Both the CUSUM and CUSUMSQ are examined for this purpose. Besides, various diagnostic tests are also performed to identify the validity of the assumption of the classical linear regression model (CLRM).

Hacker and Hatemi-J (2012) causality test

To check the appropriate cause and effect connection among the variables, this article used the approach of Hacker and Hatemi-J’s (2012) causality method in preference to the Granger causality method, which is constructed on a theory of asymptotic distribution. According to the Monte Carlo, the estimation will be biased based on asymptotic distribution if the variables are non-stationary (Newbold and Granger 1974).

The Hacker and Hatemi-J (2012) method is more robust as it also computes the modified Wald test based on the appropriate sample size as compared with the sample size of the asymptotic distribution. Moreover, Hacker and Hatemi-J (2006) analyse the size properties of the modified Wald test (MWALD) as proposed by Toda and Yamamoto (1995). They further identified that these tests perform poorly when using small samples. Additionally, Hacker and Hatemi-J (2012) introduce the bootstrap approach by endogenizing the lag length selection in Hacker and Hatemi-J (2006).

Results and discussion

As indicated in the earlier part of the study, the linearity issue needs to be taken into account before applying any linear model. In this regard, to identify the linearity of the variables, this article follows Harvey et al. (2008) to determine the non-linearity. The results of the Harvey et al. (2008) test can be viewed in Table 2. The findings confirm that Harvey statistics is less than the critical values of the variables in the series, thus the null hypothesis cannot be rejected except GDPE, thus confirming the majority of the series is linear. This further allows us to apply the linear unit root tests and linear cointegration methods.

Moreover, as stated earlier, the integration order of the series is identified by applying Perron and Vogelsang (1992) to measure the one endogenous break and the modified version of the Clemente (1998) with two breaks. The results of both the unit root tests along with one endogenous and two endogenous breaks have been shown in Table 3.

The results from Table 2 suggest that in the cases of both one endogenous and two endogenous breaks, all the variables at levels are non-stationary. However, they become stationary once the first difference is applied to the series. This infers that all the variables of this study are integrated of order one taking into account one and two endogenous breaks. The unique order of the series allows us to employ the ARDL bounds test to predict the long-term relationship among the variables of the series.

The results for the ARDL bounds test have been shown in Table 4. Table 4 shows the F bounds test along with the diagnostic tests for each model. Additionally, the error correction test has been shown, which provides evidence of the long-run relationship provided that the value of ECTt − 1 is in the range of 0–1. The ECTt − 1 must be negative showing that it will converge the variables back to the normal position. Moreover, the results show that in all models, the F bounds values are higher than the critical values as proposed by Pesaran et al. (2001). This highlights that the variables of the study are in a long-run association. Moreover, the diagnostic tests show that the estimates are blue and have no issue of multicollinearity, heteroskedasticity, and serial correlation, thus verifying various conditions of the classical linear regression model (CLRM).

Confirming the presence of a long-run connection, this study further highlights the long-run and short-run results under the framework of the ARDL model. The results for both the long-run and short-run are shown in Table 5. Following Table 5, the study finds evidence of a significant association between FE and GDP. Keeping other things constant, a 1 % upsurge in FE leads economic growth to increase by 0.12988–1.6536% and statistically significant as well at 1%. This means that fossil fuel effects economic growth positively. Furthermore, this is in accordance with the findings of the study by Solarin et al. (2019) for China, which also reported a positive effect of fossil fuel on economic growth. DCPE has a significant impact on economic development. Moreover, a 1% growth in FD improves the GDP by 0.112–0.1460%. This suggests that more access to the credit by the general public promotes entrepreneurship, thereby improving domestic production. This encourages more investors to establish new industries, which boosts domestic production. This finding is in line with the studies of Shahbaz et al. (2013) and Solarin et al. (2019), implying that financial development strengthens economic development. Additionally, keeping other things constant, this study finds an insignificant effect of HEP on economic development. This further highlights the weak role of hydroelectricity in Turkey. The impact of GFCF on GDP is optimistic and meaningful at 1 %. Therefore, a 1 % increase in GFCF boosts the economic growth by 0.1872–0.2145%. Thus, more usage of capital in the form of trained personnel will contribute to the GDP. Moreover, the globalization index, economic globalization, and financial globalization have a negative impact on the country’s GDP. The coefficients of globalization index, economic globalization, and financial globalization are − 0.5627%, − 0.2622%, and − 0.1388% respectively. This negative impact of globalization increases inequality, which leads to deterioration in environmental and social standards. Moreover, it further increases the risk of economic crisis thereby causing excessive capital moments across the country, which will weaken the financial institutions that are vulnerable to any negative external shock. Moreover, such negative events of globalization, if not managed properly, might have a deteriorating effect on economic development (Zerrin and Dumrul 2018). Furthermore, the adjusted R2 values are 0.94, 0.95, and 0.96, which implies that 94%, 95%, and 96% of variations in the model are explained by globalization index, economic globalization index, and financial globalization index model along with the capital, hydroelectricity consumption, domestic credit to the private sector, and FE. The Durbin Watson is in acceptable range that suggests no problem of autocorrelation. Moreover, our estimations also confirmed no problems of serial correlation or heteroscedasticity. The F-statistic values show the overall reliability and validity of our models with the corresponding P value less than 1%.

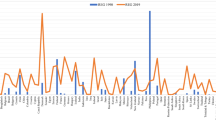

The short-run analysis has been displayed in the lower panel of Table 5. The results suggest a positive influence of FE on economic growth. Moreover, 1 % consumption of fossil fuels rises the GDP by 0.1022–0.9455% at the 1 % level. Likewise, DCP has significant and positive effect on GDP. Hydroelectricity has an insignificant effect on economic development. GFCF has a substantial and positive influence on economic development. Moreover, a 1 % rise in capital contributes to the GDP by 0.10 to 0.16%. Likewise, the globalization index, financial globalization, and economic globalization have a negative effect in the short-run as well. This further implies that the Government of Turkey must optimally use its resources to manage the negative effects of the resources in the short-run as well to avoid negative consequences that will lead to a decline in the GDP. The ECTs for the model including GOI, EG, and FGI are − 0.57, − 0.60, and − 0.78. The signs of all the coefficients are negative, which implies the convergence of the respective dynamics to the equilibrium position. However, the speed of convergence in the financial globalization model is greater than in the GI and EG. Moreover, 78% of convergence takes place in 1 year. The adjusted R2 in the short-run panel is 64%, 66%, and 72% respectively. This further highlights that sufficient variation has been explained by the independent variables in economic growth using globalization, economic globalization, and financial globalization. Moreover, the F-statistic values imply the validity and reliability of the overall models following the corresponding values of all three models in this case. The Durbin Watson statistic shows no indication of any autocorrelation problem. Additionally, the stability tests of the long-run coefficients were carried out by using the CUSUM and CUSUM square tests as suggested by Brown et al. (1975). Both CUSUM and CUSUMSQ show the stability of the long-run elasticity in the selected sample period in all three models (Figs. 1, 2, and 3).

Finally, this study investigates the causal impact by applying Hacker and Hatemi-J (2012). The results of the Hacker and Hatemi-J (2012) test have been displayed in Table 6. Table 6 illustrates a uni-directional causality from hydroelectricity to economic growth. This suggests that the electricity produced from hydro sources can upsurge the economic growth on the one hand, while keeping the level of carbon dioxide emission on the other. This can facilitate the economy by generating clean energy. This also suggests that energy is playing a vital role in the economic development of Turkey. Decreasing the volume of energy, in this case, may have a deteriorating effect on the economic growth for Turkey. Moreover, economic growth is causing financial development with a significant value of Wald statistics at 5 %. This means that the upsurge in economic growth raises the per capita income of the individuals (investor/producer, customer), which increases the demand for financial services. This relationship also validates the demand-side hypothesis for this study. This finding of our study is in concordance with the study of Shahbaz et al. (2017) for India. Another uni-directional causal relationship moves from the globalization index to economic growth with a Wald stat of 4.024, which is significant at 10%. This implies that managing globalization will have a favourable influence on GDP. However, if it not managed properly, it will harm economic growth.

Conclusion and policy implications

The purpose of this article is to explore the role of hydroelectricity, FD, economic development, fossil fuel, and globalization in the production demand function. This paper employs the data for the sample period from 1970 to 2015. In this regard, the Harvey et al. (2008) unit root was adopted to identify the linearity of the sequence. The ARDL bounds method was employed to identify the long-run connection between the variables. Moreover, the long-run and short-run elasticities are estimated under the framework of the ARDL bounds technique. The findings suggested a positive effect of fossil fuels, FD, and capital on economic growth. Hydroelectricity has an insignificant effect on GDP. Moreover, the globalization index, EG, and FG have a negative impact on economic development. Furthermore, the diagnostic tests were performed, which revealed the absence of heteroscedasticity, and serial correlation. The CUSUM and CUSUMSQUARE tests showed the stability of the long-run elasticities.

To identify the cause and effect nexus among the variables, this study applied the Hacker and Hatemi-J (2012) causality approach. The findings exhibited that hydroelectricity consumption and globalization index cause GDP. In addition to this, economic growth causes financial development, which validates the demand-side hypothesis for Turkey.

The following policies can be recommended in light of our study.

Turkey is an energy import-dependent country. The main sources of imported energy for generating electricity that is used for residential, industrial, commercial, and transportation purposes are coal, natural gas, oil, and petroleum. This has also been quite evident with our estimation results, which revealed that fossil fuels are having a positive impact on Turkey’s economic growth. Moreover, these resources fulfil the country’s energy needs in achieving economic development together in the short-run and long run. However, the ultimate effect of using these resources for energy production is that they represent the primary source of CO2 emissions. Also, Turkey specifically imports fossil fuels and the demand is increasing, which upsurges environmental pollution.

Therefore, based on the above discussion, this study also recommends that to decrease the country’s imports and to achieve sustainable development of both social and economic growth, Turkey’s government should continue their long-term policies with a focus on renewable sources, particularly hydropower energy. The results of our estimation showed that the insignificant effect of hydroelectricity on economic growth is primarily because of the greater importance of the consumption of fossil fuels in Turkey compared with hydroelectricity. In this regard, Turkey [possess abundant natural resource and renewable energy sources. This includes larges reservoirs of water including dams, but there is less focus on these resources as they only produce 166 TWH of total 433 TWH capacity of hydro energy. Secondly, using renewable sources for generating hydroelectricity will help in achieving the country’s plan for 100 GW by 2023 and the aim of shifting from immense CO2 emissions to green sources of energy production to lessen the environmental pollution. Thirdly, hydroelectric is a cheap and easy source of energy production, which has favorable impacts on the environment (i.e. green fields) and can help to meet the increasing demand for green energy. Moreover, using renewable sources will decrease the country’s imports of fossil fuels. Nevertheless, developing hydropower projects will create a significant amount of employment opportunities in the country. In this regard, the banks credit must be advanced to finance the dams by promoting the generation of electricity through hydro sources. Similarly, foreign investors are motivated to leverage the investment in hydro sources for Turkey through tax rebates and cheap labour costs. The European Bank for Reconstruction and Development (EBRD) is investing in different projects in Turkey, including hydropower for the promotion of clean energy, thus improving the living standards. Apart from this, the banking sector needs to encourage the local citizens by giving easy access to credits by leveraging their investment in hydropower, which will also serve as an employment opportunity thereby contributing to the country’s economic progress. The government of Turkey needs to take transitional changes into the account to counter the negative effects of globalization. More effective management of globalization can have a positive impact on economic growth, which can add significant value to the economy of Turkey.

Lastly, this study can further be expanded by considering the MENA countries. Moreover, the second generation panel techniques can be applied, which can provide further interesting insights.

Notes

Please refer to Dreher (2006) for further information and definitions about globalization index, financial globalization, and economic globalization

References

Acaravci A (2010) The causal relationship between electricity consumption and GDP in Turkey: evidence from ARDL bounds testing approach. Economic research-Ekonomska istraživanja 23:34–43

Akkemik KA, Göksal K (2012) Energy consumption-GDP nexus: heterogeneous panel causality analysis. Energy Econ 34:865–873

Altay B, Topcu M (2015) Relationship between financial development and energy consumption: the case of Turkey. Bulletin of Energy Economics (BEE) 3:18–24

Apergis N, Chang T, Gupta R, Ziramba E (2016) Hydroelectricity consumption and economic growth nexus: evidence from a panel of ten largest hydroelectricity consumers. Renew Sust Energ Rev 62:318–325

Aydın L (2010) The economic and environmental impacts of constructing hydro power plants in Turkey: a dynamic CGE analysis (2004-2020). Nat Res Forum 1:69–79

Bildirici ME, Gökmenoğlu SM (2017) Environmental pollution, hydropower energy consumption and economic growth: evidence from G7 countries. Renew Sust Energ Rev 75:68–85

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc Ser B Methodol 37:149–163

Cakmak I (2015) Energy consumption and GDP in Turkey: cointegration and causality analysis. Int J Appl Manag Sci 1:130–132

Çetin M, Ecevit E, Seker F, Günaydin D (2015) Financial development and energy consumption in Turkey: empirical evidence from cointegration and causality tests. In Handbook of research on behavioral finance and investment strategies: decision making in the financial industry 297–314. IGI Global

Clemente J, Montañés A, Reyes M (1998) Testing for a unit root in variables with a double change in the mean. Econ Lett 59:175–182

Dreher A (2006) Does globalization affect growth? Evidence from a new index of globalization. Appl Econ 38:1091–1110

Energy Information Agency (2020) Energy International Administration Available from: https://www.eia.gov/international/data/country/TUR

Gozgor G, Lau CKM, Lu Z (2018) Energy consumption and economic growth: new evidence from the OECD countries. Energy 153:27–34

Gungor H, Simon AU (2017) Energy consumption, finance and growth: the role of urbanization and industrialization in South Africa. Int J Energy Econ Policy 7:268–276

Hacker RS, Hatemi-J A (2006) Tests for causality between integrated variables using asymptotic and bootstrap distributions: theory and application. Appl Econ 38(13):1489–1500

Hacker S, Hatemi-J A (2012) A bootstrap test for causality with endogenous lag length choice: theory and application in finance. J Econ Stud 39:144–160

Halkos GE, Tzeremes NG (2014) The effect of electricity consumption from renewable sources on countries′ economic growth levels: evidence from advanced, emerging and developing economies. Renew Sust Energ Rev 39:166–173

Harvey DI, Leybourne SJ, Xiao B (2008) A powerful test for linearity when the order of integration is unknown. Studies in Nonlinear Dynamics & Econometrics 12:1558–3707

Kilian L, Vigfusson RJ (2011) Are the responses of the US economy asymmetric in energy price increases and decreases? Quant Econ 2:419–453

Lise W, Van Montfort K (2007) Energy consumption and GDP in Turkey: is there a co-integration relationship? Energy Econ 29:1166–1178

Newbold P, Granger CWJ (1974) Spurious regressions in econometrics. J Econ 2:111–120

Ozatac N, Gokmenoglu, KK, Taspinar N (2017) Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: the case of Turkey. Environ Sci Pollut Res 24(20):16690–16701

Perron P, Vogelsang TJ (1992) Nonstationarity and level shifts with an application to purchasing power parity. J Bus Econ Stat 10:301–320

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Rashid A (2015) Contribution of financial development in electricity-growth nexus in Pakistan. Acta Universitatis Danubius Economica 11:223–240

Saud S, Baloch MA, Lodhi RN (2018) The nexus between energy consumption and financial development: estimating the role of globalization in Next-11 countries. Environ Sci Pollut Res 25:18651–18661

Sebri M (2015) Use renewables to be cleaner: meta-analysis of the renewable energy 23 consumption – economic growth nexus. Renew Sust Energ Rev 42:657–665

Shahbaz M, Khan S, Tahir MI (2013) The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Econ 40:8–21

Shahbaz M, Van Hoang TH, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Econ 63:199–212

Shakouri B, Khoshnevis Yazdi S (2017) Causality between renewable energy, energy consumption, and economic growth. Energy Sources, Part B: Economics, Planning, and Policy 12(9):838–845

Solarin SA, Bello MO (2018) Persistence of policy shocks to an environmental degradation index: the case of ecological footprint in 128 developed and developing countries. Ecol Indic 89:35–44

Solarin SA, Ozturk I (2015) On the causal dynamics between hydroelectricity consumption and economic growth in Latin America countries. Renew Sust Energ Rev 52:1857–1868

Solarin SA, Shahbaz M, Hammoudeh S (2019) Sustainable economic development in China: Modelling the role of hydroelectricity consumption in a multivariate framework. Energy 168:516–531

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66:225–250

Topcu M, Çoban S (2017) Financial development and firm growth in Turkish manufacturing industry: evidence from heterogeneous panel based non-causality test. Economic research-Ekonomska istraživanja 30(1):1758–1769

Uyar U, Gökçe A (2017) The relationship between energy consumption and growth in emerging markets by panel quantile regression: evidence from VISTA countries. Pamukkale University Journal of Social Sciences Institute/Pamukkale Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 27

Wang S, Deng LH, Zhou WT, Zhu ZY (2011) Empirical research on the relationship between energy consumption and economic growth in Heilongjiang province. In Proceedings of International Conference on Information Systems for Crisis Response and Management (ISCRAM) IEEE 76-81

World Bank, (2019) World development indicators. Retrieved from http://www.worldbank.org. Accessed 30 Jan 2019

Xingang Z, Lu L, Xiaomeng L, Jieyu W, Pingkuo L (2012) A critical-analysis on the development of China hydropower. Renew Energy 44:1–6

Yalta AT (2011) Analyzing energy consumption and GDP nexus using maximum entropy bootstrap: the case of Turkey. Energy Econ 33:453–460

Zerrin K, Dumrul Y (2018) The impact of globalization on economic growth: empirical evidence from the Turkey. Int J Econ Financ Issues 8:115

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Faisal, F., Khan, M.N., Pervaiz, R. et al. Exploring the role of fossil fuels, hydroelectricity consumption, and financial sector in ensuring sustainable economic development in the emerging economy. Environ Sci Pollut Res 28, 5953–5965 (2021). https://doi.org/10.1007/s11356-020-10608-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-10608-3