Abstract

It is globally acceptable that carbon dioxide (CO2) emissions are one of the greenhouse gases are considered the main factor influencing global warming and environmental degradation. The present study focuses on China, the world’s largest carbon emitter. The study aims to capture the time-frequency dependency of economic growth and CO2 emissions in China for the time period 1950–2016 using a wavelet coherence approach, which allows us to investigate both the long-run and short-run causal links of the estimated variables. In order to capture the long-run and causal linkage between economic growth and CO2 emissions, the study employs Maki cointegration, wavelet coherence, Toda-Yamamoto causality, Fourier Toda-Yamamoto causality, and nonparametric Granger causality tests. The findings of this study reveal that (i) there is a significant vulnerability between economic growth and CO2 emissions throughout the 2000s both the short-term and medium-term; (ii) there is long-run cointegration linkage between economic growth and CO2 emissions in China; (iii) economic growth in China has an important power for predicting CO2 emissions over the selected study period, especially in the short-term and medium-term; and (iv) it was observed that there is positive correlation between economic growth during the 1980s and 1990s in the short-term only. The outcome of the Toda-Yamamoto causality, Fourier Toda-Yamamoto causality, and nonparametric Granger causality tests underlines that economic growth is a robust policy variable for predicting CO2 emissions in China.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

It is globally acceptable that CO2 emissions are one of the greenhouse gases and considered the main factor influencing global warming and environmental degradation. Environmental sustainability and climate changes are the main environmental issues in the world agenda, and they have attracted researchers to explore the nexus between economic growth and CO2 emissions. It is known that the burning of fossil fuel, coal, oil, and natural gas is the reason behind rising CO2 emissions and thus the main reason behind the deterioration of natural environment. Similarly, Mardani et al. (2019) stated that despite the positive effect of economic growth on leaving standards for both the developed and developing economies, tripling the world economy in the last four decades is blamed for rising CO2 emissions and decreasing natural resources.

Nowadays, China is the world’s largest carbon emitter in the world. In the 13th Five-Year Plan of China, the main target is to significantly shrink its CO2 emission per unit of GDP by 18% from 2015. Therefore, like in other emerging economies, CO2 emission reduction is the key for the policymakers in China to achieve the national reduction goal at the minimum cost. The majority of previous studies for the past two decades have used linear and traditional models while estimating the linkage between economic growth and CO2 emissions. According to the China Renewable Energy Outlook 2019, the targets of COP25 in Madrid and China will increase renewable energy investments, which might reduce the CO2 intensity of GDP in China and protect the climate. In order to avoid the risks and effects of climate change in the world, the Paris agreement (COP21) was signed by 189 countries in 2015 to hold the rising global average temperature below 2 °C, and the target will be 1.5 °C (Rhodes 2016). Wang et al. (2019a, b) estimated that China’s emissions are likely to reach its peak in the first half of the 2020s by reaching 13 to 16 gigatonnes of CO2 emissions. This estimation reveals that China is around 5 years ahead of the current Paris target of 2030.

According to Climate Change Performance Index of Germanwatch, the CO2 reduction and energy consumption of China still did not in expected level in 2019, and this might make the path to reach the Paris climate targets of COP21 more difficult for China. The Paris climate targets is to let both the developed and developing countries put their agenda on one core strategy of continuously reducing the CO2 intensity of GDP. Previous studies have investigated the nexus between economic growth and CO2 emissions in the relevant environment literature. However, there is no consensus about whether China will achieve the Paris climate targets by 2030 (Gallagher et al. 2019; Wang et al. 2019a, b). Hence, this study employed the time-frequency dependency to examine the relationship between economic growth and a CO2 emission in China covering 1950–2016, which has not yet been explored using the wavelet coherence test.

In order to explore the relationship between economic growth and a CO2 emission in China, the present study contributes to the body of related literature in several ways. First, we broaden both the theoretical and empirical association of the relevant related literature on economic growth and CO2 emissions. Second, we employed the wavelet coherence techniques to model China’s economic growth and CO2 emissions’ dataset from 1950 to 2016. The wavelet analysis has taken both the frequency and time dimension into account simultaneously. In other words, the present study explores the co-movement between economic growth and CO2 emissions for China’s case in the short-run and long-run separately. Regarding the linkage between economic growth and CO2 emissions, scholars have mainly tested four points of views in both empirical and theoretical studies, namely, growth-led CO2 hypothesis; CO2-led growth hypothesis; feedback causality between economic growth and CO2 emissions; and no casualty between economic growth and CO2 emissions, the so-called neutrality hypothesis. Also, the majority of earlier empirical studies have used relatively small datasets, but in the present study, we use the largest dataset ever employed, which spans more than a half-century. Third, the present study performed the following econometric techniques of nonparametric Granger causality of Diks and Panchenko (2006) to consider nonlinearity and Fourier Toda-Yamamoto causality of Nazlioglu et al. (2016) in order to take into account structural break. Another novelty of this study is to use linear econometric techniques without taking into account structural breaks and nonlinearity assumption, while exploring causal linkages among the time series variables have been heavily criticized by Racine and Li (2004) and Shahbaz et al. (2017). Finally, the outcomes of the study delivered valuable insights and recommendations for policymakers to reduce CO2 emissions while sustaining economic growth.

The empirical analysis also finds that (i) there is a significant vulnerability in economic growth and CO2 emissions throughout the 2000s in the short-term and medium-term; (ii) there is a long-run cointegration linkage between economic growth and CO2 emissions in China; (iii) economic growth in China has an essential power for predicting CO2 emissions over the selected period, especially short-term and medium-term; and (iv) in the short term, we also observe that there is a positive correlation between economic growth during the 1980s and 1990s. Our results are robust and highlight the nonlinear and linear causality running from economic growth to CO2 emissions in China. The rest of the paper is organized as follows: Section 2 presents a literature review and discusses previous researches upon the relevant issue. Section 3 describes the data and methodology that the present study applied. Section 4 presents the findings of the conducted empirical study, and the conclusions drawn are summarized in Section 5.

Literature review

In today’s world, global warming is a critical issue to deal with. As stated by Wang et al. (2020), continuously reducing the CO2 intensity of GDP and eventually controlling CO2 emissions growth are dual targets of the COP21 and the Kyoto protocol without slowing down economic growth. In both agreements, it underlined that global warming could impact on the people living around the world. Throughout the years, the number of theoretical and empirical studies has investigated the CO2 emissions-growth nexus to describe this relationship better. Regarding the linkage between economic growth and CO2 emissions, scholars have mainly tested four point of views in both empirical and theoretical studies, namely, growth-led CO2 hypothesis; CO2-led growth hypothesis; feedback hypothesis (two-way causality between economic growth and CO2 emissions); and no casualty between economic growth and CO2 emissions, the so-called neutrality hypothesis.

The growth-led CO2 hypothesis argues that economic growth drives CO2 emissions in a country. The growth-led CO2 hypothesis is supported by Wasti and Zaidi (2020), Aydoğan and Vardar (2020), Shahbaz et al. (2017), Riti et al. (2017), Shahbaz et al. (2016a, b), Jafari et al. (2015), and Shahbaz et al. (2015). Using the ARDL and Granger causality test, Wasti and Zaidi (2020) identify the relationship between CO2 emissions, trade liberalization, gross domestic product, and energy consumption in Kuwait from 1971 to 2017. They find that (i) economic growth causes CO2 emissions; (ii) there is feedback causality between CO2 emissions and energy consumption; and (iii) there is unidirectional running from energy consumption to trade liberalization. Aydoğan and Vardar (2020) focus on E7 countries while exploring the relationship between CO2 emissions per capita, economic growth, agricultural value-added, renewable, and non-renewable energy consumption. In the E7 countries, they confirm the validity of the Environmental Kuznets Curve (EKC) hypothesis. Moreover, their findings also indicate that economic growth causes CO2 emissions per capita. On the other hand, the study by Chontanawat (2020) aims to explore the linkage between energy consumption, CO2 emissions, and economic output in ASEAN countries in 1971–2015. The study concludes that there is no significant causality running from economic growth to CO2 emissions.

Furthermore, CO2-led growth hypothesis states that CO2 emissions are the determining factor in causing variations in economic growth. The empirical findings of the studies of Adedoyin et al. (2020), Wang et al. (2016b), Joo et al. (2015), Omri et al. (2014), Alam et al. (2012), and Saboori et al. (2012) strongly support and well document for the CO2-led growth hypothesis. Adedoyin et al. (2020) find the relationship between coal rent, economic growth, and CO2 emissions by taking into account the regulatory quality in the BRICS countries from 1990 to 2014. The outcomes of the Dumitrescu and Hurlin causality test of Adedoyin et al. (2020) support the hypothesis of the CO2-led growth hypothesis since they conclude that CO2 emissions cause economic growth in the BRICS countries. Using a linear causality test, Granger causality test, and a nonlinear causality test, Hiemstra and Jones causality test, Wang et al. (2016b) investigate the relationship between economic growth, energy consumption, and CO2 emission in China in 1978–2012. The findings of Wang et al. (2016b) reveal a one-way causality running from CO2 emissions to economic growth in China. Tong et al. (2020), Liu et al. (2019), Acheampong (2018), Al-Mulali and Che Sab (2018), Bakirtas and Cetin (2017), Mirza and Kanwal (2017), Bakirtas and Cetin (2017), and Shahbaz et al. (2015) report that there is the two-way linkage between CO2 emissions and economic growth, supporting the view of feedback hypothesis. CO2 emissions and economic growth, according to this hypothesis, are dependent upon each other. Several studies, Gorus and Aydin (2019), Han et al. (2018), Pablo-Romero and De Jesús (2016), Wang et al. (2016a), and Gökmenoğlu and Taspinar (2016), have found no causality between CO2 emissions and economic growth. In other words, these studies support the view of the neutrality hypothesis. Gorus and Aydin (2019) focus on eight oil-rich MENA countries for the period 1975–2014 and investigate the nexus between CO2 emissions and economic growth using a panel-based frequency domain causality test. They find that there is no dependency between CO2 emissions and economic growth. Similarly, the results reported by Gökmenoğlu and Taspinar (2016) are also in favor of the neutrality hypothesis for CO2 emissions and economic growth interactions using the time series data of Turkey over the period from 1974 to 2010.

Notably, China is the world’s largest carbon emitter globally; numerous empirical and theoretical studies have been conducted on the case of China on the nexus between CO2 emissions and economic growth (Table 1). To the best the author’s knowledge, no study has been devoted to analyzing the time-frequency dependency of CO2 emissions and economic growth in China using a wavelet approach. Since the present study also employs Toda-Yamamoto causality, Fourier Toda-Yamamoto causality, and nonparametric Granger causality as robust tests, the outcomes are not sensitive to nonlinearity and structural changes.

From the above-cited studies, one could conclude inconclusiveness among these studies, as mentioned earlier, leaving the subject matter open to further deliberations. Hence, the present paper aims to capture the time-frequency dependency of economic growth and CO2 emissions in China covering 1950–2016. The study used a wavelet coherence approach, which allows the study to investigate both the long-run and short-run causal links between economic growth and CO2 emissions in China. Further, the paper employed Maki cointegration test, Toda-Yamamoto causality, Fourier Toda-Yamamoto causality, and nonparametric Granger causality tests as robust causality tests which are presented in detail in the Data and Methodology section.

Data and methodology

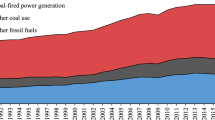

This section explains the data and methodological approach involved in modeling China economic growth and CO2 emissions’ variable. China remains the world’s largest carbon emitter producer globally; therefore, many studies have investigated the effects and determinants CO2 emission. However, to the best the author’s knowledge, no study has been conducted to capture time-frequency dependency of economic growth and CO2 emissions in China using a wavelet coherence approach. In other words, the present study explores the co-movement between economic growth and CO2 emissions in China. To investigate the relationship among the time series variables, the annual data from 1950 to 2016 are used. The dataset of the CO2 emissions’ variable is extracted from the Carbon Dioxide Information Analysis Centre (CDIAC), while the economic growth dataset is gathered from the Maddison Project Database (MPD). Figure 1 presents the pattern of GDP per capita and CO2 emissions per capita in China, while Table 2 presents data sources of variables and summary of the descriptive statistics.

As an initial step, in line with the aim of the present study, the orders of integration of economic growth and CO2 emissions’ variables are captured using the DF-GLS unit root test (developed by Elliott et al. (1996) using GLS de-trending procedure) and Zivot-Andrews unit root test with a single structural break (proposed by Zivot and Andrews 2002).

The next step is to capture the cointegration equation between economic growth and CO2 emissions in China using the Maki cointegration test (Maki 2012). By taking into account multiple structural breaks, the present study employs the Maki cointegration test to examine the null hypothesis of the cointegrating relationship of CO2 emissions’ variables in China. The present study employed the two separate regression models of the Maki cointegration test: Regime Shift and Regime Shift with Trend. The equation of these regression models are shown below:

Regime Shift:

Regime Shift with Trend:

In Eqs. 1–4, "t" denotes the period, i.e., t = 1, 2, 3……T; CO2t is the CO2 emission per capita variable in China while EGt represents the GDP per capita; and εt is the error term. Here, TSB, i is for the specific period of each structural break with "k" for the maximum number of breaks obtained (Khan et al. 2020).

In the present study, the empirical approaches applied to the dataset also include continuous wavelet power spectrum and coherence. The wavelet analysis takes both the frequency and time dimension into account simultaneously, which is a useful tool in the econometric analysis since the economic literature studies are widely conducted by either time series analysis or based on frequency domain. Besides, employing time-based traditional causality tests and fixed parameters causes erroneous results when there are structural breaks in time series. At this point, determining where structural breaks occur in the modeling technique is quite remarkable. In this context, the Fourier transform is developed by using a different frequency domain approach. In this approach, neglecting the information in the time domain and focusing on the frequency domain pose a critical problem (Orhan et al. 2019). Besides, the wavelet analysis brings the two widely used separated techniques under a unified frame of time and frequency dimension. In other words, the continuous wavelet coherence approach allows the present study to explore how the economic growth and CO2 emissions in China are related at different frequencies and how their relationship varies over time since the wavelet analysis has taken both the frequency and time dimension into account simultaneously. However, it is worth mentioning that the number of studies in the economic and environment literature employing the continuous wavelet power spectrum and coherence is considerably low compared with the other fields such as medicine and engineering fields. Nevertheless, the continuous wavelet power spectrum and coherence approaches have become more prevalent in recent years since the approach allows for obtaining highly valuable information about the interaction of the economic, financial, and environment time series variables which cannot be observed by the other techniques applied.

As the primary purpose of this study is to investigate the relationship between economic growth and CO2 emissions, I use the wavelet equation developed by Goupillaud et al. (1984) as follows: \( \psi (t)={\pi}^{-\frac{1}{4}}{e}^{-i{\omega}_0t}{e}^{-\frac{1}{2}{t}^2} \), p(t), t = 1, 2, 3….., T, where ψ is applied on limited observations by Kirikkaleli et al. (2020). The simple equation of the continuous wavelet is shown below in equation two. The continuous wavelet is constructed from ψ with k and f paramiters for the the time series data p(t) as follows:

where k and f indicate the time and frequency, respectively. “The main role of the k is to define a wavelet’s particular location in time by exchanging the wavelet while f controls the distended wavelet for localizing various frequencies” (Kirikkaleli and Sowah 2020). Equation 6 presents the modified p(t) with the ψ coefficient.

The present study employed the wavelet power spectrum (WPS) to obtain information about the vulnerability of economic growth and CO2 emissions in China. Therefore, WPS allows us to capture the vulnerable periods and frequencies of the time series variables.

As mentioned, the advantage of the wavelet coherence approach against traditional correlation and causality tests is that the approach brings out any correlation or causality between the economic growth and CO2 emissions in combined time-frequency based causalities. As Kirikkaleli et al. (2020) stated, the squared wavelet coherence equation is constructed as shown below:

where C denotes time and the smoothing process over time, with 0 ≤ R2(k,f) ≤ 1. Whenever the value of R2(k,f) approaches to one indicates a correlation among the time series variables. In the figures, correlated areas are surrounded by a black line and depicted in red color. However, whenever the value gets close to 0, this indicates no correlation between the time series variables and is pictured by blue color. Obtaining R2(k,f) does not give us a chance to discuss the relationship’s sign. To deal with this, Torrence and Compo (1998) postulated a means by which I can detect “the wavelet coherence differences through indications of deferrals in the wavering of two-time series. The equation of the wavelet coherence difference phase is constructed as follows”:

where L and O denote an imaginary operator and a real part operator, respectively.

The present study uses Toda-Yamamoto causality (proposed by Toda and Yamamoto (1995)), Fourier Toda-Yamamoto causality (proposed by Nazlioglu et al. 2016), and nonparametric Granger causality (proposed by Diks and Panchenko (2006)) tests as robust causality tests.

Empirical findings

Even though the immeasurable numbers of studies have explored the nexus between economic growth and CO2 emissions, no study has been conducted to capture time-frequency dependency of economic growth and CO2 emissions in China using a wavelet coherence approach. Therefore, as an initial step, the orders of integration of economic growth and CO2 emissions variables are investigated using the DF-GLS unit root test and Zivot-Andrews unit root test with a single structural break. Table 3 reports the outcomes of the DF-GLS and Zivot-Andrews unit root tests. For the EG variable, the integration of order zero, I(0), is not detected since the calculated T-stats of − 1.053 in the DF-GLS unit root rest and − 1.488 in the Zivot-Andrews unit root test are greater than the 5% critical values of the unit root tests, respectively. However, at the first difference, the null hypothesis that the EG variable has a unit root can be rejected, meaning that the EG variable is integrated of order one, I(1). Moreover, Table 3 also reports that the CO2 variable does not seem stationary at levels but stationary at the first difference. It can be concluded that the integration of the order of the CO2 and EG variables is one.

Table 4 reports the Maki cointegration test outcomes with regression models of (1) Regime Shift and (2) Regime Shift and Trend. The majority of the models up to five structural breaks prove the existence of a cointegrating relationship between the CO2 and EG variables at Regime Shift and Regime Shift and Trend models. This outcome approves a cointegrating linkage between the time series variables in the presence of structural breaks. These cointegration findings, in some form, are supported by earlier studies like Jalil and Mahmud (2009) and Saboori et al. (2012).

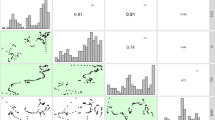

A wavelet power spectrum for the variables of GDP per capita and CO2 emissions per capita in China is reported in Figs. 2 and 3. In the present study, a scale of 23 periods has been determined, since the dataset covers the period from 1950 to 2016 (67 observations). The white cone-shaped curve indicates the cone of influence, representing an edge below where the wavelet power is affected by discontinuity, while the thick black shape presents a 5% significance level determined by Monte Carlo simulations. Although the GDP per capita variable exhibits low power between 1950 and 2001, the variable between 2002 and 2015 appears highly vulnerable at very high frequency (at 3–6 scale periods) in Fig. 2, meaning that economic growth had a significant volatility for the period 2001–2015 in the short-run. As seen in Fig. 3, a high variation occurs for CO2 emissions per capita in China at 4 and 6 scale periods from 1955 to 1965. Moreover, a significant high volatility is noted in CO2 emissions per capita in China, as seen in Fig. 3 between 2000 and 2015 at different frequencies.

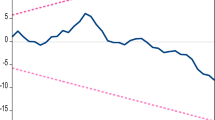

To capture the signs of and causal relationship between economic growth and CO2 emissions in China, a continuous wavelet coherence approach is applied in the present study, and the outcomes from this approach are pictured in Figs. 4. The cold (blue) colors represent no dependency between economic growth and CO2 emissions in China in Fig. 4, whereas warmer color areas denote the significant correlation or causality between the time series variables. In the continuous wavelet coherence approach, the direction of the significant causality is represented by arrows surrounded by the thick black line. “While arrows pointing to the left indicate negative correlation among the variables, arrows point to the right represent the positive correlation.” Besides, arrows pointing up, right-up, or left-down show that CO2 emissions cause economic growth in China, whereas arrows pointing down, right-down, or left-up indicate that changes in the economic growth variable significantly lead to changes in the CO2 emissions’ variable. As clearly demonstrated in Fig. 4, arrows point right down at the thick black shape at 6, 8, and 11 scales, implying that economic growth leads to CO2 emissions in the medium-term. This result clearly shows that economic growth was an important predictor of CO2 emissions in China. Moreover, detecting rightward arrows between 1970 and 1990 reveal that economic growth and CO2 emissions are in phase at 3 and 4 scales—at high frequency. In other words, there is a significant positive correlation between economic growth and CO2 emissions in China in the short-term.

As robust tests for the outcomes of continuous wavelet coherence technique, Toda-Yamamoto causality, Fourier Toda-Yamamoto causality, and nonparametric Granger causality tests are applied to investigate the causal relationship between economic growth and CO2 emissions in China. The findings from these tests are reported in Table 5, proving that the null hypothesis that economic growth does not cause CO2 emission can be rejected at a 5% significance level. In other words, there is a unilateral causality running from economic growth to CO2 emissions in China. This finding is rational and inline with the studies of Wasti and Zaidi (2020), Aydoğan and Vardar (2020), Riti et al. (2017), Shahbaz et al. (2015) and Jafari et al. (2015) which underline growth-led CO2 emissions hypothesis in their studies. It is worth mentioning that the outcomes of more Fourier Toda-Yamamoto causality and nonparametric Granger causality tests are in line with the outcomes of the continuous wavelet coherence approach which is pictured in Fig. 4.

Conclusion

Since the four decades, economic growth has become a vital policy indicator for the Chinese government to measure environment crises. Current studies on China’s economic growth mainly discuss the typical cases of economic growth mode concerning specific stimuli, while few researches deal with the efficiency trend of macro-economy from the regional perspective, along with great many studies on the impact of CO2 emissions in both the developed and developing countries. Previous researches have also explored the determinants of CO2 emissions using panel and time series based models in the literature. However, up to date, no previous studies have explicitly examined time-frequency dependency of economic growth and CO2 emissions in China, precisely by using a continuous wavelet coherence approach. The wavelet coherence technique allows the present study to investigate the short-term and long-term relationships between economic growth and CO2 emissions in China. Apart from the continuous wavelet coherence approach, the present study also employs the Maki cointegration test to capture the long-run linkage between economic growth and CO2 emissions in China. Furthermore, the robust causality approaches of Toda-Yamamoto causality, Fourier Toda-Yamamoto causality, and nonparametric Granger causality tests were implemented respectively. The outcomes of the present study underline that (i) there is a significant vulnerability in economic growth and CO2 emissions throughout the 2000s in the short-term and medium-term; (ii) there is a long-run cointegration linkage between economic growth and CO2 emissions in China; (iii) economic growth in China has an important power for predicting CO2 emissions over the selected time period, especially short-term and medium-term; and (iv) in the short-term, it is also observed that there is a positive correlation between economic growth during the 1980s and 1990s.

Based on these findings, the present study makes several unique and substantial contributions to the literature, which is significant for future sustainable development in the case of China. In addition, since China is the largest carbon emitter in the world and has signed the COP21 agreement to hold the rising global average temperature below 2 °C and the target will be 1.5 °C, governors and investors in China should invest in environmentally friendly and renewable energy sources to enhance expected economic growth while continuously reducing the CO2 intensity of GDP. Besides, China should intensively substitute fossil fuel with new and renewable energy sources to reduce CO2 emissions based on the main target of COP21, which is to reach peak emissions earlier than the current Paris target of 2030. Although the present study provides valuable contribution and robust empirical findings, further studies should include other time series macroeconomic variables to deepen these findings, and the regional comparative study on the nexus between economic growth and CO2 emissions could offer a remarkable contribution for emerging markets.

References

Acheampong AO (2018) Economic growth, CO2 emissions, and energy consumption: what causes what and where? Energy Econ 74:677–692

Adedoyin FF, Gumede MI, Bekun FV, Etokakpan MU, Balsalobre-lorente D (2020) Modeling coal rent, economic growth, and CO2 emissions: does regulatory quality matter in BRICS economies? Sci Total Environ 710:136284

Ahmad, M., Hengyi, H., Rahman, Z. U., Khan, Z. U., Khan, S., & Khan, Z. (2018). Carbon emissions, energy use, gross domestic product, and the total population in China. Ekonomia i Środowisko

Ahmad M, Zhao ZY, Irfan M, Mukeshimana MC, Rehman A, Jabeen G, Li H (2020) Modeling heterogeneous dynamic interactions among energy investment, SO 2 emissions, and economic performance in regional China. Environ Sci Pollut Res 27(3):2730–2744

Alam MJ, Begum IA, Buysse J, Van Huylenbroeck G (2012) Energy consumption, carbon emissions, and economic growth nexus in Bangladesh: cointegration and dynamic causality analysis. Energy Policy 45:217–225

Al-Mulali U, Che Sab CNB (2018) Electricity consumption, CO2 emission, and economic growth in the Middle East. Energ Sour, Part B: Econ Plan Policy 13(5):257–263

Aydoğan B, Vardar G (2020) Evaluating the role of renewable energy, economic growth, and agriculture on CO2 emission in E7 countries. Int J Sustain Energ 39(4):335–348

Bakirtas I, Cetin MA (2017) Revisiting the environmental Kuznets curve and pollution haven hypotheses: MIKTA sample. Environ Sci Pollut Res 24(22):18273–18283

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132

Chontanawat J (2020) Relationship between energy consumption, CO2 emission, and economic growth in ASEAN: cointegration and causality model. Energy Rep 6:660–665

Diks C, Panchenko V (2006) A new statistic and practical guidelines for nonparametric Granger causality testing. J Econ Dyn Control 30(9–10):1647–1669

Elliott G, Rothenberg TJ, James H (1996) Stock, 1996, “Efficient tests for an autoregressive unit root”. Econometrica 64(4):813–836

Gallagher KS, Zhang F, Orvis R, Rissman J, Liu Q (2019) Assessing the policy gaps for achieving China’s climate targets in the Paris agreement. Nat Commun 10(1):1–10

Gökmenoğlu K, Taspinar N (2016) The relationship between CO2 emissions, energy consumption, economic growth, and FDI is Turkey's case. J Int Trade Econ Develop 25(5):706–723

Gorus MS, Aydin M (2019) The relationship between energy consumption, economic growth, and CO2 emission in MENA countries: causality analysis in the frequency domain. Energy 168:815–822

Goupillaud P, Grossmann A, Morlet J (1984) Cycle-octave and related transforms in seismic signal analysis. Geoexploration 23(1):85–102

Han J, Du T, Zhang C, Qian X (2018) Correlation analysis of CO2 emissions, material stocks, and economic growth nexus: evidence from Chinese provinces. J Clean Prod 180:395–406

Jafari Y, Ismail MA, Othman J, Mawar MY (2015) Energy consumption, emissions, and economic growth in Bahrain. Chin J Populat Resour Environ 13(4):297–308

Jalil A, Mahmud SF (2009) Environment Kuznets curve for CO2 emissions: a cointegration analysis for China. Energy Policy 37(12):5167–5172

Joo YJ, Kim CS, Yoo SH (2015) Energy consumption, CO2 emission, and economic growth: evidence from Chile. Int J Green Energy 12(5):543–550

Khan Z, Hussain M, Shahbaz M, Yang S, Jiao Z (2020) Natural resource abundance, technological innovation, and human capital nexus with financial development: China's case study. Res Policy 65:101585

Kirikkaleli D, Adedoyin FF, Bekun FV (2020) Nuclear energy consumption and economic growth in the UK: evidence from the wavelet coherence approach. Journal of Public Affairs

Kirikkaleli D, Sowah JK Jr (2020) A wavelet coherence analysis: nexus between urbanization and environmental sustainability. Environ Sci Pollut Res Int

Liu H, Lei M, Zhang N, Du G (2019) The causal nexus between energy consumption, carbon emissions, and economic growth: new evidence from China, India, and G7 countries using convergent cross-mapping. PLoS One 14(5)

Maki D (2012) Tests for cointegration allowing for an unknown number of breaks. Econ Model 29(5):2011–2015

Mardani A, Streimikiene D, Cavallaro F, Loganathan N, Khoshnoudi M (2019) Carbon dioxide (CO2) emissions and economic growth: a systematic review of two decades of research from 1995 to 2017. Sci Total Environ 649:31–49

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions, and economic growth in Pakistan: dynamic causality analysis. Renew Sust Energ Rev 72:1233–1240

Munir Q, Lean HH, Smyth R (2020) CO2 emissions, energy consumption, and economic growth in the ASEAN-5 countries: a cross-sectional dependence approach. Energy Econ 85:104571

Nazlioglu S, Gormus NA, Soytas U (2016) Oil prices and real estate investment trusts (REITs): gradual-shift causality and volatility transmission analysis. Energy Econ 60:168–175

Omri A, Nguyen DK, Rault C (2014) Causal interactions between CO2 emissions, FDI, and economic growth: evidence from dynamic simultaneous-equation models. Econ Model 42:382–389

Orhan A, Kirikkaleli D, Ayhan F (2019) Analysis of wavelet coherence: service sector index and economic growth in an emerging market. Sustainability 11(23):6684

Pablo-Romero MDP, De Jesús J (2016) Economic growth and energy consumption: the energy-environmental Kuznets curve for Latin America and the Caribbean. Renew Sust Energ Rev 60:1343–1350

Racine J, Li Q (2004) Nonparametric estimation of regression functions with both categorical and continuous data. J Econ 119(1):99–130

Rhodes CJ (2016) The 2015 Paris climate change conference: COP21. Sci Prog 99(1):97–104

Riti JS, Song D, Shu Y, Kamah M (2017) Decoupling CO2 emission and economic growth in China: is there consistency in estimation results in analyzing the environmental Kuznets curve? J Clean Prod 166:1448–1461

Saboori B, Sulaiman J, Mohd S (2012) Economic growth and CO2 emissions in Malaysia: a cointegration analysis of the environmental Kuznets curve. Energy Policy 51:184–191

Saint Akadiri S, Alola AA, Olasehinde-Williams G, Etokakpan MU (2020) The role of electricity consumption, globalization, and economic growth in carbon dioxide emissions and its implications for environmental sustainability targets. Sci Total Environ 708:134653

Shahbaz M, Solarin SA, Sbia R, Bibi S (2015) Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecol Indic 50:215–224

Shahbaz M, Jam FA, Bibi S, Loganathan N (2016a) Multivariate granger causality between CO2 emissions, energy intensity, and economic growth in Portugal: evidence from cointegration and causality analysis. Technol Econ Dev Econ 22(1):47–74

Shahbaz M, Mahalik MK, Shah SH, Sato JR (2016b) Time-varying analysis of CO2 emissions, energy consumption, and economic growth nexus: statistical experience in next 11 countries. Energy Policy 98:33–48

Shahbaz M, Shafiullah M, Papavassiliou VG, Hammoudeh S (2017) The CO2–growth nexus revisited: a nonparametric analysis for the G7 economies over nearly two centuries. Energy Econ 65:183–193

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1–2):225–250

Tong T, Ortiz J, Xu C, Li F (2020) Economic growth, energy consumption, and carbon dioxide emissions in the E7 countries: a bootstrap ARDL bound test. Energ Sustain Soc 10:1–17

Torrence C, Compo GP (1998) A practical guide to wavelet analysis. Bull Am Meteorol Soc 79(1):61–78

Wang S, Li Q, Fang C, Zhou C (2016a) The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci Total Environ 542:360–371

Wang K, Zhu B, Wang P, Wei YM (2016b) Examining the links among economic growth, energy consumption, and CO 2 emission with linear and nonlinear causality tests. Nat Hazards 81(2):1147–1159

Wang D, He W, Shi R (2019a) How to achieve the dual-control targets of China's CO2 emission reduction in 2030? Future trends and prospective decomposition. J Clean Prod 213:1251–1263

Wang H, Lu X, Deng Y, Sun Y, Nielsen CP, Liu Y, Zhu G, Bu M, Bi J, McElroy MB (2019b) China’s CO 2 peak before 2030 implied from characteristics and growth of cities. Nat Sustain 2(8):748–754

Wang L, Vo XV, Shahbaz M, Ak A (2020) Globalization and carbon emissions: is there any role of agriculture value-added, financial development, and natural resource rent in the aftermath of COP21? J Environ Manag 268:110712

Wasti SKA, Zaidi SW (2020) An empirical investigation between CO2 emission, energy consumption, trade liberalization, and economic growth: a case of Kuwait. J Build Eng 28:101104

Zivot E, Andrews DWK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20(1):25–44

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kirikkaleli, D. New insights into an old issue: exploring the nexus between economic growth and CO2 emissions in China. Environ Sci Pollut Res 27, 40777–40786 (2020). https://doi.org/10.1007/s11356-020-10090-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-10090-x