Abstract

This paper explores the dynamic relationship between CO2 emissions, urbanization, trade openness, and technology innovation based on the panel data of 13 Asian countries over the period of 1985–2019. The STIRPAT model is used as a framework for the analysis. For estimation purpose, panel cointegration and FMOLS techniques are utilized. The causality between the concerned variables is also examined by estimating a panel VECM model. The results of panel cointegration reveal the presence of long-run relationship among the variables. FMOLS estimations show that energy consumption increases CO2 emissions while technology change, urbanization, and trade openness compact it. Panel causality analysis indicates bidirectional causality between urbanization and emissions, technology and emissions, trade and emissions, and trade and technology in the long run. Overall findings support the idea that urbanization, technology innovation, and trade openness can play important role to achieve environmental sustainability.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Over the years, the increasing volume of greenhouse gases (GHGs) is a major factor behind environmental degradation worldwide (Seetanah et al. 2018). The global warming and environmental degradation arises as a result of increased energy pollution that adversely affects climate and human health (Adedoyin et al. 2020; Mardani et al. 2019). Being a main source of greenhouse gases, carbon dioxide (CO2) emission has attracted greater attention from researchers over the past two decades. The CO2 emissions contribute to 75% of greenhouse gas emissions (Abbasi and Riaz 2016). Furthermore, CO2 emissions increased to 1.9% during 2018 as compared to 1.2% in 2016 which is quite high (EDGAR 2019). This sharp rise in global temperature and its impact on the climate prompted the origination of the United Nations Framework Convention on Climate Change in 1992. Later, the “Kyoto Protocol” in 1997 and the “Paris Contract” in 2015 were established with the purpose to alleviate the global warming. Asian countries actively participate in competitions to improve production, but policies to protect the environment failed to mitigate CO2 emissions, as carbon emissions in the Asian region account for 47% of that worldwide (Hanif et al. 2019). Thus, prompt actions are required to mitigate CO2 emission from the major Asian countries.

In order to analyze the factors that lead to increased CO2 emissions, urbanization is considered as a main indicator that causes increased CO2 emissions. With substantial increase in economic growth and development, the labor force is moving from agriculture to industrial sector that is mostly located in urban zones. Consequently, the movement from agriculture to industrial sector dramatically affects the settlement patterns, and thus contributes to increasing CO2 emissions (Al-mulali et al. 2015; Salim et al. 2019). According to the United Nations report, about 54% of the world’s population is living in urban areas, which expands to 66% by 2050 (United Nations 2018). With fast-paced urbanization, CO2 emissions are increasing dramatically (WDI 2019). According to International Energy Agency (IEA), about 70% of the increasing CO2 emissions is caused by urbanization and it will increase to 76% by 2030 (IEA 2019). The growth of urbanization in Asia is reported 64% which is much faster than in other regions in the world.

The present study aims to introduce the role of technology innovation (TI) that plays a substantial role in mitigating CO2 emissions in Asian countries. Several existing studies (see, e.g., Santra 2017; Hasanbeigi et al. 2012; Goulder and Mathai 2000) have emphasized that modern technology adoption has potential to reduce CO2 emissions by improving energy efficiency without limiting economic growth trends. For instance, environmental policies affect CO2 emissions in two ways. On the one hand, it affects the prices of carbon-based fuels by imposing energy taxes that directly discourage energy use and reduce pollution emissions, while on the other hand, such policies may also encourage firms to purchase or invent new technology in order to bring alternative fuels that emit less carbon (Santra 2017; Carraro and Siniscalco 1994). Therefore, energy efficiency technologies such as renewable energy and minimization of wastes and residues during production, transmission, and distribution systems are important to reduce energy sector emissions (Jiaqiang et al. 2017; Sohag et al. 2015; Apergis and Danuletiu 2014; Madsen et al. 2010; Pao and Tsai 2010). However, it is also argued that technology advancement contributes toward depletion of resources as well as environmental degradation by the rebound effect. The use of technology in industrial sector tends to increase production activities that require more raw materials and energy resources which harm environmental quality (Khan et al. 2017; Greening et al. 2000). There is, however, not much empirical work available that indicates the relationship between technological innovation and CO2 emissions. This paper, therefore, contributes to the existing literature by examining whether or not environment-related technological innovation helps to mitigate CO2 emissions. Thus, this study helps policymakers to implement efficient policies for environmental sustainability.

However, the implementation of various energy saving measures and the pattern of energy consumption (EC) also depend on the economic activities in a country. Economic growth (EG) is likely to be more energy intensive with greater tendency of economic activities which are largely fossil fuel driven and cause environmental deterioration. Moreover, increasing economic growth causes to improve technology, promote alternative energy sources and rely on these renewable energy sources (for instance, geothermal, hydropower, biomass, wind, solar, and marine energies) for production, and expand the tertiary and services sector which helped to contain carbon emissions (Kaika and Zervas 2013). Several studies have demonstrated that the scale of economic activities (commonly measured by GDP per capita) is positively associated with EC and thus increases CO2 emissions (Omri 2013; Shahbaz et al. 2013; Marrero 2010; Chebbi and Boujelbene 2008). On the other hand, higher EG is also needed to improve energy efficiency that ultimately reduces CO2 emissions. The countries with higher level of GDP use resources more efficiently and can also devote more resources to invent or import energy-efficient technologies to reduce pollution emissions (Lapinskienė et al. 2017).

Another important factor affecting energy CO2 emissions is trade openness (TO). Recent studies have shown that TO might affect energy CO2 emissions through different channels such as income, economies of scale, technique, and composite effects (Wan et al. 2015; Sadorsky 2010; Feridun et al. 2006; Frankel and Rose 2005; Antweiler et al. 2001). It is argued that international trade is an essential component of EG, and a rise in TO is associated with higher economic activities, energy demand, and CO2 emissions (Sadorsky 2012; Jalil and Feridun 2011). On the other hand, international trade linkage is also a source of advance technology spillovers from developed countries to developing ones. The diffusion of more sophisticated technology increases productivity of energy use and thus lowers carbon emissions (Nasreen and Anwar 2014; Antweiler et al. 2001).

Therefore, it is important to examine the dynamics between urbanization, technology, trade, and CO2 emission for policymakers because of its direct implications for sustainable environment and economic development. This paper contributes to the literature by extending the analysis of causal dynamics between CO2 emissions, technology innovation, and trade openness by controlling for several important variables such as energy use, economic development, and population to a panel data of 13 Asian countries over the period of 1985–2019. Limited to our knowledge, there has thus far been no attempt to examine the relationship between these variables within a multivariate framework across these 13 Asian countries. It is well known that Asia is a region of the world’s largest economies, with more than half of the world’s total population size. The choice of Asia is also motivated by the fact that this region accounts for over one quarter (28%) of the global primary energy demand and more than half (53%) of the world’s total coal consumption, which are among the major sources of CO2 emissions (Nasreen and Anwar 2014; Bloch et al. 2012). According to Asia/World Energy Outlook (2018), energy conservation and pollution reduction efforts in Asian countries have important implications for the future of global environmental sustainability because of the larger share of this region in global energy consumption and pollution emissions, especially in China and India, which will account for 32% of the world’s total energy consumption by 2040. Thus, the relationship between TI, TO, and CO2 emissions in such a heavily populated and rapidly growing region is the focus of our study.

The present study utilizes Stochastic Impacts by Regression on Population, Affluence and Technology (STIRPAT) model. To examine the long-run co-movement and the causal relationship among the variables, we utilized (Baltagi 2009; Pedroni 1999, 2004; Im et al. 2003; Maddala and Wu 1999; Kao 1999) panel cointegration tests (Levin et al. 2002) and panel fully modified OLS (FMOLS) technique. FMOLS corrects the standard OLS for bias induced by endogeneity and serial correlation. Moreover, we estimated a panel vector error correction model (VECM) that is appropriate for heterogeneous panel to detect the direction of causality between the variables. The results of this study indicate the presence of cointegration among the variables such as EC, TI, TO, EG, and CO2 emissions. Long-run elasticity estimation results of FMOLS report that EC and EG increase emission level while TI and TO reduce it in our sample of Asian countries. The Granger causality analysis provides further evidence on the long-run relationship among the variables and reveals bidirectional long-run causality between emissions and energy consumption, emissions and technology change, emissions and trade openness, and trade and technology. These findings may yield new avenues for policymakers to design a comprehensive energy, technology, and trade and environmental policy to attain sustainable economic development.

The rest of the paper is organized as follows: “Literature review” provides literature review; “Econometric model and data collection” describes model, estimation techniques, and data source; “Analytical framework” presents results of empirical estimations; and finally, “Panel cointegration tests” concludes the whole discussion.

Literature review

The last two decades have seen an emergence of research on the link between environmental degradation and human activities. The earlier studies examining the relationship between output growth and environmental pollution mainly concentrate on environmental Kuznets curve (EKC), which suggests an inverted U-shaped relationship between EG and pollution emission. The EKC hypothesis implies that at first, economic development increases pollution level but beyond a turning point, pollution level decreases with a rise in income due to increasing environmental awareness, regulations, and public spending on environment protection (Shahbaz et al. 2013). Starting with the pioneering work of Grossman and Krueger (2004), numerous studies have been devoted to empirically test the EKC hypothesis, which yields mixed results (Halicioglu 2009; Dinda 2004; Shahbaz et al. 2012; Al-mulali et al. 2015; Alam et al. 2016; Kwakwa and Adu 2016; Aboagye 2017; Dong et al. 2018; Sinha and Shahbaz 2018). Another group of studies concentrates on energy consumption-economic growth (EC-EG) nexus (Sarkodie et al. 2019; Mardani et al. 2019; Dogan et al. 2020), which suggests that economic development and energy consumption might be determined jointly because economic development is both a cause and a consequence of energy consumption. Moreover, the higher economic development requires more energy consumption, and more efficient energy use needs a higher level of economic development (Lapinskienė et al. 2017). Starting from the seminal work of (Kraft and Kraft 1978), the relation between EC and EG has been investigated extensively (Halicioglu 2009; Narayan and Narayan 2008; Wolde-Rufael 2006; Masih and Masih 1996). The findings of empirical research, however, appear to be inconsistent.

The latest literature on this issue combines both approaches and also includes some new variables like population, trade openness, technology development, and other country-specific factors that are likely to affect environmental quality. Empirical results of these studies mainly depend on the variables included in the empirical model, data frequency, and econometric techniques used in the analysis. Several studies have been conducted to show that EC, EG, and CO2 emissions are interrelated but the results of empirical studies are mixed. For instance, Chebbi and Boujelbene (2008) investigated the relationship between these three variables using time series data during 1971–2004 for Tunisia. The results revealed that output induces higher energy use and the resulting energy consumption leads to CO2 emissions. Pao and Tsai (2010) by using panel data of four BRIC countries (Brazil, Russia, India, and China) investigated the dynamics of EC, GDP growth, and CO2 emissions. The results indicate that EC increases CO2 emissions while the relationship between GDP growth and CO2 emissions follows EKC hypothesis. Furthermore, the results also indicate bidirectional long-run causality between EC, GDP growth and CO2 emissions, and unidirectional short-run causality from emissions to EC and output, respectively. By using panel data of 27 EU countries, Marrero (2010) reported positive effects of EC and EG on CO2 emissions. Pao and Tsai (2011) extended this idea by examining the association between GDP growth, EC, and CO2 emission for Brazil by using the gray prediction model and found that emissions are more sensitive to energy consumption than output while supporting the EKC hypothesis. Long-run association between EC, EG, and CO2 emissions is also confirmed by Omri (2013) for 14 MENA countries and Shahbaz et al. (2015) for a panel of 99 countries. However, empirical findings provided by Baek (2015) are different about growth-pollution nexus. The study utilized panel data of seven Arctic countries (namely Canada, Denmark, Iceland, Finland, Norway, Sweden and USA) using panel ARDL and generalized least square methods. The results showed positive impact of EC on CO2 emissions but an inverse relationship between GDP growth and CO2 emissions.

Like EC and EG, international trade also helps explain the dynamics of CO2 emissions. The effect of TO can be classified into scale, technique, and composition effects (Antweiler et al. 2001). Many believe that trade deteriorates environment quality (Ertugrul et al. 2016). Race to the bottom is the most widely discussed hypothesis, according to which the true effects of openness depend on the environmental policies in a country (Machado 2000). Less developed economies adopt weaker environmental regulations and decrease energy prices to stay competitive in international markets. Weaker regulations and cheaper energy reduce energy efficiency which could have a negative effect on environment quality (Wan et al. 2015; Antweiler et al. 2001). Frankel and Rose (2005) noted that free trade may also result in importing of polluted goods in poor countries having low environmental standards, i.e., the so-called pollution haven countries. Similar arguments are presented by Shahbaz et al. (2013) who argued that free trade and movement of production factors may shift dirty industries toward pollution haven countries where environmental regulations are mere formalities. Some other studies which concluded harmful impact of trade on environment are Al-mulali et al. (2015), Kasman and Duman (2015), Jalil and Feridun (2011), Nasir and Rehman (2011), Cole et al. (2000), and Machado (2000).

On the other hand, supporters of gain from trade theory claim that international trade increases competition between countries and promotes efficient use of scarce resources and facilitates transfer of cleaner technologies in order to combat environmental pollution (Shahbaz et al. 2013; Frankel and Rose 2005; Yanikkaya 2003; Helpman 1998). The positive impacts of trade on environmental quality are reported by many researchers using both country-specific and panel data (Wan et al. 2015; Shahbaz et al. 2012; Grether et al. 2007; Frankel and Rose 2005; Antweiler et al. 2001; Ferrantino 1997; Birdsall and Wheeler 1993; Shafik and Bandyopadhyay 1992). For instance, Antweiler et al. (2001) provided empirical evidences from a panel of 43 countries to show that trade-induced technique and scale effects have positive impact on environment quality. Frankel and Rose (2005) investigated trade-pollution nexus using cross country data and revealed that trade openness reduces three measures of environment pollution namely SO2, NO2, and particulate matter. A recent study by Wan et al. (2015) provides useful insights on trade-facilitated technology spillovers and energy productivity convergence across 16 EU countries. The analysis revealed that trade helps reduce energy productivity gap by encouraging common environmental regulations and accelerating technology spillovers.

With respect to technology-pollution nexus, several researchers have emphasized that environmental quality and technology innovation are connected (Santra 2017; Hasanbeigi et al. 2012; Lantz and Feng 2006; Berndt et al. 1993; Sterner 1990; Jorgenson and Fraumeni 1981). Adoption of advance technology has potential to reduce energy consumption and pollution level without limiting GDP growth trend (Santra 2017; Hasanbeigi et al. 2012). Recent studies utilized both country-specific and panel data to provide empirical evidences on the relationship between technology innovation and environmental sustainability. For example, Ang (2009) utilized Chinese data to examine the effect of R&D expenditure and technology transfer on CO2 emissions. The results indicated that both the R&D and technology transfer have reduced emissions in both the long run and short run in China. By using panel data of 20 OECD countries, Wong et al. (2013) argued that technology adoption has played an important role to gain greater energy efficiency and economic growth in OECD countries. Sohag et al. (2015) used Malaysian Data to investigate the effect of technology innovation on energy consumption. The results showed a negative impact of technology innovation on energy consumption in Malaysia. Park et al. (2017) collected data from China and Korea to investigate the relationship between residential CO2 emissions and technology use. The results indicated a reduction in residential CO2 emissions due to the use of efficient technologies in both countries. Santra (2017) extends this idea to show that technological innovation has positively helped BRICS countries, namely, Brazil, Russia, India, China, and South Africa, to increase energy productivity and environmental quality. Furthermore, environmental regulations like pollution taxes can stimulate the firms to purchase or invent new technologies in order to combat pollution emissions without reducing their output level. By using high-tech industries data from China, Xu and Lin (2018) reported that high-tech industries are beneficial to control CO2 emissions. Moreover, the emission reduction performance of the central and western regions is better than of the eastern region, which is mainly because of greater R&D expenditure and technology endowments of the formers.

Material and methods

The current paper makes use of STIRPAT model of Dietz and Rosa (1994) and extends it further by incorporating other variables (CO2 emissions per capita, population, economic growth, energy consumption per capita, technology innovation, and trade openness) for empirical estimation. The STIRPAT model is an extension of well-known IPAT model and provides a framework to empirically estimate the effects of anthropogenic activities on environmental change. In general form, the STIRPAT model can be formulized as follows:

where I represents environmental effects or energy pollution; P, A, and T denote population size; affluence or economic activities per capita, usually measured by real per-capita GDP (RGDPP); and technology level, respectively. The b is an intercept term while the c, d, and e are the coefficients of the environmental effects of P, A, and T respectively. The term t stands for the year and εt is the usual random error term. Since logarithmic transformation of all the variables can avoid possible heteroscedasticity and also linearize the model that makes elasticity calculations easier as the estimated coefficients capture the percentage changes in the underlying variables. Thus, Eq. (1) is rewritten as

where ln(.) is natural logarithm and I, P, A, and T are the same as in above Eq. (1). The STIRPAT model permits to incorporate other factors that affect environmental pressure. Dietz and Rosa (1994) argued that other factors affecting the relationship can be replaced by the term T in the original specification. Based on the discussion in “Introduction” and “Literature review”, we extend this model by including energy consumption, trade openness, and technology innovation. The extended STIRPAT model can be expressed as

where CO is CO2 emissions per capita, P is total population, URB is urbanization, A is economic activities or economic growth measured as RGDPP, EC is energy consumption per capita, T is technology innovation measured by the number of patents, and TO represents trade openness. The subscript i (i = 1, 2,…,N) and t (t = 1,2,…,T) represent cross sections and time periods respectively.

We use kg of oil equivalent per capita to measure EC following common practice in literature (Azam et al. 2015; Nasreen and Anwar 2014). The coefficient of EC is expected to be positive because it is the basic factor to increase emissions level (Lapinskienė et al. 2017; Shahbaz et al. 2012; Pao and Tsai 2010). Affluence is measured by RGDPP in constant 2010 US dollar. The RGDPP is a widely used indicator of economic activities in empirical studies, and its impact on CO2 emissions can be assumed positive because higher economic activities increase demand for energy and other natural resources that ultimately generate higher pollution emissions (Xu and Lin 2018; Shahbaz et al. 2013; Wang et al. 2011; Pao and Tsai 2010; Dietz and Rosa 1994). TO is measured as percentage of export and import value to GDP that is also a common routine in empirical studies. The impact of TO can be either positive or negative on CO2 emissions (Azam et al. 2015; Nasir and Rehman 2011; Feridun et al. 2006). Some recent studies show that TO improves environmental quality by transferring clean technology into developing countries (Wan et al. 2015; Shahbaz et al. 2012; Frankel and Rose 2005). However, the actual impact of trade on pollution emissions depends on a country’s environment policies. As discussed in the “Literature review” section, free trade may also shift pollution-intensive industries from home countries to developing ones where environmental regulations are relatively weaker which could have adverse effect on environment quality (McCarney and Adamowicz 2006; Antweiler et al. 2001). For technology innovation, we use number of patents following Sohag et al. (2015). A large body of empirical literature supports the number of patents to measure technology change in a country (Sohag et al. 2015; Ang 2011; Madsen et al. 2010). Sohag et al. (2015) used patent data to investigate the effect of technology innovation on EC. They argued that patents are the quantitative measure of technology innovation because they reflect the interest of organizations to explore new technologies. The impact of technology innovation on CO2 emissions is expected to be negative because adoption of new technologies improves efficient use of energy and natural resources that result in fewer wastes and less environmental pollution (Park et al. 2017; Sohag et al. 2015; Wong et al. 2013).

We select 13 Asian countries for the estimation of empirical model on the basis of data availability. The countries included in the study are Bangladesh, India, China, Hong Kong, Indonesia, Iran, Japan, South Korea, Malaysia, Philippines, Sri Lanka, Thailand, and Turkey. Data on all the variables spanning 1985–2019 is taken from World Development Indicators.

Econometric added Methodology

The basic concern of empirical analysis is the sign and size of the coefficients of technology change and trade openness, although the effects of the other variables also provide useful insights. The study utilizes panel cointegration and causality analysis to test the long-run relationship among the underlying variables. The standard procedure to test for cointegration is first to check stationary of the variables.

Panel cointegration tests

To examine cointegration among the variables, we apply Pedroni (1999, 2004)’s and Kao (1999)’s panel cointegration tests. Pedroni (1999)’s cointegration test is a powerful tool to test cointegration for both homogeneous and heterogeneous panels. The test equation can be written as

In Eq. (4), it is assumed that x and y are I (1). Furthermore, the individual intercept ∝i and the coefficients θ1i, θ2i, …, θmi may vary across individual series in a panel. Pedroni (1999, 2004) suggested seven test statistics to check cointegration in heterogeneous panel. These different tests are corrected for bias due to endogenous variables and to deal with cross-sectional dependence by including time dummies. Mainly, these tests are classified into within dimension and between dimensions tests. The null hypothesis for all these tests is no cointegration H0: γi = 1 (where i = 1,2..,N) against the alternative of cointegration but different for between and within dimensions. The alternative hypothesis for between dimension H1: γi < 1 (where i = 1,2..,N) and for within dimension H1: γi = γ < 1 (where i = 1,2..,N).

Equation (4) is at first estimated by OLS method and then the relevant test is computed from the following statistics:

Within dimension statistics

-

1.

Panel v-statistics: \( {Z}_v\equiv {T}^2{N}^{3/2}{\left({\sum}_{i=1}^N{\sum}_{t=1}^T{\hat{\kappa}}_{11,i}^{-2}{\hat{u}}_{it-1}^2\right)}^{-1} \)

-

2.

Panel ρ- statistics: \( {Z}_{\rho}\equiv T\sqrt{N}{\left({\sum}_{i=1}^N{\sum}_{t=1}^T{\hat{\kappa}}_{11,i}^{-2}{\hat{u}}_{it-1}^2\right)}^{-1}{\sum}_{i=1}^N{\sum}_{t=1}^T{\hat{\kappa}}_{11,i}^{-2}\left({\hat{u}}_{it-1}\Delta {\hat{u}}_{it}-{\hat{\lambda}}_i\right) \)

-

3.

Non-parametric panel t-statistics: \( {Z}_t\equiv {\left({\overset{\sim }{\mathcal{o}}}^2{\sum}_{i=1}^N{\sum}_{t=1}^T{\hat{\kappa}}_{11,i}^{-2}{\hat{u}}_{it-1}^2\right)}^{\raisebox{1ex}{$-1$}\!\left/ \!\raisebox{-1ex}{$2$}\right.}{\sum}_{i=1}^N{\sum}_{t=1}^T{\hat{\kappa}}_{11,i}^{-2}\left({\hat{u}}_{it-1}\Delta {\hat{u}}_{it}-{\hat{\lambda}}_i\right) \)

-

4.

Parametric panel t-statistics: \( {Z}_t^{\ast}\equiv {\left({\overset{\sim }{s}}_{N,T}^{\ast^2}{\sum}_{i=1}^N{\sum}_{t=1}^T{\hat{\kappa}}_{11,i}^{-2}{\hat{u}}_{it-1}^2\right)}^{\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$2$}\right.}{\sum}_{i=1}^N{\sum}_{t=1}^T{\hat{\kappa}}_{11,i}^{-2}{\hat{u}}_{it-1}^2\Delta {\hat{u}}_{it}^{\ast } \)

Between dimension statistics

-

1.

Group ρ-statistics: \( {\overset{\sim }{Z}}_{\rho}\equiv T{N}^{-1/2}{\sum}_{i=1}^N{\left({\sum}_{t=1}^T{\hat{u}}_{it-1}^2\right)}^{-1}{\sum}_{t=1}^T\left({\hat{u}}_{it-1}\Delta {\hat{u}}_{it}-{\hat{\lambda}}_i\right) \)

-

2.

Non-parametric group t-statistics: \( {\overset{\sim }{Z}}_t\equiv {N}^{-1/2}{\sum}_{i=1}^N{\left({\hat{\mathcal{o}}}_i^2{\sum}_{t=1}^T{\hat{u}}_{it-1}^2\right)}^{-1/2}{\sum}_{t=1}^T\left({\hat{u}}_{it-1}\Delta {\hat{u}}_{it}-{\hat{\lambda}}_i\right) \)

-

3.

Parametric group t-statistics: \( {\overset{\sim }{Z}}_t^{\ast}\equiv {N}^{-1/2}{\sum}_{i=1}^N{\left({\sum}_{t=1}^T{\overset{\sim }{s}}^{\ast^2}{\hat{u}}_{it-1}^{2\ast}\right)}^{-1/2}{\sum}_{t=1}^N\left({\hat{u}}_{it-1}^{\ast}\Delta {\hat{u}}_{it}^{\ast}\right) \)

where \( {\hat{\lambda}}_i=\frac{1}{2}\left({\hat{\mathcal{o}}}_i^2-{\hat{s}}_i^2\right) \) and \( {\overset{\sim }{s}}_{N,\mathrm{T}}^{\ast^2}=\frac{1}{N}{\sum}_{i=1}^N{\hat{s}}^{\ast^{2.}} \)

To make the distribution of the calculated panel test statistics asymptotically normal, adjusted terms of mean and variance are applied as follows:

where ϰN, T is the standardized form of the statistics with respect to N and T, and μ and ℧ are the moments functions of the underlying Brownian motion. Pedroni (1999) suggests that for smaller T, the group ADF test outperforms and has the best power followed by panel ADF while panel v and group ρ tests show poor performance.

Kao (1999) panel cointegration test is based on DF and ADF tests which include fixed effect or individual intercept in the initial equation but no deterministic trend. The test regression is as follows:

and ξit = ρξit − 1 + θit. Both Pedroni (1999) and Kao (1999) tests assume the existence of a single cointegration vector, although Pedroni test permits heterogeneity across cross-sections.

Estimation of long run elasticity

If cointegration is found among the variables, the OLS estimator is not appropriate because it yields inconsistent and biased results. To deal with these weaknesses of traditional estimator, different models have been developed. For instance, Kao and Chiang (2000) suggest that the parametric dynamic OLS (DOLS) approach performs well in cointegrated panel. However, the major limitation of panel DOLS is that it ignores the cross-sectional heterogeneity in the alternative hypothesis. For this, Pedroni 2000, 2001proposed fully modified OLS (FMOLS) as an alternative estimator for cointegrated panel. It is a non-parametric approach which yields consistent results when sample size is small and also corrects for serial correlation and endogeneity. FMOLS has advantage over DOLS by allowing cross-sectional heterogeneity in the alternative hypothesis and provides asymptotically unbiased estimations (Lee and Chang 2008). Following Pedroni (2001), the panel FMOLS estimator can be expressed as

where \( {z}_{it}^{\ast }=\left({z}_{it}-\overline{z}\right)-\frac{{\hat{L}}_{21i}}{{\hat{L}}_{22i}}\Delta {y}_{it} \), \( {\hat{\eta}}_i={\hat{\Gamma}}_{21i}+{\hat{\psi}}_{21i}^0-\frac{{\hat{L}}_{21i}}{{\hat{L}}_{22i}}\left({\hat{\Gamma}}_{22i}+{\hat{\psi}}_{22i}^0\right) \), and \( {\hat{L}}_i \) is a lower triangular decomposition of \( {\hat{\psi}}_i \). The associated t-statistics are given as

where \( {t}_{{\hat{\beta}}^{\ast }},i=\left({\hat{\beta}}_i^{\ast }-{\beta}_0\right){\left[{\hat{\psi}}_{11i}^{-1}\ {\sum}_{t=1}^T{\left({y}_{it}-\overline{y}\right)}^2\right]}^{\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$2$}\right.} \)

Panel VECM analysis

The existence of cointegration also requires investigating the causality between the variables. For this, we apply panel VECM-based causality test to examine the direction of relationship. Following Lee and Chang (2008), we use a two-step procedure. In the first step, Eq. (3) is estimated by FMOLS estimator in order to obtain the residuals and in the second stage, this estimated residual (or error correction term by using lagged value) is used to estimate the individual error correction model which jointly form a vector. Specifically,

where ECTt−1 is the lagged error correction term used to detect long-run causality from independent variables to dependent variable. In Eq. (9), all the variables are treated as endogenous variables where each variable, in turn, becomes dependent variable for causality testing procedure. The significance of coefficient of ECTt−1 provides evidence of long-run causality because ECTt−1 causes the endogenous variables to converge toward long-run equilibrium due to variations in the exogenous variables. Short-run causality is detected using F-test of joint significance of the lagged first difference of independent variable.

Results and discussion

Unit root test

This study utilizes the Zivot–Andrews unit root test with structural break followed by Shahbaz et al. (2013) and Ertugrul et al. 2016. The results of the Zivot–Andrews test presented in Table 1 demonstrate that none of the variable is found stationary at level, while other statistics provide strong evidence that the series are stationary at first difference. The break dates also shown in Table 1 correspond to structural changes in the time-series. The structural break period refers to several elements, for instance economic downfall, energy crises, fluctuations in business cycle, and changes in legislations and openness of markets.

Panel cointegration test results

To test the existence of long-run relationship among the variables, Pedroni (1999, 2004) panel cointegration test is applied with and without time effects. As discussed earlier in methodology section, Pedroni (1999, 2004) proposed a total of seven test statistics where four statistics tests are within dimension (panel) while three statistics tests between dimension (group) cointegration among the variables. Within-dimension estimator constructs the test statistics by pooling the autoregressive (AR) coefficients across individual countries during the unit root test process and thus restricts the first-order AR parameter to be similar across countries. On the other hand, between-dimension estimators use average of individual AR for each cross-section to perform the test. The results of both types of tests are given in Table 2. The results clearly reject the null hypothesis of no cointegration in most cases, and we conclude that CO2 emission, technology innovation, trade openness, and other control variables are cointegrated in our sample of 13 Asian countries for the period of 1985–2019.

Table 3 displays the results of Kao (1999)’s residual-based cointegration test results. The test statistics clearly reject the null hypothesis of no cointegration at less than 1% level of significance. The results confirm the Pedroni test statistics and strengthen the claim that a stable long-run relationship exists between the variables in selected Asian countries.

Long-run elasticity estimation

Table 4 displays the FMOLS estimation results at individual country and aggregate level where dependent variable is CO2 emissions. The panel estimators are shown at the bottom of Table 4. In addition to heterogeneous FMOLS, we also report the results of the fixed-effects FMOLS estimator suggested by Mark and Sul (2003), using a sandwich form which allows for heterogeneous variance. The difference between the coefficients estimated from these two estimators is not very marked in terms of sign, size, and significance level.Footnote 1 The coefficients of EC, A, and P are found to have positive impact on CO2 emissions, while technology and trade have negative impact on CO2 emissions.

The coefficient of EC is positive and significance at 1% level, implying that a 1% rise in EC leads to a 0.711% increase in CO2 emissions per capita in our sample of Asian countries. At individual level, EC has a significantly positive impact on CO2 emissions per capita in all the selected countries. The results provide strong evidence that greater energy consumption tends to increase CO2 emissions in our sample of Asian countries. The coefficient of urbanization is positive and significant for all countries except Hong Kong and Thailand. The positive coefficient shows that an increase in urbanization leads to increase CO2 emissions in Asian countries. Our results are similar with Poumanyvong and Kaneko (2010), Bekhet and Othman (2017), and Pata (2018). The finding is contradictive with Sharma (2011) and Ali et al. (2019). The coefficient associated with technology innovation is highly significant and negative, implying that a rise in technology innovation by 1% leads to decrease of CO2 emissions per capita by about 0.024% in the long run. In case of individual countries, technology coefficient is negative and significant in China, Hong Kong, Indonesia, Iran, Japan, Malaysia, Philippines, and Turkey whereas negative and insignificant in Bangladesh, India, and Sri Lanka. Almost all the countries in our sample show negative coefficient of technology innovation except Korea and Thailand. The negative coefficient of technology suggests that a rise in technology innovation leads to reduce CO2 emissions in selected Asian countries. The coefficient of trade openness is negative and significant at 5% level for the panel of our selected countries. The estimated elasticity of trade openness is − 0.025, implying that a 1% increase in trade openness is associated with a 0.025% decrease in CO2 emissions per capita. At country level, the coefficient of trade openness bears negative sign in Bangladesh, China, India, Iran, Philippines, Thailand, and Turkey, more than half of our sample countries. These findings support the idea that through technology spillover effects, trade openness can reduce CO2 emissions in these Asian countries. However, trade openness is also found to have positive impact on CO2 emissions in five countries namely Hong Kong, Indonesia, Japan, Korea, Malaysia, and Sri Lanka. These country-specific results might be due to the rebound effects of trade-facilitated technology change on energy consumption and thus on CO2 emissions as reported by Sohag et al. (2015) in case of Malaysia. Another possible reason behind the positive coefficient of trade could be the country-specific factors like weaker environmental standards and subsidized energy prices as argued by Wan et al. (2015), Antweiler et al. (2001), and McCarney and Adamowicz (2006). However, when combined with panel estimation, we can conclude that overall trade openness has inverse impact on CO2 emissions.

To conclude, the country-specific and panel cointegration results suggest that there exists a cointegrated relationship between EC, TO, technology change, and other variables in our sample of Asian countries. Moreover, technology and trade have potential to combat energy CO2 emissions in the long run.

Panel causality analysis

The existence of the cointegration among emissions, energy, trade, technology, and other variables suggests that there must be Granger causality in at least one direction. For this, we apply a panel VECM causality test to identify the direction of relationship among the variables. To compute panel VECM, we consider 3 lags based on FPE, AIC, and HQ criteria, given in Table 5.

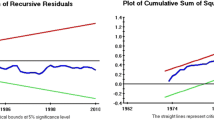

Short-run and long-run causality results are given in Table 6. We find that the coefficient of ECTt−1 is significant and negative at 1% level of significance when CO2 emission is assigned as dependent variable. The coefficient of ECTt−1 is − 0.0158 which indicates that the speed of adjustment toward full equilibrium is 1.58% in a year. The results confirm the existence of long-run Granger causality from energy consumption, technology change, trade openness, and other variables to CO2 emissions.

When energy consumption is taken as dependent variable, the coefficient of ECTt−1 is negative and significant at the 1% level, indicating that energy consumption responds to long-run equilibrium. It explores that EC has long-run causality with all other variables. The significance and negative ECTt−1 in case of technology change panel VECM equation shows that all selected variables cause technology innovation in our sample countries. Similarly, trade openness showed long-run causality with all other variables. The feedback relationship between technology and trade suggests that trade openness Granger causes technology and in result, technology change leads to higher trade. These findings are consistent with Wan et al. (2015), Grether et al. (2007), and Frankel and Rose (2005) and support the idea that trade facilitates technology spillover from other countries to Asia that ultimately reduces pollution emissions. Moreover, unidirectional Granger causality is found from RGDPP to CO2 emissions but the same is not true from opposite direction. This implies that any effort to reduce CO2 emissions would not affect the pace of economic growth in Asian countries. The long-run causal relationship is found bidirectional between CO2 emissions and energy consumption, CO2 emissions and technology, and CO2 emissions and trade. With respect to short-run causality, the results are, however, not so strong. Among our variables of interest, only technology Granger causes energy consumption at 10% level of significance but the same is not true from the opposite direction. The overall results imply that all the four variables (CE, EC, T, and TO) dynamically interact to restore long-run equilibrium whenever there is a deviation from the cointegration relationship. It is also important to note here that the long-term impact of technology and trade are likely to be more significant, both because it takes time for trade-facilitated technology to diffuse through industry and because higher prices may induce new technology for several years (Popp 2001).

Conclusion

To control pollution emissions without hampering economic growth has been the major concern of policymakers in every corner of the world. Previous studies have highlighted that urbanization, technology innovation, and trade openness have potential to combat environmental pollution while maintaining stable economic growth. Thus, the study is an effort to investigate the dynamics of urbanization, technology innovation, trade openness, and CO2 emissions by controlling for several important variables, i.e., energy consumption, economic growth, and population size. For this, we use STIRPAT function to specify our empirical model by using panel data of 13 Asian countries over the period of 1985–2019. For empirical analysis, we adopt Pedroni and Kao panel cointegration approaches and fully modified OLS (FMOLS) for long-run elasticity estimation. We also specify a panel VECM model based on FMOLS estimation to examine the direction of causality among the variables in Asian countries.

Empirical results obtained from Pedroni and Kao cointegration techniques provide strong evidence to believe that there exists stable long-run relationship among the variables. The results of FMOLS reveal a positive relationship between urbanization, energy consumption, and CO2 emissions whereas a negative impact of trade and technology on CO2 emissions is observed. The causality analysis confirms the presence of feedback causality between energy consumption and emissions, trade and emissions, technology, and emissions in the selected sample of Asian countries. In other words, causality results imply that all these four variables (CE, EC, T, and O) dynamically interact to restore long-run equilibrium whenever there is a deviation from the cointegration relationship.

The empirical findings suggest that technology and trade play important role in reducing CO2 emissions. These findings are very much in line with the latest report of Asia Energy Outlook (2016–2017), which suggests that technology innovation must be combined with technology transfer to support emission reduction efforts globally. The negative coefficient of technology change indicates that meeting the objective of pollution reduction without reducing economic growth is possible through adopting new technologies. The government needs to allocate more resources to R&D activities to generate new innovations. The negative coefficient of trade openness advocates the gain from trade theory and suggests that higher openness facilitates technology transfer and reduces pollution emissions. Moreover, Asian economies need to increase the scale of trade openness to get the benefit of advanced technologies from other developed countries of the world. However, the country level mixed results of trade also require more careful thought while regulating trade flows and designing a comprehensive technology, trade, and environmental policy to achieve sustainable economic development.

Change history

18 December 2021

This article has been retracted. Please see the Retraction Notice for more detail: https://doi.org/10.1007/s11356-021-18040-x

Notes

Since both the heterogeneous and fixed-effects estimators provide almost similar results, so we focus only on heterogeneous estimator for discussion to conserve the space.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Aboagye S (2017) Economic expansion and environmental sustainability nexus in Ghana. Afr Dev Rev 29(2):155–168

Adedoyin FF, Gumede ML, Bekun FV, Etokakpan MU, Balsalobre-Lorente D (2020) Modelling coal rent, economic growth and CO2 emissions: does regulatory quality matter in BRICS economies? Sci Total Environ 710:136284. https://doi.org/10.1016/j.scitotenv.2019.136284

Alam MM, Murad MW, Noman AHM, Ozturk I (2016) Relationships among carbon emissions, economic growth, energy consumption and population growth: testing environmental Kuznets curve hypothesis for Brazil, China, India and Indonesia. Ecol Indic 70:466–479

Al-mulali U, Weng-Wai C, Sheau-Ting L, Mohammed A (2015) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323. https://doi.org/10.1016/j.ecolind.2014.08.029

Ali R, Bakhsh K, Yasin MA (2019) Impact of urbanization on CO2 emissions in emerging economy: Evidence from Pakistan. Sustain Cities Soc 48:101553

Ang JB (2009) CO2 emissions, research and technology transfer in China. Ecol Econ 68(10):2658–2665. https://doi.org/10.1016/j.ecolecon.2009.05.002

Ang JB (2011) Financial development, liberalization and technological deepening. Eur Econ Rev 55(5):688–701. https://doi.org/10.1016/j.euroecorev.2010.09.004

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 1(4):877–908

Apergis N, Danuletiu DC (2014) Renewable energy and economic growth: evidence from the sign of panel long-run causality. Int J Energy Econ Policy 4(4):578–587

Asia/World Energy Outlook The Institute of Energy Economics, Japan; 2018–2019

Azam M, Khan AQ, Zaman K, Ahmad M (2015) Factors determining energy consumption: evidence from Indonesia, Malaysia and Thailand. Renew Sust Energ Rev 42:1123–1131. https://doi.org/10.1016/j.rser.2014.10.061

Baek J (2015) Environmental Kuznets curve for CO2 emissions: the case of Arctic countries. Energy Econ 50:13–17. https://doi.org/10.1016/j.eneco.2015.06.014

Baltagi B (2009) Econometric analysis of panel data. Wiley

Bekhet HA, Othman NS (2017) Impact of urbanization growth on Malaysia CO2 emissions: Evidence from the dynamic relationship. J Clean Prod 154(15 June):374-388.

Berndt ER, Kolstad CD, Lee J (1993) Measuring the energy efficiency and productivity impacts of embodied technical change. Energy J 14:33–55. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol14-No1-2

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2:137–149. https://doi.org/10.1177/107049659300200107

Bloch H, Rafiq S, Salim R (2012) Coal consumption, CO2 emission and economic growth in China: empirical evidence and policy responses. Energy Econ 34(2):518–528. https://doi.org/10.1016/j.eneco.2011.07.014

Carraro C, Siniscalco D (1994) Environmental policy reconsidered: the role of technological innovation. Eur Econ Rev 38:545–554. https://doi.org/10.1016/0014-2921(94)90090-6

Chebbi HE, Boujelbene Y (2008) CO2 emissions, energy consumption and economic growth in Tunisia. In A paper presented at the 12th congress of the European Association of Agricultural Economists 2008 Aug

Cole MA, Elliott RJR, Azhar AK (2000) The determinants of trade in pollution intensive industries: North–South evidence. University of Birmingham, UK. Mimeo 2000

Dietz T, Rosa EA (1994) Rethinking the environmental impacts of population, affluence, and technology. Hum Ecol Rev 1:277–300

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49:431–455

Dogan E, Ulucak R, Kocak E, Isik C (2020) The use of ecological footprint in estimating the environmental Kuznets curve hypothesis for BRICST by considering cross-section dependence and heterogeneity. Sci Total Environ 138063

Dong K, Sun R, Jiang H, Zeng X (2018) CO2 emissions, economic growth, and the environmental Kuznets curve in China: what roles can nuclear energy and renewable energy play? J Clean Prod 196:51–63. https://doi.org/10.1016/j.jclepro.2018.05.271

EDGAR (2019) https://edgar.jrc.ec.europa.eu/overview.php?v=booklet2019

Ertugrul HM, Cetinb M, Seker F, Dogan E (2016) The impact of trade openness on global carbon dioxide emissions: evidence from the top ten emitters among developing countries. Ecol Indic 67:543–555. https://doi.org/10.1016/j.ecolind.2016.03.027

Feridun M, Ayadi FS, Balouga J (2006) Impact of trade liberalization on the environment in developing countries: the case of Nigeria. J Dev Soc 22:39–56. https://doi.org/10.1177/0169796X06062965

Ferrantino MJ (1997) International trade, environmental quality and public policy. World Econ 20:43–72. https://doi.org/10.1111/1467-9701.00057

Frankel JA, Rose AK (2005) Is trade good or bad for the environment? Sorting out the causality. Rev Econ Stat 87(1):85–91. https://doi.org/10.1162/0034653053327577

Goulder LH, Mathai K (2000) Optimal CO2 abatement in the presence of induced technological change. J Environ Econ Manag 39(1):1–38. https://doi.org/10.1006/jeem.1999.1089

Greening LA, Greene DL, Difiglio C (2000) Energy efficiency and consumption—the rebound effect—a survey. Energy Policy 28(6–7):389–401. https://doi.org/10.1016/S0301-4215(00)00021-5

Grether JM, Mathys NA, Melo JD (2007) Is trade bad for the environment? Decomposing world-wide SO2 emissions 1990–2000. Discussion Paper, University of Geneva

Grossman G, Krueger A (2004) Economic growth and the environment. Q J Econ 110(2):353–372

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37(3):1156–1164. https://doi.org/10.1016/j.enpol.2008.11.012

Hanif I, Raza SMF, Gago-de-Santos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171:493–501. https://doi.org/10.1016/j.energy.2019.01.011

Hasanbeigi A, Price L, Lin E (2012) Emerging energy-efficiency and CO 2 emission-reduction technologies for cement and concrete production: a technical review. Renew Sust Energ Rev 16(8):6220–6238. https://doi.org/10.1016/j.rser.2012.07.019

Helpman E (1998) Explaining the structure of foreign trade: where do we stand? Weltwirtschaftliches Arch 134(4):573–589

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74. https://doi.org/10.1016/S0304-4076(03)00092-7

International Energy Agency, IEA (2019) https://www.iea.org/articles/global-co2-emissions-in-2019

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):84–91. https://doi.org/10.1016/j.eneco.2010.10.003

Jiaqiang E, Pham M, Zhao D, Deng Y, Le D, Zuo W, Zhu H, Liu T, Peng Q, Zhang Z (2017) Effect of different technologies on combustion and emissions of the diesel engine fueled with biodiesel: a review. Renew Sust Energ Rev 80:620–647. https://doi.org/10.1016/j.rser.2017.05.250

Jorgenson DW, Fraumeni BM (1981) Relative prices on technical change. In: Field BC, Berndt ER (eds) Modeling and Measuring Natural Resource Substitution. MIT Press, Cambridge, pp 17–47

Kaika D, Zervas E (2013) The environmental Kuznets curve (EKC) theory—part a: concept, causes and the CO2 emissions case. Energy Policy 62:1392–1402

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90(1):1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Kao C, Chiang MH (2000) On the estimation and inference of a cointegrated regression in panel data. Nonstationary panels, panel cointegration, and dynamic panels 15:179–222. https://doi.org/10.2139/ssrn.2379

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103. https://doi.org/10.1016/j.econmod.2014.10.022

Khan MTI, Yaseen MR, Ali Q (2017) Dynamic relationship between financial development, energy consumption, trade and greenhouse gas: comparison of upper middle income countries from Asia, Europe, Africa and America. J Clean Prod 161:567–580. https://doi.org/10.1016/j.jclepro.2017.05.129

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3:401–403 https://www.jstor.org/stable/24806805

Kwakwa PA, Adu G (2016) Effects of income, energy consumption and trade openness on carbon emissions in Sub-Saharan Africa. The Journal of Energy and Development Vol. 41, No. 1/2 (Autumn 2015 and Spring 2016), pp. 86–117

Lantz V, Feng Q (2006) Assessing income, population, and technology impacts on CO2 emissions in Canada: where's the EKC? Ecol Econ 57(2):229–238. https://doi.org/10.1016/j.ecolecon.2005.04.006

Lapinskienė G, Peleckis K, Slavinskaitė N (2017) Energy consumption, economic growth and greenhouse gas emissions in the European Union countries. J Bus Econ Manag 18(6):1082–1097. https://doi.org/10.3846/16111699.2017.1393457

Lee CC, Chang CP (2008) Energy consumption and economic growth in Asian economies: a more comprehensive analysis using panel data. Resour Energy Econ 30(1):50–65. https://doi.org/10.1016/j.reseneeco.2007.03.003

Levin A, Lin CF, Chu CS (2002) Unit root tests in panel data: asymptotic and finite sample properties. J Econ 108(1):1–24. https://doi.org/10.1016/S0304-4076(01)00098-7

Machado GV (2000) Energy use, CO2 emissions and foreign trade: an IO approach applied to the Brazilian case. In Thirteenth international conference on input–output techniques, Macerata, Italy 21:21–25

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61(S1):631–652. https://doi.org/10.1111/1468-0084.0610s1631

Madsen JB, Ang JB, Banerjee R (2010) Four centuries of British economic growth: theroles of technology and population. J Econ Growth 15(4):263–290. https://doi.org/10.1007/s10887-010-9057-7

Mardani A, Streimikiene D, Cavallaro F, Loganathan N, Khoshnoudi M (2019) Carbon dioxide (CO2) emissions and economic growth: a systematic review of two decades of research from 1995 to 2017. Sci Total Environ 649:31–49. https://doi.org/10.1016/j.scitotenv.2018.08.229

Mark NC, Sul D (2003) Cointegration vector estimation by panel DOLS and long-run money demand. Oxf Bull Econ Stat 65:655–680. https://doi.org/10.1111/j.1468-0084.2003.00066.x

Marrero GA (2010) Greenhouse gases emissions, growth and the energy mix in Europe. Energy Econ 32(6):1356–1363. https://doi.org/10.1016/j.eneco.2010.09.007

Masih AMM, Masih R (1996) Energy consumption, real income and temporal causality results from a multi-country study based on cointegration and error correction modeling techniques. Energy Econ 18:165–183. https://doi.org/10.1016/0140-9883(96)00009-6

McCarney G, Adamowicz V (2006) The effects of trade liberalization of the environment: an empirical study. International Association of Agricultural Economists 2006 Annual meeting, Queensland, Australia; 2006

Narayan PK, Narayan S, Prasad,A (2008) Energy Policy 36:2765–2769. https://doi.org/10.1016/j.enpol.2008.02.027, A structural VAR analysis of electricity consumption and real GDP: Evidence from the G7 countries

Nasir M, Rehman FU (2011) Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39(3):1857–1864. https://doi.org/10.1016/j.enpol.2011.01.025

Nasreen S, Anwar S (2014) Causal relationship between trade openness, economic growth and energy consumption: a panel data analysis of Asian countries. Energy Policy 69:82–91. https://doi.org/10.1016/j.enpol.2014.02.009

Omri A (2013) CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ 40:657–664. https://doi.org/10.1016/j.eneco.2013.09.003

Pao HT, Tsai CM (2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38(12):7850–7860. https://doi.org/10.1016/j.enpol.2010.08.045

Pao HT, Tsai CM (2011) Modeling and forecasting the CO2 emissions, energy consumption, and economic growth in Brazil. Energy 36(5):2450–2458. https://doi.org/10.1016/j.energy.2011.01.032

Park C, Xing R, Hanaoka T, Kanamori Y, Masui T (2017) Impact of energy efficient technologies on residential CO2 emissions: a comparison of Korea and China. Energy Procedia 111:689–698. https://doi.org/10.1016/j.egypro.2017.03.231

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J Clean Prod 187:770-779

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61(S1):653–670

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels, in Baltagi, B. H. ed. nonstationary panels, Panel Cointegration and Dynamic Panels 15:93–130

Pedroni P (2001) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83:727–731. https://doi.org/10.1162/003465301753237803

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econ Theory 20(3):597–625. https://doi.org/10.1017/S0266466604203073

Popp DC (2001) The effect of new technology on energy consumption. Resour Energy Econ 23(3):215–239

Poumanyvong P, Kaneko S (2010) Does urbanization lead to less energy use and lower CO2 emissions? A cross-country analysis. Ecol Econ 70(2):434-444.

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38:2528–2535. https://doi.org/10.1016/j.enpol.2009.12.048

Sadorsky P (2012) Energy consumption, output and trade in South America. Energy Econ 34(2):476–488. https://doi.org/10.1016/j.eneco.2011.12.008

Salim R, Rafiq S, Shafiei S, Yao Y (2019) Does urbanization increase pollutant emission and energy intensity? Evidence from some Asian developing economies. Appl Econ 51:4008–4024. https://doi.org/10.1080/00036846.2019.1588947

Santra S (2017) The effect of technological innovation on production-based energy and CO2 emission productivity: evidence from BRICS countries. Afr J Sci Technol Innov Dev 9(5):503–512. https://doi.org/10.1080/20421338.2017.1308069

Sarkodie SA, Strezov V, Weldekidan H, Asamoah EF, Owusu PA, Doyi INY (2019) Environmental sustainability assessment using dynamic autoregressive-distributed lag simulations—nexus between greenhouse gas emissions, biomass energy, food and economic growth. Sci Total Environ 668:318–332

Seetanah B, Sannassee RV, Fauzel S, Soobaruth Y, Giudici G, Nguyen APH (2018) Impact of Economic and Financial Development on Environmental Degradation: Evidence from Small Island Developing States (SIDS). Emerg Mark Financ Trade 55(2):308-322

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: time series and cross-country evidence. Background paper for the world development report. The World Bank, Washington, DC

Shahbaz M, Lean HH, Shabbir MS (2012) Environmental Kuznets curve hypothesis in Pakistan: cointegration and Granger causality. Renew Sust Energ Rev 16(5):2947–2953. https://doi.org/10.1016/j.rser.2012.02.015

Shahbaz M, Hye QM, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 1(25):109–121. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Nasreen S, Abbas F, Anis O (2015) Does foreign direct investment impedeenvironmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287

Sharma SS (2011) Determinants of carbon dioxide emissions: Empirical evidence from 69 countries. Applied Energy 888:376–382

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy Elsevier 119(C):703–711

Sohag K, Begum RA, Abdullah SM, Jaafar M (2015) Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 90:1497–1507. https://doi.org/10.1016/j.energy.2015.06.101

Sterner T (1990) Energy efficiency and capital embodied technical change: the case of Mexican cement manufacturing. Energy J 11:155–167. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol11-No2-9

United Nations (2018) Department of Economics and Social Affairs Population Dynamics

Wan J, Baylis K, Mulder P (2015) Trade-facilitated technology spillovers in energy productivity convergence processes across EU countries. Energy Econ 48:253–264. https://doi.org/10.1016/j.eneco.2014.12.014

Wang Q, Wu N (2012) Long-run covariance and its applications in cointegration regression. Stata J 12(3):515–542. https://doi.org/10.1177/1536867X1201200312

Wang SS, Zhou DQ, Zhou P, Wang QW (2011) CO2 emissions, energy consumption and economic growth in China: a panel data analysis. Energy Policy 39(9):4870–4875. https://doi.org/10.1016/j.enpol.2011.06.032

Wolde-Rufael Y (2006) Electricity consumption and economic growth: a time series experience for 17 African countries. Energy Econ 34:1106–1114. https://doi.org/10.1016/j.enpol.2004.10.008

Wong SL, Chang Y, Chia WM (2013) Energy consumption, energy R&D and real GDP in OECD countries with and without oil reserves. Energy Econ 40:51–60. https://doi.org/10.1016/j.eneco.2013.05.024

World Bank (2019) http://datatopics.worldbank.org/world-development-indicators/

Xu B, Lin B (2018) Investigating the role of high-tech industry in reducing China’s CO 2 emissions: a regional perspective. J Clean Prod 177:169–177. https://doi.org/10.1016/j.jclepro.2017.12.174

Yanikkaya H (2003) Trade openness and economic growth: a cross-country empirical investigation. J Dev Econ 72(1):57–89. https://doi.org/10.1016/S0304-3878(03)00068-3

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article has been retracted. Please see the retraction notice for more detail:https://doi.org/10.1007/s11356-021-18040-x

About this article

Cite this article

Amin, A., Aziz, B. & Liu, XH. RETRACTED ARTICLE:The relationship between urbanization, technology innovation, trade openness, and CO2 emissions: evidence from a panel of Asian countries. Environ Sci Pollut Res 27, 35349–35363 (2020). https://doi.org/10.1007/s11356-020-09777-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09777-y