Abstract

Balancing economic growth, resource conservation, and atmospheric environmental protection has topped the agenda of academics and policy makers. The article takes the panel data of 37 Chinese industrial sectors from 2003 to 2016 as the research object to explore the impact of atmospheric environmental regulation on industrial total factor productivity and the possible path of capital intensity. Furthermore, to analyze the possible industry heterogeneity of the above results, the article classifies the industrial sectors into heavy polluting industries and light polluting industries, based on their air pollution emission intensity. The key discoveries of this study are as follows: (1) Generally, the regulation of atmospheric environment has a significant inhibitory effect on industrial total factor productivity. However, if measured by industry group, atmospheric environmental regulation has a significant inhibitory effect on industrial total factor productivity in the light polluted industry group, while in the heavy polluted industry group, the impact is less significant. (2) Across all the industries and especially the light polluted industry group, the capital intensity is a partial intermediate variable of the influence of atmospheric environmental regulation on industrial total factor productivity, but the mediating effect is not significant in the heavy polluted industry group. Finally, policy suggestions are given from the following three aspects: promoting accurate industrial governance, selecting environmental regulation methods and improving supporting policies, which provide practical and feasible solutions for improving the current atmospheric environment governance and promoting the improvement of industrial total factor productivity.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent years, frequent outbreaks of smog in China have become a cause for concern of domestic and international academic circles and policy makers. In 2017, only 99 out of 338 Chinese cities at prefectural level or above met the ambient air quality standards, accounting for only 29.3%.Footnote 1 Foul air hurts people and economy. It has tarnished the image of China as an advocate in the international community of environmental protection (Schlenker and Walker 2015; Ito and Zhang 2016; Li and Zhang 2019). Therefore, taking effective measures to protect the atmospheric environment is a pressing problem for China.

The major air pollutants of Chinese industrial sectors are sulfur dioxide, nitrogen oxides, and smoke (dust), which respectively account for 83.74%, 63.77%, and 80.14% of the national emissions.Footnote 2 The data adequately shows that the industrial sector is the main source of air pollutants in China. Therefore, the governance of industrial emission sources is critical for China’s air pollution control. Globally, the general industrial sector contributes 40% of the total energy consumption (Li and Lin 2017), while Chinese industrial sector accounts for 65.66% of the total energy consumption.Footnote 3 Obviously, such high-energy consumption industrial development model is unsustainable, calling for improved total factor productivity (TFP) of industry, and economic development of higher quality, better efficiency, and greater sustainability.

Environmental regulation is viewed as a traditional tool for solving environmental problems (Wang et al. 2016). A noteworthy question therefore arises: Has China’s “Winning the Defense of the Blue Sky” Campaign improved the total factor productivity of industry and achieved the balanced development of the economy and the atmospheric environment? The “Porter Hypotheses” shows that stricter but well-designed environmental regulation (especially market-based environmental policies such as taxation and pollution permits) can stimulate innovation and then partially or even completely offset the cost of complying with environmental regulation, achieving the dual goals of environmental cleanliness and enhanced competitiveness (Porter and Van der Linde 1995). Based on this hypothesis, research on environmental regulation, innovation, and productivity has received wide attention, but there has been no consensus on whether innovation or technological progress is the way in which environmental regulation improves productivity.

Jin and Shen (2018) conducted an empirical test on the “Porter Hypotheses,” and the results show that technological progress is not a transmission mechanism for environmental regulation to affect corporate productivity, which is consistent with the conclusion of Albrizio et al. (2017). The main reason is that the process of environmental regulation from promoting enterprises to increase innovation investment to promoting substantial technological progress and ultimately increasing productivity is a long process. Environmental regulation often affects total factor productivity by changing the efficiency of resource allocation of enterprises (Andrews et al. 2014; Popp 2015; Jin and Shen 2018). When environmental regulation improves environmental performance, it is inevitable that it will affect resource redistribution, capital investment and technological innovation in the production process of enterprises (Albrizio et al. 2017). Therefore, our paper believes that capital allocation may be an important transmission path for environmental regulation to affect total factor productivity, but there is limited literature on this path and inadequate corresponding empirical tests.

Based on the above analysis, our paper takes the panel data of 37 Chinese industrial industries from 2003 to 2016 as the research object. Global Malmquist index was used to measure total factor productivity in various industries, and the influence of atmospheric environmental regulation on industrial total factor productivity and the mediating effect of capital intensity were further empirically tested through fixed-effect and random-effect models. At the same time, according to the intensity of air pollution emissions, the industrial sectors are categorized as heavily polluting industries and light polluting industries to analyze the heterogeneous effects of industries. The main contribution of this paper is to study the impact of environmental regulation on industrial total factor productivity in the field of air pollution control, and put forward the capital intensity as the action path of the above impact. This study expands and improves the existing environmental regulation theory, and has very important practical significance for the government to improve the air pollution control policy and achieve high-quality economic development.

The follow-up part of our research is arranged as follows: the second part is the literature review and hypotheses, the third part the research method, the fourth part the analysis of empirical results, and the fifth part is the conclusion and policy implications.

Literature review and hypotheses

Environmental regulation and total factor productivity

There are two main points about the impact of environmental regulation on total factor productivity. The first is that environmental regulation can improve total factor productivity. This view is mainly based on the “Porter Hypotheses.” However, because the “Porter Hypotheses” is very different from the results of earlier studies, there has always been controversy about it, mainly around the mechanism of innovation. For example, Franco and Marin (2017) believe that regulation within the industry only affects productivity but not innovation. Moreover, both Li et al. (2019) and Yuan (2019) believe that environmental regulation has a significant inhibitory effect on technological innovation. Assuming that environmental regulation is conducive to promoting innovation, the process of environmental regulation from stimulating innovation to promoting productivity growth is often long, so the “Porter Hypotheses” may be difficult to realize in the short term.

Another view is that environmental regulation will have a negative impact on total factor productivity. For example, Wang and Yuan (2018) took Chinese industrial industry as the research object and found that air pollution control has a significant inhibitory effect on production efficiency. The study by Hou et al. (2019) shows that the sulfur dioxide emission-trading scheme inhibits the growth of green TFP. This view is based largely on the cost of environmental compliance, which limits the profit maximization behavior of enterprises and government intervention ultimately reduces productivity (Gollop and Roberts 1983; Chatzistamoulou et al. 2017). Gollop and Roberts (1983) studied the impact of sulfur dioxide emission restrictions on the productivity growth of the power industry, and the results showed that emission regulations have led to a significant increase in power generation costs, with an average productivity reduction of 0.59 percentage points per year. Gray and Shadbegian (1993) analyzed the cost of environmental compliance and productivity at the enterprise level, and found that compared with less regulated companies, more regulated companies have significantly lower productivity levels and slower productivity growth. Environmental regulation will create more tasks and use more resources in the production process, forcing companies to invest resources and labor in non-core activities such as environmental management, which will inevitably have a negative impact on productivity (Jaffe et al. 1995; Becker 2011).

At least in the short and medium term, environmental policies are a burden of economic activity, because they increase costs without increasing output and limit production technology and output (Kozluk and Zipperer 2014). Therefore, environmental regulation may lead to a decline in the productivity of enterprises (Jorgenson and Wilcoxen 1990; Lannelongue et al. 2017). Hence, we hypothesize as follows:

Hypothesis 1: Atmospheric environmental regulation is negatively correlated with industrial total factor productivity.

Environmental regulation and capital intensity

Stigler (1971) believes that the government is a potential resource or threat to various industries in the market, and regulation will have an impact on resource allocation. Organizational legitimacy is critical to the survival of a company, and it ensures a continuous inflow of external resources and support from different stakeholders (Dacin et al. 2007). Therefore, under the pressure of environmental regulation, companies must make corresponding environmental compliance arrangements.

At the enterprise level, environmental regulation inhibits the increase of capital intensity (capital per capita). The increasing pressure of environmental compliance forces enterprises to break the original factor configuration of production system. A large number of production factors are transferred to environmental management (Becker 2011), which will cause enterprises to replace productive investment with environmental investment (Fujii et al. 2013). Moreover, environmental regulation brings policy uncertainty, and companies are reluctant to make irreversible investment commitments (Viscusi 1983). Therefore, the process of capital deepening (increasing capital intensity) such as the upgrading of production equipment and the introduction of new technologies and equipment has been hindered.

From the perspective of the industry, environmental regulation will restrict the entry of new and more efficient enterprises (Becker 2011), resulting in a reduction in investment in equipment or other assets, which limits the optimization of the industry’s capital allocation structure. In addition, environmental regulation can also lead to capital outflows. Greenstone (2002) showed that, relative to environmentally acceptable regions, environmental regulation has caused losses in employment, capital stock, and output of pollution-intensive industries in non-compliant regions. Hamamoto (2006) also believes that there is a significant negative correlation between pollution control expenditure and capital stock. Strict environmental regulation has greatly impacted the traditional economic development model and caused a crowding out effect on the productive resources. In the long run, it will also drive the flow of resources from polluting, energy-intensive and low-yielding industries to high-value-added ones, and change the structure and pattern of capital deepening (Song and Zhao 2018). Generally speaking, environmental regulation will adversely affect the increase in capital intensity. Therefore, our article makes the following hypothesis:

Hypothesis 2: Regulation of the atmospheric environment inhibits the increase in capital intensity.

Capital intensity and total factor productivity

Research shows that increasing capital intensity (capital deepening) is an important factor to promoting labor productivity (Burmeister and Turnovsky 1972; Kumar and Russell 2002). Tu and Xiao (2006) decomposed labor productivity growth into capital deepening, technological frontier progress, and technological efficiency improvement, and found that the average contribution rate of capital deepening to productivity was 12.9% per year. Song and Zhao (2018) used panel data from 35 industries in China from 2003 to 2015 to study the impact of capital deepening on labor productivity. They found that the degree of capital deepening was significantly positively correlated with labor productivity, but there is industrial heterogeneity in the magnitude of its impact.

Generally speaking, capital deepening is a necessary stage of industrialization, which can promote the upgrading of industrial structure, improve total factor productivity, and realize rapid economic growth. The change of capital-labor ratio means the innovation of factor combination, which is necessary for the continuous economic growth. Moreover, the increase in capital intensity often reflects industrial technological progress, which leads to a large amount of capital investment in new equipment.

At the corporate level, companies with high capital intensity are more inclined to use their investments, which have led to greater attention to costs and efficiency. At the same time, capital-intensive companies have large operating scales and can maximize use of economies of scale to achieve high-level production. In addition, companies with higher capital intensity are more committed to equipment upgrades and technology research and development. Thus, higher capital intensity means higher labor productivity (Datta et al. 2005; Wang and Liu 2014; Lannelongue et al. 2017). Therefore, we hypothesize the following:

Hypothesis 3a: The increase in capital intensity is positively correlated with industrial total factor productivity.

The researchers of this paper believe that the regulation of the atmospheric environment is not conducive to the increase of capital intensity, and that the increase of capital intensity can promote industrial total factor productivity. When enterprises are facing pressure from environmental regulation, in order to achieve environmental compliance, they must inevitably adjust their own productive resources, change their capital allocation, and ultimately have an impact on total factor productivity. Therefore, this article expects that the change in capital intensity is an important mechanism for the impact of atmospheric environmental regulation on industrial total factor productivity, and thus puts forward the following hypothesis:

Hypothesis 3b: Capital intensity is an intermediary variable in which atmospheric environmental regulation affects the total factor productivity of industry.

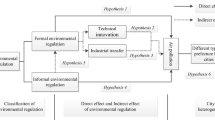

Based on the above analysis, this paper proposes the following conceptual model to reflect the impact of atmospheric environmental regulation on industrial total factor productivity and the mediating effect of capital intensity, as shown in Fig. 1.

Methods

Variables

Atmospheric environmental regulation

In this paper, atmospheric environmental regulation (aert-1) is defined as the core independent variable. At present, domestic and foreign researchers usually choose pollutant discharge density (Cole and Elliott 2003), pollutant treatment rate (Fu and Li 2010; Wang and Liu 2014), and operating costs of pollution treatment facilities (Becker et al. 2013; Rubashkina et al. 2015) and other indicators to measure the strength of environmental regulation. This paper refers to the method of Wang and Yuan (2018) and combines the availability of industrial industry data, and selects the proportion of the operating costs of industrial waste gas treatment facilities in the industry’s main business income as an indicator of the strength of the atmospheric environment regulation.Footnote 4 In addition, a lag period of independent variables is included in the regression equation to alleviate possible endogeneity.

Capital intensity

In this article, capital intensity (ci) is the mediating variable. CI is an important factor affecting total factor productivity. An increase in CI usually also means the substitution of capital for labor. Two main methods for measuring capital intensity are available: total assets per capita (Lannelongue et al. 2017) and fixed assets per capita (Tu and Xiao 2006). This article refers to the practice of Tu and Xiao (2006), the capital intensity is expressed by dividing the total fixed assets of the industry by the number of industry employees.

Industrial total factor productivity

In this article, industrial total factor productivity (tfp) is the dependent variable. TFP not only reflects the technical efficiency of decision-making unit (DMU) but also reflects the technical change. Therefore, we used the Malmquist index to analyze the total factor productivity of 37 industrial sectors in China from 2004 to 2016. In order to ensure the transitivity of the index and multiply the index in adjacent periods, the global Malmquist index method proposed by Pastor and Lovell (2005) is adopted in this paper. Since the Malmquist index is the rate of change, taking 2004 as the base period and assuming its TFP is 1, the global Malmquist index in 2005 is multiplied by 1 to obtain the TFP in 2005, and so on, the TFP of each year can be obtained. The evaluation index system is shown in Table 1.

Control variables

We selected control variables from the perspective of industry characteristics, mainly including industry ownership structure, innovation ability, barriers to entry, and scale.

Ownership structure

In the ownership structure, the large proportion of state-owned enterprises is not conducive to the improvement of total factor productivity (Brandt et al. 2012; Yang 2015). Our paper refers to the method of Wang and Yuan (2018), and uses the ratio of industrial state-owned fixed assets to total industrial fixed assets to define the ownership structure of the industry.

Innovation ability

There are three main indicators for measuring innovation: R&D expenditure (Jaffe and Palmer 1997), number of patents (Hong et al. 2016; Li et al. 2016), and revenue from new product sales (Roper et al. 2008; Cruz-Cázares et al. 2013). The sale of new products reflects not only the ability of a company to develop new products or services but also the commercial success of technological innovation (Roper et al. 2017). Therefore, our paper adopts this method, and further measures the relative innovation ability by the ratio of the output value of new products in the industrial industry to the main business income. The larger the ratio, the stronger the innovation ability.

Barriers to entry

The returns of some industries are consistently higher than others, a phenomenon that implies the existence of barriers to entry (Demsetz 1982). Higher barriers to industry entry, such as control over raw materials, patent protection, and economies of scale, are important for companies to maintain high returns (George 1968). This article refers to the method of Yuan et al. (2017), and uses the growth rate of the number of industry enterprises to represent the barriers to entry. The larger the value, the lower the barrier and the vice versa.

Industry scale

The larger the scale of an enterprise, the more it can enjoy economies of scale and scope. In addition, it has a very large resource advantage. A lot of literature discusses the impact of scale on productivity at the enterprise or city level. For example, the study of Tovar et al. (2011) found that the size of enterprises is important for industry productivity, and Sveikauskas et al. (1988) believed that agglomeration effects related to the size of cities did exist. This article chooses the ratio of the industry’s main business income to the number of enterprises as the measure of the industry size.

Regression equation model

According to the testing method of mediation effect (MacKinnon et al. 2002; Zhao et al. 2010; Wen and Ye 2014), the following regression equation models are constructed to test the above hypotheses and mediating effects of capital intensity.

First, the regression model of atmospheric environmental regulation and industrial total factor productivity is as follows:

Second, the regression model of atmospheric environmental regulation and capital intensity is as follows:

Third, constructing a regression model of capital intensity and industrial total factor productivity as follows:

Fourth, the regression model for atmospheric environmental regulation, capital intensity, and industrial total factor productivity is as follows:

Among them, i represents the sector category (i = 1,2,3, ..., 37), t represents the period (t = 1,2,3, ..., 13), and εit is the residual term. The variables of the econometric regression model are shown in Table 2.

Industry classification

To further distinguish the heterogeneity of industries, this article classifies the industrial sector as heavy pollution industry and light pollution industry according to their intensity of air pollution emissions. Based on the classification method of Wang and Liu (2014) and Fu and Li (2010), our article uses the standardization of air pollutant emissions data, and then uses the equal-weighted average method to divide the air pollution intensity of various industries in China. The selected single indicators of pollution emissions are nitrogen oxide emissions, sulfur dioxide emissions, and smoke (dust) dust emissions.Footnote 5 The specific calculation method is as follows:

First, the air pollutant emissions of unit output value of various industries are calculated:

Among them, Ei tj is the emission value of major air pollutants j in industry i in year t, and the Oi t is the total output value of industry i in year t (i = 1,2, ... 37; j = 1,2,3).

Second, the emissions per unit output value of each pollutantFootnote 6 is standardized.

Among them, Zi tj is the original value of the indicator, M(Zt j) represents the mean of Zi tj across all industries, S is the standard deviation, and \( {Z}_{i\kern0.1em t\kern0.1em j}^s \) is the standardized value.

Third, the standardized values of various industries on an annual basis is averaged.

Fourth, the average standardized value of each pollutant is averaged.

That is, the total air pollution emission intensity λi of the industry is obtained. A larger value indicates a higher air pollution emission intensity; otherwise, the air pollution emission intensity is lighter. The classification results of 37 industrial industries in China are shown in Table 3.

The industry code is in parentheses

Data

Our article takes the panel data of 37 industrial sectors in China from 2003 to 2016 as the research object. For the convenience of data statistical analysis, our article has accessed data from China’s National Economic Industry Classification (GB/T 4754-2011), as well as China Statistical Yearbook, China Industrial Statistical Yearbook, China Environmental Statistics Yearbook, China Energy Statistical Yearbook. The paper divides the Chinese industrial sectors into 37 specific industries. Among them, the other mining industry (B12) was eliminated due to the large amount of data missing. The automobile manufacturing industry (C36) was merged with the railway, shipping, aerospace, and other transportation equipment manufacturing industry (C37) into the transportation equipment manufacturing industry (C36).Footnote 7

The data used for the empirical analysis in this article are from the National Bureau of Statistics of China, various statistical yearbooks of China, the CEIC database, and the EPS (Easy Professional Superior) data platform. Because the atmospheric environmental regulation variable is lagging behind by one period, the data from 2003 to 2015 are used for this variable and the data from 2004 to 2016 for other variables. In addition, this article uses the industrial producer’s ex-factory price index and fixed asset investment price index to convert the current year’s monetary value into a constant price based on the year of 2000. The descriptive statistical results of related variables are shown in Table 4.

Analysis of empirical results

Before we discuss the results from the econometric analysis, we first test the stationarity of the variables. Our paper uses three methods for unit root test: Levin, Lin and Chu (LLC), Im, Pesaran and Shin (IPS), and Fisher-PP (Levin et al. 2002; Im et al. 2003; Choi 2001). The test results show that the first-order difference sequence of all variables is stationary (Table 5). This paper uses a fixed-effect model (FE) and a random-effect model (RE) to test the relevant panel data. Furthermore, the applicable model is determined based on the Hausman test results (Wooldridge 2010). In addition, in order to avoid possible heteroscedasticity effects, this paper uses robust standard error for regression analysis. The empirical results are shown in Tables 6, 7, and 8.

Analysis of the whole industrial sectors

Table 6 reports the overall empirical results of 37 industrial sectors in China. Hausman test results show that FEs are suitable for each model. According to the results of model (1), atmospheric environmental regulation has a significant inhibitory effect on industrial total factor productivity (α1 = − 0.0616, p < 0.01), which verifies Hypothesis 1. Obviously, such a result sounds self-defeating for the Chinese government, which aims for a win-win-win of economic development, energy conservation and emission reduction.

To get to the bottom of the paradox, two things merit our attention. First, when China’s vigorously transforms its economic development model from extensive to intensive, it steps up regulation of the atmospheric environment, causing strong disruptions in the production of enterprises. Environmental compliance has broken the original allocation of factors in the production system of enterprises, as a large amount of capital, labor, and energy inputs have been transferred to environmental management. As a result, a company’s environmental investment has replaced more productive investment, and the continuous adjustment of production factors has led to inconsistencies between production activities and atmospheric environmental protection of the company. Second, the regulation of atmospheric environment will raise the cost of enterprises. Especially, the additional environmental “compliance costs” have squeezed out companies’ investment in technology research and development and equipment upgrades, reducing the total factor productivity of industry (Becker 2011; Fujii et al. 2013; Wang and Yuan 2018).

From the empirical results of model (2), atmospheric environmental regulation has a significant inhibitory effect on industry capital intensity (β1 = − 0.0545, p < 0.05), which verifies Hypothesis 2. The main reason is that the atmospheric environmental regulation has impacted an enterprise from the outside, forcing the enterprise to toe the line. An enterprise has to adjust the original production asset allocation plan and prioritize resources to environmental protection and governance, thus hindering its capital deepening. In addition, it is difficult to offset the cost of environmental compliance through continued production or increased capital investment, causing some assets to withdraw from the market.

From the empirical results of model (3), capital deepening can significantly improve the total factor productivity of industry, which validates Hypothesis 3a. Greater capital intensity expects higher caliber and more skillful workers, and better technology, which will drive overall factor productivity of the industry.

This research further analyzes the combined impact of atmospheric environmental regulation and capital intensity on industrial total factor productivity, as shown in model (4). Capital intensity has a significant promotion effect on industrial total factor productivity (γ2 = 0.354, p < 0.01). In addition, atmospheric environmental regulation has a significant inhibitory effect on total factor productivity (γ1 = − 0.0423, p < 0.05). Its coefficient sign is the same as the estimated coefficient in model (1), and it has a smaller absolute value. The empirical results show that capital intensity is part of the mediating variable that atmospheric environmental regulation affects industrial total factor productivity. Hypothesis 3b is verified overall industry. Further calculations show that the mediating effect of capital intensity is β1 × γ2 = − 0.0193, and the ratio of total effect is − 0.0193/− 0.0616 = 0.3133. In other words, 31.33% of the inhibitory effect of atmospheric environmental regulation on industrial total factor productivity was achieved through the capital intensity approach.

The results of control variables show that ownership structure is negatively correlated with total factor productivity, which means that the increase of the proportion of state-owned enterprises is detrimental to the improvement of total factor productivity. Both innovation ability and industry scale have a significant role in promoting total factor productivity, while barriers to entry have no significant effect on total factor productivity.

Robust standard error is in parentheses; prob value is in square brackets; *p < 0.1, **p < 0.05, ***p < 0.01

Analysis of heavy polluting industries

Table 7 reports the empirical results of heavily polluting industries. According to the Hausman test results, the FE is suitable for each model. Basing on the results of model (5), the coefficient of atmospheric environmental regulation on industrial total factor productivity is − 0.0088. That means the atmospheric environmental regulation has a restraining effect on industrial total factor productivity in heavily polluting industries, but the impact is not significant. In heavily polluting industries, the results are different from the whole industrial sectors. Largely because if the company is in a heavily polluting industry, its pollution subject to very strict government regulation often attracts more attention from the society and government watchdogs’. For example, the “Air Pollution Prevention and Control Action Plan” issued by the Chinese government in 2013 focused on heavily polluting industries such as cement, non-ferrous metal smelting, chemical, and steel industries. Aware of regulatory expectations heavily polluting companies have made corresponding environmental compliance arrangements in product structure, organizational structure, management mode, capital allocation, and technology. Therefore, faced with atmospheric environmental regulation, those heavily polluting enterprises, which have made arrangements and anticipated the regulation, can maintain their normal operation without disrupting the original production order and reconfiguring production factors and avoid a significant inhibitory effect on the total factor productivity of industry.

From the empirical results of model (6), there is a negative correlation between atmospheric environmental regulation and industry capital intensity. Its elasticity is − 0.0811, but it is not significant. The reason is that in the highly polluting industries, the enterprises have formed expectations for the atmospheric environmental regulation policies, and have made environmental compliance arrangements in advance in terms of capital budget, productive investment plans, and environmental management. Therefore, the impact of atmospheric environmental regulation on capital allocation is limited.

From the empirical results of model (7), the increase of industry capital intensity is conducive to the improvement of industrial total factor productivity, which is consistent with the results in the industrial industry as a whole. Hypothesis 3a is verified. For heavy polluting industries including non-ferrous metal smelting, steel, petrochemical, power, and other industries, transforming to cleaner production requires a large amount of fixed asset reinvestment. Consequently, with increased capital intensity, such industries can realize scale and intensive operation, hence boosting total factor productivity.

The research analyzes the combined impact of atmospheric environmental regulation and capital intensity on industrial total factor productivity, as shown in model (8). From the empirical results, capital intensity is seen as a significant positive impact on industrial total factor productivity (γ2 = 0.367, p < 0.01); however, the impact of atmospheric environmental regulation on industrial total factor productivity is not significant. Combining the results of model (6), we can see that the indirect effect of atmospheric environmental regulation on industrial total factor productivity is not significant. Therefore, in heavily polluting industries, capital intensity is not an intermediary variable in which atmospheric environmental regulation affect industrial total factor productivity.

The results of control variables show that ownership structure is negatively correlated with total factor productivity, which indicates that the increase of the proportion of state-owned enterprises in heavily polluted industries inhibits the growth of total factor productivity. Barriers to entry are negatively correlated with total factor productivity, that is, the higher the growth rate of the number of enterprises in the industry is, the worse the improvement of total factor productivity is, which means that the industry needs to maintain a certain level of barriers to entry. The industry scale has a significant promoting effect on total factor productivity, while the innovation ability has an insignificant promoting effect on total factor productivity.

Robust standard error is in parentheses; prob value is in square brackets; *p < 0.1, **p < 0.05, ***p < 0.01

Analysis of light polluting industries

Table 8 reports the empirical results of the light pollution industry. The Hausman test results show that each model is suitable for analysis with FE. From the results of model (9), atmospheric environmental regulation has a significant inhibitory effect on industrial total factor productivity (α1 = − 0.0729, p < 0.01). Hypothesis 1 is verified. This means that, unlike the heavily polluting industries, the regulation of atmospheric environment in the lightly polluting industries has a significant inhibitory effect on the total factor productivity, and there is a large heterogeneous impact among industries. The reason is that for a long time, China has mainly relied on compulsory environmental management tools to control pollution, with the characteristics of “one size fits all.” The development of market-based environmental management tools is not completed, and light polluting companies have difficulties in choosing different compliance methods to achieve optimal energy conservation and emission reduction efficiency (Wang and Yuan 2018).

From the results of model (10), it can be seen that atmospheric environmental regulation has a significant inhibitory effect on capital deepening (β1 = − 0.0589, p < 0.01), which validates hypothesis 2. The reason is that light pollution industries have greater marginal emission reduction costs than heavily polluting industries. The rigid Chinese environment regulation and the “one-size-fits-all” environmental protection measures have compelled such industries to bear costs that exceed their marginal emission reduction levels, so the enterprises suffer a large “crowding out effect,” which hampered the introduction of advanced production factors and the upgrading of equipment, thereby inhibiting the deepening of the industry’s capital.

From the results of model (11), the increase in capital intensity is significantly positively correlated with industrial total factor productivity, indicating that in light polluting industries, capital deepening is conducive to the improvement of industrial total factor productivity. Hypothesis 3a is verified. In the light pollution industry group where assets and equipment are updated quickly, such as special equipment manufacturing (C35), transportation equipment manufacturing (C36), electrical machinery and equipment manufacturing (C38), communications equipment, computers and other electronic equipment manufacturing (C39), instrumentation and culture, and office machinery manufacturing (C40). These companies need to continuously upgrade existing assets and equipment and further increase capital intensity to keep pace with the development of industry production technology. Therefore, capital deepening will inevitably lead to an increase in the industrial total factor productivity.

We further analyze the combined impact of atmospheric environmental regulation and capital intensity on industrial total factor productivity, as shown in model (12). Capital intensity has a significant promotion effect on industrial total factor productivity (γ2 = 0.276, p < 0.01), and atmospheric environmental regulation has a significant inhibitory effect on industrial total factor productivity (γ1 = − 0.0567, p < 0.01). Its coefficient sign is the same as the estimated coefficient in model (9), and it has a smaller absolute value. The empirical results show that in light pollution industries, capital intensity is part of the mediating variables that atmospheric environmental regulation affects industrial total factor productivity. Hypothesis 3b is verified. Further calculations show that the mediating effect of capital intensity is β1 × γ2 = − 0.0163, and the proportion of the total effect is − 0.0163/− 0.0729 = 0.2236. That is, 22.36% of the inhibition effect of atmospheric environmental regulation on industrial total factor productivity is achieved through capital intensity path.

From the results of control variables, ownership structure is negatively correlated with total factor productivity, indicating that the increase of the proportion of state-owned enterprises in the light pollution industry also has a significant inhibitory effect on total factor productivity. Both innovation ability and industry scale have significant promoting effects on total factor productivity, while barriers to entry do not.

Robust standard error is in parentheses; prob value is in square brackets; *p < 0.1, **p < 0.05, ***p < 0.01

Robustness test

We change the measurement method of atmospheric environment regulation and conduct robustness test. Du et al. (2019) used the proportion of industrial pollution treatment investment in the total industrial output value to measure the environmental regulation intensity, and the proportion of industrial pollution treatment investment in the main business cost of industry as the robustness test index. Referring to Du et al. (2019), we use the ratio of the operating cost of industrial waste gas facilities to the main business cost of industry (aer2t-1) as the robustness test index. The results of the robustness test are shown in Table 9. The results show that the coefficient sign and significance level of the main variables are consistent with the empirical results. Capital intensity is a partial intermediate variable in the whole industrial industry and light polluting industry. It is not an intermediate variable in the heavily polluting industry. Therefore, the empirical results of this paper are robust.

Robust standard error is in parentheses; prob value is in square brackets; *p < 0.1, **p < 0.05, ***p < 0.01

Conclusions and policy implications

Breaking through the development bottleneck of Chinese industrial sector and achieving coordinated development of economic growth, resource conservation, and atmospheric environmental protection are the common concerns of academics and policy makers at this stage. This article takes the panel data of 37 industrial sectors in China from 2003 to 2016 as the research object, and analyzes the impact of atmospheric environmental regulation on capital intensity. And then, on industrial total factor productivity from both theoretical and empirical aspects, it has been verified that capital intensity acts as an effect path of atmospheric environmental regulation on industrial total factor productivity.

Conclusions

The research has arrived at the following conclusions. First, in general, atmospheric environmental regulation has a significant inhibitory effect on the total factor productivity of industrial industries; however, an industry heterogeneity effect is evident, as the inhibition is significant and serious in light pollution industries but not so in heavy pollution industries. Second, in the whole industrial industry, the heavy pollution industry and the light pollution industry, the increase of capital intensity is conducive to the improvement of industrial total factor productivity. The effect of capital deepening on industrial total factor productivity is consistent across industries of different natures.

Third, atmospheric environment regulation affects industrial total factor productivity through capital intensity. Capital intensity has a partial mediating effect, but the effect is heterogeneous in industry. Overall, capital intensity is a partial intermediate variable; from the perspective of industry groupings, capital intensity is a partial intermediate variable in lightly polluting industries, while capital intensity is not an intermediate variable in heavily polluting industries. Based on this conclusion, this paper finds a new path for environmental regulation to affect total factor productivity, that is, environmental regulation has an impact on total factor productivity through capital intensity.

Policy implications

The research in this paper also provides some enlightenments for the policy practice of air pollution control. First, the industrial sector to implement classified air pollution control. Since the emission intensity of air pollution is different among industries, and the cost of pollution reduction is also different, the government should improve its atmospheric environment governance behavior, and formulate differentiated environmental policies and measures for different industries to achieve accurate governance. The government should strengthen the control of heavy polluting industries, and at the same time, reduce the negative impact on light polluting industries, so as to avoid the situation of “one-size-fits-all” environmental governance.

Second, a combination of various forms of environmental regulation should be adopted to control air pollution. Should not only play a command-and-control environmental regulation of mandatory pollution reduction effect, at the same time, also should promote market-oriented environmental regulation (such as emissions trading and the environmental protection tax) to form the price mechanism to guide enterprises to carry out pollution reduction, let each enterprise can choose flexible way to realize energy conservation and emissions reduction targets, and hence a win-win-win of economic development, resource conservation, and atmospheric environmental protection. For heavy polluting industries, a combination of command-and-control environmental regulation and market-oriented environmental regulation should be adopted for pollution control, while for light polluting industries, the soft constraint effect of market-oriented environmental regulation should be given full play.

Third, the supporting policies for atmospheric environment regulation should be improved. Considering that atmospheric environmental regulation has a negative impact on industrial total factor productivity by inhibiting capital deepening. On one hand, atmospheric environmental regulation should be given full play to phrasing out outdated equipment and achieving the goal of slashing air pollution. On the other hand, incentives and fiscal policies like tax cut and capital depreciation should be provided to help enterprises update and purchase advanced technology and equipment, optimize corporate capital structure, and upgrade technology and ultimately improve their industrial total factor productivity.

Future research and limitations

This article has proposed and verified that capital intensity the path of atmospheric environmental regulation influencing industrial total factor productivity, and the results show that capital intensity has a partial mediation effect in the overall industrial industry and in light pollution industries, but not in the heavy pollution industry. Therefore, whether there are other intermediary variables needs to be further explored, so as to enrich the study of the path of atmospheric environmental regulation in affecting the industrial total factor productivity.

Although the research team has been working hard for a reliable and robust analysis, like any research, this research has some shortcomings. First of all, we failed to collect complete data at the enterprise level, the enterprises being the ultimate implementing party of atmospheric environmental protection. In this research, we used the industrial industry as the research object. Second, when evaluating the total factor productivity of Chinese industry, this article does not include emissions of air pollutants such as exhaust gas, SO2, and smoke (dust) into the evaluation system. The approach is different from that of some researchers who consider environmental factors as undesired outputs; therefore, there will be some divergences.

Notes

Data source: The 2017 Bulletin of the State of the Ecological Environment of China, http://www.mee.gov.cn/.

Data source: National Environmental Statistics Bulletin 2015, http://www.mee.gov.cn/.

Data source: National Bureau of Statistics of China, http://www.stats.gov.cn/.

According to the China Environmental Statistics Yearbook, industrial waste gas treatment facilities refer to facilities that reduce or recycle pollutants discharged to the atmosphere during fuel combustion and production processes, including dust removal, desulfurization. The costs incurred in the operation of flue gas treatment facilities for denitration and other pollutants are the operating costs of industrial waste gas treatment facilities. The treatment of air pollutants such as sulfur dioxide, smoke (dust), and nitrogen oxides cannot be separated from the operation of exhaust gas treatment facilities. The greater the amount of pollutants removed, the greater the intensity of the operation of the exhaust gas treatment facilities, and the higher the corresponding operating costs. The smaller the removal amount, the opposite is true. Therefore, the operating costs of the exhaust gas treatment facilities intuitively reflect the cost of the enterprise to achieve compliance with the atmospheric environment to deal with atmospheric pollutants.

As the disclosure of nitrogen oxide emissions data of China’s industrial industry only started in 2011, to ensure a more accurate result of the industry classification, this article uses the 2011–2015 nitrogen oxide, sulfur dioxide, and smoke (dust) emission data of three types of air pollutants.

The standardization process is performed using Stata15’s standardization commands.

The National Economy Industry Classification (GB/T4754-2011) splits the transportation equipment manufacturing industry (C37) from the National Economy Industry Classification (GB/T4754-2002) into an automobile manufacturing industry (C36) and railway, ship, aerospace, and other transportation equipment manufacturing (C37). In order to maintain data consistency, this article combines data from the automobile manufacturing (C36) and railway, marine, aerospace, and other transportation equipment manufacturing (C37) into transportation equipment manufacturing (C36). The industry code is in parentheses.

References

Albrizio S, Kozluk T, Zipperer V (2017) Environmental policies and productivity growth: evidence across industries and firms. J Environ Econ Manag 81:209–226

Andrews D, Criscuolo C, Menon C (2014) Do resources flow to patenting firms? Cross-country evidence from microdata. STI Policy Paper, Forthcoming, OECD

Becker RA (2011) Local environmental regulation and plant-level productivity. Ecol Econ 70:2516–2522

Becker RA, Pasurka C Jr, Shadbegian RJ (2013) Do environmental regulations disproportionately affect small businesses? Evidence from the pollution abatement costs and expenditures survey. J Environ Econ Manag 66:523–538

Brandt L, Van Biesebroeck J, Zhang Y (2012) Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J Dev Econ 97:339–351

Burmeister E, Turnovsky SJ (1972) Capital deepening response in an economy with heterogeneous capital goods. Am Econ Rev 62:842–853

Chatzistamoulou N, Diagourtas G, Kounetas K (2017) Do pollution abatement expenditures lead to higher productivity growth? Evidence from Greek manufacturing industries. Environ Econ Policy Stud 19:15–34

Choi I (2001) Unit root tests for panel data. J Int Money Financ 20:249–272

Cole MA, Elliott RJ (2003) Do environmental regulations influence trade patterns? Testing old and new trade theories. World Econ 26:1163–1186

Cruz-Cázares C, Bayona-Sáez C, García-Marco T (2013) You can’t manage right what you can’t measure well: technological innovation efficiency. Res Policy 42:1239–1250

Dacin MT, Oliver C, Roy JP (2007) The legitimacy of strategic alliances: an institutional perspective. Strateg Manag J 28:169–187

Datta DK, Guthrie JP, Wright PM (2005) Human resource management and labor productivity: does industry matter? Acad Manag J 48:135–145

Demsetz H (1982) Barriers to entry. Am Econ Rev 72:47–57

Du L-Z, Zhao Y-H, Tao K-T, Lin W-F (2019) Compound effects of environmental regulation and governance transformation in enhancing green competitiveness. Econ Res J 54:106–120 (in Chinese)

Franco C, Marin G (2017) The effect of within-sector, upstream and downstream environmental taxes on innovation and productivity. Environ Resour Econ 66:261–291

Fu J-Y, Li L-S (2010) Empirical research on environmental regulation, factor endowment and international competitiveness of industries: based on panel data of China’s manufacturing industry. Management World 10:87-98 + 187 (in Chinese)

Fujii H, Iwata K, Kaneko S, Managi S (2013) Corporate environmental and economic performance of Japanese manufacturing firms: empirical study for sustainable development. Bus Strateg Environ 22:187–201

George KD (1968) Concentration, barriers to entry and rates of return. Rev Econ Stat 50:273–275

Gollop FM, Roberts MJ (1983) Environmental regulations and productivity growth: the case of fossil-fueled electric power generation. J Polit Econ 91:654–674

Gray WB, Shadbegian RJ (1993) Environmental regulation and manufacturing productivity at the plant level (No. w4321). National Bureau of Economic Research

Greenstone M (2002) The impacts of environmental regulations on industrial activity: evidence from the 1970 and 1977 clean air act amendments and the census of manufactures. J Polit Econ 110:1175–1219

Hamamoto M (2006) Environmental regulation and the productivity of Japanese manufacturing industries. Resour Energy Econ 28:299–312

Hong J, Feng B, Wu Y, Wang L (2016) Do government grants promote innovation efficiency in China’s high-tech industries? Technovation 57:4–13

Hou B, Wang B, Du M, Zhang N (2019) Does the SO2 emissions trading scheme encourage green total factor productivity? An empirical assessment on China’s cities. Environ Sci Pollut Res 27:6375–6388

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74

Ito K, Zhang S (2016) Willingness to pay for clean air: evidence from air purifier markets in China (No. w22367). National Bureau of Economic Research

Jaffe AB, Palmer K (1997) Environmental regulation and innovation: a panel data study. Rev Econ Stat 79:610–619

Jaffe AB, Peterson SR, Portney PR, Stavins RN (1995) Environmental regulation and the competitiveness of US manufacturing: what does the evidence tell us? J Econ Lit 33:132–163

Jin G, Shen K-R (2018) Beggar-thy-neighbour or neighbour? Interaction of environmental regulation enforcement and urban productivity growth. Management World 34:43–55 (in Chinese)

Jorgenson DW, Wilcoxen PJ (1990) Environmental regulation and US economic growth. RAND J Econ 21:314–340

Kozluk T, Zipperer V (2014) Environmental policies and productivity growth - a critical review of empirical findings. OECD Journal: Economic Studies 2014:155–185

Kumar S, Russell RR (2002) Technological change, technological catch-up, and capital deepening: relative contributions to growth and convergence. Am Econ Rev 92:527–548

Lannelongue G, Gonzalez-Benito J, Quiroz I (2017) Environmental management and labour productivity: the moderating role of capital intensity. J Environ Manag 190:158–169

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econ 108:1–24

Li J, Lin B (2017) Ecological total-factor energy efficiency of China’s heavy and light industries: which performs better? Renew Sust Energ Rev 72:83–94

Li W-B, Zhang K-X (2019) The impact of air pollution on business productivity: evidence from Chinese industrial companies. Management World 35:95-112 + 119 (in Chinese)

Li J, Strange R, Ning L, Sutherland D (2016) Outward foreign direct investment and domestic innovation performance: evidence from China. Int Bus Rev 25:1010–1019

Li W, Gu Y, Liu F, Li C (2019) The effect of command-and-control regulation on environmental technological innovation in China: a spatial econometric approach. Environ Sci Pollut Res 26:34789–34800

MacKinnon DP, Lockwood CM, Hoffman JM, West SG, Sheets V (2002) A comparison of methods to test mediation and other intervening variable effects. Psychol Methods 7:83–104

Pastor JT, Lovell CK (2005) A global Malmquist productivity index. Econ Lett 88:266–271

Popp D (2015) Using scientific publications to evaluate government R&D spending: The case of energy (No. w21415). National Bureau of Economic Research

Porter ME, Van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9:97–118

Roper S, Du J, Love JH (2008) Modelling the innovation value chain. Res Policy 37:961–977

Roper S, Love JH, Bonner K (2017) Firms’ knowledge search and local knowledge externalities in innovation performance. Res Policy 46:43–56

Rubashkina Y, Galeotti M, Verdolini E (2015) Environmental regulation and competitiveness: empirical evidence on the Porter Hypotheses from European manufacturing sectors. Energy Policy 83:288–300

Schlenker W, Walker WR (2015) Airports, air pollution, and contemporaneous health. Rev Econ Stud 83:768–809

Song D, Zhao F (2018) The influence of environmental regulation and capital deepening on labor productivity. China Population, Resources and Environment 28:158–166 (in Chinese)

Stigler GJ (1971) The theory of economic regulation. Bell J Econ Manag Sci 2:3–21

Sveikauskas L, Gowdy J, Funk M (1988) Urban productivity: city size or industry size. J Reg Sci 28:185–202

Tovar B, Ramos-Real FJ, De Almeida EF (2011) Firm size and productivity. Evidence from the electricity distribution industry in Brazil. Energy Policy 39:826–833

Tu Z-G, Xiao G (2006) Transformation of China’s industrial growth model: a dynamic analysis of labor productivity in large and medium-sized enterprises. Management World 10:57-67 + 81 (in Chinese)

Viscusi WK (1983) Frameworks for analyzing the effects of risk and environmental regulations on productivity. Am Econ Rev 73:793–801

Wang J, Liu B (2014) Environmental regulation and enterprise’ TFP: an empirical analysis based on China’s industrial enterprises data. Chin Ind Econ 3:44–56 (in Chinese)

Wang Q, Yuan B (2018) Air pollution control intensity and ecological total-factor energy efficiency: the moderating effect of ownership structure. J Clean Prod 186:373–387

Wang Z, Zhang B, Zeng H (2016) The effect of environmental regulation on external trade: empirical evidences from Chinese economy. J Clean Prod 114:55–61

Wen Z-L, Ye B-J (2014) Analyses of mediating effects: the development of methods and models. Adv Psychol Sci 22:731–745 (in Chinese)

Wooldridge JM (2010) Econometric analysis of cross section and panel data. MIT press

Yang R-D (2015) Study on the total factor productivity of chinese manufacturing enterprises. Econ Res J 50:61–74 (in Chinese)

Yuan B (2019) Effectiveness-based innovation or efficiency-based innovation? Trade-off and antecedents under the goal of ecological total-factor energy efficiency in China. Environ Sci Pollut Res 26:17333–17350

Yuan B, Ren S, Chen X (2017) Can environmental regulation promote the coordinated development of economy and environment in China’s manufacturing industry? – a panel data analysis of 28 sub-sectors. J Clean Prod 149:11–24

Zhao X, Lynch JG Jr, Chen Q (2010) Reconsidering Baron and Kenny: myths and truths about mediation analysis. J Consum Res 37:197–206

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, Q., Ren, S. & Hou, Y. Atmospheric environmental regulation and industrial total factor productivity: the mediating effect of capital intensity. Environ Sci Pollut Res 27, 33112–33126 (2020). https://doi.org/10.1007/s11356-020-09523-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09523-4