Abstract

Foreign direct investment (FDI) and the consumption of non-renewable energy have been on the increase in the coastal Mediterranean countries (CMCs) over the last few decades. Both trigger growth, but the environmental impact could be far-reaching as environmental distortions are mainly human-induced. This study examines the environmental issues facing CMCs. Specifically, we investigate whether the pollution haven hypothesis holds for CMCs. We employ a quantile panel data analysis for CMCs to account for heterogeneity and distributional effects of socioeconomic factors. The result reveals that the influence of FDI on environmental degradation is a function of the indicators utilized and also depends on the initial levels of environmental degradation. The results suggest that the pollution haven hypothesis does not hold for CMCs. However, we also find that energy consumption significantly increases environmental degradation for all indicators and across the observed quantiles. The effects of economic growth and urbanization on the environment were mixed for the different indicators and across quantiles. We recommend that it is pertinent for CMCs to limit their “dirty” energy sources and substitute them with renewables to promote environmental sustainability.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Driven by economic globalization and trade liberalization, the inflows of foreign direct investment (FDI) to emerging countries have enormously risen in the last 50 years. According to UNCTAD (2019), FDI to emerging economies have increased from 28.4% in 1970 to 46.9% in 2017 relative to the world’s FDI. Economic theories such as the life cycle hypothesis (Vernon 1966), the internationalization theory (Buckely and Casson 1976), and the theory of technology diffusion (World Bank 1993) explains that the rationale for FDIs include factors such as market size expansion, exchange rate differentials, human capital, and technological transfer, among others. For example, it is widely believed that FDIs represent one of the instruments for mitigating the global pressures for the increase in energy demand as it allows for technological transfer between countries for sustainable production.

Despite the motivation for FDIs, there have also been concerns about their environmental impacts. Scholars have theorized that multinational companies (MNCs) in industrialized countries are more inclined to outsource “dirty” industries to emerging countries with more relaxed environmental regulations to take advantage of the absence of/low negative externality costs. This phenomenon is referred to as the pollution haven hypothesis (PHH). Several studies have been motivated by the PHH. Most of the initial studies on the hypothesis focused on establishing whether environmental regulation is a precursor for FDI flows (Xie et al. 2017; Shen et al. 2017; Cai et al. 2016). Over time, these studies were critiqued as they could not directly explain the surge in air pollution.

Consequently, new sets of studies have emerged to explain the relationship between FDI flows and carbon dioxide emissions (Sarkodie and Strezov 2019; Chang and Li 2019; Shao et al. 2019; Koçak and Şarkgüneşi 2018; Liu and Kim 2018; Solarin and Al-Mulali 2018; Abdouli and Hammami 2018; Solarin et al. 2017; Sun et al. 2017). The results of these studies have been mixed ranging from cases of no relationship to positive or negative uni/bi-directional relationships running from FDI to carbon dioxide emissions and vice versa.

The objective of this study is to ascertain whether FDI inflows can be associated with environmental degradation in coastal Mediterranean countries (CMCs). A positive relationship between FDI inflows and environmental degradation raises the question of whether CMCs are acting as pollution havens for MNCs. Conversely, a negative relationship could indicate that FDI encourages technological transfer for sustainable development. The focus on CMCs is predicated on the technology diffusion theory, which suggests that recipient countries need to attain a certain threshold level of development to stimulate a successful diffusion. In line with this, developed countries would have surpassed such as the threshold for the diffusion to be successful. On the other hand, least developed countries (LDCs) are not positioned to have attained the level of industrialization needed to attract FDIs sufficient to galvanize the technological diffusion (Cole and Elliott 2005). Thus, CMCs are suitable for this study because they exist in between the spectrum of LDCs and developed countries. As middle-income countries, most CMCs are experiencing rapid growth and accounts for a significant proportion of global consumption of energy. Their level of energy consumption is partly a consequence of FDI inflows, which serves as a catalyst for productivity, increase in per capita income, and advancements in overall economic growth and development. Based on the foregoing, this study attempts to shed light on the PHH. It uses panel data of ten CMCs to address the following hypotheses:

-

Hypothesis 1 (H1): Foreign direct investment would reduce environmental degradation in CMCs.

-

Hypothesis 2 (H2): Energy consumption would reduce environmental degradation in CMCs.

In addressing these hypotheses, some of the gaps that this study intends to fill are as follows: (i) this study employs different indicators for measuring environmental degradation such as carbon dioxide emissions, carbon footprint, and ecological footprint (EFP). These variables will allow for some form of robustness check for the different pathways through which FDI impacts on environmental degradation; (ii) the selected countries for this study were strategic; the CMCs consist mostly of emerging economies that must have attained a significant level of industrialization. This makes it suitable for technology diffusion to successfully occur; (iii) the study employs the STIRPAT framework with the advantages of the quantile regression (QR) for analyzing the effects of human activities on the environment with an emphasis on population, affluence, and technology (Shi 2003; York et al. 2003; DeHart and Soule 2000; Cramer 1998; Soulé and DeHart 1998; Dietz and Rosa 1997). The QR model is suitable for this study because of the nature of the relationship between environmental degradation and FDI, which can be non-linear as a result the haven or halo effects. This econometric approach addresses the violation of the conditional mean assumption of the linear regression and controls for heterogeneous effects (Graham et al. 2015; Abrevaya 2001; Chamberlain 1984).

The results of this research will be useful in different ways. Firstly, it will be relevant to academics and researchers because it will improve their understanding of how the PHH applies to middle-income countries. Additionally, this research can be useful to policy-makers in CMCs in designing policies that can attract or protect their economies from foreign investments based on the nature of the relationship that exists between FDIs and environmental degradation.

The rest of this paper is organized as follows. “Literature review” focuses on the literature review and “Methodology, model, and data” introduces the panel QR within the STIRPAT framework, the data, and its sources. “Results and discussion of findings” focuses on data analysis and presentation, and the discussion of the empirical results. “Conclusion and policy direction” entails the conclusion of the study.

Literature review

The foremost hypothesis that describes the relationship between FDI and environmental degradation is the PHH. The hypothesis proposes that MNCs are compelled to relocate their heavy or dirty industries to countries with more permissive environmental regulations in order to avoid incurring the regulatory compliance costs in their home country (Zhang and Zhou 2016). Copeland and Taylor (1994) posit that the motivation to geographically shift pollution outputs to emerging countries springs from the need to lower both environmental and financial cost in developed countries. At the same time, emerging countries are compelled to undercut one another by lowering their environmental regulation stringency in order to attract FDIs. The culmination of these scenarios will lead to a “race to the bottom” among developing countries with more relaxed regulations. This will result in an enormous increase in the environmental pollution in the countries that lack stringent environmental regulation.

Grossman and Krueger (1991) identified three channels that define how FDI impacts on pollution such as the scale effect. If the scale effect and the composition effect outweigh the technique effect, it infers the pollution haven hypothesis (PHH). The converse of the PHH is the pollution halo hypothesis, where the technique effect and the composition effect overwhelm the scale effect. The scale effect suggests that an increase in FDI stimulates economic growth but leads to negative effects on the environment. The second phenomenon is the composition effect, which emphasizes the pathway through which FDI influences the composition of industries and leaves the possibilities of increasing the polluting or less-polluting sectors. Grossman and Krueger (1991) posit that this mechanism can lead to either positive or negative environmental impacts. The third mechanism is the technique effect, which suggests that FDI may lead to technological transfers that reduce pollution as well as positive spillover to local firms.

If the scale and composition effect outweigh the technique effect, we refer to this as a pollution haven effect. The converse of the PHH is the pollution halo hypothesis, where the technique effect and the composition effect overwhelm the scale effect. The halo effect proposes that FDI will mitigate environmental degradation in the host country. This is achieved when MNCs transfer their greener technology to emerging economies through FDI in line with the theory of technology diffusion. One of the motivations for this is that MNCs might signal inefficient production processes and can culminate into a loss of goodwill, reputation, and business in the long term.

Empirical literature

There is growing empirical evidence on the relationship between FDI and environmental degradation. Most studies that reveal that FDIs are attracted by countries with lax environmental regulations imply the PHH. On the other hand, if these FDIs promote the use of clean technologies to the extent that domestic industries try to replicate these clean technologies, the outcome will tend towards the pollution halo hypothesis. Considering the possible pathways through which FDI might impact carbon dioxide emission, the relationship between these two variables is not very clear. One of the reasons for this lack of clarity is the identification issue regarding environmental degradation. Therefore, this study expands the definition of environmental degradation to include carbon dioxide emission, carbon footprint, and EFP. The empirical literature shall be discussed in the context of these themes and limited to very recent studies with a focus on their areas of agreement and disagreement.

FDI and carbon dioxide emission

There are numerous studies that support the existence of the PHH (Solarin et al. 2017; Sun et al. 2017; Abdouli and Hammami 2018; Koçak and Şarkgüneşi 2018; Chang and Li 2019; Sarkodie and Strezov 2019). However, beyond implying the PHH, some of these studies attempted to tease out pathways through which these FDIs can be sustained in an environmentally friendly manner. These were mostly based on other control factors that were used in these studies. The study by Solarin et al. (Solarin et al. 2017) was carried out to validate the PHH in Ghana. They employed the ARDL methodology using data for the period of 1980–2012 and suggested that strong institutional can help to curtail the adverse effect of FDI on the environment.

Abdouli and Hammami (2018) understudied the relationship between FDI, economic growth, and environmental degradation in the Middle and North African countries (MENA). A generalized method of moment (GMM) approach was applied to a dynamic simultaneous equation model for data, which ranged between 1990 and 2012. The results revealed a unidirectional causality that ran from FDI inflows to carbon dioxide emission; thus, one of the findings was that emerging countries should impose environmental quality policies on FDIs which can help the countries in question avoid pollution haven traps.

Kocak and Sarkgunesi (Koçak and Şarkgüneşi 2018) carried out a study on the effect of FDI on carbon dioxide emissions in Turkey using data ranging from 1974 to 2013, the bootstrap causality test, and structural cointegration test. Findings from the study reveal a bidirectional causality between FDI and carbon dioxide and suggest that the PHH is valid in Turkey. Similarly, the study by Sun et al. (Sun et al. 2017) applied the ARDL approach to examine the PHH in China. The data used covered the period 1980–2012 and results revealed that the PHH exists in China. Generally, the studies by Kocak and Sarkgunesi (Koçak and Şarkgüneşi 2018) and Sun et al. (Sun et al. 2017) suggests that emerging countries should accommodate FDIs that are only targeted towards technologically intensive, service industry or environmentally friendly areas.

Unlike the studies highlighted above, the paper by Chang and Li (2019) focused more on population thresholds (least, moderate, and very populated regimes) in their study where they examined the effects of FDI on carbon emissions. Their study revealed where they attempted to and shows that carbon dioxide emission declines significantly with increasing FDI in the least populated regime—their suggestions was that the PHH can better be managed in countries with small population. To the best of our knowledge, the only study that refutes the haven effect hypothesis is by Shao et al. (Shao et al. 2019). This study was aimed at ascertaining the PHH for two country groups employing the panel error correction model (VECM) and panel cointegration test for BRICS (Brazil, China, India, China, and South Africa) and MINT (Mexico, Indonesia, Nigeria, and Turkey) countries. Data for the study spanned between 1982 and 2014 and the findings support the existence of the halo effect hypothesis in these country groups; thus, the study suggests more FDIs for these economies.

FDI and carbon/ecological footprint

Unlike carbon dioxide emission, the relationship between FDI, carbon footprint, and EFP for emerging countries has been captured by limited empirical literature in recent times. Most of them support the PHH. The study by Solarin and Al-Mulali (2018) was extended to capture carbon footprint and EFP beyond carbon dioxide emission as proxies for environmental degradation. The results reveal the existence of the PHH (for emerging economies) and pollution halo effect (for developed economies) using carbon dioxide emission, carbon footprint, and EFP as proxies for environmental degradation.

Liu and Kim (2018) understudied 44 countries that are affiliated with the Belt & Road Initiative (BRI). They employed the panel vector autoregression model with data ranging from 1990 to 2016. The result of their study revealed a bidirectional relationship between FDI and EFP after accounting for weight values into the PVAR estimation. Still, on BRI countries, Baloch et al. (2019) conducted a study on the effect of financial development on the EFP for 59 countries. The Driscoll-Kraay panel regression model was employed for the study and the data spanned between 1990 and 2016. FDI was used as one of the regressors; the result revealed that FDI causes increases in EFP. The study suggested that carbon pricing should be employed for firms that rely on outdated technology or any form of dirty production process. It also suggested that incentives be given to industries that promote clean production.

Fakher (2019) examined the determinants of environmental quality for OPEC countries using 22 regressors for EFP, which were ranked by the Bayesian model averaging and weighted averaging least squares. The data used by this study ranges between 1996 and 2016. FDI was employed as one of the explanatory variables and findings from the study revealed that FDI leads to environmental degradation. The study suggested that emerging countries should be encouraged by FDI that emphasize environment-friendly technologies and pollution control in the industrial sector. Sabir and Gorus (2019) investigated the effects of globalization and technological changes on the EFP in South Asian countries. The study employed the panel ARDL model. The result revealed that FDI has a significant effect on EFP and recommended a shift to renewable energy sources in order to mitigate greenhouse effects and promote environmental preservation.

Energy consumption and ecological footprint

Since its introduction in the 1990s, EFP is used as an indicator in determining sustainable development as it facilitates the understanding of human demand on biological resources by highlighting the components of impact in terms of land (or sea) area (Hubacek et al. 2009). A plethora of studies have used EFP to measure environmental degradation (Bello et al. 2018; Wang and Dong 2019; Dogan et al. 2019; Hassan et al. 2019; Alola et al. 2019). These studies concluded that EFP is far superior to CO2 emissions. Nathaniel et al. (Nathaniel 2019) explored the effects of energy consumption on EFP in South Africa while controlling for urbanization, financial development, and economic growth. Findings revealed that growth, energy use, and financial development contribute to environmental degradation.

Ahmed and Wang (2019) investigated the impact of human capital and energy consumption on EFP in India from 1971 to 2014. They discovered that human capital reduces environmental degradation, while energy consumption drives EFP. Destek and Sinha (2020) explored the impact of trade, energy consumption, and GDP on EFP in 24 OECD countries from 1980 to 2014. From their findings, renewable energy reduces EFP while non-renewable energy increases EFP thereby adding to environmental degradation. A similar result was discovered by Wang and Dong (2019) for 14 sub-Saharan Africa, Destek and Sarkodie (2019) and Danish and Wang (Danish,, and Wang, Z. 2019) for 11 newly industrialized countries, Mikayilov et al. (Mikayilov et al. 2019) for Azerbaijan, Ahmed et al. (Ahmed et al. 2019) and He et al. (He et al. 2019) for Malaysia, Zafar et al. (Zafar et al. 2019) for the USA, Fakher (2019) for OPEC countries, and Sarkodie (2018) for 17 African countries.

Methodology, model, and data

Methodology

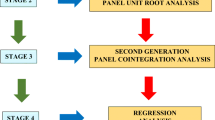

Cross-sectional dependence test

The section proceeds with the cross-sectional dependence (CD) tests. This test is necessary because it gives direction to the right estimation technique(s) to employ. The results of the CD tests help to ascertain whether to apply first-generation or second-generation panel data econometric procedures. If the CD is not considered, the estimators will be bias, inconsistent, and meaningless (Dong et al. 2018). The study adopts three CD tests which include the Breusch-Pagan (BG) Lagrangian Multiplier (LM) test, the Pesaran CD test, and the Pesaran scaled LM test for robustness purpose. We, however, give more relevance to the BG LM test and the Pesaran scaled LM test due to the nature of our dataset where the number of time periods (T) is greater than the number of cross-sections (N). The equation for the CD test is given in Eq. 1 as:

From Eq. (1), \( \overline{\hat{\rho}}=\left[\frac{2}{N\left(N-1\right)}\right]{\sum}_{i=1}^{N-1}\ {\sum}_{j=i+1}^N\hat{\rho_{ij}}, \) where \( \hat{\rho_{ij}} \) is the pair-wise cross-sectional correlation coefficients of residuals from the ADF regression. T and N represent the sample and panel size respectively.

Panel unit root test

The presence of CD makes the first-generation unit root tests (e.g., Im et al., 2003) inefficient. This will warrant the use of a second-generation unit root test (CIPS) to make up for the inefficiency of the former. In line with Pesaran (2007), the unit root equation is specified as:

where φit, xit, ∆, T, and εit represent the intercept, study variables, difference operator, time span, and disturbance term respectively. In the vicinity of first difference stationary variables, second-generation cointegration test would be applied. This is in order to ascertain if the variables to be examined have a long-run equilibrium relationship.

Panel cointegration test

The study relied on the Westerlund (2007) test to gain information about evidence of cointegration among the variables. The error correction form of the test is given as:

where δt = (δi1, δi2)′, dt = (1, t)′, and ϕ are the vector of parameters, deterministic components, and the error correction parameter respectively. Four tests were developed to examine the presence of cointegration. These four tests were based on the OLS estimation of ϕi in Eq. 3. Two of these four tests are the group mean statistics given as:

\( {G}_{\tau }=\frac{1}{N}{\sum}_{i=1}^N\frac{\hat{\alpha_i}\ }{SE\Big(\hat{\alpha_i\Big)}} \) and \( {G}_{\alpha }=\frac{1}{N}{\sum}_{i=1}^N\frac{T\ \hat{\alpha_i}\ }{\hat{\alpha_i}(1)} \)

The standard error of \( \hat{\alpha_i} \)is represented by \( SE\Big(\hat{\alpha_i\Big)} \). The semiparametric kernel estimator of \( {\alpha}_i(1)\kern0.5em is\kern0.5em \hat{\alpha_i}(1) \). The remaining two tests are the panel mean tests which suggest that the whole panel is cointegrated. They are given as follows:

\( {P}_{\tau }=\frac{\hat{\alpha_i}\ }{SE\Big(\hat{\alpha_i\Big)}} \) and \( {P}_{\alpha }=T\hat{\alpha} \)

OLS and quantile regression

The study employs the OLS and the QR procedure. The presence of cointegration makes it econometrically reasonable to estimate a long-run relationship using the OLS. However, we employ the OLS with the Driscoll and Kraay (1998) standard errors. This procedure enables us to account for (1) heteroskedasticity, (2) serial correlation, and (3) cross-sectional dependence. The QR was, however, the favored estimation technique because it is superior to the OLS on various grounds. The normal distribution and zero mean assumption of the error term associated with the OLS is so unreal since socioeconomic indicators could have various distribution patterns (De Silva et al. 2016). The QR ameliorates for this deficiency (Salman et al. 2019). The technique (QR) makes no assumption as regards the presence of moment function (Zhu et al. 2016a, 2016b). It estimates are still robust in the presence of outliers (Bera et al. 2016). No distributional assumptions are considered (Sherwood and Wang 2016). The QR model is given as:

x is the exogenous variable, while y is the endogenous variable. The distribution point of the explained variable and the disturbance term are θth and μ respectively. To be specific, we employ the conditional quantile regression which examines the influence of the regressors to be employed in our econometric model based on initial values of the dependent variable. The studies that have adopted the QR technique in the past include Zhu et al. (Zhu et al. 2016a), Hammoudeh et al. (2014), Hübler (2017), and Xu and Lin (2018).

Model

This study built on the STIRPAT framework. The STIRPAT model stipulates that environmental degradation is both a function of economic and demographic factors.

From Eq. 5, I is an indicator of environmental degradation, P, A, and T stand for population, affluence, and technology respectively. φ1 − φ3 and μ are the parameter estimates and the error term respectively. T can be decomposed depending on the researcher’s interest (Bello et al. 2018; Anser 2019). Following the studies of Solarin and Al-Mulali (2018), as earlier mentioned, I, in this study, is captured by three environmental indicators. On the other hand, P and A are captured by urbanization and economic growth respectively. We use FDI and energy consumption to proxy T. Thus, the expanded model is specified as:

The model is further linearized by taking the logarithm of each of the variables.

The lower-case letters urb, gdp, fdi, and eus represent urbanization, economic growth, foreign direct investment, and energy consumption. I captures the three environmental indicators. Therefore, to capture the effects of urb, gdp, fdi, and eus on I at the selected quantile level, we put forward Eqs. (8) to (10).

While the other variables retained their initial definition, efp, cfp, and co2 represent total ecological footprint, ecological footprint per capita, and carbon footprint respectively. The distributional point for the explanatory variables is τ. Qτ denotes the regression parameters of the τth distributional point, which can be computed using the formulae in Eq. (11)

q, T, N, and \( {\mathcal{w}}_{it} \) stand for the number of quantiles, years, cross-sections, and weight of the ith country in the tth year respectively. The study considered ten (10) CMCs. The data for the study started in 1980 and ended in 2016. The time period was sorely based on data availability (Table 1).

Results and discussion of findings

This section proceeds with the trend of selected variables in the selected CMCs countries.

Figure 1 revealed an increase in the consumption of non-renewable energy in Algeria, Morocco, Tunisia, and Turkey. Though more of this energy is consumed in France, Spain, and Israel, its consumption is rather dwindling than increasing.

Energy use by country from 1990 to 2016. Source: author’s computation from WDI (2019)

From Fig. 2, the urban population has witnessed persistent growth in almost all the countries sampled, but it is observed to be relatively constant in Egypt. Israel remains the most urbanized, while Egypt is the least urbanized of all the countries.

Urban population (percentage of total population) from 1990 to 2016. Source: author’s computation from WDI (2019)

From Fig. 3, Cyprus, France, Greece, Israel, and Spain have the highest GDP in the region, while Tunisia, Algeria, Egypt, and Morocco are the countries with low GDP. GDP has grown dramatically over the last few decades in France.

Gross domestic product by country from 1990 to 2016. Source: author’s computation from WDI (2019)

Figure 4 revealed that FDI flows into these countries are meager especially in Algeria, Turkey, Greece, and Morocco. However, Cyprus has received more FDI inflows than any other country in the region.

FDI by country from 1990 to 2016. Source: author’s computation from WDI (2019)

From Figure 5, CO2 emissions are persistently increasing in Turkey, Morocco, and Tunisia. However, this is not the case in France, Israel, Cyprus, Greece, and Spain where CO2 emissions have been declining over time.

Carbon emissions by country from 1990 to 2016. Source: author’s computation from WDI (2019)

From Table 2, the distribution of the variables is skewed, and the kurtosis values suggest that the seven series distributions are more concentrated than the normal distribution. Also, the Jarque-Bera tests reject the null hypotheses of normality.

Table 3 provides evidence of CD in the constructs. With this evidence, the study proceeds with estimation techniques that are robust amidst CD.

Table 4 presents the unit root tests results. The results obtained from Im et al. (Im et al. 2003) confirmed that, at first difference, all the variables are stationary. The same result was observed from the CIPS unit root test, a second-generation test that is robust to serial correlation and CD.

Table 5 presents the Westerlund (2007) cointegration test. The test confirms the presence of cointegration among the variables in the three models. With these results, we can proceed with the OLS and QR estimation. However, our discussion will be based on the QR estimates.

Firstly, we analyze the impact of FDI, energy consumption, and urbanization on environmental degradation with ecological footprint as the dependent variable (our measure for environmental degradation). It should be noted that model 1, where the ecological footprint is the dependent variable, is the focus of the current study since the ecological footprint is a more comprehensive proxy of environmental degradation.

The empirical results revealed that the impact of energy consumption on environmental degradation is positive but decreases as environmental degradation increases. This means that the impact of energy consumption on environmental degradation is high for countries where initial levels of environmental degradation are low and lower for countries where the initial levels of environmental degradation are high. This result generally points to an overreliance on non-renewable energy (non-RE) sources (especially fossil fuels) in CMCs. Non-RE are high in greenhouse gas emissions (Dogan and Ozturk 2017; Nathaniel et al. 2020c; Dogan and Seker 2016; Nathaniel and Iheonu 2019; Nathaniel et al. 2019), thereby leading to environmental deterioration (Dogan and Turkekul 2016; Nathaniel and Bekun 2019). This finding is also supported by Zhang et al. (Zhang et al. 2019) for BRICS, Gorus and Aslan (2019) and Gorus and Aydin (2019) for MENA, Ssali et al. (Ssali et al. 2019) for sub-Saharan Africa, and Sinha et al. (Sinha et al. 2019) and Nathaniel et al. (2020b) for CIVETS, Destek and Sarkodie (2019) for N-11 countries, and Nathaniel (2020) for Indonesia.

Countries in this region are growing at the expense of their environment. This finding is supported by Zrelli (2017) which suggests that non-RE contributes more to economic growth in CMCs than renewable energy. This was also the case in the study by Belaid and Zrelli (2019), which focused on nine CMCs. Generally, all economies desire energy consumption to grow. However, for such growth to be sustainable, the energy source has to be ‘clean.’ Examples of such clean energy sources include solar, wind, geothermal, tide, and hydropower. The use of these energy sources, which are mostly renewables, will not only promote environmental sustainable without hurting growth but also put the countries on track towards achieving the SDGs objectives by 2030.

Further findings suggest that FDI has a negative impact on environmental degradation, indicating that increase in FDIs is associated with an increase in environmental quality across all the different quantiles. FDI is not harmful to the environment in CMCs, suggesting the pollution halo hypothesis, and not the pollution haven hypothesis. However, this negative impact is more pronounced, based on the coefficients, for countries where initial levels of environmental degradation are high and less pronounced for countries where the initial levels of environmental degradation are low. This result also applied to energy consumption, GDP, and urbanization; thus, the influence of all the variables on the EFP is clearly homogeneous. These findings contradict those of Khan and Bin (2019) for 65 Belt and Road Initiative (BRI) countries, Solarin and Al-Mulali (2018) for 20 countries, Fakher (2019) for OPEC, Zafar et al. (2019) for the USA, Sabir and Gorus (2019) for South Asian countries, and Baloch et al. (Baloch et al. 2019) for 59 BRI countries. These discrepancies could be as a result of the estimation techniques and the region considered by each of the studies.

Economic growth negatively affects environmental degradation better in countries where the initial levels of environmental degradation are at their lowest. However, economic growth increases environmental degradation in countries where the initial levels of environmental degradation are high. Urbanization, on the other hand, is seen to negatively affect environmental degradation across the observed quantiles. The negative effect of urbanization is observed to be at the median (that is, the 50th quantile).

As the CMCs become more urbanized, the lesser their level of environmental degradation. This suggests that urbanization is not particularly harmful to the environment. This complements the earlier studies like those of Danish et al. (Danish 2020) for BRICS, but contradicts those of Nathaniel et al. (Nathaniel et al. 2020a), He et al. (He et al. 2019), Danish and Wang (Wang and Dong 2019), Ahmed and Wang (2019), Mikayilov et al. (Mikayilov et al. 2019), Nathaniel et al. (Nathaniel et al. 2019), Baloch et al. (Baloch et al. 2019), Wang and Dong (2019), and Solarin and Al-Mulali (2018) for MENA, Malaysia, N-11 countries, India, Azerbaijan, South Africa, 59 BRI, 14 SSA countries, and 20 countries respectively. The aforementioned studies adopted the OLS techniques which neither considered the CMCs nor the impact of urbanization on the environment at different quantiles.

The study proceeds to analyze the impact of FDI, energy consumption, and urbanization on environmental degradation when carbon footprints act as the measure of environmental degradation. The result revealed that energy use has a positive and significant influence on environmental degradation across the observed quantiles. However, the positive impact of energy consumption on environmental degradation is more pronounced in countries where the initial levels of environmental degradation are low i.e. the 10th and 25th quantiles.

On the other hand, FDI has a positive but insignificant influence on environmental degradation in the 10th quantile. Across the other quantiles, FDI has a negative impact on environmental degradation with statistical significance revealed in the 75th and 90th quantiles. However, model 2 is not the focus of the current study, and the results of the primary model with a more comprehensive proxy of environmental degradation do not support any outcome. Economic growth is likewise revealed to have a positive and statistically significant impact on environmental degradation across the quantiles. The impact of economic growth is an increasing function of environmental degradation. On the other hand, urbanization has an insignificant impact on environmental degradation across the quantiles.

Finally, we examine the impact of FDI, energy consumption, and urbanization on environmental degradation when CO2 emissions act as a proxy for environmental degradation. Studies like (Barros et al. 2016; Gil-Alana et al. 2016) have shown that CO2 emissions are a negative environmental indicator. From the results, energy consumption has a positive and significant impact on environmental degradation across the observed quantiles. However, the positive impact is more pronounced in countries where the initial level of environmental degradation is higher, that is, from the 50th quantile and above, compared with the countries where the initial level of environmental degradation is lower. FDI positively and significantly influences environmental degradation in countries where the initial levels of environmental degradation are at their lowest levels. GDP is observed to positively and significantly influence environmental degradation across the observed quantiles with its impact more prominent in the median i.e. the 50th quantile.

In conclusion, urbanization is seen to positively and significantly influence environmental degradation in countries where the initial levels of environmental degradation are at their lowest point i.e. 10th quantile as well as in countries where the initial levels of environmental degradation are at their highest points i.e. the 75th and 90th quantiles.

Robustness analysis

The study employs the quantile process plots to validate the empirical findings of the study using graphical procedures. It can be revealed from the plots that the quantile regression result presented in Table 6 is similar to the findings in Figs. 6, 7, and 8.

Conclusion and policy direction

This study investigated the link between energy consumption, urbanization, FDI, economic growth, and environmental indicators (ecological footprint, carbon footprint, and CO2 emissions) in ten (10) CMCs. The data for the study started in 1980 and ended in 2016. The study addressed a gap in the literature by applying the second-generation panel estimation techniques, which controls for heterogeneity and conditional dependence. The panel regression results generally reveal that FDI promotes environmental quality in CMCs. However, energy consumption significantly increases environmental degradation while economic growth and urbanization lead to mixed results for the different representation of environmental degradation.

Given that the non-renewable energy sources underlie environmental deterioration, it is pertinent for CMCs (especially those in the southern Mediterranean) to limit their “dirty” energy sources and substitute them with renewables to promote environmental sustainability. Countries in the southern Mediterranean can take a cue from their counterpart in the northern shore of the Mediterranean. Establishing environmental regulatory standards that incentivize the use of renewable energy sources’ technologies will serve as a useful policy tool. Other policy tools that CMCs can adopt include providing tax rebates, interest rate holidays, and other forms of subsidies for economic agents that adopt or engage in greener technologies.

Despite the seemingly harmless relationship between FDI and the environment, policy-makers have to incentivize the use of clean production processes by foreign firms in order to stimulate the technique effect, which can complement the composite effect in order to ensure that the scale effects are avoided. This will entail creating and enforcing strict environmental laws for the inflow of FDI to avoid negative outcomes like economic dumping. The imposition of dumping duties for an example will discourage the importation of hazardous goods that could harm the environment and encourage the direction of FDI to the non-polluting sectors of the economy. These countries can also encourage environmentally friendly investments through better sustainable human capital and infrastructural development. Urbanization is an offshoot of discrepancies in development factors ranging from household income, basic amenities, infrastructural provision, etc. To curb the adverse effect of urbanization on the environment, there is a need for an aggressive investment in rural infrastructures and human capital formation. This will help with the emergence of smart cities, which emphasizes sustainability, innovation, and efficiency in the use of energy for housing, transportation, production, and other economic activities.

This study suffered from data availability; as a result, some determinants of the CO2 emissions, carbon footprint, and EF were not added to the estimated models. Future researchers could leverage on this. Also, the study can be extended to other countries in Africa, and other regions in the world.

References

Abdouli M, Hammami S (2018) The dynamic links between environmental quality, foreign direct investment, and economic growth in the Middle Eastern and North African countries (MENA Region). J Knowl Econ 9(3):833–853

Abrevaya J (2001) Nonparametric Econometrics. Econ J 111(472)471–471

Ahmed Z, Wang Z (2019) Investigating the impact of human capital on the ecological footprint in India: an empirical analysis. Environ Sci Pollut Res 26(26):26782–26796

Ahmed Z, Wang Z, Mahmood F, Hafeez M, Ali N (2019) Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environ Sci Pollut Res:1–18

Alola AA, Bekun FV, Sarkodie SA (2019) Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci Total Environ 685:702–709

Anser MK (2019) Impact of energy consumption and human activities on carbon emissions in Pakistan: application of STIRPAT model. Environ Sci Pollut Res 26(13):13453–13463

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26(6):6199–6208

Belaid F, Zrelli MH (2019) Renewable and non-renewable electricity consumption, environmental degradation and economic development: evidence from Mediterranean countries. Energy Policy 133:110929

Bello MO, Solarin SA, Yen YY (2018) The impact of electricity consumption on CO2 emission, carbon footprint, water footprint and ecological footprint: the role of hydropower in an emerging economy. J Environ Manag 219:218–230

Bera AK, Galvao AF, Montes-Rojas GV, Park SY (2016) Asymmetric laplace regression: maximum likelihood, maximum entropy and quantile regression. Journal of Econometric Methods 5(1):79–101

Buckely PJ, Casson M (1976) The future of multinational experience. Homes and Meier Publishers, New York

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85

Chamberlain, G. (1984). Panel Data. Handbook of Economics, 2; 1274 – 1318. Amsterdam: North Holland.

Chang SC, Li M-H (2019) Impacts of foreign direct investment and economic development on carbon dioxide emissions across different population regimes. Environ Resour Econ 72(2):583–607

Cole MA, Elliott RJ (2005) FDI and the capital intensity of “dirty” sectors: a missing piece of the pollution haven puzzle. Rev Dev Econ 9(4):530–548

Copeland BR, Taylor MS (1994) North-south trade and the environment. Q J Econ 109(3):755–787

Cramer JC (1998) Population growth and air quality in California. Demography 35(1)45–56

Danish Ulucak R, Khan SU (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc 101996

Danish, & Wang, Z. (2019) Investigation of the ecological footprint’s driving factors: what we learn from the experience of emerging economies. Sustain Cities Soc 49

De Silva PNK, Simons SJR, Stevens P (2016) Economic impact analysis of natural gas development and the policy implications. Energy Policy 88:639–651

DeHart JL, Soule PT (2000) Does I=PAT work in local place? Prof Geogr 52(91):1–10

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic Co-operation and development countries. J Clean Prod 242:118537

Dietz T, Rosa EA (1997) Effects of population and affluence on CO2 emissions. Proceedings of the National Academy of Science of the USA 94:–175, 179

Dogan E, Ozturk I (2017) The influence of renewable and non-renewable energy consumption and real income on CO 2 emissions in the USA: evidence from structural break tests. Environ Sci Pollut Res 24(11):10846–10854

Dogan E, Seker F (2016) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energy 94:429–439

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Dogan, E., Taspinar, N., & Gokmenoglu, K. K. (2019). Determinants of ecological footprint in MINT countries. Energy & Environment, 0958305X19834279.

Dong K, Sun R, Li H, Liao H (2018) Does natural gas consumption mitigate CO 2 emissions: testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew Sust Energ Rev 94:419–429

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80(4):549–560

Fakher HA (2019) Investigating the determinant factors of environmental quality (based on ecological carbon footprint index). Environ Sci Pollut Res 26(10):10276–10291

Global Footprint Network (2019). Global Footprint Network. https://www.footprintnetwork.org/our-work/ecological-footprint/(2019), Accessed 1st May 2019.

Gorus MS, Aslan M (2019) Impacts of economic indicators on environmental degradation: evidence from MENA countries. Renew Sust Energ Rev 103:259–268

Gorus MS, Aydin M (2019) The relationship between energy consumption, economic growth, and CO2 emission in MENA countries: Causality analysis in the frequency domain. Energy 168:815–822

Graham, B.S., J. Hahn, A. Poirier & J.L. Powell (2015). Quantile regression with panel data. National Bureau of Economic Research (NBER) Working Paper, No. 21034, Cambridge: Massachusetts.

Grossman, G.M. & A.B. Krueger (1991). Environmental impact of a North American Free Trade Agreement, National Bureau of Economic Research (NBER) Working Paper No. 3914, Cambridge: Massachusetts.

Hammoudeh S, Nguyen DK, Sousa RM (2014) Energy prices and CO2 emission allowance prices: a quantile regression approach. Energy Policy 70:201–206

Hassan ST, Xia E, Khan NH, Shah SMA (2019) Economic growth, natural resources, and ecological footprints: evidence from Pakistan. Environ Sci Pollut Res 26(3):2929–2938

He FS, Gan GGG, Al-Mulali U, Solarin SA (2019) The influences of economic indicators on environmental pollution in Malaysia. Int J Energy Econ Policy 9(2):123–131

Hubacek K, Guan D, Barrett J, Wiedmann T (2009) Environmental implications of urbanization and lifestyle change in China: ecological and water footprints. J Clean Prod 17(14):1241–1248

Hübler M (2017) The inequality-emissions nexus in the context of trade and development: a quantile regression approach. Ecol Econ 134:174–185

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74

Khan Y, Bin Q (2019) The environmental Kuznets curve for carbon dioxide emissions and trade on belt and road initiative countries: A spatial panel data approach. The Singapore Economic Review 1–28

Koçak E, Şarkgüneşi A (2018) The impact of foreign direct investment on CO2 emissions in Turkey: new evidence from cointegration and bootstrap causality analysis. Environ Sci Pollut Res 25(1):790–804

Liu H, Kim H (2018) Ecological footprint, foreign direct investment, and gross domestic production: evidence of Belt & Road Initiative countries. Sustainability 10(10):1–28

Mikayilov JI, Mukhtarov S, Mammadov J, Azizov M (2019) Re-evaluating the environmental impacts of tourism: does EKC exist? Environ Sci Pollut Res:1–14

Nathaniel SP (2019) Modelling urbanization, trade flow, economic growth and energy consumption with regards to the environment in Nigeria. GeoJournal:1–15

Nathaniel SP (2020) Ecological footprint, energy use, trade, and urbanization linkage in Indonesia. GeoJournal:1–14

Nathaniel, S. P., & Bekun, F. V. (2019). Environmental management amidst energy use, urbanization, trade openness, and deforestation: the Nigerian experience. Journal of Public Affairs, e2037.

Nathaniel SP, Iheonu CO (2019) Carbon dioxide abatement in Africa: the role of renewable and non-renewable energy consumption. Sci Total Environ 679:337–345

Nathaniel S, Nwodo O, Adediran A, Sharma G, Shah M, Adeleye N (2019) Ecological footprint, urbanization, and energy consumption in South Africa: including the excluded. Environ Sci Pollut Res:1–12

Nathaniel S, Anyanwu O, Shah M (2020a) Renewable energy, urbanization, and ecological footprint in the Middle East and North Africa region. Environ Sci Pollut Res:1–13

Nathaniel S, Nwodo O, Sharma G, Shah M (2020b) Renewable energy, urbanization, and ecological footprint linkage in CIVETS. Environ Sci Pollut Res:1–14

Nathaniel, S., Barua, S., Hussain, H., & Adeleye, N. (2020c). The determinants and interrelationship of carbon emissions and economic growth in African economies: fresh insights from static and dynamic models. Journal of Public Affairs, e2141.

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Sabir S, Gorus MS (2019) The impact of globalization on ecological footprint: empirical evidence from the South Asian countries. Environ Sci Pollut Res 26(32):33387–33398

Salman M, Long X, Dauda L, Mensah CN, Muhammad S (2019) Different impacts of export and import on carbon emissions across 7 ASEAN countries: a panel quantile regression approach. Sci Total Environ 686:1019–1029

Sarkodie SA (2018) The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ Sci Pollut Res 25(22):21993–22022

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Shao Q, Wang X, Zhou Q, Balogh L (2019) Pollution haven hypothesis revisited: a comparison of the BRICS and MINT countries based on VECM approach. J Clean Prod 227:724–738

Shen J, Wei YD, Yang Z (2017) The impact of environmental regulations on the location of pollution-intensive industries in China. J Clean Prod 148:785–794

Sherwood B, Wang L (2016) Partially linear additive quantile regression in ultra-high dimension. Ann Stat 44(1):288–317

Shi A (2003) The impact of population pressure on global carbon dioxide emissions, 1975/1996: evidence from pooled cross-country data. Ecol Econ 44(1):24–42

Sinha A, Gupta M, Shahbaz M, Sengupta T (2019) Impact of corruption in public sector on environmental quality: implications for sustainability in BRICS and next 11 countries. J Clean Prod

Solarin SA, Al-Mulali U (2018) Influence of foreign direct investment on indicators of environmental degradation. Environ Sci Pollut Res 25(25):24845–24859

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Soulé PT, DeHart JL (1998) Assessing IPAT using production- and consumption-based measures of I. Soc Sci Q 79(4):754–765 JSTOR

Ssali MW, Du J, Mensah IA, Hongo DO (2019) Investigating the nexus among environmental pollution, economic growth, energy use, and foreign direct investment in 6 selected sub-Saharan African countries. Environ Sci Pollut Res 26(11):11245–11260

Sun C, Zhang F, Xu M (2017) Investigation of pollution haven hypothesis for China: an ARDL approach with breakpoint unit root tests. J Clean Prod 161:153–164

UNCTAD (2019). Foreign direct investment: inward and outward flows and stock, annual, United Nations conference on trade and development, Available online: https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740.

Vernon R (1966) International investment and international trade in the product cycle. Q J Econ 80(20):18

Wang J, Dong K (2019) What drives environmental degradation? Evidence from 14 sub-Saharan African countries. Sci Total Environ 656:165–173

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

World Bank (1993) Foreign direct investments - benefits beyond insurance. Development Brief Number 14

World Development Indicator (WDI) (2019). World Bank Development Indicators database (online) available at https://data.worldbank.org/ Accessed date 24.10.2019.

Xie R, Yuan Y, Huang J (2017) Different types of environmental regulations and heterogeneous influence on “green” productivity: evidence from China. Ecol Econ 132:104–112

Xu B, Lin B (2018) Investigating the differences in CO2 emissions in the transport sector across Chinese provinces: evidence from a quantile regression model. J Clean Prod 175:109–122

York R, Rosa EA, Dietz T (2003) Footprints on the earth: the environmental consequences of modernity. Am Sociol Rev 68(2):279–300

Zafar MW, Zaidi SAH, Khan NR, Mirza FM, Hou F, Kirmani SAA (2019) The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: the case of the United States. Res Policy 63:101428

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sust Energ Rev 58:943–951

Zhang Z, Xi L, Bin S, Yuhuan Z, Song W, Ya L et al (2019) Energy, CO2 emissions, and value added flows embodied in the international trade of the BRICS group: a comprehensive assessment. Renew Sust Energ Rev 116:109432

Zhu H, Duan L, Guo Y, Yu K (2016a) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248

Zhu H, Guo Y, You W, Xu Y (2016b) The heterogeneity dependence between crude oil price changes and industry stock market returns in China: evidence from a quantile regression approach. Energy Econ 55:30–41

Zrelli MH (2017) Renewable energy, non-renewable energy, carbon dioxide emissions and economic growth in selected Mediterranean countries. Environ Econ Policy Stud 19(4):691–709

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nathaniel, S., Aguegboh, E., Iheonu, C. et al. Energy consumption, FDI, and urbanization linkage in coastal Mediterranean countries: re-assessing the pollution haven hypothesis. Environ Sci Pollut Res 27, 35474–35487 (2020). https://doi.org/10.1007/s11356-020-09521-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09521-6

Keywords

- FDI

- Carbon emissions

- Carbon footprint

- Ecological footprint

- Energy consumption

- Urbanization

- Quantile regression method