Abstract

This study inspects the empirical association between inflation instability, GDP growth volatility, and the environmental quality in Pakistan, covering the period 1975–2018 by using an asymmetric autoregressive distributed lag (ARDL) methodological approach. The asymmetric ARDL results document that positive and negative shocks of inflation instability have different effects on environmental quality. Negative shocks of inflation instability have a positive influence on carbon dioxide emissions (CO2) and nitrous oxide emissions (N2O), while positive shocks of inflation instability have insignificant effects in the long run. Asymmetric findings also suggest that positive and negative fluctuations in GDP growth volatility affect CO2 and N2O emissions differently, while they have insignificant results on methane emissions (CH4) in the long run. Additionally, in the short run, positive and negative shocks of inflation instability and GDP growth volatility behave differently in terms of their impact on pollution emissions. Based on these findings, the study opens up innovative intuitions for policymakers to support a robust role of economic stability in attaining targets relevant to pollution reduction.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

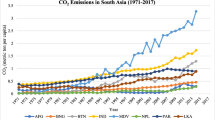

The evolution process of the Pakistan economy has been considered by large periods of contractions, brief recessions, unstable GDP growth, and exchange rate volatility, since the 1970s. The country has experienced prolonged macroeconomic instabilityFootnote 1 by following unstable economic policies, fiscal and monetary, over prolonged periods. During their chronic instability periods, the normal developing country exhibited extreme and persistent budget deficits, high inflation rates, credit constraints in the financial sector, and high debt to GDP ratios. As a result, the country has been suffering from substantial macroeconomic instability records, severe and volatile rates of inflation, dramatic slowdowns of its economic activity, and a low economic growth record concerning South Asian countries. According to the Asian Development Bank (ADB), the inflation rate was highest in Pakistan at 7.3%, followed by Bangladesh (5.5%), Nepal (4.6%), India (3.5%), and Sri Lanka (3.1%), while GDP growth rate was highest in Bangladesh at (8.1%), followed by Nepal (7.1%), India (6.5%), Pakistan (3.3%), and Sri Lanka (2.6%) in South Asia (Asian Development Bank 2019). Based on such an economic performance, environmental pollution is expected to be affected by the presence of macroeconomic instability in Pakistan (Khan 2019) (Tables 1, 2).

Over the past 50 years, Pakistan has faced macroeconomic instability in the form of inflation, while the country has managed to avoid extreme inflation. In response to inflationary pressures, the State Bank of Pakistan has only managed to cut the discount rate so as to promote domestic investment, necessary to achieve economic growth, with this policy ignoring its environmental impact. However, the country had to cope with serious loopholes in its policies. Fundamentally, environmental pollution is a continuing problem. There is no doubt that the country has been characterized as one of the leading carbon emitters in the South Asia region with 0.82 million tons, which signifies the second-highest emitter after India. Pakistan has been ranked 16 out of 48 countries across Asian economies, while it ranked 42 out of 198 across world economies (World Bank 2019a).

Α bulk of empirical studies have examined various determinants of carbon emissions worldwide, with the nexus of energy-GDP and environment being one that has been extensively debated. The results document that energy consumption is responsible for carbon emissions in an economy (Asghar et al. 2019; Mohsin et al. 2019; Lin and Raza 2019). Another assumption drawn from these empirical studies suggests that environmental quality expands with higher levels of economic growth (Alam et al. 2012; Ahmad et al. 2016; Rahman and Kashem 2017; Wang et al. 2017), while many other studies have also considered several variables, for instance, industrialization, urbanization, FDI, trade, energy consumption, human development, transportation, corruption, and governance in the relevant link. It is obvious that these indicators have a vital role to play in environmental quality. Similarly, macroeconomic instability also performs a fundamental role in environmental pollution emissions. A sound and stable economic system should help in boosting the country’s environmental quality.

It is observed that financial stability has an imperative role in environmental quality. Based on the theoretical background, a sound financial sector encourages economic growth by inviting FDI into the domestic economy. Foreign investors employ clean and green energy consumption that is more efficient as compared to local investors, particularly in emerging and developing economies (Shahbaz 2013; Khan 2019). Similarly, macroeconomic stability in the finance sector not only helps investment business activities by making finance capital inexpensive but also enters those firms that damage the environment by charging penalty fees and reducing their access to formal lending (Nasreen et al. 2017). The literature also infers that the development of stock markets is a gateway for environmentally friendly technologies that substantially affect energy consumption and carbon emissions. Thus, a stable finance sector performs an imperious role in monitoring carbon pollution by encouraging the adoption of advanced technologies in the energy sector (Shahbaz 2013).

However, a different strand of school argues that macroeconomic stability performs a twofold role in decreasing carbon pollutants. On the contrary, it can improve economic growth and lower carbon releases by assigning more economic resources to ecologically friendly ventures. On the contrary, a stable macroeconomic system can limit nonrenewable energy for those firms which discharge more waste in the environment (Hanif and Gago-de-Santos 2017). Also, a stable macroeconomic system can play a vital role in supporting the supply side of environmentally friendly infrastructure by providing more global warming incentives. Whereas, on the other hand, there is another strand in the literature postulating that macroeconomic stability stimulates carbon emissions by minimizing the role of liquidity constraints and enlarging economic growth leading to improved non-clean energy consumption and more CO2 emissions (Ahmad et al. 2018). Furthermore, macroeconomic stability makes it easier for consumers to purchase household durable goods and services, such as automobiles, home appliances, air conditioners, and others, which increase carbon emissions (Khan 2019). They also revealed that a stable economic situation not only enhances economic growth in the long run but also helps economies to reduce their carbon footprint, while enhanced stability in the financial sector allows producers to access low-cost financing and grow their production levels, generating positive spillovers to energy consumption and carbon emissions (Baloch et al. 2018). In contrast, macroeconomic instability is a source of environmental pollution, since both fiscal and monetary problems tend to become core issues for those economies (Gough and Meadowcroft 2011). Another potential cause is that macroeconomic uncertainty limits the entry of firms, contributing to lower production, along with lower carbon emissions (Rousseau and Wachtel 2002). In an unstable macroeconomic environment, both public and private investors are small to invest in clean and green technologies, since the predictable payment is highly uncertain. Similarly, macroeconomic instability also affects both consumers and producers which improves environmental quality, implying that macroeconomic instability is also correcting the associated environmental quality; as a result, a positive link between macroeconomic instability and environmental quality is established.

However, there is a large controversy in the relevant environmental literature on whether macroeconomic uncertainty has positive or negative spillovers to environmental pollution. The current bulk of empirical literature is silent about the nonlinear association between macroeconomic uncertainty and environmental pollution across the globe. Therefore, some previous environmental studies have focused on macroeconomic instability indicators, i.e., inflation uncertainty (Khan 2019), financial uncertainty (Shahbaz 2013; Nasreen et al. 2017; Baloch et al. 2018), and economic uncertainty (Hanif and Gago-de-Santos 2017); all these studies have employed linear ARDL methods that give rise to the biased results problem. The main issue that applies to Khan’s study, as well as to all previous literature, assumes that the effects of inflation instability on environmental pollution are symmetric, implying that if an X% increase in inflation instability deteriorates environmental pollution by Y%, then an X% decrease in inflation instability should improve environmental pollution by Y%. This need not be the case, however, since inflation instability, finance instability, and GDP growth volatility could all change in an asymmetric manner, implying that the effects of positive shocks on the relevant variable could be different from the negative shocks on environmental quality. However, given that macroeconomic uncertainty variables could have an asymmetric behavior with respect to environmental pollution, this is a study that contributes to the literature by inspecting the asymmetric effects of macroeconomic uncertainty on environmental quality by using a time series dataset from the Pakistani economy, spanning the period 1975–2018. This study pays consideration to the environmental literature in the subsequent ways. It captures macroeconomic uncertainty dynamics by using the non-linear or asymmetric ARDL methodological approach. There is a small number of studies on the macroeconomic uncertainty-environmental quality nexus; however, this study provides new empirical insights to the literature by being the first study on the Pakistani economy that considers the presence of non-linear (asymmetric) effects. Second, since the inflation rate is in double-digit, while GDP growth is highly volatile in the case of Pakistan, the importance of inflation instability and GDP growth rate volatility as asymmetric determinants of environmental pollution has significantly gained a certain momentum. Therefore, the asymmetric analysis will reduce the bias and generate more significant and superior outcomes in environmental economics that are hidden in the case of the symmetric model. This phenomenon is now a new part of environmental economics in this country, as well as in a global fashion. Finally, the study also allows us to recommend certain policy implications concerning the role of macroeconomic policies in importance to their influence on environmental quality in the case of Pakistan and potentially other developing countries.

The remaining study is ordered as follows. “Literature review” offers a background of the literature. “Model and methodology” describes methodologically the econometric method while providing a detailed data description. “Data” presents the empirical results and discussions, while “Results and discussion” sums up the findings and offers certain policy implications.

Literature review

The literature focuses on the analysis of the relationship between macroeconomic instability and pollution emissions. Therefore, the prime conjecture is that higher levels of macroeconomic instability precipitate the postponement in the investors’ planning of investments and, consequently, impede the evolution from fossil- to non-fossil-based energy consumption. Hence, it manifests a direct association between economic instability and carbon emissions.

Considering the first part of the related literature, i.e., the bidirectional nexus between economic growth and environmental degradation, a bulk of empirical evidence is available for both developing and developed economies. Grossman and Krueger (1991) present a seminal study on environmental quality for the case of Mexico City. They highlight that the non-linear relationship between the income-environmental pollution nexus for Mexico City. Furthermore, they argue that in order to encourage economic growth at the earlier stages, economies deploy their energy inputs very intensively. This surges the emissions of carbon dioxide, consequently, worsening environmental quality. Moreover, Hanif and Gago-de-Santos (2017) document that stronger economic growth has a significant effect on environmental degradation in the case of developing economies. Furthermore, they also reveal that macroeconomic instability generates negative externalities that stimulate harmful effects on the environment in the case of developing economies. However, after achieving a specific threshold level, it becomes possible for them to use clean energy production methods that are environmentally friendly on account of higher ratios of income. As a result, the emission of harmful gases declines and environmental quality enhances (Usman et al. 2020). Thus, the mixture of these two competitive effects indicates that the association between economic growth and environmental degradation bears a resemblance to a non-linear shape. Shafik and Bandyopadhyay (1992) are the first to employ panel data for 149 countries, spanning the period 1960–1990, to inspect the rationality of the environmental Kuznets curve (EKC) proposition; their results support the invalidity of this hypothesis. Similarly, Carson et al. (1997) conducted a country-based study to investigate the dynamic association between economic growth and CO2 emissions. Using data from the 50 US states for the period 1988–1994, their findings validate the EKC hypothesis.

The subsequent studies advance the scholarly disagreement on the presence of the EKC hypothesis across different economies (Al-Mulali et al. 2015; Sinha et al. 2017). These studies can be classified into two major strands. The first includes those that are in favor of the increase in the argument that economic growth leads to the enhancement of ecological quality (Nasir and Rehman 2011; Ahmed and Long 2012; Wang et al. 2017; Balaguer and Cantavella 2018). However, the studies in the second strand conclude that the EKC proposition does not exist (Halicioglu 2009; Ozturk and Acaravci 2010; Alshehry and Belloumi 2015; Ozturk and Al-Mulali 2015). However, we wonder how the results of both strands can be justified and the relevant conflict can be resolved. To solve this puzzle, Baek and Kim (2013) and Khan (2019) explain that on account of different biophysical, economic, political, and social factors, both variables demonstrate the different relationships across different economies during the process of economic growth. In other words, we are unable to generalize the results concerning an economy based on specific environmental indicators coming from other economies. Moreover, Shahbaz (2013) inspects the effects of financial instability on carbon emissions using data from Pakistan over the period 1971–2009. His findings document the rationality of the EKC proposition, while Nasreen et al. (2017) find similar results for the case of the South Asia region, with their results displaying that financial stability improves environmental quality. Baloch et al. (2018) show that financial instability has an insignificant effect on carbon emissions in Saudi Arabia, while Fredriksson and Svensson (2003) provide supportive evidence that political instability exerts a negative effect on environmental regulations, albeit a positive effect in the case when the country enjoys political stability.

Furthermore, the pertinent literature also reports that different scholars deploy different covariates for checking the validity of the EKC hypothesis. For instance, Soytas et al. (2007) and Alam et al. (2012) use a bivariate framework which suffers from reduced reliability and accuracy of the relevant studies (Balaguer and Cantavella 2018). To overcome this problem, the subsequent strands of evidence commence controlling the dynamic impact of certain macroeconomic determinants, while seeking to validate the nexus between economic growth volatility and environmental deterioration. Energy consumption plays an essential role in attaining economic growth in the current era, while on the other hand, energy consumption produces pollution emissions due to the consumption of non-renewable resources (Shahbaz 2013; Dogan and Turkekul 2016). Other common covariates employed are those of trade openness (Atici 2009; Halicioglu 2009), urbanization (Soytas et al. 2007; Jafari et al. 2012; Farhani and Ozturk 2015), industrialization (Ullah et al. 2020), fiscal policy instruments (Yuelan et al. 2019), financial development (Jalil and Feridun 2011), and macroeconomic instability (Khan 2019).

Additionally, the uncertainty has to do with economy-specific features that potentially impact the macroeconomic environment. Overall, the macroeconomic uncertainty or instability is proxied by the uncertainty in inflation that hampers the growth process through reduced capital formation, savings, and total factor productivity (Fischer 1993). Moreover, the economy endures the postponement in long-run investment projects on account of extensive levels of uncertainty in inflation, with one of these projects being the conversion of non-renewable energy to environmentally friendly renewable energy production. Furthermore, macroeconomic instability brings the depletion in research and development (R&D) finance that is indispensable to introduce energy-efficient appliances, thus promoting environmental degradation. All this discussion indicates that macroeconomic unsustainability can affect economic activities and environmental quality through direct and indirect channels. Therefore, the results reveal that macroeconomic instability raises pollution emissions in developing countries (Khan 2019), thus ensuring that economic, political, and financial uncertainty in the macroeconomic environment also affects environmental pollution.

Focusing on the economic growth strand of the literature, many empirical studies have explored the nexus between uncertain inflation and economic growth on both theoretical and empirical basisFootnote 2. In theoretical-based studies, Lucas (1973) assumes that the production factors become less efficient due to price instability, stemming from inflation uncertainty that makes the economic activities sluggish; consequently, it slows down long-run economic growth, hence attains environmental quality. Similarly, Pindyck and Solimano (1993) suggest that both kinds of uncertainties (i.e., inflation uncertainty and political uncertainty) influence investment projects, while they claim that investors require a higher rate of return for their projects due to the associated uncertainties, thus discouraging capital formation and economic growth and improving environmental quality. Certain empirical studies also support the argument of an adverse nexus between inflation uncertainty and capital formation. For instance, deploying data from the USA for the period 1962–1999, Byrne and Davis (2004) assess the dynamic association between inflation unsustainability and foreign investments. Their findings illustrate the accumulation of capital contracts when inflation gets more uncertain. Similarly, Grier (2005) advocates the presence of adverse effects of volatile inflation on physical capital formation in 21 Sub-Saharan African economies during 1970–2000Footnote 3. Additionally, Alola et al. (2019) find that a high inflation regime in a positive influence on environmental quality in coastline Mediterranean countries with low carbon emissions, especially in the long-run.

Exploring the direct influence of inflation uncertainty on economic growth, Friedman (1977) presents the fundamental notion that the mechanism of resource allocation endures the adverse distortion on account of unexpected changes in inflation; hence, it results in reducing the pace of economic growth. In addition, researchers examine this relationship using different datasets across different economies. For example, Grier and Perry (2000) evaluate the dynamic nexus and report that the growth of the US economy declines due to the deleterious effects of the volatility of inflation uncertainty. Likewise, Fountas et al. (2002) reach similar findings for Japan. By contrast, Fountas and Karanasos (2007) use a dataset from the G7 economies and provide evidence that inflation uncertainty has mixed effects. To illustrate, the growth rate of Canada and Japan gets the benefits, while the USA, the UK, and Germany go through lower growth, with the output in France and Italy remaining stable when fluctuations in inflation occur. This infers that inflation uncertainty indirectly affects the environmental quality in advance economies.

Overall, the discussion presented above highlights that macroeconomic instability affects environmental pollution through the channels of GDP growth volatility and inflation variability, implying that macroeconomic instability can affect environmental quality through increasing CO2 emissions (Khan 2019); however, this effect has not been explored before in an asymmetric framework. It is worth inspecting the presence of asymmetric or non-linear effects of macroeconomic instability on pollution emissions in the case of the Pakistani economy.

Model and methodology

This section first develops a model based on the previous literature. Given that the goal is to explore the impact of inflation uncertainty and GDP growth rate volatility on environmental quality, the latter (EQ) is proxied by a set of dependent variables such as methane, carbon & nitrous oxide emissions, while the independent variables include inflation uncertainty, GDP growth volatility, and financial development (INFinstab, GDPvolat, FD, respectively):

where vt is a white noise error term. However, the above specification would only give us long-run coefficients estimates, and therefore, to obtain short-run coefficients estimates, we make use of the method recommended by Pesaran et al. (2001) rewriting Eq. (1) in error correction pattern as below:

Equation (2) is commonly known as the ARDL model, it possesses certain advantages over other methods. Its foremost advantage is that we can get both short-run, as well as long-run results from a single equation. The coefficients linked with “∆” signs are short-run estimates, whereas coefficients φ2--φ4 normalized on φ1signify long-run estimates. Moreover, the integrating properties of the model variables are not an issue in the case of this model. Hence, another leverage provided by this method is that it allows us to use variables with different integrating properties, I(0), I(1), and a mixture of both. In estimating the environmental quality in Pakistan, the previous literature has assumed that inflation instability and the GDP growth rate volatility have symmetric effects on environmental quality. However, since the goal here is to measure the asymmetric effects of inflation instability and GDP growth rate volatility, the analysis needs to modify Eq. (2). To be able to compare the outcomes with those in previous studies, we must check whether there are any asymmetries in the effect of inflation uncertainty and GDP growth volatility on environmental quality. To this end, we differentiate inflation uncertainty and GDP growth volatility into their positive component (INFinstab+, GDPvolat+) and their negative component (INFinstab−, GDPvolat−) by following a partial sum procedure as below:

Once we introduce the positive and negative components of these variables into Eq. (2), then the new equation yields:

Equation (5) depicts a non-linear ARDL model recommended by Shin et al. (2014). This equation is different from Eq. (2) in the sense that Eq. (2) relies on the assumption that if increased inflation instability and GDP volatility both have a negative effect on environmental quality, then declines in them will make the environmental quality better by the same magnitude. In contrast, Eq. (5) separately checks the effects of INFinstab+(GDPvolat+) and INFinstab−(GDPvolat−) on environmental quality and whether these effects follow an asymmetric pattern. After obtaining the non-linear estimates, the analysis applies Wald tests to ratify the existence of both short- and long-run asymmetries. We can define the occurrence of short-run joint asymmetry between the sum of positive negative components if we reject the null hypothesis (∑ηi = ∑ ϕi , ∑λi = ∑ ρi) of the short-run Wald test. Similarly, the rejection of the null hypothesis \( \left(\raisebox{1ex}{${\upvarphi_2}^{+}$}\!\left/ \!\raisebox{-1ex}{${\upvarphi}_1$}\right.=\raisebox{1ex}{${\upvarphi_3}^{-}$}\!\left/ \!\raisebox{-1ex}{${\upvarphi}_1$}\right.,\raisebox{1ex}{${\upvarphi_4}^{+}$}\!\left/ \!\raisebox{-1ex}{${\upvarphi}_1$}\right.=\raisebox{1ex}{${\upvarphi_5}^{-}$}\!\left/ \!\raisebox{-1ex}{${\upvarphi}_1\ $}\right.\right) \) of long-run Wald tests implies the presence of asymmetry in the long-run estimates concerning the positive and negative partial sum factors of the independent variables.

Data

The analysis covers data from Pakistan, covering the period 1975-2018. The model includes three dependent variables: CO2 emissions (metric tons), methane emissions (kilotons of CO2 equivalent), and nitrous oxide emissions (thousand metric tons of CO2 equivalent). The independent variables are inflation instability and GDP growth rate volatility. For analysis, inflation instability is considered by inflation variation from its mean values (Grier 2005; Khan 2019), while the standard deviation of GDP growth rate is the measure of unconditional volatility of GDP growth rate (Diebold and Yilmaz 2008). However, financial development is used as a proxy of domestic credit to the private sector as a percentage to GDP. All data is obtained from the World Bank database (World Bank 2019b) and is on an annual basis, except the GDP growth rate volatility which is on a monthly basis. As the analysis needs to investigate the influence of GDP instability on pollution emissions. We compute volatility through two methods. First, we take the standard deviation of a 12-month period of GDP in a particular year; thus, the time series is left with one value of GDP for each year. Finally, we change the GDP transformed monthly data into annual data. This is a measure of unconditional fundamental volatility. In that case, there is not any difference in the frequencies employed. Alternatively, following Schwert (1989), we use the residuals from a generalized autoregressive conditional heteroskedasticity (GARCH) model to fit the GDP growth rate. This is a measure of conditional fundamental volatility. However, we use the former measure of unconditional volatility through standard deviation.

Results and discussion

In this section, the results of all three models are discussed. We obtain both short- and long-run estimates in each model separately by using both the symmetric or linear and asymmetric or non-linear ARDL models. First, the decision concerning the choice of lags is established on the Schwarz Information Criterion (SIC). Next, the analysis confirms that one variable INFinstab in our model is I(2) stationary, by applying both the Elliott, Rothenberg, and Stock (ERS) and Phillips Peron (PP) unit root tests. However, all other variables are stationary either at their level or first difference in both tests.

Next, the analysis discusses the results of the linear models. The first model in line with the CO2 model. Table 3 presents short-run findings regarding the CO2 model which implies that the coefficient of INFinstab is statistically insignificant. However, the estimate for GDPvolat is positive and statistically significant at 5%, indicating that a 1% raise in GDPvolat leads to a 384 kilotons upsurge in CO2 emissions. The results suggest that GDP growth volatility increases the environment un-friendly infrastructure that upsurges carbon pollution. However, the coefficients of GDPvolat are statistically significant, albeit negative in the previous year, suggesting the reduction in CO2 emissions by 480 kilotons after increases in GDPvolat by 1%. The coefficient estimate of FD infers that a 1% improvement in financial development leads to 576 kilotons of CO2 emissions. This estimate justifies the fact that financial development provides better access to credit in the short-run, which encourages more economic activities and, thus, higher carbon emissions. This finding is also reliable with Sadorsky (2011) and Tang and Tan (2014).

In the long run, all coefficients are positive and statistically significant. The estimates of variables INFinstab, GDPvolat, and FD indicate that a 1% upsurge in them boosts CO2 emissions by 4,423 kilotons, 16,635 kilotons, and 15,770 kilotons, respectively. The possible reason may be that macroeconomic uncertainty weakens the rules and regulations in the country associated with activities that emit more carbon pollution. Then, we discuss the results with Nitrous Oxide (N2O) emissions as a proxy for the dependent variable. The estimates of GDPvolat and FD do not indicate any significant impact on N2O emissions. However, the increased instability in inflation positively affects N2O emissions with a magnitude of 0.004%, implying that 1% increase in inflation instability leads to 96 thousand metric tons increase in N2O emissions. The long-run findings have an insignificant influence on N2O emissions. In the last model, the analysis includes Methane emissions (CH4) as the dependent variable. The new results show that a 1% increase in INFinstab and GDPvolat both reduce methane emissions by 559 kilotons and 671 kilotons, respectively. However, a financial development by 1% enhances methane emissions by 335 kilotons. Nevertheless, all long-run estimates are statistically insignificant, implying that they do not have any impact on methane emissions.

Panel C in Table 3 reports certain diagnostic tests. First, it presents the bounds F statistic which confirms the joint significance of long-run estimates. Depending upon the critical values of this test, co-integration is confirmed only in the first model, i.e., the CO2 model. In the remaining two models, long-run estimates are absurd because co-integration is established neither through the F test nor through the error correction model (ECM) testFootnote 4. To test that the linear models are free from first-order serial correlation, the analysis relies upon the Lagrange multiplier (LM) test, which is not significant in any of the models under study, confirming that all three models are free from serial correlation. The correct specification is confirmed through the RESET test, which is insignificant across all models. Then, to the exam, the stability of the parameters in each model, the analysis performs both CUSUM and CUSUMSQ tests, with “S” indicating stability and “US” instability of the estimated coefficients.

Next, the effects of asymmetric or non-linear models are described in Table 4. Short-run estimates of all three models are described in Panel A, while the long-run results are in panel B. Starting from the CO2 model, the analysis documents that positive shocks in INFinstab has insignificant effects on CO2 emissions, whereas the negative shock has a positive significant effect on CO2 emissions, implying that 1% upsurge in INFinstab leads to 1,057 kilotons upsurge in carbon emissions. Similarly, the positive component of GDPvolat is insignificant; however, a negative shock exerts a positive impact on carbon emissions and reduced 673 kilotons of carbon emissions in Pakistan. From the above results, we can conclude that as the variability in both inflation and GDP growth increase, CO2 emissions remain unaffected. In contrast, decreases in the instability of both variables lead to higher CO2 emissions. Financial development exerts a positive significant effect on carbon emissions. The long-run results confirm that a 1% reduction in INFinstab contributes positively to CO2 by 6,923 kilotons, while the figure increases to 17,405 kilotons in the case of increased volatility in GDP growth.

Thus, negative shocks of INFinstab have a positive influence on environmental pollution, implying that in a stable inflation zone, consumers are involved in more economic activities that lead to more energy use for vehicles and home appliances, encouraging increases in environmental pollution. This finding also suggests that consumers in a stable economic system purchase more vehicles when the financial sector provides easier access to lending at low-interest rates (Shahbaz 2013; Tang and Tan 2014; Baloch et al. 2018). However, an opposing argument claims that if, on one side, we can keep the costs of borrowing low and, on the other side, we can simplify the process of shifting from conventional to green energy, we can induce the negative shocks of INFinstab to increase environmental quality (Tamazian et al. 2009). One of the possible reasons is that negative shocks of INFinstab encourage firms and governments to invest in environment-friendly technologies. During a stable inflation era, households become less mindful about their expenditure, therefore, they drive and fly more, and eventually consume more fossil-fuel energy. In reality, a low inflation rate regime is determined by a higher stock market performance and financial development, which in turn, lower inflation increases the pollution emissions in the atmosphere. Another reason is the negative shock of inflation that promotes economic growth activities, but causes environmental pollution. Thus, the low inflation rate is a major threat to environmental quality in Pakistan.

Similarly, positive shocks of GDPvolat have a positive effect on environmental pollution, suggesting that economic stability raises the progress of the finance sector in Pakistan, which increases the consumption of energy in the agriculture, industry, and services sectors. The results also illustrate that GDPvolat is based on fossil fuels in developing countries, like Pakistan, that contributes to environmental pollution. The results additionally suggest that most of the developing countries increase GDP by affecting the environment; therefore, GDPvolat has a positive significant effect on environmental pollution. The results are in line with those by Hanif and Gago-de-Santos (2017) who provide evidence that economic instability has detrimental effects on the environment in the case of developing and emerging economies. This finding is also consistent with Shahbaz (2013) in the case of Pakistan. However, Pakistan has formulated a comprehensive long-term national environmental policy, i.e., “clean and green Pakistan,” in 2019 that was not on before (World Bank 2019a). The results also infer that economic growth and environment are linked to ensure all positive shocks of economic activities are based on the environment. Pakistan's industrial growth requires greater volumes of energy to enhance carbon pollution than other sectors of the economy. Another interesting finding is that high economic growth volatility is affecting the environment more than low economic growth volatility. This implies that Pakistan’s economy at the early stage of development has faced more environmental problems due to the presence of high volatility in economic growth. Pakistan needs to sacrifice economic growth to cut its environmental pollution levels that are in reality not feasible for developing countries. Sound policy intervention is preferred to Pakistan in the context of GDP growth and environmental quality. However, the results also suggest that negative shocks of GDPvolatility are harmful to the environment in Pakistan, both in the short- and in the long-run. Long-run coefficient estimates for FD show a significant positive effect, implying that carbon emissions increase with a stronger financial development process.

In the next model, i.e., the N2O model, short-run positive shocks at the third lag in INFinstab contribute positively to carbon emissions, with the estimate being 168 thousand metric tons. This result suggests that three years ago INFinstab has a positive significant impact on nitrous emissions in the short run. However, reduced variability in inflation exerts a positive significant impact on N2O emissions in the current year, whereas this contribution is negative in the first and third lags. Moreover, the coefficients associated with the positive component of GDPvolat are positively significant in the current year and negative and statistically significant three years ago. In the current year, the negative shock of GDPvolat would lead to a 216 thousand metric tons increase in N2O emissions. This estimate, however, puts adverse effects on N2O emissions during the first interval, with the scale of estimate being 384 thousand metric tons. In terms of the long-run the estimates in the N2O model, they are positively significant in the case of negative INFinstab shocks, positive GDPvolat shocks, and negative GDPvolat shocks, implying that they all contribute to the release of N2O by 2,976, 5,473, and 1,848 thousand metric tons, respectively. A similar economic interpretation is maintained in this model. By contrast, financial development reduces N2O emissions by 2,976 thousand metric tons. This finding is consistent with Hao et al. (2016) who note that financial development has a positive influence on environmental quality in the early stages of the development process than in the later stages. Lastly, the analysis discusses the non-linear effects of the macroeconomic variables on methane emissions. In the short run, increased variability in inflation exerts a negative effect on methane emissions. The estimate of negative INFinstab is negative, suggesting an adverse effect on CH4 emissions. Similarly, the variable of positive shocks of GDPvolat negatively contributes to methane emissions in the previous year, while the estimate of the negative shock of GDPvolat is negative and statistically significant in the current year. However, none of the variables in the long-run has any significant effect on methane emissions.

To test the validity of the non-linear models, the analysis makes use of a few diagnostics reported in panel C of Table 4. Depending upon the values of the F test, we confirm the presence of co-integration in both the CO2 and N2O models, noticing that the long-run results are valid. To test the first-order serial correlation, the correct specification, the stability of the parameters, the analysis performs LM, RESET, CUSUM, and CUSUMSQ tests. The goodness of fit measure, i.e., ADJ-R2 confirms that all models are fitted well. Finally, in the case of the non-linear models, the analysis implements Wald tests that confirm whether the effect of macroeconomic indicators on pollution emissions is symmetric or asymmetric. The short-run Wald test checks the joint significance of short-run estimates of the INFinstab and GDPvolat variables; the findings highlight that they are insignificant across all cases, confirming the presence of symmetries in the short run. However, the long-run Wald test for the variable of INFinstab is significant in the case of the CO2 model, indicating that the results of positive shocks of INFinstab and negative shocks of INFinstab on CO2 emissions are different. Similarly, the long-run Wald test checks the asymmetry in the effects of increased volatility in GDP growth vis-a-vis that of decreased volatility in GDP growth; the results display that they are significant in the case of the N2O and CH4 models. Furthermore, CUSUM and CUSUM square tests in the NARDL model are also depicted in Fig. 1.

Conclusion

The objective of this study was to estimate the asymmetric or nonlinear effect of macroeconomic instability on environmental pollution in Pakistan, over the period 1975 to 2018. Employing the method of nonlinear ARDL models, the outcomes confirmed the presence of asymmetric short- and long-run impacts of inflation instability and GDP growth volatility on pollution emissions. However, the negative shocks of inflation instability and the positive shocks of GDP growth volatility had a positive significant effect on pollution emissions. The results also revealed that negative changes in inflation instability affect pollution emissions more than positive changes in the long run, while adverse results were found with respect to GDP growth volatility in the long-run since positive changes in GDP growth rate volatility affect pollution emissions more than their negative changes. The findings also suggested that there were insignificant asymmetries between macroeconomic instability indicators and pollution emissions. Finally, the findings also documented that in the short-run, macroeconomic instability affected environmental pollution both with respect to negative and positive shocks.

This empirical study offers several key policy implications. More specifically, stable inflation impedes environmental pollution and infers that the government should impose taxes on the supply side that extensively contributes to pollutant emissions. Inflation control will be a serious step towards macroeconomic stability if it is truly applied. Another possible reason is that stable inflation raises fossil fuel consumption due to low energy prices; thus, negative externalities affect the quality of life and create further pollution. Governments should adopt stabilizing inflation policies on a priority basis. They should also employ an approach that carefully considers the inflation pros and cons of each sector, especially on the environment. While GDP growth volatility affects pollution emissions, it is very crucial for the country to increase GDP growth by primarily using clean and green energy and environmentally friendly policies and technologies. The government may also shift non-green economic growth to green economic growth. Pakistan can sacrifice the early period of economic growth on environmental quality and, thus, the government needs to describe its priorities if it is serious on the environment rather than on polluted economic growth. The government of Pakistan should set a comprehensive stable macroeconomic policy without affecting environmental pollution. Moreover, the present macroeconomic instability also stimuli academia and policymakers to revise the policy structure of Pakistan regarding environmental pollution. Pakistan should focus on loopholes in its macroeconomic instability and environmental policies.

Future research should scrutinize the influence of other parameters available on environments. The use of the asymmetric methodology will enable us to obtain robust and different results of the impacts of macroeconomic instability on environmental pollution. The findings point towards a new track of using asymmetric models in the ecological literature, which will bear the fruits in the future.

Notes

Macroeconomic instability can be measured by the unsustainability or volatility of key macroeconomic variables (e.g., inflation instability, GDP growth rate volatility, and exchange rate volatility)

The available studies on inflation instability and economic growth can be grouped into twin classes. The first testifies the impact of inflation instability on capital formation, since capital and economic growth have a one-to-one relationship as pointed out by Solow (1956), while the second analyzes the direct influence of inflation uncertainty on economic growth.

However, Dotsey and Sarte (2000) and Varvarigos (2008) dissent and support the positive nexus between both variables. The possible reason of a positive association is that during the high inflation uncertainty, agents save their money for precautionary purposes and invest it during stability periods, leading to a stronger capital accumulation.

If we are facing such a situation that calculated F statistics value is insignificant, implying that our long results are absurd, then we shift our attention to an alternative test of co-integration known as error correction (ECM) test. In this test, the normalized long-run estimates and Eq. (1) help us in obtaining an error correction term (ECT). We then replace ECTt−1 in place of lagged level variables from Eq. (2) and estimates this resulting equation with the same number of lags. A significant and negative value of ECMt−1 implies that our long results are converging and means long-run results are co-integrated.

References

Ahmad A, Zhao Y, Shahbaz M, Bano S, Zhang Z, Wang S, Liu Y (2016) Carbon emissions, energy consumption and economic growth: an aggregate and disaggregate analysis of the Indian economy. Energy Policy 96:131–143

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Manage 9(6):631–644

Ahmed K, Long W (2012) Environmental Kuznets curve and Pakistan: an empirical analysis. Proc Econ Finance 1:4–13

Alam MJ, Begum IA, Buysse J, Van Huylenbroeck G (2012) Energy consumption, carbon emissions and economic growth nexus in Bangladesh: cointegration and dynamic causality analysis. Energy Policy 45:217–225

Al-Mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22(19):14891–14900

Alola AA, Yalçiner K, Alola UV (2019) Renewables, food (in) security, and inflation regimes in the coastline Mediterranean countries (CMCs): the environmental pros and cons. Environ Sci Pollut Res 26(33):34448–34458

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sust Energ Rev 41:237–247

Asghar, M.M., Wang, Z., Wang, B., Zaidi, S.A. H. (2019) Nonrenewable energy-environmental and health effects on human capital: empirical evidence from Pakistan. Environ Sci Pollut Res: 1-17.

Asian Development Bank (2019) Asian Development Outlook 2019 Update: fostering growth and inclusion in Asia’s cities. Retrieved from ADB website: https://doi.org/10.22617/FLS190445-3.

Atici C (2009) Carbon emissions in Central and Eastern Europe: environmental Kuznets curve and implications for sustainable development. Sustain Dev 17(3):155–160

Baek J, Kim HS (2013) Is economic growth good or bad for the environment? Empirical evidence from Korea. Energy Econ 36:744–749

Balaguer J, Cantavella M (2018) The role of education in the environmental Kuznets curve. Evidence from Australian data. Energy Econ 70:289–296

Baloch MA, Meng F, Zhang J, Xu Z (2018) Financial instability and CO 2 emissions: the case of Saudi Arabia. Environ Sci Pollut Res 25(26):26030–26045

Byrne JP, Davis EP (2004) Permanent and temporary inflation uncertainty and investment in the United States. Econ Lett 85(2):271–277

Carson RT, Jeon Y, McCubbin DR (1997) The relationship between air pollution emissions and income: US data. Environ Dev Econ 2(4):433–450

Diebold, F.X., Yilmaz, K. (2008) Macroeconomic volatility and stock market volatility, worldwide. National Bureau of Economic Research. Working Paper, No. 14269.

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Dotsey M, Sarte PD (2000) Inflation uncertainty and growth in a cash-in-advance economy. J Monet Econ 45(3):631–655

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676

Fischer S (1993) The role of macroeconomic factors in growth. J Monet Econ 32(3):485–512

Fountas S, Karanasos M (2007) Inflation, output growth, and nominal and real uncertainty: empirical evidence for the G7. J Int Money Financ 26(2):229–250

Fountas S, Karanasos M, Kim J (2002) Inflation and output growth uncertainty and their relationship with inflation and output growth. Econ Lett 75(3):293–301

Fredriksson PG, Svensson J (2003) Political instability, corruption and policy formation: the case of environmental policy. J Public Econ 87(7-8):1383–1405

Friedman M (1977) Nobel lecture: inflation and unemployment. J Polit Econ 85(3):451–472

Gough I, Meadowcroft J (2011) Decarbonizing the welfare state. Oxford University Press, Oxford

Grier R (2005) The interaction of human and physical capital accumulation: evidence from sub-Saharan Africa. Kyklos 58(2):195–211

Grier KB, Perry MJ (2000) The effects of real and nominal uncertainty on inflation and output growth: some garch-m evidence. J Appl Econ 15(1):45–58

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. National Bureau of Economic Research, Working Paper, No. 3914

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37(3):1156–1164

Hanif I, Gago-de-Santos P (2017) The importance of population control and macroeconomic stability to reducing environmental degradation: an empirical test of the environmental Kuznets curve for developing countries. Environ Dev 23(1):1–9

Hao Y, Zhang ZY, Liao H, Wei YM, Wang S (2016) Is CO 2 emission a side effect of financial development? An empirical analysis for China. Environ Sci Pollut Res 23(20):21041–21057

Jafari Y, Othman J, Nor AHSM (2012) Energy consumption, economic growth and environmental pollutants in Indonesia. J Policy Model 34(6):879–889

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Khan M (2019) Does macroeconomic instability cause environmental pollution? The case of Pakistan economy. Environ Sci Pollut Res 26(14):14649–14659

Lin B, Raza MY (2019) Analysis of energy related CO2 emissions in Pakistan. J Clean Prod 219:981–993

Lucas RE (1973) Some international evidence on output-inflation tradeoffs. Am Econ Rev 63(3):326–334

Mohsin M, Rasheed AK, Sun H, Zhang J, Iram R, Iqbal N, Abbas Q (2019) Developing low carbon economies: An aggregated composite index based on carbon emissions. Sustainable Energy Technol Assess 35:365–374

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37(17):1979–1990

Nasir M, Rehman FU (2011) Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39(3):1857–1864

Nasreen S, Anwar S, Ozturk I (2017) Financial stability, energy consumption and environmental quality: evidence from South Asian economies. Renew Sust Energ Rev 67:1105–1122

Ozturk I, Acaravci A (2010) CO2 emissions, energy consumption and economic growth in Turkey. Renew Sust Energ Rev 14(9):3220–3225

Ozturk I, Al-Mulali U (2015) Investigating the validity of the environmental Kuznets curve hypothesis in Cambodia. Ecol Indic 57:324–330

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Pindyck RS, Solimano A (1993) Economic instability and aggregate investment. NBER Macroecon Annu 8:259–303

Rahman MM, Kashem MA (2017) Carbon emissions, energy consumption and industrial growth in Bangladesh: empirical evidence from ARDL cointegration and Granger causality analysis. Energy Policy 110:600–608

Rousseau PL, Wachtel P (2002) Inflation thresholds and the finance– growth nexus. J Int Money Financ 21(6):777–793

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39(2):999–1006

Schwert GW (1989) Why does stock market volatility change over time? J Financ 44(5):1115–1153

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: time-series and cross-country evidence (Vol. 904): World Bank publications

Shahbaz M (2013) Does financial instability increase environmental degradation? Fresh evidence from Pakistan. Econ Model 33:537–544

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. Festschrift in Honor of Peter Schmidt, 281–314

Sinha A, Shahbaz M, Balsalobre D (2017) Exploring the relationship between energy usage segregation and environmental degradation in N-11 countries. J Clean Prod 168:1217–1229

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Soytas U, Sari R, Ewing BT (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62(3-4):482–489

Tang CF, Tan BW (2014) The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Qual Quant 48(2):781–797

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

Ullah S, Ozturk I, Usman A, Majeed MT, Akhtar P (2020) On the asymmetric effects of premature deindustrialization on CO2 emissions: evidence from Pakistan. Environ Sci Pollut Res: 1-11

Usman A, Ullah S, Ozturk I Chishti MZ, Zafar SM (2020) Analysis of asymmetries in the nexus among clean energy and environmental quality in Pakistan. Environ Sci Pollut Res: 1-12

Varvarigos D (2008) Inflation, variability, and the evolution of human capital in a model with transactions costs. Econ Lett 98(3):320–326

Wang Y, Zhang C, Lu A, Li L, He Y, ToJo J, Zhu X (2017) A disaggregated analysis of the environmental Kuznets curve for industrial CO2 emissions in China. Appl Energy 190:172–180

World Bank (2019a) Opportunities for a clean and green Pakistan: a country environmental analysis. World Bank Group, Washington, D.C.

World Bank (2019b) World development indicators 2019. World Bank Publications.

Yuelan P, Akbar MW, Hafeez M, Ahmad M, Zia Z, Ullah S (2019) The nexus of fiscal policy instruments and environmental degradation in China. Environ Sci Pollut Res 26(28):28919–28932

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ullah, S., Apergis, N., Usman, A. et al. Asymmetric effects of inflation instability and GDP growth volatility on environmental quality in Pakistan. Environ Sci Pollut Res 27, 31892–31904 (2020). https://doi.org/10.1007/s11356-020-09258-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09258-2