Abstract

This study investigates the spatial influence and spillover effects of foreign direct investment (FDI) on environmental pollution (EP) by using panel spatial data in 1970–2016 for 12 selected Arab countries. It employs the STochastic Impacts by Regression on Population, Affluence, and Technology (STIRPAT) model. The spatial econometric approach is applied to examine the validity of the pollution haven hypothesis (PHH) and the pollution halo hypothesis (P-HH) (from now on, we will use the acronyms PHH and P-HH to denote the pollution haven hypothesis and pollution halo hypothesis, respectively). The Sustainable Development Goals (SDGs) are linked to the study results with a focus on cleaner production practices. The global Moran’s I, local Moran’s I, and Lagrange multiplier (LM) tests are used to ascertain the existence of spatial autocorrelation (SAR) and determine its trend. We also apply the spatial lag model (SLM), the spatial error model (SEM), and the spatial Durbin model (SDM) to achieve the study objectives. Data are analyzed by using the SDM on the basis of the results of the Wald and likelihood ratio tests. The results of the LM and global and local Moran’s I tests confirm the existence of SAR. The SDM results reveal that a slight increase in CO2 is an influence of the FDI on EP. Findings support the existence of PHH in the Arab countries. The direct effect of the FDI is increased CO2 and environmental degradation, and the spatial spillover effects are statistically insignificant. This study suggests a set of policies for managing and directing FDI toward clean technology-based industries and reduced CO2 emissions. Such policies may contribute to the achievement of some SDGs and balancing economic development and environmental sustainability according to the cleaner production practice perspective in the Arab countries and other states with similar conditions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Arab countries have abundant mineral and non-mineral resources. Thus, they have striven to achieve rapid and sustainable economic development in recent decades. Consequently, their economic structures have shifted from agricultural to industrial economies and finally to a service-driven economy (Shahbaz et al. 2019). This transition has been accompanied with increased in foreign direct investment (FDI) inflows (Charfeddine and Mrabet 2017). FDI has become an important driving force in the last decades, with host countries relying on FDI to achieve sustainable economic development (Wang and Chen 2014). Yuping and Helian (2015) reported that FDI has a favorable impact on the host country’s environment and benefits from scale and technique effects. However, these countries pay the high cost of ecosystem quality for the FDI inflows and development. One of the leading causes of acute environmental pollution (EP) is intensive energy utilization, and the large proportion of FDI inflows toward pollution-intensive industries (Liu and Wang 2017).

Arab states are developing countries that are undergoing economic development. Their economies are still in the early industrialization phase and are founded on a broad base of manufacturing industries and primarily on oil and gas, which are the primary sources of pollutant emissions. This study focused on the 12 selected Arab countriesFootnote 1 due to several reasons. First, these countries account for two-thirds of the oil and gas production in the region, producing 84.07% of crude oil and 57.33% of natural gas in 1990–2016 (OABIC 2018). Second, according to the EDGARFootnote 2 (2017), the CO2 emissions of the Arab countries in 2014 were estimated at more than 1.90 million metrics tons of CO2 equivalent, which accounted for approximately 6% of the global emissions from fossil fuel combustion, while the CO2 emissions almost doubled in the subject countries in 1970–2016, reaching 64.38% of CO2 emissions. Thus, CO2, as a greenhouse gas component, has contributed the most to environmental deterioration in the Arab countries over the past three decades.

Third, the FDI inflows to the Arab countries exceeded 4% of the global FDI, while the subject countries attracted nearly two-thirds of those FDI inflows during the same period, accounting for more than 59% (UNCTAD 2018). The FDI flows in the Arab states were heavily concentrated on extraction industries, chemicals, and real estate sectors at 65.55%, and the FDI in other sectors represented the rest of the ratio in 2003–2016 (AIECGC 2016). Fourth, these countries have an abundance of mineral and non-mineral natural resources that attract foreign companies to invest in extractive industries. Fifth, these countries represent a single convergent bloc and share close land boundaries, making them suitable for the enforcement of the spatial econometrics technique. Sixth, the Arab nations are characterized as possible investment destinations for foreign firms due to their population of approximately 433 million in 2016, which includes a large youthful labor force. These nations implement good policies to support the private sector and offer great advantages to attract FDI inflow. In addition, they have a location advantage, which allows access to large markets. Lastly, according to Shahbaz et al. (2019), Middle Eastern and North African (MENA) countries have not signed the Kyoto Protocol, which was designed to maintain emission levels below a predetermined limit. Given these factors, the current study focused on the 12 selected Arab regions.

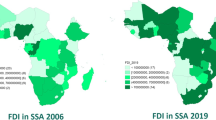

Figure 1 illustrates the changes in CO2 emissions (mkt) and FDI inflows (in US$) in the 12 Arab countries in 1970–2016. Figure 2 shows the spatial distribution characteristics of the CO2 emissions. The Arab countries have attracted FDI to the highly polluting sectors due to the weak structure of these countries’ environmental laws and the extractive industries. These sectors primarily depend on high energy, resulting in the continued heavy dependence on nonrenewable energy sources, such as coal and oil, to meet the rising energy demand (Rafindadia et al. 2018). Hammamet (2013) submitted to the ESCWA a report indicating that in 2013, the CO2 emissions from manufacturing industries, construction, electricity, and heat production ranged from 60 to 86%, whereas those from transport ranged from 13 to 28% for all the subject countries.

According to USGS (2017), the MENA countries have abundant natural resources; they produced 11.7%, 12.4%, 7.2%, 11.3%, and 22.1% of the world’s total aluminum, ammonia, cement, gypsum, and phosphate rock production in 2014, respectively. The Arab region has not stabilized since the World War I and is still experiencing intensifying wars and conflicts, which involve weapons that contain substantial pollutants whose effects are practically impossible to determine precisely. Given the amount of polluted emissions from all these sectors, the subject countries have a high pollution rate. Thus, pollution is expected in these countries and the surrounding states.

The concepts of sustainable development and efficiency emerged in the last decade. The Sustainable Development Goals (SDGs) were adopted in 2015 as a strategic framework and guiding principle for all the United Nations’ member states to rationalize their policies and activities to achieve these goals by the end of 2030. In light of this issue, evaluating any country’s potential to fulfill the SDGs by reviewing and evaluating the challenges and economic policies, including energy production and consumption policies and other existing policies, is compulsory (Shahbaz et al. 2019). Given the need to ameliorate environmental quality, this paper discusses the analysis results in light of the performance of current policies and mechanisms for implementing the SDGs with focus on cleaner production practices. This study relies on the pollution haven hypothesis (PHH) and pollution halo hypothesis (P-HH) theories (for more details, see “Theoretical framework and literature review”) to extrapolate and examine the effect of FDI on EP in the selected Arab countries through validation or negation. This study makes the following contributions:

-

1-

The influence of FDI on EP is analyzed using the STochastic Impacts by Regression on Population, Affluence, and Technology (STIRPAT) model for the Arab countries from the PHH and P-HH perspectives.

-

2-

The practical outcomes are discussed and linked with the general policy performance level to implement the SDGs by concentrating on cleaner production practices in the selected Arab countries.

-

3-

Additional determinantsFootnote 3 are incorporated into the carbon emission function with a long-updated panel data to improve the estimation accuracy.

-

4-

Robust and informative spatial econometric technique (i.e., two types of exploratory spatial data analysis [ESDAFootnote 4], namely, global and local Moran’s I, and three types of spatial econometric regression techniques, namely, spatial autocorrelation [SAR], spatial error model [SER], and spatial Durbin model [SDM]) is employed to address the SAR and discover the impact of FDI on EP and distinguish between the direct and indirect spatial effects of independent variables on EP emission. To the best of our knowledge, this study is possibly the first to apply this technique for the Arab countries.

-

5-

Diagnostic tests are performed to confirm whether the estimated results are accurate; these tests were not used in most previous studies that utilized the spatial analysis technique.

Studies on FDI and EP with focus on SDGs and cleaner production practices in the Arab countries are generally scarce. This study fills this gap and enriches the literature in this field. On the basis of the outcomes, this study is expected to provide useful suggestions to policymakers in achieving sustainable economic development and formulating effective environmental policies.

The remainder of this paper is organized as follows: “Theoretical framework and literature review” includes a brief theoretical framework and literature review. “Methodology” describes the econometric methodology used, the data, and the scope of the study. “Empirical results and analysis” presents the empirical results and analysis. “Implications for theory and practice” discusses implications for theory and practice. The conclusions and policy recommendations are provided in “Conclusions and recommendations.”

Theoretical framework and literature review

Increasing scientific research attention has been given to studying the FDI effect on EP. Two contradictory theories, namely, PHH and P-HH, are related to the influence of FDI on the environmental quality of the host country (Copeland and Taylor 1994; Tobey 1990). To review theories and previous studies logically and smoothly, the related literature can be broadly classified into three categories, namely, (1) theory and studies on the PHH, (2) theory and studies on the P-HH, and (3) studies with statistically insignificant results or mixed results. In the following paragraphs, we indicate the relevant theories and empirical evidence for each segment.

According to Mert et al. (2019), OECD 1999 stated that “pollution control is no easy task, it is generally debate that there is a trade-off between economic development and environmental protection.” The FDI’s effect on environmental pollution is dependent on the development level. FDI affects the environmental quality of host countries through various channels (i.e., scale, technique, and composition effects) (Grossman and Krueger 1991). The scale effect suggests that the FDI may increase emissions through its influence on economic activity as a result of scaling up the size of the economy, ceteris paribus (Shahbaz et al. 2018). The technique effect captures the influence of the relocation and diffusion of modern technology and the introduction of new environmental regulations on environmental quality, which can be induced by the FDI inflow (Pazienza 2015). The composition effect indicates that FDI can increase or decrease the emissions depending on whether a high FDI would shift the economic structure toward more or less polluting sectors (Pazienza 2019).

Brief on PHH and associated studies

The PHH proposes a theoretical framework to interpret the effect of FDI on EP. This theory asserts that the assumed relationship between FDI and EP may result in multinational companies relocating their investments or exporting waste goods by expanding trade from developed countries to developing ones that have lax environmental standards instead of helping improve local mitigation efforts. In other words, the increase in the production and consumption levels in developed economies and the increase in the FDI inflows in developing ones can deteriorate the domestic environmental quality via increased emissions, especially because the production sectors of these countries adopt nonrenewable and energy-intensive technologies. Another factor that contributes to environmental quality degradation is the low consumer awareness in these countries (Solarin et al. 2017; Nadeem et al. 2020).

According to Al-Mulali and Tang (2013), the PHH implies that FDI has a positive relationship with environmental pollution. The governments of host countries usually seek to attract and encourage FDI by undermining interest in the environment via lightened or non-enforced regulations to meet development needs (Copeland and Taylor 1994; Asghari 2013; Zhu et al. 2016). Thus, multinational companies tend to shift their pollution-intensive investments to developing countries, which have weaker or less stringent environmental laws and regulations than developed countries these developing countries also have more abundant natural resources and cheaper labor force than the developed one (Walter and Ugelow 1979; Baumol et al. 1988; Seker et al. 2015; Nadeem et al. 2020). Therefore, the cost of meeting environmental regulations appears lower in the former. Moreover, developing countries may have a comparative advantage in pollution-intensive production, and the PHH provides further evidence to those who have allegations that developed countries export their pollution-intensive productions to developing ones (Cole 2004). This condition results in emissions, which in turn cause excessive pollution and deteriorate the environmental criteria of the host countries (Jiang et al. 2018). Consequently, developing countries become pollution havens.

In this context, the first segment comprises several studies conducted in this regard and that support the hypothesis. Ren et al. (2014) and Zhou et al. (2018) studied the influences of FDI on CO2 emissions in the industrial sectors of China and 285 Chinese cities and determined that large FDI inflows lead to increased and aggravated CO2 emissions in China.

The study on 19 African countries by Aliyu and Ismail (2015) validated the PHH. Many other studies, such as those by Baek (2016), Liu and Kim (2018), and Shahbaz et al. (2018), proved the PHH either for time series or panel data in the samples. Sekar et al. (2015) studied the impact of FDI on environmental quality in Turkey and found that FDI has a positive impact but a relatively small effect in long and short runs. Bakhsh et al. (2017) and Zhu et al. (2017) in their studies in Pakistan and 10 Chinese cities in the Beijing–Tianjin–Hebei provinces, respectively, corroborated the positive influence of FDI on CO2 emissions. A recent study by Shahbaz et al. (2019) for the MENA countries demonstrated the PHH and confirmed the N-shaped relationship between FDI and CO2 emissions.Footnote 5

Brief on P-HH and related studies

Despite the well-established economic reasoning, theoretical clarifications and practical evidences of the PHH, many researchers (Grossman and Krueger 1991; Keller 2004, Liu et al. 2017a, b; among others) adopted an opposite view to the PHH and they emphasized that FDI improves the local environmental quality in host countries (i.e., states that have a negative relation between FDI inflow and environmental degradation). This view is known as the P-HH, which states that multinational companies use modern technology in addition to having management systems that contribute to improved environmental management practices (Zarsky 1999; Cai et al. 2018), transfer advanced and environmentally friendly technologies to local firms, and stimulate local firms into adopting and applying environmental criteria as a result of market competition, empowering them to achieve cleaner and green production. Such contributions improve the global ecological quality and regional sustainable development abilities, thereby leading to a clean environment in the host countries (Asghari 2013; Zhu et al. 2016; Liu et al. 2017a, b; Jiang et al. 2018; Rafindadi et al. 2018).

In this perspective, the P-HH affirms that FDI enhances the host country’s economy and reduces ecological degradation. Consequently, FDI has a favorable influence on the host country’s environment quality. Asghari (2013) reported that FDI promotes the MENA region’s environmental quality, and the P-HH hypothesis is validated in this region by applying the POLS method. Al-Mulali and Tang (2013) investigated the P-HH’s validation in GCC countries by using the Pedroni cointegration test and FMOLS. They found that FDI is not a source of pollution, and their finding confirms the P-HH.

In individual countries, such as China, many researchers have examined the impact of FDI on EP through the panel data approach and different econometric methods. Zhang and Zhou (2016) and Jiang et al. (2018) used provincial- and city-level data, respectively, while Sung et al. (2018) used subsector data from large cities in China. Meanwhile, Jiang et al. (2018) used air quality index as a dependent variable, while the other two studies used CO2 as a dependent variable. The authors found that FDI has a negative effect on dependent variables. These studies present supporting evidence for the P-HH in the Chinese economy. Studies conducted in multiple countries obtained the same result. Abdouli et al. (2018) and Zhu et al. (2016) addressed the impact of FDI on CO2 emissions in BRICS and ASEAN-5 countries, respectively. Their results corroborate the existence of the P-HH in these countries.Footnote 6

Studies with statistically insignificant and mixed results

In the third segment, the consensus on the results of studies is insufficient, which is probably due to the range of research aims and techniques used in these works. Lee (2013) proved the insignificant impact of FDI on CO2 emissions in G-20 states. Pao and Tsai (2011) tested the effects of EG and FDI on environmental degradation in BRIC countries by applying the panel cointegration technique presented by Johansen, Fisher, Kao, and Pedroni. Their empirical feedback revealed a bidirectional relationship between CO2 emission and FDI, which supported the PHH and P-HH scale effects. Yildirim (2014) used the bootstrap-corrected test of panel causality and the analysis of cross-correlation for 76 states and found that the PHH exists in several countries and the P-HH in others.

Solarin and Al-Mulali (2018) determined the effect of FDI on CO2 emissions, carbon footprint and ecological footprint. Their outcome revealed that FDI does not affect pollution, whereas the country-level results showed that FDI increases pollution in developing countries and alleviates it in developed countries. Liu et al. (2018) utilized data from 285 Chinese cities and the spatial econometric mechanism to examine the impact of FDI on environmental degradation. Their study proved that the PHH exists for wastewater and sulfur dioxide pollution, whereas the P-HH exists for waste soot and dust pollution.Footnote 7

The literature review indicates that an explicit consensus has not been reached. The empirical conclusions are mixed, inconclusive, and conflicting. This problem is attributed to several possible causes. First, the research aims and ideas differed. Second, the samples used in the studies were different in size and type. Third, the independent and control variables utilized in the studies varied. Fourth, the majority of studies used traditional econometric techniques and condoned the effect of SAR, which may have resulted in partial and perhaps biased estimations (Liu et al. 2018; Jiang et al. 2018). Fifth, some errors may have occurred during the collection, conversion, and measurement of data, thereby producing misleading results during the statistical tests. The current study avoids repeating these observations and attempts to use accurate, realistic, and comprehensive data, as well as concentration on the examination of the PHH and P-HH in the selected Arab countries.

Methodology

Model specification and data

To examine the effects of FDI on EP and prove that either the PHH or P-HH exists in the 12 selected Arab countries by employed panel data from 1970 to 2016, this study adopts the STochastic Impacts by Regression on Population, Affluence, and Technology (STIRPAT) model following York et al. (2003) who formulated IPAD into a stochastic model (Wang and Zhao 2015; Khan et al. 2018; Solarin and Al-Mulali 2018; and Koçak and Ulucak 2019, among others). The STIRPAT model reflexes the effect of human actions on the economic development of any country, and is based on IPAT model (where is I represents pollutants emitted, P is population, A is affluence, and T is technology). Under the original STRIPAT model, a country’s environmental quality is formed by demographic dimensions, economic flourishing or opulence level, and accessible technology in an economy (Solarin and Al-Mulali 2018).

The changes in the demographic dimensions can be captured by the population density in a specific country. An increase in the population density of a region generally leads to an increase in consumption and induces pressure on resources, resulting in rapid depletion. Consequently, the environmental quality will be affected by the increased amount of greenhouse gases, which mostly comprise CO2 emissions. The high population density of any region results in the expansion of urbanization and increased human activities, which then increase the population’s need for large amounts of diverse, uninterrupted energy. Growing demand is often met by fossil fuel derivatives, which are considered a main source of pollution (Rasool et al. 2019). The population of the MENA countries rose from 138 million people in 1970 to more than 433 million people in 2016, and the urban population rose from 59 million people in 1970 to more than 280 million people in 2016 (WDI 2020). Economic flourishing (affluence) is linked to the average consumption of each person in the population and can be captured using the average propensity to consume. Consumption is measured using the GDP per capita and is thus often assumed to increase as production increases, thereby consequently aggravating environmental pollution. However, not all forms of economic growth are damaging to the environment. Over the past few centuries, GDP per capita has been rising steadily and is considered the main driver of human influence on the environment (Abdouli et al. 2018).

In the STIRPAT model framework, technology explains the other factors that affect environmental quality and may affect our planet negatively or positively. The negative effect occurs in two main ways: pollution and depletion of natural resources. On the other hand, many positive efforts are being made to solve major environmental concerns by shifting toward clean environmental technology to control or reduce the negative effect. Several variables, such as FDI, energy consumption, and industrial structure, can act as agents of technology. As we previously mentioned in the theoretical framework, FDI can incur positive and negative effects, consistent with the PHH and P-HH. The negative impact occurs either through foreign companies’ transfer of investments or unclean technologies, which damage the environment, to developing countries because of these countries’ weak environmental laws and because developed countries are inhospitable to such investments given their strong environmental laws. Another negative effect is generated through the unjust large-scale depletion of natural resources, especially nonrenewable ones, by foreign companies, which disregard environmental quality standards. The positive impact is embodied in the P-HH theory, which suggests that foreign companies have administrative expertise and advanced technologies that consume less energy and that they also use renewable energy resources, thus contributing to the reduction of CO2 emissions and to the improvement of environmental quality. With regard to the energy and industrial structure, the technology in the Arab countries is still not modern enough and depends mainly on unclean energy sources, such as oil, gas, and coal. These variables contribute to a negative environmental impact by increasing pollutant emissions as a result of the use of nonrenewable energy. Moreover, dirty extractive industries are not subjected to adequate environmental control, thereby leading to environmental degradation in these countries.

According to Dietz and Rosa (1997), the STIRPAT model can be adjusted by decomposing the factors of population (P) and affluence (A). Hence, in this study, CO2 is used to measure the environmental pollution (I), population density (POPD) is used as an index of the population (P), and economic growth and domestic capital stock (DCS) is utilized to capture the affluence (A) of an economy. To include additional factors in the STIRPAT model, York et al. (2003) and Chikaraishi et al. (2015) emphasized that technology can be directly disaggregated. Therefore, in this study, T is disaggregated into three factors: FDI, energy consumption (EC), and industrial structure (IS). The POP, EG, FDI, EC, and IS have also been used as the main determinants of EP in various previous studies, such as those by Pao and Tsai (2011), Al-Mulalia and Tang (2013), Seker et al. (2015), Shahbaz et al (2015), Baek (2016), Zhu et al. (2016), Bin and Wu (2017), Abdouli et al. (2018), and Shahbaz et al. (2018). To assess the impact of elements that are not included, York et al. (2003) noted that additional factors could be added to the basic STIRPAT model as long as they are theoretically appropriate for the model’s multiplicative specification. Subsequently, this study adds environmental regulation (ER) that may have a significant effect on the environment. On the basis of the previous clarification, within the scope of the STIRPAT model, the following equation is expressed as:

If we integrated all proxy (see Table 1) of the primary variables into Eq. (1), as well as, the parameters, a constant, and an error term are added, then we obtain the following linear panel model:

where α represents a constant term; β1, β2, …, β7 are the parameters to be estimated with the variables; suffixes i and t clarify the countries and years for the panel model, respectively; and ε is the error term. Table 1 presents comprehensive details about the variables and the data sources. In this study, variables FDIPC and ER include negative and zero values. Thus, not all variables are transformed into the natural logarithm form. The expectation–maximization technique is implemented to estimate the missing values for some years of the variables considered. The sample used in this study is panel data for the period 1970–2016. Gujarati (2004), Baltagi (2005), and Pesaran (2015)Footnote 8 indicated that researchers are strongly motivated to use panel data because panel data are informative and have more variability, have less collinearity among variables, and have more degrees of freedom and more efficiency. Moreover, panel data can be used to control individual heterogeneity, comprehensively study the dynamics of adjustments, and alleviate the bias that might result from the aggregation problem. This study also applies the spatial analysis technique to spatially converge the Arab countries as an aggregate, which share borders and appear as a geographic group or a single block. According to Hansen (2020), “The macro panels are typically national or regional macroeconomic variables and are characterized by a medium number of variables (e.g., 7–20) and a medium number of time periods (20–60 years).”

Econometric methods

Spatial econometrics focuses on the spatial interaction among different geographical regions and concentrates on the spatial dependence and spatial heterogeneity among variables unlike traditional time series or panel data techniques. The ESDA technique is among the most commonly used methods. The spatial econometric method has four advantages. First, spatial econometrics can appropriately visualize spatial information. Second, according to Jiang et al. (2018), this method enables researchers to focus on spatial diffusion and can capture the spatial spillovers of exogenous variables in the model. Third, this method considers spatial dependence and generates unbiased outcomes unlike traditional econometric methods (Reinhard and Linderhof 2013). Fourth, this method allows for dynamics and can handle possible spatial correlation effectively, guaranteeing precise and reliable estimates (Elhorst 2014; Hao and Peng 2017). Thus, this study applies two types of ESDA techniques, namely, global and local Moran’s I, and three types of spatial econometric regression techniques, namely, SAR, SER, and SDM.

Spatial autocorrelation

Global Moran’s I

According to Wang et al. (2019), Moran’s I is utilized to study the grade of total SAR and the pattern of spatial distribution with a global perspective that determines the resemblance of observations among neighboring geographical units. Global Moran’s I is expressed as:

where n indicates the spatial units indexed number denoted by i and j, \( \overline{\mathrm{X}}=\frac{1}{\mathrm{n}}\sum \limits_{\mathrm{i}=1}^{\mathrm{n}}{\mathrm{x}}_{\mathrm{i}},{\mathrm{S}}^2=\frac{1}{\mathrm{n}}\sum \limits_{\mathrm{i}=1}^{\mathrm{n}}{\left(\mathrm{x}-\overline{\mathrm{X}}\right)}^2 \), xi and xj are the variables of interest, \( \overline{X} \) represents the mean of the variables of interest, and wij refers to the corresponding value in the spatial weight matrix.

The values of the global Moran’s I vary from − 1 to 1. If the global Moran’s I < 0, then the variables have a negative spatial correlation, clearly implying that a spatial difference exists among cells and adjacent cells in the attribution values. If the global Moran’s I > 0, then the variables have a positive spatial correlation, revealing the clear spatial range of cells with high or low attribute values. If the global Moran’s I = 0, then no spatial correlation exists among the variables, indicating a pattern of random spatial distribution.

Local Moran’s I

Yu (2012) noted that the global Moran’s I cannot illustrate the patterns of spatial correlation in various locations. Local Moran’s I can be used to identify the spatial grouping style that may be present in various spatial locations and consider atypical features in several areas (Goodchild 1986; Anselin 1995; Wu et al. 2017; Wang et al. 2019); it is calculated as follows (Anselin 1995; Liu and Lin 2019):

The above symbols are described in Eq. (3) of the global Moran’s I. The local indicators of spatial association (LISA) are widely used in the local Moran’s I. Based on the results of the LISA calculation, a positive value of the local Moran’s I indicates high–high (HH) or low–low (LL) clustering. HH clustering implies that the regions with high values are surrounded by areas with high values, whereas LL clustering indicates that the areas with low values are surrounded by areas with low values. Conversely, a negative local Moran’s I denotes high–low (HL) or low–high (LH) clustering. HL clustering implies that the regions with high values are surrounded by regions with low values, and the opposite situation is implied by LH clustering.

Spatial panel data econometric technique

Spatial panel data models are characterized by accurate estimation models because the spatial and temporal influences on dependent variables are considered (Liu et al. 2017a, b). According to Elhorst (2003), three models, namely, SLM, SEM, and SDM, are widely used.

-

1.

The basic form of the SLM is:

where i and j are spatial units that represent countries i and j, respectively (i ± j, and j = 1, …, N); t represents the periods (t = 1, …, T); Yit denotes the dependent variable; ρ is the coefficient of spatial regression, which represents the spatial dependence of the adjacent area observations; Wij indicates the (N × N) spatial weight matrix; \( \sum \limits_{\mathrm{j}=1}^{\mathrm{N}}{\mathrm{W}}_{\mathrm{ij}}{\mathrm{Y}}_{\mathrm{j}\mathrm{t}} \) is the interaction effect of dependent variable Yit with spatial lag explanatory variable in adjacent units; is the constant term parameter; is a matrix of independent variables; β is a vector of coefficients that will be used for estimation; Yi is the spatial specific effect of a spatial unit; ƞt denotes the time-specific effect of spatial units; and εit is the error term for i and t with zero mean and σ2 variance. If we substitute the values of Yit and Xit into Eq. (5) with the values of Eq. (2), then we obtain the SLM of this study as follows:

The meanings of the above symbols are the same as those in Eqs. (2) and (5).

-

2.

The basic form of the SEM is:

where φit reflects the spatial error autocorrelation term. λ describes the SAR coefficient of the error term, and \( \sum \limits_{\mathrm{j}=1}^{\mathrm{N}}{\mathrm{W}}_{\mathrm{ij}}{\upvarphi}_{\mathrm{j}\mathrm{t}} \) indicates the interaction impacts among the spatial error autocorrelation terms of the neighboring units. The remaining parameters are the same as those in Eq. (5). If we substitute the values of Yit and Xit into Eq. (7) with the values of Eq. (2), then we obtain the SEM of this study as follows:

The meanings of all parameters are the same as those in Eqs. (2), (5), and (7).

-

3.

The basic form of the SDM is:

The third model supposes that the spatial lags of the dependent and explanatory variables affect the dependent variable, which is specified as:

where φ is the vector of the spatial lag autocorrelation coefficient of independent variables, and \( \sum \limits_{\mathrm{j}=1}^{\mathrm{N}}{\mathrm{W}}_{\mathrm{ij}}{\mathrm{X}}_{\mathrm{ij}\mathrm{t}} \) indicates the interaction impact of dependent variable Yit with spatial lag independent variable Xit in neighboring units. The other parameters are the same as those in Eqs. (5) and (7). To obtain the SDM for this study, we substitute the values of Yit and Xit in Eq. (9) with the values of Eq. (2) as follows:

The meanings of all parameters are the same as those in Eqs. (2), (5), and (7). Notably, the SDM is an extension of the SLM with the addendum of spatial lag terms of all independent variables. The SDM tests have two hypotheses. The first hypothesis is H0 = 0, and the second hypothesis is H0 + = 0. If the two hypotheses are accepted, then the SDM can be simplified to either the SLM or SEM according to the results of the hypothesis tests. Otherwise, the SDM best captures the spatial correlation of data.

Spatial weight matrix

The proper selection of the weight matrix is a key determinant of the spatial regression results and accurate estimations. “Its elements can depend on geographical, economic, or political distances among countries” (Yesilyurt and Elhorst 2017). For robustness, we adopt four types of spatial weight matrix. The first one depends on contiguity weights, whereas the last three depends on distance weights.

The first matrix uses queen contiguity spatial weights, in which elements equal to one if two countries share a common border, whether land or maritime, and 0 otherwise. While the distance weights of the spatial weight matrix are constructed depending on the space between the capital pairs of all countries. The second matrix is the adaptive Karnal quartic function spatial weight matrix with diagonal weights equal to 1 and K nearest neighbors. The third matrix is the distance bandwidth of the spatial weight matrix, and the last form is the K nearest neighbors of the spatial weight matrix. This study uses the abbreviations A-K-weights, D-b-weights, and K-N-n-weights for the three spatial weight matrices. The effects of independent variables on EP are assessed by estimating Eqs. (2), (3), (4), (6), (8), and (10). The estimation procedures are presented in Fig. 3.

Empirical results and analysis

Descriptive statistics and correlation matrix

A review of the descriptive statistics and correlation coefficient is necessary in any study. Table 2 contains the descriptive statistics and the correlation matrix, which provide a clear insight into and a generalized view of the dataset utilized in this study. The matrix results suggest a mixed correlation, but no strong correlation is observed among the independent variables. The outputs also denote that CO2 has a strong positive relationship with EUPC and a weak positive correlation with POPD. The other variables have medium and weak mixed correlations with CO2.

Spatial autocorrelation measures

Global Moran’s I result

Table 3 indicates that all global Moran’s I values corresponding to the study period are statistically significant with a positive sign at levels of 1%, 5%, and 10% for all weight matrices, except in 1970 in which the value corresponding to the D-b-weights is statistically insignificant. Figure 4 shows the global Moran’s I values of CO2 emissions with three weights for the same period and their SAR general trends.

As illustrated in Fig. 4, the global Moran’s I values of CO2 emissions with A-K-weights are higher than those for emissions with other weights. The values present a downward trend. The values for the CO2 emissions with D-b-weights are lower than those for emissions with other weights and have an upward trend. The values for the CO2 emissions with K-N-n-weights have an upward trend but are more volatile than those for the CO2 emissions with D-b-weights. Therefore, the D-b-weights have a good fit to describe global SAR better than the other two weight matrices and imply that an obvious positive SAR of country-level CO2 exists with an upward trend from 1970 to 2016. This finding indicates the strongly interdependent SAR of the CO2 among neighboring countries. A change in the CO2 emission level in one country will indirectly effect on the CO2 emissions in adjacent countries.

Local Moran’s I result

Dong et al. (2019) stated that the global Moran’s I index test cannot reflect the SAR of local areas. Anselin (1995, 1996, 2002) indicated that the Moran’s I scatterplot is an optical tool for clarifying the SAR of local areas. Therefore, the current study uses the local Moran’s I analysis by using the LISA and scatterplots to capture the dependence of local areas. As shown in Fig. 5, this study utilizes the LISA cluster maps for CO2 emissions with three weight matrices for the years 1971, 1986, 2001, and 2016. The insignificant cluster numbers for the three weight matrices during the 4 years are compared. The D-b-weights contain the fewest insignificant clusters among the three weights. This weight is selected as a basis for analyzing the results.

Figure 5 indicates that the CO2 spatial distribution contains three clusters, namely, HH, LL, and LH. The HH cluster in 1971 includes UAE, Qatar, and Kuwait. In 1986, the number of countries belonging to the same cluster increased to five with the entry of Qatar and Bahrain. In 2001, the number of countries declined to four when Saudi Arabia left the cluster. In 2016, the spatial distribution of the number of highly polluting countries changed twice as much as that in 1972, which covers all GCC countries. The LL cluster contains four countries, namely, Syria, Jordan, Lebanon, and Palestine. No changes in the members of this cluster occurred during the four selected years. Oman remained in the LH cluster in 1970, 1986, and 2001, and Bahrain and Saudi Arabia joined in 1971 and 2001, respectively. The results of Iraq and Yemen are insignificant during the 4 years.

For robustness, this study uses Moran’s I scatterplots for the average CO2 emissions (1970–2016) with different weights to support the LISA results in Fig. 5. The three weights are compared in Fig. 6 in terms of point clusters in the first and third quadrants. The middle shape with D-b-weights represents the highest point clusters in the two quadrants. Therefore, this study uses it as a basis to analyze the results.

As shown in Fig. 6, more than two-thirds of the countries are located in the first (upper right) and third (lower left) quadrants, and the Moran’s I value of the average CO2 is positive. Thus, the results in Figs. 5 and 6 indicate positive significant spatial characteristics of autocorrelation for the CO2 emissions among the selected Arab countries. This finding implies that highly polluted countries are surrounded by highly polluting countries, and pollution tends to move from a highly polluted country to its neighboring countries, and vice versa for countries with low CO2 emissions. Consequently, the CO2 emissions in the selected Arab countries have a strong regional distribution. Significant attention should be given to the SAR of CO2 emissions in those countries.

Estimation regression results of spatial panel models

This study tests SAR by employing Moran’s I tests in “Estimation regression results of spatial panel models” to construct spatial analysis models. For high precision and robustness, this study also uses the LM test to detect the existence of SAR and determine whether the traditional or spatial panel data models can be used. If any of the test outcomes is statistically significant, then the spatial econometric models are chosen to capture the SAR of data because their results are more accurate and consistent than those of traditional models; otherwise, the traditional panel econometric models are used (Liu et al. 2017a, b; Zhang et al. 2018; Wang et al. 2019).

Table 4 demonstrates the results of traditional the LM tests, which are implemented by OLS with different weight matrices. All results are positive and statistically significant at 1% and 5% levels. Consequently, the null hypotheses of LM-lag, robust LM-lag, LM-error, and robust LM-error tests are rejected. These results prove the existence of SAR and show that the spatial econometric models are more convenient than the traditional panel econometric models for addressing the influence of FDI on EP in the selected Arab countries. To summarize, the SLM, SEM, and SDM are not rejected and can thus be used for estimation.

The next step is estimating the three regressions, SLM, SEM, and SDM, with three different weight matrices.Footnote 9 Then, we attempt to determine the appropriate regression, considering that every regression has three estimates with different weights. According to Anselin (2005), “the best fit regression has a higher value of LLF and the lowest values of AIC and SC.” After comparing the three regressions per model individually, we found that the D-b-weight regression has the highest value of LLF, the lowest values of AIC and SC, and the highest R2 and \( \overline{R^2} \) among the three weight matrix regressions of the SLM and SDM. Furthermore, the similar results of the K-N-n-weight regression of the SEM, the F-test, the Wald test, and σ are all highly significant in three regressions. These results indicate that the regressions included in Table 5 are the best-fitted regressionsFootnote 10 and are entirely significant at the 5% level.

As shown in Table 5, the outputs of SAR coefficients 휌 휌 and λ are highly statistically significant at the 5% and 1% levels of the three regressions, which suggest that the increase in CO2 emissions of one country’s neighboring regions leads to the increased CO2 emission of this country. In other words, the CO2 emissions in an area significantly affect the CO2 emissions in the vicinity. Table 6 shows the robustness and reliability results of the diagnostic tests conducted on the SLM, SEM, and SDM. All the regressions passed the diagnostic tests with high statistical significance at the 1% level, thereby supporting the results obtained by the LM test and the SAR measures.

We must ensure that the SDM regression with D-b-weights can be simplified to the SLM or SEM regressions. In this step, we adopt the likelihood ratio (LR) and Wald tests of spatial lag and spatial error to test the first hypothesis (H0, φ = 0) and the second hypothesis (H0, φ + ρ + β = 0), respectively. The test outcome in Table 7 shows that the two hypotheses are strongly rejected by the Wald and LR tests at a significance level of 1%. In sum, the two tests suggest that the SDM is the best and reject SLM and SEM. Therefore, the SDM’s illustrative power can be accessed and reasonably adopted. This study adopts the SDM regression with a D-b-weight matrix to investigate the impact of FDI on EP in the selected Arab countries.

However, the analyses based on the SDM’s estimates to decide whether indirect spatial effects exist may lead to incorrect conclusions because of the spatial dependence pattern. That is, explanatory variables may have direct and indirect effects on the dependent variable, so the SDM coefficient cannot fully reflect the fundamental relationships between variables (LeSage and Pace 2009; Elhorst 2010; Jiang et al. 2018; Du et al. 2019). Thus, we should focus on analyzing the direct and indirect effects of explanatory variables. The results are shown in Table 8.

This study disaggregates the effects of independent and control variables on EP of the SDM into direct and indirect effects, as suggested by Lesage and Pace (2009). We begin analyzing the independent variable (FDIPC). Table 8 indicates that the direct effect coefficient of FDIPC is positive and highly statistically significant at the 1% level. Thus, if FDIPC increases by 1%, then the CO2 emissions in the selected Arab countries will increase by 0.68%. This increase has a negligible proportion, but it has a distinct significance to the existence and validity of the PHH in the selected Arab countries. This result is practically the same as that in the fifth column of Table 5, with a slight difference in values. The possible explanation for this phenomenon is twofold. First, a country’s FDI inflow can promote EG and drive the host country development via the technology spillover effect. Thus, the Arab states have been attempting to attract additional FDI and prioritize and facilitate investment in capital-intensive productive sectors to achieve rapid and sustainable economic development. Therefore, governments exercise flexibility and tolerance in handling FDI in the enforcement and strengthening of environmental laws. This approach leads to the excessive usage of resources in the dirty industries, thereby increasing the CO2 emissions through the diffusion effect and promotes environmental degradation. Second, the FDI in the Arab countries concentrates on pollution-intensive extraction sectors (specifically, the oil and gas sectors) and the construction and service sectors. Thus, the majority of foreign firms operating in these sectors have not been using energy-saving systems and require high energy consumption, which in turn increase the demand for EC. These factors contribute significantly to air pollution through the spread of CO2, which is cone of the leading causes of global warming. This finding is consistent with those of previous studies, such as those by Zhu et al. (2017), Liu and Kim (2018), Zhou et al. (2018), Gorus and Aslan (2019), and Shahbaz et al. (2019). Some researchers have proven the opposite of this study’s findings, such as Zhang and Zhou (2016), Jiang et al. (2018), Abdouli et al. (2018), Sung et al. (2018), and Liu and Lin (2019). Moreover, FDIPC has a statistically insignificant positive indirect effect; this implies that the rising in FDIPC of one country’s adjacent regions has insignificant impact on CO2 emissions and deteriorates the environment in this country.

The empirical outcomes in Table 8 show that GDP has a negative statistically significant direct effect at the 5% level, suggesting that an increase in GDP will reduce the CO2 emissions and enhance the environmental quality. This outcome is consistent with those of Zhou et al. (2018), Hafeez et al. (2018), and Liu et al. (2019). By contrast, GDP has a positive statistically significant indirect effect at the 1% level. If GDP increases in one state’s adjacent regions, then the CO2 emissions and environmental hazards will increase in this state.

Another remarkable result that can be derived from Table 8 is that EUPC and POPD have a positive statistically significant direct effect on CO2 at the 10% and 5% levels, respectively. This result indicates that the growth in EUPC and POPD leads to increased CO2 emissions. The indirect effect has a positive sign and is statistically significant at the 1% level. This effect demonstrates that increases in EUPC and POPD in one country’s adjacent regions lead to increased CO2 emissions in this country. These practical results are similar to those of Zhu et al. (2017), Rafindadia et al. (2018), and Shahbaz et al. (2018). This study also disaggregates GFCFP into direct and indirect effects. As revealed in Table 8, GFCFP has statistically significant direct and indirect effects at the 1% level. If GFCFP rises by 1%, then the CO2 will directly increase by 0.20%; otherwise, it will indirectly decrease by 0.35%. This empirical finding is consistent with those of Ye et al. (2018), Rauf et al. (2018), and Liu et al. (2019). However, Rafindadia et al. (2018) indicated the opposite in their study of EP for GCC. The indirect effect is that an increase in GFCFP in one country’s adjacent regions leads to reduced CO2 emissions in this country.

This study separates other factors that affect EP. As shown in Table 8, ISP has a positive statistically significant direct effect on CO2 at the 10% level. If ISP increases by 1%, then CO2 will directly increase by 0.43%. This result is consistent with those of Lin et al. (2017), Liu et al. (2018), Zhou et al. (2018), Wang and He (2019), and Liu et al. (2019). The ISP’s indirect and total effects are positive but statistically insignificant. ER has a positive sign for direct and indirect effects; however, the effects are all statistically insignificant. This insignificant effect is due mainly to the weakness of the legal and regulatory structure of environmental laws and the lack of interest in them from both the Arab community and governments. Table 8 shows that all direct effects are smaller than the corresponding indirect effects of most variables. These variables have powerful spatial spillover effects on the adjacent countries’ CO2 emissions.

For robustness check reasons, geographically weighted regression (GWR), spatial autoregressive generalized method of moments (SPGMM), and SAR model with spatial weight matrices are used to investigate and check the robustness of the results in Table 5. As shown in Table 9, the regression results remain nearly the same as the results in Table 5, with a slight difference in coefficient size. Therefore, the results are robust.

Implications for theory and practice

To some extent, this study analyzed the influence of FDI, EG, EC, POP, IS, DCS, and ERs on EP for the 12 selected Arab countries. The experimental spatial analysis highlighted several ideas on the clean production practices and sustainable development in these states. Few studies on these aspects are conducted from a sustainable development perspective in the Arab countries. Thus, in this section, we illustrate the findings’ implications. The results of this study show that FDIPC has the PHH, and FDIPC, EUPC, POPD, GFCFP, and ISP have a positive direct effect, but GDP has a negative direct effect. Furthermore, GDP, EUPC, and POPD have positive indirect effects, whereas GFCFP has negative indirect effects. In addition, the insignificant direct effect has been found on FDIPC and ISP; the same indirect effect result was found for the ER. This study’s results indicate that because most variables have either a direct or indirect negative impact, we can assume that the impact’s mechanism in the Arab countries are not environmentally friendly and are detrimental to sustainable development and cleaner production. Therefore, the decision-makers in these countries must reengineer policies related to foreign and domestic investments, energy, industry, and trade to guarantee sustainable economic development and environmental quality and protect against environmental degradation.

Over the past decades, several studies have strongly defended the positive impact of FDI, economic growth, and renewable energy sources on sustainable development and environmental quality (Lee 2013; Zhu et al. 2016; Abdouli et al. 2018; Rafindadi 2018; Shahbaz et al. 2019). Given that the Arab countries are still developing countries and in the emerging phase, unplanned and unguided FDI flows to economic sectors, especially pollution-intensive sectors, and the concomitant negligence and leniency in enforcing basic environmental standards may harm environment quality and delay the achievement of SDGs in these countries. Notably, countries with high and stable growth are witnessing increased societal awareness of and demand for services with stringent environmental standards, leading to the high efficiency of resource utilization in modern production, which improves environmental quality and lowers CO2 emissions. The opposite situation was observed among countries with low and volatile economic growth, who seek to achieve high, rapid, and sustainable growth by exploiting their resources and importing production inputs from neighboring countries at the expense of environmental quality, resulting in increased energy consumption, waste production, and further environmental degradation. These countries thus have to adopt and enforce global environmental standards; direct, stimulate, and assist FDI in adopting and importing cleaner production technology; and rely on modern and renewable energy systems to save energy. Diversifying investments in various economic sectors and adopting domestic and regional economic and trade policies can also help achieve cooperation and integration and fulfill part of the following SDGs: (1) SDG 8, namely, decent work and economic growth; (2) SDG 12, namely, responsible consumption and production; (3) SDG 13, namely, climate action; and (4) SDG 16, namely, peace, justice, and strong institutions (UNDP 2017).

Similarly, Shahbaz et al. (2019) stated that the enforcement of high-end renewable energy solutions in these countries may be harmful to economic growth, and CO2 emissions will increase and lead to environment deterioration with continued use of fossil fuel and coal to generate energy. Thus, these countries should use modern and renewable energy systems as an alternative to conventional energy systems by adopting a gradual and balanced substitution policy, especially because of the low and negligible use of renewable energy sources in these countries despite the appropriate environment. In addition, renewable energy sources are energy-efficient and can help reduce energy poverty in the Arab countries. Typically, the development of such systems endogenously requires more time. Therefore, the policymakers in these countries should focus on developing green trade policies that would limit the import of conventional unclean energy, fossil fuels, and coal through import substitution policies. Such mechanisms can contribute and pave the path for the enforcement of alternative energy solutions across countries and the reduction of CO2 and protection of both environmental quality and trade balance. In addition, part of the SDGs might be achieved: (1) SDG 7, namely, affordable and clean energy, and (2) SDG 13, namely, climate action (UNDP 2017).

The high and rapid population growth rate of the Arab countries along with other factors (e.g., population distribution, population density, migration, age distribution, and societal awareness) are considered a major driving force for the high demand of limited natural resources, energy, and another services (Zhang et al. 2017; Zhang et al. 2018). Thus, they impose diverse and volatile effects on EP. On the basis of this view, the empirical analysis results show existence of direct and indirect negative impacts on EP, which exert additional pressure on the fragile environmental quality in the Arab countries. Therefore, policymakers in these countries should direct and stimulate (e.g., tax exemptions, financial subsidies, investment facilities, and training) both population and companies to use renewable energy systems to generate and consume energy from clean sources, whether in household or in production processes. Furthermore, governments should promote public–private partnerships in this area to raise community awareness of the benefits and efficiency of clean renewable energy solutions and of concepts associated with the environment and to encourage the adoption of a modern green lifestyle based on economy and low-carbon consumption. These measures can help the Arab countries lay the groundwork for developing local alternative energy solutions that will protect and upgrade environmental quality, increase the rate of cleaner production, and achieve part of the following SDGs: (1) SDG 4, namely, quality education; (2) SDG 11, namely, sustainable cities and communities; and (3) SDG 12, namely, responsible consumption and production (UNDP 2017).

In the same context, the Arab countries are developing countries and are still in the initial stages of industrialization, which is why they seek to increase their industrial production in various sectors with a focus on the oil and gas sector. They also provide facilities and incentives for domestic companies to contribute to increased production and competition in the market. Some companies usually take advantage of these features to thrive and profit by using resources to the fullest. However, some of these industries and companies lack standards and regulations that limit emissions from production processes, human activities, and high energy demand. Furthermore, these countries have not signed the Kyoto Protocol because the majority of these countries are institutionally weak. Therefore, may not wish to promote the formulation or strengthening of effective ERs and their enforcement, unlike developed countries (Rafindadia et al. 2018). Accordingly, these reasons contribute significantly to various pollutant emissions, particularly CO2, resulting in low-quality environment. To reduce these pollutants, these countries should ratify the Kyoto Protocol, and policymakers in this region should develop and enforce strict standards and regulations in line with the circumstances of each country. The industrial sector, especially local companies, must also be encouraged to use and adopt business mechanisms that promote competition based on creativity and innovation in energy-saving and low-carbon production in addition to strengthening institutionalization and business automation. These approaches may help reduce the CO2 emissions in the region, halting environmental degradation and achieving a fraction of the following SDGs: (1) SDG 8, namely, decent work and economic growth; (2) SDG 9, namely, industry, innovation, and infrastructure; (3) SDG 13, namely, climate action; and (4) SDG 16, namely, peace, justice, and strong institutions (UNDP 2017).

In general, and in line with the global vision of achieving SDGs, these countries must design a clear path to achieving these goals in accordance with a concise and comprehensive national and regional vision. These implications may guide these countries toward achieving the 2030 SDGs, with cleaner production processes as the main catalysts, thereby improving environmental quality, increasing energy efficiency, and increasing professional opportunities, which in turn will increase the per capita income of these countries (Shahbaz et al. 2019).

Conclusions and recommendations

This study considered the interest of the Arab countries to improve the mechanisms that address environmental issues in accordance with their development plans and in conformity with the literature on international conventions’ requirements and the SDGs. The study focused on the influence of FDI on EP, and the set of control variables (i.e., EG, EC, POP, IS, DCS, and ERs) in the model are included for the 12 selected Arab countries in 1970–2016. Unlike previous studies in the Arab countries, this study used the STIRPAT model to guide the practical results and link them with the implementation of ٍSDGs by focusing on cleaner production practices. Modern spatial econometric analysis methods were also applied. Spatial autocorrelation criteria were used to ascertain whether SAR exists and to determine its trend. The study also utilized spatial econometric panel data analysis, on the basis of which, several standard tests were conducted to determine the best-fit models—SLM, SEM, and SDM—for estimating data (see Fig. 3). The SDM regression with D-b-weight matrix was adopted as the best-fit regression for estimation. The direct and indirect effects adopted in the analysis were estimated.

The empirical results of the global and local Moran’s I and LM tests show that SAR exists among the variables for the selected Arab countries. The main conclusion is that FDIPC has a positive but small direct effect on EP, proving the existence and validity of the PHH. The results also show that FDIPC has a positive direct effect and an insignificant spatial spillover effect. GDP has a negative direct effect and a positive indirect effect. The direct and indirect effects of EUPC are positive but small. The direct and indirect effects of POPD are positive and higher than those of EUPC. In contrast to GDP, GFCFP has a positive direct effect and a negative indirect effect. The impact ratio in both cases was higher than in other variables. Thus, the GFCFP tends to be a significant factor in CO2 emissions. The direct effect of ISP on CO2 is positive, and ISP has the highest influence ratio among the direct effects of all variables, while the indirect effects are insignificant. The ER coefficients were statistically insignificant in the direct and indirect effects.

Our empirical results indicate that FDI negatively affects the EP in the Arab countries. The role of FDI is essential and crucial in this aspect. FDI inflows can be an effective channel for attracting and importing modern technology and clean production inputs, or vice versa. However, dirty FDI inflows in the Arab countries were concentrated in extractive sectors, during the past decades, especially in the oil boom period. This concentration in polluting sectors has directly or indirectly contributed to an increase in CO2 emissions. To alleviate this phenomenon and gradually prevent subsequent deterioration, these countries’ policymakers should enact and strictly implement local and international laws, including the Kyoto Protocol.

Clearly, most of these countries are not politically stable and secure. Thus, they lack efficient institutional capacity and effective financial systems, which hinder the efforts of governments to enact and implement effective environment laws. Therefore, policymakers should directly distribute FDI inflows to various economic sectors and grant them facilities in accordance with binding environmental standards for the rapid transfer of environmentally friendly technology. These procedures will help reduce dirty new FDI inflows and transform the old pollution-producing sectors into modern and clean sectors. Thus, these countries can achieve the SDGs and cleaner production, which will in turn reduce CO2 emissions and improve the environmental quality.

The empirical analysis results show that the Arab countries still face great challenges in implementing SDGs strategies at all levels. Given that most the Arab countries are developing and less developed and are experiencing fluctuations in their economic growth, they are strongly driven to achieve high and sustainable growth. Thus, these countries give significant incentives to the industrial sector in general to achieve targeted growth. The industries in the Arab countries are concentrated in dirty and pollution-intensive activities. Furthermore, these countries suffer from low environmental awareness. As a result, unclean energy is in high demand and the exploitation and consumption of natural resources have increased, thus increasing CO2 emissions and aggravates environmental degradation. To constrain emissions, the integration among these countries should be enhanced to adopt green and balanced regional growth policies that facilitate the development of neighboring countries that have fragile economies by raising the production efficiency and low-carbon intra-trade. The industrial sector should also be encouraged to adopt modern production technologies and low-carbon energy systems and rely on renewable energy sources. Moreover, governments should direct and stimulate society’s awareness about the damage caused by environmental pollutants to adopt a green and modern lifestyle. Governments should also promote coordinated development among different cities to mitigate the adverse environmental effects of rapid urbanization. These solutions will lead to highly efficient resource utilization in modern production. Furthermore, economic sectors will be able to provide different services with cleaner and higher environmental standards. These situations will be reflected in the quality and improvement of the environment and thus reduce the of CO2 emissions under a sustainable development context.

Our results show that energy is one of the major variables that cause pollution in the Arab states. The energy sector in the Arab countries is a traditional sector that relies mainly on fossil fuels and coal for electricity generation. The sector suffers from low energy efficiency and does not exploit renewable energy sources, which are available in this region. This situation results in increased CO2 and worsened environmental degradation, which leads to higher expenditure and delayed implementation of SDG strategies because of the focus on addressing the pollutants’ adverse effects. To control this situation, governments need to participate and manage energy projects, increase energy system efficiency, and prevent energy wastage. Renewable energy should be given the utmost importance in scientific research, innovation, and investment. Governments should impose a customs and consumption tax on companies and sectors that want to continue importing or using conventional energy production systems or provide facilities, tax, and customs exemptions if they have switched to renewable energy production systems. Renewable energy is an appropriate alternative to fossil fuels and coal, especially if supported by government initiatives. Imposing this approach will accelerate the implementation and realization of SDG strategies and cleaner production and inevitably enhance environmental management and quality. Furthermore, CO2 emissions will be reduced, and the environmental welfare of these countries will be ensured.

In summary, this study provides policymakers with valuable suggestions for the formulation of sound economic and environmental policies, which may have a prominent and profound role in achieving SDGs and high environmental quality in the Arab countries and in countries with similar conditions. The governments of these Arab countries must modify and implement environmental laws and regulations and strengthen the institutional capacity to achieve environment management efficiency and the transfer of modern energy-saving technology. Such actions will consequently prompt foreign and domestic companies to practice cleaner production. They must also embrace and support the transition to renewable energy systems and sources, increase energy production efficiency, and guide and stimulate community awareness, which will lead to the local and regional adoption of a green lifestyle and sustainable green development to create an attractive environment for clean FDI. Otherwise, imposing more restrictive regulations on FDI, polluting industries, inter-trade, and international activities that harm environmental quality may effectively accelerate the achievement of SDGs and the reduction of CO2 emissions, thus achieving the target environmental quality according to the circumstances of each country.

This study attempted to use the spatial econometric methodology to address the influence of FDI on EP in the Arab countries. However, several limitations were observed, such as the use of country-level data because of the limited availability of data. For future works, city- or provincial-level data should be used to evaluate the EP in the Arab countries taking into account implement the unit root test with structural break of panel data. Variables other than CO2 emissions, such as solid waste and wastewater, should be used to study all aspects of environmental degradation. The results of the LISA cluster maps indicate that GCC countries have high CO2 concentrations. To accurately diagnose this problem, this paper suggests that a study on these countries should be conducted using time series analysis and with a focus on two structural break unit root tests by employed Lee and Strazicich 2003 LM unit root test or Narayan and Popp (NP) 2-break test.

Notes

Bahrain, Iraq, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi, Syria, the UAE, and Yemen

Emissions Database for Global Atmospheric Research

Economic growth, energy consumption, industrial structure, population, domestic capital stock, and environmental regulation

The exploratory spatial data analysis (ESDA) technique

For more details of these studies, see Table 10 in the Appendix.

For more details of these studies, see Table 11 in the Appendix.

For more details of these studies, see Table 12 in the Appendix.

The coefficients ρ and λ of queen contiguity spatial weights are insignificant, so they are not presented in this paper due to the limited space available for publication. However, they are available upon request.

The results of the SLM, SEM, and SDM with all spatial weights are not presented in this paper due to the limited space available for publication. However, they are available upon request.

References

Abdouli M, Kamoun O, Hamdi B (2018) The impact of economic growth, population density, and FDI inflows on CO2 emissions in BRICTS countries: does the Kuznets curve exist? Empir Econ 54:1717–1742. https://doi.org/10.1007/s00181-017-1263-0

Aliyu AJ, Ismail NW (2015) Foreign direct investment and pollution haven: does energy consumption matter in African countries. J Econ Manag 9(S):21–39 https://www.semanticscholar.org/paper/Foreign-Direct-Investment-and-Pollution-Haven-%3A-in-Aliyu-Ismail/e06ba8691f2f0a399d7d814bc405a5ab6872e55c

Al-Mulalia U, Tang C (2013) Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60:813–819. https://doi.org/10.1016/j.enpol.2013.05.055

Anselin L (1995) Local indicators of spatial association-LISA. Geogr Anal 2:93–115

Anselin L (1996) The Moran scatterplot as an ESDA tool to assess local instability in spatial association. In: Fischer M, Scholten H, Unwin D (eds) Spatial analytical perspectives on GIS. Taylor and Francis, London, pp 111–125

Anselin L (2002) Under the hood issues in the specification and interpretation of spatial regression models. Agric Econ 27(3):247–267. https://doi.org/10.1111/j.1574-0862.2002.tb00120.x

Anselin L (2005) Exploring spatial data with GeoDa: a workbook. Center for Spatially Integrated Social Science.

Asghari M (2013) Does FDI promote MENA region’s environment quality? Pollution Halo or pollution haven hypothesis. Inter J Sci Res Environ Sci 1(6):92–100. https://doi.org/10.12983/ijsres-2013-p092-100

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2 emissions, renewable waste, and FDI relation in Pakistan: new evidence from 3SLS. J Environ Manag 196:627–632. https://doi.org/10.1016/j.jenvman.2017.03.029

Baltagi H B (2005) Econometric analysis of panel data. In: Chapter (1) introduction, 3rd edn. John Wiley & Sons ltd, pp 4-7

Baumol WJ, Baumol WJ, Oates WE, Bawa VS, Bawa WS, Bradford DF (1988) The theory of environmental policy. Cambridge University Press

Bin L, Wu S (2017) Effects of local and civil environmental regulation on green total factor productivity in China: a spatial Durbin econometric analysis. J Clea Prod 153:342–353. https://doi.org/10.1016/j.jclepro.2016.10.042

Cai X, Che X, Zhu B, Zhao J, Xie R (2018) Will developing countries become pollution havens for developed countries? An empirical investigation in the Belt and Road. J Clea Prod 198:624–632. https://doi.org/10.1016/j.jclepro.2018.06.291

Charfeddine L, Mrabet Z (2017) The impact of economic development and social-political factors on ecological footprint: a panel data analysis for 15 MENA countries. Renew Sust Energ Rev 76:138–154. https://doi.org/10.1016/j.rser.2017.03.031

Chikaraishi M, Fujiwara A, Kaneko S, Phetkeo Poumanyvong P, Komatsu S, Andrey Kalugin (2015). The moderating effects of urbanization on carbon dioxide emissions: A latent class modeling approach.Technological Forecasting and Social Change 90( A):302-317. https://doi.org/10.1016/j.techfore.2013.12.025

Cole MA (2004) Trade, the pollution haven hypothesis and the environmental Kuznets curve: examining the linkages. Ecol Econ 48:71–78. https://doi.org/10.1016/j.ecolecon.2003.09.007

Copeland B, Taylor MS (1994) North-South trade and the environment. Q J Econ 109(3):755–787. https://doi.org/10.2307/2118421

Dietz T, Rosa E A (1997). Effects of population and affluence on CO2 emissions. Proceedings of the National Academy of Sciences USA 94 (1):175–179. https://doi.org/10.1073/pnas.94.1.175

Dong K, Hochman G, Kong X, Sun R, Wang Z (2019) Spatial econometric analysis of China’s PM10 pollution and its influential factors: evidence from the provincial level. Ecol Indic 96:317–328. https://doi.org/10.1016/j.ecolind.2018.09.014

Du Y, Wan Q, Liu H, Liu H, Kapsar K, Peng J (2019) How does urbanization influence PM2.5 concentrations? Perspective of spillover effect of multi-dimensional urbanization impact. J Clea Prod 220:974–983. https://doi.org/10.1016/j.jclepro.2019.02.222

Elhorst JP (2003) Specification and estimation of spatial panel data models. Int Regional Sci Rev 26:244–268. https://doi.org/10.1177/0160017603253791

Elhorst JP (2010) Applied spatial regression: raising the bar. J Spatial Econ Anal 5(1):9–28. https://doi.org/10.1080/17421770903541772

Elhorst JP (2014) Spatial econometrics: from cross-sectional data to spatial panels. Springer, New York NY

Emissions Database for Global Atmospheric Research , EDGARv4.3.2_FT2016 dataset (2017) https://edgar.jrc.ec.europa.eu/overview.php?v=CO2andGHG1970-2016&sort=des8 . Accessed 3 March 2018

Goodchild M F (1986) Spatial autocorrelation. Geo Books, 47. Norwich

Gorus M S, Aslan M (2019). Impacts of economic indicators on environmental degradation: Evidence from MENA countries.Renewable and Sustainable Energy Reviews 103:259-268. https://doi.org/10.1016/j.rser.2018.12.042

Grossman G M, Krueger AB (1991) Environmental impacts of a North American Free Trade Agreement. NBER Working Paper No. 3914, MIT Press: Cambridge, MA, USA pp. 1–57. https://doi.org/10.3386/w3914

Gujarati D N (2004) Basic econometrics. In: Chapter (16), panel data regression models, 4th edn. The McGraw−Hill Companies, pp 637–638

Hafeez M, Chunhui Y, Strohmaier D, Ahmed M, Jie L (2018) Does finance affect environmental degradation: evidence from One Belt and One Road Initiative region? Environ Sci Pollut Res 25:9579–9592. https://doi.org/10.1007/s11356-018-1317-7

Hammamet (2013) Overview of CO2 emissions in the Arab region: national versus sectoral emissions. ESCWA, Economic Development and Globalization Division https://www.unece.org/fileadmin/DAM/trans/doc/themes/ForFITS/ESCWA%20-%20Overview%20of%20CO2%20emissions%20in%20the%20Arab%20Region.pdf.

Hansen B E (2020) Econometrics. In: Chapter (17) panel data. University of Wisconsin, Department of Economics, pp 586. https://www.ssc.wisc.edu/~bhansen/econometrics/Econometrics.pdf

Hao Y, Peng H (2017) On the convergence in China’s provincial per capita energy consumption: new evidence from a spatial econometric analysis. Energy Econ 68:31–43

Jiang L, Zhuo HF, Bai L, Zhuo P (2018) Does foreign direct investment drive environmental degradation in China? An empirical study based on air quality index from a spatial perspective. J Clea Produ 176:864–872. https://doi.org/10.1016/j.jclepro.2017.12.048

Keller W (2004) International technology diffusion. J Econ Lit 42(3):752–782. https://doi.org/10.1257/0022051042177685

Khan AQ, Saleem N, Fatima ST (2018) Financial development, income inequality, and CO2 emissions in Asian countries using STIRPAT model. Environ Sci Pollut Res Int 25(7):1–12. https://doi.org/10.1007/s11356-017-0719-2

Koçak E, Ulucak ZS (2019) The effect of energy R&D expenditures on CO2 emission reduction: estimation of the STIRPAT model for OECD countries. Environ Sci Pollut Res Int 26:14328–14338. https://doi.org/10.1007/s11356-019-04712-2

Lee JW (2013) The contribution of foreign direct investment to clean energy use, carbon emissions, and economic growth. Energy Policy 55:483–489. https://doi.org/10.1016/j.enpol.2012.12.039

LeSage J, Pace R K (2009) Introduction to spatial regressions. Chapman and Hall CRC

Lin S, Wang S, Marinova D, Zhao D, Hong J (2017) Impacts of urbanization and real economic development on CO2 emissions in non-high-income countries: empirical research based on the extended STIRPAT model. J Clean Prod 166:952–966. https://doi.org/10.1016/j.jclepro.2017.08.107

Liu H, Kim H (2018) Ecological footprint, foreign direct investment, and gross domestic production: evidence of Belt & Road Initiative countries. J Sustai 10(10):3527. https://doi.org/10.3390/su10103527

Liu K, Lin B (2019) Research on influencing factors of environmental pollution in China: a spatial econometric analysis. J Clean Prod 206:356–364. https://doi.org/10.1016/j.jclepro.2018.09.194