Abstract

Emission trading system is a significant market-based environmental regulation tool worldwide. This study fills existing knowledge gap on whether ETSs have “weak” and “strong” version of Porter hypothesis effects in China, by examining the effects of the Chinese SO2 emission trading on corporate innovation and productivity. Using the micro-data of domestic-listed manufacturing companies from 2004 to 2015, this study regarded China’s SO2 emission trading system as a quasi-natural experiment by applying a difference-in-difference framework to eliminate endogenous problems. It was found that the SO2 emission trading system significantly promoted corporate innovation but did not have a significant effect on corporate productivity. The cause analysis showed that suboptimal institutional context and lack of corporate dynamic response led to the failure of strong Porter hypothesis effect. In addition, small- and medium-sized enterprises and non-state-owned enterprises gained greater innovation compensation effects of the emission trading system. This research believed that, the design, institutional context, and market incentives of emission trading systems need to be improved from the top down, to achieve the dual goal of environmental sustainability and economic growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Emission trading systems (ETSs) are market-based environmental regulation tools worldwide, which are of great significance for promoting cleaner production and sustainable development. The first SO2 ETS was implemented in the USA in 1990, when the US Congress passed the Clean Air Act Amendment (Schmalensee and Stavins 2013). With the acceleration of industrialization and economic growth, China’s energy consumption and SO2 emissions have become enormous environmental challenges (Zeng et al. 2019; Tan et al. 2017), and SO2 ETS was introduced in 2007 to reduce pollution and help internalize the cost of public pollution control. In 2005, total emissions reached 22.35 million tons, making China the largest SO2 emitter worldwide at that time (Su et al. 2011). By 2016, China’s industrial SO2 emissions had fallen by 26% compared with 2005 levels, and India surpassed China as the country with the highest SO2 emissions (Li et al. 2017). In the process of SO2 pollution control, China has implemented a series of environmental policies (Streets and Waldhoff 2000; Hao et al. 2007; Zhang 2007; Schreifels et al. 2012; Tian et al. 2013; Zhang et al. 2019). How does the implementation of SO2 ETS environmental policy affect the economy, and specifically, what effect does it have on corporate innovation and productivity? More importantly, through which micro-channels will SO2 ETS affect corporate innovation and productivity? Unfortunately, few literatures have discussed these. Questions have been raised if, in addition to reducing air pollution, SO2 ETS can promote win-win situations for the environment and the economy.

This study focuses on how SO2 ETSs affect corporate innovation and total factor productivity, followed by cause analysis and heterogeneity analysis. According to the Porter hypothesis (PH) (Porter 1991; Porter and van der Linde 1995), environmental regulations can generate incentives for innovation and efficiency, which may help increase the productivity of companies. Jaffe and Palmer (1997) further referred to a “weak” PH, if environmental regulations only lead to innovations, and a strong PH, if environmental policies promote productivity improvements in companies. China launched a pilot SO2 ETS program in 11 provinces (Fig. 1) in 2007; this study used the 2007 SO2 ETS pilot program as a quasi-natural experiment, to evaluate whether the economic outcomes of ETSs in China correspond to a weak or a strong version of the PH. For this purpose, micro-economic data from China’s domestic-listed companies from 2004 to 2015 were analyzed, using a difference-in-difference (DID) method, to estimate the effects of the ETS on innovation and total factor productivity of these companies. More importantly, the difference-in-difference-in-difference (DDD) method was used to analyze the causes of ETS effects. This is essential for optimizing ETSs and improving the corporate competitiveness under environmental regulation. Finally, the study explores practical challenges faced by ETSs, which can provide important guidance for China and other countries to fully implement similar market-based mechanisms.

The marginal contribution of this study is as follows: First, this study fills the gap in the research of micro-economic effects of SO2 ETS environmental regulation. To our knowledge, studies on emission trading are rare. Most of previous studies did not distinguish among different tools of environmental regulations. Instead, government environmental expenditures (Li and Wu 2017; Hua et al. 2018; Huang 2018), administrative measures, regulatory objectives (Davies et al. 2014; Chen et al. 2018; Shi and Xu 2018), environmental subsidies (Schreifels et al. 2012; Liu et al. 2016), and compound indicators (Zhao and Sun 2016; Albrizio et al. 2017) were used to measure the effects of environmental regulation, which is not conducive to observing the economic effects of ETSs. Besides, most of the research on ETSs aimed to determine their environmental regulation effects at macroeconomic level, such as among entire regions or industry sectors (Jiang et al. 2016). Jiang et al. (2016) examined the differences in SO2 emissions, emission reduction potentials, and abatement costs between 32 regions of China. In addition, they analyzed policy challenges, such as justice issues and proposed cost-effective pollution control strategies at regional scales.

Second, we studied the relationship between the emission trading system, innovation, and productivity, which is a retest of the weak version and the strong version of PH in China. As a market-based mechanism, ETSs provide businesses with greater flexibility in implementing emission reduction strategies (Albrizio et al. 2017). Because the implementation of ETSs provides clear market price signals, and enterprises can store surplus emission indicators for later use or paid sales to obtain economic benefits, ETSs bring continuous dynamic economic incentives for innovation and productivity improvement of enterprises. Thus, ETSs not only enable enterprises to reduce pollution at the lowest cost but are also likely to promote innovation and productivity. Several studies have confirmed that environmental regulation can promote innovations (Jaffe and Palmer 1997; Levinson and Taylor 2008; Botta and Kozluk 2014; Ramanathan et al. 2017), but less is known about the effects of ETSs on innovation and productivity in companies. Our study attempted to answer the question of whether the emission trading can achieve the weak version and the strong version of PH effects and explore the practical challenges it faces.

Third, compared with the existing literature, this study solved the possible endogenous problems of ETS policy to a greater extent and used a more scientific method to measure the enterprise’s total factor productivity. First of all, the DID method used in this study can effectively avoid the endogenous problems caused by environmental regulations such as environmental pollution expenditure, sewage charges, pollution reduction, and other indicators (Cai et al. 2016); secondly, we use DDD method to fully consider the causes of the institutional context and corporate dynamic responses to the empirical results; thirdly, different from the previous literature using the simple indicators such as profit margin, ROA (Zhao and Sun 2016; Yuan et al. 2017; Qiu et al. 2018) to test the strong version of PH, this article uses the most forefront Levinsohn-Petrin’s (LP) semi-parametric method (Levinsohn and Petrin 2003) to measure enterprise total factor productivity to test the strong version of PH.

The content of the paper is organized as follows: the second part is the policy background, literature review and theoretical analysis; the third part covers the methods, which is the empirical strategy, including model setting, variable measurement and data processing; the fourth part is the empirical result analysis, including the analysis of the baseline estimation results and robustness test; the fifth part is cause analysis; the sixth part is heterogeneity analysis; and the last part is research conclusion and policy implications.

Policy background, literature review, and theoretical analysis

Policy background

In order to control pollution, the Chinese government has implemented a series of environmental policies since the 1980s (Fig. 2). The Chinese government began to impose charges on industrial waste water, gas emissions, and solid waste in 1982. In 1988, the Air Pollution Prevention and Control Act was implemented. In 1998, the State Council approved the implementation of the “Two Control Zones” policy, which delineates SO2 and acid rain control zones and establishes targets for SO2 emissions. In this early stage, the environmental policies of the Chinese government mainly consisted in command-and-control regulations and in a method referred to as “closing, stopping, merging, and transferring” which forced enterprises to either achieve environmental compliance or be shut down. This authoritarian approach may limit the motivation of enterprises and minimizes the flexibility of pollution control measures. In early 2000, the central government began to explore market-based environmental mechanisms. In 2002, a limited SO2 ETS was launched for the first time within the power industry. In 2003, the “Regulations on the Collection and Use of Sewage Charges” was implemented. In 2007, the SO2 ETS pilot program was officially launched, including the 11 provinces of Jiangsu, Tianjin, Zhejiang, Hebei, Shanxi, Chongqing, Hubei, Shaanxi, Inner Mongolia, Hunan, and Henan. It involved the steel, cement, glass, chemical, mining, and other industries. In 2017, the SO2 ETS was extended to the entire country. In 2018, the sewage charge system was abolished, and instead, an environmental protection tax was levied. Recently, ETSs have become an important means of controlling pollution and protecting the environment in China. Their introduction also marked a shift from command and control to more market-oriented mechanisms. Whereas the carbon ETS has only been launched recently, the SO2 ETS has been implemented in China for more than 10 years and can serve as a model for studying this approach to control pollution.

The 11 pilot provinces have successively established emission trading centers, operational emission markets, and regulations. SO2 ETS has forced emitters to install pollution control devices, change the fuel mix used by the facilities, or reduce the scale of operations, in order to achieve the goal of a cleaner and profitable production. In 2014, the General Office of the State Council issued the “Guide on Further Promoting the Pilot Work of Paid Use and Transaction of Emission Permits” and determined that the SO2 ETS will be rolled out nationwide in 2017. The SO2 ETS is implemented with the cooperation of government institutions in administrative hierarchies. To date, the ETS pilot has achieved remarkable results. By 2012, all pilot areas had completed the establishment of provincial or municipal emission trading centers, and several areas had introduced management systems for emission trading. According to the local emission trading centers, the amount of transactions totaled nearly 4 billion yuan between 2007 and 2013. According to the China Environmental Statistics Yearbook, SO2 emissions in the pilot provinces declined significantly in 2007 (Fig. 3). Total SO2 emissions in the 11 pilot provinces decreased by 32.2%, from 10.63 million tons in 2006 to 7.19 million tons in 2015.

Literature review

Environmental regulation and corporate innovation

The literature on environmental regulation and corporate innovation dates back to the early 1970s, while empirical research did not emerge until the mid-1990s. Some scholars have studied from a static perspective and believed that environmental regulation increased the tax burden and management costs of enterprises, reduced the competitiveness of enterprises, and is not conducive to corporate innovation (Jaffe and Stavins 1995); However, Porter’s analysis from a dynamic perspective found that designing a reasonable environmental regulation policy can provide enterprises with information and motivation for technological innovation, which will have an “innovation compensation effect” in the long run, increase the international competitiveness of their products, and thus achieve “win-win” between environmental regulation and technological innovation (Porter and Van der Linde 1995). The Porter hypothesis has attracted widespread attention from scholars. Since then, scholars have empirically tested it from different time dimensions, econometric analysis methods and variable design, and most scholars believe that environmental regulation is conducive to technological innovation of enterprises (Ellerman et al. 2000; Keohane 2003; Carlson and Hites 2004; Schmalensee and Stavins 2013). Hamamoto (2006) and Yang et al. (2012) demonstrated that environmental regulation can promote innovation in manufacturing companies in Japan and Taiwan, respectively.

Environmental regulation and corporate productivity

The relationship between environmental regulation and corporate productivity has been controversial in academia. According to neoclassical economics, environmental policies increase the additional burden on enterprises, which will cause resources to shift from traditional “production” uses to “pollution control” uses (Gray 1987). Other scholars have come to a similar conclusion. Barbera and McConnell (1990) and Gray and Shadbegian (2003) found that the impact of command-and-control environmental regulation on the US manufacturing industry’s total factor productivity was negative. Lanoie et al. (2008) found that strict environmental regulations in Quebec, Canada had a short-term negative impact on productivity. Against this, economists represented by Porter have raised objections. Porter and Van der Linde (1995) proposed through a case study that the influential Porter hypothesis that strict and flexible environmental regulations can generate higher productivity through innovation incentives, efficiency improvements, and internal redistribution. The Porter hypothesis is supported by many scholars. Testa et al. (2011) confirmed that under the more flexible environmental regulations in the EU’s construction industry, companies’ R&D investment has increased significantly, thereby increasing their productivity. Franco and Marin (2017) found that environmental taxes had a positive impact on the productivity of European countries in the early 2000s. However, some evidence from recent research shows that the effects of environmental regulation on enterprise productivity have mostly been not significant (Kozluk and Zipperer 2014; Cohen and Tubb 2015). Rubashkina et al. (2015) found that industrial productivity did not improve for 17 European manufacturing sectors, although corporate patents increased. Albrizio et al. (2017) studied the impact of environmental policy stringency in OECD countries on industry and enterprise productivity growth, and they found that environmental policies had a short-term positive effect on companies with high production efficiency, but that productivity declined for companies with low initial efficiency.

Research on ETS

The research on the effects of ETS is mainly based on developed countries, focusing on environmental performance, economic performance, and technological innovation. On the one hand, the research conclusions of some scholars support the policy effect of ETS (Montgomery 1972; Ellerman et al. 2000; Majumdar and Marcus 2001; Keohane 2003; Carlson and Hites 2004; Goulder and Parry 2008; Schmalensee and Stavins 2013). Schleich and Betz (2004) found through experimental simulations that the emission permit trading system has a positive impact on the emission reductions of small- and medium-sized enterprises. Anderson et al. (2011) used an empirical method to study the impact of EU emission trading system (EU-ETS) on CO2 emission reduction in manufacturing, and the results show that companies participating in the emission trading framework have a greater possibility of environmental innovation. Perman et al. (2011) held that the ETS provides continuous and dynamic economic incentives for technological innovation. Schmalensee and Stavins (2013) found that the US SO2 ETS reduced corporate compliance costs by 15–90%, in comparison with command-and-control policies. On the other hand, some scholars believe that the effect of ETS is limited. Stavins et al. (1998) argued that if market efficiency is low and emission rights are not effectively allocated, the return of ETSs will be lower than their marginal abatement costs. Hoffmann (2007) conducted an empirical analysis of the EU-ETS through a dynamic panel model. This study attempts to decompose two reasons for emission reduction: one is the emission reduction achieved by ETS, and the other is the emission reduction achieved by the 2008 economic crisis. The results show that what has played a greater role in reducing emissions is the impact of the economic crisis. Borghesi et al. (2015) found through the panel data of the Italian manufacturing industry that the implementation of EU-ETS has limited policy effects due to excessively loose quotas.

Summarizing the above literature, it can be seen that the existing research mainly focuses on the impact of ETSs on corporate innovation or productivity in developed countries and relatively little research on developing countries. In addition, the selection of ETS policy measurement and the endogenous issues between ETSs and innovation and productivity are important reasons for the inconsistency of existing research conclusions. Moreover, many existing studies predict the effect of policies by constructing a mathematical model of emissions trading, but mathematical models impose a lot of assumptions and restrictions on the emission trading market. In practice, it is difficult to use empirical data to verify the models, and the literature on the impact of market-based environmental regulation on corporate innovation and total factor productivity at the micro-firm level is even scarcer. Based on the above, this paper takes the 2007 ETS pilot policy as the research object, and studies the impact of the emission trading system on Chinese enterprises’ innovation and total factor productivity, which is a retest of the weak Porter hypothesis effect and the strong Porter hypothesis effect in China.

Theoretical analysis

According to Porter hypothesis, strict and flexible environmental regulations will bring “innovation compensation” effects to enterprises, and may also increase productivity. As an important market-based regulatory tool, China’s SO2 ETS is based on clear market price signals. It can provide enterprises with greater flexibility in the process of reducing emissions and enable enterprises to achieve pollution control at the lowest cost. In the face of increasing environmental compliance costs, companies seeking to maximize profits have more flexibility to choose to increase innovation input and increase productivity, and ultimately reduce or offset cost pressures brought by government environmental regulations.

Firstly, analyzing the impact of China’s SO2 ETS on the corporate innovation is a retest of the weak version of the PH. Because innovation implies long-term investments and potentially high risks, enterprise innovation depends on the level of incentives that companies receive. The impact of China’s SO2 ETS on innovation is mainly reflected in the following aspects: First, compared with command-and-control environmental regulations, the cost of achieving these environmental goals through ETS is significantly reduced; second, under ETSs, companies can save surplus pollutant permits for later use or sell them to obtain economic benefits; third, the implementation of ETS provides enterprises with more market information for technological improvements, thus reducing uncertainties associated with technological innovation. Therefore, SO2 emission trading system is conducive to corporate innovation, and we propose hypothesis 1:

Hypothesis 1: ETS has a positive effect on corporate innovation.

Secondly, examining the impact of China’s SO2 ETS on the corporate productivity is a retest of the strong version of the PH, which is harder to achieve, because it involves more difficult processes. Porter and van der Linde (1995) identified two conditions necessary for the existence of positive impacts of environmental regulations on corporate productivity: (1) rigor and flexibility of environmental regulation policies; and (2) dynamic response of regulated enterprises. Thus, innovation will actively drive productivity growth only under strict and flexible environmental regulations. Moreover, as far as the enterprise itself is concerned, in addition to innovation achievements, compliance costs and resource allocation efficiency will also affect productivity under environmental regulations. As China’s ETS implementation still faces problems, such as operative difficulties, immature markets, and high transaction costs during the pilot period, it is considered that in its initial stage of implementation, the impact of ETS on the enterprise productivity may not be significant. Therefore, we propose hypothesis 2:

Hypothesis 2: The ETS does not have significant effect on corporate productivity.

Methods

Modeling framework

The impact of China’s SO2 ETS on the competitiveness of enterprises, that is, ETS influence on innovation and total factor productivity, was analyzed by comparing differences between ETS pilot provinces and non-pilot provinces before and after 2007, using a DID model:

In models (1) and (2), Innovationit and TFPit represent innovation and total factor productivity of the enterprise i in the year t, respectively. ETSi denotes, if a company i is located in one of the 2007 SO2 ETS pilot provinces, and belongs to the SO2 emitting industry sectors, such as chemical, petrochemical, steel, nonferrous, pharmaceutical, paper, metallurgy, cement, or glass industries, among others. In this case, ETSi is equal to 1; otherwise, it is 0; Postt indicates the time after policy implementation. For years after 2007, the value of Postt is 1; otherwise, it is 0. The coefficient β1 represents the impact of the SO2 ETS on enterprise innovation or total factor productivity; μi is a fixed, inherent effect of each enterprise that does not change with time; λt is an annual fixed effect, which represents factors that affect all enterprises, such as macroeconomic indicators; Xit is a set of control variables, including enterprise size (lnEmployeesit), fixed-asset ratio (Fixedassetit), enterprise age (Ageit), enterprise ownership (Ownerit), asset-liability ratio (Leverageit), fiscal decentralization (Fiscaldecenit) of the province, environmental legislation (Legislationit), and environmental enforcement (lnCasesit). Lastly, εit is an error term. Considering that the variables in the model may present heteroscedasticity and sequence correlation, the method proposed by Bertrand et al. (2004) was used to cluster the standard errors at the enterprise level.

The framework and methods of this study is as follows (Fig. 4). In order to further validate the estimation results of model (1), a robustness test was conducted. The robustness analysis evaluates assumptions on common trends and tendencies between ETS pilot and non-pilot enterprises, using the DID model estimates after propensity score matching (PSM-DID), and testing alternative variables of innovation and total factor productivity. The analysis of the robustness test results are described in “Robustness test.” Moreover, we use DDD model to explore the causes of results, and also analyze the heterogeneity of effects in the following parts.

Data sources and processing

This study selected manufacturing enterprises from China’s domestic listed companies for the period 2004 to 2015 as a sample. The study period and companies were selected based on the following criteria: (1) The selected period was 2004 to 2015, because the SO2 EST policy pilot started in 2007. (2) Although industries with SO2 emissions include mining, manufacturing, and energy, the sampled companies were all from the manufacturing sector to ensure that the calculation of the TFP was based on a unified production function. This study used LP semi-parameters to calculate TFP. Considering that the mining industry’s production processes rely primarily on natural resources, the TFP of enterprises in mining industry cannot be characterized by a Cobb-Douglas production function. In addition, existing methods for TFP analysis do not apply to companies in mining, petroleum and other industries (Brandt et al. 2012; Hsieh and Klenow 2009). Also, considering that the 2007 ETS pilot program stipulated that the emission licenses for the power industry can only be traded internally, this sector has been excluded. Data from 29 manufacturing industries were included in the study. The data were further processed as follows: (1) samples with missing variables were deleted, resulting in a final sample size of 11,336 enterprise-year observations. (2) Deflators using 2004 as a base year have been applied to all actual values for variables in the sample, and the deflators were taken from the China Statistical Yearbook. (3) All the continuous variables were winsorized. The company data were taken from the CSMAR database (http://www.gtarsc.com). The provincial data of the control variables came from the China Statistical Yearbook.

Explanatory variables measurement

The explanatory variables in this study were corporate innovation (Innovationit) and total factor productivity (TFPit). The variable Innovationit is represented by the logarithm of the number of patents. TFPit is calculated by the LP semi-parametric method. The LP semi-parameter method establishes parameters for the relationships between the industrial added value, labor, and capital. Figures 5 and 6 compare the trends of Innovationit and TFPit before and after the SO2 ETS pilot program was implemented. In Fig. 5, the average level of enterprise innovation in the ETS pilot area was lower than the average level in non-pilot areas before 2007, but it gradually exceeded the level of non-pilot areas from 2007. However, in Fig. 6, the average TFP of enterprises in the EST pilot area has been lower than the average TFP of non-pilot areas before 2012. These preliminary results indicate that the SO2 ETS program seemed to promote enterprise innovation, but did not significantly improve enterprise TFP.

Control variables measurement

The control variables in this study represented inherent characteristics of the companies, macroeconomic indicators, and the institutional context. Individual characteristics of companies included the lnEmployeesit, Fixedassetit, Ageit, Ownerit, and Leverageit. Macro-environmental and institutional conditions were measured by Fiscaldecenit, the marketization index (Marketizationit), Legislationit, and lnCasesit in the provinces. These variables were calculated as follows:

Marketizationit was calculated following Fan (2016), as the marketization index of each province, Legislationit was measured by the logarithm of the number of environmental regulations passed in each province during a given year, and lnCasesit used the logarithm of the number of environmental sanctions imposed within each province.

In addition, in the robustness test, cause analysis, and heterogeneity analysis, we used carbon emission trading policy dummy variable (Cpoliyit), water rights trading policy dummy variable (Wpolicyit), the logarithm of enterprise invention patents (lnInventionit), book value-to-market ratio (BMit), return on assets (ROAit), operating costs (Costit), and investment level (Investit). Descriptive statistics for all variables are shown in Table 1.

Results and discussion

Baseline estimations

The regression results for the relationships between all explanatory variables and enterprise innovation and TFP are shown in Table 2. Column (1) gives the DID estimation results of the effect of ETS on enterprise innovation, based on ordinary least squares (OLS) regression and after controlling for time, province, and industry-fixed effects (FE). The model coefficient for the effect of the interaction ETSi × Posti on enterprise innovation is positive and significant at the 5% level, indicating that the increase in enterprise innovation was greater in the areas that implemented the ETS. Column (2) considers the influence of individual characteristics of enterprises using a FE model. The coefficient for the effect of the interaction term ETSi × Posti on enterprise innovation is again positive and significant on the 1% level, which further demonstrates that the SO2 ETS had a significant role in promoting enterprise innovation.

Columns (3) and (4) use OLS and FE models to analyze the effects of the SO2 ETS on enterprise TFP. Column (3) shows the DID estimate result of how ETS affects enterprise TFP growth, based on OLS after controlling for time, province, and industry FE. The coefficient for the effect of the interaction term ETSi × Posti on enterprise TFP growth is not statistically significant, indicating that the ETS implemented in 2007 did not improve enterprise TFP significantly. Column (4) gives the regression result based on the FE model. The coefficient for the effect of the interaction term ETSi × Posti on enterprise TFP is again not statistically significant, and the finding is consistent with the result from column (3) which indicates that the regression results are robust.

Interpreting the economic meaning of these findings a model coefficient of 0.422 in column (2) indicates an increase of 42.2% in the level of enterprise innovation, as measured by the logarithm of the number of patents, which demonstrates that ETS can trigger innovation. The innovation offset effects from market-oriented environmental regulation can be divided into product compensation and process compensation (Porter and van der Linde 1995). However, the current innovation effects did not convert to higher TFP. The estimates in columns (3) and (4) show that the ETS pilot program did not promote the enterprise TFP and thus has not achieved an outcome consistent with the strong PH. Overall, the SO2 ETS pilot program had effects on companies that are consistent with the weak PH but not with the strong PH. One possible explanation is that there are problems with the institutional environment for policy implementation and the dynamic response of the company itself, and the causes of thus two aspects are further analyzed in “Effects based on different ownerships of corporation” and “Effects based on different sizes of corporationS2.”

Robustness test

Time trend test

The premise of the consistency of DID estimation results is that the treatment group and the control group meet the time trend assumption, that is, before policy intervention, the trend of the outcome variables in the treatment group and the control group is consistent. This study uses the event study approach proposed by Jacobson et al. (1993) to conduct a time trend test by building the following models:

where, with 2004 as the base year, βt represents a series of coefficient estimates for 2004–2015, and the other variables have the same meaning as the variables in model (1). Figures 7 and 8 show time trend of effect on corporate innovation and TFP, respectively, by plotting the estimated coefficient βt. From two figures, it can be seen that βt was not significant from 2004 to 2006, indicating that there is no obvious difference between the treat group and the control group before the implementation of ETS policy, and they meet the parallel trend assumption.

PSM-DID method test

In order to overcome systematic differences in enterprise innovation and TFP trends between the ETS pilot areas and non-pilot areas, and to reduce the inherent bias of DID method estimation, this paper uses the PSM-DID method to further validate the initial estimation results. To achieve this, a Logit regression was performed on the matching variables, using a dummy variable ETSi for ETS implementation, to obtain the propensity score value. Following a previous work (Bernard and Okubo 2016), the present study used the enterprise scale (lnAssetit), Ageit, financing constraints (Leverageit), and Fixedassetit as matching variables. Secondly, based on the above matching variables and propensity scores, the companies in ETS pilot areas and non-pilot areas will be matched 1:1, and finally, the matching samples will be retained. Columns (1) and (2) of Table 3 report the results of the PSM-DID robustness test. The dependent variable in column (1) is corporate innovation (Innovationit). The coefficient of the interaction ETSi × Postt is positive and significant at a 1% level, showing that the ETS had a significant positive effect on enterprise innovation in the ETS pilot areas after matching, which is consistent with the results of the baseline analysis presented above. The dependent variable in column (2) is enterprise TFP and the coefficient of ETSi × Postt is not statistically significant, indicating that the ETS did not have a significant effect on TFP, which is also consistent with the results of the baseline regression. In conclusion, this study demonstrates that that the ETS pilot program in China has improved enterprise innovation but did not promote the growth of TFP, which supports the initial hypotheses.

Alternative variables test

In order to further validate the robustness of the initial results, we used lninventionit as a substitute for innovation, and BMit, as well as ROAit, as substitute variables for enterprise competitiveness. The DID regression results of the substitute variables are shown in columns (3), (4), and (5) of Table 3. The explanatory variable (lninventionit) in column (3) is the logarithm of the number of invention patents. As the invention patent is the most technical category among patents, it represents a good indicator for the quality of enterprise innovation. The coefficient of ETSi × Postt in column (3) is positive and significant at the 10% level. This further demonstrates that ETSs can stimulate enterprise innovation. The explanatory variables in columns (4) and (5) are BMit and ROAit, respectively, which are important indicators for evaluating performance and competitiveness of companies. None of the coefficients of ETSi × Postt in columns (4) and (5) are statistically significant, indicating that the ETS did not significantly improve corporate competitiveness during the study period.

Interference of other policies

Another problem with the baseline DID estimation strategy is that in addition to the SO2 emission trading pilot policy, there may be other policies that affect the corporate innovation and total factor productivity in the pilot and non-pilot regions, thereby making the estimates biased. The policies most likely to interfere with the baseline estimation results are the pilot policy on carbon emission trading in Beijing, Shanghai, Tianjin, Chongqing, Shenzhen, Hubei, and Guangdong in 2011, and pilot policy on water rights trading in Ningxia, Jiangxi, Hubei, Inner Mongolia, Henan, Gansu, and Guangdong in 2014. This article incorporates these two policies as dummy variables into the baseline DID model and builds a new model as follows:

where Yit is either the Innovationit or TFPit and Cpolicyit represents the dummy variable of the carbon emission trading pilot policy. When the company i is located in the carbon emission pilot city and ti ≥ 2011, the value of Cpolicyit is 1. Otherwise, it is 0. Wpolicyit represents the dummy variable of the water rights trading pilot policy. When the company i is located in the water rights trading pilot city and t ≥ 2014, the value of Wpolicyit is 1. Otherwise, it is 0. Other variables are consistent with the variables in the benchmark model. In model (6), the impact of carbon emission trading policies and water rights trading pilot policies on corporate innovation and productivity is separated, and β1 is the net effect of SO2 emission trading policies. Table 4 reports the estimation results of model (6). The results are basically consistent with the estimation results of the baseline model, indicating that the pilot policy of SO2 emission trading has significantly promoted the innovation of enterprises without significantly affecting the total factor productivity.

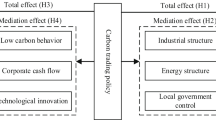

Causes analysis

The results show that China’s SO2 ETS promoted corporate innovation but not improve corporate productivity. Why can the innovation compensation effect of the ETS not translate into higher productivity? We will examine the macro-institutional context and the dynamic response of enterprises as follows, to explore why the effects of China’s ETS are only consistent with a weak version of the PH but not a strong version of the PH.

Suboptimal institutional context

The implementation of SO2 ETS requires a systematic effort, because the implementation process is complex, and the operation is difficult. The effectiveness of ETS implementation is closely related to the functioning of local institutions. The institutional environment includes the degree of decentralization, environmental law enforcement, and marketization. China has a vast territory, and institutional environments vary strongly among the ETS pilot provinces. This study used a DDD model that includes the institutional environment:

where the institutional environment (Contextit-1) is represented by the degree of Fiscaldecenit of a given province, lnCasesit, Marketizationit, and the other variables are used in the model (1).

The effects of the institutional variables on the outcomes of ETS implementation are shown in Table 5. Columns (1) and (2) show that the coefficients of the interaction term ETSi × Postt × Fiscaldecenit are not significant, indicating that the micro-economic effects of the implementation of ETS were not affected by the degree of decentralization. Columns (3) and (4) show that the coefficients of the interaction term ETSi × Postt × ln(Cases)it are positive and significant at the 1 and 5% levels, respectively, indicating that local environmental law enforcement had a positive impact on enterprise innovation and TFP. It should be noted that under stringent environmental enforcement, the ETS not only promoted corporate innovation but also led to increased TFP. Columns (5) and (6) show that the coefficients of ETSi × Postt × Marketizationit are positive and significant at 5 and 10% levels, respectively, indicating that the degree of marketization positively influenced the microeconomic effects of the ETS. When the degree of marketization of an enterprise is high, both the weak and the strong versions of the Porter effect can be achieved, although the strong version of Porter effect is not obvious.

The analysis of these impact mechanisms showed that ETS as a market-based environmental regulation tool, was not affected by the degree of local decentralization, but was clearly affected by environmental law enforcement and marketization. Conversely it can be concluded that weaker environmental regulation enforcement and inefficient markets were the main factors restricting ETSs from producing a strong version of the PH. Currently, ETS implementation is not matched by stringent environmental enforcement, and thus external pressures on enterprises to reduce emissions are weak. In addition, current methods for the allocation of emission rights are not perfect, transaction rules are inefficient, and monitoring capabilities are deficient. Excessive transaction costs may also reduce internal motivation for companies to reduce emissions. As a result, inefficient markets undercut the functioning of the ETS.

Lack of dynamic response

Under the ETS, companies incur additional costs to improve technology and purchase desulfurization equipment. On the other hand, measures, such as reducing product packaging or increasing recycling may help to reduce costs. In this study, the main Costit was selected as the explanatory variable. Columns (1) and (2) in Table 6 report the results of OLS and FE regression, respectively, and the coefficient of ETSi × Postt was not statistically significant, showing that the ETS had little impact on cost. This finding indicates that ETSs not only controls SO2 emissions but can also enable enterprises to offset costs by replacing by improving production processes.

The effect of ETSs on resource allocation is another important factor to consider. Limited emission rights exert economic pressure on enterprises. Based on long-term economic considerations, enterprises will aim to reallocate production factors to reduce pollution and inefficient production processes. Investments into efficient resource allocation will affect the productivity of enterprises. We used the resource allocation efficiency Investit as the explanatory variable, according to the capital allocation efficiency model proposed by Wurgler (2000). This method was modified to serve as an “investment-investment opportunity” sensitivity model, in order to examine whether ETSs will affect enterprise resource allocation:

where Investit is the current investment level of the enterprise, expressed as:

ROAit denotes enterprise investment opportunities, expressed by the return on assets of the first period, and other variables and control variables are consistent with model (1). The coefficient ϕ1 denotes the impact of the ETS pilot program on corporate investment efficiency. If ϕ1 is negative and statistically significant, it indicates that the ETS reduces the sensitivity of companies to investment opportunities, which means that the ETS reduces investment efficiency and thus the efficiency of resource allocation. A positive value for ϕ1, on the contrary, indicates that the ETS pilot program has improved the efficiency of enterprise investments.

The results of model (8) are shown in columns (3) and (4) of Table 6. It can be seen that the coefficients of the interaction term ETSi × Postt × ROAit after DDD estimation are negative and significant at a 1% level. This shows that after the introduction of the 2007 ETS pilot program, the resource allocation efficiency of the pilot corporations was significantly lower than that of the non-pilot corporations. This may be due to the lack of information on marginal abatement costs in the early stages of the ETS pilot, or a lack of regulatory compliance of government authorities, which could have distorted or limited the response of companies to environmental regulations. The coordination between the two increases system costs, which makes it difficult for companies to adjust resource allocation during ETS implementation. These difficulties in turn may adversely affect TFP growth of an enterprise.

The analysis of dynamic response of enterprises showed that the ETS had an effect of “innovation offsets”, which means that it did not significantly increase production costs of companies. However, ETS had a negative impact on resource allocation efficiency of companies. Regulated companies lacked a dynamic response, and it was not possible to optimize their resource allocation level in a short period of time. For this reason, the ETS only improved enterprise innovation and inhibited enterprise productivity growth.

Heterogeneity analysis

Effects based on different ownerships of corporation

Different types of company ownership lead to different government-enterprise relationships. For example, they have different levels of negotiation power regarding ETSs, which influence the effects of environmental regulation on these companies. Columns (1) and (2) in Table 7 show the different policy effects enterprise innovation (Innovationit) regarding state-owned and non-state-owned enterprises. The coefficients of ETSi × Postt for state- and non-state-owned enterprises are both positive and significant at 1% level. However, the coefficient of non-state-owned enterprises is higher by 0.303 in comparison with state-owned companies, indicating that the effect of the ETS on promoting innovation is 30.3% higher for non-state-owned enterprises. In columns (3) and (4) of Table 7, the explanatory variable is TFP. The coefficient for the interaction term of ETSi × Postt was significantly negative for state-owned enterprises. This result indicates that the innovation offset effect was stronger for non-state-owned enterprises. Therefore, state-owned enterprise TFP growth has been suppressed, and their competitiveness has not improved faster compared with non-state enterprises. When local governments implement ETSs, there is a game process between them and local enterprises. State-owned enterprises have closer relations to the government, and thus they have stronger negotiating power. Therefore, the environmental control of state-owned enterprises is less stringent, which may decrease the incentive to implement innovations.

Effects based on different sizes of corporation

Different sizes in companies will lead to differences in parameters, such as innovation capabilities, tax contributions, and management efficiency. Generally, larger enterprises can investment more in innovation, have higher management efficiencies, and deliver more tax revenues to local governments. Therefore, if enterprises of different sizes are subjected to SO2 ETSs, they also exhibit heterogeneity. In columns (1) and (2) of Table 8, the explanatory variable is technology innovations (Innovationit). The coefficients of ETSi × Postt for large and small-to-medium-sized enterprises were both positive and significant at the 1% level. However, the coefficient of small-to-medium enterprises (SMEs) was higher by 0.146, indicating that the effect of the ETS on promoting innovation is 14.6% higher for SMEs. In columns (3) and (4) of Table 8, the explanatory variable is enterprise TFP. Only the coefficient of ETSi × Postt for SMEs is statistically significant, and the value is negative, indicating that there are certain obstacles for SMEs. These results show that SMEs are more responsive to market-based environmental mechanisms. It appears that smaller businesses are investing heavily in innovation, in order to remain competitive in the market. When converting innovation to higher productivity, possibly because resource allocation efficiency of SMEs is lower than that of larger companies, their TFP may become more inhibited by environmental regulations than that of large enterprises.

Conclusions and policy implications

ETSs are market-based environmental regulation tools, which are of great significance for promoting cleaner production and sustainable development. This study fills existing knowledge gap that whether ETSs have weak and strong version of Porter hypothesis effects in China. This study examined the effects of the Chinese SO2 ETS pilot program, launched in 2007, on corporate innovation and TFP. Based on the DID method, data of China’s domestic listed manufacturing companies from 2004 to 2015 were analyzed. It was found that: (1) the SO2 ETS significantly promoted corporate innovation, but did not have a significant effect on corporate productivity. Consequently, the effects of the ETS on companies corresponded to a weak version of the PH, instead of a strong version; (2) the suboptimal institutional context and lack of corporate dynamic response lead to the failure of strong PH effect. The microeconomic effects of ETS were positively influenced by local environmental law enforcement and marketization, but such institutional context is not good in China. For corporations, their resource allocation efficiency was restrained under ETS policy, so the innovation offset did not transform into higher TFP growth; and (3) the effects of ETS are heterogeneous among different corporations. Based on corporate ownership and size, the heterogeneity analysis results showed that small- and medium-sized enterprises and non-state-owned enterprises gain greater innovation offsets effects.

Based on these results, it can be concluded that it is necessary to improve system design, institutional context, and trading market incentives from the top down, in order to achieve the dual goals of cleaner production and economic growth, consistent with a strong version of the PH. The following recommendations can be derived from this study:

First, the design of the ETS needs to be further improved. Specifically, reasonable trading rules and guidelines for the allocation of initial emission rights need to be formulated. Methods for verifying compliance with emission targets have to be stipulated clearly in the regulations. The ETS system design should consider the heterogeneity caused by enterprise ownership. In addition to creating fair conditions for private and small-to-medium-sized enterprises, it could be considered to increase pressure on state-owned enterprises by applying more stringent quota and supervision mechanisms.

Second, it is important to actively create an institutional context and market structures in which the ETS can function effectively. Although stringent legislation has been promulgated to ensure the continuity and stability of emission trading policies, the frequency of monitoring pollution sources needs to be increased, to ensure the collection of accurate information. Cases of non-compliance with ETS rules should receive attention in the media. In addition, sanctions need to be implemented rigorously and local governance needs to be strengthened. Air pollution performance evaluation mechanisms and emission transactions must be transparent. Finally, the implementation of all ETS processes should be included in the performance evaluations of government agencies to prevent local administrations from protecting polluting enterprises.

Furthermore, it is essential to cultivate a market, which is based on reasonable and standardized emission permits. Trading rules also need to be standardized to encourage companies to participate extensively. Fiscal and tax incentives, such as easing income taxes on corporate emission trading will motivate transactions, and accelerate the development of a functioning trading market. An open platform for regional emission trading would help to expand the scope of transactions and encourage more companies to carry out transactions. Increased availability of Information on emission trade and trading opportunities can help to achieve optimal allocation of resources.

Ultimately, the formulation of quotas is an important aspect of the design of ETSs, which determines the effectiveness of policy implementation. Future research should address the micro-economic effects of different quotas on enterprises in order to maximize environmental and economic benefits from ETS.

References

Albrizio S, Kozluk T, Zipperer V (2017) Environmental policies and productivity growth: evidence across industries and firms. J Environ Econ Manag 81:209–226. https://doi.org/10.1016/j.jeem.2016.06.002

Anderson B, Convery F, Di Maria C (2011) Technological change and the EU ETS: the case of Ireland. SSRN Electron J 216(1):233–238. https://doi.org/10.2139/ssrn.1855495

Barbera AJ, Mcconnell VD (1990) The impact of environmental regulations on industry productivity: direct and indirect effects. J Environ Econ Manag 18(1):50–65. https://doi.org/10.1016/0095-0696(90)90051-Y

Bernard, A.B., Okubo, T.2016. Product switching and the business cycle. (No. w22649). National Bureau of economic research. https://doi.org/10.3386/w22649

Bertrand M, Duflflo E, Mullainathan S (2004) How much should we trust differences-in-differences estimates? Q J Econ 119:249–275. https://doi.org/10.1162/003355304772839588

Borghesi S, Cainelli G, Mazzanti M (2015) Linking emission trading to environmental innovation: evidence from the Italian manufacturing industry. Res Policy 44:669–683. https://doi.org/10.1016/j.respol.2014.10.014

Botta, E., Kozluk, T., 2014. Measuring environmental policy stringency in OECD countries: a composite index approach. OECD economics department working paper, No. 1177. OECD Publishing. https://doi.org/10.1787/5jxrjnc45gvg-en

Brandt L, Van Biesebroeck J, Zhang Y (2012) Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J Dev Econ 97:339–351. https://doi.org/10.1016/j.jdeveco.2011.02.002

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85. https://doi.org/10.1016/j.jdeveco.2016.08.003

Carlson DL, Hites RA (2004) Comment on “simulating the influence of snow on the fate of organic compounds”. Environ Sci Technol 38:6904–6904. https://doi.org/10.1021/es048708r

Chen YJ, Li P, Lu Y (2018) Career concerns and multitasking local bureaucrats: evidence of a target-based performance evaluation system in China. J Dev Econ 133:84–101. https://doi.org/10.1016/j.jdeveco.2018.02.001

Cohen MA, Tubb A (2015) The impact of environmental regulation on firm and country competitiveness: a meta-analysis of the Porter hypothesis. J Assoc Environ Resour Econ 5:371–399. https://doi.org/10.1086/695613

Davies G, Kendall G et al (2014) Regulators as agents: modelling personality and power as evidence is brokered to support decisions on environmental risk. Sci Total Environ 466-467:74–83. https://doi.org/10.1016/j.scitotenv.2013.06.116

Ellerman AD, Joskow PL, Schmalensee R, Bailey EM, Montero JP (2000) Markets for clean air: the US acid rain program. Cambridge University Press

Fan, G., 2016. China’s provincial marketization index report. China (in Chinese)

Franco C, Marin G (2017) The effect of within-sector, upstream and downstream environmental taxes on innovation and productivity. Environ Resour Econ 66:261–291. https://doi.org/10.1007/s10640-015-9948-3

Goulder LH, Parry IWH (2008) Instrument choice in environmental policy. Rev Environ Econ Policy 2:152–174. https://doi.org/10.1111/j.1465-7295.1983.tb00616.x

Gray WB (1987) The cost of regulation: OSHA, EPA and the productivity slowdown. Am Econ Rev 77(77):998–1006. https://doi.org/10.1016/0038-0121(88)90025-0

Gray WB, Shadbegian RJ (2003) Plant vintage, technology, and environmental regulation. J Environ Econ Manag 46:384–402. https://doi.org/10.1016/S0095-0696(03)00031-7

Hamamoto M (2006) Environmental regulation and the productivity of Japanese manufacturing industries. Resour Energy Econ 28:299–312. https://doi.org/10.1016/j.reseneeco.2005.11.001

Hao J, He K, Duan L, Li J, Wang L (2007) Air pollution and its control in China. Front Environ Sci Eng China 1:129–142. https://doi.org/10.1007/s11783-007-0024-2

Hoffmann VH (2007) EU ETS and investment decisions: the case of the German electricity industry. Eur Manag J 25(6):464–474. https://doi.org/10.1016/j.emj.2007.07.008

Hsieh C, Klenow P (2009) Misallocation and manufacturing TFP in China and India. Q J Econ 124:1403–1448. https://doi.org/10.1162/qjec.2009.124.4.1403

Hua Y, Xie R, Su Y (2018) Fiscal spending and air pollution in Chinese cities: identifying composition and technique effects. China Econ Rev 47:156–169. https://doi.org/10.1016/j.chieco.2017.09.007

Huang J (2018) Sulfur dioxide (SO2) emissions and government spending on environmental protection in China—evidence from spatial econometric analysis. J Clean Prod 175:431–441. https://doi.org/10.1016/j.jclepro.2017.12.001

Jacobson L, La Londe R, Sullivan D (1993) Earnings losses of displaced workers. Am Econ Rev 83:685–709. https://doi.org/10.1257/aer.100.1.572

Jaffe A, Palmer K (1997) Environmental regulation and innovation: a panel data study. Rev Econ Stat 79:610–619. https://doi.org/10.1162/003465397557196

Jaffe AB, Stavins RN (1995) Dynamic incentives of environmental regulations: the effects of alternative policy instruments on technology diffusion. J Environ Econ Manag 29(3):43–63. https://doi.org/10.1006/jeem.1995.1060

Jiang J, Xie D, Ye B, Shen B, Chen Z (2016) Research on China’s cap-and-trade carbon emission trading scheme: overview and outlook. Appl Energy 178:902–917. https://doi.org/10.1016/j.apenergy.2016.06.100

Keohane NO (2003) What did the market buy? Cost savings under the U.S. Tradeable Permits Program for Sulfur Dioxide. Working papers—Yale School of Management’s Cconomics Research Network, pp. 1–24

Kozluk T, Zipperer V (2014) Environmental policies and productivity growth: a critical review of empirical findings. OECD J Econ Stud 2014:155–185. https://doi.org/10.1787/eco_studies-2014-5jz2drqml75j

Lanoie P, Patry M, Lajeunesse R (2008) Environmental regulation and productivity: testing the Porter hypothesis. J Prod Anal 30:121–128. https://doi.org/10.1007/s11123-008-0108-4

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70:317–341. https://doi.org/10.1111/1467-937X.00246

Levinson A, Taylor M (2008) Unmasking the pollution haven effect. Int Econ Rev 49:223–254. https://doi.org/10.2307/20486793

Li B, Wu S (2017) Effects of local and civil environmental regulation on green total factor productivity in China: a spatial Durbin econometric analysis. J Clean Prod 153:342–353. https://doi.org/10.1016/j.jclepro.2016.10.042

Li C, Mclinden C, Fioletov V et al (2017) India is overtaking China as the World’s largest emitter of anthropogenic sulfur dioxide. Sci Rep 7:14304. https://doi.org/10.1038/s41598-017-14639-8

Liu X, Lin B, Zhang Y (2016) Sulfur dioxide emission reduction of power plants in China: current policies and implications. J Clean Prod 113:133–143. https://doi.org/10.1016/j.jclepro.2015.12.046

Majumdar SK, Marcus AA (2001) Rules versus discretion: the productivity consequences of flexible regulation rules versus discretion. Acad Manag J 44:170–179. https://doi.org/10.2307/3069344

Montgomery WD (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 3:395. https://doi.org/10.1016/0022-0531(72)90049-X

Perman R, Ma Y, McGilvray J, Common M (2011) Natural resource and environmental economics. Am J Agric Econ 32:195–210. https://doi.org/10.1111/j.0169-5150.2005.00338.x

Porter ME (1991) America’s green strategy. Sci Am 264:168

Porter ME, van der Linde C (1995) Toward a new conception of the environment competitiveness relationship. J Econ Perspect 9:97–118. https://doi.org/10.1257/jep.9.4.97

Qiu LD, Zhou M, Wei X (2018) Regulation, innovation, and firm selection: the porter hypothesis under monopolistic competition. J Environ Econ Manag 92:638–658. https://doi.org/10.1016/j.jeem.2017.08.012

Ramanathan R, He Q, Black A, Ghobadian A, Gallear D (2017) Environmental regulations, innovation and firm performance: a revisit of the Porter hypothesis. J Clean Prod 155:79–92

Rubashkina Y, Galeotti M, Verdolini E (2015) Environmental regulation and competitiveness: empirical evidence on the Porter hypothesis from European manufacturing sectors. Energy Policy 83:288–300. https://doi.org/10.1016/j.enpol.2015.02.014

Schmalensee R, Stavins R (2013) The SO2 allowance trading system: the ironic history of a grand policy experiment. J Econ Perspect 27:103–122. https://doi.org/10.2139/ssrn.2124037

Schleich J, Betz R (2004) EU emissions trading and transaction costs for small and medium size companies. Intereconomics 39(3):121–123. https://doi.org/10.1007/BF02933576

Schreifels JJ, Fu Y, Wilson EJ (2012) Sulfur dioxide control in China: policy evolution during the 10th and 11th five-year plans and lessons for the future. Energy Policy 48:779–789. https://doi.org/10.1016/j.enpol.2012.06.015

Shi X, Xu Z (2018) Environmental regulation and firm exports: evidence from the eleventh five-year plan in China. J Environ Econ Manag 89:187–200. https://doi.org/10.1016/j.jeem.2018.03.003

Stavins RN, Keohane N, Revesz R (1998) The choice of regulatory instruments in environmental policy. Harvard Environl Law Rev 22(2):313–367

Streets DG, Waldhoff ST (2000) Present and future emissions of air pollutants in China: SO2, NOx, and CO. Atmos Environ 34:363–374. https://doi.org/10.1016/s1352-2310(99)00167-3

Su S, Li B, Cui S, Tao S (2011) Sulfur dioxide emissions from combustion in China: from 1990 to 2007. Environ Sci Technol 45:8403–8410. https://doi.org/10.1021/es201656f

Tan J, Fu J, Huang K, Yang CE, Zhuang G, Sun J (2017) Effectiveness of SO2 emission control policy on power plants in the Yangtze River delta, China—post-assessment of the 11th five-year plan. Environ Sci Pollut Res 24(9):8243–8255. https://doi.org/10.1007/s11356-017-8412-z

Testa F, Iraldo F, Frey M (2011) The effect of environmental regulation on firms’ competitive performance: the case of the building & construction sector in some EU regions. J Environ Manag 92(1):2136–2144. https://doi.org/10.1016/j.jenvman.2011.03.039

Tian H, Qiu P, Cheng K, Gao J, Lu L, Liu K, Liu X (2013) Current status and future trends of SO2 and NOx pollution during the 12th FYP period in Guiyang city of China. Atmos Environ 69:273–280. https://doi.org/10.1016/j.atmosenv.2012.12.033

Wurgler J (2000) Financial markets and the allocation of capital. J Financ Econ 58:187–187. https://doi.org/10.1016/s0304-405x(00)00070-2

Yang C, Tseng Y, Chen C (2012) Environmental regulations, induced R&D, and productivity: evidence from Taiwan’s manufacturing industries. Resour Energy Econ 34:514–532. https://doi.org/10.1016/j.reseneeco.2012.05.001

Yuan B, Ren S, Chen X (2017) Can environmental regulation promote the coordinated development of economy and environment in China’s manufacturing industry? A panel data analysis of 28 sub-sectors. J Clean Prod 149:11–24. https://doi.org/10.1016/j.jclepro.2017.02.065

Zeng Y, Cao Y, Qiao X, Seyler BC, Tang Y (2019) Air pollution reduction in China: recent success but great challenge for the future. Sci Total Environ 663:329–337. https://doi.org/10.1016/j.scitotenv.2019.01.262

Zhang M, Liu X, Ding Y, Wang W (2019) How does environmental regulation affect haze pollution governance?—an empirical test based on Chinese provincial panel data. Sci Total Environ 695:133905. https://doi.org/10.1016/j.scitotenv.2019.133905

Zhang Z (2007) China is moving away the pattern of “develop first and then treat the pollution”. Energy Policy 35:3547–3549. https://doi.org/10.1016/j.enpol.2007.02.002

Zhao X, Sun B (2016) The influence of Chinese environmental regulation on corporation innovation and competitiveness. J Clean Prod 112:1528–1536. https://doi.org/10.1016/j.jclepro.2015.05.029

Acknowledgements

We thank seminar participants at the School of Finance in Renmin University in China for their comments.

Funding

This research has been supported by the Natural Science Foundation of Hainan Province (118MS042), the Hunan Provincial Philosophy and Social Science Planning Fund Office (17ZDB002), the Humanities and Social Science Fund of Ministry of Education of China (19YJCZH055), the Natural Science Foundation of Hunan Province (2019JJ50020), and Hunan Provincial Department of Education (18B481).

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tang, Hl., Liu, Jm., Mao, J. et al. The effects of emission trading system on corporate innovation and productivity-empirical evidence from China’s SO2 emission trading system. Environ Sci Pollut Res 27, 21604–21620 (2020). https://doi.org/10.1007/s11356-020-08566-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08566-x