Abstract

The paper investigates the potential of circular economy of authorized e-waste collectors, dismantlers, and recyclers of Maharashtra. The study determines the drivers and barriers associated with e-waste collection in the region. Furthermore, it explores the handling techniques including dismantling, recycling, and scrap disposal. This is done through a case study of a recycling company based in Mumbai, Maharashtra. A questionnaire-based survey is used to study e-waste processing units. The qualitative analysis of the questionnaire shows that lack of awareness of environmental impact is the greatest constraint in the collection of e-waste and data security is the most crucial driver for enhancing the collection of e-waste. The case study reveals that the quantity and type of e-waste are more important than the distance between the processing unit and the collection point. It discloses that the primary factor for building trust between e-waste collectors and waste holders is data security.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Waste electrical and electronic equipment (WEEE) is becoming one of the fastest-growing waste streams in the world, which contains toxic metal and toxic organics (Lithner et al. 2012). Rapid innovation in technology is possibly the primary reason for a global increase in e-waste, which in turn causes rapid resource depletion (Amit et al. 2017). Consider the case of today’s consumers: as they constantly update their electronic equipment (e.g., laptops, mobile phones, and computers) to the latest version, older versions become obsolete, which many discard; this, in essence is the crux of WEEE. Nevertheless, circular economy (CE) tends to reduce resource depletion by promoting reuse, recycle, and recovery, which in turn yields economic benefits, often by increasing the product lifecycle. CE primarily aims at larger economic prosperity, followed by environmental quality and social equity (Kirchherr et al. 2017). In fact, CE’s core principle is recycling, but it prioritizes WEEE reuse and remanufacturing over recycling, for improved resource recovery (Ghisellini et al. 2016; Parajuly and Wenzel 2017).

The present study aims to determine the CE potential of the e-waste collectors, dismantlers, and recyclers of Maharashtra with a case study of a recycling company situated in Mumbai. The structure of the paper is as follows: “Introduction” llustrates the background of the research topic; “Literature review” provides an overview of both the global and Indian scenario of e-waste generation. Section “Methodology” describes the methodology; followed by “Results and discussions,” which provides an analysis of the responses to the questionnaire. Finally, the “Conclusion” section concludes the study.

Literature review

Global scenario of e-waste generation and its management

In 2016, global e-waste generation stood at 44.7 million metric tonnes (Mt); it is expected to increase to 52.2 Mt by 2021 (Balde et al. 2017). Asia generated the largest e-waste (18.2 Mt), while Europe, America, Africa, and Oceania have generated 12.3 Mt, 11.3 Mt, 2.2 Mt, and 0.7 Mt respectively (Balde et al. 2017). Table 1 shows continent-wise e-waste generation and the management scenario of some countries.

Globally, concern surrounding WEEE generation and its unsustainable practices have led to the enforcement of several laws on WEEE management. The European Union (EU), for instance, has put forward two legislations to address this problem: WEEE directive (2002/96/EC) and RoHS directive (2002/95/EC) (Ongondo et al. 2011). Both WEEE and RoHS Directives were revised in 2012 and 2011 respectively and became effective 2 years later. The recast of the WEEE directive updated the collection and recycling targets to improve WEEE management (Salhofer et al 2016). Under the WEEE directive, the producers provide a free take-back system to increase e-waste collection, increasing thereby the performance of WEEE management (Yla-Mella and Roman 2019). The stakeholders of e-waste collection vary across Europe; UK for instance manages their e-waste through producers, distributors, and designated collection centers using distributor takeback scheme or free in-store take back schemes (Clarke et al. 2019). Finland manages their e-waste through retailers and waste management companies under the compliance of the WEEE Directive (2012/19/EU). In Germany, a foundation “Elektro-Altgeraete-Register” was specifically established in 2005 to organize e-waste pickup processes and control the collection and recycling process (Walther et al 2010). Switzerland manages their e-waste by the Swiss Association for Information, Communication and Organization Technology (SWICO) (1993). Additionally, some not-for-profit organizations like Swiss Foundation for Waste Management (S.EN. S) (1990), the Swiss Light Recycling Foundation (SLRS), and the Stakeholder Organization for Battery Disposal (INOBAT) manage the e-waste (Ongondo et al. 2011). Although the WEEE directive enforced e-waste management, still large amount of e-waste is shipped to developing economies including India, China, and Nigeria (Yla-Mella and Roman 2019).

In American continent, e-waste legislation and the collection routes vary across countries (de Souza et al 2016). For instance, the WEEE reverse logistics system of Brazil is based on the concept of shared responsibility among electrical and electronic equipment (EEE) producers, importers, distributors, retailers, and government (de Souza et al 2016). Australia manages their e-waste by voluntary take-back system of companies and by banning WEEE disposal to landfill (Morris and Graciela 2016). In South Africa, Kenya and Morocco both formal and informal sectors manage the e-waste (Laissaoui and Rochat 2008; Langwen 2012). On the other hand, only an informal sector is actively collecting e-waste in Nigeria and Uganda (Amachree 2013; Schluep et al 2008). In China and India for instance, e-waste is managed by both formal and informal sector, while in Pakistan, it is managed by the informal sector only (Awasthi and Li 2017; Imran et al 2017). In Japan and Korea, retailers, manufacturers, and some local recycling companies handle e-waste (Rhee 2016; Wei and Liu 2012).

E-waste management in India

India is the fifth largest e-waste generator in the world, with an annual growth rate of 21% (Pankaj et al. 2017). In 2016, the domestic e-waste generation in India was about 1.975 Mt (Balde et al. 2017). However, the specific statistics on e-waste generation in India is unclear, as India tends to import almost 50–60% of e-waste from OECD countries (Borthakur and Kunal 2013; Dasgupta et al 2017; Narain 2018). Methods to estimate e-waste generation include material flow analysis, market supply method, consumption use method, econometric analysis, and questionnaire-based survey (Yedla 2016). Different studies have tried to estimate WEEE generation in India (e.g., Chatterjee (2007), Dwivedy and Mittal (2010), Ahmed and Rashmi (2015), Yedla (2016), and Borthakur and Kunal (2013)). At the state and city level, some studies include for instance the city of Chandigarh (Khaiwal and Mor 2019b; Singh et al. 2018a), Delhi (Jain and Rajneesh 2006; Streicher-Porte et al 2005), Hyderabad, and Bangalore (EPTRI 2014). Largely, going by these studies, about 50000 tonnes of e-waste is imported to India (Chatterjee 2007). The main stakeholders of e-waste management in India include the policymakers (MoEFCC, CPCB, SPCB), producers, consumers, recyclers (formal and informal sector), importers/distributors, collection centers, dismantlers, refurbishment centers, and producer responsibility organizations (Union 2014; MoEFCC 2018).

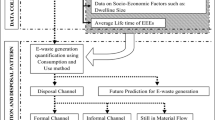

Figure 1 covers an overview of e-waste management in India. In 2008, the Ministry of Environment Forest and Climate Change (MoEFCC) issued guidelines for management of e-waste, and the procedures required to handle e-waste in an environmentally sound manner (CPCB 2008). The e-waste management and handling rules introduced “Extended Producer Responsibility” (EPR) in 2011, which came into force on 1 May 2012. The EPR gave additional responsibility to the producers for their products once the consumer has discards them. Now, a producer is liable to finance or channelize e-waste in order to comply with EPR (CPCB 2011). The recast in 2016 has fixed collection targets for every producer under EPR. Presently, 1239 producers have registered under EPR, and the Central Pollution Control Board (CPCB) has fixed their collection targets (CPCB 2018; MoEFCC 2016). But, EPR is still not successfully implemented (Awasthi and Li 2017). For effective implementation of EPR, the players need adequate infrastructure and enforcement tools (Bhaskar and Turaga 2018; Akenji et al 2011). Most importantly, India suffers from the problem of the informal sector, which causes useful WEEE to get disposed in a landfill rather than being reused or recycled (Awasthi and Li 2017). The Indian media, especially the print media, tend to highlight that the informal workers face health risks, but they are not able to convincingly explain on what causes the risks. Is it during the e-waste collection process, dismantling, and recycling (Radulovic 2018).

Generalized e-waste management in India (Awasthi et al. 2018)

Essentially in India, primitive methods are used for processing of e-waste, such as acid leaching, open burning, and manual dismantling (Pradhan and Kumar 2014; Awasthi and Li 2017). Moreover, the conventional e-waste disposal methods in India include landfill and incineration, both of which can cause contamination risks (Cousins 2017). Landfill leachates pollute the soil surface, as well as groundwater, and combustion in an incinerator tends to emit toxic gases into the atmosphere. E-waste is toxic to human health both in terms of chronic and acute conditions, and has become a serious societal problem (Peeranart et al. 2013). E-waste-related problems have been demonstrated by case studies in India (Eguchi et al 2012; Ha et al 2009; Pradhan and Kumar 2014; Chakraborty et al 2018; Singh et al. 2018b; Khaiwal and Mor 2019a). But, to date, there has been no formal study conducted by MoEFCC to understand the health hazards of e-waste recycling in India (Narain 2018). Lot of e-waste is exported to developing countries like India for dumping or recycling (Garlapati 2016). In fact, about 70% of e-waste processed in India is illegally imported from abroad (Sthiannopkao and Wong 2013). The “Basel Convention on the Control of Transboundary Movement of Hazardous Wastes and their Disposal” was launched on March 22, 1989 and enforced on May 5, 1992 (UNEP 1992) to prevent transfer of hazardous waste (UNEP 1992). As of January 2015, 182 states, including India and the EU, are parties to the convention. The USA was a signatory of the convention but did not ratify it. However, there are still some legal loopholes, which permit the export of products to other countries provided it is not for recycling (Peeranart et al. 2013).

E-waste processing at state level

According to the e-waste management rules 2016, the producers of EEE need to channelize their e-waste generated; for instance, it could take-back e-waste through dealers, collection centers, or directly through authorized dismantlers/recyclers (MoEFCC 2016). It could also channelize the e-waste by involving relevant stakeholders such as consumers, bulk consumers, informal sector, resident associations, retailers, dealers, or through producer responsibility organization (MoEFCC 2016). A producer responsibility organization is responsible for collection and channelization of e-waste on behalf of the producers (MoEFCC 2018). A collection center alludes to a collection point established by either a producer or dismantler/refurbisher/recycler, which is authorized by the State Pollution Control Board (SPCB) (MoEFCC 2016). However, in case of end of life of products containing hazardous substances such as used fluorescent and other mercury containing lamps, they should be sent for treatment storage and disposal facility. A dismantler performs two operations, namely de-dusting and manual dismantling. It disassembles used EEE into smaller components or parts with equipments such as screwdrivers, wrenches, pliers, wire cutters, tongs, weigh bridge, and hammers. Moreover, it uses data eraser to remove data from end of life products (MoEFCC 2016). After the dismantling process, volume/size reduction operation can be done for dismantled parts, such as steel, aluminum, and plastic. Other dismantled components for instance include batteries, printed circuit boards, toner cartridges, plastic and external electrical cables transfers to authorized recyclers. A recycler is a person or organization involved in recycling and reprocessing of WEEE or assemblies or their components. Based on the facilities available, a recycler can perform the following operations: (1) manual/semi-automatic/automatic dismantling; (2) shredding/crushing/fine grinding/wet grinding/enrichment operations,gravity/magnetic/density/eddy current separation; (3) pyro metallurgical operations—Smelting furnace; (4) hydro metallurgical operations; (5) electro-metallurgical operations; (6) chemical leaching; (7) CRT/LCD/Plasma processing; (8) toner cartridge recycling; (9) melting, casting, molding operations (for metals and plastics) (MoEFCC 2016). The subsequent paragraph discusses the potential of collectors, dismantlers, and recyclers in Indian states.

E-waste units and its capacity in major Indian states in million tonnes per annum (MTPA) are given in Table 2. Maharashtra with 112 million inhabitants has the maximum per capita e-waste generation; it contributes to 19.8% in India. But the capacity of e-waste units of Maharashtra is very low as compared with Uttar Pradesh for instance, which has low per capita e-waste generation (ASSOCHAM 2018). Presently, 261 EEE producers have EPR authorization in Maharashtra (CPCB 2018). They channelize their e-waste mainly through producer responsibility organizations and in agreement with e-waste units of Uttar Pradesh. From Table 2, it may be inferred that the number and capacity of collectors of Uttar Pradeshare quite large as compared with Maharashtra. Although the number of dismantlers is highest in Maharashtra, their capacity is very low as compared with states like Karnataka and Uttar Pradesh. Producer responsibility organizations involved in channelizing e-waste from Maharashtra are Pro Connect, R2 PRO, Reteck Environtech, Auctus, and Karo Sambhav etc. (MoEFCC 2016). Some of the e-waste units of Uttar Pradesh involved include Greeniva Recycler Private Limited (dismantling capacity—1500 MTPA) and E-waste Recyclers India (dismantling capacity—6000 MTPA) (MoEFCC 2016). Importantly, even the recycling capacity of Maharashtra is very low as compared with their collection and dismantling capacity, suggesting thereby that the recycling capacity in other states such as Uttar Pradesh is larger. Hence, Maharashtra needs to increase the capacity of their e-waste units, especially their recycling capacity. Moreover, e-waste units are mainly based in Mumbai and Pune; this tends to incur significant logistics cost to collect e-waste from other cities of Maharashtra.

Tamil Nadu on the other hand has a high per capita e-waste generation; and information regarding their collection capability is not explicit. There are 22 dismantlers with 67,121 MTPA capacity, and only 2 recyclers with 30,150 MTPA capacity. Thus, there is a need to increase the number of recyclers and their capacity in Tamil Nadu. Gujarat in comparison has a high collection (49,053 MTPA) and dismantling capacity (46,053 MTPA), but they are plagued with very low recycling capacity (16,583 MTPA). There are a few e-waste units in Madhya Pradesh, which are inadequate for their per capita e-waste generation. Moreover, the trend of capacity of e-waste units in Madhya Pradesh is similar to other states with low recycling capacity (6000 MTPA) as compared with their collection (9600 MTPA) and dismantling capacity (9600 MTPA). West Bengal has equal capacity of dismantling (1860 MTPA) and recycling (1860 MTPA), but information on the number of collectors are not explicit. Similarly, in Andhra Pradesh and Telangana, information regarding the number of collectors are unavailable, but their recycling capacity (43,255 MTPA) is more than their dismantling capacity (23,363 MTPA), suggesting thereby that they import waste from nearby states like Karnataka with both high dismantling and low recycling capacity. Information regarding the number and capacity of e-waste units in other states such as Arunachal Pradesh, Bihar, Himachal Pradesh, Jharkhand, and Kerala are not explicit. The North-eastern states do not have authorized e-waste processing units. Thus, from the above discussion, it may be inferred that collection and dismantling capacity of states is higher than their recycling capacity.

E-waste collection in India

The collection system is critical to e-waste management, which has two alternatives of collector producer responsibility and individual producer responsibility (Chi et al. 2014). The CE potential of e-waste collectors, recyclers, and dismantlers is determined by understanding the effectiveness of the e-waste collection, dismantling, and recycling system. The scope of the paper is to understand the barriers and drivers in the context of collector producer responsibility, along with handling techniques.

The economic driver for WEEE collection and treatment is precious metal (gold and palladium) and copper as illustrated in studies (Charles et al 2017; Streicher-Porte et al 2005). According to previous studies, the local e-waste market is mainly driven by the recovery of precious metals and plastics (Jain 2010). But the amount of recovery of metals depends on the type and amount of e-waste received by a unit (Tiwari et al 2019). Furthermore, enhancement of e-waste collection can go up further by giving economic incentives to informal workers (Dwivedy and Mittal 2013; Wang et al 2011; Dixit and Anurika 2015). Similarly, to raise fund for the collection and recycling of WEEE, external financing is essential (Chaudhary and Prem 2018; Sinha 2004). For organizations, data security is a crucial aspect, and hence it is also considered as a driver in the e-waste collection process (Jain 2010; Tan et al 2018; Qu et al 2019).

Illegal WEEE import and the established grey market for some electronic waste create difficulties in the implementation of an e-waste management system (Manomaivibool 2009). The role of public-private partnership is significant in establishing an effective e-waste management system (Wath et al 2010). E-waste collection by the informal sector employs a lot of poor people, leading thereby to higher collection rates. Thus, a major promoter of the informal sector is affordable labor (Chandrakant 2018). The survey conducted by Chi et al. (2014) stated that a major challenge for formal e-waste collection is the insufficient control of locals and low entry barriers. Furthermore, lack of policies and regulation, inefficient collection system, and geographical distance between the source of generator and recycler are main barriers to e-waste collection (Kumar and Gaurav 2018; Dwivedy and Mittal 2013).

Consumer behavior is critical to e-waste management (Kumar 2019). The two key elements, which influence sustainable e-waste collection system, are disposal behavior and awareness (Awasthi and Li 2018). In India, consumers prefer to store WEEE at home rather than to return it to producers, as they do not receive any return cost (Jain 2010; Borthakur and Madhav 2017). Moreover, only 2% of residents consider the environmental impact while disposing of their e-waste (Jain 2010). Irrespective of the criticality of consumer behavior, a few studies did focus on the public disposal behavior and the awareness of e-waste collection system (Awasthi and Li 2018; Borthakur and Madhav 2017).

Methodology

Maharashtra has been chosen as the study location, as it is the largest e-waste generator of India. The survey method has been used to gather information regarding authorized e-waste units (i.e., dismantler, collectors, and recyclers) of Mumbai, Vasai Thane, and Navi Mumbai. Fifty-four e-waste units, which are authorized dismantlers, recyclers, and collectors, were approached for the study using a questionnaire. The informative questionnaire consisted of both open-ended and closed-ended questions. Most of the questions were multiple-choice type, which is easier to answer by the respondents. The sentences of the questionnaire were short to maintain the respondents’ interest. The questionnaire was given to each respondent by visiting his/her respective units.

The questionnaire included 45 questions segregated under seven sections; they include general information about the unit, collection of WEEE, dismantling of WEEE, recycling of WEEE, environmental measures, safety measures, and health measures. General information of companies included information such as the type of unit (i.e., dismantler, collectors, and recyclers), organization type (private/government), and the organizational size. Section 2 consisted of multiple-choice questions on the type of e-waste collected, along with the drivers and barriers of e-waste collection. The options given for drivers of e-waste collection included consumer behavior, recycling infrastructure facility, data security, precious metal flow, economic incentive, international trade, and external financing. For barriers, the options given included unawareness of environmental impact, residential behavior for e-waste discards, lack of efficient collection system, cost, the distance between the source of generation and the recycler, insufficient control from local authorities, and liberal government regulations. Sections 3 and 4 consisted of questions on capacities and type of facility available for dismantling and recycling process of WEEE. Section 5, 6, and 7 had open-ended questions on environment, safety, and health measures taken by the e-waste processing units. The variables have been identified using literature review, as discussed in the previous section. The questionnaire is attached as supplementary material; after data cleaning, the responses are given in the A. The data obtained is analyzed in both qualitative and quantitative manner. Qualitative data were used to strengthen the results of the respondents further, while the quantitative data were analyzed by calculating the frequency and the percentage of multiple-choice questions answered by the respondents, adopted from Kwatra et al. (2014). Also, one of the respondents in our survey is chosen for the case study, which is a recycling company based in Mumbai to further understand the e-waste recycling process.

Results and discussions

Among 54 companies, responses were received from 26 of them. Thus, the response rate is 48.15%. It may be noted that studies conducted at the organizational level are likely to experience a lower response rate (Baruch 1999). Baruch and Brooks (2008) suggested the benchmark of 35–40% response rate for studies conducted at the organizational level. Figure 2 shows the location map of the e-waste processing units; it is observed that they are not dispersed, but in clusters. The two major clusters in Maharashtra are in Mumbai and Pune. Three other units used for the study were from Vasai Thane, Mumbai, and Navi Mumbai. Respondents include three recyclers, ten collectors, and thirteen dismantlers. Among them, only two were government/public organizations, whereas all others were private organizations, suggesting thereby that private organizations are more involved in e-waste treatment facilities.

Predominantly, these e-waste treatment facilities, considered as medium scale units, treat 400–600 tonnes of e-waste per annum. Table 3 includes the details of the e-waste recyclers. All e-waste treatment facilities collect both IT and telecommunication equipment (i.e., computers, printers, laptops, mobiles) along with consumer electrical and electronics waste (e.g., television sets, refrigerator, washing machine, air conditioner) except one dismantling facility, which does not treat consumer electrical and electronic waste. E-waste treatment is highest in two dismantling facilities, treating 800–1000 tonnes per annum. However, five facilities process 400–600 tonnes/annum of e-waste in which 2 are recyclers, 1 is a collector, and 2 are dismantlers (Table 4). Exceptionally, one e-waste processing unit dismantles 600–800 tonnes/annum and recycles up to 1000 tonnes/annum, which is greater than the e-waste collected by that facility. This reveals that recyclers buy e-waste from other sources like informal collectors. Therefore, the informal sector exists in recycling rather than in dismantling. Only one dismantling facility collects and dismantles 200–400 tonnes/annum of e-waste, but there are 11 dismantlers which dismantle 0–200 tonnes/annum.

Drivers and barriers of e-waste collection

The analysis shows that unawareness of environmental impact is the greatest constraint in e-waste collection according to 20 e-waste units. It was mentioned by 76% of e-waste units, which will subsequently affect dismantling and recycling. Lack of collection system is a second predominant barrier, which hampers e-waste collection in 57.7% units. Furthermore, residential behavior and cost add up to affect the collection system of 14 units out of 26 units. Respondents clarified that distance between generation and recycling units is the factor, which least hinders e-waste units (i.e., 26.92%) (Table 5).

Further, the respondents revealed that data security is the most important driver for enhancing e-waste collection. It is the primary factor for building trust between e-waste collectors and generators. The survey results show that it is a driver of e-waste collection in 80.76% of cases when e-waste is collected from companies rather than consumers (Table 6). Interestingly, the survey study done by Tan et al (2018) and Qu et al (2019) reveals that data security is also crucial to build trust between collectors and residents. Furthermore, residents show more trust towards governmental collectors, which provide quality certification, and has established collection points in the locality (Tan et al 2018; Qu et al 2019). From the recycler’s perspective, both infrastructure facility and data security are significant drivers for e-waste collection, whereas, for collectors and dismantlers, data security is the most significant driver of e-waste collection. The other significant drivers include previous metal flow, economic incentives, and infrastructure facility. The driver “external financing” quote by only three respondents and therefore has a minimum effect in promoting the e-waste collection.

E-waste units are unable to take adequate initiatives for environmental awareness of e-waste within residential areas and colleges because it requires a separate team, which might incur higher costs. Additionally, under the Swachh Bharat Abhiyan mission, no initiative has been taken by any of the e-waste units. The government has been supporting the unit at the policy level, as they get their licenses from CPCB, and the unit does receive e-waste from various government agencies such as Brihanmumbai Corporation (BMC) and other banks. However, no economic incentives are provided by the government, which possibly could serve as one of the drivers for e-waste collection. Moreover, the initial investment for setting up an e-waste treatment unit is high (approximately INR eight lakhs), which does seem to be a challenge in promoting the formal or organized sector of e-waste.

Handling techniques

These e-waste units mostly seem to be relying on semi-automated dismantling techniques; only five units were based on manual and automated dismantling. About twenty e-waste units manage plastic waste through recycling, but the survey questionnaire does not explicitly mention the type of polymers recycled. Interestingly, only one e-waste unit handles plastic waste through energy recovery; most of them otherwise seem to use mechanical recycling techniques. Out of three e-waste recyclers, only one has been entirely using mechanical recycling, the second one uses chemical recycling, while the third practices both mechanical and thermal techniques. It is interesting to note that the recycler using mechanical techniques generates 1–20% scrap in one recycling process, while the other recycler (i.e., chemical recycling) generates 21–40% scrap in one recycling process. Fourteen e-waste units together generate about 1–20% of scrap after the recycling process; six e-waste units generate 21–40% of scrap and one unit generates 41–60% scrap after the recycling process. Then the scrap is landfilled, neglecting thereby the incineration process or the possibility of producing electricity out of the scrap. Hence, the potential of CE should further be explored in terms of energy generation. Moreover, urban mining could help in assessing the value left in the landfill, since very limited work has been done on this value retention option in the context of CE. Nevertheless, one needs to note that not all landfills exploitation would be profitable, as it depends on the types of waste and technologies available (Reike et al. 2018).

Case study company

Company ABC is an authorized recycler and one of the respondents in our survey. The field visit consisted of observing and interviewing to understand various operations performed within the recycling company. At the first visit, we viewed the hard drive-shredding machine, which breaks the belt of the DIY hard drive, eliminating thereby its data, and ensuring that it cannot be reused. The capacity of the shredding machine was 800 kg, while the average weight of a hard disk is about 400 g. Thus, the shredding operation is performed once or twice a month when the capacity of the shredding machine reaches its operational level. At the second visit, we viewed the cable-stripping machine, which is typically useful in recovering copper from wire. The leftover shredded elements collected are sold or re-used for manufacturing different products. The scrap generated after each recycling process is in between 1 and 20%.

In case of liquid crystal display (LCD) and light emitting diode (LED), the recycling potential is mainly based on the recovery of printed circuit boards (PCBs). The materials recovered from LCD are zinc-coated steel, aluminum, cable copper content, poly methyl methacrylate (PMMA) light diffuser, plastics, and optical-enhancement films. However, the unit does not have facility to recover indium available in the screen. PCBs are recovered using component separation machine. Approximately, 10–12 PCBs can be recovered simultaneously in a heating operation of component separation machine. The plastic of PCBs is heated to 100 ∘C, which yields cooking gas and oil. The e-waste unit does not have operational facility to recover components such as gold, silver, and nickel from the PCBs. E-wastes like fluorescent and other mercury containing lamps have hazardous substances and are sent to treatment storage and disposal facility.

Our next visit was to the cluster-sorting device, used to categorize plastic. It categorizes plastic based on the color and grade. Since the economic potential of plastic depends on the grade of the plastic, therefore, cluster sorting is essential. Based on the grade, plastic flow on belt and sensors separate it into two: one is for better quality and the other for lower quality. A white bush machine is used for recovering compressed gases from washing machines, air conditioners, and fridges. The collected gas is further sent to the Mumbai Waste Management.

The company collects e-waste from various contractors, IT companies, and corporate units like Multinational Banks within India. They also collect e-waste from a few residential areas too. Collection of e-waste follows an irregular pattern by the unit throughout the year, as it depends on the capacity of the containers at the location from where e-waste is to be collected. E-waste is collected by sending a vehicle, which may be free or paid. Generally, household waste is not preferred, since the quantity of e-waste collected per vehicle from residential areas is quite less, thereby there is significant logistics cost. Household waste may be directly given to an e-waste unit, which will quote the amount of money for the e-waste. Hence, the quantity plays a crucial role in e-waste collection. Household e-wastes like laptops, TV, and LCD usually reach to the informal sector where there is no chance of reuse. If the authorized e-waste units receive a laptop, for instance, the engineers will first check for electrical faults and then their parts. The e-waste unit will then seek the possibility of reusing the laptop. Herein, data security is an important driver, which can build trust between the e-waste unit and the company, which generate e-waste like laptops. The maximum quantity of e-waste received by the case study company in a year is 700–800 tonnes/annum, which is 10% of the licensed amount. The interviewer said that the generation of e-waste in Mumbai is in large amount, but the e-waste treatment facilities are not capturing the attention of waste holders (EEE customers). The possible reason behind the low collections can be lack of environmental impact according to the respondents. Also, the informal sector may result in low collections (Manomaivibool 2009).

The e-waste unit is following environmental measures by installing wastewater treatment facilities and air pollution control equipment. These environmental measures are regulated by conducting environmental audit by CPCB twice a year. The unit has also taken safety measures for the workers. The workers are well equipped with goggles, masks, gloves, helmet, and gumboot. They are well-trained for segregating and operational processes of machines. The unit gives training to the staff members once a month. The detailed information regarding the e-waste unit are available on their official website. The documentation of the flow of e-waste is maintained by enterprise resource planning. Hence, the flow of e-waste is well documented. The customer can ask their query on the website of the e-waste unit.

In contrast, in some European countries, take-back channels are responsible for collecting household e-waste (Salhofer et al 2016). On the other hand, in India, the e-waste collection is through the informal sector with a transition towards the formal sector (Wei and Liu 2012). In Switzerland, domestically they collect and dismantle e-waste and the remaining recyclable fractions (aluminum, iron, plastics, etc.) sent to other European countries because they do not have the reprocessing facility (Yla-Mella and Roman 2019). In the case of India, the recycling facilities are available but with lower capacity than their dismantling capacity. Since the recycling facilities are limited in India, therefore, the remaining quantity of recycling is done in the informal sector. In Norway, the e-waste is processed partly in their own country and partly abroad with energy recovery facilities (Yla-Mella and Roman 2019). Hence, the problem of limited recycling capacity in India can be considered quite similar to Norway. Considering the solution adopted by Norway suggests that e-waste dismantling can be done in India and full or partial recycling can be done abroad. The rationale behind suggesting full recycling abroad because the recycling facilities of India do not have the technology to extract precious metals from WEEE as discussed below.

The case study company mainly recovers copper and aluminum during the metal recovery process. It does not have the required technology for extracting precious metals (i.e., gold, silver, palladium, platinum). These technologies are very costly for the e-waste units of developing countries like India. Hence, an effective solution for improving the recovery of secondary raw materials from WEEE of developing countries would be to apply the best of 2 worlds’ philosophy proposed by Wang et al (2012). The 2 worlds’ philosophy states that the full dismantling should be done in developing countries and the end-processing should be done in developed countries. This solution can simultaneously solve the constraint of resource loss, environmental impact, and the technology required in developing nations.

Conclusion

Our analysis shows that lack of awareness of environmental impact is the greatest constraint in the collection of e-waste followed by the lack of collection system, residents’ behavior, and cost. The least affecting factor to e-waste collection is the distance between generation and recycling units. The case study further reiterates that the quantity and type of e-waste are more important than the distance between their company and the collection point. The case study company receives only 10% of e-waste as compared with their recycling capacity, which essentially proves that there is a significant gap between the generation and the official e-waste collection processes. The Indian government should thereby take initiatives to channelize e-waste to formal recyclers, as 95% of e-waste goes to the informal sector (Awasthi et al. 2018). It will help recyclers to get sufficient quantity of e-waste, which is critical to the recycling company. From e-waste recyclers perspective, they should approach household waste which has a maximum amount of WEEE by collaborating with collectors (Parajuly et al. 2017).

Moreover, the results show that data security is a crucial driver for enhancing e-waste collection. It also plays a critical role in building trust between e-waste collectors and waste holders. The case study validates it since they have regular customers of e-waste which are concerned about data security. The case study further reveals that the e-waste units do not have adequate infrastructure facility for recycling, which in fact is the second driver of e-waste collection. Apart from data security and infrastructure facility, the other significant drivers for e-waste collection include previous metal flow and economic incentives. In contrast, external financing is the least impacting the e-waste collection. The limitation of the study is that the number of recyclers, collectors, and dismantlers is not uniform to draw effective results. Furthermore, the study shows that landfill is the only option for scrap disposal. The informal sector practices open-air incineration (Shirodkar and Terkar 2017). Hence, the CE potential for energy generation using incineration needs to be further explored by taking emission reduction measures for removing heavy metals in air. Further study could also be done to determine the amount of e-waste generated, collected, and recycled, considering variation in the product lifetime and technology, as forecasted in Peeters et al (2018). Quantifying the flows of e-waste could help improving the recovery of secondary raw materials.

References

Akenji L et al (2011 ) EPR policies for electronics in developing Asia: an adapted phase-in approach. In: Waste Management & Research 29.9, pp. 919–930

Ahmed S, Rashmi MP (2015) Hazardous constituents of e-waste and predictions for India. In: Proceedings of the Institution of Civil Engineers-Waste and Resource Management. Vol. 169. 2. Thomas Telford Ltd, pp. 83–91

Amachree M (2013) Update on e-waste management in Nigeria. In: In: 3rd Annual Meeting of the Global E-Waste Management Network, San Francisco. Available: https://www.epa.gov/sites/production/files/2014-05/documents/nigeria.pdf.

Amit K, Holuszko M, Espinosa DCR (2017) E-waste:an overview on generation, collection, legislation and recycling practices. In: Resources, Conservation and Recycling 122, pp. 32–42

ASSOCHAM (2018) Electricals and electronics manufacturing in India

Awasthi AK, Li J (2017) Management Of electrical and electronic waste: a comparative evaluation of China and India. In: Renewable and sustainable energy reviews 76, pp. 434–447

Awasthi AK, Li J (2018) Assessing resident awareness on e-waste management in Bangalore, India: a preliminary case study. In: Environmental science and pollution research 25, vol 11, pp 11163–11172

Awasthi AK et al (2018) E-waste management in India: a mini-review. In: Waste Management & Research 36.5, pp. 408–414

Balde CP, et al. (2017) The global e-waste monitor 2017: quantities flows and resources. International Telecommunication Union, and International Solid Waste Association, United Nations University

Baruch Y (1999) Response rate in academic studies-a comparative analysis. In: Human relations 52.4, pp. 421–438

Baruch Y, Brooks CH (2008) Survey response rate levels and trends in organizational research. In: Human relations 61.8, pp. 1139– 1160

Bhaskar Kalyan, Turaga RMR (2018) India’s e-waste rules and their impact on e-waste 404 management practices: a case study. In: Journal of Industrial Ecology 22.4, pp. 930–942

Boeni H, Silva U, Ott D (2008) E-waste recycling in Latin America: overview, challenges and po406 tential. In: Proceedings of the 2008 Global Symposium on Recycling, Waste Treatment and Clean Technology, REWAS, pp. 665–673

Borthakur A, Kunal S (2013) Generation of electronic waste in India: current scenario, dilemmas and stakeholders. In: African Journal of Environmental Science and Technology 7.9, pp. 899–910

Borthakur A, Madhav G (2017) Emerging trends in consumers E-waste disposal behaviour and awareness: a worldwide overview with special focus on India. In: Resources, Conservation and Recycling 117, pp. 102–113

Chakraborty P et al (2018) PCBs and PCDD/Fs in soil from informal e-waste recycling sites and open dumpsites in India: levels, congener profiles and health risk assessment. In: Science of the Total Environment 621, pp. 930–938

Chandrakant SS (2018) Impact of e-waste on environment, human health and employment-a review. In: Indo American Journal of Pharmaceutical Sciences 5.1, S115–119

Charles RG et al (2017) An investigation of trends in precious metal and copper content of RAM 419 modules in WEEE: implications for long term recycling potential. In: Waste management 60, pp. 505–520

Chatterjee S Dr. (2007) Electronic waste and India. https://meity.gov.in/writereaddata/files/EWaste_Sep11_892011.pdf

Chaudhary K, Prem V (2018) Case study analysis of e-waste management systems in Germany, Switzerland, Japan and India: A RADAR chart approach. In: Benchmarking: An International Journal 25.9, pp. 3519–3540

Chi X, YLWang M, Reuter MA (2014) E-waste collection channels and household recycling behaviors in Taizhou of China. In: Journal of cleaner production 80, pp. 87–95

Clarke C, Williams ID, Turner DA (2019) Evaluating the carbon footprint of WEEE management in the UK. In: Resources, Conservation and Recycling 141, pp. 465–473

Cousins S (2017) e-waste: the problem persists after recycling. In: The lancet child and adolescent health. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85031717707&doi=10.1016%2fS2352-4314642%2817%2930031-7&partnerID=40&md5=8d9510a8393e0b996640cbf3a3f36861

CPCB (2008) Guidelines for environmentally sound manangement of e-waste. https://cpcb.nic.in/displaypdf.php?id=UHJvamVjdHMvRS1XYXN0ZS9mdWxsLXRleHQucGRm https://cpcb.nic.in/displaypdf.php?id=UHJvamVjdHMvRS1XYXN0ZS9mdWxsLXRleHQucGRm

CPCB (2011) Implementation of E-Waste Rules 2011 Guidelines

CPCB (2018) EPR authorization. https://cpcb.nic.in/epr-authorization/

CPCB (2019) List of authorised e-waste dismantler/recycler. https://cpcb.nic.in/uploads/Projects/E-Waste/437List_of_E-waste_Recycler.pdf

Dasgupta D et al (2017) Scenario of future e-waste generation and recycle-reuse-landfill-based disposal pattern in India:a system dynamics approach. In: Environment, Development and Sustainability 19.4, pp. 1473–1487

de Souza RG et al (2016) Sustainability assessment and prioritisation of e-waste management options in Brazil. In: Waste management 57, pp. 46–56

Dias P, Bernardes AM, Huda N (2018) Waste electrical and electronic equipmentWEEE management:an analysis on the australian e-waste recycling scheme. In: Journal of cleaner production 197, pp. 750–764

Dixit S, Anurika V (2015) Perceived barriers, collection models, incentives and consumer pref445 erences:an exploratory study for effective implementation of reverse logistics. In: International Journal of Logistics Systems and Management 21.3, pp. 304–318

DPCC (2019) E-waste. https://www.dpcc.delhigovt.nic.in/EMPANELLED_EWASTE.htm

Dwivedy M, Mittal RK (2010) Estimation of future outflows of e-waste in India. In: Waste Management 30.3, pp. 483–491

Dwivedy M, Mittal RK (2013) Willingness of residents to participate in e-waste recycling in India. In: Environmental Development 6, pp. 48–68

Eguchi A et al (2012) Different profiles of anthropogenic and naturally produced organohalogen compounds in serum from residents living near a coastal area and e-waste recycling workers in India. In: Environment international 47, pp. 8–16

EPTRI (2014) Inventorization of e-waste in two cities in Andhra Pradesh and Karnataka Hyderabad and Bangalore. http://www.indiaenvironmentportal.org.in/files/Chemical-e-waste_in_two_cities_in_andhra_pradesh_and_karnataka_.pdf

Finlex (2014) Government decree on waste electrical and electronic equipment. https://www.finlex.fi/fi/laki/alkup/2014/20140519

Gallo DT (2013) Broad overview of e-waste management policies in the U.S. https://www.epa.gov/sites/production/files/2014-05/documents/overview.pdf

Garlapati VK (2016) E-waste in India and developed countries: management, recycling, business and biotechnological initiatives. In: Renewable and Sustainable Energy Reviews 54, pp. 874–881

Ghisellini Patrizia, Cialani Catia, Ulgiati Sergio (2016) A review on circular economy: the expected transition to a balanced interplay of environmental and economic systems. In: Journal of cleaner production, vol 114, pp 11–32

GPCB (2019) E-waste registered dismantler / recyclers in the State of Gujarat. https://gpcb.gujarat.gov.in/uploads/e_waste_recyclers.pdf

Ha NN et al (2009) Contamination by trace elements at e-waste recycling sites in Bangalore, India. In: Chemosphere 76.1, pp. 9–15

Imran M et al (2017) E-waste flows, resource recovery and improvement of legal framework in Pakistan. In: Resources, Conservation and Recycling 125, pp. 131–138

Jain A (2010) E-waste management in India: current status, emerging drivers and challenges. In: Regional Workshop on E-waste/WEEE Management July 8th

Jain A, Rajneesh S (2006) E-waste assessment methodology and validation in India. In: Journal of Material Cycles and Waste Management 8.1, pp. 40–45

Khaiwal R, Mor S (2019) Distribution and health risk assessment of arsenic and selected heavy metals in groundwater of Chandigarh, India. In: Environmental Pollution 250, pp. 820–830

Khaiwal R, Mor S (2019) E-waste generation and management practices in Chandigarh, India and economic evaluation for sustainable recycling. In: Journal of Cleaner Production 221, pp. 286–294

Kirchherr J, Denise R, Marko H (2017) Conceptualizing the circular economy:an analysis of 114 definitions. In: Resources, Conservation and Recycling 127, pp. 221–232

KSPCB (2018) Updated list of e-waste dismantlers, recyclers, both dismantlers and recyclers and refurbisher. https://kspcb.gov.in/E-Waste-Dismantlers-Recyclers-Both-Collection

Kumar A (2019) Exploring young adults e-waste recycling behaviour using an extended theory of planned behaviour model:a cross-cultural study. In: Resources, Conservation and Recycling 141, pp. 378–389

Kumar A, Gaurav D (2018) An analysis of barriers affecting the implementation of e-waste management practices in India:a novel ISM-DEMATEL approach. In: Sustainable Production and Consumption 14, pp. 36–52

Kwatra S, Pandey S, Sumit S (2014) Understanding public knowledge and awareness on e-waste in an urban setting in India: a case study for Delhi. In: Management of Environmental Quality: An International Journal 25.6, pp. 752–765

Laissaoui SE, Rochat D (2008) Technical report on the assessment of e-waste management in Morocco

Langwen B (2012) Solid waste management in Kenya opportunities and challenges. URL:https://globalmethane.org/documents/events_land_120910_6.pdf

Lithner D, Maja H, Goran D (2012) Toxicity of electronic waste leachates to Daphnia magna:screening and toxicity identification evaluation of different products, components, and materials. In: Archives of environmental contamination and toxicology 62.4, pp. 579–588

Manomaivibool P (2009) Extended producer responsibility in a non-OECD context: the management of waste electrical and electronic equipment in India. In: Resources, Conservation and Recycling 53.3, pp. 136–144

MoEFCC (2016) Ministry of Environment, Forest and Climate Change. http://www.moef.gov.in/sites/default/files/EWM

MoEFCC (2018) E-waste management amendment rules

Morris A, Graciela M (2016) Assessing effectiveness of WEEE management policy in Australia. In: Journal of environmental management 181, pp. 218–230

MPCB (2019) List of e-waste recyclers and dismantlers. http://mpcb.gov.in/ewaste/pdf/EWASTE_21062019.pdf

MPPCB (2019) Authorised e-waste dismantler/recycler/refurbisher/ producer/manufacturer and their collection centers in Madhya Pradesh. http://www.mppcb.mp.gov.in/e-waste-eng.htm

Narain S (2018) Report e-waste management: generation; collection and recycling Submitted to the Hon’ble High Court in W.P. (C) 8917/2015. Centre for Science and Environment

Ongondo FO, Williams ID, Cherrett TJ (2011) How are WEEE doing? A global review of the management of electrical and electronic wastes. In: Waste management 31.4, pp. 714–730

Pankaj P, Srivastava RR et al (2017) Assessment of legislation and practices for the sustainable management of waste electrical and electronic equipment in India. In: Renewable and Sustainable Energy Reviews 78, pp. 220–232

Parajuly K, Habib K, Liu G (2017) Waste electrical and electronic equipment (WEEE) in Denmark: flows, quantities and management. In: Resources, Conservation and Recycling 123, pp. 85–92

Parajuly K, Wenzel H (2017) Potential for circular economy in household WEEE management. In: Journal of Cleaner Production 151, pp. 272–285

Peeranart P, Naidu R, Wong MH (2013) Electronic wastemanagement approaches:an overview. In: Waste Management 33.5, pp. 1237–1250

Peeters JR et al (2018) Forecasting the recycling potential based on waste analysis: a case study for recycling Nd-Fe-B magnets from hard disk drives. In: Journal of cleaner production 175, pp. 96– 108

Pradhan JK, Kumar S (2014) Informal e-waste recycling: environmental risk assessment of heavy metal contamination in Mandoli industrial area, Delhi, India. In: Environmental Science and Pollution Research 21.13, pp. 7913–7928

Qu Y et al (2019) Understanding residents preferences for e-waste collection in China-a case study of waste mobile phones. In: Journal of Cleaner Production 228, pp. 52–62

Queiruga D, Benito JG, Lannelongue G (2012) Evolution of the electronic waste management system in Spain. In: Journal of cleaner production 24, pp. 56–65

Radulovic Verena (2018) Portrayals in print:media depictions of the informal sector’s involvement in managing e-waste in India. In: Sustainability 10.4 p. 966

Reike D, Vermeulen WJV, Witjes S (2018) The circular economy: new or refurbished as CE 3.0? Exploring controversies in the conceptualization of the circular economy through a focus on history and resource value retention options. In: Resources, Conservation and Recycling 135, pp. 246–264

Rhee S-W (2016) Beneficial use practice of e-wastes in Republic of Korea. In: Procedia Environmental Sciences 31, pp. 707–714

Salhofer S et al (2016) WEEE management in Europe and China-a comparison. In: Waste management 57, pp. 27–35

Schluep M et al (2008) E-waste generation and management in Uganda. In: Proceedings of the 19th waste management conference of the IWMSA WasteCon2008

Shirodkar N, Terkar R (2017) Stepped recycling: the solution for E-waste management and sustainable manufacturing in India. In: Materials Today: Proceedings 4.8, pp. 8911–8917

Singh M, Thind PS, John S (2018) An analysis on e-waste generation in Chandigarh: quantification, disposal pattern and future predictions. In: Journal of Material Cycles and Waste Management 20.3, pp. 1625–1637

Singh M, Thind PS, John S (2018) Health risk assessment of the workers exposed to the heavy metals in e-waste recycling sites of Chandigarh and Ludhiana, Punjab, India. In: Chemosphere 203, pp. 426–433

Sinha D (2004) The management of electronic waste. University of St. Gallen

Statistics Ministry of and Implementation (2016) Area and population- statistical year book India 2016. http://www.mospi.gov.in/statistical-year-book-india/2016/171

Sthiannopkao S, Wong MH (2013) Handling e-waste in developed and developing countries:initiatives, practices, and consequences. In: Science of the Total Environment 463, pp. 1147–1153

Streicher-Porte M et al (2005) Key drivers of the e-waste recycling system: assessing and modelling e-waste processing in the informal sector in Delhi. In: Environmental impact assessment review 25.5, pp. 472–491

Tan Q et al (2018) Rethinking residential consumers behavior in discarding obsolete mobile phones in China. In: Journal of cleaner production 195, pp. 1228–1236

Tiwari D et al (2019) A study on the e-waste collection systems in some asian countries with special reference to India. In: Nature Environment and Pollution Technology 18.1, pp. 149–156

TNPCB (2019) List of authorized E-waste dismantling units in Tamil Nadu. https://www.tnpcb.gov.in/ewastemanagement.php

TSPCB (2019) List of authorised e-waste dismantlers, recyclers, collection centres and producers under EPR. https://tspcb.cgg.gov.in/Pages/eWaste.aspx

UNEP (1992) Basel convention on the control of transboundary movements of hazardous wastes and their disposal. https://www.basel.int/portals/4/basel

Union European (2014) Waste electrical and electronic equipment The EU and India: sharing best practices. http://eeas.europa.eu/archives/delegations/india/documents/eu_india/final_e_waste_book_en.pdf

UPPCB (2018) Status of e-waste recycling /collection/generation units in the state of UP. http://www.uppcb.com/pdf/NEW-E-Weste-230819.pdf

Walther G et al (2010) Implementation of theWEEE-directive economic effects and improvement potentials for reuse and recycling in Germany. In: The International Journal of Advanced Manufacturing Technology 47.5-8, pp. 461–474

Wang F et al (2012) The Best-of-2-Worlds philosophy:developing local dismantling and global infrastructure network for sustainable e-waste treatment in emerging economies. In: Waste Management 32.11, pp. 2134–2146

Wang Z et al (2011) Willingness and behavior towards e-waste recycling for residents in Beijing city, China. In: Journal of Cleaner Production 19.9-10, pp. 977–984

Wath SB et al (2010) A roadmap for development of sustainable E-waste management system in India. In: Science of the Total Environment 409.1, pp. 19–32

Wei L, Liu Y (2012) Present status of e-waste disposal and recycling in China. In: Procedia Environmental Sciences 16, pp. 506– 514

Yedla S (2016) Development of a methodology for electronic waste estimation: a material flow analysis based SYE-Waste Model. In: Waste Management and Research 34.1, pp. 81–86

Yla-Mella J et al (2014) Implementation of waste electrical and electronic equipment directive in Finland:evaluation of the collection network and challenges of the effective WEEE management. In: Resources, Conservation and Recycling 86, pp. 38–46

Yla-Mella J, Roman E (2019) Waste electrical and electronic equipment management in Europe: learning from best practices in Switzerland, Norway, Sweden and Denmark. In: Waste Electrical and Electronic Equipment (WEEE) Handbook. Elsevier, pp. 483–519

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Philippe Loubet

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Singh, A., Panchal, R. & Naik, M. Circular economy potential of e-waste collectors, dismantlers, and recyclers of Maharashtra: a case study. Environ Sci Pollut Res 27, 22081–22099 (2020). https://doi.org/10.1007/s11356-020-08320-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08320-3