Abstract

The objective of this research is to examine the effects of stock market on air pollution in Malaysia during the period 1980–2017. To realize this aim, a nonlinear autoregressive distributed lag (ARDL) model is constructed. The short results in general revealed that the increase in stock markets will increase CO2 emissions and its significance increases in the long run. Moreover, the decline in stock market will reduce Malaysia’s CO2 emissions but only in the long run. From the outcomes obtained, a number of policy recommendations were provided for the investigated country.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

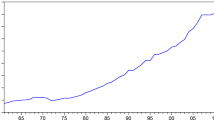

It is clear that the stock market and its importance to Malaysia’s economy is growing substantially as it plays a crucial role in the country’s industry and commerce growth. Malaysia’s stock market is currently named Bursa Malaysia and it was known as Kuala Lumpur Stock Exchange (KLSE) in the past. It is the third oldest stock exchange in Southeast Asia region after the Indonesia Stock Exchange and Philippine Stock Exchange. It ranked 18th in the world in terms of number of non-financial company IPOs for the period of 2008–2017. It ranked fourth in terms of market capitalization and third in terms of trading volume in Southeast Asia region in 2017 (OECD 2018). Basically, Bursa Malaysia controls most of the exchanges in the country’s capital market and Malaysia’s main financial market is Financial Times Stock Exchange (FTSE). Malaysia’s financial markets are one of the most competitive and growing financial institutions in Southeast Asia. Therefore, it is undeniable that Malaysia’s stock market plays an important role in its economic growth and development. However, stock market may be an important indicator of Malaysia’s air pollution. There are a large number of listed firms in Malaysia’s stock market that are associated with manufacturing, industrial, and construction activities. These activities not only play a sizable rule to Malaysia’s GDP but accounts for its large contribution to the country’s emission (World Bank 2019).

Basically, air pollution is an ongoing dilemma that Southeast Asia is facing and Malaysia has no exception. There is no doubt that Malaysia is one of the largest air pollution emitters in the region as CO2 emission is 8.03 metric tons per capita which represents the third highest after Brunei and Singapore (World Bank 2019). Moreover, the Malaysian government efforts towards industrialization caused other important determinants of air pollution to rise. Determinants such as energy intensity which increased by 15%, urban population increased by 30%, and GDP per capita which represent the third highest in Southeast Asia; increased by 45% (Malaysia Energy Information Hub, 2019). Therefore, analyzing the fluctuation effects of these variables on Malaysia’s CO2 emission is essential.

There are considerable numbers of studies which examine the main macroeconomic factors that influence air pollution (see Table 1). Most of the scholars utilized GDP (Alam et al. 2016; Rodríguez et al. 2016; Ali et al. 2017; Ahmad et al. 2017; Özokcu and Özdemir 2017; Balaguer and Cantavella 2018; Xu 2018;), energy use (Alam et al. 2016; Özokcu and Özdemir 2017), trade (Ali et al. 2017; Xu 2018), financial development indicators (Xu 2018), and population (Alam et al. 2016) in their studies. Most of these studies utilized the Stochastic Impacts by Regression on Population, Affluence and Technology (STIRPAT) model to estimate the effect of population, economic activities, affluence, and technology on pollution.

Recently, few studies emerged that examined the effect of stock markets on pollution (Paramati et al. 2016, 2017, 2018) and their outcomes in general revealed that the increase in stock market activities will influence environmental degradation. The results in general show that the effect of stock market on environmental degradation is negative in the developed countries (Paramati et al. 2016, 2017, 2018) while it has a positive effect in the emerging and the developing countries (Paramati et al. 2016, 2017, 2018). Moreover, it is proven that stock markets are sensitive to green policy announcements (Ramiah et al. 2013), major environmental accidents and events (He and Liu 2018), and pollution levels (Levy & Yagil, 2011; Wu et al. 2018).

There are lack of studies that examined the effect of stock market on pollution in Malaysia despite the undeniable increase in stock market activities and its importance to Malaysia’s economy. Moreover, different from the previous studies that examined the symmetry (linear) relationship between the variables; this study will investigate the asymmetric (nonlinear) relationship. The asymmetric relationship can reveal whether the negative or the positive shocks of stock markets on air pollution have similar effects. Therefore, the outcome of this study can provide the Malaysian government a clear understanding on the effect of the increase and the decrease of stock market on the country’s air pollution. This will help the government to provide more accurate policies to control air pollution levels that is generated from stock markets.

Methodology

Similar to the previous studies, this study utilized the Stochastic Impacts by Regression on Population, Affluence and Technology (STIRPAT) established by Dietz and Rosa (1994). The STIRPAT model is an extension to the basic model I = P × A × T (I, P, A, and T represent pollution, population, economic activities, and technology) created by (Ehrlich and Holdren 1971). Moreover, the STIRPAT model is suitable to test the hypothesis of this study.

Following Paramati et al. (2018); the model (1) below is constructed; however, this study examines the asymmetric effects stock market on Malaysia’s air pollution. The model below can be specified as follows:

CO2 is CO2 emission measured in millions of metric tons; PD is population density measured by number of persons per square kilometer, GDP is the gross domestic product per capita measured in constant (2018) millions of US dollars. EIN is energy intensity measured as total energy per unit of GDP. ST is a percentage of stock traded to total GDP as an indicator of stock market. Moreover, t represent time, − and + represent the negative and positive shocks for stock traded. The data range is from 1980 to 2017, the variables CO2, PD, GDP, and ST were retrieved from the Euromonitor International (2019) while EIN was retrieved from Malaysia Energy Information Hub (2019). All the variables (excluding ST) will be transformed to its natural logarithm.

Changes in time series data are likely to be gradual instead of being sudden following economic shocks including stock market activities. Therefore, the nonlinearity unit root test of Kruse (2011)Footnote 1 is adopted to investigate the presence of stationarity in each of the variables. The Kruse (2011) test is essentially an improvement of the nonlinear unit root tests introduced by Kapetanios et al. (2003), who proposed a stationarity test with null hypothesis of non-stationarity as oppose to the alternative of globally ESTAR.

where y is the variable of interest. Wald test introduced by Kruse (2011) can be used in testing the null hypothesis of non-stationarity, H0 : ∂1 = ∂2 = 0. The Akaike information criterion is employed to choose the optimal lag length.

The next step is to examine the asymmetric effects of stock market activities and the other independent variables on pollution. The nonlinear autoregressive distributed lag bound (ARDL) proposed by Shin et al. (2011)Footnote 2 is applied to reveal the asymmetric relationship in the short run and long run. Unlike previous studies, the outcomes of this research reveal whether the short-run and long-run positive shocks of the independent variable is similar to the short-run and long-run negative shocks. The nonlinear ARDL is presented as follows:

The general version of (3) is presented as follows:

α+and α− are the long-run parameter and z1 is the vector of several regressors which is expressed as follows:

zt−and zt+ are the negative and positive partial sums which are expressed as follows:

The nonlinear ARDL framework has the same process as the linear ARDL suggested in Pesaran et al. (2001). Estimating Eq. (9) involves the use of the null hypothesis of ρ = ∅+ = ∅− = 0. Besides, in nonlinear ARDL, the Wald test is adopted to estimate the long-run coefficient by ∅+ = ∅− as well as the short-run coefficient as μ+ = μ−. Lastly, the increasing dynamic multiplier impacts of z+ and z− on yt is presented as follows:

where \( k\to \infty, \mathrm{the}\ {m}_k^{+}\to {\upalpha}^{+},{m}_k^{-}\to {\upalpha}^{-} \) and where the long-run asymmetric α+ and α− is already computed, and therefore be employed as below:

Empirical results

We start the empirical analysis by presenting the linearity tests on the variables presented in Table 2. The method proposed by Harvey et al. (2008) has been employed and the findings suggest that the null of linear process can be rejected in all the variables.Footnote 3 Therefore, we examine the unit root properties of the series with the method of Kruse (2011). For comparison sake, the findings of Kapetanios et al. (2003) test are also stated and the findings are not substantially diverse from the results generated from the Kruse (2011) test.Footnote 4,Footnote 5 The outcomes of the Kruse (2011) test, which are displayed in Table 3, suggest that the variables are all stationary at first differences.

The next step is to examine the long-run relationship between the series by utilizing the bound test. The bound test results in Table 4 revealed that the F-statistics value is larger than the critical values at 10%, 5%, and 2.5% of significance. Therefore, the null hypothesis of no long-run relationship can be rejected and cointegration exists among the variables.

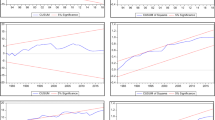

As cointegration is present among the variables, the short-run and long-run nonlinear ARDL is performed. The short-run results of nonlinear ARDL are presented in Table 5. The results in general revealed that the increase in stock traded (ST+) leads to an increase in CO2 emission. However, the decrease in stock traded (ST−) have no short-run significant effect on CO2 emission. In addition, population density, GDP and energy intensity have no significant short-run effect on Malaysia’s CO2 emission.

Finally, according to the long-run outcomes of nonlinear ARDL estimation obtained in Table 6, it is shown that the increase in ST leads to an increase CO2 emission while the decrease in ST will decrease CO2 emission significantly in the long run. Moreover, population density has a significant long-run positive effect on CO2 emission. However, GDP and energy intensity have no significant effect on Malaysia’s CO2 emission.

The foregoing findings suggest that the long-run results in general indicate that the effects of stock traded increased significantly when comparing them with the short-run results. In other words, the fluctuations of stock traded are far more significant in the long run than the short run. The foregoing results which suggest that expansion in stock market activities will increase emission is consistent with the results of Paramati et al. (2017) who showed that stock market development will promote pollution in emerging countries.

It is possible to justify the positive impact of stock market activities on pollution in Malaysia on two rationales. Firstly, stock markets in the developing countries including the market in Malaysia concentrates on the growth of economic activities while paying little attention towards the CO2 emissions. Stock market serves as a platform through which manufacturing, industrial, and construction activities raise capital for their operations. Many of the listed firms on the stock market in Malaysia (including the Main market, “Access, Certainty, and Efficiency” or ACE market and the Leap market) are involved manufacturing, industrial, and construction activities. The activities of these sectors account for about 28% of the GDP, directly account for 13% of the emission from fuel combustion and more than 50% of the emission from fuel combustion (World Bank 2019).

Secondly, green financing is still at the embryonic stage in the country. Although it has been attracting attention in the recent years, green financing has not taken off in a significant manner in Malaysia relative to the situation in the developed countries. Besides, as a result of inadequate legislative structure for green technologies, sustainability has not been adequately inculcated into activities of financial system in Malaysia (Sim and Putuhena 2015). Having several years without adequate green financing existing in the system, it has been very difficult for stock market and the financial system to actively contribute to the reduction in emission in the country. However, in the developed countries, where stringent stock market policies exist, market participants ensure that firms listed in the market control the emissions by embracing green technologies (Paramati et al. 2017).

Conclusion and policy suggestions

The main objective of this research is to examine the asymmetric effects of stock market on Malaysia air pollution. In order to realize this objective, a nonlinear ARDL model was employed for the period of 1980–2017. CO2 emission has been used to proxy air pollution and stock traded as an indicator of stock market development. Moreover, a number of variables were utilized as determinants of air pollution namely population density, GDP, and energy intensity. The short-run results revealed that the increase in stock traded, population density, GDP, and energy intensity increased Malaysia’s CO2 emissions. However, the decline stock traded have no significant effect on Malaysia’s CO2 emission. Moreover, it appears that the increase stock traded and population density are the most important variables to consider when dealing with CO2 emission in the short run.

The long-run results also revealed similar outcomes; as the increase in stock traded and population density increase Malaysia’s CO2 emission. Moreover, the decrease in stock traded will decrease CO2 emission significantly in the long run.

The foregoing results which suggest that expansion in stock market activities in Malaysia will increase the country’s CO2 emissions is not surprising given that the stock traded in Malaysia mostly comes from companies that are basically not environmentally friendly. Therefore, adopting energy conservation policies, enhancing energy efficiency, and sustaining infrastructure projects for the listed companies is essential to reduce Malaysia’s air pollution levels. Moreover, policy makers should provide serious investment incentives for the listed companies that are greener and sustainable in their production activities. The relevant authorities can also introduce measures to counterbalance the tendency of stock market to be a platform for financing relatively dirty industries. An example of such measure is the introduction of the Green Technology Financing Scheme (GTFS) in 2009.

The foregoing results have shown that solving pollution in Malaysia goes beyond introducing appropriate policies for the stock market only. Moreover, increasing the utilization of renewable energy in the energy mix will ensure that the expansion in GDP and population will not necessarily translate into more pollution in the country. Policy makers should provide private–public partnership investment projects that focus on renewable energy. Because, currently, most Malaysia’s energy comes from non-renewable sources, especially from fossil fuels.

The research has its own limitations; basically, this research focuses on the effect of stock market in general on CO2 emission utilizing annual data. Therefore, the outcome of this research revealed only a general idea on the positive and the negative effects of stock traded on CO2 emission in Malaysia. Thus, for future research, it is essential to disaggregate the stock market into sectors, as Malaysia stock markets contain 9 main sectors, namely consumer product, construction, property, industrial production, trading/services, mining, technology, plantation, and the finance sector. This can help to provide more detailed outcomes which can provide more accurate recommendations. Moreover, utilizing monthly data is more appropriate as it contains higher frequency, which increases it capability to capture the movement between the stock market and CO2 emission.

Notes

References

Ahmad N, Du L, Lu J, Wang J, Li HZ, Hashmi MZ (2017) Modelling the CO2 emissions and economic growth in Croatia: is there any environmental Kuznets curve? Energy 123:164–172

Alam MM, Murad MW, Noman AHM, Ozturk I (2016) Relationships among carbon emissions, economic growth, energy consumption and population growth: testing Environmental Kuznets Curve hypothesis for Brazil, China, India and Indonesia. Ecol Indic 70:466–479

Ali G, Ashraf A, Bashir MK, Cui S (2017) Exploring Environmental Kuznets Curve (EKC) in relation to green revolution: a case study of Pakistan. Environ Sci Policy 77:166–171

Al-Mulali U, Ozturk I (2015) The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy 84:3382–3389

Balaguer J, Cantavella M (2018) The role of education in the Environmental Kuznets Curve. Evidence from Australian data. Energy Econ 70:289–296

Dietz T, Rosa EA (1994) Rethinking the environmental impacts of population, affluence and technology. Hum Ecol Rev 1:277–300

Ehrlich, P. R. & Holdren, J. P. (1071). Impact of population growth. Science 171, 1212–1217

Harvey DI, Leybourne SJ, Xiao B (2008) A powerful test for linearity when the order of integration is unknown. Studies in Nonlinear Dynamics & Econometrics 12(3)

He X, Liu Y (2018) The public environmental awareness and the air pollution effect in Chinese stock market. J Clean Prod 185:446–454

Kapetanios G, Shin Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econ 112:359–379

Kruse R (2011) A new unit root test against ESTAR based on a class of modified statistics. Stat Pap 52(1):71–85

Levy, T. & Yagil (2011) Air pollution and stock returns in the US. Journal of Economic Psychology 32, 374–383

Malaysia Energy Information Hub (2019) Energy Commission. Retrieved from https://meih.st.gov.my/. Acessed 20 June 2019

OECD (2018) OECD Equity Market Review of Asia 2018 www.oecd.org/corporate/OECD-Asia-Equity-Market-Review-2018.pdf Accessed 5 June 2019

Özokcu S, Özdemir Ö (2017) Economic growth, energy, and environmental Kuznets curve. Renew Sust Energ Rev 72:639–647

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ 56:29–41

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371

Paramati SR, Alam MS, Apergis N (2018) The role of stock markets on environmental degradation: a comparative study of developed and emerging market economies across the globe. Emerg Mark Rev 35:19–30

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001) Bounds testing approaches to the analysis of level relationships. Journal of applied econometrics 16(3), 289–326

Ramiah V, Martin B, Moosa I (2013) How does the stock market react to the announcement of green policies? J Bank Financ 37:1747–1758

Rodríguez M, Pena-Boquete Y, Pardo-Fernández JC (2016) Revisiting Environmental Kuznets Curves through the energy price lens. Energy Policy 95:32–41

Shin Y, Yu B, Greenwood-Nimmo M (2011) Modelling asymmetric cointegration and dynamic multiplier in a nonlinear ARDL framework. Mimeo, New York

Sim, Y.L., Putuhena, F.J. (2015). Green building technology initiatives to achieve construction quality and environmental sustainability in the construction industry in Malaysia. Manag Environ Qual Int J 26, 233–249.

World Bank (2019) World development indicators 2019. World Bank Publications

Wu X, Chen S, Guo J, Gao G (2018) Effect of air pollution on the stock yield of heavy pollution enterprises in China’s key control cities. J Clean Prod 170:399–406

Xu T (2018) Investigating Environmental Kuznets Curve in China–aggregation bias and policy implications. Energy Policy 114:315–322

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Al-mulali, U., Solarin, S.A. & Ozturk, I. Examining the asymmetric effects of stock markets on Malaysia’s air pollution: a nonlinear ARDL approach. Environ Sci Pollut Res 26, 34977–34982 (2019). https://doi.org/10.1007/s11356-019-06710-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-06710-w