Abstract

Australia is the sixth largest country in the world, celebrating its 26th consecutive year without a recession. However, the country is one of the ten largest emitters of greenhouse gases, mainly caused by energy use. As such, Australia is facing a trade-off between economic growth and reducing carbon dioxide (CO2) emissions. This paper empirically analyses the relationship between economic growth and CO2 emissions in Australia, based on annual data from 1965 to 2016, considering the consumption of the fossil fuels oil and coal and renewable energy. This analysis is performed using the environmental Kuznets curve (EKC) and the Decoupling Index (DI). The EKC is assessed by employing the autoregressive distributed lag model. In addition, a robustness check is provided through the vector error correction model, which allows for the employment of the Granger causality test. The results show that in Australia, there is evidence for the EKC hypothesis, and that the country is undergoing increasing relative decoupling. These results mean that economic growth causes CO2 emissions and consequently environmental degradation. To achieve environmental targets and reduce the rate of CO2 emissions while continuing to grow, Australia needs to implement measures and policies to cut CO2 emissions, such as energy demand management and control, energy efficiency, reducing fossil fuel consumption, and investing in renewable energy technology.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since the 1970s, it has been thought that economic growth would be the main reason for environmental problems. The question that came up was whether there is a trade-off between economic growth and environmental damage, or whether economic growth can be compatible with environmental protection. Since the industrial revolution, the world’s economy has relied heavily on fossil fuels and they remain the largest energy source worldwide. With the Earth Summit conference held at Rio de Janeiro in 1992 and the Kyoto Summit in 1997, greater emphasis started to be placed on environmental impacts. Global warming is a threat to humanity and its preeminent cause is greenhouse gas (GHG) emissions, mainly composed of carbon dioxide (CO2) emissions. Globally, the CO2 emissions from fossil fuel consumption and industrial processes doubled between 1974 and 2014, increasing from 16.9 to 35.5 Gt, (BP, BP Statistical Review of World Energy 2015, 2015, BP press).

In the case of Australia, to the best of our knowledge, studies analyzing CO2 emissions and economic growth are scarce. Its trajectory of continuous economic growth, along with some other particularities, make Australia an interesting country to study. Indeed, this country has a free market economy with a high gross domestic product (GDP) per capita and a low level of poverty. Between 1994 and 2004, Australia recorded an annual average real GDP growth of 3.7%, higher than the Organization for Economic Co-operation and Development (OECD) average of 2.6%. In 2017, Australia recorded its 26th consecutive year of continuous economic growth (Rank et al. 2017). With respect to CO2 emissions, in 2007, Australia was the world’s largest CO2 emission emitter per capita. In 2010, it reached the amount of 403 million tons (Mt), reducing to 400.2 Mt in 2015.

In terms of energy sources, Australia has extensive natural resources, such as hydraulic, solar, and wind power as well as reserves of fossil fuels (IEA 2012). In this country, the energy sector plays a key role in the whole economy. Domestically, coal, natural gas, and petroleum represent the main sources of energy. In 2000, 95% of its main energy came from non-renewable sources, with coal being the main source (Lastres 2007). Moreover, in 2011, it was the world’s largest exporter of coal and in 2012 ranked ninth among the world’s largest energy producers and was one of the three OECD exporters (IEA 2012). Coal mining produces about 38% of GHG emissions. Regarding energy consumption, oil products are the main source of energy, with the transport sector being the largest consumer.

The study of the complexity of the relationship between economic growth and CO2 emissions motivated the use of two different concepts: the environmental Kuznets curve (EKC) and the Decoupling Index (DI). These concepts have different characteristics. On the one hand, the EKC explains two distinct phases of economic growth. In the first phase, there is an increase in environmental degradation factors with income. In the second phase, when a certain level of income is reached, emissions start to decrease. The inverted U-shape of the Kuznets curve illustrates the variation of CO2 emissions alongside the increase in income. This concept emerged to describe, over time and income, how pollution arises in a country as a result of its economic development (Grossman and Krueger 1991; Shafik and Bandyopadhyay 1992; Panayotou 1993). On the other hand, the DI consists of analyzing the behavior of CO2 emissions. In other words, the DI determines if CO2 emissions are increasing or decreasing and if they are increasing faster or slower than the GDP. The DI used in this study was proposed by the OECD (2002). Using these two concepts, it is possible to reach conclusions about the trajectory of CO2 emissions and GDP and determine which is growing faster.

The main objective of this paper is to study the relationship between economic growth and CO2 emissions, and to do this, it intends to answer the following central questions: (I) Is the EKC hypothesis verified in Australia? (II) How does the decoupling index behave in Australia? (III) Does Australia have a trade-off between economic growth and CO2 emissions? To answer the central questions I and III, the autoregressive distributed lag (ARDL) approach has been used. Overall, this paper, using ARDL estimation, verifies the EKC hypothesis and oil and RES consumption have a positive effect on CO2 emissions. Furthermore, it concludes that the behavior of the DI is a relative decoupling. In addition, the vector error correction model (VECM) has been employed as a robustness check of the ARDL model results. Through VECM, the Granger causality test has been employed.

This paper contributes to the literature by exclusively studying Australia, using a current approach, the ARDL model, and studying the relationship between economic growth and CO2 emissions through two different concepts, EKC and DI, and using the EKC with energy variables. There is no previous individual study of this topic for the country. Furthermore, this paper provides a robustness check with VECM.

From this point, the paper is organized as follows: the “Debate” section presents a literature review; the “Methodology” and “Results” sections present the data used and a complete description of the method used, and the ARDL model results respectively; the “Robustness checks” section is dedicated to the robustness check; and the “Discussion” and “Conclusion” sections present the discussion and conclusions, respectively.

Debate

The environmental degradation resulting from the growth of economies has become increasingly evident over the years. It has been the subject of numerous studies to understand its underlying causes and how this phenomenon can be mitigated. In the first study, the aspect addressed was the relationship between economic growth and energy consumption (Kraft and Kraft 1978). Currently this topic continues to merit the attention of the scientific community (Rafiq and Salim 2009, 2011; Gozgor et al. 2018; Shahbaz et al. 2018).

In the meantime, the studies began to analyze the relationship between economic growth and the environment, and the EKC was first proposed by Grossman and Krueger (1991). Regarding the decoupling, the literature is more recent, and naturally scarcer. This term was first used in environmental studies in the early 2000s by Zhang (2000). The present paper goes further and combines the two methods in order to relate both results in order to draw more comprehensive conclusions regarding the relationship between economic growth and environmental degradation. The literature review for each individual method is presented below.

Environmental Kuznets curve

The EKC was developed to study the relationship between economic growth and environmental quality and had its origin in the “inverted-U hypothesis” developed by Kuznets (1955). No formal theory was used for its development. Instead, it is based only on the explanation that the initial economic growth associated with increasing industrialization would increase CO2 emissions, while income also increases. The inverted U-shaped can be verified using CO2 emissions, but the curve can also be obtained using other atmospheric pollutants and national datasets (Holtz-Eakin and Selden 1995). The more common atmospheric pollutant used, excluding the CO2 emissions, are the GHG (Olale et al. 2018).

Over the years, the estimation of the EKC became more complex and started to be extended by including variables other than CO2 emissions and GDP, such as energy consumption (e.g., Suri and Chapman 1998; Roca and Alca 2001; Soytas et al. 2007; Apergis and Payne 2010), technology (e.g., Lantz and Feng 2006), specifically renewable energy sources (e.g., López-Menéndez et al. 2014), trade openness (e.g., Farhani et al. 2014), a combination of several of these (Ben Jebli and Ben Youssef 2015), and urbanization (Xu et al. 2018). Simultaneous to the extended version of the EKC, there have also been development and application of new techniques, such as dynamic estimation (Narayan and Narayan 2010) and forecasts (Waslekar 2014; Robalino-López et al. 2015).

In the literature on this topic can be found studies for countries individually or in groups, as well as empirical and theoretical studies. Examples of theoretical studies are Dinda (2004), Stern (2004), and (Kaika and Zervas 2013). The first two articles provide extensive review surveys of the economic growth and environmental pollution nexus, and all of them provide strong theoretical information about the EKC. Recent surveys, such as those from Tiba and Omri (2017), for the period 1978 to 2014; Moutinho et al. (2017), for 2001 to 2017; and Mrabet and Alsamara (2017), for 2002 to 2017, provide a fairly comprehensive summary of current EKC literature.

The validity of the EKC hypothesis can vary according to the country or countries studied. This means that there is no consensus about the relationship between economic growth and environmental degradation. For instance, Yan et al. (2016) separate countries by income level, and Ozokcu and Ozdemir (2017) performed two models, one for the OECD countries and another for emerging countries. Considering the lack of consensus, it is possible to find studies that confirm the validity of the EKC and others that do not. In a few examples, the EKC hypothesis is verified by Bouznit and del P. Pablo-Romero (2016), while authors such as Al-Mulali et al. (2015) and Ben Jebli and Ben Youssef (2015) do not find evidence for the EKC hypothesis.

The methodology used also differs in the literature; the authors Riti et al. (2017) employed the ARDL model, fully modified ordinary least squares (FMOLS), dynamic ordinary least squares (DOLS), and VECM. As the EKC is a long-run concept (Brown and McDonough 2016), the ARDL model is the approach most commonly used in the literature (Ali et al. 2015; Bölük and Mert 2015; Bouznit and del P. Pablo-Romero 2016; Mrabet and Alsamara 2017).

The EKC can also have political and policy implications. In order to achieve a long-run solution for climate change, the economic challenges for consumers, companies, and regulators must be considered (Brennan 2010). The EKC can make a very significant contribution to policy and policy makers, due to the information it provides about the impact of economic growth on the environment. Policies should be geared towards conserving the environment.

Decoupling index

The concept of DI arose from the dilemma between economic prosperity and environmental damage. In the early of 2000s, decoupling began to be used in environmental studies to characterize the relationship between economic activity and environmental degradation. After that, it was presented as an indicator by the OECD (2002). According to the OECD, the employment of the decoupling in environmental studies is to break the linkage of “economic goods” and “environmental bads.” The DI gained popularity in the literature because it is a simple calculation method that is also a reasonable indicator of policy accomplishments.

Over the years, several decoupling indicators have been developed, which analyze the relationship between environmental pressures and economic growth (Tapio 2005; Wang et al. 2013). It is worthwhile to note two references which bring synthetases in this field. The first one, the article by Conte Grand (2016), compares the decoupling indicators most commonly used in the literature. The other article, by Wu et al. (2018), presents a considerable number of articles of the common decoupling method used. The article Wang et al. (2018) presents an updated literature review divided into skeptical, non-skeptical, and progress of decoupling.

In general, the literature shows that absolute decoupling tends to occur with greater frequency in upper-, middle-, and high-income countries, while developing countries tend to have a minor occurrence of decoupling events (Kojima and Bacon 2009). The use of the DI has some limitations, and the literature warns about them. For example, the decoupling concept does not capture the effect of environmental externalities (OECD 2002). Furthermore, the DI is more effective when combined with other methods, such as econometrics (Climent and Pardo 2007; Mazzanti and Zoboli 2008).

The decoupling index can be employed with different types of environmental pressure and different variables of economic activity. For example, the author Hong Wang (2011) studies the relationship between economic development and energy consumption, whose results are classified as decoupling or re-coupling and subclassified according to the signs of the chain index of energy consumption and the chain index of GDP. Another example is the study developed by Q. Wang et al. (2016), which used industrial growth and carbon emissions to analyze the behavior of the DI in Taiwan. For there, they concluded that there was a negative decoupling from 2007 to 2009 and a decoupling from 2009 to 2013. The phenomenon of negative decoupling occurs when the carbon intensity increases. Contrarily, the phenomenon of decoupling occurs when the carbon intensity decreases. The carbon intensity corresponds to the ratio between industrial carbon emissions and total industrial output. One more example, for different types of environmental pressure, is the analysis by Yu et al. (2017), which uses economic growth and six different environmental pressure indicators, namely CO2 emissions, energy consumption, SO2 emissions, soot, waste water, and solid waste. The authors conclude that during the period of 1999–2010, the DI indicated an absolute decoupling between economic growth and emissions of SO2, soot, and waste water, while for total energy consumption, CO2 emissions and solid waste, the DI revealed a relative decoupling.

Methodology

Methodology

In this section, the variables used in this study are presented, as well as their measurement, data sources, and the descriptive statistics. In addition to this, the preliminary analysis employed on the variables is presented, and the method and concepts used are explained.

Data

The time span under analysis ranges from 1965 till 2016, thus covering 52 years. The period chosen was determined by the availability of data. The following table (Table 1) describes the variables, their sources, and units of measurement:

The variables COAL, OIL, and RES were transformed into percentages of primary energy consumption, in order to reduce the correlation between the variables. Posteriorly, all variables were transformed into their natural logarithms (prefix “L”) to obtain the growth rates of the respective variables by their differenced logarithms and to reduce the heteroscedasticity phenomenon. The Table 2 presents the descriptive statistics:

After transforming the variables and analyzing the descriptive statistics, the next step was to determine the variables’ integration order. The next subsection presents the results of the unit root tests.

Preliminary analysis

To assess the integration order of the variables, the traditional unit root tests were employed, namely, ADF (Dickey and Fuller 1981), PP (Phillips and Perron 1988), and KPSS (Kwiatkowski et al. 1992). In both the ADF and PP tests, in contrast to what happens in the KPSS test, the null hypothesis is that the variable is not stationary (has a unit root). The following table shows the results of the traditional unit root tests:

By observing Table 3, it is possible to conclude that all variables are stationary in differences, so they are I (1). However, structural breaks were observed, which may be a limitation for the traditional unit root tests. For this reason, the Zivot and Andrews (1992) (ZA) structural unit break test (Table 4) was performed.

The unit root test with structural breaks contains information on the existence of breaks in the series, referring to the specific period when they occur. This information can be used to apply dummies for the years when the test identifies a break point. The structural break detection was also employed for Australia by Salim and Bloch (2009).

Through the results of the ZA test (Table 4), it is possible to conclude that all variables are stationary in first difference in the presence of structural breaks. This means that the ZA test corroborates the traditional unit root tests and the variables are I(1) even in the presence of structural breaks.

Considering the break points, the structural break in 1982 suggested by the ZA is corrected with an impulse dummy in the model estimated. The other identified breaks in the ZA test were not included in the model due to the fact that they are not significant and do not add explanatory power to the model.

However, for instance, the structural breaks detected for DLOIL_P in 1980 and possibly in 1982 could be explained by the energy crisis of 1980s, the “oil glut.” This event could also explain the structural break detected for DLCOAL_P, DLCO2, and DLGDP in 1981 and 1984, considering that this event had consequences over some years. This event could have had impact on GDP due to the oil prices. Another example is the structural break detected for DLRES_P in 1997 that could be explained by the initiation of GreenPower, a government program.

When all information on variables is collected, it is possible to employ the chosen model. The next subsection includes an explanation of the characteristics of the ARDL approach that are important for the data used, as well as the steps for verifying the EKC and calculating the DI.

Method

In order to analyze the validity of the EKC hypothesis, the ARDL method, developed by Pesaran et al. (2001), was used. This being same methodology used, for instance, by Acaravci and Ozturk (2010), Farhani et al. (2014), Bouznit and del P. Pablo-Romero (2016), Ahmad et al. (2017), and Pata (2018).

Autoregressive distributed lag

The ARDL approach is appropriate for handling these data characteristics. As previously mentioned, the data spans 51 years and over this period, events occurred that need to be tested in the model, and the ARDL model allows the application of dummies without affecting the results. Moreover, it is possible to treat endogeneity and provide unbiased long-run estimation. The separation of the short- and long-run effects is also important for verifying the EKC hypothesis (Ahmad and Du 2017).

The following equation represents the general unrestricted error correction model (UECM) in its equivalent ARDL bounds test:

where D indicates the first differences of variables, L is the natural logarithm, ∝and ω are the coefficients of the explanatory variables, c is an intercept, t refers to the period in years from 1965 to 2016, k is the number of observations, εt is a white-noise error term, and DLCO2t − 1 represents the error correction mechanism (ECM). The variables used in the equation are defined in Table 1.

The ARDL model was estimated with CO2 as a dependent variable, analyzing the optimal number of lags required, as well as the number of dummies. The significance of the parameters was observed and the residues were analyzed.

As previously mentioned, EKC shows the trajectory of CO2 with an increasing income level. This hypothesis is tested through the signs of the coefficients and the elasticities obtained through an ARDL model. In order to verify the existence of EKC, the elasticity and coefficient of GDP must be positive and statistically significant, and the elasticity and coefficient of GDP squared must be negative and statistically significant. In short, the inverted U-shaped relationship, i.e., EKC, is satisfied by the following condition: β1 > 0, β2 < 0, and β3 = 0. If the signals found do not match with the earlier mentioned condition, the relationship possibly found could be the U-shaped relationship, that it is represented by the following condition: β1 < 0, β2 > 0, and β3 = 0. In both conditions, β1 is the coefficient of GDP, β2 is the coefficient of GDP squared, and β3 is the coefficient of GDP cubed. The validity of the EKC hypothesis does not give information about the time line, i.e., the years needed to achieve the turning point (TP).

The quality of the estimated model was assessed by using diagnostic tests, namely, the Jarque-Bera normality test (including Skewness, Kurtosis and Jarque-Bera), the Breusch-Godfrey serial correlation LM test, the ARCH test for heteroscedasticity, the Ramsey RESET test in order to model specification, and the stability tests of CUSUM and CUSUM squares.

The ARDL bounds test from Pesaran et al. (2001), with the null hypothesis of there being no long-run relationship, was performed. Besides that, short-run semi-elasticities and long-run elasticities were calculated. Semi-elasticities are derived directly from the coefficients of the model variables in the short run, and the elasticities are calculated according to the following equation: [c(var)/c(ECM)] ∗ (−1) = 0. This equation means that the coefficient number of the respective long-run variable is divided by the coefficient of the ECM, and the ratio is multiplied by − 1.

Decoupling index

Decoupling is a phenomenon that occurs when the growth rate of environmental degradation is lower than that of economic growth.

According to the OECD (2002), the decoupling ratio can be estimated through the ratio between CO2 emissions and GDP at an end and a beginning of the selected periods, which is represented by the following expression (2):

The results of the decoupling ratio are interpreted according to the reference value 1 and it only has two possible results. On the one hand, if the ratio is less than 1, this indicates the occurrence of decoupling. On the other hand, if the ratio is greater than 1, then it indicates the existence of coupling. When subtracted from 1, this represents the DI, which is defined as

where 0 and t are the starting year and the final year of the study, respectively. EPI is the indicator of global environmental pressure. The results of the index are evaluated as follows:

-

1.

DI ≥ 1—there is strong decoupling (absolute decoupling). This result shows that CO2 emissions decrease as the economy grows. It is the most desirable effect for economies.

-

2.

0 < DI < 1—there is a weak effect of decoupling (relative decoupling). The CO2 emissions grow simultaneously with the economy, with the economy growing at a faster rate.

-

3.

DI ≤ 0—the DI is negative and as such there is no decoupling effect (coupling). The CO2 emissions grow together with the economy, but emissions grow faster.

Results

Following the abovementioned path, this section shows the results of the ARDL model estimation, as well as the diagnostics tests carried out. Subsequently, the ARDL bounds were calculated to analyze the cointegration or long-run relationship between variables and semi-elasticities and elasticities.

ARDL model

To analyze the hypothesis of the inverted U-shaped EKC, the ARDL model was calculated with the CO2 variable as dependent and with the incorporation of the GDP squared. As mentioned in the previous section, for the EKC to occur, the coefficient of the GDP variable should be positive, and the GDP squared coefficient should be negative. The results of the model estimation are represented in Table 5.

The diagnostic tests confirm the normality of the residuals, the rejection of both first- and second-order serial correlation, the homoscedasticity of residuals, the proper specification of the model, and that the parameters are stable during the period considered. Beside this, the ECM is situated in the interval between − 1 and 0 and has a fast speed of adjustment.

The ARDL model was estimated through an ordinary least squares (OLS) regression, and the optimum lag length was determined by the Schwarz Information criterion (SIC), due to the fact that it is the most parsimonious criterion considering the sample size used. This lags selection is employed in the ARDL regression, and the number of lags is selected through the lowest value of the SIC. Accordingly, the most parsimonious model is that estimated in Table 5.

The structural breaks detected by ZA tests in 1982 were tested using a dummy in the model. Considering that the ARDL model allows dummy application without affecting the results, the dummy in 1982 revealed to be statistically significant in the estimation. This structural break could be explained by new institutions being set up to integrate environmental and economic issues in the early 1980s, and in the 1980s, there also occurred the energy crisis oil glut that could be related with CO2 emissions. In addition, other moments have shown to be relevant, namely, 2012 and 2015. The first justified with the introduction of the Carbon Pricing Mechanism, and the second after the dissolution of the Carbon Pricing Mechanism, a new plan was raised with its main tool the Emissions Reduction Fund.

The ARDL bounds test was carried out by the F-statistic in the Wald test. The non-existence of cointegration is the null hypothesis. In other words, if the coefficients are equal to 0, there is no long-run relationship.

By the analysis of Table 6, it is possible to conclude that the coefficients of the model are different from 0, so there is a long-run relationship (cointegration), i.e., the null hypothesis is rejected.

Semi-elasticities and elasticities

As the ARDL method allows the analysis of direct and indirect effects in elasticities, semi-elasticity with short-run coefficients, and elasticities with long-run coefficients were calculated, as shown in Table 7.

The results show that an increase of 1% of the GDP and of the GDP squared causes an increase of 15.65% and a decrease of 0.28%, respectively, in CO2. In the short run, by measuring the variation in percentage points, the variation of OIL and GDP squared generates an increase of 0.38 and 0.34 respectively, while GDP and RES generates a decrease of 17.86 and 0.06, respectively, in CO2.

Turning point

The inverted U-shape can be obtained with different environmental pressure factors, i.e., not only through CO2 emissions but also through emissions of other GHGs. However, the TP varies for different types of environmental indicators. In addition to pollution indicators, social and political factors also influence the verification of the EKC and the calculation of the TP.

Taking into account the variables that were used in the estimation of the model, the cointegration equation is presented as follows:

The long-run coefficients were used, and their signs checked for verification of the EKC hypothesis. The estimated long-run relationship between CO2 and GDP can be written as follows:

The TP is calculated using the following expression:

Taking into account the above expression, the TP was calculated as follows:

As the variables have been transformed into their natural logarithms, it is necessary to reverse the process to obtain the actual value of GDP at which the TP occurs:

The value 1928.38 thousand million corresponds to the income required in order for CO2 to start its downward trajectory. After this level of yield, a continuous GDP is verified simultaneously with the reduction of CO2.

Decoupling (DI)

Following the DI developed by the OECD (2002), the index was calculated for two different time intervals: initially for the period 1965–2016, and then for 10-year intervals. The DI calculated for the total period is important to evaluate the real evolution of the country of the entire period studied. However, considering the number of years of the data, the DI calculated for the total period could omit several particular events. This means that the global effect can accommodate several partial effects in time. As such, in order to understand if the variables had a linear behavior or if there were events that provoked changes in variables in the short periods, the calculation for 10-year intervals is relevant also considering that 10 years includes the phases of an economic cycle. Therefore, the DI for 10-year intervals were calculated.

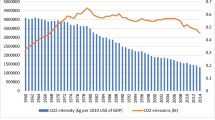

The DI calculated for the entire period resulted in a DI = 0.3367, which, according to Yu et al. (2017), falls within the interval 0 < DI < 1 which corresponds to a weak decoupling or relative decoupling effect. This effect consists of CO2 emissions growing simultaneously with the economy, but at a slower rate. For the DIs calculated for the 10-year intervals, the following results were obtained.

According to the above interpretation, it can be concluded from Table 8 that, in the first decade of this study, Australia had a negative DI (DI < 0), which corresponds to a coupling effect, i.e., the CO2 emissions increased simultaneously with the economy, but at a faster rate. In the following decades, this same effect did not occur. In this way, the economic growth began to grow faster than the CO2 emission. Thus, a weak decoupling effect or relative decoupling is verified, which corresponds to the result obtained in the index calculated for the total period.

Robustness checks

This section is intended to prove the robustness of the results obtained with the ARDL model. For that, the VECM was also used. This approach was carried out with the objective of employing the Granger causality (Engle and Granger 1987; Granger 1988) test to check the existence of causality from all variables to CO2 emissions. The Granger causality tests is commonly used in the literature together with the ARDL model to test the EKC hypothesis (e.g., Farhani et al. 2014; Ben Jebli and Ben Youssef 2015; Riti et al. 2017).

Thereupon, the first step was to determinate the optimal number of lags through the vector autoregressive (VAR) model. The lag length criteria suggest that the optimal number of lags is 1 lag, considering the SIC the most parsimonious for the sample used. After that, the Johansen cointegration test (Johansen 1988; Johansen and Juselius 1990) was applied. Considering the same criterion used above, the SIC, the Johansen test suggested one cointegrating vector between the variables. The third step was to estimate the VECM. The model used is the VECM instead of the VAR model due to the fact that the VAR model is unspecified in the presence of cointegration.

Table 9 only presents the results of Granger causality with CO2 emissions as dependent variables in line with the ARDL model estimated. With the objective of confirming the validity of the estimated VECM, the diagnostic tests have been employed (Table 10), namely, the Jarque-Bera normality residual test, the autocorrelation LM test, and the White homoscedasticity test.

The Jarque-Bera test checks the normality of the residuals. This test evidences the normality for all individual components. The autocorrelation LM test indicates that the null hypothesis of no serial correlation is accepted up to 5 lags. Lastly, the White test with the no cross terms evidences the non-heteroscedasticity. Hence, the model passes all the diagnostic tests successfully.

The results obtained on the Granger causality test (Table 9), which has been employed through VECM, are in accordance with the ARDL results. Indeed, the main result, the validity of the EKC hypothesis, is reinforced by the existence of causalities from GDP and GDP of square to CO2 emissions. In addition, the effects observed in the ARDL model, such as RES and OIL, have also been confirmed. In short, VECM employment provides additional evidence of the main finding of this research. In the following section, all the results are discussed.

Discussion

This paper employed the ARDL model to provide empirical evidence for the EKC hypothesis in Australia. In addition, the VECM was employed as robustness for the results obtained through the main approach. In line with Bilgili et al. (2016) and Ben Youssef et al. (2016), the EKC hypothesis is confirmed for Australia. Regarding the decoupling index, for the entire period, Australia had a relative decoupling. This result means that CO2 emissions grew at the same time as the economy, but at a slower rate. When the decoupling index is calculated by 10-year intervals, a coupling effect was obtained in the first interval from 1965 to 1975, while in the following decades, Australia experienced a relative decoupling. Through a joint analysis of the results, that is the DI and the EKC, it is possible to conclude that economic growth in Australia causes CO2 emissions. Therefore, it is possible to conclude that Australia is in the initial stage of the EKC and has not yet reached the TP. This means that both variables, CO2 and GDP, are increasing together.

The inverted U-shaped can be explained by the fact that poorer people make less demands for environmental quality but, as income increases, and people become richer, they demand better environmental quality. This means that, after reaching the TP, people are willing to pay for a cleaner environment (Roca 2003). In the long-run, it is expected that Australia will reach the TP and CO2 emissions will start to decline, and the decoupling index will be greater than or equal to 1, which means a strong decoupling effect (absolute decoupling). This is inferred from the trajectory of the EKC and the increasing value of the decoupling index since 1985.

The EKC confirmed for Australia could be explained by the growing economy for several consecutive years but simultaneously also by the intensive energy consumption which puts Australia in the ten largest emitters. In addition, Australia faces a trade-off between economic growth and CO2 emissions; this means that the growing economy implies increasing CO2 emissions. In the long-run, this trend is expected to change, and the economy will continue to grow, while the CO2 emissions will begin to decline. In order to reduce CO2 emissions, it is important to understand which energy sources have an impact on CO2 emissions.

Regarding RES, it has the smallest impact on CO2 emissions. In Australia, this result can be explained by the limited and reduced growth of renewable energy technologies (Warren et al. 2016). Indeed, Australia is one of the few member countries of the OECD whose share of RES in total primary energy supply (TPES) has been decreasing in the last 10 years. RES represented only 6% of TPES in 2000 and 5.6% in 2010 (IEA 2012). Considering that the share of RES in primary energy consumption is also small, this could explain the trajectory of CO2, i.e., the small share of RES has a small impact on the reduction of CO2 emissions.

Oil consumption is definitely a cause of CO2 emissions. An increase in oil consumption provokes an increase on CO2 emissions, and this is explained by the fact that oil is the main source of energy in Australia. Oil is the most-consumed fossil fuel, corresponding to 37.8% of energy consumption in 2014–2015, considering that the coal produced in Australia is largely exported. In addition, coal consumption was also included in the estimation, but the variable has no impact on CO2 emissions. This result could be explained by the fact that since 2008, the share of coal in primary energy consumption suffered a significant drop in Australia. In the long-run, OIL and RES have no impact on CO2. On the one hand due to the fact that if CO2 emissions start to decrease, oil consumption cannot increase CO2 emissions. On the other hand, Australia must increase their share of RES for it to contribute to CO2 reduction in the long-run together with energy efficiency measures.

Over the years, Australia has implemented and agreed to many environmental policies and protocols, such as the revision of the National Energy Efficiency Program in 1990. This consisted of defining actions for the main economic sectors, such as obtaining certification and minimum standards of energy performance. Still in the 1990s, environmental protection legislation was passed to promote ecologically sustainable development, and in 1997, the Kyoto Protocol was signed and later ratified in 2007. Under the Copenhagen Accord and subsequent Cancun agreements, Australia agreed to reduce emissions to 80% below 2000 levels by 2050. On the one hand, many measures implemented have been successful, while on the other hand, earlier existing measures were not. For example, directives for the electricity generation sector in 2000 in New South Wales, Australia, was put in force the Load Based Licensing, which consist in set restrictions on the pollutant loads emitted by the bearer of environmental protection licenses. The study by Contreras et al. (2014) concluded that the environmental taxes were not enough for generators to reduce their emission intensity.

As mentioned earlier, Australia should implement energy efficiency measures to reduce the long-run production of CO2. With the continuous increase of GDP, it will be possible to implement energy efficiency measures in all sectors. These should be implemented individually and according to the characteristics of each sector to meet the specific needs of each one. For instance, in the transport sector, the country may invest more in electric vehicles technology and charging infrastructures and in addition implement incentives for electric vehicle adoption. Another example could be in the residential sector, by designing and implementing measures of demand side management (DSM) through good practice guides to encourage energy saving or to encourage the purchase of efficient home appliances. The energy efficiency measures not only contribute to reducing climate change but also to productivity and energy security. Consequently, they are an asset for all sectors of the Australian economy. As the Australian economy is energy-intensive, and there is a strong link between energy and climate change, it is important that all the levels of government are involved in energy efficiency initiatives.

Besides energy-efficiency measures, Australia should consider technology policies that reduce the cost of RES. Australia has some of the best RES resources in the world, but it is recognized that the true potential of some RES resources, such as hot rock geothermal and ocean energy, are not as well understood as are fossil fuels. In the year 2014–2015, 54.4% of all RES consumption was biomass, followed by hydro with 14.1%. Furthermore, the biofuel most used in Australia is primary solid biomass such as wood and vegetal waste. The Australian economy should invest more in expanding the capacity of renewable sources to increase the contribution of RES to the TPES, and consequently reduce CO2 emissions. In this way, Australia will be able to reach the TP and absolute decoupling, as well as achieving the environmental targets to which it has committed itself.

Conclusion

This paper analyses the relationship between economic growth and CO2 emissions in Australia, considering the consumption of the fossil fuels, oil and coal, and RES. With this objective, two different concepts were employed, the EKC and the DI. They were applied for the period from 1965 to 2016. The methodology selected was the ARDL approach due to its ability to apply dummies to control for events that may have occurred over the 52 years considered in the study without affecting its results, and also permitting the separation of short- and long-run estimates that are essential for verifying the EKC. In addition, as a robustness of the results obtained with the main approach, the ARDL model and the VECM were employed. Through this model, the Granger causality test was performed. The results obtained with VECM are in concordance with the results of the ARDL model. Regarding the DI, it has been calculated in two different ways. By 10-year intervals, to determinate the evolution of the DI, and for the whole period, to reflect the overall effect.

The results of the ARDL approach show that the EKC hypothesis is confirmed for Australia in the period considered. The coefficient and elasticity of the GDP are positive and significant in the long run, and with respect to the GDP squared are negative and significant in the long-run. The TP was calculated and, in order to begin decreasing CO2, Australia needs to achieve an income of 1928.38 thousand million. The results also show that, on the one hand, the estimated coefficients for oil consumption are positive, indicating that an increase in consumption of oil causes an increase in CO2. OIL contributes significantly to increasing CO2, because it is the most consumed fossil fuel. One the other hand, RES contributes to reducing CO2, but has the smallest magnitude. The results of the Granger causality test prove that GDP, GDP of square, oil and RES consumption cause CO2 emissions, which corroborates the results of the ARDL model.

The results of the DI calculation show that its behavior in Australia is a relative decoupling. This means that GDP and CO2 emissions are both increasing, with GDP growing faster. According to its EKC trajectory and the increasing value of the decoupling index since 1985, in the long run, Australia will eventually reach a TP and begin to experience an absolute decoupling. To achieve this and meet its environmental targets, such as the 2015 agreement (to reduce CO2 emissions by 26% by 2030, using 2005 as a reference), Australia needs to implement measures and policies to help reduce CO2 emissions. To do this, it is recommended that measures be introduced such as increasing the “Objective of Renewable Energies” whereby a minimum amount of electricity must be produced by RES, and charges are levied on entities that emit too many GHGs. Likewise, energy demand management and control policies are recommended. In this respect, energy-efficiency measures should continue to be developed, such as policies to reduce the cost of RES technology.

Abbreviations

- ADF:

-

Augmented Dickey-Fuller

- ARDL:

-

Autoregressive distributed lag

- CO2 :

-

Carbon dioxide

- DI:

-

Decoupling Index

- DOLS:

-

Dynamic ordinary least squares

- DSM:

-

Demand-side management

- ECM:

-

Error correction model

- EKC:

-

Environmental Kuznets curve

- FMOLS:

-

Fully modified ordinary least squares

- GDP:

-

Gross domestic product

- GHG:

-

Greenhouse gas

- GT:

-

Gigatons

- KPSS:

-

Kwiatkowski–Phillips Schmidt

- Mt.:

-

Million tons

- OECD:

-

Organization for Economic Co-operation and Development

- OLS:

-

Ordinary least squares

- PP:

-

Phillips and Perron

- RES:

-

Renewable energy

- SIC:

-

Schwarz Information criterion

- TP:

-

Turning point

- VAR:

-

Vector autoregressive

- VECM:

-

Vector error correction model

- ZA:

-

Zivot and Andrews

References

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35:5412–5420. https://doi.org/10.1016/j.energy.2010.07.009

Ahmad N, Du L (2017) Effects of energy production and CO2 emissions on economic growth in Iran: ARDL approach. Energy 123:521–537. https://doi.org/10.1016/j.energy.2017.01.144

Ahmad N, Du L, Lu J et al (2017) Modelling the CO2 emissions and economic growth in Croatia: is there any environmental Kuznets curve? Energy 123:164–172. https://doi.org/10.1016/j.energy.2016.12.106

Ali W, Abdullah A, Azam M (2015) Re-visiting the environmental Kuznets curve hypothesis for Malaysia: fresh evidence from ARDL bounds testing approach. Renew Sust Energ Rev 77:0–1. https://doi.org/10.1016/j.rser.2016.11.236

Al-Mulali U, Saboori B, Ozturk I (2015) Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 76:123–131. https://doi.org/10.1016/j.enpol.2014.11.019

Apergis N, Payne JE (2010) The emissions, energy consumption, and growth nexus: evidence from the commonwealth of independent states. Energy Policy 38:650–655. https://doi.org/10.1016/j.enpol.2009.08.029

Ben Jebli M, Ben Youssef S (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sust Energ Rev 47:173–185. https://doi.org/10.1016/j.rser.2015.02.049

Ben Youssef A, Hammoudeh S, Omri A (2016) Simultaneity modeling analysis of the environmental Kuznets curve hypothesis. Energy Econ 60:266–274. https://doi.org/10.1016/j.eneco.2016.10.005

Bilgili F, Koçak E, Bulut Ú (2016) The dynamic impact of renewable energy consumption on CO2 emissions: a revisited environmental Kuznets curve approach. Renew Sust Energ Rev 54:838–845. https://doi.org/10.1016/j.rser.2015.10.080

Bölük G, Mert M (2015) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sust Energ Rev 52:587–595. https://doi.org/10.1016/j.rser.2015.07.138

Bouznit M, del P. Pablo-Romero M (2016) CO2 emission and economic growth in Algeria. Energy Policy 96:93–104. https://doi.org/10.1016/j.enpol.2016.05.036

Brennan TJ (2010) The challenges of climate policy. Aust Econ Rev 43:225–239. https://doi.org/10.1111/j.1467-8462.2010.00598.x

Brown SPA, McDonough IK (2016) Using the environmental Kuznets curve to evaluate energy policy: some practical considerations. Energy Policy 98:453–458. https://doi.org/10.1016/j.enpol.2016.09.020

Climent F, Pardo A (2007) Decoupling factors on the energy-output linkage: the Spanish case. Energy Policy 35:522–528. https://doi.org/10.1016/j.enpol.2005.12.022

Conte Grand M (2016) Carbon emission targets and decoupling indicators. Ecol Indic 67:649–656. https://doi.org/10.1016/j.ecolind.2016.03.042

Contreras Z, Ancev T, Betz R (2014) Evaluation of environmental taxation on multiple air pollutants in the electricity generation sector-evidence from New South Wales Australia. Econ Energy Environ Policy 3:119–143. https://doi.org/10.5547/2160-5890.3.2.zcon

Dickey D, Fuller W (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072. https://doi.org/10.2307/1912517

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49:431–455. https://doi.org/10.1016/j.ecolecon.2004.02.011

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251. https://doi.org/10.2307/1913236

Farhani S, Chaibi A, Rault C (2014) CO2 emissions, output, energy consumption, and trade in Tunisia. Econ Model 38:426–434. https://doi.org/10.1016/j.econmod.2014.01.025

Gozgor G, Lau CKM, Lu Z (2018) Energy consumption and economic growth: new evidence from the OECD countries. Energy 153:27–34. https://doi.org/10.1016/j.energy.2018.03.158

Granger CWJ (1988) Causality, cointegration, and control. J Econ Dyn Control 12:551–559. https://doi.org/10.1016/0165-1889(88)90055-3

Grossman GM, Krueger AB (1991) Environmental impacts of a north American free trade agreement. Natl Bur Econ Res Work Pap Ser No 3914:1–57. https://doi.org/10.3386/w3914

Holtz-Eakin D, Selden T (1995) Stoking the fires? CO 2 emissions and economic growth. J Public Econ 57:85–101. https://doi.org/10.1016/0047-2727(94)01449-X

IEA (2012) Energy policies of IEA countries—Australia 2012 review

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254. https://doi.org/10.1016/0165-1889(88)90041-3

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on Cointegration--with applications to the demand for money. Oxf Bull Econ Stat 52:169–210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Kaika D, Zervas E (2013) The environmental Kuznets curve (EKC) theory—part a: concept, causes and the CO2 emissions case. Energy Policy 62:1392–1402. https://doi.org/10.1016/j.enpol.2013.07.131

Kojima M, Bacon R (2009) Changes in CO2 emissions from energy use: a multicountry decomposition analysis. Extr Ind Dev Ser #11 World Bank 34:11–14

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3:401–403

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45:1–28. https://doi.org/10.1596/978-0-8213-7318-7

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root. J Econ 54:159–178. https://doi.org/10.1016/0304-4076(92)90104-Y

Lantz V, Feng Q (2006) Assessing income, population, and technology impacts on CO2 emissions in Canada: Where’s the EKC? Ecol Econ 57:229–238. https://doi.org/10.1016/j.ecolecon.2005.04.006

Lastres CGECEHMM (2007) Projeto BRICS: Estudo Comparativo dos Sistemas de Inovação no Brasil, Rússia, Índia, China e África do Sul Agenda, pp 1–19

López-Menéndez AJ, Pérez R, Moreno B (2014) Environmental costs and renewable energy: re-visiting the environmental Kuznets curve. J Environ Manag 145:368–373. https://doi.org/10.1016/j.jenvman.2014.07.017

Mazzanti M, Zoboli R (2008) Waste generation, waste disposal and policy effectiveness. Evidence on decoupling from the European Union. Resour Conserv Recycl 52:1221–1234. https://doi.org/10.1016/j.resconrec.2008.07.003

Moutinho V, Varum C, Madaleno M (2017) How economic growth affects emissions? An investigation of the environmental Kuznets curve in Portuguese and Spanish economic activity sectors. Energy Policy 106:326–344. https://doi.org/10.1016/j.enpol.2017.03.069

Mrabet Z, Alsamara M (2017) Testing the Kuznets curve hypothesis for Qatar: a comparison between carbon dioxide and ecological footprint. Renew Sust Energ Rev 70:1366–1375. https://doi.org/10.1016/j.rser.2016.12.039

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth: panel data evidence from developing countries. Energy Policy 38:661–666. https://doi.org/10.1016/j.enpol.2009.09.005

OECD (2002) Indicators to measure decoupling of environmental pressure from economic growth. Sustain Dev SG/SD 20

Olale E, Ochuodho TO, Lantz V, El Armali J (2018) The environmental Kuznets curve model for greenhouse gas emissions in Canada. J Clean Prod 184:859–868. https://doi.org/10.1016/j.jclepro.2018.02.178

Ozokcu S, Ozdemir O (2017) Economic growth, energy, and environmental Kuznets curve. Renew Sust Energ Rev 72:639–647. https://doi.org/10.1016/j.rser.2017.01.059

Panayotou T (1993) Empirical tests and policy analysis of environmental degradation at different stages of economic development. Technol Environ Employ Geneva Int Labour Off World Empl 13–36

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779. https://doi.org/10.1016/j.jclepro.2018.03.236

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of long run relationships. J Appl Econ 16:289–326. https://doi.org/10.1002/jae.616

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346. https://doi.org/10.1093/biomet/75.2.335

Rafiq S, Salim RA (2009) Temporal causality between energy consumption and income in six Asian emerging countries. Appl Econ Q 55:335–350. https://doi.org/10.3790/aeq.55.4.335

Rafiq S, Salim R (2011) The linkage between energy consumption and income in six emerging economies of Asia. Int J Emerg Mark 6:50–73. https://doi.org/10.1108/17468801111104377

Rank W, Rank R, Status EF (2017) 81.0 ( ▲. 112–113

Riti JS, Song D, Shu Y, Kamah M (2017) Decoupling CO2emission and economic growth in China: is there consistency in estimation results in analyzing environmental Kuznets curve? J Clean Prod 166:1448–1461. https://doi.org/10.1016/j.jclepro.2017.08.117

Robalino-López A, Mena-Nieto Á, García-Ramos JE, Golpe AA (2015) Studying the relationship between economic growth, CO2 emissions, and the environmental Kuznets curve in Venezuela (1980-2025). Renew Sust Energ Rev 41:602–614. https://doi.org/10.1016/j.rser.2014.08.081

Roca J (2003) Do individual preferences explain the environmental Kuznets curve? Ecol Econ 45:3–10

Roca J, Alca V (2001) Energy intensity, CO emissions and the environmental Kuznets curve. The Spanish case. Energy Polocy 29:553–556

Salim RA, Bloch H (2009) Business expenditures on R&D and trade performances in Australia: is there a link? Appl Econ 41:351–361. https://doi.org/10.1080/00036840601007302

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: time series and cross-country evidence. Policy Res Work Pap Ser 18:55. https://doi.org/10.1108/14777830710778328

Shahbaz M, Zakaria M, Shahzad SJH, Mahalik MK (2018) The energy consumption and economic growth nexus in top ten energy-consuming countries: fresh evidence from using the quantile-on-quantile approach. Energy Econ 71:282–301. https://doi.org/10.1016/j.eneco.2018.02.023

Soytas U, Sari R, Ewing BT (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62:482–489. https://doi.org/10.1016/j.ecolecon.2006.07.009

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Dev 32:1419–1439. https://doi.org/10.1016/j.worlddev.2004.03.004

Suri V, Chapman D (1998) Economic growth , trade and energy : implications for the environmental Kuznets curve. 25:195–208

Tapio P (2005) Towards a theory of decoupling: degrees of decoupling in the EU and the case of road traffic in Finland between 1970 and 2001. Transp Policy 12:137–151. https://doi.org/10.1016/j.tranpol.2005.01.001

Tiba S, Omri A (2017) Literature survey on the relationships between energy, environment and economic growth. Renew Sust Energ Rev 69:1129–1146. https://doi.org/10.1016/j.rser.2016.09.113

Wang H (2011) Decoupling measure between economic growth and energy consumption of China. Energy Procedia 5:2363–2367. https://doi.org/10.1016/j.egypro.2011.03.406

Wang Q, Hang Y, Zhou P, Wang Y (2016) Decoupling and attribution analysis of industrial carbon emissions in Taiwan. Energy 113:728–738. https://doi.org/10.1016/j.energy.2016.07.108

Wang H, Hashimoto S, Yue Q et al (2013) Decoupling analysis of four selected countries: China, Russia, Japan, and the United States during 2000-2007. J Ind Ecol 17:618–629. https://doi.org/10.1111/jiec.12005

Wang Q, Zhao M, Li R, Su M (2018) Decomposition and decoupling analysis of carbon emissions from economic growth: a comparative study of China and the United States of America. J Clean Prod 197:178–184. https://doi.org/10.1016/j.jclepro.2018.05.285

Warren B, Christoff P, Green D (2016) Australia’s sustainable energy transition: the disjointed politics of decarbonisation. Environ Innov Soc Trans 21:1–12. https://doi.org/10.1016/j.eist.2016.01.001

Waslekar SS (2014) World environmental Kuznets curve and the global future. Procedia Soc Behav Sci 133:310–319. https://doi.org/10.1016/j.sbspro.2014.04.197

Wu Y, Zhu Q, Zhu B (2018) Decoupling analysis of world economic growth and CO2emissions: a study comparing developed and developing countries. J Clean Prod 190:94–103. https://doi.org/10.1016/j.jclepro.2018.04.139

Xu Q, Dong YX, Yang R (2018) Urbanization impact on carbon emissions in the Pearl River Delta region: Kuznets curve relationships. J Clean Prod 180:514–523. https://doi.org/10.1016/j.jclepro.2018.01.194

Yan D, Lu L, Li Z et al (2016) Durability comparison of four different types of high-power batteries in HEV and their degradation mechanism analysis. Appl Energy 179:1123–1130. https://doi.org/10.1016/j.apenergy.2016.07.054

Yu Y, Zhou L, Zhou W et al (2017) Decoupling environmental pressure from economic growth on city level: the case study of Chongqing in China. Ecol Indic 75:27–35. https://doi.org/10.1016/j.ecolind.2016.12.027

Zhang Z (2000) Decoupling China’s carbon emissions increase from economic growth: an economic analysis and policy implications. World Dev 28:739–752. https://doi.org/10.1016/S0305-750X(99)00154-0

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil price shock, and the unit root hypothesis. J Bus Econ Stat 10:251–270. https://doi.org/10.1198/073500102753410372

Acknowledgments

The authors would like to express their thanks for the opportunity to present a previous version of this paper at the 2nd IAEE Eurasian Conference and at the 2nd AIEE Energy Symposium, as well as to the comments and suggestions received at these events. We also like to express our thanks to the anonymous reviewers for their helpful and invaluable comments and suggestions.

Funding

Financial support was provided by the NECE-UBI—Research Unit in Business Science and Economics, Project no. UID/GES/04630/2013, sponsored by the Portuguese Foundation for the Development of Science and Technology.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Nicholas Apergis

Rights and permissions

About this article

Cite this article

Marques, A.C., Fuinhas, J.A. & Leal, P.A. The impact of economic growth on CO2 emissions in Australia: the environmental Kuznets curve and the decoupling index. Environ Sci Pollut Res 25, 27283–27296 (2018). https://doi.org/10.1007/s11356-018-2768-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-018-2768-6