Abstract

The main purpose of this work is to analyze the impact of environmental degradation proxied by CO2 emissions per capita along with some other explanatory variables namely energy use, trade, and human capital on economic growth in selected higher CO2 emissions economies namely China, the USA, India, and Japan. For empirical analysis, annual data over the period spanning between 1971 and 2013 are used. After using relevant and suitable tests for checking data properties, the panel fully modified ordinary least squares (FMOLS) method is employed as an analytical technique for parameter estimation. The panel group FMOLS results reveal that almost all variables are statistically significant, whereby test rejects the null hypotheses of non cointegration, demonstrating that all variables play an important role in affecting the economic growth role across countries. Where two regressors namely CO2 emissions and energy use show significantly negative impacts on economic growth, for trade and human capital, they tend to show the significantly positive impact on economic growth. However, for the individual analysis across countries, the panel estimate suggests that CO2 emissions have a significant positive relationship with economic growth for China, Japan, and the USA, while it is found significantly negative in case of India. The empirical findings of the study suggest that appropriate and prudent policies are required in order to control pollution emerging from areas other than liquefied fuel consumption. The ultimate impact of shrinking pollution will help in supporting sustainable economic growth and maturation as well as largely improve society welfare.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Sustainable economic growth and development is desirably dire to improve social welfare. It implies that economic development should not be at the cost of environmental degradation, but rather environmental sustainability should be maintained. It has been observed that environmental degradation or pollution is a hot issue in the economic growth and development process. Because worsening of environment arises to have a direct effect on the quality of human life and economic performance as well. It is evident, that pollution has some ruthless effect on health, resource reduction, and natural disasters linked to climate change and necessitated the slowdown of the economic growth and development. Atmospheric pollution, land degradation, soil pollution, water pollution, and noise pollution are the major forms of pollution. Whereas, atmospheric pollution sources consist of (i) burning of fuels to generate energy for heating and power production in both the household and industrial sectors; (ii) deplete emissions from the vehicles that consume petrol, diesel oil, etc.; and (iii) waste gases, dirt, and heat from several industrial sites comprising chemical manufacturers and stations of electric power generating. Similarly, sulfur dioxide (SO2), nitrogen dioxide (NO2), and particulate matter (PM) are major pollutants of ambient air quality. Generally, carbon dioxide (CO2) and methane (CH2) are the main contributor in the greenhouse gas emission inventory (Srivastava et al. 2010). Indeed, global warming has become a notable universal concern, where pollution is mainly as an outcome of excessive uncontrolled CO2 emission which is commonly considered one of the key atmospheric gases which basically lead to planetary heating. Consequently, environmental degradation badly affects available scarce resources and makes inefficient human capital to contribute much to enhance the aggregate output.

Apparently, environmental pollution grows due to industrialization, modernization, and urbanization that have severely become severe major environmental problems not merely for advanced world but equally in the developing world too. The changeover from the state of stagnation to growth and development commenced by the industrial revolution caused, via an enormous adverse effect on the environment, unfavorable influence on individuals’ health condition in terms of disease and life expectancy (Galor and Weil 2000; Schaefer 2013). Pollutants have largely squeezed economic growth in Asia (Borhan et al. 2012). Every state makes effort to accomplish higher stages of economic growth at the cost of consuming the present, mainly, nonrenewable natural resources right from the industrial revolution. Due to which greenhouse gas emission upsurges, where mostly CO2 emissions do play a critical part in the expansion of global warming as well as ozone exhaustion, the principal contributors to the human-induced heating are CO2 emissions (Canadell et al. 2007; Friedlingstein et al. 2010; Le Quere et al. 2012).

Indeed, the available resources are largely inadequate and scanty; therefore, humans need to employ practices that allow effective and durable use of the available scarce resources in the environment. Sustainable development then becomes a device that supports assurance of the persistent and long enduring utilization of resources. The environmental degradation problem is rising largely in developing economic systems. For example, the extreme use of natural resources is related to negative environmental effects, including damage of forest and forested undergrowth, damage of habitat, loss of biodiversity, the reduction of fish stock, soil erosion, and pollution (Aikins 2012; 2014). The critical aim of every economy is to accomplish the desired level of economic growth and development for a long term. Most probably, achieving this target may damage environmental quality (Bozkurt and Akan 2014). Along with increase in level of growth rate, where it is expected that, environmental deterioration and climate change will have harmful impacts on the natural order, humanity, economies, and infrastructure as well. The inverse association between economic growth and environmental deterioration requires environmental policy reactions and plans on a local, regional, national, and worldwide scale.Footnote 1

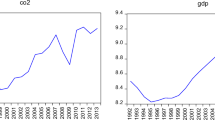

It is evident that global CO2 emissions from fossil fuel combustion and from industrial activities (i.e., cement and metal production) enlarged in 2013 to the maximum figure of 35.3 billion tonnes (Gt) CO2, and it was 0.7 Gt greater as compared to the last year’s figure. This increase is driven largely by emerging economies with the gradually growing energy consumption over the past decade. The six largest CO2 emitting countries in 2013 were namely China, the USA, the European Union (EU28), the Russian Federation, India, and Japan with their share of 29, 15, 11, 6, 5 and 4 %, respectively. Where notable trends were perceived at the top three CO2 emitting nations, which only account for 55 % of aggregate worldwide CO2 emissions (see Fig. 1). The spread in China’s CO2 emission was equal to almost 60 % of the net global CO2 emission expansion in 2013, whereas in the USA and India, this was about 15 %, while the EU shows a reduction of 10 % in the same year.Footnote 2 Figure 1 portrays a comparison of the global CO2 emissions per region from fossil fuel consumption and cement production.

The relationship between environmental degradation and economic growth has been a crucial topic, therefore, to examine whether the growing level of CO2 emissions has any impact on the economic growth or none at all. As we need sustainable economic growth and development, which would not be at the cost of future generation and would be without environmental degradation, environmental suitability needs to be maintained however. Thus, the prime aim of this work is to look into the impact of environmental degradation proxied by CO2 emission per capita on economic growth in selected higher CO2 emissions economies’ namely China, the USA, India, and Japan. For empirical analysis, annual data over the period between 1971 and 2013 were used. This is an inclusive empirical study, which will certainly adds to the literature on the CO2 emissions and economic growth relationship in the sample countries under the study and may be extended to other countries.

The design of this study is devised as follows: “Literature review” section handles with a literature review on the relationship between CO2 emissions and economic growth. “Date description and methodology” section discusses the data description and empirical methodology used. “Estimation procedure” section interprets the empirical results. Finally, “Results and discussion”section concludes the study.

Literature review

The available literature reveals that empirical studies on the impact of environmental degradation on economic growth in the context of higher CO2 emission countries are yet scanty.

For instance, the study of Menyah and Wolde-Rufael (2010) obtains a one-way causality running from CO2 emissions to economic development in South Africa during 1965–2006. The findings suggest to mitigate CO2 emissions by evolving energy replacements for coal, the core source of carbon emissions. Ghosh’s (2010) study did not reach to determine long-term equilibrium connection and causality in CO2 emissions and economic growth; though, the study further shows that there exists two-way short-term causality between CO2 emissions and economic growth in India during 1971–2006. The findings imply that in the short run, any effort to decrease CO2 emissions could lead to diminish in the economic growth of India. Pao and Tsa (2010) investigate causal linkages between pollutant emissions, energy use, and economic growth for BRIC (Brazil, Russia, India, and China) countries during 1971–2005, while in case of Russia time period (1990–2005). In general, the results suggest that to mitigate emissions and not to badly affect output, rising both energy supply investment and energy efficiency and marching up energy conservation policies to decrease needless wastage of energy can be launched for energy-dependent BRIC economies.

In a study by Chang (2010), it was mentioned that in all of the developed and developing economies, China is the main producer of CO2 emissions and the highest consumer of energy, and a trend of stable exponential growth has become evident in recent years. The empirical findings of the study reveal that economic growth persuades a higher level of energy use and CO2 emissions in China during 1981–2006; therefore, the implementation of an energy conservation policy would have opposing impacts on China’s economic prosperity. The Granger causality tests of Lean and Smyth (2010) study indicate that in the long term, there is a one-way Granger causality running from carbon emissions to economic growth in five ASEAN countries during 1980–2006. Farhani and Rejeb’s (2012) study fails to find causal linkage between gross domestic product (GDP) and energy use and between CO2 emissions and energy use in the short run, while in the long run, there exists one-way causality flowing from GDP and CO2 emissions for 15 MENA countries during 1973–2008. Borhan et al. (2012) find that results in CO2 emissions indicate a significant negative relationship with GDP per capita income for ASEAN-8 covering the period from 1965 to 2010. The study adds that the long-run destructive effect of the environmental pollution can contribute to damaging effects on human welfare and economic prosperity.

A study by Azlina et al. (2014) observes the existence of long-term association between energy usage, economic growth, and pollutant emission for Malaysia during 1970–2010. The empirical findings further show a one-way causality running from pollutant emissions to economic growth. Saboori and Sulaiman’s (2013) study reveals that there exists bidirectional causality between economic growth and carbon dioxide emissions, with coal, gas, electricity, and oil usage in Malaysia during 1980–2009. The panel short-run Granger causality test results of Papiez’s (2013) study show two-way causality between CO2 emissions and economic growth for Visegrad group countries during 1992–2010. Zhao and Ren (2013) examine the causal linkage among CO2 emissions intensity, energy consumption structure, energy intensity, and industrial structure in China over the period spanning between 1980 and 2009. The Granger causality test results show that there exist unidirectional causality relationships from CO2 emissions intensity to industrial structure. In the same way, the study of Bozkurt and Akan (2014) explores the causal association among economic growth, energy structure, research and development (R&D) investment, and CO2 emissions in China during 1990–2011. The results reveal that both the long- and short-run relationships, CO2 emissions have a positive impact on the economic growth in China during the period under the study.

The study of Alam (2013) finds that in cases of the developed countries, short-term causality is flowing from CO2 emissions to economic growth, while in case of developing countries, both the short-run and strong-form causality estimates showed that economic growth causes CO2 emissions for a panel of total 25 countries during 1993–2010. Lim et al. (2014) observe a unidirectional causality flowing from CO2 emissions to economic growth in the Philippines over the period ranging from 1965–2012; the results indicates that economic growth can continue without growing CO2 emissions in the country. Ghosh et al. (2014) find that CO2 emissions have an inverse but insignificant impact during 1972–2011, confirming that economic growth in Bangladesh can be accomplished without degrading environment quality. In a similar vein, the study of Rahman and Porna (2014) detects that CO2 emission and GDP are cointegrated, and to be more particular, pollution precedes GDP, which goes with the level of growth of six countries from SAARC namely Bangladesh, Bhutan, India, Nepal, Pakistan, and Sri Lanka during 1970–2008. The empirical findings of Hwang and Yoo’s (2014) study in the context of Indonesia suggest that energy conservation and/or CO2 emissions cutback policies should be set up without the resulting damaging economic side effects. Yang and Zhao (2014) find that there is two-way causality between CO2 emissions and economic growth in India during 1970–2008. Bhattacharya et al. (2014) find a unidirectional causality between economic growth and CO2 emissions in India 1980–2010.

The study of Ejuvbekpokpo (2014) examines the effect of carbon emission along with some other control variables on economic growth of Nigeria during 1980–2010. The empirical findings indicate that CO2 emissions have significantly negative impact on economic growth in Nigeria. Alam et al. (2014) summarize that environmental quality indicators are indispensable for worthwhile policies. The study tests the association between environmental quality indicators and financial development in the context of Malaysia during1975-2013. Using for environmental quality indicators is air pollution measured by CO2 emissions, population density, cereal production, livestock production, and energy resources measured by energy consumption and fossil fuel energy use, which affect the financial development of Malaysia. A study on BRICS (Brazil, Russia, India, China, and South Africa) countries during 1971–2010, Sebri and Salha (2014) suggest an upsurge in CO2 emissions, which is the major source of global warming. In a study on the relationship among energy use, economic growth, and CO2 emission for Pakistan over the period 1975–2013, the study of Haseeb and Azam (2015) finds that energy consumption creates CO2 which damage environmental quality in Pakistan. Similarly, the study of Saidi and Hammami (2015) finds that CO2 emissions have statistically significant impact on energy use for three regional panels: Europe and North Asia, Latin America and Caribbean, and Sub-Saharan, North African, and Middle Eastern over the period ranging from 1990–2012.

The abovementioned studies reveal that mostly the prior studies focused either on the relationship among economic growths; CO2 emissions and energy consumption as modest effort have been made to verify the effect of CO2 emissions on economic growth in the context of a set of countries namely China, India, Japan, and the USA. The present study mainly focuses on analyzing environmental degradation retarding pace effect on economic growth by taking two developing and two developed countries; the result of this study will enable us to conclude that in which region, i.e., developed or developing countries environmental degradation retarding pace, is higher. Therefore, investigating the impact of CO2 emissions on economic growth will certainly fill the gap and contribute to the literature on the topic under the study. The empirical findings will guide the policy makers to chalk out an appropriate policy in order to control pollution, and consequently, it will help to boost sustainable economic growth and development.

Data description and methodology

Data sources

Annual time series data ranging from 1971 to 2013 are used for empirical analysis. Data on variables namely CO2 emissions (kg per 2005 US$ of GDP) are used as a proxy for pollution, energy consumption is energy use (kg of oil equivalent per capita), exports of goods and services (% of GDP), GDP per capita data is taken as constant 2005 US$, human capital (HC) data is taken school enrollment, and secondary (% gross) is used for analysis. The data are obtained from the World Development Indicators (2015), the World Bank database. Descriptive statistics and correlation matrix of the data are given in Table 1.

Model specification

The purpose of this study is to analyze the relationship among pollution, energy consumption, and economic growth in the case of the USA, Japan, China, and India using annual data over the period of 1971–2013. In this study, we employed Cobb–Douglas production function to analyze the relationship between pollution and economic growth, including energy usage, trade, and human capital as an additional factors of production. Generally, the equation of the production function is written as follows:

In Eq. (1), Y is domestic output per capita in real terms; CO2, EU, T, and HC indicate pollution, energy use, trade, and human capital, respectively, while A shows the level of technology (assumed to be constant) utilized in the country. The returns to scale are associated with pollution, energy consumption, trade, and human capital which are shown by α1, α2, α3, and α4, respectively. All the series are converted into logarithms in order to linearize the nonlinear form of Cobb–Douglas production. The non-linear specification does not seem to provide reliable results and not accommodating for policy making purposes (Shahbaz and Feridun 2012). The Cobb–Douglas production function is modeled in linear functional form as follows:

The above empirical Eq. (2) will investigate the relationship between pollution and economic growth keeping technology constant. The linear model showing the relationship of pollution and economic growth after keeping technology constant can be written as follows:

where Y, CO2, EU, T, and HC represent per capita GDP, pollution, energy use, trade, human capital, μ error term, and t time index.

Estimation procedure

Panel unit root test

The unit root test is used to determine whether the trend data in a research should be regressed on the focused to render it to data stationary. Most of economic theory suggests the long-run connection between the variables, and the cointegration techniques can be used to detect the long-run relation between those variables. Economic theory requires all variables to be stationary if the regressions are to be realistic. Therefore, all the variables in the growth function should be tested to determine whether they are influenced by economic factors of relatively permanent nature or by self-correcting forces that indicate temporary elements in their dynamics.

In order to investigate the possibility of panel cointegration, it is first necessary to determine whether per capita GDP and the independent variables evolve as unit root processes. There are several unit root tests specifically for panel data which have been introduced in past decades. Among them are Quah (1992, 1994), Levin and Lin (1992, 1993), Maddala and Wu (1999), Hadri (2000), Levin et al. (2002), and Im et al. (2003, 1997). This panel unit root test is a continuation of the univariate unit root test identified earlier but which has low power like the augmented Dickey–Fuller test (Said and Dickey 1984).

The panel unit root test as above has the specification for a null hypothesis and an alternative and methodology to identify problems such as heterokedasticity and different correlations. Each panel unit root test data has its own benefits and limitations, and for this study, we have chosen the Levin, Lin, and Chu version (LLC) and Im et al. (1997; IPS hereafter), which are based on the well-known Dickey–Fuller procedure. This LLC test is not only considered simple when estimation is carried out but has also been widely used in empirical studies, and the strength of this test has been tested in various Monte Carlo tests.

Levin, Lin, and Chu (LLC; 2002)

In LLC, it is found that the main hypothesis of panel unit root is as follows:

where y it refers to variable lnFDIit, lnVAit, lnPIit, lnINSit, and lnGDPit. Δ refers to the first difference. The hypothesis test is H 0 : Φ i = 0 for existence of unit root whereas H a : Φ i < 0 for all i for non-existence of a unit root. As p i is unknown, Levin, Lin, and Chu (LLC) suggest a three-step procedure in the test. In the first step, obtain the Augmented Dickey–Fuller (ADF) regression which has been separated for each individual in the panel, generate two orthogonal residuals.

The second step requires an estimation of the ratio of long runs to short-run innovation standard deviation for each individual. The last step requires us to compute the pooled t-statistics.

In the first step, we generate ADF regression for each individual i:

The lag order for p i is allowed to be distinguished for each individual. Campbell and Perron (1991) suggest a methodology used by Hall (1990; 1994) in choosing the appropriate lag order, that is, providing a sample span of T, choose a lag order which maximizes P MAX, and then use t-statistics for \( {\widehat{\rho}}_L \) to determine if the order of a smaller lag order is preferred. [T-statistics have a standard normal distribution in a null hypothesis (\( {\widehat{\rho}}_{iL}=0\Big), \) when Φ i = 0 or Φ i < 0.]

The order of autogression was determined for p i which generates two auxiliary regressions to obtain orthogonal residuals. Carry out a regression Δy i,t and y i,t on Δy i,t − L (L = 1,…p i ), then get residuals ê i,t and \( {\widehat{v}}_{i,t-1} \) from these regression. Specifically, this model is shown as below:

To control heterogeneity among individuals, LLC has normalized ê i,t and \( {\widehat{v}}_{i,t-1} \) through standard error regression which is:

where \( {\widehat{\sigma}}_{\varepsilon, i} \) is standardized error also be calculated from regression ê i,t on \( {\widehat{v}}_{i,t-1} \).

The second step is to estimate the ratio of long-run to short-run standard deviation. In this null hypothesis for unit root, long-term variance for the model can be estimated as below:

where w refers to weights. The truncation lag parameter, \( \overline{K} \), depends on data. For each individual i, LLC defines the ratio of the long-run standard deviation to innovation standard deviation as

and mark this estimation with \( {\widehat{s}}_i=\widehat{\sigma}{y}_i/{\widehat{\sigma}}_{\varepsilon, i} \). The average standard deviation ratio is S N = (1/N)∑ N i = 1 S i , and the estimation is Ŝ N = (1/N)∑ N i = 1 Ŝ i .

Before we proceed to the third stage, LLC reminds us that there are two items that should be noted. Firstly, the estimation for \( {\widehat{\sigma}}_{y,i} \) under a null hypothesis is \( {\widehat{\sigma}}_{\varepsilon, i}^2/{\left(1-{\displaystyle {\sum}_{i=1}^{pi}{\widehat{\rho}}_{i,L}}\right)}^2 \), and as a result of \( {\widehat{\sigma}}_{\varepsilon, i}^2 \) being a constant estimation for \( {\widehat{\sigma}}_{\varepsilon, i}^2 \) under the null hypothesis, thus, ŝ i can be estimated with \( \left|1-{\displaystyle {\sum}_{i=1}^{pi}{\widehat{\rho}}_{i,L}}\right| \). Secondly, the feature of size and power for the panel unit root test is increased via first difference to estimate the long-term variance. In the null hypothesis for unit root, Schwert (1989) found long-term estimation based on first difference has a smaller bias in a limited sample compared to the long-term variance based on residuals in level.

The third step in the LLC version of the panel unit root test is to estimate coefficient Φ and to calculate the value of t-statistic for the panel. For this, combine all cross-sectional and time series observations to estimate

based on the total of observations \( N\tilde{T} \), where \( \tilde{T}=T-\overline{g}-1 \) is the average of the number of observations per individual in the panel and \( \overline{p}=\frac{1}{N}{\displaystyle {\sum}_{i=1}^N{p}_i} \) is the average interval for individual ADF regression. The conventional t-statistic regression to test Φ = 0 is

where

In the hypothesis H0: Φ = 0, LLC states that t-statistic regression (t Φ ) has a normal distribution for the ADF model without intercept and trend but diverges to a negative for the ADF model with intercept and trend.

Subsequently, the calculation of coordinated t-statistic is as below:

where tabulated mean value is adjustment for \( {\mu}_{m\tilde{T}}^{*} \) and the standard deviation is adjustment \( {\mu}_{M\tilde{T}}^{*} \) has been given by LLC with a deterministic specification (m = 1,2,…) and time series dimension \( \tilde{T}. \)

Levin et al. (2002) state that limited tabulation for corrected statistics if normal where N → ∞ and T → ∞ with \( \sqrt{N/T\;} \) → 0 or N/T → 0, depends on the model specification. Furthermore, the Monte Carlo simulation shows that this test is still suitable for a moderate-sized panel (value of N is between 10 and 250 individuals and T between a span of 20 and 250) whereby they are almost similar with panel data for this study.

Generally, the LLC test has been accepted as one of the panel unit root test. However, it should be mentioned that this LLC test has a homogeneity limitation, where a null hypothesis is Φ i = Φ = 0 versus the alternative hypothesis Φ i < 0 for all individual units I.

Im, Pesaran, and Shin (IPS; 1997)

Im et al. (1997) denoted IPS proposed a test for the presence of unit roots in panels that combines information from the time series dimension with that from the cross-sectional dimension, such that little time observations are required for the test to have power. Since the IPS test has been found to have superior test power by researchers in economics to analyze long-run relationships in panel data, we will also employ this procedure in this study. The advantage of the IPS method over previous panel unit root tests is that it allows the data generating processes to vary across countries with respect to ADF coefficients and error structures. This can be particularly important with respect to the number of lagged difference terms in the ADF equation.

As with univariate tests, where setting the lag length can be a critical step in appropriate implementation, our experimentation suggests that it is important for the IPS test to allow the lag length to vary across countries rather than imposing a uniform lag length (McCoskey and Selden 1998). Another advantage of the IPS test is to allow for heterogeneity in the value of ρ i under the alternative hypothesis. The IPS tests allow for individual unit root processes so that ρ i may vary across cross sections. All the tests are characterized by combining individual unit root tests to derive a panel-specific result.

IPS begins by specifying a separate ADF regression for each cross section with individual effects and no time trend:

The null hypothesis may be written as, H 0 : ρ i = 0, for all i = 1,….N, While the alternative hypothesis is given by

IPS use separates unit root tests for the N cross-sectional units. Their test is based on the ADF statistics averaged across groups. After estimating the separate ADF regressions, the average of the t-statistics for p 1 from the individual ADF regressions, \( {t}_{i{T}_i}\left({p}_i\right): \)

is then adjusted to arrive at the desired test statistics. Under the crucial assumption of cross-sectional independence, this statistic is shown to sequentially converge to a normal distribution when T tends to infinity, followed by N. A similar result is conjectured when N and T tend to infinity while the ration N/T tends to a finite non-negative constant (Hurlin 2004).

In order to propose a standardization of the \( \overline{t} \) statistic, IPS has to compute the value of \( E\left({\overline{t}}_{iT}\left({p}_i,{\beta}_i\right)\right) \) and \( Var\kern0.5em \left({\overline{t}}_{iT}\left({p}_i,{\beta}_i\right)\right) \). The standardization of the \( {\overline{t}}_{iT} \) statistic using the means and variances of t iT (p i , 0) evaluated by simulation under the null ρ i = 0. IPS shows that a properly standardized \( {\overline{t}}_{NT} \) statistic, denoted \( {W}_{{\overline{t}}_{NT}} \), has an asymptotic standard normal distribution under the null of non stationary along the diagonal \( \raisebox{1ex}{$N$}\!\left/ \!\raisebox{-1ex}{$T$}\right.\to k, \) with k > 0:

The expressions for the expected mean and variance of the ADF regression t-statistics, \( E\left({\overline{t}}_{iT}\left({p}_i,{\beta}_i\right)\right) \) and \( Var\kern0.5em \left({\overline{t}}_{iT}\left({p}_i,{\beta}_i\right)\right) \), are provided by IPS for various values of T and p and differing test equation assumptions. The IPS test statistic requires specification of the number of lags and the specification of the deterministic component for each cross-sectional ADF equation.

Maddala and Wu (1999)

This is known as Fisher’s test. The advantage of this test is that it does not require a balanced panel as in the case of the IPS test. Also, one can use different lag lengths in the individual ADF regressions. Another advantage of the Fisher test is that it can also be carried out for any unit root test derived.

A Fisher’s (pë) test should be noted that the IPS test is for testing the significance of the results from N independent tests of a hypothesis. The Fisher test based on the sum of the log p values has been widely recommended. The advantage of this test is that it does not require a balanced panel as in the case of the IPS test. Also, one can use different lag lengths in the individual ADF regression. Another advantage of the Fisher test is that it can also be carried out for any unit root test derived. The disadvantage is that the p values have to be derived by Monte Carlo simulation.

The Fisher test and the IPS test are directly comparable. The aim of both tests is a combination of the significance of different independent tests. The Fisher test is non-parametric; the IPS test, on the other hand, is parametric.

Panel cointegration test

Pedroni (1999, 2004) extends the Engle and Granger (1987) two-step strategies to panels and relies on ADF and PP principles. First, the cointegration equation is estimated separately for each panel member. Second, the residuals are examined with respect to the unit root feature. If the null hypothesis is rejected, the long-run equilibrium exists, but the cointegration vector may be different for each cross section. In addition, deterministic components are allowed to be individual specific. The residuals are pooled either along the within or the between dimension of the panel, giving rise to the panel and group mean statistics (Pedroni 1999).

In the case of the panel statistics, the first order autoregressive parameter is restricted to be the same for all cross sections. If the null is rejected, the parameter is smaller than 1 in absolute value, and the variables in question are cointegrated for all panel members. In the group statistics, the autoregressive parameter is allowed to vary over the cross section, as the statistics amount to the average of individual statistics. If the null is rejected, cointegration holds at least for one individual. Hence, group tests offer an additional source of heterogeneity among the panel members (Dreger and Reimers 2005). To a certain limit, the statistics are distributed as standard normal with a left hand side rejection area, except for the variance ratio test, which is right, sided. Standardization factors arise from the moments of Brownian motion functional. The factors depend on the number of regressors and whether or not constants or trends are included in the cointegration relationships.

The procedures proposed by Pedroni make use of estimated residual from the hypothesized long-run regression of the following form (Pedroni 1999):

for t = 1,…..,T; i = 1,….,N; m = 1, ….,M, where T is the number of observations over time, N number of cross-sectional units in the panel, and M number of regressors. In this setup, α i is the member specific intercept or fixed effects parameter which varies across individual cross-sectional units. The same is true of the slope coefficients and member specific time effects, δ i t.

The tests for the null of non cointegration are based on testing whether the error process e it is stationary. This is achieved by testing whether ρ i = 1 in

Pedroni (1999) has proposed seven tests which can be divided into two groups of panel cointegration statistics designed to test the null hypothesis of cointegration between the variables in Eq. (22) against the alternative hypothesis of cointegration. Similarly, the first category of four statistics we consider is what Pedroni labels as within-dimension statistic or Panel t-statistic which includes a variance ratio statistic, a non-parametric Philips- and perron-type ρ-statistic, a non-parametric Phillips- and Perron-type t-statistic, and a Dickey-Fuller-type t-statistic.

The second category of three panel cointegration statistics is defined as a between-dimension statistic or group t-statistic including a Phillips- and Perron-type ρ-statistic, a non-parametric Phillips- and Perron-type t-statistic, and finally an Augmented Dickey-Fuller-type t-statistic.

Pedroni (1999) proposes the heterogeneous panel and heterogeneous group mean panel test statistics to test for panel cointegration as follows:

-

1.

Panel v-statistic:

$$ {T}^2{N}^{3/2}{Z}_{\widehat{v},N,T}={T}^2{N}^{3/2}{\left({\displaystyle \sum_{i=1}^N{\displaystyle \sum_{t=1}^T{\widehat{L}}_{11i}^{-2}{\widehat{e}}_{i,t-1}^2}}\right)}^{-1} $$(24) -

2.

Panel ρ-Statistic:

$$ T\sqrt{N}{Z}_{\widehat{\rho}N,T-1}=T\sqrt{N}{\left({\displaystyle \sum_{i=1}^N{\displaystyle \sum_{t=1}^T{\widehat{L}}_{11i}^{-2}{\widehat{e}}_{i,t-1}^2}}\right)}^{-1}{\displaystyle \sum_{i=1}^N{\displaystyle \sum_{t=1}^T{\widehat{L}}_{11i}^{-2}\left({\widehat{e}}_{i,t-1}\varDelta {\widehat{e}}_{i,t}-{\widehat{\lambda}}_i\right)}} $$(25) -

3.

Panel t-statistic (non-parametric):

$$ {Z}_{tN,T}={\left({\tilde{\sigma}}_{N,T}^2{\displaystyle \sum_{I=1}^N{\displaystyle \sum_{T=1}^T{\widehat{L}}_{11i}^{-2}{\widehat{e}}_{i,t-1}^2}}\right)}^{-1/2}{\displaystyle \sum_{i=1}^N{\displaystyle \sum_{t=1}^T{\widehat{L}}_{11i}^{-2}{\widehat{e}}_{i,t-1}^2\left({\widehat{e}}_{i,t-1}\varDelta {\widehat{e}}_{i,t}-{\widehat{\lambda}}_i\right)}} $$(26) -

4.

Panel t-statistic (parametric):

$$ {Z}_{tN,T}^{*}={\left({\tilde{s}}_{N,T}^2{\displaystyle \sum_{i=1}^N{\displaystyle \sum_{t=1}^T{\widehat{L}}_{11i}^{-2}{\widehat{e}}_{i,t-1}^{*2}}}\right)}^{-1/2}{\displaystyle \sum_{i=1}^N{\displaystyle \sum_{t=1}^T{\widehat{L}}_{11i}^{-2}}}{\widehat{e}}_{i,t-1}^{*}\varDelta {\widehat{e}}_{i,t}^{*} $$(27) -

5.

Group ρ-statistic:

$$ T{N}^{-1/2}{\tilde{Z}}_{\widehat{\rho}N,{T}^{-1}}=T{N}^{-1/2}{{\displaystyle \sum_{i=1}^N\left({\displaystyle \sum_{t=1}^T{\widehat{e}}_{i,t-1}^2}\right)}}^{-1}{\displaystyle \sum_{t=1}^T\left({\widehat{e}}_{i,t-1}\varDelta {\widehat{e}}_{i,t}-{\widehat{\lambda}}_i\right)} $$(28) -

6.

Group t-statistic (non-parametric):

$$ {N}^{-1/2}{\tilde{Z}}_{tN,{T}^{-1}}={N}^{-1/2}{{\displaystyle \sum_{i=1}^N\left({\displaystyle \sum_{t=1}^T{\widehat{e}}_{i,t-1}^2}\right)}}^{-1/2}{\displaystyle \sum_{t=1}^T\left({\widehat{e}}_{i,t-1}\varDelta {\widehat{e}}_{i,t}-{\widehat{\lambda}}_i\right)} $$(29) -

7.

Group t-statistic (parametric):

$$ {N}^{-1/2}{\tilde{Z}}_{tN,T}^{*}={N}^{-1/2}{{\displaystyle \sum_{i=1}^N\left({\displaystyle \sum_{t=1}^T{\widehat{s}}_i^{*2}{\widehat{e}}_{i,t-1}^{*2}}\right)}}^{-1/2}{\displaystyle \sum_{t=1}^T{\widehat{e}}_{i,t-1}^{*}}\varDelta {\widehat{e}}_{i,t}^{*} $$(30)where

$$ {\widehat{\lambda}}_i=\frac{1}{T}{\displaystyle \sum_{s=1}^{k_i}\left(1-\frac{s}{k_i+1}\right)}{\displaystyle \sum_{t=s+1}^T{\widehat{\mu}}_{i,t}}{\widehat{\mu}}_{i,t-s}, $$(31)$$ {\widehat{s}}_i^2=\frac{1}{T}{\displaystyle \sum_{t=1}^T{\widehat{\mu}}_{i,t}^2,\kern1em {\widehat{\sigma}}_i^2}={\widehat{s}}_i^2+2{\widehat{\lambda}}_i, $$(32)$$ {\tilde{\sigma}}_{NT}^2=\frac{1}{T}{\displaystyle \sum_{t=1}^T{\widehat{L}}_{11i}^2}{\widehat{\sigma}}_i^2\kern0.5em ,\kern1em {\widehat{s}}_i^{*2}=\frac{1}{T}{\displaystyle \sum_{t=1}^T{\widehat{\mu}}_{i,t}^{*2}} $$(33)$$ {\tilde{s}}_{N,T}^{*2}=\frac{1}{N}{\displaystyle \sum_{i=1}^N{\widehat{s}}_i^{*2}} $$(34)and

$$ {\widehat{L}}_{11i}^2=\frac{1}{T}{\displaystyle \sum_{t=1}^{k_i}{\widehat{\eta}}_{i,t}^2}+\frac{2}{T}{\displaystyle \sum_{T=1}^T\left(1-\frac{s}{k_i+1}\right)}{\displaystyle \sum_{t=s+1}^T{\widehat{\eta}}_{i,t}{\widehat{\eta}}_{i,t-s}} $$(35)and where the residuals \( {\widehat{\mu}}_{i,t}, \kern0.5em {\widehat{\mu}}_{i,t}^{*}, \) and \( {\widehat{\eta}}_{i,t} \) are obtained from the following regressions:

$$ {\widehat{e}}_{i,t}={\widehat{\gamma}}_i{\widehat{e}}_{i,t-1}+{\widehat{\mu}}_{i,t} $$(36)$$ {\widehat{e}}_{i,t}={\widehat{\gamma}}_i{\widehat{e}}_{i,t-1}+{\displaystyle \sum_{k=1}^{K_i}{\widehat{\gamma}}_{i,k}}\varDelta {\widehat{e}}_{i,t-k}+{\widehat{\mu}}_{i,t}^{*} $$(37)and

$$ \varDelta {y}_{i,t}={\displaystyle \sum_{m=1}^M{\widehat{b}}_{mi}\varDelta {x}_{mi,t}}+{\widehat{\eta}}_{i,t} $$(38)Δ \( {y}_{it} \) is the first difference operator. Pedroni suggests some adjustments for each of all test statistics (both for panel unit root tests and panel cointegration tests) described above that produces standard normal distributions (Hatemi and Irandoust 2005).

According to Pedroni, those seven test statistics can be rescaled so that they are distributed as standard normal. The standardization of the cointegration statistics can be expressed as

$$ \frac{K_{NT}-\mu \sqrt{N}}{\sqrt{v}}\Rightarrow N\left(0,1\right) $$(39)where KNT refer to the standardized form of the test statistic with respect to the N and T. The value of the mean (μ) and the variance (ν) are tabulated in Pedroni (1999).

The values of the normalized statistics are to be compared to the critical values implied by a one-tailed standard normal distribution. Consequently, for the panel variance test, the right tail of the standard normal distribution (large positive value) is used to reject the null of non cointegration and for the other six tests, the left tail is used (large negative value implies rejection of the null).

In a study, Harris and Sollis (2003) argue that in practice, it is possible for different tests to give contradicting conclusions. Choosing which test is more appropriate is not easy. The group mean tests particularly strength is that they are less restrictive. Regarding the best way to correct for autocorrelation, non-parametric tests are likely to be more robust to outliers but have poor size properties and tend to over-reject the null when it is true.

The ADF-type tests have better power if the errors follow an autoregressive process. Therefore, we followed from the other researcher that we report the adjusted values so that in all cases, the reported test values can be compared to the standard normal distribution. This is the case for both the cointegration and unit root tests.

FMOLS estimation

In order to obtain asymptotically efficient, consistent estimates in panel series, non-exogeneity, and serial correlation problems are tackled by employing fully modified ordinary least squares (FMOLS) introduced by Pedroni (1996). Since the explanatory variables are cointegrated with a time trend, and thus a long-run equilibrium relationship exists among these variables through the panel unit root test and panel cointegration test, we proceed to the method FMOLS for heterogeneous cointegrated panels (Pedroni 1996, 2000).

This methodology allows consistent and efficient estimation of cointegration vector and also addresses the problem of non-stationary regressors, as well as the problem of simultaneity biases. It is well known that OLS estimation yields biased results because the regressors are endogenously determined in the I(1) case. The starting point OLS as in the following cointegrated system for panel data:

Where ξ it = [e it , ε ′ it ] is the stationary with covariance matrix. The estimator β will be consistent when the error process ω it + [e it , ε ′ it ]′ satisfies the assumption of cointegration between y it and x it . The limiting distribution of the OLS estimator depends upon nuisance parameters. Following Phillips and Hansen (1990), a semi-parametric correction can be made to the OLS estimator that eliminates the second order bias caused by the fact that the regressors are endogenous. Pedroni (1996, 2000) follows the same principle in the panel data context and allows for the heterogeneity in the short-run dynamics and the fixed effects. FMOLS Pedroni’s estimator is constructed as follows:

where the covariance matrix can be decomposed as Ω i = Ω 0 i + 1Γ i + Γ i where Ω 0 i is the contemporaneous covariance matrix and Γ i is a weighted sum of autocovariances. Also, \( {\widehat{\varOmega}}_i^0 \) denotes an appropriate estimator of Ω 0 i .

In this study, we employed both the within-dimension and between-dimension panel FMOLS test from Pedroni (1996, 2000). An important advantage of the between-dimension estimators is that the form in which the data is pooled allows for greater flexibility in the presence of heterogeneity of the cointegrating vectors. Specifically, whereas test statistics constructed from the within-dimension estimators are designed to test the null hypothesis H 0 : β i = β 0 for all I against the alternative hypothesis, where the value β A is the same for all i, test statistics constructed from the between-dimension estimators are designed to test the null hypothesis H 0 : β i = β 0 for all i against the alternative hypothesis H A : β i ≠ β 0, so that the values for β i are not constrained to be the same under the alternative hypothesis.

Clearly, this is an important advantage for applications such as the present one, because there is no reason to believe that, if the cointegrating slopes are not equal to one, which they necessarily take on some other arbitrary common value. Another advantage of the between-dimension estimators is that the point estimates have a more useful interpretation in the event that the true cointegrating vectors are heterogeneous. Specifically, point estimates for the between-dimension estimator can be interpreted as the mean value for the cointegrating vectors. This is not true for the within-dimension estimators (Pedroni 2001).

Results and discussion

In order to decide the occurrence of a unit root in a panel data set and to check the results from the individual unit root of the ADF tests, panel unit test based on the Levin, Lin, and Chu and Im, Pesaran, and Shin procedure (LLC and IPS, respectively) will be employed. Furthermore, Akaike’s Information Criterion (AIC) will be used to find the appropriate number of lagged differences term and overall calculate the results. Table below reports the results of the LLC and IPS panel unit root tests for the data on technical efficiency for both the scenarios of constant and constant plus time trend term. Table 2 presents the results of the tests at level and first difference for LLC and IPS tests in constant and constant plus time trend. From the result, there is evidence that all the series are in fact integrated of order one [I(1)]. We can conclude that the results of panel unit root tests (IPS and LLC) represented in Table 2 support the hypothesis of a unit root in all variables as well as the hypothesis of zero order integration in first differences.

Table 3 shows that in constant level, all the dependent variables indicate that 5 out of 7 statistics reject null by hypothesis of non cointegration at the 1 % level of significance except for the Panel-rho and Group-rho which are not significant. Overall, the results of the panel cointegration tests in the model with constant level show independent variable cointegration in the long run across countries.

Following Pedroni (1996, 2004), cointegrating independent variables for the data are estimated using the FMOLS technique. FMOLS method makes inferences in cointegrated panels with heterogeneous dynamics, whereby cross-sectional dimension becomes large even during short-time series. The results given in Table 4 reveal that panel group (FMOLS) shows that almost all variables are statistically significant and 1 % level, whereby test rejects the null hypotheses of non cointegration, indicating all variables play an important role in affecting the dependent role across countries. Two variables namely CO2 emissions and EU show the negative sign which indicates that 1 % increase in both variables will decrease the dependent variable at 1.97 and 1.02. For T and HC, they tend to show the positive sign which reflects that 1 % increase in both variables will increase the dependent variable (economic growth measured by GDP per capita) at 0.01 and 0.94.

For the individual analysis across countries, the USA shows the estimate of CO2, EU, T, and HC, which are positive and statistically significant at the 1 % level except for EU with a negative sign. These results show that all independent variables have long-run cointegration effects of the dependent variable. Thus, this indicates that 1 % increase in CO2 emission, T, and HC will increase the dependent variable at 1.77, 0.87, and 1.17. However, a 1 % increase in the EU will decrease the dependent variable at 2.25. Besides that, all independent variables also have a long-run effect in China, whereby CO2, T, and HC are positive and statistically significant at 1 % level, while EU is negative and significant at 5 % level. This shows that 1 % increase in CO2, T and HC will increase the dependent variable 1.07, 0.82, and 1.33. However, negative sign of EU shows that 1 % increase in EU will decrease the dependent variable at (1.05). Japan also shows that all independent variables are significant at 1 % level except CO2, which is positive and significant at 5 % level, thus, indicates that 1 % increase in CO2, T and HC will increase the dependent variable at 0.21, 0.91, and 0.76. EU shows negative and statistically significant at 1 % level. This indicates that 1 % increase in EU will decrease the dependent variable at 2.21. Finally, all independent variables show significant effects for India at 1 % level for CO2 and EU. Furthermore, T is positive and statistically significant at 5 % level and HC at 10 % level, thus, indicates that 1 % increase in T and HC will increase the dependent variable at 0.73 and 0.50 while, 1 % increase in CO2 and EU will decrease the dependent variable at 1.09 and 1.56. The empirical results of the study on the positive relationship between CO2 emissions and economic growth are in line with the findings of Bozkurt and Akan (2014), while on the negative correlation between CO2 emissions and economic growth are consistent with the findings of Borhan et al. (2012) and Ejuvbekpokpo (2014). Similarly, the empirical results on energy consumption and economic growth relationship are in line with the finds of Saatci and Dumrul (2013).

Though, it has been observed in the literature that usually CO2 emissions affect destructively economic growth in the absence of not using green technology or not following the environmental protection agency rules. However, the empirical results for the individual analysis across countries reveal that the impact of CO2 emissions in case of the USA, China, and Japan is positive and it implies that these countries are either using green technology or implementing the environmental protection agency rules. While in the case of India, the estimated coefficient found is significantly negative and it indicates that only country’s top CO2 emitter India is yet not using green technology or violating the environmental protection agency rules which need more concentration. Therefore, the empirical results of the study found are robust and statistically accepted and plausible for further policy implication.

Concluding remarks

This study is conducted in order to analyze the hypothesis that whether CO2 emission has a positive/negative impact on economic growth in four countries from different region covering developing countries namely India and China and developed countries namely Japan and the USA. Annual data over the period of 1971 to 2013 were employed. The association between pollution measured by CO2 emissions and economic growth is checked along with some other variables namely energy usage, trade, and human capital. The panel FMOLS method is employed as an analytical technique for parameter estimation. The panel group FMOLS results reveal that almost all variables are statistically significant at percent level, whereby test rejects the null hypotheses of non cointegration, demonstrating that all variables play an important role in affecting the economic growth role across countries. CO2 emissions and energy use show significantly negative impacts on economic growth, for trade and human capital, they tend to show the significantly positive impact on economic growth. However, for the individual analysis across countries, the panel estimate suggests that CO2 emissions have a significant positive relationship with economic growth for China, Japan, and the USA, while it is found significantly negative in case of India during the period under the study.

The empirical findings of the study suggest that appropriate policies are required in order to reduce pollution emerging from other than liquefied fuel consumption. Energy generating from fuel consumption and trade boosting from faster communication are found to have a desirable impact on the environment, and these two factors are also becoming the key factors playing an important role in the process of economic development. Therefore, both developed and developing countries required to make the environment less pollutant by controlling pollution forming from undesirable factors. Among many other economic benefits of condensing pollution have increased crop yield, timber yields, livestock productivity, decreased risk of illness, and death and, thereby, enhance human capital and help in sustaining sustainable economic growth and development.

A suggestion for future research is that it may be remarkable to conduct a cross country as well using panel data covering the top ten CO2 emissions countries including EU28. Empirical findings from such, further research are expected to produce the findings more expressive for policy consideration.

References

Aikins EKW (2012) Evidence of climate change (global warming) and temperature increases in Arctic areas. Int Scholar Sci Res Innov 6(12):1453–1458

Aikins EKW (2014) The relationship between sustainable development and resource use from a geographic perspective. Nat Res Forum 38:261–269

Alam A (2013) Nuclear energy, CO2 emissions and economic growth: the case of developing and developed countries. J Econ Stud 40(6):822–834

Alam A, Azam M, Abdullah A, Malik IAI, Khan A, Hamzah TA, Faridullah, Khan MM, Zahoor H, Zaman K (2014) Environmental quality indicators and financial development in Malaysia: unity in diversity. Environ Sci Pollut Res 22(11):8392–8404

Auci S, Trovato G (2011) The environmental Kuznets curve within European countries and sectors: greenhouse emission, production function and technology. MRPA Paper No. 53442. Retrieved from http://mpra.ub.uni-muenchen.de/53442/1/MPRA_paper_53442.pdf

Azlina AA, Law SH, Mustapha NHN (2014) Dynamic linkages among transport energy consumption, income and CO2 emission in Malaysia. Energy Policy 73:598–606

Bhattacharya M, Lean HH, Bhattacharya S (2014) Economic growth, coal demand, carbon dioxide emissions: empirical findings from India with policy implications. Department of Economics, Discussion Paper 47/14. Monash University, Caulfield

Borhan H, Ahmed EM, Hitam M (2012) The impact of CO2 on economic growth in ASEAN-8. Procedia Soc Behav Sci 35:389–397

Bozkurt C, Akan Y (2014) Economic growth, CO2 emissions and energy consumption: the Turkish case. Int J Energy Econ Policy 4(3):484–494

BP (2014) BP Statistical Review of World Energy 2011–2014. Available at http://www.bp.com/en/global/ corporate/about-bp/energy-economics/statistical-review-of-world-energy.html

Campbell JC, Perron P (1991) Pitfall and opportunities: what macroeconomists should know about unit roots. NBER Technical Working Paper No. 100

Canadell JG, Le Quere C, Raupach MR, Field CB, Buitenhuis ET, Ciais P, Marland G (2007) Contributions to accelerating atmospheric CO2 growth from economic activity, carbon intensity, and efficiency of natural sinks. Proc Natl Acad Sci 104(47):18866–18870

Chang C-C (2010) A multivariate causality test of carbon dioxide emissions, energy consumption and economic growth in China. Appl Energy 87(11):3533–3537

Dreger C, Reimers HE (2005) Health care expenditures in OECD countries: a panel unit root and cointegration analysis. The Institute for the Study of Labor (IZA) Discussion Paper No. 1469, Bonn, Germany

Ejuvbekpokpo SA (2014) Impact of carbon emissions on economic growth in Nigeria. Asian J Basic Appl Sci 1(1):15–25

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation and testing. Econometrica 55(2):251–276

Farhani S, Rejeb JB (2012) Energy consumption, economic growth and CO2 emissions: evidence from panel data for MENA region. Int J Energy Econ Policy 2(2):71–81

Friedlingstein P, Houghton RA, Marland G, Hackler J, Boden TA, Conway TJ, Canadell JG, Raupach MR, Ciais P, Le Quere C (2010) Update on CO2 emissions. Nat Geosci 3(12):811–812

Galor O, Weil DN (2000) Population, technology, and growth: from Malthusian stagnation to the demographic transition and beyond. Am Econ Rev 90:806–824

Ghosh S (2010) Examining carbon emissions economic growth nexus for India: a multivariate cointegration approach. Energy Policy 38(6):3008–3014

Ghosh BC, Alam KJ, Osmani AG (2014) Economic growth, CO2 emissions and energy consumption: the case of Bangladesh. Int J Bus Econ Res 3(6):220–227

Hadri K (2000) Testing for unit roots in heterogeneous panel data. Econ J 3:148–161

Hall A (1990).Testing for a unit root in time series with pretest data-based model selection. North Carolina State University Working Paper, 1990

Hall A (1994) Testing for a unit root in time series with pretest data-based model selection. J Bus Econ Stat 12(4):461–470

Harris R, Sollis R (2003) Applied time series modelling and forecasting. John Wiley, Chichester

Haseeb M, Azam M (2015) The energy consumption, economic growth and CO2 emission nexus: evidence from Pakistan. Asian J Appl Sci 8(1):27–36

Hatemi A, Irandoust M (2005) Energy consumption and economic growth in Sweden: a leveraged bootstrap approach, 1965–2000. Int J Appl Econ Quant Stud 2(4):87–98

Hurlin C (2004) Testing Granger causality in heterogeneous panel data models with fixed coefficients. Document de recherche LEO

Hwang JH, Yoo SH (2014) Energy consumption, CO2 emissions, and economic growth: evidence from Indonesia. Qual Quant 48(1):63–73

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(revise version of 1997’s work):53–74

JRC/PBL (2012) Emission Database for Global Atmospheric Research (EDGAR), release version 4.2 of 11 November 2011 and version 4.2 FT 2010 released in 2012. European Commission, Joint Research Centre (JRC) and PBL Netherlands Environmental Assessment Agency, Ispra/The Hague. Available at: http://edgar.jrc.ec.europa.eu

Le Quere C, Andres RJ, Boden T, Conway T, Houghton RA, House JI, Zeng N (2012) The global carbon budget 1959–2011. Earth Syst Sci Data Discuss 5(2):1107–1157

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87(6):1858–1864

Levin A, Lin CF (1992) Unit root test in panel data: asymptotic and finite sample properties, University of California at San Diego, Discussion Paper 92–93

Levin A, Lin CF (1993) Unit root test in panel data: new results. University of California at San Diego, Discussion Paper 93–56

Levin A, Lin C, Chu CJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econ 108(1):1–24

Lim K-M, Lim S-Y, Yoo S-H (2014) Oil consumption, CO2 emission, and economic growth: evidence from the Philippines. Sustainability 6:967–979

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61(S1):631–652

McCoskey SK, Selden TM (1998) Health care expenditure and GDP: panel data unit roots test results. J Health Econ 17:369–376

Menyah K, Wolde-Rufael Y (2010) Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ 32:1374–1382

NBS (2014) Statistical Communique of the People’s Republic of China on the 2013 National Economic and Social Development. National Bureau of Statistics of China. Available at http://www.stats.gov.cn/english/PressRelease/201402/t20140224_515103.html

Olivier JGJ, Janssens-Maenhout G, Muntean M, Peters JAHW (2014) Trends in global CO2 emissions; 2014 Report, The Hague: PBL Netherlands Environmental Assessment Agency; Ispra: European Commission, Joint Research Centre

Pao H-T, Tsa C-M (2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38:7850–7860

Papiez M (2013) CO2 emissions, energy consumption and economic growth in the Visegrad Group countries: a panel data analysis. 31st International Conference on Mathematical Methods in Economics 2013, 696–701

Pedroni P (1996) Fully modified OLS for heterogeneous cointegrated panels and the case of purchasing power parity, Indiana University Working Papers in Economics, No. 96–020

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61:653–670

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. Adv Econ 15:93–130

Pedroni P (2001) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83(4):727–731

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econ Theory 20:597–625

Phillips P, Hansen B (1990) Statistical inference in instrumental variables regression with I(1) processes. Rev Econ Stud 57:99–125

Quah D (1992) The relative importance of permanent and transitory components: identification and some theoretical bounds. Econometrica 60:107–118

Quah D (1994) Exploiting cross-section variation for unit root inference in dynamic data. Econ Lett 44:9–19

Rahman AFMA, Porna AK (2014) Growth environment relationship: evidence from data on South Asia. J Account Finance Econ 4(1):86–96

Saatci M, Dumrul Y (2013) The relationship between energy consumption and economic growth: evidence from a structural break analysis for Turkey. Int JEnergy Econ Policy 3(1):20–29

Saboori B, Sulaiman J (2013) Environmental degradation, economic growth and energy consumption: evidence of the environmental Kuznets curve in Malaysia. Energy Policy 60:892–905

Said SE, Dickey DA (1984) Testing for unit roots in autoregressive-moving average processes of unknown order. Biometrika 71:599–607

Saidi K, Hammami S (2015) The impact of CO2 emissions and economic growth on energy consumption in 58 countries. Energy Rep 1:62–70

Schaefer A (2013) The growth drag of pollution. University of Leipzig, Institute of Theoretical Economics / Macroeconomics, Grimmaische Strasse, Leipzig, Germany. Retrieved from http://www.wifa.uni-leipzig.de/fileadmin/user_upload/itvwl-vwl/makro/team/schaefer/InPol1.pdf

Schwert GW (1989) Tests for unit roots: a Monte Carlo investigation. J Bus Econ Stat 7:147–160

Sebri M, Salha BO (2014) On the causal dynamics between economic growth, renewable energy consumption, CO2 emissions and trade openness: fresh evidence from BRICS countries. Renew Sust Energ Rev 39:14–23

Shahbaz M, Feridun M (2012) Electricity consumption and economic growth empirical evidence from Pakistan. Qual Quant 46(5):1583–1599

Srivastava DK, Kumar KS, Rao, CB, Purohit BC, Sengupta B (2010) Integrating pollution-abating economic instruments in goods and service tax (GST) regime. Discussion Paper, Project Funded by British High Commission, New Delhi, Project Executed by Madras School of Economics, Chennai

USGS (2014) Cement statistics and information, and other commodities. US Geological Survey. Internet: http://minerals.usgs.gov/minerals/pubs/commodity/cement/mcs-2014-cemen.pdf

World Development Indicators (2015) The World Bank database. Available at http://data.worldbank.org/data-catalog/world-development-indicators

WSA (2014) World Steel in Figures 2014. World Steel Association. Available at: http://www.worldsteel.org/dms/internetDocumentList/bookshop/World-Steelin-Figures.2014/document/World%20Steel%20in%20Figures%202014%20Final.pdf

Yang Z, Zhao Y (2014) Energy consumption, carbon emissions, and economic growth in India: evidence from directed acyclic graphs. Econ Model 38:533–540

Zhao T, Ren XS (2013) The empirical research of the causality relationship between CO2 emissions intensity, energy consumption structure, energy intensity and industrial structure in China. The 19th International Conference on Industrial Engineering and Engineering Management, pp. 601–609

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Rights and permissions

About this article

Cite this article

Azam, M., Khan, A.Q., Abdullah, H.B. et al. The impact of CO2 emissions on economic growth: evidence from selected higher CO2 emissions economies. Environ Sci Pollut Res 23, 6376–6389 (2016). https://doi.org/10.1007/s11356-015-5817-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-015-5817-4