Abstract

We analyse the determinants of the regional disparity of FDI inflows to Russia. The spatial distribution of FDI is attributed to regional and/or trans-regional factors. Region specific characteristics such as wage, education level, transportation as well as gross regional product, which accounts for market size, in host and alternative regions are considered to analyze the spatial interaction between regions employing spatial econometrics. We find that shocks to FDI levels in proximate regions have no effect on FDI inflows to hosts. However, FDI in a region depends on spatial market size and endowment of natural resources in alternative host regions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Foreign direct investment (FDI) emerges from firms engaging in international activity, which can be in two different forms, i.e. international trade and foreign direct investment. Sometimes these two types of international activities become complementary but sometimes one substitutes for the other. Market access and cost reduction are the two main motivations for firms engaging in FDI. Depending on the market targeted, the type of FDI can be identified as purely horizontal if firms prefer to supply the domestic market of the host, or as export-platform FDI if the firms use the host to have easier access to proximate markets (see Blonigen et al. 2007 for a comprehensive evaluation). On the other hand, vertical FDI refers to investments made to reduce costs of production by having access to some of the location advantages of the host country, such as cheap labour.Footnote 1 Additionally, in resource rich countries such as Russia, resource seeking constitutes one of the primary motivations of FDI.Footnote 2

Russia, stretched across the Eurasian plains and mountains, is geographically the largest country in the world. With its vast natural resources, large market and skilled labour force, it is the perfect location for FDI. However, these resources and other features of the Russian Federation are not evenly distributed among the republics, oblasts and krais. Footnote 3 Therefore, we observe the agglomeration of multinational enterprises (MNEs) in some regions rather than others. There may be many different reasons for this unequal distribution of FDI among Russian regions including region-specific characteristics as well as the competition between them to attract FDI. Hence, this paper is designed to investigate the causes of the regional disparity in attracting FDI.

Following the upsurge in FDI flows around the world in the late 1990s and early 2000s, determinants of FDI have attracted more attention of researchers. Uneven distribution of FDI between regions of destination countries has led many to investigate the determinants of this issue. Economic geography and regional development literatures became the main sources of studies on the determinants of regional FDI. These studies discovered that the level of economic activity in a region depends on others. The interaction or dependence of proximate regions can generate agglomeration effects augmenting the overall economic activity in those regions.

There are three main strands of empirical literature that can be used to address the interaction issue, i.e. gravity models,Footnote 4 market potential modelsFootnote 5 and spatial models. The spatial dependence models rest on the argument that FDI into a host country is not independent of FDI to alternative hosts therefore a structure which captures this dependency needs to be incorporated into the models. A number of papers use spatial models to explain the main factors affecting the location choice of multinational enterprises. Some of these studies focus on the regions in a country while others examine an economic region such as the EU or a geographic region such as the Central and Eastern European Countries (CEEC).

In this paper we investigate the reasons of regional disparity in FDI inflows to Russian regions in the 1995–2003 period. We account for the region specific characteristics in both the host and alternative regions, and the spatial interaction between them. The contribution of this paper is two-fold. First of all, we use the additions to fixed capital investment by foreign firms as the indicator of FDI rather than the amount of inflows only.Footnote 6 This variable includes reinvested profits by foreign firms as FDI. Secondly, we analyse how the target region is affected by FDI flowing into other regions and by the socio-economic characteristics of the regions in Russia. Accordingly, we use a spatial model developed for these purposes with both time and cross-section dimensions.

The rest of the paper is designed as follows: “FDI inflows to Russian regions” section introduces the idea of location and spatial dependence models. Spatial econometrics methodology and the data are explained in “Spatial dependence models, methodology and data” section followed by the results of empirical analysis. Finally, “Conclusion” section provides with some suggestions on how to interpret estimation coefficients and some policy recommendations.

FDI Inflows to Russian Regions

Although it is the smallest of the G8 economies, Russian gross domestic product (GDP) is measured in trillions of dollars.Footnote 7 As a result of the transition from a planned centralized economy to a decentralized liberal system, Russia opened up its doors to foreign investors. Despite the fact that it has started far behind, FDI inflows to Russia has increased from 2.02 billion dollars in 1995 to 9.42 billion dollars in 2004, with an approximate average of 1 million dollar increase per year. Just before the recent financial and economic crises that surrounded the world, developments in the world economy (such as rising oil prices) caused FDI to Russia to increase from $14.6 billion in 2005 to $45 billion in 2007. The total amount of FDI inward stock to Russian Federation reached $271.6 billion by the end of 2006.

Similar to many developing countries, Russian Federation enacted some reforms to attract FDI and thereby increase GDP. These reforms and regulations varied between regions and republics. Unfortunately, preferential treatment of foreign investors, by district governments, through special FDI laws and regulations,Footnote 8 has not improved the FDI performance of less developed regions in Russia. The efforts failed and the Russian Federation could not fulfil the expectations in terms of FDI inflows that are proportional to its size and to its endowment of human capital and natural resources in early 2000s (Fabry and Zeghni 2002). Iwasaki and Suganuma (2005) attribute this poor performance to the badly executed policy measures.

Brock (1998) observes that in the mid-transition period of Russia, FDI has provided externalities and induced growth for the local economies by changing the business culture as well as introducing best practices.Footnote 9 Relatively developed regions, which have attracted the major part of FDI, became the motor of the whole economy in Russia. Obviously, the uneven distribution of investment across regions leads to uneven development, posing a threat for political and economic stability.

The distribution of FDI among Russian regions is in a way predetermined by natural resources. In other words, a region with oil or natural gas reserves is bound to attract more FDI than a region in the Siberian nowhere. Therefore, the link between regional and sectoral FDI is quite close and tight. Hence, the allocation of FDI across sectors is a good indicator of the distribution across Russian regions.

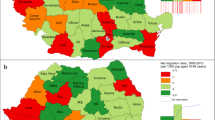

Table 1 shows that the FDI inward stock by the end of 2006 has gone mostly to final goods and energy sectors. Among these sectors, oil extraction constitutes 19.9 %, iron and steel 7.5 %, other metals 7.9 %, machinery 3.9 % and chemicals 2.2 % of FDI inward stock. These figures help to explain why the Sakhalinskaya Oblast—being the centre of oil and natural gas extraction—has attracted 29.6 % of total FDI. The high share of the trade and food industry (32 % in total) gives evidence for the multinational investors’ view of Russia as a large market rather than a production centre. Hence, they invest in regions with a large and active market, e.g. in Moscow city, which on its own attracted 36.5 % of total FDI inflows in 2003. In contrast, the Moskovskaya Oblast,Footnote 10 which is the industrial region around Moscow, obtained only 10.4 %Footnote 11 and the second largest city in the Russian Federation, Saint Petersburg could attract only 2.1 % of total inflows in the same year. In other words, only some of the 89 regions that form the seven federal states in Russian Federation can benefit from the externalities generated by FDI because of agglomeration of MNEs.

Brock (2005) notes that the total FDI inward stock in Russia is actually the sum of the FDI attracted by the regions and that FDI has played an important role in regional development. In other words, investors treat Russian regions as separate markets from Russia and decide on the location by considering the regulations and investment promotion mechanisms in addition to economic factors.

In most studies on Russia, regions are evaluated only with respect to host characteristics such as the market size, climate, education level and local investments, as used by Broadman and Recanatini (2001) to explain the regional FDI and total FDI in Russia, for the period between 1995 and 1999. Cost of labour, transportation infrastructure and investment rating score of the ‘Expert Magazine’ are the other explanatory variables and have been found to have a significant impact on FDI. In addition to these traditional explanatory variables, Iwasaki and Suganuma (2005) emphasize the stance of local government to attract FDI in the form of free economic zones (FEZ) or production sharing agreements (PSA) when examining the regional distribution of FDI in the regions of Russian Federation.

However, there is interdependence between regions—especially neighbours- in terms of economic activity. Therefore, the potential of neighbouring regions for FDI and their characteristics should also be taken into consideration while investigating the determinants of regional FDI. Only, Ledyaeva (2009), following the pioneers in spatial FDI literature (Baltagi et al. 2007; Blonigen et al. 2007) adopts the spatial economics approach and includes the market size of other regions into the analysis on distribution of FDI in Russia.Footnote 12 While including market size of other regions and the FDI they attract, she excludes region specific characteristics and ignores their impact on FDI distribution. In fact, when there are no borders to cross or economic barriers to overcome, the neighbouring or close by regions have some interaction with each other. Including this interaction into the models is expected to increase the explanatory power of any analysis of regional FDI.

Spatial Dependence Models Methodology and Data

A firm deciding to invest in the Russian Federation might consider many alternative regions but will invest in only one, i.e. foreign investment in a host region is investment forgone for the others. One might, on the other hand, argue that foreign investment in a region can generate a gravitational pull for other foreign investments to proximate regions because of the agglomeration effects. All in all, investment decision in one region may influence the amount of investment not only in that region but also in alternative hosts. This causes the observations in one location to depend on observations in other locations, i.e. spatial dependence or autocorrelation (LeSage 1999). Failing to address spatial dependence in data would lead to inefficient parameter estimates (Anselin 1999; LeSage 1999). Hence, we consider the spatial dependence that the data might exhibit in the estimation of this model. The dependency of economic activity in a region on the size of economic activity and other variables of its proximate regions can be best modeled using spatial econometrics, which have become a widely used technique to analyze such a relationship.Footnote 13

Spatial models have two spatial elements, i.e. the spatial lag term and the spatial error structure. The spatial lag term reflects the influence of spatially weighted neighbouring units on the dependent variable. The spatial error structure captures the spatial correlation in the error term that remains after taking the influence of explanatory variables into account. The most general form of a spatial autoregressive model is

where y contains the nx1 vector of cross-sectional dependent variables, X is the nxk matrix of explanatory variables, W 1 and W 2 are nxn spatial weight matrices. By making assumptions about W 1 and W 2 we can get the most widely used structures, i.e. spatial autoregression models (SAR) and spatial error models (SEM).

If W 2 = 0 then the structure becomes a mixed regressive-spatial autoregressive (SAR) model (LeSage 1999):

These (spatial lag) models establish a direct relationship between the FDI a region gets and FDI received by other regions. As Blonigen et al. (2007) point out SAR models exhibit whether the location choice of a multinational company was singling out a host among many, i.e. substitution or whether it was complementary due to agglomeration. In these models, the strength of spatial dependence is indicated by the explicitly defined spatial relationship between dependent variables, i.e. in the form of spatial dependence parameter (ρ). Here, Wy shows the spatially weighted dependent variable. This specification allows us to observe whether the foreign direct investments in a region at a given time period have been affected from FDI into other regions or not.

On the other hand, if W 1 = 0 then we get spatial autocorrelation in disturbances, i.e. SEM models:

These models impose a specific structure to the unobserved determinants of FDI, which in traditional models would be captured by the error term (Blonigen et al. 2007). The ‘spatially-treated error structure’ may improve standard errors and decrease residual sum of squares but it will not affect the point estimates (Blonigen et al. 2007). In this model the error term is different from the SAR specification. Here, we have a spatially autocorrelated error term, u. λ is the coefficient of weighting matrix and ε is the standard error term. With this structure, we expect to see whether FDI to a region is affected from FDI shocks in other regions. Following Blonigen et al. (2007) Footnote 14 we consider this possible spatial dependence in the form of spatially correlated error terms in the estimation of our model.

In addition to the characteristics of the host region, features of the proximate regions also play an important role in the location choice. A multinational firm evaluating the alternative locations for its investment will consider and compare the characteristics of all potential hosts. Including only the characteristics of the host region in the model is not sufficient to explain the FDI flows. Therefore, this study incorporates the alternative region characteristics in the estimations by multiplying the explanatory variable matrix with the weighting matrix. Hence, in addition to the two model structures explained above (SAR and SEM), we estimate two more models. These are actually extensions of those two most extensively used structures. The Durbin-spatial autoregression (DSAR) model extends the SAR model by including the spatially weighted explanatory variables, WX to the SAR specification mentioned above and thus by incorporating the features of other regions in determining the regional FDI. We can observe how FDI to other regions and region-specific characteristics (own and other) affect the host region FDI inflows. Whereas the general spatial error model (GSEM) adds the spatially weighted explanatory variables matrix to the right hand side of the SEM model. Table 2 gives a summary of all the model structures used.

The essence lies in including the interdependence between alternative hosts or proximate regions into the estimation model with specifically defined weights.Footnote 15 The weights are used to position all alternative regions with respect to each other as elements of a symmetric matrix that includes all the regions in rows and in columns, i.e. the weighting matrix (W). In spatial econometrics analysis, the choice of W structure determines the way interaction between two regions is defined. There are a number of alternatives available in terms of defining W. First, it is possible to allocate 1 to the neighbors and 0 to all non-neighbor regions, i.e. addressing only neighborhood effects (see Coughlin and Segev 2000). This type of weighting matrix assumes interaction among only bordering regions causing a bias in favor of neighbors. In order not to exclude proximate regions, which may have more interaction than some neighbors, from the evaluation of FDI determinants, we do not use this structure. Second method constructs the weighting matrix by defining an impact frontier and ignoring the changes further away. The regions within this frontier would be weighted according to the distance from the target region (see Blonigen et al. 2007). However, this structure excludes all the far away regions or causes islands to be formed in the Russian case. Additionally, there is no consensus on how to determine the impact frontier. Therefore, in this study we prefer to use the third method and take the distance between district centers to weight the regional features as in many previous studies (Baltagi et al. 2007) and as suggested by Anselin (1999).Footnote 16 As a result, we consider all the regions without causing any islands to be formed. The weighting matrix we choose helps us explain FDI with respect to geographic proximity of all feasible alternatives.

Data used in this study is obtained from the official publication of the Federal State Statistics Service of the Russian Federation (Rosstat) titled “Russian Regions, Social and Economic Indicators” for 2004 and 2005 (Rosstat 2004, 2005). The Russian Federation has 89 administrative regions of which 21 are republics, 6 krais, 49 states, 10 autonomous regions, 1 autonomous state and 2 federal cities, i.e. Moscow and St. Petersburg. Some data for autonomous regions are collected as part of their associated states therefore we choose to do the same for all variables. Five regions have no data for foreign investments and 10 have some gaps in the data. Therefore, our dataset covers 64 regions for the period between 1995 and 2003. All monetary variables are obtained in Ruble and converted to real dollar values.

In most statistical databases, FDI data usually covers only the initial investment made by foreigners however firms usually reinvest part of their profits in the years after establishment. Therefore, they continue to contribute to the capital stock of the economy. Hence, investment in fixed capital of organisations with foreign charter capital, as the dependent variable, is a better measure for our purposes. We have 576 observations for 64 regions, of these, 18 have zero as the value of additions. These have been included as 0.001 into the dataset.Footnote 17 As far as the regional distribution of FDI goes, Russian Federation experiences a high polarization. Cumulatively Moscow City and St. Petersburg City, together with Krasnodar territory, Tyumen region, Moscow region, Tatarstan republic, and Sakhalin region have received the most FDI. Moscow City and St. Petersburg City are the largest cities in Russia and they have federal entity status whereas Moscow oblast is where the industry in Moscow is located. The other four regions have important oil and natural gas reserves and are among the most attractive regions on a yearly basis. Most of the figures for the dependent variable range between zero and 20 million dollars but taking the logarithm of FDI variable ensures we have an approximately normal distribution (see Table 3).

Gross regional product (GRP) is used to capture the size of the economic activity in each region.Footnote 18 An increase in GRP is evaluated as the enlargement of the market and is supposed to have a positive impact on FDI. Therefore, we expect the GRP variable to have a positive sign in the estimations. Since population and GRP are usually considered as alternative measures of market size in FDI studies, we do not include population in the model. In order to represent the regional differences of the labour market in our estimations we employ two variables, i.e. UNEMP that shows the observed unemployment rate is expected to capture availability of workers and EDU, which is the number of vocational and higher education graduates, shows the skill level of the labour force. As the skill level increases we claim that the region will attract more FDI therefore the sign of EDU variable is expected to be positive. Similar proxies for labour supply characteristics have been employed in prior studies, such as illiteracy rate (Coughlin and Segev 2000) and education level (Broadman and Recanatini 2001).

WAGE, which denotes the average regional wage, actually reflects the labour compensation. Since we do not have unit labour cost, we include this variable to capture the impact of labour cost on FDI. As average wage increases, we expect vertical FDI to decrease. However, if the main motivation for FDI is not cost-reduction, i.e. vertical, then the sign of the parameter is indeterminate. On the other hand, this variable may as well be an indicator of the average income per worker. In that case, we would expect the sign of WAGE parameter to be positive displaying increased attractiveness of the region as average income per worker increases. While, Broadman and Recanatini (2001) directly include the cost of labour, Coughlin and Segev (2000) use average productivity adjusted nominal wage and overall labour productivity in each province to test for the effects of labour cost on FDI inflows to China.

Regional transportation cost index (TRANS) is a proxy for the cost of transportation within a region. We assume that high regional transportation costs may, ceteris paribus, deter foreigners from investing to that region so the expected sign of TRANS variable is negative. In order to embody the infrastructure of the region we use the number of telephones per 1,000 persons (TEL) as another independent variable. Many studies in the literature, such as Broadman and Recanatini (2001), take a similar approach and include infrastructure variables. For example, Iwasaki and Suganuma (2005) use kilometres of paved roads per person, kilometres of railway per 1,000 km2 and number of telephone units per 1,000 people as the elements of the second component of urbanization.

Extraction of energy producing materials draws a high percentage of FDI inflows to the Russian Federation. In order to identify the impact of resource-seeking FDI in regional distribution, we include a dummy variable, which takes one if there is some sort of natural gas or oil in the region and 0 otherwise. The presence of natural resources, i.e. the RESOURS variable, is expected to have a positive parameter sign. These types of variables that account for the differences in endowments between regions are widely used in the literature. Iwasaki and Suganuma (2005) use potential rating of natural resources by region as the resource variable.

The spatially lagged FDI and spatially weighted dependent variables have unpredictable effects on FDI flows to a host region. Wy can have a negative or a positive value depending on whether there is substitution or agglomeration. Similarly, we anticipate most of the WX variables to take opposite signs for alternative host region effects (see Table 4) .Footnote 19

Some studies in the literature emphasize the importance of institutional factors such as ‘sound legal and economic environment’ (Carstensen and Toubal 2004), decentralization and respective institutional arrangements (He 2006) and political stability (Chakrabarti 2003). Although, Fabry and Zeghni (2002) claim institutional factors to be important in determining total foreign investments in Russia, Bevan and Estrin (2004) find that ‘host country risk’ is an insignificant determinant of FDI in European transition economies. Since the results on the significance of these variables are disputable and it is difficult to find disaggregated data for institutional factors on Russian regions, we do not explicitly incorporate institutional differences between Russian regions however the panel data models capture these region specific characteristics.

Results

The spatial analysis of FDI interdependence between Russian regions reveals that regional FDI in Russia does not generate agglomeration or substitution effects but foreign investors choose the location by considering the region-specific characteristics in all alternatives. We derive this result from two groups of estimations. The first group, estimated as a benchmark for comparison purposes, ignores the impact of alternative-host-region features on FDI inflows to a location. The second group incorporates these alternative-host-region characteristics to determine whether they have any influence on regional distribution of FDI. These characteristics are included as a weighted average of the alternative regions, where the weight attached changes inversely with distance. Both groups of estimations use two model specifications, one with a spatial lag dependent variable and the other with spatial disturbances in the error term. The estimation results are given in Table 5.Footnote 20 The first two models are the specifications defined by Eqs. (2) and (3), above and are included as benchmark models. Both of these SAR and SEM specifications show quite similar results. The coefficient estimates are close in terms of value and the parameter signs do not change from one model to the other. The second group of estimations, which include the spatial effects of proximate region characteristics to the analysis, use DSAR and GSEM models, reported in the third and fourth columns of the table.

In the benchmark models gross regional product, unemployment, education level, average regional wage, number of telephones and presence of natural resources all have significant estimates and all, but only unemployment, have a positive sign. In contrast to these variables, regional transportation cost index have no significant impact.

The coefficient estimates in the DSAR and GSEM models are again similar to each other. However, this time the unemployment variable has become insignificant with the inclusion of other region characteristics. Yet, it is observed that the error terms in these models are far from being normally distributed and they have a significant autocorrelation problem. The error term correlation structure indicates correlation with 1 year lag. Consequently, we utilize the AR(1) model to get better estimates for both of the spatial models. The autocorrelation corrected estimation results, which report the best specifications, are shown in the last two columns of the table.

The results indicate that as the market size of a region increases the amount of FDI it attracts increases as well. To be exact, a one per cent increase in GRP, i.e. market size, increases FDI by 0.48 %. On the other hand, the average GRP of alternative regions affects FDI negatively, i.e. if WGRP increases by 1 % then FDI in the host region is expected to decrease by 0.26 %. This result implies that regions are competing with each other to attract FDI and those with greater GRP can divert the FDI that might go to proximate regions.

We also observe that host-region-specific features such as natural resources, education level, average regional wage and infrastructure influence the FDI inflows indicated by the positive and significant coefficients. The presence of oil and natural gas reserves causes FDI to be approximately 2.4 times more in the host region, whereas it reduces FDI inflows if located in alternative hosts. The average regional wage, which measures the income per worker, influences FDI inflows as the increases in purchasing power would, i.e. positively. Therefore, as the income per worker increases, the attractiveness of the region for market-seeking FDI increases. The estimation results also show that spatially weighted socioeconomic characteristics of alternative-host-regions have no significant effect on FDI inflows. All of these results actually point to the same fact that FDI inflows to Russian regions are diversified as either market oriented or resource seeking. Regions with large markets attract FDI and regions, which have oil and/or natural gas, attract foreign investors that have obtained extraction rights from local and federal governments.

Other than the significance of spatially weighted market size and resource variables, we find no evidence for spatial dependence, whether represented by spatial lag or spatial error structure. The spatial lag parameter in the SAR models measures the effect of FDI inflows to other regions on the FDI in the host region, i.e. the agglomeration or the substitution effects. The spatial error parameter in the SEM models, on the other hand, shows the impact of a shock observed in the other regions on the FDI levels of the host region. The results reveal that neither the spatial lag (ρ) nor the spatial error (λ) structures have a significant effect on FDI inflows, implying that the FDI level in a region is not influenced by the FDI inflows or the shocks occurring in the alternative regions. In other words, FDI inflows to Russian regions do not generate agglomeration or substitution effects.

Conclusion

In this study, we examined the causes of regional disparity of FDI in Russia using spatial models that integrate proximate region features into analysis, i.e. DSAR and GSEM models. The motivation of foreign firms for investing in Russian regions gives some evidence of the causes of regional distribution of FDI. Diverging from Blonigen et al. (2007) criteria for deciding the type of FDI, which states that if the FDI motivation is purely horizontal then the spatial lag variable and the spatially weighted market potential variable will be zero and the signs of spatial lag and spatial market size variables are expected to be negative and positive, respectively for export-platform FDI, our findings show that the spatial lag variable is statistically zero and the spatially weighted market size variable is negative. This indicates that FDI inflows to other regions do not have any impact on FDI inflows to the host region. Nevertheless, if alternative-host-regions have larger markets, then FDI in a region will decrease. In other words, FDI in Russia is located with respect to the market size of the regions.

The other variable which shows a spatial dependence is the resource variable. We get a negative sign for the spatially weighted resource variable meaning that if there are more regions with resources then FDI inflows to a region will be negatively affected.

In conclusion, regional diversity of FDI in Russia is the result of differences in market size and resource endowments. Given the market size in each region, favourable factors of production increases the FDI inflows but have no effect on FDI received by proximate regions. Given everything else, a 1 % increase in the spatially weighted market size of alternative-host-regions will affect the FDI inflows to the host region by half the change caused as a result of a similar increase in its own GRP, but of course, negatively. Regions rich in endowment of natural resources attract FDI flows away from other regions.

Although there is dependence of FDI in a region on market size and endowment level of other regions, the FDI decision does not lead to a zero-sum game for Russian regions. The high but unexploited FDI potential of Russian regions create this result, which finds its roots in the theoretical model of Altomonte (2008). The dynamic nature of integration causes positive profits in a region, which attract multinational enterprises until these profits are eroded because of fierce competition and exploitation of resources leading to a new equilibrium with a higher foreign capital stock.

Since foreign investors come to Russia with quite limited motivations, i.e. market or resource, and this fact restricts the manoeuvre area for local authorities to develop strategies that would attract more FDI. Presence of resources has to be taken as given, you either have it or not. It’s not possible to transfer natural resources from one region to another. Therefore, any strategy to improve FDI flows into Russian regions should emphasize the opportunities each region can offer to foreign investors.

Notes

See Blonigen (2005) for a survey of the empirical literature on FDI determinants.

Blonigen et al. (2007) mention resource-seeking FDI as part of vertical-complex type.

Krai is mostly translated as province or territory and oblast means region.

These models originate from the seminal paper of Harris (1954) and have been used by Krugman (1992) and others (such as Hanson, 2005) in analysing geographic concentration of economic activity at inter- and intra-national levels such as Head and Mayer (2004), Cieslik and Ryan (2004) and Carstensen and Toubal (2004), Altomonte (2008) investigate the determinants of FDI employing market potential models.

Statistical data sometimes include portfolio investment and business loans as well as direct investment in the foreign investment item. Portfolio investment indicates that although the foreigners have some shares in the firm they have no control over its operations. FDI, on the other hand, means that foreign investors have control over the operations of the company.

It was 1.286 trillion dollars in 2007.

See Bayulgen (2005) for details.

According to Yudaeva et al. (2000) as the share of foreigners grow in a company, the firm becomes more productive and as the foreign share increases in an industry, productivity of the medium-sized firms increases. FDI is observed to force local firms to reorganize and restructure their activities.

The region administered by the city council.

Moscow city and the surrounding region are treated separately.

She estimates the model for three different periods, i.e. 1995–1998, 1999–2002 and 2003–2005. The variables indicate averages in each period.

Coughlin and Segev (2000), who look at the geographic distribution of FDI within China, find that a shock to FDI in one province has a positive effect on FDI in a nearby province. Baltagi et al. (2007) analyse the third country effects on US outward FDI in different industries to various host countries and find evidence for spatial correlation in independent variables and error terms. Emphasizing that FDI into a particular host country is not independent of FDI into alternative host countries, Blonigen et al. (2007) estimate a model, which differentiates between types of US based FDI to OECD countries and find a significant interdependence between the FDI a host country receives and the FDI inflows to its neighbours.

They suggest to use the spatial error model in case that the ‘groups’ are not defined by “specifically observable characteristics but by ‘likeness’ in a way that is best captured by geographic proximity”.

The elements of the weighting matrix are the inverse distances between regions. Following the general practise, rows are normalised to 1. An extensive evaluation of weights can be found in Anselin (1988)

Since the natural logarithms are used in the estimations, substituting such a small number for zero outward FDI observations does not affect the estimation results, however allows us to keep the regions without any FDI at a given period in the data set. Razin et al. (2004) and Eichengreen and Tong (2007) have done a similar fill-in without any change in estimation results.

We could have used GRP per capita to reflect final demand and industry output to capture intermediate demand but these variables are closely correlated therefore we opted for the GRP variable on its own.

Apart from these variables we used domestic investments, profitability, railway and road density as alternative explanatory variables however they were statistically insignificant.

We have calculated the Moran’s I statistics on annual basis. For all years, but only 1999, the statistics show significant spatial autocorrelation.

References

Altomonte C (2008) Regional economic integration and the location of multinational firms. Rev World Econ 143:277–305

Anselin L (1988) Spatial econometrics: Methods and models. Kluwer Academic Publishers, Boston

Anselin L (1999) Spatial econometrics (mimeo) University of Texas, Dallas

Baltagi BH, Egger P, Pfaffermayr M (2007) Estimating models of complex FDI: are there third-country effects? J Econ 140:260–281

Bayulgen O (2005) Foreign investment, oil curse, and democratization: a comparison of Azerbaijan and Russia. Bus Polit 7:1–37

Bevan AA, Estrin S (2004) The determinants of foreign direct investment into European transition economies. J Compar Econ 32:775–787

Blonigen BA (2005) A review of the empirical literature on FDI determinants. NBER Working Paper Series, Cambridge 11299

Blonigen BA, Davies RB, Waddell GR, Naughton HT (2007) FDI in space: spatial autoregressive relationships in foreign direct investment. Europ Econ Rev 51:1303–1325

Brenton P, Di Mauro F, Lucke M (1999) Economic integration and FDI: an empirical analysis of foreign investment in the EU and in Central and Eastern Europe. Empirica 26:95–121

Broadman HG, Recanatini F (2001) Where has all the foreign investment gone in Russia? World Bank Policy and Research Working Paper No. 2640, World Bank, Washington

Brock G (1998) Foreign direct investment in Russia’s regions, 1993–95: why so little and where has it gone? Econ Transit 6:349–360

Brock G (2005) Regional growth in Russia during the 1990 s-What role did FDI play? Post Communist Econ 17:319–329

Buch CM, Kokta RM, Piazolo D (2003) Foreign direct investment in Europe: is there redirection from the South to the East? J Compar Econ 31:94–109

Carstensen K, Toubal F (2004) Foreign direct investment in Central and Eastern European Countries: a dynamic panel analysis. J Compar Econ 32:3–22

Chakrabarti A (2003) A theory of the spatial distribution of foreign direct investment. Int Rev Econ Financ 12:149–169

Cieslik A, Ryan M (2004) Explaining Japanese direct investment flows into an enlarged Europe: a comparison of gravity and economic potential approaches. J Japan Intern Econ 18:12–37

Coughlin CC, Segev E (2000) Foreign direct investment in China: a spatial econometric study. World Econ 23:1–23

Eichengreen B, Tong H (2007) Is China’s FDI coming at the expense of other countries? J Japan Intern Econ 21:153–172

Fabry N, Zeghni S (2002) Foreign direct investment in Russia: how the investment climate matters. Communist Post Communist Stud 35:289–303

Hanson GH (2005) Market potential, increasing returns and geographic concentration. J Intern Econ 67:1–24

Harris CD (1954) The market as a factor in the localization of industry in the United States. Ann Assoc Am Geogr 44:315–348

He C (2006) Regional decentralisation and location of foreign direct investment in China. Post Communist Econ 18:33–50

Head K, Mayer T (2004) Market potential and the location of Japanese investment in the European Union. Rev Econ Stat 86:959–972

Iwasaki I, Suganuma K (2005) Regional distribution of foreign direct investment in Russia. Post Communist Econ 17:153–172

Krugman PR (1992) A dynamic spatial model, NBER Working Papers 4219, NBER, Cambridge

Ledyaeva S (2009) Spatial econometric analysis of determinants and strategies of foreign direct investment in Russian regions. World Econ 32:643–666

LeSage PJ (1998) Spatial econometrics, Working Paper, Department of Economics, University of Toledo, Toledo

LeSage PJ (1999) The theory and practice of spatial econometrics, Working Paper, Department of Economics, University of Toledo, Toledo

LeSage JP (2006) Spatial econometrics library, www.spatial-econometrics.com

Linneman H (1966) An econometric study of international trade flows. North Holland Publishing Company, Amsterdam

Pöyhönen P (1963) A tentative model for the volume of trade between countries. Weltwirtschaftliches Archiv 90:93–99

Razin A, Rubinstein Y, Sadka E (2004) Which countries export FDI, and how much? HKIMR Working Paper No. 15/2004, HKIMR, Cambridge

Rosstat (2004) Russian Regions, Social and Economic Indicators, Moscow, Russia

Rosstat (2005) Russian Regions, Social and Economic Indicators, Moscow, Russia

Rosstat (2007) www.gks.ru

Tinbergen J (1962) Shaping the World Economy: Suggestions for an International Economic Policy, New York

Yudaeva K, Kozlov K, Melentieva N, Ponomareva N (2000) Does foreign ownership matter? Russian experience, CEFIR Working Paper No.1, Russia

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Kayam, S.S., Yabrukov, A. & Hisarciklilar, M. What Causes the Regional Disparity of FDI in Russia? A Spatial Analysis. Transit Stud Rev 20, 63–78 (2013). https://doi.org/10.1007/s11300-013-0272-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11300-013-0272-8