Abstract

In this paper, I estimate extended income equivalence scales from income satisfaction and time-use data contained in the German Socio-Economic Panel. Designed to capture the needs of additional household members, these scales account for both, increases in households’ money income and domestic production requirements. The estimation procedure determines equivalence weights in these two components separately by combing the subjective with the objective approach. The findings suggest greater monetary equivalence weights for adults than for children, whereas household production increases more strongly in the number of children than in the presence of an adult partner. Differences in relative needs tend to balance out in the extended income equivalence scale, assigning additional adults and children almost identical weights of about 45%. I illustrate the implications of these estimates for measures of income inequality using the same dataset.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In many empirical and policy-relevant applications, economists need to assess the material standard of living of different households and their individual members. Typically, they approximate households’ living standards by considering their disposable monetary incomes, i.e. after-tax earnings and government transfers. This is because money incomes are relatively easy to measure, are available in many datasets and approximate the household’s market consumption relatively well. The fact that two households have the same amount of money at their disposal does not necessarily mean that they enjoy the same standard of living, however. This is mainly because of two reasons.Footnote 1 First, households differ in their size and structure. With money income shared among unequal numbers or kinds of people, an individual’s standard of living may strongly depend on which household he or she lives in. Second, households can enlarge their material consumption possibilities by producing goods and services domestically and may do so to varying extents while sharing the benefits among their members again.

The first objection is at the heart of all welfare analyses carried out at the household level. Almost certainly, the members of two differently structured households will not enjoy the same standard of living when they have the same monetary income, all other things being equal. An additional household member requires additional funds, even though probably not as many as a single person does. To account for differences in needs and economies of scale and thus make the economic well-being of differently structured households comparable, empirical economists typically adjust incomes by equivalence scales. These indicate the percentage increase in income necessary to keep a household’s living standard constant as additional members join that household. In the past, these scales were often limited to considering money incomes or expenditures. However, monetary measures only provide an incomplete account of a household’s total consumption. Households satisfy their needs not only by market consumption at the expense of money but also by household production at the expense of time. Their members produce goods and services, such as “accommodation, meals, clean clothes and the care of children and adults”, that they consume themselves (Ironmonger 2001). Gronau (1977) formalized this idea assuming individuals’ utility to depend on total commodities consumption and leisure when they can either purchase commodities in the market or produce substitutes domestically at the cost of forgone leisure. The benefits from the three components, money income, household production and leisure enjoyed by all family members, add up to form a household’s full income (going back to Becker 1965). A closely related concept is the extended household income, which captures total commodities consumption by the sum of monetary incomes and the proceeds from household production. In considering extended instead of monetary incomes of households, one can account for the fact that larger households typically produce more goods and services domestically, which might expand their consumption possibilities relative to smaller households. At the same time, their household production requirements may also be larger. This may be, for instance, because their relatively greater living spaces require more cleaning or, even more obviously, because a young child needs childcare.

Many recent welfare analyses have realized the importance of household production in generating additional consumption possibilities for households and their members. With simultaneous increases in the availability of time-use data, the distribution of extended incomes has become a matter of growing interest in the literature (see e.g. Jenkins and O’Leary 1996; Frazis and Stewart 2011; Frick et al. 2012; Folbre et al. 2013). Many studies account for the fact that domestic production needs vary across households by applying conventional equivalence scales to extended incomes and thereby assume that differences in needs and economies of scale in household production are the same as in market consumption. With most of the commonly applied equivalence scales lacking a profound empirical basis in the first place, it is unclear why this should be the case. Researchers in the field have also been aware of this shortcoming. Jenkins and O’Leary (1996), for instance, note, “Arguably the equivalence scale rates for money income and the proceeds of household production should differ (…)” [p. 406]. Yet, the lack of reliable estimates of monetary and household production equivalence scales has led to the pragmatic approach of applying monetary expert scales to extended incomes. Only recently, Folbre et al. (2018) have proposed an expert scale for extended incomes but left its empirical estimation to further research. The present paper’s contribution is to propose an empirical method to determine equivalence scales in the two components of extended income—money income and household production. A monetary equivalence scale is determined using a well-established method based on subjective evaluations of income satisfaction. Income satisfaction data is not used to estimate household production equivalence scales because preliminary analyses have indicated that increases in household work are associated with lower levels of income satisfaction. Instead, objectively measurable time costs of additional household members provide the basis for the estimation of household production equivalence scales. A combination of the resulting two scales yields the extended income equivalence scale, which serves to identify (dis)similarities in the average extended income needs of different household members.

An application of the estimation procedure to German survey data shows that the monetary equivalence weight of an adult is significantly larger than that of a child. At the same time, household production requirements are greater for children than for adults. These differences tend to balance out, leaving the extended income needs of additional adults and children to be virtually identical, unless one accounts for large differences in the home production requirements of children depending on their age.

The remainder of this paper is structured as follows. In Sect. 2, I review the related literature. Section 3 presents the identifying assumptions underlying the empirical strategy followed by an explanation of the estimation procedure. After that, I introduce the data from the German Socio-Economic Panel used in the estimations. Section 5 contains the results. Section 6 shows implications of the estimated equivalence scales for the assessment of inequality, whereas Sect. 7 discusses limitations. Section 8 concludes.

2 Literature Review

To date, numerous studies have been devoted to empirically estimating the cost of additional household members. Frequently, these costs are embedded in equivalence scales that provide a relative account of the compensations needed for differently structured households to enjoy the same standard of living. While most research on equivalence scales is limited to households’ market consumption, the identification of their counterparts in household production and leisure has become more and more important. This is because of their significance in modifying the relative well-being of different household types when the welfare-enhancing effect of these alternative consumption sources is recognized in comparative analyses (see Folbre et al. 2018).Footnote 2 Yet, the consideration of time use has just begun to find its way into the three different approaches to determining equivalence scales—the expert-based, the subjective and the objective approach.

Folbre et al. (2018) are the first to propose separate equivalence scales for components of extended incomes. The specific values of these scales are set by the authors to provide an exemplary reflection of market-consumption and time-use patterns identified in the earlier literature. In taking this expert-based approach, the empirical estimation of equivalence scales in extended income components remains for the present analysis to be carried out. Often lacking a sound theoretical and empirical basis, the expert approach summarizes experts’ evaluations of the relative needs of households. Depending on the equivilisation purpose, which can be either the statistical assessment of inequality and poverty or the definition of benefits for social programs (see Buhmann et al. 1988), these experts usually consist of social science analysts or social security specialists. Even though they typically base their assessment of the equivalence scale on indicative statistical evidence, their judgment about what constitutes desirable baskets of goods and services, the degree of how they are shared or the specific equivalence weights remain largely arbitrary. Despite of these shortcomings, expert-based equivalence scales, such as the OECD or square-root scale, are widely used by academics, statistical offices and social security practitioners because of their simplicity and apparent plausibility. Folbre et al. (2018) follow the experts’ tradition and base their arbitrary equivalence scale parameters on an extensive review of empirical results regarding differences in the expenditure of time and money across households. They propose weights that apply to market incomes and the proceeds from household production and childcare separately, assigning the partner a weight of nearly 70% in money income and 40% in household work. The first (second) child to a couple increases market income needs by 60 (55) percent and household production requirements by 59 (45) percent. Childcare needs associated with the first child exceed the household production requirements of the first adult by about 30%. These costs decline strongly in the number of additional children. Using thus specified parameters, the authors show that deflating non-market household production by the same equivalence scale as monetary incomes overstates the contribution of household production to households’ living standards and hence overstates the well-being of families.

An empirical validation of these results has to rely on two approaches that are more systematic—the subjective and the objective approach.Footnote 3 The subjective approach makes use of directly surveyed concepts of household welfare by considering individuals’ evaluations of their own or hypothetical living standards or incomes (see Bradbury 1989). The validity of this approach crucially depends on the assignment of verbal labels to welfare being consistent across individuals (see van Praag and van der Sar 1988). Because of difficulties that respondents might face when evaluating conditions that they have never actually experienced, recent studies make increasing use of how individuals perceive their actual household income. The use of this concept in the estimation of equivalence scales typically involves different variants of a model regressing income/financial satisfaction on equivalent income and other possibly relevant control variables. Definitions of the underlying equivalence scale vary from constant-elasticity (see Buhmann et al. 1988) to fixed-weights scales (see OECD 2005) to combinations of these two (see Cutler and Katz 1992).

Like the present paper, a number of studies consider income satisfaction data from the German Socio-Economic Panel to estimate the equivalence weight of adults and children (see e.g., Charlier 2002; Schwarze 2003; Van Praag and Ferrer-i-Carbonell 2004; Biewen and Juhasz 2017; Borah et al. 2019). Although they focus on different aspects of the equivalence scale, most of these studies find similarly low weights for additional household members. The top panel of Table 1 provides an overview of some of their results. Various other studies carry out similar analyses using survey data from other countries (see e.g., Melenberg and van Soest 1996 for the Netherlands; Van Praag and Ferrer-i-Carbonell 2004, and Bollinger et al. 2012 for Great Britain; Rojas 2007 for Mexico; Buetikofer and Gerfin 2017 for Switzerland). The magnitude of the estimated equivalence parameters differs considerably across studies. Yet, apart from Bollinger et al. (2012) and Borah et al. (2019), all of them agree in the finding that children receive significantly lower weights than adults.

Implicitly presuming that household production does not increase income satisfaction,Footnote 4 almost all studies based on this proxy of household utility largely ignore the positive welfare effect of household production. Thus, they are limited to identifying monetary equivalence scales, i.e. the extra amount of money income different households need to achieve equivalent market consumption (see Sect. 3.2). Only Van Praag and Ferrer-i-Carbonell (2004) extend their analysis of income satisfaction data to include the aspect of time. They distinguish between households with one and two breadwinners and find that monetary equivalence weights are higher for the latter household type. Using hypothetical income responses from an online survey of individuals in Belgium and Germany, Koulovatianos et al. (2009) support this finding. The second panel of Table 1 presents a selection of the resulting equivalence scale estimates.

While the subjective approach has been able to include only parts of the time costs of additional household members in the equivalence scale estimates, a relatively small number of studies using the objective approach estimates equivalence scales in full incomes, including money income, household production and leisure. The bottom panel of Table 1 illustrates some of their results. The objective approach uses household expenditure data to either proxy household welfare directly through specific expenditure shares (such as on food or adult goods) or indirectly via revealed consumer preferences. Accordingly, the range of objective methods encompasses single as well as multiple-equation models with various degrees of model complexity. Due to problems related to the identification of the utility function (see Pollak and Wales 1979) all of the related estimations rely on relatively strong (and partly untestable) assumptions. When these are fulfilled, the approach is not restricted to households’ observable market behavior but can also be extended to considering their time-use patterns.

Apps and Rees (2002) integrate Australian time-use information into an analysis of cross-sectional income data to estimate the cost of children, defined in terms of their full consumption of market and domestically produced goods as well as parental leisure time. Focusing on families with two adults and two children, the authors find that the money cost of children differs significantly across households with two full-time employed parents and households with only one full-time employed adult. When the allocation of parental time is included into a full-consumption equivalence scale, the difference between household types vanishes and produces considerably higher equivalence weights for children. Bradbury (2008) estimates the full cost of children using the “adult goods” approach proposed by Rothbarth (1943). Assuming adults’ personal time to be an appropriate indicator of household welfare, he derives the increase in full income necessary to hold parental leisure constant. Applying earlier empirical findings regarding the time use of differently structured Australian households (by Bittman and Goodin 2000, see below) and the income elasticity of labor supply, he finds that the full cost of children is much higher than the monetary cost assigned by common equivalence scales and that the full cost declines with children’s age. His results suggest that the full costs of the first infant amounts to 50–80% of a childless couple’s monetary income. Using matched French family budget and time-use data, Gardes and Starzec (2018) estimate a complete system of demand functions, specifying the relationship between households’ monetary and time expenditure on eight consumption categories and their demographic size and structure. This allows them to develop full cost equivalence scales, capturing the total expenditure requirements of additional household members in terms of monetary resources, domestic work and leisure time. Employing a variety of model specifications, they find that monetary equivalence scale parameters are generally higher for adults than for children whereas in full cost equivalence scales this difference diminishes. Moreover, full costs of both, additional adults and children, relative to the first adult turn out to be higher than their monetary costs when accounting for changes in relative monetary and non-monetary prices associated with household size and structure. The authors also illustrate that considering full incomes and full income equivalence scales instead of their monetary counterparts considerably reduces measured inequality.

Bittman and Goodin (2000) construct an equivalence scale exclusively for time. Using male and female individuals’ observable time spending on paid and unpaid labor as the dependent variable in two separate single-equation settings, these authors also employ the objective approach. Their analysis of time-use data from 28 different surveys demonstrates that engagement in unpaid domestic work crucially depends on household structure, especially for women. Their results indicate that, given their weekly hours in paid work, men (women) spend on average half an hour (7 h) more per week in unpaid labor when there is a partner or another adult in the household and about 3.3 (eleven) h more when there are children. Hence, they confirm that most of the domestic work requirements associated with additional household members is born by women, which illustrates the gendered nature of household work. Couprie and Ferrant (2015) estimate economies of scale in time use within childless couples when non-market time is the only source of individual utility. They estimate a system of time use demand equations based on the concept of indifference scales developed by Browning et al. (2013), allowing for an uneven distribution of welfare gains across husbands and wives. Using data from the UK Time Use Survey, they find relatively large equivalence weights in spare time. Two singles need just about 6.3% more spare time a day to achieve the same utility as they did as a couple. Various other studies investigate the objective time cost of children more generally. Craig and Bittman (2008) and Ekert-Jaffé and Grossbard (2015) estimate the time cost of children in terms of sacrificed leisure. By restricting the analysis to couples with two full-time employed spouses, while accounting for selection and endogenous wages, the latter study limits the scope for substitution effects between home production and labor supply. The results indicate that a child reduces men’s leisure by 0.7 h and women’s leisure by 0.8 h on an average weekday. The loss in leisure is significantly larger for children under the age of three and close to zero for children aged 15 or older. Using Swiss time-use data, Sousa-Poza et al. (2001) compare the monetary value of domestic production (based on different evaluative methods) across household types and find that the home production cost of children is very high for the first child but does not increase considerably with additional children.

The latter set of studies on the time cost of additional household members provides the present paper with a suitable basis to estimate household production equivalence scales using objective time-use data in separation from monetary income equivalence scales using subjective income satisfaction data while allowing for a possible link of monetary well-being to household production. In contrast to the few existing studies that include family members’ time costs in inseparable full income equivalence scales derived from only objective data, this combination of different approaches allows for the identification of distinct equivalence scales in the two components of extended income. Thereby, the present paper adds empirical estimates of extended income equivalence scales as proposed by Folbre et al. (2018) to the literature and validates their significant implications for welfare comparisons across households.

3 Empirical Strategy

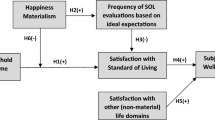

The empirical strategy followed in this paper combines the subjective with the objective approach to estimating equivalence scales. Money income equivalence scales are determined using subjective evaluations of income satisfaction, whereas equivalence scales in household production rest upon observable time use patterns. Based on a set of identifying assumptions, the proposed estimation procedure allows for the determination of equivalence scales in the two components of extended income separately. Joining these two yields the extended income equivalence scale.

3.1 Identifying Assumptions

To be able to estimate equivalence scales in extended income, I have to make a number of crucial assumptions regarding household members’ material well-being, its components and their measures. These are summarized as follows.

Assumption 1

Each member of a given household attains the same level of material well-being\( u_{jt} \), which positively depends on this member’s equivalent consumption of both, marketed and domestically produced goods and services. The material welfare function is separable in both components and summarizes the preferences of each household member.

By this assumption, one can formally express the material well-being of all members of household j at time t by

where mjt is the household’s equivalent market consumption and djt is the equivalent consumption of domestic produces. Both components enter the household member’s welfare function via the respective sub-utility functions Vm and Vd assuming complete income pooling by all household members. Note that u may be quite different from individuals’ total utility in that it does not include benefits from leisure. This is because the extended income equivalence scale only aims at compensating for differences in the material consumption but not leisure requirements of different household types.

Assumption 2

Subjective statements about one’s satisfaction with household income are comparable across households and represent a direct measure of Vm. They crucially depend on equivalent market-consumption possibilities.

The interpersonal comparability of subjective income evaluations is a necessary condition for using the subjective approach to estimating equivalence scales (van Praag and van der Sar 1988). If income satisfaction captures individuals’ utility from their own equivalent market consumption, this measure together with information on their households’ money income will allow me to derive the monetary equivalence scale. Of course, factors other than equivalent market consumption may have an impact on individuals’ evaluations of household income. As long as these are uncorrelated with household size and structure, their omission will not cause a bias in the estimated money equivalence weights. Omission of factors that do depend on the demographic characteristics of households, however, potentially biases monetary scale parameters. This may also have a bearing on estimates of household production equivalence scale when accounting for substitution effects between market consumption and household production. Section 7 discusses this possible relation in further detail.

In an ideal setting, the existence of a direct measure of Vd would allow for the straightforward identification of equivalence scales in household production as well. Unfortunately, social surveys lack direct evidence on this welfare component. To my knowledge, no subjective measure adequately captures individuals’ satisfaction with their consumption of domestically produced goods and services. Given this data restriction, observable household characteristics appear to be the only suitable basis for approximating the welfare derived from household production. This leads to Assumption 3.

Assumption 3

There is a set of characteristics X jt that implies the exact same level of welfare from domestic production V d Footnote 5 for individuals living in differently sized or structured households.

For this to be true, Xjt will have to define the realized level of equivalent home production djt (i.e. the per-head consumption of domestically produced goods and services).Footnote 6 To ensure equal levels of home-produced welfare across households of different size and structure, Xjt must not include the number of adults or children, however. This is a strong but necessary condition for being able to estimate household production equivalence scales. It precludes larger households from choosing to generate higher levels of domestic welfare at the sacrifice of leisure when economies of scale are more favorable in household production. My empirical strategy cannot accommodate such interactions between household size, domestic production and leisure, whose existence would prevent the identification of household production equivalence scales. Therefore, it has to focus on other characteristics that can sensibly define a household’s equivalent domestic production possibilities (and needs).

Among the factors that determine what kinds and quantities of goods and services are producible at home are total non-market time available to individuals that potentially engage in household production (Bittman and Goodin 2000) and cultural aspects (Sousa-Poza et al. 2001; Kimmel and Connelly 2007). In theory, health conditions and domestic assets may also be suspected to have an impact on potential household production. Furthermore, equivalent domestic production may depend on households’ equivalent money income because this allows them to purchase substitute goods and services in the market (Kornrich and Roberts 2018; Gardes 2018).Footnote 7

Assumption 4

Equivalent market consumption is exogenously determined by adults’ fixed labor supply, period-fixed wages, non-labor incomes and family size and structure.Footnote 8

By this assumption, feedback effects from non-market activities to market consumption are excluded, which corresponds to a rather short-term notion of the allocation of time. This allows me to consider the substitution of household production by market consumption. Otherwise, the endogeneity of market work, and hence monetary incomes, will likely lead estimates of the household production equivalence scale to be biased if equivalent money income is used to explain household production.

Assumption 5

The trade-off between equivalent market income and domestic consumption is identical across household types.

By definition, households with the same equivalent money income can afford equivalent bundles of market goods and services. With substitutes for household production exhibiting the same economies of scale as other market goods, households of different size or structure experiencing an identical increase in their equivalent money income can thus replace equivalent household production to the same extent. The fulfillment of this condition warrants the identification of household production equivalence scales when equivalent money incomes have an impact on home production efforts.

Assumption 6

The value of household production proportionally relates to time and this relation is identical across all households.

This assumption greatly simplifies the analysis as it implies that it will be sufficient to quantify differences in the time use of differently sized or structured household types with otherwise identical characteristics to estimate equivalence scales in household production. It is not a necessary condition for the identification of household production equivalence scales, but could be replaced with alternative assumptions, e.g. household or individual-specific productivity levels or diminishing returns to domestic work time. In that case differences in thus defined values of household production would need to be quantified across households exhibiting identical characteristics Xjt. Yet, the equivalence parameters estimated below critically depend on the assumption of linearity and identity of returns to domestic production across households. This is because of systematic cross-household-type differences that exist in variables potentially affecting the value of 1 h of domestic work (e.g. income and hours spent in household production; see Table 8 in the “Appendix”). Section 7 discusses likely consequences of the assumption’s violation for the estimated equivalence scale parameters.

3.2 Estimation Procedure

-

Step 1: Estimation of Monetary Equivalence Scales

Under the condition that income satisfaction is a valid proxy for household members’ monetary wellbeing Vm (Assumption 2), one can rely on the same subjective approach that previous studies have used to identify the market consumption requirements of differently sized or structured households (see e.g., Schwarze 2003; Van Praag and Ferrer-i-Carbonell 2004; Biewen and Juhasz 2017; Borah et al. 2019). This involves the following type of model.

The dependent variable Sijt is satisfaction with household income as indicated by individual i in household j at time t. Yjt is the respondent’s household’s net monetary income, which is deflated by the household’s total monetary equivalence weight MEQ that depends on the number of adults ajt and the number of children kjt. The function g(.) allows for nonlinearities in the association between equivalent income and income satisfaction. In the following, I assume the relationship to be logarithmic, which implies that the marginal utility from equivalent money income is diminishing. Cijt is a vector containing other personal and household characteristics that may be relevant determinants of income satisfaction.

Following Biewen and Juhasz (2017) and Borah et al. (2019), I estimate equivalence scales that assign fixed weights to additional adults and children, i.e. after setting the first adult’s equivalence weight to one, they linearly increase in the number of additional adults and children. This is the approach followed by the frequently used (‘old’ and ‘new’) OECD-scales. For \( MEQ \), this means that \( MEQ(a_{jt} ,k_{jt} ) = 1 + \upgamma_{a} (a_{jt} - 1) + \upgamma_{k} k_{jt} \), where the coefficients linked to the number of additional adults and children represent their fixed monetary equivalence weights, respectively. With the equivalence weight of specific household members being independent of the total number of household members, this parametrization benefits from a very intuitive interpretation that clearly distinguishes the systematically different needs of adults and children. Due to its simplicity, this functional form cannot account for possible economies of scale in the number of children, however. Applying the definition of the equivalence scale to Eq. (2) yields estimation Eq. (3), which provides the basis for the first-step regressions.

Although the model used to identify the monetary income equivalence scale perfectly corresponds to that of previous studies estimating equivalence scales from income satisfaction data, one must note the differences in its assumptions and their implications. Previous studies rely on the assumption that income satisfaction is a valid indicator of households’ material (or general) well-being or utility of income u (see, e.g. Schwarze 2003; Biewen and Juhasz 2017). By considering only monetary income, they focus exclusively on market consumption m, however. If income satisfaction indeed measured a household’s material well-being u which includes benefits from domestic production as defined by (1), one could estimate the extended income equivalence scale directly by including equivalent household production in Eq. (2). An investigation of the determinants of income satisfaction carried out before the present analysis revealed that increases in household work are associated with lower levels of income satisfaction, however.Footnote 9 As income satisfaction responses thus do not seem to (distinguishably) capture the positive consumption effect of household production, they do not constitute appropriate accounts of the household’s total material well-being. The empirical finding thus prohibits the direct estimation of extended income equivalence scales from income satisfaction data and supports its treatment as a measure of households’ monetary well-being only. One should hence interpret previous results as monetary income equivalence scales holding only utility from market consumption constant. Consequently, I need to estimate the equivalence scale in household production in a second step.

-

Step 2: Estimation of Household Production Equivalence Scales

Equivalence scales in household production need to capture differences in the consumption of domestically produced goods and services across household types when their members attain the same level of domestically produced welfare. The proceeds from household production and hence their consumption are naturally unobservable, though. Yet, adults’ time spent on household-related activities may provide a reasonable approximation of total household production and consumption thereof (for a discussion, see Van de Ven et al. 2018). If there is a linear relationship between input and output and the consumable benefits from one hour of domestic work are the same across households (Assumption 6), it will be sufficient to compare the time use of different family types to estimate household production equivalence scales.Footnote 10

As per the identifying Assumption 3, a set of household characteristics (excluding household size and structure) defines the level of domestically produced welfare. The estimation of equivalence scales in household production thus involves a descriptive analysis of total time spent on domestic work by different household types that share the same characteristics and hence experience identical levels of home-produced welfare. Along these lines, it applies a single equation approach with objective indicators of welfare that is similar in kind to the well-known Engel (1895) approach. Considering various socio-demographic parameters that could have an impact on time expenditure apart from family size and structure, the empirical specification may be understood as a functionalized linear expenditure equation similar to the components of the functionalized extended linear expenditure system developed by Merz (1983). This specification builds upon the following relation.

It states that equivalent household production djt is equal to the household’s total time spent on domestic activities Tjt multiplied by the consumption value of each hour spent in domestic work w and deflated by the household production equivalence weight HEQ. By assumption, equivalent household production linearly depends on household characteristics Xjt. Parameter w only has a scaling effect on the constant β0 and the vector of coefficients β so that the equivalence weights can be estimated by

where the rescaling of coefficients is indicated by asterisks and νjt is a random error term. Aligning HEQ with the functional form of the monetary equivalence scale yields the following estimation equation on which all second-step regressions rely.

The first sum in brackets measures equivalent household production time, i.e. the average time a single adult with the given characteristics spends on home production. The second term in brackets represents the equivalence scale in household production, which assigns additional adults and children the fixed household production equivalence weights δa and δk, respectively. These measure the percentage increase in the time (and value) of household production associated with the respective household member at given levels of home-produced welfare. Note that the estimation equation involves several interaction effects between household characteristics Xjt and the number of adults or children, respectively. While the change in any one variable contained in the first linear function in principle may affect domestic work time differently in differently structured households, estimation Eq. (6) constraints the relative difference to be identical for changes in each household characteristics. Therefore, one should interpret the equivalence weights as the average differential effect of changes in the given characteristics.

As argued above, the set of characteristics Xjt should contain all household characteristics that reasonably define the level of welfare a household can derive from domestic production. Depending on whether substitution between market and home produced consumption is to be expected, this may or may not include money equivalent income. Because of its property of being an estimate itself, introduction of this variable into the estimation model requires special attention. Therefore, Eq. (7) includes \( \hat{m}_{jt} \), i.e. the households’ money income divided by the previously estimated money equivalence scale, separately.

Controlling for this factor results in a comparison of the time different households spend on domestic production when they enjoy the exact same material standard of living as defined by Eq. (1). Besides accounting for the substitution between monetary income and household production, this specification also bears the advantage of producing equivalence scale estimates that are less prone to error if productivity grows in monetary incomes (violation of Assumption 6).

-

Step 3: Estimation of Extended Income Equivalence Scales

When comparing material living standards across households, the distinction between monetary and domestically produced incomes as well as their respective equivalence scales should be maintained. This is because domestic and money income shares vary substantially across households. Ignoring crucial information on differences in non-average households’ requirements of the two income types, a unified scale will therefore be inappropriate in comparative welfare analyses and the assessment of extended income inequality. However, the construction of aggregate extended income equivalence scales, which measure the increase in extended income necessary to keep different households’ standards of living unchanged, will prove informative when evaluating the average total material needs of adults and children and differences therein.

The determination of extended income equivalence scales rests upon the comparison of households’ extended income and the sum of their equivalent money income and household production, i.e. their equivalent extended income. To make household production comparable to money incomes, I multiply total hours of domestic labor \( T \) by the median wage rate \( w \) to approximate market replacement costs and thus convert household production time into its monetary value (wT). Households’ actual extended income is equal to the sum of monetary incomes (Y) and the value of household production. Their equivalent money income and household production result from dividing the respective values by the component-specific equivalence weight defined by the previously estimated scale parameters.

Putting household j’s actual extended income in relation to the sum of equivalized incomes yields the extended income equivalence weight (EEQ) of that particular household.

Its size depends on the relative share of monetary in extended income as this determines the weight with which both components’ scales enter the extended income equivalence scale. To impose the same linear relationship onto the conditional means of households’ extended income equivalence weight as the two components’ scales, I run a constrained linear regression of EEQ on the number of adults and children. More specifically, I estimate

where ρa and ρk are adults’ and children’s average extended income equivalence weights, respectively. Thus, the extended income equivalence weight is linearly increasing in the number of additional adults and children, when a constant term equal to one represents the reference household.

3.3 Estimation Method

The nonlinear model of Eq. (3) as well as the constrained linear regressions proposed by Eqs. (6) and (7) will be fitted by nonlinear least squares (using Stata’s nl command). The average extended income equivalence weights will be determined using constrained ordinary least squares regressions of Eq. (9). Although the employed data is of a panel structure, I will refrain from the application of an individual or household fixed effects model. This is because within changes in household structure, providing the basis for all equivalence scale parameter estimates in the fixed-effects setting, are associated with two problems. First, changes in household size or structure are typically expected. They may affect income satisfaction well before their actual occurrence, which could bias monetary equivalence scale estimates in a fixed-effects setting. Second, when a child enters a household it typically does so as a newborn baby whereas it leaves as an adult. This means that the addition of a child will usually be associated with an exorbitant increase in household production intensified by maternity and paternity leaves. On the other hand, an adult–child moving out may reduce household production insignificantly or might as well increase it (if the child contributed to household production before). To identify equivalence scale parameters more accurately, I therefore carry out pooled regression analyses. I cluster standard errors by households in all steps. Monetary equivalent incomes included in some of the second-step regressions to identify household production equivalence scales (according to Eq. 7) crucially depend on the first-stage estimates of the monetary equivalence scale (using regression Eq. 3). Therefore, I bootstrap standard errors with 1000 replications in the regression of household production time when controlling for monetary equivalent income.

4 Data

The data needed to estimate extended income equivalence scales according to the proposed empirical procedure is available in the German Socio-Economic Panel. This representative longitudinal dataset provided by the German Institute for Economic Research (DIW) covers annual responses to a wide range of questions regarding the life circumstances of about 30,000 individuals in nearly 15,000 households in Germany.Footnote 11 Among the inquired variables are income satisfaction, family composition and household income. Adding to that, the SOEP also contains relatively comprehensive time use data. This makes it a suitable basis for studying differences in monetary incomes, home production and extended incomes across different household types.

I assume income satisfaction to be an adequate measure of a household’s monetary well-being that is comparable across households. In the SOEP, it is assessed by asking each individual above the age of 16 to indicate on a zero-to-ten scale how satisfied they are with their current household income. Presumably, individuals evaluate their household’s net monthly income as stated by the head of the household to which the individual belongs. To ensure intertemporal comparability of incomes across different years, I calculate household incomes (as well as all other monetary measures) in real terms using consumer price indices from the German statistical office (2010 = base). In an attempt to handle implausible income records, I exclude the lowest and highest percentile of each year’s household income distribution. I classify households according to the number of adults and children below the age of eighteen living therein and restrict the analysis to a sample of adult respondents within “classical households”, consisting of either a single or two partnered adults with or without children. Other exogenous variables used to explain variations in income satisfaction are the respondent’s age, age squared, sex, federal state (Bundesland), survey year, education, nationality and dummies for unemployment, home ownership, residence in a rural area and the presence of a person in need of care.

To consider domestic work, I use answers to the following question: “What is a typical day like for you? How many hours do you spend on the following activities on a typical weekday, Saturday and Sunday?” Stated hours spent on running errands, housework, childcare, caring and repairing determine the level of household production, which I define as the output of these five activities. As per the survey instructions, respondents indicate a value of zero when an activity does not apply to them. The sample is restricted to individuals, whose adult household members give complete information about hours spent on each activity on weekdays, Saturdays and Sundays. As the SOEP includes such detailed time-use questions only biannually between 2001 and 2015, this limits the analysis to eight survey waves. To obtain the number of hours spent on household production on an average day, I use a weighted average of the hours spent on all the activities specified above. Hours spent in domestic production on an average weekday receive a weight of 5/7. Hours spent on typical Saturdays and Sundays receive a weight of 1/7 each. To avoid possibly erroneous measurements, I drop households with any adult member claiming to spend more than 18 h on household production on an average day and all households whose total household production is zero.

In principle, my measure of household production should only capture activities that benefit the respondent’s own household to make sure that household production approximates consumption of its proceeds. It is however impossible to distinguish activities dedicated to other households’ well-being. Childcare is a notable exception—respondents that live in a household with no children but do spend time on childcare clearly contribute to another household’s home production. Thus, I replace any positive hours in childcare by zeros when there are no children in the respective respondent’s household.

As argued above, several control variables might affect the extent of household production. They mainly consist of the household characteristics controlled for in the first step regression, most of which previous empirical results have shown to be important determinants of individuals’ domestic work time. Among these are home ownership and residence in a rural area to account for domestic assets, and nationality of the household head to consider cultural aspects (Sousa-Poza et al. 2001; Kimmel and Connelly 2007). Year dummies account for changes in social norms and household production technologies (Bittman and Goodin 2000). State dummies capture regional differences herein (Kimmel and Connelly 2007). A dummy indicating the presence of a person in need of care regards special needs and obstacles related to health. Furthermore, I include the household’s total nonworking time to control for time availability (Bittman and Goodin 2000). It equals all adults’ daily time endowment, i.e. 24 h into the number of adults, minus contracted working hours of working adults on an average day.

All mentioned sample restrictions together with the requirement of non-missing values on each of the included variables for all adults within the household leave me with a sample of 29,808 respondents living in 18,858 households. With many of them being observed repeatedly, the number of individual-level (household-level) observations amounts to 78,133 (49,975). Table 7 in the “Appendix” summarizes sample characteristics by listing means and standard deviations of these observations on the most important variables used in the subsequent analysis.

To make daily household production time comparable to monthly monetary income when deriving the extended income and equivalence scale therein, I multiply the total of adults’ average daily hours of domestic work by thirty to obtain total monthly home production time. As mentioned above, I assess its monetary value using the market replacement cost method, which assumes that there is a market substitute for each activity of domestic production. A very simple and comprehensible approach is to value each hour spent in household production by the average hourly wage rate of all full-time employees subject to social insurance contributions. Therefore, I use annual data on median gross monthly wages included in the Jahresentgeltstatistik 2016, which the Federal Employment Agency provides (Statistik der Bundesagentur für Arbeit 2016).Footnote 12 To obtain hourly wages, I divide monthly figures by 172 h.Footnote 13 Table 8 in the “Appendix” shows mean monthly monetary incomes, daily hours of domestic work and monthly values of household production by the most common household types contained in the estimation sample. Unsurprisingly, larger households tend to exhibit higher monetary incomes, greater numbers of domestic work and, consequently, higher values of household production that increasingly exceed monetary incomes.

5 Results

The presentation of results proceeds along the three steps proposed by the estimation procedure. All baseline results refer to a fixed-weights scale that distinguishes only between the number of adults and children. To gain further insights into the market and domestic needs of additional family members, one may also choose to classify household members according to alternative criteria. In addition to the baseline model, I consider a specification that distinguishes money and home production requirements of children by age group. To do so, I differentiate between infants that are between 0 and 5 years old, children aged 6–13 and teenagers aged 14–17. Due to the stepwise procedure of determining the extended income equivalence weights, I present this extension along with the basic results in each table.

Table 2 presents the results obtained from individual-level regressions of income satisfaction on log equivalent income, which is observed net monthly household income deflated by the household’s concurrently estimated monetary income equivalence weight, i.e. \( Y_{jt} /(1 + \upgamma_{a} (a_{jt} - 1) + \upgamma_{k} k_{jt} ) \). Column 1 reports the results from the baseline specification that is very close to the model used in previously cited studies that estimate equivalence scales from income satisfaction data (Schwarze 2003; Van Praag and Ferrer-i-Carbonell 2004; Biewen and Juhasz 2017).

It is reassuring to find similar results as earlier such studies using the German SOEP. Despite different sample definitions and control variables used, the estimated equivalence scale parameters turn out to be of comparable magnitudes and the effect of log equivalent income is significantly positive and large. More specifically, the analysis suggests that the monetary equivalence scale should assign a weight of 34% to additional adults and a weight of about 16% to each child.

The coefficients on each of the various other control variables suggest that they affect income satisfaction in the expected direction. Income satisfaction as a function of the respondent’s age follows a U-shape. Female respondents are more satisfied with their household income, whereas higher levels of education (as measured by years spent in education) decrease satisfaction. Respondents’ unemployment is associated with strong declines in income satisfaction. An explanation for all these effects may be relative income comparisons, by which an individual’s income satisfaction gains or suffers at given equivalent incomes because this individual’s reference group’s income changes (Ferrer-i-Carbonell 2005).Footnote 14 Some household characteristics probably affect individuals’ income satisfaction more directly. Home ownership significantly increases income satisfaction, as it reduces the monetary burden of rent payments (D’Ambrosio and Frick 2007). Presence of a person in need of care is associated with significantly lower levels of income satisfaction, most likely because of additional monetary expenditures related to it.Footnote 15 Residence in a rural area as well as nationality do not seem to have strong effects on individuals’ satisfaction with household income.

Column 2 presents estimates of a monetary equivalence scale that considers the number of children in each of three age groups separately. This redefinition of the equivalence scale neither affects the coefficients on the control variables nor the equivalence weight for an adult partner greatly. However, one does observe differences in the equivalence weight of children across different ages. While the monetary needs of children up to the age of 13 seem to be similarly small (at 14 and 13%, respectively), the weight of teenagers (almost 26%) is significantly larger and thus clearly approaches the weight of an additional adult.

Table 3 quantifies the percentage increases in household production necessary for additional family members. The first column to each specification of the equivalence scale, i.e. columns 1 and 3, reports the results of the household-level regressions of Eq. (6) not accounting for the substitution between marketed and domestically produced goods and services. Both columns show that all control variables hypothesized to determine equivalent household production significantly affect households’ hours of domestic work.

Equivalent household production increases significantly with home ownership, residence in a rural area and presence of a person in need of care. Supposedly, home ownership comes with other domestic assets (a garden, a workshop etc.) that can be put into productive use, whereas a person in need of care implies that more time has to be spent on caring activities. Living in a rural area implies several challenges. For instance, it will be associated with overcoming greater geographical distances, such that time spent on running errands increases. Greater properties will likely be associated with more repairing and gardening work. Cultural differences could explain the significantly negative coefficient for households whose head does not have the German nationality (Kimmel and Connelly 2007). Greater time availability as measured by the total nonworking hours naturally translates into greater household production (Bittman and Goodin 2000). Column 1 indicates that as households’ nonmarket time increases by one hour, a single adult’s time spent in household production increases by about 6 min a day.

The parameters of interest are presented in the top of Table 3. The equivalence scale parameter for an adult partner in the baseline specification without accounting for monetary wellbeing is about 36% and thus very similar to the respective weight in the money equivalence scale. A large difference appears between children’s monetary and household production equivalence weight, with the latter being close to 65%. This result certainly reflects substantial childcare requirements, which considerably affect the time spent on household production. The regression results in column 3 support this idea. It shows that household production requirements are very large for infants. With an equivalence weight of 117%, a child in the age range of 0– 5 years needs more household production efforts than the first adult. This result appears plausible keeping in mind how much active and supervisory care an infant requires (Folbre et al. 2005). Household production needs decline as children grow older. A child aged 6–13 receives an equivalence weight of 67% in the estimated household production equivalence scale. With a weight of nearly 51%, an additional adult’s home production requirements turn out to be higher than in the baseline specification. The scale parameter for teenagers is surprisingly small amounting to only 20%. This leaves the oldest group of children with a significantly lower home production weight than adults. A plausible explanation for this finding may be that teenagers themselves contribute to household production and thus substitute for their parents’ household work, which is something I cannot account for in my household production measure, unfortunately.Footnote 16

In Sect. 3, I argued that one might reasonably expect equivalent household production to vary with households’ monetary wellbeing. Columns 2 and 4 report the results obtained from estimating Eq. (7), which includes equivalent money income based on the scale parameters derived in the first step. As hypothesized before, I find that household production decreases significantly as equivalent money income rises. In the baseline specification, an increase of equivalent monthly money income by 1000 euros is associated with a 17-minute decrease in a single adult’s domestic work on an average day. While the inclusion of this variable bears no consequences for the direction of the other control variables’ effect, it does affect the magnitude of some of their coefficients and, most importantly the estimated equivalence scale parameters. The equivalence parameter for an additional adult in the baseline specification of 54% is considerably larger as compared to the regression excluding monetary well-being. This is because conditioning on monetary incomes leads to larger, typically richer households (see Table 8) being compared to reference households with higher incomes than before. Because these reference households more strongly substitute household production by marketed goods, the difference between the household production time of couples and single adults, and hence the equivalence weight of a partner, increases. The additional adult’s weight in household production is now closer to a child’s household production equivalence weight, which has increased less considerably to about 70%. Considering the age-dependent scale, similar changes become apparent. An additional adult’s weight amounts to about 69% and is therefore very close to a 6- to-13-year-old child’s weight (73%). Infants require about 127% of the household production of a single adult, whereas teenagers’ equivalence parameter remains relatively stable at 19%.

The finding that money equivalent income significantly affects equivalent home production clearly supports the idea that individuals tend to substitute domestic work by marketed goods and services. Hence, specification (7) may provide a better representation of reality and be more suitable for estimating extended income equivalence scales. Therefore, I proceed with the analysis based on the household production equivalence scales reported in columns 2 and 4 of Table 3. It is important to emphasize that these scales imply greater economies of scale in the consumption of marketed than in the consumption of domestically produced goods and services (except for teenagers).

While the equivalence scale parameters for money and domestic income should be applied separately in welfare comparisons such as the assessment of extended income inequality below, a unified scale will provide interesting insights about the average extended income needs of additional household members. To derive the extended income equivalence scale, I calculate the extended income equivalence weight \( EEQ \) of each household in the previously used sample according to Eq. (8), i.e. I divide households’ observed extended income by the sum of equivalent money income and equivalent household production. These weights crucially depend on the relative shares of monetary and home produced incomes. As can be seen from Column 5 of Table 8, mean relative shares vary substantially across household types. While half of the extended income of a one-adult household with no children is monetary and half is home produced on average, the mean share of money income decreases to about 40% when there is a partner and to about 30% when there are children. The extended income equivalence weight of households with children hence depends more strongly on the household production equivalence scale. Comparing the extended income equivalence weights across households and calculating differences therein by means of the simple linear regression Eq. (9) using the extended income equivalence weight as the dependent variable, I obtain the equivalence scale parameters listed in Table 4.

In the baseline specification, both, an additional adult and each child receive an extended income equivalence weight of about 45%. This is considerably larger than their weights in the monetary equivalence scale, especially so for children. Smaller monetary needs of children seem to be outweighed by their relatively larger household production needs as compared to an additional adult’s. The average percentage increase in extended income necessary for an additional adult and a child and hence their material needs appear to be virtually identical. Considering average children may cover up some very interesting relations though. The extension of the equivalence scale by the age of children supports this hypothesis. Larger household production requirements associated with young children dominate the effect of their relatively low monetary needs. The extended income equivalence weight of children below the age of 14 is therefore greater than that of an additional adult. On the other hand, the very low weight of teenagers in household production results in a very low extended income equivalence weight, as well. This is much smaller than the weight of an additional adult and surprisingly even smaller than a teenager’s weight in the household production equivalence scale. As mentioned above, these extremely low weights must be interpreted with caution, though, as they may be ascribable to own home production efforts by teenagers.

6 Implications

In this section, I explore the implications of comparing the standard of living of households according to their extended instead of their monetary income depending on the applied equivalence scales. In order to do this, I calculate three inequality indices—the Gini coefficient, the Theil index and mean log deviations. These calculations are based on all year-2015 household observations contained in the sample on which I estimated the extended income equivalence scale. Hence, they include singles and couples with no or various numbers of children. Table 5 presents the results.

The first row relates to the comparison of monetary incomes not accounting for differences in household size and structure. Because this income measure fails to take differences in needs and economies of scale into account, inequality in households’ unadjusted money income is relatively high, exhibiting a Gini coefficient of 0.297. The most common practice to make living standards of different households comparable is to equivalize money incomes according to the (modified) OECD-scale, which assigns the second adult an equivalence weight of 0.5 and each child a weight of 0.3. The second row shows that following this approach lowers all three measures of inequality considerably. The Gini coefficient, for instance, falls by 4.4 percentage points. The OECD-scale lacks a solid conceptual basis, however. Therefore, it may be more appropriate to assess money income inequality based on an empirical estimate of the monetary equivalence scale. The third row considers monetary incomes deflated according to the equivalence scale parameters derived from the first step of my analysis. This has almost no additional effect on the inequality measures. With the estimated equivalence weight of the second adult (each child) falling below the OECD-scale weight by 16 (14) percentage points (see Table 2), this may be indicative of differences in monetary incomes being relatively minor across household types. Adjusting the monetary income of larger but not considerably richer households by greater equivalence weights reduces the width of the income distribution only marginally. This supports the use of the OECD-scale in approximating the money equivalence scale.

The bottom four rows define the standard of living of households in terms of their extended income with household production evaluated at median wages. As visible from row 4, inequality in unadjusted extended incomes is even larger than inequality in unadjusted monetary incomes. As soon as equivalence scales are applied in rows 5–7, however, measured inequality in extended is lower than in monetary incomes. Households that are relatively poor in money income thus seem to be able to, at least in parts, compensate for their lack of monetary funds by greater household production. The negative correlation found between money income and household production supports this idea and accounting for it does affect measured inequality negatively. Inequality in extended incomes appears particularly low when monetary incomes are equivalized by the monetary scale and domestic incomes are equivalized by the household production scale, which are the two scales estimated in this paper (see row 7). Accounting for differential needs of additional household members in household production as compared to market consumption thus may reflect an even greater ability of money–income poor households to improve their living standards by household production.Footnote 17 Using the OECD scale produces similar results (see row 5), whereas inequality in extended income appears to be upward-biased when applying the estimated money equivalence scale (see row 6). Differences between the monetary and the OECD scale are much more pronounced in the assessment of extended than monetary income inequality because income from household production differs much more significantly across household types than monetary income (see Table 8). As a result, relatively minor changes in the applied equivalence scale produce relatively greater discrepancies in extended than in monetary income inequality (comparing row 2–3 vs. row 5–6). This also becomes apparent in the comparison of changes from unadjusted to adjusted incomes between monetary and extended incomes (comparing row 1–3 vs. row 4–6). The very low weights suggested by the monetary equivalence scale imply high equivalent domestic incomes of large families, leaving extended incomes largely unequal. In contrast, the OECD scale deflates high incomes of larger families more significantly leading to lower measured inequality. As it represents a compromise between the relatively low weights to be applied to the monetary and the relatively high weights to be applied to the domestic production component of extended income, its results are also quite similar to those in row 7.Footnote 18 Even though the OECD scale seems to be relatively well suited for comparing the extended income of households in the present sample, it may be inappropriate in intertemporal or cross-national comparisons if equivalence scales in the two components of extended income differ across time and countries. Previous empirical results on monetary equivalence weights point towards substantial cross-country variations herein (Lancaster et al. 1999; Bishop et al. 2014). Unfortunately, there is a lack of empirical evidence on local and temporal differences in household production equivalence scales but variations in technologies and social norms make these appear theoretically just as likely as in money equivalence scales.Footnote 19 In consequence, the proposed methodology for estimating extended income equivalence scales should be used in the respective research setting. In contrast to the invariant OECD scale, resulting equivalence scales may be quite different across countries and time (Hagenaars et al. 1994) but will provide a substantiated basis for welfare comparisons.

7 Limitations

The previous section illustrated that different income concepts and estimates of the associated equivalence scales affect implied inequality measures quite strongly. To be of real relevance to policy and research, equivalence scale estimates therefore need to be quantitatively accurate and reliable. As other studies in the field, the present paper marks a step forward but also suffers from several limitations in reaching this goal.

First, the results rely on a set of relatively strong assumptions. One of these is that households’ money income is determined before their members decide about their home production efforts (Assumption 4). The identification strategy thus cannot account for the possible endogeneity of market work and income. Similarly, equivalent domestic production possibilities and market-substitution patterns must be independent of family size and structure (Assumptions 3 and 5). In the absence of an indicator of domestically produced welfare, this represents a possible, but certainly strong simplification to ensure the identification of equivalence parameters in the two components of extended income.

Secondly, the data employed to measure household production does not account for simultaneity of different activities or the intensity of actions. Large increases in household production associated with additional adults may stem from both partners working at home together with only half the individual effort, for instance. Household production may also be over- or underestimated, depending on how respondents consider simultaneous activities in their time assessment. Unfortunately, there is no way to check for the severity of these problems. Their potential occurrence emphasizes the need for a careful interpretation of the obtained parameters.

Thirdly, the method by which I assign monetary value to household production may have a bearing on the estimated household production as well as extended income equivalence scales. As noted above, the scale parameters in household production might take on different values, if the value of 1 h of domestic work differed across households. Reasonably expectable productivity differences across individuals or households may be caused by diminishing returns to domestic work or differences in characteristics such as health, education or income. These may alter subsequent estimation results significantly if they are unequally distributed across household types. Systematic differences across household types especially appear in income and hours spent in household production (see Table 8 in the “Appendix”). If the value of household production actually increased in household income (because of more expensive input goods producing output of greater quantity or quality), domestic production equivalence weights for additional household members based on Assumption 6 would be underestimated. This is because larger, typically richer families would enjoy greater proceeds from household production than under the assumption of equal returns. The extent of this bias will grow as the link between income and productivity becomes stronger. On the contrary, diminishing returns to hours of domestic work would imply positively biased equivalence scales if unaccounted for. Assessing productivity differences by other approaches to the evaluation of household production may hence yield different estimates for the household production and consequently the extended income equivalence scale. The evaluation method may affect the extended income equivalence scale even if it evaluates hours of domestic work identically across households. By determining the relative share of domestically produced in extended income, taking a generalist approach, for instance, may affect the relative weight of the two distinct scales and therefore the extended income equivalence scale.

One last aspect requires some closer attention. This is the strong assumption that income satisfaction measures the market consumption possibilities of households (Assumption 2) and thus provides a suitable basis for estimating the monetary equivalence scale on which subsequent estimations rely. Borah et al. (2019) provide empirical evidence for a violation of this assumption. The study shows that income comparisons greatly affect income satisfaction and that accounting for reference incomes leads equivalence parameters to differ from those previously determined. In principle, many other factors that are unrelated to households’ market consumption opportunities may be important for income satisfaction. To be able to estimate a pure money equivalence scale in that case, it would be necessary to identify all determinants of income satisfaction that are correlated with family size or structure. The present paper neither can nor intends to achieve a complete understanding of the process that generates income satisfaction. However, it is important to realize the implications of a misspecification of the model estimated in the first step when money equivalent income is subsequently included as a control variable. Therefore, I rerun the second-step regression of the baseline model under different assumptions about the true money equivalence scale to investigate the sensitivity of the estimated household production equivalence scale. Considering three alternative, possibly true specifications of the monetary equivalence scale that enter the estimation via the equivalent money income regressor yields the household production equivalence weights reported in Table 6. These can be compared among each other and to the previously estimated weights reported in Table 3, Column 2 to evaluate the implied extent of bias.

Columns 1 and 3 build upon two extreme assumptions one can make about the money equivalence scale. In column 1, each additional household member receives an equivalence weight of zero, which corresponds to perfect economies of scale in market goods consumption. Equivalent money income is thus equal to unadjusted household income, which enters the estimation as a control variable. Comparing the estimated equivalence parameters to the full model results in column 2 of Table 3, one recognizes that these values are higher, for both, the additional adult and children. If economies of scale in market consumption were actually perfect, using the monetary equivalence scale estimated from income satisfaction would thus lead to a downward bias of household production equivalence weights (by 0.058 for adults and 0.079 for children). Column 3 considers the other extreme of the money equivalence scale, which assumes no economies of scale and hence assigns a weight of one to each additional household member. Thus controlling for per-capita income in the household production equation yields considerably lower weights for adults and children. With no economies of scale existing, previous results would overstate household production equivalence weights (by 0.124 for adults and 0.118 for children). Column 2 is based on the OECD-scale, which is a more moderate version of the money equivalence scale and assigns different weights to adults and children. Not surprisingly, the resulting home production weights lie in between those implied by the two extreme money equivalence scales and are relatively close to the results reported in Table 3. A similar finding appears in the coefficient on money equivalent income. Its magnitude is relatively small in column one and grows larger as economies of scale in market consumption decline. These results illustrate that the estimated size of equivalence weights in domestic production seems to be relatively sensitive to changes in the results obtained in the first step of the model. Yet, it is noteworthy that similar changes occur in the weight of both, adults and children, such that the relation of their equivalence parameters is largely unaffected.

8 Conclusion

The aim of this paper was to appreciate the role of domestic production in enhancing a household’s consumption possibilities and hence its material standard of living, and to determine equivalence scales that capture the market and domestic consumption requirements of different households. To this end, I have proposed a novel approach that first determines money income and household production equivalence scales separately from each other and subsequently combines them into an extended income equivalence scale. I have pointed out assumptions regarding the determinants of households’ standard of living and their time allocation upon which this procedure relies. Based on these assumptions, I could link findings from two strands of the literature in an application to data from the German SOEP.