Abstract

This study attempts to investigate the influence of remittances on the development of higher education in top remittances receiving countries. Using annual data from 1994 to 2013 from top eight middle income group remittances receiving countries, a hypothesized model was tested. We used income per capita as a controlled variable and applied panel unit root, panel co-integration, and panel ARDL techniques. Panel unit root tests and Panel co-integration test supported the long term relationship between studied variables. Coefficients of pooled mean group (PMG) (panel ARDL) proved that remittances are highly influential in the higher education development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

During the recent decades, the tendency of migration from developing to developed countries has dramatically moved in an upward direction. This increasing trend not only benefits the host nation, but also the origin state, in terms of economic and social growth. Skilled migrants gain international exposure and contribute to the advancement of host nation. On the other side, they send money back to the home country which is referred to as remittances. Worker remittances are considered as one of the most valuable source of income notably for developing economies. Ratha (2005) stated that remittances are assumed as a stable source of income in comparison to foreign direct investment. However, Hassan et al. (2013) cited that remittances inflow appeals foreign direct investment into the country and hence boost economic growth. Socially, remittances play a crucial role in household improvement.

In recent times, according to a World Bank press release, it is officially announced that remittances flow to developing countries in 2015 has recorded US$ 431.6 billion.Footnote 1 Thus, the flow of remittances improves the livelihood of households, helps in educational attainment, and ultimately increases the national output. As a result, policy makers embarked on the debate on remittances flow and its consequences (Campbell 2009; Adams and Cuecuecha 2010; Anyanwu and Erhijakpor 2010; Viet Cuong and Mont 2012; Docquier et al. 2012; Köllner 2013; and so forth). The main idea emerging from the above-mentioned studies was that remittances are vital for developing nations in terms of living standards, poverty elevation, and subsequent growth in the economy.

The graph of migrants from developing to developed nations has risen and the policy makers have been reviewing the merits and demerits of remittances in developing countries. Numerous studies have discussed the channels of remittances through which it can help households and the economy at large (Taylor 1992, 1999; Orozco 2002; Adams 2011). Remittances directly provide money to people, reduce poverty, and contribute in generating money for the receiving economy. They further play a vital role in raising the consumption pattern of recipients and increasing the human capital investment. Pant (2008) maintained that remittances can be used to enhance the purchasing power by the increasing demand of a product, and hence it will ultimately affect the economy. Extant studies have also focused on remittances and human capital development (Calero et al. 2009; Acosta et al. 2007). These studies have proved that there is a direct association between remittances and human development; flow of remittances improves the life cycle of recipient families, reduces poverty, increases investment in human capital, and finally boosts the economy.

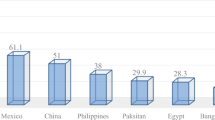

The present research evaluates the effect of remittances on higher education enrollment in top remittances receiving countries (Bangladesh, China, Egypt, India, Mexico, Nigeria, Pakistan, and Philippines). The remarkable increase of remittances in these developing nations has motivated us to determine the role of remittances in the evolution of high skilled work force through higher education. Various studies have found positive support for the association of remittances and increased educational attainment. Edwards and Ureta (2003) and Zhunio et al. (2012) found that remittances reduce school dropout hazard rates. Borraz (2005) and Hanson and Woodruff (2003) also found that having a migrated family member has a positive effect on educational outcomes. Mansuri (2006) found strong positive effects of temporary economic migration on investments in children’s schooling in Pakistan, especially for girls. But, all the above referred studies were related to either primary or secondary school qualification. We noted that in existing literature, there is a scarcity of research where the impact of remittances on higher education has been discussed. Human capital investment, particularly on tertiary education, plays a key role in economic success of a county. As, it produces highly skilled labor that spurs the productivity of the nation. Thus, the present research is an attempt to fill the gap by exploring the relationship between remittances and the development of higher education.

2 Literature Review

2.1 Theoretical Background

McKenzie and Rapoport (2011) expounded a model showing different channels through which workers’ remittances influence investment in human capital, notably education. The first channel referred to as the Remittances Effect, shows that in the wake of migration, money in the form of remittances diminishes poverty and encourages families to enroll their children in an educational institution. Another channel is Disruptive, which deals with an inverse effect. In the absence of the father or the head of the family, remittances do not directly impact children; however, it inversely influences children’s performance. The third issue is called Substitution Effect, in which children prefer to migrate rather than to enroll in a school or any other institution.

2.1.1 Development of Labor Force: Theoretical and Empirical Perspective

Several existing studies suggest that remittance is an extra income of non-workers for their family members, and it is theorized that the existence of remittances causes a fall in labor force development. Similarly, a fundamental concept of getting involved in labor force depends on the workers’ income. This indicates the amount of extra income the individual would need to be encouraged for giving up one unit of leisure during his unemployment period. Rodriguez and Tiongson (2001) and Funkhouser (1992) found remittances as a reducing factor of labor force development.

Secondly, if children build up a perception about their immigrant parents getting higher remunerations in unskilled employments, they will lose motivation to pursue higher levels of education. The results of Kandel and Kao (2001) found migration as an alternate factor to attain economic achievement without pursuing higher education. Children and migrant parents may possibly increase their chances to migrate without getting more education due to the fact that the marginal return to education is higher in the receiving country as compared to their host country (Kandel and Kao 2001; McKenzie and Rapoport 2011). Likewise, Stark and Wang (2002) stated that migration may have a positive effect on educational investments in developing countries, as it is used as a substitute for education subsidies.

2.1.2 Remittances and Human Capital: Theoretical and Empirical Perspective

Kroeger and Anderson (2014) studied the impact of remittances on the human capital of children and found no correlation between schooling and remittances. Salas (2014) examined the relationship between international remittances and human capital formation, and their results revealed a positive and significant impact implying that due to international remittances, there is a probability of acquiring higher education. Similarly, Hines (2014) explored the association of migration remittances with human capital investment and found a significant impact of remittances on educational investment. Köllner (2013) examined the relationship between remittance and educational level, and revealed positively significant outcomes. In addition, Matano and Ramos (2013) established the link of remittances with educational attainment, and the results showed that the chances of getting an education in remittance receiving families increases by 34% on an annual basis.

On the other hand, Hassan et al. (2013) investigated the consequences of workers’ remittances on human capital and concluded that the remittances show insignificant impact on education because the money, which is sent by migrant parents, is spent on other expenses rather than their children’s education.

2.1.3 Remittances and Higher Education Development: Empirical Evidence

Many studies have been conducted to find the connection between remittance flow and investment in education, and it is found that remittance flow among poor families, encourages parents to send their children to school (Griffith and Rothstein 2009). Remittances have a direct impact on education, as it increases enrollment of students in primary education and reduces child labor (Edwards and Ureta 2003; Calero et al. 2009; Mansuri 2006). It is also found that remittances do not merely enhance primary education interest, but also provide opportunities for higher education (Bouoiyour and Miftah 2015; Docquier and Rapoport 2012; Satti et al. 2016). Numerous studies have proven the direct and significant relationship of foreign remittances and educational development (Adams and Cuecuecha 2010; Acosta et al. 2007; Di Maria and Lazarova 2012; Vogel and Korinek 2012; Zhunio et al. 2012; Alcaraz et al. 2012; and others).

Migration has also played a significant role in promoting education, as immigrants send money to their families, which positively influences their children’s education and raises their chances of acquiring quality education (Hines 2014; Salas 2014). Antman (2012) highlighted the fact that remittances do effect education, but the place of migration also matters. In addition, parental education and remittances both influence children to attain education and subsequently, it spurs the productivity of the country (Edwards and Ureta 2003; Acosta et al. 2007). Amuedo-Dorantes and Pozo (2010) found that the flow of remittances augments the appearance of students in the school. Moreover, international remittances using a domestic level of data help eradicate poverty and social issues (Adams and Page 2005; Lokshin et al. 2010).

On the contrary, some researchers have found negative or no correlation among remittances and education development. Some studies have reported that remittances do not encourage education and have an inverse effect on education, because in the absence of parents, children are not properly guided (Mckenzie and Rapoport 2011; Nguyen and Nguyen 2015; Javed et al. 2015). Likewise, maternal education is also one of the determinants which affect children’s enrollment (Hu 2012). Cattaneo (2011) also found no correlation between remittances and education.

To sum up, the majority of the previous studies have corroborated the positive linkage of remittances and school education. Remittances not only influence household and education, but also indirectly increase the productivity and subsequent economic growth. Oppositely, there were some studies that rejected the positive relationship of remittances and school education.

From the above reviewed literature, we can conclude that existing literature has only tried to explain the impact of remittances on school (primary) education and the opportunities for higher education. However, these studies have not focused on the direct effect of remittances in the development of higher education. This paper is an attempt to fill this gap in the literature by exploring the role of remittances in the development of higher education in high remittance receiving middle-income countries.

3 Data and Methodology

We used balanced panel data from 1994 to 2013 from top eight middle Income Group remittance recipient countries, as classified by the World Bank in 2015 (Table 1).

3.1 The Dependent, the Control and the Independent Variable

The dependent variable Higher education development \(\left( {HED} \right)\) is measured through the enrollment in higher education. It is defined as the number of people enrolled in higher education institutions during a year and the data on it were drawn from Thomson Reuter Datastream. For the control variable, per-capita income and for focused variable, the worker remittances, were used. We used data reported by World Bank for each country.

where, ‘\(X\)’ = control variable.

There is a limitation in the model due to non-availability of secondary data on other determinants of enrollment in higher education. We have considered variables like Government expenditure on education (% of government expenditure, % of GDP), Government expenditure on higher education, number of higher education institutes, educational attainment till graduation, educational staff compensation at tertiary, academic staff at tertiary level etc., but does not find the consistent data for all the countries. Due to this non-availability of the data the model cannot be controlled. It would have been better if we could have controlled the model with vital factors such as parents’ education, parents’ occupational status, and the labor market demand for higher education, in determining the effect of remittance on higher education enrollment. Despite these limitations, the results from the PMG/MG remain robust from a descriptive and policy standpoint. The only consequence is that the marginal effects of remittances on higher education development outcomes may need to be interpreted with caution until data on controlling variables become available.

3.2 Static vs Dynamic Panel Models

On reviewing different frameworks available for panel data analysis in terms of efficiency and consistency, we noted that standard panel data analysis, like pooled OLS, fixed effect, and random effect, has some sort of limitations. Pooled OLS does not consider heterogeneity in the cross-section, foist collective intercept, and slope coefficients which makes it a highly restrictive model. The fixed effect model while retaining the assumption of estimators having a common slope and variance tried to overcome the restriction of the pooled OLS model by introducing cross-section specific intercepts and dummy variables to capture the time and cross-section effect. However, this estimator remains less efficient due to loss in degree of freedom (Baltagi 2008). Moreover, when some regressors are endogenous, the fixed effect model produces biased parameter estimates (Campos and Kinoshita 2008). Although the problem of degree of freedom in the fixed effect model is overcome by the random effect model by assuming common intercepts, its assumption that all models are time invariant which implies strict exogeneity is often invalid.

In recent literature, researchers used GMM-difference and GMM-system estimators to estimate panel data model, but according to Roodman (as cited in Samargandi et al. 2015) for small N and large time series, GMM estimators produce spurious results. Moreover, these estimators only capture short run dynamics of panel data and the assumption of homogeneity of lagged dependent variables leads to biased estimates. Within case of large time span, the number of instruments required gets larger and the validity of Sargan test of over identification becomes doubtful (Pesaran et al. 1999).

Pesaran et al. (1999) suggested that for the estimation of large cross-section and time spanned dynamic heterogeneous panel data, panel regression and the error correction model should be combined by applying auto regressive distributive lag \(ARDL_{p,q}\) procedure. This will incorporate heterogeneity in the cross-section.

Here, \(\ln HED\) is the measure of development in higher education, ‘\(X\)’ represents a set of explanatory variables including both focused and control variables, ‘\(\delta\)’ is short-run coefficient of lagged independent variable, ‘\(\gamma\)’ is short-run coefficient of lagged dependent variable, ‘\(\beta\)’ represents long-run coefficients, ‘\(p\)’ and ‘\(q\)’ are the lag of dependent and independent variable respectively, ‘\(i\)’ represents country \(i = 1, 2, 3, \ldots N\), and ‘\(t\)’ represents time index \(t = 1,2,3, \ldots T\). ‘\(\varphi\)’is the coefficient of speed of adjustment to the long-run equilibrium, ‘\(\mu_{i}\)’ is the vector of coefficients indicating the country specific effects, and ‘\(\in_{i}\)’ is the disturbance term with different variances across groups.

Equation (1) with all the dynamic and error correction terms can be estimated by using the mean group (MG) model estimators (Pesaran and Smith 1995) which impose no restrictions, as using Pooled mean group (PMG) model estimators impose common long-run effects, and by using Dynamic fixed effect which constrains slope coefficient and error variances to be the same (Pesaran et al. 1999).

4 Model Selection

To estimate the relationship between remittances and higher education development, we used two dynamic models \(MG\;and\;PMG\). As this study’s focus is only middle-income class countries, we can expect the sample to be homogenous with respect to higher education development and remittance. Finally, we used Hausman test to pick the suitable test outcome for the interpretation and policy recommendation.

4.1 Empirical Analysis

To determine the long-run relation between variables, it has become a norm to check variables (series) for \(I\left( 1 \right)\). Since we are using panel data, we analyzed our data for cross-section dependence, before testing it for the unit root. For the examination of cross-section dependence and independence, we used Pesaran (2004) CD test, because applying conventional unit root test, when there is cross-section dependence in the data, may result in weak findings with low power of the test. The CD test results for \(\ln HED, \ln REM, \,and\, \ln PCI\) are presented in Table 2. The test statistics suggest for the rejection of null hypothesis of cross-section independence at 1% significance level. The rejection of this null hypothesis has motivated us to use second-generation unit root test developed by Pesaran (2007), called CIPS test. The results of the CIPS unit root test with constant and trend terms with one lags are also presented in Table 2. It can be noted from the CIPS unit root test statistics that at I(0) level all studied variables have a unit root and they become stationary at first difference, hence they all are integrated at order \(I\left( 1 \right)\). This finding also suggests that there may be a cointegration relationship between these variables.

The first step in the data analysis is to establish the order of integration of the variable in question. Once it is established, the test of cointegration is applied to verify the existence of least one linear relationship among the variables. We started with the test of the null hypothesis of no cointegration. Panel C in Table 2 reports Kao’s (1999) \(ADF\) based tests and Pedroni’s (2004) \(v - Statistics\). Both the tests reject the null hypothesis of no cointegration at 1% significant level. However, in the presence of cross section dependence, for increasing the robustness of our test, we used Westerlund (2007) error correction based panel cointegration test. Westerlund (2007) test reports four Gaussian distributed tests: \(roup {-} \tau , Group - \alpha , Panel - \tau \,and\,Panel - \alpha\). The initial two tests are mean-group tests and the next two tests are performed under the assumption of common error-correction parameter a; cross cross-section units. The results of Westerlund’s tests are somewhat mixed. \(Group {-} \tau , Panel - \tau \, and\,Panel - \alpha\) support Panel cointegration at 5, 10, and 10% respectively. Hence overall test results of panel cointegration tests confirm a long-run cointegration relationship among the considered variables.

We estimated Eq. (2) with PMG and MG. As we were studying only top remittance receiving and middle-income group countries, we presumed that they have similar economic growth and higher education development, and we may expect that our data is homogeneous. Moreover, in the short-run, there can be a country specific heterogeneity owing to the local laws and regulations.

Under long-run homogeneity assumption, PMG estimators are more efficient as compared to MG estimators. Subsequently, PMG is more suitable for this analysis. Nonetheless, to pick between the PMG and MG estimators we used the Hausman test. The Hausman test, test for the significant difference between the MG and PMG estimation and the null hypothesis is that the difference between PMG and MG is not significant. If p value of the Hausman test is greater than 5% level of significant we reject the null hypothesis and we use PMG estimations.

For ARDL lag structure we used Schwartz Bayesian criterion and we impose following lag structure (1, 1, 1) for higher education development, remittance, and income.

Table 3 report the results of PMG and MG estimation along with the Hausman test to measure the efficiency and consistency among them. According to the PMG estimator remittance has a positive and significant impact on higher education development in the long-run and have negative and significant influence in the short run. Whereas the MG estimator has a positive and insignificant coefficient in the long run but negative and significant coefficient in the short term.

4.2 Conclusion and Policy Implications

The purpose of this study is to examine the remittance and education development nexus in eight middle-income group countries namely Bangladesh, India, China, Egypt, Pakistan, Philippine, Nigeria, and Mexico. The data is taken from 1994 to 2013 and the panel ARDL approach has been used to analyze the long run relationship. The study concludes that remittance plays a significant role in the education development. From the policy perspective, the positive association between the inflow of remittance and education development advocates that the remittances should be encouraged. The policy makers should make those reforms that help increase the inflows of the remittances. The government should also focus on lowering remittance transfer fee, as this will help in minimizing the remittance inflows through unauthorized channels. The financial institutions should also target migrant families and give saving plans and products to the target group. They should be given interest on their savings, as this will help the financial institutions to attract more remittances in the region.

The government should encourage the migrants and their families to invest in the capital accumulation projects which will be beneficial for them as well as the country. The government should develop linkages with the financial institutions and develop new channels through which the remittances can be sent/delivered, in order to encourage the migrants to save and use those remittances in a productive manner. The government should also ensure that the migrants get an attractive exchange rate as it will increase the remittance inflows. Another way through which remittances can be increased is making the transfer process easier, quicker, and more reliable. The strategies that encourage remittances to be used as a business investment should be encouraged. It has an indirect link with the education ratio, because when higher income is earned through the investment, it also increases the education rate. Moreover, awareness programs related to the importance of education should be conducted in these middle-income countries. These programs will increase the awareness and importance associated with child education, which in turn will increase the expenditure share and ultimately upsurge the usage of remittance amount on education.

The one of the main limitation of the study is the model limitation. The non-availability of secondary data on the variables like Government expenditure on education (% of government expenditure, % of GDP), Government expenditure on higher education, number of higher education institutes, educational attainment till graduation, educational staff compensation at tertiary, academic staff at tertiary level etc., Due to this non-availability of the data the model can be controlled. This set the direction for the future researches by suggesting to add more education related variables to make the model more robust (e.g. scholarships, free education, Stipend, parents’ education, parents’ occupational status, and the labor market demand for higher education, etc.). These studies can be done by using the primary type of data. Additionally, a contrasting study of private and public educational institutions should also be conducted in order to check the impact of remittances on higher education enrollment in the target countries.

Notes

Latest brief on Migration and Development.

References

Acosta, P. A., Fajnzylber, P., & Lopez, H. (2007). The impact of remittances on poverty and human capital: Evidence from Latin American household surveys. World Bank Policy Research Working Paper, 4247. Available at SSRN: http://ssrn.com/abstract=992396.

Adams, R. H. (2011). Evaluating the economic impact of international remittances on developing countries using household surveys: A literature review. Journal of Development Studies, 47(6), 809–828. https://doi.org/10.1080/00220388.2011.563299.

Adams, R. H., & Cuecuecha, A. (2010). Remittances, household expenditure and investment in Guatemala. World Development, 38(11), 1626–1641. https://doi.org/10.1016/j.worlddev.2010.03.003.

Adams, R. H., & Page, J. (2005). Do international migration and remittances reduce poverty in developing countries? World Development, 33(10), 1645–1669. https://doi.org/10.1016/j.worlddev.2005.05.004.

Alcaraz, C., Chiquiar, D., & Salcedo, A. (2012). Remittances, schooling, and child labor in Mexico. Journal of Development Economics, 97(1), 156–165.

Amuedo-Dorantes, C., & Pozo, S. (2010). Accounting for remittance and migration effects on children’s schooling. World Development, 38(12), 1747–1759.

Antman, F. M. (2012). Gender, educational attainment, and the impact of parental migration on children left behind. Journal of Population Economics, 25(4), 1187–1214.

Anyanwu, J. C., & Erhijakpor, A. E. O. (2010). Do international remittances affect poverty in Africa? African Development Review, 22(1), 51–91. https://doi.org/10.1111/j.1467-8268.2009.00228.x.

Baltagi, B. (2008). Econometric analysis of panel data. Hoboken: Wiley.

Borraz, F. (2005). Assessing the impact of remittances on schooling: The Mexican experience. Global Economy Journal, 5(1), 1524–5861. https://doi.org/10.2202/1524-5861.1054.

Bouoiyour, J., & Miftah, A. (2015). The impact of migrant workers’ remittances on the living standards of families in Morocco: A propensity score matching approach. Migration Letters, 12(1), 13–27.

Calero, C., Bedi, A. S., & Sparrow, R. (2009). Remittances, liquidity constraints and human capital investments in Ecuador. World Development, 37(6), 1143–1154.

Campbell, E. K. (2009). The role of remittances in Botswana: Does internal migration really reward sending families? Population, Space and Place, 16(2), 151–164.

Campos, N., & Kinoshita, Y. (2008). Foreign direct investment and structural reforms: Panel evidence from Eastern Europe and Latin America. IMF Staff Papers.

Cattaneo, C. (2011). Migrants’ international transfers and educational expenditure. Economics of Transition, 20(1), 163–193. https://doi.org/10.1111/j.1468-0351.2011.00414.x.

Di Maria, C., & Lazarova, E. A. (2012). Migration, human capital formation, and growth: An empirical investigation. World Development, 40(5), 938–955.

Docquier, F., & Rapoport, H. (2012). Globalization, brain drain, and development. Journal of Economic Literature, 50(3), 681–730.

Docquier, F., Rapoport, H., & Salomone, S. (2012). Remittances, migrants’ education and immigration policy: Theory and evidence from bilateral data. Regional Science and Urban Economics, 42(5), 817–828.

Edwards, A. C., & Ureta, M. (2003). International migration, remittances, and schooling: Evidence from EI Salvador. Journal of Development Economics, 72(2), 429–461.

Funkhouser, E. (1992). Migration from Nicaragua: Some recent evidence. World Development, 20(8), 1209–1218.

Griffith, A. L., & Rothstein, D. S. (2009). Can’t get there from here: The decision to apply to a selective college. Economics of Education Review, 28(5), 620–628.

Hanson, G. H., & Woodruff, C. (2003). Emigration and educational attainment in Mexico. Mimeo: University of California at San Diego.

Hassan, M., Mahmood, H., & Shahid, M. (2013). Consequences of worker’s remittances on human capital: An in-depth investigation for a case of Pakistan. Middle-East Journal of Scientific Research, 14(3), 443–452.

Hines, A. (2014). Migration, remittances and human capital investment in Kenya. New York: Colgate University.

Hu, F. (2012). Migration, remittances, and children’s high school attendance: The case of rural China. International Journal of Educational Development, 32(3), 401–411.

Javed, M., Awan, M. S., & Waqas, M. (2015). International migration, remittances inflow and household welfare: An intra village comparison from Pakistan. Social Indicators Research, 130(2), 779–797. https://doi.org/10.1007/s11205-015-1199-8.

Kandel, W., & Kao, G. (2001). The impact of temporary labor migration on Mexican children’s educational aspirations and performance. International Migration Review, 35(4), 1205–1231.

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics, 90(1), 1–44.

Köllner, S. (2013). Remittances and educational attainment: Evidence from Tajikistan (No. 124).

Kroeger, A., & Anderson, K. H. (2014). Remittances and the human capital of children: New evidence from Kyrgyzstan during revolution and financial crisis, 2005–2009. Journal of Comparative Economics, 42(3), 770–785.

Lokshin, M., Bontch-Osmolovski, M., & Glinskaya, E. (2010). Work-related migration and poverty reduction in Nepal. Review of Development Economics, 14(2), 323–332. https://doi.org/10.1111/j.1467-9361.2010.00555.x.

Mansuri, G. (2006). Migration, school attainment, and child labor: evidence from rural Pakistan. World Bank Policy Research Working Paper, (3945).

Matano, A., & Ramos, R. (2013). Remittances and educational outcomes: evidence for Moldova. SEARCH working paper WP3/10. April 2013. http://www.ub.edu/searchproject/wp-content/uploads/2013/05/SEARCH-WP-3.10.pdf.

McKenzie, D. J., & Rapoport, H. (2011). Can migration reduce educational attainment? Evidence from Mexico. Journal of Population Economics, 24(4), 1331–1358.

Nguyen, C. V., & Nguyen, H. Q. (2015). Do internal and international remittances matter to health, education and labor of children and adolescents? The case of Vietnam. Children and Youth Services Review, 58, 28–34. https://doi.org/10.1016/j.childyouth.2015.09.002.

Orozco, M. (2002). Globalization and migration: The impact of family remittances in Latin America. Latin American politics and society, 44(2), 41–66.

Pant, B. (2008). Mobilizing remittances for productive use: A policy-oriented approach. Nepal Rastra Bank, Research Department Working Paper, 4.

Pedroni, P. (2004). Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory, 20(3), 597–625.

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels general diagnostic tests for cross section dependence in panels. SSRN Electronic Journal. https://doi.org/10.17863/CAM.5113.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22(2), 265–312. https://doi.org/10.1002/jae.951.

Pesaran, M. H., Shin, Y., & Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association, 94(446), 621–634.

Pesaran, M. H., & Smith, R. (1995). Estimating long-run relationships from dynamic heterogeneous panels. Journal of econometrics, 68(1), 79–113.

Ratha, D. (2005). “Workers’ remittances: An important and stable source of external development finance”. Economics Seminar Series. Paper 9. http://repository.stcloudstate.edu/econ_seminars/9.

Rodriguez, E. R., & Tiongson, E. R. (2001). Temporary migration overseas and household labor supply: Evidence from urban Philippines. International Migration Review, 35(3), 708–725.

Salas, V. B. (2014). International remittances and human capital formation. World Development, 59, 224–237.

Samargandi, N., Fidrmuc, J., & Ghosh, S. (2015). Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income countries. World Development, 68, 66–81. https://doi.org/10.1016/j.worlddev.2014.11.010.

Satti, S. L., Hassan, M. S., Hayat, F., & Paramati, S. R. (2016). Economic growth and inflow of remittances: Do they combat poverty in an emerging economy? Social Indicators Research, 127(3), 1119–1134. https://doi.org/10.1007/s11205-015-1003-9.

Stark, O., & Wang, Y. (2002). Inducing human capital formation: Migration as a substitute for subsidies. Journal of Public Economics, 86(1), 29–46.

Taylor, J. E. (1992). Remittances and inequality reconsidered: Direct, indirect, and intertemporal effects. Journal of Policy Modeling, 14(2), 187–208. https://doi.org/10.1016/0161-8938(92)90008-z.

Taylor, J. E. (1999). The new economics of labor migration and the role of remittances in the migration process. International Migration, 37(1), 63–88.

Viet Cuong, N., & Mont, D. (2012). Economic impacts of international migration and remittances on household welfare in Vietnam. International Journal of Development Issues, 11(2), 144–163. https://doi.org/10.1108/14468951211241137.

Vogel, A., & Korinek, K. (2012). Passing by the girls? Remittance allocation for educational expenditures and social inequality in Nepal’s households 2003–2004. International Migration Review, 46(1), 61–100.

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69(6), 709–748.

Zhunio, M. C., Vishwasrao, S., & Chiang, E. P. (2012). The influence of remittances on education and health outcomes: A cross country study. Applied Economics, 44(35), 4605–4616. https://doi.org/10.1080/00036846.2011.593499.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Arif, I., Raza, S.A., Friemann, A. et al. The Role of Remittances in the Development of Higher Education: Evidence from Top Remittance Receiving Countries. Soc Indic Res 141, 1233–1243 (2019). https://doi.org/10.1007/s11205-018-1857-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-018-1857-8