Abstract

This study explores the relationship between inclusive wealth, economic growth, and productivity of natural capital (including forestry, fishery, fossil energy reserves and minerals) for 140 countries between 1990 and 2014. For this objective, a Malmquist productivity index is developed, and regression analysis is performed. The results are threefold. First, we found that natural capital deterioration constituted the main driving force of declining wealth per capita following fossil fuel extraction. Second, the adjustment to a conventional productivity growth measure depends on GDP growth and an endowment growth shift of natural capital relative to other input factors. Third, we also found that the initial phase of GDP growth was accompanied by slower natural capital utilization followed by a phase of deterioration as these countries continue to develop economically. With further economic development, enhanced technology and effective natural resources utilization limit the material basis and result in reduced natural capital extraction. These results imply that natural capital extraction management for a broader income level can be implemented for sustainability in both the short and long term.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Wellbeing is defined as a function of the consumption of both market and non-market goods and services, including natural resources and environmental services (Mumford 2016). The extraction of sub-soil assets has a significant role in production and contributes a considerable share to some nations’ GDPs, but the contribution of natural resources in production is missing (Halkos and Psarianos 2016). While ecological impacts are frequently thought to be “non-market,” many of the effects are often reflected in market accounts through damages that might include factors such as the decreased productivity of agroecosystems due to land degradation (Reilly 2012). Typically, studies analyze Total Factor Productivity (TFP) by estimating average production functions or by non-parametric index approaches. In both cases, it is assumed that production is carried out by using only physical capital and labor. All forms of capital that serve both goods and services should be considered in the production function since neglecting natural capital tends to lead to an underestimation of countries’ productivity growth (Brandt et al. 2017).

Natural capital represents an essential pool of resources that can induce the growth of other capital assets. It has three social values, including intrinsic value, use value and option value, and these three values have varying combinations (Arrow et al. 2012). A decreasing productive base, including natural capital, implies that the next generation may have decreasing levels of wellbeing (Arrow et al. 2012). Ecological resource efficiency is considered as an important aspect of sustainable development (Frye-Levine 2012). Depleting natural capital such as fishery resources is frequently uneconomical in most countries. Recognizing natural capital as an input may change measured productivity growth and the assessment of the sources of economic growth (Kurniawan and Managi 2017).

Few studies have incorporated natural capital in productivity measures. These include Murillo-Zamorano (2005), Liu et al. (2014), and Brandt et al. (2017). However, their natural capital data are limited to sub-soil assets such as oil, gas, and various minerals. The coverage of natural capital datasets in previous studies is constrained by data limitations. For example, the World Bank’s (2011) wealth dataset does not cover other types of natural capital that also contribute to the production process, such as fisheries and another renewable resources. While nations gather large quantities of data to produce national account systems, they collect relatively little natural capital, especially non-market data.

Having a wider picture of productivity by incorporating natural capital is important for researchers and policymakers. According to the definition by UNU-IHDP and UNEP (2012), productivity changes in resource utilization can lead to an increase (or decrease) in aggregate output over time. Massive resource utilization could also escalate pollution and emissions as undesirable outputs (Akao and Managi 2007). While ecological impacts are frequently thought to be “non-market,” many of the effects are often reflected in market accounts through damages that might include decreased productivity of agroecosystems due to land degradation (among others) (Reilly 2012).

Against this backdrop, there are three main objectives of this study. First, we aim to understand the natural capital contributions to countries’ wealth. In addition to natural capital accounts that consider non-renewable sub-soil wealth, we also include renewable capital such as fisheries and forests. Second, attempts are made to measure the contributions of renewable and nonrenewable natural capital to countries’ TFPs. Third, the changes in natural capital productivity in different countries are linked with their respective per capita income. We intend to investigate the relationship between natural capital productivity and income growth.

To achieve the objective, we account for natural capital using data on 140 countries from 1990 to 2014. These data represents 99% of global GDP and 95% of the global population from 1990 to 2014. Then, we conduct a two-step approach. Productivity measures are estimated by Malmquist productivity in the first step. This methodology is often used in measuring productivity (see Samut and Cafri 2016; Carboni and Russu 2015). The index based on a distance function is suitable for assessing the relationship between multivariate inputs and outputs. In addition, the measurement takes into account the efficiency of resource use and productivity changes. In the second step, to understand the relationship between income and natural capital productivity, we performed regressions using a system generalized method of moments (GMM) model. This method eliminates the serial correlation problem while analyzing TFP measurements, as was suggested by Zhengfei and Lansink (2006).

This paper is organized as follows. Section 2 provides the research background on productivity and wealth studies. This section overlooks the importance of wealth inclusiveness and productivity by considering natural capital, which has several implications for the development of each nation. Section 3 describes the methodology. The results are presented in Sect. 4. Conclusions and policy implications are presented in Sect. 5.

2 Background

Wealth and productivity have long been measured with metrics focused on economic indicators such as GDP, income and human and physical capital. Recent literature suggests that such approaches to wealth and productivity are limited since they overlook important social and environmental components, that have several implications on the development of each nation.

2.1 Wealth Metrics Overview and Inclusiveness

There have been criticisms toward GDP due to its role as a proxy for wealth. Regardless of its substantial role in measuring a country’s progress, GDP cannot describe the social and environmental status that may oppose the financial benefits (Talberth et al. 2007). GDP also does not consider all dimensions of societal progress (Schoenaker et al. 2015). It also ignores developing countries’ irresponsible production of resources to boost their GDP growth (Costanza et al. 2014). Imran et al. (2014) argued that ecological welfare is not secondary but rather equal to human welfare. There are many market goods and services that are not calculated in GDP but actually have significant contributions to wellbeing.

Wellbeing includes income and other aspects such as health, educational, life satisfaction, ecosystems services, and biocapacity (UNU-IHDP and UNEP 2014). Despite the challenges, there are now a number of proposed indicators that go beyond GDP and available to track the meaningful progress of nations in improving wellbeing, including (but not limited to) the genuine progress indicator (Kubiszewski et al. 2013), the human development index (United Nations Development Programme 1990–2013), the happiness index (Helliwell et al. 2012), and the better life index (OECD 2014). This multidimensional nature presents prominent deviance for providing quantitative measures within the robust theoretical framework.

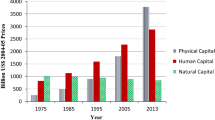

By being theoretically consistent with the determinants of economic wellbeing, inclusive wealth framework continuously shows progressive measurements (Mäler 2008; Arrow et al. 2012; UNU-IHDP and UNEP 2014; Dasgupta et al. 2015). By adapting Mumford (2016), we present a schematic relationship between GDP, the productive base (human, physical, and natural capital), and wellbeing, as shown in Fig. 1. Dasgupta and Mäler (2000) argued that potential intergenerational wellbeing increases if the productive base increases. A rising productive base does not guarantee that wellbeing will increase, but the country does have the potential to produce more goods and services. Consumption is considered to comprehensively cover all non-market goods and services that provide wellbeing. Then, the productive base must include all forms of capital that serve both goods and services. All these forms of capital (human, produced, and natural capital) and the social values are referred to as inclusive wealth or comprehensive wealth (See World Bank (2011), Arrow et al. (2012) and UNEP/UNU-IHDP (2012, 2014). On an ideal development trajectory, economic growth and wellbeing proportionally and concurrently increase. Therefore, current consumption can increase by decreasing investment, essentially reducing the capital stock such as natural capital. Arrow et al. (2004) also discussed whether economic development in one country will not meet the sustainability development criterion if a country’s wealth growth is negative.

2.2 Productivity Metrics and Natural Capital Components

TFP is viewed as an important long-term driver of economic growth in both economic theory and empirical research. According to Klenow and Rodriguez-Clare (1997), TFP growth accounts for 90% of the global variation in output growth. Utilizing capital and labor as inputs, Arrow et al. (2004) found that the contribution of TFP to the IW growth rate to be between 6.33% (China) and − 0.40% (Middle East/North Africa). Arrow et al. (2012) found that the contribution changed from − 2.12% (Venezuela) to 2.71% (China).

Therefore, previous studies on TFP ignore the effects of human capital and natural capital, which are key variables in the capital approach. Xepapadeas and Vouvaki (2009) suggested that the externality of the environment drives conventional TFP downwards. In addition, an explicit analysis of the role of natural capital in production is an important element to better understand the sustainability of economic development.

We treat TFP as residual. TFP represents the contribution to the production of multiple implicit factors after produced, human, and capital items have been isolated, as shown in Fig. 1. Depleting natural capital often leads to higher economic growth in the short term, but this can only be sustained if sufficient associated revenues are used to build other assets, such as human or physical capital, in order to secure the economy’s ability to generate long run income. Utilizing this approach, we can capture to a closer approximation of the real contributions of technological innovation and efficiency in production as well as other implicit capital types not yet considered in developing the country’s productive assets.

2.3 Wealth and Productivity Relationship

The environmental Kuznets curve (EKC) hypothesis reflects the idea that indicators of environmental degradation tend to worsen as GDP grows until average income reaches a certain point over the course of development (Stern et al. 1996). Empirical evidence for the EKC hypothesis shows that it holds only for a specific subset of indicators. Chimeli and Braden (2005) found that TFP differences account for much of the variation in income across countries, which has important implications for environmental quality. By focusing on India with several pollutants, including sulfur dioxide, nitrogen dioxide, and suspended particular matter, Managi and Jena (2008) found that environmental productivities decreased from 1991 to 2003. Choi et al. (2010) specify that improvements in environmental quality with the help of environmentally friendly development paths cannot continue, and it would decline again. Wang et al. (2011) show agreement on this hypothesis using SO2 emissions as an environmental indicator.

Taking energy use as the indicator, Özokcu and Özdemir (2017) did not prove the hypothesis that environmental degradation could not be automatically resolved by GDP growth. Using forests as the indicator, Joshi and Beck (2016) found that OECD countries’ deforestation had reversed but then began to rise again, indicating that more valuable forest products and land will lead to further deforestation as income grows.

We attempt to find a relationship between GDP per capita and its respective natural capital productivity. Natural capital productivity indicates the difference between conventional productivity (which only considers human and produced capital) and productivity, which also considers natural capital as an input beside the conventional inputs. In this type of two-step approach, productivity measures are estimated by Malmquist productivity in the first step and regressed on explanatory variables in the second step.

We follow Dinda (2004), Galeotti and Lanza (2005), and Akbostancı et al. (2009), who develop the equation for the cubic model to test the EKC hypothesis as follows.

In this equation, Y denotes environmental indicators, X represents income (or GDP per capita), uit is the traditional error term, i symbolizes individuals and/or groups, and t is time. The signs of the coefficients of X, X2, and X3 determine the shape of the curve. Therefore, the existence of the EKC hypothesis can be verified or not as follows.

-

When 1 > 0 and 2 = 3 = 0, there is a monotonically increasing relationship between X and Y.

-

When 1 < 0 and 2 = 3 = 0, there is a monotonically decreasing relationship between X and Y.

-

When 1 > 0, 2 < 0, and 3 = 0, there is an inverted U-shape relationship between X and Y. In other words, the EKC hypothesis is valid.

-

When 1 < 0, 2 > 0, and 3 = 0, there is a U-shape relationship between X and Y.

-

When 1 > 0, 2 < 0, and 3 > 0, there is an N-shape relationship between X and Y.

-

When 1 < 0, 2 > 0, and 3 < 0, there is an inverted N-shape relationship between X and Y.

These different curve shapes have different interpretations. A monotonically decreasing curve means that the environmental indicator improves as income increases, while a monotonically increasing curve refers to an environmental indicator that declines as income increases.

In addition, the inverted U-shape posited by the EKC reveals that the environmental indicator degrades as income increases up to the turning point. After that, the environmental indicator improves as income increases. The inverted U-shape suggests that environmental quality improves as income rises, but after some point, it starts to decline as income increases (Fan and Zheng 2013). The N-shaped curve signifies that environmental degradation rises again after a reduction to a specific level. The inverted N-shaped graph implies the opposite of the N-shaped relationship; that is, environmental deterioration decreases again after an increase to a certain level.

3 Method and Datasets

In this study, our method consists of three steps. First, we develop and update the dataset that accounts for natural capital for 140 countries from 1990 to 2014 (see also UNU-IHDP and UNEP 2014; Managi and Kumar 2018). The aim of this step is to consider both renewable and nonrenewable natural capital as inputs to the production function. The natural capital accounts include fishery resources, one of the most threatened renewable resources. We also consider forest resources (timber and non-timber), and agricultural land (cropland and pasture land). The nonrenewable natural capital wealth consists of fossil fuels (oil, natural gas, coal) and minerals (bauxite, nickel, copper, phosphate, gold, silver, iron, tin, lead, zinc). Another conventional capital is human and produced (physical) capital. Human capital is derived from education, while produced capital consists of a country’s infrastructure and physical assets, such as equipment, machinery, and roads, among others. The following table illustrates the dataset and its sources (Table 1).

For the second step, we compute productivity measures using the previous dataset. We used a deterministic non-parametric analysis based on the data envelopment analysis. This methodology has previously been used in the measurement of productivity (see Samut and Cafri 2016; Carboni and Russu 2015; Tamaki et al. 2017). The index based on the distance function is suitable for assessing the relationship between multivariate inputs and outputs.

As for the third step, to understand the relationship between income and natural capital productivity, we performed a regression using a system GMM model. This method eliminates the serial correlation problem while analyzing TFP measurements, as suggested by Zhengfei and Lansink (2006).

4 Result

4.1 Natural Capital Contribution to Countries Inclusive Wealth

By using the natural capital calculation covered by both renewable and non-renewable resources, we provide a quantitative evaluation of natural capital’s contribution to inclusive wealth per capita. Measuring stock, inclusive wealth is related to potential intergenerational wellbeing. We found that natural capital depreciation constitutes the main driving forces of declining wealth per capita in the majority of countries. Across 140 countries, natural capital has experienced a large decline while produced and human capital have experienced large increases. In particular countries, they simply extract more from nature than they have invested in healthcare, education, infrastructure and other physical capital. A decrease in inclusive wealth indicates that the next generation will inherit a smaller productive base that will result in lower levels of wellbeing.

We found the interesting result in terms of the composition of natural capital from 1990 to 2014. Renewable resources account for more than half of natural capital (53%), which consists of forests 37%, agricultural 14%, and fish 2%. In the other part, nonrenewable resources consist of oil (22%), coal (17%), gas (7%) and minerals (1%).

By grouping countries based on income levels, we obtain 42 high-income economies, 35 upper middle-income economies, 37 lower-middle-income economies, and 26 low-income economies. In the 26 countries classified as “low income,” we found that natural capital makes up 37% of the total productive assets. Natural capital, in several low-income countries in African region such as Central African Republic, Liberia, Mozambique, makes up more than 70% of their total capital. Assets like fossil fuels, minerals, forests, and agricultural land that provide important goods and services make up a country’s natural capital. As these populations grow and the pressures on land and water increase, their natural resources might be under increasing threats.

We found that countries have high differences in their shares of natural capital’s contribution compared to total wealth capital. In terms of composition, countries with higher shares of natural capital, tend to have a lower share of human capital, and vice versa. In several oil-producing countries such as Kuwait, Iraq, Qatar, and Saudi Arabia, the contribution of natural capital to their productive assets is more than 60%. At the other extreme, in several countries such as Singapore, Japan, and the UK, their natural resources make small contributions to the total productive assets. These particular countries have a relatively proportion of their wealth in human capital and a relatively low proportion in natural capital. It is largely explained by the relative stability of produced capitals, such as infrastructure, in total wealth. Therefore, these natural capital shares must be interpreted with caution. It reflects the worth of natural capital formation in relation to the total wealth of a country, but it is not aimed to provide information about absolute wealth. For example, in Norway, natural capital is only 12% since they have a high level of human capital. Actually, Norway has a high level of total wealth in natural capital.

For some countries, including Japan, Malaysia, and India, the annual reduction in natural capital decreases over time. In other countries, including Indonesia, Russia, Australia, the decline in natural capital is accelerating. Several countries, such as Bahrain, United Arab Emirates, and Qatar, show the largest declines in natural capital. It is related to the increased extraction of fossil fuels in particular countries. This decline leads to an overall decline in inclusive wealth.

In many countries with positive GDP per capita growth, inclusive wealth per capita declined for 1990–2014. Myanmar, Cambodia, Lao, Liberia, Mozambique, Iraq, Kuwait, Trinidad and Tobago, Mongolia, Nepal, Bolivia, Iran, Zambia, Paraguay, Pakistan, Malawi, Benin, Zimbabwe, and Afghanistan, experienced positive GDP growth per capita and a decline in inclusive wealth per capita.

4.2 TFP Considering Natural Capital

We extend current measures of productivity by capturing the efficient utilization of natural capital and other conventional inputs using the Malmquist productivity index approach. Conventional productivity growth only considers labor and capital as inputs in the production function. In this study, we treat each country’s produced capital, human capital and natural capital as inputs for GDP.

Productivity change is based on how many economic goods and services reflected by GDP are produced given specific inputs (human, produced and natural capital). Separate frontiers and benchmarks are estimated for each year, and shifts in the frontiers over time are used to measure the efficiency/technological change. The arithmetic means of the Malmquist productivity indices for each country in each year are estimated under the assumptions of constant returns to scale in production technologies. Note that we also estimate the productivities under the assumptions of variable returns to scale and find similar results (Fig. 2).

Using the framework, we found that the adjustment to the conventional productivity growth measure depends on the output growth (i.e., GDP) and the growth of natural capital relative to other input factors. By utilizing natural capital as an input, we found that 49 out of 140 countries had negative average TFP changes.

TFP growth of countries has undergone a powerful revival since 1990, but the economic crisis in 2008 that hit several countries had an impact on declining TFP scores. Since productivity growth is measured as the residual between output and input growth, declining GDP growth definitely lowered TFP during the crisis.

Considering natural capital makes a big difference for several countries, as 42 countries move from the positive to the negative bracket. We found that 24 out of 42 countries in the high-income group have negative differences after natural capital is considered, which lowers TFP rather than conventional TFP. This finding indicates that conventional TFP overestimates productivity. Even though the average difference is negative, we found the lower discrepancy at the end of study periods. These trends reflect declining natural capital endowments. Some countries, notably the U.S., Denmark, Spain, Ireland and the Netherlands, experienced a decline in natural capital inputs over the sample period. This is because oil and gas reserves were already decreasing over the largest part of the period considered here.

Productivity growth in these countries was stronger than the traditional TFP growth measure, which would suggest that the failure to account for declining natural capital inputs leads to an overestimation of aggregate factor input growth, which is equivalent to an underestimation of productivity growth. Since labor and capital generally tend to grow, (except in very severe recessions), the adjustment will be negative when natural capital input growth is negative.

By failing to account for a very fast-growing input factor, the traditional TFP growth measure overestimates productivity growth in these countries. The following table shows several countries with the highest discrepancies (Table 2).

Several countries such as Singapore, Canada, and South Africa show higher positive trends. Singapore is the country with the highest growth rate of the produced capital (6.5%), human capital (4.1%), and GDP (6.5%) during this period (7%). However, their utilization of natural capital is more modest compared to other countries (− 0.3%). The evolution of capital in the broad sense (including conventional and natural capital) is more modest, so Singapore’s TFP growth rate increases significantly when natural capital is considered.

South Africa, which joined the BRIC bloc in 2011, has positive TFP when considering natural capital. It increased 0.30% after being adjusted for natural capital. Historically, gold mining and minerals have long been the backbone of South Africa’s economy. However, there has been a shift to industrial and service industries. South Africa has a population much younger than the other members of BRICS countries. According to the United Nations Population Fund (2017), South Africa’s population is largely made up of young people. People below the age of 35 years constitute approximately 66% of the total population. This allows South Africa to enjoy the benefits of dividends in the future, which has provided a substantial investment in human capital.

On the opposing side, including natural capital as an input caused negative TFP adjustments for several countries, including the Netherlands, Denmark, and Great Britain. The adjustment to the conventional TFP growth measure is negative, as natural capital grew faster than the traditional input index (which combined human and produced capital only) over the sample period. In GBR, during the study period, their produced and human capital growth are 3 and 1%, respectively and their natural capital extraction grew at 3.9%. In their case, this result is mainly related to the high rates of oil and natural gas depletion.

TFP with both renewable and nonrenewable natural capital is also useful in studying the changing role of natural capital to build countries’ wealth. It can provide important information regarding the sustainability of growth, especially for countries where natural capital contributes to a high share to their wealth, such as China. TFP growth is also considered as an important underlying reason for China’s remarkable economic growth over the past several decades, in addition to other proximate determinants such as physical and human capital accumulation (see, for instance, Ding and Knight 2011). Even though TFP still remains positive, considering natural capital lowered China’s TFP − 1.26% to 1.0315, as shown in the following figure (Fig. 3).

Natural capital plays a significant role in China. In 1990, natural capital contributed to 34% of total wealth. It consists of nonrenewable natural capital, which accounted for 45% of total natural capital. Massive infrastructure in China allowed produced capital to increase to 35%, while natural capital declined to 15% of total capital. The share of nonrenewable natural capital shrank to 35% at the end of study period.

Following this change, the adjustment of the conventional TFP and TFP considering natural capital growth shifted, especially in relation to resource utilization. In the years starting from 2006, when the rate of extraction of minerals and oil was fast, the use of natural capital grew faster. During 1990–2005, the declining rate of natural capital in China is 0.63%. From 2006 to 2014, this value became on average 1%. The decline of natural capital in China was related to massive extractions of coal and oil. As a result, the conventional TFP growth measure after 2005 underestimates input growth in those years and productivity growth is overestimated. This remarkable result highlights that China, as the world’s largest consumer of natural resources, must become a leader in environmental innovation for sustainable development.

4.3 Income and Natural Capital Productivity Relationship

To understand the relationship between income and natural capital productivity, we performed regressions using a system GMM model. Natural capital productivity refers to the difference between conventional productivity (which considers only human and produced capital) and productivity, which also considers natural capital as an input along with conventional inputs.

Result test of the model with natural capital productivity differences are shown in Table 3. This table provides the results of the GMM estimation for 140 countries for 1990–2014. Income per capita as an independent variable has statistically significant impacts. This result indicates that economic development has a significant impact on natural capital productivity. The second-order test AR (2) cannot reject the null hypothesis of no autocorrelation, which indicates that serial correlation does not exist in the model. The Sargan test for overidentifying restrictions and the hypothesis of no second-order autocorrelation imply that the instruments used in the GMM estimation are valid.

By examining the results in the table, we uncovered some important trends. It has approximately a third-order polynomial shape, indicating improved natural capital productivity at the initial phases of growth, followed by a phase of deterioration, and then further improvement once a critical level of per capita GDP is reached. For these countries, the initial deterioration of environmental conditions and its improvement in later stages of economic growth manifest as an initial decline and then an improvement of natural capital productivity as measured by the indexes.

GDP per capita has positive and significant signs. This finding indicates that natural capital grew slower than the other traditional input index (which combines human and produced capital input growth only) and GDP growth. This result reflects a trend among lower income countries, 25 out of 26 of which have a positive adjustment after accounting for natural capital. This positive adjustment related to the utilization of the local natural capital is not captured in modern accounting. For example, in the energy sector, local fuels such as firewood, dung, crop residues, and other biomass-based products still contribute to a major share of energy requirements for rural populations in low-income countries. Filmer and Pritchett (2002) noted the importance of the local natural resource base in rural life.

The quadratic form of GDP per capita shows a negative and significant outcome, revealing the N-shaped curve for natural capital productivity. Countries extract more natural capital such as forests and fossil fuels as they continue to develop economically. Deforestation rates rose with economic development in several low-to-middle-income countries. Deforestation then declined in particular countries due to pressure by environmentalists for better environmental policies, such as selective logging. Such additional deforestation can come from many different causes, but the key reason for this deforestation remains the harvesting of forest products for economic gain (Joshi and Beck 2016). Many OECD countries still cut down forests to create lumber or other products for export and domestic use, particularly as second-growth forests have matured (OECD 2015).

In addition, further technology has frequently implied a bigger need for natural resource-related products. For example, high-income countries have begun to rely more on wood chips and wood pellets for their biomass energy generation (Wong and Bredehoeft 2014). Increasing income also may generate a larger middle class that has the predominant attitude of over-consumption in many developed countries.

5 Conclusions and Policy Implications

This study has three main objectives. First, we provide a quantitative evaluation of natural capital’s contributions to inclusive wealth per capita. We covered 140 countries from 1990 to 2014 and calculated their productive natural capital bases. Our natural capital calculations covered both renewable and non-renewable resources such as fisheries, forests, agricultural land, fossil fuels, and minerals. Second, we measure the contribution of the updated natural capital to countries’ productivities. Third, we investigate the relationship between natural capital productivity and income growth. To achieve this objective, we include natural capital accounting for 140 countries. Then, we conduct a two-step approach. In the first state, we calculate the Malmquist productivity with natural capital and conventional inputs. Furthermore, we performed a regression using a system generalized method of moments (GMM) model.

We found several important results. Nonrenewable natural capital constitutes almost half of natural capital wealth. The depreciation of this particular capital constitutes the main driving forces of declining wealth per capita following massive extractions of fossil fuels in particular countries. This decline leads to an overall decline in inclusive wealth. In certain countries, natural capital depletion burdens both human and physical capital growth.

The adjustment to the conventional productivity growth measure depends on the output growth (GDP) and shift of natural capital relative to other input factors. The adjustment to the conventional TFP growth measure is negative, since natural capital grew faster over the sample period than the traditional input index that combines only human and produced capital input growth. It adjusted to be positively higher for several countries that utilized modest natural capital to accompany their GDP growth. The adjustment of the conventional and TFP considering natural capital growth measurement may shift over time with respect to resource utilization.

Concerning the relationship between natural capital productivity and income growth, we found a third-order polynomial shape. GDP per capita has positive and significant signs, which indicates that GDP growth in the initial stage is accompanied by slower natural capital utilization than the other traditional input index. It is related to the utilization of local natural capital such as traditional biomass. Then, it is followed by a phase of deterioration, possibly due to massive extractions of forests and fossil fuel as these countries continue to develop economically. At a further stage, natural capital productivity increased again as a result of more effective utilization of natural resources.

These results provide several noteworthy contributions. Having limited natural capital as a productive base, countries inclusive wealth accounting should be added to the national accounting departments in each nation. This approach will provide another metric to monitor their performance, with special focus on the importance of environmental investments. Broadening the accounts will give a better picture of changing goods and services and also potential changes in wellbeing. Depleting forests or extracting fossil fuels and minerals will increase GDP in the short run, but will endanger future consumption potential. While demand for natural capital services such as agriculture, renewable energy, and food products is increasing, the natural resources available for production are decreasing. In the face of increasing scarcity, the natural direction should be toward investments in renewable resources to meet energy production requirements through renewable energy, such as solar, biomass, wind, and others.

Governments also need to increase the productivity of all resources used in production. Increasing investments in areas such as technology and efficiency measures (thought to make up the bulk of TFP) could be used to increase productivity. It also encourages policymakers to support the development of renewable resources technologies by showing the significant impact of these resources on productivity. The contribution of investment in technology is crucial to address dwindling resources and to achieve the desired productivity growth.

References

Akao, K. I., & Managi, S. (2007). Feasibility and optimality of sustainable growth under materials balance. Journal of Economic Dynamics and Control, 31(12), 3778–3790. https://doi.org/10.1016/j.jedc.2007.01.013.

Akbostancı, E., Türüt-Aşık, S., & Tunç, Gİ. (2009). The relationship between income and environment in Turkey: Is there an environmental Kuznets curve? Energy Policy, 37(3), 861–867.

Arrow, K., Dasgupta, P., Goulder, L., Daily, G., Ehrlich, P., Heal, G., et al. (2004). Are we consuming too much? The Journal of Economic Perspectives, 18(3), 147–172.

Arrow, K. J., Dasgupta, P., Goulder, L. H., Mumford, K. J., & Oleson, K. (2012). Sustainability and the measurement of wealth. Environment and Development Economics, 17(03), 317–353.

Barro, R. J., & Lee, J. W. (2013). A new data set of educational attainment in the world, 1950–2010. Journal of Development Economics, 104, 184–198.

Bolt, K., Matete, M., & Clemens, M. (2002). Manual for calculating adjusted net savings (pp. 1–23). World Bank: Environment Department.

BP. (2015). Statistical review of world energy 2015. Retrieved from http://www.bp.com/statisticalreview.

Brandt, N., Schreyer, P., & Zipperer, V. (2017). Productivity measurement with natural capital. Review of Income and Wealth, 63(1), S7–S21. https://doi.org/10.1111/roiw.12247.

Brundtland, G. H. (1987). World commission on environment and development (1987): Our common future. World Commission for Environment and Development.

Carboni, O. A., & Russu, P. (2015). Assessing regional wellbeing in Italy: An application of Malmquist–DEA and self-organizing map neural clustering. Social Indicators Research, 122(3), 677–700.

Chimeli, A. B., & Braden, J. B. (2005). Total factor productivity and the environmental Kuznets curve. Journal of Environmental Economics and Management, 49(2), 366–380.

Choi, E., Heshmati, A., & Cho, Y. (2010). An empirical study of the relationships between CO2 emissions, economic growth and openness. IZA discussion paper no. 5304. Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1708750.

Conference Board. (2016). Total economy database. Retrieved from http://www.conference-board.org/data/economydatabase/.

Costanza, R., Kubiszewski, I., Giovannini, E., Lovins, H., McGlade, J., Pickett, K. E., et al. (2014). Development: Time to leave GDP behind. Nature, 505(7483), 283–285. https://doi.org/10.1038/505283a.

Dasgupta, P., & Mäler, K. G. (2000). Net national product, wealth, and social well-being. Environment and Development Economics, 5(1), 69–93.

Dasgupta, P., Duraiappah, A., Managi, S., Barbier, E., Collins, R., Fraumeni, B., et al. (2015). How to measure sustainable progress. Science, 350(6262), 748. https://doi.org/10.1126/science.350.6262.748.

Dinda, S. (2004). Environmental Kuznets curve hypothesis: a survey. Ecological Economics, 49(4), 431–455.

Ding, S., & Knight, J. (2011). Why has China grown so fast? The role of physical and human capital formation. Oxford Bulletin of Economics and Statistics, 73(2), 141–174.

Fan, C., & Zheng, X. (2013). An empirical study of the environmental Kuznets curve in Sichuan Province, China. Environment and Pollution, 2(3), 107.

Färe, R., Grosskopf, S., Lindgren, B., & Roos, P. (1994). Productivity developments in Swedish hospitals: a Malmquist output index approach. In Data envelopment analysis: Theory, methodology, and applications (pp. 253–272). Dordrecht: Springer.

Feenstra, R. C., Inklaar, R., & Timmer, M. P. (2015). The next generation of the Penn world table. The American Economic Review, 105(10), 3150–3182.

Filmer, D., & Pritchett, L. H. (2002). Environmental degradation and the demand for children: searching for the vicious circle in Pakistan. Environment and Development Economics, 7(1), 123–146.

Food and Agriculture Organization of the United Nations (FAO). (2015). Global forest resources assessment 2015—main report. http://www.fao.org/3/a-i4808e.pdf.

Frye-Levine, L. A. (2012). Sustainability through design science: Re-imagining option spaces beyond eco-efficiency. Sustainable Development, 20(3), 166–179. https://doi.org/10.1002/sd.1533.

Galeotti, M., & Lanza, A. (2005). Desperately seeking environmental Kuznets. Environmental Modelling and Software, 20(11), 1379–1388.

Halkos, G., & Psarianos, I. (2016). Exploring the effect of including the environment in the neoclassical growth model. Environmental Economics and Policy Studies, 18(3), 339–358.

Helliwell, J., Layard, R., & Sachs, J. (2012). World happiness report. http://eprints.lse.ac.uk/47487/.

Imran, S., Alam, K., & Beaumont, N. (2014). Reinterpreting the definition of sustainable development for a more ecocentric reorientation. Sustainable Development, 22(2), 134–144. https://doi.org/10.1002/sd.537.

International Labor Organization. (2016). Key indicators of the labour market (KILM) database. Retrieved from www.ilo.org.

Joshi, P., & Beck, K. (2016). Environmental Kuznets curve for deforestation: evidence using GMM estimation for OECD and non-OECD regions. iForest-Biogeosciences and Forestry, 10(1), 196.

Kerstens, K., & Managi, S. (2012). Total factor productivity growth and convergence in the petroleum industry: empirical analysis testing for convexity. International Journal of Production Economics, 139(1), 196–206.

Klenow, P. J., & Rodriguez-Clare, A. (1997). Economic growth: A review essay. Journal of Monetary Economics, 40(3), 597–617.

Kubiszewski, I., Costanza, R., Franco, C., Lawn, P., Talberth, J., Jackson, T., et al. (2013). Beyond GDP: Measuring and achieving global genuine progress. Ecological Economics, 93, 57–68.

Kurniawan, R., & Managi, S. (2017). Sustainable development and performance measurement: Global productivity decomposition. Sustainable Development, 25(6), 639–654. https://doi.org/10.1002/sd.1684.

Lenzen, M., Moran, D., Kanemoto, K., & Geschke, A. (2013). Building Eora: a global multi-region input–output database at high country and sector resolution. Economic Systems Research, 25(1), 20–49.

Liu, M., Zhang, D., Min, Q., Xie, G., & Su, N. (2014). The calculation of productivity factor for ecological footprints in China: A methodological note. Ecological Indicators, 38, 124–129.

Mäler, K. G. (2008). Sustainable development and resilience in ecosystems. Environmental & Resource Economics, 39(1), 17–24.

Managi, S., & Jena, P. R. (2008). Environmental productivity and Kuznets curve in India. Ecological Economics, 65(2), 432–440.

Managi, S., & Kumar, P. (2018). Inclusive wealth report 2018: Measuring progress toward sustainability. New York: Routledge (Forthcoming).

Mizobuchi, H. (2014). Measuring world better life frontier: a composite indicator for OECD better life index. Social Indicators Research, 118(3), 987–1007.

Mumford, K. J. (2016). Prosperity, sustainability and the measurement of wealth. Asia & The Pacific Policy Studies, 3(2), 226–234.

Murillo-Zamorano, L. R. (2005). The role of energy in productivity growth: A controversial issue? The Energy Journal, 26(2), 69–88.

Narayanan, B., Aguiar, A., & Mcdougall, R. (2012). Global trade, assistance, and production: The GTAP 8 data base. Center for Global Trade Analysis, Purdue University. http://www.gtap.agecon.purdue.edu/databases/v8/v8_doco.asp.

OECD. (2014). Better life index. OECD Better Life Initiative. Retrieved from http://oecdbetterlifeindex.org.

OECD. (2015). Material resources, productivity and the environment. Paris: OECD Publishing. https://doi.org/10.1787/9789264190504-en.

OECD. (2016). OECD national accounts. Retrieved from http://stats.oecd.org/.

Özokcu, S., & Özdemir, Ö. (2017). Economic growth, energy, and environmental Kuznets curve. Renewable and Sustainable Energy Reviews, 72, 639–647.

Pauly, D., & Zeller, D. (2016). Catch reconstructions reveal that global marine fisheries catches are higher than reported and declining. Nature Communications, 7, 10244.

Reilly, J. M. (2012). Green growth and the efficient use of natural resources. Energy Economics, 34, S85–S93.

Samir, K. C., & Lutz, W. (2017). The human core of the shared socioeconomic pathways: Population scenarios by age, sex and level of education for all countries to 2100. Global Environmental Change, 42, 181–192.

Samut, P. K., & Cafrı, R. (2016). Analysis of the efficiency determinants of health systems in OECD countries by DEA and panel tobit. Social Indicators Research, 129(1), 113–132.

Schoenaker, N., Hoekstra, R., & Smits, J. P. (2015). Comparison of measurement systems for sustainable development at the national level. Sustainable Development, 23(5), 285–300. https://doi.org/10.1002/sd.1585.

Stern, D. I., Common, M. S., & Barbier, E. B. (1996). Economic growth and environmental degradation: the environmental Kuznets curve and sustainable development. World Development, 24(7), 1151–1160.

Talberth, J., Cobb, C., & Slattery, N. (2007). The genuine progress indicator 2006 (p. 26). Oakland, CA: Redefining Progress. http://sustainable-economy.org/wp-content/uploads/GPI-2006-Final.pdf.

Tamaki, T., Shin, K. J., Nakamura, H., & Managi, S. (2017). Shadow prices and production inefficiency of mineral resources, Economic Analysis and Policy (forthcoming).

United Nations Development Programme (UNDP). (1990–2013). Human development report. New York: UNDP

United Nations Population Division. (2015). World population prospects: The 2015 revision. New York: UNDP.

United Nations Statistics Division. (2016). National accounts estimates of main aggregates. Retrieved from http://data.un.org.

United Nations Population Fund. (2017). Worlds apart: Reproductive health and rights in an age of inequality. https://www.unfpa.org/sites/default/files/pub-pdf/UNFPA_PUB_2017_EN_SWOP.pdf.

United Nations University International Human Dimension Program (UNU-IHDP), UNEP. (2012). Inclusive wealth report 2012. Measuring progress toward sustainability. Cambridge: Cambridge University Press.

UNU-IHDP and UNEP. (2014). Inclusive wealth report (2014): Measuring progress toward sustainability. Cambridge: Cambridge University Press.

U.S. Energy Information Administration. (2015). International energy statistics. Retrieved from http://www.eia.gov/countries/data.cfm.

U.S. Geological Survey. (2015). Mineral commodity summaries. https://minerals.usgs.gov/minerals/pubs/mcs/2015/mcs2015.pdf.

Van der Ploeg, S., De Groot, R. S., & Wang, Y. (2010). The TEEB valuation database: Overview of structure, data and results. Wageningen: Foundation for Sustainable Development.

Wang, S. S., Zhou, D. Q., Zhou, P., & Wang, Q. W. (2011). CO 2 emissions, energy consumption and economic growth in China: A panel data analysis. Energy Policy, 39(9), 4870–4875.

Wong, P., & Bredehoeft, G. (2014). US wood pellet exports double in 2013 in response to growing European demand (p. 1). Washington, DC: US Energy Information Administration.

World Bank. (2011). The changing wealth of nations: Measuring sustainable development in the new millennium. Washington, DC: World Bank.

World Health Organization. (2016). Life tables for WHO member states. Retrieved from http://www.who.int/healthinfo/statistics/mortality_life_tables/en/.

World Bank. (2016). Indonesia [data by country]: World Bank Data. http://data.worldbank.org/country/indonesia.

Xepapadeas, A., & Vouvaki, D. (2009). Total factor productivity growth when factors of production generate environmental externalities. Fondazione Eni Enrico Mattei Working Papers, 281, 1–31.

Zhengfei, G., & Lansink, A. O. (2006). The source of productivity growth in Dutch agriculture: a perspective from finance. American Journal of Agricultural Economics, 88(3), 644–656.

Acknowledgements

This paper was supported by a Grant-in-Aid for Specially Promoted Research (26000001) by the Japan Society for the Promotion of Science. Any opinions, findings, and conclusions expressed in this material are those of the authors and do not necessarily reflect the views of the institution’s and funding agencies.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Wealth Accounting Method

The Brundtland Commission defines sustainable development as ‘development that meets the needs of the present without compromising the ability of future generations to meet their own needs’ (World Commission on Environment and Development 1987). Many previous studies, such as Arrow et al. (2004), define sustainable development as non-declining well-being in the future:

where V, U, C and \(\delta\) represent well-being, current well-being, consumption, and the social discount rate respectively.

The direct measurement of well-being, V, might be a suitable approach in assessing sustainability, along with Eq. (1). However, because of the difficulty of observing well-being, Arrow et al. (2004) proposed for an alternative approach, namely measuring the productive base of V based on the determinants of well-being. This aggregated capital of productive based is termed as Inclusive Wealth (IW). It is includes produced capital, human capital, natural capital, and intangible capital, such as knowledge and institutions. Accordingly, we can define IW at time t.

Each P is shadow price of the capital asset, defined as δWt/δC, where K is each capital which is PC(t), HC(t) and NC(t) represent produced capital, human capital and natural capital at time t, respectively. We utilize gross domestic product (GDP) as the desirable output. This calculation is based on millions of constant 2005 US$.

1.2 Productivity Measure

There are several method to calculate productivity growth, such as data envelopment analysis, parametric methods or econometric methods. Several methodological issues emerge when TFP is estimated using traditional methods, i.e. by applying ordinary least squares (OLS) to a panel of (continuing) firms. First, because productivity and input choices are likely to be correlated, OLS estimation of firm-level production functions introduces a simultaneity or endogeneity problem. We used a deterministic nonparametric analysis called Malmquist Productivity Index, based on the Data Envelopment Analysis (see review for Färe et al. 1994, Kerstens and Managi 2012). The index is suitable for assessing the relation between multivariate inputs and outputs. In addition, the measurement takes into account the efficiency of resource use and productivity changes. DEA is an established method in order to measure the relative efficiency of decision-making unit based on input and output in the sample (Mizobuchi 2014).

We apply physical, human and natural capital as a separate unit, each capital as an input and GDP as an output in our calculating of TFP. Using the distance function specification for the index, we can formulate our problem as follows:

Let x = \(\left( {x^{1} , \ldots x^{M} } \right) \in R_{ + }^{M}\)and y = \(\left( {y^{1} , \ldots y^{N} } \right) \in R_{ + }^{N}\) be the input and output vectors, respectively. The technology set, defined by Eq. (3), consists of all feasible input vectors, xt, and output vectors, yt, at time t, and satisfies certain axioms that are sufficient to define meaningful distance functions. The distance function is defined as:

where \(\delta\) is the maximal proportional amount to which yt can be expanded, given technology T(t). In this analysis, we characterize production technology as having constant returns to scale. This formulation produces an output-oriented distance function. Equation 5 is a formulation of the Malmquist Productivity Index (M as TFP to inclusive investment), as follows:

where d is the geometric distance to the production frontier caused by production inefficiency, while the frontier denote the best available technology from the given inputs and outputs; i refers to the country under analysis, running i from 1 up to 140 nations in our sample; GDP is the corresponding value of gross domestic product; HC stands for human capital; PC represents produced capital; NC represents natural capital. Thus we capture the productivity change from the variations in inefficiencies between two years.

1.3 Kuznets Curve Relationship: Natural Capital Productivity and Income Level

According to the EKC literature (see Dinda 2004; Stern et al. 1996), it is expected that per capita income has a negative relation with environmental degradation. After a sufficiently high per capita income is reached, further increment in income is expected to reduce environmental degradation. We follow Dinda (2004), Galeotti and Lanza (2005), and Akbostancı et al. (2009) which develop the equation for cubic model to test the EKC hypothesis as revealed below:

In this equation, Y denotes natural capital productivity, X represents GDP per capita, uit is traditional error term, i symbolizes individuals and/or groups, and t is time. The signs of the coefficients of X, X2, and X3 determine the shape of the curve.

We employ panel regression techniques to estimate Eq. (6). Panel data approach encompasses data across cross-sections and over time series, thus provides a comprehensive analysis to examine variables of interest. However, the use of panel data and dynamic specifications make this problem more complex. Alternatively, to eliminate the serial correlation problem, Zhengfei and Lansink (2006) suggest the use of a dynamic generalized method of moments (GMM) model to analyze TFP measures estimated by DEA. Therefore, we employ system GMM to analyze productivity change in this article.

Rights and permissions

About this article

Cite this article

Kurniawan, R., Managi, S. Linking Wealth and Productivity of Natural Capital for 140 Countries Between 1990 and 2014. Soc Indic Res 141, 443–462 (2019). https://doi.org/10.1007/s11205-017-1833-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-017-1833-8