Abstract

We re-examine the concept of beta-convergence in living standards across countries during the period 1980–2012. In this study, well-being is assessed using the Human Development Index (HDI) which considers income aspects as well as social indicators, thus reflecting the multidimensional nature of this process. The existence of sigma convergence is evidenced in this study and hence beta convergence, as a necessary condition, is also pointed out. However, the linearity of this process has been questioned. Therefore, we apply a semiparametric specification of this process to the HDI and each of its intermediate indices. These models allows for nonlinearities in the estimation of the convergence speed. Our results reveal that absolute convergence in human well-being is satisfactorily represented by the conventional linear specification. However the income and education indices show nonlinear patterns. We also include structural variables to capture differences in the steady-state (conditional convergence). Under this model, convergence speed of all indicators is higher and the convergence process seems to be linear only for the health index.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The study of convergence has risen to prominence among academics since the presentation of the classical works of Solow (1956, 1957) and Swan (1956). Several papers have tried to determine if there is a long-run tendency towards equalisation, a question that lies in the heart of the convergence debate.

According to the Solow–Swan neoclassical growth model, if countries only differ in their level of capital, poor countries tend to grow faster than developed nations due to the assumption of diminishing returns of capital. This theory is the so called absolute beta-convergence, which assumes that all economies in the world converge to the same steady state. Much of the existing literature on convergence hypothesis (see e.g. de la Fuente 1997; Islam 2003; Sala-i-Martin 1996) supports the existence of divergence among world economies. Therefore, it is concluded that the currently rich nations are expected to be even wealthier in the future, hence leaving developing countries behind. Note however that economies usually differ in technology, population growth and human capital. Therefore, differences in the structural parameters would result in different steady states. This concept is called conditional beta-convergence in the classical literature, which has been evidenced by numerous studies (see e.g. Barro and Sala-i-Martin 1990, 1992; Sala-i-Martin 1996), thus pointing out that when taking the structural characteristics into account, poor countries converge to their own steady state faster than the advanced economies.Footnote 1

The concept of sigma-convergence has also been widely studied given its close relationship with the concept of beta-convergence. It is assumed that there is sigma convergence if the dispersion of per capita income decreases over time, whereas beta-convergence is evidenced when poor countries grow faster than wealthy nations. To achieve sigma-convergence, the growth rate of developing countries needs to be higher than those observed for rich countries. In this sense, it is said the beta-convergence is a necessary condition for sigma-convergence. It could be also possible that the poor countries grow so fast that they leave the initially rich nations behind until the point to increase the dispersion of the variable under study. As a consequence, we would observe sigma-divergence along with beta-convergence patterns, thus revealing that beta-convergence is not a sufficient condition for sigma-convergence (Sala-i-Martin 1996). Previous studies conclude the existence of sigma divergence across world economies for the second half of the last century (Decancq et al. 2009; Milanovic 2005; Pritchett 1997; World Bank 2006), revealing that inequality across countries tends to increase over time.

Conventionally, the specification of absolute beta-convergence focuses on testing a common linear trend between growth rate of per capita income and the initial level of output. This regression is augmented with structural variables for testing conditional beta-convergence. A negative sign of the coefficient on initial per capita income is interpreted as a support for convergence across countries. However, many authors have questioned the assumption of linearity (Durlauf et al. 2001; Fiaschi and Lavezzi 2007; Huang 2005), concluding the existence of multiple growth regimes associated with different levels of development.

Traditionally, income variables have played a main role in the measurement of quality of life. However, there is a discontent with the hegemony of per capita GDP as an indicator of well-being since there are other relevant dimensions which are imperfectly captured by purely economic variables. There is by now nearly consensus that development is a multidimensional concept, which, in addition to income, also should consider social indicators. This line of argumentation has gained prominence among academics over the last decades, thus resulting in many attempts to synthesize different aspects of well-being, in a composite index which offers a more comprehensive perspective of such a process than per capita income alone.

In 1979, David Morris from the Overseas Development Council designed the Physical Quality Life Index (Morris 1979) constructed by a weighted average of infant mortality, literacy rate and life expectancy at age one. Becker et al. (2005) developed an indicator which combined income and longevity for measuring well-being inequality. More recently, there have been many attempts to construct a composite index centred on the notion that development entails more than just economic aspects (see e.g. Alkire and Foster 2010; Bilbao-Ubillos 2013; Edgier and Tatlidil 2006; Fakuda-Parr et al. 2009; Grimm et al. 2008; Morrison and Murtin 2012).

This line of thinking has induced academics to test the convergence hypothesis in other dimensions such as health and education. A theoretical framework of convergence in life expectancy is developed in Mayer-Foulkes (2003), concluding the existence of convergence clubs, whereas global convergence is found to be weak. This result is confirmed in Sab and Smith (2001), who also point out the existence of strong absolute and conditional convergence in education. Mazumdar (2003) tests the existence of convergence in five dimensions of well-being, including calorie intake, life expectancy, infant mortality, per capita GDP and adult literacy rate, concluding divergence in all variables except for income among the advanced economies.

A natural extension of these works is to test the hypothesis of convergence in an aggregate index of quality of life, considering jointly social factors and economic indicators. Note that this approach makes it possible to draw general conclusions regarding the evolution of cross-country patterns of quality of life. There have been many attempts to test whether a catching-up process in human well-being has taken place in the last decades (see e.g. Konya and Guisan 2008; Mayer-Foulkes 2010; Noorbakhsh 2006), concluding that living standards have converged slowly over the last 30 years. Nevertheless, some authors questioned the linearity of this process. Mayer-Foulkes (2010), using series of superposed transitions and quantile regression, concluded that complex relations of divergence and convergence exist in the components of the HDI. In fact, nonlinear parametric models, such as the quadratic specification, have been also proposed as a possible approximation of this phenomenon (Mazumdar 2002, 2003). Note, however, that the parametric approach requires making a priori assumptions about the evolution of the convergence speed, thus the model might present misspecification bias. We opt for a semiparametric specification which lets the data describe by themselves the convergence/divergence process, thus offering a complete and continuous panorama of the distributional patterns of well-being.

Through the more flexible methodology of partially linear models (PLM), this work aims to provide a reappraisal of the convergence process in terms of quality of life, using the Human Development Index (HDI) as an indicator of this phenomenon, for the period 1980–2012. Note that this is the first study that uses the HDI with the changes introduced in 2010, which are argued to reveal a complete new situation in several aspects of human development (Klugman et al. 2011). This fact will allow us to compare our estimates with previous results, in order to investigate if the recent modifications applied to this indicator have affected the conclusions regarding the process of convergence in well-being. According to the results obtained by Martínez (2012), the new version of the HDI presents higher levels of inequality than its predecessor and similar inequality trends are observed for both definitions except for leftist indices such as the Kolm measure. The previous result would be related to the concept of sigma-convergence, but nothing is said about the consequences of the modification of the HDI on beta-convergence patterns.

Having reached this point, it should be emphasised that considering the hypothesis of convergence in a composite indicator presents some shortcomings that should be taken into account (Mazumdar 2003). In fact, these are the same criticisms that are attached to any multidimensional indicator of well-being, namely the arbitrarily of the weights and the lack of meaningfulness of the resulting indicator. Therefore, we also adopt a dimension-by-dimension approach to obtain more detailed conclusions regarding convergence in living standards.

The rest of the paper is organised as follows. Section 2 describes the characteristics of the HDI as an indicator of well-being. Section 3 relates the convergence hypothesis to the non-income variables. A detailed explanation of the data used and the methodology applied is presented in Sect. 4. Section 5 explores the hypothesis of sigma-convergence and presents the evolution of global well-being inequality over the last three decades. Beta-convergence is tested in Sect. 6 using non-parametric techniques. Finally, Sect. 7 includes some conclusions and discusses possible policy implications.

2 Measuring Development: Beyond Income

Since it was launched in 1990, the HDI attracts a large amount of attention from the media, academics and policymakers. The HDI was designed following the Sen’s capability approach (Sen 1988, 1989, 1999) which considers development as a process of enhancing individuals’ choices. This new paradigm of development was presented in the first Human Development Report which stated:

Human development is a process of enlarging people’s choices. In principle, these choices can be infinite and change over time. But at all levels of development, the three essential ones are for people to lead a long and healthy life, to acquire knowledge and to have access to resources needed for a decent standard of living. (UNDP 1990, p. 10).

To materialise this eminently subjective concept into a single number, three dimensions were proposed, which were considered essential to measure the complex reality of human development. Therefore, the HDI is made up of three intermediate indices, using country-level data on income, health and education, which reflect achievements in each dimension respect to the subsistence value and the historical maximum value observed.

Since 2010, the HDI of the country i in year t is constructed using a geometric mean of the three intermediate indices as follows:

The health index (\(I_{it}^{health}\)) is measured by life expectancy at birth (LE), which is considered an indicator of longevity. This indicator is standardised according to the following expression:

where the minimum is the so-called level of subsistence fixed at 20 years, and the upper bound is the maximum value observed between 1980 and 2011,Footnote 2 that is 85 which corresponds to Japan in 2011. It should be noted that life expectancy only measures years of life, but no insights about the quality of these years are made. Notwithstanding its limitations, life expectancy is the sole variable that has not been changed since the HDI was launched, due to the scarcity of data on health indicators for long temporal periods (Klugman et al. 2011).

The education index (\(I_{it}^{Education}\)) comprises two variables, expected years of schooling (EYS) and mean years of schooling (MYS). These indicators replaced gross enrolment ratios and literacy rates in 2010, since they were considered to have higher discriminatory power than their predecessors (Klugman et al. 2011). The education component is, then, computed with the geometric mean, given by:

MYS and EYS have lower bounds of zero given that societies would survive without education. The maximum corresponds to Czech Republic in 2005 with 13.1 expected years of schooling, whereas MYS variable has a fixed maximum of 18 years, which is achieved in several developed countries. These variables have been introduced in 2010 substituting adult literacy rate and the combined gross enrolment ratio. These indicators were considered uninformative since no discrimination across countries is provided, especially in the developed nations whose literacy rates are superior to 95 %. Then, the introduction of these variables has increased the variability of the education index and hence the dispersion of the HDI, being consistent with the results obtained by Martínez (2012).

Income is represented by Gross National Income (GNI) per capita measured in PPP 2005 US dollars, to make incomes comparable across countries and over time. It should be noted that income is regarded as the mean to acquire goods and services, concept which is different to how much is produced in a particular economy. Thus, per capita GDP has been replaced by per capita GNI in 2010, given that such a variable represents the economic reality of countries more accurately, in terms of the capability approach, due to the consideration of international aid and foreign remittances. The intermediate index of income (\(I_{it}^{Income}\)) is computed as follows:

where the maximum value is 107,721 (per capita GNI for Qatar in 2011), whereas the minimum value is fixed at the level of subsistence which is 100 US$. Logarithmic transformation was introduced in 2001 with the objective to reflect that income is conceived as a mean to purchase goods and services, thus the concavity of the logarithmic function characterises impact of diminishing returns of income on well-being.

In spite of its popularity, the HDI has been highly criticised [see Kovacevic (2010) for a review] on the grounds of construction (Kelley 1991), selection of variables (Srinivasan 1994; Alkire 2002), arbitrary weighting scheme (McGillivray and White 1993; Noorbakhsh 1998), and redundancy with its components (Cahill 2005; McGillivray 1991; Ravallion 1997).

Some authors argue that the HDI omits important aspects of well-being that should be incorporated in the index. Among them, we emphasise democracy (Domínguez et al. 2011), social cohesion (Bilbao-Ubillos 2011), personal safety (Bilbao-Ubillos 2013) and environment (Briassoulis 2001; Neumayer 2001; Sagar and Najam 1998). Distributional aspects have also been proposed for its consideration in the construction of the index (Alkire and Foster 2010; Hicks 1997; Seth 2010) since inequality in the different aspects of well-being has a deep impact on the progress of a particular country. Conversely, some authors have suggested removing the income component from the HDI (Anand and Sen 2000).

Concerning the construction of the HDI, two main criticisms need to be addressed. An equal weight scheme seems to be arbitrary hence not based on social choice nor normative arguments. Notwithstanding this subjective format, statistical methods (principal components analysis) have been applied to determine the weights supported by the data, concluding that the simple average is empirically justified (Ogwang and Abdou 2003). On the other hand, the traditional simple average is considered problematic since the components of the index are regarded as perfect substitutes, thus implying that the marginal rate of substitution is constant. This axiom can lead to incongruent results, in the sense that the maximisation of the HDI in a society may lead to corner solutions, promoting one dimension and disregarding others (Klugman et al. 2011). The formula introduced in 2010 marks a conceptual change concerning the relationship between the three dimensions given that some degree of complementarity is also considered.

Several studies point out that there is a high rank correlation of the HDI and its underlying components, reflecting a problem of redundancy in the information provided by the composite index. This result implies that “assessing inter-country development levels on any one of these variables yields similar results to those that the index itself yields” (McGillivray 1991, pp. 1462). Therefore, the HDI would not provide us with complementary information than the traditional indicator of development, i.e. per capita GDP, provides. Note that the previous statement would lead to the loss of the relevance of this study. Since there is apparently no difference between income and human development, the conclusions reached by previous studies on the convergence hypothesis would apply. However, it has been concluded that the distributions of income, health, education and the HDI are remarkably different (McGillivray and Markova 2010; McGillivray and Pillarisetti 2004; Pillarisetti 1997), also pointing out different evolutions over time. This result emphasises the point that the consideration of a growth-centred approach or a more comprehensive definition of human development strongly affects our assessment of progress hence our conclusions about convergence might be also altered.

The criticisms exposed before suggest that the HDI is not an ideal indicator of well-being. However, the assessment of quality of life is complex, abstract and difficult to synthesise. Independently of its limitations, the HDI seems to be the most adequate alternative to perform cross-country analyses of well-being since it has homogeneous available data for a wider period of time and for more countries than other related indices.

3 Convergence in Well-Being

The concept of convergence in well-being is essentially studied using inequality measures of the composite indicators (see e.g. Decancq et al. 2009; McGillivray and Markova 2010; McGillivray and Pillarisetti 2004). There is a common result which indicates that well-being levels are converging over the time but at slow rate:

For most of the past 40 years human capabilities have been gradually converging. From a low base, developing countries as a group have been catching up with rich countries in such areas as life expectancy, child mortality, and literacy. A worrying aspect of human development today is that overall state of converging is slowing—and for a large group of countries divergence is becoming the order of the day. (UNDP 2005, pp. 25).

Since the concept of beta convergence was derived from the Solow model, its theoretical framework is especially suitable for income. The principal mechanism behind the convergence hypothesis is the assumption of diminishing returns of capital. Accordingly, the vast majority of the papers that test convergence in living standards focuses on income variables whereas social aspects of development are assumed to play little role. However, there have been few attempts to test the convergence hypothesis in a more comprehensive indicator per capita GDP (Mazumdar 2002; Noorbakhsh 2006; Konya and Guisan 2008; Konya 2011; Mayer-Foulkes 2010), thus extrapolating the concept of diminishing results to the non-income dimensions of the HDI.

According to Noorbakhsh (2006), the concept of diminishing returns can be “equally applicable” to the educational variables and health indicators of the HDI but with some peculiarities. Diminishing returns were derived from the mobility of the capital in the pure economic model. In contrast, for non-income aspects, they are linked to the assumption that investment returns in education and health diminish with the level of investment. In a country with low levels of primary education, relatively less investment is necessary to increase the mean years of schooling than in a developed nation, since tertiary education is the most expensive type of education. Therefore, investment returns to increase the mean years of schooling and the expected years of schooling will be higher in countries with low levels of education. Moreover, given the nature of the educational indicators considered in the HDI, which are basically quantitative variables that do not account for the quality of education, they have upper limits that make plausible the existence of a convergence process across countries.

Similarly, for the health dimension, it is supported that investment returns in health are higher in countries with low life expectancy, since less amount of investment is needed to improve health levels in countries with high rates of mortality. In fact, according to the last report of millennium development goals (MDG), a large proportion of the deaths of children under five could be saved through low-cost prevention and treatment measures (United Nations 2012). Moreover this type of medical research is easily exported to other countries, whereas advanced medical technology is more difficult to be implemented in developing countries mainly due to lack of suitable personnel which also increases the amount of investment (Mazumdar 2000).

4 Data and Methodology

We use the most recent available data from International Human Development Indicators (UNDP 2012) on the HDI and its three components for 132 countries in the period 1980–2012 with different data frequency. For the period 1980–2005 we have 5-year intervals and from 2005 to 2012 the data has annual frequency. Originally, our data comprised only 105 countries, covering less than the 75 % of global population. We had non-available data for 26 countries for one or more years before 1995. In order to offer comparable results across periods and to not restricting the sample considerably, missing values have been estimated. The estimation is based on two complementary methodologies which jointly provide feasible and consistent results according to the sample: piecewise cubic Hermite interpolating polynomial (PCHI) and the average rate of change, which is used when PCHI offers unfeasible estimates or out of range results. After this procedure, our dataset covers over 90 % of the world population during the whole period, including 132 countries whose indicators of income, health and education are available for thirteen points of time.

To shed light on the well-being convergence process over the last three decades two methodologies have been applied in this study. As a starting point, we calculate four inequality measures which reveal the evolution of dispersion of national levels of well-being over the study period. Therefore, in the first step we analyse the so called sigma-convergence, not only using the classical indicator (i.e. the variance) but also considering the Gini, Theil’s Entropy and the Atkinson indices. All measures indicate the amount of dispersion of well-being distribution across countries, however different weighting schemes are applied for each part of the distributionFootnote 3 depending on the measure considered. The Theil index is a special case of the generalised entropy measures when the sensitivity parameter is set to 1 (Cowell 2011). Such a parameter determines the weight assigned to the upper tail, which in the case of the Theil index the same weight to all countries, independently of its level of development. The Atkinson index is interpreted as the proportion of total income that would be required to achieve an equal level of welfare. This inequality measure also includes a parameter which is called inequality aversion parameter, since it adjusts the index to be more sensitive to the lower tail as the parameter increases (Atkinson 1970). The expressions of the Gini, the Theil and the Atkinson indices are, respectively, the following:

and

where \(x_{i}^{(t)}\) denotes HDI or one of its intermediate indices for the country i at time t, μ is the arithmetic mean of the indicator under study, n is the number of countries, and finally, ε is the inequality aversion parameter of the Atkinson index.

Consequently, our analysis provides a broad picture of the evolution of inequality over the last 30 years which allows us to determine whether distances between countries have been reduced in terms of well-being. As stated before, a necessary condition for sigma convergence is that beta-convergence also takes place, thus implying that developing countries increase their levels of HDI relatively faster than the advanced nations.

The hypothesis of absolute beta-convergence is evidenced when there is a negative relationship between the value of a variable at the beginning of the period and its growth rate, which conventionally is tested using the following model:

where y i0 is the logarithm of the HDI or any intermediate index which are denoted as Yit, \(\dot{y}_{i} = (1/T)\,\ln \,(Y_{it} /Y_{i0} )\) is the growth rate of Yit and, finally, εit is the unexplained residual. Positive values of the β parameter imply divergence, whereas negative values reveal evidence of a catching-up process between developing and developed countries. Equation (4) assumes that all countries of the sample converge to the same steady state. However, nations have different structural features which lead to a multiple steady state equilibrium (Sala-i-Martin 1996), which is related to the so-called conditional convergence hypothesis, traditionally specified as an augmented regression of Eq. (4):

where the matrix ω i contains structural variables which are constant in the steady state. In this study, a battery of conditioning variables is included along with regional dummy variables for Latin America and the Caribbean and Sub-Saharan Africa.Footnote 4 In particular, we have included trade and foreign direct investment (FDI) both indicators as a percentage of the GDP. According to Mayer-Foulkes (2010), these two variables are seen as indicators of globalisation and technological change. As a measure of institutions, we have considered the Economic Freedom of the World (EFW) Index, which seems to represent adequately the quality of national institutions with respect to economic performance (Berggren 2003; De Haan et al. 2006).Footnote 5 As domestic determinants of the expansion of well-being, we have included public expenditures on health and on education as a percentage of the GDP. Domestic investment is expected to have a positive effect on economic and human well-being which is measured with the variable gross capital formation in relative terms to the GDP. Finally, following Noorbakhsh (2006), the number of mobile lines (per 100 people) has been also considered to measure the level of infrastructure. All variables have been drawn from World Development Indicators Database (World Bank 2013) except the EFW index, which has been provided by Gwartney et al. (2013).

It should be, however, noted that a number of studies have challenged the assumption of linearity of income convergence. Using nonlinear specifications, it has been concluded that the catching-up process is not adequately represented as a linear trend, thus classifying countries into different groups which exhibit different convergence patterns (Azomahou et al. 2011; Durlauf 2001; Durlauf et al. 2001; Liu and Stengos 1999). Along this line, a generalisation of the process of convergence in well-being is considered in Mazumdar (2002), who includes quadratic and logarithmic terms to represent nonlinearities in the convergence speed. Having reached this point, it is important to recall that parametric specifications require making a priori assumptions about the functional form of the relationship under study. On the other hand, Mayer-Foulkes (2010) performed quantile regressions to study non-linearities in convergence in a number of indicators of quality of live. Note that this methodology provides a restricted view of the process of convergence, given that it assumes common distributional patterns within each quantile, not allowing for variability in the direction and the intensity of this process.Footnote 6 Therefore, we consider a more flexible model which allows the data to describe by themselves the path of the convergence or divergence process. Following the notation in Eqs. (4) and (5), we specify a semiparametric partially linear regression (Wand 2005; Ruppert et al. 2003) for testing absolute and conditional beta-convergence, given respectively by the following expressions:

where y i0 denotes Y i0 expressed in natural logarithms, η it is the error term identically and independently distributed with mean 0 and variance \(\sigma_{\eta }^{2}\), and f(y 0) is an unknown unidimensional smooth function \(f(Y_{0} ) = E\left[ {\left. {\dot{y}} \right|Y_{0} } \right]\) which is represented by a linear combination of polynomial functions, regression parameters and radial basis functions which need to be chosen to be numerically stable. Therefore, the smooth function in Eq. (6) is expressed as a radial basis function of degree three:

where β i for i = 0, 1 are the so-called fixed effects. The unknown vector of parameters \({\mathbf{u}} = \left( {u_{1} ,u_{2} , \ldots ,u_{K} } \right)^{\prime }\) follows a Normal distribution with mean 0 and variance \(\sigma_{u}^{2} \varSigma^{\prime }\), being K the number of bases, and k k are fixed knots calculated as \(q_{k} = \left( {{{k + 1} \mathord{\left/ {\vphantom {{k + 1} {K + 2}}} \right. \kern-0pt} {K + 2}}} \right),\,\forall \,k = 1, \ldots ,K\). Note that if u k = 0 for all k, then the semiparametric model used in this study turns out to be the linear specification of beta-convergence, since the last term disappears.

The estimation is based on the so-called penalized spline smoothing, which minimizes the following expression:

where θ = [β, u] is the parameter vector, H is a matrix that contains the polynomial basis functions and the k radial basis functions, \(\lambda^{3} \theta^{\prime } {\mathbf{D}}\theta\) is called roughness penalty since it penalises fits that are too rough (Ruppert et al. 2003). The first parameter \(\lambda > 0\), estimated by restricted maximum likelihood, determines the amount of smoothing, thus controlling the trade-off between roughness and goodness of fit. Finally, D is a block identity penalty matrix whose first two elements are zero given that the fixed effects (intercept and linear term) are not penalised.

The solution of the optimisation problem in Eq. (8) is the estimator matrix:

being \(S_{\lambda } = {\mathbf{H}}^{\prime } ({\mathbf{H}}^{\prime } {\mathbf{H}} + \lambda^{3} {\mathbf{D}})^{ - 1} {\mathbf{H}}\) the so called hat matrix.

We also compute a test to analyse the adequacy of the semiparametric models with respect to the linear specifications in Eq. (4) and (5) respectively (Crainiceanu and Ruppert 2004). Assuming that u is identically and independently distributed with mean 0 and variance \({\mathbf{G}} = \sigma_{u}^{2} {\mathbf{I}}\), the null hypothesis u 1 = u 2 = … = u k is equivalent to \(\sigma_{u}^{2} = 0\):

Note that if the null hypothesis is no rejected, convergence in human development is correctly represented by the conventional linear model. Otherwise, a more flexible semiparametric approximation is required.

We use the restricted log-likelihood ratio test (RLRT) expressed as follows:

where REL is the restricted maximum likelihood for the non-restricted model (PLM) and the restricted specification (parametric model) respectively.

The computation of RLRTFootnote 7 is relatively simple, however the derivation of its distribution under the null has to be bootstrapped since the observations of the dependent variable are not independent under the alternative. Therefore, the asymptotic probabilistic theory does not hold.

5 Well-Being Inequality and Sigma Convergence

As a preliminary analysis, in this section we investigate sigma-convergence in the HDI and each of its intermediate indices. This concept of convergence assumes that dispersion from the cross-country mean tends to decrease over time (Barro 1991; Barro and Sala-i-Martin 1992). In the empirical literature, the variance of the logarithm of the variable under consideration is the most commonly used measure of dispersion. We also have considered three additional measures of inequality: the Gini [Eq. (1)], the Theil [Eq. (2)] and the Atkinson [Eq. (3)] indices, whose evolution over the last three decades is presented in Fig. 1. To facilitate the comparison of results, inequality has been normalised to be 100 in 1980.

Convergence trends are observed for each component although the intensity of this process varies across dimensions. The dispersion of the educational indicator decreases continuously during the entire period, thus experiencing the greatest fall of inequality, ranged from 35 to 60 % depending on the inequality measure analysed. Such convergence has its origin in the increase of the mean years of schooling, which has been doubled in the last 40 years, thanks to the efforts in education performed in developing countries, especially in Asia (Morrison and Murtin 2012; World Bank 2006). Even when notable achievements have been accomplished in developing countries in terms of education, it should be noted that, this trend can be interpreted as an artificial convergence pattern due to the upper limit that characterizes the educational variables included in the HDI (Neumayer 2003; McGillivray and Pillarisetti 2004).

In line with previous investigations, the fall of health inequality has been remarkably lower, ranging from 15 to 30 % over the last three decades (McGillivray and Markova 2010). A process of divergence is observed in this dimension during the nineties decade as a consequence of the rapid extension of AIDS in Sub-Saharan Africa (Becker et al. 2005; Neumayer 2003), effect partially offset by the decrease in infant mortality (Deaton 2004). This trend is also driven by the health crisis in most Eastern European countries derived from social upheaval, alcohol and tobacco consumption (McMichael et al. 2004; Moser et al. 2005). Conversely, much more egalitarian distribution is observed for the second half of the study period, mainly due to the enhancement of life expectancy in East and South Asia and in the North of Africa (Goesling and Firebaugh 2004).

Income inequality has received by far more attention than the other dimensions. It is well-known that cross-country inequality has increased over the second half of the last century (see e.g. Milanovic 2005; Pritchett 1997; World Bank 2001). In spite of the success of Asia which rapidly converged to the incomes of developed countries in the last 30 years, the failure of Africa in the eradication of poverty has led to the increase of income disparities. Notwithstanding this trend, income inequality across countries has been reduced by about 10 % over the last 30 years, thanks to the strong convergence process that took place in the last decade. According to Decancq (2011), the fall of unweighted income inequality over the last decade would reveal that the financial crisis has affected to wealthiest countries more than proportionally.

In line with previous studies, our results reveal the presence of a global convergence process in living standards during the study period (Decancq et al. 2009; Martínez 2012; McGillivray and Markova 2010).Footnote 8 Taking the study period as a whole, it is observed that inequality in human development decreased about 20 % according to the Gini index and about 40 % for the Theil and the Atkinson indices over the last three decades. However, two phases are clearly distinguishable. A stagnation term is observed from 1980 to 2000 which is derived from the slight increase of disparities in income and health during that period, which was offset by the strong fall in disparities in education. Conversely, the last decade of the study period is characterized by a sharp process of convergence in quality of life, given that all components of the HDI reduced its inequality levels considerably.

Note however that the patterns described previously do not apply for the variance because, as an absolute indicator, it does not take into consideration the mean of the distribution. It should be stated that, for variables that show sharply positive or negative trends over time, the coefficient of variation would provide more realistic reflection of the convergence or divergence process (Kenny 2005). In fact, a number of papers consider relative measures of well-being inequality to study sigma-convergence (Marchante et al. 2006; Ferrara and Nisticò 2013; Konya and Guisan 2008; Noorbakhsh 2006), which is also convenient in this case since the mean of the HDI has increased considerably over the last decades, from 0.433 in 1980 to 0.621 in 2012 (UNDP 2013). We have calculated percentage change of coefficient of variation which is called the rate of sigma-convergence (O’Leary 2001). Therefore, negative values indicate convergence in the sense of sigma, whereas positive trends point out divergence patterns. Table 1 shows the growth rate of the coefficient of variation for the countries included in the sample, calculated for each dimension of the HDI and the index itself in the whole period and within each decade.

As for the other inequality measures, once the mean is taken into account, countries converge in the sense of sigma, which implies that the dispersion tends to decrease over the time. However, different patterns are presented across dimensions. Whereas a continuous decrease is observed for the dispersion of the education indicator, inequality in income and health is characterised by some fluctuations. Focusing on the evolution of inequality in the composite index, it is concluded that, as in the case of education, a smooth linear process of convergence has taken place over the last three decades. These dynamics point out that uneven behaviours of different aspects of development are hidden when studying convergence in well-being composite indices. Notwithstanding this fact, it is also important to remark that convergence in the considered indicators of quality of life has taken place mainly during the last decade in all cases.

At this point, it could be relevant to decompose the Theil index in two components: inequality within-regions and inequality between-region in order to study the patterns of sigma convergence more in detail (for the regions and the countries included see “Appendix”). Among the inequality measures used in this study, the Theil index is the only additively decomposable indicator.Footnote 9 This measure can be expressed in terms of the inequality within regions (which is a weighted average of the inequality within each region) and inequality between regions (which represents the level of inequality that would be if there were no differences within regions) using the following expressions (Cowell 2011):

where, s r is the proportion of countries included in the region (given that we are measuring unweighted inequality), μ r and μ T are, respectively, the mean of the region and the global mean of the variable under study. Finally, T r is the Theil index of the region.

The evolutions of both components over the study period are presented in Fig. 2. In terms of education we see that both types of inequality decreased steadily during the last 30 years, thus resulting in a decrease of educational disparities. Disparities in health presented an ascending pattern from 1980 to 2000 which was mainly driven by differences between regions which increased by 25 % in the first 20 years. In contrast, inequality within-regions presented a decreasing trend except for the second half of the eighties. Income inequality within-region reported an ascending pattern from 1980 to 2000, while differences between regions remained rather constant. These dynamics resulted in the increase of overall income disparities observed previously. Consequently, the last decade, is characterised by the fall of both components. Similar trends are reported for disparities in human development. Inequality within regions decreased continuously over the last three decades, while an increase of the differences across regions is observed during the nineties, followed by a decade of convergence. Since we observed a decreasing pattern of global inequality in well-being over the whole period (see Fig. 1), it can be concluded that the decrease in the within- region component offset the increase in disparities between regions during the nineties.

It should be emphasized that even when different patterns are observed across dimensions there are also common features that should be highlighted. First, differences between regions dominate global inequality, representing more than the 75 % of overall disparities in all cases. This result would indicate that the regions considered are homogeneous groups, and hence the bulk of inequality comes from disparities between these territories. Secondly, the within-region component decreased substantially in for all indicators considered, thus indicating that there was a process of convergence within the borders of the regions, which became even more homogeneous groups at the end of the study period. Third, a decrease in the differences between regions is observed except for income whose inequality levels between these territories remained constant. The fall of this component would imply that additionally to the convergence observed within regions, the differences across them were also reduced. To sum up, a process of convergence in the HDI is observed within regions and at the same time, differences across regions have been also reduced, thus resulting in a global convergence process in quality of life.

6 Beta-Convergence in Well-Being

Table 2 presents the estimation results of absolute convergence according to Eq. (6) using as dependent variable the growth rate of the HDI and its intermediate indices. For comparative purposes, we also present the conventional linear estimation of beta-convergence [Eq. (4)]. According the parametric estimates, all dimensions show statistically significant negative coefficients of y i0, thus suggesting a negative relationship between the growth rate of the considered indicators and their value in 1980. In line with previous studies, the magnitude of the coefficient is relatively low, but significantly higher than the convergence rates reported by previous studies with similar time spans (Noorbakhsh 2006; Konya and Guisan 2008, Mayer-Foulkes 2010). Since this is the first study that uses the new version of the HDI, the previous result would suggest that the changes applied to the HDI in 2010 not only changed the method to assess well-being levels. These modifications also reported different convergence patterns that are more intense under the new normative framework.

It should be also noted that the speed of convergence differs across dimensions. In line with Mayer-Foulkes (2010) and Neumayer (2003), the educational dimension has seen the most intense process of convergence, with rates close to 4 %. In contrast, income shows the lowest reduction in the gap between developed and developing countries. Consequently, even when little advance have been achieved in income levels, significant improvements in non-income dimensions and human well-being have been accomplished. This result points out the relevance of considering non-income dimensions in the study of convergence hypothesis, since their distributional patterns differ substantially from income.

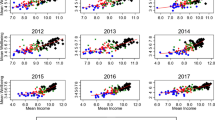

According to the results of the RLRT test, the null hypothesis of linearity is rejected for the income and education indices (see the last row in Table 2), given that the bootstrapped p values are practically equal to zero. As a result, we might conclude that the convergence process has been nonlinear for both indicators. This conclusion would imply that, using parametric models, the convergence speed is overestimated or underestimated for some levels of income and education. These dynamics are observed from Fig. 3 which shows the estimated function f(y i0) with the corresponding 95 confidence interval for absolute convergence. The parametric counterpart (y i0) and its confidence bands are also plotted. Education shows a decreasing and convex pattern which approaches to a linear trend for medium and high educational standards. In contrast, the speed of convergence is underestimated for less educated countries given that the parametric estimates lies below the confidence bands of the PLM model. The fact that the speed of convergence is higher in countries with low educational standards could be related with the promotion of primary education by Millennium Development Goals. One of the main concerns of this global partnership is to achieve universal primary education. Then, the efforts undertaken by the international community would have focused on this type of education, thus accelerating convergence in this part of the educational distribution.

Nonparametric estimation of f(y i0) according to Eq. (6). In each case y i0 represents the natural logarithm of the HDI or its intermediate indices. The solid blue line corresponds to the estimate of f(y i0) and the dashed curves delimit the 95 % confidence bands. The solid green line represents the classical linear estimation of beta-convergence. (Color figure online)

The income dimension presents a high convergence speed for low developed countries, whereas a stagnation phase is observed for medium developed economies, which seems to turn into convergence for the most advanced nations. This conclusion is also found in other studies of global income convergence (see e.g. Dobson et al. 2003), also being consistent with the well-known fact of the twin-peaked income distribution (Quah 1993, 1996). Previous studies point out that the income distribution has evolved from a unimodal distribution (in the decades of sixties and seventies) to a bimodal shape (in 2000). This change reflects two different dynamics of medium developed countries. On the one hand a number of medium developed nations converged to the poorest economies, while the rest converged to the wealthiest countries (Sala-i-Martin 2000). These two opposite trends seem to balance in the aggregate, thus explaining the flat shape of the convergence speed for medium income countries. Therefore, an important part of the linear estimated trend lies outside the nonparametric confidence interval, thus indicating that the conventional specification to test beta-convergence would mask nonlinearities which are actually captured by the semiparametric model. On the other hand, semiparametric estimates reveal that the speed of convergence of the health index and the HDI follow linear trends which are analogous to the conventional convergence models since the parametric estimations lie inside the confidence bands in both cases.

We have augmented Eqs. (4) and (6) with a set of conditioning variables which capture the existence of specific characteristics in each country thus allowing for the existence of different steady states. Estimated results for conditional convergence [Eqs. (5) and (7)] are presented in Table 3. From the parametric models, it is observed that the estimates of the speed of convergence increase substantially when structural variables are included. This raise is particularly evident in the case of health and education, whose speed of convergence under the conditional framework is almost double the rate of absolute convergence.Footnote 10 It should be also noted that, as in the case of the unconditional model, we observe higher rates of convergence than those of reported by previous studies (Noorbakhsh 2006; Mayer-Foulkes 2010), thus reinforcing the hypothesis that the changes applied to the HDI in 2010 have modified the concept of development and the evaluation of levels of quality of life, and consequently, its distribution has been also affected.

We have included all the conditioning variables only in the model for the HDI, which tests the hypothesis of convergence in well-being. Instead, for each individual component, we only include the auxiliary variables that have influence on the particular dimension. In the case of the educational component we have considered as conditioning variables the public expenditure on education and the dummies for Sub-Saharan Africa and Latin America. Both dummies are significantly negative, thus indicating that educational levels in the steady state are lower in the countries that belong to these regions. Public expenditure in education would also show a positive effect on convergence in education, a result that emphasizes the role of the public policies in the expansion of educational levels.

For the health dimension, the dummy variables have been also included along with the public expenditure in health as a percentage of the GDP. The signs of the dummies are the same as in the case of education, also suggesting that the health levels in the steady state are lower in Latin American and African countries. The role of the public services in health is significant and the sign of the coefficient indicates that it has a positive influence in the enhancement of life expectancy.

For the Income component, we have included several conditioning variables since this dimension is related with trade, FDI, domestic investment, and the EFW index. According to the value of the coefficient on the EFW index and consistently with previous investigations (Gwartney and Lawson 2004; De Haan et al. 2006), the quality of institutions seems to have a positive and highly significant effect on the increase of income. Similarly, there is a positive relationship between gross capital formation and economic growth. In the case of trade as a percentage of the GDP we have obtained a negative coefficient value which is in line with the results presented by Slaughter (2001). Note that the effect of trade openness on economic growth is far from consensual. Some authors argue that there is a positive relationship (see e.g. Frankel and Romer 1999), while others found a negative link in a number of country case studies (Greenaway et al. 1998; Wacziarg and Welch 2008). Staying in the middle, some studies have pointed out a conditional relationship which depends on structural and geographical variables of the countries involved in international trade agreements (Lundberg and Squire 2003; Rodrik et al. 2004). On the other hand, FDI seems to have no effect on income growth, a result that was also obtained in previous studies (Mayer-Foulkes (2010)). The rationale behind the null effect of external investments seems to be the low stock of capital in some developing countries. According to Borensztein et al. (1998), FDI potentiates economic growth only when the host economy has enough absorptive capability of advanced technologies. As observed for the other dimensions, dummy variables are found to be negative since income levels at the steady state are lower in these to regions.

For the model of the HDI that would test the hypothesis of convergence in human well-being, we observe a significant relationship between the composite index and all indicators that were significant for individual dimensions. Then, FDI is the sole variable that seems to be no related with the enhancement of quality of life. Similar to the results presented by Noorbakhsh (2006), the coefficient associated with trade is negative. The inverse relationship between openness and well-being seems to be driven by its negative correlation with the income component. Negative coefficients are also found for the dummy variables. Since we found empirical evidence that Latin America and Sub-Saharan Africa would present lower levels of income, health and education at the steady state, the levels of human development would be also lower. Congruently with the regression results of individual dimensions, the rest of variables are significantly positive.

According to the results of the RLRT test, the health component is the sole dimension that is adequately represented by the conventional linear specification (see the last row in Table 3), given that the bootstrapped p value is almost cero. In contrast, the null hypothesis of linearity is rejected in the cases of income, education and human well-being. Using parametric models for testing the convergence hypothesis in these indicators will overestimate or underestimate the convergence rate for some parts of the distribution.

To analyse how conditional convergence speed evolves with the level of development, nonparametric estimates for each dimension are presented in Fig. 4. Conditional convergence patterns tend to be similar to the absolute ones (see Fig. 3) but with higher slopes. In the case of education, we observe higher convergence speed for primary education, but the change in the slope is less pronounced under the conditional model. Income dimension presents high rates of convergence for poor countries as well as for wealthy nations, while medium developing countries show a flat shape that again indicates the absence of convergence, thus reinforcing the hypothesis of a convergence clubs pattern. As concluded by the RLRT test, the convergence process of the HDI seems to be nonlinear in this case. Medium developed countries slowed down the convergence speed, which can be derived from the stagnation phase that we observed for the income dimension. Note that the parametric estimation of convergence in human well-being and income lies completely below the semiparametric estimates, non-overlapping in any case. This result along with the higher slope observed for the convergence process in the least educated countries would highlight the fact that semiparametric models report different convergence patterns than those obtained using the classical linear specification. If the nonlinearities are ignored, our estimates of convergence speed would be underestimated for some parts of the distribution, also distorting the design of international strategies to achieve convergence. Note that some authors argue that more efforts are needed from donor countries and international aid agencies to accelerate the process of convergence in lees developed countries (Noorbakhsh 2006). This conclusion is also supported by our results, but according to the semiparametric estimates, medium developed countries should be also considered as possible recipients of these funds or other expansive policies, given the deceleration of convergence in well-being observed in these countries.

Nonparametric estimation of f(y i0) according to Eq. (7). In each case y i0 represents the natural logarithm of the HDI or its intermediate indices. The solid blue line corresponds to the estimate of f(y i0) and the dashed curves delimit the 95 % confidence bands. The solid green line represents the classical linear estimation of beta-convergence. (Color figure online)

7 Conclusions

In this paper we re-examine the hypothesis of beta-convergence in well-being across different economies during the period 1980–2012. The HDI is used as an indicator of such process, which considers education and health as essential as income in the measurement of well-being. Specifically, we analyse the concepts of sigma-convergence, which assumes that dispersion of living standards tends to decrease over time; and beta-convergence, which implies a negative relationship between the initial levels of a particular indicator and its growth rate. Conversely to previous studies which estimate parametric models focused on a linear trend, we opt for a flexible semiparametric approach. This specification does not require making a priori assumptions about the model specification thus letting the data state by themselves how the convergence rate evolves as the level of human well-being increases. For comparative purposes, the parametric model is also estimated and structural variables are included to capture differences in the steady-state, which is associated with the concept of conditional beta-convergence.

Our results point out that the gap between developed and developing countries has been substantially reduced in a wide range of indicators of quality of life. The educational dimension shows the greatest reduction, around 60 %, followed by health whose inequality levels have fallen about 30 %, and finally, the income dimension only reduced its inequality in 10 % over the study period. These trends have resulted in a much more egalitarian distribution of human well-being than 30 years ago. We decompose the Theil index in two components, which represent inequality within and between regions. This analysis reveals that disparities in well-being are dominated by differences across regions, which represent more than the 75 % of overall disparities. A decrease in inequality within-region is observed along with the fall of differences across regions, thus resulting in a global process of convergence in quality of life.

Regarding beta-convergence, the results obtained from the classical linear analysis at least suggest weak absolute convergence in living standards over the last 30 years. It should be worth noting that the convergence rates obtained in this study using the new framework of the HDI, are unambiguously higher than those of reported by previous studies. This finding is robust to the introduction of conditioning variables which leads to higher rates of convergence speed. Consequently, the changes applied to the HDI in 2010 affected substantially the method to evaluate well-being, thus redefining the convergence patterns of this indicator.

The results of the RLRT test point out that the process of convergence has been nonlinear for some of the indicators considered. In particular, PLM models reveal that whereas the absolute convergence process in human well-being is adequately represented by a parametric trend, conditional convergence shows nonlinear patterns. In fact, semiparametric estimates show that convergence in well-being seems to be slowed down for medium developed countries, whereas for the advanced economies, the convergence process is again accelerated. Our results suggest that, even when little advances have been achieved in income levels, significant improvements in non-income dimensions and human well-being have been accomplished. This conclusion highlights the relevance of considering non-income dimensions in the study convergence hypothesis, since their distributional patterns differ substantially from income.

This study reveals that some degree of equalisation in well-being levels has taken place in the last decades. However, the convergence process is being rather slow and hence the action of international organisations is essential to achieve faster rates of convergence. International cooperation in social policies plays also a crucial role in increasing well-being levels in developing countries in the near future, thus moving on the direction MDG. Given that less developed countries have a scarcity of technological and capital resources (UNDP 2003; WHO 2003) more efforts are needed from donor countries and international aid agencies (Noorbakhsh 2006). In fact, the fulfilment of a global partnership seems to be the key in achieving the eight targets of MDG by 2015 (United Nations 2012). Note that medium developed countries should also be considered as possible recipients of these funds or other expansive policies, given the deceleration of convergence in well-being observed for these nations. The role of the national governments is also important especially in expanding schooling rates. Their efforts to improve primary care are also determinant to enhance the quality of life (Kenny 2005), thus encouraging a catching-up process between developing countries and leader economies.

Notes

The upper bounds of all sub-indicators have been redefined in order to avoid the practice of capping variables at the top of the distribution. Consequently, the new bounds has lead an increase in the variability of the intermediate indices and hence in the HDI.

The inclusion of other measures to determine the dispersion of the distribution, responds to the problems presented by the variance, which is “unsatisfactory in that were we simply to double everyone’s incomes (and thereby double mean income and leave the shape of the distribution essentially unchanged)” (Cowell 2011, 27).

We include only dummies for these two regions since they show remarkable different convergence patterns than the rest of the world being characterized as the most unequal regions (see e.g. Chotikapanich et al. 2009).

Note that Mayer-Foulkes (2010) focuses on the dimensions of the HDI rather than the composite index and then no global conclusions can be achieved in terms of well-being since these different components show different convergence patterns. In fact, as stated in this paper “Each human development component follows its own set of transitions”, Mayer-Foulkes (2010, pp. 28).

For a detailed explanation of the procedure for testing the null hypothesis of non-significance of the variance component in linear mixed models with one variance component see Crainiceanu and Ruppert (2004). In that paper the finite and asymptotic distribution of the RLRT is derived to provide consistent results.

Note that in Decancq et al. (2009) the sensibility of the results to different trade-offs between dimensions is investigated in relation to the evolution of multidimensional inequality in well-being convergence. Actually, multidimensional inequality is beyond de scope of this paper. In any case, it should be stated that if we apply unidimensional inequality measures to the HDI, we are assuming some degree of substitution and complementarity among dimensions since the composite indicator follows a Cobb–Douglas type function.

The Atkinson index is decomposable but not additively, and then an interaction term is involved. The Gini index can be additively decomposable if there is no overlapping between groups, but since we are considering a regional classification, this is not the case.

The acceleration of the convergence process under the conditional framework is a common result in the literature (see Noorbakhsh (2006) and Konya and Guisan (2008) for examples related to convergence in human well-being). Note that the absolute model implies that all countries converge to the same steady state, while the consideration of structural variables allows for the existence of multiple steady state equilibrium. Then, only countries that share these characteristics are converging to the same steady state, and this process should be faster than universal convergence.

References

Alkire, S. (2002). Dimensions of human development. World Development, 30, 181–205.

Alkire, S., & Foster, J. (2010). Designing the Inequality-Adjusted Human Development Index (IHDI). Human development research paper, 2010/28. UNDP.

Anand, S., & Sen, A. (2000). The income component of the Human Development Index. Journal of Human Development, 1, 83–106.

Atkinson, A. (1970). On the measurement of inequality. Journal of Economic Theory, 2, 244–263.

Azomahou, T. T., Nguyen-Van, P., & Pham, T. K. C. (2011). Testing convergence of European regions: A semiparametric approach. Economic Modelling, 28, 1202–1210.

Barro, R. J. (1991). Economic growth in a cross section of countries. The Quarterly Journal of Economics, 106, 407–443.

Barro, R. J., & Sala-i-Martin, X. (1990). Economic growth and convergence across the United States. NBER working paper no. 3419.

Barro, R., & Sala-i-Martin, X. (1992). Convergence. Journal of Political Economy, 100, 407–433.

Becker, S. G., Philipson, T. J., & Soares, R. R. (2005). Quantity and quality of life and the evolution of world inequality. American Economic Review, 95, 277–291.

Berggren, N. (2003). The benefits of economic freedom. A survey. The Independent Review, 8, 193–211.

Bilbao-Ubillos, J. (2011). The limits of Human Development Index: The complementary role of economic and social cohesion, development strategies and sustainability. Sustainable Development. doi:10.1002/sd.525.

Bilbao-Ubillos, J. (2013). Another approach to measuring human development: The Composite Dynamic Human Development Index. Social Indicators Research. doi:10.1007/s11205-012-0015-y.

Borensztein, E., De Gregorio, J., & Lee, J. W. (1998). How does foreign direct investment affect economic growth? Journal of International Economics, 45(1), 115–135.

Briassoulis, H. (2001). Sustainable development and its indicators: Through a planner’s glass darkly. Journal of Environmental Planning and Management, 41, 409–427.

Cahill, M. B. (2005). Is the human development index redundant? Eastern Economic Journal, 31, 12–19.

Chotikapanich, D., Grifiths, W., Rao, D.S.P., Valencia, V. (2009). Global Income Distribution and Inequality: 1993 and 2000. University of Melbourne research paper no. 1062.

Cowell, F. A. (2011). Measuring inequality (5th ed.). New York: Oxford University Press.

Crainiceanu, M. C., & Ruppert, D. (2004). Likelihood ratio test in linear mixed models with one variance component. Journal of the Royal Statistical Society: Series B, 66, 165–185.

De Haan, J., Lundström, S., & Sturm, J. E. (2006). Market-oriented institutions and policies and economic growth: A critical survey. Journal of Economic Surveys, 20(2), 157–191.

De la Fuente, A. (1997). The empirics of growth and convergence: A selective review. Journal of Economic Dynamics and Control, 21, 23–73.

Deaton, A. (2004). Health in age of globalization., Washington, DC: Brookings Trade Forum, Brookings Institution.

Decancq, K. (2011). Measuring global well-being inequality: A dimension-by-dimension or multidimensional approach? Reflets et perspectives de la vie économique, 4, 179–196.

Decancq, K., Decoster, A., & Schokkaert, E. (2009). Evolution of world inequality in well-being. World Development, 37, 11–25.

Dobson, S., Ramlogan, C., & Strobl, E. (2003). Cross-country growth and convergence: A semi-parametric analysis. Economics Discussion Papers No. 0301, University of Otago.

Domínguez, R., Guijarro, M., & Trueba, C. (2011). Recuperando la dimensión política del desarrollo humano. Sistema, 220, 11–31.

Durlauf, S. N. (2001). Manifesto for a growth econometrics. Journal of Econometrics, 100, 65–69.

Durlauf, S. N., Kourtellos, A., & Minkin, A. (2001). The local Solow growth model. European Economic Review, 45, 928–940.

Edgier, V. S., & Tatlidil, H. (2006). Energy as an indicator of human development: A statistical approach. The Journal of Energy and Development, 31(2), 213–232.

Fakuda-Parr, S., Lawson-Remer, T., & Randolph, S. (2009). An index of economic and social rights fulfilment: Concept and methodology. Journal of Human Rights, 38, 195–221.

Ferrara, A. R., & Nisticò, R. (2013). Well-being indicators and convergence across Italian regions. Applied Research in Quality of Life, 8(1), 15–44.

Fiaschi, D., & Lavezzi, A. M. (2007). Nonlinear economic growth: Some theory and cross-country evidence. Journal of Development Economics, 84, 271–290.

Frankel, J. A., & Romer, D. (1999). Does trade cause growth? American Economic Review, 89, 379–399.

Goesling, B., & Firebaugh, F. (2004). The trend in international health inequality. Population and Development Review, 30(1), 131–146.

Goldsmith, A. A. (1997). Economic rights and government in developing countries: Cross-national evidence on growth and development. Studies in Comparative International Development, 32(2), 29–44.

Greenaway, D., Morgan, M., & Wright, P. (1998). Trade reform, adjustment and growth: What does the evidence tell us? Economic Journal, 108, 1547–1561.

Grimm, M., Harttgen, K., Klasen, S., & Misselhorn, M. (2008). A Human Development Index by income groups. World Development, 36, 2527–2746.

Gwartney, J., & Lawson, R. (2004). Ten consequences of economic freedom. Policy Report, 268.

Gwartney, J., Lawson, R., & Hall, J. (2010). Economic freedom of the world 2010 annual report. Vancouver, BC: The Fraser Institute.

Gwartney, J., Lawson, R., & Hall, J. (2013). Economic freedom of the world 2013 annual report. Vancouver, BC: The Fraser Institute.

Hicks, D. A. (1997). The Inequality-Adjusted Human Development Index: A constructive proposal. World Development, 25, 1283–1298.

Huang, H. C. (2005). Diverging evidence of convergence hypothesis. Journal of Macroeconomics, 27, 233–255.

Islam, N. (2003). What have we learnt from the convergence debate? Journal of Economic Surveys, 17, 309–362.

Kelley, A. (1991). The Human Development Index: “Handle with Care”. Population and Development Review, 17, 315–324.

Kenny, C. (2005). Why are we worried about income? Nearly everything that matters is converging. World Development, 33(1), 1–19.

Klugman, J., Rodríguez, F., & Choi, H.-J. (2011). The HDI 2010: New controversies, old critiques. Journal of Economic Inequality, 9, 249–288.

Konya, L. (2011). New panel data evidence of human development convergence from 1975 to 2005. Global Business and Economics Review, 13, 57–70.

Konya, L., & Guisan, M. C. (2008). What does the human development index tell us about convergence? Applied Econometrics and International Development, 8, 19–40.

Kovacevic, M. (2010). Review of HDI critiques and potential improvements. Human development research paper no. 33. UNDP.

Liu, Z., & Stengos, T. (1999). Non-linearities in cross-country growth regressions: A semiparametric approach. Journal of Applied Econometrics, 14, 527–538.

Lundberg, M., & Squire, L. (2003). The simultaneous evolution of growth and inequality. The Economic Journal, 113(487), 326–344.

Marchante, A. J., Ortega, B., & Sánchez, J. (2006). The evolution of well-being in Spain (1980–2001): A regional analysis. Social Indicators Research, 76, 283–316.

Martínez, R. (2012). Inequality and the new Human Development Index. Applied Economics Letters, 19, 533–535.

Mayer-Foulkes, D. (2003). Convergence clubs in cross-country life expectancy dynamics. In R. van der Hoeven & A. Shorrocks (Eds.), Perspectives on growth and poverty (pp. 144–171). Tokyo: United Nations University Press.

Mayer-Foulkes, D. (2010). Divergences and convergences in human development. Human development research paper no. 2010/20. UNDP.

Mazumdar, K. (2000). Inter-country inequality in social indicators of development. Social Indicators Research, 49, 335–345.

Mazumdar, K. (2002). A note on cross-country divergence in standard of living. Applied Economics Letters, 9, 87–90.

Mazumdar, K. (2003). Do standards of living converge? A cross-country study. Social Indicators Research, 64, 29–50.

McGillivray, M. (1991). The Human Development Index: Yet another redundant composite development indicator? World Development, 19, 1461–1468.

McGillivray, M., & Markova, N. (2010). Global inequality in well-being dimensions. Journal of Development Studies, 46, 371–378.

McGillivray, M., & Pillarisetti, J. R. (2004). International inequality in well-being. Journal of International Development, 16, 563–574.

McGillivray, M., & White, H. (1993). Measuring development? The UNDP’s Human Development Index. Journal of International Development, 5, 183–192.

McMichael, A. J., McKee, M., Shkolnikov, V., & Valkonen, T. (2004). Mortality trends and setbacks: Global convergence or divergence? The Lancet, 363(9415), 1155–1159.

Milanovic, B. (2005). Worlds apart: Measuring international and global inequality. Princeton: Princeton University Press.

Morris, M. D. (1979). Measuring the conditions of the world’s poor: The Physical Quality of Life Index. New York: Pergamon.

Morrison, C., & Murtin, F. (2012). The Kuznets curve of human capital inequality: 1870–2012. Journal of Economic Inequality. doi:10.1007/s10888-012-9227-2.

Moser, K., Shkolnikov, V., & Leon, D. A. (2005). World mortality 1950–2000: Divergence replaces convergence from the late 1980s. Bulletin of the World Health Organization, 83(3), 202–209.

Neumayer, E. (2001). The Human Development Index and Sustainability—A constructive proposal. Ecological Economics, 39, 101–114.

Neumayer, E. (2003). Beyond income: Convergence in living standards, big time. Structural Change and Economic Dynamics, 14, 275–296.

Noorbakhsh, F. (1998). The Human Development Index: Some technical issues and alternative indices. Journal of International Development, 10, 589–605.

Noorbakhsh, F. (2006). International convergence or higher inequality in human development? Evidence for 1975–2002. WIDER research paper no. 2006/15.

Norton, S. W. (1998). Poverty, property rights, and human well-being: A cross-national study. Cato Journal, 18, 233.

Ogwang, T., & Abdou, A. (2003). The choice of principal variables for computing human development indicators. Social Indicators Research, 64, 139–152.

O’Leary, E. (2001). Convergence of living standards among Irish regions: The roles of productivity, profit outflows and demography, 1960–1996. Regional Studies, 35(3), 197–205.

Pillarisetti, J. R. (1997). An empirical note on inequality in the world development indicators. Applied Economic Letters, 4, 145–147.

Pritchett, L. (1997). Divergence, big time. Journal of Economic Perspectives, 11(3), 3–17.

Quah, D. (1993). Galton’s fallacy and tests of the convergence hypothesis. Scandinavian Journal of Economics, 95, 427–443.

Quah, D. (1996). Regional convergence clusters across Europe. European Economic Review, 40, 1951–1958.

Ravallion, M. (1997). Good and bad growth: The human development reports. World Development, 25, 631–638.

Rodrik, D., Subramanian, A., & Trebbi, F. (2004). Institutions rule: The primacy of institutions over geography and integration in economic development. Journal of Economic Growth, 9(2), 131–165.

Ruppert, D., Wand, M. P., & Carroll, R. J. (2003). Semiparametric regression. London: Cambridge University Press.

Sab, R, & Smith, S. C. (2001). Human capital convergence: International evidence (Vol. 1). IMF working paper. International Monetary Fund.

Sagar, A. D., & Najam, A. (1998). The Human Development Index: A critical review. Ecological Economics, 25, 249–264.

Sala-i-Martin, X. (1996). The classical approach to convergence analysis. The Economic Journal, 106, 1019–1033.

Sala-i-Martin, X. (2000). Apuntes de Crecimiento Economómico (2nd ed.). Barcelona: Antoni Bosch Editor.

Sen, A. (1988). The concept of development. In H. Chenery & T. N. Srinivasan (Eds.), Handbook of development economics (pp. 9–26). Amsterdam: Elsevier.

Sen, A. (1989). Development as capabilities expansion. Journal of Development Planning, 19, 41–58.

Sen, A. (1999). Development as freedom. Oxford: Oxford University Press.

Seth, S. (2010). A class of distribution and association sensitive multidimensional welfare indices. The Journal of Economic Inequality. doi:10.1007/s10888-011-9210-3.

Slaughter, M. J. (2001). Trade liberalization and per capita income convergence: A difference-in-differences analysis. Journal of International Economics, 55(1), 203–228.

Solow, R. M. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70, 65–94.

Solow, R. M. (1957). Technical change and the aggregate production function. Review of Economics and Statistics, 39, 312–320.

Srinivasan, T. N. (1994). Human development: A new paradigm or a reinvention of the wheel? American Economic Review, 84, 238–243.

Swan, T. W. (1956). Economic growth and capital accumulation. Economic Record, 32, 334–361.

UNDP. (1990). Human development report. Concept and measurement of human development. New York: United Nations Development Program.

UNDP. (2003). Human development report. Millennium development goals: A compact among nations to end human poverty. New York: United Nations Development Program.

UNDP (2005). Human Development Report. International cooperation at a crossroads: Aid, trade and security in an unequal world. New York: United Nations Development Program.

UNDP. (2012). International human development indicators. Retrieved from http://hdr.undp.org/en/statistics/. Accessed March 28, 2013.

UNDP. (2013). Human development report. The rise of the south: Human progress in a diverse world. New York: United Nations Development Program.

United Nations. (2012). The millennium development goals report. New York: United Nations.

Wacziarg, R., & Welch, K. H. (2008). Trade liberalization and growth: New evidence. The World Bank Economic Review, 22(2), 187–231.

Wand, M. P. (2005). SemiPar: An R package for semiparametric regression. Working paper.

World Bank. (2001). World development report 2000/2001: Attacking poverty. Oxford: Oxford University Press.

World Bank. (2006). World development report 2005/2006: Equity and development. Oxford: Oxford University Press.

World Bank. (2013). World development indicators database. Retrieved from http://data.worldbank.org/data-catalog/world-development-indicators. Accessed November 15, 2013.

World Health Organization (WHO). (2003). The world health report: Shaping the future. Geneva: World Health Organization.

Acknowledgments

The authors thank the Ministerio de Economía y Competitividad (Project ECO2010-15455) and the Ministerio de Educación (FPU AP-2010-4907) for partial support of this work. Authors are grateful for the constructive suggestions provided by the reviewers, which improved the paper substantially.

Author information

Authors and Affiliations

Corresponding author

Appendix: Regions and Countries Included

Appendix: Regions and Countries Included

Western Europe, North America, and Oceania: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Korea (republic of), Luxembourg, Malta, Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom, United States |

Arab States: Algeria, Bahrain, Egypt, Israel, Jordan, Morocco, Qatar, Saudi Arabia, Sudan, Syrian Arab Republic, Tunisia, Yemen, United Arab Emirates |