Abstract

Nanotechnology is promising to be the ‘transformative’ technology of the 21st century with its boundless potential to revolutionize a wide range of industries. Stakes are high as projected estimate of market value and economic and social benefits are immense for countries that can attain competency in this technology. This has stimulated OECD countries as well as emerging economies to channel huge resources for developing core capabilities in this technology. Unlike, other key technologies, recent influential reports highlight China in particular and to some extent India, Brazil and other emerging economies competing with advanced OECD countries in ‘nanotechnology’. The present paper investigates through bibliometric and innovation indicators to what extent China and India have been able to assert their position in the global stage. The paper also underscores the importance of capturing indications from standards and products/processes along with publications and patents to capture more accurately the latent variable ‘performance’. Study shows that China’s progress is remarkable; it has already attained leading position in publications and standard development. India is making its presence more visible particularly in publications. China’s research is more sophisticated and addresses nano-materials and its applications whereas India’s research shows healthy trend towards addressing developmental problems.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Nanotechnology is not a discreet technology or an industry sector. It simply refers to a range of technologies that operates at the nano-scale (roughly 1–100 manometers, 1 nanometer is 10–9 meter). Although ‘size’ is a convenient way of defining the area; in practice nanotechnology has more to do with the investigation of novel properties that manifests themselves at the size scale, and the ability to manipulate and artificially construct structures at that scale. The pervasive potentiality of nanotechnology makes it most attractive (Tolles and Roth 2003); as a generic technology (for example its impact can be in diverse industries similar to ICT), as an enabling technology (adding new functions to existing products) and its disruptive potentiality (can displace existing products or can obliterate a particular type of product in the market). Another characteristics that makes nanotechnology appealing is that not only it can provide solutions in high technology but also in areas that are of pressing concerns in developing and improvised economies, i.e., environment, water purification, agriculture, energy and in a host of other products and services. For example in water treatment and re-use, engineered nanoparticles can provide a number of opportunities: high absorption that can help remove arsenic and other heavy metals, anti-microbial properties, fouling-resistant, filtration membranes, florescence that can detect pathogens and other primary pollutants. Already products are in the market and more multi-functional water treatment/re-use products are being developed. These demonstrated applications are changing the perception of skepticism towards a realisation that “If properly addressed nanotechnology can provide a ‘window of opportunity’ for countries to catch up”. This has motivated developing countries to channelize their scarce resources for increasing their capacity and capability in nanotechnology. Developing countries also perceive this technology can help them to leapfrog the technology development life cycle and compete globally through value enhanced products.

Influential studies predict nanotechnology as the key technology that will drive global competition (see for example, Nanoroadmap project co-funded by the sixth framework program of the European Commission (NRM Project Report 2006). A recent research report (BCC 2011) has for example estimated global market value for nanotechnology of $15.7 billion in 2010, expected to increase to nearly $27 billion in 2015. The largest segment of the market as per this report is made up of nanomaterials, which will rise from nearly $10 billion in 2010 to nearly $19.6 billion in 2015 followed by second-largest segment, nanotools, expected to reach a value of more than $6.8 billion in 2015 from $5.8 million in 2010. The smallest segment nanodevices, is projected to increase from an estimated $35.4 million $234 million during 2010–2015. The large market for nano-materials augers well for countries moving in this high technology area as it is relatively easier to develop capability in nanomaterials then in creating nanodevices. This is due to the technological challenge involved; a repeated scaling down approach (Top down) is more feasible and can help to develop varied types of nanomaterials.

Recent influential reports, scholarly articles, country reports highlights emerging economies making significant investment to create capacity in nanotechnology (see for example Hassan (2005)) and evidences are already showing them competing with advanced OECD economies. The National Intelligence Council, USA (NIC 2004) reports projection of the global future till 2020, Lux Research (LUX 2010) report of the changing trends in nanotechnology, Forbes/Wolfe (2007) report of global ranking in nanotechnology; all these studies point to the emergence of China, its establishing itself among the big players in nanotechnology. These studies are also mentioning India as making significant progress in this technology. These reports liberally use bibliometric indicators along with other qualitative methods (expert assessment, survey etc.) to develop the picture of global trends and country’s/firms position in this technology.

The emergence of China and India signals an important change as moving up in a frontier technology shows that they are developing innovative capabilities which can help them leapfrog their economy to the levels of advanced economies. In the last decade or so China has been able to challenge the dominance of OECD economies in manufacturing (Kaplinsky and Messner 2007). Factor cost advantages and production capabilities have made China a major producer of products for world market. India on the other hand has become the global outsourcing hub. However, both the countries are at the lower end of the value chain with core competency behind product development residing with developed economies in China’s case and in India’s case, the full enterprise based business solutions resting with global entities (Bhattacharya and Lal 2010; Altenburg et al. 2008). Thus, in this context it is important to underscore to what extent these two countries are progressing in this frontier technology. Progress in this key technology will help them exploit the acquired intellectual asset for high value added attribution.

Study objectives

The study investigates in details to what extent China and India are making assertion in this technology at the global stage. The questions that drive this paper are: To what extent these two countries have developed competency in this high technology area? Is this technology providing ‘window of opportunity’ for these two countries to ‘catch up’ with advanced OECD economies? Is research able to address their areas of concern?. The study also intends to demonstrate the importance of integrating bibliometric and innovation indicators in constructing a more informed picture of a country’s performance.

Methodology

Chinese and Indian progress and assertion in Nanotechnology was investigated by examining publications, patents, standards and processes/products. Indicators based on publications provide an important indication of country’s progress in this technology as mastering this technology and developing applications is contingent upon advanced scientific research. Patents help us to judge the inventive ability and a possible indication of developing novel products/processes. Standard activity and its international adoption of a country’s standard provide an indication more so in a high technology area like nanotechnology of future technology leverage. Product/process is the successful outcome of its development. Thus, we argue that that analysis based on these four indicators would help us to get an informed picture of progress these two countries have made in this technology.

Publication data was downloaded from Science Citation Index Expanded (SCI-E). Search string defined by Kostoff et al. (2007) was applied in the title and/or abstract and/or keyword field to capture nanotechnology publications. Keyword analysis was based on descriptions (keywords attached to each article).

Co-occurrence of most active keywords (co-word analysis) was undertaken using the Bibexel software (http://www.umu.se/inforsk/Bibexcel/). Graphs were constructed using Pajek (Vladimir and Andrej 2005) and Citespace (Chen 2005). To have uniformity with the intellectual space of scientific research, the same search string, i.e., defined by Kostoff et al. (2007) was applied for downloading patent data from the Thomson Innovation Patent database. To capture the core patenting activity within nanotechnology, patents were also searched by classification code 977 assigned to nanotechnology by the USPTO (US patent and trademark office). USPTO database (http://patft.uspto.gov) was also used for validation.

Standards being developed were delineated from Bureau of Standards (India), from International Organization for Standardization (ISO) Technical Committee (TC) activity in nanotechnology identified by TC 229 (http://www.iso.org/iso/iso_technical_committee?commid=381983), and World Watch Institute (WWI 2006).

Nanotechnology products/processes developed by these two countries were captured from multiple sources. Woodrow Wilson International Center for Scholars’ Project on Emerging Nanotechnologies database (see www.nanotechproject.org) was used to capture their nanotechnology based products in the major global markets. This database tracks nanotechnology products globally and thus gives a global view of nanotechnology products, industry sectors where nanotechnology is making an impact and also helps to analyse different country’s activity and impact. Various reports, brochures, trade journals were used to enrich the data and uncover products/processes that are in their domestic market or have shown promise of novel applications.

The key players in the global nanorace: contemporary scenario from scientometric studies

The study examines the progress of China and India in nanotechnology and to what extent they are making a global assertion in this technology. Keeping this in context, we examine contemporary influential bibliometric studies that have investigated how nanotechnology is developing and who are emerging as key players.

Miyazakia and Islam (2007) study was based on data extracted from 1990 to 2006 from SCI-E. The study highlighted the dominance of US over Europe from 2000 onwards. They cited massive investment by US through its ‘National Nanotechnology Initiative’ as the main reason for US publication growth. Their analysis also showed that Japan was losing its leadership in Asia in comparison to other countries, whereas China was showing significant growth. Kostoff et al. (2007) extracted data from both SCI and SSCI to capture the research publication activity in nanotechnology covering the period 1991–2005. The result indicated that over this time period, the United States and Japan’s shares of global nanotechnology/nanoscience publications have dropped (the USA from 36 to 23%, and Japan from 16.5 to 12.5%), as countries that were not as prolific at the beginning of the 1990s grew rapidly over the course of the decade. China and South Korea both published about forty times more research articles in 2005 than in 1991. This study is further supported by other studies done in different parts of the world. Porter and Youtie (2008) pointed to the rapid growth of Asian countries in nanotechnology publications. They examined the relative positions with respect to nanotechnology research publications of the European Union (EU), the United States (US), Japan, Germany, China, and three Asian Tiger nations (South Korea, Singapore, and Taiwan). China’s publication count showed a particularly steep slope; its cumulative publication count increased by more than 300% from 2001 to 2006. Zhou and Leydesdorff (2006) also found similar results for China’s publication performance. However, the most surprising finding comes from study by Kostoff et al. (2006) based on data extracted from SCI for the year 2003. Their study pointed out the increasing centrality of Chinese scientists and engineers in nanotechnology; of the twenty most prolific authors in nanotechnology,nineteen were found having Chinese surnames, along with half of all first authors. Some of these were citizens or permanent residents of countries other than China, while many were graduate students or post-docs studying in Europe, Japan, or the United States, or working in laboratories in those countries.

Porter and Cunningham made an interesting finding by undertaking a comparative study of INSPEC and SCI for the period 1986–1995 of nanotechnology content. They found substantial differences among researchers in the ‘nanosciences’. They concluded that, in SCI nanotechnology coverage is less applied and more oriented towards basic research, so much so that the word ‘nanotechnology’ itself is only infrequently used. In SCI, nanotechnology research relates much more closely to the life sciences and most particularly to bio and organic chemistry. ‘Bottom-up nanotechnology’ items in INSPEC share this orientation (Porter and Cunningham 1999). This study underscores that studies undertaken using SCI is primarily the more fundamental research in nanotechnology.

Recent patent studies again point out the emergence of new players in the nanotechnology patent race. In a recent study by Dang et al. (2009) nanotechnology patent applications during the period 1991–2008 were covered. The study is comprehensive as respective patent families have been evaluated for 15 national patent office’s covering 98% of the global activity. China patent office emerges as one of the important locus of patent filing. It ranks 2nd after USA in receiving patents in nanotech; it received 18,438 applications during the period 2001–2008. In comparison, USA received 19,665 applications whereas its nearest rival Japan received 10,763 applications. On examining the data further, it is observed that there is a significant change in applications received if one takes snapshot of two different years namely 2000 and 2008. In 2000 China’s patent office received only 105 applications ranking 3rd after USA and Japan whereas in 2008 it received 5,030 applications ranking 1st with USA following with 3,729 applications received. China with 17,000 applications along with the US lead the number of patent applications filed globally (includes patent filing in domestic patent office). However, China’s international patenting activity is only 4% unlike the US that has 20% of the activity internationally. This is one of the drawbacks of China’s activity. However, China is very active in filing in South Korea, ranking third with fifty-three patents in that office. In another detailed study, Liu (2009) examined the trends for nanotechnology development in China, Russia, and India through publication and patent based analysis of the US patent office for the period 2000–2007. Their study shows significant increase in publication and patenting activity in all the three countries. Among an important aspect of their research was the categorization of nanotechnology domain in three major sub-topics nanomaterial, nano-devices and measurement and characterization. Their study again reasserts strong progress by China particularly in publication activity.

Brand (2010) performed a study on the basis of EPO′s “Worldwide Patent Statistical database” (PATSTAT) and the online patent service “esp@cenet” making use of the specific preliminary classification code “Y01N”. This study investigated the Europe′s position internationally and also undertook internal comparison to identify key players and application areas. “Europe” included the EU27 and associated states (approximately 40 countries). The numbers of patent applications were delineated into ten specific application sectors.

The evaluation showed the temporal development of the worldwide applications in nanotechnology. Chemistry/Materials, ICT and Health/Bio Medicine sectors accounted for the largest sectoral fractions. The United States and Japan were in the leading positions with respective shares of 47 and 25% of the total applications. Germany follows as the main European contributor with 8%, followed by France (4%), and the UK (4%). EU27 accounts for 20% of all nano related patent applications; coming in third position behind the US and Japan. The absolute contribution of emerging nations was still far below the activity of the US, Japan or Europe. Only Korea and China were the other countries apart from USA, Japan and EU-27 showing significant growth in the last few years.

Preschitschek and Bresser (2010) examined nanotechnology patenting activity in the patent offices of the US, Japan, Germany and China for the period of 2000–2007. China showed a significant increase during this period with an annual average growth rate of 34%. Taking 2000 as the base year, the growth was 49% in 2007, i.e., from 1,100 patents in 2000–11,000 patents in 2007. Since 2005, China’s total patents exceeded Japan and the United States the technological leaders in nanotechnology. The study showed that China holds a considerable higher amount of patents within the field of nanotechnology compared to Germany. Especially the high growth rate indicates that China will play a key role within this sector during the next years. However, there is a caveat that follows in interpreting this result. As we found in examining the data presented in Dang et al. (2009) that China’s international patenting activity is only 4% and thus China’s strength comes from its domestic patenting activity.

The contemporary publication based analysis shows strong assertion by China. Patent studies are pointing out that China is emerging as a key player although in the US and/or European patent office it still lags behind advanced OECD countries. However, trends in these patent offices are also changing with China emerging as an important player. Some of the studies also inform us of India’s progress particularly in global publication activity. The above studies provide grounding to the present study. A drawback, however, which we find in these studies is that they are drawing a picture of nanotechnology development by examining primarily publication and patent studies. There are studies, however, that have been able to make a more informed assessment of the nanotechnology development (see for example Meyer (2007); Hullman (2007)). These studies primarily inform us of the nanotechnology development in OECD economies; the emergence of Asian countries in the nanotechnology race is not addressed in details. Strategy studies are visible that address emergence of Asian economies in nanotechnology in a more comprehensive manner. Two recent studies (Huang and Wu 2010; Shapira and Wang 2009) have examined China’s emergence and have also applied bibliometric indicators as evidence while analysing its progress in nanotechnology. The present study intends to construct a more detailed picture of performance by applying four performance indicators namely publications, patents, standards, and products/processes developed. Novelty of this paper is also in examining standard activity which we argue is an important indication of development in an emerging technology. We also posit that China and India are two big countries with the most advanced scientific capacity in the developing world. It is therefore important to look at the progress of these two countries in a frontier technology. The present study intends to contribute in these directions.

The Chinese and Indian nanotechnology initiative

Nanotechnology requires strong government stimulation for capability creation as unlike some of the other knowledge based sectors, the barriers to entry in nanotechnology is very high; as risk (return to investment) is unpredictable, technology is highly uncertain and capital intensive, requires skill manpower, and sophisticated capital instruments, etc. Moreover, nanotechnology is at an early phase of development with many applications still at the concept stage requiring much more basic research before they can be incorporated into a viable product. Thus, firms are reluctant to invest and devote R&D fund in this technology especially so in developing countries where private sector research is miniscule and investment is more towards adaptive R&D and development.

China had made an early commitment in this technology as early as 1990, investing over 1.5 billion yuan (approx. 228 million USD) during the period 2001–2005 and 5 billion yuan (approx. 760 million USD) between 2006 and 2010. Among its key initiatives was the thrust on development of indigenous instruments for nanotechnology research. This led to the development of sophisticated instruments (atomic force microscope (AFM), scanning tunnel microscopy (STM)) which were fraction of cost of imported instruments (Bhattacharya and Bhati 2011). These sophisticated instruments provided researchers to undertake more extensive and accurate research, for example improved nanomaterial characterization a key component of nonmaterial research. Another characteristic of Chinese capacity development was the thrust on the standard development and creation of technical standardization committees and health, safety and environment institutions. Figure 1 depicts the Chinese nanotechnology roadmap.

Chinese nanotechnology initiatives source: Bhattacharya and Bhati (2011); Huang and Wu (2010); Shapira and Wang (2009) and constructed using website: www.gliffy.com

In comparison to China, Indian initiatives started much later and also funding was much lower. Indian government placed nanotechnology as a priority area in 2001 with the launching of ‘nano science and technology initiative’ (NSTI) with investment of $15 million for the first 5 years. To give further thrust to Nanotechnology Development, Nano Science and Technology (Nano Mission) was initiated in 2007 with an allocation of USD250 million for 5 years focusing on basic research, infrastructure development, commercialization, education, and international collaboration. Key actions under these programs have been towards creating centers of excellence, supporting nanotechnology projects, developing human resource, and initiate public–private partnerships. Besides launching the mission mode initiative, India has also entered into bilateral nanotechnology programmes with the European Union, Germany, Italy, Taiwan and the United States. A tangible outcome of foreign collaboration was the creation in 2004 at ARCI (international advanced research centre for powder metallurgy and new materials), a national centre for nanomaterials in collaboration with Germany, Japan, Russia, Ukraine and the United States. Figure 2 highlights Indian initiatives.

Indian nanotechnology initiatives source: DST (http://dst.gov.in/scientific-programme/ser-nsti.htm), Teri (2009) and constructed using website: www.gliffy.com

China and India’s nanotechnology performance

Publication activity

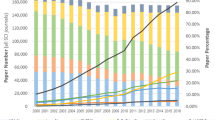

It is surprising to observe China emerging as the most prolific in research publications in 2009! Nanotechnology is a highly science intensive field wherein technology development critically depends on scientific research. China taking a leading position ahead of USA and other OECD economies makes a strong statement. The picture has dramatically changed from what it was in 2000. In 2000, USA accounted for 27% of the nontechnology papers whereas Japan accounted for 14.5% of papers and China 9.8% in that year. In 2009, China has emerged as leader accounting for 23% of papers with USA accounting for 21% of paper whereas Japan is considerably less visible, accounting for 8% of total papers (Fig. 3).

Although India is much behind China but it is making its presence felt. It accounted for 5% of the total papers in 2009 (global rank 7th) whereas in 2000 it only contributed to 2% of total papers (global rank 13th). A steady rise in publication output is observed particularly since 2007, surpassing even England. This trend is consistent with findings from previous studies (Liu 2009; Madhan et al. 2010). Taking 2000 as the base year, India’s relative growth rate has been much higher than that of China from 2007 onwards. Overall for the publication aggregate from 2000 to 2009, China accounts for 62,782 papers in nanotechnology (16.4% of the total world papers) and India 13,092 papers (3.4% of the total world papers).

China and India have both increased their publication; however, China’s growth has been remarkable. Taking 2000 as the base year, we find 363% growth in 2005 and 929% growth in 2009 for China; whereas for India it was 334% growth in 2005 and 1,209% in 2009. Citation measure provides a view of the reception of papers by the international community (Glanzel 2008). However, citations received and CPP indicator is strongly affected by the citation window which the results also signify. The larger volume of Chinese papers leads to more citations than India. However, the differences becomes less when this is normalized by number of papers. Interestingly, we do not observe much difference in the corpus of papers that remain uncited. One important indication is how fast the papers of both the countries are received by the international community? We find that in 2009, both the countries have much better reception of their papers. Thus, this is one indication that their research is addressing important problems, advancing knowledge and making researchers take note of that (Table 1).

Further indication of reception was uncovered by examining the papers that were above the world average citation papers, the papers in top 10% and those in top 1% (which is the most stringent criterion and shows papers that are attracting the most attention). The world average of citation per paper in 2000, 2005 and 2009 were 39, 92, and 8, respectively. Table 2 highlights number of papers of both the countries above the world average.

Table 2 shows that a significant number of papers in the two countries are receiving citation below the world average. This shows that although China is dominating world research in this area and India also emerging as an important player, they are not able to draw to that extent the attention of the research community in this field. The world average was high in 2005 and this makes both the countries having much lesser number of papers above world average.

However, better performance is observed in terms of papers present in top 10% and top 1% cited papers, particularly by China. In the top 10% cited papers, China had 81 papers in 2000, 362 in 2005 and 1,072 in 2009. USA with 475 and Germany with 132 papers were above China in 2000 whereas it was second only to USA in 2005 and 2009 which had 1,150 papers and 1,950 papers, respectively in these 2 years. On the other-hand India had 21 papers in 2000 (14th among the top 10% cited papers), 41 papers in 2005 (15th rank), and 168 papers in 2009 (9th rank). The Table 3 highlights the top 1% cited papers.

China is among the top ten countries in all the years in this 1% cited papers league and asserts its position among countries particularly in 2009. India is not among the top ten countries and has made its presence somewhat more visible only in 2009. However, it can be observed from the Table 1 that in the ratio, i.e., citation normalized by total output, China has figures lesser than other countries and the same is true for India. This implies that in spite of China and to some extent India leading in the publishing race, its visibility among the research community is lagging in comparison to other countries with much lesser number of publications. Thus, nanotechnology is exhibiting the same broad trend highlighted by Madhan et al. (2010) “that inspite of Chinese researchers increasingly publishing in high quality journals, it is still lagging behind USA and European Union in attracting citations”. Language might not be the reason for low citation as more than 90% of papers by Chinese researchers in journals covered by the web-of-science are in English.

There is, however, a silver lining as the ratio is much greater for China in 2009 in comparison to 2000 and 2005 in spite of the number of papers (denominator) increasing significantly. India is also performing better in 2009. With 336 papers (global rank 13) in 2000, only 3 papers were in the top 1% cited papers and with 1185 papers (global rank 11th) in 2005 there were only 6 papers in this list. In 2009, India produced 3086 papers (global rank 7) and had 26 papers among the top 1% cited papers in nanotechnology. Still there is a cause of concern as although India is in the top ten most active players in terms of research papers as reflected in the SCI-E; their papers are not attracting attention to that extent.

The top 1% papers are important as these papers are creating the major international impact. It can be argued that these papers may have significant theoretical and/or experimental novelty that is helping draw the attention of the research community. Characteristic feature we observe in these highly cited papers of both the countries is that majority of the papers are result of authors from different institutions collaborating with each other. Figures 4 and 5 highlights these linkages.

Network of linkages among Chinese institutions in their top 1% cited papers (2009), Note: Analysis using Bibexcel and visualization using UCINET; **132 papers from China in the top 1% cited publication rank in 2009 involved 156 institutions. The network is built for the institutions with more than 2 publications

Of the 26 cited papers in the top 1% cited articles in year 2009 from India, 16 papers (61%) are collaborative papers and of China’s 132 papers in this list in the same year, 87 papers (66%) are collaborative papers. Also we observe multi-linkages, central hub (particularly in case of China) and foreign institutions involvement. The result points out the importance of linkages in developing high quality papers. However, one disturbing finding is the limited role of firms involvement; only one paper from India (Reliance Life Sci Pvt Ltd in collaboration with JNCASR) and three papers from China (Magnolia Opt Technol Inc, CBrite Inc, Japan Sci & Technol Agency) have firm involvement.

Nanotechnology research is widely dispersed across different journals due to its interdisciplinary nature. However, to capture journals primarily addressing this area, SCI has provided a separate category ‘nanoscience and nanotechnology’. Using the Journal Citation Reports (JCR)—Web Edition (2008), we delineated the journals with high IF in this category and examined publication activity of the two countries in these journals. This provides an indication to what extent these two countries are successful in publishing in top notch journals in this area.

There were 7,296 papers published in these journals during the period 2000–2009 with 60 countries contributing to these papers. USA was most active with 4,033 papers (55% of total contribution), Germany published 779 papers (11% of contribution, 2nd rank), China published 509 papers (7% of contribution, 3rd rank), Japan published 401 papers (6% of contribution, 4th rank) and India published 68 papers (1% contribution, 20th rank). More details of the activities of the two countries are highlighted in the Table 4 below.

Table 4 indicates some important aspects of these two countries publication in high IF journals in this field. In the three top journals (in terms of IF), both the countries particularly India has very insignificant presence. In general it can be concluded that their publication dominance is not visible in high IF journals in this field. Table 4 also reflects that collaboration (among authors from different institutes) do play an important role in getting papers published in these journals. This is similar to the findings we observe in the top 1% cited papers.

Nanotechnology is highly interdisciplinary emerging out of strong intersection of different traditional disciplines. Thus, for a country to create competency in nanotechnology research is to an extent contingent upon its overall research activity in different disciplines of natural and engineering sciences (Kanama and Kondo 2007). Also ideally country’s research strength should find reflection in areas within nanotechnology research. We examine to what extent research activity of both these countries match with their publication activity within nanotechnology.

In general, China is making a very strong presence in the global research output in different fields. China’s active research areas in the period 2000–2009 were in EE: Electrical Engineering Electronics (121,234 papers, 12% of its total output), MS: Material Science (107,075 papers, 10% of its total output) with major thrust in Material Science (Multidisciplinary) 77,302 papers accounting for 72% of the output within this field, CS: Computer Science Artificial intelligence with 68,678 papers (7% of its total output). USA was the top publishing country in EE and MS accounting for 200,380 papers (23% of global contribution) and 129,135 papers (19% of global contribution) respectively. In CS, China (68,688 papers) was the global leader accounting for 22% of total output. Other areas where China was very active/has been showing high growth rates were: Chemistry Multidisciplinary (50,873 papers), Physics Applied (48,972 papers), Optics (45,814 papers), Physical Chemistry (46,350).

India has shown similar research activity like China, although in terms of output it is much less during the period 2000–2009. Its maximum research activity was in Material Science, particularly in areas covered under Material Science (Multidisciplinary) (19,702 papers). The other areas of major research focus were: Electrical Engineering Electronics (18,265 papers), and Chemistry Multidisciplinary (17,771 papers). Some of the areas where high growth rates were observed: Chemistry Organic (14,100), Biochemistry Molecular Biology (11,827), and Pharmacology Pharmacy (10,394).

Table 5 underscores areas where China and India are actively publishing within nanotechnology.

Publication activity within nanotechnology in China is increasingly dominated by Material Science (Multidisciplinary). This area alone accounts for approx. 31% of research activity within nanotechnology during 2000–2009. Thus, China is able to translate its strength in Material Science (Multidisciplinary) in addressing nanotechnology research. China is among the leader in ‘Nano material applications’ and research activity provides an indication of its strength in this field. On closer examination of other countries activity within nanotechnology reveals China’s strong performance further. China has produced the maximum number of research papers in four areas within nanotechnology namely polymer science, electrochemistry, metallurgy metallurgical engineering.

India also seems to be building up on its strength in material science research, applied physics research, physical chemistry and condensed matter physics research while addressing nanotechnology research. Polymer Science is observed to be an active area of focus of both the countries. But Electrical Engineering Electronics is the most dominant publication area of China and has high publication activity by India. This area is not prominently addressed within nanotechnology by both these countries. Areas of nanotechnology research that have bio-medical focus seem to be less addressed by China as well as India in their nanotechnology research.

Institutional activity and linkages

Table 6 highlights the prolific institutes in terms of publication activity in the two countries. Indian research institutes are also collaborating more. Whereas in 2000, 37% of the total papers involved at least two authors from different institutes (92 out of 247 papers published), 9 years later, i.e., in 2009, 47% of total papers were collaborative papers involving different institutes (1,530 out of 3,233 papers). Figure 6 highlights the linkages among institutes as visible through their co-authored publications.

Institutional linkages are developing from sparse network (2000) towards involvement of more institutes and dense network in 2009. University and researcher institutes are dominating the network. We also observe a major linkage with a foreign university. Also cluster formation show strong bearing on geographical location. This formation may be due to sharing of sophisticated capital intensive instrument that are pre-requisite for nanotechnology research. This seems to be the most probable factor among others as we observe institutions like ‘Inter university accelerator centre’, ‘UGC DAE consortium’ that are providing resources to researchers.

Figure 7 highlights the institutional linkages in China in 2009 as visible thorough their co-authored publications.

Similar to India, we observe involvement of more institutes and connection getting denser in 2009 than the earlier two periods 2000 and 2005. However, there are some key differences. University-research institute linkages are very strong as almost all the institutes (majority being university) exhibit linkages with CAS: Chinese Academy of Sciences (CAS represents over 100 research institutes, and there has been over 400 S&T enterprises created by it). Each of the entity involved have substantial number of papers and the papers co-authored are much higher than India.

Keywords and linkages

The keyword ranked frequency list and linkages among frequently occurring keywords provide an indication of intellectual structure of research.

Figure 8 exhibit keyword linkages from Indian papers in 2009.

Introspecting from 2000, and 2005 we find more directional and applied research in 2009. In 2000, inorganic nano-materials like copper, silver, palladium, structures like thin film, powder are the most frequently occurring keywords. Connections are also observed among them in the linkage map showing nanostructures are appearing in powder, thin film and particles form. Non-existence of instrument specific to characterization of nanotechnology indicates that characterization has been done with the existing spectroscopy instrumentation like Infrared spectroscopy (also visible in the linkage map). In 2005 we observe presence of various instruments in the network specific to characterization of optical, mechanical, physical and chemical properties of nanoparticles, e.g., scanning electron microscopy (SEM), transmission electron microscopy (TEM) and X-ray photoelectron spectroscopy. Along with the frequently occurring sophisticated instruments, drug delivery, catalyst, gold nanoparticle are also prominently observed. Linkages are observed in the map indicating research taking place in drug delivery system with gold nanoparticle as probably being researched in terms of carrier and/or catalyst.

In 2009, as the Fig. 8 shows, the network is maturing with focus on applied research namely in biomedical, water, and environmental mitigation. New nanoparticles are also observed (Fig. 9).

The map shows connections among various types of nanostructures, properties, and instrument. The present structure is contingent upon the evolution over a period of time. Unlike India, in China’s case we observe high frequency of occurrence of sophisticated instruments (SEM, TEM and X-ray photoelectron spectroscopy) required for advanced nanotechnology research visible in the frequency list in 2000 itself. In 2005 we observe high frequency of occurrences of new nanoparticles (for example: TiO(2), Si, Pt, Silica, Pd, Cu, Fe, Phenol, Carbon, SnO(2), CdS, CdSe). Also we observe a wet chemical synthesis technique of sol–gel, along with traditional techniques such as ‘chemical vapor deposition’. The reason for the synthesis of new nanoparticles is strongly dependent upon advanced instruments. The linkage map indeed reflects this fact, a strong connection to the sophisticated instruments. Among the other high frequency keywords are biosensors, nanowires, thin films, quantum dots, nanotubes, nano rods, nanofiber, coatings, doped semiconductors, solar cells, catalysts, drug delivery. This shows that Chinese researchers are working in many different areas in nanotechnology. In 2009, more sophisticated instrument like Raman spectroscopy, Mossbaur spectroscopy, X-ray photoemission spectroscopy, scanning probe microscope, deep level transient spectroscopy etc. are occurring frequently. Also we observe high frequency of occurrence of properties and material types. Linkages help to delineate the domains where major activity is observed namely in photoelectrochemistry, nanocrystalline coating on various material, nanocomposite magnets, nanocomposite magnets, biomineralisation etc.

Keywords delineate each research article and provide signal to others of the key aspects that form the core of the said article (Bhattacharya et al. 2003). In patents, classifications provide insight of the technology class in which the patent belongs. This is useful but for emerging technology where field of evolution is fast, keywords extracted from patent title and/or abstract can provide a more current delineation. In the present exercise therefore we extracted conceptual words from patent topics to capture the dynamics more accurately.

Table 7 highlights the prominent keywords visible in publication and patents.

The above table highlights nano-particle based materials as the dominant core. It is also interesting to observe two key instruments ‘transmission electron microscope’ and ‘atomic force microscope’ as prominent keywords especially for China. This highlights that Chinese authors have better access to these two sophisticated instruments. A probable reason would be the indigenous development of these instruments by China, Bhattacharya and Bhati (2011).

For India, key patent terms gaining prominence are in metrology i.e. measurement aspect (nanometer), and nanoparticles, and nanostructured materials of varied types.

Patenting activity

Changing trends are visible in the later years in the nanotechnology patent applications filed in the US patent office (USPTO). One of the striking finding is the emergence of China. Table 8 highlights this changing dynamics.

Table 8 points out the highly skewed nature of patenting activity particularly in the first two block periods with USA and Japan the dominating countries. Korea shows a very strong progress but China’s progress is remarkable! Only its activity is visible from the block period 2004–2006 but in 2007–2009 it has a substantial filing and is accounting for 6% of filing in this patent office (4th rank as per filing during this period). India has insignificant presence with one filing in 2004–2006 and seven filing in 2007–2009.

In general, we observe from filing statistics, the strong performance by Asian entities in the US patent office during the contemporary period (2007–2009). Taiwanese Hon Hai precision industry is the leading entity in this period with 132 patents filed. Tsinghua University from China is in 2nd rank (120 patents filed), followed by Samsung (117 patents filed). In the same time period Tsinghua University and Hon Hai have published 118 patents in collaboration; thus joint patenting is leading both the countries to dominate patent filing in nanotechnology. India filed eight applications during this period.

Patent publications provide a more recent picture of inventive activity. Table 9 highlights how many applications have been successful.

Similar to patent application statistics in this area, we observe a skewed distribution with USA and Japan dominating. Korea and Germany are also active players. China shows substantial activity in 2007–2009 similar to its filing activity during this period. It is already among the top five countries that have been granted patents during the period 2007–2009. India remains insignificant with eight patents granted during 2001–2003 and three patents in 2004–2006 and only one patent in 2007–2009.

One finding that is a matter of concern is that only a few entities are involved in patenting activity in both the countries. From 2000 to 09, in China we observe 14 entities involved in application filing whereas from India only two entities are visible. Among the 14 entities there are four university, three research institutes (all belonging to CAS), and seven firms that also includes four foreign firms (three from Taiwan and one from South Korea). In Indian case both the applicants belong to research institute. In grant we find 15 entities involved in China’s case comprising of five university, four research institutes (one from US), six firms including three foreign firms (two from Taiwan and one from US). In India six entities are involved comprising of two university, one research institute and three firms including one US firm.

The Table 10 provides details of activity within various technology classes within nanotechnology.

One of the striking features of China’s patenting activity is the joint patenting activity, particularly visible in applications filed. Four distinct universities-industry, and one industry–industry link is observed in the application filed by China. Two foreign entities Hon-Hai precision and Samsung have applications filed in the USPTO with Chinese university Tsinghua, and Peking university, respectively. Tsinghua has also filed one patent jointly with a domestic firm. In the grant we find three links all of Tsinghua university; one with domestic firm and one with Hon Hai precision, and one with a research institute in US. The joint patenting among Hon Hai Precsion Industry ltd and Tsinghua University is striking. Tsinghua University is a leading university of China, part of C9 league that comprises the top 9 universities in China and is among the top 100 universities in different global university rankings. Hon Hai Precision Industry is a Taiwan based entity, commonly known by its trade name, Foxconn and is the world’s largest contract electronics manufacturer. The joint patent activity has led to filing of 118 patents during the period 2001–2009 accounting for 72% of patents filed by China. Similarly it has led to the grant of 22 joint patents which is 49% of the patents granted to China during the period 2001–2009. The examination of their joint patents provides an indication of the inventive capability that is developing over the years by China. The patents in the early applications are in varied methods of growing carbon nanotubes. Later patents address specific applications of carbon nanotubes, i.e., yarn (textile), microscopic electronics, nanoscale integrated circuits, nano based display panels (for computer, LCD, TV and mobile screen). Later patent applications also address Lithium battery, composite material for automotive, carbon based array sensors and electron emission device. Thus, we observe the joint activity is not only strengthening over the years but are also directed to specific applications.

Indian patenting is just beginning in the US patent office. Unlike China collaboration is just beginning with only one patent jointly granted to Delhi University and a pharmaceutical firm namely Dabur. However, some patents seem to provide new pathways to advance technology with novel solutions. Sensor patents by Ajay Sood’s group in IISc are one example of this. This group made international news in 2002 when they generated electricity by making a fluid flow through single-walled nanotubes. The discovery led to an entirely new class of nanosensors. Concept Medical Research Private Limited has applied for patents in the US and India for introducing nano particles to release drugs to block cell proliferation in the narrowed diseased coronary arteries. This is the first patent filed of this kind anywhere in the world to release drugs into the diseased coronary arteries. The present solution is through stents, which although are bio-absorbable but being made of polymers can create complications of inflammation, clotting and toxicity.

Standardisation activity

International Organization for Standardization—Technical Committee 229 is responsible for developing international guidelines for nanotechnology. China is among a few countries involved in developing standards for nanotechnology (Bhattacharya and Bhati 2011). China has developed a range of standards; initiating this process from 2003 onwards with different agencies involved in this process. In fact China was the first country to issue national standards for nanotechnology in April, 2005 (WWI 2006). In response to these newly identified needs, in 2008, a new working group on Material specification (WG4) was formed which had already been identified as a priority area in the TC 229 business plan. China was made convener of this group in recognition of its key role in the creation of WG4 (W. Porter 2008). China has created 27 Nano-dimensional material and characterization standards, two standards on terminology and nomenclature and 12 nano materials/products standards (Hatto 2009; Liu 2009). Twenty one standards have been implemented so far. The standards created cover various nano-material types, new means of measuring nanotechnology product dimensions, behaviors and properties for quality assurance. Nanotechnology standard developed for example in textile industry can regulate the products being created. This is important in the context of entry of ‘proper’ product into the market, i.e., in this case it would check that the nanotechnology embedded textile is conducive for apparel. This also increases acceptance level of consumers for nanotechnology enabled apparel.

Activity in standard creation started at a much later stage in India. In 2010, four national mirror working groups were created by BIS (Bureau of Indian Standards) adopting from ISO TC229. Presently two standards are at the initial testing stage: National standard on use of AFM for characterization and evaluation of nanomaterials, and Electron microscopic characterization of multi-wall carbon nanotubes. The remaining two standards proposed are: Luminescent nanomaterials and magnetic nanoparticles and Standard on toxicity of zinc oxide nanomaterials.

Products and processes developed

Analysis of nanotechnology based products in the international market through the Widrow Wilson database show China’s emergence as a key player in nanotechnology. As of November 24, 2011, this database contains 1,317 products or product lines. Thirty countries show their presence in this database. USA, Germany, Korea, China and Japan have major presence with 587, 168, 126, 55, and 51 products, respectively. Majority of the products (60% of the total products) globally are in health and fitness segment in which China is also active. Home and garden segment is another area that dominates global activity. China (as per this database) has no nanotechnology product in the automotive sector where incidentally China is very active. Products are not visible in two key medical segments where nanotechnology based applications can play a key role namely drug delivery and therapeutics, and biosensors and medical devices. This may be due to the limitations of this database as they focus on product and not process inventory. India just entered in the list with two personal care products.

To have a more informed picture, we examined the nanotechnology products and processes visible in their domestic markets or are in the research stage. China had an early lead in this area and outcome of this is also visible through the range of products and processes it has developed. Also it created indigenously capital intensive instruments essential for nanotechnology research. It created “Atomic Force Microscope” a key instrument for nanotechnology research as early as 1989 which is commercially manufactured by a Chinese company. Research in carbon nanotubes, began as early as 1992 and China has emerged as a world leader in the commercialization of basic nano-materials application such as coatings and composites. It was successful in creating the world’s smallest carbon nanotubes (0.5 nm in diameter) in 1999. Tsinghua University made yarns out of carbon nanotubes. After appropriate heat treatment, these pure carbon nanotube yarns have possibility of being woven into a variety of macroscopic objects for different applications, such as bulletproof vests and materials that block electromagnetic waves. Institute of Metal Research in Shenyang discovered the superplastic property of nanostructured copper in 2002. Copper with these nanoscale structural motifs has a tensile strength about 10 times as high as that of its conventional counterpart, while retaining electrical conductivity comparable to that of pure copper. Fudan University demonstrated a general synthetic strategy for creating stable multi-component materials—such as mixed metal phosphates, mixed metal oxides, and metal borates—featuring a variety of porous structures. Such materials could lead to new families of catalysts, environmental filtration devices, and other technologies that rely on molecular interactions occurring in tiny nanoscale spaces.

India, although was a late starter, but has shown promise with its research and have developed few applications which can make global impact. Nano-biotechnology is one of the important areas where India is now getting attention. University of Delhi has developed a process of entrapping genetic materials in nanoparticles of inorganic compounds to form non-viral carriers. This technology transferred to American Bioscience Inc., USA. IIT Bombay has developed a cardiac diagnosis product using nanotechnology that provides exact reading of an individual’s heart. This is already being used in many hospitals in India. Other areas that are attracting attention are energy, and water sector. There is strong emphasis in energy sectors to create efficient and cost effective Solar Photo-voltaic Cell and alternate semiconductors that can replace silicon. In wind power, nanotechnology is helping in technology up-gradation and developing indigenous wind electric generators for generating power at very low cut in speeds. Carbon fibre (nanotechnology based product) is being applied to make the rotating fan light and efficient. In water sector, nanotechnology interventions have helped develop advanced water filter. Four products from ARCI (the international advanced research centre for powder metallurgy and new materials) have already been transferred to the industry, including a water filter system for rural areas that uses silver nanoparticles. Indian firms are also beginning to enter this area through consumer products. One firm has now come with various categories of home cleaning solutions and is claiming that their nano based impregnation method is first in the world. One firm has also manufactured an important instrument for nanotechnology research, the Nanofluid Interferometer used for biomedical research.

Table 11 constructed from various websites, reports and papers highlight the main nanoproducts in their domestic market or are in the research stage in the two countries.

Discussion and conclusions

The study highlights China’s emergence as a major player in nanotechnology. India has been a relatively late starter but now making its presence felt. China is already leading in the global publication race in this technology. Evidence from an earlier study Dang et al. (2009) show that China’s patenting activity in this area is primarily in the domestic patent office. This study shows that the trend is changing, i.e., visible from applications filed in the US patent office. A key aspect that calls attention is the linkages developing among university and industry. A very prominent linkage is observed between Tsinghua University and Hon Hai Precision which has created a nanotechnology research center in the campus of this university. This has already led to these two entities now leading the filing in the US patent office; patents filed by them are in nanomaterials mainly nanotubes and addressing key application areas.

China has also made a very strong claim in nanotechnology standards particularly covering nonmaterial standards. China’s active involvement in standard creation and adoption in nanotechnology is not surprising as it is a component of its overreaching strategy for future technology domination in the subarea nanomaterials. Standard setting has been undertaken in parallel with other activities taken by China so as to gain early mover advantage in this technology. Nanomaterials account for the largest segment of the nano market and are projected to rise significantly (BCC 2011). China already has leading position in nanotube based applications. Standards developed by China can help their firms to leverage further. China’s nanotechnology products are visible in the international market.

India has also made significant progress but not as remarkable as China’s. India is however making a major impact in scientific research. It is now the sixth most active country publishing in this field. Its patenting activity is just beginning but patents are addressing some key areas like sensors based applications in medicine, environmental monitoring and drug delivery. Similarly standard development process is just beginning. Inspite of these limitations, we find evidences of tangible success in the development of niche products/processes.

It is too early to say whether nanotechnology has provided the ‘window of opportunity’ for these two countries to move up the value chain. But if the two countries are able to exploit their research it would help them to make a strong global assertion by developing cutting edge products. Keyword analysis has shown one interesting aspect of the direction of both the countries research. Indian research is in key areas of pressing concerns, i.e., water, environmental mitigation, drug delivery. The products/processes identified also show India making tangible progress in nanotechnology based water solutions, drug delivery. China’s research is more wide and sophisticated but it seems India is concentrating more on address pressing problems, which augers well for the country at large. However, these findings are preliminary and would require more extensive research to come to a more definitive conclusion.

References

Altenburg, T., Schmitz, H., Stamm, A. (2008) Breakthrough? China’s and India’s Transition from Production to Innovation. World Development, 32(2), 325–344.

BCC (2011). 2010 Nanotechnology research review. BCC Research Market Forecasting Report Code: NAN047B.

Bhattacharya, S., Bhati, M. (2011). China’s emergence as a global nanotech player: Lessons for countries in transition. China Report, 47(4), 243–262.

Bhattacharya, S. & Lal, K. (2010). Innovation activity in the indian software industry. In A. Nadia et al. (Eds.) Liberalizing research in science and technology: Studies in science policy (pp 339-364). Saint-Petersburg: Politechnika.

Bhattacharya, S., Meyer, M., & Kretschmer, H. (2003). Characterizing intellectual spaces between science and technology. Scientometrics, 58(2), 369–390.

Brand, L. (2010). Report on statistical patent analysis; Observatory‐NANO, http://www.observatorynano.eu.

Chen, C. (2005). Citespace quick start guide, http://cluster.cis.drexel.edu/~cchen/citespace/.

Dang, Y., et al. (2009). Trends in worldwide nanotechnology patent applications: 1991–2008. Journal of Nanoparticle Research, 12(3), 687–706.

Glanzel, W. (2008). Seven myths in bibliometrics. About facts and fiction in quantitative science studies. In H. Kretschmer, & F. Havemann (Eds.), Proceedings of WIS 2008, Fourth International Conference on Webometrics, Informetrics and Scientometrics & Ninth COLLNET Meeting, Berlin: Humboldt University.

Hassan, M. H. A. (2005). Small things and big changes in the developing world. Science, 309, 65–66.

Hatto, P. (2009). Updates on standardization for nanotechnologies. London: DEFRA nanotechnology stakeholder forum.

Huang, C., Wu, Y. (2010). Sure bet or scientometric mirage? An assessment of Chinese progress in nanotechnology. United Nations University, Working Paper Series-2010-028.

Hullman, A. (2007). Measuring and assessing the development of nanotechnology. Scientometrics, 70(3), 739–758.

Kanama, D., & Kondo, A. (2007). Analysis of Japan’s nanotechnology competitiveness- concern for declining competitiveness and challenges for nanosystemization. Science and Technology Trends-Quarterly Review, 25, 36–49.

Kaplinsky, R., & Messner, D. (2007). Introduction: The impact of Asian drivers on the developing countries. World Development, 36(2), 197–207.

Kostoff, R. N. et al. (2007). DTIC Technical Report Number ADA 461930, Defense Technical Information Center, Fort Belvoir, VA, http://www.dtic.mil/.

Kostoff, R. N., et al. (2006). The structure and infrastructure of global nanotechnology literature. Journal of Nanoparticle Research, 8(34), 301–321.

Liu, L. (2009). Emerging nanotechnology power: Nanotechnology R&D and business trends in the Asia Pacific Rim. Singapore: World Scientific Publishing Co. Pvt. Ltd.

Lux Research. (2010). Ranking the nations on nanotech: Hidden havens and false threats.

Madhan, M., Chandrasekhar, G., & Arunachalam, S. (2010). Highly cited papers from India and China. Current Science, 99(6), 738–749.

Meyer, M. (2007). What do we know about innovation in nanotechnology? Some propositions about an emerging field between hype and path dependency. Scientometrics, 70(3), 779–810.

Miyazakia, K., & Islam, N. (2007). A nanotechnology system of innovation: An analysis of industry and academia research activities. Technovation, 27(11), 661–675.

NIC. (2004). Mapping the global future: Report of the national intelligence council’s 2020 Report, NIC (2004–2013).

NRM project report. (2006). FP6 program. European Commission, http://www.nanowerk.com/nanotechnology/reports/reportpdf/report74.pdf.

Porter, W. (2008). Nanotechnology law report, Washington, DC.

Porter, A., Cunningham, S. (1999). Whither nanotechnology? Foresight Update, Number 4, http://www.foresight.org/Updates/Update21/Update21.4.html.

Porter, A., & Youtie, J. (2008). How interdisciplinary is nanotechnology? Journal of Nanoparticle Research, 11(5), 1023–1041.

Preschitschek, N., & Bresser, D. (2010). Nanotechnology patenting in China and Germany: a comparison patent landscapes by bibliographic analyses. Journal of Business Chemistry, 7(1), 3–13.

Shapira, P., & Wang, J. (2009). From lab to market? Strategies and issues in the commercialization of nanotechnology in China. Asian Business and Management, 8(4), 461–489.

TERI. (2009). Nanotechnology developments in India: A status report. The Energy and Resources Institute, http://www.teriin.org/nano-uploads/D5_NT_Development_in_India_Apri_2010.pdf.

Tolles, W., & Roth, B. (2003). Nanotechnology, a stimulus for innovation. Current Science, 85(2), 1746–1759.

Vladimir, B. & Andrej, M. (2005). Program for analysis and visualization of large networks: Reference manual. Ljubljana: University of Ljubljana.

Wolfe, J. (2007). Nanotech gets big in China. Forbes/Wolfe Nanotech report.

Worldwatch Institute. (2006). State of the World.

Woodrow Wilson International Center for Scholars’ Project on Emerging Nanotechnologies database, www.nanotechproject.org.

Zhou, P., Leydesdorff, L. (2006). The emergence of China as a leading nation in science. Research Policy, 35(1), 83–104.

Acknowledgments

The authors thank the National Science and Technology Management Information System, Department of Science and Technology for supporting this study. We thank Ms Jayanthi A. Pushkaran for her helpful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bhattacharya, S., Shilpa & Bhati, M. China and India: The two new players in the nanotechnology race. Scientometrics 93, 59–87 (2012). https://doi.org/10.1007/s11192-012-0651-7

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11192-012-0651-7