Abstract

The patents of China in biotechnology in the United States Patent and Trademark Office during 1995–2008 have been analyzed in this paper with the help of bibliometrics and social network analysis techniques. The analysis has been carried out from several perspectives including total patent output of industries, universities and public research institutes (PRIs) and their positions in the knowledge network, the main innovators and their interactions, the collaboration among Chinese regions and the collaborations from abroad. The results show that though with some improvements, the patent performance of Chinese organizations and regions in biotechnology still need to be improved. The connections between Chinese innovators are not very cohesive and they depend heavily on foreign knowledge, especial knowledge from U.S. multinational firms and universities. The important innovators of China in this field are mainly PRIs and universities. More and stronger firm innovators, especially large and powerful multinational companies, are strongly needed for the nation’s biotechnology industry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

After the discovery of the basic technique for recombinant DNA in 1973, the biotech revolution began and new companies followed quickly. In the last 40 years we have gone from biotechnology at a macro level to working with it at a micro level. A lot of industries have benefited from biotechnology, such as chemical, plastics, paper, textiles, food, livestock, energy and environment industries (BIO 2008). The market capitalization of biotechnology has grown from 45 billion in 1994 to 392 billion in 2006 (Ernst and Young 2007). Since its widely applications and huge market demand in future, it receives much attention from policy makers, academic researchers and company managers. The biotechnology industry comes to be the new economic foci in 21st century. Both the developed countries and the emerging nations regard biotechnology as a critical field for future competiveness for its widely predicted usage in agriculture, medical treatment and industrial manufacture (BIO 2008).

As one of the largest biotechnology consumption markets in the world, in China, biotechnology has been recognized as one of the most crucial industries from both academic researchers and policy makers. According to Minister of Science and Technology of China, its goal is to turn China into a major player in the biological industry by 2020 and the predicted total output value for biotechnology industry is 2.5–3 trillion RMB by 2020 (Glaser 2007). Chinese 11th Five-Year Plan (2006–2010) and the national program for medium- to long-term scientific and technological development (2006–2020) both contain a significant increase in biotech investment in several key areas including biomedicine, biotech-based agriculture, biofuels and biotech-based manufacturing.

As an emerging country, it is hard to compete with the developed ones in more mature and traditional industries for China, whilst there are more opportunities in the emerging industries, such as the information and communication technology (ICT) in the past 20 years and the biotechnology in future. Both the investment and innovation output of biotechnology have increased rapidly in China from its 8th Five-Year period (1991–1995) to its 10th Five-Year period (2001–2005). Fund from the National High-tech R&D Program of China (863 Program) has increased from 390 million to 3.21 billion RMB during these periods. The total papers and patent applications are increased from 3509 to 23089 and from 42 to 5182, respectively. However, its international visibility is still low. The publications indexed by SCI Expanded in biotechnology during the years 1990–1993 and 2000–2003 are 152 and 1497, respectively (Kim 2007). The number of biotechnology patents applications filed under the PCT is 4 in 1995 and 90 in 2005 (OECD 2008). Additionally, there is no relative technology advantage in biotechnology till 2003–2005, as the revealed technology advantage of China in biotechnology is 0.80, while the index for ICT in the same periods is 1.42Footnote 1 (OECD 2008). In order to turn into a major player in biological industry by 2020, China needs to significantly boost its R&D efforts to realize a strong technology advantage. Thus it is meaningful to map the development of Chinese biotechnology and investigate the characters and their changes with time.

Bibliometrics analysis would provide a way to evaluate the state of Chinese bioscience and biotechnology. Scientific publications have been used frequently as a measure of scientific research, but seldom as the indicator of the state of technological competence. Biotechnology is an industry of ideas and invention. Intellectual property, typically in the form of patents, is often the most important asset a biotech institution has (BIO 2008). Thus, this study uses patent to identify the evolution of biotechnology development as previous studies (Ramani and Looze 2002; Lecocq and Van Looy 2009). The previous empirical studies show that biotechnology firms relied heavily upon external support, particularly public research organizations such as universities, hospitals and research institutes for knowledge and ideas. Hence, the ‘network forms of organization’ characterizes the industry (Powell 1990; Podolny and Page 1998; Breschi and Malerba 2005; Gilding 2008). In this paper, we use social network analysis to map the relationships among these innovation actors at both organizational level and regional level. Abundant network indicators are used to describe the positions, forces, and functions of the actors from different perspectives.

In bibliometric literature of biotechnology, the previous studies mainly carried out from two aspects. The first one focused on its scientific research using academic paper and journal data (such as Kim 2007; Patra and Chand 2005). The other one focused on the linkage between its science base and technology application using data such as scientific papers cited in patents and scientists who also inventors (such as Gao and Guan 2009a; Guan and Wang 2010). Though both of these two aspects are important and meaningful, studies mainly focused on technological capacity can provide more perspective to map this industry. Furthermore, comprehensive and long-time span studies about Chinese biotechnology have been seldom carried out. Therefore, the main purpose of this study is to analyze the technological performance of China in biotechnology, as reflected by its patenting activities during 1995–2008. In particular, the study focuses on the following issues: (1) identifying the most prolific organizations and their types of institutions, i.e. who are the leading performers of Chinese biotechnology and where do they come from, industry, public research institute (PRI), or university? Especially, whether the institutions change obviously during the study period? (2) Examining the characters of the knowledge network of the organizations and the positions of each type performer, i.e. whether the network is efficiency for knowledge and information flow among innovators, and the knowledge power and influence of industry, PRI and university for their knowledge spillover and obtainment. (3) Identifying the most prolific Chinese regions and their collaboration models, i.e. who are the leading regions of Chinese biotechnology, whether they collaborate with others, and which collaboration models do they prefer to, intra-region, inter-region or with foreign countries? (4) Exploring the knowledge network of the regions to study the knowledge source of Chinese regions for biotechnology patenting.

Data and methods

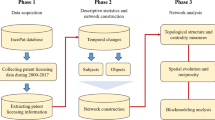

To measure technological innovation, patent analysis is commonly adopted (Hu and Jaffe 2003; Chen and Guan 2010; Nasir et al. 2010; Yuan et al. 2010). Since patent data can provide innovation information at individual level, organizational level, regional level as well as national level in a particular technology field at the same time, they can be efficiently used to map the technological activities at various levels. We limit our scope to U.S. patent statistics for their high patent quality and high data quality comparing with Chinese database. This study is based on the Chinese utility patent data in biotechnology retrieved from the United States Patent and Trademark Office (USPTO) database. Utility patents refer to invents or discovers of new and useful process, machine, article of manufacture, or composition of matter, or new and useful improvement thereof. They have been widely used as proxy output indicator of technological and innovative activity and they are the focus of this study (Gao and Guan 2009a, b). Taking the quality factors into considerations, only the granted patents are involved since they have a higher technological value than applications (Guan and He 2007; Hinze and Schmoch 2005). The biotechnology patents are identified using the following list of International Patent Classification (IPC) codes according to the proposal of OECD: A01H1/00, A01H4/00, A61K38/00, A61K39/00, A61K48/00, C02F3/34, C07G(11/00,13/00,15/00), C07 K(4/00,14/00,16/00,17/00,19/00), C12M, C12N, C12P, C12Q, C12S, G01N27/327, G01N33/(53*, 54*, 55*, 57*, 68, 74, 76, 78, 88, 92) (OECD 2005). All the patents where at least one of the inventors named on the patent resided in China (excluding Hong Kong, Macao and Taiwan) at the time of application have been retrieved. The patent numbers are illustrated in Fig. 1 according to their grant years.

The first biotechnology patent with a Chinese inventor is assigned to China National Seed Corporation in hybrid rice in 1981. Till the end of 2008, the total patents in biotechnology involving Chinese inventors are 657, accounting for about 9.13% of the total Chinese patent (7197) and 0.29% of total biotechnology patents (230338) during this period. In the period 1981–1994, there are 44 patents totally and the patents in all years are less than ten. After 14 years slowly increase, the patents exceeded ten in 1995 for the first time and grew rapidly since then with a composite increase rate up to 15.8%. Thus this study focuses on the patent activities of Chinese biotechnology from 1995 to 2008 and we split the period into two equal-length periods, i.e. 1995–2001 and 2002–2008 for comparisons. Among these patents, 503 have been granted to organizations. In the process of identifying assignees, it is possible that the name of an organization may have been inconsistently spelled and there are also problems caused by acquisitions, parent companies and their subsidiaries. In this study, patents of the acquired assignees after the acquisitions have been designed to the acquiring companies and patents of the subsidiaries have been incorporated to their parent companies as previous study (Hanaki et al. 2010). We do this with the help of specialized Internet sites (Biospace, Bioworld, and companies’ websites), news media and the annual reports. By incorporating change and variation of assignee names, 232 distinct organizations are indentified and there are 72 and 182 organizations in the two periods, respectively. This study is committed to identify the main players and their interactions of Chinese biotechnology at both organizational and regional levels. Therefore two kinds of knowledge networks are constructed for these purposes.

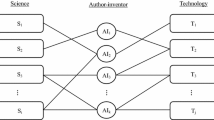

The first knowledge network is built on the organizational level. Network based on common inventors among assignees is one of the most frequently used methods to construct knowledge networks of organizations. It is believed that there are R&D collaborations if the same inventors presented on patents of different assignees, and R&D collaborations lead to knowledge diffusion (Hanaki et al. 2010). It is meaningful to construct knowledge network with this method for it can indicate knowledge interactions already existed. In this study, we try to build the networks like this while the results show that the networks are too sparse to get any significant inferences. This situation may be caused by the small size of Chinese biotechnology patents. Thus we try another method to link the organizations by the kind of technology knowledge they have created from Cantner and Graf (2006). They believed that the more fields the innovators share in research, the closer they are related in knowledge and information interactions. The network based on technological overlap can be interpreted as the potential for collaboration since the connected firms share a common knowledge base. In this network, nodes represent the organizations and links between organizations are formed whenever they patent in the same technology class. The second network is to link the regions based on the knowledge transfer through inventor collaborations. It is believed that social networks, both informal friendship and formal collaboration networks, contribute to innovation by their ability of information, knowledge and technology diffusion (Hertzum 2008). There were several studies providing evidences that research collaboration can efficiently enhance scientists’ productivity, firms’ innovation capability, regions’ technology competiveness and industries’ knowledge creation (Lee and Bozeman 2005; Gilding 2008; Fleming et al. 2007; Lim and Park 2010). Chinese mainland regions (CMRs) constitute the major body of this network. Meanwhile, other regions and countries which have collaborated with these CMRs have been involved for a more complete description of CMRs’ knowledge map. When the inventors of a patent reside in n (n > 1) different regions and countries, then there is one collaboration between any two of them. In this undirected valued network, nodes denote the regions and countries; links mean that there are collaborations between the two nodes and the number of collaboration are represented by the weighs of the links. Since the CMRs are the focus of this study, links among CMRs and links between CMRs and others are involved in the network, while links among non-CMR nodes are not considered. Program UCINet has been used for the network analysis in this study.

Performance of organizations and their interactions

There are 119 out of 160 and 384 out of 453 patents having been granted to organizations in period 1995–2001 and period 2002–2008, respectively. Table 1 lists the distributions of these patents according to their assignee types and general headquarter locations. All these patents are held by 232 organizations whose headquarters locate in 16 countries and regions. There are 97 organizations locating in mainland China and 98 in the United States and they create about 75.3% of the total patents together. The industry sector is the most prolific innovator accounting for about 58.3% of the patents, and they are followed by universities and PRIs accounting for 23.3 and 15.3%, respectively.

In period 1995–2001, the organizations are from eight countries and regions. Patents possessed by the United States organizations are even more than that of mainland China, showing some independence deficiency in patent capability of Chinese domestic organizations in biotechnology. The Chinese inventors mainly worked in or collaborated with the multinationals’ affiliations in China to be listed on the patents. The main domestic innovators are PRIs in this period, while the foreign innovators involving Chinese residents are all from industry except for 14 U.S. universities and the department of health & human services of USA. Germany and Japan are another two most important countries patenting with Chinese residents in biotechnology following the United States. In period 2002–2008, there are 15 countries and regions patenting with Chinese residents. In this period, the domestic organizations own most of these patents and the industry sector substitutes PRI to be the most prolific player, while the external innovators come to be more diversified both in country/region sources and organization types. It indicates that Chinese organizations have boosted their independent innovation capacity and changed to depend mainly on industry sector. And Chinese inventors come to seek R&D jobs or collaborations in/with different types of organizations from more countries and regions. For this period, Hong Kong and Switzerland come to be the second and third most important external innovators of mainland China. Universities from Hong Kong and U.S. are important external players, while players from other countries and regions are mainly from industry. Now we have investigated the institutions of these patents. Next, the most prolific organizations are identified and Table 2 lists the organizations with at least five patents in each period.

In period one, there are five organizations from three countries with at least five patents. The most important player is Bayer, a multinational large company from Germany. For China, the two organizations are both PRIs, the Hainan Life Nourishing Pharmacy Company with two patents is the only innovator from industry with more than one patent, and there is no university having more than one patent, indicating that the patent inventions in biotechnology have been mainly carried out by PRIs, while the visibilities of firms and universities are weak in this period. In period two, there are fourteen organizations from five countries and regions with at least five patents. For China, there are two PRIs, three universities and one firm involved in this list. Chinese Academy of Sciences comes to be the most prolific one of all and Shanghai Bio Road Company is the best firm player in this period. See together with Table 1, although the total output by firms have increased greatly, prominent innovators from industry like Bayer and Roche are still absent, and Chinese biotechnology inventions are still leaded by several top PRIs and universities. Two Hong Kong innovators are both universities, resulting from the frequent academic communications and collaborations after its return to Chinese sovereignty. Other external organizations are all from industry except for one U.S. government sector.

In above, we focused on the patent performance of organizations. Now we are also interested in the potential knowledge interaction between them in two periods. Table 3 summarizes the descriptive statistics of these two networks.

In period one, there are 72 innovators and they belong to four components. Roughly 90% of them have been involved in the largest component. In period two, the innovators increase to 182 and all of them are connected to the largest component. The network has become increasingly connected confirmed by its density and mean degree, which increased from 7.31 to 15.72% and from 5.194 to 28.462, respectively. Figure 2 illustrates the largest components for two periods. In period one, both of the organizations and their relationships are few. Most of the organizations’ headquarter are located in non CMRs and countries. Organizations from CMRs are mainly composed of PRIs. Both their quantity and links are more than other types from CMRs. Organizations from non-CMRs are mainly firms. In period two, both the nodes and links have increased significantly, especially for CMRs’ firms. More frequent collaborations generate a relatively closely connected cluster. CMR organizations take important positions in this cluster. Now, we are interested in the role each kind organization has played in the knowledge network.

Table 4 lists the number of organizations according to their types and locations, their average degree centralities, closeness centralities, and betweenness centralities. Degree centrality of a vertex is its degree and it measures the direct number of sources accessible to an innovator. Closeness centrality is the number of other vertices divided by the sum of all distances between the vertex and all others. Higher closeness centrality indicates closer relationship to others and easier information obtainment. Betweenness centrality of a node is calculated as the proportion of all geodesics between pairs of other nodes that include this node. An innovator with higher betweenness has more capacity to facilitate or limit interaction between its neighbors. Thus degree centrality and closeness centrality measure the direct and indirect capability to reach others and obtain information from others, respectively, while betweenness centrality estimates its influence and power to others, i.e. its ability to inhabit and facilitate the knowledge flow among others.

In period one, the two U.S. government organizations have the highest average patent, degree and betweenness caused by the high patents and connections of U.S. Health & Human Services department which connects with two Chinese organizations, twelve U.S. organizations and five organizations from elsewhere. Besides this, Chinese PRIs have the highest average patent, degree and betweenness, while Chinese universities have the highest average closeness. Chinese firms are below average in patent numbers and all centrality indices. It shows that Chinese PRIs not only have the best performance in patent, but also hold important position in the knowledge network, showing more ability to reach others and more influence on the interaction among others. The high average closeness of Chinese universities has been contributed mainly by Fudan University (0.389) which has connected with two Chinese PRIs, two U.S. firms and two U.S. universities. In this period, Chinese Academy of Medical Sciences, Chinese Academy of Science and Beijing Vegetable Research Center are listed on the top three in all centrality measures and all of them are PRIs. In period two, the highest patent and centralities belong to universities from other countries and regions besides Chinese mainland and U.S. By detail investigation, we find that the high value mainly contributed by two universities from Hong Kong, i.e. Chinese University of Hong Kong and University of Hong Kong with degrees up to 103 and 75, respectively. Besides them, Chinese universities substitute the PRIs to be the most important players in the network. The size of Chinese firm group has increased rapidly to be the largest one in this period, but the average performance of them are still below average not only in the patent number, but also in all centrality measures. It shows that there is still a long road to go for Chinese firms to boost their innovation capacity and improve their knowledge influence. In this period, the best performers are not as consistent as previous according to different measures. The top five players according to degree and closeness are Peking University, Chinese Academy of Science, Xiamen Bioway Biotech Company (spinoff of Peking University), Shanghai Bio Road Gene Development Company and Fudan University. Meantime, the top five players measured by betweenness are Peking University, Chinese Academy of Science, Academy of Military Medical Sciences, Tianjin Yanling Health Food Company and Fudan University. The network is no longer dominated just by PRIs, universities and firms show more importance in this period.

Public research institutes and universities have played important roles in Chinese biotechnology innovation during the studied period. It is different from most of the developed market economies, where firms are the main innovation actors. China is in transition from formal central planning to market economy during this period. In central planning period, government ultimately controlled over economic plans and resource allocation. Organizations have been established functionally specialized. As a result, research was conducted by PRIs and research centers in universities, manufacturing by firms. In the transition period, both resource allocation and operational decisions have been decentralized from central government to organizational actor level gradually. Completions and incentives have been created for firms to establish in-house R&D departments. Thus, more firms have participated in innovation activity and played more important roles in new technology development (Liu and White 2001).

Summarizing, we find obvious increased level of participation of Chinese organizations in biotechnology patent activities, especially organizations from industry. However, the most powerful Chinese organizations in patent performance and knowledge network are still mainly constituted by PRIs and universities, indicating that stronger firms, especially large and powerful multinational companies, are badly needed for Chinese biotechnology industry.

Performance of Chinese regions and their interactions

In the previous section we focused on the competencies of the organizations in biotechnology and knowledge network based on technology overlap. Now in this section, we investigate the performance of each CMRs and knowledge network of them based on interpersonal relationships. Table 5 shows the CMRs which have been presented on the inventor lists in no less than five patents.

There are 10 and 16 regions on the list for two periods, separately. The top two players are the capital and the largest commercial centre of China, i.e. Beijing and Shanghai, and then followed by three eastern coastal provinces, i.e. Guangdong, Zhejiang and Jiangsu. This is not surprising as all of them are the leading regions of Chinese economy for policy preference and geography advantage. Tianjin, another region with both policy and geography advantage which followed Guangdong to be the fifth player in period one, has fallen to tenth in period two. Hunan is another region with obvious decline from ninth to fiftieth. Meanwhile, Hubei is noticeable for its performance and upward trend. Biotechnological industry is highly valued in this region and the regional government aims to build it to another pillar of regional economy following optoelectronics industry. As showed by C/A in Table 5, no less than half patents are outcomes of inter-region collaboration for all listed regions except for Shandong, Sichuan and Chongqing, showing high proportions of inter-region collaboration in this technology field. Most of the regions listed in period one show decline in the proportion of inter-region collaboration in period two except for Zhejiang, Jiangsu and Sichuan. Chongqing has achieved all patents within the region. In above, we focused on the patent performance of leading regions. Now Table 6 lists the overall collaboration information. In period one, 19% patents have been created by a single inventor without any collaboration, 18% patents have been invented by more than one inventor from the same CMRs and the other 63% patents refer to outside region collaboration with other CMRs or other countries and regions. In this period, the two-region/country model is the most common type. In period two, the proportion of intra-CMR collaboration has doubled and jumped to 36% to be the most popular model, while share of two-region/country model drops by 17–36%. Meanwhile, the no collaboration model drops by 5% and the multi-region/country model (no less than three) rises slightly by 3%. The two-region/country model is no longer the first choice for the innovators in CMRs and they trend more to the intra-CMR innovation. This may be caused by the increasing innovators in each region bringing more opportunities for intra-CMR collaboration. The increase of multi-region/country model may results from the ascending R&D influence of multinational corporations in China and the trend of R&D globalization.

In above, we focused on the patent performance of CMRs and the basic collaboration models of these patents. Now we will investigate the knowledge network of these regions and the referred external regions and countries based on the interpersonal relationships. Figure 3 illustrates the knowledge network for two periods. In period one, the inventors are from 24 CMRs, Hong Kong, Taiwan and 13 other countries. All of the CMRs have inter-region or foreign collaboration except for Shanxi and Fujian. In period two, there are 25 CMRs, Hong Kong, Taiwan and 24 other countries involved. Except for Chongqing, Guizhou, Shanxi and Tibet, all of the CMRs have collaborated with other regions or countries. In this study, we are interested in the knowledge diffusion related to CMRs while the knowledge relationship between their external partners is not concerned here. Thus, in our network, links between CMRs and links between CMRs and their external partners are reserved, while links among their external partner are not involved.

Table 7 lists the basic statistics of this network. The external partners have increased from 15 to 26 during the times, showing more abundant sources for external knowledge. However, the domestic knowledge interactions are few. In period one, just 12.5% knowledge relationships link between CMRs and these links account for 5.6% of the total number of collaboration. In period two, the proportions of links and number of inter-CMR collaboration increase to 28.7 and 15.7%, respectively. In both periods, the share of links between CMRs are lower than collaboration number between them, indicating that the inter-CMR knowledge interactions are not only few, but also weak when comparing with external interactions. U.S. is the most important external knowledge source for CMRs and it has cooperated with most of them (17 in period one and 19 in period two) and accounted for more than 54% of total number of collaboration in both periods. Besides U.S., Japan and Germany, Japan and Hong Kong are the second and third important external knowledge sources in two periods, separately. Though the network gets denser, it is still sparse relatively as reflected by the network density.

Table 8 lists the leading CMRs according to their degree centralities and number of collaboration and Table 9 lists the closest collaboration relationships. In period one, four out of six inland links are related to Beijing. Beijing and Shanghai are the top two both in collaboration width and depth. Tianjin has the third widest collaboration partners, while Hubei takes the third place in depth list with its closest collaboration with U.S. Among the top five closest collaboration relationships, three of them are linked to U.S. and three of them are linked to Beijing. Collaboration between Beijing and U.S. is the closest one, and the top three links of U.S. account for 53.8% of all collaboration from this country. In period two, collaboration between inland regions increases significantly. Beijing, Shanghai, Jiangsu, Guangdong and Fujian are the top five in both width and depth. The gap between Shanghai and Beijing in number of collaboration is no longer that obvious as previous. And Shanghai takes over Beijing to be the closest partner of U.S. In this period, the top five closest collaboration relationships are more diversified in the side of inland regions as all of them related to different ones, while they are more concentrated in the side of external partners as all of them are concentrated in U.S. The top three relationships of U.S. make up 69.2% of their collaborations. Although the total share of collaboration relationships from U.S. has dropped from 64.6 to 54.2% during periods (as showed from Table 7), they have concentrated more of their efforts on several top Chinese regions.

Summarizing, CMRs are highly dependent upon foreign knowledge sources, especially U.S., in their patent innovations. However, we find improving patent performance of CMRs and increasing cohesion between them. These regions turn to more intra-region collaboration, which may be interpreted as the increasing within region partner choices brought by the growing local innovators.

Conclusions

This paper examined the innovation performance of China in biotechnology in 1995–2008 and the period has been split into two equal-length periods for comparisons. All patents in biotechnology with at least one inventor resided in Chinese mainland have been involved in this study. Bibliometrics and social network analysis have been employed to measure the patent performance and knowledge relationship at organization level and region level respectively. Two kinds of networks have been constructed based on knowledge overlap and interpersonal interaction, respectively. These methodologies have been successfully applied to reveal the performance of Chinese innovators and the structural nature of their knowledge network.

At organization level, most of patents belong to foreign organizations, especially U.S. Less than one-third patents are owned by Chinese organizations and the main Chinese participators are PRIs. In period two, the engagement of Chinese organizations, especially firms, improved significantly to be the largest patent holder. Though the size of firms is the largest among Chinese innovators, prominent firm innovators are lacking. The leading Chinese players both in patent performance and knowledge diffusion are mainly constituted by PRIs and universities, while Chinese firms are below average according to patent performance, direct and indirect knowledge influence. In order to construct biotechnology industry to one of pillars of Chinese national economy, stronger firms, especially large and powerful multinational companies, are strongly needed for Chinese future biotechnology industry. In both periods, there are obvious small world characters in the knowledge network, showing well knowledge diffusion efficiency.

At regional level, in both periods, most of the patents are performed by collaboration and no less than half of them are inter-region/country collaborations. In period one, two-region/country model is most popular. In period two, the proportion of intra-region model rose to be the most common style for innovation. These regions turn to more intra-region collaboration, which may be interpreted as the increasing within region partner choices brought by the growing local innovators. The CMRs are highly dependent upon foreign knowledge sources, especially U.S., in their patent innovations. However, we find improving patent performance of CMRs and increasing cohesion between them. The dependence on U.S. declines and the external knowledge sources become more diversified. The collaborations between CMRs increased.

In conclusion, though with some improvements, the patent performance of Chinese organizations and regions in biotechnology still need to be improved. The connections between Chinese innovators are not very cohesive and they depend heavily on foreign knowledge, especial knowledge from U.S. multinational firms and universities. The important innovators of China in this field are mainly from PRIs and universities. More and stronger firm innovators, especially large and powerful multinational companies, are strongly needed for the nation’s biotechnology industry.

Notes

Revealed technology advantage of country A in technology I is calculated by the share of I in A’s patents relative to the share of I in total patents. Patent counts are based on the priority data, the inventor’s country of residence and use fractional counts on PCT filings at international phase (EPO designations) (OECD 2008).

References

BIO. (2008). Guide to biotechnology 2008. Washington, DC: BIO.

Breschi, S., & Malerba, F. (Eds.). (2005). Clusters. Oxford: Networks and Innovation Oxford University Press.

Cantner, U., & Graf, H. (2006). The network of innovators in Jena: An application of social network analysis. Research Policy, 35(4), 463–480.

Chen, Z. F., & Guan, J. C. (2010). The impact of small world on innovation: An empirical study of 16 countries. Journal of Informetrics, 4(1), 97–106.

Ernst and Young LLP. (2007). Beyond borders: the global biotechnology report 2007. Palo Alto: Ernst and Young LLP.

Fleming, L., King, C., & Juda, A. I. (2007). Small worlds and regional innovation. Organization Science, 18, 938–954.

Gao, X., & Guan, J. C. (2009a). Networks of scientific journals: An exploration of Chinese patent data. Scientometrics, 80(1), 283–302.

Gao, X., & Guan, J. C. (2009b). A scale-independent analysis of the performance of the Chinese innovation system. Journal of Informetrics, 3(4), 321–331.

Gilding, M. (2008). ‘The tyranny of distance’: Biotechnology networks and clusters in the antipodes. Research Policy, 37, 1132–1144.

Glaser, V. (2007). China expanding bioresearch acivities. Genetic Engineering and Biotechnology News, 27(28), 1.

Guan, J. C., & He, Y. (2007). Patent-bibliometric analysis on the Chinese science-technology linkages. Scientometrics, 72(3), 403–425.

Guan, J. C., & Wang, G. B. (2010). A comparative study of research performance in nanotechnology for China’s inventor-authors and their non-inventing peers. Scientometrics, 84(2), 331–343.

Hanaki, N., Nakajima, R., & Ogura, Y. (2010). The dynamics of R&D network in the IT industry. Research Policy, 39(3), 386–399.

Hertzum, M. (2008). Collaborative information seeking: The combined activity of information seeking and collaborative grounding. Information Processing & Management, 44, 957–962.

Hinze, S., & Schmoch, U. (2005). Opening the black box. In H. F. Moed, W. Glänzel, & U. Schmoch. (Eds.), Handbook of quantitative science and technology research (pp. 215–235). Dordrecht: Kluwer Academic Publishers.

Hu, A. G. Z., & Jaffe, A. B. (2003). Patent citation and international knowledge flow: The case of Korea and Taiwan. International Journal of Industrial Organization, 21(6), 849–880.

Kim, M.-J. (2007). A bibliometric analysis of the effectiveness of Korea’s biotechnology stimulation plans, with a comparison with four other Asian nation. Scientometrics, 72(3), 371–388.

Lecocq, C., & Van Looy, B. (2009). The impact of collaboration on the technological performance of regions: Time invariant or driven by life cycle dynamics? An explorative investigation of European regions in the field of biotechnology. Scientometrics, 80(3), 845–865.

Lee, S., & Bozeman, B. (2005). The impact of research collaboration on scientific productivity. Social Studies of Science, 35(5), 673–702.

Lim, H., & Park, Y. (2010). Identification of technological knowledge intermediaries. Scientometrics, 84, 543–561.

Liu, X. L., & White, S. (2001). Comparing innovation systems: a framework and application to China’s transitional context. Research Policy, 30, 1091–1114.

Nasir, A., Ali, T. M., Shahdin, S., & Rahman, T. U. (2010). Technology achievement index 2009: Ranking and comparative study of nations. Scientometrics. doi:10.1007/s11192-010-0285-6.

OECD. (2005). A framework for biotechnology statistics. Paris: OECD.

OECD. (2008). Compendium of patent statistics. Paris: OECD.

Patra, S. K., & Chand, P. (2005). Biotechnology research profile of India. Scientometrics, 63(3), 583–597.

Podolny, J., & Page, K. (1998). Network forms of organization. Annual Review of Sociology, 24, 57–76.

Powell, W. W. (1990). Neither market nor hierarchy: Network forms of organization. Research in Organizational Behaviour, 12, 295–336.

Ramani, S. V., & Looze, M. A. (2002). Using patent statistics as knowledge base indicators in the biotechnology sectors: An application to France, Germany and the U.K. Scientometrics, 54(3), 319–346.

Yuan, J. P., Yue, W. P., Su, C., et al. (2010). Patent activity on water pollution and treatment in China: A scientometric perspective. Scientometrics, 83, 639–651.

Acknowledgments

This research is funded by the National Natural Science Foundation of China (Project no. 70773006) and the National Social Science Foundation of China (Project no. 10zd&014).The authors are very grateful for the valuable comments and suggestions of the anonymous reviewers and Editor-in-Chief Prof. Braun, which significantly improved the article.

Author information

Authors and Affiliations

Corresponding author

Additional information

These authors contributed equally to this paper.

Rights and permissions

About this article

Cite this article

Chen, Z., Guan, J. Mapping of biotechnology patents of China from 1995–2008. Scientometrics 88, 73–89 (2011). https://doi.org/10.1007/s11192-011-0380-3

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11192-011-0380-3