Abstract

The expanding practice of accepting patents as collateral for loans has increasingly caught academic attention and the value of a patent has been verified as an important determinant. In this paper, we focus on validity and uncertainty in the context of innovative startups’ patent pledge valuation, arguing that their interplay poses a timing dilemma to lenders. Our empirical tests utilized a database of Chinese innovative startups and their patents for the period 2008–2015. Using patent age as a proxy for time, our findings demonstrate that timing dynamically influences the collateralization potential of a patent. The results also suggest that lenders can use information cues from third parties, such as venture capital backing from the market and high-tech certification from the government, to cope with this timing dilemma, however in different ways. Thus, we advance existing literature on startups’ debt financing by expanding the range of patent collateralization determinants to include dynamic multilevel factors.

Plain English Summary

The timing dilemma in innovative startups’ patent collateralization for loans: the dynamically changing likelihood of a patent being accepted as loan collateral and different roles of information cues from third parties in coping with this dilemma. This study theorizes a timing dilemma that lenders confront when weighting in patents’ validity legal lifetime and the uncertainty of patent valuation for innovative startups proposing patents as loan collaterals. Using a unique panel dataset of Chinese startups and their granted patents, multilevel analyses supported a dynamic view and showed that the age of a valid patent has an inverted U-shaped relationship with the likelihood of this patent being accepted as loan collateral. Being invested by venture capital or certificated as high-tech enterprise by government can accelerate acceptance by lenders. Thus, the principal implication of this study is that small innovative businesses should actively seek to obtain government certification and venture capital investments because this will not only improve their legitimacy and help them obtain equity financing but may also help them obtain more capital from debt investors through using patents as loan collaterals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Using patents as loan collaterals creates hope for resource-restricted startups to access additional capital (Fischer & Ringler, 2014; Hochberg et al., 2018; Mann, 2018). For firms of all sizes, supplementary capital is important to increase their financial liquidity, further stabilize their business operations, and respond to investment opportunities and strategy changes (Fang et al., 2014; Shleifer & Vishny, 1992). Debt financing is an important source of such additional financing (Berger & Udell, 1998), but it is often affected by typical information asymmetry friction (Mann, 1997). Hence, offering collaterals has become a well-known and widely used mechanism in both corporate finance theory and practice (Bosse, 2009; Chan & Kanatas, 1985; Coco, 2000). However, because of the lack of tangible assets that can be used as collateral, it is often difficult for fast-growing startups with uncertain future prospects to secure debt financing (Cassar, 2004; Denis, 2004). In recent years, as the technology market has developed (Arora & Gambardella, 2010; de Marco et al., 2017), the world has witnessed an increasing phenomenon of patent pledging used for accessing debt financing (Brassell & King, 2013; Deshpande & Nagendra, 2017; Loumioti, 2012; OECD, 2015).

When focusing on the determinants of lenders accepting patents as collateral for loans, pioneering scholars have indicated the value of a qualified patent as the one having the largest bearing (Amable et al., 2010; Caviggioli et al., 2020; Fischer & Ringler, 2014; Hochberg et al., 2018; Mann, 2018; Zhang et al., 2021). Most of these scholars offer some vital empirical evidences by using forward citations as a measurement, which refers to the accumulated number of citations a patent receives after being issued. For instance, in the first quantitative study on collateralized US patents, Fischer and Ringler (2014) found that it is the technology underlying a patent, which is measured by the number of forward citations, that supports patent collateralization. Likewise, Mann (2018) and Caviggioli et al. (2020) found supporting evidence for the notion that patents being pledged as collaterals score highly on observable forward citation counts and generality, which reflect the wide range of technologies building on the patent. In addition, using a database for three innovation-intensive sectors (i.e., software, semiconductor devices, and medical devices), Hochberg et al. (2018) showed that the likelihood of being able to use patents to secure a loan increases when the technology market for patent trading becomes more liquid, and particularly when startups’ patent assets are less firm-specific (computed based on the forward citations that a patent receives within a 3-year time window).

However, one important issue that has been ignored by research relates to the fact that the patent right is assigned a legal protection period, and the value of a patent varies within this limited timeframe. When a patent is newly disclosed, its value, which depends on the endogenous outcomes of technology and the evolution of the product market (Scherer & Harhoff, 2000), is subject to a high degree of uncertainty (Gans et al., 2008). Hence, lenders must rely on a wait-and-see strategy until the relevant indicator (i.e., forward citations) (Fischer & Leidinger, 2014; Harhoff et al., 2003) is updated as time passes. However, as intellectual property rights, patents offer their owners the option to exclude others from making, using, or selling the related inventions (Landers, 2006). In most countries, this exclusive right is legally protected for up to 20 years from the date on which the application for a patent was filed and is subject to the payment of maintenance fees. In practice, due to the accelerated evolution of underlying technology, the majority of patents may become obsolete in just a few years after being issued (Kim, 2016). As a patent is approaching its legal life term, its value will soon disappear. Thus, the remaining validity time is also vital for lenders in assessing the value of a patent as loan collateral. They must have enough time to liquidate their pledged patents in cases of borrowers’ defaults.

Consequently, in the context of startups’ patent collateralization, we theorize and demonstrate the existence of a timing dilemma that lenders confront when weighing in the validity of patents’ legal lifetime and the uncertainty of patent valuation in order to decide whether to grant a loan or not. When considering the former, they demand that the collateral patent be newly filed because it has a relatively longer legal lifetime and can be liquidated at an appropriate value in case of defaults; when factoring in the latter, lenders need to wait for some time until information about the patent value is updated so as to identify whether the collateral patent is valuable or not. Hence, using patent age as a proxy for time, we argue that it has an inverted U-shaped relationship with the approval likelihood of a patent pledge. More specifically, we propose that as a patent’s age increases, the likelihood also increases because more relevant information on its value becomes available, and the uncertainty of patent valuation gradually decreases. However, as the remaining legal time of a patent lapses, its probability of being accepted as loan collateral subsequently declines because the expected potential benefit for the lender decreases. Moreover, we argue that lenders can use endorsements from external third parties, i.e., venture capital (VC) backing and government certification, to address the uncertainty of patent valuation and cope with this timing dilemma. We further argue that lenders might place more emphasis on the information cues provided by the market than by the government. Using an unbalanced panel dataset of 7194 patents granted to Chinese domestic startups from 2008 to 2015 and patent owners’ VC backing or government certification, we found support for all of our hypotheses.

This study makes several contributions to the research on innovative startups’ debt financing. First, it adds to the currently few studies on patent pledging by focusing on the determinants of accepting patents as loan collaterals from a dynamic perspective of time. There is an emerging literature on innovative firms’ debt financing based on patent pledges, which presents the roles of patent value in influencing the likelihood of a patent being used as collateral (Caviggioli et al., 2020; Fischer & Ringler, 2014; Hochberg et al., 2018; Mann, 2018; Zhang et al., 2021). We acknowledge existing conclusions and complement them by arguing that the value of a patent varies across time. In the context of startups’ patent collateralization, we demonstrate a timing dilemma that lenders confront and suspect that due to the interplay of validity and uncertainty in patent valuation, the likelihood of a patent being accepted as collateral for loans is dynamically and nonlinearly related to its age. We also present that the endorsements from third parties can offset the uncertainty and further accelerate startups’ patent pledges.

Second, this study contributes to the literature on the information role of third parties in startups’ debt financing by simultaneously introducing VC backing and government certification as external observable and credible information cues in the context of innovative startups’ patent-backed loans and investigating their different roles in helping lenders cope with the timing dilemma. Previous research has confirmed that, in case of uncertainty, the choices made by third parties vis-à-vis firms can influence stakeholders’ decisions (Kleinert et al., 2020; Rindova et al., 2005); VC backing, or government certification can thus serve as endorsements and help firms establish legitimacy or obtain external financing (Kleer, 2010; Li et al., 2019; Marti & Quas, 2018; Wu, 2017; Wu et al., 2021). However, the different roles of these indicators are rarely compared in the same context. By using VC backing and government certification as information cues from the market and the government, respectively, our study highlights that, lenders rely more on the endorsement from the market than that from the government to offset the uncertainty of patent valuation.

Third, while some prior studies took US patents as their collateral sample (Caviggioli et al., 2020; Fischer & Ringler, 2014; Hochberg et al., 2018; Mann, 2018; Zhang et al., 2021), only Yang et al. (2021) focused on how Chinese startups obtain loan financing this way and found some internal determinants by studying these startups. As the largest developing economy with the most patent applications (Hu et al., 2017), China has experienced one of the world’s highest entrepreneurship rates during the last two decades (Ge et al., 2017; He et al., 2019). There are a rapidly increasing number of innovative startups that demand debt financing by taking advantage of their intangible assets (i.e., patents). However, the quality of Chinese patents shows a highly skewed distribution with relatively lower value (Fisch et al., 2017). Taken together, these challenges engender the important work of utilizing information cues to help lenders address the uncertainties of startups’ patent valuation for collateralization. Our quantitative study on Chinese collateralized patents attempts to extend the research setting beyond the USA and focuses on multilevel determinants, thus providing novel evidence for future theorizing.

2 Theoretical background and hypothesis development

2.1 Debt financing and the use of patents as collateral for loans

An important source for any firm to raise financing is debt, which innovative startups also rely on (Bates, 1997; Cassar, 2004). In this financing relationship, lenders make loan decisions based on strict criteria to predict the probability of repayment by borrowers (de Bettignies, 2008), and thus cede them an amount of money for a certain period of time. In turn, lenders earn a profit by applying an interest rate. However, debt financing is often paralyzed by information asymmetry friction with lenders at an information disadvantage relative to borrowers (David et al., 2008), particularly when firms have limited cash flows and fewer historical records (Berger & Udell, 1995; Hanedar et al., 2014). It is difficult for lenders to accurately access borrowers’ quality levels and their willingness to repay the loans. To mitigate this informational friction, a typical solution is to offer tangible assets as collateral, such as plants or machines (Inderst & Mueller, 2007; Rajan & Winton, 1995; Williamson, 1988). The term “collateral” refers to a lender’s right to seize the asset used as security if the borrower does not voluntarily repay a loan in the event of a default (Chan & Kanatas, 1985), like not paying the interest or violating some covenant, they can thus sell collateral assets to compensate losses. Hence, on a credit market, using collateral that facilitates easy valuation and liquidation is a key variable incentivizing lenders to lend (Coco, 2000; Shleifer & Vishny, 1992).

As an important arrangement to alleviate startups’ financial constraints, a patent pledge is the use of a patent as collateral to secure debt and this practice has been gaining traction (OECD, 2015). In the USA, approximately 16% of patents granted to American companies have been pledged as collateral for loans at some point prior to their expiration date (Mann, 2018). According to the statistics from the China National Intellectual Property Administration (CNIPA), a total of RMB 155.8 billion (US$ 22.6 billionFootnote 1) were loaned against 48,045 patents in 2020. However, the literature on collateralized patents remains limited. Taking the USA as a research setting, some scholars focused on the firm-level analysis and found that patenting companies raise more debt when creditors’ rights over patents strengthen (Mann, 2018), and that startups with more redeployable (i.e., less firm-specific) patents have greater chances to access debt financing when the secondary market for patent trading becomes more liquid (Hochberg et al., 2018). Other scholars focused on the patent-level analysis and found that patents with a larger number as well as a wider range of forward citations are more likely to be used as collateral (Fischer & Ringler, 2014; Mann, 2018), while patents linked to moderately new external inventions (as measured by backward citations) are more likely to be pledged within the semiconductor industry (Zhang et al., 2021). Additionally, Caviggioli et al. (2020) documented that lenders’ greater experience or specialization positively correlated with the likelihood of patent collateralization. In the first study on Chinese pledged patents, Yang et al. (2021) focused on the firm-level analysis and identified an inverted U-shaped relationship between the startups’ age and their patent-backed debt financing, this relationship being further optimized by startups’ innovation capabilities and pledging experience.

As a typical type of intangible asset, patents can be legally sold on the technology market and are this way eligible to be used as collateral for loans (Amable et al., 2010; Harhoff, 2011; Nguyen, 2007). In practice, patent-pledged loans are similar to their traditional tangible asset-secured counterparts, when a certain patent is pledged, the borrower (i.e., the original patent owner) continues to hold the legal ownership of this patent, unless this loan defaults (Caviggioli et al., 2020). The lender releases a security and returns the rights on the collateral to the original owner when their arrangement terminates (Marco et al., 2015). In other words, pledging a patent does not affect the borrower’s right to use it, unless the loan defaults. However, although it is the lender who makes the final decision on whether to accept the patent(s) offered by the borrower as loan collateral, they face a relative information disadvantage compared to the borrower and the risk of not being able to liquidate the pledged patent (Zhang et al., 2021). Therefore, we continue the line of research based on patent-level analysis and consider the lender’s perspective in this process.

2.2 Validity vs. uncertainty in patent pledging by innovative startups

When innovative startups propose to pledge their patents, the key challenge for lenders in exerting their due diligence for loan decision-making is evaluating and selecting valuable patents that are easier to liquidate in case of a default. Here, the patent value means a patent’s economic “private” value (Rosenberg, 1982), which relates to the revenue generated by a patent over its legal lifetime (Bessen, 2008; Harhoff et al., 2003). Therefore, one practical difficulty in estimating the value of a patent refers to timeliness, that is, the need to use reliable indicators to reflect the value of a patent early enough (OECD, 2009). Thus, lenders have to simultaneously take into account the validity and uncertainty involved in patent valuation.

Since the legal lifetime of a patent is limited, the acceptance of newly disclosed patents as debt collateral means that lenders should have sufficient time to find potential buyers in the case of a startup’s default. On the one hand, patents are “wasting assets” whose value is bound to their legal life span. Some patents may be abandoned over just a few years after being issued due to increasing maintenance fees that exceed their economic value (Hall & Harhoff, 2012). Once a patent approaches its expiration date, the inherent technical information will soon be freely used, and no company or entity is willing to pay for this outcome. On the other hand, when a patent is in effect, due to the inevitable disclosure of the underlying technical information (Chien, 2016), which will attract competitors and facilitates imitation (Clarkson & Toh, 2010; James & Shaver, 2016), the economic value of a certain patent starts to decrease rapidly somewhere in the middle of its legal life. Even in some industries where patent protection is particularly effective and plays an important role in preventing imitation (Sternitzke, 2010), patents may lose their economic value quickly due to significant spillover effects of R&D activities (Chen & Chang, 2010; Deshpande & Nagendra, 2017). Therefore, a longer period of remaining validity is vital for lenders in case of startups’ default because they can dispose of the collateral at a reasonable price while these patents are still of relatively high economic value.

Nevertheless, as relevant information needs time to be updated, the uncertainty of patent valuation makes it difficult for lenders to identify valuable patents when they are newly disclosed. First, patents vary widely in value, and the uncertain future of the underlying technologies makes it harder for both the innovators themselves and external potential buyers to evaluate them properly in advance (Munari & Oriani, 2011). Even the most frequently used indicator (i.e., forward citations) takes time to accumulate (Gambardella et al., 2008; Harhoff et al., 1999). Second, the challenge to accepting new patents as collateral for loans lies in their market uncertainty because future buying is usually very difficult to predict (Fischer & Ringler, 2014). Some firms file for patents even if they do not have the resources to bring their products to the market, and they may tend to be overoptimistic about these patents’ market value (Giuri & Mariani, 2007). Lenders thus face uncertainty regarding market opportunities prior to the patent being commercialized. Although potential competitors or non-practicing entities may be interested in buying them (de Rassenfosse & Fischer, 2016), only a few new patents can be subsequently liquidated on the technology market (Hagiu & Yoffie, 2013). Therefore, when a patent is too new, the multiple sources of uncertainty surrounding it may exacerbate the difficulties in its valuation and thus hinder its usage as debt collateral.

2.3 Changes in patent validity and uncertainty over time

As noted above, when valuating patents proposed by startups as debt collateral, lenders should give consideration to both their validity and uncertainty. In factoring in the former, the demand is for patents to be newly filed while, with the latter, there is a need to wait for some time and lenders thus find themselves in a dilemma. This is solved only when the validity outweighs uncertainty and the patent can thus be accepted as debt collateral. We therefore suggest that the likelihood of a patent being accepted as loan collateral dynamically changes over time.

In the earliest stage after a patent application, its probability of being pledged is relatively low due to its high level of uncertainty. First, some observable and reliable value indicators (e.g., forward citations) might not be obtained due to the patent’s recentness in the patent system (Mowery & Ziedonis, 2002). Second, considering the probability inherent to a patent system, certain unknown prior work or other facts might have been ignored by inventors or patent examiners. With the publication of patents, it is unclear if competitors would doubt the worth of investing to extract value from the disclosed technologies, whether the information revealed would, on the contrary, inspire rivals to imitate or invent around the patent and whether the patent would infringe on others (Henkel, 2009; Johnson & Popp, 2003; Lemley & Shapiro, 2005). Third, given the rapid technological obsolescence and intense competition, when substitutive technologies will emerge and to what extent they will replace the startup’s technologies is ambiguous (Wagner, 2011), and the availability of complementary assets for internally commercializing the invention is also occasionally uncertain (Dahlander & Gann, 2010).

Considering that a patent’s uncertainty gradually reduces as time elapses, the probability of a patent being accepted as loan collateral thus increases. Specifically, in observing competitors’ follow-up patent applications, innovative startups can trace their rivals’ capabilities for imitation or workarounds. Additionally, by analyzing the market’s evolution and investigating the frequency of new products released by rivals, innovative startups may be able to foresee market changes and predict the potential of their patented inventions and the right timing for commercialization. Consequently, they may decide on maintaining their valuable patents by paying relevant fees and retaining validity (Giummo, 2014; Tsang et al., 2015). This obtainable information can further be used by lenders as a signal that illustrates patents’ value (Lanjouw et al., 1998). Thus, one can predict that as relevant information keeps being updated, the likelihood of a patent being accepted as collateral for loans by lenders may increase.

However, after a certain threshold is reached, this probability might actually decrease due to the shortening of its remaining period of validity. Generally, to achieve the full extent of patent protection, patent owners must pay maintenance fees several times during a patent’s legal life. The amount required each time is greater than that paid in the previous stage. Since the rapid technological development and resulting patent obsolescence may quickly render some patented inventions valueless, in practice, only when the value of a patent exceeds the costs of its maintenance will this patent be renewed by owners (Deng, 2011). Thus, as more information becomes available in the market, innovative startups can make deliberate strategic decisions on renewal (Liu, 2014) and abandon some patents (Clarkson & Toh, 2010). Even when all maintenance fees are paid, a patent will still expire after a certain period of time. As validity time lapses, it will be increasingly difficult to seek economic returns from these patents in the event of startup loan defaults. As a result, it is almost impossible for lenders to accept an aged patent as debt collateral.

By combining these various arguments, we may observe that the acceptance likelihood will increase in the early postgrantingFootnote 2 time but decrease later on. Consequently, we introduce the patent age in our analysis as a proxy expressing the amount of time that has passed between a patent application and its expiration. Our first hypothesis is thus formulated as follows:

-

Hypothesis 1: The patent’s age has an inverted U-shaped relationship with its likelihood of being accepted as loan collateral.

2.4 The role of endorsements from third parties in patent pledging by innovative startups

In this section, we focus on the role of endorsements from external third parties, namely, VC backing and government certification, as information cues in innovative startups’ patent collateralization with all other variables remaining unchanged. Here, we only analyze their effect on reducing uncertainty in the valuations process since the remaining life of a patent is not influenced (at least not directly) by external information cues referring to its owner. As already outlined, lenders prefer to accept patents with a longer remaining period of validity as collateral for loans, but they have to sacrifice a certain period of time to wait for related information to be updated due to the higher uncertainty of these patents. Hence, we posit that, if the uncertainty of a startup’s patent can be effectively reduced, its probability of being accepted as collateral should further increase. In extending this issue on organizational ability predictions and external financing, some studies have suggested the important role of observable information from third parties (Cumming, 2007; Gulati & Higgins, 2003; Hoenig & Henkel, 2015; Kleer, 2010; Rindova et al., 2005; Wu, 2017; Wu et al., 2021). These studies have shown that through linkages with VC firms or investment banks or through obtaining funds or certifications from the government, startups can establish firm legitimacy and receive additional capital. In practice, our interviewsFootnote 3 with relevant staff in Chinese banks revealed that, when startups seek patent-backed loans, banks are more likely to choose those with VC backing or government’s high-tech enterprise certification.

By specializing in financing startups with high growth potential (Gompers & Lerner, 2004; Hoenig & Henkel, 2015), VC backing provides a positive signal about a patent owner’s technical quality and repayment capabilities. When making funding decisions, VC firms (VCs) spend a considerable amount of time evaluating startups’ probabilities of success (Hoenen et al., 2014; Hoenig & Henkel, 2015). The factors considered include the capital intensity of the business model, the competition encountered, the market in which it operates, and the novelty and quality of its technologies (de Rassenfosse & Fischer, 2016; Vo, 2019). These decision criteria effectively represent a startup’s chances of survival (Shepherd, 1999) and positively impact its initial public offering (IPO) success (Gulati & Higgins, 2003; Megginson & Weiss, 1991). Moreover, VCs typically back firms in several rounds of venturing financing, which provide money that can be used by startups to repay a loan (de Rassenfosse & Fischer, 2016). Hence, as in venture debt financing, a critical factor that lenders rely on relates to whether the firm has received backing from VCs (Mann, 1999). In the context of innovative startups’ patent collateralization, VC backing is beneficial to lenders in two ways: first, it adds value to a young firm (Jain & Kini, 2000) and brings in managerial input that enhances its chances of success (Hellmann & Puri, 2002), which consequently increases the repayment capacity. Second, it acts as a certification agent (Stuart et al., 1999) and reduces the information asymmetry between borrowers and lenders by signaling the quality of startups’ patented invention (de Rassenfosse & Fischer, 2016), which further reduces the risk of default. This legitimate third-party information can thus be used as a cue by lenders to reduce uncertainty. Therefore, we hypothesize the following:

-

Hypothesis 2: The VC backing of a patent owner can further increase the likelihood of a patent being accepted as loan collateral and speed up patent collateralization.

Apart from VC backing, certification from the government is also an important consideration in Chinese lenders’ practice. Focusing on the role of government support in debt financing, previous studies have suggested that capital from the government can be regarded as an effective signal to external investors (Islam et al., 2018; Lerner, 1999; Li et al., 2019; Meuleman & De Maeseneire, 2012). The empirical evidence for Europe (Guerini & Quas, 2016; Marti & Quas, 2018; Meuleman & De Maeseneire, 2012), the USA (Islam et al., 2018), and China (Chen et al., 2018; Li et al., 2019; Wu, 2017) demonstrates the government’s role in increasing the likelihood of supported companies accessing external financing. This is particularly the case when firms are startups that prefer not to disclose a large amount of related information publicly for the purpose of self-protection (Hsu & Ziedonis, 2013) due to the positive externalities of innovation activities (Wu, 2017). Support from the government is based on the government’s careful ex-ante screening process and is publicly observable (Cumming, 2007; Meuleman & De Maeseneire, 2012; Takalo & Tanayama, 2010). When focusing on the certifying abilities of the government (Guerini & Quas, 2016; Li et al., 2019; Marti & Quas, 2018), we used the high-tech enterprise certification issued by the Chinese central government and suggested that government certification can act as another credible information cue for lenders to offset patent uncertainty.

In China, to support and encourage the development of innovative firms, the government launched a widely publicized form of high-tech enterprise certification program in 2008.Footnote 4 The criteria used to select candidates include R&D investments, IP ownership, the proportion of new product or service revenue, and operating behaviors without environmental violations. All certified enterprises can enjoy preferential tax policies over a period of 3 years. With these tax incentives, certified firms can hold more money and are thus highly likely to repay their loans. Furthermore, under the supervision and administration of the Chinese government, this legitimate and credible information cue can be used by potential lenders to predict borrowers’ levels of technological innovation competence and repayment capabilities, particularly when firms have fewer historical trust records and disclose minimal information to the public. Taken together, in sorting innovative firms and supporting them, government certification is also vital to lenders by offsetting their incomplete information in innovative startups’ patent collateralization. Hence, we propose the following:

-

Hypothesis 3: The government certification of a patent owner can further increase the likelihood of a patent being accepted as loan collateral and speed up patent collateralization.

After analyzing the roles of the above information cues from third parties, we further argue that lenders might place more emphasis on those provided by the market (i.e., VC backing) than on those provided by the government (i.e., high-tech enterprise certification). The basic logic behind this would be that, in addition to providing financial resources, VCs provide firms with many value-adding services such as advice and monitoring following their initial investment (Gorman & Sahlman, 1989; Sahlman, 1990; Sørensen, 2007). These activities, which involve recruiting senior managers or developing corporate strategies in which VC is expected to engage in the future, can beneficially affect the firm’s efficiency and performance over the long term as well (Bygrave & Timmons, 1992; Chemmanur et al., 2011; Fernhaber & McDougall-Covin, 2009; Hellmann, 1998). The positive effect of VC backing on innovation, productivity, and top management team quality in target firms has been confirmed by prior research (Chemmanur et al., 2021; Croce et al., 2013; Kortum & Lerner, 2000). Thus, for innovative startups, the affiliation with VCs signals quality (Kleinert et al., 2020; Stuart et al., 1999). Compared to VCs, the government is not familiar with the specific conditions in different industries and will not provide follow-up professional guidance. The reassessment for maintain the certification after 3 years of validity may also lead to more uncertainty regarding this information cue. Therefore, when a startup with development potential is invested in by a VC, its possibility of ceding pledged patents will be reduced accordingly. As a result, the two types of information cues play different roles in reducing the uncertainty of patent valuation. Based on the above arguments, we formulate the following hypothesis:

-

Hypothesis 4: Compared to government certification, the VC backing of a patent owner is more likely to increase the probability of its patents being accepted as loan collateral and to speed up patent collateralization.

3 Data and methodology

3.1 Data and sample selection

3.1.1 Data sources

We formed a dataset based on the Chinese granted patent data by combining information from various data sources: patent applications and assignments in China were obtained from the CNIPA’s Patent Search and Analysis website; firms’ high-tech certification data were obtained from the Torch Center of the Chinese Ministry of Science and Technology, which is a government agency that annually identifies innovation companies (high-tech enterprises, to be specific); data on VC investments were obtained from Zero2IPO Research, which is a company specializing in gathering entrepreneurship and investment data for China; and the information about the time of firms’ IPO was obtained from the China Stock Market and Accounting Research (CSMAR) database. According to the latest administration requirements,Footnote 5 the CNIPA publishes all patent collateralization contracts formed in China with borrower and lender names, patent numbers, pledging dates, and release dates when loans are expected to be paid off. We thus retrieved all granted invention patentsFootnote 6 included in this system and assembled a dataset of general information on each patent such as patent number, application and grant dates, inventor and applicant name(s), addresses of applicant(s), patent classification code(s), the number of claims, the number of application pages, backward and forward citations, and other legal statuses, such as licensing, invalidation, expiration due or out of maintenance, pledge contracting date(s), and borrower (i.e., patent owner) and lenders’ names for each patent used as debt collateral.

3.1.2 Pledge data

The patent applications made between 1985 and 2015 and ultimately granted by the CNIPA to firms before the end of 2015 were used to measure the related variables in our dataset. Among the 1,433,908 granted patents released officially by the CNIPA from 1985 to 2015, 1,013,797 patents were primarily filed by firms. During sample screening, we eliminated 451 outliersFootnote 7 and thus obtained a datasetFootnote 8 of 1,013,346 units of observation, among which 4947 patents were pledged by the end of 2015. A comparison of the patents filed by foreign, Hong Kong/Macao/Taiwan, and domestic entities showed that 97.7% of the pledged patents were from domestic entities.

Thus, we further observed the patents granted to domestic firms. Figure 1 shows the general distribution of the patents granted and patents pledged yearly from 1985 to 2015. As we can see, the earliest pledging event in China occurred in 2002, and since then, an increasing trend had been observed. In the first 3 years, only 32 patents were used as debt collateral by Chinese domestic firms while this number skyrocketed to 1326 in 2015. However, compared to the rapid increase in patents granted by the CNIPA, the ratio of patents pledged to all patents granted remained at less than 1% in most years with the highest rate observed in 2014 (2.01%).

Figure 2 plots the distribution of a patent’s age when this was pledged as debt collateral for the first time, that is, the difference between the patent’s pledge year and the application year. Interestingly, most patents were pledged as collateral 3 to 5 years after their application (57.88% experience a 3–5-year lag), 97.93% of patents were pledged within a 10-year lag, and the average pledge lag was 4.7 years.

With respect to the types of lenders involved, banks made up a majority of 65.57% from the total. Other types included individuals (1.01%), companies (31.73%), and government institutions (1.69%).

In accordance with the Organization for Economic Cooperation and Development (OECD), we categorized the 4834 patents pledged by domestic firms into 30 technological fields by their main classification code in the International Patent Classification (IPC) system of the World Intellectual Property Organization (WIPO). Figure 3 shows that the ratio of pledged patents varied distinctly among different sectors (with a maximum of 8.38% and a minimum of 0.02%). Sectors such as the Polymer Chemistry, Communication, Control and Instrumentation Technology, Pharmaceuticals and Cosmetics, and Electrical Devices and Engineering were the top 5 on the list.

3.1.3 Sample selection

A group of patents granted from 2008 to 2015 to startups in mainland China was selected as our research sample. As noted above, a security agreement needed to specify a patent or a subset of patents from the owner’s patent portfolio, and we thus decided to take the patent as our primary analysis unit. Furthermore, acting as information cues in our hypotheses, both VC backing and government certification applied to firms only. In particular, government certification of high-tech enterprises applied only to firms registered in mainland China. Therefore, we further chose to use those patents primarily filed by domestic firms. Meanwhile, to ensure that the firms in our sample were innovative startups, we followed previous research (Islam et al., 2018) and eliminated all the firms that were older than 10 years in 2015 or had applied for less than one patent a year on average during that time. In principle, any patents during their legal lifetime can be pledged. Practically, since the earliest implementation date of high-tech enterprise certification in China was 2008, we eliminated the patents granted to domestic startups before 2008 from our dataset. Of the 258,785 observation units, 3598 patents had been pledged by the end of 2015, accounting for 74.43% of all pledged patents (i.e., 4834 patents pledged by domestic firms).

Based on these pledged patents, we selected a control sample of non-pledged patents as a matched group by applying propensity score matching (PSM) (Heckman et al., 1998), which involved using the propensity scores obtained from the first-stage model explaining patent pledge to identify pairs of patents. We first specified a logistic regression on our full sample, where the dependent variable, whether pledge,Footnote 9 was regressed on predictor variables. The covariates are the control variables in our baseline model, which do not change over time. Meanwhile, we also added the variables including patent’s legal lifetime,Footnote 10apply year, technology sector, and region to control for both time and technology differences (Fischer & Ringler, 2014) in our empirical design. Table 1 shows the results of the first-stage model.

Based upon the first-stage model, we then identified 6998 propensity-matched pairs using a caliper-matching approach (caliper = ± 0.10) with no replacement (Quigley et al., 2019), half of which had been accepted as collateral for loans. Table 2 provides a comparison of the pledged patents and their matched control group, including the means and standard deviations. The t-test results of the group comparison show non-significant differences between most covariates.Footnote 11

Regarding the empirical analysis, our cross-section sample allowed us to focus on the timing of patent acceptance as loan collateral relative to changes in information cues. We thus identified all information related to VC backing and high-tech enterprise certification for each patent based on the firm to which it had been assigned each year until 2015, the final year of our sample period. Hence, our final dataset consisted of 23,190 patent-year observations in an unbalanced panel with all years running between a patent’s grant yearFootnote 12 and its end year. The three ways in which a patent’s observation period could “end” considered in this study were as follows: (1) the patent reached the end of 2015, (2) the patent was out of maintenance or had been declared invalid, and (3) the patent had been pledged as collateral for loans.

3.2 Variables and measures

3.2.1 Dependent variable

The dependent variable, the pledge, is a dummy variable indicating whether a patent was pledged in a given year. This flag variable is set to 0 for all periods in which a patent had not been pledged at all. When a patent had been pledged multiple times, we only focused on the earliest transaction because the information disclosure of follow-up transactions is different from the way it is defined in this study. Therefore, for each pledged patent i, we defined pledgeit as equal to 0 until the year in which the first pledge occurred, at which point pledgeit is equal to 1.

3.2.2 Independent variable

At the patent level, we used patent age (number of years since being filed) to measure time changes (Gans et al., 2008; Serrano, 2010). To demonstrate the inverted U-shaped relationship between patent age and the likelihood of a patent pledge being accepted, we further combined the variables for the age and the square of age terms. Meanwhile, we introduced two variables at the firm level: VC backing and High-tech certification. These independent variables are set to 1 for observations after a firm had obtained VC investment or had been certified as a high-tech enterprise in the previous 3 years, and they are 0 otherwise. For firms in which VCs had invested multiple times, we only used the earliest year (i.e., initial-round investments) because the decision-making mechanism of subsequent VC investment may have been different from the first.

3.2.3 Control variable

A series of control variables at the patent, firm, industry, and region levels are included to rule out factors that may influence the likelihood of a patent being accepted as loan collateral.

At the patent level, we controlled for patent characteristics that might make it valuable, including core, the number of inventors, the number of applicants, the number of pages, the number of claims, the number of fields, the number of backward and forward citations, and whether they were filed through the Patent Cooperation Treaty (PCT). Considering that a firm dedicates unequal efforts to its technology domains and treats some of them as its core technology domains, this finding partially denotes the strategic value of patents in its core technology domain (Granstrand et al., 1997). Hence, we controlled for core using a dummy variable set to 1 for a patent belonging to the top technology domain in a firm’s patent portfolio in the technology category and to 0 otherwise (Song et al., 2003). A patent’s number of inventors and applicants listed in the application were used here as an indication of the size of the team involved in the innovative research being patented and operated, respectively. The involvement of more inventors or applicants reflects the fact that a patent is more embedded within a certain group with less mobility (Hoetker & Agarwal, 2007). Since patents with higher quality are more probable to be accepted by lenders as collaterals (Fischer & Ringler, 2014) and present a greater likelihood of mobility (de Marco et al., 2017), we controlled for the number of pages, claims, fields, and the number of forward citations that a patent received within 3 years before the observation year. We also controlled for a patent’s number of backward citations which measures the focal patent’s external technology linkage and may influence the likelihood of a patent being approved as loan collateral (Zhang et al., 2021). Additionally, the presence of a PCT application indicates that the potential market of a certain patent covers a larger number of countries and that such patents would have had a greater likelihood of being traded (de Marco et al., 2017). Therefore, we introduced a dummy variable of equal to 1 when a PCT application had been filed. Meanwhile, since China’s number of triadic patent families is relatively small (OECD, 2019), given the availability of the data, we also used PCT as a proxy variable for the patent family and used it to predict the patent’s value (Harhoff et al., 2003).

To control for the impact of a firm’s attributes on a patent pledging potential, the characteristics of each patenting firm at the corresponding observation year after the first time it had applied for a patent were used, including the firm age, patent portfolio size, pledge experience, technological diversity, technological competence, and the firm’s public status. We calculated the firm age by subtracting the year of a firm’s entry into the technological market (i.e., the earliest year a firm applied for a patent) (Hoetker & Agarwal, 2007) from each observation year of the patent. A firm’s patent portfolio size was calculated based on its number of valid patents. Theoretically, all valid patents have a potential of being pledged. Therefore, here, valid patents refer to those that remained legally in effect until the observation year while excluding any patents that had previously been pledged and those that had expired or did not have their maintenance fees paid. Meanwhile, to reflect technological obsolescence more accurately (Hall et al., 2005), we took a 15% depreciation rate per year into account. The patent portfolio size at the time of an observation is then calculated as:

where \(\delta\) is the depreciation rate. Moreover, since a firm’s prior experience in using patents as debt collateral may signal its strong relationship to lenders, we controlled for the firm’s pledge experience by using the number of pledged patents a firm had in the 5 years prior to the observation year (Mann, 2018). Two other control variables, technological diversity and technological competence, are respectively measured as 1-HHI (Herfindahl–Hirschman index) and RTA (revealed technology advantage) at the time of an observation. Given that the diversity of technological fields in which the company activates may vary across different firms, in accordance with previous studies (Liston-Heyes & Pilkington, 2004; Trajtenberg et al., 1997), it was controlled in our study and operationalized as follows:

where Sij is the percentage of the patents applied for in technological field i out of all patents applied for by firm j. The RTA index for a given firm in the observation year is defined as the firm’s share of patents in a certain technological field out of all its patents, divided by all firms’ share of patents in that certain technological field out of all their patents registered at the CNIPA, which is operationalized as follows:

where Pij is the number of patents applied for in technological field i by firm j (Granstrand et al., 1997). Additionally, we also controlled for a firm’s public status, which is set to 1 if the firm is publicly listed at the time of the observation year.

At the industry level, industrial licensing probability and market structure were included in our model. As a commonly observed type of patent assignment, firms’ licensing behavior promotes knowledge transactions (Ruckman & McCarthy, 2017). Thus, the licensing probability in a certain industry can serve as a positive signal of patent liquidity to lenders. This control variable is measured by the percentage of licensed patents in a certain technological field for the previous 5 years. Existing research stated that, in different industries with distinct market structures, firms build on the use of their patents differently in terms of technological and commercial strategies (Kim, 2004). Hence, the market structure was controlled for in our study and is calculated as the ratio of the top three firms’ patent holdings against all patents of the same class in a certain technological field at the time of an observation. Moreover, since Chinese banks’ lending decisions vary along levels of market development (Firth et al., 2009; Li et al., 2019), we controlled for the market development conditions in different regions for the corresponding observation year by using the National Economic Research Institute of China’s (NERI) marketization index (Wang et al., 2017).

Finally, year dummies were introduced to control for potential cohort effects. To control for industry development effects and regional environmental effects, we included industry dummies and region dummies, respectively. It is important to note that the industry dummies distinguish whether a focal patent belongs to strategic emerging industries, which are key industries selected by the Chinese central government as the core part of China’s economic growth plan (Prud'homme, 2016). A full list of variables used in the empirical analysis along with their brief descriptions and specific log transformations used are provided in Table 3.

3.3 Empirical strategy

With respect to the regression model, our analysis employed a Cox proportional hazard-rate model (Cox, 1972) with time-varying regressors, which is useful in verifying the dynamic process of patent valuation and uncertainty reduction. Using the estat phtest command in STATA, the global chi-squared (p > 0.1) shows no evidence that the proportional hazards assumption was violated (Morita et al., 1993). Meanwhile, considering that the propensity to pledge a patent varies across startups, we clustered the standard error at the firm levelFootnote 13 in our model to control for other unobservable heterogeneities. Letting hpledge represents the hazard rate of pledge changing from 0 to 1 (i.e., the instantaneous probability of failure at t, conditional on survival until t) (Gans et al., 2008), including controls for observable factors, which yields the following:

where Z includes the patent, firm, industry, and region characteristics. Under the assumption that Eq. (4) is the true model, \({\beta }_{AGE}\) can be interpreted as the pledge hazard rate related to the patent’s age. On this basis, \({\beta }_{VC}\) and \({\beta }_{HT}\) can be respectively interpreted as the impacts of VC backing and High-tech certification on the pledge hazard rate. To disentangle the impact of certain “treatment effects” (i.e., VC backing and High-tech certification in our case) from unobserved heterogeneity, it is useful to recognize that although the value of \({v}_{i}\) impacts the hazard rate in all periods, VC backing and High-tech certification only impact the pledge hazard rate as information cues after the patenting startup receives funding or certification (Abbring & Van den Berg, 2003).

However, our regression model might be vulnerable to self-selection bias, because the role of patents in financial market varies among firms with different characteristics (Greenberg, 2013; Hsu & Ziedonis, 2013; Useche, 2014). That is, startups might make decisions on whether relying on patents to obtain loans based on their own conditions, and lenders may also take the firms’ quality into account when making decisions on whether accepting a patent pledge. Therefore, we employed self-selection correction by using an instrumental variable to address this issue. Given that firms often take peers as their reference group when making strategic decisions (Henisz & Delios, 2001), we used the number of pledged patents by other firms within a same group in the observation year as our instrumental variable. Peer pledge is calculated based on 13 groups with a similar patent portfolio size incorporating a 15% depreciation rate per year. In the first-stage logistic regression, we estimated the probability of patent pledging by a focal firm using this instrumental variable and other firm-level predictors. Table 4 shows that peer pledging significantly and positively predicts the focal firm’s using patents as loan collateral and thus is a relevant instrument (\(\beta =0.752, p<0.01\)). Based on the first-stage logistic estimation, the inverse Mills ratios was calculated and inserted as a firm-level control for self-selection in our second-stage regression.

4 Empirical results

The descriptive statistics and correlations for the key variables of the matched sample are shown in Table 5. The correlation coefficients do not suggest any major multicollinearity problems. Moreover, a review of the correlations shows a mean variance inflation factor (VIF) of 1.46 and a maximum VIF of 3.35, which are lower than the critical threshold value of 10 (Chatterjee & Price, 1991), revealing no multicollinearity concerns.

4.1 Cox hazard regression results

Table 6 presents the Cox hazard regression results based on yearly data. In this empirical data table, we report both the estimated coefficients and the implied hazard ratios, which should be assessed relative to one another because the latter renders the estimated size effects more apparent (Gans et al., 2008). The “failure” event in these regressions is the first instance of a patent being pledged. Model 1 shows only the baseline model with control variables. In turn, the independent variables of the patent age and its square term, VC backing, and High-tech certification are inserted into models 2, 3 and 4. The final specification, model 5, includes all variables. Each specification includes a complete set of year, industry, and region fixed effects.

Hypothesis 1 predicts that, after a patent application, with the accumulation of relevant information, the uncertainty of its valuation decreases gradually, and the probability of this patent being accepted by lenders as debt collateral increases. Once a certain threshold is reached, the pledge acceptance probability starts to decrease as the remaining validity shortens. To test this hypothesis, we add a square term to the patent age. If our hypothesis is correct, we should find a significantly positive coefficient for the patent age and a significantly negative coefficient for its square term. As shown in Table 6, when the patent age and its squared term are introduced together into models 2–5, the coefficients of age are consistently positive and significant whereas the coefficients of the square of age are all negative and significant. The combination of these variables demonstrates the inverted U-shaped relationship between the age of a patent and the likelihood of it being accepted as collateral for loans.

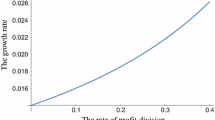

To further examine the changes in the pledge acceptance probability up to and after a certain threshold, in line with previous studies (Gans et al., 2008; Serrano, 2010), we estimate another model with year, industry and region specific fixed effects that is similar to model 2. In the place of the patent age and its square, we estimate eight mutually exclusive time window dummies.Footnote 14 The results are presented in Fig. 4, where we can see that, in the first 2 years after a patent is granted, there is a dramatic spike (statistically significant) in the pledge hazard, and the hazard rate jumps by more than 100% during these two periods. In contrast, in the following four 1-year windows after the threshold, the hazard rate of a patent pledge declines rapidly. Thereafter, the hazard rate stabilizes at a level of approximately 1.0 after 7 years from which the patent has been granted. These results offer further significant evidence to our earlier analysis of an inverted U-shaped distribution for the pledge hazard. Thus, Hypothesis 1 is supported.

Hypotheses 2 and 3 propose that when acting as information cues from external third parties, both the VC backing and government certification of patent owners can help lenders reduce the patent uncertainty and thus accelerate their acceptance of a patent pledge. Indeed, as we argued above, on the basis of an inverted U-shaped distribution for the pledge hazard, the likelihood of a patent being accepted as loan collateral is positively correlated with VC backing and government certification. As represented in models 3 and 4 of Table 6, the coefficients on both VC backing and High-tech certification are positive and statistically significant (\({\beta }_{VC}=0.710, p<0.01\); and \({\beta }_{HT}=0.189, p<0.01\)), indicating that the likelihood of a patent collateralization is significantly enhanced after the patent owner obtains VC investment or government certification. Meanwhile, the hazard ratios of VC backing and High-tech certification are 2.033 (\(p<0.01\)) and 1.208 (\(p<0.01\)), respectively, which implies that VC backing is associated with a more than 103% increase in the probability of speeding up a patent pledge approval and that High-tech certification is associated with an approximately 20% increase in this probability. Therefore, we find support for Hypotheses 2 and 3.

Furthermore, we argue that compared to government certification, lenders might place more emphasis on VC investment. From model 5, which simultaneously includes VC backing and High-tech certification with the other variables left unchanged, we can observe that compared to High-tech certification, VC backing presents a higher significantly positive coefficient in Table 6 (\({\beta }_{VC}>{\beta }_{HT}\)). Following this final regression, we also use a statistical t-test to analyze the differences in these coefficients. The result (\({H0:\beta }_{VC}={\beta }_{HT}, {\text{chi}}^{2}=14.25, p<0.01\)) indicates that lenders judge differently the role of VC investment and government certification in reducing uncertainty. Specifically, VC backing is associated with 102.2% increase in the likelihood of successfully accelerating a patent pledge acceptance, which is more than five times the value for High-tech certification. These findings support Hypothesis 4.

4.2 Robustness tests

We conducted additional robustness tests to rule out potential endogeneity problems and to ensure that our findings are not contingent on specific choices in the above empirical analysis.Footnote 15

First, the hypothesized role of information cues from third parties in accelerating a patent collateralization could be influenced by the length of time elapsed since patent owners acquired VC backing or government certification. For instance, lenders may treat differently the effect of VC backing acquired recently and of that acquired 5 years ago in reducing uncertainty (de Rassenfosse & Fischer, 2016). Likewise, the value of information cues from the government is most pronounced in the period immediately following certification (Islam et al., 2018). Similarly, in the financial market, recent patents may provide the most up-to-date information about a focal firm’s inventive capabilities at the time of event (Heeley et al., 2007). As a result, our measurements of VC backing, High-tech certification, and patent portfolio size may have been biased by the length of the intervals. To address this concern, we redefined these variables using an alternative measure. VC backing and High-tech certification are set to 1 when the patent owner has obtained VC investment or has been certified as a high-tech enterprise within 3 years before the observation year, respectively, and to 0 otherwise. The patent portfolio size is measured by summing the number of valid patents that has been granted to the focal firm within 5 years prior to the observation year. The results comprised in Table 7 are consistent with the main results reported in the paper. From the unreported models of hazard ratios, we found similar results.

Second, practically, on the technology market, patents are conceived as tradable assets and thus can be traded between different entities (de Marco et al., 2017). These patent transactions, which can take the form of licensing agreements or sales assignments, might affect the likelihood of a patent being used as loan collateral. That is, when a patent has been licensed or sold on the technological market, it may no longer be at risk of being used as a collateral for loan. Given this, the competing events such as licensing or sale might have appeared as a kind of omitted variable and might have thus affected the value of our covariates in the Cox model. Therefore, based on the survival analysis, we further characterized and modeled the time-to-event by using the competing risks approach, which is tailored to model durations that end with multiple events (Giot & Schwienbacher, 2007). It thus allows for analyzing the influence of different events on patent pledging. The results of the competing risks model presented in Table 8 are in line with those in the single-risk Cox model.

Third, we considered an alternative estimator to assess the predicted relationships between information cues and patent pledge acceptance. In our main analyses, we used the Cox model. To resolve the biases that may have come from different models, our supplementary analysis involves estimating a logistic regression (Prentice & Pyke, 1979; Scott & Wild, 1986) to identify the likelihood of a patent being accepted as loan collateral. Using the xtlogit command in STATA, the constructed matched sample with time-varying panel data is useful in verifying the timing dilemma in patent valuation. Meanwhile, we clustered the standard errors at the firm level in our model to control for other unobservable heterogeneities.Footnote 16The results shown in Table 9 are consistent with the findings derived using the Cox model. Moreover, following the steps suggested by Haans et al. (2016), we tested the existence of the inverted U-shaped relationship between a patent’s age and the likelihood of this patent being accepted as loan collateral. The result of the overall test is significant (\(t\text{-value}=2.61, p<0.01\)). The estimated turning point is 1.941 (the Fieller 90% confidence interval is [1.764, 2.188]), which is within the range of patent age. Besides, the results show that the slope at the lower bound (0) is 6.479 (\(t\text{-value}=9.30, p<0.01\)), while at the upper bound (2.398) is − 1.526 (\(t\text{-value}=-2.61, p<0.01\)). Taken together, the results of the U test verify the presence of this inverted U shape.

Finally, considering that various technology categories may possess different average patent values and the costs of bringing these patents to the market are likely just as different, we replaced the industry dummies with a field dummy variable to control for the first technological field of each patent. Since decisions regarding whether to accept patents as collateral for loans are made by lenders, we clustered the standard errors at the levels of the potential lender and the dyadic relationship between a borrower and a potential lender. The Cox hazard regression results remain consistent across these different model specifications.

5 Discussion and conclusion

5.1 Summary and contribution

In this quantitative study on innovative startups using patents as collateral for loans, we argue that time is an additional determinant of a patent’s likelihood to be accepted as loan collateral by lenders. The interplay of a patent’s validity and uncertainty dynamically influences this probability. Moreover, we argue that endorsements from third parties, such as VC backing and government certification, can be used as information cues to reduce uncertainty and thus help lenders cope with the timing dilemma. Based on 3597 pledged patents from Chinese startups and their matched group, a unique panel dataset is formed and used to test the hypotheses. First, the age of a valid patent is found to have an inverted U-shaped relationship with the likelihood of this patent being accepted as loan collateral. Second, with all other variables left unchanged, we find that both VC backing and government certification (high-tech enterprise certification as the proxy variable) are significantly related to innovative startups’ patent collateralization and can accelerate this outcome. Third, our proposition that lenders place more emphasis on VC backing than on government certification in their patent-pledged loan decision-making is also empirically supported. These findings contribute to the research on startups’ patent-backed debt financing in the following several ways.

First, prior studies on innovative firms’ debt financing through patent collateralization have tested and verified that patents should be valuable in order to be pledged (Caviggioli et al., 2020; Fischer & Ringler, 2014; Hochberg et al., 2018; Mann, 2018; Zhang et al., 2021). We acknowledge these findings and assume that the value of a patent varies along time. We describe a timing dilemma that lenders confront when factoring in validity and uncertainty in patent valuation, and verify how lenders cope with this dilemma by using information cues from external third parties. To the best of our knowledge, very little prior research has examined the dynamic time process involved in patent valuation and its limited economic life (Gambardella et al., 2017; Maresch et al., 2016; Wu, 2011; Wu & Tseng, 2006). In reference to a specific setting (i.e., startups’ patent-backed loans), our empirical analysis considered the timing effect on lenders’ decision-making process, thus shedding light on the determinants of using patents as collateral for loans from a dynamic perspective of time.

Second, studies on innovation have demonstrated that VC backing or government certification can serve as information cues and help firms establish legitimacy or obtain external financing (Cumming, 2007; Gulati & Higgins, 2003; Hoenig & Henkel, 2015; Kleinert et al., 2020; Lerner, 1999), but rarely consider their distinct effects under the same conditions. We extend previous research by examining these aspects in the specific context of startups’ patent collateralization. Using VC backing and government certification as information cues from the market and the government respectively, our study shows that lenders can rely on these indicators to cope with the timing dilemma and speed up patent pledging, however they place more importance on VC backing than on government certification. These findings provide a systematic perspective which refines our understanding of how lenders decide whether to accept startups’ patents as collateral or not.

Third, most existing studies on patent pledging predominately use US patents or US firms as their collateral sample and perform a patent-level or firm-level analysis (Caviggioli et al., 2020; Fischer & Ringler, 2014; Hochberg et al., 2018; Mann, 2018; Zhang et al., 2021), only Yang et al. (2021) utilize Chinese startups as a research sample and focus on the internal firm-level factors that affect patent pledging. By setting China as our study context, we continue the patent-level analysis and propose a timing dilemma that lenders confront. We also capture the role of VC backing and government certification at the firm-level in coping with this dilemma by lenders. Our work thus addresses an imbalance in this research field by providing preliminary results in the context of emerging economies. We also extend the investigation of the collateralization determinants from patent-level factors (i.e., citation-based indicators) (Fischer & Ringler, 2014; Zhang et al., 2021) and internal firm-level factors (Yang et al., 2021) to external firm-level factors.

5.2 Practical implications

In addition to extending the field literature, our results have practical implications for both startups and lenders. First, innovative startups can more easily identify the appropriate time to pledge their patents depending on the patent’s age in order to attain obvious monetary value of their collateralized assets and improve the firm’s value. Generally, startups can access external capital through patent selling, patent licensing, and patent pledging. However, startups will lose the ownership of their patents in case of selling (Serrano, 2010), and they might create future competitors in the case of licensing (Gans et al., 2008). By maintaining their valuable patents and pledging them at a certain point in their legal lifetime, innovative startups can make full use of patents’ value on the debt market, obtain external capital, and thus build competitive advantages in the future. Second, startups can also pre-emptively strategize by accessing VC investments or by obtaining government certification to most advantageously position their patents to lenders. In doing so, they can accelerate lenders’ favorable response and use additional capital to increase investment in innovation, which further enhances their commercial value (Kleinert et al., 2020). Third, when creditors make loan decisions on startups’ patent pledges, they can use the patent age and endorsements from third parties as information cues, thus effectively coping with the information asymmetry friction.

5.3 Limitations and avenues for future research

Despite our rigorous efforts, this study bears certain limitations. First, there may be concerns about the validity of our control sample. For example, we were not able to identify those startups who did not utilize their patents as collateral for loans but were actively searching for debt financing (i.e., type I error) (Dechow et al., 2011). While this study employed self-selection correction by using an instrumental variable in the first-stage regression, the qualitative case study approach to the question of why some patents are pledged by startups but not accepted by lenders would also be interesting. Second, regarding the measuring of information cues from third parties, although we introduced VCs and widely publicized high-tech enterprise certification as dummy variables due to data availability, whether these cues have measurable effects on reducing uncertainty in patent valuation has not been considered. Future studies could facilitate in-depth discussions and improve this assessment by determining whether the size of VC investments or government subsidies (Wu & Xu, 2020; Wu et al., 2021) has a similar effect. Finally, using patent data in the Chinese context, we tested and verified the effects of time and endorsements from third parties on the likelihood of a patent being accepted as loan collateral. Given that institutional settings may impact the results produced by information cues (King et al., 2005), future analysis may replicate this research in reference to other developing countries or developed ones.

Potential research opportunities and future avenues of research are suggested as follows: first, the empirical results of this study show that startups’ patent portfolio size and public status negatively relate to patent pledging. In other words, those startups who utilize patents as loan collaterals have a relatively small number of patents and are not yet publicly listed. Since the role of patents in entrepreneurial financing has been largely investigated, the findings illustrate that a higher number of patents can be a signal of technological maturity to the financial market and has positive correlations with entrepreneurial firms’ accessing debt or equity financing, such as equity crowdfunding, venture or bank debt, and IPO (Hsu & Ziedonis, 2013; Rossi et al., 2021; Useche, 2014; Vismara, 2014). In line with such previous studies, it would be worthwhile to investigate whether patent pledging has a signaling effect for startups’ equity financing, such as IPO, especially when entrepreneurial firms are relatively disadvantaged by a small patent portfolio. Second, while we examined the effects of the patent’s age, VC backing, and government certification on innovative startups’ patent pledging, it would be worthwhile to consider other potential information cues such as patent assignments and firm events. For example, licensing-based commercialization strategies (Morricone et al., 2017), patent invalidation (Horsch et al., 2021), and various exit routes of firms (Cefis et al., 2022). Third, as an important indicator, the signaling role of investments made by VCs may change depending on the latter’s type. Previous studies have described the heterogeneity across VCs, which differ in terms of size, previous experience, affiliation, and stage specialization (Elango et al., 1995; Hirsch & Walz, 2013; Meuleman et al., 2009). These differences affect their investment behavior. For instance, Croce et al. (2015) showed that independent and bank-affiliated VCs have different investment behaviors in relation to entrepreneurial firms. Further analysis taking into account different types of VCs would enhance our understanding of the influencing mechanism of information cues in patent collateralization.

Data availability

The data can be obtained from the official website (http://www.innocom.gov.cn/) operated by the Torch Center (http://www.ctp.gov.cn/gaoqi/index.shtml), China Stock Market and Accounting Research (https://www.gtarsc.com/), Zero2IPO Research (http://www.pedata.cn/data/invest_data.html), and CNIPA’s Patent Search and Analysis website (http://pss-system.cnipa.gov.cn/).

Code availability

Code is available from the authors upon request.

Change history

08 September 2022

A Correction to this paper has been published: https://doi.org/10.1007/s11187-022-00682-x

Notes

According to the average exchange rate of RMB against the US dollar in 2020 released by the National Bureau of Statistics of China.

In most countries, including China, only granted patents can be used as loan collateral.

The interviews were conducted on November 27, 2019. The interviewees were participants in the 3rd Tianfu Intellectual Property Summit, which was sponsored by the Sichuan Intellectual Property Service Promotion Center. They were employees of Chinese banks, such as China Minsheng Bank, the Agricultural Bank of China, and the Industrial and Commercial Bank of China.

Specifically, high-tech enterprise certification is annually implemented by the Chinese Ministry of Science and Technology.

In 1996, the CNIPA issued its first experimental administration regulation: “The Temporary Rules for Recording Contracts of Patent Collateralization in China.” On November 15, 2021, the latest formal administration regulation “The Rules for Recording Contracts of Patent Collateralization in China” was issued by the CNIPA.

In China, there are three types of patents: invention, utility model, and design. Due to the technological importance of inventions, according to the administration regulations, only the invention patent can be pledged as collateral. Therefore, we only focus on invention patents in this paper. Unless specified otherwise, all patents considered in this study are inventions.

Some patents were licensed or traded after becoming invalid.

The control variables were calculated based on this dataset.

This dependent variable is coded as 1 if a patent had been pledged by the end of 2015, and 0 if not.

This variable is calculated by the length of time from the application year to invalid year or 2015.

In Table 2, only No. of backward citations is significant (p < 0.1). However, compared with its result of the t-test on group differences based on the full sample (p = 0.000), the significance has been greatly reduced.

According to “The Rules for Recording Contracts of Patent Collateralization in China,” only granted patents can be used as collateral for loans in China. Thus, we set the observation years in our panel dataset starting from each patent’s grant year to analyze the role of information cues in the probability of a patent pledge occurring during the possible period of time.

In our regression model, the standard error is clustered at the firm level (i.e., patent owners) since patents belonging to the same firm tend to be correlated. For instance, a patent owner may pledge multiple patents simultaneously to obtain more bank loans. Moreover, a firm’s pledging of a certain patent might reduce the probability of using its other patents as collateral because the financial demands of this firm have been met.

The windows represent 0, 1, 2, 3, 4, 5, 6, and 7–10 years after a patent is granted. Because these time window dummies are exhaustive and mutually exclusive, we cannot separately estimate the impact of the patent age on the pledge hazard rate. Instead, we focus on the changes occurring overtime.

Some of the results are not reported here due to space limitations and are available from the authors upon request.

Since this study compares the differences in patents within and between firms, we use the random effect in our logistic regression, which is also supported by the Hausman test.

References

Abbring, J. H., & Van Den Berg, G. J. (2003). The nonparametric identification of treatment effects in duration models. Econometrica, 71(5), 1491–1517. https://doi.org/10.1111/1468-0262.00456

Amable, B., Chatelain, J. B., & Ralf, K. (2010). Patents as collateral. Journal of Economic Dynamics & Control, 34(6), 1092–1104. https://doi.org/10.1016/j.jedc.2010.03.004

Arora, A., & Gambardella, A. (2010). Ideas for rent: An overview of markets for technology. Industrial and Corporate Change, 19(3), 775–803. https://doi.org/10.1093/icc/dtq022

Bates, T. (1997). Financing small business creation: The case of Chinese and Korean immigrant entrepreneurs. Journal of Business Venturing, 12(2), 109–124. https://doi.org/10.1016/s0883-9026(96)00054-7

Berger, A. N., & Udell, G. F. (1995). Relationship lending and lines of credit in small firm finance. Journal of Business, 68(3), 351–381. https://doi.org/10.1086/296668

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22(6–8), 613–673. https://doi.org/10.1016/s0378-4266(98)00038-7

Bessen, J. (2008). The value of US patents by owner and patent characteristics. Research Policy, 37(5), 932–945. https://doi.org/10.1016/j.respol.2008.02.005