Abstract

This study examines when small- and medium-sized enterprises (SMEs) benefit from innovation ambidexterity for their growth. We argue that innovation ambidexterity in SMEs is sensitive to resource configuration, necessitating a careful fit assessment among firms’ internal resources (firm size), external resources (customer concentration) and the forms of innovation ambidexterity. Patent and utility model data from 912 firm-years for the 2000–2017 period in the Korean electronic parts industry were analysed using a feasible generalised least squares (FGLS) model. Consistent with our prediction, we establish that firm size is negatively related to the growth effect of balanced innovation ambidexterity (BIA), but positively to that of combined innovation ambidexterity (CIA), and that customer concentration is positively related to the growth effect of CIA. The three-way interaction patterns further demonstrate that smaller firms with high customer concentration achieve the best growth when pursuing BIA, whereas the same configuration can lead to the worst growth if they adopt CIA.

Plain English Summary

When does smallness help or hinder firms to implement innovation ambidexterity? We collected longitudinal innovation data from SMEs in the Korean electronic parts industry to examine how firm size, customer concentration and innovation ambidexterity affect firm growth individually and jointly. There are two important implications. First, for research, this study indicates that smallness is a liability for combined innovation ambidexterity (CIA), but it is an asset for balanced innovation ambidexterity (BIA). Our configurational approach further suggests that research should include a careful fit assessment of firm size, customer concentration and the organisational and technological requirements involved in BIA and CIA to be able to determine the liability and asset of smallness in innovation ambidexterity. Second, for practice, smaller firms are advised to pursue BIA to achieve sustainable growth, but larger SMEs are recommended to adopt CIA. Further to this, smaller firms with high customer concentration can achieve the best growth when pursuing BIA, whereas the same configuration of internal and external resources can lead to the worst growth if they adopt CIA. However, larger SMEs with high customer concentration can effectively pursue CIA and achieve the best growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The innovation literature suggests that pursuing both exploratory and exploitative innovation (henceforth, ‘innovation ambidexterity’) promotes sustainable growth (Benner & Tushman, 2003; March, 1991; O’Reilly & Tushman, 2013; Wang et al., 2019). This proposition attracts many small- and medium-sized enterprises (SMEs) that strive to grow through innovation (Audretsch, 2004; Bamiatzi & Kirchmaier, 2014). Yet, considerable debate regarding if and when SMEs benefit from innovation ambidexterity still persists in the literature (Bierly & Daly, 2007; Chang & Hughes, 2012; Solís-Molina et al., 2018).

The main debate concerns whether exploration and exploitation are incompatible or complementary (Cao et al., 2009; March, 1991; Uotila et al., 2009; Wei et al., 2013). The incompatibility perspective originally conceived by March (1991) claims that exploratory and exploitative activities involve trade-offs as they demand conflicting resources and organisational orientation. Therefore, it is more desirable for firms with limited resources to achieve an appropriate balance between the two to achieve sustainable performance, which reflects the balanced form of innovation ambidexterity (BIA) (Cao et al., 2009; He & Wong, 2004). By contrast, the complementary perspective suggests that exploration and exploitation reinforce each other as firms increase both activities; firms should therefore pursue their combined magnitude (He & Wong, 2004; Katila & Ahuja, 2002; Simsek et al., 2009), which reflects the combined form of innovation ambidexterity (CIA) (Cao et al., 2009). Prior studies have examined the effects of BIA and CIA on SMEs’ performance, but the findings have been mixed. For example, several studies have reported that enhanced performance is associated with the combined magnitude of exploration and exploitation by SMEs (He & Wong, 2004; Katila & Ahuja, 2002), but others have observed a negative relationship (Atuahene-Gima & Murray, 2007; Nerkar, 2003). This disparity might imply that theory on innovation ambidexterity is incomplete, as very few studies have examined internal and external resources and their compatibility with the characteristics of BIA and CIA.

This study focuses on nuanced differences in the resources required to implement BIA and CIA along with the attributes of SME resources such as the liabilities and assets of smallness. BIA and CIA might differ in terms of the ideal scale and attributes of the required resources. Further to this, as an organisational form, SMEs are characterised by not only their small resource scale, which may be considered a liability, but also their flexibility, which may function as an asset for managing innovation (Barney, 1991; Lee et al., 2010; Penrose, 1959; Terziovski, 2010). Another aspect of scarce resources that is mentioned by March (1991), yet has rarely been examined in the literature is external resources such as customers. Social capital theory suggests that SMEs can mobilise complementary resources and identify new opportunities through external networks with valuable resource holders (Granovetter, 1985; Pennings & Lee, 1999). In the commercialisation of technology, critical external networks include customer relationships (Birley & Westhead, 1990; Hewitt-Dundas, 2006). Social capital theory also suggests that the value of a firm’s internal resources is contingent on its social capital (Burt, 1997), which implies that the interplay of internal and external resources can affect the outcome of innovation ambidexterity.

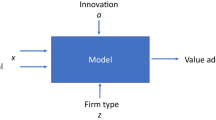

This study examines how SMEs’ resource configurations—internal resources, external resources and their interplay—influence the effects of BIA and CIA on firm growth. It is necessary to test our research model in a context in which SMEs face frequent changes in technological development, market demand and global competition. These conditions were met by the Korean electronic parts industry, which has undergone significant technological transformation. The advent of recent technological changes such as mobile telecommunication technologies, the Internet of things (IOT), sensors and robotics created entirely new product categories such as smartphones, flat-screen digital televisions and digital imaging. Such transformation usually results in the complete annihilation of old products. This accelerating rate of change especially impacts the electronic parts industry, as firms must constantly upgrade product performance to satisfy application demands for higher speed, reduced size and global availability (Hult, 2020). We collected longitudinal patent and utility model data from the Korean electronic parts industry from 2000 to 2017, which consists of 912 firm-years. We adopted panel-data linear models using a feasible generalised least squares (FGLS) model to calculate reliable estimates, accommodating for heteroskedasticity and autocorrelation (Greene, 2012; Wooldridge, 2002).

The findings of the present study demonstrate that smaller firms are relevant for BIA, but not for CIA, while larger SMEs are relevant for CIA, but not for BIA. Furthermore, customer concentration improves the effect of CIA on firm growth. Our three-way interaction analyses reveal that customer concentration is a sufficient condition for achieving growth through BIA in smaller SMEs and for realising growth through CIA in larger SMEs, indicating that the appropriate fit between internal and external resources and the proper form of innovation ambidexterity is critical. The empirical evidence, drawn from objective and longitudinal innovation data, complements existing empirical findings obtained with subjective and static survey data and offers a comprehensive and nuanced resource-based model of innovation ambidexterity in the context of SMEs.

2 Theoretical background and hypotheses

2.1 Balanced innovation ambidexterity (BIA) and combined innovation ambidexterity (CIA)

Exploratory innovation refers to developing new technology aimed at revealing new possibilities and variations novel to a firm, taking the technology into a field’s new aspect or into an unrelated business (March, 1991). Exploration challenges a firm’s existing cognitive structure (Lei et al., 1996) and increases its stock of knowledge and problem-solving ability (Ahuja & Lampert, 2001; Katila & Ahuja, 2002). Conversely, exploitative innovation refers to developing technology that falls within a firm’s existing technology portfolio and deepens its current technological base, which usually involves incremental problem-solving and product and process improvements (March, 1991). Exploitation describes a firm’s efforts to make maximum use of its competencies by combining its existing technological knowledge in the most efficient manner (Katila & Ahuja, 2002).

The extant literature identifies two forms of innovation ambidexterity to pursue exploration and exploitation (Cao et al., 2009; Chang & Hughes, 2012; He & Wong, 2004). First, the perspective of BIA accommodates the incompatible learning activities associated with exploration and exploitation and therefore suggests that firms dynamically balance the relative levels of exploration and exploitation to optimally distribute scarce resources and attain sustainable performance (Cao et al., 2009). This perspective also posits that excessive exploration can increase the costs of knowledge integration, decrease search productivity and ultimately lead to diminishing returns to learning (Ahuja & Lampert, 2001; Katila & Ahuja, 2002; Levinthal & March, 1993; Lewin et al., 1999). Similarly, an overemphasis on exploitation often leads to the ‘success traps’ of single-loop learning, local searches or evolutionary learning (Katila & Ahuja, 2002; Levinthal & March, 1993; Lewin et al., 1999; March, 1991), which might foster inertia and reduce a firm’s adaptability to new opportunities and fresh product development (Cao et al., 2009; Gibson & Birkinshaw, 2004). Therefore, firms benefit from BIA since it enables them to avoid incompatibility in learning and take advantage of increasing returns of both exploration and exploitation.

Second, the CIA perspective is based on the idea that exploratory and exploitative activities do not necessarily compete for limited resources, but might actually complement each other in terms of learning and resource development (Cao et al., 2009). For example, exploration and exploitation may take place in complementary technological and market domains (Gupta et al., 2006). The idea of complementarity is deeply rooted in the absorptive capacity argument, given that the deep technological understanding that firms develop in the course of their exploitative activities facilitates their ability to reconfigure existing internal knowledge and identify and assimilate novel external knowledge (Cohen & Levinthal, 1990; Hansen & Hamilton, 2011; Wei et al., 2014; Zahra & George, 2002). For example, Intel’s early identification of a sustainable advantage in the microprocessor industry was based on its existing deep competencies in the memory chip industry (Burgelman, 1994). Exploration can promote exploitation as newly internalised outside knowledge and resources can be applied on a greater scale when combined with a firm’s existing competencies (Cao et al., 2009). The CIA concept therefore suggests that firms should engage in high levels of both exploration and exploitation activities to establish the sustainable performance that arises from the multiplicative effect of these complementarities (Cao et al., 2009; Gupta et al., 2006; Simsek et al., 2009).

As shown in Table 1, tests of whether BIA and CIA improved firm performance, especially SMEs, report mixed results. We claim that this limitation is, in part, due to the fact that most previous studies did not consider the resource issue. A few limited studies have analysed the impact of resources (Cao et al., 2009; Voss & Voss, 2013), but focused on internal resources and overlooked external ones such as customer networks. Further to this, the different attributes of internal resources such as the scale of internal resources and organisational flexibility (Choi & Shepherd, 2005) would have different roles in BIA and CIA. Another aspect untapped in the extant literature is determining the fit relationship between internal and external resources in conjunction with innovation ambidexterity.

2.2 Internal and external resources of SMEs

Internal resources, which can be represented by firm size (Wiklund & Shepherd, 2003), include intangible as well as financial and physical resources (Christensen, 1996). The small scale of resources in SMEs, compared to large firms, has been treated as a liability for innovation, because smaller firms must forgo the benefit of scale effects and increasing returns in their innovative activities (Aldrich & Auster, 1986; Gimenez-Fernandez et al., 2020). However, small firms might have unique attributes or benefit from intangible resources that form the basis of their competitive advantage. Resource theorists emphasise that a firm’s intangible resources play a role in conceptualising, using and transforming a firm’s resources in ways that maximise their value (Penrose, 1959). Small firms have unique intangible resources that can function as an asset for innovation in several respects (Josefy et al., 2015). First, small firms are heavily influenced by owner-entrepreneurs’ vision; as firm size increases, the influence of top management diminishes (Chen & Hambrick, 1995). Second, a smaller firm has better personal connections and a more unified culture and a stronger identity, which facilitates coordination and lowers transaction costs (Kogut & Zander, 1996). Third, small firms’ simpler asset profiles, ad hoc organisational routines and close management-employee communications improve learning processes (Rumelt, 1995). These attributes of small firms make them more flexible than large firms and able to quickly respond and adapt to environmental change. We therefore surmise that although smallness might be detrimental for CIA, it can be beneficial for BIA.

Social capital theory indicates that SMEs’ external networks enable them to acquire complementary external resources and new opportunities (Granovetter, 1985; Leenders & Gabbay, 1999; Pennings & Lee, 1999). Innovation occurs as firms, based on their resources and capabilities, recombine and assimilate external knowledge and technologies. In particular, networks with large and influential customers are a useful source of innovation and new opportunities (Chowdhury, 2011). The combined effects of internal and external resources improve firms’ in-depth understanding of how SMEs integrate internal and external resources to enhance firm growth by means of an ambidextrous innovation strategy.

2.3 BIA, resource configuration and SME growth: smallness as an asset

2.3.1 Smallness as an asset for BIA

The ‘asset of smallness’ thesis proposes several advantages of SMEs. The lean, cohesive and concentrated formal and informal organisational structures of SMEs facilitate more interaction between departments, increase synergies and promote speedy responses to environmental change (d’Amboise & Muldowney, 1988; Katila & Shane, 2005; Son et al., 2019). SMEs can compete effectively in small, niche markets in which their size justifies their investment in terms of products, customers and technology, which are sufficiently large for their size but unattractive to large firms (Arend & Wisner, 2005; Choi & Shepherd, 2005; Katila & Shane, 2005). Reflecting this fact, large firms have scale-based cost advantages, but SMEs create unique advantages arising from organisational flexibility, which can be achieved by relying more heavily on labour than capital and utilising more variable factors of production (Mills & Schumann, 1985). Output flexibility helps SMEs adapt easily to changing environments (Fiegenbaum & Karnani, 1991; Liñán et al., 2019).

We suggest that these attributes of smallness are suitable for forging a balance between exploration and exploitation. Smaller firms might be more capable of achieving close coordination between departments and personnel involved in exploration and exploitation so as to achieve a subtle balance between the two (Tripsas, 1997). Successful management of BIA needs to resolve a paradox—the contradictory yet interrelated elements that exist simultaneously and persist over time—which helps address the trade-offs between exploration and exploitation. This can be done more effectively in smaller organisations, where hierarchies are flat, production output is flexible and information exchange and coordination can be managed through informal structures and concentrated leadership (Andrevski & Ferrier, 2019; Chen & Hambrick, 1995; Liñán et al., 2019). Wherever these conjectures are appropriate, BIA seems to be a better fit for the scale and attributes of smaller firms’ resources. Therefore, BIA has a more significant effect on firm growth in smaller firms than in larger firms.

-

Hypothesis 1: The relationship between BIA and SME growth is moderated by the scale of a firm’s internal resources, such that the relationship is stronger for smaller SMEs.

2.3.2 External resources and BIA

Firms must build new resources and redeploy existing ones to implement BIA, but SMEs are usually slow in building new resources (Penrose, 1959). Social capital theory suggests that SMEs might overcome this limitation by tapping into customer networks because they provide access to customers’ financials, knowledge and other complementary resources (Birley & Westhead, 1990; Chowdhury, 2011; Hewitt-Dundas, 2006). In this regard, SMEs might benefit more from large customers, which are usually acquired by maintaining high sales concentrations rather than many small customers who each contribute a small percentage of sales (Birley & Westhead, 1990; Dolan & Humphrey, 2000; Yli-Renko et al., 2001). Creating a new business with emerging technology entails enormous uncertainty that easily exceeds what the typical SME can handle independently. Large customers supply committed small suppliers with the necessary technologies and resources to develop or co-develop new parts or modules for new products.

Furthermore, large customers and small suppliers can maintain collaborative relationships for exploitative activities to continuously improve their current products. Although exploitative (e.g. cathode ray tube (CRT) display products) and exploratory (e.g. liquid crystal display (LCD) display products) innovations are more likely to require different physical assets and technological knowledge, existing large clients and small suppliers can share extensive common understanding of each other’s assets and capabilities in existing businesses, which also enhance their knowledge on each other in exploration. Further to this, they might have a better understanding of human resources and therefore not require new social relationships to conduct exploratory innovation. In such close relationships, large customers’ knowledge of emerging technologies can spill over to smaller partners and enable them to make timely investments as well as develop their competencies in new technologies (Chowdhury, 2011). Therefore, when SMEs utilise the benefits of a high level of customer concentration, they can mitigate the trade-offs in their pursuit of BIA (Birley & Westhead, 1990). This is consistent with the point that a realistic solution to discovering new businesses for SMEs lies in pursuing those businesses targeted by large customers (Priem et al., 2012). If SMEs deal with many small customers, the aforementioned benefits would dissipate and the social and technological costs of BIA would increase. Thus,

-

Hypothesis 2: The relationship between BIA and SME growth is moderated by the concentration of customer resources such that the relationship is stronger for firms with a higher level of customer concentration.

2.3.3 Internal and external resource configurations for BIA

A deeper understanding of the relationship between innovation ambidexterity and firm growth can be determined through a configurational analysis among a firm’s smallness, external resources and the forms of innovation ambidexterity (cf. Ketchen et al., 1993; Miller, 1996; Wiklund & Shepherd, 2005).

We suggest that small firm size and high customer concentration create synergy in BIA implementation as external resources from highly concentrated customers mitigate the trade-offs in BIA in the context of resource constraints, thereby further enhancing the fit between smaller firms and BIA. Innovative small firms often lack the capabilities to effectively commercialise those innovations; that is, they need the manufacturing capacity and marketing capabilities to introduce and sell the innovative product in the market (Josefy et al., 2015). The value of smaller firms’ accrual of BIA by means of close coordination between exploration and exploitation in terms of organisational communication and production can be further enhanced by the presence of complementary resources and information on emerging technologies from large customers. For example, the pursuit of BIA by SMEs could be discussed with large customers acting as a strategic partner that will accordingly invest their resources to achieve the collaborative objectives communicated by SMEs. Specifically, large customers are positioned to identify and develop more rewarding opportunities and acquire additional complementary resources for smaller partners pursuing BIA. These useful external resources complement and enhance the suitable relationship between smaller firms and BIA, rather than create conflicts or misalignment. Therefore, the resulting new products can be more easily linked to sales by large customers. If these external resources from large customers are absent, smaller firms would face critical resource constraints in pursuing BIA, limiting their ability to accommodate the fit relationship between firm smallness and BIA.

In summary, our proposed synergistic relationship indicates that as firm size decreases, the fit between SMEs and BIA increases, which can be further enhanced by high customer concentration. Accordingly, the magnitude of growth for smaller firms adopting BIA will increase as customer concentration increases. Thus,

-

Hypothesis 3: There is a three-way interaction of BIA, firm size and customer concentration in predicting SME growth, such that the association between BIA and firm growth will be strongest when firm size is smaller and customer concentration is higher.

2.4 CIA, resource configuration and SME growth: smallness as a liability

2.4.1 Smallness as a liability for CIA

The present study postulates that while the complementary and absorptive capacity logics of CIA are compelling for general situations, there are several reasons that make them less applicable to SMEs. First, CIA focuses on the total magnitude of innovation. The pursuit of scale in innovation is inappropriate for resource-constrained SMEs. More importantly, the complementarity of exploration and exploitation in CIA relies on strong absorptive capacity—for example, having deep knowledge in each area of exploitation and exploration—but SMEs might not have such strong absorptive capacity since it is a function of the firm’s existing related knowledge and diversity of expertise. This process is path-dependent on early investment in a technological area (Cohen & Levinthal, 1990), which is conducted by large established firms that are able to secure financing for risky research and development (R&D) projects, not by SMEs that lack the capital and extensive resources of their larger counterparts (Schumpeter, 1942). The innovation literature has established the existence of a positive size effect on R&D investment (Ortega-Argilés et al., 2009). The suggestion that successful exploration enhances the economics of exploitation (Cao et al., 2009) also indicates that CIA is essentially based on scale.

Second, large-scale operations of exploration and exploitation would ‘entail not only separate structural units for exploration and exploitation but also different competencies, systems, incentives, processes and cultures each internally aligned’ (O’Reilly & Tushman, 2008: p. 192). CIA requires organisational remedies to coordinate complex activities and potential conflict between the two technological areas within the firm. Firms may adopt several organisational solutions to mitigate the tension and achieve positive interaction between exploitation and exploration, which include structural differentiation, top management integration, fostering appropriate context or sequential shifting, forming two loosely coupled, specialised organisations and inserting buffering between organisational units (Benner & Tushman, 2003; Cao et al., 2009; Christensen, 1997; Gibson & Birkinshaw, 2004; Jansen et al., 2009; Levinthal, 1997; O’Reilly & Tushman, 2004; Simsek et al., 2009; Tushman & O’Reilly, 1996; Wei et al., 2014). These organisational remedies require additional resources and organisational attention. The amount of resources required to mitigate the acute organisational trade-offs involved in CIA might exceed what SMEs can afford independently (Nason et al., 2015).

The above-mentioned attributes of CIA may become more severe constraints as firm size decreases. The liability of smallness thesis suggests several disadvantages of smaller firms, since they face financial constraints, scarcity of slack resources and insufficient managerial talent (Aldrich & Auster, 1986; Arend, 2014; Carreira & Silva, 2010; Fackler et al., 2013; Tsvetkova et al., 2014). Prior studies such as Nason et al. (2015) and Wiklund and Shepherd (2003) reported that small firms holding insufficient slack resources to invest in innovative activities experience less growth than resource-rich firms. The negative effect of resource constraints on the relationship between innovation and growth will become more severe as smaller firms pursue CIA. As the magnitude of exploration and exploitation activities increases in smaller firms, the tension and conflict between the two become more significant. If small firms divide their limited resources to support both exploration and exploitation, neither might reach a critical mass. Integrating different learning activities between relatively few individuals might be insufficient to create a significant synergy at the organisational level. Therefore, there will be a trend for firms to develop specialisation in each innovation field and install specialised units (Christensen, 1997; Tushman & O’Reilly, 1996). Even so, organisational conflict between the exploration and exploitation units might arise as resources become severely limited, making smaller firms unable to maintain a high level of engagement and fail to develop specialisation in each innovation. Further to this, smaller firms’ flexible attributes might lose merit with CIA.

-

Hypothesis 4: The relationship between CIA and SME growth is moderated by the scale of a firm’s internal resources, such that the relationship is weaker for smaller SMEs.

2.4.2 External resources and CIA

In CIA, exploration and exploitation support each other and help leverage the effects of the other. In this relationship, each innovation should have deep technological knowledge or absorptive capacity in its own area (Katila & Ahuja, 2002). However, strong absorptive capacity in exploration and/or exploitation requires large-scale operations and R&D investment, which SMEs are likely to have difficulty building independently (Cohen & Levinthal, 1990). As CIA requires critical mass or scale in innovation activities, SMEs pursuing CIA could be motivated to use external resources. Embedded relationships with large customers involve the exchange of reciprocal favours, a long-term horizon, governance flexibility and continuity in the relationship (Fischer & Reuber, 2004; Larson, 1992; Uzzi, 1997), which enables SMEs to better leverage knowledge acquired from their key customers (Yli-Renko & Janakiraman, 2008). Therefore, the presence of such embedded relationships with large customers can be a useful external resource with which SMEs can achieve deep knowledge or absorptive capacity in exploration and/or exploitation. Research suggests that cooperation with large customers is an important source of knowledge for firms pursuing radical innovation, which facilitates growth in innovative sales, even in the absence of formal R&D cooperation (Belderbos et al., 2004; Fritsch & Lukas, 2001). In particular, when products are novel and complex and therefore require adaptation-in-use by customers, collaboration might be essential to ensure market expansion (Tether, 2002). Furthermore, those benefits from large customers in terms of resource acquisition enable SMEs to reduce the resource gap in CIA.

-

Hypothesis 5: The relationship between CIA and SME growth is moderated by the concentration of customer resources, such that the relationship is stronger for firms with a high level of customer concentration.

2.4.3 Internal and external resource configurations for CIA

On the relationship between CIA and SMEs, we have argued that CIA is more suitable for firms of a larger size and with a higher level of customer concentration. We further argue that large firm size and high customer concentration create synergy in implementing CIA because external resources from highly concentrated customers can enhance the complementarity in CIA in the context of resource constraints, thereby further enhancing the fit between larger SMEs and CIA.

We conjecture that the value of larger SMEs on CIA is accrued by means of strong absorptive capacity and that organisational slack can be further enhanced by the presence of large customers since they strengthen the fit through their complementary resources. Large customers might act as a strategic partner for SMEs. SMEs’ pursuit of CIA would be communicated to large customers, who might provide complementary resources that can help SME partners create scale effects and deeper absorptive capacity in exploration and exploitation.

The value of high customer concentration on CIA is further enhanced by the presence of larger SMEs. The influence of large customers would be catered to a level suitable to their understanding of CIA, which would be unabsorbed by smaller firms. There might be a large gap between the absorptive capacity of smaller firms and the resources and knowledge brought by large customers. The mismatch between smaller firms’ resource attributes and their innovation dimension (i.e. CIA) would dissipate the positive effect of customer concentration on the relationship between CIA and firm growth. Smith and his colleagues (1991) reported that innovation collaborations between large and small firms sometimes did not fulfil their commercial function due to size disparity. Some aspects of size disparity are described as follows, ‘the larger company imposed standards on the instrument which the technical staff in the smaller company knew would make it too complex to operate. Those involved in the technical collaboration were unable to withstand the pressure to make the instrument overly sophisticated and the market for the product turned out to be smaller than expected’ (Smith et al., 1991: p. 464). Therefore, the influence of large customers in improving the effect of CIA on firm growth might become marginal or ineffective if firm size decreases.

In summary, as firm size and customer concentration increase, the effects of firm size and customer concentration can be multiplied. Accordingly, the magnitude of growth for larger SMEs adopting CIA will increase as customer concentration is improved and vice versa.

-

Hypothesis 6: There is a three-way interaction of CIA, firm size and customer concentration in predicting SME growth, such that the association between CIA and firm growth will be strongest when firm size and customer concentration are highest.

3 Methods

3.1 Research setting

The research model of this study was tested with data from SMEs in the Korean electronic parts industry. A number of considerations motivated the choice of the electronics parts industry as the setting of the study. To investigate how SMEs’ resource configuration (i.e. internal resources, external resources and their interplay) influenced the effects of BIA and CIA on firm growth, it was necessary to test our research model in a context in which SMEs faced frequent changes in technological development, market demand and global competition.

For the past 20 years, Korea has been the world’s third—or fourth—largest producer of electronic components along with the USA, China and Japan (ILO, 2014; Suh, 2002). The industry in Korea is composed largely of SMEs—96% of the firms had fewer than 300 employees (KOSIS 2016). These SMEs supplied a wide variety of products from labour-intensive products such as transformers, mono-layered printed circuit boards (PCBs) and traditional resistors to technology-intensive novel products such as multi-layered flexible PCBs, connectors and stepping motors. The industry has undergone a series of technological changes. The launch of Windows in 1995 and the emergence of e-business led to an information communication technology (ICT) boom. The industry also experienced significant changes such as the introduction of the smartphone in the 2000s and fourth industrial revolution technologies such as the IOT, sensors and robotics in the 2010s. Table 2 shows that broadcasting and wireless communication emerged as the next dominant product categories during the 2000s and 2010s, whereas the markets for wired communication and personal computers had become saturated.

Table 3 demonstrates the growth patterns of various segments of the Korean electronic parts industry during the same period. The markets for semiconductors and display devices rapidly expanded, whereas the market for electronic tubes was almost eliminated. ICT and digitalisation technologies reduced the demand for traditional electronic parts, but a series of new products that digitalised the functions of traditional electronic products were rushed to market. The pressure for digitalisation and the accelerated time-to-market of end products inevitably required technological innovations in the electronic parts industry, which resulted in the modularisation and integration of several different parts into smaller chips. In response to such environmental change, some SMEs that hastened to compete in their traditional product lines established automated production facilities to achieve better quality and cost efficiency. This effort involved exploiting their current technological capabilities to the maximum extent. Conversely, other SMEs searched extensively for new opportunities by exploring novel technological capabilities, often in cooperation with large client companies located downstream on the industry value chain. Furthermore, this industry is mostly an industrial market in which the customers are industrial companies, although there are also quite substantial markets for dealers and distributors where they can meet end customers, indicating that SMEs in this industry have substantial room to make strategic choices on their target markets.

3.2 Sample and data collection

To test SMEs’ changes in innovation activities and their effects on firm growth, we targeted SMEs with a sufficiently long history. We formed a dataset by conducting in-depth interviews and archival data collection for the sample firms identified from the Korean Association of the Electronic Parts Industry’s directory in 1990. We targeted SMEs deriving more than 80% of their revenue from electronic parts and having between 50 and 300 employees in 1990. In Korea, the SME category for the electronics industry includes firms with fewer than or up to 300 employees. We did not include firms with fewer than 50 employees as it appeared that the information and data required for this study were not readily available in firms with limited managerial resources. Through this process, we identified 143 firms that satisfied the above criteria.

Of the identified 143 SMEs, 28 firms were excluded due to insufficient data on technology development activities and financial data and 38 firms were bankrupt or had merged, mainly due to the Asian financial crisis in 1997. As a result, our final sample for this study comprised 77 firms representing 912 firm-years of unbalanced panel data for the 2000–2017 period (observations from the initial period, 1998–1999, were used to calculate lagged variables). The final sample’s average age was 27 years, the average assets were 72 billion Korean won (i.e. 60 million US dollars), the average sales growth rate was 7% and the average return on sales (ROA) was 3.5%. We used multiple sources to collect data, including interviews, Korea Enterprise Data, a leading Korean credit information company, and the Korea Institute of Patent Information database.

3.3 Measurements

3.3.1 Dependent variable

Firm growth was measured in terms of the annual percentage growth in a firm’s sales (He & Wong, 2004), which is defined as [(Salest − Salest−1)/(Salest−1)] × 100, where t is an annual index.

3.3.2 Independent and moderating variables

Scholars in innovation studies have long used patents as an indication of innovation, which include information on a description of a technical problem and a solution and consistent chronology of how firms solve problems (Katila & Ahuja, 2002; Walker, 1995). The fact that patents contain information on the chronology of technological problem-solving is well-suited for measuring a firm’s exploration and exploitation activities (Katila & Ahuja, 2002; Rosenkopf & Nerkar, 2001). While the propensity for patenting considerably differs across industries, as they differ in the degree of patentable knowledge and the use of trade secrets (Cockburn & Grilliches, 1988), the present study is relatively free from this issue since it focuses on a single industry—electronics parts—and patents are a major appropriability mechanism in the electronics industry (Kim et al., 2016).

Exploratory innovation was measured as a firm’s average number of patents and utility models for 2 years, which did not overlap, at the four-digit level of the International Patent Classification (IPC) system, with any prior patents or utility models previously awarded to the firm (Ahuja & Lampert, 2001). For exploitative innovation, we used a firm’s average number of patents and utility models for 2 years that overlapped, at the four-digit level of the IPC, with prior patents or utility models previously awarded to the firm. We used a 2-year average value of patents and utility models to reduce the variation in the timing. This also addresses the gap between knowledge creation/technology development represented by patents and utility models (cf. Hoskisson et al., 1993) and the introduction of products to the market (Grupp et al., 1990; Katila & Ahuja, 2002). Our own qualitative investigation of the sample firms suggests that they took 10 months, on average, to develop new products that differed significantly from their previous products. Using four-digit IPC classifications is consistent with the procedure followed by prior studies (Lerner, 1994) and enabled a more detailed comparison of technologies (Quintana-García & Benavides-Velasco, 2008). In the operationalisation of balanced innovation ambidexterity (BIA), we followed the treatment used in prior studies (He & Wong, 2004) and calculated it by taking the negative of the absolute difference between exploratory and exploitative innovations. Consistent with previous studies (Gibson & Birkinshaw, 2004; He & Wong, 2004), we measured combined innovation ambidexterity (CIA) by multiplying the values of exploratory and exploitative innovations.

Past studies measured the smallness of internal resources according to firm size (Djupdal & Westhead, 2015; Fackler et al., 2013; Short et al., 2009; Varum & Rocha, 2012). Firm size has been long and widely investigated in the SME literature to determine its impact on SMEs’ innovation and internal characteristics such as organisational and financial structure (Acs & Audretsch, 1988; Blau, 1970; Bluedorn, 1993; Degryse et al., 2012; Wiklund & Shepherd, 2003). In this study, we measured firm size by total assets (He & Wong, 2004) in 10 billion Korean won (US$10 million), which was then transformed to its natural logarithm to reduce skewness (Gomez-Mejia et al., 2003).

We focused on external resources in the form of what SMEs could access through external networks with large customers. The notion of customer concentration has been investigated to explain its influence on new product development and initial public offerings in technology-based businesses (Heide & John, 1988; Yli-Renko & Janakiraman, 2008; Yli-Renko et al., 2001). In these studies, the most commonly used measure of customer concentration is the proportion of total sales accounted for by the largest customer. Following prior studies, we operationalised customer concentration with the largest customer’s sales ratio to total sales in a firm.

3.3.3 Control variable

Several variables were included in the analysis to explain industry- and firm-specific effects. The dependent variable with 1-year and 2-year lags, firm growth (lag1) and firm growth (lag2), were included in the analysis to account for the effects of firm-specific factors on growth. A firm’s profitability was measured according to its return on assets (ROA). Firm age has been found to influence firm growth (Carroll & Hannan, 2000; He & Wong, 2004). We controlled for firm age, which was quantified using the focal year minus the founding year of the firm. To control for year-specific effects, year dummies were also included in the analyses.

3.3.4 Analysis

For panel data, ordinary least squares (OLS) estimation might yield biased estimates due to unobservable heterogeneity in firm characteristics. We therefore adopted panel-data linear models using FGLS, which is known to provide more reliable estimates in the presence of heteroskedasticity and autocorrelation (Greene, 2012; Wooldridge, 2002). While patents are comprised of count data, the general property of count data is that as the count scale and the number of trials become larger, its distribution approaches normality (Box et al., 1978). Moreover, when count variables are used as explanatory variables, they do not violate any distributional assumptions regarding explanatory variables. For example, using integer-valued explanatory variables does not violate any OLS regression assumptions. In the FGLS estimation model adopted in this study, whether an independent variable is normally distributed is not a condition for the best linear unbiased estimator (BLUE) property. For these reasons, previous studies using patents treated patent counts as a continuous variable (Katila & Ahuja, 2002; Quintana-García & Benavides-Velasco, 2008). Since BIA and CIA are correlated, interaction terms involving BIA and CIA raise concerns about multicollinearity. Several studies such as Cohen et al. (2003) have shown that if the first-order variables are mean-centred, the resulting interaction term will be minimally correlated. In this study, we adopted the mean-centred approach for variables entered into an interaction term and investigated the possibility of multicollinearity by using the variance inflation factor (Kleinbaum et al., 1988).

4 Results

Table 4 presents descriptive statistics and correlation coefficients describing the variables. Our dependent variable, firm growth, shows low coefficients with independent, moderating and control variables. Although the majority of the correlation coefficients are low, several correlations involving variables such as firm size, customer concentration, BIA and CIA were significant. To reduce the impact of these correlations on the estimates, the variables involved in the interaction terms were mean-centred and our results suggested that multicollinearity is not a serious concern in the analysis.

Table 5 presents the coefficients of the FGLS panel estimations. In model 1, the control variables, moderating variables and BIA and CIA were entered. The results indicate that firm growth (lag1), ROA and firm age were significantly related to firm growth.

Hypothesis 1 suggests that BIA has a greater impact on firm growth in smaller firms than larger firms. In model 2, the term representing the interaction of BIA and firm size has a negative and significant coefficient (− 0.102, p ≤ 0.001). The nature of the interaction is plotted in Fig. 1, in which low and high levels are plotted on the x-axis of BIA and the y-axis of firm growth. The plot indicates that the impact of BIA on firm growth increases when firm size is low, but decreases when firm size is high. These findings support hypothesis 1.

Hypothesis 2 proposes that any positive relationship between BIA and firm growth is strengthened as customer concentration increases. The coefficient of the interaction term between BIA and customer concentration in model 2 is positive but insignificant, thus rejecting hypothesis 2.

Hypothesis 3 suggests a three-way interaction effect among BIA, firm size and customer concentration on firm growth. Model 3 shows a negative and significant coefficient for the three-way interaction term (− 0.425, p ≤ 0.001), along with a negative and significant coefficient for the interaction between BIA and firm size (− 0.184, p ≤ 0.001) and a positive and significant coefficient for the interaction between BIA and customer concentration (2.442, p ≤ 0.001). The nature of the three-way interaction is plotted in Fig. 3a, where low and high levels are plotted on the x-axis of BIA and the y-axis of firm growth. The plots indicate that the effect of an increase in BIA on firm growth is improved with a lower firm size, while it does not change much with a higher firm size. Furthermore, for smaller SMEs, the effect is much greater when customer concentration is higher rather than lower. These findings support h3.

Hypothesis 4 proposes that the influence of CIA on growth is positively augmented as firm size increases. In model 4, the interaction term between CIA and firm size has a positive and significant coefficient (0.006, p ≤ 0.05). The nature of the interaction is plotted in Fig. 2a. The plot indicates that the impact of an increase in CIA on firm growth is negative when firm size is low, while it is positive when firm size is high, which supports hypothesis 4.

Hypothesis 5 proposes that the influence of CIA on growth is enhanced with an increase in customer concentration. In model 4, the interaction term between CIA and customer concentration has a positive and significant coefficient (0.169, p ≤ 0.01). The nature of the interaction is plotted in Fig. 2b. The plot indicates that the impact of CIA on firm growth becomes positive when customer concentration is high, while it becomes negative when customer concentration is low.

Hypothesis 6 proposes a three-way interaction effect among CIA, firm size and customer concentration on firm growth. Model 5 shows a positive and significant coefficient for the three-way interaction term (0.09, p ≤ 0.01), along with a positive and significant coefficient for the interaction between CIA and firm size (0.027, p ≤ 0.001) and a negative and significant coefficient for the interaction between CIA and customer concentration (− 0.328, p ≤ 0.05). The nature of the three-way interaction is plotted in Fig. 3b, in which low and high levels are plotted on the x-axis of CIA and the y-axis of firm growth. The plots indicate that the effect of an increase in CIA on firm growth is significantly improved when both firm size and customer concentration are high, but is drastically decreased when firm size is low and customer concentration is high. These findings support hypothesis 6.

The results appear to be robust to the use of alternative estimation methods, measures and time periods. The adoption of different estimation methods in FGLS returned consistent results. Further to this, the three-way interaction models including only hypothesised lower-interactions returned very consistent coefficients. The results obtained with each year’s number of patents and utility models for exploratory and exploitative innovation also returned consistent findings as those obtained using a 2-year average. The inclusion and exclusion of the lagged dependent variable as a control variable did not alter the findings. In addition, we tested our model in a different time period, from 2010 to 2017, and verified that the results were consistent with those we obtained using the entire period. Given that there might be various environmental uncertainties, stages of product/market evolution and technological capability levels over time (Sidhu et al., 2007) that alter the relationships among those variables between the two periods, the consistent results obtained with the different dataset strongly indicate that the hypotheses presented by this study are applicable to a different time period for the electronic parts industry.

The results reported in this study appear to have substantial statistical power. According to studies analysing the estimates of statistical power under varying sample sizes in multi-level models (Heo & Leon, 2010; Scherbaum & Ferreter, 2009), our sample of 912 firm-year observations from 77 firms over 12 years satisfies the condition that a significant three-way interaction effect has 90% statistical power. Further to this, Snijders and Bosker (1999) suggest that when sample size is large enough the estimate of a regression coefficient in multi-level models is approximately normally distributed and hence statistical power can be calculated based on standard errors in reference to the standard normal distribution. In this approach, the coefficients of the three-way interactions involving BIA and CIA and their standard errors turned out to satisfy the condition to have 90% statistical power. These analyses indicate that the question of whether three-way interactions have enough statistical power in organisational research (Murphy & Russell, 2017) would be not a concern for our study.

5 Discussion and conclusion

5.1 Theoretical and practical implications

This study offers a resource-based explanation and empirical evidence for the extent to which resource-constrained SMEs successfully manage innovation ambidexterity and achieve sustainable growth. The empirical findings of this study contribute to the ambidexterity theory and the practice of SMEs in several important ways.

5.1.1 Theoretical implications

Our findings, obtained with objective and longitudinal innovation data for a technology-intensive industry, demonstrate that BIA is highly instrumental for the growth of smaller firms and CIA is effective for larger SME growth. While many previous studies reported a positive effect of CIA on growth (Cao et al., 2009; He & Wong, 2004; Katila & Ahuja, 2002), our findings cast strong doubt regarding this generally positive influence. Instead, our findings provide contingent support for a positive influence, provided firm size is sufficiently large (Atuahene-Gima & Murray, 2007). Among those studies that investigated ambidexterity in the context of SMEs (see Table 1), this study, to the best of our knowledge, is the first to provides empirical results based on long-term, objective innovation data that support March’s (1991) seminal work on the relationship between resources and ambidexterity—a positive effect of BIA and a negative effect of CIA on firm growth in smaller firms and vice versa for larger SMEs.

Conceptually, we applied an extended notion of resources by not only including resource constraints but also incorporating the organisational attributes associated with small and large firms, such as the organisational flexibility of SMEs (Blau, 1970; Bluedorn, 1993; Penrose, 1959). We argued that the distinct attributes of small organisations are better aligned with the requirements that BIA demands for the best performance, while the attributes of larger organisations are better matched with the requirements that CIA demands for the best performance. Consistent with this argument, this study’s empirical evidence suggests that firm smallness is not always a liability for innovation ambidexterity; it might be a liability for CIA, but it could be an asset for BIA. These more nuanced relationships extend the extant literature that draws on resource scale and the liability of smallness. Therefore, the argument that due to resource constraints, SMEs are inept at conducting innovation ambidexterity requires modification. Our findings strongly suggest that firms’ ability to benefit from innovation ambidexterity depends on the fit between the form of innovation ambidexterity and firm size.

In addition to internal resources, this study investigated external resources that have rarely been studied in the innovation ambidexterity literature. Our findings that external networks with large customers (i.e. high customer concentration) improve the effect of CIA suggest that SMEs should consider external networks as a valuable input for the process of innovation ambidexterity. A good example that illustrates the positive influence of customer concentration is Elantec, a Samsung Electronics supplier. Founded in 1977, Elantec supplied Samsung Electronics with CRT monitor components such as CRT sockets, remote controllers for home appliances and wire harness products, generating 4 billion won (US$3.6 million) of revenue in the late 1980s. At the beginning of the 1990s, the demand for CRT products began declining due to the emergence of LCD products. Elantec, however, remained in the CRT market, focusing on less developed regions, such as Asia and Africa, and making many small electronic products for consumer markets, such as portable karaoke systems, pagers, caller identification telephones, closed-circuit televisions, video door phones, dehumidifiers, air-cleaners and water purifiers. While it was exploring these consumer markets, the firm missed out on the entire emerging LCD market and failed to attract new customers. In 1996, Elantec resumed its relationship with Samsung Electronics, supplying new battery pack products for portable electronic devices such as notebook computers and mobile phones and has grown rapidly ever since. Before the firm started its battery pack business with Samsung in 1995, its revenue was 10,400 million won (US$9.2 million); this revenue increased tenfold by 1999. Our empirical findings and the anecdotal example above exemplify the fact that the effects of innovation ambidexterity on SMEs are not uniform, but depend on social capital gained through external networks with customers, especially large ones. This finding requires additional attention to be accorded to the role that external resources play in studying innovation ambidexterity.

Further to this, this study has offered novel empirical evidence for the fit relationship between innovation ambidexterity, firm size and external networks in influencing SME growth. Despite the extensive literature on ambidexterity, not much is known about the fit mechanisms that illustrate the best internal and external resource configurations for a specific form of innovation ambidexterity (cf. Ketchen et al., 1993; Miller, 1996). By examining three-way interaction relationships, we discovered that greater understanding could be gained by the concomitant consideration of the form of innovation ambidexterity, firm size and external networks. The nature of these configurations suggests that smaller resource-constrained firms with a flexible organisation can experience superior growth if they pursue BIA with a high level of customer concentration. This highlights that customer concentration is a sufficient condition for SMEs to achieve growth through BIA. Although smaller firms are relevant for BIA, if they lack external resources, their ability to grow as a result of BIA is significantly limited (see Fig. 3a). Similarly, the configurational approach helps identify the appropriate resource conditions for SMEs’ implementation of CIA by suggesting that larger SMEs with a higher level of customer concentration achieve superior growth when they pursue CIA. This highlights that customer concentration is a sufficient condition for SMEs to achieve growth through CIA. Although larger SMEs are relevant for CIA, if they lack external resources, their growth is significantly limited (see Fig. 3b). The findings also imply that it is very dangerous for smaller firms with a high level of customer concentration to choose CIA, whereas they can significantly improve their growth by pursuing BIA.

Except for Katila and Ahuja (2002), most previous studies used subjective measures in their investigation of ambidexterity innovation and firm performance. In the management literature, subjective measures are widely used for research and generally understood as equivalent to objective measures (Wall et al., 2004). Subjective and objective measures feature their own limitations. Subjective measures are subject to systematic bias and random error, while objective measures tend to be narrowly focused and are usually representative of lower-order factor structures (Bommer et al., 1995). In this sense, the results we obtained with objective measures complement previously calculated empirical evidence developed using subjective measures on innovation ambidexterity and firm growth.

5.1.2 Practical implications

The findings of this study provide valuable practical implications for SME owners and managers. SMEs, in choosing innovation strategies, should carefully assess their internal resources in terms of scale and attributes and their access to external networks with large customers. SMEs should design their innovation ambidexterity strategy to match their resource configuration. In technology-intensive industries in which technological discontinuities occur, smaller SMEs can achieve sustainable growth by pursuing BIA, not CIA. However, in doing so, small firm owners should ensure access to large customers as a strategic partner or collaborator. Otherwise, as our three-way interaction results suggest, their BIA would result in limited growth. Although the majority of past studies have indicated that SMEs can achieve growth through CIA, our findings suggest that CIA is sensitive to the scale of exploration and exploitation operations and therefore can be the incorrect ambidexterity strategy for most SMEs. If SMEs pursue CIA without substantial scale, CIA becomes a risky innovation strategy and even riskier with the participation of large customers. SMEs must be very cautious of the risk of CIA and should conduct a thorough independent evaluation rather than be swayed by large customers’ decisions.

5.1.3 Limitations and future research

Future studies will benefit from comparative research to further examine whether the relationships identified in this study hold in different industrial and geographic environments. The organisational and production flexibility associated with SMEs might differ across various industries. In industries where production efficiency relies on automation, the smallness of SMEs may not guarantee their flexibility (Fujimoto, 2007) and therefore not fit with BIA. As the relationship between innovation ambidexterity and performance consequences can be affected by various environmental uncertainties, the stage of product/market evolution and technological capability level (Bierly & Daly, 2007; Sidhu et al., 2007), our findings must be verified in other industries in both advanced and developing contexts. SMEs might also differ in their dependence on large customers in innovation across countries. For example, in Italy, small firms form a community such as industrial districts ‘in which productive resources are jointly procured, developed and utilised, commercial services shared and intermediary institutions created to elicit and maintain interfirm cooperation’ (Loveman & Sengenberger, 1991: p. 1). Therefore, investigating the effect of external resources on such industrial districts in terms of the way that SMEs pursue BIA and CIA is a worthwhile endeavour.

Moreover, there is a concern that forming a close relationship with large customers might depend on a small firm’s capabilities, which could influence findings with respect to customer concentration. Past studies have reported that the dependence of SMEs on large customers is influenced by several factors such as the CEOs’ prior work relationship and the customisation of products to certain customers’ needs. Those studies indicated that a higher level of customer concentration might lead to lower bargaining power and reduced profitability, which will abbreviate SMEs’ slack and lead to less exploration. This perspective counters the argument that large customers select technologically superior suppliers.

More research on the fit relationships would be worthwhile for deeper insight into SMEs’ ambidexterity. For example, identifying the environmental and industrial conditions that maximize the returns on innovation ambidexterity for SMEs with various internal and/or external resources is necessary (Katila & Shane, 2005; Zimmermann et al., 2018) as is examining how SMEs make the necessary strategic changes to establish a dynamic fit between dimensions of ambidexterity and environmental and organisational contingencies (cf. Zajac et al., 2000). In doing so, future research might determine more instrumental findings by incorporating past studies that have investigated organisational structure and leadership (Chang & Hughes, 2012), corporate shareholdings (Gedajlovic et al., 2012) and top management team’s behavioural integration (Lubatkin et al., 2006) as factors that enable ambidexterity.

While this study has focused on sales growth, firm growth is a multi-dimensional concept that includes employment growth (Baum et al., 2001). Many scholars agree that sales growth and employment growth are two distinct dimensions of firm growth and have demonstrated that they are influenced by different factors (Baum et al., 2001; Delmar et al., 2003). For example, Chandler et al. (2009) showed that the relationship between sales growth and employment growth is moderated by transaction cost factors such as asset specificity and behavioural uncertainty, which is stronger when resources are deficient. Other previous research reported a weak correlation between the two growth measures (Delmar et al., 2003; Weinzimmer et al., 1998). This aspect should be considered in interpreting this study’s findings and future research would benefit from the development of a theoretical model that explains how BIA and CIA contribute to employment growth and/or how employment growth co-evolves along with BIA and CIA in a firm.

6 Conclusion

This study has offered a comprehensive and nuanced resource-based model for explaining when SMEs operating in technology-intensive industries achieve growth through innovation ambidexterity. We have investigated how BIA and CIA are configured with internal resources (i.e. firm size) and external networks (i.e. customer concentration) to achieve firm growth. In doing so, we applied an extended notion of resources to include not only resource scale but also resource attributes, which enabled this study to reflect the role of smaller firms’ flexibility in innovation ambidexterity. The findings drawn from objective data on innovation ambidexterity have demonstrated that the effect of BIA on firm growth is positive for smaller firms and CIA is effective for growth when firms are larger. Also, customer concentration improves the effect of CIA on firm growth. Our three-way interaction analyses further highlighted that smaller firms with high customer concentration achieve the best growth when pursuing BIA, while the same configuration of internal and external resources can lead to the worst growth if they adopt CIA. In sum, this study suggests that the traditional approach to evaluating innovation ambidexterity in SMEs must include a careful fit assessment of firm size, the availability of external resources and the organisational and technological requirements involved in BIA and CIA, which would then be able to determine the liability and asset of smallness in innovation ambidexterity.

References

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms: an empirical analysis. American Economic Review, 78(4), 678–690. https://www.jstor.org/stable/1811167

Ahuja, G., & Lampert, C. M. (2001). Entrepreneurship in the large corporation: A longitudinal study of how established firms create breakthrough inventions. Strategic Management Journal, 22, 521–543. https://doi.org/10.1002/smj.176

Aldrich, H., & Auster, E. R. (1986). Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in Organizational Behaviour, 8, 165–198. https://psycnet.apa.org/record/1988-12,412-001

Andrevski, G., & Ferrier, W. J. (2019). Does it pay to compete aggressively? Contingent roles of internal and external resources. Journal of Management, 45(2), 620–644. https://doi.org/10.1177/0149206316673718

Arend, R. J. (2014). Entrepreneurship and dynamic capabilities: How firm age and size affect the ‘capability enhancement–SME performance’ relationship. Small Business Economics, 42(1), 33–57. https://doi.org/10.1007/s11187-012-9461-9

Arend, R. J., & Wisner, J. D. (2005). Small business and supply chain management: Is there a fit? Journal of Business Venturing, 20(3), 403–436. https://doi.org/10.1016/j.jbusvent.2003.11.003

Atuahene-Gima, K., & Murray, J. Y. (2007). Exploratory and exploitative learning in new product development: A social capital perspective on new technology ventures in China. Journal of International Marketing, 15(2), 1–29. https://doi.org/10.1509/jimk.15.2.1

Audretsch, D. B. (2004). Sustaining innovation and growth: Public policy support for entrepreneurship. Industry and Innovation, 11(3), 167–191. https://doi.org/10.1080/1366271042000265366

Bamiatzi, V. C., & Kirchmaier, T. (2014). Strategies for superior performance under adverse conditions: A focus on small and medium-sized high-growth firms. International Small Business Journal, 32(3), 259–284. https://doi.org/10.1177/0266242612459534

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

Baum, J. R., Locke, E. A., & Smith, K. G. (2001). A multidimensional model of venture growth. Academy of Management Journal, 44(2), 292–303. https://doi.org/10.5465/3069456

Belderbos, R., Carree, M., & Lokshin, B. (2004). Cooperative R&D and firm performance. Research Policy, 33(10), 1477–1492. https://doi.org/10.1016/j.respol.2004.07.003

Benner, M. J., & Tushman, M. L. (2003). Exploitation, exploration, and process management: The productivity dilemma revisited. Academy of Management Review, 28(2), 238–256. https://doi.org/10.5465/amr.2003.9416096

Bierly, P., & Daly, P. S. (2007). Alternative knowledge strategies, competitive environment, and organizational performance in small manufacturing firms. Entrepreneurship Theory and Practice, 31, 493–516. https://doi.org/10.1111/j.1540-6520.2007.00185.x

Birley, S., & Westhead, P. (1990). Growth and performance contrasts between ‘types’ of small firms. Strategic Management Journal, 11(7), 535–557. https://doi.org/10.1002/smj.4250110705

Blau, P. M. (1970). A formal theory of differentiation in organizations. American Sociological Review, 35, 201–218. https://doi.org/10.2307/2093199

Bluedorn, A. C. (1993). Pilgrim’s progress: Trends and convergence in research on organizational size and environments. Journal of Management, 19(2), 163–191. https://doi.org/10.1177/014920639301900201

Bommer, W. H., Johnson, J. L., Rich, G. A., Podsakoff, P. M., & MacKenzie, S. B. (1995). On the interchangeability of objective and subjective measures of employee performance: A meta-analysis. Personnel Psychology, 48(3), 587–605. https://doi.org/10.1111/j.1744-6570.1995.tb01772.x

Box, G. E., Hunter, W. H., & Hunter, S. (1978). Statistics for experimenters. (Vol. 664)John Wiley and sons.

Burgelman, R. A. (1994). Fading memories: A process theory of strategic business exit in dynamic environments. Administrative Science Quarterly, 39, 24–24. https://doi.org/10.2307/2393493

Burt, R. S. (1997). The contingent value of social capital. Administrative Science Quarterly, 339–365.https://doi.org/10.2307/2393923

Cao, Q., Gedajlovic, E., & Zhang, H. (2009). Unpacking organizational ambidexterity: Dimensions, contingencies, and synergistic effects. Organization Science, 20(4), 781–796. https://doi.org/10.1287/orsc.1090.0426

Carreira, C., & Silva, F. (2010). No deep pockets: Some stylized empirical results on firms’ financial constraints. Journal of Economic Surveys, 24(4), 731–753. https://doi.org/10.1111/j.1467-6419.2009.00619.x

Carroll, G. R., & Hannan, M. T. (2000). The demography of corporations and industries. Princeton University Press.

Chandler, G. N., McKelvie, A., & Davidsson, P. (2009). Asset specificity and behavioral uncertainty as moderators of the sales growth—Employment growth relationship in emerging ventures. Journal of Business Venturing, 24(4), 373–387. https://doi.org/10.1016/j.jbusvent.2008.04.002

Chang, Y. Y., & Hughes, M. (2012). Drivers of innovation ambidexterity in small-to medium-sized firms. European Management Journal, 30(1), 1–17. https://doi.org/10.1016/j.emj.2011.08.003

Chen, M. J., & Hambrick, D. C. (1995). Speed, stealth, and selective attack: How small firms differ from large firms in competitive behavior. Academy of Management Journal, 38(2), 453–482. https://doi.org/10.5465/256688

Choi, Y. R., & Shepherd, D. A. (2005). Stakeholder perceptions of age and other dimensions of newness. Journal of Management, 31(4), 573–596. https://doi.org/10.1177/0149206304272294

Chowdhury, S. (2011). The moderating effects of customer driven complexity on the structure and growth relationship in young firms. Journal of Business Venturing, 26(3), 306–320. https://doi.org/10.1016/j.jbusvent.2009.10.001

Christensen, C. M. (1997). The innovator’s dilemma: When new technologies cause great firms to fail. Harvard Business School Press.

Christensen, J. F. S. (1996). Innovative assets and inter-asset linkages—A resource-based approach to innovation. Economics of Innovation and New Technology, 4(3), 193–210. https://doi.org/10.1080/10438599600000009

Cockburn, I., & Grilliches, Z. (1988). The estimation and measurement of spillover effects of R&D investment: Industry effects and appropriability measures in stock market’s valuation of R&D and patents. AEA Papers and Proceedings, 78, 419–423.

Cohen, J., Cohen, P., West, S. G., & Aiken, L. S. (2003). Applied multiple regression/correlation analysis for the behavioral sciences. Lawrence Erlbaum Associates.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152. https://doi.org/10.2307/2393553

d’Amboise, G., & Muldowney, M. (1988). Management theory for small business: Attempts and requirements. Academy of Management Review, 13(2), 226–240. https://doi.org/10.5465/amr.1988.4306873

Degryse, H., de Goeij, P., & Kappert, P. (2012). The impact of firm and industry characteristics on small firms’ capital structure. Small Business Economics, 38(4), 431–447. https://doi.org/10.1007/s11187-010-9281-8

Delmar, F., Davidsson, P., & Gartner, W. B. (2003). Arriving at the high-growth firm. Journal of Business Venturing, 18(2), 189–216. https://doi.org/10.1016/S0883-9026(02)00080-0

Djupdal, K., & Westhead, P. (2015). Environmental certification as a buffer against the liabilities of newness and smallness: Firm performance benefits. International Small Business Journal, 33(2), 148–168. https://doi.org/10.1177/0266242613486688

Dolan, C., & Humphrey, J. (2000). Governance and trade in fresh vegetables: The impact of UK supermarkets on the African horticulture industry. Journal of Development Studies, 37(2), 147–176. https://doi.org/10.1080/713600072

Fackler, D., Schnabel, C., & Wagner, J. (2013). Establishment exits in Germany: The role of size and age. Small Business Economics, 41(3), 683–700. https://doi.org/10.1007/s11187-012-9450-z

Fiegenbaum, A., & Karnani, A. (1991). Output flexibility—a competitive advantage for small firms. Strategic Management Journal, 12(2), 101–114. https://doi.org/10.1002/smj.4250120203

Fischer, E., & Reuber, A. R. (2004). Contextual antecedents and consequences of relationships between young firms and distinct types of dominant exchange partners. Journal of Business Venturing, 19(5), 681–706. https://doi.org/10.1016/j.jbusvent.2003.09.005

Fritsch, M., & Lukas, R. (2001). Who cooperates on R&D? Research Policy, 30(2), 297–312. https://doi.org/10.1016/S0048-7333(99)00115-8

Fujimoto, T. (2007). Architecture-based comparative advantage: A design information view of manufacturing. Evolutionary and Institutional Economics Review, 4(1), 55–112. https://doi.org/10.14441/eier.4.55

Gedajlovic, E., Cao, Q., & Zhang, H. (2012). Corporate shareholdings and organizational ambidexterity in high-tech SMEs: Evidence from a transitional economy. Journal of Business Venturing, 27(6), 652–666. https://doi.org/10.1016/j.jbusvent.2011.06.001

Gibson, C. B., & Birkinshaw, J. (2004). The antecedents, consequences, and mediating role of organizational ambidexterity. Academy of Management Journal, 47(2), 209–226. https://doi.org/10.5465/20159573

Gimenez-Fernandez, E. M., Sandulli, F. D., & Bogers, M. (2020). Unpacking liabilities of newness and smallness in innovative start-ups: Investigating the differences in innovation performance between new and older small firms. Research Policy, 49(10), 104049. https://doi.org/10.1016/j.respol.2020.104049

Gomez-Mejia, L. R., Larraza-Kintana, M., & Makri, M. (2003). The determinants of executive compensation in family-controlled public corporations. Academy of Management Journal, 46(2), 226–237. https://doi.org/10.5465/30040616

Granovetter, M. (1985). Economic action and social structure: The problem of embeddedness. American Journal of Sociology, 91(3), 481–510. https://doi.org/10.1086/228311

Greene, W. H. (2012). Econometric analysis. Prentice Hall.

Grupp, H., Schwitalla, B., Schmoch, U., & Granberg, A. (1990). Developing industrial robot technology in Sweden, West Germany, Japan, and the U.S.A. In J. Sigurdson (Ed.), Measuring the dynamics of technological change: 106–129. Pinter Publishers.

Gupta, A. K., Smith, K. G., & Shalley, C. E. (2006). The interplay between exploration and exploitation. Academy of Management Journal, 49(4), 693–706. https://doi.org/10.5465/amj.2006.22083026

Hansen, B., & Hamilton, R. T. (2011). Factors distinguishing small firm growers and non-growers. International Small Business Journal, 29(3), 278–294. https://doi.org/10.1177/0266242610381846

He, Z., & Wong, P. (2004). Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organization Science, 15, 481–494. https://doi.org/10.1287/orsc.1040.0078

Heide, J. B., & John, G. (1988). The role of dependence balancing in safeguarding transaction-specific assets in conventional channels. Journal of Marketing, 52(1), 20–35. https://doi.org/10.1177/002224298805200103

Heo, M., & Leon, A. C. (2010). Sample sizes required to detect two-way and three-way interactions involving slope differences in mixed-effects linear models. Journal of Biopharmaceutical Statistics, 20(4), 787–802. https://doi.org/10.1080/10543401003618819

Hewitt-Dundas, N. (2006). Resource and capability constraints to innovation in small and large plants. Small Business Economics, 26(3), 257–277. https://doi.org/10.1007/s11187-005-2140-3

Hoskisson, R. E., Hitt, M. A., & Hill, C. W. (1993). Managerial incentives and investment in R&D in large multiproduct firms. Organization Science, 4(2), 325–341. https://doi.org/10.1287/orsc.4.2.325

Hult, R. (2020). Significant electronic technology trends over the past 20 years. Available online: https://www.connectorsupplier.com/significant-electronic-technology-trends-over-the-past-20-years/ (Accessed on 27 September 2020).

ILO. (2014). Ups and downs in the electronics industry: Fluctuating production and the use of temporary and other forms of employment, Sectoral Policies Department.

Jansen, D., Von Goertz, R., & Heidler, R. (2009). Knowledge production and the structure of collaboration networks in two scientific fields. Scientometrics, 83(1), 219–241. https://doi.org/10.1007/s11192-009-0022-1

Jansen, J. J. P., Van den Bosch, F. A. J., & Volberda, H. W. (2006). Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Management Science, 52(11), 1661–1674. https://doi.org/10.1287/mnsc.1060.0576

Josefy, M., Kuban, S., Ireland, R. D., & Hitt, M. A. (2015). All things great and small: Organizational size, boundaries of the firm, and a changing environment. Academy of Management Annals, 9(1), 715–802. https://doi.org/10.5465/19416520.2015.1027086

Katila, R., & Ahuja, G. (2002). Something old, something new: A longitudinal study of search behavior and new product introduction. Academy of Management Journal, 45, 1183–1194. https://doi.org/10.5465/3069433

Katila, R., & Shane, S. (2005). When does lack of resources make new firms innovative? Academy of Management Journal, 48(5), 814–829. https://doi.org/10.5465/amj.2005.18803924

Ketchen, D. J., Jr., Thomas, J. B., & Snow, C. C. (1993). Organizational configurations and performance: A comparison of theoretical approaches. Academy of Management Journal, 36(6), 1278–1313. https://doi.org/10.5465/256812

Kim, Y. K., Kim, T. U., Park, S. T., & Jung, J. R. (2016). Establishing the importance weight of appropriability mechanism by using AHP: The case of the China’s electronic industry. Cluster Computing, 19(3), 1635–1646. https://doi.org/10.1007/s10586-016-0608-3