Abstract

Previous research suggests that both formal institutions (e.g., pro-market institutions) and informal institutions (e.g., individualistic cultural values) are critical drivers of innovation. Most studies, however, consider the independent role of either formal or informal institutions. We contribute to this gap in the literature by exploring the potential interaction between informal institutions, measured by Hofstede’s individualism-collectivism index, and formal institutions, measured by the Economic Freedom of the World index (i.e., pro-market institutions). Using cross-sectional data for a diverse sample of 84 countries, we find that both individualism and pro-market institutions are positively associated with innovation. However, the extent to which pro-market institutions promote innovation depends largely on how individualistic a country is and vice versa. For example, more individualistic countries tend to be more innovative, but even the most individualistic countries have below-average levels of innovation when their formal institutional environment lacks market support. At the same time, our findings suggest that the most innovative countries tend to have both strong pro-market institutions and individualistic cultural values.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Innovation is increasingly viewed by policymakers, scholars, and practitioners as essential to sustaining the economic competitiveness and prosperity of nations (Acs et al. 2013; Colombelli et al. 2016; Wong et al. 2005). Previous research suggests that culture (i.e., informal institutions) is an important determinant of innovative activity. Most of this literature is focused on the role of individualistic cultural values, which emphasize individual freedom and recognize personal achievement (Hofstede 1980), in fostering innovation (Bennett and Nikolaev 2020; Rinne et al. 2012; Shane 1992, 1993; Taylor and Wilson 2012). A related body of literature suggests that pro-market institutions, which reduce transaction costs and uncertainty of market interactions and shape the relative rewards from productive and unproductive activities (Baumol 1990; Foss et al. 2019; North 1994), are also critical for innovative activity (Bennett and Nikolaev 2019; Bjørnskov and Foss 2012, 2013; Zhu and Zhu 2017). While the national systems of innovation (NSI) framework suggests that the innovative performance of an economy depends on the interactions between formal and informal institutions (Acs et al. 2017), previous research has largely focused on the role of either informal or formal institutions independently, leading to an incomplete understanding of the impact of institutions on innovation (Bruton et al. 2010). As Eesley et al. (2018, p. 393) note, “there is a scarcity of empirical research that explicitly examines the joint or interactive influence of formal versus informal institutions.”

We contribute to this gap in the literature by examining the joint influence of pro-market institutions (formal institutions) and individualistic cultural values (informal institutions) on country-level innovation. We argue that, consistent with previous studies, both types of institutions are important determinants of innovation, but their impact depends on each other. In other words, we argue that the positive effect of pro-market institutions on national innovation depends, to a great extent, on the level of individualistic cultural values in a country. Similarly, the effect of individualism on national innovation is conditional on the extent to which economic institutions support freedom of market exchange. In doing so, we contribute to the growing multidisciplinary literature seeking to understand how formal and informal institutions jointly affect economic development (Alesina and Giuliano 2015).

We analyze the joint effect of individualistic cultural values and pro-market institutions on innovation using cross-sectional data from a diverse sample of 84 countries. We use Hofstede’s (1980) individualism-collectivism (I-C) cultural value dimension as our measure of informal institutions and the Economic Freedom of the World (EFW) index (Gwartney et al. 2018) as our measure of pro-market institutions. To measure innovation, we utilize the output innovation sub-index from the Global Innovation Index (GII) (Dutta et al. 2018). Controlling for a large number of confounding variables, our results suggest that both individualism and pro-market institutions are positively and significantly associated with innovation. However, these effects are contingent on each other—the effect of individualism on innovation is stronger in countries with more pro-market institutions, and the effect of pro-market institutions on innovation becomes stronger in countries that are more individualistic. For example, more individualistic countries tend to be more innovative, but even the most individualistic societies have below-average levels of innovation when their formal institutional environment lacks market support. At the same time, the most innovative countries tend to have both strong pro-market institutions and individualistic cultural values.

While previous innovation studies largely utilize singular measures of innovation such as patented inventions and scientific article publications (e.g., Shane 1992, 1993; Taylor and Wilson 2012), our measure of innovation captures a rich set of radical and incremental innovations that comprise the complex nature of national innovation. We further contribute to the literature by decomposing the GII innovation output index to explore the relationship between individualism, pro-market institutions, and a variety of innovation types. In addition, previous research indicates that different aspects of the pro-market institutional environment may differentially influence entrepreneurial activity (e.g., Bjørnskov and Foss 2008; McMullen et al. 2008; Nyström 2008). We also, therefore, examine the five main areas of the EFW index to explore the potential heterogeneous effects of pro-market institutions on innovation. This part of our analysis also provides more granular policy insights. Finally, it is conceivable that the effects of individualism and pro-market institutions differ depending on the level of innovation, so we examine this possibility using quantile regression.

In the next section, we provide a brief review of the extant literature to motivate our study and discuss the conceptual foundations that contribute to our theory development.

2 Literature review and theoretical considerations

Institutions are defined as “the humanly devised constraints that structure political, economic, and social interactions” (North 1991, p. 97). A society’s institutions consist of both informal (i.e., cultural values, beliefs, and norms) and formal (e.g., economic, legal, and political) rules. Institutions “create order and reduce uncertainty in exchange,” thereby lowering transaction costs and determining the incentive structure faced by agents in society (North 1994). In this way, institutions influence the relative costs and benefits of entrepreneurial and innovative activities (Baumol 1990). As such, institutions serve as the rules of the game governing entrepreneurial activity (North 1990; Williamson 2000) and may act in both a constraining and enabling capacity (Bennett 2019a; Bruton and Ahlstrom 2003; Davidsson 2015).

Bjornskov and Foss (2016, p. 294) describe institutions as the “antecedents of the incidence and nature” of entrepreneurship and innovation. Indeed, a large body of empirical research suggests that institutions are important determinants of entrepreneurial and innovative activity. However, most of this work considers either the effect of formal or informal institutions in isolation (Eesley et al. 2018).Footnote 1 We address this important gap in the literature by examining not only how formal and informal institutions impact national innovation independently of each other but also, and more importantly, their joint effect on various innovative outputs (van Waarden 2001).Footnote 2 More specifically, we propose the following research question: To what extent is the effect of pro-market institutions (i.e., formal institutions) on innovation dependent on individualistic cultural values (i.e., informal institutions), and vice versa?

2.1 Pro-market institutions and innovation

With respect to formal institutions, there is a large body of evidence that pro-market institutions—the laws, policies, and regulations that support market transactions and limit government intervention in the economy (Cuervo-Cazurra et al. 2019)—are positively associated with entrepreneurial and innovative activity. Many of these studies have used a multidimensional measure of economic freedom, a philosophically consistent concept based on the principles of “personal choice, voluntary exchange, freedom to compete, and protection of person and property,” (Gwartney and Lawson 2003, p. 406) as a proxy for pro-market institutions. Pro-market institutions provide entrepreneurs, innovators, and their investors with confidence that their investments of time, talent, and resources will be protected from “aggressors seeking to use violence, coercion, and fraud to seize things that do not belong to them” (Gwartney and Lawson 2003, p. 406). This, in turn, reduces institutional uncertainty (Bylund and McCaffrey 2017) and provides a powerful market incentive for productive entrepreneurial and innovative activity (Baumol 1990).

Entrepreneurs and innovators embedded in societies with strong pro-market institutions face lower transaction costs of “searching for, combining, adapting, and fitting heterogeneous resources in the pursuit of profit under uncertainty” (Bjørnskov and Foss 2012, p. 248). Additionally, they face fewer institutional constraints on their ability to utilize their time, talents, and resources to recognize and capitalize on unexploited opportunities that they perceive may satisfy a market need (Bennett 2019b), thereby encouraging a competitive environment that incentivizes entrepreneurship and innovation (Zhu and Zhu 2017). In other words, countries with stronger pro-market institutions enable natural and spontaneous social orders (Hayek 1988) that provide individuals with the freedom to engage in creative activity and pursue enterprising and innovative activities that have the potential to result in disruptive products, services, and processes that benefit society (Schumpeter 1942; Von Mises 1990).

Indeed, numerous cross-country studies have found a strong positive correlation between economic freedom and various measures of entrepreneurial and innovative activity, including self-employment (Gohmann 2012; Nyström 2008), opportunity-motivated entrepreneurship (Angulo-Guerrero et al. 2017; Bjørnskov and Foss 2008; Boudreaux et al. 2019; McMullen et al. 2008; Nikolaev et al. 2018), formal entrepreneurship (Dau and Cuervo-Cazurra 2014; Saunoris and Sajny 2017), firm patents (Zhu and Zhu 2017), and total factor productivity (Bjørnskov and Foss 2012). Similarly, there is a growing body of evidence that sub-national economic freedom is associated with entrepreneurial activity across US states (Gohmann et al. 2008; Hall et al. 2013; Kreft and Sobel 2005; Powell and Weber 2013; Sobel 2008) and cities (Bennett 2019b, 2020; Bologna 2014). While the preponderance of evidence from these studies, which use a variety of measures, methods, and samples, supports the theory that pro-market institutions enable productive entrepreneurial activity, our focus is on country-level innovation, which we conceptualize as a discovery-based process (Shane and Venkataraman 2000) that leads to a broad set of incremental and radical innovative outputs (e.g., creative goods, intangible assets, online creativity, and knowledge creation, diffusion, and implementation), motivating the following hypothesis:

-

H1: Countries with stronger pro-market institutions are more innovative.

2.2 Individualism and innovation

With respect to informal institutions, the multifaceted value system of individualism-collectivism, which has been identified as the main dimension of cultural variation across societies (Heine 2016; Thornhill and Fincher 2014; Triandis 1995), is a particularly salient cultural feature because, as Autio (2013, p. 337) highlights, entrepreneurial and innovative behavior is fundamentally an individual-level behavior that involves “proactiveness, competitive orientation, innovativeness, and risk-taking.” According to Hofstede (1991, p. 51), individualistic societies are those “in which the ties between individuals are loose: everyone is expected to look after himself or herself and his or her immediate family.” Meanwhile, collectivistic societies are those “in which people from birth onwards are integrated into strong, cohesive in-groups, which throughout people’s lifetime continue to protect them in exchange for unquestioning loyalty.” As such, individualistic societies tend to value individual freedom, opportunity, personal achievement, advancements, and recognition, while collectivistic cultures place a higher value on harmony, cooperation, and relations with superiors (Hofstede 1980).

Because entrepreneurs often take substantial personal risks associated with market entry and innovation (Shane et al. 1995), they also expect to be rewarded individually if they succeed (Hayton et al. 2002). Personal rewards and recognition of achievements are more culturally acceptable in individualistic societies (Shane 1992). Because individualistic cultures promote self-expression and independent thinking, people are more likely to develop positive attitudes towards the creation and adoption of new innovations (Alesina and Giuliano 2010). In addition, innovation requires individual characteristics such as creativity, risk-taking, intellectual autonomy, ambition, mastery, uncertainty tolerance, and breaking from traditional ways of doing things (Rogers 1995). Many of these characteristics are explicitly associated with individualistic cultural values (Hofstede 1980; Schwartz 1994; Shane 1992). Individualistic cultural beliefs also better facilitate anonymous exchange than collectivist cultural beliefs, leading to a larger market for goods and services, a greater division of labor and specialization (Smith 1776), and, hence, more productivity-enhancing innovations (Greif 1994).

Numerous studies provide empirical support that societies with more individualistic cultural values exhibit higher levels of entrepreneurship (del Junco and Brás-dos-Santos 2009; Hayton et al. 2002; Nikolaev et al. 2018; Steensma et al. 2000; Stephan and Uhlaner 2010) and innovation (Bennett and Nikolaev 2020; Rinne et al. 2012; Shane 1992, 1993; Taylor and Wilson 2012). We, therefore, propose the following hypothesis:

-

H2: Countries with more individualistic cultural values are more innovative.

2.3 Pro-market institutions, individualism, and innovation

As we showed above, previous research provides strong evidence that both pro-market institutions and individualistic cultural values are important enablers of innovative activity. While insightful, these studies have largely emerged as two distinct strands of literature—we are unaware of any study that simultaneously considers the effect of both pro-market institutions and individualistic cultural values, much less their potential interdependence. Yet, institutional scholars largely agree that there is an important complementarity between informal and formal institutions (Alesina and Giuliano 2015; Aoki 2001; Platteau 2000). North (2005, pp. 49–50), for instance, argues that informal institutions “embody the internal representation of the human landscape” and formal institutions provide the “structure that humans impose on the landscape” such that the former serve as the internal representation and the latter the external manifestation of that representation. Similarly, Li and Zahra (2012, p. 98) state that “formal institutions are embedded in different cultural settings.” Mokyr (2017, p. 10) adds that formal and informal institutions “coevolve and provide stability to the economic system when aligned.”

It is clear, therefore, that there is an interdependence between formal and informal institutions, and economic performance depends on both (Alesina and Giuliano 2015). According to North (2005, p. 79), “the key to improved performance is some combination of formal rules and informal constraints and the task we face is to achieve an understanding of exactly what combination will produce the desired results.” Mokyr (2017, p. 11) adds that good institutions “interact with a culture that enforces them, whereas bad institutions may reinforce a culture that perpetuates them.”

In the context of innovation, the national systems of innovation (NSI) literature suggests that “knowledge is produced and accumulates through an interactive and cumulative process of innovation that is embedded in a national institutional context,” which consists of both formal and informal institutions (Acs et al. 2017, p. 1002). Together, formal and informal institutions influence the development, diffusion, and use of innovation that powers the engine of economic performance (Lundvall 2010; Nelson 1993).

As such, innovative behavior is influenced by the fit between a nation’s formal institutional environment and its citizen’s cultural values (van Waarden 2001). We contend that individualistic cultural values and pro-market institutions are complementary in shaping an environment conducive to innovation. The structure of a market economy, as represented by the degree to which its formal institutions support market activity, therefore reflects the beliefs and values of those in a position to shape the rules of the game (North 2005). Using game theory, Greif (1994) shows that individualistic cultures foster the development of formal enforcement institutions that support anonymous market exchange.

According to Hayek (1948, p. 21), two conditions must be satisfied for a workable individualistic order that encourages innovation. First, the expected remunerations that an individual can expect to receive from the “different uses of his abilities and resources correspond to the relative utility of the result of his effort to others.” Second, these “remunerations correspond to the objective results of his efforts rather than to their subjective merits.” In other words, an individualistic society that provides rewards on the basis of value created for others rather than on the basis of the goodness of intentions will encourage individuals to utilize their unique skills and knowledge to pursue innovative activity. Hayek argues that these conditions are satisfied when embodied in a system of private property rights and long-run economic policies supportive of a competitive market that provides individuals the freedom to choose how to utilize their time, talents, and resources. Individualistic societies rely on market-supporting economic institutions to enforce contracts, minimize transactions costs, expand market opportunities, and provide economic incentives for entrepreneurial and innovative activity (Li and Zahra 2012). They are also reluctant to accept and support burdensome regulation of the economy (Holmes et al. 2013).

The above logic suggests that pro-market institutions and individualistic cultural values have a joint effect on innovation. Indeed, the top decile of the most innovative countries in our sample (i.e., Finland, Germany, Ireland, Luxembourg, Sweden, Switzerland, the UK, and the USA) all have relatively high levels of both individualistic cultural values and economic freedom. Meanwhile, the bottom decile of countries (i.e., Bangladesh, Burkino Faso, El Salvador, Honduras, Malawi, Mozambique, Nepal, Nigeria, and Zambia) all have relatively low levels of both individualism and economic freedom. We, therefore, propose the following two hypotheses:

-

H3a: The effect of pro-market institutions on innovation is higher in countries with more individualistic cultural values.

-

H3b: The effect of individualistic cultural values on innovation is higher in countries with stronger pro-market institutions.

3 Data and methods

In this section, we describe the main variables used in our empirical analysis. Table 1 provides descriptions, sources, and summary statistics for all variables.

3.1 Innovation outputs

We follow Bennett and Nikolaev (2020) in using the output score from the Global Innovation Index (GII) as our measure of innovation (Dutta et al. 2018). The GII was originally developed in 2007 to better capture the richness of innovation in society than traditional singular measures of innovation used by researchers (e.g., level of R&D expenditures; the number of research articles published; patents filed/granted). The GII has been updated annually since its inception, and it attempts to account for the innovative contributions of a wide spectrum of innovative actors such as scientists, manufacturing and service sector firms, and public entities. GII thus captures a large variety of incremental and radical innovations.

The innovative outputs’ sub-index is comprised of two main pillars that capture various outputs of innovative activities within an economy. First is the knowledge and technology outputs pillar that is comprised of three sub-pillars: knowledge creation, knowledge impact, and knowledge diffusion. Second is the creative outputs sub-pillar that is composed of three sub-pillars: intangible assets; goods and services; and online creativity. Each sub-pillar is derived from multiple innovation indicators, compiled using data from a large number of international public bodies and private organizations. In total, 27 individual indicators were used to create the innovation output index. Most of the indicators are normalized by either population or GDP as a means to enable cross-country comparability. Because the GII is comprised of a large number of indicators from various sources, data is not available for all indicators for all countries. The latest GII provides data for 126 economies, covering more than 90.8% of the global population and 96.3% of global economic output. Table A1 in the Appendix describes the composition of the innovation output index.

3.2 Individualistic cultural values

Following a large literature in cross-cultural entrepreneurship and innovation, we use the I-C index created by Hofstede (1980) as our measure of cultural values. It is available for more than 100 countries and ranges from 0 (most collectivistic) to 100 (most individualistic). We use the most recent version of the international values survey module, which consists of twenty-four values questions rated on a scale of 1 (most important) to 5 (least important). The data were originally collected through a global survey of 100,000 IBM employees in 1967 and 1973. Subsequent waves of the survey and replication studies have included, in addition to IBM employees, a number of additional sub-groups, including airline pilots, students, civil service managers, and “up-market” consumers and elites (Hofstede 2010).

3.3 Economic freedom

Following a growing body of entrepreneurship (e.g., Bennett and Nikolaev 2019) and international business studies (e.g., Cuervo-Cazurra et al. 2019), we utilize the Fraser Institute’s EFW index as our measure of pro-market institutions. EFW incorporates 42 distinct variables derived from publicly available sources (e.g., World Bank, International Monetary Fund, and the Global Competitiveness Report). The original data are transformed to a zero to 10 scale, with higher values reflecting more economic freedom. The components are used to derive both a summary rating for each country and ratings in five areas: the size of government; legal system and property rights; sound money; international trade freedom; and regulatory freedom (Gwartney et al. 2018). Countries that achieve a high economic freedom score provide secure protection of privately owned property, even-handed enforcement of contracts, and a stable monetary environment. They also maintain low tax rates, refrain from creating barriers that restrict domestic and international exchange, and rely primarily on markets (as opposed to the political process) to allocate resources (Bennett et al. 2017).

3.4 Control variables

We control for a large set of country-level characteristics that may influence cross-national differences in innovation, cultural values, and/or formal institutions (e.g., Nikolaev et al. 2018). First, because there is considerable evidence that the origins of a country’s legal system and regulatory processes may influence a wide range of developmental outcomes such as innovation and institutional development (La Porta et al. 2008), we include a set of legal origins dummies (French, UK, Socialist, and Scandinavian, omitting German as a baseline for comparison) (La Porta et al. 1999). Next, geographic conditions may influence access to resources and global markets, constraining a country’s capacity to engage in innovative activity. A substantial literature, for example, suggests that poorer and less innovative countries tend to be concentrated around the tropics. This could be partly explained by two ecological impediments—low agricultural productivity due to soil erosion as a result of heavy rainfall and the prevalence of infectious diseases, which is strongly correlated with animal and human mortality and morbidity (Bennett and Nikolaev 2020; Nikolaev and Salahodjaev 2017; Sachs 2003). We, therefore, control for two geographic factors—latitude and share of the population living in the tropics (Bennett et al. 2017; Easterly and Levine 2003; Sachs et al. 2001).

We also control for the shares of a nation’s population belonging to the major world religions—Catholic, Muslim, and Protestant. Religious values define how people handle in-group interactions, work, and contract enforcement. Thus, religion is related to both cultural values and formal institutions and, in turn, may influence innovative activity (Barro and McCleary 2003). In his influential work, for example, Weber (1988) argued that capitalism, which is characterized by strong pro-market institutions, evolved out of the Protestant ethic, which encouraged people to dedicate themselves to work in the secular world by starting their own ventures, engaging in free trade, and acquiring wealth.

Additionally, we control for income inequality using the Gini coefficient, which provides a measure of the distribution of income across a population (Solt 2016), and ethnolinguistic fractionalization, which shows the probability that two people selected at random from a country’s population belong to the same ethnic group (Alesina et al. 2003). Both inequality and ethnolinguistic fractionalization have been previously linked to underdevelopment (Alesina and Ferrara 2005; Easterly 2007). Tselios (2011), however, suggests that higher inequality may encourage innovation. Higher levels of individualism and pro-market institutions have also been correlated with lower levels of income inequality (Bennett and Nikolaev 2016; Nikolaev et al. 2017).

Finally, we control for a set of regional fixed effects (Africa, Asia, Europe, Oceania, and South America, omitting North America as baseline region for comparison) to account for the potential impact of unobserved factors that are common across the countries of a region that may influence innovative activity.

3.5 Methods

We use ordinary least squares (OLS) regression (Wooldridge 2010) to estimate the effects of culture and pro-market institutions on innovation using the following equation, where Innovi, Culturei, and Institutionsi represent innovation outputs, individualism, and economic freedom in country i; Xi denotes a matrix of control variables, and ϵi is an idiosyncratic error term. For statistical inference, we cluster standard errors at the country such that they are robust to heteroskedasticity (White 1980). To test hypotheses H1 and H2, we assess parameters α1 and α2, which capture the marginal effects of EFW and individualism, respectively. We anticipate both α1 and α2 to be positive.

To assess H3a and H3b, which suggest that EFW and individualism are complementary institutions such that the effect of EFW [individualism] on innovation is increasing in the level of individualism [EFW], we assess the marginal effects of EFW and individualism from estimates of the below non-linear equation. The marginal effect of EFW on innovation is conditional on the level of individualism (\( \frac{\partial Innov}{\partial EFW}={\beta}_1+{\beta}_3 Individualism \)). Similarly, the marginal effect of individualism on innovation is conditional on the level of EFW (\( \frac{\partial Innov}{\partial Individualism}={\beta}_1+{\beta}_3 EFW \)). We anticipate that β3 > 0.

Our final sample consists of 84 countries. Appendix Table A2 provides a list of the countries in our sample as well as each country’s innovation output, individualism, and EFW measures. We use the Stata 15 software for all statistical analyses.

4 Empirical results

Our theory suggests that both individualistic cultural values and pro-market institutions will have a positive effect on innovative outputs. However, and more importantly, it also suggests that the extent to which pro-market institutions affect national innovation levels will largely depend on how individualistic a country is and vice versa. Specifically, the positive effect of pro-market institutions on innovation will be much stronger in more individualistic societies, and, similarly, more individualistic societies will have greater levels of innovation when there is greater support for pro-market institutions. Below, we test the predictions of our theoretical developments.

4.1 Baseline results

We present estimates from our linear OLS regressions of innovation output on individualism and EFW in Table 2. Heteroskedastic-robust standard errors are given in parentheses and standardized coefficients in brackets. Model 1 is a parsimonious specification that does not include any control variables. Both individualism and EFW enter positively and are highly statistically significant. Together, they explain nearly 58% (R2 = 0.576) of the variation in innovation among the countries in our sample. Subsequent models introduce additional variables to hold constant other potential determinants of innovation. We constrain the sample to a common set of countries throughout Table 2 so that the results are comparable across models because it has been demonstrated that cross-country empirical research results can be quite sensitive to the sample of countries used (Bennett and Nikolaev 2017). We report the adjusted R2 value so that we can assess the additional explanatory power of the supplementary regressors in each model.

Model 2 introduces a set of legal origins dummy variables, omitting German legal origins as the baseline for comparison. Model 3 introduces two measures of geography—latitude and the share of the population living in the tropics. Several measures of religion are added to model 4. Model 5 controls for income inequality and ethnolinguistic fractionalization. Finally, model 6 controls for regional fixed effects. Throughout Table 2, both individualism and EFW remain positively and highly significantly associated with innovation output, although the magnitude of the estimated effects is reduced when controlling for additional factors.

The independent and control variables in model 6, which we consider to be our baseline model, explain 70% of the variation in innovation output for our sample of countries. The estimates in this model suggest that unit increases in individualism and EFW are associated with 2.1 and 5.9 unit increases in the innovation output index. Economically, the magnitude of our two institutional variables on innovation is similar, as standard deviation increases in individualism and EFW are associated with 0.34 and 0.36 standard deviation increase in innovation outputs, respectively. Overall, the results from Table 2 strongly support both H1 and H2, suggesting that pro-market institutions and individualistic cultural values are both positive determinants of innovation. With the exception of the legal origins variables, none of the other controls is robustly associated with innovation.

4.2 Results by innovation type

Next, we decompose the innovation output index into its two main pillars and six sub-pillars to examine if formal and informal institutions have differential effects by innovation type. We report linear model estimates of OLS regressions of innovation on individualism and EFW by innovation type in Table 3. Each row represents a different model using the measure of innovation denoted as the DV. All models hold constant the baseline set of control variables (Table 2, model 6), but, for space, we only report the results for individualism and EFW. Model 1 uses innovation outputs as the DV and is reproduced from Table 2 for ease of comparison. Model 2 uses the creative output pillar as the DV, while models 3–5 use its sub-pillars (i.e., intangible assets, creative goods and services, and online creativity). Model 6 uses the knowledge and technology output pillar as the DV, while models 7–9 use its sub-pillars (knowledge creation, knowledge impact, and knowledge diffusion). EFW is positively and highly significantly associated with both pillars, creative output and knowledge and technology output, as well as the following sub-pillars: creative goods and services, online creativity, knowledge impact, and knowledge diffusion. The standardized coefficient estimates, reported in brackets, range from 0.286 (knowledge and technology output) to 0.51 (creative goods and services) for these measures of innovation. EFW is also positively associated with intangible assets, but the standardized coefficient estimate of 0.213 is only significant at the 10% level. EFW is not, however, significantly associated with knowledge creation. Similarly, individualism is positively and significantly associated (at the 5% level or better) with the two pillars and 5 of the 6 sub-pillars (all but intangible assets). The standardized coefficient estimates for these measures of innovation range from 0.235 (creative output) to 1.184 (knowledge creation).

4.3 Interaction model results

We present the results from the interaction model estimates in Table 4. For space, we only present the estimates for the two main effects (individualism and EFW) and the interaction effect, but all models include the set of baseline control variables and regional fixed effects. We are interested in the marginal effect of EFW [individualism], which is conditional on the level of individualism [EFW]. We, therefore, perform a joint test of significance of the EFW [individualism] main effect and the interaction terms for statistical inference (Brambor et al. 2006) and report the results of this test as p(Economic Freedom) [p(individualism)].

The conditional marginal effect of individualism is significant at the 5% level or better in all but one of the models (intangible assets is the exception). Interestingly, the main effect term for individualism is negative in all of the models. As anticipated, the interaction between individualism and EFW enters positively in all but model 3 (intangible assets). That the main effect is negative and the interaction effect positive suggests that there may be a level of EFW for which the conditional marginal effect of individualism on innovation changes from negative to positive. We estimate this threshold from the conditional marginal effect of individualism and report it as MET(Individualism).Footnote 3

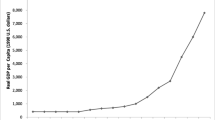

In model 1, which uses our primary measure of innovation (innovation output) as the DV, MET(Individualism) = 5.6, suggesting that the marginal effect of individualism is negative for countries with a EFW < 5.6. Only two countries (Argentina and Mozambique) in our sample of 84 nations have an EFW score below this threshold. As such, the conditional marginal effect of individualism on innovation output is positive and increasing in the level of EFW for nearly our entire sample. Figure 1 shows the estimated conditional marginal effects of individualism on innovation output by EFW percentile, along with 95% confidence bands. The value of EFW at each percentile is given in brackets. As illustrated, the marginal effect of individualism is increasing in the level of EFW, but the marginal effect is not statistically significant at the 5% level in countries below the 30th percentile of EFW values. Countries around the threshold value of EFW for which the marginal effect of individualism on innovation output is positive and statistically significant include India, Trinidad and Tobago, and Zambia. The marginal effect of individualism on innovation output increases from 1.4 at the 30th percentile of EFW to 3.0 at the 90th percentile. This suggests that the marginal effect of individualism on innovation output in the countries with the strongest pro-market institutions is more than double that of those with the weakest. This provides strong support for H3b.

The estimated threshold is 3.8 and 4.6 in models 2 (DV = creative output) and 4 (DV = creative goods and services), and the minimum EFW value in our sample is 4.8, suggesting that the marginal effect of individualism on these two measures of innovation is positive and increasing in the level of EFW for our entire sample. In model 9 (DV = knowledge diffusion), the threshold is 5.4, and only Mozambique has an EFW score below this level, suggesting that the marginal effect of individualism on knowledge diffusion is positive and increasing in the level of EFW for nearly our entire sample. The threshold ranges from 6.0 to 6.2 in models 5–8. There are 6 countries in our sample with an EFW < 6 and another 4 countries with EFW scores between 6.0 and 6.1, suggesting that the marginal effect of individualism on these measures of innovation is positive for most of the countries in our sample, but negative for the 10% of the sample of countries with the weakest pro-market institutions. Figures depicting the marginal effects of individualism on the two innovation pillars by EFW percentile are presented in Appendix B.

Next, we examine the conditional marginal effect of EFW on innovation output. The main effect and interaction effect terms both enter positively in model 1 of Table 4 and are jointly significant at the 1% level. This suggests that the marginal effect of EFW on innovation output is positive for our sample of countries, irrespective of the level of individualism. Figure 2 shows the estimated conditional marginal effects of EFW on innovation output by individualism percentile, along with 95% confidence bands. The value of individualism at each percentile is given in brackets. The figure indicates that the marginal effect of EFW, which is statistically significant at the 5% level above the 10th percentile of individualism values, is increasing in the level of individualism. Countries around the threshold of individualism for which the marginal effect of EFW is significant include Albania, Bangladesh, China, El Salvador, Honduras, Singapore South Korea, Thailand, and Vietnam. Among these countries with relatively low levels of individualistic cultural values, the mean EFW value is 7.1, and the mean innovation output value is 30.8. The mean EFW and innovation output values for this sub-sample of countries with relatively low levels of individualism are approximately equivalent to the means of these variables for the entire country sample. The estimated conditional marginal effect of EFW on innovation output increases from 4.2 at the 20th percentile of individualism to 11.2 at the 90th percentile, suggesting that the marginal effect of EFW on innovation output in the most individualistic countries in our sample is more than 2.5 times that of the least individualistic nations. This provides strong support for H3a.

We also perform analogous analyses of the conditional marginal effects of EFW on innovation for the other two innovation pillars and six innovation sub-pillars. These results are presented in models 2–7 of Table 4. The results using creative output, creative goods and services, online creativity, and knowledge diffusion as the DV are qualitatively similar to our primary results that use innovation output as the DV. That is, the main effect and interaction effect terms are both positive and jointly significant at the 5% level or better, suggesting that the marginal effect of EFW on innovation is positive for our sample of countries and increasing in the level of individualism. However, the main effect term enters negatively when using knowledge and technology output, knowledge creation, and knowledge impact as the DV. These latter results suggest that there may be a level of individualism for which the marginal effect of EFW on these measures of innovation is negative. The estimated individualism threshold is 0.8 and 0.6 in models 6 (knowledge and technology output) and 8 (knowledge impact), respectively. Within our sample, only Ecuador and Guatemala have individualism values below 0.8, suggesting that the marginal effect of EFW on these two measures of knowledge innovation is positive for nearly our entire sample. The estimated threshold is 2.6 in model 7 (knowledge creation). Thirty countries in our sample have an individualism value below this threshold, suggesting that the marginal effect of EFW on knowledge creation is negative for more than one-third of our sample. Countries with individualism values near this threshold include Malaysia, Portugal, and Slovenia. Meanwhile, the conditional marginal effect of EFW on intangible assets is not statistically significant. Figures depicting the marginal effects of EFW on the two innovation pillars by individualism percentile are presented in Appendix B.

4.4 Additional results

We perform a number of additional analyses that we briefly discuss here. First, we control for several additional variables that potentially matter for innovation. This includes the level of economic development (Anokhin and Wincent 2012), the historical disease prevalence (Bennett and Nikolaev 2020), and a measure of civic and political freedoms (Lehmann and Seitz 2017). Controlling for these additional factors results in a small reduction in sample size and the magnitude of the effect sizes for our independent variables of interest, but it does not qualitatively affect our main conclusions. These results are provided in Appendix Table A3. Note that we re-estimate the baseline linear and non-linear models using the country sample for which data is available for the additional three control variables and report these results in models 1 and 5. Subsequent models introduce the additional control variables iteratively.

Next, we re-estimate our baseline linear model using quantile regression (Chamberlain 1994). Our baseline OLS regressions provide estimates of the effects of individualism and EFW on the mean value of innovation output, but it is possible that culture and institutions exert differential effects across the distribution of innovation. Quantile regression allows us to estimate the effects on specific innovation quantiles. Using the Stata program sqreg, we estimate the effects of individualism and EFW on the following innovation percentiles using simultaneous quantile regression, which produces bootstrapped standard errors that contain between-quantile blocks in the variance-covariance matrix: 5th, 10th, 25th, 50th, 75th, 90th, and 95th.Footnote 4 For example, the median (i.e., 50th percentile) regression of innovation output on individualism and EFW specifies the changes in innovation output as a function of individualism, EFW, and the baseline set of control variables and regional fixed effects. Our results suggest the effect of EFW on innovation in the 5th, 10th, and 25th percentile regressions is positive but not statistically significant. Meanwhile, the magnitude of the coefficients is much larger and enters significantly in the higher quantiles. This seems to suggest that the effects of EFW on innovation are larger for higher levels of innovation; however, pairwise equality of coefficient tests suggests that the estimates across quantiles are not significantly different from one another. Individualism enters positively and is statistically significant in all 7 quantile regressions, and equality of coefficient tests similarly suggests that the individualism coefficients are not significantly different from one another across regressions. We present these results in Appendix Table A4.

Finally, previous research suggests that the various areas of economic freedom may exert differential impacts on entrepreneurship (Angulo-Guerrero et al. 2017; Bjørnskov and Foss 2008; McMullen et al. 2008; Nyström 2008). Similarly, the different areas of economic freedom may exert differential impacts on innovation. We, therefore, decompose the EFW index into its five major areas and re-estimate the effects of economic freedom on innovation output using each of the five areas. In the linear specification, the legal institutions and property rights, international trade freedom, and regulatory freedom areas enter as positive and significant correlates of innovation output. The government size and sound money areas are not statistically significant at conventionally accepted levels. In the interaction model, the marginal effects of four of the five areas (government size is the exception) are statistically significant at the 5% level or better, suggesting that the positive effect of economic freedom for these areas on innovation is increasing in the level of individualism for our sample of countries. Individualism enters positively and is statistically significant in all of the specifications. These results are presented in Appendix Table A5.

5 Discussion

A large number of studies have identified individualistic cultural values and pro-market institutions as critical drivers of entrepreneurship and innovation. However, most of these comparative studies examine the effect of these factors independently of each other (Bruton et al. 2010). Yet, the NSI literature suggests that innovation is a function of the institutional context that includes both formal and informal institutions. Most analyses also focus on a singular measure of innovation (e.g., R&D expenditures, patents, scientific articles), potentially omitting important sources of innovation that are also important for economic advancement. We contribute to these important gaps in the literature in several ways. First, we utilize a broad measure of innovation output—the innovation output sub-index from the GII, which accounts for a large variety of incremental and radical innovations from numerous actors and better captures the richness of innovation in society than any singular measure.

Second, we consider the joint effects of both pro-market institutions (i.e., formal institutions) and individualistic cultural values (i.e., informal institutions) on innovation. Our results from OLS regressions for a cross-sectional sample of 84 countries suggest that, controlling for a large number of potential confounding variables and regional fixed effects, both individualism and pro-market institutions are positively and significantly associated with innovation output.

Lastly, we consider the interdependence formal and informal institutions for innovation (Eesley et al. 2018). Our results from regressions that include an interaction term between individualism and pro-market institutions suggest that the effect of individualism on innovation is higher for countries with stronger pro-market institutions. Similarly, the effect of pro-market institutions on innovation is higher for countries with higher levels of individualism.

5.1 Policy implications

Our study suggests that both individualistic cultural values and pro-market institutions are important enablers of innovation. Similar to results obtained by Li and Zahra (2012), who find that individualism and formal governance institutions are complementary in stimulating venture capital investments, our results indicate that formal and informal institutions complement one another in facilitating high levels of innovation. Appendix Figure C1 reveals this complementary relationship, plotting the predicted level of innovation output (color scale) by level of individualism (x-axis) and EFW (y-axis), holding the set of baseline controls and regional effects constant.Footnote 5

This contour graph suggests that innovation is predicted to be highest in countries with high levels of both individualism and EFW, an indication of the importance of having complementary informal and formal institutions that provide individuals with the freedom and economic incentives to engage in innovative activity. Indeed, the top decile of innovative countries in our sample all have high levels of both individualism and EFW. The graph also suggests that innovation is predicted to be very low in countries with low levels of EFW and individualism. The least innovative nations in our sample all have relatively low levels of individualism and EFW.

Interestingly, it also suggests that countries with high levels of EFW but low levels of individualism can still achieve moderately high levels of innovation, but the same is not true of countries with high levels of individualism but low levels of EFW. Hong Kong and Singapore, for instance, are the two most economically free countries in the world, and both have relatively low levels of individualism. They both are also in the upper quartile of the most innovative countries in our sample. Meanwhile, South Africa has an individualism rating in the top quintile of our sample, but it ranks among the bottom quintile on EFW. Its innovation output score is around the 35th percentile of our sample. Argentina and Morocco also have relatively high levels of individualism (both rank in the top 35% of our sample), but Argentina is the least economically free country in our sample, and Morocco is in the bottom 15%. Both countries rank in the bottom two-thirds of our sample in terms of innovation output.

Most countries in our sample, however, have intermediate levels of both individualism and EFW, and the graph suggests that innovation is predicted to be increasing as the levels of both individualism and EFW rise. The median values of individualism and EFW in our sample are 3.4 and 7.2. Countries such as Dominican Republican and the Philippines have individualism and EFW values very close to the sample medians, and their innovation output scores are in line with the predicted values—both rank around the 35th percentile. Interestingly, Bulgaria has an individualism score very close to the median, but an EFW score around the 60th percentile. Meanwhile, Jamaica has an EFW score very close to the median, but an individualism score around the 60th percentile. Bulgaria’s innovation score is around the 60th percentile, while Jamaica is around the 25th percentile.

While there are certainly other factors that contribute to national innovation, the anecdotal comparison between Bulgaria and Jamaica suggests that incremental increases in pro-market institutions may be more valuable for encouraging innovation than incremental increases in individualism for countries with intermediate levels of both. This seems to also be supported by the above discussion that countries with relatively high levels of EFW and low levels of individualism are more innovative than countries for which the opposite is true. This insight is valuable for policymakers seeking to encourage innovation, as formal institutions are more malleable through the political process than informal institutions (Roland 2004). As North (2005, p. 50) describes, “While formal institutions can be changed by fiat, informal institutions evolve in ways that are still far from completely understood and therefore are not typically amenable to deliberate human manipulation.”

Therefore, policymakers are better positioned to implement pro-market institutional reforms than to influence culture, which is “one of the most important and stable contexts for economic activity in a society” (Li and Zahra 2012, p. 108). Doing so will help establish the formal institutional framework that supports and encourages innovative and entrepreneurial activity (Audretsch and Belitski 2017); however, policymakers should adopt market-based rules and policies that align with the cultural values, norms, and beliefs of their population, rather than simply importing institutional blueprints from other successful countries (Boettke et al. 2008; Rodrik 2008).

5.2 Limitations and future research directions

As with all empirical studies, ours has several limitations that can be addressed in future research. First, although our sample represents countries at various stages of development located in every major region of the world, it is constrained by data availability. For example, Greene (1997) recommends using N > 50 + 8 × m (m is the number of IVs) per independent variable to obtain sufficient statistical power. Unfortunately, in the context of our study, we are limited by the number of countries for which data is available (e.g., there are simply not enough countries in the world to satisfy this condition). As additional data become available for a larger number of countries, it would be worthwhile to re-examine the relationship between culture, institutions, and innovation.

Second, our analysis is based on cross-sectional data, limiting our ability to draw causal inferences or to analyze the innovation effects of cultural and institutional change. Thus, our results should be interpreted as suggestive rather than causal. Future research that uses panel data could improve our understanding of these processes and their importance for innovation and economic development more generally (Alesina and Giuliano 2015). Two challenges to doing so are immediately evident. First is devising metrics that capture the richness of innovation in society that are comparable across both countries and time. Although the GII index that we use is available annually, its methodology and variable coverage have changed over time. Second, there is some evidence that cultural values along the I-C cleavage have changed in recent decades for many countries (Taras et al. 2012). However, Hofstede’s (1980) cultural value dimensions were designed to capture relative differences across countries, and much of the measured cultural shift in recent decades represents absolute rather than relative changes such that differences between country pairs have remained relatively stable over time (Beugelsdijk et al. 2015).

Next, we follow numerous entrepreneurship and innovation studies in using Hofstede’s individualism index to capture cultural variation across countries. However, the relationship between individualism and innovation is likely more nuanced than what our conceptualization and measurement enable us to assess (Gorodnichenko and Roland 2017; Stephan and Uhlaner 2010). Shane (1995), for instance, suggests that individualism influences the type of innovation strategy and not necessarily the sheer volume of innovation activity. Taylor and Wilson (2012) argue that certain types of collectivism (e.g., patriotism and nationalism) can promote innovation at the national level while other forms of collectivism (e.g., familism and localism) can harm innovation rates as well as slow progress in science and technology. Others have suggested that the relationship between individualism and innovation may be curvilinear (Efrat 2014; Morris et al. 1993) or depend on a country’s level of development (Zhao et al. 2012). Still, others suggest using alternative cultural measures (Schwartz 1994). Future research that examines some of these nuances could deepen our understanding of the relationship between culture, institutions, and innovation.

Additionally, our analysis points to the complementary role of formal and informal institutions for national innovation. This presents an opportunity for two research extensions. First, future research could examine their interaction in the context of firm-level innovation (Zhu and Zhu 2017). In other words, while we focus on macro-macro linkages, it would be fruitful to examine the relationship between formal and informal institutions at the macro-level and individual-level behavior (Boudreaux et al. 2019). Second, there exists cultural (Tung 2008; Vedula and Fitza 2019), institutional (Arregle et al. 2013; Audretsch and Belitski 2017; Bennett 2020), and innovative heterogeneity (Fritsch and Wyrwich 2018; González-Pernía et al. 2012) across regions within a country. Future research that explores a similar framework at the sub-national level would shine additional light on the importance of the interdependent institutional environment for innovation.

Notes

For exceptions, see: (1) Li and Zahra (2012), who find that venture capital activity is higher in countries with better governance institutions, as measured by the World Governance Index, but the effect is weaker in more uncertainty avoiding and collectivistic societies; and (2) Lehmann and Seitz (2017), who find that personal freedom, as proxied by the Gay Travel Index, is positively associated with innovation (i.e., per capita patents and trademarks), while controlling for measures of social capital and trust in some specifications.

According to Coleman’s (1990) “bathtub” model, macro-level factors such as formal institutions and culture create constraints on individual-level behavior. In turn, individuals make choices under those constraints, and individual-level actions accumulate at the macro-level. For example, higher levels of regulation at the macro-level can create constraints that prevent individuals from taking advantage of business opportunities (Boudreaux et al. 2019). In turn, fewer people will engage in entrepreneurial action, leading to overall lower levels of new start-ups at the macro-level. In this paper, we are interested in exploring macro-macro level linkages.

Specifically, the marginal effect is given by \( \frac{\partial Innov}{\partial Individualism}={\beta}_1+{\beta}_3 EFW. \) Setting the marginal effect equal to zero, we solve for the threshold level of EFW at which the marginal effect of individualism on innovation changes from negative (β1 < 0) to positive (β3 > 0). In other words, \( EFW=-\frac{\beta_2}{\beta_3} \).

We use 100 bootstrap replications to obtain the variance-covariance matrix and set the random number generating seed at 5.

We provide analogous contour graphs for the two innovation output pillars in Appendix C.

References

Abramowitz, M. J. (2018). "Freedom in the world 2018: Democracy in crisis." Freedom House, 8 (2018).

Acs, Z. J., Audretsch, D., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41, 757–774 https://doi.org/10.1007/s11187-013-9505-9.

Acs, Z. J., Audretsch, D. B., Lehmann, E. E., & Licht, G. (2017). National systems of innovation. The Journal of Technology Transfer, 42(5), 997–1008. https://doi.org/10.1007/s10961-016-9481-8.

Alesina, A., & Ferrara, E. L. (2005). Ethnic diversity and economic performance. Journal of Economic Literature, 43(3), 762–800. https://doi.org/10.1257/002205105774431243.

Alesina, A., & Giuliano, P. (2010). The power of the family. Journal of Economic Growth, 15(2), 93–125. https://doi.org/10.1007/s10887-010-9052-z.

Alesina, A., & Giuliano, P. (2015). Culture and institutions. Journal of Economic Literature, 53, 898–944. https://doi.org/10.1257/jel.53.4.898.

Alesina, A., Devleeschauwer, A., Easterly, W., Kurlat, S., & Wacziarg, R. (2003). Fractionalization. Journal of Economic Growth, 8, 155–194. https://doi.org/10.1023/A:1024471506938.

Angulo-Guerrero, M. J., Pérez-Moreno, S., & Abad-Guerrero, I. M. (2017). How economic freedom affects opportunity and necessity entrepreneurship in the OECD countries. Journal of Business Research, 73, 30–37. https://doi.org/10.1016/j.jbusres.2016.11.017.

Anokhin, S., & Wincent, J. (2012). Start-up rates and innovation: a cross-country examination. Journal of International Business Studies, 43(1), 41–60. https://doi.org/10.1057/jibs.2011.47.

Aoki, M. (2001). Toward a comparative institutional analysis. MIT Press https://mitpress.mit.edu/books/toward-comparative-institutional-analysis.

Arregle, J.-L., Miller, T. L., Hitt, M. A., & Beamish, P. W. (2013). Do regions matter? An integrated institutional and semiglobalization perspective on the internationalization of MNEs. Strategic Management Journal, 34(8), 910–934. https://doi.org/10.1002/smj.2051.

Audretsch, D. B., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: establishing the framework conditions. The Journal of Technology Transfer, 42(5), 1030–1051. https://doi.org/10.1007/s10961-016-9473-8.

Autio, E., Pathak, S., & Wennberg, K. (2013). Consequences of cultural practices for entrepreneurial behaviors. Journal of International Business Studies, 44(4), 334–362. https://doi.org/10.1057/jibs.2013.15.

Barro, R. J., & McCleary, R. M. (2003). Religion and economic growth across countries. American Sociological Review, 68, 760–781. https://doi.org/10.2307/1519761.

Baumol, W. J. (1990). Entrepreneurship: productive, unproductive, and destructive. Journal of Political Economy, 98, 893–921.

Bennett, D. L. (2019a). Infrastructure investments and entrepreneurial dynamism in the U.S. Journal of Business Venturing, 34(5), 28. https://doi.org/10.1016/j.jbusvent.2018.10.005.

Bennett, D. L. (2019b). Local economic freedom and creative destruction in America. Small Business Economics. https://doi.org/10.1007/s11187-019-00222-0.

Bennett, D. L. (2020). Local institutional heterogeneity & firm dynamism: decomposing the metropolitan economic freedom index. Small Business Economics. https://doi.org/10.1007/s11187-020-00322-2.

Bennett, D. L., & Nikolaev, B. (2016). Factor endowments, the rule of law and structural inequality. Journal of Institutional Economics, 12(04), 773–795. https://doi.org/10.1017/S1744137416000084.

Bennett, D. L., & Nikolaev, B. (2017). On the ambiguous economic freedom–inequality relationship. Empirical Economics, 53, 717–754. https://doi.org/10.1007/s00181-016-1131-3.

Bennett, D. L., & Nikolaev, B. (2019). Economic freedom, public policy, and entrepreneurship. In J. Gwartney, R. Lawson, J. Hall, & R. Murphy (Eds.), Economic Freedom of the World: 2019 edition (pp. 199–224). Fraser Institute.

Bennett, D. L., & Nikolaev, B. (2020). Historical disease prevalence, cultural values, and global innovation. Entrepreneurship Theory and Practice, In Press.

Bennett, D. L., Faria, H. J., Gwartney, J. D., & Morales, D. R. (2017). Economic institutions and comparative economic development: a post-colonial perspective. World Development, 96, 503–519. https://doi.org/10.1016/j.worlddev.2017.03.032.

Beugelsdijk, S., Maseland, R., & Van Hoorn, A. (2015). Are scores on Hofstede’s dimensions of national culture stable over time? A cohort analysis. Global Strategy Journal, 5(3), 223–240.

Bjørnskov, C., & Foss, N. J. (2008). Economic freedom and entrepreneurial activity: some cross-country evidence. Public Choice, 134(3–4), 307–328. https://doi.org/10.1007/s11127-007-9229-y.

Bjørnskov, C., & Foss, N. J. (2012). How institutions of liberty promote entrepreneurship and growth. In Economic Freedom of the World: 2012 annual report (pp. 247–270). Fraser Institute.

Bjørnskov, C., & Foss, N. (2013). How strategic entrepreneurship and the institutional context drive economic growth. Strategic Entrepreneurship Journal, 7(1), 50–69. https://doi.org/10.1002/sej.1148.

Bjornskov, C., & Foss, N. J. (2016). Institutions, entrepreneurship, and economic growth: what do we know and what do we still need to know? Academy of Management Perspectives, 30, 292–315. https://doi.org/10.5465/amp.2015.0135.

Boettke, P. J., Coyne, C. J., & Leeson, P. T. (2008). Institutional stickiness and the new development economics. The American Journal of Economics and Sociology, 67, 331–358.

Bologna, J. (2014). A spatial analysis of entrepreneurship and institutional quality: evidence from U.S. metropolitan areas. Journal of Regional Analysis and Policy, 44(2), 109–131.

Boudreaux, C. J., Nikolaev, B., & Klein, P. (2019). Socio-cognitive traits and entrepreneurship: the moderating role of economic institutions. Journal of Business Venturing, 34(1), 178–196. https://doi.org/10.1016/j.jbusvent.2018.08.003.

Brambor, T., Clark, W. R., & Golder, M. (2006). Understanding interaction models: improving empirical analyses. Political Analysis, 14, 63–82. https://doi.org/10.1093/pan/mpi014.

Bruton, G. D., & Ahlstrom, D. (2003). An institutional view of China’s venture capital industry. Journal of Business Venturing, 18(2), 233–259. https://doi.org/10.1016/S0883-9026(02)00079-4.

Bruton, G. D., Ahlstrom, D., & Li, H. (2010). Institutional theory and entrepreneurship: where are we now and where do we need to move in the future? Entrepreneurship Theory and Practice, 34(3), 421–440. https://doi.org/10.1111/j.1540-6520.2010.00390.x.

Bylund, P. L., & McCaffrey, M. (2017). A theory of entrepreneurship and institutional uncertainty. Journal of Business Venturing, 32(5), 461–475. https://doi.org/10.1016/j.jbusvent.2017.05.006.

Chamberlain, G. (1994). Quantile regression, censoring, and the structure of wages. In C. A. Sims (Ed.), Advances in econometrics: sixth world congress (Vol. 1, pp. 171–210). Cambridge Core: Cambridge University Press. https://doi.org/10.1017/CCOL0521444594.005.

Coleman, J. S. (1990). Foundations of social theory. Cambridge: Belknap Press of Harvard University Press.

Colombelli, A., Krafft, J., & Vivarelli, M. (2016). To be born is not enough: the key role of innovative start-ups. Small Business Economics, 47(2), 277–291. https://doi.org/10.1007/s11187-016-9716-y.

Cuervo-Cazurra, A., Gaur, A., & Singh, D. (2019). Pro-market institutions and global strategy: the pendulum of pro-market reforms and reversals. Journal of International Business Studies, 50(4), 598–632. https://doi.org/10.1057/s41267-019-00221-z.

Dau, L. A., & Cuervo-Cazurra, A. (2014). To formalize or not to formalize: entrepreneurship and pro-market institutions. Journal of Business Venturing, 29, 668–686. https://doi.org/10.1016/j.jbusvent.2014.05.002.

Davidsson, P. (2015). Entrepreneurial opportunities and the entrepreneurship nexus: a re-conceptualization. Journal of Business Venturing, 30(5), 674–695. https://doi.org/10.1016/j.jbusvent.2015.01.002.

del Junco, J. G., & Brás-dos-Santos, J. M. (2009). How different are the entrepreneurs in the European Union internal market?—an exploratory cross-cultural analysis of German, Italian and Spanish entrepreneurs. Journal of International Entrepreneurship, 7(2), 135–162. https://doi.org/10.1007/s10843-009-0037-y.

Dutta, S., Lanvin, B., & Wunsch-Vincent, S. (2018). Global Innovation Index 2018: energizing the world with innovation, 11th edition. Cornell University, INSEAD, and WIPO.

Easterly, W. (2007). Inequality does cause underdevelopment: insights from a new instrument. Journal of Development Economics, 84, 755–776. https://doi.org/10.1016/j.jdeveco.2006.11.002.

Easterly, W., & Levine, R. (2003). Tropics, germs, and crops: how endowments influence economic development. Journal of Monetary Economics, 50, 3–39. https://doi.org/10.1016/S0304-3932(02)00200-3.

Eesley, C. E., Eberhart, R. N., Skousen, B. R., & Cheng, J. L. C. (2018). Institutions and entrepreneurial activity: the interactive influence of misaligned formal and informal institutions. Strategy Science, 3(2), 393–407. https://doi.org/10.1287/stsc.2018.0060.

Efrat, K. (2014). The direct and indirect impact of culture on innovation. Technovation, 34(1), 12–20. https://doi.org/10.1016/j.technovation.2013.08.003.

Foss, N. J., Klein, P. G., & Bjørnskov, C. (2019). The context of entrepreneurial judgment: organizations, markets, and institutions. Journal of Management Studies, joms.12428. https://doi.org/10.1111/joms.12428.

Fritsch, M., & Wyrwich, M. (2018). Regional knowledge, entrepreneurial culture, and innovative start-ups over time and space―an empirical investigation. Small Business Economics, 51(2), 337–353. https://doi.org/10.1007/s11187-018-0016-6.

Gohmann, S. F. (2012). Institutions, latent entrepreneurship, and self-employment: an international comparison. Entrepreneurship Theory and Practice, 36(2), 295–321. https://doi.org/10.1111/j.1540-6520.2010.00406.x.

Gohmann, S. F., Hobbs, B. K., & McCrickard, M. (2008). Economic freedom and service industry growth in the United States. Entrepreneurship Theory and Practice, 32, 855–874. https://doi.org/10.1111/j.1540-6520.2008.00259.x.

González-Pernía, J. L., Peña-Legazkue, I., & Vendrell-Herrero, F. (2012). Innovation, entrepreneurial activity and competitiveness at a sub-national level. Small Business Economics, 39(3), 561–574. https://doi.org/10.1007/s11187-011-9330-y.

Gorodnichenko, Y., & Roland, G. (2017). Culture, institutions, and the wealth of nations. The Review of Economics and Statistics, 99, 402–416. https://doi.org/10.1162/REST_a_00599.

Greene, W. H. (1997). Econometric analysis. Prentice-Hall International.

Greif, A. (1994). Cultural beliefs and the organization of society: a historical and theoretical reflection on collectivist and individualist societies. Journal of Political Economy, 102, 912–950.

Gwartney, J., & Lawson, R. (2003). The concept and measurement of economic freedom. European Journal of Political Economy, 19, 405–430. https://doi.org/10.1016/S0176-2680(03)00007-7.

Gwartney, J., Lawson, R., Hall, J., & Murphy, R. (2018). Economic Freedom of the World: 2018 annual report. http://www.deslibris.ca/ID/10097993.

Hall, J. C., Nikolaev, B., Pulito, J. M., & VanMetre, B. J. (2013). The effect of personal and economic freedom on entrepreneurial activity: evidence from a new state level freedom index. American Journal of Entrepreneurship, 6(1).

Hayek, F. A. (1948). Individualism and economic order. The University of Chicago Press.

Hayton, J. C., George, G., & Zahra, S. A. (2002). National culture and entrepreneurship: a review of behavioral research. Entrepreneurship: Theory and Practice, 26, 33–52.

Heine, S. J. (2016). Cultural psychology. W.W. Norton.

Hofstede, G. (1980). Culture’s consequences: national differences in thinking and organizing. Beverly Hills, Calif: Sage.

Hofstede, G. (1991). Organizations and cultures: software of the mind. New York: McGrawHill.

Hofstede, G. (2010). The GLOBE debate: Back to relevance. Journal of International Business Studies, 41(8):1339-1346.

Hofstede, G., Hofstede, G. J., & Minkov, M. (2010). Dimension data matrix. Electronic document. Accessed 10 2010.

Holmes, R. M., Miller, T., Hitt, M. A., & Salmador, M. P. (2013). The interrelationships among informal institutions, formal institutions, and inward foreign direct investment. Journal of Management, 39(2), 531–566. https://doi.org/10.1177/0149206310393503.

Kreft, S. F., & Sobel, R. S. (2005). Public policy, entrepreneurship, and economic freedom. Cato Journal, 25(3), 595–616.

La Porta, R., Florencio, L.-S., Shleifer, A., & Vishny, R. (1999). The quality of government. Journal of Law, Economics, and Organization, 15, 222–279.

La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2008). The economic consequences of legal origins. Journal of Economic Literature, 46, 285–332. https://doi.org/10.1257/jel.46.2.285.

Lehmann, E. E., & Seitz, N. (2017). Freedom and innovation: a country and state level analysis. The Journal of Technology Transfer, 42(5), 1009–1029. https://doi.org/10.1007/s10961-016-9478-3.

Li, Y., & Zahra, S. A. (2012). Formal institutions, culture, and venture capital activity: a cross-country analysis. Journal of Business Venturing, 27(1), 95–111. https://doi.org/10.1016/j.jbusvent.2010.06.003.

Lundvall, B.-Å. (2010). National systems of innovation: toward a theory of innovation and interactive learning. Anthem Press; JSTOR. https://www.jstor.org/stable/j.ctt1gxp7cs.

McMullen, J. S., Bagby, D. R., & Palich, L. E. (2008). Economic freedom and the motivation to engage in entrepreneurial action. Entrepreneurship Theory and Practice, 32, 875–895. https://doi.org/10.1111/j.1540-6520.2008.00260.x.

Mokyr, J. (2017). A culture of growth: the origins of the modern economy. Princeton University Press.

Morris, M. H., Avila, R. A., & Allen, J. (1993). Individualism and the modern corporation: implications for innovation and entrepreneurship. Journal of Management, 19(3), 595–612. https://doi.org/10.1177/014920639301900305.

Murray, D. R., Schaller, M. (2010). Historical Prevalence of Infectious Diseases Within 230 Geopolitical Regions: A Tool for Investigating Origins of Culture. Journal of Cross-Cultural Psychology, 41(1):99-108.

Nelson, R. R. (1993). National innovation systems: a comparative analysis. Oxford University Press on Demand.

Nikolaev, B., & Salahodjaev, R. (2017). Historical prevalence of infectious diseases, cultural values, and the origins of economic institutions. Kyklos, 70, 97–128.

Nikolaev, B., Boudreaux, C., & Salahodjaev, R. (2017). Are individualistic societies less equal? Evidence from the parasite stress theory of values. Journal of Economic Behavior & Organization, 138, 30–49. https://doi.org/10.1016/j.jebo.2017.04.001.

Nikolaev, B., Boudreaux, C. J., & Palich, L. (2018). Cross-country determinants of early-stage necessity and opportunity-motivated entrepreneurship: accounting for model uncertainty. Journal of Small Business Management, 56(S1), 243–280. https://doi.org/10.1111/jsbm.12400.

North, D. C. (1990). Institutions, institutional change, and economic performance. Cambridge University Press.

North, D. C. (1991). Institutions. Journal of Economic Perspectives, 5(1):97-112.

North, D. C. (1994). Economic performance through time. The American Economic Review, 84, 359–368.

North, D. C. (2005). Understanding the process of economic change. Princeton University Press.

Nyström, K. (2008). The institutions of economic freedom and entrepreneurship: evidence from panel data. Public Choice, 136, 269–282. https://doi.org/10.1007/s11127-008-9295-9.

Platteau, J.-P. (2000). Institutions, social norms, and economic development. Routledge.

Powell, B., & Weber, R. (2013). Economic freedom and entrepreneurship: a panel study of the United States. American Journal of Entrepreneurship, 6, 67+.

Rinne, T., Steel, G. D., & Fairweather, J. (2012). Hofstede and Shane revisited: the role of power distance and individualism in national-level innovation success. Cross-Cultural Research, 46(2), 91–108. https://doi.org/10.1177/1069397111423898.

Rodrik, D. (2008). One economics, many recipes: globalization, institutions, and economic growth. Princeton University Press.

Rogers, E. M. (1995). Diffusion of innovations (4th ed). Free Press.

Roland, G. (2004). Understanding institutional change: fast-moving and slow-moving institutions. Studies in Comparative International Development, 38, 109–131. https://doi.org/10.1007/BF02686330.

Sachs, J. D. (2003). Institutions don’t rule: direct effects of geography on per capita income. National Bureau of Economic Research Working Paper Series, No. 9490.

Sachs, J. D., Mellinger, A. D., & Gallup, J. L. (2001). The geography of poverty and wealth. Scientific American, 284, 70–75.

Saunoris, J. W., & Sajny, A. (2017). Entrepreneurship and economic freedom: cross-country evidence from formal and informal sectors. Entrepreneurship and Regional Development, 29(3–4), 292–316. https://doi.org/10.1080/08985626.2016.1267806.

Schumpeter, J. A. (1942). Capitalism, socialism, and democracy. Harper.

Schwartz, S. H. (1994). Beyond individualism/collectivism: new cultural dimensions of values. In Ŭ. Kim, H. C. Triandis, C. Kagitcibasi, S.-C. Choi, & G. Yoon (Eds.), Individualism and collectivism: theory, method, and applications (pp. 85–122). Sage Publications.

Shane, S. (1992). Why do some societies invent more than others? Journal of Business Venturing, 7(1), 29–46. https://doi.org/10.1016/0883-9026(92)90033-N.

Shane, S. (1993). Cultural influences on national rates of innovation. Journal of Business Venturing, 8(1), 59–73.

Shane, S. (1995). Cultural differences in innovation championing strategies. Journal of Management, 21(5), 22.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. The Academy of Management Review, 25, 217–226.

Shane, S., Venkataraman, S., & MacMillan, I. (1995). Uncertainty avoidance and the preference for innovation championing roles. Journal of International Business Studies, 26(1), 47–68.

Smith, A. (1776). In E. Cannan (Ed.), An inquiry into the nature and causes of the wealth of nations. Library of Economics and Liberty.

Sobel, R. S. (2008). Testing Baumol: institutional quality and the productivity of entrepreneurship. Journal of Business Venturing, 23, 641–655. https://doi.org/10.1016/j.jbusvent.2008.01.004.

Solt, F. (2016). The standardized world income inequality database*. Social Science Quarterly, 97(5), 1267–1281. https://doi.org/10.1111/ssqu.12295.

Steensma, H. K., Marino, L., Weaver, K. M., & Dickson, P. H. (2000). The influence of national culture on the formation of technology alliances by entrepreneurial firms. Academy of Management Journal, 43(5), 951–973. https://doi.org/10.5465/1556421.

Stephan, U., & Uhlaner, L. M. (2010). Performance-based vs socially supportive culture: a cross-national study of descriptive norms and entrepreneurship. Journal of International Business Studies, 41(8), 1347–1364. https://doi.org/10.1057/jibs.2010.14.

Taras, V., Steel, P., & Kirkman, B. L. (2012). Improving national cultural indices using a longitudinal meta-analysis of Hofstede’s dimensions. Journal of World Business, 47(3), 329–341. https://doi.org/10.1016/j.jwb.2011.05.001.

Taylor, M. Z., & Wilson, S. (2012). Does culture still matter?: the effects of individualism on national innovation rates. Journal of Business Venturing, 27(2), 234–247. https://doi.org/10.1016/j.jbusvent.2010.10.001.

Thornhill, R., & Fincher, C. L. (2014). The parasite-stress theory of values and sociality: infectious disease, history and human values worldwide. Springer.

Triandis, H. C. (1995). Individualism & collectivism. Westview Press.