Abstract

Prior research on the effect that formal and informal institutions have on high-growth entrepreneurship has tended to propose policies aimed at either lowering the social cost of failure in society, or creating business-friendly entry environments aimed at increasing the rate of entrepreneurship. These policies have triggered a debate about whether policies that focus on stimulating high-growth entrepreneurship conflict with policy goals aimed at decreasing the social cost of failure in society. Using approach/avoidance as a lens, we examine the relationship between high social costs of failure and the odds of individuals engaging in growth-based entrepreneurship. Our unique dataset captures the entry decisions of 208,089 individuals in 29 OECD countries. We find that while countries with a higher social cost of failure experience lower total entrepreneurial activity, they have higher odds of entrepreneurs having high-growth aspirations and firms with export-led orientations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Scholarly interest in the drivers of high-growth entrepreneurship has increased in recent years, as have policies to support them, because high-growth firms are thought to drive job creation and economic growth in society (e.g., Acs et al. 2008b; Shane 2009; Lerner 2010). However, policies aimed at supporting high-growth entrepreneurship may conflict with policies aimed at increasing overall entrepreneurial activity. For example, low social costs of failure in a country seems associated with higher rates of entry into entrepreneurship because more people are willing to try entrepreneurship when the penalties for failing are lower (Arenius and Minniti 2005; Vaillant and Lafuente 2007; Stuetzer et al. 2014). But at the same time, higher social cost of failure might push individuals to work harder to avoid failing, making them more likely to succeed and grow (Cacciotti et al. 2016; Mitchell and Shepherd 2011). Specifically, research on approach/avoidance behavior indicates that high social costs of failure may act as “fuel” for success (Elliot 1999; Elliot and Church 1997; Morgan and Sisak 2016; Shepherd and Haynie 2011). This suggests that there may actually be advantages to higher social cost of failure (cf. Cacciotti et al. 2016:303) because although fewer may enter entrepreneurship, those that do could be more growth oriented.

To date, how the social costs of failure concomitantly influence the level of entrepreneurship and the growth orientation of entrepreneurs has not been examined. As noted, there is reason to believe that the effects are opposite. Therefore, in this paper, we examine how formal and informal institutional norms reflecting the social costs of failure influence: (1) the likelihood of entering entrepreneurship, (2) the likelihood of entering entrepreneurship with growth aspirations, and (3) the likelihood of firms emerging with export-led orientations. We approach this subject from a new lens that shifts the focus away from the negative ramifications of failure on firm closure and bankruptcy, to the positive implications of increasing the supply of high-growth firms.

In carrying out this research, we make three primary contributions to the literature. First, although prior studies have contributed to our understanding of the impact of the social cost of failure on the number of new startups (Damaraju et al. 2010; Lee et al. 2007; Lee et al. 2011), the results of this study suggest that there is more to learn about how these social costs influence the composition of entrepreneurial activity in society (Baumol 1996). In particular, we add nuance to prior assumptions about how stigma and hostile regulatory environments impact the growth of early-stage ventures (Cacciotti et al. 2016; Arenius and Minniti 2005).

Second, we contribute to a long-running debate about the role of institutions in entrepreneurial entry decisions (Kuratko and Hudson 2017). Central to this debate is the question of whether all forms of entrepreneurial activity should be encouraged by public policy makers (Morris et al. 2015) or whether economies should instead focus exclusively on fostering high-growth entrepreneurship (Shane 2009; Lerner 2010). In recent studies, scholars have inquired about the viability of institutional frameworks that seek to encourage or deter certain forms of entrepreneurial activities (Mason and Brown 2013; Arshed et al. 2014). Although many of these questions were unanswerable at the outset of the debate, key insights are now possible thanks to the emergence of several global studies dealing with entrepreneurial entry decisions, including the Global Entrepreneurship Monitor, European Flash Barometer (EUFB), and World Bank Development Indicator (WDI) and Doing Business databases (WBDB).

Third, by studying both individual aspirations and firm orientations, we are able to provide additional insights on the interplay between intrinsic and extrinsic motivations on high-growth entrepreneurship (Murnieks et al. 2019). Prior research has demonstrated that national socio-economic and cultural factors affect employee aspirations and orientation towards work within an organization (Huang and Van de Vliert 2003). By pursuing this line of inquiry in entrepreneurship, we provide insights on why individuals with the same skills and aspirations make different entry decisions in institutional contexts with a high social cost of failure.

2 Theoretical development

2.1 Social costs of failure

Risk and uncertainty lie at the heart of all entrepreneurial endeavors, and the probability of failure occurring is the reality for over 50% of entrepreneurs who start a new business (BLS 2012). As such, it is not surprising to find that the fear of failure is a significant predictor of entrepreneurial entry (Vaillant and Lafuente 2007; Stuetzer et al. 2014). To date, research on the fear of failure has largely been examined as an individual level measure of entrepreneurial intentions, independent of contingent relationships at the macro level. However, several studies suggest that the relationship between fear of failure and entrepreneurial behavior is more complex and that the fear that entrepreneurs experience is a derivative of societal attitudes about transacting with failed entrepreneurs, and the normative expectation of institutional sanctions (Kreiser et al. 2010; Schmutzler et al. 2019; Simmons et al. 2014).

Unlike the individual fear of failure, which is both temporal and event specific (Cacciotti and Hayton 2015), the social costs of failure refer to institutional sanctions placed on unsuccessful entrepreneurs by other members of society, including both the stigma surrounding failure and the visibility of that failure among the broader community (Simmons et al. 2014). The institutions that make up these social costs have been shown to have a significant impact on the entry decisions and industry selection of nascent entrepreneurs (Kreiser et al. 2010; Bruton et al. 2010; Thornton 1999; Davidsson and Wiklund 1997), and some have argued that differences in national and regional rates of entrepreneurship can be explained by the interactive influence of the two on individual decision making (Eesley et al. 2018).

While formal institutions describe the regulations and other operating rules that societies codify into law (Eesley et al. 2018), social norms and other informal institutions refer to the unwritten rules that define the social costs for those who decline to follow society’s approved modes of behavior (Schmutzler et al. 2019). Such norms “have long been considered an important source of influence on individuals’ attitudes towards a specific career option” (Merton 1968; Schmutzler et al. 2019: 884). These institutions dictate what activities are deemed legitimate behaviors for individuals to pursue (Lee et al. 2007; Aldrich and Fiol 1994), and the failure to meet expectations can result in severe stigmatization (the magnitude of which varies across countries) (Simmons et al. 2014).

The social costs of failure can accrue for an undefined period of time following a firm’s closure and can have both direct and indirect effects on an entrepreneur’s reentry options (Semadeni et al. 2008). The long-term impairment to stakeholder relationships has been shown to negatively impact the reentry decisions of experienced entrepreneurs (Sutton and Callahan 1987; Simmons et al. 2014). Some of them have even opted for a kind of self-imposed exile (Singh et al. 2007). Others find it more difficult to access capital for reentry attempts (Lee et al. 2007) or regain legitimacy with external stakeholders (Mitsuhashi and Bird 2011).

Because regions with a higher social cost of failure have long been associated with decreased rates of entrepreneurship (Arenius and Minniti 2005; Stuetzer et al. 2014), efforts to reduce it have long been based on the assumption that doing so will result in an increase in different types of entrepreneurship (i.e., tech-based, high growth, small business, etc.) (Lee et al. 2011; Simmons et al. 2014). However, numerous studies have shown that the fear of failure “can have a differential effect on entrepreneurial action, impeding it on the one hand, while motivating it on the other” (Mitchell and Shepherd 2011: 195). For countries with a high social cost of failure, this could have significant implications for how the surrounding environment affects the mode and manner of entrepreneurial entry, including the type of firms that emerge as a result.

2.2 Approach/avoidance behavior

Scholarly work on approach/avoidance behavior dates back almost 80 years, to early research on the motivational cues that guide individual quests for achievement (Atkinson 1957; Covington and Beery 1976; Hoppe 1931; Maslow 1955; McClelland 1951; Murray 1938). Within the field, scholars developed two motivational orientations to account for achievement-seeking behavior in individuals: the attainment of success, and the avoidance of failure (Elliot 1999). While the aim of one class of motives (known as approach tendencies) is to maximize satisfaction, the aim of the other class (avoidance tendencies) is to minimize pain (Atkinson 1957: 360). Elliot and Church (1997: 221) noted that several researchers have portrayed failure as “an inhibitor of effort and performance when unaccompanied by achievement motivation, but a facilitator of effort and performance when accompanied by it.”

The basic principles of approach/avoidance behavior have been said to exist in several major theoretical conceptions of the self (Elliot 1999), including psychodynamic (Freud 1957), dispositional (Cattell 1957), humanistic (Maslow 1955), social-cognitive (Rotter 1954), and cognitive (Heider 1958). They have also been applied in numerous entrepreneurship studies to explain the differential effect that failure has on entrepreneurial action (Cacciotti et al. 2016; Hayton et al. 2013; Shepherd and Haynie 2011). This research suggests that far from inhibiting the actions of individual entrepreneurs, the social costs of failure can in some cases energize and direct their behavior to achieve greater levels of success (Elliot and Church 1997; McClelland et al. 1989).

When considered at the national level, this research suggests that some countries may benefit from having a higher social cost of failure (Hayton et al. 2002; Wyrwich et al. 2016). Elliot (1999), for instance, found that external factors can have a significant impact on the goal adoption process of individuals, independent of any pre-existing ‘hard wiring’ (Ames 1992; Meece 1991). That is, “if the achievement setting is strong enough, it alone can establish situation-specific concerns that lead to goal preferences for the individual” (Elliot 1999: 176).

The individual-environment relationship is similarly important to understanding the impact that the social cost of failure has on entrepreneurial decision making (Cacciotti et al. 2016). Because society’s values indicate the extent to which it considers entrepreneurial behavior desirable, “cultures that value and reward such behavior promote a propensity to develop and introduce radical innovation, whereas cultures that reinforce conformity and group interests” do not (Hayton et al. 2002: 33). This context-specific process (Wyrwich et al. 2016) affects the goal adoption of entrepreneurs, by imposing constraints on the “feasibility and desirability” of potential outcomes (Cacciotti et al. 2016: 316).

These costs are often described as a multi-level phenomenon in which macro-level judgments surrounding the undesirability of a particular action become attached to a person’s social identity (Goffman 1963; Simmons et al. 2014; Shepherd and Haynie 2011; Arenius and Minniti 2005). Because institutional norms and societal expectations dictate which activities are deemed legitimate behaviors for entrepreneurs to pursue (Lee et al. 2007; Aldrich and Fiol 1994), the failure to meet these expectations can result in stigmatization. The impact of a higher social cost of failure can thus be both unscripted and ambiguous and dissuade some individuals from pursuing entrepreneurship, while encouraging others to excel in it (Simmons et al. 2014).

2.3 Formal and informal institutions in the entry environment

The type and level of sanctions associated with the social costs of failure depend on formal and informal institutional norms (Landier 2005; Simmons et al. 2014). Formal costs of failure include those imposed by a country’s credit agencies and bankruptcy regulations (Eesley et al. 2018). Informal costs of failure include stigmas that attach to the entrepreneurs and their ventures (Schmutzler et al. 2019). We examine the effects of both the formal and informal aspects of social costs of failure on the entry decisions of individual entrepreneurs.

Among the formal institutions that affect the social cost of failure in a country is the visibility of entrepreneurs’ previous failures recorded in national credit registries (both public and private). These registries provide access to the credit history of individual borrowers, and, in some cases, make it substantially harder for individuals considering entry into entrepreneurship to acquire the resources necessary for startup (Simmons et al. 2014). The World Bank (2018) has reported that the depth of information shared by national credit bureaus directly affects the amount of bank lending to young firms. They have also noted that within high-income countries, the enforcement of credit rights (i.e., collateral and bankruptcy laws) matters more to the availability of credit than the existence of mechanisms for information sharing (i.e., public and private credit bureaus).

In addition to formal institutions, there are normative expectations embedded in a society’s informal institutions that also dominate the rules of behavior (Eesley et al. 2018). Kibler et al. (2014) argue that “regions develop specific cultural cognitive, normative, and regulative contexts that lead to various shared meanings and social perceptions of economic behavior” (Wyrwich et al. 2016: 468). Norms have been found to affect both the supply and demand of entrepreneurs in a region, as well as the availability of key resources and the manner of organizing entrepreneurial entry (Simmons et al. 2014). This “distal socio-cultural environment behaves as a magnifying glass for the interaction between personal characteristics, and the proximate cultural context in molding entrepreneurial intentions” (Schmutzler et al. 2019:27).

The formal and informal institutions discussed above are representative of the social cost of failure in society. Prior research has consistently found that countries with a higher social cost of failure are negatively associated with lower overall rates of entrepreneurship (Arenius and Minniti 2005; Vaillant and Lafuente 2007; Stuetzer et al. 2014). Before examining the impact that higher social costs of failure have on the specific intent to enter high-growth entrepreneurship (and subsequent orientation of the emerging firm), we first investigate whether this study confirms the findings of previous research.

Hypothesis 1: The likelihood that individuals will be engaged in entrepreneurial activity is lower in countries with a high social cost of failure.

2.4 High-growth entrepreneurial aspirations

Belief in the upside gain of entrepreneurship is largely synonymous with the belief in the possibility of future growth—growth is viewed as the most relevant performance indicator among entrepreneurs and scholars alike, and early growth largely determines the value of the new venture, should the business be sold (e.g., Wennberg et al. 2013; Wiklund and Shepherd 2003). Among the factors that contribute to the emergence of high growth of firms are the quality of available opportunities to exploit, the resource endowments of founding teams, and the presence of various intrinsic and extrinsic motivations for growing the business (Penrose 1959; Wiklund and Shepherd 2003).

Most new ventures do not grow at all, and very few exhibits extensive growth (i.e., Shepherd and Wiklund 2009). Many entrepreneurs simply do not have growth aspirations and therefore do not expand their firms (e.g., Wiklund and Shepherd 2003). They establish their businesses for other reasons, primarily to achieve greater autonomy (Carter et al. 2003). Growth aspirations are a necessary but not sufficient conditions for actual growth—only those new ventures headed by entrepreneurs who wish to expand their businesses are likely to realize actual growth (Wiklund and Shepherd 2003). Prior research has established empirically that the degree of growth aspirations influences the degree of actual firm growth (Delmar and Wiklund 2008).

Entrepreneurs’ growth aspirations, and thus subsequent growth, are influenced by a range of factors—for example, Wiklund and Shepherd (2003) identified eight different variables that affected growth aspirations. In countries where the social cost of failure is high, higher returns from entrepreneurship are required in order for entrepreneurship to be a viable alternative to employment (Hayward et al. 2010). As such, entrepreneurs who pursue opportunities in countries where the social costs of failure are high will have stronger beliefs that they can build successful businesses than in countries where these costs are low. As such, they will likely be more oriented towards higher growth aspirations (Arora and Nandkumar 2011). The higher opportunity cost associated with the social cost of failure is likely to increase the probability that entrepreneurs demand a higher return as a condition of entry. Those entering in such countries are more likely to be ambitious about their firm’s growth prospects and invest more aggressively as a result (Arora and Nandkumar 2011), leading them to have higher growth aspirations. This leads to the following hypothesis:

Hypothesis 2: The likelihood that individuals will be engaged in entrepreneurial activity with growth aspiration higher in countries with a high social cost of failure.

2.4.1 High-growth entrepreneurial activity with export orientation

Prior research suggests that a strong relationship exists between growth opportunities and the internationalization of new ventures (Castaño et al. 2015; Lu and Beamish 2001; Zahra et al. 1997). Autio, Sapienza, and Almeida (2000: 909) argued that certain firms orient themselves internationally because they are provoked, pushed, or pulled toward the opportunity, and that ventures that internationalize early experience positive learning and growth effects that latecomers are less likely to benefit from. Hessels and van Stel (2011: 259) similarly noted that export-oriented firms “tend to be more productive, more capital intensive, more innovative, and more efficient” than those which focus on domestic markets (Clerides et al. 1998; Girma et al. 2004; Kneller and Pisu 2007).

Although entrepreneurs can employ several modes of international entry—including exporting, licensing, acquisition, strategic alliances and foreign direct investment (Hitt et al. 2001)—exporting is by far the most common (Kogut and Chang 1996; Zahra et al. 1997). Exporting is described in the literature as a vehicle for high-growth entrepreneurship in developed countries by facilitating knowledge spillovers, financial rewards, access to new technology, and entrepreneurial learning (Hessels and van Stel 2011). As a method of internationalization, it does not require entrepreneurs to make substantial capital investments (Root 1998) and tends to involve less commercial and financial risk than other methods of internationalization (Jaffe and Pasternak 1994).

Environments with a high social cost of failure may encourage entrepreneurs to avoid domestic markets when they are perceived as being hostile to entrepreneurship (Oviatt and McDougall 1994). Several scholars have argued that in such circumstances, entrepreneurs will search for ways to achieve higher performance by increasing their exports to other countries. Ibeh (2003), for instance, found that hostile domestic markets (i.e., those where entrepreneurs encounter adversity in their pursuits) facilitate the emergence of export-oriented ventures. Similarly, Zahra et al. (1997, p. 25) found that when new venture executives view the domestic environment as hostile to the firm’s mission or outputs, “exporting activities will intensify and export performance will increase.”

Prior research from Cavusgil (1980) found that the international orientation of firms can be explained by management’s desire to overcome unfavorable conditions in the domestic market, while others have suggested that the internationality of new ventures often “occurs at inception largely because competitive forces preclude a successful domestic focus” Oviatt and McDougall (1994, p. 60). This can be seen in the decision to enter certain industries characterized by higher levels of risk and reward, including export markets. As such, our last hypothesis reads:

Hypothesis 3: The likelihood that individuals will be engaged in entrepreneurial activity with export orientation is higher in countries with a high social cost of failure.

3 Methods

3.1 Research design and sample

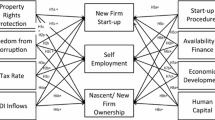

Our conceptual model is shown in Fig. 1. To test our hypotheses, we use multi-level modeling, in which individuals are nested within countries. We constructed a unique dataset that combines data from the Global Entrepreneurship Monitor (GEM), European Flash Barometer (EUFB), and World Bank Development Indicator (WDI) and Doing Business data (WBDB). For individual-level data, we used the GEM Adult Population Survey (APS). Since 1999, the GEM project has been conducting an ongoing cross-national survey with the purpose of measuring entrepreneurial activities across countries (Bosma 2013). In 2012, 69 countries took part in the GEM survey. This group of countries represented 74% of the world population and 87% of the world’s GDP (Xavier et al. 2012).

The GEM project randomly selects survey respondents from the general population of the participating countries. Although the survey method varies due to country-specific conditions, in each country at least 2000 individuals are drawn from the working age population and interviewed about their entrepreneurial attitudes, intentions, and activities and about information on individual characteristics, such as gender, education, age, and household income. To increase the stability of the measures, we pooled the GEM data across the 4-year period 2009 to 2012 and included only the working population between the ages of 18 and 64 in OECD countries.

Country-level variables were drawn from the European Flash Barometer (FB), World Bank Development Indicators (WDI) and World Bank Doing Business (WBDB) reports. Our final dataset consists of 208,089 GEM respondents between the ages of 18 and 64 from the 29 OECD countries.Footnote 1,Footnote 2

3.2 Dependent variables

To test our hypotheses, we use three dependent variables that reflect individual engagement in entrepreneurial activity, including Total Entrepreneurial Activity, High-Growth Entrepreneurial Activities with Growth Aspiration, and High-Growth Entrepreneurial Activities with Export Orientation. The Total Entrepreneurial Activity (TEA) variable is constructed from the total early-stage activity variable in GEM. TEA is a combination of nascent entrepreneurs currently involved in starting a new business, and the owners of young businesses in operation less than 42 months. The individuals included in the TEA measure are identified using the following three questions: (1) is the individual currently involved in a startup? (2) does their current job involve a startup? or (3) is the individual the owner/manager of a new business? The Total Entrepreneurial Activity variable is measured dichotomously, with 1 indicating that the individual is engaged in TEA.

Various indicators have been used to classify a firm as high growth (Brown et al. 2017; Brown and Mawson 2013). Based on GEM data, Autio (2003) identified two questions that could be used to identify startups with high growth potential. These include the growth aspiration of the entrepreneurs during startup, as well as their export orientation.

The High Growth Aspiration variable measures whether individuals engaged in TEA have high job growth aspirations. Specifically, the GEM question asks if people desire to hire 20 or more employees within the subsequent 5 years. Thus, the variable measures growth aspirations rather than realized growth, which is consistent with prior GEM studies (Autio 2003; Estrin et al. 2013). The variable is coded 1 if the individual is engaged in TEA with high-growth aspirations and 0 otherwise.

The Export Oriented High Growth Entrepreneurship variable measures whether the firm has an export orientation. Specifically, the GEM question asks the respondents what proportion of customers normally live outside of their home country. Consistent with prior studies (Chen et al. 2016; De Clercq et al. 2008), we considered entrepreneurs with 25% or more of their customers in foreign countries as export oriented. Consequently, Export Oriented Entrepreneurship was coded 1 for entrepreneurs expecting 25% or more of their customers to live outside their country and coded 0 otherwise.

3.3 Independent variables

Social costs of failure

We use a multi-item measure for the social costs of failure that aggregates country level measures of the informal stigma of business failure and the formal visibility of business failures. It is a necessary condition to construct the social cost of failure, by considering both the stigma of business failure and the visibility of business failure. This is because different levels of societal tolerance for business failure and information asymmetries in the regulatory disclosure of failure events coexist in institutional environments.

‘Stigma of business failure’ is constructed from survey data collected by the European Commission. We utilized the European Flash Barometers #283 (EOS Gallop Europe 2010) and #354 (EOS Gallop Europe 2013), which measure country-level attitudes toward entrepreneurship in the European Union between 2009 and 2012. Although these reports focus on countries within the European Union, they also include data from non-European countries, such as South Korea, China, Japan, Brazil, India, Israel, Russia, Sweden, Norway, and the United States, for comparative analysis.

The informal institutional variable constructed for the stigma of business failure measures the percentage of responses to the statement “People who have started their own business and have failed, should be given a second chance,” with the following options: (1) strongly agree, (2) agree, (3) disagree, (4) strongly disagree, and (5) do not know. Using a (− 2, 2) scale, we weighted responses and reversed negative values, such that higher levels of perceptual stigma indicate greater sanctions on failed businesses. This construction of stigma has been used in prior research (Simmons et al. 2014).

The formal institutional variable constructed for the ‘visibility of business failures’ is a depth of credit information indicator found in the World Bank Doing Business (WBDB) Report (World Bank Group 2013). The WBDB collects data on regulations governing small and medium-sized business in 183 countries. The measure explores the strength of the country’s credit reporting system. In the WBDB database, the total score for the depth of credit information (i.e., the accessibility of credit information, such as the original loan amount, outstanding loan, late payment, and the number/amount of defaults is reported from 0 to 100, and represents rules and practices affecting the coverage, scope and accessibility of credit information available through either a credit bureau or a credit registry).

3.4 Control variables

It is important that our study includes individual and country-level control variables to examine our hypotheses. Individual differences can affect the opportunity cost of each individual, influencing entrepreneurial decisions (Shepherd et al. 2015). In particular, we controlled for a participant’s Dispositional Avoidance Trait. We coded 1, if an individual responded that fear of failure would not prevent the individual from starting a business and 0 for otherwise. We included this individual level variable to align with the cognitive approach and avoidance literature. We also controlled for participants’ demographic characteristics. Because women tend to show lower rates of entrepreneurial entry than men, we include a Gender variable as 1 for male and 0 for female. Further, Age is a continuous variable between 18 and 64. Age Squared is also included in our model to control for the curvilinear effect of age. Prior literature also suggests that social capital and financial capital determines entrepreneurial decisions. Social Capital is measured by a dummy variable that assesses whether the respondents “personally know someone who had started a business in the past two years” (Minniti and Nardone 2007). Household Income is constructed as a categorical variable, which assesses whether a respondent belongs to the lower, middle, or higher tier of the country’s distribution of household income, a measurement approach similar to those used in prior research (Denning 2014; Morduch 1999). Lastly, we control for individual differences in human capital, by adjusting for the Education of the entrepreneur. The human capital of entrepreneurs has been identified in previous studies as having a positive relationship to both new venture growth (Baum and Bird 2010), and the effectiveness of institutional policies aimed at reducing barriers to high-growth entrepreneurship (Eesley 2016).

This study also controls for the effects of several country-level factors. First, the level of a country’s development influences entrepreneurial activities (Acs et al. 2008a). We control the economic development of a country by using per capita GDP at purchasing power parity (GDP PPP). Second, it is also known that a country’s GDP change can determine individuals’ intention to be entrepreneurs (Acs et al. 2008a). Accordingly, we include the GDP Growth Rate. Third, we control for the population size of a country, which determines the domestic market size. Lastly, we also include Bankruptcy Laws, which determines the formal costs of failure and influences entrepreneurial activities of a country (Armour and Cumming 2008; Lee et al. 2011). In particular, we use the resolving insolvency data from the WBDB database (Lee et al. 2011). This index reflects the time, cost, and outcome of insolvency proceedings, as well as the strength of the legal framework for liquidation and reorganization process.

3.5 Statistical analysis

To test the effect of country-level social costs of failure on an individual’s entrepreneurial entry decisions, we conducted a series of multilevel logistic regression analyses. This method is appropriate given that individuals within particular countries share common experiences that differ from those living in other countries (Stephan et al. 2014).

Before examining the hypotheses, we conducted an intra-class correlation (ICC) analysis to justify using a multi-level regression model (Bliese 2000). According to Bliese (2000), multi-level techniques are recommended, if the ICC estimates reside within the normal range (i.e., between 5% and 20%). Our results indicate that 5.3% of the total variance for general entrepreneurial activities resided at the country level, with 12.5% for growth aspirations, and 29.6% for export orientations. These results justify the application of multi-level regression techniques for this study.

We first tested the effect of individual and country-level control variables on the dependent variables for entrepreneurial entry, entry with growth aspirations, and entry with an export orientation. We then added a country-level independent variable for the social cost of failure. In our multi-level regression model, we also examine the variance inflation factor (VIF) statistics to control the possibility of strong multicollinearity influencing our results. We find that all VIF scores are below 5, suggesting that multicollinearity is not a concern for our analysis (Hair Jr et al. 1998).

To aid with interpretation, we present odds ratios (OR) in the results table, in lieu of log-odds coefficients. The baseline category is that an individual does not engage in start-up activity. Thus, an OR > 1 means that a variable increases the likelihood of engagement in entrepreneurship. In addition to regression coefficients, we report pseudo-R2, as suggested by Hox et al. (2010). The pseudo-R2 compares the residual country-level variance of the base model with the model, including independent variables.

Table 1 summarizes the study variables, and Table 2 presents descriptive statistics and correlations.

4 Results

Hypothesis 1 states that the likelihood that individuals will be engaged in entrepreneurial activity is lower in countries with a high social cost of failure. As shown in model 2 (Table 3), we find a statistically significant negative relationship (odds ratio 0.95, p < 0.01) between the social cost of failure and engagement in entrepreneurship. The likelihood-ratio (LR) test has a significant between-group variance in the slopes, indicating that when individuals live in a society with a higher social cost of failure, they are less likely to engage in entrepreneurship. Lorah (2018) suggested that the difference of the ICC change can be interpreted as an effect size for multilevel models. Thus, when comparing differences in the ICC estimates between models 1 and 2, we see that the social cost of failure explains 7.2% more of the country-level variation. In addition, compared to the null model, where we check the ICC estimates of our dependent variable without any control and independent variables, our model with the social cost of failure explains 34.1% more of the country-level variance for our dependent variable. These results support hypothesis 1.

Hypothesis 2 states that the likelihood that individuals will be engaged in entrepreneurial activity with growth aspiration is higher in countries with a high social cost of failure. As shown in models 3 and 4 (Table 3), we find a statistically significant relationship (odds ratio 1.14, p < 0.01) between the social costs of failure and the likelihood that entrepreneurs have high-growth aspirations. This result indicates that when individuals live in a society with a higher social cost of failure, they are more likely to enter entrepreneurship with growth aspirations. When comparing differences in the ICC estimates between models 3 and 4, we see that the social cost of failure explains 11.9% more of the country-level variation. Moreover, compared to the null model, our model with the social cost of failure explains 34.3% more of the country-level variance for our dependent variable. The results of our test support hypothesis 2.

Hypothesis 3 states that the likelihood that individuals will be engaged in entrepreneurial activity with export orientation is higher in countries with a high social cost of failure. Models 5 and 6 (Table 3) show a statistically significant effect for the social cost of failure on the likelihood that the entrepreneurial firms in our sample will have the export orientation (odds ratio 1.06, p < 0.1). This result indicates that when individuals live in a society with a higher social cost of failure, they are more likely to enter entrepreneurship with a high-growth export orientation. Furthermore, when comparing differences in the ICC estimates between models 5 and 6, we see that the social cost of failure explains 7.1% more of the country-level variation. Moreover, compared to the null model, our model with the social cost of failure explains 88.8% more of the country-level variance for our dependent variable. This analysis supports hypothesis 3.

4.1 Robustness tests

We conducted several robustness tests on the above analysis, presented in Appendix. First, because there is a potential concern in that it is difficult to judge the effect of the social cost of failure on the likelihood of engaging in high growth entrepreneurship due to the decreased number of start-ups influenced by the social cost of failure, we changed the baseline comparison from the general population to only those entering entrepreneurship (that is, examining growth aspirations and export orientation conditional on entry; see Table 4). As expected, the results from the robustness test do not differ from our main results.

We also conducted additional analyses excluding individuals who had experienced business failure within a year before the survey was conducted. This is because prior experience with business failure may influence different decisions and behaviors (Simmons et al. 2014). The results are very similar to our main analysis (see Table 5). Moreover, intrapreneurs who do entrepreneurial activities within an existing organization may not be influenced by the social costs of failure. We conducted additional test and the result of the analysis is not different from the main result (see Table 6). We also conducted a range of other robustness tests, by adding more control variables, such as a country’s institutional strength to protect intellectual property rights. (Table 7). Lastly, we excluded a country-level control variable, Bankruptcy Laws, because of its high correlation with a country’s economic development status (Table 8). The results of these additional analyses also support our main findings.

5 Discussion

There is now widespread acceptance of the idea that the financial and social costs of failure influence entrepreneurial entry decisions. Prior research, however, has primarily focused on formal institutions (i.e., bankruptcy laws) and the financial costs of failure (Lee et al. 2007; McGrath 1999), while the informal institutions that contribute to social costs of failure have received far less attention. Because these institutions have been shown to have a significant impact on both individuals’ career choices (Merton 1968; Schmutzler et al. 2019) and the entry decisions of nascent entrepreneurs (Kreiser et al. 2010; Bruton et al. 2010; Davidsson and Wiklund 1997), exploring the individual-environment relationship is important to understanding the impact that the social cost of failure has on entrepreneurial decision making (Cacciotti et al. 2016; Simmons et al. 2014).

On these premises, the extant body of research suggests that lowering the social cost of failure will have positive implications for entrepreneurship. Although the merits of this argument may have been demonstrated in the context of general entrepreneurial entry, it is important to recognize that there are different manners of organizing entry that can be productive, unproductive or destructive (Baumol 1996). This study shows that there is a positive association with the social costs of failure and entrepreneurial activities for those who aspire to higher levels of growth.

Consistent with prior research, we find that countries with a higher social cost of failure are associated with a lower propensity for entrepreneurial entry. In this paper, however, we push this line of research a step further by discussing the potential trade-offs involved in pursuing policy goals that seek to both lower the social costs of failure and promote high-growth entrepreneurship. Specifically, our study applies achievement motivation theory to examine the relationship between the social costs of failure in developed countries, and two entrepreneurial startup types that increase knowledge spillovers, regional competition and the diversity of entrepreneurship activity (Hessels and van Stel 2011).

We examine the interaction of the intrinsic motivation to succeed with the extrinsic motivation to approach or avoid high stigma environmental conditions on entrepreneurial decision making (Cacciotti et al. 2016; Hayton et al. 2002). By doing so, we find that a higher social cost of failure positively influences the quantity of high-growth entrepreneurship, both in terms of individuals with high growth aspirations, and firms with an export orientation. These results are based on the propensity of individuals to enter entrepreneurship in both absolute terms, and as a relative share of high-growth firms conditional on entry. The results held when we interacted individual fear of failure with social costs of failure as a robustness check. Our theoretical approach is timely, as Murnieks et al. (2019) recently noted that studies examining the interaction of intrinsic and extrinsic motivations on start-up activity were unfortunately few and far between.

As discussed earlier, the external conditions of the institutional environment can have a significant impact on the aspirations that individual entrepreneurs have for the growth of their ventures (Ames 1992; Meece 1991). Prior research has found that high social costs of failure can lower startup activity (Simmons et al. 2014). We extend these findings to demonstrate group differences and show that while some individuals may avoid contexts with high social costs of failure, individuals with high growth aspirations may be encouraged to excel. This conversation is important, as the reward for countries with formal and informal institutions that promote high growth entrepreneurship is sustainable economic growth (Hessels and van Stel 2011). High-growth firms contribute substantially to economic development, increasing knowledge spillovers, regional competition, and the diversity of entrepreneurship activity in the region (Hessels and van Stel 2011). However, the aspiration for the growth of entrepreneurs’ ventures in an environment with a higher level of social costs of failure may cause another issue in that entrepreneurs can potentially escalate their entrepreneurial efforts or investment. Especially in an environment that does not tolerate failure, failure itself can be an important factor to increase fear of failure in others (Wyrwich et al. 2018). Accordingly, actual losses of an entrepreneurial failure can be greater in a society with a higher level of social costs of failure.

In addition to impacting the aspirations of entrepreneurs for high growth in their domestic entrepreneurial activities, high social costs of failure may motivate entrepreneurs to orient their firms towards international markets (Autio et al. 2000). The export decision can be a reactive or proactive strategic response to favorable or unfavorable environment conditions in the domestic market (Zahra et al. 1997). Prior studies of exporting as a strategic action focus primarily on the pressures of competitive markets on firm performance (Zahra et al. 1997) that can arise from industry and product uncertainties. We demonstrate in this study that punitive domestic regulatory environments, which are differentiated from competitive market conditions, may also motivate entrepreneurs to organize their firms with a high growth export orientation.

Collectively, our findings challenge earlier assumptions (Arenius and Minniti 2005; Vaillant and Lafuente 2007; Stuetzer et al. 2014) and suggest that a higher level of social costs of failure may serve as a desirable selection mechanism that leads to higher quality entrepreneurship. It would seem that low social costs of failure may incentivize entry and the persistence of entrepreneurs in low value activities and that high social costs of failure may motivate entrepreneurs who aspire to engage in activities that spur economic growth and prosperity. Hence, our findings illuminate the importance of recognizing that the institutions within a country can have different effects on the options for entrepreneurial activities with different characteristics (cf. Baumol 1996).

5.1 Implications for research

This study has several implications for future research. The institutional variables that motivate or dissuade individuals from starting firms have received insufficient consideration to date. First, prior research on the costs of failure has mainly focused on formal institutions, such as bankruptcy law (Lee et al. 2007; McGrath 1999). Informal institutions such as stigmas have received far less attention (Simmons et al. 2014). Given our findings, it seems that this may be an important oversight, as the social costs of failure are composed of both normative and regulatory ramifications. Hence, understanding the interaction of different informal and formal institutions with the intrinsic motivations of entrepreneurs is an important avenue of inquiry for future researchers and policymakers. In this paper, we focused on high growth aspirations and export orientations; however, other intrinsic motivations such as fear of failure (Mitchell and Shepherd 2011) and passion (Cardon et al. 2009) are worthy of future study.

Interestingly, our control variables of age, gender, education, social capital, and household income had significant direct relationships to the rates of entrepreneurial entry with growth aspirations and firms with export orientations. Although these relationships align to the current literature, a better understanding of how these variables moderate the effects of the social costs of failure on entrepreneurial entry is needed. It has been theorized that high-growth firms are more likely to be founded by entrepreneurs who are older (Azoulay et al. 2018) or have higher levels of education (Eesley 2016), household income (Cassar 2006), or social capital (Florin et al. 2003). Gender gaps are even less understood, although the findings of the Simmons et al. (2018) study suggest that the social costs of failure may have disparate implications on male and female entrepreneurs. These are certainly relationships that deserve further scholarly attention.

5.2 Study limitations

There are some important limitations to our study that we hope future researchers will be able to address. First, while we study the entry decisions of more than 200,000 individuals from 29 OECD countries, most of the countries in our sample are members of the European Union. This limitation could be addressed in future studies. Specifically, there are opportunities to examine whether our findings for developed countries extend to undeveloped countries (Hessels and van Stel 2011). These studies are important because unstable formal institutions may weaken stigma sanctions and lead to different approach and avoidance behaviors, such as decreases in high growth entrepreneurship due to increased entry using unregistered businesses or into informal markets (Eesley et al. 2018). In addition, regional studies (González-Pernía and Peña-Legazkue 2015) may provide additional insights into relationships between social costs of failure and the mobility or export orientation of entrepreneurs with high growth aspirations.

Second, this study develops a sophisticated multi-level regression model to examine growth aspirations and export orientation at the early stage. Specifically, our measure of the social costs of failure interacts with formal regulations that expire with informal norms that exist for undefined periods of time (Semadeni et al. 2008). Pryor et al. (2004) suggest that these temporal patterns and differences are significant indicators of anticipated stigma responses and the behaviors of stigmatized individuals. Moreover, there is a possibility of entrepreneurs facing greater loss in a society with a higher level of social costs of failure because they may escalate their effort and investment to achieve high growth (Hsu et al. 2017). We recommend future studies that apply more fine-grained methodologies such as experimental or longitudinal studies that use repeated measures or random assignments to investigate causal or time and context variant variable relationships.

Third, we argued that the social cost of failure is positively associated with high growth entrepreneurial activities because the benefit of engaging in these types of entrepreneurship can exceed potential social costs of failure. However, one could argue that social costs of failure may increase the exaggeration of start-up opportunities or activities that entrepreneurs pursue, which allows them to receive support from their stakeholders in the society with a higher level of social costs of failure. Although this study examines the relationship between the social costs of failure and real action on export orientation, we only explore the effect of the social costs of failure on growth aspiration in terms of expected employment size because our dataset does not allow to test on actual employment size of existing entrepreneurs. Accordingly, it is important to understand the relationship between the social costs of failure and actual growth even though previous studies show the positive association between growth aspiration and its outcome (Delmar and Wiklund 2008; Wiklund and Shepherd 2003). We hope that future studies can address this gap in our research.

Lastly, the social cost of failure may have different effects on high growth intraprenuership and corporate venturing within established organizations (Biniari et al. 2015). There is a myth that high-growth firms are predominantly young, venture-backed startups in the high-tech industry (Brown et al. 2017). However, several studies have shown that high growth entrepreneurial activities often occur within firms that are older and larger, operate in non-tech-based sectors, and are funded using various funding mechanisms, including traditional lines of credit and self-funding (Biniari et al. 2015). This research question is outside the bounds of the current study. We hope future studies will examine these relationships and strengthen our understanding of the social costs of failure.

6 Conclusion

The premise in many country-level entrepreneurship studies is that by lowering the social cost of failure, people will be more willing to attempt entrepreneurial careers. We believe that this view provides an overly simplistic picture of the relationship between the social cost of failure and entrepreneurial entry. We find that countries with a higher social cost of failure are negatively associated with total entrepreneurial activity, but positively associated with the likelihood that entrepreneurs who have high-growth aspirations will start firms. We also found a significant correlation between higher social costs of failure and the quantity of early stage firms with export orientations.

Notes

GEM surveys were completed via telephone interview or face-to-face interview where telephone is not prevalent in the country, reducing selection bias.

The countries in our sample are Austria, Belgium, Brazil, China, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, South Korea, Latvia, Lithuania, Netherlands, Norway, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, and United States of America.

References

Acs, Z. J., Desai, S., & Hessels, J. (2008a). Entrepreneurship, economic development and institutions. Small Business Economics, 31(3), 219–234. https://doi.org/10.1007/s11187-008-9135-9.

Acs, Z. J., Parsons, W., & Tracy, S. (2008b). High impact firms: Gazelles revisited. An Office of Advocacy Working Paper, U.S. Small Business Administration.

Aldrich, H. E., & Fiol, C. M. (1994). Fools rush in? The institutional context of industry creation. Academy of Management Review, 19(4), 645–670. https://doi.org/10.5465/amr.1994.9412190214.

Ames, C. (1992). Classrooms: Goals, structures, and student motivation. Journal of Educational Psychology, 84(3), 261. https://doi.org/10.1037/0022-0663.84.3.261.

Arenius, P., & Minniti, M. (2005). Perceptual variables and nascent entrepreneurship. Small Business Economics, 24(3), 233–247. https://doi.org/10.1007/s11187-005-1984-x.

Armour, J., & Cumming, D. (2008). Bankruptcy law and entrepreneurship. American Law and Economics Review, 10, 303–350. https://doi.org/10.1093/aler/ahn008.

Arora, A., & Nandkumar, A. (2011). Cash-out or flameout! Opportunity cost and entrepreneurial strategy: Theory, and evidence from the information security industry. Management Science, 57, 1844–1860. https://doi.org/10.1287/mnsc.1110.1381.

Arshed, N., Carter, S., & Mason, C. (2014). The ineffectiveness of entrepreneurship policy: Is policy formulation to blame? Small Business Economics, 43(3), 639–659. https://doi.org/10.1007/s11187-014-9554-8.

Atkinson, J. W. (1957). Motivational determinants of risk-taking behavior. Psychological Review, 64(6p1), 359. https://doi.org/10.1037/h0043445.

Autio, E. (2003). High-potential entrepreneurship in the light of GEM data. Helsinki: University of Technology.

Autio, E., Sapienza, H. J., & Almeida, J. G. (2000). Effects of age at entry, knowledge intensity, and imitability on international growth. Academy of Management Journal, 43(5), 909–924. https://doi.org/10.5465/1556419.

Azoulay, P., Jones, B., Kim, J. D., & Miranda, J. (2018). Age and high-growth entrepreneurship. National Bureau of Economic Research: Technical report.

Baum, R. J., & Bird, B. J. (2010). The successful intelligence of high-growth entrepreneurs: Links to new venture growth. Organization Science, 21(2), 397–412. https://doi.org/10.1287/orsc.1090.0445.

Baumol, W. J. (1996). Entrepreneurship: Productive, unproductive, and destructive. Journal of Business Venturing, 11, 3–22. https://doi.org/10.1016/0883-9026(94)00014-X.

Biniari, M. G., Simmons, S. A., Monsen, E. W., & Moreno, M. P. (2015). The configuration of corporate venturing logics: An integrated resource dependence and institutional perspective. Small Business Economics, 1–17. https://doi.org/10.1007/s11187-015-9635-3.

Bliese, P. D. (2000). Within-group agreement, non-independence, and reliability: Implications for data aggregation and analysis. In K. J. Klein & S. W. J. Kozlowski (Eds.), Multilevel theory, research, and methods in organizations (pp. 349–381). San Francisco: JosseyBass.

Bosma, N. (2013). The global entrepreneurship monitor (GEM) and its impact on entrepreneurship research. Foundations and Trends in Entrepreneurship, 9, 143–248. https://doi.org/10.1561/0300000033.

Brown, R., & Mawson, S. (2013). Trigger points and high-growth firms: A conceptualisation and review of public policy implications. Journal of Small Business and Enterprise Development, 20(2), 279–295. https://doi.org/10.1108/14626001311326734.

Brown, R., Mawson, S., & Mason, C. (2017). Myth-busting and entrepreneurship policy: The case of high-growth firms. Entrepreneurship & Regional Development, 29(5–6), 414–443. https://doi.org/10.1080/08985626.2017.1291762.

Bruton, G. D., Ahlstrom, D., & Li, H. L. (2010). Institutional theory and entrepreneurship: Where are we now and where do we need to move in the future? Entrepreneurship Theory and Practice, 34(3), 421–440. https://doi.org/10.1111/j.1540-6520.2010.00390.x.

BLS (2012), Bureau of Labor Statistics: Business Employment Dynamics, US Department of Labor, 13. Retrieved from https://www.sba.gov/sites/default/files/Business-Survival.pdf. Accessed 15 Dec 2019.

Cacciotti, G., & Hayton, J. C. (2015). Fear and entrepreneurship: A review and research agenda. International Journal of Management Reviews, 17(2), 165–190.

Cacciotti, G., Hayton, J. C., Mitchell, J. R., & Giazitzoglu, A. (2016). A reconceptualization of fear of failure in entrepreneurship. Journal of Business Venturing, 31(3), 302–325. https://doi.org/10.1016/j.jbusvent.2016.02.002.

Cardon, M. S., Wincent, J., Singh, J., & Drnovsek, M. (2009). The nature and experience of entrepreneurial passion. Academy of Management Review, 34(3), 511–532. https://doi.org/10.5465/amr.2009.40633190.

Carter, N. M., Gartner, W. B., Shaver, K. G., & Gatewood, E. J. (2003). The career reasons of nascent entrepreneurs. Journal of Business Venturing, 18(1), 13–39. https://doi.org/10.1016/S0883-9026(02)00078-2.

Cassar, G. (2006). Entrepreneur opportunity costs and intended venture growth. Journal of Business Venturing, 21(5), 610–632. https://doi.org/10.1016/j.jbusvent.2005.02.011.

Castaño, M. S., Méndez, M. T., & Galindo, M. Á. (2015). The effect of social, cultural, and economic factors on entrepreneurship. Journal of Business Research, 68(7), 1496–1500. https://doi.org/10.1016/j.jbusres.2015.01.040.

Cattell, R. B. (1957). Personality and motivation structure and measurement. Oxford: World Book Co..

Cavusgil, S. T. (1980). On the internationalization process of firms. European Research, 8, 273–281. https://doi.org/10.1016/0148-2963(84)90006-7.

Chen, J., Saarenketo, S., & Puumalainen, K. (2016). Internationalization and value orientation of entrepreneurial ventures—A Latin American perspective. Journal of International Entrepreneurship, 14(1), 32–51. https://doi.org/10.1007/s10843-016-0169-9.

Clerides, S. K., Lach, S., & Tybout, J. R. (1998). Is learning by exporting important? Micro-dynamic evidence from Colombia, Mexico, and Morocco. The quarterly journal of

Covington, M. V., & Beery, R. G. (1976). Self-worth and school learning. Oxford: Holt, Rinehart & Winston.

Damaraju, N. L., Barney, J., & Dess, G. (2010). Stigma and entrepreneurial risk taking. In Summer Conference, Imperial College London Business School.

Davidsson, P., & Wiklund, J. (1997). Values, beliefs and regional variations in new firm formation rates. Journal of Economic Psychology, 18(2–3), 179–199. https://doi.org/10.1016/S0167-4870(97)00004-4.

De Clercq, D., Hessels, J., & van Stel, A. (2008). New ventures’ export orientation: Outcome and source of knowledge spillovers. Small Business Economics, 31(3), 283–303. https://doi.org/10.1007/s11187-008-9132-z.

Delmar, F., & Wiklund, J. (2008). The effect of small business managers’ growth motivation on firm growth: A longitudinal study. Entrepreneurship Theory and Practice, 32(3), 437–457. https://doi.org/10.1111/j.1540-6520.2008.00235.x.

Denning, S. (2014). An economy of access is opening for business: Five strategies for success. Strategy & Leadership, 42, 14–21. https://doi.org/10.1108/SL-05-2014-0037.

Eesley, C. (2016). Institutional barriers to growth: Entrepreneurship, human capital and institutional change. Organization Science, 27(5), 1290–1306. https://doi.org/10.1287/orsc.2016.1077.

Eesley, C. E., Eberhart, R. N., Skousen, B. R., & Cheng, J. L. (2018). Institutions and entrepreneurial activity: The interactive influence of misaligned formal and informal institutions. Strategy Science, 3(2), 393–407. https://doi.org/10.1287/stsc.2018.0060.

Elliot, A. J. (1999). Approach and avoidance motivation and achievement goals. Educational Psychologist, 34(3), 169–189. https://doi.org/10.1207/s15326985ep3403_3.

Elliot, A. J., & Church, M. A. (1997). A hierarchical model of approach and avoidance achievement motivation. Journal of Personality and Social Psychology, 72(1), 218. https://doi.org/10.1037/0022-3514.72.1.218.

EOS Gallup Europe. (2010). Flash Eurobarometer No. 283. Entrepreneurship in the EU and beyond. Brussels: Eurostat.

EOS Gallup Europe (2013). Flash Eurobarometer, No. 354. Entrepreneurship in the EU and beyond. Brussels: Eurostat.

Estrin, S., Korosteleva, J., & Mickiewicz, T. (2013). Which institutions encourage entrepreneurial growth aspirations? Journal of Business Venturing, 28, 564–580. https://doi.org/10.1016/j.jbusvent.2012.05.001.

Florin, J., Lubatkin, M., & Schulze, W. (2003). A social capital model of high-growth ventures. Academy of Management Journal, 46(3), 374–384. https://doi.org/10.5465/30040630.

Freud, S. (1957). Some character-types met with in psycho-analytic practice. The Standard Edition of the Complete Psychological Works of Sigmund Freud, 14, 309–333.

Girma, S., Greenaway, A., & Kneller, R. (2004). Does exporting increase productivity? A microeconometric analysis of matched firms. Review of International Economics, 12(5), 855–866. https://doi.org/10.1111/j.1467-9396.2004.00486.x.

Goffman, E. (1963). Behavior in public places: Notes on the social organization of gatherings. New York: Free Press.

González-Pernía, J. L., & Peña-Legazkue, I. (2015). Export-oriented entrepreneurship and regional economic growth. Small Business Economics, 45(3), 505–522. https://doi.org/10.1007/s11187-015-9657-x.

Hair Jr., J., Anderson, R., Tatham, R., & Black, W. (1998). Multivariate data analysis. Englewood: Prentice-Hall.

Hayton, J. C., George, G., & Zahra, S. A. (2002). National culture and entrepreneurship: A review of behavioral research. Entrepreneurship Theory and Practice, 26(4), 33–52. https://doi.org/10.1177/104225870202600403.

Hayton, J. C., Cacciotti, G., Giazitzoglu, A., Mitchell, J. R., & Ainge, C. (2013). Understanding fear of failure in entrepreneurship: A cognitive process framework. Frontiers of Entrepreneurship Research, 33(6), 1 https://digitalknowledge.babson.edu/fer/vol33/iss6/1.

Hayward, M. L., Forster, W. R., Sarasvathy, S. D., & Fredrickson, B. L. (2010). Beyond hubris: How highly confident entrepreneurs rebound to venture again. Journal of Business Venturing, 25, 569–578. https://doi.org/10.1016/j.jbusvent.2009.03.002.

Heider, F. (1958). The psychology of interpersonal relations. New York: John Wiley. https://doi.org/10.4324/9780203781159.

Hessels, J., & van Stel, A. (2011). Entrepreneurship, export orientation, and economic growth. Small Business Economics, 37(2), 255–268. https://doi.org/10.1007/s11187-009-9233-3.

Hitt, M. A., Ireland, R. D., Camp, S. M., & Sexton, D. L. (2001). Strategic entrepreneurship: Entrepreneurial strategies for wealth creation. Strategic Management Journal, 22, 479–491. https://doi.org/10.1002/smj.196.

Hoppe, F. (1931). Untersuchungen zur handlungs-und affektpsychologie. Psychological Research, 14(1), 1–62. https://doi.org/10.1007/BF00403870.

Hox, J. J., Moerbeek, M., & van de Schoot, R. (2010). Multilevel analysis: Techniques and applications. Routledge.

Hsu, D. K., Wiklund, J., & Cotton, R. D. (2017). Success, failure, and entrepreneurial reentry: An experimental assessment of the veracity of self–efficacy and prospect theory. Entrepreneurship Theory and Practice, 41(1), 19–47. https://doi.org/10.1111/etap.12166.

Huang, X., & Van de Vliert, E. (2003). Where intrinsic job satisfaction fails to work: National moderators of intrinsic motivation. Journal of Organizational Behavior: The International Journal of Industrial, Occupational and Organizational Psychology and Behavior, 24(2), 159–179. https://doi.org/10.1002/job.186.

Ibeh, K. I. (2003). Toward a contingency framework of export entrepreneurship: Conceptualisations and empirical evidence. Small Business Economics, 20(1), 49–68. https://doi.org/10.1023/A:1020244404241.

Jaffe, E. D., & Pasternak, H. (1994). An attitudinal model to determine the export intention of non-exporting, small manufacturers. International Marketing Review, 11(3), 17–32. https://doi.org/10.1108/02651339410067030.

Kibler, E., Kautonen, T., & Fink, M. (2014). Regional social legitimacy of entrepreneurship: Implications for entrepreneurial intention and start-up behaviour. Regional Studies, 48(6), 995–1015. https://doi.org/10.1080/00343404.2013.851373.

Kneller, R., & Pisu, M. (2007). Industrial linkages and export spillovers from FDI. The World Economy, 30(1), 105–134. https://doi.org/10.1111/j.1467-9701.2007.00874.x.

Kogut, B., & Chang, S. J. (1996). Platform investments and volatile exchange rates: Direct investment in the US by Japanese electronic companies. The Review of Economics and Statistics, 221–231. https://doi.org/10.2307/2109924.

Kreiser, P. M., Marino, L. D., Dickson, P., & Weaver, K. M. (2010). Cultural influences on entrepreneurial orientation: The impact of national culture on risk taking and proactiveness in SMEs. Entrepreneurship Theory and Practice, 34(5), 959–984. https://doi.org/10.1111/j.1540-6520.2010.00396.x.

Kuratko, D. F., & Hudson, E. N. (2017). Gazelle solution vs. portfolio thinking. In The Great Debates in Entrepreneurship (pp. 47-59). Emerald publishing limited.

Landier, A. (2005). Entrepreneurship and the stigma of failure. Working paper, University of Chicago Graduate School of Business, Chicago, IL https://doi.org/10.2139/ssrn.850446

Lee, S.-H., Peng, M. W., & Barney, J. B. (2007). Bankruptcy law and entrepreneurship development: A real options perspective. Academy of Management Review, 32, 257–272. https://doi.org/10.5465/amr.2007.23464070.

Lee, S.-H., Yamakawa, Y., Peng, M. W., & Barney, J. B. (2011). How do bankruptcy laws affect entrepreneurship development around the world? Journal of Business Venturing, 26, 505–520. https://doi.org/10.1016/j.jbusvent.2010.05.001.

Lerner, J. (2010). The future of public efforts to boost entrepreneurship and venture capital. Small Business Economics, 35(3), 255–264. https://doi.org/10.1007/s11187-010-9298-z.

Lorah, J. (2018). Effect size measures for multilevel models: Definition, interpretation, and TIMSS example. Large-Scale Assessments in Education, 6(1), 8. https://doi.org/10.1186/s40536-018-0061-2.

Lu, J. W., & Beamish, P. W. (2001). The internationalization and performance of SMEs. Strategic Management Journal, 22, 565–586. https://doi.org/10.1002/smj.184.

Maslow, A. (1955). Deficiency motivation and growth motivation. In M. R. Jones (Ed.), Nebraska symposium on motivation: 1955 (pp. 1–30). Lincoln: University of Nebraska Press.

Mason, C., & Brown, R. (2013). Creating good public policy to support high-growth firms. Small Business Economics, 40(2), 211–225. https://doi.org/10.1007/s11187-011-9369-9.

McClelland, D. C. (1951). Measuring motivation in phantasy: The achievement motive. In H. Guetzkow (Ed.), Groups, leadership and men; research in human relations (pp. 191–205). Oxford: Carnegie Press.

McClelland, D. C., Koestner, R., & Weinberger, J. (1989). How do self-attributed and implicit motives differ? Psychological Review, 96(4), 690. https://doi.org/10.1037/0033-295X.96.4.690.

McGrath, R. G. (1999). Falling forward: Real options reasoning and entrepreneurial failure. Academy of Management Review, 24, 13–30. https://doi.org/10.5465/amr.1999.1580438.

Meece, J. L. (1991). The classroom context and students' motivational goals. Advances in Motivation and Achievement, 7, 261–285.

Merton, R. K. (1968). Social theory and social structure. New York: Simon and Schuster.

Minniti, M., & Nardone, C. (2007). Being in someone else’s shoes: The role of gender in nascent entrepreneurship. Small Business Economics, 28, 223–238. https://doi.org/10.1007/s11187-006-9017-y.

Mitchell, J. R., & Shepherd, D. A. (2011). Afraid of opportunity: The effects of fear of failure on entrepreneurial action. Frontiers of Entrepreneurship Research, 31(6), 1.

Mitsuhashi, H., & Bird, A. (2011). The stigma of failure and limited opportunities for ex-failed entrepreneurs’ redemption in Japan. In Usui, C. (Ed.), Comparative Entrepreneurship Initiatives (pp. 222-244): Springer. https://doi.org/10.1057/9780230314368_9.

Morduch, J. (1999). The microfinance promise. Journal of Economic Literature, 37, 1569–1614. https://doi.org/10.1257/jel.37.4.1569.

Morgan, J., & Sisak, D. (2016). Aspiring to succeed: A model of entrepreneurship and fear of failure. Journal of Business Venturing, 31(1), 1–21. https://doi.org/10.1016/j.jbusvent.2015.09.002.

Morris, M. H., Neumeyer, X., & Kuratko, D. F. (2015). A portfolio perspective on entrepreneurship and economic development. Small Business Economics, 45(4), 713–728. https://doi.org/10.1007/s11187-015-9678-5.

Murnieks, C. Y., Klotz, A. C., & Shepherd, D. A. (2019). Entrepreneurial motivation: A review of the literature and agenda for future research. Journal of Organizational Behavior. https://doi.org/10.1002/job.2374.

Murray, H. A. (1938). Explorations in personality: A clinical and experimental study of fifty men of college age. Oxford: Oxford Univ. Press.

Oviatt, B. M., & McDougall, P. P. (1994). Toward a theory of international new ventures. Journal of International Business Studies, 25(1), 45–64. https://doi.org/10.1057/palgrave.jibs.8490193.

Penrose, E. T. (1959). The theory of the growth of the firm. New York: Sharpe.

Pryor, J. B., Reeder, G. D., Yeadon, C., & Hesson-McInnis, M. (2004). A dual-process model of reactions to perceived stigma. Journal of Personality and Social Psychology, 87(4), 436–452.

Root, F. R. (1998). Entry strategies for international markets. San Francisco: Jossey-Bass.

Rotter, J. B. (1954). Social learning and clinical psychology. Englewood Cliffs: Prentice-Hall, Inc. https://doi.org/10.1037/10788-000.

Schmutzler, J., Andonova, V., & Diaz-Serrano, L. (2019). How context shapes entrepreneurial self-efficacy as a driver of entrepreneurial intentions: A multilevel approach. Entrepreneurship Theory and Practice, 43(5), 880–920. https://doi.org/10.1177/1042258717753142.

Semadeni, M., Cannella Jr., A. A., Fraser, D. R., & Lee, D. S. (2008). Fight or flight: Managing stigma in executive careers. Strategic Management Journal, 29(5), 557–567. https://doi.org/10.1002/smj.661.

Shane, S. (2009). Why encouraging more people to become entrepreneurs is bad public policy. Small Business Economics, 33(2), 141–149. https://doi.org/10.1007/s11187-009-9215-5.

Shepherd, D. A., & Haynie, J. M. (2011). Venture failure, stigma, and impression management: A self-verification, self-determination view. Strategic Entrepreneurship Journal, 5(2), 178–197. https://doi.org/10.1002/sej.113.

Shepherd, D., & Wiklund, J. (2009). Are we comparing apples with apples or apples with oranges? Appropriateness of knowledge accumulation across growth studies. Entrepreneurship Theory and Practice, 33(1), 105–123. https://doi.org/10.1111/j.1540-6520.2008.00282.x.

Shepherd, D. A., Williams, T. A., & Patzelt, H. (2015). Thinking about entrepreneurial decision- making review and research agenda. Journal of Management, 41, 11–46. https://doi.org/10.1177/0149206314541153.

Simmons, S. A., Wiklund, J., & Levie, J. (2014). Stigma and business failure: Implications for entrepreneurs’ career choices. Small Business Economics, 42, 485–505. https://doi.org/10.1007/s11187-013-9519-3.

Simmons, S. A., Wiklund, J., Levie, J., Bradley, S. W., & Sunny, S. A. (2018). Gender gaps and reentry into entrepreneurial ecosystems after business failure. Small Business Economics, 1–15. https://doi.org/10.1007/s11187-018-9998-3.

Singh, S., Corner, P., & Pavlovich, K. (2007). Coping with entrepreneurial failure. Journal of Management & Organization, 13(4), 331–344. https://doi.org/10.1017/S1833367200003588.

Stephan, U., Uhlaner, L. M., & Stride, C. (2014). Institutions and social entrepreneurship: The role of institutional voids, institutional support, and institutional configurations. Journal of International Business Studies, 46, 308–331. https://doi.org/10.1057/jibs.2014.38.

Stuetzer, M., Obschonka, M., Brixy, U., Sternberg, R., & Cantner, U. (2014). Regional characteristics, opportunity perception and entrepreneurial activities. Small Business Economics, 42(2), 221–244. https://doi.org/10.1007/s11187-013-9488-6.

Sutton, R. I., & Callahan, A. L. (1987). The stigma of bankruptcy: Spoiled organizational image and its management. Academy of Management Journal, 30, 405–436. https://doi.org/10.5465/256007.

Thornton, P. H. (1999). The sociology of entrepreneurship. Annual Review of Sociology, 25(1), 19–46. https://doi.org/10.1146/annurev.soc.25.1.19.

Vaillant, Y., & Lafuente, E. (2007). Do different institutional frameworks condition the influence of local fear of failure and entrepreneurial examples over entrepreneurial activity? Entrepreneurship and Regional Development, 19, 313–337. https://doi.org/10.1080/08985620701440007.

Wennberg, K., Pathak, S., & Autio, E. (2013). How culture moulds the effects of self-efficacy and fear of failure on entrepreneurship. Entrepreneurship & Regional Development, 25(9–10), 756–780. https://doi.org/10.1080/08985626.2013.862975.

Wiklund, J., & Shepherd, D. (2003). Aspiring for, and achieving growth: The moderating role of resources and opportunities. Journal of Management Studies, 40(8), 1919–1941. https://doi.org/10.1046/j.1467-6486.2003.00406.x.

World Bank Group (2013). Doing business 2014: Understanding regulations for small and medium-size enterprises (Vol. 11). World Bank Publications.

World Bank Group (2018). World development indicators. Available online at http://www.worldbank.org.

Wyrwich, M., Stuetzer, M., & Sternberg, R. (2016). Entrepreneurial role models, fear of failure, and institutional approval of entrepreneurship: A tale of two regions. Small Business Economics, 46(3), 467–492. https://doi.org/10.1007/s11187-015-9695-4.

Wyrwich, M., Sternberg, R., & Stuetzer, M. (2018). Failing role models and the formation of fear of entrepreneurial failure: A study of regional peer effects in German regions. Journal of Economic Geography, 19(3), 567–588. https://doi.org/10.1093/jeg/lby023.

Xavier, S., Kelly, D., Kew, J., Herrington, M., & Vorderwülbecke, A. (2012). Global Entrepreneurship Monitor, 2012 Global Report, Global entrepreneurship research association (GERA). Wellesley: Babson College.

Zahra, S. A., Neubaum, D. O., & Huse, M. (1997). The effect of the environment on export performance among telecommunications new ventures. Entrepreneurship Theory and Practice, 22, 25–46. https://doi.org/10.1177/104225879702200102.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Lee, C.K., Cottle, G.W., Simmons, S.A. et al. Fear not, want not: Untangling the effects of social cost of failure on high-growth entrepreneurship. Small Bus Econ 57, 531–553 (2021). https://doi.org/10.1007/s11187-020-00324-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-020-00324-0