Abstract

A nascent body of research suggests that economic freedom is positively associated with entrepreneurial activity. Most of this literature is based on cross-countries analyses, although there is significant regional heterogeneity in entrepreneurial activity and the institutional and policy context within countries. The literature also largely overlooks the potential for the entrepreneurial inducing effects of economic freedom to drive less efficient firms out of the market. Additionally, economic freedom is a multi-dimensional construct comprised of numerous underlying aspects of the institutional and policy environment, but most studies have employed a composite economic freedom measure to assess its impact on entrepreneurial activity. I contribute to these gaps in the literature by decomposing the recently developed Metropolitan Economic Freedom Index into its underlying institutional indicators to explore their potential impact on the firm entry and firm exit rates for a sample of nearly 300 US cities over the period 1972–2012.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

While a large body of research in economics and political science links economic freedom to a variety of socio-economic outcomes (Hall and Lawson 2014), including notably economic growth and development (Bennett et al. 2017; Faria et al. 2016; Murphy and O’Reilly 2018), entrepreneurship scholars have only recently begun to account for economic freedom in their models and empirical analyses (Bjornskov and Foss 2016; Bradley and Klein 2016). The context for most of the research on economic freedom and entrepreneurship is cross-national, while a few studies consider this relationship using the US states as the unit of analysis (Bennett and Nikolaev 2019). Although these studies have used a variety of alternative measures of both entrepreneurship and economic freedom, considered various geographic and time period samples and employed a number of different econometric models—factors that can contribute to heterogeneous empirical findings (Bennett and Nikolaev 2017)—the emerging consensus from this nascent literature is that economic freedom is a robust, positive predictor of entrepreneurship (Nikolaev et al. 2018).

There are a number of gaps in this literature. First, entrepreneurship has been described as a largely regional phenomenon (Feldman 2001) and a growing body of research suggests that subnational differences in economic freedom are associated with a variety of socio-economic outcomes (Stansel and Tuszynski 2018).Footnote 1 Because regional measures of economic freedom such as the Metropolitan Area Economic Freedom Index (MEFI) for US cities have only recently become available, prior research has been very limited. Next, economic freedom is a reflection of the degree to which the institutional environment encourages the market selection mechanism, which enhances competitive market pressures that force unprofitable firms to exit the market (Sobel et al. 2007). Yet there has been very little research on the relationship between economic freedom and firm exits. Only one study considers how local economic freedom potentially influences both firm entry and firm exit. Bennett (2019b) found a robust positive relationship between MEFI and the local firm entry rate but failed to find a significant effect of MEFI on firm exits.

Additionally, most previous research on economic freedom and entrepreneurship uses an economic freedom index derived from numerous underlying institutional variables, but these underlying variables may exert heterogeneous effects on entrepreneurial actions (Bjørnskov and Foss 2008; McMullen et al. 2008; Nyström 2008). MEFI, for instance, is comprised of nine different measures that reflect different aspects of the local institutional environment. More local economic freedom in some of the components may serve as an enabling factor for new venture creation (Davidson et al. 2018; Davidsson 2015) by reducing the institutional constraints faced by entrepreneurs, but less economic freedom in others may be a less binding constraint on entrepreneurs (Terjesen et al. 2016). Similarly, more economic freedom in some of the institutional components may facilitate a competitive local market environment that encourages a survival of the fittest scenario that efficiently forces the weakest firms out of business, but other components may reduce uncertainty and facilitate the survival of firms (Gimeno et al. 1997; Tran 2018).

I extend the work of Bennett (2019b) by decomposing the MEFI into its nine institutional components to explore how each potentially influences firm entry and firm exit for a sample of 294 US cities over the period 1972–2012. In doing so, I contribute to these gaps in the literature in several ways. First, I examine how regional economic freedom in America’s cities influences entrepreneurial activity. Next, by decomposing MEFI and examining how its individual components influence entrepreneurial activity, I provide evidence that economic freedom exerts heterogeneous impacts. Lastly, I contribute to the firm dynamism and entrepreneurial ecosystem literatures by considering the effects of local institutions on both firm entry and firm exit.

The results suggest that cities with high property taxes and minimum wage mandates, as well as a large volume of social security and insurance payments, have lower firm entry and higher firm exit rates. Meanwhile, cities with more generous welfare benefits and those with greater private sector union representation exhibit lower exit rates. I also find some evidence linking cities with: (1) high sales taxation to lower entry rates and higher exit rates, (2) high income taxation to higher entry rates and lower exit rates, and (3) large shares of government employment to higher entry rates.

The remainder of the paper is organized as follows. In Sect. 2, I provide a background for the analysis, describing the main concepts used in the study and reviewing the extant literature on economic freedom and firm dynamism. I develop the hypotheses to be tested empirically in Sect. 3. I describe the data and methods used for the empirical analysis in Sect. 4 and present the results in Sect. 5. In Sect. 6, I offer a discussion of the results, practical implications, and guidance for future research.

2 Background

2.1 Firm dynamism

Firm dynamism reflects the flow of newly created firms into a local economy as well as the exit of incumbent firms from the market during a given period, representing the shifting of resources away from less productive to more productive firms (Decker et al. 2014; Haltiwanger 2012). This churning of firms consists of two processes that reflect, at the micro level, opposing entrepreneurial actions: firm entry into the market and firm exit from the market. Because these two actions represent distinct processes that may be affected differentially by environmental shifts such as institutional changes, they should be examined separately as well as in tandem, to understand the mechanisms driving regional firm dynamism (Bennett 2019a, b). My main focus is therefore on firm entry and firm exit as distinct dynamism concepts.

2.2 Economic freedom

Institutions, or “the humanly devised constraints that structure political, economic and social interactions” that arise as a “means to create order and reduce uncertainty in exchange” (North 1991, p. 97), take many forms, but of particular interest to policymakers and scholars interested in understanding the drivers of firm dynamism are economic policies and regulations that impact the actions of entrepreneurs (Wood et al. 2016). Economic freedom is a multi-dimensional concept that reflects the degree to which an economy’s policies and regulations reflect the principles of “personal choice, voluntary exchange, freedom to compete, and protection of person and property” (Gwartney and Lawson 2003, p. 406). It provides all individuals with the right to decide how to expend their time, talents, and resources to produce and/or consume the bundle of goods and services of their choosing, but they do not have a right to the time, talents and resources of others (Von Mises 1990). This entails that individuals and their property are protected from being involuntarily confiscated, seized, or stolen through the use of violence, coercion, or fraud. Rather, economic freedom requires individuals to engage in voluntary exchange as a means to obtain one another’s property, resulting in mutually beneficial gains from trade (Gwartney et al. 2018). Economic freedom is therefore a philosophically consistent concept that is closely associated with the concept of negative rights (Gwartney and Lawson 2003).

2.3 Literature review: economic freedom and dynamism

Many scholars have treated economic freedom as a composite construct (Bjørnskov and Foss 2008) and associated it with the degree of market-orientation of an economy’s institutions and policies (Angulo-Guerrero et al. 2017; Dau and Cuervo-Cazurra 2014). Economies characterized by high levels of economic freedom not only permit the unhindered movement of labour, capital, and goods, but they also constrain the government and other economic actors from using coercion to limit these liberties (Saunoris and Sajny 2017). As such, economic freedom enables entrepreneurs to enter and compete freely in markets without undue interference from the government or other organizations, resulting in lower transactions costs and less uncertainty concerning governmental interference in the market process (Bradley and Klein 2016).

Economic freedom lowers the transactions costs faced by entrepreneurs, including the costs of “searching for, combining, adapting, and fitting heterogeneous resources in the pursuit of profit under uncertainty” (Bjørnskov and Foss 2012, p. 248). Bennett (2019b, p. 9) adds that “entrepreneurs living in more economically free regions are less constrained in their ability to utilize their time, talents and resources to create a new venture to satisfy a perceived market need or recognize and capitalize on an unexploited entrepreneurial opportunity.” Economic freedom therefore encourages more entrepreneurial activity by lowering transactions costs and reducing institutional uncertainty (Bjørnskov and Foss 2012; Bylund and McCaffrey 2017). Economic freedom is associated with fewer government distortions of the market process, thereby reducing the relative costs and benefits of entrepreneurial decisions (Saunoris and Sajny 2017) and providing incentives for productive entrepreneurial activity (Baumol 1990).

Indeed, previous cross-country empirical research identifies a positive association between composite measures of economic freedom and several different measures of entrepreneurial activity. For a sample of 17 European countries and the USA over the period 2001–2004, Gohmann (2012) found that individuals living in more economically free countries are more likely to be self-employed, as well as more likely to prefer to be self-employed rather than wage-employed. Sobel et al. (2007) found a positive relationship between economic freedom and Total Entrepreneurial Activity in 2002. Nikolaev et al. (2018) found economic freedom to be the most robust determinant of opportunity-motivated entrepreneurship (OME) for a cross-sectional sample of 73 countries using a robustness analysis method that accounts for model uncertainty. Angulo-Guerrero et al. (2017) also found a positive relationship between economic freedom and OME for a longitudinal sample of 33 OECD countries over the period 2001–2012. Additionally, Dau and Cuervo-Cazurra (2014), who considered a sample of 51 countries over the period 2002–2009, and Saunoris and Sajny (2017), who examined a cross sectional sample of 60 countries, both found a positive relationship between economic freedom and formal entrepreneurship.Footnote 2,Footnote 3

There is also a small body of literature suggestive that state-level economic freedom is positively associated with several measures of entrepreneurial activity. Using a cross sectional sample of the 48 contiguous states, Sobel (2008) found economic freedom to be positively associated with numerous measures of productive entrepreneurial activity such as venture capital investments, patenting, the establishment birth rate, and the growth of the sole proprietorship rate. Kreft and Sobel (2005) also found a positive relationship between economic freedom and the sole proprietorship growth rate for a cross-sectional sample of the US states. Using the recently developed MEFI, Bennett (2019b) found a positive relationship between economic freedom and the firm entry rate across US cities over the period 1972–2012.

Economic freedom, in addition to providing entrepreneurs with the freedom to enter and compete in markets (Bradley and Klein 2016), also provides them with the freedom to suffer losses and fail when they do not satisfy their customer’s needs (Kirzner 1973; Sobel et al. 2007; Von Mises 1990). Economic freedom therefore represents the degree to which the competitive market selection mechanism is unimpeded by government intervention in the economy, allowing it to facilitate both the creation and destruction of firms (Schumpeter 1942; Sobel et al. 2007). More economically free regions are characterized by fewer entry barriers, lower transactions costs, and less institutional uncertainty. This facilitates a more competitive business environment in which firms that fail to efficiently provide highly valued goods and services will face greater competitive pressure (Park et al. 2006), leading to potential losses and eventual failure if they are unable to improve productivity and/or better serve their customers (Fritsch and Mueller 2007). Yet there has been significantly less research on the relationship between economic freedom and business exits. Sobel et al. (2007) observed for a sample of 21 OECD countries that business failure rates are higher in more economically free countries. Campbell et al. (2012), however, found no relationship between state-level economic freedom and firm death rates in a longitudinal analysis covering the period 1989–2004. Similarly, Bennett (2019b) found no relationship between city-level economic freedom and firm exit rates for a longitudinal sample of 294 US cities over the period 1972–2012.

Several studies have also looked at composite measures of firm dynamism using the US states as their context. Campbell and Rogers (2007) found a positive relationship between economic freedom and the net business formation rate, or the difference between the business birth and business death rates, using longitudinal data spanning the period 1990–2001. Barnatchez and Lester (2017) found economic freedom to be positively associated with the net establishment entry rate, as well as the gross establishment entry rate, or the sum of the establishment entry and exit rates, across the US states over the period 1981–2013.

With the exception of Bennett (2019b), who finds that MEFI is positively associated with firm entry but has no effect on firm exit, the extant literature has largely neglected to consider how economic freedom may impact both types of entrepreneurial activities. I build on Bennett’s analysis by decomposing MEFI into its underlying institutional components to consider the potential heterogeneous effects of economic freedom on firm dynamism.

3 Hypothesis development

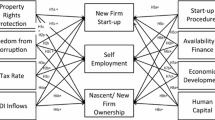

In this section, I develop hypotheses for how each of the variables included in the MEFI influence firm entry and firm exit. The MEFI index is comprised of nine variables that are assigned to one of three main area sub-indices. First is the Size of Government Index (EF1), which is comprised of three measures that reflect the degree to which local resources are allocated by the government towards (1) government consumption, (2) transfer payments and subsidies, and (3) insurance and retirement payments. Next is the Taxation Index (EF2), which is comprised of three measures that reflect government distortions of economic activity via taxation of (4) income, (5) sales, and (6) property. Third is the Labor Market Distortions Index (EF3), which is comprised of three measures of labour market distortions, including (7) minimum wage legislation, (8) government employment, and (9) union density (Stansel 2019). Table 1 summarizes the composition of MEFI and the three sub-indices and describes how each indicator is measured.Footnote 4

3.1 Government expenditures

Governments spend taxpayer resources on a variety of goods, services, and programs, many of which are beyond the scope of pure public goods (McMullen et al. 2008). To the extent that non-public goods and services are provided either directly by government enterprises or subsidies to private organizations, the scope of market activity available for current and potential entrepreneurs to exploit is reduced (Bjørnskov and Foss 2008; Nyström 2008). By publicly financing the provision of such goods and services, governments potentially crowd-out private market activity because it is very difficult for a non-subsidized firm to compete with an entity that can sell its goods and services below their cost of production (Henrekson 2005). Prospective entrepreneurs will therefore be deterred from entering into markets for which the government is a major supplier, resulting in less entrepreneurial entry. Additionally, government entry into new markets, or the subsidization of certain firms, may result in the failure of incumbent firms that can no longer compete with a highly subsidized entity. This motivates the following hypotheses:

-

Hypothesis 1a: Firm entry rates are lower in cities with higher government consumption expenditures.

-

Hypothesis 1b: Firm exit rates are higher in cities with higher government consumption expenditures

Government safety net programs provide transfer payments and subsidies in-kind to individuals and families based on need. These welfare programs are generally means-tested and provide the least well-off members of society with basic needs such as food, housing, and clothing. While the availability of these welfare programs may serve as a sort of insurance for prospective entrepreneurs who may otherwise be deterred from starting a business for fear of failure (Sinn 1997), they may also reduce the incentives for entrepreneurship by acting as a de facto reservation wage. The more generous the welfare benefits, the higher this reservation wage and the less likely that low-income individuals pursue entrepreneurship as a means to earn a living (Bjørnskov and Foss 2008). More generous welfare spending may also reduce the supply of less skilled labor, increasing the costs faced by firms that need to hire low-skilled labor (Bartik 1989). Governments with more generous welfare programs are therefore likely to discourage some prospective entrepreneurs from entering the market. Welfare programs may, however, provide a consumption smoothing effect (Gruber 1997) by providing recipients with stable purchasing power. This minimizes revenue volatility for firms providing goods and services to low-income households, acting to stabilize their cash flows. The above theory motivates the following hypotheses.

-

Hypothesis 2a: Firm entry rates are lower in cities with more generous welfare programs.

-

Hypothesis 2b: Firm exit rates are lower in cities with more generous welfare programs.

In addition to means-tested welfare programs, governments also provide income to individuals in the form of retirement and insurance schemes. In the U.S., social security is a mandatory pay-as-you-go system. Such systems have a tendency to reduce individual incentives for savings and wealth formation because individuals receiving a large portion of their income from social security and other insurance payments are more likely to use this income for consumption than savings, while those paying into these programs have a reduced incentive to save and invest. This results in a lower savings rate (Feldstein 1996) and a reduction in the amount of capital that would otherwise be available for investment in new businesses (Henrekson 2005). Considerable evidence exists that individuals without savings face a liquidity constraint and are less likely to enter into entrepreneurship (Lindh and Ohlsson 1996; Schäfer et al. 2011; Taylor 2001). Additionally, entrepreneurs with greater savings and access to capital are less likely to go out of business (Holtz-Eakin et al. 1994). This motivates the following hypotheses.

-

Hypothesis 3a: Firm entry rates are lower in cities with higher social security and insurance payments.

-

Hypothesis 3b: Firm exit rates are higher in cities with higher social security and insurance payments.

3.2 Taxation

While a tax on any economic activity is distortionary, the effect of taxation on entrepreneurial activity is theoretically ambiguous. On the one hand, high taxes reduce the potential rewards from entering entrepreneurship and divert income that could otherwise be used to finance entry, serving as a labor supply effect that acts to reduce entrepreneurial entry (Coomes et al. 2013). On the other hand, high taxation may induce a tax avoidance effect that increases the rewards for wage employees to reclassify as proprietorships to reduce their tax liability, acting to increase entrepreneurship (Belitski et al. 2016; Nyström 2008).Footnote 5 While much of the empirical literature considering the effects of taxation on entrepreneurship supports dominance of the tax avoidance effect, most of these studies have focused on national income and/or payroll tax rates (Bruce and Deskins 2012). Businesses, however, are also subject to taxation by subnational governments and there is mixed evidence concerning the relationship between subnational tax policies and entrepreneurial activity (Bruce and Deskins 2012). Coomes et al. (2013), for instance, found that higher effective state income taxes are associated with lower regional rates of proprietorship. Meanwhile, Georgellis and Wall (2006) found a U-shaped relationship between top marginal tax rates and the sole proprietorship rate across the US states.

The structure of taxes may also influence entrepreneurial decisions. Bruce and Deskins (2012) found that state income tax rates had no effect on self-employment but tax progressivity is associated with more self-employment, suggesting that progressive income taxation may serve as insurance against the risks of entrepreneurship. Within the context of Europe, Baliamoune-Lutz and Garello (2014) found that tax progressivity discourages entry into entrepreneurship among those with high incomes, but it encourages entry among those with lower incomes. Meanwhile, Robson and Wren (1999) distinguished between marginal and average tax rates, showing that lower marginal rates provide a greater incentive for entrepreneurial effort, acting to encourage more self-employment. Lower average tax rates reduce the gains from tax avoidance, however, acting to discourage self-employment. Because the measure of income taxation used in the MEFI approximates the average effective income tax rate, I anticipate that it will be positively associated with the firm entry rate and negatively associated with the firm exit rate, motivating the following two hypotheses:

-

Hypothesis 4a: Firm entry rates are higher in cities with higher average effective income tax rates.

-

Hypothesis 4b: Firm exit rates are lower in cities with higher average effective income tax rates.

In addition to income taxation, businesses also face a variety of other taxes, although there has been considerably less research on the effects of non-income taxation on entrepreneurship (Bruce and Deskins 2012). Sales taxes may impose an economic burden on businesses during their start-up phase when they need to procure capital, inventory, and supplies (Bartik 1989). This may act to increase the costs of starting a business, potentially deterring some entrepreneurs from entering the market. A few studies have found empirically that state sales taxes are associated with less entrepreneurship (Bartik 1989; Bruce and Deskins 2012). Sales taxes also increase the ongoing costs of operating a business, reducing profitability and lowering the prospects that a business survives (Chen and Williams 1999). Given that the measure of sales taxation used in the MEFI approximates that average effective sales tax rate, I anticipate that it will be negatively associated with the firm entry rate and positively associated with the firm exit rate, motivating the following two hypotheses.

-

Hypothesis 5a: Firm entry rates are lower in cities with higher average effective sales tax rates.

-

Hypothesis 5b: Firm exit rates are higher in cities with higher average effective sales tax rates.

Businesses are also subject to taxation on the property that they own. Property taxes must generally be paid regardless of whether a business is profitable or not. Given that most new businesses are not profitable during their first few years of operation, property taxes entail a start-up cost that may act to deter some entrepreneurs from entering the market (Bartik 1989). Bartik (1989) found that higher state property taxes reduce small business start-ups and Bartik (1985) found a negative relationship between state property taxes and the number of new manufacturing plants. Property taxes also serve as an ongoing cost of doing business that reduce a firm’s profitability, potentially resulting in a greater number of firm exits. Given that the measure of property taxation used in the MEFI approximates the average effective property tax rate, I anticipate that it will be negatively associated with the firm entry rate and positively associated with the firm exit rate, motivating the following two hypotheses.

-

Hypothesis 6a: Firm entry rates are lower in cities with higher average effective property tax rates.

-

Hypothesis 6b: Firm exit rates are higher in cities with higher average effective property tax rates.

3.3 Labor market distortions

Neoclassical economic theory suggests that a profit-maximizing firm pays labor a wage equal to its marginal product. Government-mandated minimum wages have the potential to set the price of low-skilled labor above its marginal product, resulting in higher costs and inefficiency for firms that rely on low-skilled labor (Garrett and Wall 2006). This undermines entrepreneurial autonomy and marginalizes the influence that entrepreneurs have on optimizing their production functions (McMullen et al. 2008), as well as reducing incentives to become an entrepreneur (Coomes et al. 2013). Georgellis and Wall (2006) found that higher minimum wages in states with low productivity reduce entrepreneurship. This suggests that the effect of the minimum wage on entrepreneurship is conditional on the degree to which it serves as a binding constraint. In other words, the effects of the same mandatory minimum wage level in two regions with different productivity or income levels may exert differential effects on entrepreneurial entry. The minimum wages may have an adverse impact on entrepreneurship in a region with low productivity/income levels, but it may not serve as a constraint in high productivity/income level regions such that it has no influence on entrepreneurial decisions. Similarly, increases in the minimum wage relative to the productivity/income level will likely increase the relative costs of labor for incumbent firms, potentially imposing losses on some previously profitable firms. This motivates the following hypotheses.

-

Hypothesis 7a: Firm entry rates are lower in cities where the statutory minimum wage is a more binding constraint.

-

Hypothesis 7b: Firm exit rates are higher in cities where the statutory minimum wage is a more binding constraint.

Larger regional governments provide more goods and services and regulate economic and social activity to a greater extent than smaller governments. As such, they need to employ more workers and this may exert differential effects on entrepreneurial activity. First is a labor supply effect (Ehrenberg and Smith 2017). Government may compete with the private sector for workers, potentially decreasing the supply of labor available for employment in firms. Holding demand for labor constant, a decrease in the labor supply would put upward pressure on wages, acting to increase labor costs for prospective entrepreneurs and incumbent firms. Higher labor costs would potentially deter some entrepreneurs from entering the market and may result in losses for some previously profitable firms. This would lead to fewer firms entering the market and more firms exiting it.

Next is a consumption smoothing effect (Gruber 1997). Government employees typically have greater job security than non-unionized private sector employees because civil service protections make worker dismissals more difficult and layoffs are infrequent given that government agencies rarely downsize (Lewis and Frank 2002). Regions with more government employees may provide a benefit to firms in that the greater job security enjoyed by their employees acts to smooth goods and services consumption over time, reducing the cyclical volatility of demand. This would act to stabilize cash flows for local firms and reduce financial uncertainty, potentially encouraging more entrepreneurs to enter the market and reducing the number of firms that exit. Additionally, regions with larger public sectors may provide more opportunities for entrepreneurs to supply goods or services to the public sector, which would act to increase entrepreneurship. Given the theoretically ambiguous effects of government employment on firm entry and exit, I propose the following sets of competing hypotheses.

-

Hypothesis 8a[b]: Firm entry rates are lower [higher] in cities with more public sector employment if the labor demand [consumption smoothing] effect dominates.

-

Hypothesis 8c[d]: Firm exit rates are higher [lower] in cities with more public sector employment if the labor demand [consumption smoothing] effect dominates.

Labor unions potentially impact firm dynamism in several ways. Labor unions engage in collective bargaining with firms on behalf of their members, providing covered employees with significantly greater bargaining power than they would have as individuals. This often results in greater levels of compensation and increased job security for unionized employees. Kanniainen and Vesala (2005) developed a model to show that this results in a reduction in expected enterprise cash flows and an increased probability of economic loss, acting to deter entry in entrepreneurship. High job security among union members is also likely to generate job-lock effects that reduce the likelihood that they become entrepreneurs (Bruce 2000). Additionally, labor unions often exercise substantial influence over the operations of firms that they contract with. They may be able to deter the owners of a firm from exiting the market even if the firm is not performing well, leading to fewer firm exits (Gimeno et al. 1997). This motivates the following hypotheses.

-

Hypothesis 9a: Firm entry rates are lower in cities with higher labor unionization rates.

-

Hypothesis 9b: Firm exit rates are lower in cities with higher labor unionization rates.

4 Data and methods

The context for the analysis is US metropolitan statistical areas (MSAs), a county-based concept designed by the U.S. Office of Management and Budget using local commuting data to capture the boundaries of the entire local economy surrounding a central city (Stansel 2019). Appendix Table A1 describes the variables and their sources, as well as provides summary statistics. Appendix Table A2 contains a correlation matrix of the firm dynamism and institutional measures.

4.1 Firm dynamism

I utilize two MSA-level measures to reflect the flow of new firms into the local economy and the exit of incumbent firms: (1) the firm entry rate and (2) the firm exit rate. These firm dynamism measures were derived from the U.S. Census Bureau’s Business Dynamism Statistics (BDS) public database. The BDS database provides annual measures of business dynamics aggregated at the MSA-level over the period 1977–2014. The local institutional measures are only available quinquennially beginning in 1972, so the firm dynamism measures were mapped to these observation periods as the average number of firm entries or exits over the 5 years following the year for which the institutional measures are observed, t ∈ [1977, …, 2007, 2012], as a share of the total number of incumbent firms at the beginning of the period to normalize the measures so that they are comparable across regions and time.Footnote 6 This mapping procedure has the effect of lagging the institutional measures relative to the firm dynamism measures, which minimizes potential endogeneity as firm dynamism in period t cannot impact institutions in period t − n.

4.2 Institutional indicators

I utilize the data comprising the new MEFI, which is available every 5 years for up to 382 MSAs over the period 1972–2012. Its authors transform each institutional indicator and index to a 0–10 scale that is increasing in economic freedom, but I use the raw data measures for each of the nine institutional variables. See Table 1 above for a description of the index components.

4.3 Control variables

I follow Bennett (2019c) in controlling for a variety of MSA-level demographic and economic factors that also potentially influence firm dynamism. This includes two measures of the size of the local economy including the natural log of real per capita personal income and the natural log of population, both of which were gathered from the Bureau of Economic Analysis. Larger economies facilitate a greater degree of specialization and division of labour (Smith 1776) and may provide better access to entrepreneurial capital (Denis 2004), potentially acting to enable more entrepreneurial ventures to serve a large and economically prosperous population.

I also control for several measures of the strength and diversity of labor force, including the labor force participation rate, the unemployment rate, the college attainment rate, and the shares of the workforce employed in blue collar and white collar occupations. With respect to the workforce composition variables, the share of workers employed in the agricultural sector is omitted from the estimates and therefore serves as the baseline. As such, these variables serve as a proxy for the local industrial structure. Additionally, I control for a variety of demographic characteristics of the local population, including the shares of adults that are: (1) living below the poverty line, (2) racial minorities, (3) female, (4) married, (5) immigrants, (6) Hispanic, and (7) working age. The demographic and labor force variables were derived from the IPUMS-CPS public micro dataset (Ruggles et al. 2018).

Additionally, firm entry and exit often occur simultaneously as part of the creative destruction process (Johnson and Parker 1994; Schumpeter 1942). As such, I control for the firm entry [exit] exit rate when the firm exit [entry] rate is the DV. Finally, I control for fixed period effects to account for potential cyclical and/or secular trends experienced throughout the country (Davis and Haltiwanger 1992; Decker et al. 2014; Haltiwanger et al. 2013).

4.4 Methodology

I use panel data econometric methods to empirically test the hypotheses concerning the relationship between the local institutional environment and firm dynamism. For the baseline results, I follow Bennett (2019b) in using the fixed effects model described by the below equation to estimate the impact of the local institutional indicators on firm dynamism, where i and t denote the MSA and year; FirmDyni, t is the respective firm dynamism indicator; Institutioni, t is a matrix of institutional indicators; \( {X}_{i,t}^{\prime } \) is a matrix of control variables; ci is a fixed MSA effect; and ei, t is an idiosyncratic error term. The fixed effects estimator controls for unobserved, time invariant MSA-level heterogeneity (Wooldridge 2010).Footnote 7 I use standard errors robust to heteroscedasticity (White 1980) and autocorrelation (Rogers 1994) for statistical inference.

5 Empirical results

5.1 Main results

As a first step, I examine the effects of local institutions on firm dynamism using the overall MEFI and three sub-indices as broad measures of the institutional environment. These results are presented in Appendix Table A4 and suggest that cities with more economic freedom have higher firm entry rates, but this relationship appear to be driven by the government spending area. Meanwhile, none of the economic freedom indices are robustly associated with the firm exit rate.

Next, I decompose the MEFI into its nine underlying variables to examine the potential heterogeneous impact of local economic freedom on firm dynamism. I present these results in Table 2. The firm entry rate is the DV in models 1–4, while the firm exit rate is the DV in models 5–8. Models 1 and 5 include the three sizes of government indicators comprising the EF1 sub-index. Models 2 and 6 include the three taxation indicators comprising the EF2 sub-index. Models 3 and 7 include the three labor market friction indicators comprising the EF3 sub-index. Models 4 and 8 simultaneously include all nine indicators. All models include the full set of control variables and fixed period effects, but these results are omitted for space.

Consider first the government size indicators. The results in models 1 and 4 suggest that the negative relationship between government size, EF1, and firm entry is driven by the government insurance and retirement payment indicator (INSURET), which enters negatively and is highly significant, consistent with H3a. The coefficient suggests that a percentage point increase in INSURET (1.61 standard deviations) is associated with a 0.73 percentage point reduction in the firm entry rate (0.29 SDs). Contrary to H1a and H2a, neither the government consumption spending (GOVCONS) nor the transfer payment (TRANSFERS) indicators are significantly associated with firm entry.

In model 5, meanwhile, all three government size indicators are statistically significant at the 1% level, providing support for H1b, H2b, and H3b. GOVCONS and INSURET are both positively associated with the firm exit rate, but TRANSFERS is associated with a lower firm exit rate. The results are qualitatively similar in model 8, although GOVCONS loses significance in this model. The coefficients suggest that half percentage point increases in TRANSFERS (1.67 SDs) and INSURET (0.81 SDs) are associated with − 0.3 (0.23 SDs) and 0.09 (0.07 SDs) percentage point changes in the firm exit rate. These differences in the effects of the various government spending areas on the firm exit rate explain why the sub-index, EF1, is not robustly associated with the firm exit rate.

Next, I consider the three taxation indicators. In models 2 and 4, I find that all three taxation indicators are significant predicators of the firm entry rate. The income tax (INCTAX) measure is positively associated with the firm entry rate, but both the sales tax (SALETAX) and property tax (PROPTAX) measures are negatively associated with it. The coefficient estimates suggest that percentage point increases in INCTAX, SALESTAX, and PROPTAX (0.80, 1.04, and 1.02 SDs) are associated with 0.43, − 0.17, and − 0.26 percentage point changes in the firm entry rate (0.17, − 0.07, and 0.10 SDs), respectively. These differential effects of the tax environment on firm entry rates are consistent with H4a, H5a, and H6a, and they likely explain the null effect of the taxation sub-index, EF2.

In models 6 and 8, PROPTAX enters as a significant positive determinant of the firm exit rate. This suggests that, consistent with H6b, cities with higher property taxes also exhibit higher firm exit rates. The coefficient estimate suggests that a percentage point increase in PROPTAX (1.02 SDs) is associated with a 0.24 percentage point decrease in the firm exit rate (0.18 SDs). SALESTAX enters negatively and is marginally significant in model 6, but it loses significance in model 8, providing some support for H5b. Inconsistent with H4b, however, INCTAX has no effect on the firm exit rate in either model 6 or 8.

Lastly, I consider the effects of the three labor market distortion indicators. The results in Table 2 suggest that there is heterogeneity in the effects of the measures of labor market institutions on firm dynamism, likely explaining the null results for EF3. Models 3 and 4 suggest that, consistent with H7a, cities with more generous minimum wage mandates (MINWAGE) have lower firm entry rates. The − 0.04 coefficient suggests that a ten percentage point increase in MINWAGE (0.90 SDs) is associated with a 0.4 percentage point decrease in the firm entry rate (0.16 SDs). Consistent with H8b, cities with greater shares of government employment have higher entry rates, suggesting that the consumption smoothing effect of public sector employment dominates the labor supply effect. The coefficient suggests that a percentage point increase in GOVEMPLOY (0.9 SDs) is associated with a 0.09 percentage point increase in the firm entry rate (0.04 SDs). Meanwhile, and inconsistent with H9a, UNION has no effect on the firm entry rate.

In model 7, all three labor market variables enter as significant determinants of the firm exit rate, but only UNION remains significant in model 8. Consistent with H9b, cities with greater union membership have lower firm exit rates. The − 0.05 coefficient suggests that a five percentage point increase in the union share of employment (0.83 SDs) is associated with a 0.25 percentage point increase in the firm exit rate (0.19 SDs). The R2 values of models 4 and 8 suggest that these models explain 81 and 70 percent of the variation in firm entry and firm exit rates, respectively.

5.2 Additional results

In this section, I briefly discuss some additional results that are presented in the online supplementary appendix.

First, the cities in my sample range in population size from around 92,000 to nearly 20 million, but it is plausible that the effects of local institutions on firm dynamism differ by city size. I explore this possibility by examining the results for various sub-samples of cities. First, I exclude from the sample small cities, or those with populations less than 250,000 (model 2) and 500,000 (model 3). Next, I exclude large cities, or those with populations above 2.5 million (model 4) and 1 million (model 5). Finally, I constrain the sample to only medium-city cities or those with populations of 250,000 to 1 million (model 6) and 500,000 to 1 million (model 7). The results using firm entry and firm exit as the DVs are presented in Appendix Tables A5 and A6. The main results are qualitatively similar across the various city size samples, although some of the variables are not significantly significant in a few of the specifications. Additionally, INCTAX enters as a negative and significant predictor of firm exit in most of the sub-samples, but it is not significant statistically in the full sample specification.

Second, the results thus far examine the effects of local institutions on firm dynamism by exploring the firm entry and exit processes separately. Previous research has considered dynamism as a composite construct, employing measures such as the firm churn rate, or the sum of firm entry and exit rates, and the net firm entry rate, or the difference between firm entry and exit rates (Barnatchez and Lester 2017; Bartelsman et al. 2009). I therefore separately estimated the effects of my indicators on the firm churn and net firm entry rates. My results suggest that MEFI is negatively and significantly associated with both measures, results that appear to be driven by the strong negative impact of EF1. I also find EF3 to be positively associated with the net firm entry rate. These results suggest that cities with less government spending are more dynamic, but those with more labor market frictions experience greater net firm entry. INSURET, SALESTAX, and MINWAGE are all negatively associated with both dynamism measures. GOVEMPLOY is positively associated with both dynamism measures. TRANSFERS and UNION are negatively associated with firm churn, but the latter is positively associated with net firm entry. PROPTAX and INCTAX are negatively and positively associated with net firm entry, respectively. These results are presented in Appendix Table A7.

Next, a firm as defined as “economic activity under common operational control” and is distinct from an establishment, which is defined as a “single physical location where economic activity takes place” (Haltiwanger 2012, p. 19). My results thus far use firm-level data, but I also test the robustness of these results to establishment-level dynamism measures in lieu of firm-level measures. These results, which are similar to the firm-level estimates, are presented in Appendix Table A8.

Finally, I account for the potential hierarchical nature of my data in several ways. First, I cluster standard errors for the FE estimates at the regional level using the nine Census divisions (i.e. East North Central; East South Central; Middle Atlantic; Mountain; New England; Pacific; South Atlantic; West North Central; and West South Central), to account for potential interdependencies across MSAs within a region attributable to common unobserved factors (e.g. climate, access to natural resources, culture). Next, I use the RE estimator and control for regional fixed effects to directly account for unobserved time-invariant regional effects. Finally, I both control for regional fixed effects and cluster the standards errors using the RE estimator. The results indicate that (1) INSURET is negatively associated with firm entry; (2) MINWAGE is negatively associated with firm entry in all specifications and it is positively associated with firm exit in the RE specifications; (3) INCTAX is negatively associated with firm exits in the RE models; (4) TRANSFERS and UNION are negatively associated with firm exits in all specifications; (5) PROPTAX is negatively associated with firm entry, but this effect becomes insignificant when controlling for regional fixed effects; and (6) PROPTAX is positively associated with firm exits in all specifications.

6 Discussion

6.1 Summary

Previous research has found a positive link between economic freedom and entrepreneurial activity, but most of this research is based on cross-country analyses, with a few studies providing supporting empirical results for the US states. Even within the US states, however, there exists variation in the degree of economic freedom across regions. Given that entrepreneurship is largely a regional phenomenon (Feldman 2001), it is important to understanding how economic freedom influences entrepreneurial activity at a more granular regional level than the state. Previous studies have also largely overlooked the potential effects of economic freedom on firm exits from the market. Given that economic freedom is necessary to facilitate the market’s dynamic creative destruction process (Phan 2006; Schumpeter 1942), this is an important shortcoming of this literature. Making use of the recently-developed MEFI, Bennett (2019b) provided evidence that city-level economic freedom is associated with an increase in the firm entry rate but had no effect on the firm exit rate. Economic freedom, however, is a multi-dimensional construct comprised of numerous measures of the institutional environment that may exert heterogeneous effects on entrepreneurial activity (Bjørnskov and Foss 2008; McMullen et al. 2008; Nyström 2008).

I extend Bennett’s (2019b) study by decomposing the MEFI into its nine underlying institutional variables and explore their influence firm entry and firm exit for a sample of 294 US cities over the period 1972–2012. The results, which are summarized in Table 3, provide important insights on how local institutions influence firm dynamism, suggesting that some aspects of economic freedom (e.g. less retirement and insurance payments, lower property taxation, lower minimum wage) may act as external enablers of firm entry (Davidsson 2015; Davidsson et al. 2018), while economic freedom in other areas (i.e. income taxation and government employment) may be associated with lower firm entry rates. Similarly, the institutional indicators exert heterogeneous effects on the firm exit rate. Some components (i.e. retirement and insurance payments and property taxation) may act as external disablers (Bennett 2019a), leading to more firm exit rates. Others indicators (i.e. transfer payments, unionized labor), however, are associated with lower exit rates, likely because they facilitate income stability.

6.2 Policy implications

A growing body of empirical evidence suggests that the U.S., long considered the most entrepreneurial and dynamic economy in the world (Schramm 2004), has become increasingly less dynamic over the past few decades. This slowdown in dynamism, which is pervasive across industries, regions, and firm size classes (Decker et al. 2014; Decker et al. 2016b; Hathaway and Litan 2014), is a concern to many policymakers and scholars because dynamism reflects the reallocation of resources from less to more productive firms in a market economy. This creative destruction mechanism promotes productivity gains and innovation, which drive economic development, job creation, and improvements in living standards (Decker et al. 2016a; Schumpeter 1942). Dynamism also reflects how resilient an economy is to confront and adapt to economic changes such as technology shocks (e.g. automation) and intensifying global competition (Decker et al. 2018; EIG 2017).

Although the decline in dynamism over the past few decades is well-documented, its determinants are less well known. My study contributes to our understanding of the effects of local institutions on firm dynamism by examining empirically the link between nine different aspects of the local institutional environment on firm entry and firm exit rates. The results provide guidance for local policy influencers on how to encourage a more dynamic entrepreneurial ecosystem. My results suggest that high property taxes, minimum wage mandates, and a large volume of social security and insurance payments may be detrimental to building a local entrepreneurial ecosystem. All three are associated with lower firm entry and higher firm exit rates. Because social security and insurance programs are typically developed and administered by higher levels of government (i.e. federal and/or state), my findings may reflect local demographic patterns more so than local policy decisions. While local policymakers have little direct influence in this area, they can influence how attractive their regions are for entrepreneurs to start businesses and workers to live by keeping property taxes low and avoiding inflating labor costs by increasing the minimum wage above the federal or state statutory levels. They can also encourage their state representatives to avoid increasing the state mandated minimum wage.

I find evidence that sales taxation may also be harmful, as it is associated with lower firm entry rates and higher firm exit rates in some specifications. Income taxation, meanwhile, is positively associated with firm entry rates and negatively associated with exit rates in some specifications. These results suggest that, in terms of encouraging a more entrepreneurial ecosystem, local policymakers should place greater emphasis on income taxation as the source of revenue to finance public goods provision. It should be noted, however, that my measure of income taxation is a proxy for the average effective tax rate and previous research suggests that income tax progressivity and high marginal income tax rates may discourage entrepreneurship (Baliamoune-Lutz and Garello 2014; Gentry and Hubbard 2005; Robson and Wren 1999), while a proportional income tax structure may have no effect on entrepreneurial entry decisions (Gentry and Hubbard 2000). This is a limitation of my study and an area for future research.

Cities with more generous welfare benefits and those with greater private sector union representation exhibit lower firm exit rates. While it might be tempting to conclude that increasing transfer payments and unionization rates is an effective means to keep local firms in business, neither variable is positively associated with firm entry rates. The implication here is that neither transfer payments nor labor unionization contributes to the development of a resilient entrepreneurial culture that is capable of adapting to an increasingly dynamic global economy (Davidsson 1995; Fritsch and Wyrwich 2018). Additionally, some of my results suggest that regions with higher shares of the labor force employed by the government have higher firm entry rates. This finding, although not robust, may reflect that regions with larger public sectors provide greater opportunities for entrepreneurs to supply goods and services to the government, potentially acting to encourage unproductive rather than productive entrepreneurship (Baumol 1990; Sobel 2008).

6.3 Guidance for future research

Many policymakers and scholars are interested in utilizing public policy to facilitate high-growth start-ups that create significant numbers of jobs and generate innovation spill over effects (Colombelli et al. 2016; Henrekson and Johansson 2010; Shane 2009). The results from my research are suggestive of how different local institutions enable or constrain business creation, but the firm entry measures that I use do not distinguish between the type of firms entering the market. Future research that attempts to untangle the effects of the local institutional environment on entry by replicative small businesses and high-growth start-ups would constitute a valuable contribution (Acs and Mueller 2007; Stenholm et al. 2013). Furthermore, the MEFI dataset does not include public investment expenditures, so my results do not account for the potential impact of public infrastructure investments (Bennett 2019a) or innovation programs (Armanios et al. 2019; Fotopoulos and Storey 2018) that may be more relevant for high-growth oriented start-ups (Mason and Brown 2013; Shane 2009).

My firm dynamism indicators also do not distinguish between the entry and exit of firms in different industries and/or sectors, but institutional changes may exert a heterogeneous impact across sectors. Gohmann et al. (2008), for instance, found that state-level economic freedom is positively associated with firm and employment growth in the business and personal services sectors but negatively associated with growth in the health, legal, and social services sectors. Tran (2018) provides additional evidence of the heterogeneous impact of provincial level institutional reforms across firm types in Vietnam. Future research that examines the impact of the local institutional context on firm dynamism by industry or sector, as well as in different country contexts, would provide additional insights on how the institutional environment shapes the industry dynamics of local entrepreneurial ecosystems.

Entrepreneurial ecosystems are multi-dimensional heterogeneous configurations of numerous interdependent factors (Acs et al. 2017; Audretsch and Belitski 2017; Brown and Mason 2017). As such, there are important complementarities and potential bottlenecks between various ecosystem factors that influence their performance (Acs et al. 2018; Bruns et al. 2017). Boudreaux and Nikolaev (2018), for instance, found that economic freedom and social capital are important complements in promoting opportunity entrepreneurship in national ecosystems, but economic freedom may serve as a substitute for human and financial capital. Future research that examines the potential complementarities among the local institutional context and other local ecosystem factors, and their importance for economic development, would improve our understanding of entrepreneurial ecosystem performance.

Notes

Appendix Table A3 reports the between and within standard deviations of the MEFI and its underlying area sub-indices and component variables. There exists significant variation in economic freedom both between and within MSAs.

There is mixed cross-country evidence, however, on the relationships between economic freedom and informal entrepreneurship (cf., Dau and Cuervo-Cazurra 2014; Saunoris and Sajny 2017) and necessity-motivated entrepreneurship (cf., Angulo-Guerrero et al. 2017; Nikolaev et al. 2018). My measures of entrepreneurship more closely reflect formal and opportunity-motivated entrepreneurship for which the evidence is more consistent, as described above.

One limitation of the current study is that that newly developed MEFI dataset, which provides wide local coverage over a long period of time, does not capture all of the components of economic freedom that may vary across regions and exert an influence on the entrepreneurial ecosystem. Notably absent from the MEFI are measures of legal and regulatory institutions (Braunerhjelm et al. 2015).

Cullen and Gordon (2007) argue that a reduction in personal tax rates can discourage entrepreneurial risk taking for risk-adverse individuals because it implies less risk-sharing with the government. They also suggest that the potential tax savings from going into business as a means to reclassify earnings from personal to corporate income is reduced when personal income tax rates fall.

As an example, the firm entry rate assigned to 1997 is the average annual number of firms created over the period 1997–2001 relative to the total number of firms in 1997. Note that the BDS data series ends in 2014, so the numerator for the measures mapped to 2012 represents the average values over the 3 years spanning 2012–2014.

I ran the Hausman (1978) specification test to determine whether a fixed effects (FE) or random effects (RE) estimator is more appropriate for each dynamism indicator using the most complete model (see model 4 and 8 in Table 2). Under the null hypothesis, both the FE and RE estimators are assumed consistent and the RE estimator is more efficient. The Wu-Hausman test statistic, which has a χ2 distribution, is used to test the null hypothesis. If the null is rejected (i.e., p value ≤0.05), then the FE estimator is preferred because it is assumed consistent and the test suggests that the RE estimator is inconsistent (Wooldridge 2010). For all firm dynamism indicators, the p value of the test statistics is 0.000, suggesting that the null be rejected. I omit these results for space. The Hausman test, despite being widely used in applied research, has been criticized for its inability to account for higher-level processes (Bell and Jones 2015). I therefore report analogous results using the RE estimator in Appendix Table A9.

References

Acs, Z. J., & Mueller, P. (2007). Employment effects of business dynamics: mice, gazelles and elephants. Small Business Economics, 30(1), 85–100. https://doi.org/10.1007/s11187-007-9052-3.

Acs, Z. J., Stam, E., Audretsch, D. B., & O’Connor, A. (2017). The lineages of the entrepreneurial ecosystem approach. Small Business Economics, 49(1), 1–10. https://doi.org/10.1007/s11187-017-9864-8.

Acs, Z. J., Estrin, S., Mickiewicz, T., & Szerb, L. (2018). Entrepreneurship, institutional economics, and economic growth: an ecosystem perspective. Small Business Economics, 51(2), 501–514. https://doi.org/10.1007/s11187-018-0013-9.

Angulo-Guerrero, M. J., Pérez-Moreno, S., & Abad-Guerrero, I. M. (2017). How economic freedom affects opportunity and necessity entrepreneurship in the OECD countries. Journal of Business Research, 73, 30–37. https://doi.org/10.1016/j.jbusres.2016.11.017.

Armanios, D. E., Lanahan, L., & Yu, D. (2019). Varieties of local government experimentation: U.S. state-led technology-based economic development policies, 2000–2015. Academy of Management Discoveries, amd.2018.0014. https://doi.org/10.5465/amd.2018.0014.

Audretsch, D. B., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: establishing the framework conditions. The Journal of Technology Transfer, 42(5), 1030–1051. https://doi.org/10.1007/s10961-016-9473-8.

Baliamoune-Lutz, M., & Garello, P. (2014). Tax structure and entrepreneurship. Small Business Economics, 42(1), 165–190. https://doi.org/10.1007/s11187-013-9469-9.

Barnatchez, K., & Lester, R. (2017). The relationship between economic freedom and economic dynamism. Contemporary Economic Policy, 35, 358–372. https://doi.org/10.1111/coep.12194.

Bartelsman, E., Haltiwanger, J., & Scarpetta, S. (2009). Measuring and analyzing cross-country differences in firm dynamics. In T. Dunne, J. B. Jensen, & M. J. Roberts (Eds.), Producer dynamics: new evidence from micro data (pp. 15–76). https://doi.org/10.7208/chicago/9780226172576.001.0001.

Bartik, T. J. (1985). Business location decisions in the United States: estimates of the effects of unionization, taxes, and other characteristics of states. Journal of Business & Economic Statistics, 3(1), 14–22. https://doi.org/10.2307/1391685.

Bartik, T. J. (1989). Small business start-ups in the United States: estimates of the effects of characteristics of states. Southern Economic Journal, 55, 1004–1018. https://doi.org/10.2307/1059479.

Baumol, W. J. (1990). Entrepreneurship: productive, unproductive, and destructive. Journal of Political Economy, 98, 893–921.

Belitski, M., Chowdhury, F., & Desai, S. (2016). Taxes, corruption, and entry. Small Business Economics, 47(1), 201–216. https://doi.org/10.1007/s11187-016-9724-y.

Bell, A., & Jones, K. (2015). Explaining fixed effects: random effects modeling of time-series cross-sectional and panel data. Political Science Research and Methods, 3(1), 133–153. https://doi.org/10.1017/psrm.2014.7.

Bennett, D. L. (2019a). Infrastructure investments and entrepreneurial dynamism in the U.S. Journal of Business Venturing, 34(5), 28. https://doi.org/10.1016/j.jbusvent.2018.10.005.

Bennett, D. L. (2019b). Local economic freedom and creative destruction in America. Small Business Economics forthcoming.

Bennett, D.L. (2019c). Local economic freedom and creative destruction in America. Mendeley data, v1. https://doi.org/10.17632/c3t7yc2syn.1.

Bennett, D. L., & Nikolaev, B. (2017). On the ambiguous economic freedom–inequality relationship. Empirical Economics, 53, 717–754. https://doi.org/10.1007/s00181-016-1131-3.

Bennett, D. L., & Nikolaev, B. (2019). Economic freedom, public policy, and entrepreneurship. In J. Gwartney, R. Lawson, J. Hall, & R. Murphy (Eds.), Economic freedom of the world (2019th ed., pp. 199–224). Vancouver: Fraser Institute.

Bennett, D. L., Faria, H. J., Gwartney, J. D., & Morales, D. R. (2017). Economic institutions and comparative economic development: a post-colonial perspective. World Development, 96, 503–519. https://doi.org/10.1016/j.worlddev.2017.03.032.

Bjørnskov, C., & Foss, N. J. (2008). Economic freedom and entrepreneurial activity: some cross-country evidence. Public Choice, 134, 307–328. https://doi.org/10.1007/s11127-007-9229-y.

Bjørnskov, C., & Foss, N. J. (2012). How institutions of liberty promote entrepreneurship and growth. In Economic freedom of the world: 2012 annual report (pp. 247–270). Fraser Institute.

Bjornskov, C., & Foss, N. J. (2016). Institutions, entrepreneurship, and economic growth: what do we know and what do we still need to know? Academy of Management Perspectives, 30, 292–315. https://doi.org/10.5465/amp.2015.0135.

Boudreaux, C. J., & Nikolaev, B. (2018). Capital is not enough: opportunity entrepreneurship and formal institutions. Small Business Economics. https://doi.org/10.1007/s11187-018-0068-7.

Bradley, S. W., & Klein, P. (2016). Institutions, economic freedom, and entrepreneurship: the contribution of management scholarship. Academy of Management Perspectives, 30, 211–221. https://doi.org/10.5465/amp.2013.0137.

Braunerhjelm, P., Desai, S., & Eklund, J. E. (2015). Regulation, firm dynamics and entrepreneurship. European Journal of Law and Economics, 40(1), 1–11. https://doi.org/10.1007/s10657-015-9498-8.

Brown, R., & Mason, C. (2017). Looking inside the spiky bits: a critical review and conceptualisation of entrepreneurial ecosystems. Small Business Economics, 49(1), 11–30. https://doi.org/10.1007/s11187-017-9865-7.

Bruce, D. J. (2000). Effects of the United States tax system on transitions into self-employment. Labour Economics, 7(5), 545–574. https://doi.org/10.1016/S0927-5371(00)00013-0.

Bruce, D., & Deskins, J. (2012). Can state tax policies be used to promote entrepreneurial activity? Small Business Economics, 38(4), 375–397. https://doi.org/10.1007/s11187-010-9262-y.

Bruns, K., Bosma, N., Sanders, M., & Schramm, M. (2017). Searching for the existence of entrepreneurial ecosystems: a regional cross-section growth regression approach. Small Business Economics, 49(1), 31–54. https://doi.org/10.1007/s11187-017-9866-6.

Bylund, P. L., & McCaffrey, M. (2017). A theory of entrepreneurship and institutional uncertainty. Journal of Business Venturing, 32, 461–475. https://doi.org/10.1016/j.jbusvent.2017.05.006.

Campbell, N., & Rogers, T. M. (2007). Economic freedom and net business formation. Cato Journal, 27(1), 23–36.

Campbell, N., Heriot, K. C., Jauregui, A., & Mitchell, D. T. (2012). Which state policies lead to U.S. firm exits? Analysis with the economic freedom index. Journal of Small Business Management, 50, 87–104. https://doi.org/10.1111/j.1540-627X.2011.00345.x.

Chen, J.-H., & Williams, M. (1999). The determinants of business failures in the US low-technology and high-technology industries. Applied Economics, 31(12), 1551–1563. https://doi.org/10.1080/000368499323076.

Colombelli, A., Krafft, J., & Vivarelli, M. (2016). To be born is not enough: the key role of innovative start-ups. Small Business Economics, 47(2), 277–291. https://doi.org/10.1007/s11187-016-9716-y.

Coomes, P. A., Fernandez, J., & Gohmann, S. F. (2013). The rate of proprietorship among metropolitan areas: the impact of the local economic environment and capital resources. Entrepreneurship: Theory and Practice, 37(4), 745–770. https://doi.org/10.1111/j.1540-6520.2012.00511.x.

Cullen, J. B., & Gordon, R. H. (2007). Taxes and entrepreneurial risk-taking: theory and evidence for the U.S. Journal of Public Economics, 91(7–8), 1479–1505. https://doi.org/10.1016/j.jpubeco.2006.12.001.

Dau, L. A., & Cuervo-Cazurra, A. (2014). To formalize or not to formalize: entrepreneurship and pro-market institutions. Journal of Business Venturing, 29, 668–686. https://doi.org/10.1016/j.jbusvent.2014.05.002.

Davidson, P., Recker, J., & von Briel, F. (2018). External enablement of new venture creation: a Frameworkamp.2017.Pdf. Academy of Management Perspectives. Retrieved from https://journals.aom.org/doi/pdf/10.5465/amp.2017.0163

Davidsson, P. (1995). Culture, structure and regional levels of entrepreneurship. Entrepreneurship & Regional Development, 7(1), 41–62.

Davidsson, P. (2015). Entrepreneurial opportunities and the entrepreneurship nexus: a re-conceptualization. Journal of Business Venturing, 30(5), 674–695. https://doi.org/10.1016/j.jbusvent.2015.01.002.

Davidsson, P., Recker, J., & Von Briel, F. (2018). Characteristics, roles and mechanisms of external enablers in new venture creation processes: a framework. Academy of Management Perspectives, forthcoming. https://doi.org/10.5465/amp.2017.0163.

Davis, S. J., & Haltiwanger, J. (1992). Gross job creation, gross job destruction, and employment reallocation. The Quarterly Journal of Economics, 107, 819–863 https://doi.org/10.2307/2118365.

Decker, R., Haltiwanger, J., Jarmin, R., & Miranda, J. (2014). The role of entrepreneurship in US job creation and economic dynamism. Journal of Economic Perspectives, 28, 3–24.

Decker, R., Haltiwanger, J., Jarmin, R., & Miranda, J. (2016a). Declining business dynamism: implications for productivity? (no. Hutchins center working paper #23). Washington, DC: Brookings Institution.

Decker, R., Haltiwanger, J., Jarmin, R., & Miranda, J. (2016b). Declining business dynamism: what we know and the way forward. American Economic Review, 106, 203–207. https://doi.org/10.1257/aer.p20161050.

Decker, R., Haltiwanger, J., Jarmin, R., & Miranda, J. (2018). Changes in business dynamism: volatility of vs. responsiveness to shocks? Retrieved from http://papers.nber.org/tmp/74821-w24236.pdf

Denis, D. J. (2004). Entrepreneurial finance: an overview of the issues and evidence. Journal of Corporate Finance, 10(2), 301–326. https://doi.org/10.1016/S0929-1199(03)00059-2.

Ehrenberg, R. G., & Smith, R. S. (2017). Modern labor economics: theory and public policy (13th ed.). Retrieved from https://doi-org.ezproxy.baylor.edu/10.4324/9781315101798

EIG. (2017). Dynamism in retreat: consequences for regions, markets, and workers. Washington, DC: Economic Innovation Group.

Faria, H. J., Montesinos-Yufa, H. M., Morales, D. R., & Navarro, C. E. (2016). Unbundling the roles of human capital and institutions in economic development. European Journal of Political Economy, 45, 108–128. https://doi.org/10.1016/j.ejpoleco.2016.08.001.

Feldman, M. P. (2001). The entrepreneurial event revisited: firm formation in a regional context. Industrial and Corporate Change, 10, 861–891. https://doi.org/10.1093/icc/10.4.861.

Feldstein, M. (1996). The missing piece in policy analysis: social security reform. The American Economic Review, 86(2), 1–14.

Fotopoulos, G., & Storey, D. J. (2018). Public policies to enhance regional entrepreneurship: another programme failing to deliver? Small Business Economics. https://doi.org/10.1007/s11187-018-0021-9.

Fritsch, M., & Mueller, P. (2007). The effect of new business formation on regional development over time: the case of Germany. Small Business Economics, 30(1), 15–29. https://doi.org/10.1007/s11187-007-9067-9.

Fritsch, M., & Wyrwich, M. (2018). Regional knowledge, entrepreneurial culture, and innovative start-ups over time and space―an empirical investigation. Small Business Economics, 51(2), 337–353. https://doi.org/10.1007/s11187-018-0016-6.

Garrett, T. A., & Wall, H. J. (2006). Creating a policy environment for entrepreneurs. Cato Journal, 26(3), 525–552.

Gentry, W. M., & Hubbard, R. G. (2000). Tax policy and entrepreneurial entry. The American Economic Review, 90(2), 283–287.

Gentry, W. M., & Hubbard, R. G. (2005). “Success taxes,” entrepreneurial entry, and innovation. Innovation Policy and the Economy, 5, 87–108. https://doi.org/10.1086/ipe.5.25056172.

Georgellis, Y., & Wall, H. J. (2006). Entrepreneurship and the policy environment. Federal Reserve Bank of St. Louis Review, 88(2), 95–111.

Gimeno, J., Folta, T. B., Cooper, A. C., & Woo, C. Y. (1997). Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Administrative Science Quarterly, 42(4), 750–783. https://doi.org/10.2307/2393656.

Gohmann, S. F. (2012). Institutions, latent entrepreneurship, and self-employment: an international comparison. Entrepreneurship Theory and Practice, 36(2), 295–321. https://doi.org/10.1111/j.1540-6520.2010.00406.x.

Gohmann, S. F., Hobbs, B. K., & McCrickard, M. (2008). Economic freedom and service industry growth in the United States. Entrepreneurship Theory and Practice, 32, 855–874. https://doi.org/10.1111/j.1540-6520.2008.00259.x.

Gruber, J. (1997). The consumption smoothing benefits of unemployment insurance. The American Economic Review, 87(1), 192–205.

Gwartney, J., & Lawson, R. (2003). The concept and measurement of economic freedom. European Journal of Political Economy, 19, 405–430. https://doi.org/10.1016/S0176-2680(03)00007-7.

Gwartney, J., Lawson, R., Hall, J., & Murphy, R. (2018). Economic freedom of the world: 2018 annual report. Retrieved from http://www.deslibris.ca/ID/10097993

Hall, J. C., & Lawson, R. A. (2014). Economic freedom of the world: an accounting of the literature. Contemporary Economic Policy, 32, 1–19. https://doi.org/10.1111/coep.12010.

Haltiwanger, J. (2012). Job creation and firm dynamics in the United States. Innovation Policy and the Economy, 12, 17–38. https://doi.org/10.1086/663154.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who creates jobs? Small versus large versus young. The Review of Economics and Statistics, 92, 347.

Hathaway, I., & Litan, R. E. (2014). Declining business dynamism in the United States: a look at states and metros. Washington, DC: Brookings Institution.

Hausman, J. A. (1978). Specification tests in econometrics. Econometrica, 46, 1251–1271. https://doi.org/10.2307/1913827.

Henrekson, M. (2005). Entrepreneurship: a weak link in the welfare state? Industrial and Corporate Change, 14(3), 437–467. https://doi.org/10.1093/icc/dth060.

Henrekson, M., & Johansson, D. (2010). Gazelles as job creators: a survey and interpretation of the evidence. Small Business Economics, 35(2), 227–244. https://doi.org/10.1007/s11187-009-9172-z.

Heritage Foundation. (2019). 2019 Index of economic freedom. Retrieved from //www.heritage.org/index/book/chapter-2.

Holtz-Eakin, D., Joulfaian, D., & Rosen, H. S. (1994). Sticking it out: entrepreneurial survival and liquidity constraints. Journal of Political Economy, 102(1), 53–75.

Johnson, P., & Parker, S. (1994). The interrelationships between births and deaths. Small Business Economics, 6, 283–290. https://doi.org/10.1007/BF01108395.

Kanniainen, V., & Vesala, T. (2005). Entrepreneurship and labor market institutions. Economic Modelling, 22(5), 828–847. https://doi.org/10.1016/j.econmod.2005.05.002.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago: University of Chicago Press.

Kreft, S. F., & Sobel, R. S. (2005). Public policy, entrepreneurship, and economic freedom. Cato Journal, 25(3), 595–616.

Lewis, G. B., & Frank, S. A. (2002). Who wants to work for the government? Public Administration Review, 62(4), 395–404. https://doi.org/10.1111/0033-3352.00193.

Lindh, T., & Ohlsson, H. (1996). Self-employment and windfall gains: evidence from the Swedish lottery. The Economic Journal, 106(439), 1515–1526. https://doi.org/10.2307/2235198.

Mason, C., & Brown, R. (2013). Creating good public policy to support high-growth firms. Small Business Economics, 40(2), 211–225. https://doi.org/10.1007/s11187-011-9369-9.

McMullen, J. S., Bagby, D. R., & Palich, L. E. (2008). Economic freedom and the motivation to engage in entrepreneurial action. Entrepreneurship Theory and Practice, 32, 875–895. https://doi.org/10.1111/j.1540-6520.2008.00260.x.

Murphy, R. H., & O’Reilly, C. (2018). Applying panel vector autoregression to institutions, human capital, and output. Empirical Economics. https://doi.org/10.1007/s00181-018-1562-0.

Nikolaev, B., Boudreaux, C. J., & Palich, L. (2018). Cross-country determinants of early-stage necessity and opportunity-motivated entrepreneurship: accounting for model uncertainty. Journal of Small Business Management, 56(S1), 243–280. https://doi.org/10.1111/jsbm.12400.

North, D. C. (1991). Institutions. Journal of Economic Perspectives, 5, 97–112. https://doi.org/10.1257/jep.5.1.97.

Nyström, K. (2008). The institutions of economic freedom and entrepreneurship: evidence from panel data. Public Choice, 136, 269–282. https://doi.org/10.1007/s11127-008-9295-9.

Park, S. H., Li, S., & Tse, D. K. (2006). Market liberalization and firm performance during China’s economic transition. Journal of International Business Studies, 37(1), 127–147. https://doi.org/10.1057/palgrave.jibs.8400178.

Phan, P. H. (2006). Dynamism as a necessary property of entrepreneurial systems. Journal of Business Venturing, 21, 149–151. https://doi.org/10.1016/j.jbusvent.2005.04.001.

Robson, M. T., & Wren, C. (1999). Marginal and average tax rates and the incentive for self-employment. Southern Economic Journal, 65(4), 757. https://doi.org/10.2307/1061274.

Rogers, W. (1994). Regression standard errors in clustered samples. Stata Technical Bulletin, 3.

Ruggles, S., Flood, S., Goeken, R., Grover, J., Meyer, E., Pacas, J., & Sobek, M. (2018). IPUMS USA: Version 8.0 [dataset]. Retrieved from https://doi.org/10.18128/D010.V8.0

Saunoris, J. W., & Sajny, A. (2017). Entrepreneurship and economic freedom: cross-country evidence from formal and informal sectors. Entrepreneurship & Regional Development, 29(3–4), 292–316. https://doi.org/10.1080/08985626.2016.1267806.

Schäfer, D., Talavera, O., & Weir, C. (2011). Entrepreneurship, windfall gains and financial constraints: evidence from Germany. Economic Modelling, 28(5), 2174–2180. https://doi.org/10.1016/j.econmod.2011.05.010.

Schramm, C.J. (2004). The Entrepreneurial Imperative: How America's Economic Miracle Will Reshape the World (and Change Your Life). New York: Harper Collins.

Schumpeter, J. A. (1942). Capitalism, socialism, and democracy. New York: Harper.

Shane, S. (2009). Why encouraging more people to become entrepreneurs is bad public policy. Small Business Economics, 33, 141–149. https://doi.org/10.1007/s11187-009-9215-5.

Sinn, H.-W. (1997). The selection principle and market failure in systems competition. Journal of Public Economics, 66(2), 247–274. https://doi.org/10.1016/S0047-2727(97)00043-1.

Smith, A. (1776). An inquiry into the nature and causes of the wealth of nations (Edwin Cannan, Ed.). Library of economics and liberty.

Sobel, R. S. (2008). Testing Baumol: institutional quality and the productivity of entrepreneurship. Journal of Business Venturing, 23, 641–655. https://doi.org/10.1016/j.jbusvent.2008.01.004.

Sobel, R. S., Clark, J. R., & Lee, D. R. (2007). Freedom, barriers to entry, entrepreneurship, and economic progress. The Review of Austrian Economics, 20(4), 221–236.

Stansel, D. (2019). Economic freedom in U.S. metropolitan areas. Journal of Regional Analysis & Policy, 49(1), 40–48.

Stansel, D., & Tuszynski, M. P. (2018). Sub-national economic freedom: a review and analysis of the literature. Journal of Regional Analysis & Policy, 48(1), 61–71.

Stenholm, P., Acs, Z. J., & Wuebker, R. (2013). Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing, 28(1), 176–193. https://doi.org/10.1016/j.jbusvent.2011.11.002.