Abstract

Networks of serial entrepreneurs, investors, and their affiliated companies play a critical role in driving entrepreneurial behavior, investor focus, and innovation hot spots within specific industry sectors and are critical for shaping the character of robust regional economies. This research explores the impact of “dealmakers” Zoller ( 2010; Senor and Singer 2009) who are actors that have founded, managed, or invested in multiple private entrepreneurial firms, and hold concurrent equity ties to multiple firms. By studying the scope and connectivity of the dealmaker network within the Tampa area metropolitan statistical area, this study attempts to move the literature beyond aggregate analyses of social capital Feldman & Zoller (Regional Studies, 46: 23–37, 2012) to focus on the individuals within a specific regional ecosystem who drive entrepreneurial performance. The results of this study are influential for scholars of social network theory and for private individuals searching for strategic partners, targeting serial investors, performing competitive analysis, and gaining access to investor and entrepreneur networks. For the economic development community, this dealmaker analysis delivers fresh insight for strategic implementation of cluster and sector development and for the stimulation of inter-regional marketing, recruitment, and business development efforts.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

A major challenge for research surrounding entrepreneurial ecosystems has been to translate the complexity of the concept into useful policy prognosis. It has been argued that the complexity and the heterogeneity of ecosystems have been ignored in most policy interventions, which appear to promote a single actor in the ecosystem such as startups, community incubators, venture capital networks, university programs, etc. (Brown and Mason 2017). These limited interventions miss the crucial influence of large firms, healthcare systems, banks, and other substantial actors. It has been further argued that most policies intended to promote entrepreneurship waste taxpayer money and mostly generate low-value startup companies (Acs et al. 2016).

Recent scholarship has taken up the task of comprehending the full complexity of entrepreneurial ecosystems in an attempt to understand how successful ecosystems are developed. This is a daunting task since entrepreneurial ecosystems are heavily path dependent and exhibit distinctive characteristics that are socially, spatially, and relationally intertwined (Brown and Mason 2017). Several prominent frameworks that have been designed to apprehend these complexities within entrepreneurial ecosystems have been proposed in the literature. Daniel Isenberg (2010) explicated six primary ecosystem domains of the ecosystem that include policy, culture, supports, finance, markets, and human capital. The Kaufmann Foundation synthesized the analysis on four variables: fluidity, density, connectivity, and diversity (Stangler and Bell-Masterson 2015). Stam (2015) added new variables and demonstrated the interdependency of actors with the ecosystem between framework and systemic conditions, outputs and outcomes. Each of these efforts have motivated scholars to further refine the entrepreneurial ecosystem concept; however, the scope of these frameworks has been too broad to influence productive policy.

The aim of this work is to refocus the discussion of entrepreneurial ecosystems on the idiosyncratic characteristic of regional “dealmakers,” who play the role of boundary spanners with the potential to influence multiple actors concomitantly (Feldman and Zoller 2012; Kemeny et al. 2015; Senor and Singer 2009; Zoller 2010). Analyzing dealmakers as a focal point of entrepreneurial ecosystems has the potential to lift the dialogue to productive policy decisions, a translation that has been criticized as missing from previous scholarship on the subject (Acs et al. 2016). This article employs an inductive research approach that commences with a discussion of the prevailing literature before shifting focus to application of the concept via a comparative empirical analysis centering on the dealmaker network within the Tampa Bay, Florida MSA.Footnote 1 During the course of this analysis, the dealmaker network of the Tampa MSA is compared to the Seattle, Washington MSA to help explain respective regional performance and demonstrate opportunities for growth within the Tampa MSA’s entrepreneurial ecosystem.

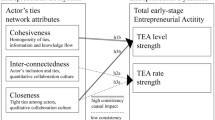

Research on dealmakers has natural application to network theory, which has shown how social networks can influence greater social processes by accessing physical, financial, natural, and human capital (Serrat 2017) and can generate novel ideas (Borgatti and Halgin 2011). Social network analysis is focused on relationships (Tichy et al. 1979; Borgatti et al. 2009) and assumes that these relationships can be affected by proximity, formality, and centrality. In particular, research has shown that centrality within a network is perhaps the most powerful determinant of the effect of the network by influencing perceptions of status or position in the broader social context (Ibarra and Andrews 1993). The analysis undertaken in this study takes an instrumental view of network centrality by narrowly defining dealmakers in terms of their relative power and connectedness in regional entrepreneurial ecosystems. In doing so, it also answers a recent call for additional work applying social network analysis to the study of entrepreneurship (Williams and Shepherd 2017).

2 Literature review

The genesis of entrepreneurial ecosystems

The entrepreneurial ecosystem is a relatively new way to contextualize the increasingly complex and interdependent social systems that stimulate entrepreneurial activity (Stam 2015). The focus on entrepreneurial ecosystems is part of a broader movement within entrepreneurship to shift away from individual, personality-based investigations toward a broader focus on the role of context, particularly of social, cultural, and economic forces, that impact entrepreneurial processes (Steyaert and Katz 2004; Dodd and Anderson 2007). Research on entrepreneurial ecosystems is concerned with economic performance and how entrepreneurship is impacted by and how it affects its contextual environment.

The concept of an ecosystem refers to the complexity of the interactivity of organisms and their environment. The systematic study of environments is rooted in the biological sciences and is most commonly applied to ecological studies of the natural habitats of animals. Human ecology is a more recent idea that extends to the domain of geographers and sociologists who are interested in the distributions of human populations. The term social ecology has evolved mainly from the efforts of behavioral scientists to direct their inquiries toward a more complete view of humankind interacting with his or her physical and social environment (Insel and Moos 1974). Ultimately, this work on social ecology has begun to influence our view of business ecosystems.

Business ecosystems are shown as an economic community supported by a foundation of interacting organizations and individuals (Moore 1993). An examination of a business ecosystem requires a well-defined notion of the environment and a demarcation of the characteristics that make it conducive to business formation and growth. A number of researchers have approached this task by identifying a set of factors that describe the optimal environment for business. This work dates back to Alfred Marshall (1879) who emphasized that agglomeration economies provide benefits of co-location to local firms in the availability of skilled labor and knowledge. Later contributions in the field, including Ethier and Markusen (1996), Breschi and Malerba (2001), Bresnahan et al. (2001), Enright (2003), Gordon and McCann (2000), and Zacharakis et al. (2003), brought the focus of agglomeration to entrepreneurship. These scholars addressed the potential advantages of entrepreneurial environments in terms of co-location, social embeddedness in a concentrated region, and value creation (Pitelis 2012).

Porter (1996) provided a theoretical backbone for entrepreneurial ecosystems, supported by compelling case studies, which suggested that it is not just the endowment of resources or factors of production influencing economic performance but also their configuration, or organization within the relevant geographic space, that enhances economic performance. He introduced the concept of clusters, which he described as geographical concentrations of interconnected companies, specialized suppliers, service providers, firms in related industries, and associated institutions (e.g., universities, standard agencies, trade associations) in a particular economic field, which compete but also cooperate. The idea is that enhancing economic performance is not limited to access to key resources but also location in a place characterized by a rich cluster of economic activity in the relevant industry. Porter’s seminal contribution was to establish that the organization of economic activity in clusters involving complementarities in production within a spatial context would enhance the performance not just of the organizations involved in that particular cluster but for the entire geographic unit of observation: a city, community, state, region, or even an entire country.

More recently, a host of additional dimensions that characterize the spatial organization and structure of economic activity have been identified and linked to economic performance. As Glaeser et al. (1995) demonstrate, one dimension involves the specialization of economic activities within a targeted location, which is argued to generate a stronger economic performance, since scale economies would be maximized and transaction costs minimized. By contrast, other scholars such as Jacobs (1975) and Feldman and Audretsch (1999) have shown that diversity is more conducive to enhancing economic performance because the differences across firms and workers provide the potential returns for generating knowledge spillovers (Audretsch and Feldmann 1996; Audretsch and Lehmann 2005) that, in turn, fuel innovative activity. Delgado et al. (2014) suggest that the dichotomy between specialization and diversity is overstated and that fostering complementary economic activities is the true impact of business clusters. This finding is echoed in studies of the benefits of positive externalities derived from co-location with related industries (Frenken et al. 2015). Prior research on complementarities has looked at the individual channels through which they operate, such as scientific knowledge (Feldman and Audretsch 1999), and our study on dealmakers follows this idea by exploring the complementarities among the channel of regional equity stakeholders.

Most cluster studies focus on the dynamics of firms and industries (Frenken et al. 2015), but the entrepreneurial ecosystem approach differs by the fact that the entrepreneur, rather than the firm, is the focal point. Entrepreneurship, by definition, is dependent upon the risk-taking actions of the individual actor, yet the entrepreneur does not act in a vacuum. As opposed to the literature on clusters, the focus of ecosystems research is placed firmly on the entrepreneur and startups and, in particular, high-growth startups that make up the basis of entrepreneurial ecosystems, which are not necessarily included in all cluster and industrial district models (Ethier and Markusen 1996). While the entrepreneurial ecosystem approach begins with the individual entrepreneur rather than the company, it also emphasizes the role of the social and economic context surrounding the entrepreneurial process. There is a growing recognition in the entrepreneurship literature that entrepreneurship theory focused only on the entrepreneur may be too narrow (Acs et al. 2014), whereas the concept of systems of entrepreneurship is based on three important premises that provide an appropriate platform for analyzing entrepreneurial ecosystems. The first premise is that entrepreneurship is fundamentally an action undertaken and driven by agents on the basis of incentives; second, that individual action is affected by an institutional framework for entrepreneurship; and finally, third, that entrepreneurial ecosystems are complex, multifaceted structures in which many elements interact to produce performance and, thus, an index method needs to allow the constituent elements to interact.

Characteristics of entrepreneurial ecosystems

Entrepreneurial ecosystems exist to encourage nascent entrepreneurs and other actors to assume the risks of starting, funding, and growing high-risk ventures (Spigel 2015; Spigel and Harrison 2017). The structure of the entrepreneurial ecosystem in which individuals find themselves contain an array of factors which may impede or enhance entrepreneurial vigor (Kirzner 1997). An entrepreneurial ecosystem includes customers, producers, competitors, and other stakeholders, and the key to a vibrant business ecosystem is leadership companies who have a strong influence over the co-evolutionary processes. While there is a mutual dependence (the system is made of up individual actors, many of whom may not know each other, who are all trying to optimize performance of their ventures via working cooperatively), there is not a formal structure by which an individual actor can direct others to his or her benefit (Acs et al. 2016).

The particular system of elements that we know as the entrepreneurial ecosystem is a set of interdependent actors, institutions, social structures, and a culture designed to support entrepreneurial activity (Spigel 2015; Neck et al. 2004). There have been many attempts to outline the variables that comprise an entrepreneurial ecosystem. Feld (2012) suggested that entrepreneurial ecosystems are communities that consist of many stakeholders, such as governments, universities, investors, mentors, service providers, media, and large companies all of whom play a key role in the development of the startup community. Audretesch and Belitski (2017) counted six distinct domains of the entrepreneurial ecosystem: formal institutions, culture, melting pot, demand, infrastructure, and IT. Desai and Motoyama (2015) identified the various components of the ecosystem: access to capital, talent, market size, and geography of the market including and relationships with vendors, customers, and competitors. The World Economic Forum (2013) has listed eight pillars of a successful ecosystem: accessible markets, workforce, funding, mentors, government, education, cultural support, and universities as catalysts. Stam (2015) segregated these attributes between framework and systemic conditions to better demonstrate the interrelations and causation within the system. Similarly, Spigel (2015) separated the entrepreneurial ecosystem between cultural, social, and material characteristics.

While each of these aforementioned scholarly achievements have helped to advance the concept of entrepreneurial ecosystems, the question of how to build proactive policy that can enhance these characteristics has thus far been elusive to answer. This limitation has caused recent scholars to sound a call to arms for entrepreneurial ecosystem research to develop tangible methods of driving ecosystem performance and entrepreneurial activity or else focus policy on decidedly non-entrepreneurship sounding objectives such as enhancing STEM education or altering the employer-based healthcare reality (Acs et al. 2016) in order to spur indirect benefits to small businesses and entrepreneurs.

The outcomes of entrepreneurial ecosystems

When a region is perceived as having a high-performing ecosystem, there is a tendency among policymakers to import best practices from thriving ecosystems without regard to the underlying local economic and cultural attributes upon which their success depends (Harrison and Leitch 2010). Neck et al. (2004) pointed out the challenges with the replication of ecosystems from one region to another, and others have used Global Entrepreneurship Monitor (GEM) data to compare urban versus non-urban areas (Bosma and Sternberg 2014). The question is whether there is a single performance algorithm or is it more likely that ecosystems are highly dependent upon the history, culture, and values of an individual region. Spigel (2015: 2) argues that there is no single performance algorithm that can determine a successful entrepreneurial ecosystem and rather that ecosystem theory should “focus on the internal attributes of ecosystems and how different configurations of these attributes reproduce the overall ecosystem.” Motoyama et al. (2014) examined survey results from participants in 1 Million Cups (1MC) to find that entrepreneurship is a local phenomenon, that the local network thickens over time, and that different programs reach different entrepreneurs.

While entrepreneurial ecosystems are complex systems of unique and heterogeneous variables, an interesting aspect of entrepreneurial ecosystems is that, while it is a system of interdependent elements, the performance of the system remains dependent upon the willingness and persistence of the individual actor (the entrepreneur) and is often enhanced by one significant entrepreneurial event or one major contributing actor. Understanding the significance of a major entrepreneurial event has been explored previously by several authors including Wiklund and Shepherd (2008) who examined the impact of government interaction and Spilling (1996) who focused on the effect of hosting a mega-event (the Olympics) on a regional entrepreneurial ecosystem. Our research builds upon this notion and, also germane to our research, Florida and Kenney (1988) addressed the notion of an overriding event variable while measuring the impact of venture capitalists.

While it is tempting to think of the output of entrepreneurial ecosystems as an increase in startup businesses, this is only an intermediate step and it can be argued that the primary outcome of entrepreneurial ecosystems is resource allocation. Entrepreneurial ecosystems in fact provide a dual service of resource allocation toward productive uses and spurring the innovative, high-growth ventures that drive the process. While the entrepreneurship literature frequently talks about opportunity recognition and the need to assemble resources, from a performance perspective, the key issue is about resource allocation from existing activities to new ones. This allocation of resources to productive uses will result in high-growth, high-value new firms, and the nutrient in the entrepreneurial ecosystem is its primary resource: venture capital. To demonstrate the vitality of financiers, investors have pumped $362 billion into new ventures between 2011 and 2016 (http://fortune.com/2016/01/21/age-of-unicorn-end/).

As discussed previously, Florida and Kenney (1988) have assessed the impact of venture capitalists on entrepreneurial ecosystems and our research attempts to deepen and build upon their work. Our approach is based on the concept of networks of serial entrepreneurs, investors, and their affiliated companies that play a critical role in driving value creation and shaping the character of robust regional economies. Firm and company level information identifying the actors and their connective relationships in the ecosystem can provide a new window into the innovation dynamics within a regional economy as a whole and, just as importantly, into the entrepreneurial behavior, investor focus, and innovation hot spots within specific industry sectors and clusters.

The impact of “dealmakers”

Our interest is to further explore the concept of “dealmakers,” first introduced to academic scholarship by Ted Zoller (2010), who are actors that have founded, managed, or invested in multiple private entrepreneurial firms, and hold concurrent equity ties to multiple firms as a consequence of their serving on the boards as advisors, investors, or managers of these firms. Attempts to better understand the impact of dealmakers shift the conversation from the heterogeneous characteristics of regional ecosystems toward a consideration of key persons who form the foundation of the entrepreneurial ecosystem and promote new business formation (Feldman and Zoller 2012). For the purposes of this study, “dealmakers” are specifically defined as individuals who have three or more concurrent equity positions in private entrepreneurial firms as a result of their entrepreneurial or investment activities.

Dealmakers are often former entrepreneurs and serial entrepreneurs who connect people throughout their network, offer guidance to budding entrepreneurs, and invest in a variety of new ventures. These individuals are embedded in the social structure of the region who routinely champion local business activity and have been called the “glue in strong ecosystems” (Napier and Hansen 2011: 13). A study of 12 regions in the USA found that dealmakers use their connections to enhance employment and sales in growing companies (Kemeny et al. 2015). Previous research has also suggested that “firm births may be more associated with a prevalence of dealmakers and especially better-connected dealmakers than with the aggregate network of entrepreneurs and investors” (Feldman and Zoller 2012: 34).

In the next section, we perform a deep dive into the Tampa MSA to analyze the dealmaker network to determine the nature of the connections among the actors within the ecosystem. In addition to demonstrating the key dealmakers (broken out between investors and entrepreneurs) within the region, this approach enables us to view the relative connectivity of the various industries within the Tampa MSA. Doing so allows us to view densities, patterns, and linkages that stimulate regional growth. It also demonstrates areas for opportunity by identifying investors and entrepreneurs whose connections to the greater ecosystem are relatively weak, representing lucrative potential targets for practitioners interested in economic development.

3 Methodology

Sample data

The output generated by the dealmaker analytical engine is drawn primarily from the Capital IQ database, a private database maintained and licensed by Standard & Poor, that provides quantitative research data and analysis applications to over 4200 investment management firms, private equity funds, investment banks, advisory firms, corporations, and universities. This unique private dataset maintains detailed records about private firms, their managements, and their boards of directors based on data submitted by the companies at incorporation and through the shelf registration process, and made available to licensees on a current snapshot basis. As a general rule, firms that have received some form of formal outside investment will be captured within this database.

The dealmaker approach also employs the Standard and Poor’s Global Industry Classification Standard (GICS) organizational scheme to structure, analyze, and present its output. The GICS system model is the global standard for categorizing companies into sectors, industries, and sub-industries. The GICS typology was developed for the worldwide financial community and has become the commonly accepted global industry analysis framework. Each company’s classification category reflects its primary business model based on its financial performance, and the GICS is comprised of 10 sectors, 24 industry groups, 68 industries, and 154 sub-industries.

Method

For the first step in this research, the output for entrepreneur and investor records across all industry domains was identified and configured in a traditional Excel spreadsheet organized by dealmaker ties. During this process, each actor was identified by sector/industry for each of their affiliated companies, their role as key executive and/or board member, and dealmaker type (e.g., serial investor, investor, entrepreneur, entrepreneur with finance tie). The corresponding data served to capture the number of equity positions within companies for each individual, their roles within the associated companies as key employee and/or board member (color-coded), the GICS sector and within that sector, and the industry for each company. Business biographical summaries were also collected for each individual in the database.

Finally, each individual was assigned to one of four “finance type” categories:

-

Serial investors: finance affiliated and a key executive of 2 or more finance firms

-

Investors: finance affiliated and a key executive of only 1 finance firm

-

Entrepreneur with finance tie: finance affiliated, but not a key executive of a finance firm

-

Entrepreneur no finance tie: no finance affiliations

To be classified as a potential dealmaker, an individual must maintain substantial influence in an entrepreneurial ecosystem, as denoted by holding at least 3 equity positions in businesses in the local economy. Our research considered individuals holding 2 equity positions as nascent dealmakers. It is also important to note that individual dealmakers are identified in this analysis only if they serve on a board or are in a senior manager or officer position within the firm. Thus, crowdfunded equity positions and those individuals that do not maintain some type of advisory capacity within the firm would not be considered for dealmaker status.

For the purposes of this research, we chose to focus our study on the burgeoning entrepreneurial ecosystem of the Tampa Bay region (Tampa MSA) of Florida. By means of comparison, this research related the dealmaker in the Tampa MSA to the Seattle MSA, a region chosen due to its similarity in population. According to the US Census Bureau,Footnote 2 the 2010 population of the Tampa MSA was 2,783,243 and that of the Seattle MSA was 3,439,809, ranked as the 18th and 15th largest MSAs in the USA by population, respectively. The dealmaker database, configured from CapIQ data, contains 9018 companies, 2742 investors, and 12,917 entrepreneur records for the Tampa MSA and 12,185 companies, 4350 investors, and 22,911 entrepreneur records for the Seattle MSA. Within these companies, investors, and entrepreneurs, we have further identified those individuals who have achieved at least “nascent dealmaker” status as those who hold at least 2 concurrent equity positions in the region, and Table 1 shows the record counts for all dealmakers within the Tampa MSA.

4 Results

The results of our analysis of the Tampa MSA are depicted in network maps that capture the density and nature of the connections among various actors and firms within the network. These maps are produced in two formats. One version is presented in a Portable Document Format (PDF) that allows for the reproductions of the map. In addition, the user can magnify the PDF-formatted map and view a specific area to extract serial entrepreneur network relationship and connection information. The second and more robust version presents the network maps in a “yEd” interactive format. The yEd-formatted maps provide quick and easy access to the useful information embedded in the maps by allowing the user to click on an individual to highlight that person’s company, investment and entrepreneurial connections and relationships within the map. This application can be downloaded as freeware at https://www.yworks.com/products/yed.

The maps show individual-to-firm connections within the network. The square icons indicate companies; the circular icons indicate individuals that the dealmaker approach classifies as primarily investors; and the triangular icons denote the individuals classified as primarily entrepreneurs. The scope of our dealmaker network analysis covers all industry sectors in the region which are color coded by industry using Global Industry Classification Standard (GICS) designations. The color of the squares is set to match the color-coding key based on the industry affiliation of the company, and the color of the icons representing individuals is determined by their most common industry connection Fig. 1.

As presently configured, the initial dealmaker network map bundle for the Tampa MSA contains two sets of eight maps—one set in PDF and one in yEd format. Each set contains network maps with and without the Finance sector. By way of example, Fig. 2 shows the Tampa MSA with the Finance sector included (in green) for the dealmaker maker network composed of individuals with at least three concurrent equity positions.

Figure 2 shows a diversified entrepreneurial economy with evident concentrations in Information Technology (blue) and Health Care (red) as well as Consumer Discretionary (maroon) and Telecommunications (magenta). The Finance sector (green) is substantive and fairly well connected into the network. At the bottom of the map are a series of “lone wolf” entrepreneurs, investors, and companies that are not connected to the core Tampa MSA network. From an entrepreneurial ecosystem perspective, an important goal is to introduce these “lone wolf” actors into the regional network by crafting approaches to generate new value and stimulate business growth.

Figure 3 shows the Tampa MSA dealmaker network of individuals with at least three concurrent equity positions for all industries except for Finance. As anticipated, eliminating the Finance sector from the map degrades its connectivity; however, some small well-connected nodes remain in Health Care (red), Telecommunications (magenta), and Consumer Discretionary (maroon).

By way of contrast, Fig. 4 shows the results of our dealmaker network analysis of the Seattle entrepreneurial ecosystem. Seattle boasts a dense and tightly connected network of actors with at least three concurrent equity positions. The Seattle ecosystem is dominated by Information Technology (blue), but also shows a well-connected and strong Health Care presence (red and includes Bioscience).

Finally, Fig. 5 presents a close-up view of a portion of the larger dealmaker network map shown in Fig. 2. In this zoomed-in view, it is possible to recognize the various actors along with their connections (recall that the square icons indicate companies; the circular icons indicate investors; and the triangular icons indicate entrepreneurs). This type of snapshot is accessible using the dealmaker network map’s interactive (yEd) mode.

As shown in this analysis of the dealmakers within the Tampa MSA, despite recent economic gains, the region maintains relatively loose connectivity within the dealmaker’s network of the entrepreneurial ecosystem. Comparing Fig. 3 (the Tampa MSA dealmaker network without finance) to Fig. 4 (the Seattle MSA dealmaker network without finance) shows a stark lack of network density in the Tampa region. While this research is diagnostic in nature and does not propose causation, the relatively scattered dealmaker network may help to explain the variation in entrepreneurial performance between the Tampa MSA and the Seattle MSA. This follows previous research that has shown how the most anemic entrepreneurial ecosystems have very few dealmakers, whereas those in Silicon Valley and Boston are nearly innumerable (Feldman and Zoller 2012).

This research also shows that removing dealmakers from the financial sector from the overall analysis of the Tampa MSA results in a much more scattered picture of the ecosystem. It is expected that the financial sector will produce a greater frequency and connectivity of dealmakers, so removing finance from the analysis will show an ecosystem with much more dispersion between dealmakers. Comparing the density between Fig. 2 (the Tampa MSA with finance) and Fig. 3 (the Tampa MSA without finance) demonstrates this feature of the Tampa MSA’s entrepreneurial ecosystem. As we can see in Fig. 5, however, this analysis also highlights areas such as telecommunications and healthcare (in purple and red on the map, respectively, and “zoomed-in” for healthcare in Fig. 5) that demonstrate greater industry connectivity than others and are poised to become even more influential in the region.

5 Discussion

Entrepreneurship has long been viewed as an engine for economic growth and wealth creation (Audretsch et al. 2006; Schumpter, 1934), and it is critical to gaining regional and national advantage (Baumol 2002). Today, entrepreneurship is also viewed as a solution to social problems (Dees 1998) with the ability to provide the necessary emancipation for individuals to pursue freedom and independence and escape their status quo (Rindova et al. 2009). As a result, there is great interest in scholarly, public and private circles in building robust and vibrant entrepreneurial ecosystems that can drive business creation. A high-performing entrepreneurial ecosystem leads to increased knowledge spillover and innovativeness (Cooke et al. 1997), and the opportunities that emerge become influential in a region’s ability to attract and retain the best and brightest talent.

Scholarly contributions

The contributions of this research are twofold: first, social capital theory suggests that ecosystems with the greatest propensity for producing new firms also possess the most well-connected and dense networks. The considerable amount of experience that dealmakers have in advising, operating, and financing new ventures plays a vital role in supporting vibrant ecosystems. They accomplish this by brokering social capital from outside and within the region to the entrepreneurial ecosystem and creates knowledge spillover effects between new ventures. Thus, the vibrancy of entrepreneurial ecosystems depends on its connectivity, and this research demonstrates how connected the dealmakers are in the current ecosystem configuration.

Proposition 1:Following social capital theory, the concentration of dealmakers will be positively related to knowledge spillovers in a regional entrepreneurial ecosystem.

Second, since previous research has highlighted the need to view ecosystems as heterogeneous and as developed in distinct ways based on unique cultural and economic attributes—rather than a definable unifying pattern—then this research shows those underlying characteristics of the ecosystem. Looking specifically at the role of dealmakers in connecting their networks within and outside of the region provides an important data point that is unique to the ecosystem. The burgeoning scholarship surrounding dealmaker networks that attempts to move the literature beyond aggregate analyses of social capital (Feldman and Zoller 2012) is benefitted by additional focus on the individuals within a specific entrepreneurial ecosystem who drive entrepreneurial performance.

As a result, this research builds upon the foundation of social network theory which assumes that relational networks represent power in social contexts (Serrat 2017). Furthermore, studies have shown that network centrality, in particular, has the potential for generating systemic power (Ibarra and Andrews 1993). A contribution of this research is the demonstration of dealmakers as points of network centrality in regional entrepreneurial ecosystems. As Kilduff (2010) contends, the strength of the weak ties theory (Granovetter 1973) considers network ties that form incidentally, whereas Burt’s theory of structural holes (Burt 2004) adopts a more instrumental and intentional view of the formation of useful network ties. This analysis of regional dealmakers adopts the latter, instrumental, perspective and suggests that as dealmakers grow that the density of connections within the ecosystem will increase.

Proposition 2: Following network theory, the network centrality of dealmakers will be positively related to the density of a regional entrepreneurial ecosystem

Practical applications

The concept of an entrepreneurial ecosystem appeals directly to practitioners, but even in his sympathetic critique of the literature, Stam (2015: 1759) suggests that “causal depth and evidence base is rather limited.” This research does not address causal relationships but provides evidence of the impact of dealmaker networks with application for a variety of stakeholders. For private enterprise, a dealmaker analysis delivers novel and actionable insight for strategic partner searches, targeted serial investor profiling, competitive analysis and prospecting, access to investor and entrepreneur social capital networks, and access to capital and investor hot spots. For the economic development community, a dealmaker analysis delivers fresh insight and strategy implementation tools for cluster and sector development support, for the build-out of innovation infrastructure and entrepreneurial ecosystems, and for the development and implementation of inter-regional marketing, recruitment, and business development efforts.

Proposition 3: The movement of actors toward dealmaker status (e.g., “lone wolf” to “nascent dealmaker” to “dealmaker”) will be positively related to ecosystem vibrancy

A focus on dealmakers has the potential to reinvigorate the analysis of entrepreneurial ecosystems by shifting its focus from difficult to quantify macro-level concepts to the micro-level of individuals who can most affect the benefits of co-location. The information gathered through a regional dealmaker analysis can be useful for policymakers as dealmakers in these sectors can become vital catalysts for regional economic transformation. Thus, the optimal way to use this dealmaker as a tool might be to review the ecosystem at longitudinal intervals to show the movement toward or away from connectivity within industries in the MSA.

Proposition 4: Greater connectivity between dealmakers will be positively related to industry connectivity in a regional entrepreneurial ecosystem

Future research in this domain will also consider additional metropolitan areas in order to explore additional areas of convergence and divergence between dealmaker networks and entrepreneurial outcomes. Additionally, as the concept of the dealmaker includes entrepreneurs as well as financiers, future studies will address how regional connectivity is affected by the relative ratios of investors versus individual and corporate actors. By doing so, the dealmaker analysis captures valuable information that can be used by ecosystems advocates and policy makers to understand whether capital is being deployed locally or is migrating to better opportunity outside the region.

Notes

A metropolitan statistical area (MSA), or a multi-core metropolitan area, is designated as a consolidated statistical area (CSA). MSAs have at least one urbanized area of 50,000 or greater population plus adjacent territory that has a high degree of social and economic integration to the urban core as measured by commuting ties.

References

Acs, Z., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: measurement issues and policy implications. Research Policy, 43(3), 476–494.

Acs, Z., Astrebro, T., Audretsch, D., & Robinson, D. (2016). Public policy to promote entrepreneurship: a call to arms. Small Business Economics, 47(1), 35–51.

Audretesch, D., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: establishing the framework conditions. Journal of Technology Transfer, 42(5), 1030–1051.

Audretsch, D., & Feldmann, M. (1996). R&D spillovers and the geography of innovation and production. American Economic Review, 86(1), 630–640.

Audretsch, D., & Lehmann, E. (2005). Mansfield’s missing link: the impact of knowledge spillovers on firm growth. Journal of Technology Transfer, 30(1&2), 207–210.

Audretsch, D., Keilbach, M., & Lehmann, E. (2006). Entrepreneurship and growth. Oxford University Press.

Baumol, W. (2002). Entrepreneurship, innovation and growth: the David-Goliath symbiosis. The Journal of Entrepreneurial Finance and Business Ventures, 7(2), 1–10.

Borgatti, S., & Halgin, D. (2011). On network theory. Organization Science, 22(5), 1168–1181.

Borgatti, S., Mehra, A., Brass, D., & Labianca, G. (2009). Network analysis in the social sciences. Science, 323(5916), 892–895.

Bosma, N., & Sternberg, R. (2014). Entrepreneurship as an urban event? Empirical evidence from European cities. Regional Studies, 48(6), 1016–1033.

Breschi, S., & Malerba, F. (2001). The geography of innovation and economic clustering: some introductory notes. Industrial and Corporate Change, 10(4), 817–833.

Bresnahan, T., Gambardella, A., & Saxenian, A. (2001). Old economy inputs for new economy outcomes: cluster formation in the new silicon valleys. Industrial and Corporate Change, 10(4), 835–860.

Brown, R., & Mason, C. (2017). Looking inside the spiky bits: a critical review and conceptualization of entrepreneurial ecosystems. Small Business Economics, 49(11), 11–30.

Burt, R. (2004). Structural holes and good ideas. American Journal of Sociology, 110(2), 349–399.

Cooke, P., Uranga, M., & Etxebarria, G. (1997). Regional innovation systems: institutional and organizational dimensions. Research Policy, 26(4&5), 475–491.

Dees, G. (1998). Enterprising nonprofits. Harvard Business Review, 76(1), 55–67.

Delgado, M., Porter, M., & Stern, S. (2014). Clusters, convergence, and economic performance. Research Policy, 43(10), 1785–1799.

Desai, S., & Motoyama, Y. (2015). The regional environment: Indianapolis insights from high-growth companies. Kauffman Foundation Research Series on City, Metro, and Regional Entrepreneurship: 1–28.

Dodd, D., & Anderson, A. (2007). Mumpsimus and the mything of the individualistic entrepreneur. International Small Business Journal, 25(4), 341–360.

Enright, M. (2003). (2003). Regional clusters: What we know and what we should know. In J. Brocker, D. Dohse, & R. Soltwedel (Eds.), Innovation clusters and interregional competition (pp. 99–129). Berline: Springer Verlag.

Ethier, W., & Markusen, J. (1996). Multinational firms, technology, diffusion, and trade. Journal of International Economics, 41, 1&2): 1–1&2):28.

Feld, B. (2012). Startup communities: building an entrepreneurial ecosystem in your city. New York: Wiley.

Feldman, M., & Audretsch, D. (1999). Innovation in cities: science-based diversity, specialization, and local competition. European Economic Review, 43(2), 409–429.

Feldman, M., & Zoller, T. D. (2012). Dealmakers in place: social capital connections in regional entrepreneurial economies. Regional Studies, 46(1), 23–37.

Florida, R., & Kenney, M. (1988). Venture capital, high technology, and regional development. Regional Studies, 22(1), 33–48.

Frenken, K., Cefis, E., & Stam, E. (2015). Industrial dynamics and clusters: a survey. Regional Studies, 49(1), 10–27.

Glaeser, E., Scheinkman, J., & Shleifer, A. (1995). Economic growth in a cross-section of cities. Journal of Monetary Economics, 36(1), 117–143.

Gordon, I., & McCann, P. (2000). Industrial clusters: complexes, agglomeration, and/or social networks. Urban Studies, 37(3), 513–532.

Granovetter, M. (1973). The strength of weak ties. American Journal of Sociology, 6(1), 1360–1380.

Harrison, R., & Leitch, C. (2010). Voodoo institution or entrepreneurial university? Spin-off companies, the entrepreneurial ecosystem, and regional development in the UK. Regional Studies, 44(9), 1241–1262.

Ibarra, H., & Andrews, S. (1993). Power, social influence, and sensemaking: effects of network centrality and proximity on employee perceptions. Administrative Science Quarterly, 38(2), 277–303.

Insel, P., & Moos, R. (1974). Psychological environments: expanding the scope of human ecology. American Psychologist, 29(3), 179–188.

Isenberg, D. (2010). How to start an entrepreneurial revolution. Harvard Business Review, 88(6), 41–49.

Jacobs, J. (1975). Diversity, stability, and maturity in ecosystems influenced by human activities. In W. H. van Dobben & R. H. Lowe-McConnell (Eds.), Unifying concepts in ecology. Dordrecht: Springer.

Kemeny, T., Feldman, M., Ethridge, F., & Zoller, T. (2015). The economic value of local social networks. Journal of Economic Geography. https://doi.org/10.1093/jeg/1bv043.

Kilduff, M. (2010). Organizational social network research: core ideas and key debates. Academy of Management Annals, 4(1), 317–357.

Kirzner, I. (1997). Entrepreneurial discovery and the competitive market process: an Austrian approach. Journal of Economic Literature, 35(1), 60–85.

Moore, J. (1993). Predators and prey: a new ecology of competition. Harvard Business Review, 71(3), 74–86.

Motoyama, Y., Konczal, J., Bell-Masterson, J., & Morelix, A. (2014). Think locally, act locally: building a robust entrepreneurial ecosystem. Kansas City, MO: Kauffman Foundation.

Napier, G., & Hansen, C. (2011). Ecosystems for young scalable firms. Cophehagen: FORA Group.

Neck, H., Meyer, B., Cohen, B., & Corbett, A. (2004). An entrepreneurial system view of new venture creation. Journal of Small Business Management, 42(1), 190–208.

Pitelis, C. (2012). Clusters, entrepreneurial ecosystem co-creation, and appropriability: a conceptual framework. Industrial and Corporate Change, 21(6), 1359–1388.

Porter, M. (1996). Competitive advantage, agglomeration economies, and regional policy. International Regional Science Review, 19(1&2), 85–94.

Rindova, V., Barry, D., & Ketchen, D. (2009). Entrepreneurship as emancipation. Academy of Management Review, 34(3), 477–491.

Schumpeter, J. (1934). The theory of economic development. Cambridge, MA: Harvard University Press.

Senor, D., & Singer, S. (2009). Start-up nation, the story of Israel’s economic miracle. New York, NY: Hachette.

Serrat, O. (2017). Social network analysis. In Knowledge solutions. Singapore: Springer.

Spigel, B. (2015). The relational organization of entrepreneurial ecosystems. Entrepreneurship: Theory and Practice, 41(1), 49–72.

Spigel, B., & Harrison, R. (2017) Towards a process theory of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, forthcoming.

Spilling, O. (1996). The entrepreneurial ecosystem: on entrepreneurship in the context of a mega-event. Journal of Business Research, 36(1), 91–103.

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: a sympathetic critique. European Planning Studies, 23(9), 1759–1769.

Stangler, D., & Bell-Masterson, J. (2015). Measuring an entrepreneurial ecosystem. Kauffman Foundation. Online at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2580336

Steyaert, C., & Katz, J. (2004). Reclaiming the space of entrepreneurship in society: geographical, discursive, and social dimensions. Entrepreneurship and Regional Development, 16(3), 179–196.

Tichy, N., Tusham, M., & Fombrun, C. (1979). Social network analysis for organizations. Academy of Management Review, 4(4), 507–519.

Wiklund, J., & Shepherd, D. (2008). Portfolio entrepreneurship, habitual and novice founders, new entry and mode of organizing. Entrepreneurship: Theory and Practice, 32(1), 701–725.

Williams, T., & Shepherd, D. (2017). Mixed method social network analysis: combining inductive concept development, content analysis, and secondary data for quantitative analysis. Organizational Research Methods, 20(2), 268–298.

Zacharakis, A., Shepard, D., & Coombs, J. (2003). The development of venture-capita-backed internet companies: an ecosystem perspective. Journal of Business Venturing, 18(1), 217–231.

Zoller, T. (2010). The dealmaking milieu: an alternative view of social capital brokerage. A dissertation submitted to the faculty of the University of North Carolina at Chapel Hill February 24, 2010.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Pittz, T.G., White, R. & Zoller, T. Entrepreneurial ecosystems and social network centrality: the power of regional dealmakers. Small Bus Econ 56, 1273–1286 (2021). https://doi.org/10.1007/s11187-019-00228-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00228-8