Abstract

This paper analyzes the historical factors that shape current levels and regional differences in new firm formation in innovative industries. Drawing on the knowledge spillover theory of entrepreneurship, we propose and test the idea that regional knowledge and creativity affect entrepreneurial activity in the long term. We investigate this in Italy using data at the NUTS-3 geographical level, which goes back as far as 1100 on some items. Our results show that the historical knowledge base, measured as the presence of public universities, is strongly related to the current level of innovative start-ups. There is also a positive relationship between past creativity, measured by the presence of scientists and inventors in the area, and current intensity of new firm formation. Lastly, these long-term effects are complementary, because provinces with both a stronger knowledge base and higher levels of creativity have more current innovative start-ups. These findings suggest that a regional entrepreneurship culture and a social environment conducive to new firm formation can explain the path-dependency of regional entrepreneurship.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Researchers in the field of industrial policy are increasingly aware that fostering the formation of new firms with high growth prospects is the real engine of economic development in advanced economies (Haltiwanger et al. 2013; Mazzucato 2011, 2013). The creation of new firms enhances employment and wealth, raises productivity, and ultimately promotes economic development (Acs and Storey 2004). The rate of new firm formation varies strongly by region, with more prosperous regions showing higher levels of entrepreneurship (Reynolds et al. 1994). Studies have therefore stressed the importance of strengthening local entrepreneurship to support regional economic development and the crucial role of public policies in this endogenous process.

Recently, some studies have emphasized the path-dependency of regional entrepreneurship, which is a long-term phenomenon (Fotopoulos 2013; Fritsch and Wyrwich 2014). This means that despite the political, social, and economic changes that influence society over time, the structure of new business formation at local level is broadly constant over a long period and changes only slowly (Andersson and Koster 2011; Fritsch and Storey 2014).

The object of this paper is to contribute to this strand of literature, by investigating whether historical factors, such as regional knowledge base and individual creativity, explain the current levels of new business formation in innovative industries and their spatial heterogeneity across regions. Fritsch and Wyrwich (2018) showed that the establishment of universities and historical self-employment in science-based industries were linked to current levels of new business formation in German regions. These findings suggest the presence of a regional culture of entrepreneurship that persists over time. The authors, however, did not explore the sources of this culture. Building on Fritsch and Wyrwich (2018), we examined the situation in Italy and confirmed a positive relationship between the historical establishment of universities and the current levels of new business formation. We have also extended their work by identifying historical creativity as a main source of a regional culture of entrepreneurship. We have therefore shown that the development of a culture of entrepreneurship requires not only favorable economic conditions but also individual values, such as creativity. This result, ultimately, emphasizes the importance of the social and cultural environment in providing fertile ground for entrepreneurial activity.

Our main contribution to the literature concerns the long-lasting role of creativity and its interaction with the local knowledge base in determining the current level of regional entrepreneurship. Some previous studies have investigated the link between entrepreneurship and current levels of creativity (e.g., Florida 2014), but the impact of historical creativity has not been explored. We also add to the entrepreneurship literature in several other ways. First, we propose a new measure of creativity based on historical data about scientists and inventors (SIs, hereafter). Second, we investigate Italy, which to the best of our knowledge has not been analyzed from an historical perspective. Italy is an interesting setting to understand the determinants of regional entrepreneurship, because it is characterized by large variations in new business formation across the different regions. Third, our empirical model includes a proxy for the historical development of the financial industry. The availability of financial resources is recognized as one of the main prerequisites for new firm creation and growth (Pan and Yang 2018). We therefore tested whether our main results survived after controlling for the presence of a well-developed local financial system. Fourth, from a methodological point of view, we also assessed the robustness of our findings by using spatial econometrics, which is useful to take into account the possible endogeneity in firm location.

The empirical analysis is based on historical data collected at the NUTS-3 level (province) and uses econometric methods. The main results suggest that history plays a major role in shaping the current intensity of entrepreneurship and the differences across Italian provinces. A local university, used as a measure of the regional knowledge base, is positively related to the current establishment of innovative start-ups, while as geographical distance from a university increases, provinces have fewer start-ups. In addition, the historical presence of SIs, considered as a proxy for levels of creativity, has a similar positive impact on current levels of entrepreneurship. These two factors are complementary, in the sense that high levels of knowledge and creativity within a province reinforce each other, leading to higher current levels of new firm formation.

These findings are consistent with previous literature highlighting the important effect of the historical knowledge base. They extend understanding of entrepreneurship and regional disparities in new business formation by highlighting the positive effect of past creativity and, ultimately, the importance of the social and cultural environment.

The rest of the paper is set out as follows. Section 2 provides a brief review of entrepreneurship literature, focusing on the regional dimension of entrepreneurial activity and on its historical roots. This section also discusses the conceptual background of the paper, which is based on the role of knowledge and creativity. Section 3 sets out the data and methodology used and describes the historical roots of knowledge in Italy. Section 4 provides the empirical results and the sensitivity analysis. Finally, Sect. 5 concludes and draws policy implications and directions for further research.

2 Literature review and theoretical framework

2.1 Regional entrepreneurship and historical roots

The entrepreneurship literature has often emphasized that new firm formation varies strongly by location. This variation, especially in technology-intensive industries, is shaped by specific characteristics of the regional economy. These factors include industry structure (Stuetzer et al. 2016), availability of equity or credit financing (Acconcia et al. 2011; Pan and Yang 2018), barriers to entry and occupational structure (Audretsch et al. 2015), agglomeration (Fritsch and Storey 2014), physical infrastructure (Ghani et al. 2014), and public programs supporting the creation of new firms and investments in R&D (Bellucci et al. 2018; Caliendo and Khunn 2014; Reynolds et al. 1994).

A different approach to explaining regional variations in entrepreneurship relies on individual behavior and characteristics, starting from the idea that entrepreneurship is a process that arises at the individual level (Obschonka et al. 2013). This approach is multidisciplinary and embraces studies from sociology, psychology, and natural sciences (Obschonka and Silbereisen 2012). The major determinants of entrepreneurship have been identified as particular personality traits of individuals, such as openness to experience and tolerance of risks (Caliendo et al. 2014), intergenerational transmission (Laspita et al. 2012), education and human capital (Acs and Armington 2004; Doeringer et al. 2004), and particular experiences of working life, such as employment in a small firm and integration in a professional environment characterized by higher self-employment rates (Elfenbein et al. 2010; Sorgner and Fritsch 2013).

A recent strand of literature has started to look at regional entrepreneurship using an historical perspective, finding that patterns tend to persist over long periods. The cross-regional attitude towards entrepreneurship has remained constant over time in countries including Germany, Sweden, USA, and UK, despite economic, political, and social changes at both national and regional levels (Andersson and Koster 2011; Armington and Acs 2002; Fritsch and Wyrwich 2014; Storey and Johnson 1987). The main explanations given for this path-dependency are the cultural heritage; the existence of formal and informal institutions, such as regulations, labor laws, and “unwritten rules of the game” (Bruton et al. 2010; Urbano et al. 2018); the regional base of knowledge, which is deeply rooted in history; and the regional culture of entrepreneurship (Fritsch and Wyrwich 2018).

2.2 The role of knowledge

The knowledge spillover theory of entrepreneurship (KSTE) suggests that new knowledge and ideas are a fundamental source of entrepreneurial opportunities (Acs et al. 2009; Audretsch and Keilbach 2007; Audretsch and Lehmann 2005). New knowledge and ideas that have not previously been commercialized by their sources are the main knowledge base encouraging entrepreneurial activity. In turn, by commercializing knowledge through the creation of a new firm, entrepreneurs act as a conduit of knowledge spillovers (Audretsch and Keilbach 2007).

According to the theory, a context with a larger knowledge base will generate more entrepreneurial opportunities (Acs et al. 2013). This relationship holds at both national and sub-national level. A number of studies have shown that geographical proximity to the sources of knowledge reduces the cost of accessing and absorbing knowledge spillovers (Audretsch and Feldman 1996; Jaffe et al. 1993). Knowledge tends to be “sticky” by location, because it is often tacit, embedded in people, and geographically bounded. Regions characterized by a higher concentration of new knowledge are therefore able to generate more entrepreneurial activities, particularly in technology-intensive industries, and this contributes to the well-documented phenomenon that entrepreneurship varies strongly by region (Acs et al. 2008; Audretsch and Keilbach 2007).

Regional knowledge and ideas can be created in several ways, including from incumbent firms, regional expenditure on R&D, public and private research institutions, and population employment experience related to the regional industry structure (Helfat and Lieberman 2002). These factors may determine the existence of entrepreneurial opportunities, crucial capabilities to recognize and exploit these opportunities, and capacity to absorb new knowledge (Qian and Acs 2013). Incumbent organizations may be unable to commercialize new knowledge and ideas generated within their research laboratories because of lack of capacity or financial resources, or high risk aversion. Knowledge and ideas provide an opportunity for new firms that can exploit and commercialize them. The creation of a new firm is therefore viewed within the KSTE theory as an endogenous response to knowledge and ideas that have been generated but not fully exploited (Colombelli 2016).

Previous studies have proxied the regional knowledge base in several ways, including investment in R&D (Acs et al. 2009), regional characteristics of the labor force (Bishop 2012), patent-based indicators (Bae and Koo 2008), and research activities carried out by universities and other research institutes (Audretsch and Lehmann 2005; Bonaccorsi et al. 2014). In our conceptual framework, the historical availability of new knowledge through universities represents a major incentive for regional entrepreneurial activity, generating spillovers from academic research and human capital embodied in well-trained and highly educated students (Audretsch and Lehmann 2005; Fritsch and Aamoucke 2017; Fritsch and Wyrwich 2018). Institutions of high education, such as universities, can be considered a valid proxy for the historical knowledge base for different reasons. Once established, they tend to exist for long periods, with very few closing down. This contributes to the accumulation of a large stock of knowledge over time. Universities act as an important source of absorption, creation, and transfer of new knowledge. Scientific knowledge in particular is a fundamental resource for innovative firms in science and technology-based sectors. A well-established university may build long-lasting networks of formal relationships or informal ties with external actors. Previous experience of cooperation may increase the benefits drawn by private industry from universities, as well as the probability of knowledge spillovers (Bellini et al. 2018). Universities provide a crucial contribution to the regional stock of human capital, which in turn is essential for the identification of entrepreneurial opportunities (Schubert and Kroll 2016). Education at a more entrepreneurial university, for example, may encourage more innovative start-ups. Universities also play a key role within regional and national innovation systems, facilitating interactions between other actors, such as private firms and local institutions, and fostering industrial innovation (Bellucci and Pennacchio 2016).

2.3 The role of creativity

In recent decades, creativity has increasingly been identified as a driver of innovation, competitiveness, and ultimately economic development (UNCTAD 2008, 2010). From a theoretical point of view, Audretsch and Belitski (2013) recognized that the KSTE fails to internalize the relationship between creativity and entrepreneurship. They proposed a modified framework supporting the creativity theory of knowledge spillover entrepreneurship. This starts by distinguishing ordinary and intellectual human capital, or creativity, embodied in people. The former is attributable to educational attainment, and the latter “is an excluded knowledge element, primarily personalized (tacit) knowledge of individuals” (Audretsch and Belitski 2013, p. 820). Both human capital and creativity in well-educated or skilled people can foster entrepreneurship at national and local level (Boschma and Fritsch 2009; Lee et al. 2004).

The concentration of creative activities in particular geographical areas over time can generate a creative environment that facilitates the innovation and generation of new ideas (Cerisola 2018; Lazzeretti et al. 2008; Scott 2006). A similar creative environment is considered the engine of a new economic paradigm (Chapain and Comunian 2010), where new and young firms are more likely to introduce process and product innovation (Lee and Rodríguez-Pose 2014). Regions with large numbers of ideas and talented people are centers of global competitiveness. Creative people are attracted to an environment characterized by diversity and availability of cultural amenities (Florida 2004). Cities with a creative environment show higher levels of innovation and more new firm formation in technology-intensive industries (Florida 2014). Therefore, regional entrepreneurship can be considered to be closely linked to creativity, because it allows the creation and spread of new knowledge and original and useful ideas (Coll-Martínez 2018; Lee et al. 2004).

The new role attributed to creativity emphasized the importance of socio-cultural factors in shaping regional entrepreneurship. A social environment characterized by both favorable economic conditions and social and cultural values conducive to creativity has an important role in determining entrepreneurship (Lee et al. 2004). The basic hypothesis is that entrepreneurship is positively associated with regional environments that promote creativity and other social dimensions, such as diversity. These social and cultural values encourage the creation and dissemination of knowledge, fostering entrepreneurship at local level (Boschma and Fritsch 2009; Piergiovanni et al. 2012).

The literature contains different conceptualizations and definitions of creativity. It is associated with historical heritage, the characteristics, and history of the society in which it is developed (Santagata 2002). It can also be viewed as the ability to synthesize (Florida 2004), or to produce new, original, unexpected, and useful work (Sternberg 1999). A more comprehensive definition was provided by the United Nations Conference on Trade and Development: “The formulation of new ideas and the application of these ideas to the production of original works and cultural products, functional creations, scientific inventions and technological innovations” (UNCTAD 2008). This definition makes clear that creativity is a multidimensional concept that embraces different contexts. Artistic creativity, for example, is associated with the imagination and the ability to generate new ideas and interpret things differently, in the form of text, sound, or image. Scientific creativity implies curiosity and the propensity to experiment and make new connections among existing pieces of information. Finally, economic creativity is a dynamic process that applies innovative solutions in technology and business domains to obtain competitive advantage.

Previous studies have used data on creative populations, such as authors, musicians, composers, actors, directors, painters, sculptors, or dancers (Coll-Martínez 2018; Florida 2002). The underlying idea is that this variable measures creativity not directly related to technological and business innovation and so accounts for the artistic and intellectual dynamism that, in turn, stimulates the dissemination of ideas. In our view, however, such variable can only approximate artistic creativity rather than scientific or economic creativity. It is possible that artistic creativity has a positive and significant relationship with the concentration of intensive high-tech industry (Florida 2002). This relationship, however, is probably indirect, in that artistic creativity is higher in richer geographical areas, which also have high rates of innovative industries. To study entrepreneurship, we believe that a good proxy for creativity should have two characteristics. First, given the discussion above, it should be closely linked to the socio-cultural environment. Second, because entrepreneurship is associated with risk, it should be related to activities with uncertain outcomes. We therefore suggest that the types of creativity that matter in studying entrepreneurship are economic creativity and scientific creativity, rather than artistic creativity. To operationalize this concept, we used a new proxy based on the presence of SIs at provincial level. This new variable has a close link to the socio-cultural conditions in the region and accounts for discoveries and inventions that are associated with a certain degree of risk. A regional culture open to scientific discoveries and science in general is likely to be characterized by common beliefs, social connections, lines of thinking, and behaviors that, in turn, affect the birth and development of scientists and inventors. The geneticist Cavalli-Sforza (2016) observed that “Potential geniuses can be born anywhere, but a suitable cultural environment is crucial for them to achieve success. Individual behavior is influenced by both genes and the external environment.” Genetic factors can partially affect the geographic distribution of scientists and inventors, but a socio-cultural environment inclined towards science is the key aspect that determines if a potential genius will become a scientist or inventor. Cavalli-Sforza noted, for example, that most Italian scientists before 1600 were born near the city of Florence. This was not because of the concentration of genetic factors but a very open and stimulating environment. From the eighth to the sixteenth century, Florence was the most stimulating city in the Western world.

We therefore propose that the number of SIs in a region is an appropriate proxy for the type of creativity that matters in economic and business domains, such as entrepreneurship.

3 Data and variables

3.1 Sources of data and variable definitions

3.1.1 Dependent variable

The dataset used in the empirical analysis has a number of different sources. Our indicator of current entrepreneurship is based on the formation of new firms in technology-intensive sectors. Information on start-ups is from the register of innovative start-ups at the Italian Chamber of Commerce. The register was created in 2013 following Law 221/2012, known as “Law for growth 2.0,” which introduced specific measures to support the creation and growth of innovative start-ups. All start-ups included in the register can benefit from the public measures provided by Law 221/2012, such as the use of flexible employment contracts, access to incentives to hire highly skilled employees, the ability to remunerate staff with stock option and equity-based rewards, incentive plans for equity and crowdfunding, easing access to bank credit, and support for internationalization strategies.

To be included in the register, start-ups need to meet some specific conditions for activity and legal form. The start-ups included in our dataset are corporations (i) not listed on regulated markets; (ii) headquartered in Italy; (iii) with a turnover below five million euros; (iv) that started operating in the previous 48 months; (v) have the majority of their capital provided by individuals; and (vi) that aim to develop innovative products/services with a high technological content. To be defined as innovative and therefore to be considered eligible for the inclusion in the register, the start-ups have to fulfill at least one of the following requirements: at least 15% of their total costs must go towards R&D activities; more than one third of employees must hold a Ph.D., or be Ph.D. students, or two thirds of employees must hold a Master degree; and they must have registered at least one patent or an original computer program.

We considered the period 2013–2017, in which 8406 start-ups were enrolled in the register. These firms operate in all sectors including agriculture, industry, and services. We retained only firms in high-technology industries, medium-high-technology industries, and knowledge-intensive services, according to the aggregation of manufacturing industries and services for technological intensity from Eurostat. The final sample consisted of 6846 innovative start-ups at NUTS 3 geographical level. This level is “small regions,” which in Italy are provinces. These administrative units include a main city and its neighboring municipalities and are characterized by homogeneous economic conditions. Firms operating in a province have frequent economic interactions, compete in the same local market, and are registered with the provincial chamber of commerce. This level is therefore appropriate to investigate the determinants of entrepreneurship (Colombelli 2016).

The dependent variable of our econometric model measures entrepreneurship in the period 2013–2017 and is computed as the average annual number of innovative start-ups per 100,000 inhabitants of the province (start-ups). Similar measures of entrepreneurial activity have been used in Colombelli (2016) and Fritsch and Wyrwich (2018), among others.

3.1.2 Main variables of interest

The main explanatory variables concern the presence of universities and SIs in the provinces. Historical data about universities, which we consider as a proxy for regional knowledge base, were from Annals of Statistics, Series VI, Volume XIV of Central Institute of Statistics (1933) (Annali di Statistica, Statistica dell’Istruzione Superiore nell’anno accademico 1926–1927). This provides information on the origin of universities, and the number of students and professors by university and faculty for the academic year 1926–1927. We used these data to build two types of proxies for knowledge at the provincial level. The first was three binary indicators for the presence of universities in 1927 (university 1927), 1900 (university 1900), and 1400 (university 1400), which were equal to 1 for provinces with at least one university and 0 otherwise. The second was a continuous variable measuring the distance in kilometers from each province to the closest university (distance to university).

To measure regional creativity, we used information on SIs from the book “Short History of Scientific Ideas to 1900” by Charles Singer (1959). This provides a list of SIs with information on their place and date of birth over the period 1100–1900.Footnote 1 We integrated the list with information about SIs born from 1900 to 1956, to give information consistent with other variables. Using these data, we computed two variables that measure the number of SIs born before 1927 (inventors 1927) and before 1600 (inventors 1600). The variables on the presence of universities and SIs have the advantage of being fairly exogenous to the dependent variable, because of the ample time lag.

3.1.3 Control variables

The control variables included the intensity of self-employment, the industrial structure of the local economy, and economic development at the beginning of the last century. The information came from the Industrial Census of 1927 (Censimento Industriale e Commerciale) and population censuses from 1901 to 1931 (Censimento Generale della Popolazione). Variables on the industrial structure of the provinces were computed from data in the Industrial Census of 1927. To proxy the intensity of entrepreneurial tradition, we used self-employment in the non-agricultural private sector and calculated the percentage of self-employment in manufacturing and services over total employment (self-employment). The size of the local financial system was proxied by the ratio of financial sector employees to total employees (share in finance). These variables were designed to evaluate whether regional entrepreneurship and financial constraints were persistent over time, and affected current levels of entrepreneurship. Another control, percentage of employees in manufacturing over total employees, took into account the size of the manufacturing sector (share in manufacturing).

To control for agglomeration and economic development, we included population density in the year 1901 and changes from 1901 to 1931. Population density provided a static measure of agglomeration and economic development, and the change over time is a dynamic indicator of economic growth. Existing studies on industrial location suggest that agglomeration economies could generate more productive environments fostering the birth of new firms (Reynolds et al. 1994). We therefore expect both variables to show a positive relationship with regional entrepreneurship.

Lastly, we included provincial dummies to capture any unobserved heterogeneity that may influence regional entrepreneurship. Table 10 in the Appendix summarizes and provides more details about the main variables used in the empirical analysis. Table 1 shows descriptive statistics and correlations.

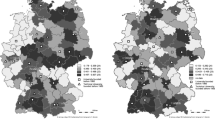

3.2 The regional distribution of innovative start-ups, universities, and SIs

The spatial distribution of our dependent variable, the number of innovative start-ups per 100,000 inhabitants during the period 2013–2017, is shown in Fig. 1. The provinces with the highest concentration of innovative start-ups were Milan (37.3), Ascoli (33.6), Trento (26.8), Trieste (23.2), and Bologna (23.1), and those with the lowest intensity of entrepreneurial activities were Ragusa (0.6), Sondrio (1.1), Vercelli (1.6), Crotone (1.7), and Enna (1.7). Of the five most “entrepreneurial” provinces, four are in the North of Italy and one in the center. Three of the weakest provinces are in southern Italy (Enna, Ragusa, and Crotone) and the other two in the North (Sondrio and Vercelli). Italy therefore shows considerable variation in new firm formation between the North and South, which have a strong economic divide and also within each broad region.

Figure 1 also shows the regional distribution of universities founded before 1927, one of the main explanatory variables of interest. Provinces with at least one university are marked by a white circle. Italian universities are among the oldest in the world. The University of Bologna was founded in 1088 and is recognized as the oldest university in the world. Others include the universities of Parma, established in 1117, Modena and Reggio Emilia, founded in 1175, Padua, from 1222, and Naples, established 2 years later. Most universities were in Northern and Central Italy. In the North, four provinces of Emilia Romagna and two provinces of Lombardy and Veneto hosted at least one university. In the center, three provinces of Tuscany and two of Marche had at least one university. In the South, by contrast, there were far fewer universities. The only provinces that hosted at least one university were Naples in Campania and Bari in Apulia. Some regions did not have universities at all, including Abruzzo, Basilicata, Calabria, and Molise. Naples and Milan had the highest number of universities, four each. On the islands, three provinces of Sicily and two of Sardinia hosted at least one university.

Figure 2 shows the distribution of the other regressor of interest, which measures the number of SIs born before 1927, a total of 90 in 41 different provinces. The majority were born in Northern and Central Italy: provinces with the highest number of SIs are Bologna and Pavia (7), followed by Turin and Florence (5), and Milan and Pisa (4). There were very few SIs born in Southern Italy, with Reggio Calabria having the most (2). The figure reveals that there is a spatially concentrated distribution of SIs. Clusters of low numbers of SIs occur in the South of Italy, while there are some clusters of high numbers of SIs in the North, especially around Milan and Pavia, and in the center, around Bologna and Florence.

The historical and cultural roots of knowledge in Italy provide evidence of a clear difference between North and South, with the North oriented towards scientific or technical knowledge, and the South more specialized in natural sciences. Northern Italy had more SIs between the twelfth and fifteenth centuries and was the first area of the country to create informal scientific societies in the fifteenth century. Some academies, however, developed in Southern Italy. The Academia Pontaniana, oriented towards classic studies, was founded in Naples in 1458 but was closed in 1542 by Don Pedro da Toledo for political reasons. Another academy, the Academia Secretorum naturae, was founded in Naples in 1560 by Giovanni Battista della Porta, a philosopher and naturalist. This academy was closed in 1578 by the Inquisition on suspicion of sorcery. In Rome, the Academia dei Lincei was founded in 1603 by the nobleman and naturalist Federico Cesi. After his death, the Academia closed because of lack of interest and fear of the Inquisition. It was reopened by Pio IX in 1847. The increasing power of Spain and the fear of the Inquisition determined the closure of scientific academies in Southern Italy. At the end of the eighteenth century, two important scientific academies were founded in the North: the Academy of the Forty and the Academy of Science of Torino. The first was founded in Verona in 1782 by 40 SIs, including Volta, Spallanzani, Lagrange, and Boscovich. The second originated from an informal association created in 1757 by Lagrange, the Count Giuseppe Angelo Saluzzo, an artillery officer, and Francesco Cigna, who was studying medicine. This was a private society until its official recognition in a royal charter by King Vittorio Amedeo III di Savoia.

Italy was late in creating national scientific societies, and many were privately founded and only later publicly recognized. They often started in regions that for cultural reasons had a favorable attitude towards science. In regions such as the Kingdom of Naples, which was dominated by Spanish culture, and Lazio, which was under the direct sovereignty of the Pope for hundreds of years, the idea of an academy of science was not supported by either civil society or the public authorities. The Kingdom of Naples produced people who excelled in arts, classical studies, history, and philosophy but not science, because of the environment. In the second half of the eighteenth century, the Kingdom of Naples was interested in reforms driven by King Charles III, but the strong opposition of Southern nobles and the move of Charles III to become King of Spain meant these projects were unsuccessful. A similar environment continued after Italian Unification. Most southern intellectuals were more open to humanities than sciences. The two most important philosophers from Southern Italy, Vico (1668–1744) and Croce (1866–1952), both saw history and philosophy as the queens of sciences. Croce, for example, criticized and demonized the cognitive value of science because he said it used only pseudo-concepts that said nothing about the world. The different attitudes towards science and a less restrictive circulation of ideas in the seventeenth century in Italian regions, such as Lombardy, Piedmont, and Emilia Romagna could explain the higher number of SIs born in Northern Italy.

4 Empirical results

4.1 The direct impact of historical knowledge base and creativity

To begin, we investigated the bivariate relationships between current entrepreneurship and the main regressors of interest: regional knowledge base and creativity. Ordinary least square estimates of the long-term effect of universities are shown in Table 2. The effect of the presence of a university in the province was examined using different dummies for provinces with at least one university in 1927 (university 1927), 1900 (university 1900), and around 1400 (university 1400). All specifications in the table include regional dummies (NUTS-2 level). The point estimates showed a positive and statistically significant relationship between the past presence of universities and current levels of entrepreneurship. The impact was stronger for more recently established universities. The dummy for universities established before 1927 had a coefficient of 5.90, decreasing to 3.88 for 1900 and 3.49 for 1400. To analyze jointly the impact of universities founded at different times on current entrepreneurship, column 4 used different types of dummies: university 1900–1927, equal to 1 for provinces with universities founded between 1900 and 1927, and 0 for others; university 1400–1900, which equals 1 for provinces with universities founded between 1400 and 1900; and university 1000–1400, equal to 1 for provinces with universities established before 1400. The coefficients confirmed the positive impact of universities on current levels of entrepreneurship and that more recently-founded universities had a stronger impact. The R-squared was higher in column 1, in line with previous findings.

There was a positive relationship also between current levels of entrepreneurship and SIs born before 1927 (inventors 1927) and before 1600 (inventors 1600). Unlike universities, however, the more recent presence of SIs did not have a stronger impact. In column 7, inventors 1600 has a coefficient of 1.21 and inventors 1600–1927 a coefficient of 1.74. This may be because universities, once established, continue to operate over a long period, contributing to the accumulation of a solid stock of knowledge. SIs, by contrast, live a relatively short time, and the value of their inventions and discoveries may decay over time as a result of technological change. SIs in more recent years may also be more mobile across regions and countries and may therefore migrate to new regions, where they contribute to entrepreneurship, rather than doing so in their birthplace (Table 2).

We now turn to analyze the full model that included also all control variables. For coherence with other regressors covering 1901–1930, we retained only the variables about universities and SIs in 1927. The results are shown in Table 3, where column 1 considers only the controls, columns 2 and 3 add university 1927 and inventors 1927, and column 4 shows all variables.

The variables covering the characteristics of the regional economy had the expected signs and were significant across the different model specifications. The rate of innovative start-ups was positively linked to the historical intensity of self-employment (self-employment), the size of the financial industry (share in finance), and the size of the manufacturing sector (share in manufacturing). The result on self-employment is consistent with Fritsch and Wyrwich (2018), who found a positive link between past attitude to self-employment and current entrepreneurship. This relationship suggests that geographical areas with a well-established tradition of entrepreneurship have developed a culture of entrepreneurship that persists over time. Our coefficients had a weaker statistical significance and were lower than those of Fritsch and Wyrwich (2018). This may be because they used self-employment in science-based industries, while we could only estimate self-employment at an aggregate level, without distinguishing the technological intensity of the sector. The historical role of the financial industry in shaping current entrepreneurship emphasizes that financing opportunities are crucial for new firms. A well-developed financial industry may foster or hamper the creation of an entrepreneurial culture. A similar result was found for the historical size of the manufacturing sector, which was positively related to the current formation of new firms in technology-intensive sectors. Taken together, these results suggest that the historical economic environment is important in shaping a culture of entrepreneurship and, in turn, current levels of entrepreneurship.

Estimates in columns 2–4 confirm the important role of the historical knowledge base and levels of creativity in determining the current numbers of innovative start-ups. In the more comprehensive model specifications of column 4, the coefficients of university 1927 and inventors 1927 were slightly decreased but still statistically significant. It is difficult to compare the effects of knowledge base and creativity on entrepreneurship in our model setting. In both columns 2 and 3, the R-squared increased from 0.49 (the specification in column 1, with controls only) to 0.57, and this may suggest a similar explanatory power on the current level of entrepreneurship. In column 4, however, R-squared increased by 0.1 (from 0.49 to 0.59). The historical knowledge base and levels of creativity therefore separately account for approximately 8% of the total variation in current entrepreneurship and 20% of the residual variation left unexplained by the controls. The coefficients were both significant and economically meaningful. Based on the estimates from column 4, provinces with a university have 2.87 innovative start-ups per 10,000 inhabitants more than those without universities. This is equal to 30% of the sample mean for innovative start-ups (9.24). A one standard deviation increase in the number of SIs (1.42) is associated with an increase in the rate of innovative start-ups of 1.33 or 14.4% of its mean.

The controls for historical population density and growth rate had a positive and long-term impact on the current establishment of new firms. These findings are consistent with Audretsch and Fritsch (1994), who found a similar effect in Germany, although both their variables were contemporaneous with the dependent variable (Table 3).

Up to this point, we have analyzed the impact of universities on entrepreneurship without distinguishing the types of universities. We now distinguish universities by their focus on natural or social sciences, because the theoretical relationship between knowledge and entrepreneurship was expected to be stronger for “technical” knowledge and technology-intensive sectors. Universities specializing in natural sciences and engineering are often more focused on the commercialization of knowledge and have strong collaborations with the private sector. They may therefore have a more pronounced culture of entrepreneurship. We used data from Annals of Statistics (1933) on the faculties in each university. Overall, Italian universities had the following faculties in academic year 1926–1927: law; political sciences; literature and philosophy; medicine and surgery; mathematics, physics and other natural sciences; pharmacy; agriculture; veterinary medicine; engineering; and economics, although not all universities had all faculties. The universities of Venice and Trieste, for example, only had an economics faculty, but the University of Naples had all faculties except political sciences. We used this data on faculties to identify two groups of technically focused universities: technical universities, which have at least three faculties of natural sciences excluding engineering (technical university); and engineering universities, with a faculty of engineering (polytechnic university).

Table 4 shows the estimates for the different types of universities. In columns 1 and 3, the inclusion of the dummies for technical and polytechnic universities led to an insignificant coefficient for university 1927. Given that the two dummies were statistically significant at the 1% level, this implied that the positive effect of the presence of universities on innovative start-ups is mainly driven by technical and polytechnic universities. All other regressors retained the expected sign and had good statistical significance. Compared to column 4 of Table 3, the R-squared increased from 0.59 to 0.61.

In Table 5, we replaced the dummies on the presence of universities with continuous variables measuring geographical distance (as a logarithm) between the province and its closest university in 1927 (distance to university), closest technical university (distance to technical university), and closest engineering university (distance to polytechnic university), to evaluate the effect on entrepreneurship of knowledge spillovers from universities, and whether the effect decreased with increased physical distance. The estimated coefficients suggest that knowledge spillovers arise from universities and are higher in provinces near universities. This holds for all universities (column 1), technical universities (column 2), and engineering universities (column 3). The point estimates suggest that spillovers are higher for technical and engineering universities, with coefficients of − 0.83 and − 0.93, compared to − 0.68 for all universities. This may be because social sciences do not rely on a well-structured scientific methodology, and their knowledge is less codified than for natural sciences. Knowledge spillover, however, also existed for universities focused on social and human sciences.

4.2 The interaction between historical knowledge base and creativity

The final step of the analysis investigated the interaction between historical regional knowledge base and creativity and its impact on current levels of entrepreneurship (Table 6). The education activities of universities may foster the creation of an environment that is favorable to scientific knowledge and, at the same time, could help individuals improve their analytical capacity, curiosity about science, and scientific and economic creativity to realize their ideas. We therefore expected that the contemporaneous presence of universities and SIs in a province reinforce the individual effects on current regional entrepreneurship. Column 1 shows the dummy for the presence of universities before 1927 (university 1927) interacting with the number of SIs (inventors 1927). The interaction term (university 1927 × inventors 1927) was positive and statistically significant, suggesting that historical factors including regional knowledge base and creativity are complementary in fostering current levels of entrepreneurship. When inventors 1927 interacted with the dummies for technical or engineering universities, however, the interaction terms were not statistically significant (results not shown for brevity). This may be because creativity mostly interacts with a generic regional knowledge base, which is less codified and difficult to disseminate. Alternatively, it may be that technical and engineering universities were only established relatively recently in Italy, and this may not be complementary with SIs who were mostly active longer ago.

So far, however, we do not have considered the possible relationship between regional knowledge base and creativity. It can be argued that the two variables are not independent each other. The presence in a province of a well-established university could be an important factor in attracting SIs, or the presence of SIs could encourage the foundation of higher education institutions, such as universities. To tackle the issue of simultaneity between universities and SIs, we measured the two variables at different times, with SIs preceding universities, which implicitly assumed that the relationship between the variables was from universities to SIs. Using lagged values for SIs should avoid the problem of simultaneity. Columns 2 and 3 include a binary indicator, which is equal to 1 for provinces where a university was founded after 1600 (university 1600–1927) and a variable that measures the number of SIs before 1600 (inventors 1600). The estimates still show a positive impact of historical knowledge base and creativity on the start-up rate in technology-intensive sectors, as well as a positive and significant interaction term.

Columns 4 and 5 replicate this model specification, but replace universities with technical universities (technical university 1600–1927). The direct impact of technical universities on current entrepreneurship remained higher than for all universities. The coefficient of the interaction, however, was slightly lower than in column (3), suggesting that generic knowledge and more applied or technical knowledge in the past have a similar strengthening effect on the relationship between historical creativity and the current levels of entrepreneurship.

Finally, another possible source of bias linked to the time structure of our model is that the establishment of universities may affect the control variables. These variables cover 1901–1927, so as a proxy for the regional knowledge base, we used a dummy variable that is equal to one for provinces with universities founded between 1900 and 1927 (university 1900–1927). This ensures that the variable accounting for the presence of a university is contemporaneous with the control variables. As a proxy for creativity, we used the numbers of SIs before 1900 (inventors 1900) to avoid simultaneity with the presence of universities. The estimates in columns 6 and 7 are consistent with previous ones, suggesting that the different times at which the regressors were computed did not affect the analysis. R-Squared was slightly higher than previous model specifications.

4.3 Sensitivity analysis and extensions

We tested the robustness of our results in several ways. First, we replicated the regression in column 4 of Table 3, our baseline model, by using alternative measures of current entrepreneurship. The results are shown in Table 7. In column 1, the dependent variable was computed as the number of innovative start-ups per 10,000 employees (Fritsch and Wyrwich 2018); in columns 2 and 3, we considered all start-ups in the register of innovative start-ups, instead of restricting the analysis to start-ups in technology-intensive sectors. These two variables take into account a wider range of sectors and can be considered a more general proxy of entrepreneurship. The total number of start-ups in the register was normalized by 10,000 employees in column 2 and 100,000 inhabitants in column 3.

In columns 1 and 2, the coefficients of university 1927 and inventors 1972 were lower than in column (3) because the dependent variables have means of 0.43 and 0.56, against a mean of the last regression of 11.77. The sign and the statistical significance, however, were consistent with the main results. When the analysis was not restricted to technology-intensive sectors, the proxy of self-employment had a stronger effect on entrepreneurship. This suggests that our variable self-employment is better able to capture the formation of new firms in the whole economy than in technology-intensive sectors.

We also tested the robustness of our findings by distinguishing universities by size. We used data on the number of students in the academic year 1926–1927 from the Annals of Statistics (1933). Table 8 shows the estimates of the baseline model in which the dummy university 1927 identifies groups of universities with increasing number of students. The results indicate that larger universities had a more positive impact on current entrepreneurship. In columns 2 and 3, the coefficient of university 1927 is more than twice that in column 4 in Table 3 (2.87), showing that the size of universities is an important factor shaping the creation of new firms. The coefficient of inventors 1927 decreased with increasing university size, but remained statistically significant in all model specifications. This confirms the previous estimates of the main analysis.

Finally, we checked whether our main results were influenced by the spatial patterns between the variables included in the model. We were concerned that start-ups might not be randomly distributed across provinces, and that their location could be the result of an endogenous choice. For example, start-ups may decide to set up in large cities, which typically offer more physical and financial infrastructures than small cities in peripheral areas. New firms may also opt to locate in regions with a higher knowledge base or a sociocultural environment more conducive to entrepreneurial activity.

To address this issue, we replicated our baseline model using spatial econometric models (Table 9). Column 1 takes into account the possibility of spatial autocorrelation in the errors, by estimating a spatial error model. Column 2 combines the spatial error model with a spatial autoregressive model, which includes the spatial lag of the dependent variable among the explanatory variables. Column 3 evaluates whether current entrepreneurship is explained by the presence of universities and SIs in contiguous areas. All three specifications used a contiguity matrix of first order to investigate spatial relationships. This means we restricted the analysis to the possible geographical patterns between contiguous provinces, without extending the investigation further.

In general, the estimates are consistent with the main analysis and confirm the positive effect of historical knowledge base and creativity on the current levels of establishment of innovative firms. The spatial coefficients, however, identified some interesting issues. The spatial lag of the error term was statistically significant in all model specifications. One possible explanation is that our model, which focuses on historical determinants of entrepreneurship, fails to include some important contemporaneous variables that explain entrepreneurship. These might include, for example, public programs used by local governments to support new innovative firms. The explanatory variables used in the regressions do not consider this important aspect, and it may therefore be captured in the error term.

The spatial lags of the dependent variable and the presence of universities were also statistically significant and negative. The number of innovative start-ups in a province therefore tends to reduce if the number of innovative start-ups in the neighboring provinces increases or if neighboring provinces have a university. These findings suggest a “competition effect” between neighboring provinces, which can influence the location choice of new firms, by strengthening their knowledge base.

As for historical creativity, instead, we find little evidence of spillovers between contiguous provinces. The spatial lag of inventors 1927 was positive, suggesting that an increase of creativity in a province also increased creativity in neighboring provinces. The coefficient, however, was not statistically significant, suggesting that the relationship needs further investigation.

5 Discussion and conclusion

We have analyzed the determinants of entrepreneurship and its geographical variation by using an historical perspective. In particular, we have tested whether historical knowledge base and creativity have shaped the current levels of innovative start-ups across Italian provinces. Overall, our findings provide empirical evidence that current differences in regional entrepreneurship are shaped by historical factors, such as the stock of knowledge and creativity, which are typically embedded within defined geographical areas.

We measured the regional knowledge base accumulated in the past using data on the establishment of public universities during the period 1088–1927. The econometric analysis showed that the historical knowledge base fostered the recent formation of new firms in technology-intensive sectors. A leading role was played by universities focused on natural sciences, which specialize in the creation and dissemination of scientific and technical knowledge. Social sciences-oriented universities, however, have also stimulated entrepreneurship through knowledge spillovers. These results are consistent with the KSTE (Acs et al. 2009; Audtresch and Keilbach 2007; Audretsch and Lehmann 2005) and also emphasize the importance of taking an historical perspective when considering the drivers of entrepreneurship.

To proxy creativity, we proposed a new measure based on the presence of great SIs over the period 1100–1956. We believe this proxy captures dimensions of creativity that are more pertinent to the economic value of innovations and the commercialization of new knowledge than previous indicators. Our analysis indicates that past creativity is positively related to current levels of entrepreneurship. In addition, the knowledge base and creativity have a non-linear effect on current entrepreneurship, in the sense that provinces characterized by both stronger knowledge base and creativity have the highest current levels of entrepreneurship. Such findings provide empirical support to the creativity theory of knowledge spillover entrepreneurship proposed by Audretsch and Belitski (2013).

Overall, our results suggest that essential factors in encouraging the formation of new firms include not only the development of higher education institutions, as highlighted by previous research (e.g., Fritsch and Wyrwich 2018), but also the presence of a social and cultural environment that foster creativity. This type of environment is conducive to creation, dissemination and use of new ideas, and needs time to develop and start to influence individual and firm behavior. Once again, this shows the importance of a historical perspective in the analysis of entrepreneurship.

Our results have important implications. Entrepreneurial activity requires both specific conditions linked to productive systems, and a solid stock of knowledge generated and diffused by higher education institutions. We have shown that historical creativity is a major element fostering entrepreneurship. It can be considered an innate characteristic of individuals, but may also be supported by an open and dynamic environment. There is no doubt that individual propensity for intellectual activities is heterogeneously distributed among the population, because great artists, scientists, politicians, and inventors may emerge anywhere. Genetic factors play an important role in the success of such individuals. Many, however, came from humble beginnings and their ancestors and descendants do not necessarily show similar qualities. At least two further determinants therefore contribute to creativity: the family environment and the more general sociocultural context. These accidental and external factors affect the intellectual development of individuals (Cavalli-Sforza 2016) and should be taken into account by both scholars and policy makers in the field of entrepreneurship. Public policies supporting entrepreneurship should pay more attention to the social and cultural context (Lee et al. 2004). They must recognize that a favorable environment can attract human capital and creative individuals to a region, or facilitate the endogenous development of talented and creative people. Public policies should therefore focus on people and places, rather than firms and industries. Florida (2014) noted that talented and creative people are attracted to places with cultural, natural, and built amenities. They prefer to live in places that protect personal freedoms and diversity have many cultural opportunities and facilitate the creation and spread of new ideas and innovations. Regions therefore need to create not only the conditions for a favorable business climate, for example through regulation and taxation, but also those for a climate that facilitates individual creativity through an open, tolerant and welcoming community. This can ensure the long-term development of a cultural attitude favoring entrepreneurship.

Public programs at national and regional level that are based on financial and fiscal incentives for firms and entrepreneurs could also have a positive effect in the short term. This is particularly true in periods of economic crisis when the resources of private firms and the financial system are limited. These policies can help regions to emerge from a downturn and recover previous levels of growth. They are, however, unlikely to support entrepreneurship in the long term, where a solid knowledge base and an environment that fosters creativity are both crucial.

This study, of course, had some limitations. We lack reliable measures for the quality of universities and their attitude towards entrepreneurship during the historical period considered. These factors could have a crucial role in determining the formation of innovative start-ups. A similar limitation concerns our proxy for creativity, because we have information on the number of Sis but we were unable to quantify the importance of each individual SIs.

Our analysis identified two relationships that link current entrepreneurship with historical regional knowledge and creativity. The time lag of more than a century of the explanatory variables suggests that causality goes from the explanatory variables to our dependent variable. Finally, we addressed the possible endogeneity in firms’ location by using spatial econometrics, but further research is needed on this.

Future work should also explore the role of SIs in more depth and examine the reliability of our proxy for creativity. We have considered the case of Italy but further evidence from other countries is required to assess the external validity of our results. It would also be interesting to take into account the heterogeneous characteristics of different scientists and inventors and to understand whether they affect the relationship between creativity and entrepreneurship. Lastly, more research is needed to identify the determinants and consequences of creativity. We have stressed the positive correlation between socio-cultural environment and creativity, but without analyzing which external characteristics are the main drivers of individual creativity. More efforts should also be made to identify the direction of causality, that is, whether the environment stimulates the birth of SIs or attracts them from elsewhere and/or whether SIs affect the environment by increasing the scientific culture of the region where they were born and lived. We have provided evidence that creativity fosters entrepreneurship in the long term, but future studies should advance our understanding on whether and through which channels it ultimately contributes to the economic development of cities and regions.

Notes

A possible concern with SIs is that the place of birth may be different from the place where they actually lived, studied, or worked. However, we emphasize that the mobility of people was quite limited in the past. Even where they were mobile, SIs probably only moved after they had already manifested their predisposition towards excellence. In some cases, SIs moved within the same region and this does not affect our proxy of creativity.

References

Acconcia, A., Del Monte, A., & Pennacchio, L. (2011). Underpricing and firm’s distance from financial centre: evidence from three European countries. In CSEF Working Papers 295. Italy: University of Naples.

Acs, Z. J., & Armington, C. (2004). The impact of geographic differences in human capital on service firm formation rates. Journal of Urban Economic, 56, 244–278. https://doi.org/10.1016/j.jue.2004.03.008.

Acs, Z. J., Audretsch, D. B., & Lehmann, E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 767–774. https://doi.org/10.1007/s11187-013-9505-9.

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30. https://doi.org/10.1007/s11187-008-9157-3.

Acs, Z. J., Desai, S., & Klapper, L. F. (2008). What does “entrepreneurship” data really show? Small Business Economics, 31(3), 265–281. https://doi.org/10.1007/s11187-008-9137-7.

Acs, Z. J., & Storey, D. J. (2004). Introduction: entrepreneurship and economic development. Regional Studies, 38(8), 871–877. https://doi.org/10.1080/0034340042000280901.

Andersson, M., & Koster, S. (2011). Sources of persistence in regional start-up rates—evidence from Sweden. Journal of Economic Geography, 11(1), 179–201. https://doi.org/10.1093/jeg/lbp069.

Armington, C., & Acs, Z. J. (2002). The determinants of regional variation in new firm formation. Regional Studies, 36(1), 33–45. https://doi.org/10.1080/00343400120099843.

Audretsch, D. B., & Belitski, M. (2013). The missing pillar: the creativity theory of knowledge spillover entrepreneurship. Small Business Economics, 41(4), 819–836. https://doi.org/10.1007/s11187-013-9508-6.

Audretsch, D. B., Belitski, M., & Desai, S. (2015). Entrepreneurship and economic development in cities. The Annals of Regional Sciences, 55(1), 33–60. https://doi.org/10.1007/s00168-015-0685-x.

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. The American Economic Review, 86(3), 630–640 https://www.jstor.org/stable/2118216.

Audretsch, D. B., & Fritsch, M. (1994). The geography of firm births in Germany. Regional Studies, 28(4), 359–365. https://doi.org/10.1080/00343409412331348326.

Audretsch, D. B., & Keilbach, M. C. (2007). The localization of entrepreneurship capital: evidence from Germany. Papers in Regional Sciences, 86, 351–365. https://doi.org/10.1111/j.1435-5957.2007.00131.x.

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191–1202. https://doi.org/10.1016/j.respol.2005.03.012.

Bae, J., & Koo, J. (2008). The nature of local knowledge and firm formation. Industrial and Corporate Change, 18(3), 1–24. https://doi.org/10.1093/icc/dtn017.

Bellini, E., Piroli, G., & Pennacchio, L. (2018). Collaborative know-how and trust in university-industry collaborations: empirical evidence from ICT firms. Journal of Technology Transfer. https://doi.org/10.1007/s10961-018-9655-7.

Bellucci, A., & Pennacchio, L. (2016). University knowledge and firm innovation: evidence from European countries. Journal of Technology Transfer, 41(4), 730–752. https://doi.org/10.1007/s10961-015-9408-9.

Bellucci, A., Pennacchio, L., & Zazzaro, A. (2018). Public R&D subsidies: collaborative versus individual place-based programs for SMEs. Small Business Economics. https://doi.org/10.1007/s11187-018-0017-5.

Bishop, P. (2012). Knowledge, diversity and entrepreneurship: a spatial analysis of new firm formation in Great Britain. Entrepreneurship and Regional Development, 24, 641–660.

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2014). The impact of local and external university knowledge on the creation of knowledge-intensive firms: evidence from the Italian case. Small Business Economics, 43(2), 261–287. https://doi.org/10.1007/s11187-013-9536-2.

Boschma, R., & Fritsch, M. (2009). Creative class and regional growth: empirical evidence from seven European countries. Economic Geography, 85(4), 391–423. https://doi.org/10.1111/j.1944-8287.2009.01048.x.

Bruton, G. D., Ahlstrom, D., & Li, H.-L. (2010). Institutional theory and entrepreneurship: where are we now and where need to move in the future? Entrepreneurship Theory and Practice, 34(3), 421–440. https://doi.org/10.1111/j.1540-6520.2010.00390.x.

Caliendo, M., Fossen, F., & Kritikos, A. (2014). Personality characteristics and the decisions to become and stay self-employed. Small Business Economics, 42(4), 787–814. https://doi.org/10.1007/s11187-013-9514-8.

Caliendo, M., & Khunn, S. (2014). Regional effect heterogeneity of start-up subsidies for the unemployed. Regional Studies, 48(6), 1108–1134. https://doi.org/10.1080/00343404.2013.851784.

Cavalli-Sforza, L.L. (2016). L’evoluzione della cultura. Codice Edizioni.

Cerisola, S. (2018). Creativity and local economic development: the role of synergy among different talents. Papers in Regional Science, 97(2), 199–215. https://doi.org/10.1111/pirs.12254.

Chapain, C., & Comunian, R. (2010). Enabling and inhibiting the creative economy: the role of the local and regional dimensions in England. Regional Studies, 44(6), 717–734. https://doi.org/10.1080/00343400903107728.

Colombelli, A. (2016). The impact of local knowledge bases on the creation of innovative start-ups in Italy. Small Business Economics, 47(2), 383–396. https://doi.org/10.1007/s11187-016-9722-0.

Coll-Martínez, E., (2018). Creativity and entrepreneurship: Empirical evidence for Catalonia. CREIP Working Paper, 2/2018.

Doeringer, P., Evans-Klock, C., & Terkla, D. (2004). What attracts high performance factories? Management culture and regional advantage. Regional Science and Urban Economics, 34(5), 591–618. https://doi.org/10.1016/j.regsciurbeco.2003.08.001.

Elfenbein, D. W., Hamilton, B. H., & Zenger, T. R. (2010). The small firm effect and the entrepreneurial spawning of scientists and engineers. Management Science, 56(4), 659–681. https://doi.org/10.1287/mnsc.1090.1130.

Florida, R. (2002). The rise of the creative class. New York: Basic Books.

Florida, R. L. (2004). Cities and the creative class. New York: Routledge.

Florida, R. L. (2014). The rise of the creative class—revisited. New York: Basic Books.

Fotopoulos, G. (2013). On the spatial stickiness of UK new firm formation rates. Journal of Economic Geography, 14(3), 651–679. https://doi.org/10.1093/jeg/lbt011.

Fritsch, M., & Aamoucke, R. (2017). Fields of knowledge in higher education institutions, and innovative start-ups-an empirical investigation. Papers in Regional Science, 96, 1–27. https://doi.org/10.1111/pirs.12175.

Fritsch, M., & Storey, D. J. (2014). Entrepreneurship in a regional context: historical roots, recent developments and future challenges. Regional Studies, 48(6), 939–954. https://doi.org/10.1080/00343404.2014.892574.

Fritsch, M., & Wyrwich, M. (2014). The long persistence of regional levels of entrepreneurship: Germany, 1925–2005. Regional Studies, 48(6), 955–973. https://doi.org/10.1080/00343404.2013.816414.

Fritsch, M., & Wyrwich, M. (2018). Regional knowledge, entrepreneurial culture, and innovative start-ups over time and space―an empirical investigation. Small Business Economics, 51(2), 337–353. https://doi.org/10.1007/s11187-018-0016-6.

Ghani, E., Kerr, W. R., & O’Connell, S. (2014). Spatial determinants of entrepreneurship in India. Regional Studies, 48(6), 1071–1089. https://doi.org/10.1080/00343404.2013.839869.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who creates jobs? Small versus large versus young. Review of Economics and Statistics, 95(2), 347–361. https://doi.org/10.1162/REST_a_00288.

Helfat, C. E., & Lieberman, M. B. (2002). The birth of capabilities: market entry and the importance of pre-history. Industrial and Corporate Change, 11(4), 725–760. https://doi.org/10.1093/icc/11.4.725.

Jaffe, A. B., Trajtenberg, M., & Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. Quarterly Journal of Economics, 108(3), 577–598 https://www.jstor.org/stable/2118401.

Laspita, S., Breugst, N., Heblich, S., & Patzelt, H. (2012). Intergenerational transmission of entrepreneurial intentions. Journal of Business Venturing, 27(4), 414–435. https://doi.org/10.1016/j.jbusvent.2011.11.006.

Lazzeretti, L., Boix, R., & Capone, F. (2008). Do creative industries cluster? Mapping creative local production systems in Italy and Spain. Industry & Innovation, 15(5), 549–567. https://doi.org/10.1080/13662710802374161.

Lee, S. Y., Florida, R., & Acs, Z. (2004). Creativity and entrepreneurship: a regional analysis of new firm formation. Regional Studies, 38(8), 879–891. https://doi.org/10.1080/0034340042000280910.

Lee, N. I., & Rodríguez-Pose, A. (2014). Innovation in creative cities: evidence from British small firms. Industry and Innovation, 21(6), 494–512. https://doi.org/10.1080/13662716.2014.983748.

Mazzucato, M. (2011). The entrepreneurial state. Soundings, 49, 131–142.

Mazzucato, M. (2013). Financing innovation: creative destruction vs. destructive creation. Industrial and Corporate Change, 22(4), 851–867. https://doi.org/10.1093/icc/dtt025.

Obschonka, M., & Silbereisen, R. K. (2012). Entrepreneurship from a development science perspective. International Journal of Development Science, 6, 107–115. https://doi.org/10.3233/DEV-2012-12105.

Obschonka, M., Schmitt-Rodermund, E., Gosling, S. D., & Silbereisen, R. K. (2013). The regional distribution and correlates of an entrepreneurship-prone personality profile in the United States, Germany, and the United Kingdom: a socioecological perspective. Journal of Personality and Social Psychology, 105, 104–122. https://doi.org/10.1037/a0032275.

Pan, F., & Yang, B. (2018). Financial development and the geographies of startup cities: evidence from China. Small Business Economics. https://doi.org/10.1007/s11187-017-9983-2.

Piergiovanni, R., Carree, M., & Santarelli, E. (2012). Creative industries, new business formation, and regional economic growth. Small Business Economics, 39(3), 539–560. https://doi.org/10.1007/s11187-011-9329-4.

Qian, H., & Acs, Z. J. (2013). An absorptive capacity theory of knowledge spillover entrepreneurship. Small Business Economics, 40(2), 185–197. https://doi.org/10.1007/s11187-011-9368-x.

Reynolds, P. D., Storey, D. J., & Westhead, P. (1994). Cross-national comparisons of the variation in new firm formation rates. Regional Studies, 28(4), 443–456. https://doi.org/10.1080/00343409412331348386.

Santagata, W. (2002). Creativity, fashion, and market behavior. University of Torino Working Paper 05/2002.

Scott, A. J. (2006). Entrepreneurship, innovation and industrial development: geography and the creative field revisited. Small Business Economics, 26(1), 1–24. https://doi.org/10.1007/s11187-004-6493-9.

Schubert, T., & Kroll, H. (2016). Universities’ effects on regional GDP and unemployment: the case of Germany. Papers in Regional Sciences, 95(3), 467–489. https://doi.org/10.1111/pirs.12150.

Singer, C. J. (1959). Short history of scientific ideas to 1900. New York: Oxford University Press.

Sorgner, A., & Fritsch, M. (2013). Occupational choice and self-employment—are they related? Jena Economic Research Papers No. 001-2013.

Sternberg, R. J. (1999). Handbook of creativity. New York: Cambridge University Press.

Storey, D. J., & Johnson, S. (1987). Regional variation in entrepreneurship in the UK. Scottish Journal of Political Economy, 34, 161–173. https://doi.org/10.1111/j.1467-9485.1987.tb00276.x.

Stuetzer, M., Obschonka, M., Audretsch, D. B., Wyrwich, M., Rentfrow, P. J., Coombes, M., Shaw-Taylor, L., & Satchell, M. (2016). Industry structure, entrepreneurship, and culture: an empirical analysis using historical coalfields. European Economic Review, 86, 52–72. https://doi.org/10.1016/j.euroecorev.2015.08.012.

UNCTAD (2008). Creative economy. Report 2008, UNDP (UNCTAD): Geneva-New York.

Urbano, D., Aparicio, S., & Audretsch, D. (2018). Twenty-five years of research on institutions, entrepreneurship, and economic growth: what has been learned? Small Business Economics. https://doi.org/10.1007/s11187-018-0038-0.

Acknowledgements

We are grateful to participants at the SIEPI (Rome, Italy) and ICEED (Bari, Italy) conferences for their invaluable comments.

Funding

Luca Pennacchio acknowledges financial support from Parthenope University through the research grants “Bando di sostegno alla ricerca individuale per il triennio 2015–2017” (years 2016 and 2017).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Del Monte, A., Pennacchio, L. Historical roots of regional entrepreneurship: the role of knowledge and creativity. Small Bus Econ 55, 1–22 (2020). https://doi.org/10.1007/s11187-019-00139-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00139-8