Abstract

Company survival after recessions depends on the entrepreneurial ability of decision makers to react to the crisis and learn how to make the best use of chances. The aim of this paper is to shed light on the relationship between post-crisis firm survival, learning, and firm’s entrepreneurial behavior measured by business model changes. Specifically, we test if firm survival after the 2009 recession has been affected by changes in the business model occurred in the period of recovery between the two recessions (2004–08), and if these changes are the result of deliberate reactions to the 2003 recession—i.e., learning hypothesis. The analysis of 67,241 Italian manufacturing firms suggests that business model changes have affected post-crisis firm survival by lowering the probability of default. However, the adoption of these default-reducing business model changes did not result to be significantly more frequent in firms that performed poorly during the 2003 crisis, thus providing weak support to the role of entrepreneurial learning in reducing defaults.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic recessions are recurring events in the world economy and they affect the competitive landscape profoundly (Srinivasan et al. 2011). Because of their cyclicality, they have two major implications for the firm behavior. On the one hand, firms must adapt and renew their strategic behavior to cope with permanent changes in the industry dynamics caused by recessions. This may take place through a significant reconfiguration of the business model. The literature on corporate entrepreneurship has recognized the change of the business model as a distinctive expression of the entrepreneurial behavior, especially when the limited organizational size does not permit the adoption of complex managerial strategies (Kuratko et al. 2015; Kuratko and Audretsch 2013; Basu and Wadhwa 2013; Chindooroy et al. 2007). On the other hand, as firms are likely to experience several crises during their life, changes in the business model can be non-randomly fostered and shaped by previous experiences of recession, as firms are expected to learn how to cope with recurring shocks.

In a recent literature review, George and Bock (2011) stress that the dynamics of business models represent a potentially rich source of information about how firm characteristics and strategies interact and adapt to environmental changes (Casadesus-Masanell and Ricart 2010). Zott and Amit (2007, 2008) and Teece (2010) argue that understanding business models, and especially how they interact with other elements, is one of the most promising avenues for explaining the firm’s competitive structure. Business model innovations have been identified as the actions of modifying the firm’s activity system to create value (Morris et al. 2005), exploit new opportunities (Cucculelli and Bettinelli 2015), and carry out strategic entrepreneurship initiatives (George and Bock 2011; Schneider and Spieth 2013. In this sense, the business model construct builds upon the value chain concept and the notions of value systems, strategic positioning (Porter 1985, 1996), strategic network (Jarillo 1995), and transaction costs (Williamson 1981).

By using the business model change as a proxy for corporate entrepreneurial reaction to recessions, this paper investigates whether post-crisis firm survival is affected by changes in companies’ business model, and identifies a set of default-reducing strategies that increase the chance for firms to survive future economic downturns. Then, the paper tests whether these strategies have been implemented by those companies that performed poorly in a previous recession, i.e., whether these changes are an outcome of a deliberate learning process driven by the experience the company had with a previous crisis, or the result of a pure random adoption.

The empirical analysis has been carried out on a sample of 67,241 Italian manufacturing firms, mostly SMEs, whose financial data are available for the periods 2002–2012. As business model changes may either occur randomly or be the result of previous crisis experience, we adopt a two-step estimation technique to investigate whether post-crisis survival was affected by changes in companies’ business model, and whether business model changes were induced by previous poor performances (learning hypothesis). We identify business model changes through the modification of a set of measures that proxies for the renewal process observed in the company. More specifically, we use the following indicators of the organizational structure: (i) the degree of vertical integration (computed as value added on sales), (ii) the intensity of investments in intangible assets (computed as R&D and advertising on total assets), and (iii) the complexity of the external services network (computed as external services on total sales).

By way of preview, in line with the idea that strategic entrepreneurship initiatives represent a valid way to ensure long-term performance (Grewal and Tansuhaj 2001; George and Bock 2011; Kuratko et al. 2015; Kuratko and Audretsch 2013), we find that business model changes positively affect post-crisis firm survival. More specifically, we find that company default probability declines with reduced vertical integration, less complex business models, and increased investment in intangible assets, which we classify as crisis-resistant business model changes or strategies. When it comes to learning, instead, we find that companies hit by the first recession (poor performers in 2003) in general did not adopt crisis-resistant business model changes, except in the case of complexity. Moreover, for those few who implemented them, the adoption has been only marginally affected by previous crisis experience, thus providing limited support to the learning hypothesis. Finally, splitting the sample by districtual affiliation and family ownership provides further evidence on the issue. If being in a districtual area does not help firms to adopt a default-reducing strategy, family ownership does help when the change of the business model involves intangible investments. This evidence supports the conclusion that some degree of isomorphism in company behavior may be present both in industrial districts and family businesses, as they tend to replicate existing courses of actions (Lieberman and Asaba 2006; Carroll and Hannan 1995; Hannan et al. 1995). This result is also consistent with the issue of renewing competencies in districtual firms, and the long-term perspective and entrepreneurial orientation of family-owned companies (Thomsen 1999; Zahra et al. 2004; Eddleston et al. 2012).

In providing this evidence, the paper contributes to different fields of the current literature. First, by analyzing business model innovation and its impact on firm survival in a very large sample of Italian manufacturing firms, we contribute to the literature on business model in small- and medium-sized enterprises. The analysis of business model innovation should be of the outmost importance in the aftermath of an economic downturn, when strategic reconfiguration is crucial for firm survival, especially in small- and medium-sized firms. Italy represents the ideal environment to carry out this study, as the industrial structure is mainly composed by SMEs, and innovation is often carried out by firms with medium size (Minetti et al. 2015). Second, we add to the literature on organizational learning, by investigating whether companies characterized by a negative performance during a recession selected strategies associated with a lower ex post default probability in a subsequent economic downturn. In this sense, we find that previous crisis experience promotes the adoption of crisis-resistant behavior only when a measure of complexity is considered in the empirical analysis. Hence, we only partially confirm the organizational learning hypothesis. Third, as business model innovation has been largely defined as a strategic entrepreneurship initiative (Kuratko and Audretsch 2013; Kuratko et al. 2015), this paper contributes to the growing literature on corporate entrepreneurship and its impact on firm performance (Corbett et al. 2013; Kuratko and Audretsch 2013; Cucculelli and Bettinelli 2015; Kuratko et al. 2015). More specifically, our finding that increasing investments in intangibles have positive effects on firm survival confirms that innovation is at the center of corporate entrepreneurship activities. Finally, we contribute to the understanding of the role of external sociocultural, economic, and market conditions in the pursuit of corporate entrepreneurship strategies, by analyzing the effects of economic crises and organizational learning in specific contexts as family-owned firms and industrial districts.

The remainder of the paper is organized as follows. Section 2 reviews the current literature on business model changes, post-crisis firm survival, and organizational learning within the crisis framework. Section 3 describes the dataset, the variables, and the econometric approach used to perform the empirical analysis. Section 4 presents the estimation results and Section 5 concludes.

2 Background literature and hypotheses development

Our research is primarily related to two strands of the business and economic literature: first, the literature on firms’ reaction to crisis in terms of business model change and its impact of firm survival and second, the research on organizational learning after a recession, and the role played by both family ownership and districtual affiliation.

2.1 Firms’ reaction to crisis: business model changes and firm survival

The literature on firms’ reaction to crisis is dominated by financial research and, more precisely, by studies that evaluate the effects of different ownership and governance models on firm’s performance during the economic recession (Leung and Horwitz 2010; Liu et al. 2012). Conversely, there are not so many papers investigating the firms’ reaction to crisis by adopting the lens and paradigms of business analysis and entrepreneurial studies (Smith and Elliott 2007; Latham 2009; Marsen 2014).

The literature on innovation is more revealing: reactive strategies towards the crisis can be particularly visible within the decision-making of innovation processes. Archibugi et al. (2013) propose two contrasting hypotheses on the relation between innovation and business cycles. According to the cyclical hypothesis, companies’ investments in innovation increase in periods of prosperity and decline during economic crises, due to the low profit margins and the overall pessimistic view in times of downturns (Freeman et al. 1982).Footnote 1 On the other hand, Mensch (1979) claims that innovations tend to be rather countercyclical, as most of the enterprises tend to “play safe” in periods of economic expansion by exploiting the existing rents, and are forced to innovate only when the value of such rents falls, as during economic recessions.

Hence, the existing theoretical literature suggests heterogeneous, or even contrasting, responses towards the crisis. The ability of the company to renew and reshape its competitive profile can benefit from difficult times, as firms may be induced to get rid of non-profitable techniques and products (“pit stop” view and “cleansing effect” of recession, Caballero and Hammour 1996). On the other hand, firm renewal may be stopped by a strategic timing effect that leads firms to introduce new procedures only when the market recovers, and not when it declines (Barlevy 2004).

A second research area considers firms’ reaction to crisis in terms of business model changes. Although business model research is gaining increasing attention, a unique definition of business model does not exist. A recent literature review concludes that business models are a holistic way of describing how companies operate, seeking to explain value creation, value delivery to customers, and value capture by the company (Zott et al. 2011; Cucculelli and Bettinelli 2015). In the context of small and medium enterprises, business models are also defined as “the design of organizational structures to enact a commercial opportunity” (George and Bock 2011:99). A change in firms’ business model, therefore, determines a change in the way companies act and it generally occurs with the specific aim to gain competitiveness. As Kuratko and Audretsch (2013) point out, there are two possible reference points to be considered when a business model change occurs: (i) how much the firm is transforming itself relative to where it was before and (ii) how much the firm is transforming itself relative to industry standards. Although certain business model changes may not be innovative to the industry, they may be new for the business itself involving simultaneous opportunity-seeking and advantage-seeking behaviors (Ireland et al. 2003).

It is generally recognized that business models can be both enabling and limiting elements for the company’s growth (Amit and Zott 2001; Morris et al. 2005). Indeed, there is evidence that business models enable a firm’s success when they are dynamic: a recent literature review reveals “an increasing consensus that business model innovation is key to firm performance” (Zott et al. 2011: 1033). However, there may be some barriers to business model improvement: firm’s assets and processes may be subject to inertia, and managers may fail to recognize the latent value of business model changes (Bouchikhi and Kimberly 2003; Chesbrough 2010). The empirical evidence shows that business models are intertwined with strategy, firm performance, and competitiveness (Acs and Amorós 2008; Zott and Amit 2008), and supports the existence of a potential persistency in firms’ organizational structure. For example, by measuring business model adjustments through changes in firm’s products and markets, Andries and Debackere (2007) found that business model changes increase firm survival in the case of new companies operating in capital-intensive and high-velocity industries, while they are not significant for those firms working in more stable industry sectors.

The empirical research also views business model adjustments as a way to exploit new opportunities and to adapt to the firm’s life-cycle changes (Franke et al. 2008; George and Bock 2011; Markides 2008). In this sense, business model innovation can be seen as a vehicle for firm rejuvenation (Demil and Lecocq 2010; Ireland et al. 2001; Johnson et al. 2008; Sosna et al. 2010). It represents a way to innovate and to ensure both firm survival (Perlow et al. 2002; Thoma 2009) and long-term performance (George and Bock 2011; Grewal and Tansuhaj 2001), especially in contexts where competition, risk, and uncertainty are high, as in times of economic downturns.

Hence, we test the following hypothesis:

Hypothesis 1 Business model changes affect post-crisis firm survival.

2.2 Learning from crisis

Since Cyert and March (1963)’s seminal work, the economic literature has considered organizational learning a key strategic capability in explaining firm success, as it allows a continuous adaptation to the rapidly changing market conditions (Bapuji and Crossan 2004; Kandemir and Hult 2005). As shown by the extensive empirical research, companies are more likely to modify their behavior when they underperform with respect to competitors or expected and desired results. However, decision makers’ propensity to change may be also correlated with slack resources, thus making the probability to observe business model changes dependent on both bad and good performances.

Recent research addresses the benefits of organizational learning in several business areas: organizational performance (Azadegan and Dooley 2010), market orientation (Santos-Vijande et al. 2005; Stein and Smith 2009), service quality (Tucker et al. 2007), innovation (Akgün et al. 2006; Weerawardena et al. 2006), and human resource performance (Bhatnagar 2007). After the recent economic crisis, many economists have also started to investigate the role of organizational learning within the crisis reaction framework, by examining whether those companies that experienced previous crises survived better to the last economic downturn. Desai (2014) analyzes whether and how public reporting of details about recent failures affects companies’ organizational learning in terms of new failure experience. Herbane (2014) investigates whether organizations have learned thanks to the introduction of crisis management planning and whether new information sources, such as SME networks and forums, have been important in shaping the learning process. Cucculelli and Bettinelli (2016) analyze how organizational learning and firm internal factors, such as CEO’s origin, tenure, and turnover, affect the firm’s reactions to the economic recession. Overall, these empirical studies claimed that former negative events and experiences affect companies’ management actions and decision-making process. Hence, firms facing economic shocks should be more likely to adopt reactive strategies in subsequent crisis frameworks as an outcome of the learning process.

The ability of learning from previous crisis may also depend on companies’ specific characteristics, and in particular, by firms’ ownership structure and industrial localization. The literature on family businesses has extensively highlighted the peculiarities of family-owned firms: long-term orientation (Miller and Le Breton-Miller 2005), family social capital (Arregle et al. 2007), survival, and reputation concerns (Miller et al. 2008). All these features are likely to induce family companies to adapt to the changes in the economic environment by learning from previous experiences. In a similar way, firms located in industrial districts (IDs, i.e., areas with a high predominance of micro and small businesses that build their competitiveness on a system of inter-firm relationships) should be more inclined to adapt their behavior to the changing market conditions. This should happen because of their imitative and herding behavior, and the optimal information sharing that characterizes the districtual areas (Dei Ottati 1995). In industrial district, tacit knowledge and values are created over long periods of time and transmitted into the wider community to facilitate low-cost coordination, efficiency, and to regulate competition. Although during economic recessions, firms operating in industrial districts may lose their renewal potential (Menzel and Fornahl 2010), they may be more able to survive and learning from crisis experiences, due to their ability to imitate better-performing companies.

Given this theoretical background, we test the following two complementary hypotheses:

Hypothesis 2 (Learning Hypothesis) The adoption of default-reducing strategies depends on previous crisis experience.

Hypothesis 3 The ability of the firm to learn from a crisis is associated with firm ownership and districtual affiliation.

3 Empirical analysis

3.1 Data

The empirical analysis has been carried out on a sample of Italian firms drawn from the BvD-AIDA database.Footnote 2 BvD-AIDA collects annual accounts from Italian companies and contains information on a wide set of economic and financial variables, such as sales, costs and number of employees, value added, tangible and intangible assets, start-up year, sector of activity, legal status, and ownership type. By relying on firms’ ATECO 2007 code,Footnote 3 we only considered in the sample Italian manufacturing firms, i.e., firms belonging to section “C” (divisions from 10 to 32), operating in the periods 2002–2012.

A total of 67,241 small- and medium-sized companies have been included in the final sample. They represent a very large share of the universe of Italian manufacturing industry: in comparison with the National Census of Economic Activities for the year 2011, sample firms represent 16.2% of all the Italian manufacturing firms (including sole proprietorships) and 51.1% of companies with compulsory obligation to deposit their financial statement. When split by firm size, the incidence of the sample on the total number of firms with compulsory financial statement deposit is 47.8% for firms with less than 50 employees and 92.9% for companies with more than 50 employees (see Table 7 in the Appendix). Given these numbers, we are confident that our sample is well suited for the analysis of the Italian manufacturing industry.

3.2 Variable definitions

In Table 1, we report the complete list of the dependent and independent variables employed in the empirical analysis, the associated descriptive statistics and definitions. Here, we provide a detailed description of their measurement.

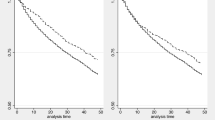

3.2.1 Firm survival

BvD-AIDA provides up-to-date information about companies’ legal status by identifying year by year “Active,” “Into Liquidation,” and “Inactive” firms. We rely on this categorization for the purpose of detecting those companies that did not survive after the economic recession. More specifically, we built a dummy variable Default, which is equal to one if the firm results to be “Into Liquidation” or “Inactive” in 2013, and 0 otherwise, i.e., if the company is “Active” in the same year.

As reported in Table 1, the incidence of failed companies in our sample is rather low, as only 5% of the sample firms result to be in default in 2013.Footnote 4

3.2.2 Business model change

Business model innovation has been largely identified as a way to carry out strategic entrepreneurship initiatives (George and Bock 2011; Schneider and Spieth 2013; Pozzana 2011; Cucculelli and Bettinelli 2015). With respect to SMEs, business model changes have been also defined as those actions aimed at modifying the firm’s existing activity system to enact and exploit new opportunities (Cucculelli and Bettinelli 2015). Morris et al. (2005) argue that the business model construct builds upon the value chain concept, the notions of value system and strategic position (Porter 1985, 1996), the strategic network theory (Jarillo 1995), and the transaction cost economics (Williamson 1981). Consistently with this view, as the current literature does not provide a unique operational definition of business model, in this paper we identify business model innovation through a set of accounting measures proxying for the innovation and strategic positioning processes observed within the company. More specifically, we use the following indicators of the organizational structure: (i) the degree of vertical integration (computed as value added on sales), which accounts for transaction costs strategies and value chain positioning; (ii) the intensity of investments in intangible assets (computed as R&D and advertising on total assets), which measures firm’s propensity to innovate; and (iii) the complexity of the external services network (computed as external services on total sales), which accounts for the firm’s positioning in a strategic network.

Kuratko and Audretsch (2013) point out that there are two possible reference points to be considered when a business model change occurs: (i) how much the firm is transforming itself relative to where it was before and (ii) how much the firm is transforming itself relative to industry standards. As we follow the first approach, business model changes between 2003 and 2008 are identified by a variation in our indicators outside the range plus/minus 10%.Footnote 5 In particular, starting from our three business model measures (Vertical Integration, Intangibles, Complexity), we built the following dummy variables: Increased Vertical Integration, a dummy variable equal to one if value added on total sales increased more than 10% between 2003 and 2008, and zero otherwise; Reduced Vertical Integration, a dummy variable equal to one if value added on total sales reduced more than 10% between 2003 and 2008, and zero otherwise; Increased Intangibles, a dummy variable equal to one if investments in intangibles (scaled by total assets) increased more than 10% between 2003 and 2008, and zero otherwise; Reduced Intangibles, a dummy variable equal to one if investments in intangibles (scaled by total assets) reduced more than 10% between 2003 and 2008, and zero otherwise; Increased Complexity, a dummy variable equal to one if external services on total sales increased more than 10% between 2003 and 2008, and zero otherwise; Reduced Complexity, a dummy variable equal to one if external services on total sales reduced more than 10% between 2003 and 2008, and zero otherwise.

3.2.3 Family ownership

In order to correctly identify family-owned firms, we rely on the “Global Ultimate Owner” (GUO) indicator provided by BvD-AIDA.Footnote 6 Despite only partially coherent with the many definitions employed in the empirical literature on family businesses, the procedure of using the GUO indicator is now a standard approach for all those empirical studies that employ data from BvD sources. More specifically, companies with a GUO equal to “one or more named individuals or families” are classified as family firms.

3.2.4 Districtual affiliation

Companies’ districtual affiliation is determined by matching information on firm localization provided by BvD-AIDA and the industrial district (ID) classification developed by the Italian Central Institute of Statistics (ISTAT). The identification of IDs is based on a multiple-stage algorithm developed by Sforzi (1987); in the first step, by grounding on census information about daily commuting movements of employees, the algorithm identifies the “Local Labor Systems” (LLSs); then, in the second step, the identified LLSs are differentiated on the basis of their economic characteristics. Only LLS with (i) high presence of small- and medium-sized firms and (ii) high degree of industry specialization are classified as “Industrial Districts” (Istat 2005). On the basis of 2001 population census and 2001 economic activities census, ISTAT identified 156 IDs in Italy: 42 in the North East, 39 in the North West, 49 in the Centre, and 26 in the South of Italy.

Following this classification, we build the dummy variable District, which is equal to one if the firm belongs to an industrial district, and zero otherwise. In our sample, as reported in Table 1, 43.4% of firms belong to IDs, whereas 56.6% are categorized as non-districtual businesses.

3.2.5 Poor performers in 2003

To test the learning hypothesis (Hypothesis n.2), we evaluate whether the adoption of default-reducing strategies (i.e., business models positively related to firm survival) has been significantly affected by companies’ past performance, and in particular, by the relative performance registered in 2003 after the economic downturn.

In this study, relative performance is measured using the following definition of adjusted ROS:

that is the difference between firm i’s ROS and the median ROS of its competitors at the same three-digit sector, province, and size class. Then, building on this indicator, we compute the dummy variable Poor Performance, which is equal to one if firm i’s individual ROS was lower than the median ROS of its industry sector in 2003 (i.e., if Adj(ROS)ijts < 0), and zero otherwise (i.e., if Adj(ROS)ijts > 0).

3.3 Econometric specification

As business model changes may either occur randomly or be the result of previous crisis experience, we adopt a two-step estimation technique to investigate whether post-crisis firm survival was affected by changes in companies’ business model, and whether business model changes were induced by previous poor performances.

More specifically, in the second stage, we estimate the following equation:

where the dependent variable Defaulti is a dummy variable equal to one if firm i is no longer active in 2013, and zero otherwise; Zi is a set of firm-specific control; ui is the error term; and \( \Delta {\widehat{BM}}_i \) are the predicted probabilities obtained from the estimation of the first-step equationFootnote 7:

where the dependent variable ∆BM denotes, alternatively, one of the business model measures described in Section 4.2.2 (i.e., Increased Vertical Integration; Reduced Vertical Integration; Increased Intangibles; Reduced Intangibles; Increased Complexity; Reduced Complexity); Poor Performancei is a dummy variable equal to one if firm i experienced a negative relative performance in 2003, and zero otherwise; Family Firmi is a dummy variable equal to one if the company is owned by a family, and zero otherwise; Districti is a dummy variable equal to one if firm i belongs to an industrial district, and zero otherwise; Xi is a set of firm specific control; and vi is the error term. The variable Poor Performancei has been then interacted with variables Family Firmi and Districti to evaluate the influence of these two variables on the learning mechanism. Correlation coefficients for all the variables included in the empirical analysis are reported in Table 2.

4 Results

4.1 Preliminary descriptive evidence

Table 3 reports some preliminary results about the relationship between business model changes and firm survival. Our three indicators of business model change (Increased/Reduced Vertical Integration; Increased/Reduced Intangibles; Increased/Reduced Complexity) are computed for the periods 2003–2008, whereas the default probability is calculated in 2013, after the economic recession.Footnote 8

Starting from Vertical Integration, only 19.1% of sample firms reduced the amount of value added on total sales, whereas more than 50% (56.7%) of companies increased their Vertical Integration index; about 24% did not change the ratio between value added and total sales. The default probability characterizing this last group of firms is the lowest (0.057%), suggesting that not to change firm’s vertical integration appears to be the best strategy for ensuring firm survival after a crisis. Conversely, reducing vertical integration appears to be associated with the highest default probability. Regarding companies’ investments in intangible assets, the most common strategy between 2003 and 2008 was to reduce the share of intangibles: 37.9% of firms are associated with an increased Intangibles indicator, whereas about 54% of companies reduced the amount of intangible assets. Interestingly, only 7.9% of companies did not change their investment in intangibles policy. When the default probability is adopted as a measure of effectiveness of the business model change, the lowest default ratio is observed for the group of firms that reduced the share of intangibles on total assets, thus making this strategy the best one. Finally, when the complexity indicator as a measure of business model is analyzed, it results that the shares of firms that increased, reduced, or did not change the amount of external services are very similar: 32.5% of companies show an increased Complexity, 33.5% are associated with an unchanged Complexity index, and 34% of firms are characterized by a reduced ratio of external services on total sales. Also, the default probability is almost similar across the possible strategies, suggesting that, apparently, there is not a preferred behavior.

Overall, the above descriptive evidence indicates that the most effective strategy for reducing the default probability in 2013 mainly involved (i) an unchanged vertical integration and (ii) a reduction of investment in intangibles. In the following section, these findings are tested through a multivariate approach, which accounts for additional variables that may affect the relationship between business model changes and firm survival.

4.2 Estimation results

In this section, we present the empirical results obtained from the estimation of the two-step model described above (Section 3.3). In particular, we first report the findings related to the impact of business model changes on post-crisis firm survival (Hypothesis 1) by identifying the default-reducing strategies. Then, we move to the learning hypothesis results, by showing whether crisis-resistant business model changes have been adopted as a consequence of previous crisis experience (Hypothesis 2). Finally, we delve into the role of districtual affiliation and family ownership within the learning process (Hypothesis 3).

4.2.1 Business model changes and firm survival

Table 4 reports the estimated coefficients of the second-step estimation equation (Eq. (2)), which investigates the impact of business model changes on post-crisis firm survival. Starting with our first measure of business model, that is Vertical Integration, as indicated in columns (1) and (2) of Table 4, Increased Vertical Integration is positively associated with the default probability, whereas Reduced Vertical Integration results to be related with a higher survival rate. The estimated coefficients are respectively 0.205*** and − 0.185***, both statistically significant at the 99% level. Taken together, these findings do not reject the hypothesis that firms adopting less integrated business models in 2008 were less likely to default after the crisis in 2013.

Moving to our second proxy of business model change, i.e., the variation of the share of intangible assets, estimation results indicate that post-crisis default reduces when the intensity of intangibles increases (Increased Intangibles, column (3)) and grows when intangible investments decreases (Reduced Intangibles, column (4)). Both the estimated coefficients, − 1.540*** and 2.791***, are statistically very significant. Overall, these findings suggest that companies increasing intangible investments between 2003 and 2008 are associated with a lower ex post default probability after the economic recession. Finally, with regard to the last two indicators of business model changes, i.e., Increased Complexity and Reduced Complexity, estimation results reported in columns (5) and (6) show that less complex business models help firm survival. The estimated coefficients are, respectively, 0.263*** for the Increased Complexity variable and − 0.344*** for the Reduced Complexity indicator.

Summing up, the evidence described above confirms our Hypothesis 1, as business model changes significantly affect post-crisis firm survival. More specifically, our findings indicate that default probability declines with reduced vertical integration, less complex business models, and increased investment in intangible assets. Therefore, Reduced Vertical Integration, Increased Intangibles, and Reduced Complexity may be classified as crisis-resistant (or good) strategies.Footnote 9

4.2.2 Organizational learning and the adoption of default-reducing strategies

Table 5 presents the estimation results of Eq. (3), which tests the learning hypothesis (Hypothesis 2). Columns (1) to (6) summarize the impact of poor performance on the probability of adopting a more (less) integrated business model, more (less) intense intangible investments, and a more (less) complex value network.

If business model changes occurred as a consequence of the 2003 economic crisis, the learning hypothesis implies a positive coefficient in the relation between the Poor Performance dummy and crisis-resistant strategies, i.e., those strategies associated with a lower default probability. From the estimation results presented in the previous section, we know that these strategies are (i) reducing vertical integration (column (2)), (ii) increasing intangible investments (column (3)), and (iii) decreasing network system complexity (column (6)). By the sign of the coefficients related to these strategic options, learning seems very unlikely to occur. As reported in columns (2) and (3), for both the Reduced Vertical Integration and Increased Intangibles indicators, the estimated coefficients are negative and statistically significant (respectively, − 0.387*** and − 0.037***). This evidence does not support our hypothesis, suggesting that poor performers actually adopted those strategies that proved to be less effective in reducing the probability of default. Conversely, poor performers seem to have selected the good strategy in the case of changes of business model aimed at reducing the complexity of the business network, as the estimated coefficient of the Poor Performance dummy is positive and statistically significant (0.179***) when related to the Reduced Complexity index.

Overall, these findings indicate that learning have had a limited impact on reshaping the firm strategic approach, except in the case of network complexity. Therefore, as the adoption of default-reducing strategies only marginally depends on previous crisis experience, Hypothesis 2 is only partially confirmed.

Table 6 reports the estimation results related to the impact of family ownership and districtual affiliation on companies’ learning ability. A positive sign of the interaction terms between these two variables (Family Firm and District) and the Poor Performance dummy indicates a positive contribution to the selection of default-reducing strategies. Conversely, a negative or null estimated coefficient suggests an adverse or null influence of the two factors. As shown in the table, the impact of family ownership and districtual affiliation is not significant in the case of Reduced Vertical Integration (column (2)), and negative and statistically significant in the case of Reduced Complexity (column (6)). This means that companies belonging to these two groups have not diverged from the average firm decision in the case of vertical integration, but have negatively affected the selection of the good strategy in the case of complexity. In this last case, inertia in the strategic behavior, together with a likely lack of competencies or risk aversion have probably motivated the no-change strategy chosen by districtual and family firms. Conversely, and contrary to the general pattern of strategic response to crisis, family businesses have positively contributed to the adoption of intangible-driven strategies (Increased Intangibles, column (3)), probably thanks to their long-term orientation and reputation concerns (Thomsen 1999; Bjuggren and Sund 2014).

5 Concluding remarks

SMEs have been strongly hit by the global financial crisis. These firms are particularly vulnerable during economic and financial recessions because of many reasons, among which are the difficulty to downsize, the lower extent of diversification in economic activities, a weaker financial structure, and the strong dependence on external credit as a main financing option. While large companies’ reactions to crises are largely based on “managerial” solutions (such as actions targeted to efficiency improvements, strategic turnarounds, international expansion via new branches or FDI, mergers and acquisitions, and more complex financing models), small firms usually respond to difficult economic conditions through entrepreneurial reactions, such as business model innovation.

The paper analyzes the role of learning from crisis on the entrepreneurial ability of a company to adapt to a new competitive landscape through the adoption of a new or renewed business model. By investigating the impact of changes occurred in business models on the company default probability, the paper contributes to the debate concerning the impact of external events in shaping the firms’ entrepreneurial strategy and the organizational learning from past experiences.

The paper identifies business model changes by using a set of measures of the business structure of the company, such as the degree of vertical integration, the intensity of investments in intangible assets, and the complexity of the external services network. We find that the probability of default estimated in 2013 increases with the complexity of the business model adopted in 2008, as measured by the firm vertical integration and the complexity of network of external services, whereas it declines with the intensity of investment in intangible assets. Furthermore, we do not find evidence of a significant learning process driven by the crisis: conditional on having adopted a new business model in 2008, poor performers have not selected—on average—business models associated with a lower default probability, the only exception being those aimed at reducing the organizational complexity. Besides, neither being in a districtual area nor having a family ownership correlates with a more intense (learning) ability to adopt default-reducing business models. However, family firms are more likely than average to adopt an intangible-driven business model that proved successful in reducing the probability of default after recession.

This evidence supports the conclusion that a degree of isomorphism in company behavior may be present both in districts and in family firms, as they tend to replicate existing courses of actions. This result is also consistent with the assumed lack of (new) competencies in districtual firms, or the preference for risk-avoiding strategies in family firms. Conversely, family corporate entrepreneurship seems to help family-owned companies to adopt long-term strategies aimed at preserving the company for future generations.

The paper presents a number of limitations, mainly concerning the variables used to operationalize the changes in the business model. Firstly, these variables can be complementary and should not be considered in isolation. Secondly, they mainly describe the operative structure of the company and only tangentially the strategic response of the company. Therefore, they could be usefully complemented by more specific proxies of the firm entrepreneurial behavior, consistently derived from the growing literature on corporate entrepreneurship and business model innovation.

As for the implications, at the firm-level, the paper suggests to avoid complexity and vertical integration as the safest strategic options to ensure post-crisis firm survival, together with an intense investment in intangible assets. At the aggregate level, instead, the research points out that the absence of significant learning by company may amplify the impact of economic downturns on aggregate performance, as this influence depends on how much firms are able to learn from previous experience. Even an equilibrating mechanism that restores stability after a crisis may turn out to be ineffective if companies are supposed to adjust once they learn from previous experience. In this scenario, self-regulating systems, as those operating in industrial districts, may be only partially effective if learning is limited. Conversely, compensating mechanisms that are usually neglected, as the role of family ownership in sustaining investment in intangibles, may gain more relevance (Thomsen 1999). Industrial policy should therefore include these tools in the larger set of instruments that are normally taken into account to address the entrepreneurial reorganization of the economy after a crisis, especially when the economic system is made of a large number of SMEs, owned and managed by families and located in districtual areas.

Notes

This view is also confirmed by the theoretical research on the demand impact on innovation (Geroski and Walters 1995): the rising demand during economic booms provides more fertile ground for the product absorption than during recessions. Moreover, as firms have only limited periods of advantage over their competitors (Schumpeter 1939), during which they reap their returns to investments, it is safer for them to come up with such activities when the economy is growing.

BvD-AIDA is an authoritative and reliable source of information on Italian companies. Information is drawn from official data recorded at the Italian Registry of Companies and from financial statements filed at the Italian Chambers of Commerce. BvD-AIDA provides information on more than 500,000 joint stock, public and private limited share companies, and limited liability companies (Spa and Srl) that furnish data on a compulsory basis. The information provided includes credit reports, company profiles, and summary financial statements (balance sheet, profit and loss accounts, and ratios) updated every year.

ATECO is the classification of economic activity used by the Italian Institute of Statistics (ISTAT). It is the translation of the NACE code (Nomenclature statistique des activités économiques dans la Communauté européenne) developed by the European Union from the International Standard Industrial Classification (ISIC) rev 3.1.

These figures are in line with the average Italian death rate computed by Eurostat http://ec.europa.eu/eurostat/data/database(2015).

A plus/minus 10% deviation from the initial value has been chosen because it permits a balanced division of the sample between firms that changed their business model and firms that did not.

To define a (Global) Ultimate Owner, BvD analyzes the shareholding structure of each company looking for the shareholder with the highest direct or total percentage of ownership. If this shareholder is independent, it is defined as the Ultimate Owner of the subject company. If the highest shareholder is not independent (as in the case of controlling companies), the same process is repeated until BvD finds a Global Ultimate Owner. Shareholders information is gathered from several sources, including annual reports or privately written communications addressed by the company to BvD.

As the correspondent increasing and reducing strategies of business model changes are significantly correlated, Eq. (3) has been estimated through a bivariate probit model for each business model proxy, i.e., Increased/Reduced Vertical Integration, Increased/Reduced Intangibles, Increased/Reduced Complexity.

We assume that business model changes produce medium-term effects in terms of firm performance and survival.

It is worth noting that the indication coming out from these estimates goes in the opposite direction of what we got from our previous preliminary analysis (Table 3). In the multivariate regression, we account for several firm-specific characteristics, such as the size, profitability, industrial sector, and geographical localization, which significantly affect post-crisis firm survival.

References

Acs, Z. J., & Amorós, J. E. (2008). Entrepreneurship and competitiveness dynamics in Latin America. Small Business Economics, 31(3), 305–322.

Akgün, A. E., Lynn, G. S., & Yılmaz, C. (2006). Learning process in new product development teams and effects on product success: a socio-cognitive perspective. Industrial Marketing Management, 35(2), 210–224.

Amit, R., & Zott, C. (2001). Value creation in e-business. Strategic Management Journal, 22(6–7), 493–520.

Andries, P., & Debackere, K. (2007). Adaptation and performance in new businesses: understanding the moderating effects of independence and industry. Small Business Economics, 29(1–2), 81–99.

Archibugi, D., Filippetti, A., & Frenz, M. (2013). Economic crisis and innovation: is destruction prevailing over accumulation? Research Policy, 42(2), 303–314.

Arregle, J. L., Hitt, M. A., Sirmon, D. G., & Very, P. (2007). The development of organizational social capital: attributes of family firms. Journal of Management Studies, 44(1), 73–95.

Azadegan, A., & Dooley, K. J. (2010). Supplier innovativeness, organizational learning styles and manufacturer performance: an empirical assessment. Journal of Operations Management, 28(6), 488–505.

Bapuji, H., & Crossan, M. (2004). From questions to answers: reviewing organizational learning research. Management Learning, 35(4), 397–417.

Barlevy, G. (2004). The cost of business cycles under endogenous growth. The American Economic Review, 94(4), 964–990.

Basu, S., & Wadhwa, A. (2013). External venturing and discontinuous strategic renewal: an options perspective. Journal of Product Innovation Management, 30(5), 956–975.

Bhatnagar, J. (2007). Predictors of organizational commitment in India: strategic HR roles, organizational learning capability and psychological empowerment. The International Journal of Human Resource Management, 18(10), 1782–1811.

Bjuggren, P. O., & Sund, L. G. (2014). A contractual perspective on succession in family firms: a stakeholder view. European Journal of Law and Economics, 38(2), 211–225.

Bouchikhi, H., & Kimberly, J. R. (2003). Escaping the identity trap. MIT Sloan Management Review, 44(3), 20.

Caballero, R. J., & Hammour, M. L. (1996). On the timing and efficiency of creative destruction. The Quarterly Journal of Economics, 111(3), 805–852.

Carroll, G. R., & Hannan, M. T. (Eds.) (1995). Organizations in Industry. Oxford: Oxford University Press.

Casadesus-Masanell, R., & Ricart, J. E. (2010). From strategy to business models and onto tactics. Long Range Planning, 43(2), 195–215.

Chesbrough, H. (2010). Business model innovation: opportunities and barriers. Long Range Planning, 43(2), 354–363.

Chindooroy, R., Muller, P., & Notaro, G. (2007). Company survival following rescue and restructuring State aid. European Journal of Law and Economics, 24(2), 165–186.

Corbett, A., Covin, J. G., O'Connor, G. C., & Tucci, C. L. (2013). Corporate Entrepreneurship: State-of-the-Art Research and a Future Research Agenda. Journal of Product Innovation Management, 30(5), 812–820.

Cucculelli, M., & Bettinelli, C. (2015). Business models, intangibles and firm performance: evidence on corporate entrepreneurship from Italian manufacturing SMEs. Small Business Economics, 45(2), 329–350.

Cucculelli, M., & Bettinelli, C. (2016). Corporate governance in family firms, learning and reaction to recession: evidence from Italy. Futures, 75, 92–103.

Cyert, R. M., & March, J. G. (1963). A Behavioral Theory of the Firm. Englewood Cliffs: Prentice Hall.

Dei Ottati, G. (1995). Tra mercato e comunità: aspetti concettuali e ricerche empiriche. Milano: Franco Angeli.

Demil, B., & Lecocq, X. (2010). Business model evolution: in search of dynamic consistency. Long Range Planning, 43(2), 227–246.

Desai, V. M. (2014). Does disclosure matter? Integrating organizational learning and impression management theories to examine the impact of public disclosure following failures. Strategic Organization, 12(2), 85–108.

Eddleston, K. A., Kellermanns, F. W., & Zellweger, T. M. (2012). Exploring the entrepreneurial behavior of family firms: does the stewardship perspective explain differences? Entrepreneurship Theory and Practice, 36(2), 347–367.

Franke, N., Gruber, M., Harhoff, D., & Henkel, J. (2008). Venture capitalists’ evaluations of start-up teams: trade-offs, knock-out criteria, and the impact of VC experience. Entrepreneurship Theory and Practice, 32(3), 459–483.

Freeman, C., Clark, J., & Soete, L. (1982). Unemployment and Technical Innovation: a Study of Long Waves in economic Development. London: Frances Pinter.

George, G., & Bock, A. J. (2011). The business model in practice and its implications for entrepreneurship research. Entrepreneurship Theory and Practice, 35(1), 83–111.

Geroski, P. A., & Walters, C. F. (1995). Innovative activity over the business cycle. The Economic Journal, 105, 916–928.

Grewal, R., & Tansuhaj, P. (2001). Building organizational capabilities for managing economic crisis: the role of market orientation and strategic flexibility. Journal of Marketing, 65(2), 67–80.

Hannan, M. T., Carroll, G. R., Dundon, E. A., & Torres, J. C. (1995). Organizational evolution in a multinational context: entries of automobile manufacturers in Belgium, Britain, France, Germany, and Italy. American Sociological Review, 60, 509–528.

Herbane, B. (2014). Information value distance and crisis management planning. SAGE Open, 4(2), 2158244014532929.

Ireland, R. D., Hitt, M. A., Camp, S. M., & Sexton, D. L. (2001). Integrating entrepreneurship and strategic management actions to create firm wealth. The Academy of Management Executive, 15(1), 49–63.

Ireland, R. D., Hitt, M. A., & Sirmon, D. G. (2003). A model of strategic entrepreneurship: the construct and its dimensions. Journal of Management, 29(6), 963–989.

Istat (2005). I Sistemi Locali del Lavoro, in Istat. Censimento 2001. Dati definitivi. Roma: ISTAT.

Jarillo, J. C. (1995). Strategic Networks. Oxford: Butterworth-Heinemann.

Johnson, M. W., Christensen, C. M., & Kagermann, H. (2008). Reinventing your business model. Harvard Business Review, 86(12), 57–68.

Kandemir, D., & Hult, G. T. M. (2005). A conceptualization of an organizational learning culture in international joint ventures. Industrial Marketing Management, 34(5), 430–439.

Kuratko, D. F., & Audretsch, D. B. (2013). Clarifying the domains of corporate entrepreneurship. International Entrepreneurship and Management Journal, 9(3), 323–335.

Kuratko, D. F., Hornsby, J. S., & Hayton, J. (2015). Corporate entrepreneurship: the innovative challenge for a new global economic reality. Small Business Economics, 45(2), 245.

Latham, S. (2009). Contrasting strategic response to economic recession in start-up versus established software firms. Journal of Small Business Management, 47(2), 180–201.

Leung, S., & Horwitz, B. (2010). Corporate governance and firm value during a financial crisis. Review of Quantitative Finance and Accounting, 34(4), 459–481.

Lieberman, M. B., & Asaba, S. (2006). Why do firms imitate each other? Academy of Management Review, 31(2), 366–385.

Liu, C., Uchida, K., & Yang, Y. (2012). Corporate governance and firm value during the global financial crisis: evidence from China. International Review of Financial Analysis, 21, 70–80.

Markides, C. (2008). Game-changing strategies: How to create new market space in established industries by breaking the rules. New York: Jossey-Bass.

Marsen, S. (2014). “Lock the Doors” toward a narrative–semiotic approach to organizational crisis. Journal of Business and Technical Communication, 28(3), 301–326.

Mensch, G., & West Internationales Institut für Management und Verwaltung (Berlin). (1979). Stalemate in technology: innovations overcome the depression. Cambridge: Ballinger.

Menzel, M-P., & Fornahl, D. (2010). Cluster life cycles—dimensions and rationales of cluster evolution. Industrial and Corporate Change, 19(1), 205–238.

Miller, D., Le Breton-Miller, I., & Scholnick, B. (2008). Stewardship vs. stagnation: an empirical comparison of small family and non-family businesses. Journal of Management Studies, 45(1), 51–78.

Miller, D., & Le Breton-Miller, I. (2005). Managing for the Long Run: Lessons in Competitive Advantage From Great Family Businesses. Cambridge: Harvard Business School Press.

Minetti, R., Murro, P., & Paiella, M. (2015). Ownership structure, governance, and innovation. European Economic Review, 80, 165–193.

Morris, M., Schindehutte, M., & Allen, J. (2005). The entrepreneur's business model: toward a unified perspective. Journal of Business Research, 58(6), 726–735.

Perlow, L. A., Okhuysen, G. A., & Repenning, N. P. (2002). The speed trap: exploring the relationship between decision making and temporal context. Academy of Management Journal, 45(5), 931–955.

Porter, M. E. (1985). Competitive advantage: creating and sustaining superior performance. New York: FreePress.

Porter, M. E. (1996). What is strategy? Harvard Business Review, 74(6), 61–78.

Pozzana, R. (2011). Modelli di business e competizione nelle piccole imprese manifatturiere. In R. Paolazzi & F. Trau (Eds.), Effetti della Crisi, Materie Prime e Rilancio Manifatturiero, le Strategie di Sviluppo delle Imprese Italiane. Rome: Confindustria Centro Studi.

Santos-Vijande, M. L., Sanzo-Perez, M. J., Alvarez-Gonzalez, L. I., & Vazquez-Casielles, R. (2005). Organizational learning and market orientation: interface and effects on performance. Industrial Marketing Management, 34(3), 187–202.

Schneider, S., & Spieth, P. (2013). Business model innovation: towards an integrated future research agenda. International Journal of Innovation Management, 17(01), 1340001.

Schumpeter, J. A. (1939). Business cycles (Vol. 1, pp. 161–174). New York: McGraw-Hill.

Sforzi, F. (1987). L’identificazione spaziale, in: G. Becattini (a cura di) Mercato e forze locali: il distretto industriale (pp. 143–167). Bologna: Il Mulino.

Smith, D., & Elliott, D. (2007). Exploring the barriers to learning from crisis: organizational learning and crisis. Management Learning, 38(5), 519–538.

Sosna, M., Trevinyo-Rodríguez, R. N., & Velamuri, S. R. (2010). Business model innovation through trial-and-error learning: the Naturhouse case. Long Range Planning, 43(2), 383–407.

Srinivasan, R., Lilien, G. L., & Sridhar, S. (2011). Should firms spend more on research and development and advertising during recessions? Journal of Marketing, 75(3), 49–65.

Stein, A., & Smith, M. (2009). CRM systems and organizational learning: an exploration of the relationship between CRM effectiveness and the customer information orientation of the firm in industrial markets. Industrial Marketing Management, 38(2), 198–206.

Teece, D. J. (2010). Business models, business strategy and innovation. Long Range Planning, 43(2), 172–194.

Thoma, G. (2009). Striving for a large market: evidence from a general purpose technology in action. Industrial and Corporate Change, 18(1), 107–138.

Thomsen, S. (1999). Corporate ownership by industrial foundations. European Journal of Law and Economics, 7(2), 117–137.

Tucker, A. L., Nembhard, I. M., & Edmondson, A. C. (2007). Implementing new practices: an empirical study of organizational learning in hospital intensive care units. Management Science, 53(6), 894–907.

Weerawardena, J., O’Cass, A., & Julian, C. (2006). Does industry matter? Examining the role of industry structure and organizational learning in innovation and brand performance. Journal of Business Research, 59(1), 37–45.

Williamson, O. E. (1981). The economics of organization: the transaction cost approach. American Journal of Sociology, 87(3), 548–577.

Zahra, S. A., Hayton, J. C., & Salvato, C. (2004). Entrepreneurship in family vs. non-family firms: a resource-based analysis of the effect of organizational culture. Entrepreneurship Theory and Practice, 28(4), 363–381.

Zott, C., & Amit, R. (2007). Business model design and the performance of entrepreneurial firms. Organization Science, 18(2), 181–199.

Zott, C., & Amit, R. (2008). The fit between product market strategy and business model: implications for firm performance. Strategic Management Journal, 29(1), 1–26.

Zott, C., Amit, R., & Massa, L. (2011). The business model: recent developments and future research. Journal of Management, 37(4), 1019–1042.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Cucculelli, M., Peruzzi, V. Post-crisis firm survival, business model changes, and learning: evidence from the Italian manufacturing industry. Small Bus Econ 54, 459–474 (2020). https://doi.org/10.1007/s11187-018-0044-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-018-0044-2