Abstract

This paper studies the relationship between entrepreneurship and regional growth by arguing that the entrepreneurship/growth relationship is mediated by the characteristics of the innovative environment in which new firms operate, which can explain the high volatility of the empirical results on the entrepreneurship/regional growth nexus existing in the literature. The innovation context represents the pool of discovery opportunities and of creative atmosphere that may explain the birth of an entrepreneurial activity. Moreover, these opportunities may or may not be grasped according to behavioral characteristics of regional entrepreneurs, interpreted as potential capacity to discover, risk orientation and strategic vision. We provide evidence of the complex and spatially heterogeneous interplay between regional innovation modes, entrepreneurial behavioral characteristics and economic growth for 252 NUTS2 regions of the European Union.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Theoretical and empirical research on the impact of entrepreneurship on regional growth has developed considerably in the last twenty years (Fritsch and Storey 2014). It has been motivated by the expectation that new business formation can stimulate new job creation and lower unemployment, as well as raise productivity and, by consequence, income (Audretsch and Thurik 2001; Shane 2003; Acs and Storey 2004).

This stream of literature has made important achievements in the last couple of decades, both on conceptual and empirical grounds (see for reviews: Sternberg 2009, 2011; Fritsch 2011). However, the empirical evidence increasingly questions the existence of a direct and automatic link between regional characteristics, new firms creation and economic growth. In fact, this link can vary in significance, intensity, sign and time according to the dependent variable chosen, industry-specific conditions and the regional environment (see for a recent review: Fritsch and Storey 2014). Therefore, despite the richness of the studies, the impact of entrepreneurship on regional growth is still subject to research.

This paper aims to contribute to this stream of research by proposing a re-assessment of the relationship between entrepreneurship and regional development with the purpose to underline under which conditions entrepreneurship plays a role on regional growth. The founding idea is in fact that the combination of two types of conditions plays a role in defining the linkages between entrepreneurship and regional growth: the innovative environment in which the new firms are formed, and the behavioral characteristics of entrepreneurship.

In particular, on the conceptual ground, this paper acknowledges that entrepreneurship’s impact on a local economy can depend on the characteristics of the context in which new firms originate, since it is a source of creativity, of knowledge creation and a pool of discovery opportunities. Although the literature has quite extensively discussed regional variations in the determinants of entrepreneurship (see among others: Armington and Acs 2002; Bosma and Schutjens 2011; Fritsch and Falck 2007; Stuetzer et al. 2014; Hundt and Sternberg 2014), it has been less concerned to investigate the context (i.e., territorial) characteristics and conditions under which entrepreneurship may affect the local economic performance. An exception is the notion of “National system of entrepreneurship,” which treats entrepreneurship as a systemic phenomenon depending on the interaction between its two components: individual business behavioral aspects and the institutional context in which entrepreneurship is embedded (Acs et al. 2014). This paper focuses on the innovative context rather than the institutional one and argues that the impact of entrepreneurship on regional growth depends on the innovative environment in which entrepreneurs are embedded—an aspect so far underexplored in the literature. In fact, the innovative context can influence the discovery of new opportunities (Acs et al. 2009), can provide a rich knowledge environment, can stimulate imitative behaviors, and is shaped by social and institutional rules and practices that support innovation activities. In other words, the innovative context influences the function of entrepreneurship identified by Kirzner as a market discovery process (Kirzner 1997), and the capacity of entrepreneurs to move from discovery to action.

The paper highlights the reasons why different regional innovation contexts act differently on the nexus between entrepreneurship and regional growth, taking various aspects of entrepreneurship into consideration. Recent literature, in fact, suggests that the interplay of regional characteristics and entrepreneurship varies according to different phases and types of entrepreneurial behavior (Hundt and Sternberg 2014). The empirical part of the paper classifies, then, regions according to their innovation mode and the extent to which they possess different entrepreneurial behavioral characteristics, i.e., potential of opportunities perception, risk orientation and strategic vision. Each of them in fact captures a specific aspect of the entrepreneurial phenomenon: the potential for successful entrepreneurial activities, the propensity to risk and opportunity discoveries and the strategic vision of an entrepreneurial mission. This distinction allows emphasizing the inherent complexity of entrepreneurial activities and their composite and systemic nature. Empirically, recently released indicators of entrepreneurship elaborated by DGRegio of the European Commission made possible the distinction among the three aspects of entrepreneurship (Szerb et al. 2013). To the best of our knowledge, these indicators are the most updated and advanced endeavor to develop a comprehensive measure of entrepreneurship at the regional level in the European context.

The discussion is organized as follows. The next section reviews the existing literature. Section 3 presents a recent taxonomy proposed to distinguish territories on the basis of their innovative capacity and proposes a logical framework to be empirically tested linking the role of different innovation modes to the explanation of the relationship between the different entrepreneurial behavioral characteristics and regional growth. Section 4 describes the empirical strategy, and Sect. 5 comments on the empirical findings. Section 6 concludes.

2 Entrepreneurship and regional growth: research questions

There is increasing awareness in the literature of the territorially embedded nature of entrepreneurial events because business opportunities frequently arise from the surrounding regional context (Stam 2007; Dahl and Sorenson 2012; Feldman 2001, 2014; Sternberg 2009, 2011; Audretsch et al. 2012; Andersson and Koster 2011).

Research on the regional determinants of entrepreneurship has greatly advanced knowledge and understanding of spatial variations in start-up rates and, more recently, has also unveiled the influence of and mechanisms through which regional characteristics can impact on individuals’ entrepreneurial potential, attitude and engagement in new businesses (Sternberg 2009; Stuetzer et al. 2014). Specific regional characteristics, in fact, can influence the recognition of entrepreneurial opportunities, the capacity to absorb new knowledge and ultimately the exploitation of these entrepreneurial opportunities (Qian and Acs 2013), especially for innovative new businesses (Fritsch and Storey 2014). These characteristics include, among others, the educational attainment of the workforce, the presence of research activities and the work experience of the population, whose complex blend comprises important sources of regional knowledge (Helfat and Lieberman 2002; Stuetzer et al. 2014).

For example, Audretsch et al. (2012) identify different regional regimes in Germany: routinized and entrepreneurial, the former with low start-up rates and the latter with high start-up rates. This distinction, which resembles the distinction between routinized and entrepreneurial sectoral regimes (Audretsch 1995), is based upon the conjecture that in regions with high rates of new business creation, small firms are the main drivers of the innovation process, whereas (large) incumbents are the main creators of innovation in regions with low rates of new business creation. Similarly, Stuetzer et al. (2014) found that regional knowledge creation positively influences start-up rates.

This conclusion is consistent with much of the recent research on entrepreneurship. Entrepreneurship research in the past twenty years has fully acknowledged the close link among knowledge, innovation and entrepreneurship (Fritsch and Storey 2014), which forms the core of the knowledge spillover theory of entrepreneurship (Audretsch et al. 2006; Audretsch and Kelibach 2007, 2008; Acs et al. 2009). This theory posits two key premises: (1) new knowledge is the main source of entrepreneurial opportunities; and (2) entrepreneurship is the main channel to commercialize and bring to the market new and unexploited knowledge and ideas, thus spurring local growth.

Several empirical tests conducted at the country, regional and urban level within the frame of this theory have confirmed the importance of entrepreneurship for local economic development (see for examples: Audretsch et al. 2006; Audretsch and Kelibach 2007, 2008; Acs et al. 2009; Qian and Acs 2013). Yet, as Qian and Acs (2013) point out, the knowledge spillover theory is somewhat silent about the process of creating and developing the knowledge and innovation base representing the (potential) source for entrepreneurial opportunities. Also, it leaves somewhat unanswered the question of whether and how the knowledge and innovation base and context can generate entrepreneurial opportunities, allow their exploitation, and ultimately shape the impact of entrepreneurship on (regional) growth.

It is therefore conceivable that the characteristics of the process through which new knowledge and innovation are developed in a region, and come to form the base from which entrepreneurial opportunities can be recognized and exploited, can ultimately affect the impact of entrepreneurship on growth. In other words, the impact of entrepreneurship on regional growth is likely to vary across regions according to their innovation modes (Fig. 1).

This paper investigates precisely this issue by offering a conceptual and empirical contribution to the understanding of the context conditions under which entrepreneurship can lead to regional growth. The paper does not restrict the context in which entrepreneurship is located to the presence of new knowledge, but considers different innovation modes, conceived as different spatial variants of the knowledge–invention–innovation logical path built on the presence/absence of territorial preconditions for knowledge creation, knowledge attraction and innovation (Capello and Lenzi 2013). Moreover, in order to unravel the relationship between entrepreneurship and regional growth, the focus of the paper is on the combination of innovation mode and type of entrepreneurship present in the region. In the literature, the “quality” of entrepreneurs in general has been considered (see for example Acs and Armington 2004; Klepper and Sleeper 2005; Audretsch and Kelibach 2008). However, some recent works underline how the interplay between regional characteristics and entrepreneurship varies according to different phases and types of entrepreneurial behavior (Hundt and Sternberg 2014). In this paper, then, the focus is on different entrepreneurial behaviors, as recently proposed in the “National system of entrepreneurship” theory. Of central importance if entrepreneurship is to generate growth, in fact, is not whether or not opportunities exist, but rather what is done about them (Acs et al. 2014), which mainly depends on the behavioral characteristics of local entrepreneurship, identified as potential of opportunities perception, risk orientation and strategic vision (Acs et al. 2014). In particular:

-

(a)

potential of opportunities perception refers to the (individual and context) potential capabilities to recognize entrepreneurial opportunities and to act as an entrepreneur;

-

(b)

risk orientation is defined as the (individual and context) risk propensity and actual capacity of pursuing entrepreneurial action;

-

(c)

strategic vision identifies the (individual and context) strategic thinking and ambition of the entrepreneurial mission.

These characteristics can be also associated with increasingly complex stages and degrees of maturity of the entrepreneurial event, similarly to what proposed by Hundt and Sternberg (2014), albeit in a different context. Whereas behavioral dispositions like entrepreneurial potential of opportunities perception and risk orientation are at the basis of purposeful discovery, a strategic vision is at the heart of the translation of discovery into (successful) action. Yet, reasoning on the linkage between these different entrepreneurial characteristics and regional growth becomes more complex when the different regional innovative modes are introduced. As highlighted by Audretsch and Fritsch (2002), in fact, there is not a single entrepreneurial model resulting into growth in every type of regions.

This paper therefore tackles the following research question: whether the impact of different behavioral characteristics of entrepreneurship on regional growth is mediated by different regional innovation modes. The next section provides a definition of regional innovation modes and, more importantly, presents a conceptual framework in which specific innovation modes represent more favorable settings for specific entrepreneurial behaviors.

3 Setting entrepreneurship in a territorial context: regional innovation modes and entrepreneurial behaviors

The conceptual framework used in this paper is based on the notion of regional patterns or modes of innovation. Regional patterns of innovation are conceived as combinations of context conditions and of specific modes of performing and linking the different phases of the innovation process, i.e., they are defined according to the presence/absence of some context conditions that allow for the creation and/or the adoption of knowledge and innovation (Capello 2013). They are obtained as different variants of the linear knowledge, invention, innovation model, once the different stages are broken down, separated, differently allocated in time and space, and finally recomposed following a relational logic of interregional cooperation and exchange (Camagni 2015). Three main “archetypal” innovation patterns have been conceptualized (Capello 2013), each of them reflecting a specific body of literature on knowledge and innovation in space. In particular, a micro-founded approach drives the conceptualization of territorial patterns of innovation because certain territorial resources and conditions influence certain types of firms’ strategies and behaviors (Capello and Lenzi 2015). The main innovation patterns or modes can be described as follows:

-

(a)

a science-based pattern, where knowledge is created by local actors and functions like universities, R&D centers and large firms, and their local relationships, enriched by interregional cooperation with selected partner, as highlighted in most of literature dealing with knowledge and innovation creation and diffusion (Jensen et al. 2007; Mack 2014);

-

(b)

an application pattern where entrepreneurial creativity and collective learning allow to source external knowledge and apply it for local innovation needs (Foray 2009; Licht 2009). Knowledge providers supporting the innovative activities of local firms are mostly located outside the region, and knowledge exchanges are nourished more by cognitive and sectoral proximity (i.e., shared cognitive maps) than by belonging to the same local community (Asheim and Isaksen 2002);

-

(c)

an imitative innovation pattern, where relationships between local firms and dominant firms (typically multinationals) allow to adopt an innovation new for the area as described in the literature dealing with innovation diffusion (Pavlínek 2002; Varga and Schalk 2004).

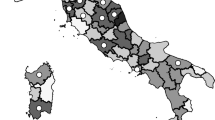

Regional innovation patterns have been recently identified empirically in European regions for the period 2002–2004 (Capello and Lenzi 2013).Footnote 1 Two distinct processes of knowledge accumulation and knowledge acquisition channels, depending on different cognitive bases, have been detected. In this respect, two clusters can be associated with the first conceptual pattern, but differing in terms of basic (general purpose) versus applied scientific formal knowledge base, and are termed, respectively, the European science-based area (ESBA) and the Applied science area (ASA). Two clusters can be associated with the second pattern, but differing in terms of formal versus informal externally sourced knowledge, and are termed, respectively, the Smart technological application area (STAA) and the Smart and creative diversification area (SCDA). One cluster can be associated with the third pattern and is named the Imitative innovation area (IIA).

The different regional innovation modes are expected to play a different role in mediating the linkage between the different entrepreneurial behavioral characteristics and regional growth. In fact, the existence of entrepreneurial opportunities and of favorable conditions for entrepreneurial activities guarantees neither discovery nor strategic action always and everywhere (Acs et al. 2014).

In particular, potential of opportunities perception may find a high probability to turn into real business activities in the science-based innovation mode, which is strongly R&D oriented (possibly driven mainly by large firms) and characterized by a rich knowledge and science-based environment. In such an environment, entrepreneurs can take advantage of the presence of unexploited knowledge and ideas generated in existing firms and ready to be commercialized and brought to the market, as posited by the knowledge spillover theory of entrepreneurship (Audretsch et al. 2006; Audretsch and Kelibach 2007, 2008; Acs et al. 2009). While the richness of local knowledge can enable the translation of potential opportunities into real activities (and possibly spur local growth), this is more likely to take place in those science-based areas where knowledge is closer to the commercialization stage (i.e., in areas specialized in applied knowledge). In areas specialized in general purpose and basic science, the possibility of breakthrough innovation is likely to be left to large R&D laboratories able to engage in expensive and high-risk R&D activities (Audretsch 1995; Audretsch and Fritsch 2002). The lack of a critical mass of financing necessary for such projects may prevent potential of opportunities perception to turn into real actions. Therefore, one may expect that potential of opportunities perception is positively associated with growth in the Applied science area, while its effect can be limited if not nil in the European science-based area (Fig. 2, panel a).

Entrepreneurship behavioral characteristics and regional growth in different regional innovation modes. a Potential of opportunities perception and regional growth in different regional innovation modes. b Risk orientation and regional growth in different regional innovation modes. c Strategic vision and regional growth in different regional innovation modes

Potential of opportunities perception can find a useful innovative environment also in the application regional innovation mode, made of regions that lack a critical mass of internal knowledge, but look for and originally use external knowledge to turn it into innovation for their internal needs and purposes. This is therefore the context that better suits the function of entrepreneurship as a market and opportunity discovery process (Kirzner 1997) and is a favorable setting where the capacity of entrepreneurs to move from potential opportunities discovery to purposeful action and strategic entrepreneurial activity can fully unfold. Even in the absence of “objective” opportunities, because of a limited local knowledge base and opportunities, entrepreneurs in this environment are able to create their own opportunities by originally replicating and adjusting external knowledge-search behaviors (Acs et al. 2014). It is therefore to be expected that the potential of opportunities perception likely turns into pursuit of entrepreneurial projects and real entrepreneurial activities, and thus ultimately affects growth.

Lastly, one may expect that the potential of opportunities perception finds little incentives to move to real business activities in an imitative environment. Imitative contexts, indeed, represent a rather unfertile ground where the probability to realize the potential for opportunities recognition is somewhat low; the scarcity of creativity and weak knowledge creation does not support new commercial ideas to turn into real business and thus growth.

On the other hand, for what concerns risk orientation, one may reasonably expect a positive impact on growth. However, competition is likely to be higher in more knowledge and innovation intensive areas (Audretsch 1995; Audretsch and Thurik 2001), where a high propensity to risk may not be sufficient to guarantee a successful entrepreneurial action and, thus, a positive impact on growth. Therefore, one may expect that the positive impact of risk orientation on growth is positive in all innovative environment modes; yet, this impact is likely to decrease with the richness of knowledge and innovation activities in the area (Fig. 2, panel b). Indeed, in imitative regions, if and when opportunities can be actually recognized, realized and exploited, they are likely to generate a strong effect on growth (Shane and Venkataraman 2000), and possibly to break the exogenously driven innovation processes, at least in the long run.

Finally, the strategic orientation of the new launched ventures is likely to play an important role for growth. This entrepreneurial characteristic is in fact the one associated with the highest degree of complexity and maturity of the entrepreneurial event, in short to ambitious, forward-looking and better quality entrepreneurial projects. It therefore guarantees a strong positive attitude toward new business, irrespective of the environment in which it is located. As better endowed and better quality entrepreneurial projects generally show the greatest performances (Acs and Armington 2004; Klepper and Sleeper 2005; Audretsch and Kelibach 2008), there is no reason to expect a differentiated impact of strategic vision across innovation modes (Fig. 2, panel c).

Summing up, our testable hypotheses are the following:

-

potential of opportunities perception has a positive effect on growth in innovative environments based on the application of scientific and technical knowledge;

-

risk orientation has a positive impact on growth, though at decreasing rates with respect to the richness and intensity of knowledge and innovative activities in the area;

-

strategic vision has a positive (and undifferentiated) impact on growth in all territorial innovative contexts.

The next section describes data and methods used to test these propositions.

4 The regional growth model

The empirical model to be estimated has been designed to test for spatial heterogeneity in the impact of the different entrepreneurial characteristics on regional growth (measured as GDP per capita growth) across the different regional innovation modes presented above. In doing so, the model takes into consideration classic explanatory variables such as the initial level of GDP per capita, employment and capital (in the frame of the Solow’s model) and human capital (in the frame of Lucas’s model and many later contributions, also at the regional level).

In particular, beyond the initial level of GDP per capita (measured as GDP per inhabitant), the model includes the following variables:

-

(a)

employment,

-

(b)

capital,

-

(c)

human capital,

-

(d)

entrepreneurship.

-

(a)

Employment

The model includes an indicator of total employment growth rate; this variable also enables to assess whether GDP per capita growth was driven by employment or productivity increases.

-

(b)

Capital

The model includes two variables to measure the importance of capital for growth: the growth rate of capital and a measure of foreign direct investments (FDI) penetration.

The capital stock series at the regional level is not available from public databases and official sources. The capital stock series—elaborated by the Centro Ricerche Economiche Nord Sud (CRENoS), University of Cagliari, Italy—was constructed by applying the perpetual inventory method on investment series in the years 1985–2007. Specifically, K r , the capital stock of region r at time t, is obtained as the sum of the flows of gross investments in the previous periods with a constant (across regions and over time) 10 % depreciation rate (d), as is customary in this kind of exercise (Marrocu and Paci 2011), as follows:

$$K_{r,t} = (1 - d)K_{r,t - 1} + I_{r,t - 1}$$(1)The capital stock value for the initial year (i.e., 1985) was computed as the sum of investment flows, I r,t , in the ten preceding years (i.e., 1975–1984).

The role of external investments (and, thus, of a region’s economic attractiveness) is captured through an indicator of FDI penetration measured as number of FDI on total population. This was expected to affect the GDP per capita growth rate positively and to generate a push effect on the local economy.

-

(c)

Human capital

The importance of human capital has been captured through two indicators. First, the share of tertiary educated (ISCED 5 and 6) population accounts for the average level of education and formal qualification in the population. Second, the share of employment in blue-collar occupations accounts for the competencies actually required in the labor market. The former is expected to show a positive sign on growth and the latter a negative one.

-

(d)

Entrepreneurship

The empirical model includes three entrepreneurship indicators: one accounting for the potential capacity to discover entrepreneurial opportunities, called potential of opportunity perception; one accounting for the propensity to take risk and launch a new business, called risk orientation; and one accounting for the outcome and quality of the entrepreneurial projects, called strategic vision.

The existence of an interesting new dataset, called REDI, facilitated the measurement of these three entrepreneurial behavioral aspects. REDI relies on a systemic view of entrepreneurship and includes composite indicators built in order to take account of the interplay between individual level desirability and feasibility considerations for entrepreneurial action and the institutional contexts in which these considerations originate.Footnote 2 Acs et al. (2014) suggest that exactly this interplay shapes the final entrepreneurial action and determines the quality and outcomes of such action, as recent literature also confirms (Bosma and Schutjens 2011; Stuetzer et al. 2014; Hundt and Sternberg 2014).Footnote 3

The entrepreneurial ability index available in REDI provides the basis to measure potential of opportunities perception. Entrepreneurial ability is, in fact, defined as the potential capacity to develop start-up activities with high-growth potential (Szerb et al. 2013). As fully described by Szerb et al. (2013), this is a composite indicator accounting for individuals’ interest in self-employment activities, and in investment in this kind of employment. It also considers context characteristics such as the favorability of the business environment, engagement in training, on business sophistication and the presence of high-tech manufacturing and knowledge-intensive services in the region. In order to have a good proxy for potential of opportunities perception, a variable was created comprising the entrepreneurial ability pillars that better capture this phenomenon, namely opportunity start-up, technology adoption and competition. This procedure also allows to avoid multicollinearity between the entrepreneurial characteristics variable and the other independent variables, like human capital.

The entrepreneurial attitude subindex available in REDI measures risk orientation. Szerb et al. (2013) indicate that this index captures risk propensity, at both individual and regional levels. It accounts for the population’s self-esteem concerning its ability to start new businesses, its risk acceptance and its capacity to recognize favorable conditions for new business. Context characteristics included in the index refer to the social status of, and respect for, an entrepreneur, and to the level of corruption and of individual freedom in the local society.

Strategic vision is measured through the entrepreneurial aspiration subindex available in REDI as this “refers to the distinctive, qualitative, strategy-related nature of entrepreneurial activity” (Szerb et al. 2013, p. 38). It accounts for the capacity of new businesses to grow, to internationalize and to raise interest in capital markets. Context characteristics considered refer to clustering, connectivity and depth and diversification of capital markets in the region. In order to limit as much as possible the information overlap and consequent risk of multicollinearity between the strategic vision variable and the innovation mode dummies, the strategic vision indicator has been computed by excluding the two pillars related to product and process innovation from the entrepreneurial aspiration index available in REDI.

Table 1 reports the description of the variables and their sources, and Table 2 their descriptive statistics.

The empirical model to be estimated therefore can be written as in Eq. 2 below

where \(\Delta {\text{GDP}}\_{\text{pc}}_{r}\) is the regional annual average real GDP per capita growth rate in the period 2006–2013. The 2006–2013 period includes the years of the burning of the financial crisis that started in Europe in 2008. Therefore, an adjusted regional growth rate was computed by using as the regional GDP level at 2013 out-of-sample estimates of regional GDP level produced by ARMA estimations with time trend, on the basis of the regional GDP series in the period 1995–2012. The results are largely robust to these controls, as shown in what follows. Because of multicollinearity among the entrepreneurial characteristics variables, they are introduced separately in the regressions.Footnote 4

To unravel the relative importance of entrepreneurial characteristics for regional growth across the EU territory, the three entrepreneurship variables were interacted, in turn, with the dummy variables capturing the regional modes of innovation described in Sect. 3. Hence, the enlarged model to be estimated can be written as in Eq. 3 below:

where D r represents the dummy variable for regional membership to the different regional modes of innovation (the Imitative innovation area being the reference case).

In terms of estimation, Varga (2006) and Varga and Schalk (2004) recommend to frame economic growth in a spatial setting and to incorporate the spatial dimension in modeling the links between technological change, innovation and growth.

As regards the specific choice of the spatial specification estimated, since the provocative paper by Gibbons and Overman (2012), recent papers put forward important criticisms to the practice of selecting the spatial specification based on automatic rules, such as robust Lagrange multiplier tests. More importantly, these works invoked a more “theory-based” choice based on economic grounds (Anselin 2010; Corrado and Fingleton 2012; Elhorst 2014). Elhorst (2014) and Vega and Elhorst (2015), among others, offer useful guidance in how to operate a sound choice of the spatial specification and suggest to use the SLX (spatial lag of X) as a starting point. LeSage (2014) shares this view and comments that spatial econometrics practitioners have payed to little attention to this model specification (and its more complex version, which is the Spatial Durbin Error Model, SDEM). Following this debate, and the consequent main recommendations in terms of econometric practice, the strategy applied was to start from a general specification, namely the Spatial Durbin Model (SDM) and next to test whether this was more appropriate to a simpler and more flexible one, such as the SLX. As the analysis reported in the following section shows, the SLX turned to be preferable in the present context; accordingly, the estimates presented and commented in the next section are based on the SLX specification. Two additional robustness checks have been finally carried out. First, results of the SLX specification have been compared to the SDEM one, when relevant, to control for the spatial diffusion of shocks to the model disturbances. Second, as the time span considered includes the years of the crisis, estimates of Eq. 3, that represents the focus of the paper, have been obtained also by using the adjusted regional real per capita GDP growth rate described above.

5 The link between modes of innovation, entrepreneurial characteristics and regional growth

Table 3 reports the estimates of Eqs. 2 and 3 with the regional GDP per capita growth rate in the 2006–2013 period as dependent variable based on a SLX specification.Footnote 5 The selection of this spatial specification was driven by the output of the tests reported in the bottom lines of Table 3. In fact, by balancing the results of the Wald test on rho (i.e., the spatial lag of the dependent variable) and the Wald test of the spatial lag of the independent variables, the SLX model seems preferable to the SDM.

Starting with the control variables, they are overall significant and show the expected sign. In particular, a process of convergence seems at place (as attested by the negative and significant effect of the coefficient of the real GDP per capita variable in 2006), despite the adverse effect of the crisis in the period considered. In addition, growth responds positively to increases in domestic (i.e., capital) and foreign investments, and negatively to low added-value competencies associated with blue-collar occupations, albeit this effect is less stable. A modest effect is also found for employment growth, but significant only in models 3 and 4.

As regards entrepreneurial behavioral characteristics, these in general have a positive effect on regional growth, both on their own as well as when interacted with the regional innovation mode dummies. However, the intensity and significance of this effect varies in the different cases.

In particular, potential of opportunities perception seems to have some direct effect on regional growth. Yet, this result may hide important differences in the way that regions characterized by different innovation modes are able to exploit the benefits deriving from the potential capacity of opportunities perception. In model 2, this variable was interacted with four of the five regional modes of innovation dummy variables, being the interaction with the dummy for the Imitative innovation area the reference case. Interaction terms in this case have to be interpreted in relative and not in absolute terms, i.e., with reference to the omitted case (the Imitative innovation area). Interestingly, the results suggest that potential capacity of opportunities perception in regions in the Imitative innovation area is not an important driver of growth with respect to the other groups of regions (i.e., the coefficient of the entrepreneurial ability variable is negative and significant). On the other hand, its effect is greater in the other groups of regions with respect to the Imitative innovation area; in fact, the coefficients of the interacted variables are positive and significant. The presence of potential of opportunities perception seems of relevance in two different situations. First, when entrepreneurs are in a relatively weaker knowledge creation context, but creatively look outside the region for new knowledge, a situation not yet examined in the literature. Second, when local applied knowledge is created in a large quantity and can therefore be exploited by local entrepreneurs, as suggested by the knowledge spillover theory. However, this effect is stronger in the science-based mode in which knowledge is of applied nature and closer to commercialization, as expected, even if the magnitude of the combined effect is limited. In fact, a t test on the equality of the interaction coefficients indicates that the interaction coefficient of the European science-based area is significantly lower than that of the Applied science area (p < 0.05) and that of the Smart technological application area (p < 0.10). On the other hand, the other interaction coefficients, in pairs, do not statistically differ among themselves, while the combined effects are limited in magnitude.

Model 3 introduces risk orientation, which on average is positive and significant. When interacted with the innovation mode variables, keeping the Imitative innovation area as the reference case (model 4), risk orientation turns out to be an important driver of growth in regions in the Imitative innovation area (i.e., the coefficient of the risk orientation variable is positive and significant), as expected. On the other hand, its effect is considerably lower in the European science-based area with respect to the Imitative innovation area (i.e., the coefficient of the interacted variables is negative and significant), even if the combined effect is limited also in this case. The other cases do not differ from the reference one. Therefore, some diminishing returns seem at play in this case, as the positive effect on growth diminishes in more knowledge and innovation intensive regions with respect to less intensive ones.

Model 5 introduces the strategic vision variable, which shows a positive and significant effect. Interestingly, when interacted with the innovation mode variables (keeping the Imitative innovative mode as the reference case), strategic vision is an important driver of growth especially in the Imitative innovation area (i.e., the coefficient of the strategic vision variable is positive and significant). Instead, its effect is considerably lower in the other groups of regions with respect to the Imitative innovation area (i.e., the coefficient of the interacted variables is negative and significant), and with a not negligible magnitude in the case of the Applied science area and of the Smart and creative diversification area. Albeit unexpected, this result highlights how a strategic vision of an entrepreneur is crucial also in an imitative innovative environment. It is likely to generate a strong effect on growth, possibly by breaking the exogenously driven innovation process and turning it into an endogenous one in the long run.

As a robustness check, a test for the presence of spatial dependence in disturbances has been implemented and indicated that SDEM might be an alternative to SLX only for models 1, 2 and 5. Re-estimating these models through SDEM instead of SLX, however, does not alter the main messages of Table 3 on interaction effects, as results in Table 5 in “Appendix” show.

Finally, as a last robustness check, a control for the possible confounding effects of the financial crisis started in 2008 was implemented by using the adjusted growth rate described in Sect. 4 as dependent variable. Estimates of Eq. 3, reported in Table 6, were qualitatively unchanged, supporting the strength of the results presented in Table 3.Footnote 6

Overall, therefore, these findings indicate that regional innovation modes influence the relationship between entrepreneurship and regional growth, and that this influence varies according to the different behavioral characteristics of entrepreneurship considered (potential of opportunities perception, risk orientation, strategic vision). Potential of opportunities perception matters for those regions in which the knowledge and innovation process is characterized by the application of specific technical and scientific knowledge (i.e., the Smart and creative diversification area, the Smart technological application area, and the Applied science area). On the other hand, risk orientation and strategic vision play a more prominent role for regional growth in less knowledge intensive and applied regions with respect to the others. In less fertile innovation environments, underexplored opportunities, risk propensity and strategic vision are likely to be scarce; but when they exist, they can have a strong effect on regional growth.

6 Conclusions

The entrepreneurship/regional growth nexus has been subject to a large number of conceptual and empirical studies, but still subject to rich and promising research. This paper has entered the debate by claiming that the relationship is not a direct one, but has to be mediated by several elements, notably the combination of entrepreneurial characteristics and of the regional innovative environment. While the existing literature has focused either on the context conditions or on the characteristics (and quality) of entrepreneurial activities, this paper has posited that both of them should be studied at the same time. Also in empirical terms, the interplay between the two dimensions—entrepreneurial characteristics and innovative context conditions—has proved to be the fruitful way to acknowledge some real situations not yet studied in the literature.

Results indicate that the potential of opportunities perception has positive effects mostly in innovative contexts based on knowledge application. In fact, in a context where innovation is fed by locally produced applied knowledge, entrepreneurs are able to turn this knowledge into innovation and to make a contribution to regional growth, as suggested by the knowledge spillover theory. However, findings also show that in a context relatively weaker in terms of knowledge creation, entrepreneurs can still play a role by using their ability to search for the right knowledge outside the region and apply and turn it into innovation, a situation not yet empirically tackled. On the other hand, risk orientation plays a role in all contexts. Still, also, in this case, results signal out situations that may at first glance be interpreted as paradoxical and suggest some diminishing returns in the impact of this entrepreneurial characteristic on growth with respect to knowledge and innovation intensity. Indeed, in regions where innovation is more R&D driven, the effect on growth is lower (if not nil) than in areas in which innovation is only imitative in nature. Lastly, a strategic entrepreneurial vision plays always a role in all innovative contexts, still with less substantial diminishing returns with respect to risk orientation.

To conclude, findings indicate that not simply the multifacet nature of entrepreneurship has to be taken into consideration in order to formulate appropriate regional entrepreneurship policy interventions. In fact, the variety of pathways through which the different entrepreneurial characteristics can impact on regional growth also suggests that policies should be tailored and adapted to the innovative context conditions to deliver expected results, as contended in the current debate on smart specialization (Boschma 2014; Camagni et al. 2014; Coffano and Foray 2014).

Notes

Regional modes of innovation have been identified by means of a k-means cluster analysis based on a series of indicators capturing the different regional knowledge and innovation propensities, i.e., the regional EU (European Union) share of total patents, the regional share of firms introducing product and/or process innovation, and the regional share of firms introducing marketing and/or organizational innovation. For further details on the variables used in the cluster analysis and the variables representing the key territorial features of the different groups of regions see Capello and Lenzi (2013).

Put briefly, REDI is obtained as the combination of three main subindexes, called entrepreneurial attitude, ability and aspiration, which in turn are the outcomes of the interplay among 14 pillars. These 14 pillars, too, are composite indicators that merge by interaction up to 76 individual and context (i.e. regional and/or national) level variables. Because of data availability constraints, REDI and its constitutive pillars and subindicators have been developed with a mix of NUTS1 and NUTS2 level, depending on the country and for all EU-27 countries with the exception of Bulgaria, Cyprus, Luxembourg, Malta, and Åland in Finland (NUTS2 code FI20). For those countries for which data were available at NUTS1 level only, data at NUTS2 level were extrapolated by assigning the same value to all NUTS2 regions belonging to the same NUTS1. For details on the precise indices forming the composite ones, the operationalization, computation and the rationale of the choice of the variables used to obtain the 14 pillars and the subindexes see the Szerb et al. (2013). A summary description is also presented in Table 4 in “Appendix”.

Acs et al. (2014) severely criticized the traditional indicators of entrepreneurship; in their opinion, their merits notwithstanding, traditional indicators fail to take account of the context in which new firms come to operate and the process through which new businesses come to operate, as well as the feasibility and actual realization of entrepreneurial events.

VIF (Variance inflation factor) for the entrepreneurial characteristics variables is quite high (namely, 6.99, 5.36 and 1.83, respectively, for potential of opportunities perception, risk orientation and strategic vision). In consideration of their high correlations (ranging from 0.62 to 0.89 and all significant at the 5 % level) and VIF, we decided to introduce the three variables separately in the regressions.

As a general remark, we are aware that the period of measurement of the dependent and the entrepreneurship variables may raise concerns. In this respect, more than causally, our estimates are better to be interpreted as a set of partial correlation indices highlighting and describing the combinations of entrepreneurial characteristics and regional innovative environments more likely to lead to growth.

We also performed an additional robustness check by excluding three NUTS2 regions (namely, Brussels, Stockholm and Inner London), suspect of being outlier as their real GDP per capita in 2006 falls in top 1 % of the variable distribution (see also Table 1). Results, unreported for reason of space but available upon request, are fully consistent with the ones presented here.

References

Acs, Z. J., & Armington, C. (2004). The impact of geographic differences in human capital on service firm formation rates. Journal of Urban Economics, 56(2), 244–278. doi:10.1016/j.jue.2004.03.008.

Acs, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: measurement issues and policy implications. Research Policy, 43(3), 476–494. doi:10.1016/j.respol.2013.08.016.

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30. doi:10.1007/s11187-008-9157-3.

Acs, Z. J., & Storey, D. J. (2004). Introduction: Entrepreneurship and economic development. Regional Studies, 38(5), 871–877. doi:10.1080/0034340042000280901.

Andersson, M., & Koster, S. (2011). Sources of persistence in regional start-up rates: Evidence from Sweden. Journal of Economic Geography, 11, 179–201. doi:10.1093/jeg/lbp069.

Anselin, L. (2010). Thirty years of spatial econometrics. Papers in Regional Science, 80(1), 3–25. doi:10.1111/j.1435-5957.2010.00279.x.

Armington, C., & Acs, Z. J. (2002). The determinants of regional variation in new firm formation. Regional Studies, 36, 33–45. doi:10.1080/00343400120099843.

Asheim, B. T., & Isaksen, A. (2002). Regional innovation systems: The integration of local ‘sticky’ and global ‘ubiquitous’ knowledge. The Journal of Technology Transfer, 27(1), 77–86

Audretsch, D. B. (1995). Innovation and industry evolution. Cambridge, MA: MIT Press.

Audretsch, D. B., Falck, O., Feldman, M. P., & Heblich, S. (2012). Local entrepreneurship in context. Regional Studies, 46(3), 379–389. doi:10.1080/00343404.2010.490209.

Audretsch, D. B., & Fritsch, M. (2002). Growth regimes over time and space. Regional Studies, 36(2), 113–124. doi:10.1080/00343400220121909.

Audretsch, D. B., & Kelibach, M. (2007). The theory of knowledge spillover entrepreneurship. Journal of Management Studies, 44(7), 1242–1254. doi:10.1111/j.1467-6486.2007.00722.x.

Audretsch, D. B., & Kelibach, M. (2008). Resolving the knowledge paradox: Knowledge spillover entrepreneurship and economics growth. Research Policy, 37(10), 1697–1705. doi:10.1016/j.respol.2008.08.008.

Audretsch, D. B., Kelibach, M., & Lehemann, E. (2006). Entrepreneurship and economic growth. New York: Oxford University Press.

Audretsch, D. B., & Thurik, R. (2001). What’s new about the new economy? Sources of growth in the managed and entrepreneurial economies. Industrial and Corporate Change, 10(1), 267–315. doi:10.1093/icc/10.1.267.

Boschma, R. (2014). Constructing regional advantage and smart specialization: Comparison of two European policy concepts. Scienze Regionali—Italian Journal of Regional Science, 13(1), 51–68. doi:10.3280/SCRE2014-001004.

Bosma, N., & Schutjens, V. (2011). Understanding regional variation in entrepreneurial activity and entrepreneurial attitude in Europe. Annals of Regional Science, 47, 711–742. doi:10.1007/s00168-010-0375-7.

Camagni, R. (2015). Towards creativity-oriented innovation policies based on a hermeneutic approach to the knowledge-space nexus. In A. Cusinato & A. Philippopoulos-Mihalopoulos (Eds.), Knowledge-creating Milieus in Europe: Firms, Cities, Territories (pp. 341–358). Berlin: Springer .

Camagni, R., Capello, R., & Lenzi, C. (2014). A territorial taxonomy of innovative regions and the European regional policy reform: Smart innovation policies. Scienze Regionali—Italian Journal of Regional Science, 13(1), 69–106. doi:10.3280/SCRE2014-001005.

Capello, R. (2013). Territorial patterns of innovation. In R. Capello & C. Lenzi (Eds.), Territorial patterns of innovation: An inquiry on the knowledge economy in European regions (pp. 129–150). Oxford: Routledge.

Capello, R., & Lenzi, C. (2013). Territorial patterns of innovation in Europe: A taxonomy of innovative regions. Annals of Regional Science, 51(1), 119–154. doi:10.1007/s00168-012-0539-8.

Capello, R., & Lenzi, C. (2015). Knowledge, innovation and productivity gains across European regions. Regional Studies, 49(11), 1788–1804.

Coffano, M., & Foray, D. (2014). The centrality of entrepreneurial discovery in building and implementing a smart specialization strategy. Scienze Regionali—Italian Journal of Regional Science, 13(1), 33–50. doi:10.3280/SCRE2014-001003.

Corrado, L., & Fingleton, B. (2012). Where is economics in spatial econometrics. Journal of Regional Science, 55(2), 210–239. doi:10.1111/j.1467-9787.2011.00726.x.

Dahl, M. S., & Sorenson, O. (2012). Home sweet home: Entrepreneurs location choices and the performance of their ventures. Management Science, 58(6), 1059–1071. doi:10.1287/mnsc.1110.1476.

Elhorst, J. P. (2014). Spatial Econometrics. Springer Briefs in Regional Science,. doi:10.1007/978-3-642-40340-8_2.

Feldman, M. P. (2001). The entrepreneurial event revisited: Firm formation in a regional context. Industrial and Corporate Change, 10(4), 861–891. doi:10.1093/icc/10.4.861.

Feldman, M. P. (2014). The character of innovative places: entrepreneurial strategy, economic development and prosperity. Small Business Economics, 43(1), 9–20. doi:10.1007/s11187-014-9574-4.

Foray, D. (2009). Understanding smart specialisation. In D. Pontikakis, D. Kyriakou, & R. van Bavel (Eds.), The question of R&D specialisation (pp. 19–28). Brussels: JRC, European Commission, Directoral General for Research. doi:10.2791/1094.

Fritsch, M. (Ed.). (2011). Elgar handbook of research on entrepreneurship and regional development—National and regional perspectives. Cheltenham: Edward Elgar.

Fritsch, M., & Falck, O. (2007). New business formation by industry over space and time: A multi-dimensional analysis. Regional Studies, 41, 157–172. doi:10.1080/00343400600928301.

Fritsch, M., & Storey, D. J. (2014). Entrepreneurship in a regional context: Historical roots, recent developments and future challenges. Regional Studies, 48(6), 939–954. doi:10.1080/00343404.2014.892574.

Gibbons, S., & Overman, H. G. (2012). Mostly pointless econometrics? Journal of Regional Science, 55(2), 172–191. doi:10.1111/j.1467-9787.2012.00760.x.

Helfat, C. E., & Lieberman, M. B. (2002). The birth of capabilities: Market entry and the importance of pre-history. Industrial and Corporate Change, 14(3), 437–467. doi:10.1093/icc/11.4.725.

Hundt, C., & Sternberg, R. (2014). Explaining new firm creation in Europe from a spatial and time perspective: A multilevel analysis based upon data of individuals, regions and countries. Papers in Regional Science. doi:10.1111/pirs.12133.

Jensen, M. B., Johnson, B., Lorenz, E., & Lundvall, B. A. (2007). Forms of knowledge and modes of innovation. Research Policy, 36(5), 680–693

Kirzner, I. (1997). Entrepreneurship discovery and the competitive market process: An Austrian approach. Journal of Economic Literature, 35(1), 60–85.

Klepper, S., & Sleeper, S. (2005). Entry by spin-offs. Management Science, 51(8), 1291–1306. doi:10.1287/mnsc.1050.0411.

LeSage, J. P. (2014). What regional scientists should know about spatial econometrics. Review of Regional Studies, 44(1), 13–32.

Licht, G. (2009). How to better diffuse technologies in Europe. Knowledge Economy Policy Brief, 7, 1–5. http://ec.europa.eu/invest-in-research/pdf/download_en/kfg_policy_brief_no7.pdf?11111.

Mack, E. (2014). Broadband and knowledge intensive firm clusters: Essential link or auxiliary connection? Papers in Regional Science, 93(1), 3–29. doi:10.1111/j.1435-5957.2012.00461.x.

Marrocu, E., & Paci, R. (2011). Education or creativity: What matters most for economic performance? Economic Geography, 88, 369–401. doi:10.1111/j.1944-8287.2012.01161.x.

Pavlínek, P. (2002). Transformation of central and east European passenger car industry: Selective peripheral integration through foreign direct investment. Environment and Planning A, 34, 1685–1709. doi:10.1068/a34263.

Qian, H., & Acs, Z. J. (2013). An absorptive capacity theory of knowledge spillover entrepreneurship. Small Business Economics, 40(2), 185–197. doi:10.1007/s11187-011-9368-x.

Shane, S. (2003). A general theory of entrepreneurship: The individual-opportunity-nexus. Cheltenham: Edward Elgar. doi:10.4337/9781781007990.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226. doi:10.5465/AMR.2000.2791611.

Stam, E. (2007). Why butterflies don’t leave. Locational behavior of entrepreneurial firms. Economic Geography, 83(1), 27–50. doi:10.1111/j.1944-8287.2007.tb00332.x.

Sternberg, R. (2009). Regional dimensions of entrepreneurship. Foundations and Trends in Entrepreneurship, 5, 211–340. doi:10.1561/0300000024.

Sternberg, R. (2011). Regional determinants of entrepreneurial activities. Theories and empirical design. In M. Fritsch (Ed.), Elgar handbook of research on entrepreneurship and regional development—National and regional perspectives (pp. 33–57). Cheltenham: Edward Elgar.

Stuetzer, M., Obschonka, M., Brixy, U., Sternberg, R., & Cantner, U. (2014). Regional characteristics, opportunity perception and entrepreneurial activities. Small Business Economics, 42, 221–244. doi:10.1007/s11187-013-9488-6.

Szerb, L., Acs, Z. J., Autio, E., Ortega-Argilés R, & Komlosi, E. (2013). REDI: The regional entrepreneurship and development index. doi:10.2776/79241.

Varga, A. (2006). The spatial dimension of innovation and growth: Empirical research methodology and policy analysis. European Planning Studies, 14(9), 1171–1186. doi:10.1080/09654310600933298.

Varga, A., & Schalk, H. (2004). Knowledge spillovers, agglomeration and macroeconomic growth: An empirical approach. Regional Studies, 38(8), 977–989. doi:10.1080/09654310600933298.

Vega, S. H., & Elhorst, J. P. (2015). The SLX model. Journal of Regional Science, 55(3), 339–363. doi:10.1111/jors.12188.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Capello, R., Lenzi, C. Innovation modes and entrepreneurial behavioral characteristics in regional growth. Small Bus Econ 47, 875–893 (2016). https://doi.org/10.1007/s11187-016-9741-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-016-9741-x