Abstract

The current literature contains mixed results regarding the impact of corruption on entrepreneurship and economic growth. In this paper, we examine a much larger set of countries and time periods to attempt to gain insights into this relationship. In particular, the central question is whether corruption can compensate for a bad business climate. Our results are clear; corruption hurts entrepreneurship. The impact is smaller, but remains negative, when business climates are bad. This is in contrast to previous literature that suggests corruption may increase entrepreneurship under a bad business climate. We find corruption never improves entrepreneurship; it simply hurts less when business climates are not conducive to growth in the first place.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A growing literature suggests that corruption can help entrepreneurship and economic growth (see, e.g., Dreher and Gassebner 2013; Rose 2000). By allowing entrepreneurs to bribe their way through the start-up process, the argument goes; it makes it easier for new ventures to be created. This strand of the literature is known as the ‘grease the wheels’ argument, as it argues that corruption can improve entrepreneurial opportunities like putting grease on a wheel can make it move faster. This literature, however, stands in stark contrast to other studies that find that, in general, corruption in government is harmful for growth and prosperity for a country (see, e.g., Shleifer and Vishny 1993; Ehrlich and Lui 1999; Mauro 1995; La Porta et al. 1999; Treisman 2000; Busenitz et al. 2000; Glaeser and Saks 2006).

In this paper, we attempt to rectify these two strands of the literature, by delineating between the direct and indirect effects of corruption on entrepreneurship. This novel insight allows us to more directly examine the issue of whether corruption is good or bad for entrepreneurship, as one of the effects only exists strongly in countries with preexisting bad business climates that create high government burdens on start-up activity. More fundamentally, even if corruption does help but only in a situation where a country’s business climate is ‘bad’—then precisely how bad does it have to be for the effect to turn positive? This is important for policy because efforts to dampen corruption in countries may be bad policy, and lower entrepreneurship and prosperity, if the business climate is not fixed first. Using panel data from the World Bank and World Governance Indicators for 104 countries, we find that while there is a slightly positive partial-equilibrium impact of corruption when business climates are bad, that across the board the general-equilibrium impact is negative. That is, always and everywhere corruption harms entrepreneurship, just not as much in countries with bad business climates. Section 2 gives a literature review and a theoretical treatment of our hypothesis. Section 3 describes the data and methodology. Section 4 contains our main empirical results, and Sect. 5 presents robustness tests. Finally, Sect. 6 concludes.

2 Literature review and theoretical arguments

The ‘grease the wheels’ strand of the literature suggests that corruption can increase the rate of entrepreneurship. Perhaps nowhere is the evidence stronger than for post-socialist economies, which have some of the highest corruption rates in the world (see, e.g., Hellman et al. 2000; Radaev 2004; Ovaska and Sobel 2005; Rose 2000). The argument that bribery or corruption may improve inefficient outcomes is not new, nor limited to the field of entrepreneurship. Spiller (1990), for example, shows formally how allowing political agents to be bribed can increase efficiency of government more generally by allowing dollar values, rather than yes/no decisions, influence outcomes.Footnote 1

Inefficient rules, by definition, create private and social deadweight losses. Those affected are willing to pay up to this value to overcome the bad policy in place, and if a bribe allows that to happen when it otherwise would not, bribery and corruption increase economic activity and lessen deadweight losses. In areas with bad business climates, inefficient rules stand in the way of productive entrepreneurship. When this happens, entrepreneurs can expand the number of ventures they can undertake if they are able to get government officials to bend or ignore the rules through other means.Footnote 2 In other words, the bribes are not simply a ‘cost of doing business’ that is higher and therefore lowers entrepreneurship rates—quite the contrary, without the bribes the businesses would not exist.

This strand of the literature, however, apparently argues that corruption is good for economic growth and entrepreneurship, conditional on a country having a preexisting bad business climate. For example, using data for 43 countries from 2003 through 2005, Dreher and Gassebner (2013) find that corruption is beneficial in highly regulated economies (specifically those with a higher number of procedures required to start a business and a larger minimum capital requirement). Their conclusion is that corruption has a positive impact on entrepreneurship in countries with bad business climates.

The contrasting strand of the literature argues that corruption in government is harmful for overall growth and prosperity in general (see, e.g., Shleifer and Vishny 1993; Ehrlich and Lui 1999; Mauro 1995; La Porta et al. 1999; Treisman 2000; Busenitz et al. 2000; Glaeser and Saks (2006). Using data from the Global Entrepreneurship Monitor (GEM) on measures of entrepreneurship (patents, TEA and realized innovation measures) and a measure of control of corruption from the World Governance Indicators for 64 countries from 1996 to 2002, Anokhin and Schulze (2009), for example, conclude that corruption is harmful to entrepreneurship and innovation, the driving source of economic growth. Employing GEM surveys in 55 countries, Estrin et al. (2012) find that controlling for the level of development, less corruption (and stronger protection of property rights), increases the growth plans of entrepreneurs. Their results suggest entrepreneurs planning larger-scale ventures should search out locations where property rights are more secure and corruption is lower. Aidis et al. (2012) find mixed results using GEM data, with some models showing weak responses to corruption and other country fixed-effect models having insignificant results, however, when the richest countries are removed from the sample the impact of corruption appears strongest in lowering entrepreneurship. This hints at the main issue we address in this paper, which is that the impact of corruption on entrepreneurship may depend on other factors, such as the quality of existing institutions.

The idea that corruption, which is normally harmful to economic activity, may be good for growth when the business climate is bad can be viewed within the framework of the ‘theory of the second best’ (see Lipsey and Lancaster 1956). This theory explains how a policy that by itself in an already efficient environment would be inefficient can, in the presence of a preexisting distortion, be a positive influence. For example, generally turning a competitive industry into a monopoly would be efficiency reducing due to the reduction in output. However, if this industry was one that created a significant negative externality, and thus already was producing an inefficiently large output, imposition of a monopoly, in theory, could improve efficiency by reducing output closer to the ideal level. That is, something that might be efficiency reducing if starting from an already efficient outcome, such as imposing a monopoly, may flip on its head if the starting point is no longer an efficient outcome. If inefficiencies already exist, something that would normally hurt may help improve efficiency. In our context, this translates into government corruption. Under normal circumstances, with a well-functioning government and efficient rules, the introduction of corruption would harm outcomes and lead to inefficiency. However, just because this is true does not mean the same conclusion necessarily follows if one begins from a point of a poorly functioning government with already inefficient rules. If the current rules prevent efficient actions from being taken legally, corruption can allow these activities to happen.

Take a simple example. During alcohol prohibition in the USA, it was illegal to operate a bar selling alcohol. If the political processes (i.e., police and courts) do their jobs properly, they will try to shut the entire industry down. If, however, an entrepreneur wanting to run a bar bribes the local police to look the other way, he may be able to operate despite the rules against his business’s existence. If there were two areas, one where police took bribes and one where they did not, quite simply, there would be more bars (i.e., more entrepreneurship) in the area where bribery and corruption existed. The more interesting question is how the number of bars will compare to a third different area where alcohol was completely legal. Obviously as the opportunities for corruption and bribery grow, there will be more bars—so we move closer to the unrestricted level as corruption expands.

Compare this to a situation where alcohol was legal and a corrupt police force decided to try mafia tactics and actually harm businesses if they did not pay bribes. In that situation, the bribes would simply function as a cost of doing business and would result in a decrease in the number of ventures. The point is that whether corruption helps or hurts the number of business ventures depends on the preexisting institutions. When current laws prevent mutually beneficial voluntary exchanges from taking place, deadweight losses are created, and bribes and corruption may expand economic activity.

The idea that corruption, which in theory should be harmful to economic growth and entrepreneurship, could be helpful in an environment in which business regulations and government policies were already too strict, is similar to this theory of the second best argument. Largely the idea is that when barriers to opening a business are severe, being able to bribe political agents can ease the business start-up process actually improving the level of entrepreneurial activity in an economy relative to an environment in which there was less corruption.

An entrepreneur attempting to start a new venture faces many bureaucratic hurdles. The World Bank’s Doing Business database, for example, shows that in many countries of the world, the number of procedures or steps (and the cost of them) can be excessive to the point of significantly hampering the ability to get a new venture formed. Whether it be bureaucratic challenges in legally forming the business, getting any necessary construction permits, electricity hook-ups, financing, or contract enforcement, all of these hurdles—in theory—could be overcome by bribing the right government official. The recent headline-making event of casino owner Sheldon Adelson admitting he likely violated US law by bribing Chinese officials (see Schwirtz 2013) is a case in point, “as with many lucrative business spheres in China, the gambling industry on Macau is laced with corruption. Companies must rely on the good will of Chinese officials to secure licenses and contracts. Officials control even the flow of visitors, many of whom come on government-run junkets from the mainland.” When government agents control the flow of licenses, contracts or customers, the entrepreneurs who provide favors to these government agents are able to successfully navigate the process of opening a successful business.

We argue that a novel framework within which to approach this question is to delineate between the direct and indirect impacts of corruption on entrepreneurship. For this purpose, it is important to be more precise than in the previous literature on the possible nature of corruption. Glaeser and Goldin (2006) outline three main sources or types of corruption: (1) public officials directly stealing public funds through embezzlement; (2) public officials taking bribes or other indirect means of compensation for favorably transferring government funds or providing breaks on government rules and regulations; and (3) public officials manipulating laws or rules to directly benefit their own financial interests.

Source (2) is clearly what we have been discussing, when corrupt public officials relax rules for entrepreneurs. This source of corruption and its impact we will call the ‘direct effect’ of corruption on entrepreneurship. Sources (1) and (3) really have nothing to do specifically with entrepreneurs trying to escape government rules. These are cases where government officials simply benefit themselves at the expense of the general public. While at first glance this may seem unrelated, it is not. The literature clearly shows that corruption like these sources harms the overall level of prosperity in a country.Footnote 3 Among many reasons, corruption endangers the trust relations necessary for economic exchange, lowers the efficiency of government provided public goods provision and increases the cost of doing business. These factors result in lowered productive activity and a lower overall standard of living and income, meaning there are fewer opportunities for entrepreneurs. We term this second effect the ‘indirect effect.’ While source (2) is the possible avenue through which corruption can help entrepreneurship, the other two sources clearly have a negative influence.

The direct effect (through source 2 of those listed above) is how corruption influences entrepreneurship through interactions with a burdensome regulatory/permit process or bad business climate. This direct effect is the debate about whether given bad rules if corruption makes it easier to navigate the process. If this direct effect is zero, then corruption must have an overall negative impact on entrepreneurship and growth. If the direct effect is positive (in that corruption makes it easier to navigate the hurdles of starting a business), then there is a new remaining question. Even if this second effect is ‘positive,’ it may or may not be large enough to outweigh the indirect effects. So even if a more corrupt economy allows more businesses to skip hurdles and open, the overall corruption may harm prosperity so much that there are significantly fewer entrepreneurial opportunities.

If the direct effect is small but positive, then corruption probably harms entrepreneurship at all levels of corruption and at all preexisting business climates, as the small positive would not outweigh the large negative indirect effects. However, if the direct effect is big enough, then corruption may actually increase the rate of entrepreneurship if this direct effect outweighs the negative indirect effects. The previous literature has not been clear on this distinction and often focuses on only one of these two effects. However, from the standpoint of growth and prosperity it is the combined effect that matters.

We now turn to our empirical analysis. In particular, we wish to see: (1) whether corruption is bad or good for entrepreneurship; (2) whether this depends on the preexistence of a bad business climate; and (3) exactly how bad does the business climate have to be (if ever) to create a positive impact on the economy of corruption.

3 Data and methodology

3.1 Data

Our dependent variable, extent of entrepreneurial initiatives in country, comes from the World Bank. The annual data are collected from 130 company registrars providing information on the number of newly registered firms over the past 7 years. Our main measure of entrepreneurship is new business entry density that is defined as ‘the number of newly registered limited liability corporations per calendar, normalized by population’ (World Bank 2013). The concept of limited liability implies that the liability of the owners of a firm is limited to their investment in the business. Due to differences and lack of consistency in the definition of partnerships and sole proprietorships across the world, those are not considered in the database. Population data come from World Development Indicators database, and the normalized values indicate the number of new entrepreneurial initiatives per 1000 working age people (between ages 15 and 64). Based on our sample, the average score for business density is approximately 2.69. The maximum value of our sample is 39, while the minimum is 0. A Kernel density plot of new business density is provided in Fig. 1.

In our paper, we use the World Bank data on formal entrepreneurship. Several previous papers have alternatively used the Global Entrepreneurship Monitor (GEM) data to examine the link between corruption and entrepreneurship. Acs et al. (2008) provide a detailed discussion of the strengths and weaknesses of these alternative databases. As stressed by Acs et al. (2008), when it comes to business barriers, as reflected in the World Governance Indicators (WGI), they are more applicable to formal-sector businesses. The concepts of time and documents needed to start up a business and minimum capital requirement are all applicable only to a formal-sector firm. The World Bank data on entrepreneurship include only businesses that are included in the formal sector, making it the more appropriate choice for our purposes than the GEM data that would include data for necessity entrepreneurs and others not subject to the formal rules. In addition, the World Bank data include more developed countries in their sample. Because a main question is whether the differing formal institutions and business climates across countries interact with corruption, the World Bank’s data allow us to use more countries with better formal institutions to more accurately isolate the relationships.

Out of the different measures capturing the extent of business regulations, we focus on business start-up costs and its sub-components. The literature has explored extensively the impact of business regulation entry cost on different macroeconomic outcomes. In this context, it is worth mentioning that public choice theory points to the rent-generating and competition-deterring effects of higher entry regulation cost (see De Soto 1989; Posner 1975). The empirical evidence finds extensive support to the public choice theory and shows that such regulation entry cost can deter employment, hamper productivity and negatively impact growth (see Kaplan et al. 2009; Aghion et al. 2008; Bruhn 2008). In the context of entrepreneurship, Fonseca et al. (2001) find that the higher start-up costs hamper entrepreneurial initiatives and, thus, affect job creation negatively. Based on a study of European firms, Klapper et al. (2006) show that higher entry regulations deter the creation of new firms.

Using all the sub-components of business regulation entry from Doing Business database 2013, (World Bank 2012) we create an index measuring the ‘starting a business’ cost. We construct this index via principal component analysisFootnote 4 by using standardized valuesFootnote 5 of the components. The sub-components are procedures required to start a business (number), time required to start a business (days), cost as percentage of income per capita and minimum capital requirement as percentage of income per capita. We term this the SB (starting a business) cost index. Higher values of the index imply greater business restrictions in terms of longer time requirement, completion of greater number of procedures, high cost and higher minimum capital requirement for starting a business.

There are a few alternate databases of corruption that are used commonly in the literature as well. Two such popular databases are the Corruption Perception Index (CPI) by Transparency International (TI) and ‘Control of Corruption’ in the World Governance Indicators (WGI) database by Kauffman et al. (2010). As stressed by Rohwer (2009), WGI adopts the basic approach used by TI and improves on it. Yet, Ackerman (2006) has shown that both these databases are strongly correlated with each other. One of the main advantages of the measure from WGI is that it is constructed based on several sources that reflect the views and assessment of a large number of enterprises, citizens, expert survey respondents, think tanks, survey institutes, non-government organizations and international organizations. Thus, the index is relatively more comprehensive compared with other measures of corruption. Additionally, WGI assigns differential weights to the individual sources from which the aggregate index is constructed that improve its accuracy. Thus, we choose to use the WGI measure of corruption.

Control of corruption is one of the six measures of governance compiled in the database. Specifically, it aims to capture the “perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as ‘capture’ of the state by elites and private interests” (Kauffman et al. 2010). Each governance indicator, including corruption, is compiled from several individual sources, and then unobserved components model (UCM) is used to ‘construct a weighted average of the individual indicators for each source.’ The database provides a range of −2.5 to 2.5 with higher numbers representing lower levels of corruption. For our convenience, we have converted the scale by using a monotonic transformation—our data range from 0 to 5 with higher values representing greater corruption. The mean of the sample is 2.4 with the maximum value being 4.2. A Kernel density plot of our corruption data is also provided in Fig. 1.

The choice of determinants for entrepreneurship follows popular literature, both macro and micro studies. As mentioned by Audretsch and Keilbach (2007), GDP growth captures the level of economic opportunities for a region. Rising wealth in a region implies increasing market size and, thus, rising opportunities for new business to thrive due to greater potential for economic exchange. Thus, as a measure for market size and wealth, we consider GDP per capita and GDP growth as control variables. Numerous previous studies, including the Global Entrepreneurship Monitor (GEM), 2009 report, have shown that population growth is significantly related to entrepreneurship, so we include it as well (Tamásy and Le Heron 2008; Armington and Acs 2002; Reynolds et al. 1995, 1999; Keeble and Walker 1994; ILO 1990).

Other than GDP per capita, growth and population growth, we include female labor force participation rate (FLPR), population in the largest city as a percentage of total population and working population as a percentage of total population. According to Delmar and Davidsson (2000), gender is strongly associated with entrepreneurship. The probability of male starting a business is higher than of female. In a similar context, countries with higher female share in the labor force have been shown to have lower percentage of self-employed individuals (Uhlaner et al. 2002). Also studies like Du Rietz and Henrekson (2000) show that the exit rates for female entrepreneurs are higher than their male counterparts (see also Verheul et al. 2006). Audretsch et al. (2002) find that, in general, total labor force participation rates along with female labor force participation rates are important determinants of entrepreneurship. We also check the robustness of our results using total labor force participation rates in alternate specifications.

Population density has been found to be significantly related to entrepreneurship rates (Reynolds et al. 2004; Wagner and Sternberg 1985). Specifically Reynolds et al. (2004) show that urbanization promotes spillovers. Population density in the cities generates externalities and opportunities for increasing returns and, thus, affects entrepreneurial initiatives positively. Other studies that have provided similar conclusions are Brüderl and Preisendörfer (1998) and Storey (1994). We control for population in the largest city as a percentage of total population and urban population as a percentage of total population in alternate specifications (see Leeson and Sobel 2008). Finally, to remove any impacts of the young or elderly, we control for working age population (see Sachs and Warner 1997).

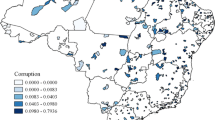

We consider an extensive unbalanced panel of 104 countries over the sample period 2004–2011. The number of years of data available for each country varies between 1 and 8. “Appendix 1” describes the countries used in our empirical analysis. We also provide the business density and corruption figures for each country in the Appendix. “Appendix 2” provides summary statistics, and “Appendix 3” presents the correlation matrix.

3.2 Empirical methodology

Our empirical strategy aims at estimating the effect on corruption on entrepreneurship conditional on the quality of the business climate of the country. As mentioned earlier, we consider the cost of starting a business along with its sub-components to measure the business climate. Specifically, we want to examine how the levels of corruption in a nation interact with the cost to start a business in determining the level of entrepreneurship for countries.

In order to deal with unobserved heterogeneity associated with panel data, fixed-effect estimators can be employed. While fixed-effect estimates are suited to take into account unobserved heterogeneity, they cannot handle several other panel data challenges. Removing unobserved heterogeneity by first differencing is commonly employed technique for panel data and falls under the family of linear dynamic panel data (DPD) model estimators. The challenge with such models is that standard errors might be rendered inconsistent since the unobserved panel-level effects are correlated with the lagged-dependent variable. Arellano and Bond (1991) proposed the general method of moments (GMM) estimator that generates consistent estimates for such models, which we employ as our benchmark estimator.

Along with panel data challenges mentioned above, we face the challenge of endogeneity associated with our variable of interest, corruption. The policies and laws of a country are not completely exogenous and can be driven by the level of economic development. Additionally, as entrepreneurial development occurs in a country due to a favorable and competitive business climate, the need to indulge in corrupt activities goes down. GDP per capita and growth should be endogenous as well. Thus, we treat corruption along with these variables to be endogenous in our specifications.

One way to handle endogeneity and omitted variable bias concerns instrumental variable (IV) strategy can be employed. In this context, Persson and Tabellini (2006) point out that it is a daunting task to find strictly exogenous instruments for regressions with country fixed effects. Thus, weak instruments can exacerbate the bias. Dynamic panel estimators solve this problem since they allow us to address the endogeneity issues by not having to find strictly exogenous instruments and, thus, have become popular for recent empirical panel studies (see, e.g., Dutta et al. 2013; Asiedu and Lien 2011; Asiedu et al. 2009; Djankov et al. 2006; Acemoglu et al. 2008 to mention a few).

The estimator proposed by Arellano and Bond (1991) is known as the difference GMM estimator that uses lagged values of the first difference of the endogenous variables as instruments. Yet, these lagged levels can be poor instruments for first differences. System GMMFootnote 6 estimator proposed by Blundell and Bond (1998) mitigates this problem by using additional moment conditions. The use of extra moment conditions by the system GMM estimates results in reduced bias and greater precision over difference GMM estimates. Thus, we rely on system GMM estimators to be our benchmark estimator.

Both difference and system GMM estimates are rendered inconsistent in the presence of second-order autocorrelation. Thus, for all specifications we report the p values from the second-order autocorrelation test. Additionally, we report p values for over-identification test checking the validity of the instruments.

We estimate the following reduced form model

where Ent it is the measure of entrepreneurship (new business entry density) for country i in time t. Ent it−1 represents business density in period t − 1. Corr it is the measure of corruption for country i in time t. X ijt is the matrix of control variables, γ i is the country fixed effect, θ t is the time-specific effect and \( \varepsilon_{it} \) is the random error term. Our coefficients of interest are β 2 and β 3. Specifically, we are interested in estimating the overall effect of corruption on entrepreneurship, which is given by \( \frac{{\delta {\text{Ent}}_{it} }}{{\delta {\text{Corr}}_{it} }} = \beta_{2} + \beta_{3} {\text{SB}}\;{\text{cost}}_{it} \). Based on whether β 2 >, = or < 0, and β 3 >, = or < 0 and the magnitude of SB cost, \( \frac{{\delta {\text{Ent}}_{it} }}{{\delta {\text{Corr}}_{it} }} \) will be >, = or < 0.

4 Main empirical results

4.1 Benchmark results

Before getting into empirical analysis, we present some fitted plots in Fig. 2 that can help to illustrate the implications of our empirical results. We plot the estimated responses for the relationship between corruption and business density for different values of business start-up cost. This allows a visual illustration of how the lines have different slopes for different values of business start-up costs. Our argument is consistent with the idea that the negative impact should be greater (e.g., a more negatively sloped line) when the business climate is worse (higher values for our measures). We consider our SB index, time (in days) and minimum capital requirement (% of income per capita).

We split the sample based on the specific value of these start-up cost sub-components. In panel (B) of Fig. 2, for example, the dashed line represents a fitted plot for the subsample between corruption and business density when time >14, thus indicating higher government regulatory costs and a worse business climate. The solid line represents a similar plotted line for the subsample for time ≤14. Both lines slope negative, suggesting that as corruption rises, business density decreases. The dashed line has a less negative slope relative to the solid line, suggesting that for similar rise in corruption, the fall in business density is more when time >14 compared to the fall in corruption when time ≤14. Thus, in the face of higher government hurdles, corruption hurts less. We find similar conclusion in the other figure when we use the measure of start-up cost—minimum capital requirement (% of income per capita) in panel (C) and for the overall index in panel (A).

Our benchmark results are presented in Table 1. As mentioned in Sect. 3, the bias arising out of lagged business density is taken care of in system GMM estimation. The coefficient of corruption, itself, is negative and significant, suggesting that corruption harms business density. Yet, the coefficient of the interaction term is positive and significant, suggesting that higher the start-up cost, greater will be the impact of corruption on business density. The overall impact of corruption is given by \( \frac{{\delta {\text{Ent}}_{it} }}{{\delta {\text{Corr}}_{it} }} \) for different levels of start-up costs. Unless we estimate this, we cannot conclude anything about the varying impact of corruption on new business entry rates across our sample.

In terms of the controls, GDP per capita has a positive impact on business density, but it is not significant for all the specifications. Female labor force participations rates (FLPR) have a significant and negative impact on entrepreneurship measure supporting studies that have found this result in previous studies. Higher population in the largest city affects entry rate of new firms positively supporting the findings of the existing literature.

Our main interest is to estimate the marginal impact of corruption on entrepreneurship for different levels of business entry regulation. In Table 2, we report the marginal effects of corruption on new density for different values of SB index cost based on \( \frac{{\delta {\text{Ent}}_{it} }}{{\delta {\text{Corr}}_{it} }} \) = β 1 + β 2SB cost it . The index of SB cost ranges from negative to positive values. Following Asiedu et al. (2009), we calculate the means for \( \widehat{{{\text{SB}}\;{\text{cost}}}} \) for each country and then calculate the marginal at the 10th, 25th, 50th, 75th, 90th and 95th percentiles of the means and the mean of SB cost. To provider a deeper perspective, we provide the names of the countries to which these percentiles correspond. So, for example, the 10th percentile corresponds to mean SB index for Romania; similarly, 25th percentile corresponds to the mean SB index for Estonia. Likewise, the other countries corresponding to the 50th, 75th, 90th, 95th percentiles and the mean of SB costs are Serbia, El Salvador, Greece, Cambodia and Czech Republic, respectively.

We report marginal estimates for four out of the six specifications of Table 1 since they have the maximum number of observations. The column numbers indicate that corresponding estimates from Table (2) have been considered to estimate the marginal impacts. We can see from the table that as the value of the SB index rises, corruption continues to have a negative impact on new density, but it hurts less and less. For example, considering the estimates in column (2), for Romania, which is at the 10th percentile in terms of SB cost, a standard deviation (SD) rise in corruption reduces new business density by 0.29 percentage points.Footnote 7 The reduction is less for Serbia (by 0.17 % points) which is at the 50th percentile. The impacts are stronger in columns (2), (3) and (4). A standard deviation rise in corruption reduces business density by 0.44 % points (see column 5). Yet, if Romania’s business regulations becomes as bad as El Salvador (SB cost = 0.47), then the same rise in corruption reduces business density by 0.28 % points, that is, 36 % less decrease compared with Romania.

Thus, our data fail to support the claim that corruption under any circumstance can actually help entrepreneurial initiatives. Increases in corruption for all countries in our sample reduce entrepreneurial initiatives. The negative indirect effect of corruption on entrepreneurship outweighs the direct beneficial impact. This has important implications as it suggests that lowering corruption levels is never harmful in an economy, contrary to what the ‘grease the wheels’ hypothesis implies. Under that hypothesis, reducing corruption actually harms the amount of entrepreneurship in countries with bad business climates, therefore only justifying attempts to curtail corruption in the countries with better business climates. Our results, to the contrary, suggest that fighting corruption is a worthwhile goal everywhere, at least to the extent that it never harms entrepreneurship to reduce corruption. On the flip side, the benefit of reducing corruption is clearly highest in those countries with the best business climates.

We check the robustness of our results to the inclusion of additional controls. The level of financial development of an economy signifies the efficiency of financial institutions and measures the size, activity and efficiency of financial intermediaries and markets (Beck et al. 2000). The previous literature has stressed a strong connection between financial development and entrepreneurship (see, e.g., Karaivanov 2012; Bianchi 2012). Additionally, previous literature has stressed that human capital affects entrepreneurial development across nations. As pointed out by Le (1999), level of education via the channels of managerial ability and outside options might increase the likelihood of being self-employed. Yet, Van Der Sluis et al. (2008) point out that higher levels of educational attainment may increase the opportunities for wage employment and thus reduce the probability of being self-employed. Thus, we include three different measures of financial development (FD)—domestic credit provided by banking sector (% of GDP), domestic credit to private sector (% of GDP) and liquid liabilities (% of GDP), and two measures of human capital—net secondaryFootnote 8 enrollment ratio and primary completion rate. Both sets of measures are considered from WDI (2013). The results are presented in Table 3. While the coefficient of corruption remains negative and significant for most of the specifications, the coefficient of the interaction term is positive and significant for almost all the specifications. We report the estimates for column (2) and column (4) specifications in Table 3 for which we have the maximum number of observations, approximately 4 observations per country. As mentioned earlier, cross-country data availability across time for human capital measures is constrained and, thus, our sample size shrinks. The primary completion rate has relatively more available data compared with the other education variable.

The marginal estimates from Table 4 reinstate our conclusions. We report the estimates for two out of the six specifications from Table 3. We choose these two specifications since they have the maximum number of observations. These are column (2) and column (4) specifications from Table 3 for which the marginal estimates are reported in Table 4. As we can see, for higher costs of starting a business, corruptions hurts less and less. The indirect (negative) effects of corruption still outweigh the direct (positive) effects, but by a lesser extent as the regulatory cost rises. For example, if Romania’s corruption rises by 1 standard deviation, then business density falls by 0.2 % points. Yet, for El Salvador, it only declines by 0.07 % points which is 65 % less decline. For very high values of SB cost, the marginal impact is not significant.

5 Robustness analysis

We perform several robustness tests to ensure the validity of our results. Our initial set of robustness analysisFootnote 9 consists of checking our results with the individual components of the starting business (SB) cost index. These are procedures (number), time (days), cost (percent of income per capita) and minimum capital requirement (percentage of income per capita). We present the results in Table 5.

All controls are included except human capital measures to maximize sample size. The sign and significance of the coefficient of corruption is retained for all the specifications. Likewise, the coefficient of the interaction term remains positive. To find out whether our benchmark results are supported, we report the corresponding marginal estimates in Table 6.

Out of the four measures, we present the marginal estimates for procedures and cost (% of income per capita) keeping the space constraint in mind. The estimates for the two other measures are available on request. We use the actual values of these variables and not the standardized values. As we can see from the table, our main conclusions are reiterated in these estimates. For both measures, as the number of procedures or percentage of cost goes up, the magnitude of the negative impact on business density decreases. Compared with Japan, Argentina faces a lower cost in terms of rising corruption on its business density as the number of procedures for Argentina required to open a new business is much higher.

Finally, we test our results to alternate measures of corruption. We consider yet another popular measure of corruption from International Country Risk Guide (ICRG) database. As mentioned by ICRG, their corruption measures assesses corruption within the political system that discourages foreign investment, distorts the incentives of both government and business people by favoring and generating patronage and nepotism activities and overall distorts the environment. It considers both business and financial corruption that are related to the running of the business as well as ‘actual corruption’ in the forms of nepotism, patronage, job reservations and so on. The index runs from 0 to 6 points with higher points representing lower levels of corruption. To be able to have comparable analysis with our benchmark results, we convert the score from 0 to 6 so that higher values reflect higher corruption.

Table 7 presents our results. We include all our benchmark controls along with the three measures of financial development and two measures of human capital. Human capital measures are included in specifications (4)–(7) so that again we can test our results with the maximum number of observations.

Except in column (3) specification, the coefficient of corruption is negative and significant for all the specifications and that of the interaction term is positive and significant. Keeping the space constraint in mind, we have not report the marginal estimates, but they reiterate our benchmark conclusions.

6 Conclusion

Previous literature points to the potential for corruption to be a positive force for economic prosperity in countries that make it difficult or costly to start a business. By allowing entrepreneurs to bribe their way through the permit and approval process, corruption allows for more new businesses. This ‘grease the wheels’ hypothesis, while plausible, is only half the story. It represents the direct effect of corruption on entrepreneurship. A large body of other literature suggests that corruption is harmful to an economy, and entrepreneurship indirectly through the indirect effect of how corruption within government hampers the effective functioning of government itself, creates a climate opposite of what a predictable ‘rule of law’ regime would provide, and lowers income and prosperity of consumers.

According to the ‘grease the wheels’ argument, efforts to stamp out corruption across the globe could be very dangerous to growth and prosperity, particularly in the poorest and least developed countries. With bad business climates, without corruption, business formation would be lower and growth less robust. These arguments, however, ignore the indirect effects of corruption on the overall economic vitality of a country through broader institutional channels and fly in the face of well-cited studies by authors such as Shleifer and Vishny (1993) and Glaeser and Saks (2006) among many others listed in our literature review that suggest corruption harms growth.

Our results help to provide some clarity to this debate. We indeed find a positive coefficient on our interaction term with corruption and the business climate, seemingly supporting the grease the wheels hypothesis. However, with a strong negative coefficient on corruption itself, the true impact of changes in corruption levels depends on the combined direct and indirect effects. Once we estimate this combined total, our results are clear, higher corruption is never positive and statistically significant. The total impact of corruption is clearly negative for the countries with the better business climates. In a nutshell, efforts to reduce corruption are not a danger to entrepreneurship, even in the countries with the worst business climates. While corruption certainly hurts less when a country has a bad business climate, it never has a positive impact on entrepreneurship in total once both the direct and indirect effects are considered. While corruption may ‘grease the wheels,’ any benefit of this is more than offset by corruption’s negative impact in terms of slowing the overall entrepreneurial engine.

Notes

The argument that corruption may improve the efficiency of a political process from a standpoint of economic efficiency has its roots in the fact that votes or political preferences sometimes do not accurately convey the full economic value of alternatives (see, e.g., Tidemann and Tulloc 1976).

While most articles approach the subject from the standpoint of viewing corruption as the exogenous determinant of entrepreneurial activity, Tonoyan et al. (2010) examine the choice of entrepreneurs to engage in bribe-paying schemes in these economies. They examine the role of both formal and informal institutions on entrepreneurs as bribe payers and find that the likelihood of engaging in this practice is influenced by the lower efficiency of financial and legal institutions and the lack of their enforcement.

PCA is a multivariate statistical technique used to examine relationships among different quantitative variables. Mathematically speaking, if there are n correlated variables, PCA generates uncorrelated indices or components, where each component is a linear weighted combination of the n variables. For example, for a set of variables \( X_{1} \ldots .X_{n} , \)

\( \begin{array}{*{20}c} {PC_{1} = w_{11} X_{1} + w_{22} X_{2} + \cdots \cdots \cdots + w_{1n} X_{n} } \\ \vdots \\ {PC_{m} = w_{m1} X_{1} + w_{m2} X_{2} + \cdots \cdots \cdots + w_{mn} X_{n} } \\ \end{array} \) where w mn represents the weight for the mth principal component and the nth variable. These weights are the eigenvectors of the covariance matrix (since we have standardized our data; otherwise it is the correlation matrix). The eigenvalue of the corresponding eigenvector is the variance (σ) for each principal component. The first principal component, PC 1, explains the largest possible variation in the dataset subject to the constraint, \( \sum\nolimits_{i = 1}^{n} {w_{1i}^{2} } \). Since the sum of the eigenvalues equals the number of variables in the original dataset, the proportion of total variation accounted for by each principal component is the ratio \( \frac{{\sigma_{i} }}{n} \).

Standardized values for each component have been used to generate the index—thus, the index ranges from negative to positive figures. A more negative number implies less business regulation.

According to Roodman (2009), GMM dynamic panel estimators are particularly suited for (1) small “T” (fewer time periods) and large “N” (many individual or country) panels, (2) a linear functional relationship, (3) a single dependent variable that is dynamic, depending on its own past realizations, (4) independent variables that are not strictly exogenous and are correlated with present as well as past realizations of the error, (5) country fixed effects and (6) heteroskedasticity and autocorrelation within countries.

SD of corruption = 1.04.

Based on World Bank definition, net enrollment ratio ‘is the ratio of children of official school age based on the International Standard Classification of Education 1997 who are enrolled in school to the population of the corresponding official school age’ (WDI 2013). Primary completion rate to the completion of primary education. The figures are expressed as a percentage of the relevant age group.

We further test our results to the inclusion of different indicators of economic freedom. Studies like Bjørnskov and Foss (2008) have shown that certain indicators of economic freedom affect entrepreneurial initiatives of nation. The different measures of economic freedom we consider from Heritage database are measures of property rights, fiscal freedom, government spending, labor freedom, monetary freedom, trade freedom and financial freedom. The coefficient on the interaction term remains positive and significant for all the alternate specifications. The coefficient of corruption is negative and significant for all the alternate specifications. The estimated marginal effects are similar to our benchmark results. The coefficients of most indicators of economic freedom are significant, indicating that they do affect entrepreneurship for nations.

References

Acemoglu, D., Johnson, S., Robinson, J. A., & Yared, P. (2008). Income and democracy. American Economic Review, 98, 808–842.

Ackerman, R. S. (2006). International Handbook on the Economics of Corruption. Northampton, MA: Edward Elgar Publishing.

Acs, Z. J., Desai, S., & Klapper, L. F. (2008). What does “Entrepreneurship” data really show? A comparison of the global entrepreneurship monitor and World Bank group datasets. Small Business Economics, 31(3), 265–281.

Aghion, P., Burgess, R., Redding, S., & Zilibotti, F. (2008). The unequal effects of liberalization: Evidence from dismantling the license raj in India. American Economic Review, 94(4), 1397–1412.

Aidis, R., Estrin, S., & Mickiewicz, T. M. (2012). Size matters: Entrepreneurial entry and government. Small Business Economics, 39(1), 119–139.

Anokhin, S., & Schulze, W. S. (2009). Entrepreneurship, innovation, and corruption. Journal of Business Venturing, 24, 465–476.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58, 277–297.

Armington, C., & Acs, Z. (2002). The determinants of regional variation in new firm formation. Regional Studies: The Journal of the Regional Studies Association, 36(1), 33–45.

Asiedu, E., Jin, Y., & Nandwa, B. (2009). Does foreign aid mitigate the adverse effect of expropriation risk on foreign direct investment? Journal of International Economics, 78(2), 268–275.

Asiedu, E., & Lien, D. (2011). Democracy, foreign direct investment and natural resources. Journal of International Economics, 84(1), 99–111.

Audretsch, D. B., & Keilbach, M. (2007). The localisation of entrepreneurship capital: Evidence from Germany. Papers in Regional Science, 86(3), 351–365.

Audretsch, D. B., Thurik, A. R., Verheul, I., & Wennekers, A. R. M. (Eds.). (2002). Entrepreneurship: Determinants and policy in an European—US Comparison. Boston/Dordrecht: Kluwer.

Beck, T., Asli, D.-K., & Ross, L. (2000). A new database on financial development and structure. World Bank Economic Review, 14, 597–605.

Bianchi, M. (2012). Financial development, entrepreneurship, and job satisfaction. Review of Economics and Statistics, 94(1), 273–286.

Bjørnskov, C., & Foss, N. (2008). Economic freedom and entrepreneurial activity: Some cross-country evidence. Public Choice, 134(3), 307–328.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–144.

Brüderl, J., & Preisendörfer, P. (1998). Network support and the success of newly founded businesses. Small Business Economics, 10(3), 213–225.

Bruhn, M. (2008). License to sell: The effect of business registration reform on entrepreneurial activity in Mexico. World Bank, Washington, DC. © World Bank. https://openknowledge.worldbank.org/handle/10986/6596 License: Creative Commons Attribution CC BY 3.0 Unported.

Busenitz, L. W., Gomez, C., & Spencer, J. W. (2000). Country institutional profiles: Unlocking entrepreneurial phenomena. Academy of Management Journal, 43(5), 994–1003.

De Soto, H. (1989). The other path: The invisible revolution in the third world. New York: Harper Row.

Delmar, F., & Davidsson, P. (2000). Where do they come from? Prevalence and characteristics of nascent entrepreneurs. Entrepreneurship & Regional Development, 12, 1–23.

Djankov, S., Montalvo, J. G., & Reynal-Querol, M. (2006). The curse of aid. Journal of Economic Growth, 13, 169–194.

Doing Business Database, The World Bank (http://www.doingbusiness.org), 2013

Dreher, A., & Gassebner, M. (2013). Greasing the wheels? The impact of regulations and corruption on firm entry. Public Choice, 155(3), 413–432.

Du Rietz, A., & Henrekson, M. (2000). Testing the female underperformance hypothesis. Small Business Economics, 14(1), 1–10.

Dutta, N., Leeson, P. T., & Williamson, C. (2013). The amplification effect: Foreign aid’s impact on political institutions. Kyklos, 66(2), 208–228.

Ehrlich, I., & Lui, F. (1999). Bureaucratic corruption and endogenous economic growth. Journal of Political Economy, 107(6), 270–293.

Estrin, S., Korosteleva, J., & Mickiewicz, T. (2012). Which institutions encourage entrepreneurial growth aspirations? Journal of Business Venturing, 28(4), 564–580.

Fonseca, R., Lopez-Garcia, P., & Pissarides, C. A. (2001). Entrepreneurship, start-up costs and employment. European Economic Review, 45(4–6), 692–705.

Glaeser, E., & Goldin, C. (2006). Corruption and reform: An introduction. In Corruption and reform (pp. 3–22). NBER: University of Chicago Press.

Glaeser, E., & Saks, R. (2006). Corruption in America. Journal of Public Economics, 90, 1053–1072.

Hellman, J. S., Jones, G., Kaufman, D., & Shankerman, M. (2000). Measuring governance, corruption and state capture: How firms and bureaucrats shape the business environment in transition economies. World Bank Policy Research Working Papers 2312. Washington, DC: The World Bank.

International Country Risk Guide. (2012). Political Risk Service (PRS) Database, 2012.

International Labor Organization (ILO). (1990). The promotion of self-employment. Geneva: ILO.

Kaplan, D. S., Piedra, E., & Seira, E. (2009). Entry regulation and business startups: Evidence from Mexico. World Bank Policy Research Working Paper 4322.

Karaivanov, A. (2012). Financial constraints and occupational choice in Thai Villages. Journal of Development Economics, 27(2), 201–220.

Kauffman, D., Kraay, A., & Mastruzzi, M. (2010). The worldwide governance indicators: Methodology and analytical issues. Policy Research Working Paper Series 5430, The World Bank.

Keeble, D., & Walker, S. (1994). New firms, small firms and dead firms: Spatial patterns and determinants in the United Kingdom. Regional Studies, 28(4), 411–427.

Klapper, L., Laeven, L., & Rajan, R. G. (2006). Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics, 82(3), 591–629.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1999). The quality of government. Journal of Law, Economics and Organization, 15(1) 222–279.

Le, A. T. (1999). Empirical studies of self-employment. Journal of Economic Surveys, 13(4), 381–416.

Leeson, P. T., & Sobel, R. S. (2008). Weathering corruption. Journal of Law and Economics, 51(4), 667–681.

Lipsey, R. G., & Lancaster, K. (1956). The general theory of second best. The Review of Economic Studies, 24(1), 11–32.

Mauro, P. (1995). Corruption and growth. Quarterly Journal of Economics, 110(3), 681–712. doi:10.2307/2946696.

Ovaska, T., & Sobel, R. S. (2005). Entrepreneurship in post-socialist economies. Journal of Private Enterprise, 21(1), 8–28.

Persson, T., & Tabellini, G. (2006). Democracy and development: The devil in the details. American Economic Review, 99, 319–324.

Posner, R. A. (1975). The social costs of monopoly and regulation. The Journal of Political Economy, 83, 807–827.

Radaev, V. (2004). How trust is established in economic relationships when institutions and individuals are not trustworthy. In J. Kornai, B. Rothstein, & S. Rose-Ackerman (Eds.), Creating social trust in post-socialist transition (pp. 91–111). Basingstoke: Palgrave.

Reynolds, P. D., Carter, N. M., Gartner, W. B., & Greene, P. G. (2004). The prevalence of nascent entrepreneurs in the United States: Evidence from the panel study of entrepreneurial dynamics. Small Business Economics, 23(4), 263–284.

Reynolds, P. D., Hay, M., & Camp, S. M. (1999). Global entrepreneurship monitor: 1999 executive report. Babson College, London Business School and Kauffman Center for Entrepreneurial Leadership.

Reynolds, P. D., Miller, B., & Maki, W. R. (1995). Explaining regional variation in business births and deaths: U.S. 1976–1988. Small Business Economics, 7, 389–407.

Rohwer, A. (2009). Measuring corruption: A comparison between the transparency International’s corruption perceptions index and the world bank’s worldwide governance indicators. CESifo DICE Report, 7(3), 42–52. Ifo Institute for Economic Research at the University of Munich.

Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 135–158.

Rose, R. (2000). Getting things done in an anti-modern society: Social capital networks in Russia. In P. Dasgupta & I. Serageldin (Eds.), Social capital: A multifaceted perspective (pp. 147–171). Washington, DC: The World Bank.

Sachs, J. D., & Warner, A. M. (1997). Fundamental sources of long-run growth. American Economic Review, 87(2), 184–188.

Schwirtz, M. (2013). in filing, casino operator admits likely violation of an antibribery law. The New York Times (March 2). http://www.nytimes.com/2013/03/03/business/in-filing-casino-operator-admits-likely-violation-of-an-antibribery-law.html?_r=0. Accessed March 8, 2013.

Shleifer, A., & Vishny, R. (1993). Corruption. Quarterly Journal of Economics, 108(3) 599–617.

Spiller, P. T. (1990). Politicians, interest groups, and regulators: A multiple-principals agency theory of regulation, or ‘Let Them Be Bribed’. Journal of Law and Economics, 33(1), 65–101.

Storey, D. J. (1994). Understanding the small business sector. University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship. SSRN: http://ssrn.com/abstract=1496214.

Tamásy, C., & Le Heron, R. (2008). The geography of firm formation in New Zealand. Tijdschrift Voor Economische En Sociale Geografie, 99(1), 37–52.

Tidemann, N., & Tulloc, G. (1976). A new and superior process for making social choices. Journal of Political Economy 1145–1159.

Tonoyan, V., Strohmeyer, R., Habib, M., & Perlitz, M. (2010). Corruption and entrepreneurship: How formal and informal institutions shape small firm behavior in transition and mature market economies. Entrepreneurship Theory and Practice, 34, 803–831.

Treisman, D. (2000). The causes of corruption: A cross-national study. Journal of Public Economics 399–457.

Uhlaner, L. M., Thurik, A. R., & Hutjes, J. (2002). Post-materialism as a cultural factor influencing entrepreneurial activity across nations. ERIM Report ERS-2002-62-STR, Erasmus University Rotterdam.

van der Sluis, J., van Praag, M., & Vijverberg, W. (2008). Education and entrepreneurship selection and performance: A review of the empirical literature. Journal of Economic Surveys, 22(5), 795–841.

Verheul, I., Stel, A. V., & Thurik, R. (2006). Explaining female and male entrepreneurship at the country level. Entrepreneurship & Regional Development, 18(2), 151–183.

Wagner, R. K., & Sternberg, R. J. (1985). Practical intelligence in real-world pursuits: The role of tacit knowledge. Journal of Personality and Social Psychology, 49, 436–458.

World Bank. (2012). Doing business, entrepreneurship database. http://www.doingbusiness.org/data/exploretopics/entrepreneurship

World Bank. (2013). World Development Indicators, Online Database.

Acknowledgments

We thank the editor and the referees for their invaluable comments and suggestions. We also thank the session participants at Southern Economic Association, 2013, and the seminar participants at University of Wollongong, Wollongong, New South Wales, Australia, for their feedback.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dutta, N., Sobel, R. Does corruption ever help entrepreneurship?. Small Bus Econ 47, 179–199 (2016). https://doi.org/10.1007/s11187-016-9728-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-016-9728-7