Abstract

The relationship between external knowledge, absorptive capacity (AC) and innovative performance for small and medium-sized enterprises (SMEs) is investigated empirically. Using data from a survey on firms located in North Norway, we ask whether AC plays a mediating role between different external knowledge inflows and innovative performance. The results are consistent with AC as an important mediator for transforming external knowledge inflows into higher innovative performance if we include all SMEs in the sample. However, this result is not robust when considering the sub-sample of non-R&D SMEs only. External knowledge inflows have a much stronger direct effect on innovation performance for non-R&D firms and leave a weak mediating effect of AC. Our findings suggest that measures of AC should be developed further in order to make AC a more relevant concept for empirical studies of SMEs without in-house R&D.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Small and medium-sized enterprises (SMEs) rely heavily on external knowledge for innovation (Ortega-Argilés et al. 2009; Rammer et al. 2009). Resource constraints may incentivize SMEs to rely on less expensive and less risky alternatives than formal in-house R&D (Dahlander and Gann 2010; Spithoven et al. 2013). In addition, SMEs may be better positioned to take advantage of external knowledge than large firms through less bureaucratic and more flexible management practices (Ortega-Argilés et al. 2009).

Understanding the mechanisms behind the effect of external knowledge on innovation performance is therefore of particular importance for informing relevant innovation policies directed at SMEs. Spithoven et al. (2013) contribute to this discussion by comparing open innovation practices in SMEs and large companies. External sources of knowledge have increasingly been pointed out as critical factors for innovation performance, and external knowledge is often seen as an essential element to optimize in-house or intramural innovation (Chesbrough 2003). In this article, we add to this important issue by empirically studying how the effect of external knowledge inflows on innovation might be mediated in SMEs. Rather than comparing SMEs to large companies, we compare non-R&D innovating SMEs to SMEs in general. A substantial number of innovative SMEs are not reporting doing their own R&D at all. These are firms that to a large extent remain neglected in terms of both research and policy support (Arundel et al. 2008; Barge-Gil et al. 2011; Hervas-Oliver et al. 2012; Som 2012). Non-R&D innovators may be seen as the opposite extreme to large R&D innovators and a cas pur of alternative innovation practices.

Empirical research on the relationship between external knowledge and innovation suggests that benefiting from external knowledge flows cannot be taken for granted (Cassiman and Veugelers 2006). In particular, it is crucial that the firm is capable of identifying and evaluating the potential value of relevant external knowledge. This capability is an important part of what is called ‘absorptive capacity’ (AC), a concept introduced by Cohen and Levinthal (1989) and defined as a firm’s ability to identify, assimilate and exploit knowledge from the environment. As Cohen and Levinthal (1994) put it: “Fortune favors the prepared firm.” The AC concept has been flexibly applied in many disciplines (Zahra and George 2002).

It is a challenge to define AC in operational terms that are sufficiently broad to make AC a relevant concept not only for large firms in hi-tech industries, but even for SMEs without R&D in low-tech industries (Muscio 2007). The presumed bias in available measures translates into systematic differences between R&D and non-R&D firms in terms of relevant knowledge, relevant research and research-ability, since knowledge regarding the determinants and the impact of innovative activity “has been largely shaped by measurement” (Audretsch 2009). Moreover, as pointed out by Arundel et al. (2008) and emphasized by Hervas-Oliver et al. (2012), ‘neglected’ (non-R&D) innovators are not properly policy-supported, even when the change in the growth annual revenues between R&D and non-R&D innovators is similar, and there is no reason for this policy bias.

Taking up this challenge, we allow in this study for differences between R&D and non-R&D firms when it comes to their innovation processes and use of external knowledge inflows. In particular, we aim at exploring whether AC plays a crucial role for SMEs that are not doing typically R&D innovations. Our analysis is based on recent survey data for the peripheral northern part of Europe (North Norway) where firms are predominantly small or very small in low- and medium-tech industries. The results may therefore be particularly relevant for regions and industries where traditional measures of innovation determinants such as patents and R&D expenditures are less relevant. We use path analysis (a subset of Structural Equation Modeling) to test the relevant hypothesis.

We believe that the most important contribution of this article is to extend the analysis of the mediating role of AC between external knowledge inflows and innovation performance to non-R&D SMEs and thereby broadening the relevance of the approach to industries and areas where these firms are located, industries and regions that both have been neglected in many respects. Typically, non-R&D innovators have been ignored in the many studies based on data from Community Innovation Surveys (see Mairesse and Mohnen 2010, and Hong et al. 2012, for recent surveys on innovations surveys).

The article is organized in six sections. Following the introduction, we present the theoretical framework and the hypothesis. In the third section, we present our empirical approach and the data. Results are given in the fourth section and discussed in the fifth. The article is rounded up with some concluding remarks.

2 Theoretical considerations and hypothesis

The first journal article launching the AC concept did contain a formal theoretical model (Cohen and Levinthal 1989). The model was based on an economic model of strategic interaction between firms within the framework of a two-stage oligopoly game. This thread has been picked up in the school of Industrial Organization in Economics and in particular been combined with the framework for strategic interaction in the presence of R&D spillovers between firms (see Grünfeld 2003 and references therein).

Although we refrain from presenting a full explicit theoretical model as a basis for our analysis, our reading of this literature suggests two points of particular interest for any empirical approach to AC. First, R&D does not need to be interpreted in a literal sense, but could rather be read as a shorthand for any purposeful commitment of resources devoted to promote innovation. This is important for making the theory relevant since even firms without their own R&D report making innovations in innovation surveys (see, e.g., Arundel et al. 2008). Second, a common feature of these theoretical models seems to be that AC is essential for transforming available potential useful external knowledge into anything of value to the firm. Without AC, external knowledge has no value. This is a maintained hypothesis, assumed to be true a priori, and predictions from the theoretical models are conditional on this assumption. Empirical testing of this assumption still makes sense—not as a test of the essentiality of AC, but rather as a test for the appropriateness and sufficiency of the measures for AC in the empirical model. Moreover, only the external knowledge that in the presence of AC is improving innovation performance is relevant external knowledge. Hence, if we fail to find evidence for AC as essential, it may be because the external knowledge considered is not relevant and it may be difficult to disentangle one cause from the other.

A firm may use different sources to accumulate knowledge, including interaction with agents within and outside the supply chain. Kostopoulos et al. (2011) argue that “When a firm has access to complementary knowledge inflows from various external sources it is more likely to engage in knowledge acquisition, assimilation, and exploitation because of the value and growth opportunities that these inflows could create; hence stimulating the level of its absorptive capacity.” The argument is substantiated by reference to the literature on resource-based theory and gives rise to this argument (Teece 1986). To develop the future absorptive capability, firms need exposure to external knowledge within their environment. In line with this, we put forward our first hypothesis:

Hypothesis 1

Complementary external knowledge inflows relate positively to the AC of an SME.

Both the concepts of AC and open innovation originated from case studies in large, R&D-intensive companies. In our study, we look at firms reporting doing their own R&D as potentially different from those that do not. We argue that it is relevant to apply these concepts also to the study of firms that are not R&D intensive. We also make a distinction between different sources of knowledge inflow in order to find out what sources are more crucial than others in facilitating a firm’s innovation performance. This may enrich the exploratory analysis and provide much more detail than many previous studies. AC may not only act as a tool for processing external knowledge, but also as a conduit for transferring knowledge within the firm that can be instrumental in facilitating innovation (Tsai 2001; Hagadon and Sutton 1997). Generation, integration and application of knowledge are potential key issues for innovation. On basis of this, we put forward our second hypothesis:

Hypothesis 2

The AC of an SME relates positively to innovation performance.

AC may mediate the relationship between knowledge inflows and the firm’s innovation performance. Building on suggestions by Todorova and Durisin (2007) and Zahra and George (2002), Kostopoulos et al. (2011) argue that “a firm that is not able to identify, assimilate, and apply new external knowledge will not derive any innovation benefit from external knowledge flows.” As mentioned previously, this is entirely consistent with all theoretical models involving AC and knowledge spillovers as well, including the one presented in the seminal paper by Cohen and Levinthal (1989). Based on this, we establish our third and fourth hypothesis:

Hypothesis 3

The AC of an SME mediates the relationship between external knowledge inflows and innovation performance.

Hypothesis 4

The AC of an SME fully mediates the relationship between external knowledge inflows and innovation performance.

Although corroboration of the third hypothesis is consistent with the underlying idea behind AC, it is not sufficient. For AC to be necessary in order to take advantage of external knowledge inflows, we need corroboration of the stronger claim made in the fourth hypothesis. As we have argued and consistent with the theoretical literature, AC is not only about mediation, but full mediation.

Mediation is often tested by a simple one-restriction test conditional on the corroboration of Hypothesis 1 and 2. Full mediation is then tested by an additional zero restriction on the direct effect between external knowledge inflows and innovation performance. In the literature, it seems that full mediation is often simply evaluated by looking at whether all of the restrictions are individually statistically significant. If the restrictions are not rejected, this is taken as evidence for full mediation. However, if rejected, this is taken as evidence against full mediation, but this is going too far. The appropriate statistical test would be to do a joint test of all restrictions.

Although we may note that in plain English ‘mediation’ seems to be both a reasonable and innocuous proposition, ‘mediation’ simply translated into mediation in the technical sense used in SEM, where mediation is evaluated exclusively by statistical testing, does not necessarily make sense. We should be careful not to base our discussion of mediation on statistical testing only. As pointed out by Little et al. (2007), full mediation will always be rejected by statistical testing provided the sample size is sufficiently large since the probability that a parameter takes a single value (in this case zero for the coefficient reflecting the direct effect between external knowledge inflows and innovation performance) is zero. Hence, we need to consider magnitudes and not only signs when distinguishing between partial and full mediation.

3 Empirical approach

3.1 Sample and data

We are taking advantage of a unique and detailed survey carried out in the spring of 2011 designed to generate data for the regional project “A knowledge-based North Norway” (“Et kunnskapsbasert Nord-Norge”).Footnote 1 The survey was distributed electronically to 3,200 firms located in North Norway. By the final response deadline 552 responses had been received. This indicates a response rate of 17 %, not high but comparable to similar surveys. As mentioned earlier, in this analysis our focus is on small companies as they often have limited resources for in-house R&D (Rammer et al. 2009). We therefore restrict our sample to companies with <50 employees. Although this cutoff is often used to define small enterprises, we follow Bianchi et al. (2010) and refer to our companies as SMEs. Out of a gross sample of 475, we end up with 431 analyzable companies. Of these 431 firms, 122 report in-house R&D, while 309 companies report none.

Descriptive statistics are presented in Tables 2 and 3 in addition to correlation tables (Tables 4, 5) in the Appendix. Variable definitions are given in Sect. 3.2 and summarized in Table 1 below.

3.2 Variable definitions and measurements

3.2.1 Innovation performance

This study is based on an indirect and subjective measure of innovation.Footnote 2 We focus on the innovation activity and not on the payoff and the results of the innovation, which are difficult to foresee up front by the firm. Innovation performance is here related to product innovation. This is an indirect subjective type of measurement, since we rely on self-reported output, without excluding the less radical and including the more incremental innovations. The respondents were asked to what degree the firm had introduced new or substantially improved products (goods or services) in the market during the last 2 years. They could choose among four alternatives from no degree to high degree (a four-point scale from zero degree = 1 to high degree = 4). Self-reporting in this context may be seen as a virtue since answers are based on perceptions that often offer more persistence and stability than the information conveyed in, for example, an innovation count at a specific point in time that may or may not be representative over a longer time span.Footnote 3

3.2.2 Absorptive capacity

Several empirical approaches have been used to measure AC. Typically, researchers have used proxies such as R&D expenditures (Cantner and Pyka 1998; Rocha 1999; Stock et al. 2001), level of R&D investment (Grünfeld 2003; Leahy and Neary 2007), continuous R&D activities (Cassiman and Veugelers 2006; Chun and Mun 2012) and existence of a R&D lab (Veugelers 1997; Becker and Peters 2000). Also related prior knowledge and individuals’ skills have been used by some authors to proxy AC: Cohen and Levinthal (1990) argue that AC is path dependent because experience and prior knowledge facilitate the use of new knowledge. This cumulative nature of knowledge has often been related to employees’ level of education (for example, Spanos and Voudouris 2009) or the share of scientists and engineers of total employees in SMEs (Rothwell and Dodgson 1991).

A firm’s AC has also been found to be dependent on the ability of an organization to stimulate and organize the transfer of knowledge (Schmidt 2010). It has been shown that the AC of a firm is determined by its expertise in stimulating and organizing knowledge sharing (van den Bosch et al. 1999). One role of knowledge management is to strengthen those capabilities that allow for sharing and utilizing the firm’s knowledge. Lane et al. (2006) argue that AC “depends on the organization’s ability to share knowledge and communicate internally” and thus is also an outcome of a firm’s knowledge management activities.

As suggested by the many aforementioned studies, there is no commonly accepted measurement of the AC concept. Our study adopts an integrative approach when operationalizing AC by including the R&D perspective, the level of education and knowledge management. We also emphasize the learning approach in this study. Similar types of approaches have been used by Escribano et al. (2009) and Kostopoulos et al. (2011). We take into account the multidimensionality of AC and build an indicator out of four main elements:

-

R&D activities (a dummy that equals to 1 if the firm had performed R&D activities during the last 2 years)

-

Share of highly educated (the share of employees with university degrees)

-

Learning activities: In the questionnaire, the companies were asked to answer how they develop knowledge and competence and to which degree they do that (a four-point scale from zero degree = 0 to high degree = 3). The three different ways to develop knowledge and competence were through learning by doing, in-company training and upgrading courses (on university level). We build up this “learning orientation” variable by summing up the scores in the three alternatives. The minimum score would then be zero, while the maximum score would be nine. We thus assume that the higher the degree and the more alternatives a company uses to develop its knowledge and competence, the more oriented it is to learning.

-

Knowledge management: In the questionnaire, the companies were asked if they used knowledge management as a part of their skills development. We use a dummy that equals one if the company answered yes and zero otherwise.

The indicator for AC is a principal component of the four above indicators. This composite proxy has two main advantages. First, it is based on R&D, which is considered a key feature for the conceptualization and measurement of AC (Zahra and George 2002). Second, our measure offers a combinative operationalization of AC, which is often regarded as a necessity for unbiased estimation of AC (e.g., Zahra and Hayton 2008).Footnote 4

3.2.3 External knowledge flows

External knowledge flows were measured by firms rating the importance of eight different sources. The firms were asked to report which external knowledge sources were used in generating new ideas and new products or services: the external knowledge sources could be suppliers, clients, competitors, research institutions, consultants, alliance partners, trade organizations and personal networks. The indicator is thus constructed as a combination of eight sources for developing new ideas, processes and products that companies report having used. The companies could report whether they had used these sources locally, nationally or internationally (they could give multiple-choice answers). Hence, we are allowing for knowledge from sources close to the firm to be mediated differently than knowledge from more distant sources. As emphasized by Boschma (2005), geographical nearness may be highly correlated with nearness or sameness along other dimensions. Geographical proximity may therefore be interpreted more broadly as an indicator for different types of nearness. Practically, we then have 8 × 3 = 24 possible sources. Each of these 24 sources are then coded as a binary variable, zero for no use and one for use of the given knowledge source. Subsequently, the 24 sources are then added up so that each firm gets a 0 when no knowledge sources are used and a maximum value of 24 (when all knowledge sources are used).

3.2.4 Controls

This study includes a number of control variables that may influence both a firm’s AC and innovation performance. According to the influential perspectives offered by Porter (1990), demanding customers could be important in providing incentives for innovation. Presuming foreign customers to be at least as demanding as local customers, we added a binary variable taking one if the firm reported sales to foreign markets. The wish to grow can affect a firm’s innovation process. Mosey et al. (2002) suggest that SMEs with aggressive growth ambitions repeatedly introduce new products. A dummy variable was therefore entered distinguishing between firms with (coded as 1) and without ambitions to succeed in international markets. Small firms might also have a lower AC than larger firms. In order to control for this, we added employment (measured in logs) as a control variable.

Many studies suggest that entrant firms are prone to innovate more. Among others, Acs and Audretsch (1988, 1990) state the importance of innovation by small entrant firms. Hansen (1992) finds that the number of new products by unit of sales and the proportion of innovative sales in a sample of American firms are inversely related to firm age. We therefore employ a control variable capturing the effect of firm age on product innovation by including a binary variable taking the value 1 if firms were at most 2 years old.

Empirical evidence suggests that very few small firms use sources of genuine risk capital (see, for example, Freel 1999; Giudici and Paleari 2000; Oakey et al. 1988). Small firms are also found to be credit constrained (Freel 2007) and predominantly rely on internal funding of innovation activities. In order to control for this, we have included returns on investment, obtained from register data.

Finally, we have controlled for industry structure, and have included a dummy variable in order to distinguish between services (coded as 1) and manufacturing firms (coded as 0), based on the NACE (Rev.2) classification.

Table A1 in the Appendix shows descriptive statistics for the whole sample, as well as non-R&D and R&D SMEs separately. The R&D SMEs clearly have higher scores on innovation performance. They also have higher AC, and they report using more external knowledge sources when developing new ideas, processes and products than their non-R&D counterparts. Looking closely at the external knowledge sources reveals that R&D SMEs also are more internationally oriented.

3.3 Statistical technique

We tested our hypotheses by using path analysis, which is a subset of structural equation modeling (SEM). We used a robust maximum likelihood estimator in Mplus 7. Although we are using a categorical variable to measure firms’ innovation performance, the literature appears to support the notion that when the number of categories is large and the data approximate a normal distribution, failure to address the ordinality of the data is likely negligible (Atkinson 1988; Babakus et al. 1987; Muthén and Kaplan 1985). Indeed, Bentler and Chou (1987) argue that, given normally distributed categorical variables, continuous methods can be used with little worry when a variable has four or more categories. Hence, we should be on the right side treating variables as continuous. We employ only observed variables in our analysis.

Path analysis may be particularly appropriate for this study because it conveniently permits the simultaneous estimation of multiple causal relationships between one or more independent variables and a dependent variable, either continuous or discrete (Kline 2005; Medsker et al. 1994). Our sample size is considered sufficient to attain valid statistical conclusions, although when we split the sample into subgroups we should be a bit careful. We have concentrated on analyzing firms without R&D and compare to results based on the whole sample. The sub-sample of firms with their own R&D is too small. Kline (2005) suggests a minimum requirement of 200 observations.

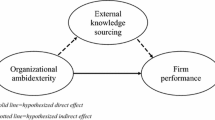

The path analysis approach may in principle be presented in the form of a path diagram as in Fig. 1. Solid arrows represent direct effects and the dashed arrow the indirect or mediating effect. The four hypotheses imply specific signs on these effects as suggested in the diagram.

Path diagram. Note For reasons of simplicity, the control variables and error variances are not shown in this diagram. Solid arrows represent direct effects and the dashed arrow the indirect (mediating) effect. H1, H2, H3 and H4 refer to the four hypothesis that are under investigation: H1 and H2 correspond to Hypothesis 1 and 2; H3 corresponds to the sign on the indirect effect, that conditional on H1 and H2 being corroborated, supports Hypothesis 3; H4 corresponds to the zero restriction on the direct effect that supports Hypothesis 4, conditional on corroboration of H1, H2 and H3

4 Results

We will first present the results on the aggregate level, keeping both SMEs with and without in-house R&D in the sample. Thereafter, we present the results for SMEs without in-house R&D and ask whether the aggregate results survive.Footnote 5 A priori we will expect that the role of knowledge inflows in the innovation process is differing between R&D- and non-R&D SMEs. Results from the estimations are presented in pictorial path diagrams similar to the one in Fig. 1 referring to the four hypotheses we are investigating.

In Fig. 2, we first present results for aggregates for the whole sample in the top panel. We see that our results lend support to the first hypothesis H1. This is completely consistent with Kostopoulos et al. (2011) using a similar methodology and comparable sample size for a sample of Greek firms. The point estimate for all firms together (top panel) as well as for non-R&D firms (bottom panel) = 0.318 and is precisely estimated. This result means that external knowledge inflows appear to stimulate the AC level among the firms.

Path analysis coefficients. Note For reasons of simplicity, only estimates significantly different from zero are presented. The estimates for the control variables and error variances are not shown in this diagram. Dashed lines represent mediating (indirect) effects. Levels of significance: *p ≤ 0.05; **p ≤ 0.01; ***p ≤ 0.001

The second hypothesis H2 suggested that AC should relate positively to innovation performance. The results reported in Fig. 2 lend support to H2. The precisely estimated point estimate for all firms of 0.267 indicates that the higher the level of AC a firm has, the more likely it is to have a higher level of innovation performance. Again, it is interesting that this result is also in line with Kostopoulos et al. (2011). The point estimate for non-R&D firms is smaller (0.115), but sufficiently large to be statistically significant at the 5 % level.

The third hypothesis H3 suggested that AC mediates the relationship between external knowledge inflows and innovation performance. H3 implies that the indirect (mediating) effect should be positive. Moreover, if the direct effect of knowledge inflows on innovation performance is zero, then there is what is called full mediation: external knowledge inflows advance innovation performance exclusively through AC, which is our fourth hypothesis H4. Our results for the whole sample do support the third hypothesis, but not full mediation. The estimate for the indirect effect is 0.085 (top panel, Fig. 2) and clearly significant. The point estimate for the direct effect from knowledge inflows to innovation performance is 0.116, but less precisely estimated and only significant at the 5 % level. A conservative assessment on the basis of the lower bound of an interval estimate would therefore suggest the mediating effect to be larger than the direct effect, although the point estimate indicates otherwise.

Again, we may make a comparison to the results in Kostopoulos et al. (2011). They interpret their results as support for full mediation. The comparable mediation effect is estimated to be 0.042, and it is reported to be significant at least at the 5 % level (but not at the 1 percent level). The direct effect is not reported, but we are told that it is not significant. Observe, however, that the distinction between partial and full mediation should not be solely based on statistical testing (Little et al. 2007). It is difficult to assess how strong the basis for full mediation is in Kostopoulos et al. (2011) without being given the point estimate for the direct effect and more information on precision.

For non-R&D SMEs, the point estimate of the mediating effect is much smaller (0.036) than for the whole sample and too small to be significant at more than the 5 % level, whereas the point estimate for the direct effect is much larger and sufficiently large to be significant at the 0.1 % level. Comparing the mediating and direct effects for non-R&D SMEs, the estimates suggest that the latter is more than five times as large as the former. For all SMEs, the difference is small. Hence, there is an obvious difference comparing non-R&D SMEs to the whole sample concerning mediation, although from a hypothesis-testing perspective partial and not full mediation is corroborated for both samples. An assessment based on magnitudes, however, clearly suggests that AC is more important as a mediator in the whole sample, and closer to full mediation, than for non-R&D SMEs.

In order to get a deeper understanding of what is going on for the non-R&D SMEs, we broke up the knowledge flow sources in our analysis according to knowledge source and location. When the aggregate measure of knowledge inflows is disaggregated into components associated with different knowledge sources, we obtain the richer picture in Fig. 3 for non-R&D SMEs. When it comes to the relationship between different types of knowledge inflows and AC, the significant results (the figure is only showing the significant relationships) are as follows:

Path analysis: separate knowledge sources for non-R&D SMEs. Note For reasons of simplicity, only estimates for direct effects that are significantly different from zero are presented. The estimates for the control variables and error variances are not shown in this diagram. Goodness-of-fit: χ 2 (d.f. = 4, N = 309) = 7.866, p = 0.0966; comparative fit index (CFI) = 0.976; root mean squared error of approximation (RMSEA) = 0.053. Number of observations: 309. Level of significance: *p ≤ 0.05; **p ≤ 0.01; ***p ≤ 0.001

-

Knowledge inflows from international and national competitors have a positive effect on AC. This result is in line with Huang et al. (2010), emphasizing those competitors are an important information source. This is also in line with the reasoning by Cohen and Levinthal (1990): the more of competitors’ spillovers there are out there, the more incentive the firm has to invest in its own AC. They also state that when this incentive is large, spillovers may stimulate AC (Cohen and Levinthal 1989).

-

Knowledge inflows from international and national trade organizations have a positive effect on AC. This result is in line with Lowik et al. (2012) who find that membership in trade organizations gave members possibilities to meet in non-traditional business settings and increased their AC as firms discovered new knowledge within existing relationships. Som (2012) also argues that conferences and trade fairs offer non-R&D-performing firms the possibility to access new knowledge at relatively low costs. Like in Bowman and Hurry (1993), our results indicate that participation in these above national and international business-specific networks is positively related to AC. Firms often participate in this kind of collaboration in order to gain complementary knowledge about a market or technology: they may share experiences and find new methods of production and new markets. These results indicate that non-R&D firms to a large extent rely on networking in order to gain access to complementary knowledge.

-

In addition to above institutional tie networks between firms, also personal networks seem to be positively related to AC. Like Bell (2005) and Uzzi (1996), we find that these networks are an important source of novel information for non-R&D firms; knowledge inflows from international and local personal networks have a positive effect on AC.

-

Our results indicate that proximity matters. We have mentioned that knowledge inflows from trade organizations, competitors and personal networks have an effect on AC. For these inflows, the effect is stronger for international than domestic (either local or national) relationships (when both have a significant effect). This result is in line with Bathelt et al. (2004) stating that international interaction is costlier than local interaction. This so-called “global pipeline” interaction implies, according to them, a conscious effort on the part of partners at both ends of the pipeline. Together with the higher costs this means that the individual rewards from international interaction may be greater.

-

We find that non-R&D SMEs use knowledge inflows from national R&D institutions as an important source of information. These inflows have a positive effect on AC. Our results also indicate that collaboration with national R&D institutions creates learning in non-R&D SMEs (stimulates AC) and indicate that interactions between the firm’s employees and R&D institutions increase the general level of competence in non-R&D SMEs.

According to Cohen and Levinthal (1990) and Zahra and George (2002), firms derive innovation benefits from new external knowledge only if they will recognize the value of this knowledge, internalize and exploit it. But which kind of knowledge inflows is AC transforming into higher innovative performance? In other words, what kind of knowledge inflows is AC mediating? Opposite to Kostopoulos et al. (2011), who find that external knowledge inflows advance innovation performance exclusively through AC (full mediation), our results imply that this is the case just for some knowledge inflows. Our significant mediation results (not shown in Fig. 3) are:

-

Knowledge inflows from both national and international trade organizations are partially mediated by AC and therefore have a significant positive indirect effect on innovation (0.635·0.146 = 0.093, p value 0.028 and 0.394·0.146 = 0.058, p value 0.037, respectively). This indicates that in addition to these networks contributing to the knowledge base, they also give the firms new ideas that they use to innovate new products.

-

Also knowledge inflows from international personal networks have a significant indirect effect on product innovation (0.426·0.146 = 0.062, p value 0.044). Like in Uzzi (1996), the managerial international networks thus seem to enhance SME innovativeness, suggesting that the personal friendship and communication network provides an important information source that is useful in innovation for non-R&D SMEs.

It has long been recognized that interaction with customers can be a decisive antecedent to innovation (Freeman 1968; Linder 1961; Rosenberg 1982; von Hippel 1976). Our results suggest that knowledge inflows from customers have a direct positive effect on innovation performance but no indirect effect, i.e., they are not mediated by AC. One possible explanation for the lack of mediation could be that we have not included any measures of the firm’s sales people in our measure of AC. Cohen and Levinthal (1990) state that the AC of an organization is dependent on its gatekeepers—when it comes to consumer knowledge, it is often the sales people who represent the link with external stakeholders and possess customer knowledge as an asset that affects knowledge acquisition.

Although we find that collaboration with R&D institutions stimulates AC, the knowledge inflows from these institutions seem not to have an impact on innovation performance. One possible explanation can be that non-R&D firms by definition lack researchers. Tödtling et al. (2009) find that researchers in the firm constitute a main channel engaging in knowledge interactions with R&D institutions, able to understand the concepts used in science and to speak ‘the same language.’ This requires the presence of so-called technological gatekeepers (Allen 1986), such as qualified technical specialists, scientists and engineers.

5 Summary and discussion

In this article, we have compared SMEs that do not report doing their own R&D to SMEs in general by testing four important hypotheses related to the idea of absorptive capacity (AC) as a mediator for the relationship between external complementary knowledge inflows (KIs) and innovation performance (IP): KIs relate positively to AC (H1), AC relates positively to IP (H2), the relationship between KI and IP is mediated by AC (H3), and the relationship between KI and IP is fully mediated by AC (H4). Based on survey data from 2011 for 431 firms located in North Norway (the counties above the Polar Circle), using aggregate measures of KI and AC, we find support for the three first hypotheses and conclude that there is evidence for partial mediation when we do the path analysis for the whole sample. The results are consistent with AC as an important condition for transforming KI into higher IP, suggested in the theoretical literature (e.g., Cohen and Levinthal 1989). It is also in line with empirical results using other data, but similar methodology (Kostopoulos et al. 2011).

The stronger claim that AC is essential and necessary in order to make use of any external knowledge, called full mediation, is not supported in our sample. However, as emphasized by Little et al. (2007, p. 211), “Despite the pervasiveness of terms like full and partial mediation, we caution against their use. Full and partial are essentially informal effect size descriptors. They are intended to capture and communicate the magnitude or importance of a mediation effect, yet they are traditionally defined in terms of statistical significance.” It is therefore more interesting that there are clear differences between non-R&D firms and the whole sample related to the mediating role of AC.

The support for H1 and H2 based on all firms is confirmed for non-R&D firms. There is also support for H3 and not for H4 in both samples. The interesting difference between all firms and non-R&D firms appears when we, following Little et al. (2007), consider the magnitudes of the estimates and not only the signs. For all firms, the mediating effect of AC is much stronger than for non-R&D firms and closer to full mediation. For non-R&D firms the direct effect is much stronger and mediation much weaker.

This pronounced difference should make us wonder whether our definition of AC is sufficiently comprehensive for the types of knowledge that are typically exchanged in the relationships in which non-R&D SMEs engage. We have built AC out of four main groups of variables: R&D, level of education, in-firm learning and knowledge management practices in the firm. Since our results for non-R&D SMEs in particular do not support the idea from theory that AC is a necessary condition for transforming KI into IP, there is reason to believe that still more variables should be added in the construction of the AC measure. Examples are variables representing experience and tacit knowledge (Rosenberg 1982; Schmidt 2010). Vinding (2006) argues that AC could be developed through the accumulation of experience, and this kind of firm-specific knowledge established through learning by doing may be measured by work experience of the employees. Other authors include compensation practices and organization structure in their definitions (Lane and Lubatkin 1998). Lewin et al. (2011) find that specific organizational routines and processes also add to AC. We have not been able to include any of these measures in our operational definition of AC at this stage because of limitations in our data.

Furthermore, we measured knowledge inflows through representations of relationships to specific agents. According to Cohen and Levinthal (1990), the AC of an organization is dependent on gatekeepers that possess customer knowledge. Our study lacks information about who the gatekeepers are for different kinds of knowledge partnerships.

More fundamentally, although our measure of AC is similar to that used in several others recent studies, systematic development and validation of a broader range of multidimensional measures that could be used across different studies would be desirable. Work in this direction has begun (Flatten et al. 2011), but so far without much relevance for non-R&D firms (testing on German research-intensive firms only).

One puzzling result from an economics perspective is that collaboration with R&D institutions appears not to have an impact on innovation performance. However, our results indicate that collaboration with national R&D institutions increases AC in non-R&D SMEs. This suggests that SMEs’ interaction with R&D institutions (such as universities) can, in addition to research and consultancy, happen in many ways, for example, teaching, training and skills development. Although knowledge inflows from R&D institutions are not mediated by AC, knowledge from R&D institutions can help firms perform the very first steps of an innovation process (Broström 2010) or keep the option alive to innovate in the future (Vanhaverbeke et al. 2008). We may also invoke ideas from institutional organization theory: The collaboration represents an attempt to gain legitimacy from the environments: Selznick (1948) describes the concept of co-optation as a mechanism by which external elements (such as network relations with R&D institutions) are incorporated into the decision-making structure of the firm. The strategy behind such a co-optation is to ensure support from their local environments. This argument is pushed even further by Meyer and Rowan (1977), who argued that formal normative organizational structure adapts norms and values form the environments, which may be inefficient regarding goal attainment, but rather encourages organizational legitimacy. Such adaptations are referred to as organizational rules that function as myths and reflect the “rationalized institutional myths” of the environment; hence, organizations incorporate these myths to achieve legitimacy.

6 Concluding remarks

Let us close this article with some concluding remarks on possible implications for policy, both for the individual SME and for policymakers, as well as advice on future research priorities.

Our results show that external knowledge inflows that improve SMEs’ innovation performance come from a multitude of sources including customers, trade organizations and personal networks. The results show that the single most important relationship for the non-R&D innovator’s innovation performance is the relationship to customers. This effect works directly and not through AC. Hence, the founder of McDonald’s Corporation, Ray Kroc, could also have a point when it comes to innovation and small firms when saying “Look after the customers and business takes care of itself.” We also find that participating in business-specific networks, co-operation with R&D institutions, personal networks and collaboration with competitors may offer particular important knowledge for building AC for the many non-R&D SMEs located in peripheral regions, so engaging in networking makes a better innovator than going alone. However, many SMEs may not be aware of non-local opportunities or may be too inward-looking to look for knowledge sources far from home. Therefore, public policy could play a role by helping to address potential information barriers and encourage establishing non-local relationships.

Our results indicate that SMEs can improve innovation performance by managing both their institutional and their personal networks with care. We find that personal networks and membership in trade organizations increase both AC and innovation performance. Although we do not have information on who performs the task as “gatekeeper” for knowledge inflows from both trade organizations and personal networks, it is reasonable to think that it is often someone with managerial responsibility. This draws attention to the SME’s managerial ability to use relationships. Freeman et al. (2010) and Witt (2004) argue that managers who have the ability to build inter-firm partnerships will establish a high-trust context for communication, which in turn will facilitate the transfer of tacit and complex knowledge. We have in this study measured AC as an organizational capability. Our findings, however, can indicate that it may be fruitful also to include managers’ relational capabilities when studying open innovation practices in SMEs as managers often fulfill the roles of gatekeepers or boundary spanners (Tushman 1977). Managers are often better able to recognize external knowledge because they stand at the interface between the internal and external environment (Cohen and Levinthal 1990).

Finally, one of the most pertinent issues for future research on the AC of non-R&D innovators would be more systematic development and validation of AC measures relevant for non-R&D innovators. This would also be a daunting task given the available data, but we believe progress in this direction is very much needed in order to move forward. It is encouraging that the Oslo manual (OECD 2005) is slowly adjusting to a more comprehensive view of the innovation process that may facilitate this work as data from new waves of innovation surveys become available.

Notes

A report from the project in Norwegian has been made public and is available from the authors upon request.

Measures of innovation can be classified as direct or indirect (Hong et al. 2012). Direct measures only measure inputs devoted to innovative activities, whereas indirect measures focus on the output. Measuring innovation as an output, such as the number of innovations or an “innovation count,” is referred to as “objective” and tends to be biased towards radical/product innovation as opposed to incremental/process innovations (where unsuccessful innovations are automatically excluded). Subjective measures consider innovation as an activity and a range of innovation-related data are collected via firm-based surveys.

We are grateful to Ossi Pesämaa for making this point to us.

The measure of AC is normalized by scaling it to [0,1]. The result of the principal component factor analysis suggests a single factor with an eigenvalue >1 (1.46).

We do not run a separate path analysis for R&D SMEs because of the small sample size (N = 122). Kline (2005) recommends that the sample size should be ten times (or ideally 20 times) as many cases as parameters, and at least 200.

References

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms. American Economic Review, 78, 678–690.

Acs, Z., & Audretsch, D. B. (1990). Innovation and small firms. Cambridge Mass: MIT Press.

Allen, T. (1986). Organizational structure, information technology and R&D productivity. IEEE Transactions on Engineering Management, 33, 212–217.

Arundel, A., Bordoy, C., & Kanerva, M. (2008). Neglected innovators: How do innovative firms that do not perform R&D innovate? Results of an analysis of the innobarometer 2007 survey no. 215. INNO-Metrics Thematic Paper, The Hague.

Atkinson, L. (1988). The measurement-statistics controversy: Factor analysis and subinterval data. Bulletin of the Psychonomic Society, 26, 361–364.

Audretsch, D. B. (2009). The entrepreneurial society. Journal of Technology Transfer, 34, 245–254.

Babakus, E., Ferguson, C. E, Jr, & Jöreskog, K. G. (1987). The sensitivity of confirmatory maximum likelihood factor analysis to violations of measurement scale and distributional assumptions. Journal of Marketing Research, 24, 222–228.

Barge-Gil, A., Nieto, M. J., & Santamaría, L. (2011). Hidden innovators: The role of non-R&D activities. Technology Analysis and Strategic Management, 23, 415–432.

Bathelt, H., Malmberg, A., & Maskell, P. (2004). Clusters and knowledge: Local buzz, global pipelines and the process of knowledge creation. Progress in Human Geography, 28, 31–56.

Becker, W., & Peters, J. (2000). Technological opportunities, absorptive capacities, and innovation. In: Volkswirtschaftliche Diskussionsreihe der Universität Augsburg No. 195.

Bell, G. G. (2005). Clusters, networks, and firm innovativeness. Strategic Management Journal, 26, 287–295.

Bentler, P. M., & Chou, C.-P. (1987). Practical issues in structural modeling. Sociological Methods and Research, 16, 78–117.

Bianchi, M., Campodall’Orto, S., Frattini, F., & Vercesi, P. (2010). Enabling open innovation in small and medium-sized enterprises: How to find alternative applications for your technologies. R&D Management, 40, 414–431.

Boschma, R. (2005). Proximity and innovation: A critical assessment. Regional Studies, 39, 61–74.

Bowman, E. H., & Hurry, D. (1993). Strategy through the option lens: An integrated view of resource investments and the incremental-choice process. The Academy of Management Review, 18, 760–782.

Broström, A. (2010). Working with distant researchers: Distance and content in university–industry interaction. Research Policy, 39, 1311–1320.

Cantner, U., & Pyka, A. (1998). Technological evolution: An analysis within the knowledge-based approach. Structural Change and Economic Dynamics, 9, 85–107.

Cassiman, B., & Veugelers, R. (2006). In search of complementarity in the innovation strategy: Internal R&D and external knowledge acquisition. Manage Science, 52, 68–82.

Chesbrough, H. W. (2003). Open Innovation. The new imperative for creating and profiting from technology. Cambridge Mass: Harvard Business School Press.

Chun, H., & Mun, S.-B. (2012). Determinants of R&D cooperation in small and medium-sized enterprises. Small Business Economics, 39, 419–436.

Cohen, W., & Levinthal, D. (1989). Innovation and learning: The two faces of R&D. The Economic Journal, 99, 569–596.

Cohen, W., & Levinthal, D. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 123–133.

Cohen, W., & Levinthal, D. (1994). Fortune favors the prepared firm. Management Science, 40, 227–251.

Dahlander, L., & Gann, D. M. (2010). How open is innovation? Research Policy, 39, 699–709.

Escribano, A., Fosfuri, A., & Tribo, J. (2009). Managing external knowledge flows: The moderating role of absorptive capacity. Research Policy, 38, 96–105.

Flatten, T. C., Engelen, A., Zahra, S. A., & Brettel, M. (2011). A measure of absorptive capacity: Scale development and validation. European Management Journal, 29, 98–116.

Freel, M. (1999). The financing of small firm product innovation in the UK. Technovation, 19, 707–719.

Freel, M. S. (2007). Are small innovators credit rationed? Small Business Economics, 28, 23–35.

Freeman, C. (1968). Chemical process plant: Innovation and the world market. National Institute of Economy, 45, 29–51.

Freeman, S., Hutchings, K., Lazaris, M., & Zyngier, S. (2010). A model of rapid knowledge development: The smaller born-global firm. International Business Review, 19, 70–84.

Giudici, G., & Paleari, S. (2000). The provision of finance to innovation: A survey conducted among Italian technology-based small firms. Small Business Economics, 14, 37–53.

Grünfeld, L. A. (2003). Meet me halfway but don’t rush: Absorptive capacity and strategic R&D investment revisited. International Journal of Industrial Organization, 21, 1091–1109.

Hagadon, A., & Sutton, R. I. (1997). Technology brokering and innovation in a product development firm. Administrative Science Quartely, 42, 716–749.

Hansen, J. A. (1992). Innovation, firm size, and firm age. Small Business Economics, 4, 37–44.

Hervas-Oliver, J.-L., Albors-Garrigos, J., & Baixauli, J.-J. (2012). Beyond R&D activities: The determinants of firms’ absorptive capacity explaining the access to scientific institutes in low-medium-tech contexts. Economics of Innovation and New Technology, 21, 55–81.

Hong, S., Oxley, L., & McCann, P. (2012). A survey of the innovation surveys. Journal of Economic Surveys, 26, 420–444.

Huang, C., Arundel, A., & Hollanders, H. (2010). How firms innovate: R&D, non-R&D, and technology adoption. UNU-MERIT Working Paper 2010-2027.

Kline, R. B. (2005). Principles and practice of structural equation modeling. New York: The Guilford Press.

Kostopoulos, K., Papalexandris, A., Papachroni, M., & Loannou, G. (2011). Absorptive capacity, innovation, and financial performance. Journal of Business Research, 64, 1335–1343.

Lane, P., Koka, B., & Pathak, S. (2006). The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of Management Review, 31, 863–883.

Lane, P. J., & Lubatkin, M. (1998). Relative absorptive capacity and inter-organizational learning. Strategic Management Journal, 19, 461–477.

Leahy, D., & Neary, J. P. (2007). Absorptive capacity, R&D spillovers, and public policy. International Journal of Industrial Organization, 25, 1089–1108.

Lewin, A. Y., Massini, S., & Peeters, C. (2011). Micro-foundations of internal and external practiced routines of absorptive capacity. Organization Science, 22, 81–98.

Linder, S. B. (1961). An essay on trade and transformation. Stockholm: Almquist and Wiksell.

Little, T. D., Bovaird, J. A., & Card, N. A. (Eds.). (2007). Modeling contextual effects in longitudinal studies. LEA: Mahwah N.J.

Lowik, S., van Rossum, D., Kraaijenbrink, J., & Groen, A. (2012). Strong ties as sources of new knowledge: How small firms innovate through bridging capabilities. Journal of Small Business Management, 50, 239–256.

Mairesse, J., & Mohnen, P. (2010). Using innovation surveys for econometric analysis. In B. H. Hall & N. Rosenberg (Eds.), Handbook of the economics of innovation (pp. 1129–1155). Amsterdam: Elsevier.

Medsker, G. J., Williams, L. J., & Holahan, P. J. (1994). A review of current practices for evaluating causal models in organizational behavior and human resources management research. Journal of Management, 20, 439–464.

Meyer, J. W., & Rowan, B. (1977). Institutionalized organizations: Formal structures as myth and ceremony. The American Journal of Sociology, 83, 340–363.

Mosey, S., Clare, J. N., & Woodcock, D. J. (2002). Innovation decision making in British manufacturing SMEs. Integrated Manufacturing Systems, 13, 176–183.

Muscio, A. (2007). The impact of absorptive capacity on SMEs’ collaboration. Economics of Innovation and New Technology, 16, 653–668.

Muthén, B., & Kaplan, D. (1985). A comparison of some methodologies for the factor analysis of non-normal Likert variables. British Journal of Mathematical and Statistical Psychology, 38, 171–189.

Oakey, R., Rothwell, R., & Cooper, S. (1988). Management of innovation in high technology small firms. London: Pinter.

OECD. (2005). Oslo manual: Guidelines for collecting and interpreting innovation data (3rd ed.). Paris: OECD Publications.

Ortega-Argilés, R., Vivarelli, M., & Voigt, P. (2009). R&D in SMEs: A paradox? Small Business Economics, 33, 3–11.

Porter, M. E. (1990). The competitive advantage of nations. New York: Free Press.

Rammer, C., Spielkamp, A., & Czarnitzki, D. (2009). Innovation success of non-R&D performers: Substituting technology by management in small firms. Small Business Economics, 33, 35–58.

Rocha, F. (1999). Inter- firm technology cooperation: Effects of absorptive capacity, firm-size and specialization. Economics of Innovation and New Technology, 8, 253–271.

Rosenberg, N. (1982). Inside the black box: Technology and economics. Cambridge: Cambridge University Press.

Rothwell, R., & Dodgson, M. (1991). External linkages and innovation in small and medium-sized enterprises. R&D Management, 21, 125–137.

Schmidt, T. (2010). Absorptive capacity-one size fits all? A firm-level analysis of absorptive capacity for different kinds of knowledge. Managerial and Decision Economics, 31, 1–18.

Selznick, P. (1948). Foundation of the theory of organization. American Sociological Review, 13, 25–35.

Som, O. (2012). Innovation without R&D: Heterogenous innovation patterns of non-R&D-performing firms in the German manufacturing industry. Wiesbaden: Springer Gabler.

Spanos, Y. E., & Voudouris, E. (2009). Antecedents and trajectories of AMT adoption: The case of greek manufacturing SMEs. Research Policy, 38, 144–155.

Spithoven, A., Vanhaverbeke, W., & Roijakkers, N. (2013). Open innovation practices in SMEs and large enterprises. Small Business Economics, 41, 537–562.

Stock, G. N., Greis, N. P., & Fischer, W. A. (2001). Absorptive capacity and new product development. Journal of High Technology Management Research, 12, 77–91.

Teece, D. J. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy, 15, 285–305.

Todorova, G., & Durisin, B. (2007). Absorptive capacity: Valuing a reconceptualization. Academy of Management Review, 31, 774–786.

Tödtling, F., Lehner, P., & Kaufmann, A. (2009). Do different types of innovation rely on specific kinds of knowledge interactions? Technovation, 29, 59–71.

Tsai, W. (2001). Knowledge transfer in interorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Academy of Management Journal, 44, 379–387.

Tushman, M. L. (1977). Special boundary roles in the innovation process. Administrative Science Quarterly, 22, 587–605.

Uzzi, B. (1996). The sources and consequences of embeddedness for the economic performance of organizations: The network effect. American Sociological Review, 61, 674–698.

Van den Bosch, F. A. J., Volberda, H. W., & De Boer, M. (1999). Coevolution of firm absorptive capacity and knowledge environment: Organizational forms and combinative capabilities. Organization Science: A Journal of the Institute of Management Science, 10, 551–568.

Vanhaverbeke, W., Van de Vrande, V., & Chesbrough, H. (2008). Understanding the advantages of open innovation practices in corporate venturing in terms of real options. Creativity and Innovation Management, 17, 251–258.

Veugelers, R. (1997). Internal R&D expenditures and external technology sourcing. Research Policy, 26, 303–315.

Vinding, A. L. (2006). Absorptive capacity and innovative performance: A human capital approach. Economics of Innovation and New Technology, 15, 507–517.

Von Hippel, E. (1976). The dominant role of users in scientific instrument innovation process. Research Policy, 5, 212–239.

Witt, P. (2004). Entrepreneurs’ networks and the success of start-ups. Entrepreneurship and Regional Development, 16, 391–412.

Zahra, S. A., & George, G. (2002). Absorptive capacity: A review and reconceptualization, and extension. Academy of Management Review, 27, 185–203.

Zahra, S. A., & Hayton, J. C. (2008). The effect of international venturing on firm performance: The moderating influence of absorptive capacity. Journal of Business Venturing, 23, 195–220.

Acknowledgments

The research for this article has been funded in part by Innovation Norway and SpareBank1 Nord-Norge. We are grateful for comments on a first draft presented at the 15th Uddevalla Symposium, Faro, June 2012. We thank Ossi Pesämaa for useful suggestions. We would also like to thank the editor and three anonymous referees for valuable comments. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Moilanen, M., Østbye, S. & Woll, K. Non-R&D SMEs: external knowledge, absorptive capacity and product innovation. Small Bus Econ 43, 447–462 (2014). https://doi.org/10.1007/s11187-014-9545-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-014-9545-9